Matthews Asia Funds | Third Quarter Report

September 30, 2008

| ASIA GROWTH AND INCOME STRATEGIES Matthews Asian Growth and Income Fund Matthews Asia Pacific Equity Income Fund |

| |

|

ASIA GROWTH STRATEGIES |

||

| Matthews Asia Pacific Fund Matthews Pacific Tiger Fund Matthews China Fund Matthews India Fund Matthews Japan Fund Matthews Korea Fund |

||

|

ASIA SMALL COMPANY STRATEGY Matthews Asia Small Companies Fund |

||

|

ASIA SPECIALTY STRATEGY Matthews Asian Technology Fund |

| YEAR END DISTRIBUTIONS | 2008 year end distributions for the Matthews Asia Funds will occur on approximately December 10. Details and estimates will be posted on matthewsasia.com the week of November 10. | |

|

If you would like to be notified when distribution estimates become available, please sign up to receive our Occasional Fund Updates emails at matthewsasia.com.

For details regarding Fund distributions visit matthewsasia.com/distributions. |

This report has been prepared for Matthews Asia Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. You should read the prospectus carefully before investing. Additional copies of the prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

| 2 | ||

| 7 | ||

| Manager Commentaries, Fund Characteristics and Schedules of Investments: |

||

| ASIA GROWTH AND INCOME STRATEGIES |

||

| 8 | ||

| 16 | ||

| ASIA GROWTH STRATEGIES |

||

| 22 | ||

| 28 | ||

| 34 | ||

| 42 | ||

| 48 | ||

| 54 | ||

| ASIA SMALL COMPANY STRATEGY |

||

| 60 | ||

| ASIA SPECIALTY STRATEGY |

||

| 66 | ||

| 72 | ||

The views and opinions in this report were current as of September 30, 2008. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Funds’ future investment intent.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Matthews Asia Funds are distributed by:

PFPC Distributors, Inc. | 760 Moore Road | King of Prussia, PA 19406

FROM THE INVESTMENT ADVISOR

Dear Valued Shareholders,

At a moment when markets worldwide are in a state of disarray and panic, we at Matthews would like to offer our thanks for your continued confidence and trust. We appreciate your focus on the long term and your ongoing support.

We are keenly aware of the cost of staying invested throughout the extreme swings of all market cycles, especially the current one. Most of our Funds have outperformed their respective benchmarks year-to-date, though this may be of little consequence when absolute losses have been so steep. However, those of you who have invested with us over longer horizons may recognize that we have seen similar conditions before, particularly during the financial crisis that swept through the Asian region a little over a decade ago. Our experience from that time leads us to believe the market’s current swing offers opportunities for those who pursue a disciplined, long-term investment process. Matthews has weathered such periods of distress before; now we will use the same approach, and aim to take advantage of the current conditions via the relatively attractive valuations they afford.

There is a cliché among investors that “cash is king.” This is because cash provides precious liquidity. It can buy capital resources, business options and even time. It serves as ballast in the storm. Nevertheless, the cliché is mistaken: confidence is the real king, and cash only its consort.

“There is a cliché among investors that ‘cash is king’… Nevertheless, the cliché is mistaken: confidence is the real king, and cash only its consort.”

The importance of confidence was never more apparent than during the third quarter, when many longstanding pillars of the U.S. financial system collapsed for lack of it. Fannie Mae, Freddie Mac, Lehman Brothers, American International Group: all had operated thinly capitalized businesses that could be sustained only as long as confidence was intact. Certainly, the poor liquidity and the narrow solvency of these institutions hastened their demise. These institutions managed to sustain their businesses for some time, and enjoyed market capitalizations worth billions until the very end. It was only when confidence waned that each of these companies collapsed overnight. Markets remain volatile as U.S. authorities continue to grapple with a solution that could restore the trust that has been so badly broken.

| 2 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

ASIA—FROM A FUNDAMENTAL PERSPECTIVE

As for the Asia Pacific region, it is grappling with the spillover shocks that have emanated from the U.S.-centric panic. From a fundamental perspective, the region and its financial architecture are quite healthy. The legacy of the financial crisis of 1997–1998 is still tangible in the region, especially in that most companies (and especially banks) have managed their balance sheets in such a way as to reduce leverage and preserve liquidity. Thus far, banks across the entire region have disclosed surprisingly low exposure to collateralized debt obligations (CDOs) and the like—about $25 billion in total (whereas the Swiss investment bank UBS disclosed $45 billion in losses alone).1

Fundamental analysis suggests that the Asian region is unlikely to suffer the same sort of balance sheet implosions that have undermined so many segments of the U.S. marketplace. Savings are high, and earnings in many segments of the market continue to grow, albeit at a more moderate pace than the past few years. Nonetheless, at this moment, fear has come to dominate markets; acting as a fundamental force in its own right. Companies with a pressing need for capital, but that lack access to it, may struggle in the coming months as banks around the world sort out the current confusion. Asian stock markets have reacted swiftly and without discrimination, reducing the valuations on large swathes of companies irrespective of their fundamental health. We intend to concentrate on those investments that we believe have sufficient resources to weather the current downturn, and whose share prices have been unduly affected along the way.

Asia’s economic growth will undoubtedly be hampered by a sharp decline in global growth, should one occur as most analysts now forecast. The region’s trade linkages with the rest of the world are far more diversified than they once were, but Asia is obviously not immune to a global slowdown. However, the macro environment is not wholly negative: just a few months ago, inflationary pressures were plaguing most countries in the region; now those same pressures have begun to subside. Most importantly, oil prices have come off sharply, offering a welcome reprieve to the region’s larger economies such as China, India and Korea, all of which are net-importers

| 1 | Bloomberg: WDCI function, 10/13/08 |

continued on page 4

| 800.789.ASIA [2742] matthewsasia.com | 3 |

MESSAGE TO SHAREHOLDERS

continued from page 3

of petroleum. Against this backdrop of greater price stability, and replete with high levels of domestic saving, Asian economies generally enjoy room to cut interest rates, ease domestic liquidity conditions, or in some cases, even engage in fiscal stimulus. Indeed, central banks in Australia, China, Hong Kong, India, Korea, Taiwan and New Zealand have already acted to increase domestic liquidity supplies by cutting interest rates or bank reserves, and additional measures may well follow.

Ultimately, we believe both the region’s fundamentals and the case for long-term investment remain intact, despite the current crisis. Perhaps the greatest threat the region faces is of a more subtle nature, one highlighted in some of our earlier letters: the growing risk of policy error on the part of local governments. Earlier in the year, some Asian leaders restricted trade activity or imposed selective price controls in reaction to higher inflation. While understandable, this response highlights the uneasy embrace that Asia has with free and open markets. The current financial crisis may only exacerbate the problem: for decades the U.S. capital markets have been the envy of nearly every finance minister in Asia, and many sought to emulate their success at home. Yet those markets have now been discredited, not least because of uneven regulation. It may provoke some in Asia to pause on the path toward more open markets. If this shift in attitude is combined with a major bout of global protectionism, it may set back the evolution of Asian markets for some time to come.

POSITIVE CHANGES

Yet still, there are many good reasons to hold out hope: China, the country arguably at the epicenter of such tensions, is bearing up best under the pressure. Regulators in the country have made what appears to be an unflagging commitment to further domestic financial market reforms, even amid a broader crisis. Meanwhile, the leadership continues to debate land reforms that have the potential to unlock much of the economic potential of the interior states, where the majority of the populace still resides in near abject poverty. China’s 800 million farmers have been constrained by relatively short usage rights of 30 years—extending these rights to 70 years and putting in place a formal legal infrastructure for transference and renting out land use rights would improve rural communities’ ability to derive an income from their land holdings. These possible measures are but part of a broader package that aims to double rural incomes in the next decade.

| 4 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

“Asia’s market capacities have expanded over the last decade, as evidenced by higher trading volumes, improved liquidity conditions and higher levels of issuance in primary markets.”

On investment performance: while we are disheartened by the declines in Asian stock markets, we are pleased that the relative performance of the Funds continues to hold steady. Notably, the Funds for the most part sidestepped the recent collapse in commodity and resource stocks. Philosophically, the Funds aim to stay invested across market cycles, and therefore prefer to target companies whose growth is more sustainable than is often the case in pro-cyclical industries. Also, we note that the performance of the Funds has been somewhat dispersed year-to-date, with the two income-oriented Funds offering greater insulation from the market’s recent volatility. This outcome is in keeping with our expectation, in that we have long felt that distinct strategies are capable of yielding differentiated results, even in “emerging markets.” Our goal has been to help investors capitalize on the growing breadth and depth of the Asia Pacific capital markets by offering a diverse range of strategies across the risk/reward spectrum.

Asia’s market capacities have expanded over the last decade, as evidenced by higher trading volumes, improved liquidity conditions and higher levels of issuance in primary markets. This added depth and breadth has meant, in our view, that private capital markets have achieved a newfound prominence in the region that is not likely to be derailed even by the current financial panic. In light of the new depth and capacity, Matthews undertook two initiatives during the third quarter: first, two of our Funds—the Matthews Asian Growth and Income Fund and the Matthews Pacific Tiger Fund—were re-opened to new investors. Second, Matthews launched a new fund that is dedicated to investment in Asia’s smaller companies. We feel that the growing breadth of private capital markets in the region may give investors access to a wider range of better quality companies. Meanwhile, smaller companies are likely to benefit from the emergence of private markets, as it means they are less dependent on government-linked banking systems for funding. For both of these reasons we are pleased to introduce the Matthews Asia Small Companies Fund. Commentary from the Fund’s managers can be found on page 60.

continued on page 6

| 800.789.ASIA [2742] matthewsasia.com | 5 |

MESSAGE TO SHAREHOLDERS

continued from page 5

Again, we appreciate your support and your focus on the long term. As always, we are honored to serve as your investment specialist in the Asia Pacific region, particularly at this challenging moment in global markets.

Sincerely,

|

|

| Andrew Foster |

| Acting Chief Investment Officer |

| Matthews International |

| Capital Management, LLC |

|

|

| Robert J. Horrocks, PhD |

| Director of Research |

| Matthews International |

| Capital Management, LLC |

|

|

| G. Paul Matthews |

| Chairman |

| Matthews International |

| Capital Management, LLC |

Matthews is pleased to announce the appointment of its new Director of Research, Robert J. Horrocks, who joined the firm in August. As Director of Research, Robert sets the research agenda for Matthews’ investment team and oversees the research process.

Robert was most recently Head of Research at Mirae Asset Management in Hong Kong, and from 2003 to 2006, he served as Chief Investment Officer for Everbright Pramerica in China, establishing its quantitative investment process. He started his career as a Research Analyst with WI Carr Securities in Hong Kong before moving on to spend eight years working in several different Asian jurisdictions for Schroders, including stints as Country General Manager in Taiwan, Deputy Chief Investment Officer in Korea and Designated Chief Investment Officer in Shanghai. Robert earned his PhD in Chinese Economic History from Leeds University in the United Kingdom and is fluent in Mandarin.

| 6 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

Market timing can disrupt the management of a Fund’s investment portfolio and cause the targeted Fund to incur costs to accommodate frequent buying and selling of shares by the market timer. These costs are borne by the Fund’s non-redeeming shareholders. As part of their efforts to discourage market timing activity, the Funds attempt to allocate these costs, to the extent permissible, to redeeming shareholders through the assessment of a redemption fee of 2.00% of the total redemption proceeds of shareholders who sell or exchange shares within 90 calendar days after purchasing them. This fee is payable directly to the Funds. For purposes of determining whether the redemption fee applies, the shares that have been held longest will be redeemed first. The Funds may grant exemptions from the redemption fee where the Funds believe the transaction or account will not involve market timing activity. The Funds reserve the right at any time to restrict purchases or exchanges or impose conditions that are more restrictive on excessive or disruptive trading, and to modify or eliminate the redemption fee at any time, without notice to shareholders. You will receive notice of any material changes to the Funds’ redemption fee policies. For more information on this policy, please see the Funds’ prospectus. Additional restrictions may apply to shareholders who purchase shares of the Funds through a financial intermediary; please consult your intermediary.

INVESTOR DISCLOSURE

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 1-800-789-ASIA [2742] or visit matthewsasia.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Investing in small companies is more risky and more volatile than investing in large companies. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Fund Holdings: The Fund holdings shown in this report are as of September 30, 2008. Holdings are subject to change at any time, so holdings shown in this report may not reflect current Fund holdings. The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is filed with the SEC within 60 days of the end of the quarter to which it relates, and is available on the SEC’s website at www.sec.gov. It may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting Record: The Funds’ Statement of Additional Information containing a description of the policies and procedures that the Funds have used to vote proxies relating to portfolio securities, along with each Fund’s proxy voting record relating to portfolio securities held during the 12-month period ended June 30, 2008, is available upon request, at no charge, at the Funds’ website at matthewsasia.com or by calling 1-800-789-ASIA [2742], or on the SEC’s website at www.sec.gov.

Shareholder Reports and Prospectuses: To reduce the Funds’ expenses, we try to identify related shareholders in a household and send only one copy of the Funds’ prospectus and financial reports to that address. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. At any time you may view the Funds’ current prospectus and financial reports on our website. If you prefer to receive individual copies of the Funds’ prospectus or financial reports, please call us at 1-800-789-ASIA [2742].

| 800.789.ASIA [2742] matthewsasia.com | 7 |

MATTHEWS ASIAN GROWTH AND INCOME FUND

| FUND OBJECTIVE AND STRATEGY | SYMBOL: MACSX |

Objective: Long-term capital appreciation. The Fund also seeks to provide some current income.

Strategy: Under normal market conditions, the Matthews Asian Growth and Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying equity securities and the convertible securities, of any duration or quality, of companies located in Asia. Asia includes China, Hong Kong, India, Indonesia, Japan, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

PORTFOLIO MANAGERS

| Lead Manager: Andrew T. Foster | Co-Manager: G. Paul Matthews |

PORTFOLIO MANAGER COMMENTARY

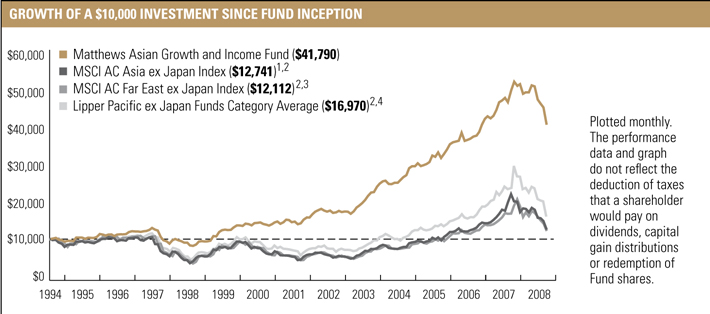

During the third quarter of 2008, the Matthews Asian Growth and Income Fund declined –13.70%, while its benchmark, the MSCI All Country Asia ex Japan Index fell –22.89%.

It has been a challenging year for the Fund, yet we believe the future may hold greater promise. Historically, the Fund has been oriented toward income-paying securities based on the belief that such holdings would insulate the Fund from volatility inherent in Asian markets. The sharp declines thus far this year have demonstrated some of the relative merit of this strategy, particularly as the Fund has held steadier than most prevailing benchmark indices in the region. Indeed, it has even outpaced some broader international benchmarks over longer horizons. However, the absolute declines in the Fund have been painful, and despite our efforts, the Fund’s performance at this time is reminiscent of the darker hours of the financial crisis that swept through the region a little over a decade ago.

NOW OPEN TO NEW INVESTORS

We are pleased to announce that the Matthews Asian Growth and Income Fund re-opened to new investors on September 2, 2008. For more information, please visit matthewsasia.com.

Even as the Fund has sought protection in income-producing securities, it has also sought meaningful exposure to the region’s long-term growth potential. For this reason, convertible bonds have played an important role in the Fund’s strategy: such instruments can offer equity participation on the upside, and bond-like protection on the downside. This characteristic, combined with the currency-protection such bonds typically afford (most are denominated in U.S. dollars), would generally make convertibles ideal for the Fund.

Ironically, year-to-date, convertibles have been of mixed benefit to our strategy. As credit markets around the world collapsed, spreads on convertible bonds expanded sharply and drove bond prices lower.

continued on page 11

| 8 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PERFORMANCE AS OF SEPTEMBER 30, 2008

| Average Annual Total Returns | |||||||||||||||||||||

| Fund inception: 9/12/94 |

3 MO | YTD | 1 YR | 3 YRS | 5 YRS | 10 YRS | SINCE INCEPTION |

||||||||||||||

| Matthews Asian Growth and Income Fund |

–13.70 | % | –20.63 | % | –18.18 | % | 6.72 | % | 13.26 | % | 17.70 | % | 10.72 | % | |||||||

| MSCI All Country Asia ex Japan Index1 |

–22.89 | % | –39.16 | % | –38.65 | % | 6.79 | % | 13.51 | % | 11.90 | % | 1.73 | %2 | |||||||

| MSCI All Country Far East ex Japan Index3 |

–23.78 | % | –37.66 | % | –38.70 | % | 6.26 | % | 12.69 | % | 11.64 | % | 1.37 | %2 | |||||||

| Lipper Pacific ex Japan Funds Category Average4 |

–21.91 | % | –37.22 | % | –35.36 | % | 6.25 | % | 13.39 | % | 12.68 | % | 3.62 | %2 | |||||||

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit matthewsasia.com.

| INCOME DISTRIBUTION HISTORY |

JUNE | DECEMBER | TOTAL | |||||||||

| 2008 |

24.82 | ¢ | N/A | N/A | ||||||||

| 2007 |

21.51 | ¢ | 68.91 | ¢ | 90.42 | ¢ | ||||||

| 2006 |

21.89 | ¢ | 39.85 | ¢ | 61.74 | ¢ | ||||||

| 1994–2005 |

$ | 1.88 | $ | 2.07 | $ | 3.95 | ||||||

For a history of the Fund’s distributions since its inception, visit matthewsasia.com.

FISCAL YEAR 2007 RATIOS

| Gross Operating Expense:5 1.15% |

Portfolio Turnover:6 27.93% |

| 1 |

The MSCI All Country Asia ex Japan Index is a free float–adjusted market capitalization–weighted index of the stock of markets of China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, and Thailand. The Fund invests in countries that are not included in the MSCI All Country Asia ex Japan Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC. |

| 2 |

Calculated from 8/31/94. |

| 3 |

The MSCI All Country Far East ex Japan Index is a free float–adjusted market capitalization–weighted index of the stock markets of China, Hong Kong, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand. The Fund invests in countries that are not included in the MSCI All Country Far East ex Japan Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC. |

| 4 |

The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

| 5 |

Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to the Advisor. Matthews Asia Funds do not charge 12b-1 fees. |

| 6 |

The lesser of fiscal year 2007 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| 800.789.ASIA [2742] matthewsasia.com | 9 |

MATTHEWS ASIAN GROWTH AND INCOME FUND

(NOW OPEN TO NEW INVESTORS)

TOP TEN HOLDINGS1

| COUNTRY | SECURITY TYPE | % OF NET ASSETS | |||||

| Taiwan Semiconductor Manufacturing Co., Ltd. |

Taiwan | Equity | 3.4 | % | |||

| Singapore Press Holdings, Ltd. |

Singapore | Equity | 3.1 | % | |||

| HSBC Holdings PLC |

United Kingdom | Equity | 3.0 | % | |||

| Hongkong Land CB 2005, Ltd., Cnv., 2.750%, 12/21/12 |

China/Hong Kong | Convertible Bond | 2.9 | % | |||

| Rafflesia Capital, Ltd., Cnv., 1.250%, 10/04/11 |

Malaysia | Convertible Bond | 2.7 | % | |||

| CLP Holdings, Ltd. |

China/Hong Kong | Equity | 2.7 | % | |||

| Cherating Capital, Ltd., Cnv., 2.000%, 07/05/12 |

Malaysia | Convertible Bond | 2.7 | % | |||

| SK Telecom Co., Ltd. |

South Korea | Equity | 2.5 | % | |||

| Advanced Info Service Public Co., Ltd. |

Thailand | Equity | 2.5 | % | |||

| Hang Seng Bank., Ltd. |

China/Hong Kong | Equity | 2.3 | % | |||

| % OF ASSETS IN TOP 10 |

27.8 | % |

COUNTRY ALLOCATION

| China/Hong Kong |

35.2 | % | |

| Singapore |

12.9 | % | |

| South Korea |

9.2 | % | |

| Taiwan |

9.1 | % | |

| India |

8.1 | % | |

| Malaysia |

6.9 | % | |

| Japan 2 |

4.6 | % | |

| Thailand |

4.5 | % | |

| United Kingdom 2 |

3.0 | % | |

| Australia 2 |

2.3 | % | |

| Philippines |

1.4 | % | |

| Indonesia |

1.3 | % | |

| Cash and other assets, less liabilities |

1.5 | % |

SECTOR ALLOCATION

| Financials | 25.1 | % | |

| Telecommunication Services | 18.1 | % | |

| Consumer Discretionary | 17.9 | % | |

| Information Technology | 11.4 | % | |

| Industrials | 9.3 | % | |

| Utilities | 6.9 | % | |

| Consumer Staples | 5.1 | % | |

| Health Care | 2.5 | % | |

| Energy | 2.2 | % | |

| Cash and other assets, less liabilities | 1.5 | % |

MARKET CAP EXPOSURE 3

| Large cap (over $5 billion) | 45.8 | % | |

| Mid cap ($1–$5 billion) | 35.9 | % | |

| Small cap (under $1 billion) | 16.8 | % | |

| Cash and other assets, less liabilities | 1.5 | % |

BREAKDOWN BY SECURITY

| Common Equities | 71.0 | % | |

| Convertible Bonds4 | 25.4 | % | |

| Preferred Equities | 2.1 | % | |

| Cash and other assets, less liabilities | 1.5 | % |

| NUMBER OF SECURITIES |

NAV |

FUND ASSETS |

REDEMPTION FEE |

12b-1 FEES | ||||

| 73 |

$15.12 | $1.5 billion | 2.00% within 90 calendar days | None |

| 1 |

Holdings may combine more than one security from same issuer and related depositary receipts. |

| 2 |

Japan, the United Kingdom and Australia are not included in the MSCI All Country Asia ex Japan Index. |

| 3 |

Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

| 4 |

Convertible bonds are not included in the MSCI All Country Asia ex Japan Index. |

| 10 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PORTFOLIO MANAGER COMMENTARY continued from page 8

Convertible bonds then suffered a second hit when most market regulators in the region banned the short-selling of many Asia-listed stocks. Such restrictions meant that arbitrageurs, who purchase convertibles while simultaneously shorting stocks, could not engage in their typical activity; the resulting decline in demand further hampered valuations on such bonds. In addition, many of the recently issued bonds were offered to investors at valuations that were hardly defensive—most had zero coupons, negligible yields and substantial equity premia. In our experience, such bonds typically do not offer much of a “bond floor” that would provide protection in a downturn. As a result, the Fund avoided such issues over the past few years, choosing instead to focus on higher-yielding common stocks.

Indeed, such common stocks have proved defensive thus far this year, as credit markets around the world have seized up amid the current financial panic. Several of the Fund’s best-performing positions year-to-date, such as Taiwan Semiconductor and HSBC, are simply large-capitalization issues with generous and sustainable dividend policies.

These conditions notwithstanding, the Fund has begun to move back into convertibles over the last quarter. Over the past few years, issuance of Asian convertibles accelerated sharply, offering a larger pool of potential bonds from which to invest. Given that convertible bond prices have retreated amid the general disarray of credit markets, attractive valuations have begun to emerge. For the first time in five years, convertibles are available to the Fund with double-digit yields and reasonable equity premia, issued by companies with relatively healthy fundamentals. This is particularly true of convertibles of Indian and Chinese origin, where precipitous declines have rendered valuations in those two markets more favorable. As painful as markets have been this year, we have grown more enthused as of late; at this juncture the Asian convertible bond market would appear to offer new potential for investors willing to hold for the long term.

| 800.789.ASIA [2742] matthewsasia.com | 11 |

MATTHEWS ASIAN GROWTH AND INCOME FUND

SCHEDULE OF INVESTMENTS a (UNAUDITED)

COMMON EQUITIES: 71.0%

| SHARES | VALUE | ||||

| CHINA/HONG KONG: 25.8% |

|||||

| CLP Holdings, Ltd. |

5,219,700 | $ | 42,105,998 | ||

| Hang Seng Bank, Ltd. |

1,849,600 | 34,965,065 | |||

| Café de Coral Holdings, Ltd. |

16,031,100 | 27,951,614 | |||

| Television Broadcasts, Ltd. |

6,568,000 | 27,891,102 | |||

| HongKong Electric Holdings, Ltd. |

4,176,000 | 26,229,328 | |||

| VTech Holdings, Ltd. |

4,331,300 | 25,333,090 | |||

| Vitasoy International Holdings, Ltd. |

50,051,000 | 21,904,765 | |||

| Next Media, Ltd. |

86,614,000 | 21,164,621 | |||

| Hang Lung Group, Ltd. |

6,586,000 | 20,862,064 | |||

| Hong Kong & China Gas Co., Ltd. |

8,553,490 | 19,525,178 | |||

| PCCW, Ltd. |

46,799,000 | 19,500,318 | |||

| BOC Hong Kong Holdings, Ltd. |

10,562,000 | 18,882,420 | |||

| Hang Lung Properties, Ltd. |

8,019,920 | 18,879,167 | |||

| Giordano International, Ltd. |

52,249,000 | 18,248,724 | |||

| ASM Pacific Technology, Ltd. |

2,986,800 | 17,263,611 | |||

| CITIC Pacific, Ltd. |

5,747,000 | 16,799,252 | |||

| I-CABLE Communications, Ltd.† |

129,832,000 | 15,262,569 | |||

| China-Hong Kong Photo Products Holdings, Ltd. |

14,998,003 | 954,469 | |||

| Other Investments |

3,224,095 | ||||

| Total China/Hong Kong |

396,947,450 | ||||

| SINGAPORE: 12.9% |

|||||

| Singapore Press Holdings, Ltd. |

16,866,500 | 47,057,095 | |||

| Ascendas REIT |

23,090,000 | 30,502,583 | |||

| DBS Group Holdings, Ltd. |

1,904,000 | 22,690,433 | |||

| Parkway Holdings, Ltd. |

15,419,093 | 20,424,994 | |||

| Fraser and Neave, Ltd. |

7,444,100 | 18,671,514 | |||

| Cerebos Pacific, Ltd. |

8,208,000 | 18,400,178 | |||

| Singapore Post, Ltd. |

24,105,000 | 16,113,182 | |||

| Parkway Life REIT |

20,436,110 | 13,893,710 | |||

| Yellow Pages Singapore, Ltd. |

6,423,000 | 1,743,376 | |||

| Other Investments |

9,446,333 | ||||

| Total Singapore |

198,943,398 | ||||

| TAIWAN: 9.1% |

|||||

| Taiwan Semiconductor Manufacturing Co., Ltd. |

28,737,469 | 48,193,653 | |||

| President Chain Store Corp. |

10,312,000 | 30,399,062 | |||

| Chunghwa Telecom Co., Ltd. ADR |

1,066,004 | 25,232,315 | |||

| Cathay Financial Holding Co., Ltd. |

12,905,240 | 17,820,188 | |||

| Cyberlink Corp. |

3,932,862 | 15,466,721 | |||

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR |

391,708 | 3,670,304 | |||

| Total Taiwan |

140,782,243 | ||||

| SOUTH KOREA: 5.1% |

|||||

| SK Telecom Co., Ltd. |

170,752 | 29,228,155 | |||

| Hana Financial Group, Inc. |

795,809 | 18,715,359 | |||

| KT Corp. ADR |

718,800 | 12,068,652 | |||

| SK Telecom Co., Ltd. ADR |

522,200 | 9,827,804 | |||

| Daehan City Gas Co., Ltd. |

280,300 | 7,222,625 | |||

| KT Corp. |

43,200 | 1,491,695 | |||

| Total South Korea |

78,554,290 | ||||

| JAPAN: 4.6% |

|||||

| Trend Micro, Inc. |

749,500 | 28,407,740 | |||

| Nippon Building Fund, Inc., REIT |

2,715 | 26,246,350 | |||

| Japan Real Estate Investment Corp., REIT |

1,911 | 15,420,548 | |||

| Total Japan |

70,074,638 | ||||

| 12 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

| SHARES | VALUE | ||||

| THAILAND: 4.5% |

|||||

| Advanced Info Service Public Co., Ltd. |

15,852,900 | $ | 38,074,349 | ||

| BEC World Public Co., Ltd. |

42,623,300 | 27,035,510 | |||

| Thai Reinsurance Public Co., Ltd. |

25,672,800 | 4,397,585 | |||

| Total Thailand |

69,507,444 | ||||

| UNITED KINGDOM: 3.0% |

|||||

| HSBC Holdings PLC ADR |

573,300 | 46,339,839 | |||

| Total United Kingdom |

46,339,839 | ||||

| AUSTRALIA: 2.3% |

|||||

| AXA Asia Pacific Holdings, Ltd. |

6,011,562 | 24,735,780 | |||

| Other Investments |

10,672,730 | ||||

| Total Australia |

35,408,510 | ||||

| PHILIPPINES: 1.4% |

|||||

| Globe Telecom, Inc. |

954,380 | 21,080,402 | |||

| Total Philippines |

21,080,402 | ||||

| INDONESIA: 1.3% |

|||||

| PT Telekomunikasi Indonesia ADR |

665,900 | 19,830,502 | |||

| Total Indonesia |

19,830,502 | ||||

| INDIA: 1.0% |

|||||

| Sun Pharmaceutical Industries, Ltd. |

470,814 | 15,049,857 | |||

| Total India |

15,049,857 | ||||

| TOTAL COMMON EQUITIES (Cost $1,057,807,728) |

1,092,518,573 | ||||

| PREFERRED EQUITIES: 2.1% |

|||||

| SOUTH KOREA: 2.1% |

|||||

| Hyundai Motor Co., Ltd., Pfd. |

566,280 | 11,200,052 | |||

| LG Household & Health Care, Ltd., Pfd. |

177,830 | 7,809,549 | |||

| Samsung Fire & Marine Insurance Co., Ltd., Pfd. |

119,550 | 7,041,078 | |||

| Hyundai Motor Co., Ltd., 2nd Pfd. |

305,760 | 6,598,642 | |||

| Total South Korea |

32,649,321 | ||||

| TOTAL PREFERRED EQUITIES (Cost $19,413,954) |

32,649,321 | ||||

See footnotes on page 15.

| 800.789.ASIA [2742] matthewsasia.com | 13 |

MATTHEWS ASIAN GROWTH AND INCOME FUND

SCHEDULE OF INVESTMENTS a (UNAUDITED) (continued)

INTERNATIONAL DOLLAR BONDS: 25.4%

| FACE AMOUNT | VALUE | ||||||

| CHINA/HONG KONG: 9.4% |

|||||||

| Hongkong Land CB 2005, Ltd., Cnv. |

|||||||

| 2.750%, 12/21/12 |

$ | 50,900,000 | $ | 44,333,900 | |||

| China Petroleum & Chemical Corp., (Sinopec), Cnv. |

|||||||

| 0.000%, 04/24/14 |

295,950,000 | b | 34,397,944 | ||||

| FU JI Food and Catering Services Holdings, Ltd., Cnv. |

|||||||

| 0.000%, 10/18/10 |

247,500,000 | b | 26,426,969 | ||||

| Yue Yuen Industrial Holdings, Ltd., Cnv. |

|||||||

| 0.000%, 11/17/11 |

177,190,000 | 21,678,526 | |||||

| Brilliance China Finance, Ltd., Cnv. |

|||||||

| 0.000%, 06/07/11 |

13,600,000 | 12,308,000 | |||||

| Other Investments |

5,601,700 | ||||||

| Total China/Hong Kong |

144,747,039 | ||||||

| INDIA: 7.1% |

|||||||

| Reliance Communications, Ltd., Cnv. |

|||||||

| 0.000%, 05/10/11 |

27,615,000 | 27,891,150 | |||||

| Tata Motors, Ltd., Cnv. |

|||||||

| 1.000%, 04/27/11 |

27,349,000 | 25,530,291 | |||||

| Rolta India, Ltd., Cnv. |

|||||||

| 0.000%, 06/29/12 |

22,116,000 | 19,572,660 | |||||

| Sintex Industries, Ltd., Cnv. |

|||||||

| 0.000%, 03/13/13 |

20,900,000 | 18,287,500 | |||||

| Financial Technologies India Ltd., Cnv. |

|||||||

| 0.000%, 12/21/11 |

17,960,000 | 17,555,900 | |||||

| Total India |

108,837,501 | ||||||

| MALAYSIA: 6.9% |

|||||||

| Rafflesia Capital, Ltd., Cnv. |

|||||||

| 1.250%,c 10/04/11 |

42,100,000 | 42,310,500 | |||||

| Cherating Capital, Ltd., Cnv. |

|||||||

| 2.000%, 07/05/12 |

44,900,000 | 41,487,600 | |||||

| Prime Venture Labuan, Ltd., Cnv. |

|||||||

| 1.000%, 12/12/08 |

11,170,000 | 11,770,387 | |||||

| YTL Power Finance Cayman, Ltd., Cnv. |

|||||||

| 0.000%, 05/09/10 |

11,000,000 | 11,412,500 | |||||

| Total Malaysia |

106,980,987 | ||||||

| SOUTH KOREA: 2.0% |

|||||||

| SK Telecom Co., Ltd., Cnv. |

|||||||

| 0.000%, 05/27/09 |

29,430,000 | 31,572,504 | |||||

| Total South Korea |

31,572,504 | ||||||

| TOTAL INTERNATIONAL DOLLAR BONDS (Cost $442,847,218) |

392,138,031 | ||||||

| 14 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

| VALUE | |||

| TOTAL INVESTMENTS: 98.5% (Cost $1,520,068,900d) |

$ | 1,517,305,925 | |

| CASH AND OTHER ASSETS, LESS LIABILITIES: 1.5% |

22,530,183 | ||

| NET ASSETS: 100.0% |

$ | 1,539,836,108 | |

| a | Certain securities were fair valued under the discretion of the Board of Trustees (Note A). |

| b | Face amount reflects principal in local currency. |

| c | Variable rate security. The rate represents the rate in effect at September 30, 2008. |

| d | Cost of investments is $1,520,068,900 and net unrealized depreciation consists of: |

| Gross unrealized appreciation |

$ | 164,163,879 | ||

| Gross unrealized depreciation |

(166,926,854 | ) | ||

| Net unrealized depreciation |

$ | (2,762,975 | ) | |

| † | Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) |

| ADR | American Depositary Receipt |

| Cnv. | Convertible |

| Pfd. | Preferred |

| REIT | Real Estate Investment Trust |

See accompanying notes to schedules of investments.

This portfolio data should not be relied upon as a complete listing of this Fund’s holdings, as information on particular holdings may have been withheld if it was in the Fund’s interest to do so.

| 800.789.ASIA [2742] matthewsasia.com | 15 |

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

| FUND OBJECTIVE AND STRATEGY | SYMBOL: MAPIX |

Objective: Total return with an emphasis on providing current income. Total return includes current income (dividends and distributions paid to shareholders) and capital gains (share price appreciation). The Fund measures total return over longer periods.

Strategy: Under normal market conditions, the Matthews Asia Pacific Equity Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying publicly traded common stocks, preferred stocks, convertible preferred stocks, and other equity-related instruments (including, for example, investment trusts and other financial instruments) of companies located in the Asia Pacific region, which includes Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

| PORTFOLIO MANAGERS |

||

| Lead Manager: Jesper Madsen, CFA |

Co-Manager: Andrew T. Foster |

PORTFOLIO MANAGER COMMENTARY

The Matthews Asia Pacific Equity Income Fund declined –12.30% during the third quarter of 2008, while its benchmark, the MSCI All Country Asia Pacific Index, fell –20.85%. In September, the Fund distributed its third quarterly dividend of 11.43 cents per share, bringing the total year-to-date income distribution to 24.82 cents per share.

Sir John Templeton, an astute contrarian and pioneer of international investing once said, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” During the past year, global equity markets have gone from a state of euphoria to one of pessimism bordering on depression as we entered into October. During the quarter, the focal point of anxiety in equity markets shifted from global inflationary pressures to the ongoing viability of the global financial system. While the epicenter of the credit crisis and its secondary effects on global economic growth have mainly resided in the U.S. and Europe, shares in Asian companies sold off as risk aversion rose. This was especially true for companies reliant on easy access to credit. However, long-term investors would be well served to pay more attention to the insights of Sir John Templeton than the daily gyrations of the stock ticker. As volatility increases, investors tend to shorten their investment horizon and question the rationale of their investments. However, falling equity markets, while painful in the short term, also represent periods of opportunity, especially for investors who can stomach the volatility and maintain a long-term time horizon.

Today, the investment universe of companies available to the Fund has greatly expanded compared to a year ago. The sell-off has allowed the Fund to consider and purchase shares in companies we deemed to be strong future dividend growers. These companies were previously not attractive due to demanding valuations. Another category of investment opportunity has involved companies that, in our opinion, had experienced selling in excess of

continued on page 19

| 16 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PERFORMANCE AS OF SEPTEMBER 30, 2008

| Average Annual Total Returns | ||||||||||||

| Fund inception: 10/31/06 |

3 MO | YTD | 1 YR | SINCE INCEPTION |

||||||||

| Matthews Asia Pacific Equity Income Fund |

–12.30 | % | –16.39 | % | –15.36 | % | 3.34 | % | ||||

| MSCI All Country Asia Pacific Index 1 |

–20.85 | % | –30.49 | % | –32.65 | % | –8.21 | % | ||||

| Lipper Pacific Region Funds Category Average 2 |

–22.14 | % | –31.34 | % | –33.48 | % | –7.67 | % | ||||

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit matthewsasia.com.

| INCOME DISTRIBUTION HISTORY |

Q1 | Q2 | Q3 | Q4 | TOTAL | ||||||||||

| 2008 |

5.86 | ¢ | 7.53 | ¢ | 11.43 | ¢ | N/A | N/A | |||||||

| 2007 |

— | 10.30 | ¢ | — | 17.12 | ¢ | 27.42 | ¢ | |||||||

| 2006 (Fund inception: 10/31/06) |

1.97 | ¢ | 1.97 | ¢ |

In March 2008, the Fund began to distribute investment income dividends on a quarterly rather than semiannual basis. For additional details regarding Fund distributions, visit www.matthewsfunds.com.

FISCAL YEAR 2007 RATIOS

| Gross Operating Expense: 3 1.41% | Portfolio Turnover:4 26.95% |

| 1 |

The MSCI All Country Asia Pacific Index is a free float–adjusted market capitalization–weighted index of the stock markets of Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. The Fund invests in countries that are not included in the MSCI All Country Asia Pacific Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC Global Investment Servicing (“PNC”), formerly known as PFPC Inc. |

| 2 |

The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

| 3 |

Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to Matthews International Capital Management (the “Advisor”). The Advisor has contractually agreed to waive fees and reimburse expenses to the extent needed to limit total annual operating expenses to 1.50% until October 31, 2009. Matthews Asia Funds do not charge 12b-1 fees. |

| 4 |

The lesser of fiscal year 2007 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| 800.789.ASIA [2742] matthewsasia.com | 17 |

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

TOP TEN HOLDINGS 1

| COUNTRY |

% OF NET ASSETS | ||||

| Taiwan Semiconductor Manufacturing Co., Ltd. |

Taiwan | 4.9 | % | ||

| Lawson, Inc. |

Japan | 3.8 | % | ||

| HSBC Holdings PLC |

United Kingdom | 3.6 | % | ||

| Chunghwa Telecom Co., Ltd. |

Taiwan | 3.4 | % | ||

| SK Telecom Co., Ltd. |

South Korea | 3.4 | % | ||

| Singapore Press Holdings, Ltd. |

Singapore | 3.1 | % | ||

| Globe Telecom, Inc. |

Philippines | 3.1 | % | ||

| Eisai Co., Ltd. |

Japan | 3.0 | % | ||

| VTech Holdings, Ltd. |

China/Hong Kong | 2.9 | % | ||

| Ito En, Ltd., Pfd. |

Japan | 2.8 | % | ||

| % OF ASSETS IN TOP 10 |

34.0 | % |

COUNTRY ALLOCATION

| Japan |

23.3 | % | |

| China/Hong Kong |

17.9 | % | |

| Taiwan |

15.4 | % | |

| Thailand |

8.2 | % | |

| Australia |

7.6 | % | |

| Singapore |

5.8 | % | |

| Malaysia |

5.7 | % | |

| South Korea |

4.4 | % | |

| United Kingdom 2 |

3.6 | % | |

| Philippines |

3.1 | % | |

| Indonesia |

2.5 | % | |

| India |

1.4 | % | |

| Cash and other assets, less liabilities |

1.1 | % | |

SECTOR ALLOCATION

| Financials | 20.9 | % | |

| Consumer Discretionary | 18.9 | % | |

| Information Technology | 15.6 | % | |

| Telecommunication Services | 14.6 | % | |

| Consumer Staples | 14.2 | % | |

| Health Care | 6.5 | % | |

| Utilities | 5.3 | % | |

| Industrials | 1.7 | % | |

| Energy | 1.2 | % | |

| Cash and other assets, less liabilities | 1.1 | % |

MARKET CAP EXPOSURE 3

| Large cap (over $5 billion) | 39.5 | % | |

| Mid cap ($1–$5 billion) | 33.2 | % | |

| Small cap (under $1 billion) | 26.3 | % | |

| Cash and other assets, less liabilities | 1.1 | % |

| NUMBER OF SECURITIES |

NAV | FUND ASSETS | REDEMPTION FEE | 12b-1 FEES | ||||

| 57 |

$9.79 | $91.8 million | 2.00% within 90 calendar days |

None |

| 1 |

Holdings may combine more than one security from same issuer and related depositary receipts. |

| 2 |

The United Kingdom is not included in the MSCI All Country Asia Pacific Index. |

| 3 |

Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

| 18 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PORTFOLIO MANAGER COMMENTARY continued from page 16

fundamentals. This was exemplified by the Fund’s addition of two Japanese real estate investment trusts (REITs), MID REIT and United Urban Investment Corp. The REIT sector in Japan, particularly REITs with a market capitalization of less than $1 billion, had experienced severe selling year-to-date due to concerns of an asset/liability mismatch in the funding of property purchases. In Japan, property acquisitions had mainly been financed with cheap short-term debt, which greatly increased refinancing risk, especially as previously abundant access to credit dried up. However, as a result of falling share prices, the dividend yield had increased to 11.9% and 7.8%, respectively, for the two REITs, representing a wide spread over the local 10-year government bond yield at 1.5%. Furthermore, both REITs had resolved their immediate financing needs and were trading below the value of their property portfolios.

The relative outperformance of the Fund vis-à-vis its benchmark during the first nine months of the year underscores the notion that when it comes to investing in the Asia Pacific region, just as in the U.S., strategy does matter. The Fund’s focus on companies with strong and sustainable cash flows, limited debt levels and growing dividends, offered some resilience even as selling of Asian equities in many cases appeared indiscriminate. Companies with less leverage and strong operational cash flows have less need to tap credit markets, insulating them somewhat from a lack of short-term credit to finance capital expenditures or meet short-term working capital needs. Importantly, it also provides funding for ongoing growth in dividend payments.

| 800.789.ASIA [2742] matthewsasia.com | 19 |

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

SCHEDULE OF INVESTMENTSa (UNAUDITED)

COMMON EQUITIES: 96.1%

| SHARES | VALUE | ||||

| JAPAN: 20.5% |

|||||

| Lawson, Inc. |

75,700 | $ | 3,490,926 | ||

| Eisai Co., Ltd. |

69,800 | 2,725,688 | |||

| The Sumitomo Trust & Banking Co., Ltd. |

383,000 | 2,551,716 | |||

| Benesse Corp. |

54,800 | 2,238,269 | |||

| Monex Group, Inc. |

4,594 | 1,663,934 | |||

| Nomura Research Institute, Ltd. |

67,000 | 1,378,948 | |||

| Takeda Pharmaceutical Co., Ltd. |

24,700 | 1,243,660 | |||

| Hitachi Koki Co., Ltd. |

108,000 | 1,101,335 | |||

| Tokyu REIT, Inc. |

155 | 1,007,624 | |||

| MID Reit, Inc. |

364 | 859,827 | |||

| United Urban Investment Corp., REIT |

125 | 548,108 | |||

| Total Japan |

18,810,035 | ||||

| CHINA/HONG KONG: 17.9% |

|||||

| VTech Holdings, Ltd. |

452,000 | 2,643,677 | |||

| CLP Holdings, Ltd. |

289,500 | 2,335,323 | |||

| BOC Hong Kong Holdings, Ltd. |

1,116,000 | 1,995,151 | |||

| Television Broadcasts, Ltd. |

432,000 | 1,834,494 | |||

| Café de Coral Holdings, Ltd. |

912,000 | 1,590,151 | |||

| ASM Pacific Technology, Ltd. |

242,000 | 1,398,752 | |||

| Sa Sa International Holdings, Ltd. |

4,094,000 | 1,219,763 | |||

| Pico Far East Holdings, Ltd. |

10,696,000 | 909,085 | |||

| Next Media, Ltd. |

3,466,000 | 846,937 | |||

| Hang Seng Bank, Ltd. |

32,600 | 616,274 | |||

| Huaneng Power International, Inc. H Shares |

836,000 | 555,812 | |||

| Huaneng Power International, Inc. ADR |

17,500 | 465,850 | |||

| Total China/Hong Kong |

16,411,269 | ||||

| TAIWAN: 15.4% |

|||||

| Taiwan Semiconductor Manufacturing Co., Ltd. |

2,411,313 | 4,043,849 | |||

| Chunghwa Telecom Co., Ltd. |

1,157,727 | 2,723,477 | |||

| Cyberlink Corp. |

540,339 | 2,124,986 | |||

| Taiwan Secom Co., Ltd. |

1,086,000 | 1,568,066 | |||

| President Chain Store Corp. |

485,000 | 1,429,746 | |||

| Johnson Health Tech Co., Ltd. |

1,216,860 | 1,379,052 | |||

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR |

50,339 | 471,677 | |||

| Chunghwa Telecom Co., Ltd. ADR |

18,000 | 426,060 | |||

| Total Taiwan |

14,166,913 | ||||

| THAILAND: 8.2% |

|||||

| Advanced Info Service Public Co., Ltd. |

810,600 | 1,946,841 | |||

| Siam Makro Public Co., Ltd. |

760,000 | 1,848,979 | |||

| Thai Beverage Public Co., Ltd. |

10,200,000 | 1,596,406 | |||

| Thai Tap Water Supply Public Co., Ltd.b |

12,129,500 | 1,533,203 | |||

| PTT Public Co., Ltd. |

91,500 | 627,997 | |||

| Total Thailand |

7,553,426 | ||||

| AUSTRALIA: 7.6% |

|||||

| Billabong International, Ltd. |

185,951 | 2,076,368 | |||

| Coca-Cola Amatil, Ltd. |

309,730 | 2,067,997 | |||

| AXA Asia Pacific Holdings, Ltd. |

413,439 | 1,701,178 | |||

| Insurance Australia Group, Ltd. |

330,121 | 1,095,763 | |||

| Total Australia |

6,941,306 | ||||

| SINGAPORE: 5.8% |

|||||

| Singapore Press Holdings, Ltd. |

1,036,000 | 2,890,413 | |||

| Venture Corp., Ltd. |

275,000 | 1,496,135 | |||

| Parkway Life REIT |

1,430,868 | 972,791 | |||

| Total Singapore |

5,359,339 | ||||

| 20 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

| SHARES | VALUE | ||||

| MALAYSIA: 5.7% |

|||||

| Top Glove Corp. BHD |

1,757,100 | $ | 2,049,517 | ||

| Public Bank BHD |

676,000 | 1,974,946 | |||

| Media Prima BHD |

3,235,900 | 1,236,433 | |||

| Total Malaysia |

5,260,896 | ||||

| SOUTH KOREA: 4.4% |

|||||

| SK Telecom Co., Ltd. |

10,570 | 1,809,300 | |||

| SK Telecom Co., Ltd. ADR |

69,300 | 1,304,226 | |||

| Hana Financial Group, Inc. |

37,640 | 885,195 | |||

| Total South Korea |

3,998,721 | ||||

| UNITED KINGDOM: 3.6% |

|||||

| HSBC Holdings PLC ADR |

26,900 | 2,174,327 | |||

| HSBC Holdings PLC |

70,800 | 1,130,732 | |||

| Total United Kingdom |

3,305,059 | ||||

| PHILIPPINES: 3.1% |

|||||

| Globe Telecom, Inc. |

130,560 | 2,883,817 | |||

| Total Philippines |

2,883,817 | ||||

| INDONESIA: 2.5% |

|||||

| PT Telekomunikasi Indonesia ADR |

55,200 | 1,643,856 | |||

| PT Telekomunikasi Indonesia |

859,000 | 641,613 | |||

| Total Indonesia |

2,285,469 | ||||

| INDIA: 1.4% |

|||||

| HCL-Infosystems, Ltd. |

340,167 | 765,554 | |||

| Chennai Petroleum Corp., Ltd. |

105,000 | 483,759 | |||

| Total India |

1,249,313 | ||||

| TOTAL COMMON EQUITIES (Cost $103,102,981) |

88,225,563 | ||||

| PREFERRED EQUITIES: 2.8% | |||||

| JAPAN: 2.8% |

|||||

| Ito En, Ltd., Pfd. |

246,700 | 2,570,657 | |||

| Total Japan |

2,570,657 | ||||

| TOTAL PREFERRED EQUITIES (Cost $2,711,890) |

2,570,657 | ||||

| TOTAL INVESTMENTS: 98.9% (Cost $105,814,871c) |

90,796,220 | ||||

| CASH AND OTHER ASSETS, |

|||||

| LESS LIABILITIES: 1.1% |

967,466 | ||||

| NET ASSETS: 100.0% |

$ | 91,763,686 | |||

| a | Certain securities were fair valued under the discretion of the Board of Trustees (Note A). |

| b | Non–income producing security |

| c | Cost of investments is $105,814,871 and net unrealized depreciation consists of: |

| Gross unrealized appreciation |

$ | 2,980,673 | ||

| Gross unrealized depreciation |

(17,999,324 | ) | ||

| Net unrealized depreciation |

$ | (15,018,651 | ) | |

| ADR | American Depositary Receipt |

| Pfd. | Preferred |

| REIT | Real Estate Investment Trust |

See accompanying notes to schedules of investments.

| 800.789.ASIA [2742] matthewsasia.com | 21 |

| FUND OBJECTIVE AND STRATEGY |

SYMBOL: MPACX |

Objective: Long-term capital appreciation.

Strategy: Under normal market conditions, the Matthews Asia Pacific Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Asia Pacific region. The Asia Pacific region includes Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. The Fund may also invest in the convertible securities, of any duration or quality, of Asia Pacific companies.

PORTFOLIO MANAGERS

| Lead Manager: Taizo Ishida | Co-Manager: Sharat Shroff, CFA |

PORTFOLIO MANAGER COMMENTARY

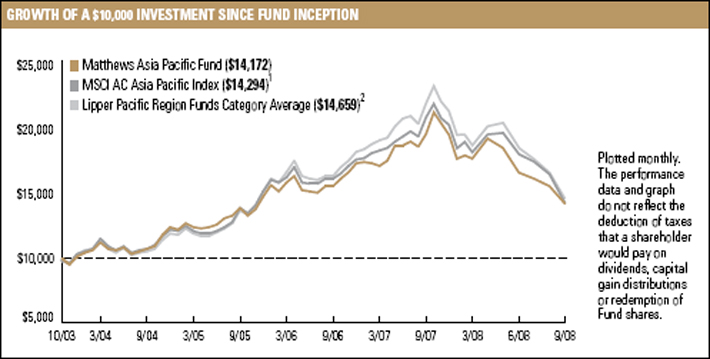

For the three months ending September 30, 2008, the Matthews Asia Pacific Fund declined –15.04%, while its benchmark, the MSCI All Country Asia Pacific Index, fell –20.85%.

One of the more dramatic developments during the quarter was the collapse of high-yielding currencies, notably Australian and New Zealand dollars, in the Asia Pacific region. The decline was triggered by similar problems to those in the U.S. and a slower economy as a result of weak commodity prices. In theory, lower commodity prices should benefit Asian manufacturers. However, this weakens the buying power of commodity-producing countries, which have become favored trading destinations for Asian companies this year. The economic slowdown in Europe also hurt Asian exports. However, one positive impact we saw this quarter was a decline in inflation, which had been the biggest issue in the first half of the year.

By sector, consumer staples and health care positively contributed to performance. The Fund’s limited exposure to commodities helped performance as the energy and materials sectors were the market’s worst performers.

During the third quarter, the Fund benefited from good stock selection across the region. Our bottom-up analysis helped the portfolio during the quarter as our tendency is to own companies with strong balance sheets and positive free cash flows. These were useful in weathering the global financial storm on a relative basis. The largest contributor to the Fund was baby care company Pigeon, a small-cap firm with growing penetration in the high-end Chinese baby product market. Unicharm PetCare, a specialty pet care product company for cats and dogs only, also significantly helped Fund performance. The company is one of the few growth companies in Japan’s consumer staples sector that has had significant pricing power. This has come from the strength of its products as well as a series of innovative new product launches.

continued on page 25

| 22 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PERFORMANCE AS OF SEPTEMBER 30, 2008

| Average Annual Total Returns | |||||||||||||||

| Fund inception: 10/31/03 |

3 MO | YTD | 1 YR | 3 YRS | SINCE INCEPTION |

||||||||||

| Matthews Asia Pacific Fund |

–15.04 | % | –28.11 | % | –28.61 | % | 0.29 | % | 7.35 | % | |||||

| MSCI All Country Asia Pacific Index 1 |

–20.85 | % | –30.49 | % | –32.65 | % | 0.39 | % | 7.53 | % | |||||

| Lipper Pacific Region Funds Category Average 2 |

–22.14 | % | –31.34 | % | –33.48 | % | 1.46 | % | 7.96 | % | |||||

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit matthewsasia.com.

FISCAL YEAR 2007 RATIOS

| Gross Operating Expense: 3 1.20% |

Portfolio Turnover: | 4 | 40.49 | % |

| 1 |

The MSCI All Country Asia Pacific Index is a free float–adjusted market capitalization–weighted index of the stock markets of Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC. |

| 2 |

The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

| 3 |

Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to the Advisor. Matthews Asia Funds do not charge 12b-1 fees. |

| 4 |

The lesser of fiscal year 2007 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| 800.789.ASIA [2742] matthewsasia.com | 23 |

MATTHEWS ASIA PACIFIC FUND

| TOP TEN HOLDINGS1

|

COUNTRY | % OF NET ASSETS | |||

| Pigeon Corp. |

Japan | 3.5 | % | ||

| Unicharm Petcare Corp. |

Japan | 3.2 | % | ||

| Benesse Corp. |

Japan | 3.0 | % | ||

| Ichiyoshi Securities Co., Ltd. |

Japan | 3.0 | % | ||

| Nintendo Co., Ltd. |

Japan | 2.9 | % | ||

| Sysmex Corp. |

Japan | 2.6 | % | ||

| Tingyi (Cayman Islands) Holding Corp. |

China/Hong Kong | 2.6 | % | ||

| Sun Pharmaceutical Industries, Ltd. |

India | 2.4 | % | ||

| Kingdee International Software Group Co., Ltd. |

China/Hong Kong | 2.3 | % | ||

| Funai Zaisan Consultants Co., Ltd. |

Japan | 2.2 | % | ||

| % OF ASSETS IN TOP 10 |

27.7 | % |

COUNTRY ALLOCATION

| Japan |

47.7 | % | |

| China/Hong Kong |

25.9 | % | |

| India |

7.0 | % | |

| South Korea |

5.1 | % | |

| Australia |

4.2 | % | |

| Thailand |

3.6 | % | |

| Indonesia |

2.5 | % | |

| Taiwan |

2.3 | % | |

| Singapore |

1.9 | % | |

| Liabilities in excess of cash and other assets |

–0.2 | % |

SECTOR ALLOCATION

| Financials |

33.9 | % | |

| Information Technology |

17.5 | % | |

| Consumer Discretionary |

14.3 | % | |

| Consumer Staples |

13.0 | % | |

| Health Care |

8.6 | % | |

| Industrials |

7.5 | % | |

| Telecommunication Services |

4.2 | % | |

| Materials |

1.2 | % | |

| Liabilities in excess of cash and other assets |

–0.2 | % | |

MARKET CAP EXPOSURE 2

| Large cap (over $5 billion) |

49.5 | % | |

| Mid cap ($1–$5 billion) |

26.5 | % | |

| Small cap (under $1 billion) |

24.1 | % | |

| Liabilities in excess of cash and other assets |

–0.2 | % |

| NUMBER OF SECURITIES |

NAV |

FUND ASSETS |

REDEMPTION FEE |

12b-1 FEES | ||||

| 70 |

$12.43 | $271.4 million | 2.00% within 90 calendar days |

None |

| 1 |

Holdings may combine more than one security from same issuer and related depositary receipts. |

| 2 |

Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

| 24 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PORTFOLIO MANAGER COMMENTARY continued from page 22

While the Fund has traditionally owned some of the region’s notable blue chip companies, such as Toyota Motor and Samsung Electronics, we are now focusing on identifying companies with faster growth potential that capitalize on the increased buying power of Asian consumers. This has led us to explore mid-cap companies in more depth. For example, during the quarter, the Fund increased its position in Kingdee International Software, a Chinese information technology company with dominant market share in the small and medium enterprise (SME) space. In addition, we began reducing the number of holdings in the Fund to increase the concentration of the portfolio.

One of the potential risks we see for 2009 is that growth expectations still seem high, both in terms of metrics such as GDP and in company earnings. We believe the current low valuations should more than offset those risk factors; however, growth expectations remain unrealistically high and that may cause downward earnings revisions. Unlike the Western world, Asia is not significantly leveraged and company fundamentals still appear healthy, in our opinion. As the West deleverages, one would expect a much slower recovery in the real economy. Though Asia has not been immune from the global downturn, we remain excited about the opportunities for investing in good businesses in the Asia Pacific region.

| 800.789.ASIA [2742] matthewsasia.com | 25 |

MATTHEWS ASIA PACIFIC FUND

SCHEDULE OF INVESTMENTSa (UNAUDITED)

COMMON EQUITIES: 100.2%

| SHARES | VALUE | ||||

| JAPAN: 47.7% |

|||||

| Pigeon Corp. |

334,300 | $ | 9,426,069 | ||

| Unicharm Petcare Corp. |

290,700 | 8,712,890 | |||

| Benesse Corp. |

201,100 | 8,213,795 | |||

| Ichiyoshi Securities Co., Ltd. |

764,900 | 8,022,241 | |||

| Nintendo Co., Ltd. |

18,800 | 7,974,467 | |||

| Sysmex Corp. |

159,800 | 7,061,715 | |||

| Funai Zaisan Consultants Co., Ltd.† |

7,081 | 5,861,171 | |||

| Yahoo! Japan Corp. |

17,612 | 5,765,593 | |||

| GCA Savvian Group Corp. |

2,007 | 5,579,104 | |||

| The Sumitomo Trust & Banking Co., Ltd. |

748,000 | 4,983,509 | |||

| Nidec Corp. |

79,500 | 4,890,739 | |||

| Takeda Pharmaceutical Co., Ltd. |

95,600 | 4,813,517 | |||

| ORIX Corp. |

37,950 | 4,751,646 | |||

| Daibiru Corp. |

598,700 | 4,515,203 | |||

| Nomura Research Institute, Ltd. |

208,900 | 4,299,435 | |||

| Honda Motor Co., Ltd. ADR |

131,400 | 3,956,454 | |||

| Fanuc, Ltd. |

47,500 | 3,573,511 | |||

| Sumitomo Realty & Development Co., Ltd. |

162,000 | 3,528,154 | |||

| Sekisui House, Ltd. |

383,000 | 3,516,333 | |||

| Keyence Corp. |

16,300 | 3,251,575 | |||

| Mitsubishi Estate Co., Ltd. |

162,000 | 3,192,234 | |||

| Nitto Denko Corp. |

123,500 | 3,141,915 | |||

| NGK Insulators, Ltd. |

216,000 | 2,644,365 | |||

| Mori Trust Sogo REIT, Inc. |

308 | 2,361,385 | |||

| Monex Group, Inc. |

6,094 | 2,207,229 | |||

| Hoya Corp. |

97,300 | 1,930,216 | |||

| Sony Corp. ADR |

44,000 | 1,358,280 | |||

| Total Japan |

129,532,745 | ||||

| CHINA/HONG KONG: 25.9% |

|||||

| Tingyi (Cayman Islands) Holding Corp. |

5,998,000 | 7,007,303 | |||

| Kingdee International Software Group Co., Ltd. |

32,406,000 | 6,247,171 | |||

| Dongfeng Motor Group Co., Ltd. H Shares |

14,558,000 | 5,357,845 | |||

| China Life Insurance Co., Ltd. H Shares |

1,367,000 | 5,092,566 | |||

| Ctrip.com International, Ltd. ADR |

120,400 | 4,648,644 | |||

| China Mobile, Ltd. ADR |

92,000 | 4,607,360 | |||

| Dairy Farm International Holdings, Ltd. |

891,000 | 4,483,197 | |||

| Hang Lung Group, Ltd. |

1,379,000 | 4,368,173 | |||

| Lenovo Group, Ltd. |

8,928,000 | 3,940,425 | |||

| Shangri-La Asia, Ltd. |

2,556,000 | 3,661,874 | |||

| China Merchants Bank Co., Ltd. H Shares |

1,459,500 | 3,524,540 | |||

| Ping An Insurance (Group) Co. of China, Ltd. H Shares |

574,000 | 3,361,324 | |||

| China South Locomotive and Rolling Stock Corp., H Sharesb |

8,334,900 | 3,166,572 | |||

| China Vanke Co., Ltd. B Shares |

4,109,922 | 2,891,056 | |||

| China Merchants Holdings International Co., Ltd. |

848,000 | 2,720,156 | |||

| China Yurun Food Group, Ltd. |

1,659,000 | 2,163,304 | |||

| Other Investments |

2,890,612 | ||||

| Total China/Hong Kong |

70,132,122 | ||||

| INDIA: 7.0% |

|||||

| Sun Pharmaceutical Industries, Ltd. |

201,218 | 6,432,056 | |||

| HDFC Bank, Ltd. |

221,500 | 5,823,404 | |||

| Bharti Airtel, Ltd.b |

205,528 | 3,486,049 | |||

| Dabur India, Ltd. |

736,185 | 1,446,755 | |||

| Infosys Technologies, Ltd. |

47,503 | 1,444,686 | |||

| Financial Technologies India, Ltd. |

20,015 | 448,947 | |||

| Total India |

19,081,897 | ||||

| 26 |

MATTHEWS ASIA FUNDS |

SEPTEMBER 30, 2008

| SHARES | VALUE | |||||

| SOUTH KOREA: 5.1% |

||||||

| Shinhan Financial Group Co., Ltd. |

113,517 | $ | 4,061,366 | |||

| NHN Corp.b |

20,470 | 2,625,734 | ||||

| Amorepacific Corp. |

4,091 | 2,212,047 | ||||

| Hanmi Pharmaceutical Co., Ltd. |

22,170 | 2,184,691 | ||||

| Hyundai Department Store Co., Ltd. |

17,652 | 1,372,575 | ||||

| Kiwoom Securities Co., Ltd. |

29,370 | 719,659 | ||||

| Other Investments |

664,711 | |||||

| Total South Korea |

13,840,783 | |||||

| AUSTRALIA: 4.2% |

||||||

| AXA Asia Pacific Holdings, Ltd. |

1,227,841 | 5,052,199 | ||||

| Computershare, Ltd. |

437,302 | 3,305,885 | ||||

| CSL Australia, Ltd. |

96,188 | 2,914,008 | ||||

| Total Australia |

11,272,092 | |||||

| THAILAND: 3.6% |

||||||

| Land & Houses Public Co., Ltd. |

19,564,700 | 3,712,727 | ||||

| Advanced Info Service Public Co., Ltd. |

1,329,800 | 3,193,818 | ||||

| Siam Commercial Bank Public Co., Ltd. |

1,264,400 | 2,609,884 | ||||

| Major Cineplex Group Public Co., Ltd. |

1,255,000 | 359,380 | ||||

| Total Thailand |

9,875,809 | |||||

| INDONESIA: 2.5% |

||||||

| Bank Rakyat Indonesia |

6,988,500 | 3,948,464 | ||||

| PT Astra International |

1,578,000 | 2,814,774 | ||||

| Total Indonesia |

6,763,238 | |||||

| TAIWAN: 2.3% |

||||||

| Taiwan Secom Co., Ltd. |

3,348,160 | 4,834,379 | ||||

| Taiwan Semiconductor Manufacturing Co., Ltd. |

846,135 | 1,418,995 | ||||

| Total Taiwan |

6,253,374 | |||||

| SINGAPORE: 1.9% |

||||||

| Hyflux, Ltd. |

1,937,812 | 3,291,601 | ||||

| Keppel Land, Ltd. |

951,000 | 1,899,446 | ||||

| Total Singapore |

5,191,047 | |||||

| TOTAL INVESTMENTS:100.2% (Cost $309,094,394c) |

271,943,107 | |||||

| LIABILITIES IN EXCESS OF CASH AND OTHER ASSETS: – 0.2% |

(547,944 | ) | ||||

| NET ASSETS: 100.0% |

$ | 271,395,163 | ||||

| a | Certain securities were fair valued under the discretion of the Board of Trustees (Note A). |

| b | Non–income producing security |

| c | Cost of investments is $309,094,394 and net unrealized depreciation consists of: |

| Gross unrealized appreciation |

$ | 29,692,698 | ||

| Gross unrealized depreciation |

(66,843,985 | ) | ||

| Net unrealized depreciation |

$ | (37,151,287 | ) | |

| † | Affiliated issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) |

| ADR | American Depositary Receipt |

See accompanying notes to schedules of investments.

This portfolio data should not be relied upon as a complete listing of this Fund’s holdings, as information on particular holdings may have been withheld if it was in the Fund’s interest to do so.

| 800.789.ASIA [2742] matthewsasia.com | 27 |

| FUND OBJECTIVE AND STRATEGY |

SYMBOL: MAPTX |

Objective: Long-term capital appreciation.

Strategy: Under normal market conditions, the Matthews Pacific Tiger Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in Asia, excluding Japan, which includes China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

PORTFOLIO MANAGERS

| Lead Managers: Richard H. Gao and Sharat Shroff, CFA | Co-Manager: Mark W. Headley |

PORTFOLIO MANAGER COMMENTARY

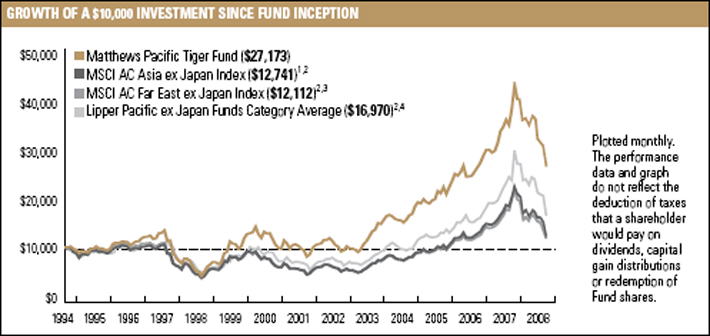

For the quarter ending September 30, 2008, the Matthews Pacific Tiger Fund declined –16.53%, while the MSCI All Country Asia ex Japan Index fell –22.89%. Steady stock performance in the consumer staples industry, and positive contributions from Indian financials helped the relative performance of the portfolio.

The third quarter’s returns were characterized by considerable weakness in some Asian currencies, most notably the Indian rupee and Korean won, which depreciated by 9% and 15%, respectively. In Thailand, political uncertainties were also an important factor behind the negative returns for the Fund.

In recent months, fears over a collapse in growth and a squeeze in liquidity have overshadowed earlier concerns over rising inflation for the Asia ex-Japan region. The shorter-term supply of capital has been impacted due to global events. That said, Asia’s financial institutions seem well capitalized after undergoing a process of deleveraging that started in the late 1990s. If anything, the recent squeeze is likely to further help refine the pricing of credit, although it will also expose those business models that have come from easy money. With improvements to the pricing of credit, there will be an opportunity for well-run banks to generate returns by extending loans to both companies and consumers in the longer term. The Fund has taken advantage of the broad-based weakness in financials to add to some of its holdings, especially where we have a strong conviction in the strength of a bank’s deposit franchise.

As we have discussed before, we expect that there will be a moderation in growth in the region, particularly as export markets around the world witness demand destruction. The portfolio is geared toward

NOW OPEN TO NEW INVESTORS

We are pleased to announce that the Matthews Pacific Tiger Fund re-opened to new investors on September 2, 2008. For more information, please visit matthewsasia.com.

continued on page 31

| 28 |

MATTHEWS ASIA FUNDS |

ALL DATA IS AS OF SEPTEMBER 30, 2008, UNLESS OTHERWISE NOTED

PERFORMANCE AS OF SEPTEMBER 30, 2008

| Average Annual Total Returns | |||||||||||||||||||||

| Fund Inception: 9/12/94 |

3 MO | YTD | 1 YR | 3 YRS | 5 YRS | 10 YRS | SINCE INCEPTION |

||||||||||||||

| Matthews Pacific Tiger Fund |

–16.53 | % | –32.56 | % | –29.48 | % | 6.60 | % | 14.74 | % | 18.52 | % | 7.37 | % | |||||||

| MSCI All Country Asia ex Japan Index 1 |

–22.89 | % | –39.16 | % | –38.65 | % | 6.79 | % | 13.51 | % | 11.90 | % | 1.73 | %2 | |||||||

| MSCI All Country Far East ex Japan Index 3 |

–23.78 | % | –37.66 | % | –38.70 | % | 6.26 | % | 12.69 | % | 11.64 | % | 1.37 | %2 | |||||||

| Lipper Pacific ex Japan Funds Category Average 4 |

–21.91 | % | –37.22 | % | –35.36 | % | 6.25 | % | 13.39 | % | 12.68 | % | 3.62 | %2 | |||||||

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit matthewsasia.com.

FISCAL YEAR 2007 RATIOS

| Gross Operating Expense: 5 1.10% |

Portfolio Turnover:6 24.09% | |||

| 1 |