|

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

|

x

|

|

|

Pre-Effective

Amendment No.

|

o

|

|

|

Post-Effective

Amendment No. 41

|

x

|

|

|

and/or

|

||

|

REGISTRATION

STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

x

|

|

|

Amendment

No. 44

|

Copies To:

|

¨

|

immediately upon filing pursuant to

paragraph (b)

|

|

¨

|

on ____________ pursuant to paragraph

(b)

|

|

¨

|

60 days after filing pursuant to paragraph

(a)(1)

|

|

x

|

on October 29, 2010 pursuant to paragraph

(a)(1)

|

|

¨

|

75 days after filing pursuant to paragraph

(a)(2)

|

|

¨

|

on _____________ pursuant to paragraph

(a)(2) of Rule 485.

|

If appropriate, check the following box:

|

|

¨

|

This

post-effective amendment designates a new effective date for a previously

filed post-effective amendment.

|

|

Matthews

Asia Funds

|

|

PROSPECTUS

|

INSTITUTIONAL

CLASS SHARES

|

|

October

[__], 2010

|

ASIAN

GROWTH AND INCOME FUND (___)

|

|

ASIA

DIVIDEND FUND (___)

|

|

|

CHINA

DIVIDEND FUND (___)

|

|

|

ASIA

PACIFIC FUND (___)

|

|

|

PACIFIC

TIGER FUND (___)

|

|

|

CHINA

FUND (___)

|

|

|

INDIA

FUND (___)

|

|

|

JAPAN

FUND (___)

|

|

|

KOREA

FUND (___)

|

|

|

ASIA

SMALL COMPANIES FUND (___)

|

|

|

ASIA

SCIENCE AND TECHNOLOGY FUND (___)

|

|

|

mamatthewsasia.com

|

|

|

The

U.S. Securities and Exchange Commission (the “SEC”) has not approved or

disapproved the Funds. Also, the SEC has not passed upon the adequacy or

accuracy of this prospectus. Anyone who informs you otherwise is

committing a

crime.

|

|

FUND

SUMMARIES

|

|

|

ASIA

GROWTH AND INCOME STRATEGIES

|

|

|

Matthews

Asian Growth and Income Fund

|

3

|

|

Matthews

Asia Dividend Fund

|

7

|

|

Matthews

China Dividend Fund

|

11

|

|

ASIA

GROWTH STRATEGIES

|

|

|

Matthews

Asia Pacific Fund

|

15

|

|

Matthews

Pacific Tiger Fund

|

18

|

|

Matthews

China Fund

|

21

|

|

Matthews

India Fund

|

25

|

|

Matthews

Japan Fund

|

28

|

|

Matthews

Korea Fund

|

31

|

|

ASIA

SMALL COMPANY STRATEGY

|

|

|

Matthews

Asia Small Companies Fund

|

35

|

|

ASIA

SPECIALTY STRATEGY

|

|

|

Matthews

Asia Science and Technology Fund

|

39

|

|

Additional

Fund Information

|

55

|

|

Important

Information

|

|

|

Financial

Highlights

|

|

|

Investment

Objectives of the Funds

|

55 |

|

Investment

Strategies

|

|

|

Risks

of Investing in the Funds

|

57

|

|

Management

of the Funds

|

68

|

|

Investing

in the Matthews Asia Funds

|

73

|

|

Pricing

of Fund Shares

|

73

|

|

Purchasing

Shares

|

74

|

|

Exchanging

Shares

|

78

|

|

Selling

(Redeeming) Shares

|

78

|

|

Market

Timing Activities and Redemption Fees

|

80

|

|

Other

Shareholder Information

|

80

|

|

Index

Definitions

|

84 |

|

General

Information

|

85

|

|

Privacy

Statement

|

86

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

||

|

Management

Fees

|

0.69%

|

|

|

Distribution

(12b-1) Fees

|

None

|

|

|

Other

Expenses

|

[0.__]%

|

|

|

Administration

and Shareholder Servicing

Fees [0.__]%

|

||

|

Total Annual Operating

Expenses

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

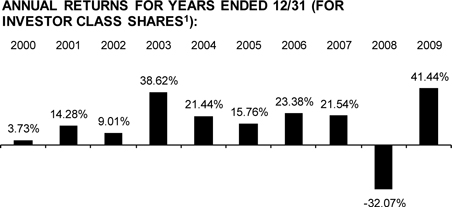

Best

Quarter

|

|

|

Q2

2009

|

21.57%

|

|

|

Worst

Quarter

|

||

|

Q3

2008

|

–14.41%

|

|

SINCE

INCEPTION

|

||||||||

|

1 YEAR

|

5 YEARS

|

10 YEARS

|

(9/12/94 Fund)

(8/31/94 Indices)

|

|||||

|

Matthews

Asian Growth and Income Fund1

|

||||||||

|

Return

before taxes

|

41.44%

|

10.77%

|

13.76%

|

11.18%

|

||||

|

Return

after taxes on distributions2

|

40.35%

|

8.89%

|

11.53%

|

8.83%

|

||||

|

Return

after taxes on distributions and sale of Fund shares2

|

27.23%

|

8.94%

|

11.16%

|

8.59%

|

||||

|

MSCI

All Country Asia ex Japan Index

|

72.53%

|

13.79%

|

6.55%

|

3.62%

|

||||

|

MSCI

All Country Far East ex Japan Index

|

|

69.39%

|

13.13%

|

5.92%

|

3.25%

|

|

1

|

Return

information is for Investor Class shares not presented in this

Prospectus. Institutional Class shares would have substantially

similar annual returns because the shares represent the same portfolio of

securities and the annual returns would differ only to the extent that

Institutional Class shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

|||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

||

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

|||

|

Management

Fee

|

0.69%

|

||

|

Distribution

(12b-1) Fees

|

None

|

||

|

Other

Expenses

|

[0.__]%

|

||

|

Administration

and Shareholder Servicing Fees

|

[0.__]%

|

||

|

Total Annual Operating

Expenses

|

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

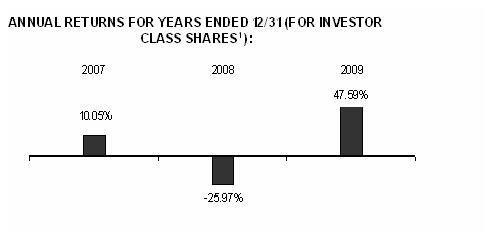

Best

Quarter

|

|

|

Q2

2009

|

25.07%

|

|

|

Worst

Quarter

|

||

|

Q3

2008

|

-12.30%

|

|

SINCE

|

||||

|

INCEPTION

|

||||

|

1 YEAR

|

(10/31/06)

|

|||

|

Matthews

Asia Dividend Fund1

|

||||

|

Return

before taxes

|

47.59%

|

11.00%

|

||

|

Return

after taxes on distributions2

|

45.90%

|

9.77%

|

||

|

Return

after taxes on distributions and sale of Fund shares2

|

31.60%

|

8.89%

|

||

|

MSCI

All Country Asia Pacific Index

|

37.86%

|

-0.56%

|

|

1

|

Return

information is for Investor Class shares not presented in this Prospectus.

Institutional Class shares would have substantially similar annual returns

because the shares represent the same portfolio of securities and the

annual returns would differ only to the extent that Institutional Class

shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

||

|

Management

Fee

|

0.69%

|

|

|

Distribution

(12b-1) Fees

|

None

|

|

|

Other

Expenses

|

[0.__]%

|

|

|

Administration

and Shareholder Servicing

Fees [0.__]%

|

||

|

Fee

Waiver and Expense Reimbursement

|

[0.__]%¹

|

|

|

Total Annual Operating

Expenses

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

||

|

Management

Fee

|

0.69%

|

|

|

Distribution

(12b-1) Fees

|

None

|

|

|

Other

Expenses

|

[0.__]%

|

|

|

Administration

and Shareholder Servicing

Fees [0.__]%

|

||

|

Total Annual Operating

Expenses

|

[0.__]%

|

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

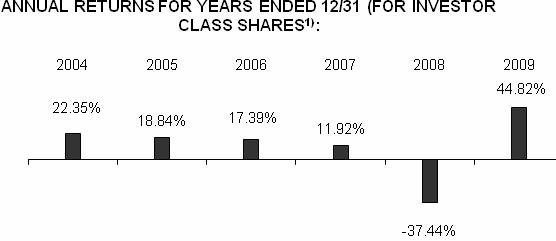

Best

Quarter

|

|

|

Q2

2009

|

33.81%

|

|

|

Worst

Quarter

|

||

|

Q3

2008

|

-15.04%

|

|

SINCE

|

||||||

|

INCEPTION

|

||||||

|

1 YEAR

|

5 YEARS

|

(10/31/03)

|

||||

|

Matthews

Asia Pacific Fund1

|

||||||

|

Return

before taxes

|

44.82%

|

7.18%

|

9.86%

|

|||

|

Return

after taxes on distributions2

|

44.58%

|

6.59%

|

9.36%

|

|||

|

Return

after taxes on distributions and sale of Fund shares2

|

29.72%

|

6.28%

|

8.70%

|

|||

|

MSCI

All Country Asia Pacific Index

|

|

37.86%

|

|

5.94%

|

|

8.51%

|

|

1

|

Return

information is for Investor Class shares not presented in this Prospectus.

Institutional Class shares would have substantially similar annual returns

because the shares represent the same portfolio of securities and the

annual returns would differ only to the extent that Institutional Class

shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

||

|

Management

Fee

|

0.69%

|

|

|

Distribution

(12b-1) Fees

|

None

|

|

|

Other

Expenses

|

[0.__]%

|

|

|

Administration

and Shareholder Servicing

Fees [0.__]%

|

||

|

Total Annual Operating

Expenses

|

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

Best

Quarter

|

|

|

Q2

2009

|

41.53%

|

|

|

Worst

Quarter

|

||

|

Q3

2001

|

–21.63%

|

|

SINCE

INCEPTION

|

||||||||

|

1 YEAR

|

5 YEARS

|

10 YEARS

|

(9/12/94 Fund)

(8/31/94 Indices)

|

|||||

|

Matthews

Pacific Tiger Fund1

|

||||||||

|

Return

before taxes

|

75.37%

|

14.50%

|

11.55%

|

9.13%

|

||||

|

Return

after taxes on distributions2

|

75.22%

|

13.18%

|

10.29%

|

8.23%

|

||||

|

Return

after taxes on distributions and sale of Fund shares2

|

49.31%

|

12.57%

|

9.77%

|

7.81%

|

||||

|

MSCI

All Country Asia ex Japan Index

|

72.53%

|

13.79%

|

6.55%

|

3.62%

|

||||

|

MSCI

All Country Far East ex Japan Index

|

|

69.39%

|

|

13.13%

|

|

5.92%

|

|

3.25%

|

|

1

|

Return

information is for Investor Class shares not presented in this Prospectus.

Institutional Class shares would have substantially similar annual returns

because the shares represent the same portfolio of securities and the

annual returns would differ only to the extent that Institutional Class

shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

||

|

Management

Fee

|

0.69%

|

|

|

Distribution

(12b-1) Fees

|

None

|

|

|

Other

Expenses

|

[0.__]%

|

|

|

Administration

and Shareholder Servicing

Fees [0.__]%

|

||

|

Total Annual Operating

Expenses

|

|

[0.__]%

|

|

One

Year

|

$[___]

|

Three

Years:

|

$[___]

|

Five

Years:

|

$[___]

|

Ten

Years:

|

$[____]

|

|

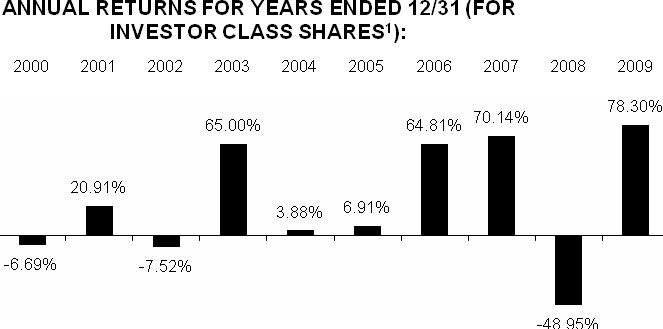

Best

Quarter

|

|

|

Q2

2009

|

34.28%

|

|

|

Worst

Quarter

|

||

|

Q3

2001

|

–27.11%

|

|

SINCE

|

||||||||

|

INCEPTION

|

||||||||

|

1 YEAR

|

5 YEARS

|

10

YEARS

|

(2/19/98 Fund)

(2/28/98 Index)

|

|||||

|

Matthews

China Fund1

|

||||||||

|

Return

before taxes

|

78.30%

|

22.23%

|

17.18%

|

13.53%

|

||||

|

Return

after taxes on distributions2

|

78.23%

|

20.88%

|

16.05%

|

12.50%

|

||||

|

Return

after taxes on distributions and sale of Fund shares2

|

50.99%

|

19.31%

|

15.04%

|

11.72%

|

||||

|

MSCI

China Index

|

62.63%

|

23.83%

|

9.72%

|

4.14%

|

|

1

|

Return

information is for Investor Class shares not presented in this Prospectus.

Institutional Class shares would have substantially similar annual returns

because the shares represent the same portfolio of securities and the

annual returns would differ only to the extent that Institutional Class

shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

||

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

||

|

Management

Fee

|

0.69%

|

|

|

Distribution

(12b-1) Fees

|

None

|

|

|

Other

Expenses

|

[0.__]%

|

|

|

Administration

and Shareholder Servicing

Fees [0.__]%

|

||

|

Total

Annual Operating Expenses

|

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

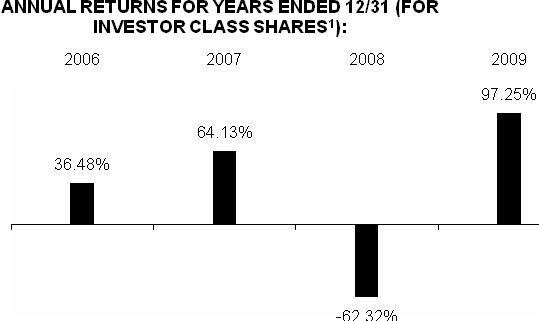

Best

Quarter

Q2

2009 66.04%

Worst

Quarter

Q4

2008 -31.17%

|

|

SINCE

|

||

|

INCEPTION

|

||

|

1

YEAR

|

(10/31/05)

|

|

|

Matthews

India Fund1

|

||

|

Return

before taxes

|

97.25%

|

16.43%

|

|

Return

after taxes on distributions2

|

96.75%

|

15.79%

|

|

Return

after taxes on distributions and sale of Fund shares2

|

63.63%

|

14.22%

|

|

Bombay

Stock Exchange 100 Index

|

95.83%

|

21.63%

|

|

1

|

Return

information is for Investor Class shares not presented in this

Prospectus. Institutional Class shares would have substantially

similar annual returns because the shares represent the same portfolio of

securities and the annual returns would differ only to the extent that

Institutional Class shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

|

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

|

|

Management

Fee

|

0.69%

|

|

Distribution

(12b-1) Fees

|

None

|

|

Other

Expenses

|

[0.__]%

|

|

Administration

and Shareholder Servicing

Fees

[0.__]%

|

|

|

Total Annual Operating

Expenses

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

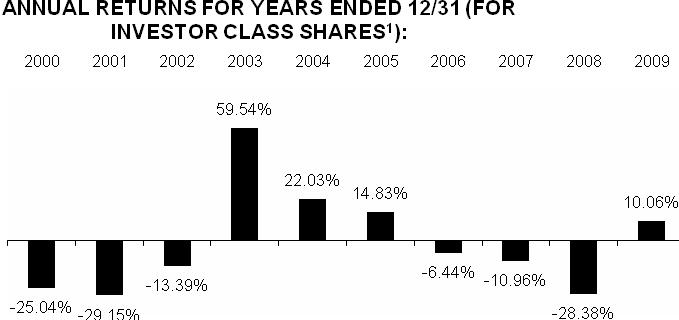

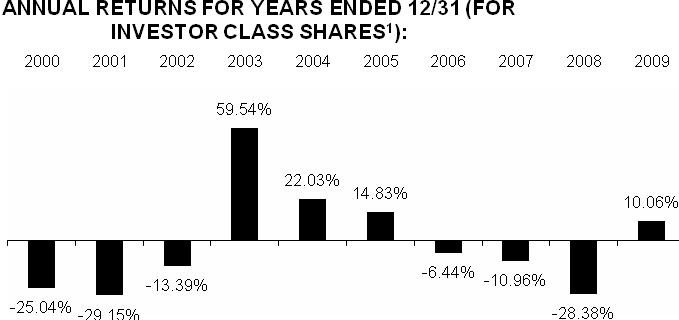

Best

Quarter

Q3

2003 37.26%

Worst

Quarter

Q4

2000 –21.54%

|

|

SINCE

|

|||||

|

INCEPTION

|

|||||

|

1

YEAR

|

5

YEARS

|

10

YEARS

|

(12/31/98)

|

||

|

Matthews

Japan Fund1

|

|||||

|

Return

before taxes

|

10.06%

|

-5.49%

|

-3.85%

|

3.11%

|

|

|

Return

after taxes on distributions2

|

9.68%

|

-5.78%

|

-4.43%

|

2.45%

|

|

|

Return

after taxes on distributions and sale of Fund shares2

|

7.21%

|

-4.53%

|

-3.39%

|

2.42%

|

|

|

MSCI

Japan Index

|

6.39%

|

-0.70%

|

-3.55%

|

1.10%

|

|

|

Tokyo

Stock Price Index

|

5.22%

|

-1.21%

|

-4.17%

|

1.43%

|

|

1

|

Return

information is for Investor Class shares not presented in this

Prospectus. Institutional Class shares would have substantially

similar annual returns because the shares represent the same portfolio of

securities and the annual returns would differ only to the extent that

Institutional Class shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

|

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

|

|

Management

Fee

|

0.69%

|

|

Distribution

(12b-1) Fees

|

None

|

|

Other

Expenses

|

[0.__]%

|

|

Administration

and Shareholder Servicing

Fees

[0.__]%

|

|

|

Total

Annual Operating Expenses

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

Best

Quarter

Q4

2001 50.51%

Worst

Quarter

Q4

2000 –24.72%

|

|

SINCE

INCEPTION

|

||||

|

1

YEAR

|

5

YEARS

|

10

YEARS

|

(1/3/95)

|

|

|

Matthews

Korea Fund1

|

||||

|

Return

before taxes

|

62.92%

|

10.47%

|

8.98%

|

4.81%

|

|

Return

after taxes on distributions2

|

61.99%

|

9.20%

|

5.65%

|

2.36%

|

|

Return

after taxes on distributions and sale of Fund shares2

|

42.10%

|

9.26%

|

6.01%

|

2.76%

|

|

Korea

Composite Stock Price Index

|

66.56%

|

11.36%

|

5.16%

|

1.22%

|

|

1

|

Return

information is for Investor Class shares not presented in this

Prospectus. Institutional Class shares would have substantially

similar annual returns because the shares represent the same portfolio of

securities and the annual returns would differ only to the extent that

Institutional Class shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

|

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

|

|

Management

Fee

|

1.00%

|

|

Distribution

(12b-1) Fees

|

None

|

|

Other

Expenses

|

[0.__]%

|

|

Administration

and Shareholder Servicing

Fees

[0.__]%

|

|

|

Fee

Waiver and Expense Reimbursement

|

[0.__]%1

|

|

Total Annual Operating

Expenses

|

[0.__]%

|

|

1

|

Matthews

has contractually agreed to waive fees and reimburse expenses until April

30, 2012 to the extent needed to limit Total Annual Operating Expenses to

2.00%. The amount of the waiver is based on estimated Fund expenses. The

fee waiver may be terminated at any time by the Funds on 60 days’ written

notice.

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years

|

$[____]

|

|

Best

Quarter

Q2

2009 45.91%

Worst

Quarter

Q1

2009 0.89%

|

|

SINCE

|

||

|

INCEPTION

|

||

|

1

YEAR

|

(9/15/08)

|

|

|

Matthews

Asia Small Companies Fund1

|

||

|

Return

before taxes

|

103.00%

|

44.05%

|

|

Return

after taxes on distributions2

|

102.32%

|

43.64%

|

|

Return

after taxes on distributions and sale of Fund shares2

|

67.17%

|

37.54%

|

|

MSCI

All Country Asia ex Japan Small Cap Index

|

113.48%

|

34.33%

|

|

1

|

Return

information is for Investor Class shares not presented in this

Prospectus. Institutional Class shares would have substantially

similar annual returns because the shares represent the same portfolio of

securities and the annual returns would differ only to the extent that

Institutional Class shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

SHAREHOLDER FEES (fees paid directly

from your investment)

|

|

|

Redemption

Fee (as a percentage of amount redeemed on shares held fewer than 90

days)

|

2.00%

|

|

ANNUAL OPERATING

EXPENSES (expenses that you

pay each year as a percentage of the value of your

investment)

|

|

|

Management

Fees

|

0.69%

|

|

Distribution

(12b-1) Fees

|

None

|

|

Other

Expenses

|

[0.__]%

|

|

Administration

and Shareholder Servicing

Fees

[0.__]%

|

|

|

Total Annual Operating

Expenses

|

[0.__]%

|

|

One

Year:

|

$[____]

|

Three

Years:

|

$[____]

|

Five

Years:

|

$[____]

|

Ten

Years:

|

$[____]

|

|

Best

Quarter

Q4

2001 34.50%

Worst

Quarter

Q4

2000 –32.78%

|

|

SINCE

|

||||

|

INCEPTION

|

||||

|

1 YEAR

|

5 YEARS

|

10 YEARS

|

(12/27/99 Fund)

(12/31/99 Index)

|

|

|

Matthews

Asia Science and Technology Fund1

|

||||

|

Return

before taxes

|

70.28%

|

8.03%

|

-1.78%

|

-1.64%

|

|

Return

after taxes on distributions2

|

70.28%

|

8.03%

|

-1.99%

|

-1.85%

|

|

Return

after taxes on distributions and sale of Fund shares2

|

45.68%

|

6.97%

|

-1.64%

|

-1.53%

|

|

MSCI/Matthews

Asian Technology Index

|

40.59%

|

4.69%

|

-6.32%

|

-6.31%

|

|

1

|

Return

information is for Investor Class shares not presented in this

Prospectus. Institutional Class shares would have substantially

similar annual returns because the shares represent the same portfolio of

securities and the annual returns would differ only to the extent that

Institutional Class shares do not have the same

expenses.

|

|

2

|

After-tax returns are

calculated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ

from those shown. After-tax returns shown are not relevant to investors

who hold their Fund shares through tax-deferred arrangements, such as

401(k) plans or individual retirement

accounts.

|

|

Minimum Initial Investment

|

Subsequent Investments

|

|

|

$3,000,000

|

$100

|

|

Year

ended Dec. 31

|

||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||

|

Net

Asset Value, beginning of year

|

$11.50

|

$19.78

|

$18.68

|

$17.14

|

$15.82

|

|

|

Income

(loss) from investment operations

|

||||||

|

Net

investment income

|

0.482

|

0.542

|

1.07

|

0.46

|

0.45

|

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

4.23

|

(6.73)

|

2.93

|

3.47

|

2.02

|

|

|

Total

from investment operations

|

4.71

|

(6.19)

|

4.00

|

3.93

|

2.47

|

|

|

Less

distributions from:

|

||||||

|

Net

investment income

|

(0.44)

|

(0.42)

|

(0.90)

|

(0.62)

|

(0.43)

|

|

|

Net

realized gains on investments

|

—

|

(1.67)

|

(2.00)

|

(1.77)

|

(0.72)

|

|

|

Total

distributions

|

(0.44)

|

(2.09)

|

(2.90)

|

(2.39)

|

(1.15)

|

|

|

Paid-in

capital from redemption fees

|

—3

|

—3

|

—3

|

—3

|

—3

|

|

|

Net

Asset Value, end of year

|

$15.77

|

$11.50

|

$19.78

|

$18.68

|

$17.14

|

|

|

Total

return

|

41.44%

|

(32.07%)

|

21.54%

|

23.38%

|

15.76%

|

|

|

Net

assets, end of year (in 000s)

|

$2,547,411

|

$1,089,712

|

$2,273,408

|

$2,021,363

|

$1,676,559

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.18%

|

1.16%

|

1.16%

|

1.20%

|

1.28%

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and

Administrator

|

1.18%

|

1.16%

|

1.15%

|

1.19%

|

1.27%

|

|

Ratio

of net investment income to average net assets

|

3.47%

|

3.19%

|

2.59%

|

2.27%

|

2.60%

|

|

Portfolio

turnover

|

17.51%

|

25.16%

|

27.93%

|

28.37%

|

20.16%

|

|

Year

ended December 31,

|

Period

ended

|

|||

|

2009

|

2008

|

2007

|

12/31/062

|

|

|

Net

Asset Value, beginning of period

|

$8.61

|

$12.00

|

$10.77

|

$10.00

|

|

Income

(loss) from investment operations

|

||||

|

Net

investment income

|

0.323

|

0.383

|

0.27

|

0.02

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

3.67

|

(3.47)

|

1.67

|

0.77

|

|

Total

from investment operations

|

3.99

|

(3.09)

|

1.94

|

0.79

|

|

Less

distributions from:

|

||||

|

Net

investment income

|

(0.55)

|

(0.30)

|

(0.27)

|

(0.02)

|

|

Net

realized gains on investments

|

—

|

(0.02)

|

(0.45)

|

—

|

|

Total

distributions

|

(0.55)

|

(0.32)

|

(0.72)

|

(0.02)

|

|

Paid-in

capital from redemption fees

|

0.01

|

0.02

|

0.01

|

—3

|

|

Net

Asset Value, end of period

|

$12.06

|

$8.61

|

$12.00

|

$10.77

|

|

Total

return

|

47.59%

|

(25.97%)

|

18.05%

|

7.90%5

|

|

Net

assets, end of period (in 000s)

|

$322,003

|

$141,951

|

$81,624

|

$25,740

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.28%

|

1.35%

|

1.42%

|

2.93%6

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.30%

|

1.32%

|

1.39%

|

1.50%6

|

|

Ratio

of net investment income to average net assets

|

3.16%

|

3.74%

|

2.66%

|

1.34%6

|

|

Portfolio

turnover

|

32.41%

|

25.07%

|

26.95%

|

0.00%5

|

|

Period

ended

Dec. 31,

|

|

|

20092

|

|

|

Net

Asset Value, beginning of period

|

$10.00

|

|

Income

(Loss) from investment operations

|

|

|

Net

investment loss

|

(0.01)3

|

|

Net

realized gain and unrealized appreciation/depreciation on investments and

foreign currency

|

0.19

|

|

Total

from investment operations

|

0.18

|

|

Paid-in

capital from redemption fees

|

—4

|

|

Net

Asset Value, end of period

|

$10.18

|

|

Total

return

|

1.80%5

|

|

The

total return represents the rate that an investor would have earned on an

investment in the Fund, assuming reinvestment of all dividends and

distributions.

|

|

|

RATIOS/SUPPLEMENTAL

DATA

|

|

|

Net

assets, end of period (in 000s)

|

$7,134

|

|

Ratio

of expenses to average net assets before reimbursement, or waiver of

expenses by Advisor

|

10.05%6

|

|

Ratio

of expenses to average net assets after reimbursement, or waiver of

expenses by Advisor

|

1.50%6

|

|

Ratio

of net investment loss to average net assets

|

(0.81%)6

|

|

Portfolio

turnover

|

0.00%5

|

|

Year

ended Dec. 31

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

Asset Value, beginning of year

|

$10.03

|

$17.29

|

$16.92

|

$14.89

|

$12.58

|

|

Income

(loss) from investment operations

|

|||||

|

Net

investment income

|

0.062

|

0.132

|

0.09

|

0.07

|

0.07

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

4.44

|

(6.64)

|

2.02

|

2.50

|

2.30

|

|

Total

from investment operations

|

4.50

|

(6.51)

|

2.11

|

2.57

|

2.37

|

|

Less

Distributions from:

|

|||||

|

Net

investment income

|

(0.24)

|

—

|

(0.09)

|

(0.07)

|

(0.06)

|

|

Net

realized gains on investments

|

—

|

(0.76)

|

(1.66)

|

(0.48)

|

—

|

|

Total

distributions

|

(0.24)

|

(0.76)

|

(1.75)

|

(0.55)

|

(0.06)

|

|

Paid-in

capital from redemption fees

|

—3

|

0.01

|

0.01

|

0.01

|

—3

|

|

Net

Asset Value, end of year

|

$14.29

|

$10.03

|

$17.29

|

$16.92

|

$14.89

|

|

Total

return

|

44.82%

|

(37.44%)

|

11.92%

|

17.39%

|

18.84%

|

|

Net

assets, end of year (in 000s)

|

$227,651

|

$168,031

|

$471,054

|

$449,699

|

$285,169

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.28%

|

1.23%

|

1.20%

|

1.26%

|

1.35%

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.28%

|

1.23%

|

1.20%

|

1.24%

|

1.34%

|

|

Ratio

of net investment income to average net assets

|

0.50%

|

0.93%

|

0.60%

|

0.47%

|

0.67%

|

|

Portfolio

turnover

|

58.10%

|

37.10%

|

40.49%

|

40.45%

|

15.84%

|

|

Year

ended Dec. 31

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

Asset Value, beginning of year

|

$11.05

|

$27.86

|

$23.71

|

$19.27

|

$15.90

|

|

Income

(loss) from investment operations

|

|||||

|

Net

investment income

|

0.062

|

0.242

|

0.30

|

0.22

|

0.14

|

|

Net

realized gain (loss) and

unrealized appreciation/depreciation on investments

and foreign currency

|

8.27

|

(13.31)

|

7.78

|

5.01

|

3.43

|

|

Total

from investment operations

|

8.33

|

(13.07)

|

8.08

|

5.23

|

3.57

|

|

Less

distributions from:

|

|||||

|

Net

investment income

|

(0.15)

|

(0.30)

|

(0.31)

|

(0.21)

|

(0.12)

|

|

Net

realized gains on investments

|

—

|

(3.44)

|

(3.62)

|

(0.58)

|

(0.09)

|

|

Total

distributions

|

(0.15)

|

(3.74)

|

(3.93)

|

(0.79)

|

(0.21)

|

|

Paid-in

capital from redemption fees

|

—

|

—3

|

—3

|

—3

|

0.01

|

|

Net

Asset Value, end of year

|

$19.23

|

$11.05

|

$27.86

|

$23.71

|

$19.27

|

|

Total

return

|

75.37%

|

(46.12%)

|

33.66%

|

27.22%

|

22.51%

|

|

Net

assets, end of year (in 000s)

|

$3,565,745

|

$1,202,441

|

$3,806,714

|

$3,303,717

|

$2,031,995

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.13%

|

1.12%

|

1.11%

|

1.18%

|

1.31%

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.13%

|

1.12%

|

1.10%

|

1.16%

|

1.31%

|

|

Ratio

of net investment income to average net assets

|

0.41%

|

1.10%

|

1.12%

|

1.12%

|

1.10%

|

|

Portfolio

turnover

|

13.22%

|

16.76%

|

24.09%

|

18.80%

|

3.03%

|

|

Year

ended Dec. 31

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

Asset Value, beginning of year

|

$14.34

|

$39.73

|

$24.16

|

$14.76

|

$14.01

|

|

Income

(loss) from investment operations

|

|||||

|

Net

investment income

|

0.092

|

0.302

|

0.12

|

0.15

|

0.22

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on investments and

foreign currency

|

11.12

|

(19.78)

|

16.85

|

9.39

|

0.74

|

|

Total

from investment operations

|

11.21

|

(19.48)

|

16.97

|

9.54

|

0.96

|

|

Less

distributions from:

|

|||||

|

Net

investment income

|

(0.07)

|

(0.33)

|

(0.11)

|

(0.15)

|

(0.22)

|

|

Net

realized gains on investments

|

—

|

(5.62)

|

(1.37)

|

—

|

—

|

|

Return

of capital

|

—

|

—

|

—

|

—3

|

—

|

|

Total

distributions

|

(0.07)

|

(5.95)

|

(1.48)

|

(0.15)

|

(0.22)

|

|

Paid-in

capital from redemption fees

|

0.02

|

0.04

|

0.08

|

0.01

|

0.01

|

|

Net

Asset Value, end of year

|

$25.50

|

$14.34

|

$39.73

|

$24.16

|

$14.76

|

|

Total

return

|

78.30%

|

(48.95%)

|

70.14%

|

64.81%

|

6.91%

|

|

RATIOS/SUPPLEMENTAL

DATA

|

|||||

|

Net

assets, end of year (in 000s)

|

$2,566,005

|

$781,104

|

$2,335,402

|

$966,528

|

$388,950

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.21%

|

1.23%

|

1.18%

|

1.27%

|

1.31%

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.21%

|

1.23%

|

1.17%

|

1.26%

|

1.30%

|

|

Ratio

of net investment income to average net assets

|

0.46%

|

1.03%

|

0.49%

|

0.96%

|

1.46%

|

|

Portfolio turnover

|

5.28%

|

7.91%

|

22.13%

|

11.65%

|

11.82%

|

| Year ended December 31 |

Period

ended

12/31/052

|

||||

|

2009

|

2008

|

2007

|

2006

|

||

|

Net

Asset Value, beginning of period

|

$8.37

|

$24.44

|

$15.45

|

$11.32

|

$10.00

|

|

Income

(loss) from investment operations

|

|||||

|

Net

investment income (loss)

|

0.073

|

0.033

|

(0.01)

|

(0.01)

|

(0.01)

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

8.06

|

(15.33)

|

9.87

|

4.11

|

1.33

|

|

Total

from investment operations

|

8.13

|

(15.30)

|

9.86

|

4.10

|

1.32

|

|

Less

distributions from:

|

|||||

|

Net

investment income

|

(0.10)

|

(0.11)

|

(0.21)

|

—

|

—

|

|

Net

realized gains on investments

|

(0.12)

|

(0.69)

|

(0.68)

|

—

|

—

|

|

Total

distributions

|

(0.22)

|

(0.80)

|

(0.89)

|

—

|

—

|

|

Paid-in

capital from redemption fees

|

0.01

|

0.03

|

0.02

|

0.03

|

—4

|

|

Net

Asset Value, end of period

|

$16.29

|

$8.37

|

$24.44

|

$15.45

|

$11.32

|

|

Total

return

|

97.25%

|

(62.32%)

|

64.13%

|

36.48%

|

13.20%5

|

|

RATIOS/SUPPLEMENTAL

DATA

|

|||||

|

Net

assets, end of period (in 000s)

|

$720,925

|

$317,516

|

$1,311,072

|

$669,643

|

$80,897

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.27%

|

1.29%

|

1.29%

|

1.41%

|

2.75%6

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.27%

|

1.29%

|

1.28%

|

1.41%

|

2.00%6

|

|

Ratio

of net investment income (loss) to average net assets

|

0.59%

|

0.16%

|

(0.04%)

|

(0.08%)

|

(1.17%)6

|

|

Portfolio

turnover

|

18.09%

|

26.68%

|

25.59%

|

21.57%

|

0.00%5

|

|

Year

ended Dec. 31

|

||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||

|

Net

Asset Value, beginning of year

|

$10.19

|

$14.55

|

$17.29

|

$18.48

|

$16.12

|

|

|

Income

(loss) from investment operations

|

||||||

|

Net

investment income (loss)

|

0.102

|

0.112

|

0.03

|

(0.08)

|

0.02

|

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

0.92

|

(4.26)

|

(1.86)

|

(1.12)

|

2.36

|

|

|

Total

from investment operations

|

1.02

|

(4.15)

|

(1.83)

|

(1.20)

|

2.38

|

|

|

Less

distributions from:

|

||||||

|

Net

investment income

|

(0.31)

|

—

|

(0.01)

|

—

|

(0.03)

|

|

|

Net

realized gains on investments

|

—

|

(0.22)

|

(0.91)

|

—

|

—

|

|

|

Total

distributions

|

(0.31)

|

(0.22)

|

(0.92)

|

—

|

(0.03)

|

|

|

Paid-in

capital from redemption fees

|

0.01

|

0.01

|

0.01

|

0.01

|

0.01

|

|

|

Net

Asset Value, end of year

|

$10.91

|

$10.19

|

$14.55

|

$17.29

|

$18.48

|

|

|

Total

return

|

10.06%

|

(28.38%)

|

(10.96%)

|

(6.44%)

|

14.83%

|

|

|

RATIOS/SUPPLEMENTAL

DATA

|

||||||

|

Net

assets, end of year (in 000s)

|

$88,334

|

$123,674

|

$166,860

|

$276,656

|

$367,618

|

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.31%

|

1.23%

|

1.24%

|

1.25%

|

1.29%

|

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.31%

|

1.23%

|

1.23%

|

1.24%

|

1.28%

|

|

|

Ratio

of net investment income (loss) to average net assets

|

0.97%

|

0.84%

|

(0.01%)

|

(0.29%)

|

(0.10%)

|

|

|

Portfolio

turnover

|

126.75%

|

88.97%

|

45.51%

|

59.95%

|

20.88%

|

|

Year

ended Dec. 31

|

||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||

|

Net

Asset Value, beginning of year

|

$2.75

|

$6.56

|

$6.23

|

$6.37

|

$4.08

|

|

|

Income

(loss) from investment operations

|

||||||

|

Net

investment income (loss)

|

(0.01)2

|

(0.02)2

|

0.07

|

0.01

|

0.01

|

|

|

Net

realized gain (loss) and

unrealized

appreciation/depreciation

on

investments and foreign currency

|

1.74

|

(3.48)

|

1.15

|

0.80

|

2.39

|

|

|

Total

from investment operations

|

1.73

|

(3.50)

|

1.22

|

0.81

|

2.40

|

|

|

Less

distributions from:

|

||||||

|

Net

investment income

|

—

|

(0.06)

|

(0.02)

|

(0.01)

|

—

|

|

|

Net

realized gains on investments

|

(0.17)

|

(0.25)

|

(0.87)

|

(0.95)

|

(0.11)

|

|

|

Total

distributions

|

(0.17)

|

(0.31)

|

(0.89)

|

(0.96)

|

(0.11)

|

|

|

Paid-in

capital from redemption fees

|

—3

|

—3

|

—3

|

0.01

|

—3

|

|

|

Net

Asset Value, end of year

|

$4.31

|

$2.75

|

$6.56

|

$6.23

|

$6.37

|

|

|

Total

return

|

62.92%

|

(52.66%)

|

18.90%

|

12.99%

|

58.76%

|

|

|

RATIOS/SUPPLEMENTAL

DATA

|

||||||

|

Net

assets, end of year (in 000s)

|

$138,371

|

$87,253

|

$250,421

|

$241,003

|

$269,925

|

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.30%

|

1.27%

|

1.21%

|

1.30%

|

1.35%

|

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.30%

|

1.27%

|

1.21%

|

1.28%

|

1.35%

|

|

|

Ratio

of net investment income (loss) to average net assets

|

(0.36%)

|

(0.34%)

|

1.17%

|

(0.09%)

|

0.27%

|

|

|

Portfolio

turnover

|

52.47%

|

28.70%

|

24.20%

|

25.82%

|

10.13%

|

|

Year

ended

Dec.

31,

|

Period

ended

Dec.

31,

|

|

|

2009

|

20082

|

|

|

Net

Asset Value, beginning of period

|

$7.89

|

$10.00

|

|

Income

(loss) from investment operations

|

||

|

Net

investment income

|

0.023

|

0.013

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

8.04

|

(2.16)

|

|

Total

from investment operations

|

8.06

|

(2.15)

|

|

Less

distributions from:

|

||

|

Net

investment income

|

(0.05)

|

(0.02)

|

|

Net

realized gains on investments

|

(0.15)

|

—

|

|

Total

distributions

|

(0.20)

|

(0.02)

|

|

Paid-in

capital from redemption fees

|

0.04

|

0.06

|

|

Net

Asset Value, end of period

|

$15.79

|

$7.89

|

|

Total

return

|

103.00%

|

(21.03%)4

|

|

RATIOS/SUPPLEMENTAL

DATA

|

||

|

Net

assets, end of period (in 000s)

|

$109,726

|

$3,173

|

|

Ratio

of expenses to average net assets before reimbursement or waiver of

expenses by Advisor

|

2.09%

|

14.31%5

|

|

Ratio

of expenses to average net assets after reimbursement or waiver of

expenses by Advisor

|

2.00%

|

2.00%5

|

|

Ratio

of net investment income to average net assets

|

0.13%

|

0.15%5

|

|

Portfolio

turnover

|

21.39%

|

3.10%4

|

|

Year

ended Dec.

31

|

||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||

|

Net

Asset Value, beginning of year

|

$4.71

|

$9.80

|

$7.92

|

$6.53

|

$5.45

|

|

|

Income

(loss) from investment operations

|

||||||

|

Net

investment income (loss)

|

—2,

3

|

0.012

|

—3

|

(0.02)

|

—3

|

|

|

Net

realized gain (loss) and unrealized appreciation/depreciation on

investments and foreign currency

|

3.31

|

(5.11)

|

1.87

|

1.40

|

1.08

|

|

|

Total

from investment operations

|

3.31

|

(5.10)

|

1.87

|

1.38

|

1.08

|

|

|

Paid-in

capital from redemption fees

|

—3

|

0.01

|

0.01

|

0.01

|

—3

|

|

|

Net

Asset Value, end of period

|

$8.02

|

$4.71

|

$9.80

|

$7.92

|

$6.53

|

|

|

Total

return

|

70.28%

|

(51.94%)

|

23.74%

|

21.29%

|

19.82%

|

|

|

RATIOS/SUPPLEMENTAL

DATA

|

||||||

|

Net

assets, end of period (in 000s)

|

$130,367

|

$74,476

|

$252,304

|

$129,819

|

$50,426

|

|

|

Ratio

of expenses to average net assets before reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.40%

|

1.33%

|

1.26%

|

1.41%

|

1.49%

|

|

|

Ratio

of expenses to average net assets after reimbursement, waiver, or

recapture of expenses by Advisor and Administrator

|

1.40%

|

1.33%

|

1.25%

|

1.39%

|

1.48%

|

|

|

Ratio

of net investment income (loss) to average net assets

|

0.30%

|

0.08%

|

(0.30%)

|

(0.29%)

|

0.08%

|

|

|

Portfolio

turnover

|

83.27%

|

44.84%

|

33.21%

|

34.77%

|

29.76%

|

|

Asia

Growth and Income Strategies

|

|

|

Matthews

Asian Growth and Income Fund

|

Long-term

capital appreciation with some current income

|

|

Matthews

Asia Dividend Fund

|

Total

return with an emphasis on providing current income

|

|

Matthews

China Dividend Fund

|

Total

return with an emphasis on providing current income

|

|

Asia

Growth Strategies

|

|

|

Matthews

Asia Pacific Fund

|

Long-term

capital appreciation

|

|

Matthews

Pacific Tiger Fund

|

Long-term

capital appreciation

|

|

Matthews

China Fund

|

Long-term

capital appreciation

|

|

Matthews

India Fund

|

Long-term

capital appreciation

|

|

Matthews

Japan Fund

|

Long-term

capital appreciation

|

|

Matthews

Korea Fund

|

Long-term

capital appreciation

|

|

Asia

Small Company Strategy

|

|

|

Matthews

Asia Small Companies Fund

|

Long-term

capital appreciation

|

|

Asia

Specialty Strategy

|

|

|

Matthews

Asia Science and Technology Fund

|

Long-term

capital

appreciation

|

|

§

|

Matthews

believes that the countries of the Asia Pacific region will continue to

benefit from economic development over longer investment

horizons.

|

|

§

|

Matthews

seeks to invest in those companies that it believes will benefit from the

long-term economic evolution of the region and that will help each Fund

achieve its investment

objective.

|

|

§

|

Matthews

generally does not hedge currency

risks.

|

|

§

|

Matthews

constructs portfolios with long investment horizons—typically five to ten

years.

|

|

§

|

Matthews

uses an active approach to investment management (rather than relying on

passive or index strategies) because it believes that the current

composition of the stock markets and indices may not be the best guide to

the most successful industries and companies of the

future.

|

|

§

|

Matthews

invests in individual companies based on fundamental analysis that aims to

develop an understanding of a company’s long-term business

prospects.

|

|

§

|

Matthews

monitors the composition of benchmark indices but is not constrained by

their composition or weightings, and constructs portfolios independently

of indices.

|

|

§

|

Matthews

believes that investors benefit in the long term when the Funds are fully

invested.

|

|

§

|

Matthews

believes that fundamental investing is based on identifying, analyzing and

understanding basic information about a company or security. These

factors may include matters such as balance sheet information; number of

employees; size and stability of cash flow; management’s depth,

adaptability and integrity; product lines; marketing strategies; corporate

governance; and financial health.

|

|

§

|

Matthews

may also consider factors such as:

|

|

|

-

|

Management: Does the

management exhibit integrity? Is there a strong corporate governance

culture? What is the business strategy? Does management exhibit the

ability to adapt to change and handle risk

appropriately?

|

|

|

-

|

Evolution of Industry:

Can company growth be sustained as the industry and environment

evolve?

|

|

|

-

|

Valuation: Is the

company’s valuation reasonable in relation to its growth prospects and

relative to other similar companies in the region or

globally?

|

|

§

|

Following

this fundamental analysis, Matthews seeks to invest in companies and

securities that it believes are positioned to help a Fund achieve its

investment objective.

|

|

§

|

Matthews

develops views about the course of growth in the region over the long

term.

|

|

§

|

Matthews

then seeks to combine these beliefs with its analysis of individual

companies and their fundamental

characteristics.

|

|

§

|

Matthews

then seeks to invest in companies and securities that it believes are

positioned to help a Fund achieve its investment

objective.

|

|

§

|

Each

of the Funds may invest in companies of any equity market capitalization

(the number of shares outstanding times the market price per share).

Except with respect to the Matthews Asia Small Companies Fund, a company’s

size (including its market capitalization) is not a primary consideration

for Matthews when it decides whether to include that company’s securities

in one or more of the Funds. The Matthews Asia Small Companies Fund

invests at least 80% of its assets in Small Companies, as defined in the

Summary for that Fund.

|

|

The

main risks associated with investing in the Funds are described below and

in the Fund Summaries at the front of this prospectus. Additional

information is also included in the Funds’ Statement of Additional

Information (“SAI”).

|

There

is no guarantee that your investment in a Fund will increase in

value. The value of your investment in a Fund could go down, meaning

you could lose some or all of your investment. An investment in a

Fund is not a bank deposit and is not insured or guaranteed by the Federal

Deposit Insurance Corporation or any other government

agency.

|

|

General

Risks

|

|

|

There

is no guarantee that a Fund’s investment objective will be achieved or

that the value of the investments of any Fund will increase. If the value

of a Fund’s investments declines, the net asset value (“NAV”) per share of

that Fund will decline and investors may lose some or all of the value of

their investment.

|

|

|

·

|

High

quality

|

|

|

·

|

Investment

grade

|

|

|

·

|

Below

investment grade (“high-yield securities” or “junk

bonds”)

|

|

Matthews

China Dividend Fund

|

0.67%

|

|

Matthews

Asian Growth and Income Fund, Matthews Asia Dividend Fund, Matthews

Pacific Tiger Fund, Matthews China Fund, Matthews India Fund, Matthews

Korea Fund, Matthews Asia Science and Technology Fund

|

0.69%

|

|

Matthews

Asia Pacific Fund, Matthews Japan Fund

|

0.70%

|

|

Matthews

Asia Small Companies Fund

|

0.99%

|

|

Robert

J. Horrocks, PhD

Robert

Horrocks is Chief Investment Officer at Matthews and a Portfolio Manager.

As Chief Investment Officer, Robert oversees the firm’s investment process

and investment professionals and sets the research agenda for the

investment team. Before joining Matthews in August 2008, Robert was Head

of Research at Mirae Asset Management in Hong Kong. From 2003 to 2006,

Robert served as Chief Investment Officer for Everbright Pramerica in

China, establishing its quantitative investment process. He started his

career as a Research Analyst with WI Carr Securities in Hong Kong before

moving on to spend eight years working in several different Asian

jurisdictions for Schroders, including stints as Country General Manager

in Taiwan, Deputy Chief Investment Officer in Korea and Designated Chief

Investment Officer in Shanghai. Robert earned his PhD in Chinese Economic

History from Leeds University in the United Kingdom, and is fluent in

Mandarin. Robert has been a Portfolio Manager of the Asian Growth and

Income Fund since 2009.

|

CO-MANAGER:

ASIAN

GROWTH AND INCOME FUND

|

|

Kenichi

Amaki

Kenichi

Amaki is a Portfolio Manager at Matthews. Prior to joining Matthews in

2008 as a Research Analyst, he was an investment officer for a family

trust based in Monaco, researching investment opportunities primarily in

Japan. From 2001 to 2004, he worked on the International Pension Fund Team

at Nomura Asset Management in Tokyo, Japan. Kenichi received a B.A. in Law