| Label |

Element |

Value |

| MATTHEWS ASIA CREDIT OPPORTUNITIES FUND |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

MATTHEWS ASIA CREDIT OPPORTUNITIES FUND

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

Total return over the long term.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses of the Fund

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of this Fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

SHAREHOLDER FEES (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

ANNUAL OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example of fund expenses, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 28% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

28.00%

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

EXAMPLE OF FUND EXPENSES

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example reflects the expense limitation for the one year period only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategy

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the Matthews Asia Credit Opportunities Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in debt and debt-related instruments issued by companies as well as governments, quasi-governmental entities, and supra-national institutions in Asia. Debt and debt-related instruments typically include bonds, debentures, bills, securitized instruments (which are vehicles backed by pools of assets such as loans or other receivables), notes, certificates of deposit and other bank obligations, bank loans, senior secured bank debt, convertible debt securities (including contingent capital financial instruments or “CoCos”), exchangeable bonds, credit-linked notes, inflation-linked instruments, repurchase agreements, payment-in-kind securities and derivative instruments with fixed income characteristics.

Asia consists of all countries and markets in Asia, such as China and Indonesia, in addition to the developed, emerging, and frontier countries and markets in the Asian region. A company or other issuer is considered to be “located” in a country or a region, and a security or instrument will deemed to be an Asian (or specific country) security or instrument, if it has substantial ties to that country or region. Matthews currently makes that determination based primarily on one or more of the following criteria: (A) with respect to a company or issuer, whether (i) it is organized under the laws of that country or any country in that region; (ii) it derives at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed, or has at least 50% of its assets located, within that country or region; (iii) it has the primary trading markets for its securities in that country or region; (iv) it has its principal place of business in or is otherwise headquartered in that country or region; or (v) it is a governmental entity or an agency, instrumentality or a political subdivision of that country or any country in that region; and (B) with respect to an instrument or issue, whether (i) its issuer is headquartered or organized in that country or region; (ii) it is issued to finance a project with significant assets or operations in that country or region; (iii) it is secured or backed by assets located in that country or region; (iv) it is a component or its issuer is included in a recognized securities index for the country or region; or (v) it is denominated in the currency of an Asian country and addresses at least one of the other above criteria. The term “located” and the associated criteria listed above have been defined in such a way that Matthews has latitude in determining whether an issuer should be included within a region or country.

The evaluation of credit risk of securities and issuers will be a key element of our analysis. Matthews uses a fundamentals-based approach with a focus on risk-adjusted return. Matthews seeks to assess whether an instrument’s return is consistent with its risks and its value relative to other investment opportunities. Matthews judges this by analyzing each issuer based on a variety of factors. These factors include, but are not limited to, the strength of the balance sheet, the quality and sustainability of cash flows, the incentives and alignment of management, the ability of a company to weather business cycles, and each issuer’s corporate and capital structure. As a result, Matthews may look for investments such as oversold assets with intrinsic value, potential ratings upgrade candidates, event-driven opportunities, as well as relative value opportunities within a company’s capital structure.

A substantial portion of the Fund’s portfolio will be rated below investment grade or, if unrated, may be deemed by the Fund’s portfolio managers to be of comparable quality. Below investment grade securities are commonly referred to as “high yield” securities or “junk bonds.” Such investments should be considered speculative and may include distressed and defaulted securities. High yield bonds tend to provide high income in an effort to compensate investors for their higher risk of default, which is the failure to make required interest or principal payments. High yield bond issuers often include small or relatively new companies lacking the history or capital to merit investment-grade status, former blue chip companies downgraded because of financial problems, companies electing to borrow heavily to finance or avoid a takeover or buyout, and firms with heavy debt loads.

Convertible securities are often below investment grade and perform more like a stock when the underlying share price is high and more like a bond when the underlying share price is low.

The Fund may invest a significant portion of its total net assets, 25% or more, in securities of issuers from a single country (including companies from that country, the government of that country, its agencies, instrumentalities and political subdivisions, and quasi-governmental entities and supra-national institutions issuing debt deemed to be of that country) and up to 25% of the Fund’s total net assets, may be invested in the securities issued by any one Asian government (including its agencies, instrumentalities and political subdivisions).

The Fund may engage in derivative transactions for speculative purposes as well as to manage credit, interest rate and currency exposures of underlying instruments or market exposures. The Fund may use a variety of derivative instruments, including for example, forward contracts, option contracts, futures and options on futures, and swaps (including interest rate swaps, credit default swaps, options or swaptions). The Fund may seek to take on or hedge credit, currency, and interest rate exposure by using derivatives, and, as a result, the Fund’s exposure to credit, currency, and interest rates could exceed the value of the Fund’s assets denominated in that currency and could exceed the value of the Fund’s net assets.

The Fund has no stated maturity or duration target and the average effective maturity or duration target may change. Matthews has implemented risk management systems to monitor the Fund to reduce the risk of loss through overemphasis on a particular issuer, country, industry, currency, or interest rate regime.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks of Investment

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

There is no guarantee that your investment in the Fund will increase in value. The value of your investment in the Fund could go down, meaning you could lose money. The principal risks of investing in the Fund are:

Credit Risk: A debt instrument’s price depends, in part, on the credit quality of the issuer, borrower, counterparty, or underlying collateral and can decline in response to changes in the financial condition of the issuer, borrower, counterparty, or underlying collateral, or changes in specific or general market, economic, industry, political, regulatory, geopolitical, or other conditions. Credit risk tends to rise and fall with credit cycles that may last several years from trough to peak default rates. As such, the underlying credit risk of a borrower might be compounded by a turn in the credit cycle that is characterized by a rise in borrowing costs or a tightening of systemic liquidity. Additionally, because a portion of the securities held by the Fund will be in an external currency to the borrower (i.e. a currency that is not the home currency of the company) there are additional risks connected with the sovereign country of the issuer. For example, these risks may include, but are not limited to, capital controls imposed by the sovereign country that may undermine an issuer’s ability to meet its debt obligations on a full or timely basis. Credit risk analysis may also include an issuer’s willingness to meet its financial obligations.

High-Yield Bonds and Other Lower-Rated Securities: The Fund’s investments in high-yield bonds (“junk bonds,” which are primarily speculative securities) and other lower-rated securities will subject the Fund to substantial risk of loss. Issuers of junk bonds are less financially secure and less able to repay interest and principal compared to issuers of investment-grade securities. Prices of junk bonds tend to be very volatile. These securities are less liquid than investment-grade debt securities and may be difficult to price or sell, particularly in times of negative sentiment toward high-yield securities.

Any investments in distressed or defaulted securities subject the Fund to even greater credit risk than investments in other below investment-grade bonds. Investments in obligations of restructured, distressed and bankrupt issuers, including debt obligations that are already in default, generally trade significantly below par and may be considered illiquid. Defaulted securities are repaid, if at all, only after lengthy bankruptcy (or similar) proceedings, during which the issuer might not make any interest or other payments. Bankruptcy proceedings typically result in only partial repayment of principal and partial payment of interest payments. In addition, recovery could involve an exchange of the defaulted obligation for other debt (which may be subordinated or unsecured) or equity securities of the issuer or its affiliates. Such securities may be illiquid or speculative and be valued by the Fund at significantly less than the original purchase price of the defaulted obligation. In addition, investments in distressed issuers may subject the Fund to liability as a lender.

Convertible and Exchangeable Securities Risk: The market value of a convertible security performs like that of a regular debt security, that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock.

The Fund may also invest in convertible securities known as contingent capital financial instruments or “CoCos.” CoCos generally provide for mandatory or automatic conversion into common stock of the issuer under certain circumstances or may have principal write down features. Because the timing of conversion may not be anticipated, and conversion may occur when prices are unfavorable, reduced returns or losses may occur. Some CoCos may be leveraged, which can make those CoCos more volatile in changing interest rate or other conditions.

Exchangeable bonds are subject to risks similar to convertible securities. In addition, bonds that are exchangeable into the stock of a different company also are subject to the risks associated with an investment in that other company.

Liquidity Risk: The debt securities and other investments by the Fund may have less liquidity compared to traded stocks and government bonds in Asia, particularly when market developments prompt large numbers of investors to sell debt securities. This means that there may be no willing buyer of the Fund’s portfolio securities and the Fund may have to sell those securities at a lower price or may not be able to sell the securities at all, each of which would have a negative effect on performance.

Dealer inventories of bonds, which provide an indication of the ability of financial intermediaries to “make markets” in those bonds, are at or near historic lows in relation to market size. This reduction in market making capacity has the potential to decrease liquidity and increase price volatility in the fixed income markets in which the Fund invests, particularly during periods of economic or market stress. As a result of this decreased liquidity, the Fund may have to accept a lower price to sell a security, sell other securities to raise cash, or give up an investment opportunity, any of which could have a negative effect on performance. If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds’ prices.

Country Concentration: The Fund may invest a significant portion of its total net assets, 25% or more, in the securities of issuers located in a single country (including the government of that country, its agencies, instrumentalities and political subdivisions, quasi-governmental entities, supra-national institutions issuing debt deemed to be of that country, and companies located in that country). The Fund has in recent years invested more than 25% of its assets in China and Hong Kong together. An investment in the Fund therefore may entail greater risk than an investment in a fund that does not concentrate its investments in a single or small number of countries because these securities may be more sensitive to adverse social, political, economic or regulatory developments affecting that country or countries, than funds that do not concentrate their investments. Events affecting a single or small number of countries may have a significant and potentially adverse impact on your investment in the Fund, and the Fund’s performance may be more volatile than that of funds that invest globally.

Political, Social and Economic Risks of Investing in Asia: The value of the Fund’s assets may be adversely affected by political, economic, social and religious instability; inadequate investor protection; changes in laws or regulations of countries within the Asian region (including countries in which the Fund invests, as well as the broader region); international relations with other nations; natural disasters; corruption and military activity. The Asian region, and particularly China, Japan and South Korea, may be adversely affected by political, military, economic and other factors related to North Korea. In addition, China’s long-running conflict over Taiwan, border disputes with many of its neighbors and historically strained relations with Japan could adversely impact economies in the region. The economies of many Asian countries differ from the economies of more developed countries in many respects, such as rate of growth, inflation, capital reinvestment, resource self-sufficiency, financial system stability, the national balance of payments position and sensitivity to changes in global trade. Deflationary factors could also reemerge in certain Asian markets, the potential effects of which are difficult to forecast. While certain Asian governments will have the ability to offset deflationary conditions through fiscal or budgetary measures, others will lack the capacity to do so. Certain Asian countries are highly dependent upon and may be affected by developments in the United States, Europe and other Asian economies. Global economic conditions, and international trade, affecting Asian economies and companies could deteriorate as a result of political instability and uncertainty, and politically motivated actions, in the United States and Europe, as well as increased tensions with certain nations such as Russia.

Risks Associated with Emerging and Frontier Markets: Many Asian countries are considered emerging or frontier markets (newer or less developed emerging markets are also sometimes referred to as frontier markets). Such markets are often less stable politically and economically than developed markets, and investing in these markets involves different and greater risks. There may be less publicly available information about companies in many Asian countries, and the stock exchanges and brokerage industries in many Asian countries typically do not have the level of government oversight as do those in the United States. Securities markets of many Asian countries are also substantially smaller, less liquid and more volatile than securities markets in the United States.

Derivatives Risk (including Options, Futures and Swaps): Derivatives are speculative and may hurt the Fund’s performance. Derivative products are highly specialized instruments that require investment techniques and risk analyses different from those associated with stocks and bonds. The use of a derivative requires an understanding not only of the underlying instrument but also of the derivative itself, without the benefit of observing the performance of the derivative under all possible market conditions. Derivatives present the risk of disproportionately increased losses and/ or reduced opportunities for gains when the financial asset or measure to which the derivative is linked changes in unexpected ways.

| T | | Options Risk. This is the risk that an investment in options may be subject to greater fluctuation than an investment in the underlying instruments and may be subject to a complete loss of the amounts paid as premiums to purchase the options. |

| T | | Futures Contracts Risk. This is the risk that an investment in futures contracts may be subject to losses that exceed the amount of the premiums paid and may subject the Fund’s net asset value to greater volatility. |

| T | | Swaps Risk. Risks inherent in the use of swaps (especially uncleared swaps) include: (1) swap contracts may not be assigned without the consent of the counterparty; (2) potential default of the counterparty to the swap; (3) absence of a liquid secondary market for any particular swap at any time; and (4) possible inability of the Fund to close out the swap transaction at a time that otherwise would be favorable for it to do so. |

Non-diversified: The Fund is a “non-diversified” investment company, which means that it may invest a larger portion of its assets in the securities of a single issuer (including governments, their agencies, instrumentalities and political sub-divisions, quasi-governmental entities, supra-national institutions and companies) compared with a diversified fund. An investment in the Fund therefore will entail greater risk than an investment in a diversified fund because a single security’s increase or decrease in value may have a greater impact on the Fund’s value and total return.

Risks Associated with China: The Chinese government exercises significant control over China’s economy through its industrial policies (e.g., allocation of resources and other preferential treatment), monetary policy, management of currency exchange rates, and management of the payment of foreign currency-denominated obligations. Changes in these policies could adversely impact affected industries or companies. China’s economy, particularly its export-oriented industries, may be adversely impacted by trade or political disputes with China’s major trading partners, including the U.S. In addition, as its consumer class emerges, China’s domestically oriented industries may be especially sensitive to changes in government policy and investment cycles. China’s currency, which historically has been managed in a tight range relative to the U.S. dollar, may in the future be subject to greater uncertainty as Chinese authorities change the policies that determine the exchange rate mechanism.

Risks Associated with Indonesia: Indonesia’s political institutions and democracy have a relatively short history, increasing the risk of political instability. Indonesia has in the past faced political and militant unrest within several of its regions, and further unrest could present a risk to the local economy and stock markets. In addition, many economic development problems remain, including high unemployment, a developing banking sector, endemic corruption, inadequate infrastructure, a poor investment climate and unequal resource distribution among regions.

Currency Risks: When the Fund invests in foreign currencies (directly or through a financial instrument) or in securities denominated in a foreign currency, there is the risk that the value of the foreign currency will increase or decrease against the value of the U.S. dollar. The value of an investment denominated in a foreign currency will decline in dollar terms if that currency weakens against the dollar. Additionally, Asian countries may utilize formal or informal currency-exchange controls or “capital controls.” Capital controls may impose restrictions on the Fund’s ability to repatriate investments or income. Capital controls may also affect the value of the Fund’s holdings.

Interest Rate Risk (including Prepayment and Extension Risks): Changes in interest rates in each of the countries in which the Fund may invest, as well as interest rates in more-developed countries, may cause a decline in the market value of an investment. Generally, fixed income securities will decrease in value when interest rates rise and can be expected to rise in value when interest rates decline. As interest rates decline, debt issuers may repay or refinance their loans or obligations earlier than anticipated. The issuers of fixed income securities may, therefore, repay principal in advance. This would force the Fund to reinvest the proceeds from the principal prepayments at lower rates, which reduces the Fund’s income.

Volatility: The smaller size and lower levels of liquidity in Asian markets, as well as other factors, may result in changes in the prices of Asian securities that are more volatile than those of companies in the United States. This volatility can cause the price of the Fund’s shares (NAV) to go up or down dramatically. Because of this volatility, it is recommended that you invest in the Fund only for the long term (typically five years or longer).

Bank Loan Risk: To the extent the Fund invests in bank loans, it is exposed to additional risks beyond those normally associated with more traditional debt securities. The Fund’s ability to receive payments in connection with the loan depends primarily on the financial condition of the borrower, and whether or not a loan is secured by collateral, although there is no assurance that the collateral securing the loan will be sufficient to satisfy the loan obligation. In addition, bank loans often have contractual restrictions on resale, which can delay the sale and adversely impact the sale price. Transactions in many bank loans settle on a delayed basis, and the Fund may not receive the proceeds from the sale of a bank loan for a substantial period of time after the sale. As a result, those proceeds will not be available to make additional investments or to meet the Fund’s redemption obligations. Bank loan investments may not be considered securities and may not have the protections afforded by the federal securities laws.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

The value of your investment in the Fund could go down, meaning you could lose money.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

The Fund is a “non-diversified” investment company, which means that it may invest a larger portion of its assets in the securities of a single issuer (including governments, their agencies, instrumentalities and political sub-divisions, quasi-governmental entities, supra-national institutions and companies) compared with a diversified fund. An investment in the Fund therefore will entail greater risk than an investment in a diversified fund because a single security’s increase or decrease in value may have a greater impact on the Fund’s value and total return.

|

|

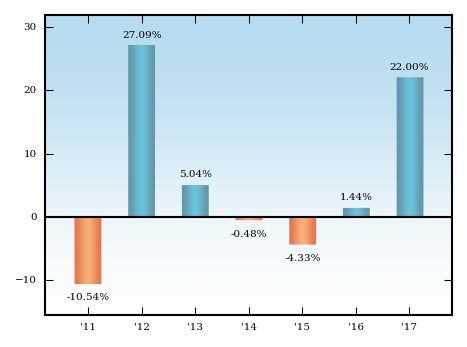

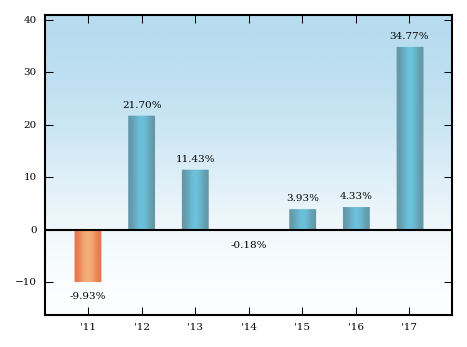

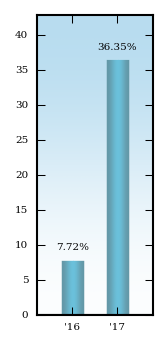

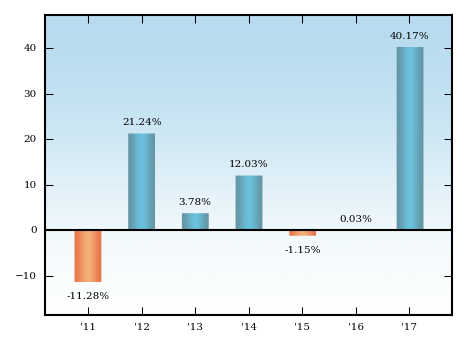

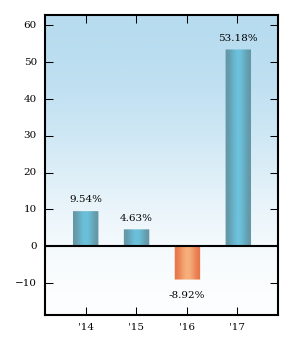

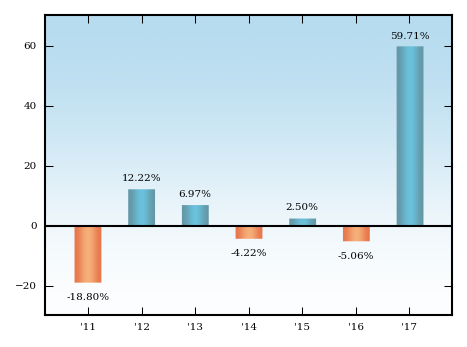

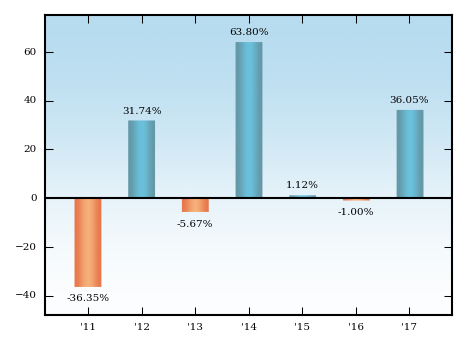

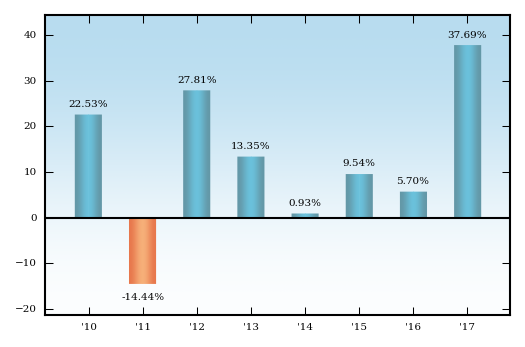

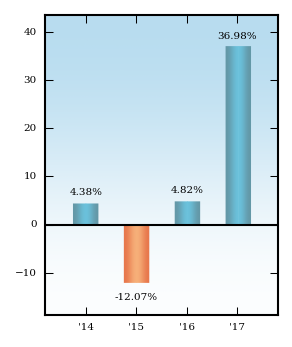

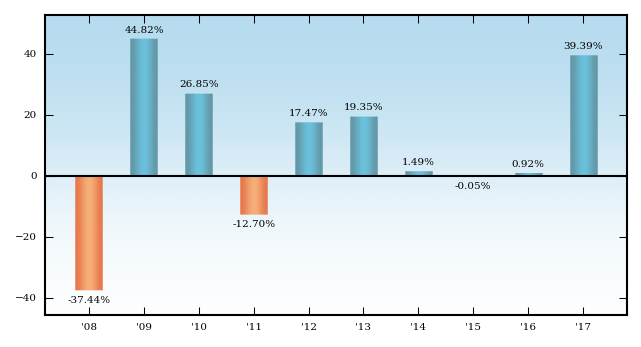

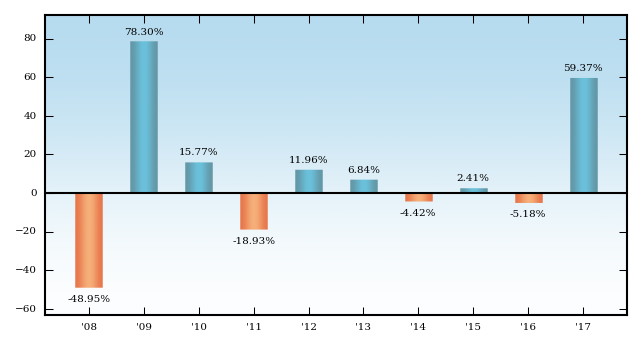

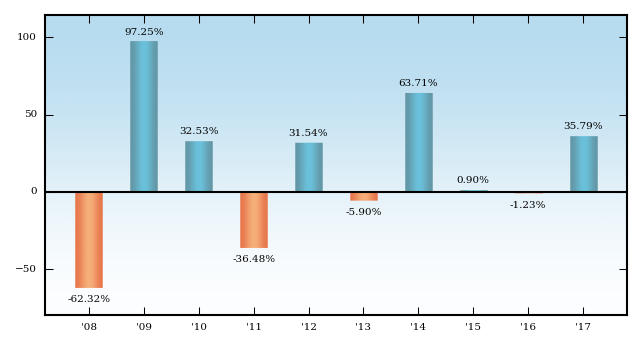

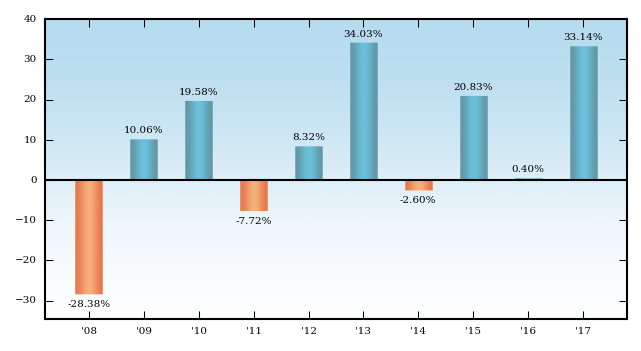

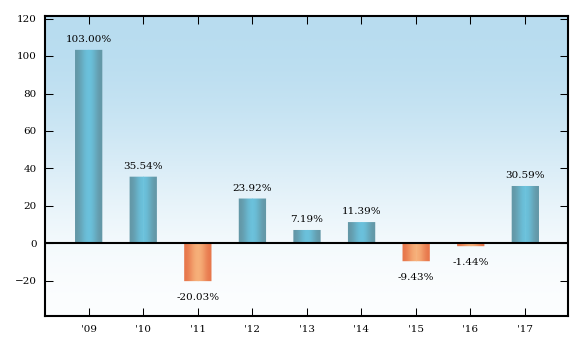

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Past Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The bar chart below shows the Fund’s performance for each full calendar year since inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. The bar chart shows performance of the Fund’s Investor Class Shares. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. The bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart below shows the Fund’s performance for each full calendar year since inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800.789.ASIA (2742)

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

matthewsasia.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The information presented below is past performance, before and after taxes, and is not a prediction of future results.

|

|

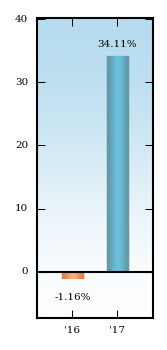

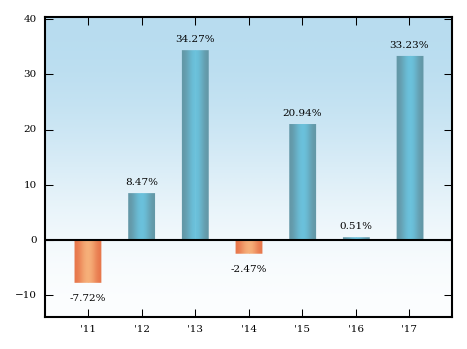

| Bar Chart [Heading] |

rr_BarChartHeading |

INVESTOR CLASS: ANNUAL RETURNS FOR YEARS ENDED 12/31

|

|

| Bar Chart Narrative [Text Block] |

rr_BarChartNarrativeTextBlock |

INSTITUTIONAL CLASS: ANNUAL RETURNS FOR YEARS ENDED 12/31 2017 8.13% Best Quarter: Q1 2017 2.71% Worst Quarter: Q4 2017 0.73%

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Best Quarter Q1 2017 2.65% Worst Quarter Q4 2017 0.70%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Mar. 31, 2017

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

2.65%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2017

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

0.70%

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

(reflects no deduction for fees, expenses or taxes)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns are shown for only one class of shares and after-tax returns for other classes of shares will vary.

|

|

| Caption |

rr_AverageAnnualReturnCaption |

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2017

|

|

| MATTHEWS ASIA CREDIT OPPORTUNITIES FUND | J.P. Morgan Asia Credit Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

5.77%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

4.28%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Apr. 29, 2016

|

|

| MATTHEWS ASIA CREDIT OPPORTUNITIES FUND | Investor Class Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Account Fee on Redemptions (for wire redemptions only) |

rr_MaximumAccountFee |

$ 9

|

|

| Management Fee |

rr_ManagementFeesOverAssets |

0.65%

|

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

|

|

| Administration and Shareholder Servicing Fees |

rr_Component1OtherExpensesOverAssets |

0.14%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

1.21%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.86%

|

|

| Fee Waiver and Expense Reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.71%)

|

[1] |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement |

rr_NetExpensesOverAssets |

1.15%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 117

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

516

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

940

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 2,122

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

7.86%

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

7.86%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

7.52%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Apr. 29, 2016

|

|

| MATTHEWS ASIA CREDIT OPPORTUNITIES FUND | Investor Class Shares | After Taxes on Distributions |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

5.62%

|

[2] |

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

5.28%

|

[2] |

| MATTHEWS ASIA CREDIT OPPORTUNITIES FUND | Investor Class Shares | After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

4.50%

|

[2] |

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

4.74%

|

[2] |

| MATTHEWS ASIA CREDIT OPPORTUNITIES FUND | Institutional Class Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Account Fee on Redemptions (for wire redemptions only) |

rr_MaximumAccountFee |

$ 9

|

|

| Management Fee |

rr_ManagementFeesOverAssets |

0.65%

|

|

| Distribution (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

|

|

| Administration and Shareholder Servicing Fees |

rr_Component1OtherExpensesOverAssets |

0.14%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.97%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.62%

|

|

| Fee Waiver and Expense Reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.72%)

|

[1] |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement |

rr_NetExpensesOverAssets |

0.90%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 92

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

441

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

813

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,861

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

8.13%

|

|

| Average Annual Returns, Since Inception |

rr_AverageAnnualReturnSinceInception |

7.78%

|

|

| Average Annual Returns, Inception Date |

rr_AverageAnnualReturnInceptionDate |

Apr. 29, 2016

|

|

|

|