| MATTHEWS CHINA SMALL COMPANIES FUND | |||||||||||||||||||||||||||||||||||||||||||||||||

| MATTHEWS CHINA SMALL COMPANIES FUND | |||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||

Long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares of this Fund. | |||||||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE OF FUND EXPENSES | |||||||||||||||||||||||||||||||||||||||||||||||||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example reflects the expense limitation for the one year period only. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | |||||||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example of fund expenses, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate for the Investor Class shares was 63% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategy | |||||||||||||||||||||||||||||||||||||||||||||||||

Under normal market conditions, the Matthews China Small Companies Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in the common and preferred stocks of Small Companies (defined below) located in China. China includes its administrative and other districts, such as Hong Kong. A company or other issuer is considered to be “located” in a country or a region, and a security or instrument will deemed to be an Asian (or specific country) security or instrument, if it has substantial ties to that country or region. Matthews currently makes that determination based primarily on one or more of the following criteria: (A) with respect to a company or issuer, whether (i) it is organized under the laws of that country or any country in that region; (ii) it derives at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed, or has at least 50% of its assets located, within that country or region; (iii) it has the primary trading markets for its securities in that country or region; (iv) it has its principal place of business in or is otherwise headquartered in that country or region; or (v) it is a governmental entity or an agency, instrumentality or a political subdivision of that country or any country in that region; and (B) with respect to an instrument or issue, whether (i) its issuer is headquartered or organized in that country or region; (ii) it is issued to finance a project with significant assets or operations in that country or region; (iii) it is secured or backed by assets located in that country or region; (iv) it is a component or its issuer is included in a recognized securities index for the country or region; or (v) it is denominated in the currency of an Asian country and addresses at least one of the other above criteria. The Fund may also invest in depositary receipts, including American, European and Global Depositary Receipts. The Fund seeks to invest in smaller companies capable of sustainable growth based on the fundamental characteristics of those companies, including balance sheet information; number of employees; size and stability of cash flow; management’s depth, adaptability and integrity; product lines; marketing strategies; corporate governance; and financial health. Matthews determines whether a company should be considered to be a small company based on the size of its revenues, number of employees, net assets, the size and depth of its product line, level of development, and other factors compared to other companies in its industry, sector or region (“Small Companies”). The Fund shall not invest in any company that has a market capitalization (the number of the company’s shares outstanding times the market price per share for such securities) higher than the greater of $3 billion or the market capitalization of the largest company included in the Fund’s primary benchmark index if, at the time of purchase, more than 20% of the Fund’s assets are already invested in such companies. The largest company in the Fund’s primary benchmark, the MSCI China Small Cap Index, had a market capitalization of $3.5 billion on December 31, 2016. Companies in which the Fund invests typically operate in growth industries and possess the potential to expand their scope of business over time. The Fund may continue to hold a security if its market capitalization increases above these levels after purchase. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks of Investment | |||||||||||||||||||||||||||||||||||||||||||||||||

There is no guarantee that your investment in the Fund will increase in value. The value of your investment in the Fund could go down, meaning you could lose money. The principal risks of investing in the Fund are: Political, Social and Economic Risks of Investing in Asia: The value of the Fund’s assets may be adversely affected by political, economic, social and religious instability; inadequate investor protection; changes in laws or regulations of countries within the Asian region (including countries in which the Fund invests, as well as the broader region); international relations with other nations; natural disasters; corruption and military activity. The Asian region, and particularly China, Japan and South Korea, may be adversely affected by political, military, economic and other factors related to North Korea. In addition, China’s long-running conflict over Taiwan, border disputes with many of its neighbors and historically strained relations with Japan could adversely impact economies in the region. The economies of many Asian countries differ from the economies of more developed countries in many respects, such as rate of growth, inflation, capital reinvestment, resource self-sufficiency, financial system stability, the national balance of payments position and sensitivity to changes in global trade. Deflationary factors could also reemerge in certain Asian markets, the potential effects of which are difficult to forecast. While certain Asian governments will have the ability to offset deflationary conditions through fiscal or budgetary measures, others will lack the capacity to do so. Certain Asian countries are highly dependent upon and may be affected by developments in the United States, Europe and other Asian economies. Global economic conditions, and international trade, affecting Asian economies and companies could deteriorate as a result of political instability and uncertainty, and politically motivated actions, in the United States and Europe, as well as increased tensions with certain nations such as Russia. Currency Risks: When the Fund conducts securities transactions in a foreign currency, there is the risk of the value of the foreign currency increasing or decreasing against the value of the U.S. dollar. The value of an investment denominated in a foreign currency will decline in dollar terms if that currency weakens against the dollar. While the Fund is permitted to hedge currency risks, Matthews does not anticipate doing so at this time. Additionally, Asian countries may utilize formal or informal currency-exchange controls or “capital controls.” Capital controls may impose restrictions on the Fund’s ability to repatriate investments or income. Such controls may also affect the value of the Fund’s holdings. Volatility: The smaller size and lower levels of liquidity in emerging markets, as well as other factors, may result in changes in the prices of Asian securities that are more volatile than those of companies in more developed regions. This volatility can cause the price of the Fund’s shares (NAV) to go up or down dramatically. Because of this volatility, it is recommended that you invest in the Fund only for the long term (at least five years). Risks Associated with Emerging and Frontier Markets: Many Asian countries are considered emerging or frontier markets (newer or less developed emerging markets are also sometimes referred to as frontier markets). Such markets are often less stable politically and economically than developed markets such as the United States, and investing in these markets involves different and greater risks. There may be less publicly available information about companies in many Asian countries, and the stock exchanges and brokerage industries in many Asian countries typically do not have the level of government oversight as do those in the United States. Securities markets of many Asian countries are also substantially smaller, less liquid and more volatile than securities markets in the United States. Depositary Receipts: Although depositary receipts have risks similar to the securities that they represent, they may also involve higher expenses and may trade at a discount (or premium) to the underlying security. In addition, depositary receipts may not pass through voting and other shareholder rights, and may be less liquid than the underlying securities listed on an exchange. Risks Associated with Smaller Companies: Smaller companies may offer substantial opportunities for capital growth; they also involve substantial risks, and investments in smaller companies may be considered speculative. Such companies often have limited product lines, markets or financial resources. Smaller companies may be more dependent on one or few key persons and may lack depth of management. Larger portions of their stock may be held by a small number of investors (including founders and management) than is typical of larger companies. Credit may be more difficult to obtain (and on less advantageous terms) than for larger companies. As a result, the influence of creditors (and the impact of financial or operating restrictions associated with debt financing) may be greater than in larger or more established companies. The Fund may have more difficulty obtaining information about smaller companies, making it more difficult to evaluate the impact of market, economic, regulatory and other factors on them. Informational difficulties may also make valuing or disposing of their securities more difficult than it would for larger companies. Securities of smaller companies may trade less frequently and in lesser volume than more widely held securities and the securities of such companies generally are subject to more abrupt or erratic price movements than more widely held or larger, more established companies or the market indices in general. The value of securities of smaller companies may react differently to political, market and economic developments than the markets as a whole or than other types of stocks. Industrial Sector Risk: Industrial companies are affected by supply and demand both for their specific product or service and for industrial sector products in general. Government regulation, world events, exchange rates and economic conditions, technological developments and liabilities for environmental damage and general civil liabilities will likewise affect the performance of these companies. Consumer Discretionary Sector Risk: The success of consumer product manufacturers and retailers is tied closely to the performance of the overall local and international economy, interest rates, competition and consumer confidence. Success depends heavily on disposable household income and consumer spending. Changes in demographics and consumer tastes can also affect the demand for, and success of, consumer products and services in the marketplace. Risks Associated with China, Hong Kong and Taiwan China: The Chinese government exercises significant control over China’s economy through its industrial policies (e.g., allocation of resources and other preferential treatment), monetary policy, management of currency exchange rates, and management of the payment of foreign currency- denominated obligations. Changes in these policies could adversely impact affected industries or companies. China’s economy, particularly its export-oriented industries, may be adversely impacted by trade or political disputes with China’s major trading partners, including the U.S. In addition, as its consumer class emerges, China’s domestically oriented industries may be especially sensitive to changes in government policy and investment cycles. China’s currency, which historically has been managed in a tight range relative to the U.S. dollar, may in the future be subject to greater uncertainty as Chinese authorities change the policies that determine the exchange rate mechanism. Hong Kong: If China were to exert its authority so as to alter the economic, political or legal structures or the existing social policy of Hong Kong, investor and business confidence in Hong Kong could be negatively affected, which in turn could negatively affect markets and business performance and have an adverse effect on the Fund’s investments. Taiwan: Although the relationship between China and Taiwan has been improving, there is the potential for future political or economic disturbances that may have an adverse impact on the values of investments in either China or Taiwan, or make investments in China and Taiwan impractical or impossible. | |||||||||||||||||||||||||||||||||||||||||||||||||

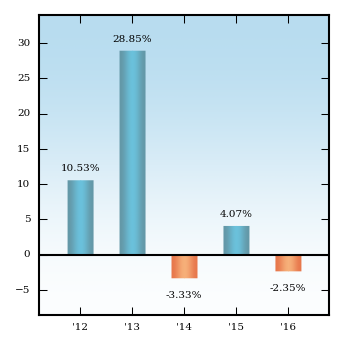

| Past Performance | |||||||||||||||||||||||||||||||||||||||||||||||||

The bar chart below shows the performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742). | |||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL RETURN FOR YEARS ENDED 12/31 (FOR INVESTOR CLASS SHARES)1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter1 Q2 2015 14.27% Worst Quarter1 Q3 2015 -19.57% | |||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016 (FOR INVESTOR CLASS SHARES) | |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||