| MATTHEWS ASIA STRATEGIC INCOME FUND | ||||||||||||||||||||||||||||||||||||

| MATTHEWS ASIA STRATEGIC INCOME FUND | ||||||||||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||||||||||

The Matthews Asia Strategic Income Fund (the “Strategic Income Fund” or the “Fund”) seeks total return over the long term, with an emphasis on income. | ||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | ||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares of this Fund. | ||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ANNUAL OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| EXAMPLE OF FUND EXPENSES | ||||||||||||||||||||||||||||||||||||

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example reflects the expense limitation for the one year period only. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example of fund expenses, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 50% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||

| Principal Investment Strategy | ||||||||||||||||||||||||||||||||||||

Under normal market conditions, the Strategic Income Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in income-producing securities including, but not limited to, dividend paying equity securities, and debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. The Fund intends to achieve its investment objective by investing in income-generating securities across currencies and the capital structure. Investments may be denominated in any currency, and may represent any part of a company’s capital structure from debt to equity or with features of both. Debt and debt-related instruments typically include bonds, debentures, bills, securitized instruments (which are vehicles backed by pools of assets such as loans or other receivables), notes, certificates of deposit and other bank obligations, bank loans, senior secured bank debt, convertible debt securities, credit-linked notes, inflation-linked instruments, repurchase agreements, payment-in-kind securities and derivative instruments with fixed income characteristics. Asia consists of all countries and markets in Asia, such as China and India, and includes developed, emerging, and frontier countries and markets in the Asian region. A company or other issuer is considered to be “located” in a country or a region, and a security or instrument will deemed to be an Asian (or specific country) security or instrument, if it has substantial ties to that country or region. Matthews currently makes that determination based primarily on one or more of the following criteria: (A) with respect to a company or issuer, whether (i) it is organized under the laws of that country or any country in that region; (ii) it derives at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed, or has at least 50% of its assets located, within that country or region; (iii) it has the primary trading markets for its securities in that country or region; (iv) it has its principal place of business in or is otherwise headquartered in that country or region; or (v) it is a governmental entity or an agency, instrumentality or a political subdivision of that country or any country in that region; and (B) with respect to an instrument or issue, whether (i) its issuer is headquartered or organized in that country or region; (ii) it is issued to finance a project with significant assets or operations in that country or region; (iii) it is secured or backed by assets located in that country or region; (iv) it is a component or its issuer is included in a recognized securities index for the country or region; or (v) it is denominated in the currency of an Asian country and addresses at least one of the other above criteria. Up to 50% of the Fund’s total net assets may be invested in securities of issuers from a single country (including the government of that country, its agencies, instrumentalities and political subdivisions), and up to 25% of the Fund’s total net assets, may be invested in the securities issued by any one Asian government (including its agencies, instrumentalities and political subdivisions). The Fund will not seek to limit its foreign currency exposure and may invest without limitation in non-U.S. dollar-denominated securities and instruments. The Fund reserves the right to hedge its exposure to foreign currencies to reduce the risk of loss from fluctuations in currency exchange rates, but normally does not expect to do so. The Fund may engage in derivative transactions for speculative purposes as well as to manage credit, interest rate and currency exposures of underlying instruments or market exposures. The Fund may use a variety of derivative instruments, including for example, forward contracts, option contracts, futures and options on futures, and swaps (including interest rate swaps, credit default swaps, options or swaptions). The Fund may seek to take on or hedge credit, currency, and interest rate exposure by using derivatives, and, as a result, the Fund’s exposure to credit, currency, and interest rates could exceed the value of the Fund’s assets denominated in that currency and could exceed the value of the Fund’s net assets. The Fund is permitted to invest in debt securities of any quality, including high yield debt securities rated below investment grade (commonly referred to as “junk bonds”) and unrated debt securities. The Fund has no stated maturity or duration target and the average effective maturity or duration target may change. Matthews has implemented risk management systems to monitor the Fund to reduce the risk of loss through overemphasis on a particular issuer, country, industry, currency, or interest rate regime. Matthews also may, from time to time, employ a currency overlay strategy for the Fund in an effort to enhance returns and moderate volatility. This strategy involves long and short positions on one or more currencies, with a total or gross notional value of these positions equal to as much as a substantial majority of the NAV of the Fund, although the net market value of these positions, on a marked-to-market basis, at most times, is expected to be substantially lower. | ||||||||||||||||||||||||||||||||||||

| Principal Risks of Investment | ||||||||||||||||||||||||||||||||||||

There is no guarantee that your investment in the Fund will increase in value. The value of your investment in the Fund could go down, meaning you could lose money. The principal risks of investing in the Fund are: Credit Risk: A debt instrument’s price depends, in part, on the credit quality of the issuer, borrower, counterparty, or underlying collateral and can decline in response to changes in the financial condition of the issuer, borrower, counterparty, or underlying collateral, or changes in specific or general market, economic, industry, political, regulatory, geopolitical, or other conditions. Interest Rate Risk (including Prepayment and Extension Risks): Changes in interest rates in each of the countries in which the Fund may invest, as well as interest rates in more-developed countries, may cause a decline in the market value of an investment. Generally, fixed income securities will decrease in value when interest rates rise and can be expected to rise in value when interest rates decline. As interest rates decline, debt issuers may repay or refinance their loans or obligations earlier than anticipated. The issuers of fixed income securities may, therefore, repay principal in advance. This would force the Fund to reinvest the proceeds from the principal prepayments at lower rates, which reduces the Fund’s income. Currency Risks: When the Fund invests in foreign currencies (directly or through a financial instrument) or in securities denominated in a foreign currency, there is the risk that the value of the foreign currency will increase or decrease against the value of the U.S. dollar. The value of an investment denominated in a foreign currency will decline in dollar terms if that currency weakens against the dollar. Additionally, Asian countries may utilize formal or informal currency-exchange controls or “capital controls.” Capital controls may impose restrictions on the Fund’s ability to repatriate investments or income. Capital controls may also affect the value of the Fund’s holdings. Convertible Securities Risk: The market value of a convertible security performs like that of a regular debt security, that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock. The Fund may also invest in convertible securities known as contingent capital financial instruments or “CoCos.” CoCos generally provide for mandatory or automatic conversion into common stock of the issuer under certain circumstances or may have principal write down features. Because the timing of conversion may not be anticipated, and conversion may occur when prices are unfavorable, reduced returns or losses may occur. Some CoCos may be leveraged, which can make those CoCos more volatile in changing interest rate or other conditions. Country Concentration: The Fund may invest a significant portion of its total net assets, 25% or more, in the securities of issuers located in a single country (including the government of that country, its agencies, instrumentalities and political subdivisions, quasi-governmental entities, supra-national institutions issuing debt deemed to be of that country, and companies located in that country). An investment in the Fund therefore may entail greater risk than an investment in a fund that does not concentrate its investments in a single or small number of countries because these securities may be more sensitive to adverse social, political, economic or regulatory developments affecting that country or countries, than funds that do not concentrate their investments. Events affecting a single or small number of countries may have a significant and potentially adverse impact on your investment in the Fund, and the Fund’s performance may be more volatile than that of funds that invest globally. Political, Social and Economic Risks of Investing in Asia: The value of the Fund’s assets may be adversely affected by political, economic, social and religious instability; inadequate investor protection; changes in laws or regulations of countries within the Asian region (including countries in which the Fund invests, as well as the broader region); international relations with other nations; natural disasters; corruption and military activity. The Asian region, and particularly China, Japan and South Korea, may be adversely affected by political, military, economic and other factors related to North Korea. In addition, China’s long-running conflict over Taiwan, border disputes with many of its neighbors and historically strained relations with Japan could adversely impact economies in the region. The economies of many Asian countries differ from the economies of more developed countries in many respects, such as rate of growth, inflation, capital reinvestment, resource self-sufficiency, financial system stability, the national balance of payments position and sensitivity to changes in global trade. Certain Asian countries are highly dependent upon and may be affected by developments in the United States, Europe and other Asian economies. Volatility: The smaller size and lower levels of liquidity in Asian markets, as well as other factors, may result in changes in the prices of Asian securities that are more volatile than those of companies in the United States. This volatility can cause the price of the Fund’s shares (NAV) to go up or down dramatically. Because of this volatility, it is recommended that you invest in the Fund only for the long term (at least five years). Risks Associated with Emerging and Frontier Markets: Many Asian countries are considered emerging or frontier markets. Such markets are often less stable politically and economically than developed markets, and investing in these markets involves different and greater risks. There may be less publicly available information about companies in many Asian countries, and the stock exchanges and brokerage industries in many Asian countries typically do not have the level of government oversight as do those in the United States. Securities markets of many Asian countries are also substantially smaller, less liquid and more volatile than securities markets in the United States. High-Yield Bonds and Other Lower-Rated Securities: The Fund’s investments in high-yield bonds (“junk bonds,” which are primarily speculative securities) and other lower-rated securities will subject the Fund to substantial risk of loss. Issuers of junk bonds are less financially secure and less able to repay interest and principal compared to issuers of investment-grade securities. Prices of junk bonds tend to be very volatile. These securities are less liquid than investment-grade debt securities and may be difficult to price or sell, particularly in times of negative sentiment toward high-yield securities. Derivatives Risk (including Options, Futures and Swaps): Derivatives are speculative and may hurt the Fund’s performance. Derivative products are highly specialized instruments that require investment techniques and risk analyses different from those associated with stocks and bonds. The use of a derivative requires an understanding not only of the underlying instrument but also of the derivative itself, without the benefit of observing the performance of the derivative under all possible market conditions. Derivatives present the risk of disproportionately increased losses and/or reduced opportunities for gains when the financial asset or measure to which the derivative is linked changes in unexpected ways. Non-diversified: The Fund is a “non-diversified” investment company, which means that it may invest a larger portion of its assets in the securities of a single issuer compared with a diversified fund. An investment in the Fund therefore will entail greater risk than an investment in a diversified fund because a single security’s increase or decrease in value may have a greater impact on the Fund’s value and total return. Risks Associated with China: The Chinese government exercises significant control over China’s economy through its industrial policies (e.g., allocation of resources and other preferential treatment), monetary policy, management of currency exchange rates, and management of the payment of foreign currency-denominated obligations. Changes in these policies could adversely impact affected industries or companies. China’s economy, particularly its export-oriented industries, may be adversely impacted by trade or political disputes with China’s major trading partners, including the U.S. In addition, as its consumer class emerges, China’s domestically oriented industries may be especially sensitive to changes in government policy and investment cycles. Risks Associated with India: Government actions, bureaucratic obstacles and inconsistent economic reform within the Indian government have had a significant effect on the economy and could adversely affect market conditions, economic growth and the profitability of private enterprises. Global factors and foreign actions may inhibit the flow of foreign capital on which India is dependent to sustain its growth. Large portions of many Indian companies remain in the hands of their founders (including members of their families). Corporate governance standards of family-controlled companies may be weaker and less transparent, which increases the potential for loss and unequal treatment of investors. India experiences many of the risks associated with developing economies, including relatively low levels of liquidity, which may result in extreme volatility in the prices of Indian securities. Religious, cultural and military disputes persist in India, and between India and Pakistan (as well as sectarian groups within each country). Both India and Pakistan have tested nuclear arms, and the threat of deployment of such weapons could hinder development of the Indian economy, and escalating tensions could impact the broader region, including China. Bank Loan Risk: To the extent the Fund invests in bank loans, it is exposed to additional risks beyond those normally associated with more traditional debt securities. The Fund’s ability to receive payments in connection with the loan depends primarily on the financial condition of the borrower, and whether or not a loan is secured by collateral, although there is no assurance that the collateral securing the loan will be sufficient to satisfy the loan obligation. In addition, bank loans often have contractual restrictions on resale, which can delay the sale and adversely impact the sale price. Bank loan investments may not be considered securities and may not have the protections afforded by the federal securities laws. | ||||||||||||||||||||||||||||||||||||

| Past Performance | ||||||||||||||||||||||||||||||||||||

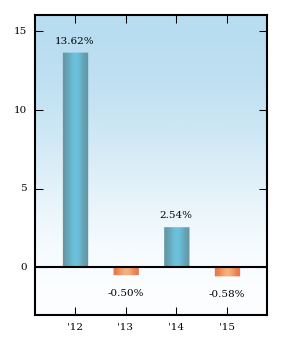

The bar chart below shows the Fund’s performance for each full calendar year since inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. The bar chart shows performance of the Fund’s Investor Class Shares. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. The bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742). | ||||||||||||||||||||||||||||||||||||

| INVESTOR CLASS: ANNUAL RETURNS FOR YEARS ENDED 12/31 | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

Best Quarter Q3 2012 5.31% Worst Quarter Q2 2013 -5.37% | ||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2015 | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||