Filed Pursuant to Rule 424(b)(2)

Registration No. 333-261845

PRICING SUPPLEMENT No. 2, dated July 25, 2022

(To prospectus, dated January 13, 2022, and

prospectus supplement, dated March 11, 2022)

TRUIST FINANCIAL CORPORATION

Medium-Term Notes, Series H (Subordinated)

This pricing supplement supplements the terms and conditions in the prospectus, dated January 13, 2022, as supplemented by the prospectus supplement, dated March 11, 2022 (the “prospectus supplement” and together with the prospectus, dated January 13, 2022 (the “base prospectus”), and all documents incorporated herein by reference therein and herein, the “prospectus”), and relates to the offering and sale of $1,000,000,000 aggregate principal amount of 4.916% Fixed-to-Floating Rate Subordinated Notes due July 28, 2033 (the “Notes”). Unless otherwise defined in this pricing supplement, terms used herein have the same meanings as are given to them in the prospectus.

| Term |

Fixed-to-Floating Rate Subordinated Notes | |

| CUSIP / ISIN Nos. | 89788NAA8 / US89788NAA81 | |

| Series | Series H (Subordinated) | |

| Form of Note | Book-Entry | |

| Principal Amount | $1,000,000,000 | |

| Trade Date | July 25, 2022 | |

| Original Issue Date | July 28, 2022 (T+3) | |

| Maturity Date | July 28, 2033 | |

| Redemption Dates and Terms | Redeemable on July 28, 2032, in whole but not in part, or on or after April 28, 2033 (three months prior to the Maturity Date), in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the Notes being redeemed, in each case, plus accrued and unpaid interest thereon to, but excluding, the date of redemption. We will provide 10 to 60 calendar days’ notice of redemption to the registered holder of the Notes. | |

| Base Rate | During the Floating Rate Period, SOFR (compounded daily over a quarterly Interest Period in accordance with the specific formula described in this pricing supplement). | |

| Distribution | Underwritten basis | |

| Authorized Denomination | $2,000, or any amount in excess of $2,000 which is an integral multiple of $1,000 | |

| Issue Price (Dollar Amount and Percentage of Principal Amount) | $ 1,000,000,000/100% | |

| Net Proceeds (Before Expenses) to the Company | $997,000,000 | |

| Fixed Rate Period | The period from, and including, the Original Issue Date to, but excluding, July 28, 2032 | |

| Floating Rate Period | The period from, and including, July 28, 2032 to, but excluding, the Maturity Date | |

| Interest Rate | During the Fixed Rate Period, 4.916% per annum; during the Floating Rate Period, a compounded average of daily SOFR determined for each quarterly Interest Period in accordance with the specific formula described under “Supplemental Description of Notes” section below, plus the Spread. | |

| Initial Interest Rate | Not applicable | |

| Interest Payment Dates | With respect to the Fixed Rate Period, each January 28 and July 28, commencing January 28, 2023; with respect to the Floating Rate Period, each January 28, April 28, July 28 and October 28, commencing October 28, 2032, as further described under “Supplemental Description of Notes” section below. | |

| Interest Periods | During the Fixed Rate Period, semiannually; during the Floating Rate Period, quarterly, as defined under “Supplemental Description of Notes” section below. | |

| Regular Record Dates | 15 calendar days prior to each interest payment date | |

| Interest Determination Dates | For the Floating Rate Period, the date two U.S. Government Securities Business Days before each interest payment date. | |

| Interest Reset Dates | For the Floating Rate Period, each interest payment date. | |

| Index Source | As published by SOFR administrator | |

| Index Maturity | Daily | |

| Spread | + 224.0 basis points | |

| Spread Multiplier | Not applicable | |

| Maximum Interest Rate | Maximum rate permitted by New York law. | |

| Day Count | During the Fixed Rate Period, 30/360; during the Floating Rate Period, Actual/360 | |

| Minimum Interest Rate | Zero | |

| Original Issue Discount Notes | Not applicable |

The Notes are unsecured and will rank junior and be subordinated to all of our senior indebtedness. The holders of the Notes may be fully subordinated to interests held by the U.S. government in the event that Truist Financial Corporation enters into a receivership, insolvency, liquidation, or similar proceeding.

The Notes are not deposits or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Investing in the Notes involves risk. See “Supplemental Risk Factors” beginning on page PS-5 of this pricing supplement as well as “Risk Factors” beginning on page S-2 of the prospectus supplement and page 19 of our Annual Report on Form 10-K for the year ended December 31, 2021, which is incorporated herein by reference.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined that this pricing supplement, the attached prospectus supplement or the attached prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Note(1) | Total | |||||||

| Price to Public |

100.000 | % | $ | 1,000,000,000 | ||||

| Underwriters’ Discount |

0.300 | % | $ | 3,000,000 | ||||

| Net Proceeds (Before Expenses) to Us |

99.700 | % | $ | 997,000,000 | ||||

| (1) | Plus accrued interest, if any, from July 28, 2022, if settlement occurs after that date. |

We expect to deliver the Notes to investors through the book-entry delivery system of The Depository Trust Company and its direct participants on or about July 28, 2022.

Joint Book-Running Managers

| Truist Securities | BofA Securities | Morgan Stanley |

Co-Managers

| CastleOak Securities, L.P. | C.L. King & Associates |

July 25, 2022

RECENT DEVELOPMENTS

Truist’s Second Quarter 2022 Financial Results

On July 19, 2022, we reported earnings for the second quarter of 2022. Outlined below is a summary of those results. Our second quarter 2022 consolidated financial results below are unaudited and preliminary. Such results are based on information available to management as of the date of the earnings report and is subject to completion by management of our financial statements as of and for the quarter ended June 30, 2022. There can be no assurance that actual results for the second quarter will not differ from these preliminary financial data, including as a result of quarter-end closing, and any such changes could be material. Complete quarterly results will be included in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. Our second quarter 2022 consolidated financial results below should be read in conjunction with our Quarterly Report on Form 10-Q for the period ended March 31, 2022 and our Annual Report on Form 10-K for the year ended December 31, 2021, which are incorporated by reference herein.

Earnings Overview — Second Quarter 2022 Compared to Second Quarter 2021

Net income available to common shareholders for the second quarter of 2022 was $1.5 billion, down 6.7% from the second quarter of last year, which we refer to as the earlier quarter, primarily due to a benefit in the provision for credit losses last year. Earnings per diluted common share were $1.09, a decrease of 6.0% compared with the same period last year. Earnings for the current quarter include merger-related and restructuring charges of $121 million ($92 million after-tax), incremental operating expenses related to the merger with SunTrust Banks, Inc. of $117 million ($89 million after-tax), and a gain on the redemption of Federal Home Loan Bank (“FHLB”) advances of $39 million ($30 million after-tax).

Our results for the second quarter produced an annualized return on average assets of 1.14%, an annualized return on average common shareholders’ equity of 10.3% and an annualized return on tangible common shareholders’ equity of 22.7%.

Total taxable-equivalent revenues were $5.7 billion for the second quarter of 2022, relatively flat compared to the earlier quarter.

Taxable equivalent net interest income for the second quarter of 2022 was up $162 million, or 4.9%, compared to the earlier quarter primarily due to higher market interest rates coupled with well controlled deposit costs, growth in the securities portfolio and lower premium amortization. These increases were partially offset by lower purchase accounting accretion and lower Paycheck Protection Program (“PPP”) revenue. Average earning assets increased $20.6 billion, or 4.5%, compared to the earlier quarter. The increase in average earning assets reflects a $13.0 billion, or 10%, increase in average securities, a $6.9 billion, or 2.4%, increase in total loans and leases, and a $1.0 billion, or 20%, increase in average interest earning trading assets. Average deposits increased $27.5 billion, or 6.9%, and average short term borrowings increased $3.5 billion, or 56%, compared to the earlier quarter, while average long-term debt decreased $5.6 billion, or 15%.

Net interest margin was 2.89%, up one basis point compared to the earlier quarter. The yield on the total loan portfolio for the second quarter of 2022 was 3.91%, down 10 basis points compared to the earlier quarter, reflecting the impact of lower purchase accounting accretion, partially offset by higher market interest rates. The yield on the average securities portfolio was 1.82%, up 35 basis points compared to the earlier quarter primarily due to purchases of higher yielding securities, favorable hedge benefits, and lower premium amortization.

The average cost of total deposits was 0.09%, up five basis points compared to the earlier quarter. The average cost of short-term borrowings was 1.26%, up 28 basis points compared to the earlier quarter. The average cost of long-term debt was 1.75%, up 15 basis points compared to the earlier quarter. The increase in rates on deposits and other funding sources was largely attributable to the higher rate environment.

PS-2

The provision for credit losses was $171 million, compared to a benefit of $434 million for the earlier quarter. The earlier quarter included a reserve release due to the improving credit environment during that period. Net charge-offs for the second quarter of 2022 totaled $159 million compared to $142 million in the earlier quarter. The net charge-off ratio for the current quarter of 0.22% was up two basis points compared to the earlier quarter.

Noninterest income for the second quarter of 2022 decreased $157 million, or 6.5%, compared to the earlier quarter. Investment banking and trading income decreased $147 million, or 37%, due to lower structured real estate fees, lower high-yield bond and equity originations fees, lower loan syndications, and lower merger and acquisition fees, partially offset by higher trading income due to higher credit valuation adjustment gains. Other income decreased $104 million, or 87%, due to valuation changes from assets held for certain post-retirement benefits, which is primarily offset by lower personnel expense, and lower investment income from the our Small Business Investment Company investments. Residential mortgage income decreased $43 million, or 37%, as lower production income (due to lower margins and refinance volumes resulting from the higher rate environment) was partially offset by higher servicing income (due to lower prepayments and servicing portfolio purchases). These decreases were partially offset by a $135 million, or 20%, increase in insurance income due to continued strong organic growth and acquisitions.

Noninterest expense for the second quarter of 2022 was down $431 million, or 11%, compared to the earlier quarter. Merger-related and restructuring charges decreased $176 million due to lower costs in connection with the voluntary separation and retirement program and lower costs associated with exiting facilities. Incremental operating expenses related to the merger decreased $73 million, primarily reflected in professional fees and outside processing expenses and personnel expense. The current quarter includes a $39 million gain on the redemption of FHLB advances. The prior quarter included $200 million of expense associated with charitable contributions to the Truist Foundation and the Truist Charitable Fund (other expense). Excluding the aforementioned items and the amortization of intangibles, adjusted noninterest expense increased $56 million, or 1.8%, compared to the earlier quarter. Personnel expense decreased $105 million, or 4.8%, ($74 million on an adjusted basis) due to lower other employee benefits as a result of the decrease in noninterest income for post-retirement benefits and lower incentives, partially offset by higher salaries due to annual merit increases and higher staffing for insurance (primarily from acquisitions) and enterprise technology. Other expense increased $73 million on an adjusted basis primarily due to increased operational losses and teammate travel expenses. Professional fees and outside processing expenses were up $42 million on an adjusted basis due to increased call center staffing and enterprise technology investments. Marketing and customer development expense was up $27 million due to increased spend to continue to build and strengthen our brand.

The provision for income taxes was $372 million for the second quarter of 2022, compared to $415 million for the earlier quarter. The effective tax rate for the second quarter of 2022 was 19.5%, compared to 20.0% for the earlier quarter. The decrease in the effective tax rate for the second quarter of 2022 was primarily driven by lower pre-tax income.

Balance Sheet Overview — Second Quarter 2022 Compared to First Quarter 2022

Average loans and leases held for investment for the second quarter of 2022 were $296.7 billion, up $8.1 billion, or 2.8%, compared to the first quarter of 2022. Excluding a $695 million decrease in average PPP loans, average loans held for investment were up $8.8 billion, or 3.1%.

Average commercial loans increased $5.8 billion, or 3.5%, due to broad-based growth of $6.7 billion, or 4.8%, within the commercial and industrial portfolio. This growth was partially offset by a $1.0 billion decrease in average commercial real estate loans.

PS-3

Average consumer loans increased $2.2 billion, or 1.9%, due to a $1.3 billion increase in residential mortgages due to the continued strategy to hold certain correspondent channel production on the balance sheet and lower prepayments. In addition, indirect other increased $611 million primarily due to growth from the Service Finance, recreational lending and Sheffield portfolios, partially offset by runoff in other partnership lending programs. Indirect auto increased $408 million primarily in the prime segment of the portfolio and residential home equity and direct increased $241 million. These increases were partially offset by $317 million of runoff in student loans.

Average deposits for the second quarter of 2022 were $423.8 billion, an increase of $8.5 billion, or 2.0%, compared to the prior quarter. Average noninterest bearing deposits increased 1.8% compared to the prior quarter and represented 35.1% of total deposits for the second quarter of 2022, unchanged compared to the prior quarter. Average money market and savings and interest checking grew 5.0% and 0.2%, respectively, compared to the prior quarter. The increase in average money market and savings was primarily due to an increase from brokered deposits. Average time deposits decreased 9.7% primarily due to the maturity of higher-cost accounts.

Asset Quality

Nonperforming assets totaled $1.2 billion at June 30, 2022, up $38 million compared to March 31, 2022 due to an increase in the commercial and industrial portfolio, partially offset by a decrease in the residential mortgage portfolio. Nonperforming loans and leases held for investment were 0.36% of loans and leases held for investment at June 30, 2022, flat compared to March 31, 2022.

Performing troubled debt restructurings were up $178 million compared to the prior quarter primarily due to an increase in government guaranteed residential mortgages.

Loans 90 days or more past due and still accruing totaled $1.8 billion at June 30, 2022, down $127 million, or seven basis points, as a percentage of loans and leases compared with the prior quarter primarily due to a decline in government guaranteed residential mortgages. Excluding government guaranteed loans, the ratio of loans 90 days or more past due and still accruing as a percentage of loans and leases was 0.04% at June 30, 2022, flat from March 31, 2022.

Loans 30-89 days past due and still accruing of $2.1 billion at June 30, 2022 were down $10 million, or three basis points as a percentage of loans and leases, compared to the prior quarter due to declines in the commercial and industrial portfolio, partially offset by a seasonal increase in the indirect auto portfolio.

Dividends and Capital

Capital ratios remained strong compared to the regulatory requirements for well capitalized banks. We declared common dividends of $0.48 per share during the second quarter of 2022 and repurchased $250 million of common stock. The dividend and total payout ratios for the second quarter of 2022 were 44% and 61%, respectively.

PS-4

The following supplemental information concerning the Notes is intended to be read in conjunction with the section entitled “Risk Factors” in the accompanying prospectus, which the following information supplements and, if there are any inconsistencies, supersedes.

Supplemental Risk Factors Relating to Acceleration Rights, Subordination and Resolution

Events for which acceleration rights under the Notes may be exercised are more limited than those available under the terms of our outstanding subordinated debt securities issued prior to the issue date of the Notes.

Immediately prior to the delivery of the Notes, we expect to enter into a fourth supplemental indenture (the “fourth supplemental indenture”), to be dated July 28, 2022, between us, as issuer, and U.S. Bank Trust Company, National Association (successor in interest to U.S. Bank National Association), as trustee (the “subordinated trustee”), to the indenture governing our subordinated debt securities, dated as of May 24, 1996 and as amended by the first supplemental indenture, dated as of December 23, 2003, the second supplemental indenture, dated as of September 24, 2004 and the third supplemental indenture, dated as of May 4, 2009 (such indenture as amended or supplemented from time to time, the “subordinated indenture”), pursuant to which the terms of our subordinated debt securities to be issued on or after the date of the fourth supplemental indenture, including the Notes, will be modified. The modifications to the terms of our subordinated debt securities will include, among other things, limiting the circumstances under which the payment of the principal amount of such subordinated debt securities can be accelerated.

All or substantially all of our outstanding subordinated debt securities issued prior to the issue date of the Notes (the “existing subordinated debt securities”) provide acceleration rights for certain events relating to the bankruptcy, insolvency or reorganization of Truist Financial Corporation or the bankruptcy, insolvency or reorganization of any Principal Constituent Bank. However, under the subordinated indenture, as supplemented by the fourth supplemental indenture, for subordinated debt securities issued on or after July 28, 2022, including the Notes, unless otherwise specified for a particular series of subordinated debt securities, the only events providing acceleration rights will be certain bankruptcy, insolvency, reorganization or similar proceedings with respect to Truist Financial Corporation only.

As a result of these differing provisions, if certain events of bankruptcy, insolvency or reorganization occur with respect to any Principal Constituent Bank, the subordinated trustee and the holders of the existing subordinated debt securities would have acceleration rights that would not be available to the subordinated trustee or the holders of the Notes. Any repayment of the principal amount of existing subordinated debt securities following the exercise of acceleration rights in circumstances in which such rights are not available to the holders of the Notes could adversely affect our ability to make timely payments on the Notes thereafter. These limitations on the rights and remedies of holders of the Notes could adversely affect the market value of the Notes, especially during times of financial stress for us or our industry.

Holders of the Notes could be at greater risk for being structurally subordinated if we sell, convey or transfer all or substantially all of our assets to one or more of our majority-owned subsidiaries.

If we sell, convey or transfer all or substantially all of our assets to one or more of direct or indirect majority-owned subsidiaries, under the subordinated indenture, as supplemented by the fourth supplemental indenture, for subordinated debt securities issued on or after July 28, 2022, including the Notes, such subsidiary or subsidiaries will not be required to assume our obligations under the Notes, and we will remain the sole obligor on the Notes. In such event, creditors of any such subsidiary or subsidiaries would have additional assets from which to recover on their claims while holders of the Notes would be structurally subordinated to creditors of such subsidiary or subsidiaries with respect to such assets. See “Supplemental Description of Notes—Consolidation, Merger, Sale, Conveyance and Lease.”

PS-5

Holders of Truist Financial Corporation’s debt, including the Notes, and equity securities will absorb losses if it were to enter into a resolution.

Federal Reserve rules require that certain globally systemically important banks (“GSIBs”) maintain minimum levels of unsecured external long-term debt and other loss-absorbing capacity with specific terms (“eligible LTD”) for purposes of recapitalizing such GSIBs’ operating subsidiaries if such GSIBs were to enter into a resolution either:

| • | in a bankruptcy proceeding under Chapter 11 of the U.S. Bankruptcy Code, or |

| • | in a receivership administered by the FDIC under Title II of the Dodd-Frank Act. |

While we are not currently subject to such requirements, it is possible that Federal Reserve will apply these requirements in the future to a larger subset of bank holdings companies, such as Truist Financial Corporation (the “Parent Company”). The Notes being offered hereby are intended to qualify as eligible LTD for purposes of the Federal Reserve’s total loss-absorbing capacity rules as currently in effect. If the Parent Company were to enter into a resolution, holders of eligible LTD and other debt and equity securities of the Parent Company will absorb the losses of the Parent Company and its subsidiaries.

As a result, the Parent Company’s losses and any losses incurred by its subsidiaries would be imposed first on holders of the Parent Company’s equity securities and thereafter on its unsecured creditors, including holders of eligible LTD and other debt securities, such as the Notes. Claims of holders of those securities would have a junior position to the claims of creditors of our subsidiaries and to the claims of priority (as determined by statute) and secured creditors of the Parent Company.

Accordingly, in a resolution of the Parent Company in bankruptcy, holders of eligible LTD and other debt securities of the Parent Company, including the Notes, would realize value only to the extent available to the Parent Company as a shareholder of Truist Bank and its other subsidiaries, and only after any claims of priority and secured creditors of the Parent Company have been fully repaid.

If the Parent Company were to approach, or enter into, a resolution, none of the Parent Company, the Federal Reserve or the FDIC is obligated to follow our resolution strategy, and losses to holders of eligible LTD and other debt and equity securities of the Parent Company, including the Notes, under whatever strategy ultimately followed, could be greater than they might have been under our resolution strategy.

Supplemental Risk Factors Relating to SOFR

The following discussion of risks should be read together with the section entitled “Description of Notes—Base Rates—SOFR” in the accompanying prospectus supplement and the section entitled “Supplemental Description of Notes” below, which define and further describe a number of terms and matters referred to in these risk factors.

The interest rate on the Notes for each Floating Rate Interest Period is based on a Compounded SOFR rate, which is relatively new in the marketplace.

For each Floating Rate Interest Period, the interest rate on the Notes is based on Compounded SOFR, which is calculated using the specific formula described under “—Supplemental Description of Notes,” not the SOFR rate published on or in respect of a particular date during such Floating Rate Interest Period or an arithmetic average of SOFR rates during such period. For this and other reasons, the interest rate on the Notes during any Floating Rate Interest Period will not be the same as the interest rate on other SOFR-linked investments that use an alternative basis to determine the applicable interest rate. Further, if the SOFR rate in respect of a particular date during a Floating Rate Interest Period is negative, its contribution to Compounded SOFR will be less than one, resulting in a reduction to Compounded SOFR used to calculate the interest payable on the Notes on the interest payment date for such Floating Rate Interest Period.

PS-6

In addition, very limited market precedent exists for securities that use SOFR as the interest rate and the method for calculating an interest rate based upon SOFR in those precedents varies. Accordingly, the specific formula for the Compounded SOFR rate used in the Notes may not be widely adopted by other market participants, if at all. If the market adopts a different calculation method, that would likely adversely affect the market value of the Notes.

Compounded SOFR with respect to a particular Floating Rate Interest Period will only be capable of being determined near the end of the relevant Floating Rate Interest Period.

The level of Compounded SOFR applicable to a particular Floating Rate Interest Period and, therefore, the amount of interest payable with respect to such Floating Rate Interest Period will be determined on the interest determination date for such Floating Rate Interest Period. Because each such date is near the end of such Floating Rate Interest Period, you will not know the amount of interest payable with respect to a particular Floating Rate Interest Period until shortly prior to the related interest payment date and it may be difficult for you to reliably estimate the amount of interest that will be payable on each such interest payment date. In addition, some investors may be unwilling or unable to trade the Notes without changes to their information technology systems, both of which could adversely impact the liquidity and trading price of the Notes.

The price at which the Notes may be sold prior to maturity will depend on a number of factors and may be substantially less than the amount for which they were originally purchased.

Some of these factors include, but are not limited to: (i) actual or anticipated changes in the level of SOFR, (ii) volatility of the level of SOFR, (iii) changes in interest and yield rates, (iv) any actual or anticipated changes in our credit ratings or credit spreads and (v) the time remaining to maturity of such Notes. Generally, the longer the time remaining to maturity and the more tailored the exposure, the more the market price of the Notes will be affected by the other factors described in the preceding sentence. This can lead to significant adverse changes in the market price of securities like the Notes. Depending on the actual or anticipated level of SOFR, the market value of the Notes may decrease and you may receive substantially less than 100% of the issue price if you are able to sell your Notes prior to maturity.

Supplemental Risk Factors Relating to Redemption

Investors should not expect us to redeem the Notes on the date the Notes become redeemable or on any particular date after the Notes become redeemable.

The Notes have no mandatory redemption date, other than on the maturity date, and are not redeemable at the option of investors. We have the option to redeem the Notes on July 28, 2032, in whole but not in part, or on or after April 28, 2033 (three months prior to the stated maturity date), in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the Notes being redeemed, in each case plus accrued and unpaid interest thereon to, but excluding, the date of redemption, with 10 to 60 calendar days’ notice of redemption of the registered holder of the Notes. Any decision we may make at any time to propose a redemption of the Notes will depend upon, among other things, our evaluation of our capital position, the composition of our stockholders’ equity and general market conditions at that time. If the Notes are redeemed prior to the stated maturity date, you may have to re-invest the proceeds in a lower interest rate environment. Any early redemption of the Notes will be subject to the receipt of the approval of the Federal Reserve, to the extent then required under applicable laws or regulations, including capital regulations.

PS-7

SUPPLEMENTAL DESCRIPTION OF NOTES

The following supplemental description of the Notes supplements and, to the extent inconsistent therewith, replaces the description of the general terms and provisions of our medium-term notes set forth in the accompanying prospectus supplement under the section entitled “Description of Notes” and the description of the general terms and provisions of our subordinated debt securities set forth in the accompanying base prospectus under the section entitled “Description of the Debt Securities.” It is important for you to consider the information contained in this pricing supplement and in the accompanying prospectus before making your investment decision with respect to the Notes.

When Interest with Respect to the Fixed Rate Period Is Paid

For the Fixed Rate Period, we will pay interest on the Notes at a rate of 4.916% per annum, payable semiannually in arrears on January 28 and July 28 of each year, commencing on January 28, 2023 (each a, “fixed rate interest payment date”). The last fixed rate interest payment date for the fixed rate period will be July 28, 2032. If any fixed rate interest payment date falls on a day that is not a business day, the interest payment will be made on the next day that is a business day, and no interest will accrue for the period from and after the scheduled fixed rate interest payment date. If the maturity date or a redemption date for the Notes falls on a day that is not a business day, the payment of interest and principal will be made on the next succeeding business day, but no additional interest shall accrue and be paid unless we fail to make payment on such next succeeding business day.

For the Fixed Rate Period, interest on the Notes will be computed and paid on the basis of a 360-day year of twelve 30-day months.

When Interest with Respect to the Floating Rate Period Is Paid

For the Floating Rate Period, we will pay interest quarterly in arrears on January 28, April 28, July 28 and October 28 of each year, commencing on October 28, 2032 (each, a “floating rate interest payment date”). If any floating rate interest payment date falls on a day that is not a business day, we will postpone such interest payment date to the next succeeding business day (and interest thereon will continue to accrue to but excluding such succeeding business day), unless the next succeeding business day is in the next succeeding calendar month, in which case such floating rate interest payment date shall be the immediately preceding business day and interest shall accrue to but excluding such preceding business day. If the maturity date or a redemption date for the Notes would fall on a day that is not a business day, the payment of interest and principal will be made on the next succeeding business day, but no additional interest shall accrue and be paid unless we fail to make payment on such next succeeding business day.

As further described herein, on each interest determination date relating to the applicable floating rate interest payment date, the calculation agent will calculate the amount of accrued interest payable on the Notes for each Floating Rate Interest Period by multiplying (i) the outstanding principal amount of the Notes by (ii) the product of (a) the interest rate for the relevant Floating Rate Interest Period multiplied by (b) the quotient of the actual number of calendar days in such Observation Period divided by 360.

The term “Interest Period” means a Fixed Rate Interest Period or a Floating Rate Interest Period. A “Fixed Rate Interest Period” refers to, during the Fixed Rate Period, the period commencing on any fixed rate interest payment date (and with respect to the initial Fixed Rate Interest Period only, commencing on the issue date of the Notes) to, but excluding, the next succeeding fixed rate interest payment date. A “Floating Rate Interest Period” refers to, during the Floating Rate Period, the period commencing on any floating rate interest payment date (or, with respect to the initial Floating Rate Interest Period only, commencing on July 28, 2032) to, but excluding, the next succeeding floating rate interest payment date. In the case of the interest payment at maturity, the Floating Rate Interest Period refers to the period from and including the floating rate interest payment date immediately

PS-8

preceding the maturity date to, but excluding such maturity date. In the event of an optional redemption, the applicable Interest Period with respect to the Notes called for redemption will run to, but excluding, the redemption date.

Compounded SOFR

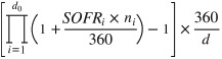

The interest rate on the Notes for each Floating Rate Interest Period (the “Floating Interest Rate”) will be equal to Compounded SOFR (as defined herein) plus a spread of 224.0 basis points. “Compounded SOFR” will be determined by the calculation agent in accordance with the following formula:

where:

“d0,” for any Observation Period, is the number of U.S. Government Securities Business Days in the relevant Observation Period;

“i” is a series of whole numbers from one to d0, each representing the relevant U.S. Government Securities Business Day in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Observation Period;

“SOFRi,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is equal to SOFR in respect of that day “i”;

“ni,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day (“i+1”); and

“d” is the number of calendar days in the relevant Observation Period.

For these calculations, the daily SOFR in effect on any U.S. Government Securities Business Day will be the applicable SOFR as reset on that date.

For purposes of determining Compounded SOFR, “SOFR” means, with respect to any U.S. Government Securities Business Day:

(1) the Secured Overnight Financing Rate published for such U.S. Government Securities Business Day as such rate appears on the Federal Reserve Bank of New York’s Website at 3:00 p.m. (New York time) on the immediately following U.S. Government Securities Business Day (the “SOFR Determination Time”); or

(2) if the rate specified in (1) above does not so appear, unless both a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the Secured Overnight Financing Rate as published in respect of the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the Federal Reserve Bank of New York’s Website.

“Observation Period” with respect of each Floating Rate Interest Period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first date in such Floating Rate Interest Period to, but excluding, the date two U.S. Government Securities Business Days preceding the interest payment date for such Floating Rate Interest Period.

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Determination Time, and (2) if the Benchmark is not Compounded SOFR, the time determined by us or the Designee (after consulting with us) in accordance with the Benchmark Replacement Conforming Changes.

PS-9

Notwithstanding the foregoing, if we, in our sole and absolute discretion, or our Designee determines on or prior to the relevant interest determination date that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR then we shall provide written notice to the trustee, paying agent and calculation agent and the provisions set forth in the accompanying prospectus supplement under the section entitled “Description of Notes—Base Rates—SOFR—Effect of SOFR Benchmark Transition Event,” which we refer to as the “benchmark transition provisions,” will thereafter apply to all determinations, calculations and quotations made or obtained for the purposes of calculating the Floating Interest Rate and the Floating Interest Amount (each as defined below) payable on the Notes during a relevant Floating Rate Interest Period. In accordance with the benchmark transition provisions, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the Floating Interest Rate that will be payable for each Floating Rate Interest Period will be a per annum rate equal to the sum of the Benchmark Replacement and the spread. The subordinated trustee, paying agent and the calculation agent, unless any of them has agreed in writing to act as the Designee and accept the responsibilities referenced in (i), (ii), (iii) and (iv) below, are not responsible in any way for (i) determining a replacement rate for Compounded SOFR, (ii) monitoring the designation of a replacement rate, (iii) determining that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, or (iv) determining whether or what changes to Compounded SOFR are necessary or advisable, if any, in connection with any of the foregoing. The subordinated trustee, paying agent and the calculation agent shall not be under any duty to succeed to, assume or otherwise perform any of our duties or duties of any Designee, or to appoint a successor or replacement Designee in the event of a Designee’s resignation or removal, or to remove and replace any Designee in the event of a default, breach or failure of performance on the part of the Designee with respect to its duties and obligations under the terms of the Notes. We will deliver to the calculation agent, prior to the issuance of any Notes, copies of the proposed forms of such Notes, including copies of the terms and conditions relating to the determination of the applicable interest rate. In the event that the calculation agent has determined or has been notified that Compounded SOFR or the then-current designated Benchmark is not available on an interest determination date, then unless the calculation agent is notified of a Benchmark Replacement in accordance with the provisions of the terms of the Notes at least one day prior to the applicable interest determination date, the calculation agent shall use the interest rate in effect for the immediately prior Interest Period.

If the calculation agent determines, following consultation with us, that there is no clear market consensus as to whether any rate has replaced Compounded SOFR in customary market usage, (A) U.S. Bank Trust Company, National Association (successor in interest to U.S. Bank National Association), or any other entity appointed as calculation agent in the applicable pricing supplement or pricing supplement, shall have the right to resign as calculation agent in respect of the Notes, and (B) we will appoint, in our sole discretion, a new calculation agent to replace U.S. Bank Trust Company, National Association (successor in interest to U.S. Bank National Association), or any other entity appointed as calculation agent in the applicable pricing supplement or pricing supplement, solely in its role as calculation agent in respect of the Notes, to act as the calculation agent in respect of the Notes.

The calculation agent will, as soon as practicable after the determination of the Floating Interest Rate for each Floating Rate Interest Period in respect of the Notes, calculate the amount of interest (the “Floating Interest Amount”) payable in respect of each Note for such Floating Rate Interest Period. The Floating Interest Amount will be calculated by applying the Floating Interest Rate for such Floating Rate Interest Period to the principal amount of such Note, multiplying the product by the actual number of days in such Floating Rate Interest Period (the “Number of Days”) divided by 360 and rounding the resulting figure to the nearest cent (half a cent being rounded upwards). The interest rate on the Notes will in no event be lower than zero.

All determinations, calculations and quotations made or obtained for the purposes of calculating the Floating Interest Rate and the Floating Interest Amount, whether by the calculation agent or us, will, in the absence of gross negligence, willful misconduct or manifest error, be binding on us, the calculation agent, the paying agent(s), the subordinated trustee and all holders of the Notes.

PS-10

We will, or will arrange for the calculation agent to, cause the Floating Interest Rate, the Number of Days, the Floating Interest Amount for each Floating Rate Interest Period in respect of the Notes and the relevant record date and interest payment date to be notified to the subordinated trustee and DTC, and such information will be notified or published to the holders of the Notes through DTC or through another reasonable manner as soon as possible after their determination. The interest payment date so notified or published may subsequently be amended.

Redemption at Our Option

We will give notice of redemption to the registered holder of the Notes at least 10 days and not more than 60 days prior to the date fixed for redemption.

We may redeem the Notes, (i) on July 28, 2032, in whole but not in part, or (ii) on or after April 28, 2033 (three months prior to the maturity date), in whole or in part, at any time and from time to time, in each case at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the redemption date.

Investors should not expect us to redeem the Notes when they become redeemable at our option. Any early redemption of the Notes will be subject to the receipt of the approval of the Federal Reserve, to the extent then required under applicable laws or regulations, including capital regulations.

Consolidation, Merger, Sale, Conveyance and Lease

The following supersedes the information in the accompanying prospectus supplement under the section entitled “Description of Notes—Consolidation, Merger, Sale, Conveyance and Lease” and the information in the accompanying base prospectus under the section entitled “Description of the Debt Securities—Debt Securities Generally—Consolidation, Merger, Sale, Conveyance and Lease” with respect to the Notes and all other series of subordinated debt securities issued under the subordinated indenture on or after July 28, 2022.

The subordinated indenture provides that we may not consolidate with or merge into another corporation, or convey, transfer or lease all or substantially all of our properties and assets to any person (other than a subsidiary) unless:

| • | the successor assumes our obligations under the subordinated indenture and the debt securities outstanding under the subordinated indenture; |

| • | after giving effect to the transaction, no event of default, as applicable, and no event which, after notice or lapse of time or both, would become an event of default, as applicable, has occurred and is continuing under the subordinated indenture; and |

| • | certain other conditions are met. |

In that event, the successor will be substituted for us and, except in the case of a lease, we will be relieved of our obligations under the subordinated indenture and the subordinated debt securities of each outstanding series, including the Notes.

With respect to subordinated debt securities issued on or after July 28, 2022, including the Notes, the foregoing requirements do not apply in the case of a sale, conveyance or transfer by us of all or substantially all of our assets to one or more entities that are direct or indirect subsidiaries in which we and/or one or more of our subsidiaries own more than 50% of the combined voting power. As a result, if we were to undertake such a transaction, such subsidiary or subsidiaries would not be required to assume our obligations under the Notes and we would remain the sole obligor on the Notes.

PS-11

Events of Default and Acceleration Events with Respect to Subordinated Debt Securities

The following supersedes (i) the information in the first two paragraphs under the section entitled “Description of Notes— Events of Default with Respect to Subordinated Notes” in the accompanying prospectus supplement and (ii) the information in the first two paragraphs under the section entitled “Description of the Debt Securities— Subordinated Debt Securities—Events of Default” and the information under the section entitled “Description of the Debt Securities— Subordinated Debt Securities—Limited Rights of Acceleration” in the accompanying base prospectus with respect to the Notes and all other series of subordinated debt securities issued under the subordinated indenture on or after July 28, 2022.

The subordinated indenture defines an event of default with respect to any particular series of subordinated debt securities issued on or after July 28, 2022, including the Notes, as being any one of the following events or any other event provided with respect to such series of subordinated debt securities (unless it is either inapplicable to a particular series or specifically deleted or modified for the subordinated debt securities of that series):

| • | default for 30 days in the payment of any interest upon any of the subordinated debt securities of that series; |

| • | default for 30 days in the payment of the principal of, or any premium on, any of the subordinated debt securities of that series when due; or |

| • | the occurrence of certain events relating to bankruptcy, insolvency or reorganization of Truist Financial Corporation. |

Rights of acceleration in case an event of default occurs are limited. Unless otherwise specified in the applicable prospectus supplement or pricing supplement relating to any series of subordinated debt securities, payment of principal of the subordinated debt securities may be accelerated only in the case of an “Acceleration Event,” which is defined in the subordinated indenture as any of the bankruptcy, insolvency or reorganization events with respect to Truist Financial Corporation that constitute an event of default, or as otherwise specified with respect to any particular series of subordinated debt securities. There is no right of acceleration in the case of a default in the payment of principal of, or any premium or interest on, the subordinated debt securities or our performance of any other covenant in the subordinated indenture.

PS-12

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the Notes to increase our Tier 2 capital and for general corporate purposes, which may include the acquisition of other companies, repurchasing outstanding shares of our common stock, repayment of maturing obligations and refinancing of outstanding indebtedness and extending credit to, or funding investments in, our subsidiaries. The precise amounts and timing of our use of the net proceeds will depend upon our and our subsidiaries’ funding requirements and the availability of other funds. Pending our use of the net proceeds from the sale of the Notes as described above, we will use the net proceeds to reduce our short-term indebtedness or for temporary investments.

PS-13

SUPPLEMENTAL INFORMATION CONCERNING THE PLAN OF DISTRIBUTION

We have entered into a syndicated underwriting agreement, dated July 25, 2022 (the “terms agreement”), with the underwriters named below. Subject to the terms and conditions set forth in the terms agreement, we have agreed to sell to the underwriters, and the underwriters have agreed, severally and not jointly, to purchase, the principal amount of Notes set forth opposite their respective names below:

| Underwriter |

Principal Amount of Notes |

|||

| Truist Securities, Inc |

$ | 450,000,000 | ||

| BofA Securities, Inc. |

260,000,000 | |||

| Morgan Stanley & Co. LLC |

260,000,000 | |||

| CastleOak Securities, L.P. |

15,000,000 | |||

| C.L. King & Associates, Inc. |

15,000,000 | |||

|

|

|

|||

| Total |

$ | 1,000,000,000 | ||

|

|

|

|||

We have been advised by the underwriters that they propose initially to offer the Notes to the public at the public offering price set forth on page one of this pricing supplement. After the initial public offering, the public offering price may be changed from time to time.

The Notes are a new issue of securities with no established trading market. The underwriters have advised us that they intend to make a market in the Notes, as applicable laws and regulations permit, but the underwriters are not obligated to do so and may discontinue any market making at any time without notice. No assurance can be given as to the liquidity of any trading market for these Notes.

The terms agreement provides that the obligations of the underwriters are subject to certain conditions precedent and that the underwriters will purchase all the Notes if any are purchased.

The underwriters expect to deliver the Notes to purchasers on or about July 28, 2022, which will be the third business day following the date of pricing of the Notes (such settlement cycle being herein referred to as “T +3”). Under Rule 15c6-1 of the Securities and Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the second business day before the delivery of the Notes will be required, by virtue of the fact that the Notes initially will settle in T +3, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to the second business day before the delivery of the Notes should consult their own advisor.

To facilitate the offering of these Notes, the underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of these Notes. Specifically, the underwriters may overallot in connection with any offering of these Notes, creating a short position in these Notes for their own accounts. In addition, to cover overallotments or to stabilize the price of these Notes, the underwriters may bid for, and purchase, these Notes in the open market. Finally, in any offering through a syndicate of underwriters, the underwriting syndicate may reclaim selling concessions allowed to an underwriter or a dealer for distributing these Notes in the offering if the syndicate repurchases previously distributed Notes in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of these Notes above independent market levels. The underwriters are not required to engage in these activities, and may end any of these activities at any time.

We and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act, or to contribute to payments made in respect of those liabilities. We have also agreed to reimburse the underwriters for specified expenses.

We estimate that the total offering expenses for the Notes, excluding the underwriters’ discount, will be approximately $1.5 million.

PS-14

In the course of their business, the underwriters and certain of their affiliates have engaged and may in the future engage in commercial banking and/or investment banking transactions with us and with our affiliates. The underwriters and their affiliates may also be customers of, engage in transactions with and perform services for us, including our subsidiaries, in the ordinary course of business. They have received and may continue to receive customary fees and commissions for these transactions.

In the ordinary course of their various business activities, the underwriters and their respective affiliates have made or held, and may in the future make or hold, a broad array of investments including serving as counterparties to certain derivative and hedging arrangements, and may have actively traded, and, in the future may actively trade, debt and equity securities (or related derivative securities), and financial instruments (including bank loans) for their own account and for the accounts of their customers and may have in the past and at any time in the future hold long and short positions in such securities and instruments. Such investment and securities activities may have involved, and in the future may involve, our securities and instruments.

If any of the underwriters or their affiliates have a lending relationship with us, certain of those underwriters or their affiliates routinely hedge, and certain other of those underwriters or their affiliates may hedge, their credit exposure to us consistent with their customary risk management policies. Typically, these underwriters and their affiliates would hedge such exposure by entering into transactions, which consist of either the purchase of credit default swaps or the creation of short positions in our securities, including potentially the Notes offered hereby. Any such credit default swaps or short positions could adversely affect future trading prices of the Notes offered hereby. The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Conflicts of Interest

Our affiliate, Truist Securities, Inc., is a participating joint book-running manager. Because Truist Securities, Inc. has a conflict of interest pursuant to Financial Industry Regulatory Authority (“FINRA”), this offering is being conducted in compliance with FINRA Rule 5121. Under FINRA Rule 5121, any underwriter who is subject to the rule will not be permitted to sell any Notes to an account over which it exercises discretionary authority without the prior written approval of the customer to which the account relates.

Notice to Prospective Investors in the European Economic Area

None of this pricing supplement, the attached prospectus supplement or the attached prospectus is a prospectus for the purposes of the Prospectus Regulation (as defined below). This pricing supplement, the attached prospectus supplement and the attached prospectus have been prepared on the basis that any offer of Notes in any Member State of the European Economic Area (the “EEA”) will only be made to a legal entity which is a qualified investor under the Prospectus Regulation (“Qualified Investors”). Accordingly any person making or intending to make an offer in that Member State of Notes which are the subject of the offering contemplated in this pricing supplement, the attached prospectus supplement and the attached prospectus may only do so with respect to Qualified Investors. Neither we nor the underwriters have authorized, nor do we or they authorize, the making of any offer of Notes other than to Qualified Investors. The expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

PROHIBITION OF SALES TO EEA RETAIL INVESTORS — The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in the Prospectus Regulation. Consequently no key information document

PS-15

required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

Notice to Prospective Investors in the United Kingdom

PROHIBITION OF SALES TO UNITED KINGDOM RETAIL INVESTORS — The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018, as amended by the European Union (Withdrawal Agreement) Act 2020 (“EUWA”); or (ii) a customer within the meaning of the provisions of the United Kingdom’s Financial Services and Markets Act 2000, as amended (the “FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of the Prospectus Regulation as it forms part of domestic law of the United Kingdom by virtue of the EUWA. Consequently no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the United Kingdom has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the United Kingdom may be unlawful under the UK PRIIPs Regulation.

The communication of this pricing supplement, the attached prospectus supplement, the attached prospectus and any other document or materials relating to the issue of the Notes offered hereby is not being made, and such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the FSMA. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom who have professional experience in matters relating to investments and who fall within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)), or who fall within Article 49(2)(a) to (d) of the Financial Promotion Order, or who are any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order (all such persons together being referred to as “relevant persons”). In the United Kingdom, the Notes offered hereby are only available to, and any investment or investment activity to which this pricing supplement, the attached prospectus supplement and the attached prospectus relates will be engaged in only with, relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this pricing supplement, the attached prospectus supplement or the attached prospectus or any of their contents.

Selling Restrictions

Canada

The Notes may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the Notes must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

PS-16

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this pricing supplement, the attached prospectus supplement or the attached prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the agents are not required to comply with the disclosure requirements of NI 33-105 regarding the agent conflicts of interest in connection with this offering.

European Economic Area

Prohibition of Sales to EEA Retail Investors

The Notes may not be offered, sold or otherwise made available to any retail investor in the EEA. For the purposes of this provision:

| (a) | the expression “retail investor” means a person who is one (or more) of the following: |

| (i) | a retail client as defined in point (11) of Article 4(1) of MiFID II; or |

| (ii) | a customer within the meaning of the Insurance Distribution Directive, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or |

| (iii) | not a qualified investor as defined in the Prospectus Regulation; and |

| (b) | the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the Notes. |

United Kingdom

Prohibition of Sales to United Kingdom Retail Investors

The Notes may not be offered, sold or otherwise made available to any retail investor in the United Kingdom. For the purposes of this provision:

| (a) | the expression “retail investor” means a person who is one (or more) of the following: |

| (i) | a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law of the United Kingdom by virtue of the EUWA; or |

| (ii) | a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA; or |

| (iii) | not a qualified investor as defined in Article 2 of the Prospectus Regulation as it forms part of domestic law of the United Kingdom by virtue of the EUWA; and |

| (b) | the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the Notes. |

Other Regulatory Restrictions in the United Kingdom

Any invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) in connection with the issue or sale of the Notes may only be communicated or caused to be communicated in circumstances in which Section 21(1) of the FSMA does not apply to us.

PS-17

All applicable provisions of the FSMA must be complied with in respect to anything done by any person in relation to the Notes in, from or otherwise involving the United Kingdom.

Hong Kong

Each agent represents and agrees that:

| (a) | it has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any Notes other than (i) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “SFO”) and any rules made under the SFO; or (ii) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong (the “C(WUMP)O”) or which do not constitute an offer to the public within the meaning of the C(WUMP)O; and |

| (b) | it has not issued or had in its possession for the purposes of issue and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the Notes, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to Notes which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning of the SFO and any rules made under the SFO. |

Japan

The Notes have not been and will not be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948, as amended, the “FIEL”), and the Notes have not been offered or sold, directly or indirectly, and will not be offered or sold, directly or indirectly, in Japan or to, or for the account or benefit of, any resident of Japan (which term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan) or to, or for the account or benefit of, others for reoffering or resale, directly or indirectly, in Japan or to, or for the account or benefit of, any resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the FIEL and any other applicable laws, regulations and ministerial guidelines promulgated by the relevant Japanese governmental or regulatory authorities. For purposes of this paragraph “resident of Japan” means any person resident in Japan, including any corporation or other entity incorporated or organized under the laws of Japan.

Singapore

This pricing supplement, the attached prospectus supplement and the attached prospectus have not been and will not be registered as a prospectus under the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”) by the Monetary Authority of Singapore, and the offer of the Notes in Singapore is made primarily pursuant to the exemptions under Sections 274 and 275 of the SFA. Accordingly, this pricing supplement, the attached prospectus supplement, the attached prospectus or any other document or material in connection with the offer or sale, or invitation for subscription or purchase of the Notes may not be circulated or distributed, nor may the Notes be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to any person in Singapore other than (i) to an institutional investor (as defined in Section 4A of the SFA) (an “Institutional Investor”) pursuant to Section 274 of the SFA, (ii) to an accredited investor (as defined in Section 4A of the SFA) (an “Accredited Investor”) or other relevant person (as defined in Section 275(2) of the SFA) (a “Relevant Person”) and pursuant to Section 275(1) of the SFA, or to any person pursuant to an offer referred to in Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA and (where applicable) Regulation 3 of the Securities and Futures (Classes of Investors) Regulations 2018, or (iii) otherwise pursuant to, and in accordance with, the conditions of any other applicable exemption or provision of the SFA.

PS-18

It is a condition of the offer that where the Notes are subscribed for or acquired pursuant to an offer made in reliance on Section 275 of the SFA by a Relevant Person which is:

| (a) | a corporation (which is not an Accredited Investor), the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an Accredited Investor; or |

| (b) | a trust (where the trustee is not an Accredited Investor), the sole purpose of which is to hold investments and each beneficiary of the trust is an individual who is an Accredited Investor, |

the securities and securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation and the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within 6 months after that corporation or that trust has subscribed for or acquired the Notes except:

| (i) | to an Institutional Investor, or an Accredited Investor or other Relevant Person, or which arises from an offer referred to in Section 275(1A) of the SFA (in the case of that corporation) or Section 276(4)(i)(B) of the SFA (in the case of that trust); |

| (ii) | where no consideration is or will be given for the transfer; |

| (iii) | where the transfer is by operation of law; |

| (iv) | as specified in Section 276(7) of the SFA; or |

| (v) | as specified in Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018. |

Singapore Securities and Futures Act Product Classification – Solely for the purposes of our obligations pursuant to Sections 309B(1)(a) and 309B(1)(c) of the SFA, we have determined, and hereby notify all relevant persons (as defined in Section 309A of the SFA) that the Notes are “prescribed capital markets products” (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018) and “Excluded Investment Products” (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

Switzerland

This pricing supplement is not intended to constitute an offer or solicitation to purchase or invest in the Notes. The Notes may not be publicly offered, directly or indirectly, in Switzerland within the meaning of the Swiss Financial Services Act of June 15, 2018 (the “FinSA”) and no application has or will be made to admit the Notes to trading on any trading venue (exchange or multilateral trading facility) in Switzerland. Neither this pricing supplement nor any other offering or marketing material relating to the Notes constitutes a prospectus pursuant to the FinSA, and neither this pricing supplement nor any other offering or marketing material relating to the Notes may be publicly distributed or otherwise made publicly available in Switzerland.

PS-19

LEGAL MATTERS

Certain legal matters will be passed upon for us by Ellen M. Fitzsimmons, Senior Executive Vice President, Chief Legal Officer and Head of Public Affairs, and Corporate Secretary of Truist Financial Corporation, and Michael J. Shumaker, Senior Vice President and Associate General Counsel of Truist Financial Corporation, and Squire Patton Boggs (US) LLP. Ms. Fitzsimmons and Mr. Shumaker will rely upon the opinion of Squire Patton Boggs (US) LLP as to matters of New York law. As of the date of this pricing supplement, Ms. Fitzsimmons and Mr. Shumaker each beneficially owns, or has the right to acquire, an aggregate of less than 1% of Truist Financial Corporation’s common stock. Certain legal matters will be passed upon for the underwriters by Sidley Austin LLP, New York, New York.

PS-20