Filed by BB&T Corporation

Commission File No. 001-10853

Pursuant to Rule 425 Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: National Penn Bancshares, Inc.

Commission File No. 000-22537-01

Date: September 16, 2015

[Following is a slide presentation for investors]

Forward - Looking Statements This communication contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 199 5 giving National Penn’s and BB&T’s expectations or predictions of future financial or business performance or conditions. Forward - looking statements are typ ically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by fu ture conditional verbs such as “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward - looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward - looking statements speak only as of the date they are made and we assume no duty to update forward - looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in National Penn’s and BB&T’s reports filed with the U.S. Securities and Exchange Co mmission (the “SEC”) and those identified elsewhere in this document, the following factors among others, could cause actual results to differ materially fr om forward - looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including app rov al by National Penn shareholders; delay in closing the merger; difficulties and delays in integrating the National Penn business or fully realizing cost saving s a nd other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of BB&T products and services; customer borrowing, repayment, investment and deposit practices ; c ustomer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost s avi ngs or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the im pact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and other legislative an d r egulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not ref lect actual results.

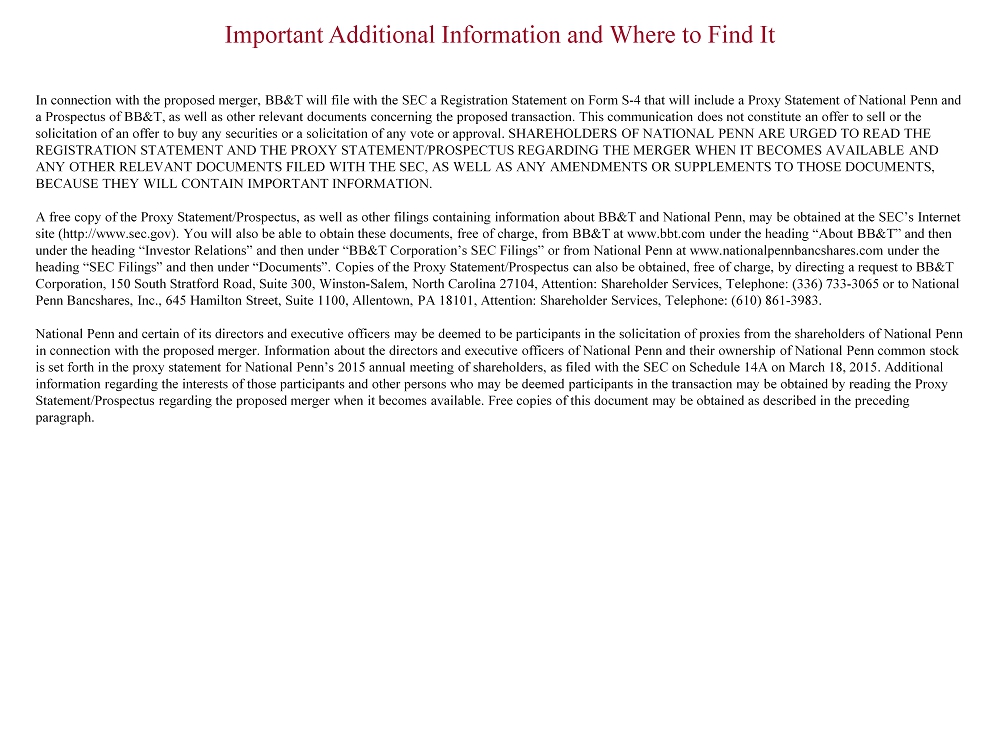

3 Important Additional Information and Where to Find It In connection with the proposed merger, BB&T will file with the SEC a Registration Statement on Form S - 4 that will include a Pro xy Statement of National Penn and a Prospectus of BB&T, as well as other relevant documents concerning the proposed transaction. This communication does not co nst itute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF NATIONAL PENN ARE U RGE D TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BB&T and National Penn, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from BB&T at www.bbt.com under th e h eading “About BB&T” and then under the heading “Investor Relations” and then under “BB&T Corporation’s SEC Filings” or from National Penn at www.nationalp enn bancshares.com under the heading “SEC Filings” and then under “Documents”. Copies of the Proxy Statement/Prospectus can also be obtained, free of char ge, by directing a request to BB&T Corporation, 150 South Stratford Road, Suite 300, Winston - Salem, North Carolina 27104, Attention: Shareholder Services, Telephon e: (336) 733 - 3065 or to National Penn Bancshares, Inc., 645 Hamilton Street, Suite 1100, Allentown, PA 18101, Attention: Shareholder Services, Telephone: (610 ) 8 61 - 3983. National Penn and certain of its directors and executive officers may be deemed to be participants in the solicitation of pro xie s from the shareholders of National Penn in connection with the proposed merger. Information about the directors and executive officers of National Penn and their own ers hip of National Penn common stock is set forth in the proxy statement for National Penn’s 2015 annual meeting of shareholders, as filed with the SEC on Schedul e 1 4A on March 18, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction ma y be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as de scribed in the preceding paragraph.

4 4 BB&T is… ▪ A values - driven highly profitable growth organization. While we have had a very successful merger history, our primary focus is on organic growth; nonetheless, we are well positioned for strategic opportunities. ▪ Our fundamental strategy is to deliver the best value proposition in our markets. Recognizing value is a function of quality to price, our focus is on delivering high quality client service resulting in the Perfect Client Experience. ▪ Our over - arching purpose is to achieve our vision and mission, consistent with our values, with the ultimate goal of maximizing shareholder returns.

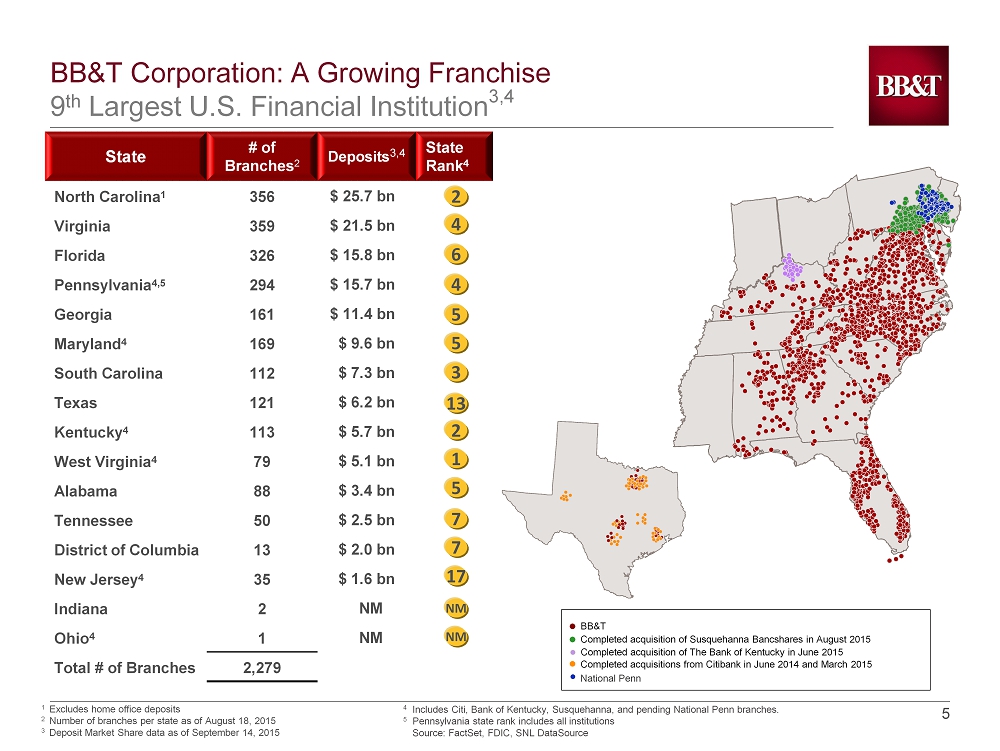

5 5 1 Excludes home office deposits 2 Number of branches per state as of August 18, 2015 3 Deposit Market Share data as of September 14, 2015 State # of Branches 2 Deposits 3,4 State Rank 4 North Carolina 1 356 $ 25.7 bn Virginia 359 $ 21.5 bn Florida 326 $ 15.8 bn Pennsylvania 4,5 294 $ 15.7 bn Georgia 161 $ 11.4 bn Maryland 4 169 $ 9.6 bn South Carolina 112 $ 7.3 bn Texas 121 $ 6.2 bn Kentucky 4 113 $ 5.7 bn West Virginia 4 79 $ 5.1 bn Alabama 88 $ 3.4 bn Tennessee 50 $ 2.5 bn District of Columbia 13 $ 2.0 bn New Jersey 4 35 $ 1.6 bn Indiana 2 NM Ohio 4 1 NM Total # of Branches 2,279 BB&T Corporation: A Growing Franchise 9 th Largest U.S. Financial Institution 3,4 Completed acquisitions from Citibank in June 2014 and March 2015 BB&T Completed acquisition of The Bank of Kentucky in June 2015 Completed acquisition of Susquehanna Bancshares in August 2015 7 7 NM 4 2 6 4 13 2 3 5 1 5 NM 5 17 National Penn 4 Includes Citi, Bank of Kentucky, Susquehanna, and pending National Penn branches . 5 Pennsylvania state rank includes all institutions Source: FactSet , FDIC, SNL DataSource

6 6 28 Banking Regions 1 Local decision - making Centralized support system Foundation for our sales and service culture model … and Diverse Non - Bank Businesses Premier Model for Community Banking… 1 Includes pending region related to National Penn

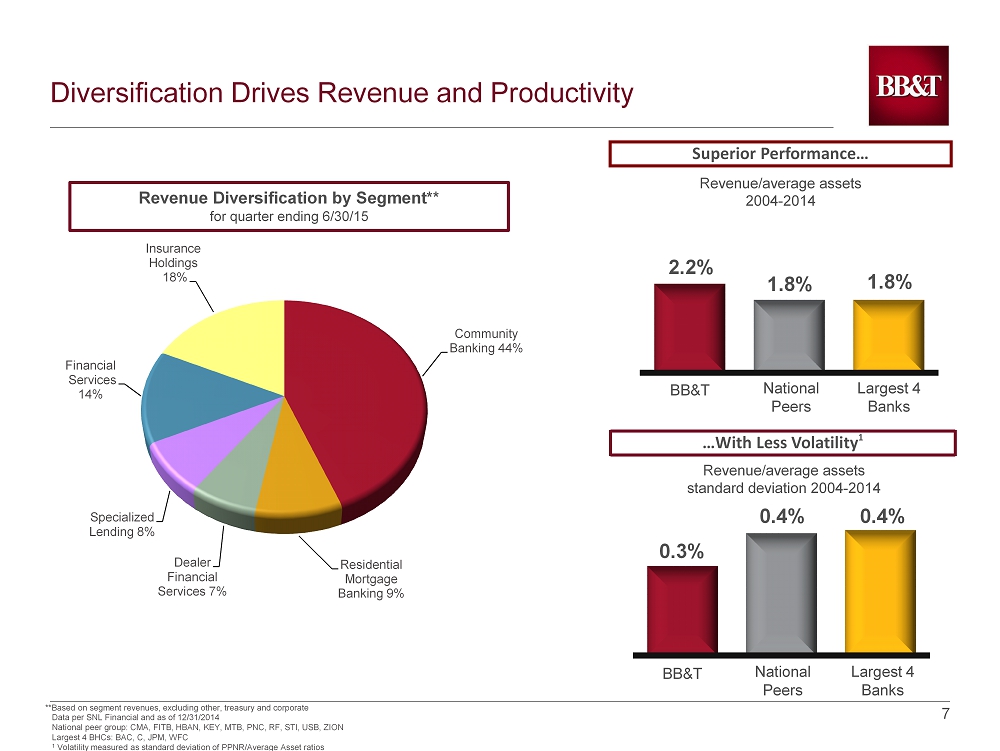

7 7 Diversification Drives Revenue and Productivity **Based on segment revenues, excluding other, treasury and corporate 2.2% 1.8% 1.8% Superior Performance… BB&T National Peers Largest 4 Banks Revenue/average assets 2004 - 2014 …With Less Volatility 1 0.3% 0.4% 0.4% Revenue/average assets standard deviation 2004 - 2014 BB&T National Peers Largest 4 Banks Data per SNL Financial and as of 12/31/2014 National peer group: CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, ZION Largest 4 BHCs: BAC, C, JPM, WFC 1 Volatility measured as standard deviation of PPNR/Average Asset ratios Revenue Diversification by Segment** f or quarter ending 6/30/15 Community Banking 44% Residential Mortgage Banking 9% Dealer Financial Services 7% Specialized Lending 8% Financial Services 14% Insurance Holdings 18%

8 8 Superior Returns 12.77% 14.83% 15.45% 14.00% 13.70% 12.51% 11.94% 11.32% 10.91% 11.04% 0.00% 5.00% 10.00% 15.00% 20.00% 2Q14 3Q14 4Q14 1Q15 2Q15 1.38% 1.56% 1.68% 1.48% 1.42% 1.31% 1.26% 1.21% 1.15% 1.13% 0.00% 0.50% 1.00% 1.50% 2.00% 2Q14 3Q14 4Q14 1Q15 2Q15 Return on Average Tangible Common Equity Return on Risk - Weighted Assets 3 1 Peers include: CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, and ZION 2 Excludes the loss sale of American Coastal; non - GAAP reconciliations included in the attached Appendix 3 Amounts are calculated using the simple average of reported quarterly RWA balances BBT Peers 1 2 2

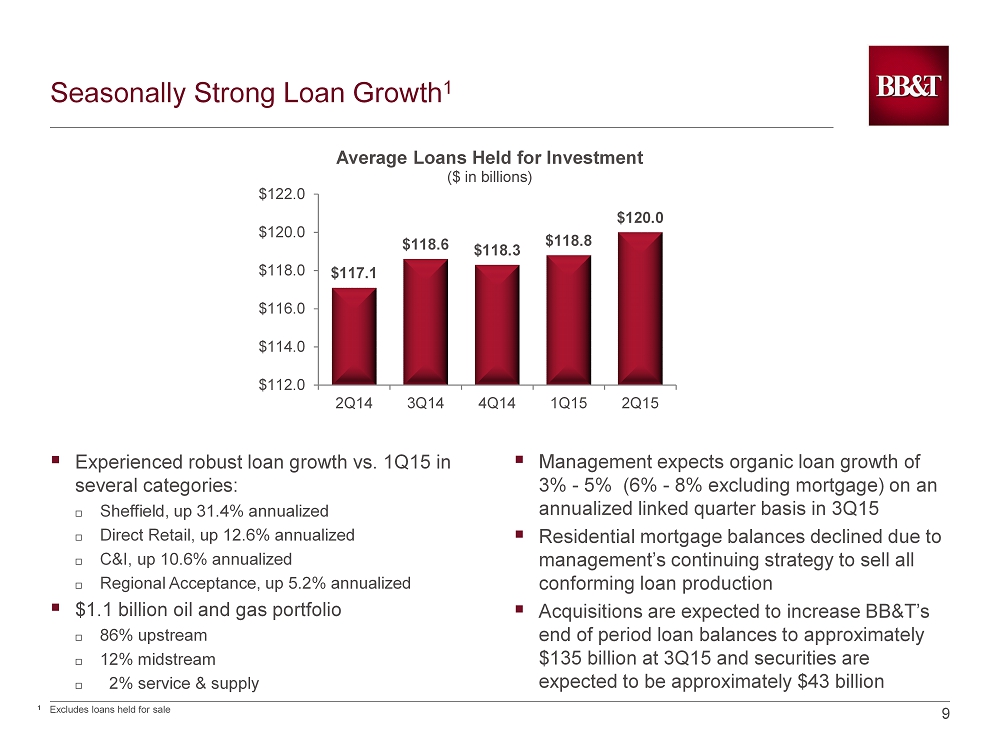

9 9 Seasonally Strong Loan Growth 1 ▪ Management expects organic loan growth of 3% - 5% (6% - 8% excluding mortgage) on an annualized linked quarter basis in 3Q15 ▪ Residential mortgage balances declined due to management’s continuing strategy to sell all conforming loan production ▪ Acquisitions are expected to increase BB&T’s end of period loan balances to approximately $135 billion at 3Q15 and securities are expected to be approximately $43 billion 1 Excludes loans held for sale $117.1 $118.6 $118.3 $118.8 $120.0 $112.0 $114.0 $116.0 $118.0 $120.0 $122.0 2Q14 3Q14 4Q14 1Q15 2Q15 Average Loans Held for Investment ($ in billions) ▪ Experienced robust loan growth vs. 1Q15 in several categories: Sheffield, up 31.4% annualized Direct Retail, up 12.6% annualized C&I, up 10.6% annualized Regional Acceptance, up 5.2% annualized ▪ $1.1 billion oil and gas portfolio 86% upstream 12% midstream 2% service & supply

10 10 Accelerating Growth in Risk / Return Advantaged Lending Platforms While Improving Diversification * Excludes sold portion of Lendmark and reflects QM transfer of loans from DRL to MLA All figures exclude FDIC acquired and loans held for sale Portfolio Q2 ’15 EOP Balance Q4 ’12 EOP Balance* CAGR Commercial Other $6.6 $5.0 11% Consumer Other $18.4 $14.4 10% Direct Retail Lending $8.7 $7.8 5% Commercial & Industrial $43.6 $38.3 5% CRE - IPP $11.1 $9.8 5% Residential Mortgage $30.1 $32.3 - 3% CRE – Const. and Dev. $2.9 $3.0 - 1% ▪ Commercial Other : Bankcard – Commercial, Dealer Finance - Wholesale, Equipment Finance, Grandbridge , and Premium Finance ▪ Consumer Other: Bankcard - Retail, Dealer Finance - Retail, Home Improvement Dealer Services, Regional Acceptance, and Sheffield More Risk / Return Advantaged Less Risk / Return Advantaged

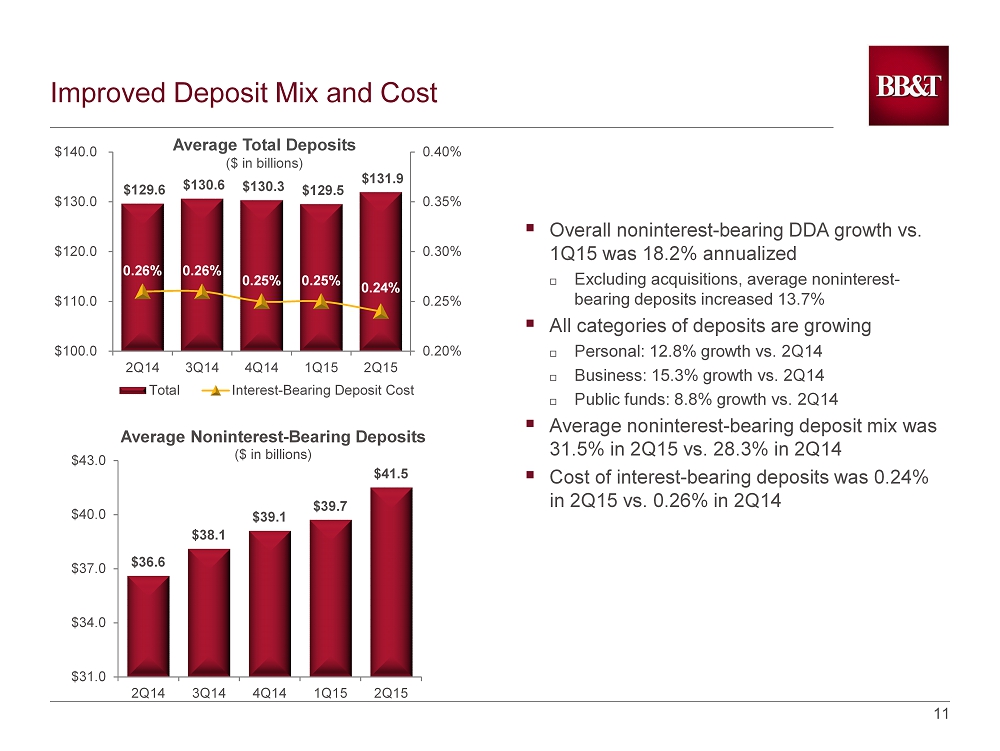

11 11 Improved Deposit Mix and Cost $129.6 $130.6 $130.3 $129.5 $131.9 0.26% 0.26% 0.25% 0.25% 0.24% 0.20% 0.25% 0.30% 0.35% 0.40% $100.0 $110.0 $120.0 $130.0 $140.0 2Q14 3Q14 4Q14 1Q15 2Q15 Total Interest-Bearing Deposit Cost ▪ Overall noninterest - bearing DDA growth vs. 1Q15 was 18.2% annualized Excluding acquisitions, average noninterest - bearing deposits increased 13.7% ▪ All categories of deposits are growing Personal: 12.8% growth vs. 2Q14 Business: 15.3% growth vs. 2Q14 Public funds: 8.8% growth vs. 2 Q14 ▪ Average noninterest - bearing deposit mix was 31.5% in 2Q15 vs. 28.3% in 2Q14 ▪ Cost of interest - bearing deposits was 0.24% in 2Q15 vs. 0.26% in 2Q14 Average Total Deposits ($ in billions) $36.6 $38.1 $39.1 $39.7 $41.5 $31.0 $34.0 $37.0 $40.0 $43.0 2Q14 3Q14 4Q14 1Q15 2Q15 Average Noninterest - Bearing Deposits ($ in billions)

12 12 Net Interest Margin Expected to Increase 3.43% 3.38% 3.36% 3.33% 3.27% 3.22% 3.20% 3.20% 3.18% 3.16% 3.16% 3.07% 3.02% 2.99% 2.98% 2.75% 3.00% 3.25% 3.50% 3.75% 2Q14 3Q14 4Q14 1Q15 2Q15 Reported NIM Core NIM Peers ▪ Maintain slight asset sensitivity due to balance sheet positioning Net Interest Margin 1 - 0.18% 0.99% 1.90% 2.55% 0.18% 0.81% 1.60% 2.23% -0.20% 0.80% 1.80% 2.80% Down 25 Up 50 Up 100 Up 200 Sensitivities as of 03/31/15 Sensitivities as of 06/30/2015 Rate Sensitivities 1 Excludes assets acquired from the FDIC. See non - GAAP reconciliations included in the attached Appendix 2 Peers include CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, and ZION 2 ▪ 2Q15 NIM declined 6 bps vs. 1Q15 as a result of: Runoff of assets acquired from the FDIC (4 bps) Lower yields on new loans and other earning assets, offset by lower liability costs (2 bps) ▪ Including acquisitions, management expects GAAP margin to: Increase approximately 4 - 6 bps in 3Q15 ▪ Including acquisitions, management expects core NIM to remain relatively stable in 3Q15

13 13 Strong Fee Income ▪ Insurance income will be seasonally slower in 3Q15 ▪ Mortgage banking income increased $20 million vs. 1Q15 primarily reflecting higher net mortgage servicing rights income and higher commercial mortgage fee income due to increased volumes 44.7% 44.3% 46.2% 45.8% 46.3% 37.7% 37.6% 37.9% 38.0% 39.5% 35.0% 40.0% 45.0% 50.0% 2Q14 3Q14 4Q14 1Q15 2Q15 Fee Income Ratio 1,3 BB&T Peers 1 Excludes securities gains (losses), the impact of FDIC loss share accounting and other selected items. See non - GAAP reconciliations incl uded in the attached Appendix 2 Peers include CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, and ZION 3 Effective 1/1/15, BB&T retrospectively adopted new accounting guidance for Qualified Affordable Housing investments. Prior period infor mat ion has been revised to conform to the current presentation 2 ▪ Investment banking and brokerage fees and commissions increased $14 million vs. 1Q15 driven by increased capital markets activity ▪ Including acquisitions, management expects noninterest income to be flat to down 2% in 3Q15

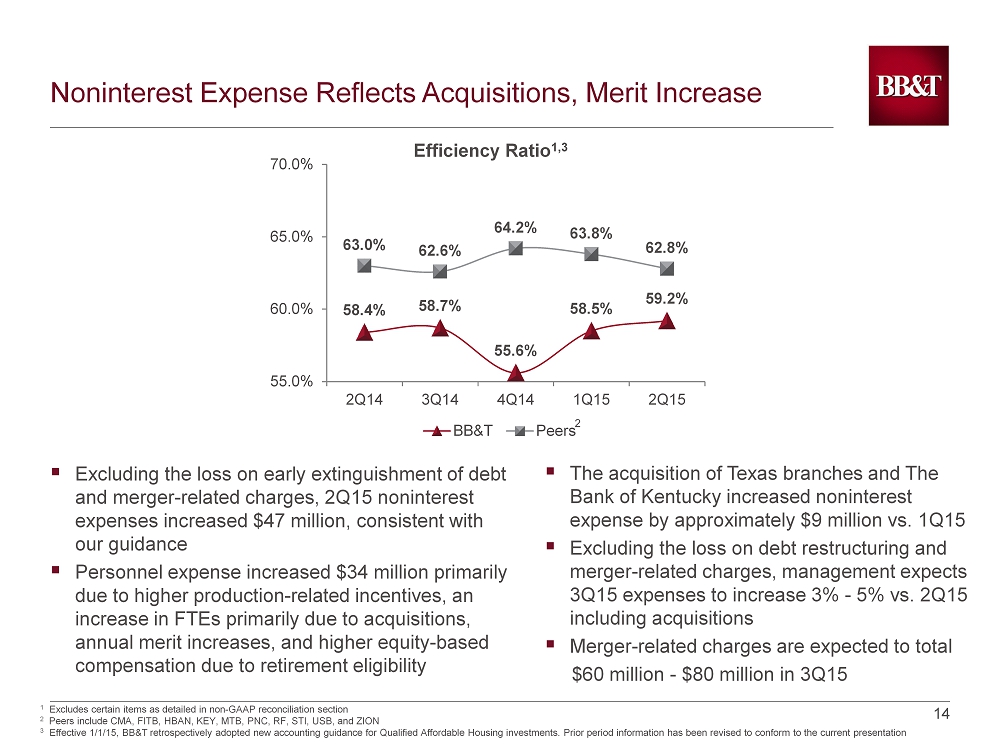

14 14 Noninterest Expense Reflects Acquisitions, Merit Increase ▪ Excluding the loss on early extinguishment of debt and merger - related charges, 2Q15 noninterest expenses increased $47 million, consistent with our guidance ▪ Personnel expense increased $34 million primarily due to higher production - related incentives, an increase in FTEs primarily due to acquisitions, annual merit increases, and higher equity - based compensation due to retirement eligibility 1 Excludes certain items as detailed in non - GAAP reconciliation section 2 Peers include CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, and ZION 3 Effective 1/1/15, BB&T retrospectively adopted new accounting guidance for Qualified Affordable Housing investments. Prior period infor mat ion has been revised to conform to the current presentation 58.4% 58.7% 55.6% 58.5% 59.2% 63.0% 62.6% 64.2% 63.8% 62.8% 55.0% 60.0% 65.0% 70.0% 2Q14 3Q14 4Q14 1Q15 2Q15 Efficiency Ratio 1,3 BB&T Peers 2 ▪ The acquisition of Texas branches and The Bank of Kentucky increased noninterest expense by approximately $9 million vs. 1Q15 ▪ Excluding the loss on debt restructuring and merger - related charges, management expects 3Q15 expenses to increase 3% - 5% vs . 2Q15 including acquisitions ▪ Merger - related charges are expected to total $60 million - $80 million in 3Q15

15 15 Committed to Achieving Cost Savings Goals 2015 4Q16 56% - 57% Efficiency $160 million 58% - 60% Efficiency $65 million related to Susquehanna related to National Penn * The above graph assumes no increase in interest rates. Efficiency reflects “cash” efficiency consistent with SNL’s definit ion . Target core expense growth f lat - to - up 2% Target Efficiency

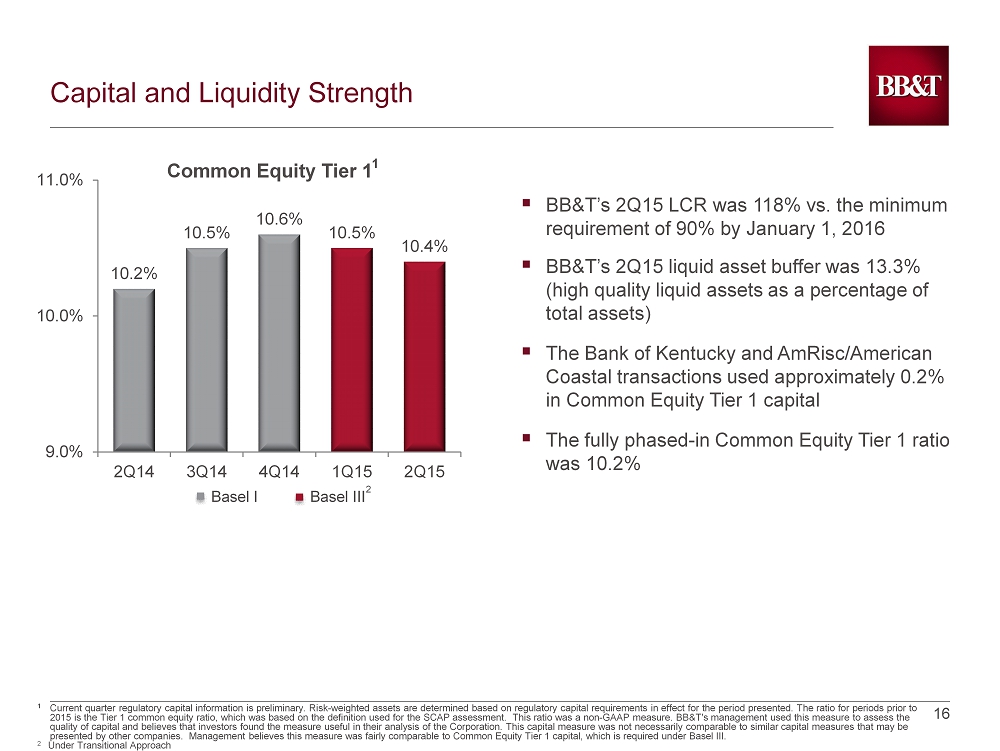

16 16 Capital and Liquidity Strength 10.2% 10.5% 10.6% 10.5% 10.4% 9.0% 10.0% 11.0% 2Q14 3Q14 4Q14 1Q15 2Q15 ▪ BB&T’s 2Q15 LCR was 118% vs. the minimum requirement of 90% by January 1, 2016 ▪ BB&T’s 2Q15 liquid asset buffer was 13.3% (high quality liquid assets as a percentage of total assets) ▪ The Bank of Kentucky and AmRisc/American Coastal transactions used approximately 0.2% in Common Equity Tier 1 capital ▪ The fully phased - in Common Equity Tier 1 ratio was 10.2% 1 C urrent quarter regulatory capital information is preliminary. Risk - weighted assets are determined based on regulatory capital requirements in effect for the period presented. The ratio for periods prior to 2015 is the Tier 1 common equity ratio, which was based on the definition used for the SCAP assessment. This ratio was a non - GA AP measure. BB&T's management used this measure to assess the quality of capital and believes that investors found the measure useful in their analysis of the Corporation. This capital measure was not necessarily comparable to similar capital measures that may be presented by other companies. Management believes this measure was fairly comparable to Common Equity Tier 1 capital, which is required under Basel III . 2 Under Transitional Approach Common Equity Tier 1 1 Basel I Basel III 2

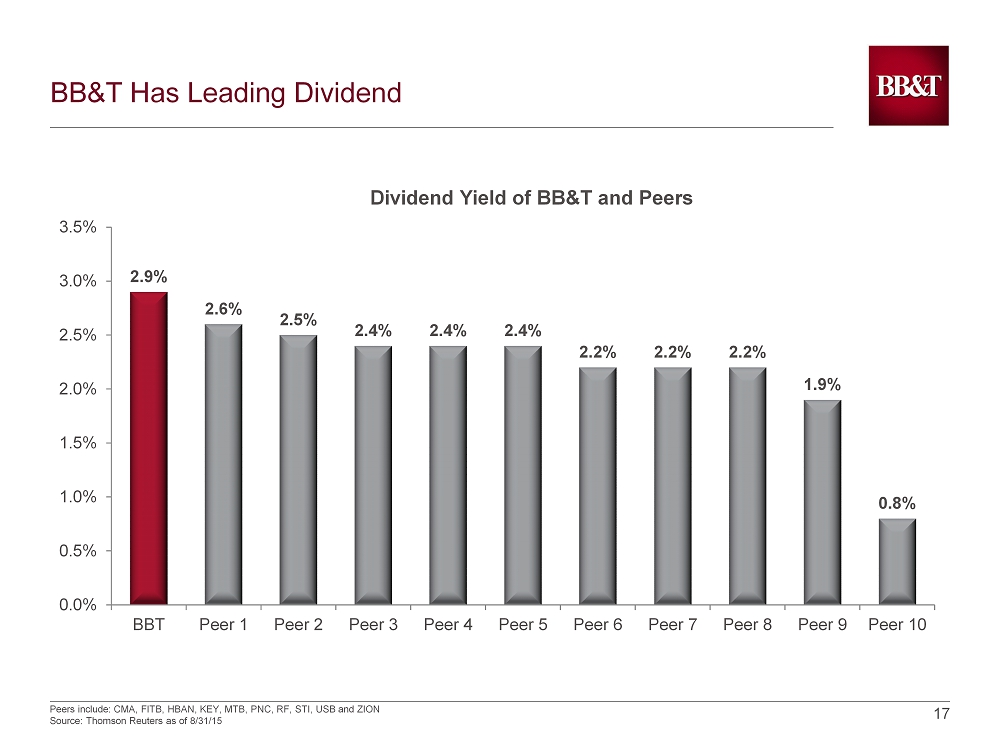

17 17 BB&T Has Leading Dividend 2.9% 2.6% 2.5% 2.4% 2.4% 2.4% 2.2% 2.2% 2.2% 1.9% 0.8% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% BBT Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Dividend Yield of BB&T and Peers Peers include: CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB and ZION Source: Thomson Reuters as of 8/31/15

18 18 Strategic and Compelling Acquisition of National Penn ▪ Strategically compelling ▪ Financially attractive ▪ Significant expansion of attractive Mid - Atlantic footprint ▪ BB&T well prepared to successfully execute on this acquisition ▪ Compatible culture with BB&T Assets ($MM) $9,604 Loans ($MM) 6,168 Deposits ($MM) 6,733 Common Equity ($MM) 1,138 YTD ROAA 1.1% YTD ROAE 9.5 YTD ROATE 13.3 TCE / TA 8.9 Common Equity Tier 1 Ratio 12.1 Note: Financial data at or for the six months ended June 30, 2015. Loan and deposit composition based on regulatory filings. National Penn Financial Highlights

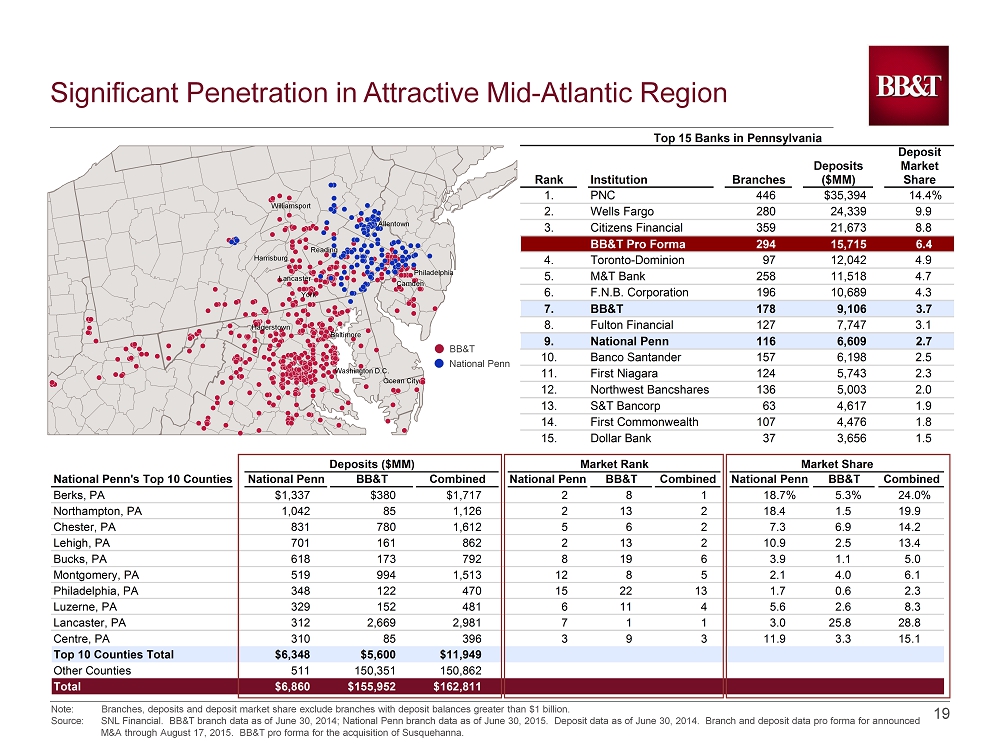

19 19 York Williamsport Washington D.C. Hagerstown Baltimore Philadelphia Reading Harrisburg Camden Lancaster Ocean City Allentown Top 15 Banks in Pennsylvania Deposit Deposits Market Rank Institution Branches ($MM) Share 1. PNC 446 $35,394 14.4% 2. Wells Fargo 280 24,339 9.9 3. Citizens Financial 359 21,673 8.8 BB&T Pro Forma 294 15,715 6.4 4. Toronto-Dominion 97 12,042 4.9 5. M&T Bank 258 11,518 4.7 6. F.N.B. Corporation 196 10,689 4.3 7. BB&T 178 9,106 3.7 8. Fulton Financial 127 7,747 3.1 9. National Penn 116 6,609 2.7 10. Banco Santander 157 6,198 2.5 11. First Niagara 124 5,743 2.3 12. Northwest Bancshares 136 5,003 2.0 13. S&T Bancorp 63 4,617 1.9 14. First Commonwealth 107 4,476 1.8 15. Dollar Bank 37 3,656 1.5 Deposits ($MM) Market Rank Market Share National Penn's Top 10 Counties National Penn BB&T Combined National Penn BB&T Combined National Penn BB&T Combined Berks, PA $1,337 $380 $1,717 2 8 1 18.7% 5.3% 24.0% Northampton, PA 1,042 85 1,126 2 13 2 18.4 1.5 19.9 Chester, PA 831 780 1,612 5 6 2 7.3 6.9 14.2 Lehigh, PA 701 161 862 2 13 2 10.9 2.5 13.4 Bucks, PA 618 173 792 8 19 6 3.9 1.1 5.0 Montgomery, PA 519 994 1,513 12 8 5 2.1 4.0 6.1 Philadelphia, PA 348 122 470 15 22 13 1.7 0.6 2.3 Luzerne, PA 329 152 481 6 11 4 5.6 2.6 8.3 Lancaster, PA 312 2,669 2,981 7 1 1 3.0 25.8 28.8 Centre, PA 310 85 396 3 9 3 11.9 3.3 15.1 Top 10 Counties Total $6,348 $5,600 $11,949 Other Counties 511 150,351 150,862 Total $6,860 $155,952 $162,811 Note: Branches, deposits and deposit market share exclude branches with deposit balances greater than $1 billion. Source: SNL Financial. BB&T branch data as of June 30, 2014; National Penn branch data as of June 30, 2015. Deposit data as of June 30, 2014. Bran ch and deposit data pro forma for announced M&A through August 17, 2015. BB&T pro forma for the acquisition of Susquehanna. BB&T National Penn Significant Penetration in Attractive Mid - Atlantic Region

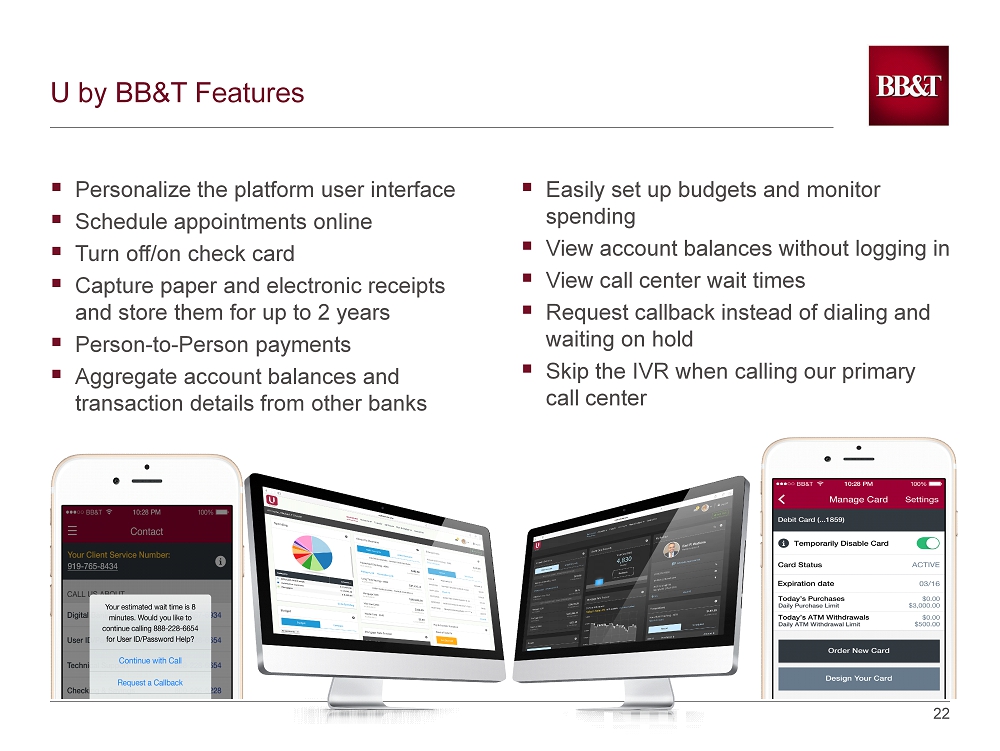

21 21 Introducing U by BB&T It was developed to provide an outstanding experience across a variety of device types and it addresses several fundamental client needs by: ▪ Allowing the client to tailor the experience according to their preferences ▪ Specific focus on the elimination of client pain points ▪ Providing seamless movement across channels ▪ Delivering functionality that goes beyond the basics to streamline and simplify financial management U by BB&T is our new digital banking platform for consumer banking clients

22 22 U by BB&T Features ▪ Personalize the platform user interface ▪ Schedule appointments online ▪ Turn off/on check card ▪ Capture paper and electronic receipts and store them for up to 2 years ▪ Person - to - Person payments ▪ Aggregate account balances and transaction details from other banks ▪ Easily set up budgets and monitor spending ▪ View account balances without logging in ▪ View call center wait times ▪ Request callback instead of dialing and waiting on hold ▪ Skip the IVR when calling our primary call center

23 23 U by BB&T Initial Feedback Very Positive ▪ 77% prefer or strongly prefer U by BB&T ▪ 12% prefer or strongly prefer classic online banking 0% 25% 50% 75% 100% Strongly Prefer U Prefer U No Preference Prefer Classic OLB Strongly Prefer Classic OLB

24 24 U by BB&T: Preview Available to all BB&T clients by September 27, 2015

25 25 Culture page

26 26 Everything else is strategic or tactical and will be adapted to accomplish our ultimate goal of maximizing shareholder returns 3 Non - negotiables at BB&T

27 27 Values Are Consistent and Important 27

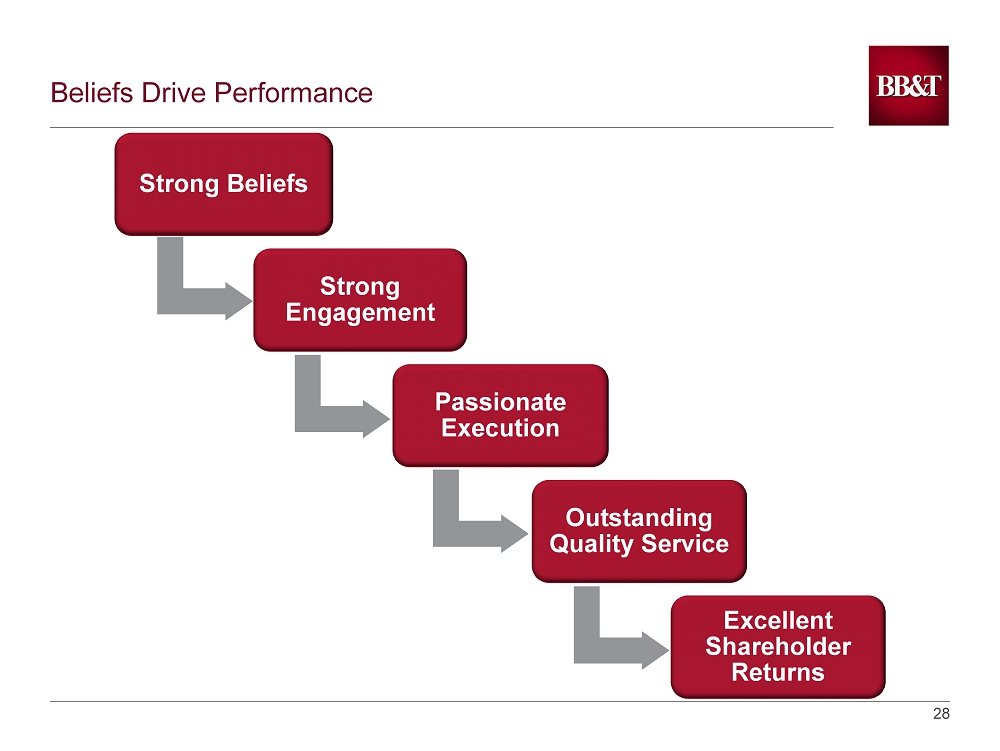

28 28 Beliefs Drive Performance Strong Beliefs Strong Engagement Passionate Execution Outstanding Quality Service Excellent Shareholder Returns

While we’re performing at a superior level, we believe

Appendix

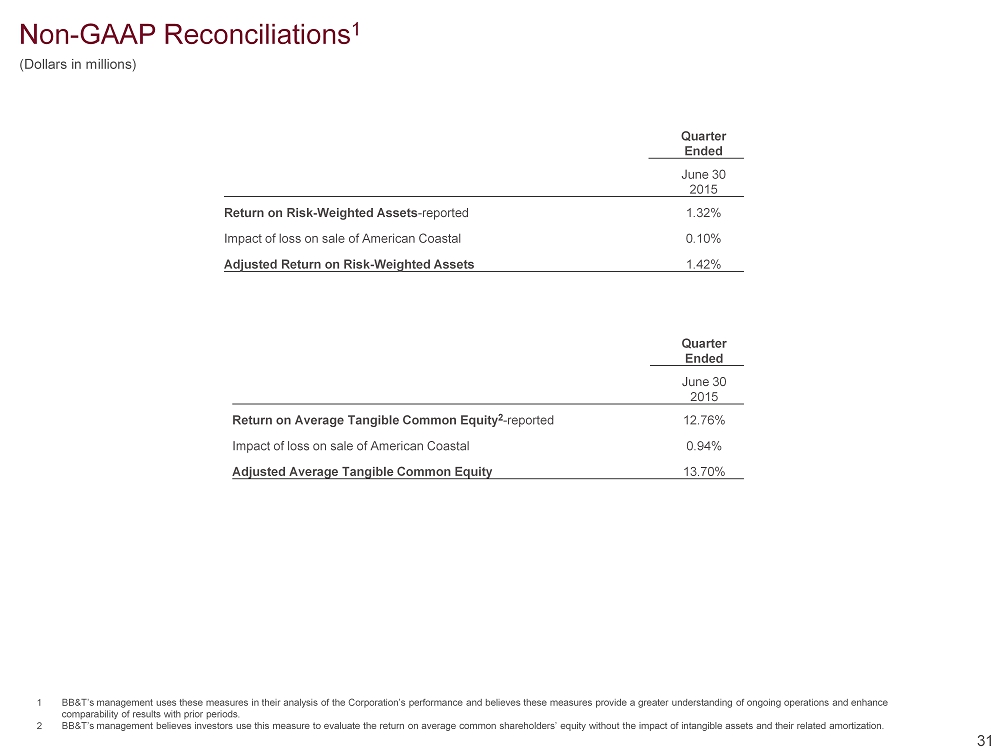

31 1 BB&T’s management uses these measures in their analysis of the Corporation’s performance and believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods. 2 BB&T’s management believes investors use this measure to evaluate the return on average common shareholders’ equity without t h e impact of intangible assets and their related amortization. Non - GAAP Reconciliations 1 (Dollars in millions) Quarter Ended June 30 2015 Return on Risk - Weighted Assets - reported 1.32% Impact of loss on sale of American Coastal 0.10% Adjusted Return on Risk - Weighted Assets 1.42% Quarter Ended June 30 2015 Return on Average Tangible Common Equity 2 - reported 12.76% Impact of loss on sale of American Coastal 0.94% Adjusted Average Tangible Common Equity 13.70%

Non - GAAP Reconciliations 1 Quarter Ended Reported net interest margin vs. core net interest margin June 30 2015 March 31 2015 Dec. 31 2014 Sept. 30 2014 June 30 2014 Reported net interest margin - GAAP 3.27% 3.33% 3.36% 3.38% 3.43% Adjustments to interest income for assets acquired from FDIC: Effect of securities acquired from FDIC (0.04) (0.06) (0.06) (0.06) (0.06) Effect of loans acquired from FDIC (0.08) (0.10) (0.11) (0.13) (0.16) Adjustments to interest expense: Effect of interest expense on assets acquired from FDIC 0.01 0.01 0.01 0.01 0.01 Core net interest margin 3.16% 3.18% 3.20% 3.20% 3.22% 32 1 BB&T management uses this measure to evaluate net interest margin, excluding the impact of assets acquired from FDIC and beli e ves this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods.

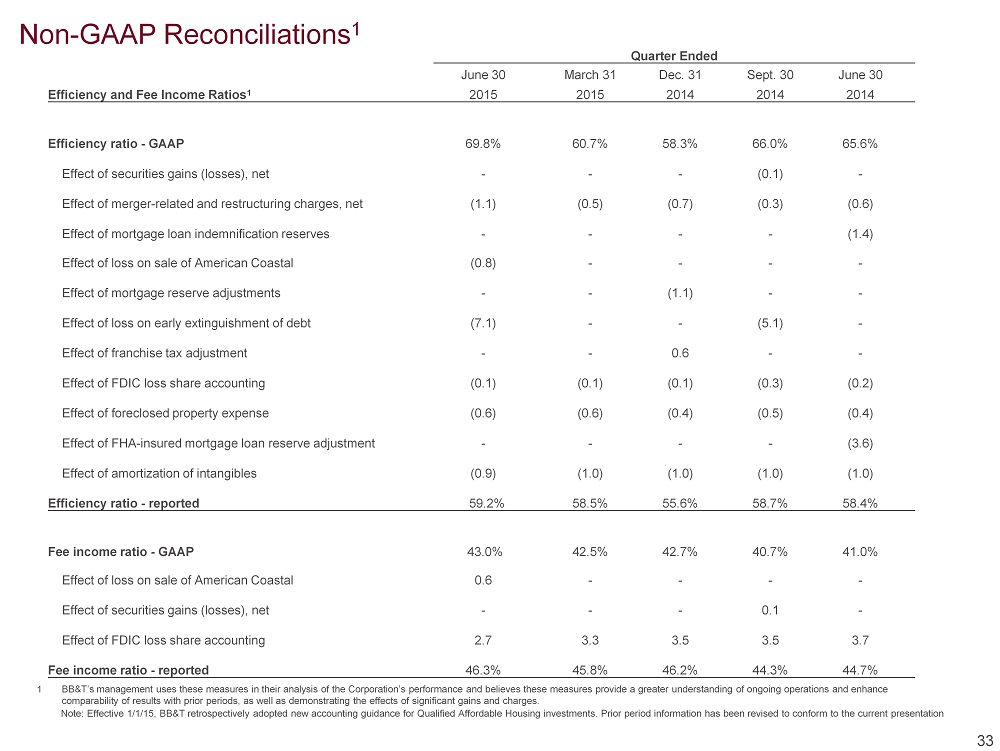

Non - GAAP Reconciliations 1 33 1 BB&T’s management uses these measures in their analysis of the Corporation’s performance and believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrating the effects of significant gains and charges. Quarter Ended June 30 March 31 Dec. 31 Sept. 30 June 30 Efficiency and Fee Income Ratios 1 2015 2015 2014 2014 2014 Efficiency ratio - GAAP 69.8% 60.7% 58.3% 66.0% 65.6% Effect of securities gains (losses), net - - - (0.1) - Effect of merger - related and restructuring charges, net (1.1) (0.5) ( 0.7) ( 0.3) ( 0.6) Effect of mortgage loan indemnification reserves - - - - ( 1.4) Effect of loss on sale of American Coastal (0.8) - - - - Effect of mortgage reserve adjustments - - ( 1.1) - - Effect of loss on early extinguishment of debt (7.1) - - ( 5.1) - Effect of franchise tax adjustment - - 0.6 - - Effect of FDIC loss share accounting (0.1) (0.1) ( 0.1) ( 0.3) ( 0.2) Effect of foreclosed property expense (0.6) (0.6) ( 0.4) ( 0.5) (0.4 ) Effect of FHA - insured mortgage loan reserve adjustment - - - - ( 3.6) Effect of amortization of intangibles (0.9) ( 1.0) ( 1.0) ( 1.0) ( 1.0) Efficiency ratio - reported 59.2% 58.5% 55.6% 58.7% 58.4% Fee income ratio - GAAP 43.0% 42.5% 42.7% 40.7% 41.0% Effect of loss on sale of American Coastal 0.6 - - - - Effect of securities gains (losses), net - - - 0.1 - Effect of FDIC loss share accounting 2.7 3.3 3.5 3.5 3.7 Fee income ratio - reported 46.3% 45.8% 46.2% 44.3% 44.7% Note: Effective 1/1/15, BB&T retrospectively adopted new accounting guidance for Qualified Affordable Housing investments. Pr io r period information has been revised to conform to the current presentation