UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark one)

For the fiscal year ended

For the period from ____________ to ___________

Commission file number

| CYCLO THERAPEUTICS, INC. |

(Exact name of registrant as specified in its charter)

| | | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | The |

| | | The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding twelve months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | ☒ | Smaller reporting company | |

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes

As of June 30, 2021, the aggregate market value of the registrant’s Common Stock held by non-affiliates was $

As of March 10, 2022, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the registrant’s 2022 Annual Meeting of Stockholders which will be filed with the Commission no later than 120 days after the registrant’s fiscal year ended December 31, 2021, are incorporated by reference into Part III of this report.

CYCLO THERAPEUTICS, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2021

Table of Contents

| Item |

Description |

Page |

||

| Part I |

||||

| 1. |

Business |

1 |

||

| 1A. |

Risk Factors |

20 |

||

| 1B. |

Unresolved Staff Comments |

31 |

||

| 2. |

Properties |

31 |

||

| 3. |

Legal Proceedings |

31 |

||

| 4. |

Mine Safety Disclosures |

31 |

||

| Part II |

||||

| 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

32 |

||

| 6. |

Selected Financial Data |

32 |

||

| 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 |

||

| 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

38 |

||

| 8. |

Financial Statements and Supplementary Data |

F-1 |

||

| 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

39 |

||

| 9A. |

Controls and Procedures |

39 |

||

| 9B. |

Other Information |

40 |

||

| Part III |

||||

| 10. |

Directors, Executive Officers and Corporate Governance |

41 |

||

| 11. |

Executive Compensation |

41 |

||

| 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

41 |

||

| 13. |

Certain Relationships and Related Transactions and Director Independence |

41 |

||

| 14. |

Principal Accountant Fees and Services |

41 |

||

| Part IV |

||||

| 15. |

Exhibits, Financial Statement Schedules |

42 |

||

| Signatures |

||||

PART I

Item 1. Business.

Overview

Cyclo Therapeutics, Inc. (“we,” “our,” “us,” or the “Company”) was organized as a Florida corporation on August 9, 1990, with operations beginning in July 1992. In conjunction with a restructuring in 2000, we changed our name from Cyclodextrin Technologies Development, Inc. to CTD Holdings, Inc. We changed our name to Cyclo Therapeutics, Inc. in September 2019 to better reflect our current business, and on November 6, 2020, we reincorporated from the State of Florida to the State of Nevada.

We are a clinical stage biotechnology company that develops cyclodextrin-based products for the treatment of disease. We filed a Type II Drug Master File with the U.S. Food and Drug Administration (“FDA”) in 2014 for our lead drug candidate, Trappsol® Cyclo™ (hydroxypropyl beta cyclodextrin) as a treatment for Niemann-Pick Type C disease (“NPC”). NPC is a rare and fatal cholesterol metabolism disease that impacts the brain, lungs, liver, spleen, and other organs. In 2015, we launched an International Clinical Program for Trappsol® Cyclo™ as a treatment for NPC. In 2016, we filed an Investigational New Drug application (“IND”) with the FDA, which described our Phase I clinical plans for a randomized, double blind, parallel group study at a single clinical site in the U.S. The Phase I study evaluated the safety of Trappsol® Cyclo™ along with markers of cholesterol metabolism and markers of NPC during a 14-week treatment period of intravenous administration of Trappsol® Cyclo™ every two weeks to participants 18 years of age and older. The IND was approved by the FDA in September 2016, and in January 2017 the FDA granted Fast Track designation to Trappsol® Cyclo™ for the treatment of NPC. Initial patient enrollment in the U.S. Phase I study commenced in September 2017. Enrollment in this study was completed in October 2019, and in May 2020 we announced Top Line data showing a favorable safety and tolerability profile for Trappsol® Cyclo™ in this study.

We have also completed a Phase I/II clinical study approved by several European regulatory bodies, including those in the United Kingdom, Sweden and Italy, and in Israel. The Phase I/II study evaluated the safety, tolerability and efficacy of Trappsol® Cyclo™ through a range of clinical outcomes, including neurologic, and respiratory, in addition to measurements of cholesterol metabolism and markers of NPC. The European/Israel study was similar to the U.S. study, providing for the administration of Trappsol® Cyclo™ intravenously to NPC patients every two weeks in a double-blind, randomized trial but it differs in that the study period is for 48 weeks (24 doses). The first patient was dosed in this study in July 2017, and in February 2020, we announced completion of enrollment of 12 patients in this study. In March of 2021 we announced that 100% of patients who completed the trial improved or remained stable, and 89% met the efficacy outcome measure of improvement in at least two domains of the 17-domain NPC severity scale.

Additionally, in February 2020 we had a face-to-face “Type C” meeting with the FDA with respect to the initiation of our pivotal Phase III clinical trial of Trappsol® Cyclo™ based on the clinical data obtained to date. At that meeting, we also discussed with the FDA submitting a New Drug Application (NDA) under Section 505(b)(1) of the Federal Food, Drug, and Cosmetic Act for the treatment of NPC in pediatric and adult patients with Trappsol® Cyclo™. A similar request was submitted to the European Medicines Agency (“EMA”) in February 2020, seeking scientific advice and protocol assistance from the EMA for proceeding with a Phase III clinical trial in Europe. In October 2020 we received a “Study May Proceed” notification from the FDA with respect to the proposed Phase III clinical trial, and in June of 2021 we commenced enrollment in TransportNPC, a pivotal Phase III study of Trappsol® Cyclo™ for the treatment of NPC.

Preliminary data from our clinical studies suggest that Trappsol® Cyclo™ releases cholesterol from cells, crosses the blood-brain-barrier in individuals suffering from NPC, and results in neurological and neurocognitive benefits and other clinical improvements in NPC patients. The full significance of these findings will be determined as part of the final analysis of these clinical trials.

On May 17, 2010, the FDA designated Trappsol® Cyclo™ as an orphan drug for the treatment of NPC, which would provide us with the exclusive right to sell Trappsol® Cyclo™ for the treatment of NPC for seven years following FDA drug approval. In April 2015, we also obtained Orphan Drug Designation for Trappsol® Cyclo™ in Europe, which will provide us with 10 years of market exclusivity following regulatory approval, which period will be extended to 12 years upon acceptance by the EMA’s Pediatric Committee of our pediatric investigation plan (PIP) demonstrating that Trappsol® Cyclo™ addresses the pediatric population. On January 12, 2017, we received Fast Track Designation from the FDA, and on December 1, 2017, the FDA designated NPC a Rare Pediatric Disease.

We are also exploring the use of cyclodextrins in the treatment of Alzheimer’s disease. In January 2018, the FDA authorized a single patient IND expanded access program using Trappsol® Cyclo™ for the treatment of Alzheimer’s disease. After 18 months of treatment in this geriatric patient with late-onset disease, the disease was stabilized and the drug was well tolerated. The patient also exhibited signs of improvement with less volatility and shorter latency in word-finding. We prepared a synopsis for an early stage protocol using Trappsol® Cyclo™ intravenously to treat Alzheimer’s disease that was presented to the FDA in January of 2021. We received feedback from the FDA on this synopsis in April 2021 and incorporated the feedback into an IND for a Phase II study for the treatment of Alzheimer’s disease with Trappsol® Cyclo™ that we submitted to the FDA in November 2021. In December of 2021, we received IND clearance from the FDA, allowing us to proceed with our Phase II study of Trappsol® Cyclo™ for the treatment of Alzheimer’s disease. We expect to begin enrollment in this study during 2022.

We filed an international patent application in October 2019 under the Patent Cooperation Treaty directed to the treatment of Alzheimer’s disease with cyclodextrins, and are pursuing national and regional stage applications based on this international application. The terms of any patents resulting from these national or regional stage applications would be expected to expire in 2039 if all the requisite maintenance fees are paid.

We also continue to operate our legacy fine chemical business, consisting of the sale of cyclodextrins and related products to the pharmaceutical, nutritional, and other industries, primarily for use in diagnostics and specialty drugs. However, our core business has transitioned to a biotechnology company primarily focused on the development of cyclodextrin-based biopharmaceuticals for the treatment of disease from a business that had been primarily reselling basic cyclodextrin products.

Niemann-Pick Type C Disease

NPC is a rare, genetic and progressive disease that impairs the ability of the body to recycle cholesterol and other types of lipids, resulting in damage to the body’s tissues, including the brain. The symptoms upon onset of NPC vary from fatality during the first months after birth to a progressive disorder not diagnosed until adulthood. The disease affects the brain as well as various internal organs. Symptoms of NPC usually occur during early to late childhood, including difficulties in swallowing, loss of speech and cognition, motor coordination and ambulation. During this period, affected individuals may also develop impairment of intellectual ability, psychiatric disturbances and progressive loss of memory. Symptoms include enlargement of the liver and/or spleen and lung diseases, epileptic seizures and dystonia. Systemic symptoms of NPC are more common in infancy or childhood and the rate of progression is usually much slower in individuals with onset of symptoms during adulthood. Age of onset of neurologic symptoms is one predictor of severity of disease. Approximately half of NPC patients are adults with a less aggressive form of the disease that progresses more slowly, and is frequently initially misdiagnosed, as these patients are more likely to present with dementia, psychiatric symptoms and other symptoms. In the US, patients are increasingly diagnosed in their 50’s and 60’s.

NPC is caused by mutations in one of two genes, NPC1 or NPC2, which prevent cells from properly processing cholesterol and other lipids and lead to an accumulation of lipids in the lysosomes, resulting in cell toxicity, loss of cell function or cell death. In the central nervous system, it results in progressive motor and brain impairment. Approximately 95% of people with the disease have mutations in NPC1. Genetic diseases are determined by the combination of the pair of genes for a particular trait received from the father and the mother. NPC is an autosomal recessive disorder, i.e. two copies of an abnormal gene must be present in order for the disease or trait to develop. Although uncertainty exists about the exact function of the NPC1 and NPC2 protein products, they are known to be involved in the trafficking (transportation) of cholesterol within a compartment of the cell called the lysosome. Hence, a mutated gene may lead to faulty NPC protein production and, as a consequence, an abnormal accumulation of cholesterol and other lipids in the organs most commonly affected, such as the liver, spleen and brain. In addition, as with other neurodegenerative diseases such as Alzheimer's disease and Parkinson’s disease, NPC patients exhibit elevated levels of the protein tau in their cerebrospinal fluid.

Addressable Market

The incidence of NPC is estimated at one in 100,000 live births annually, with approximately eight new NPC cases per year worldwide. There are currently over 9,000 NPC patients worldwide. We estimate that the addressable annual market for treating NPC patients with Trappsol® Cyclo™ is approximately $300 million in the Unites States and approximately $600 million globally.

Treatment Options for NPC

The majority of current treatment options are directed towards the specific symptoms apparent in each individual. These include, for example, referral to a therapist to optimize the swallowing function, prescription of anti-seizure medications to prevent seizures and prescription of melatonin to treat insomnia and other sleep problems caused by the disease. Symptomatic treatment may require the coordinated efforts of a team of specialists.

Zavesca (miglustat), which was originally developed by Actelion Pharmaceuticals and is now owned by Johnson & Johnson and is also now available as a generic product in several countries, is currently the only approved treatment for NPC. It is approved only in Europe, Canada, Australia, New Zealand and several countries in Asia and in South America as Zavesca and in Japan as Brazaves. In Europe, miglustat is indicated for the treatment of progressive neurological manifestations in adult patients and pediatric patients with NPC disease. The FDA declined to approve miglustat for NPC in 2010 and requested more data be provided. A range of side effects are known to be associated with miglustat, including weight loss, decreased appetite, diarrhea, nausea and thrombocytopenia. While miglustat has not been approved by the FDA for the treatment of NPC, it has been approved by the FDA for the treatment of Gaucher Type I disease. In addition, studies are currently being performed to test the safety and efficacy of other treatment options, which are discussed in more detail below under “—Competition.”

Due to the limited availability, efficacy and side effects of existing treatment options, we believe that a significant unmet need for treatment of NPC continues to exist, and that we may be the only company with a drug candidate that treats both the systemic and neurological manifestations of NPC.

Cyclodextrins

Cyclodextrins are donut shaped rings of glucose (sugar) molecules. Cyclodextrins are formed naturally by the action of bacterial enzymes on starch. They were first noticed and isolated in 1891. The bacterial enzyme naturally creates a mixture of at least three different cyclodextrins depending on how many glucose units are included in the molecular circle; six glucose units yield alpha cyclodextrin; seven units, beta cyclodextrin; eight units, gamma cyclodextrin. The more glucose units in the molecular ring, the larger the cavity in the center of the ring. The inside of this ring provides an excellent resting place for “oily” molecules while the outside of the ring is compatible with water, allowing clear, stable solutions of cyclodextrins to exist in aqueous environments even when an “oily” molecule is carried within the ring. The net result is a molecular carrier that comes in small, medium, and large sizes with the ability to transport and deliver “oily” materials using plain water as the solvent. It is the ability of molecular encapsulation of compounds that makes cyclodextrins so useful chemically and pharmaceutically.

Use of Cyclodextrins to Treat NPC

Natural cyclodextrins have been confirmed to be generally recognized as safe (GRAS) in most of the world, including the U.S. Moreover, approvals of products containing cyclodextrins by the FDA since 2001 suggest that regulatory approval for new products may be easier to obtain in the future. In 2001, Janssen Pharmaceutica, now a subsidiary of Johnson & Johnson, received FDA approval to market Sporanox®, an antifungal which contained hydroxypropyl beta cyclodextrin as an excipient. In 2009, one of our products was used in an FDA approved compassionate use investigational new drug protocol for the treatment of NPC. Under the Orphan Drug Act, companies that develop a drug for a disorder affecting fewer than 200,000 people in the United States may seek designation as an orphan drug. If such designation is approved, a company will have the ability to sell the drug exclusively for seven years following FDA drug approval, and the company may receive clinical trial tax incentives.

Trappsol® Cyclo™ is the first use of a cyclodextrin as an active pharmaceutical and not just as an inactive formulation excipient. On May 17, 2010, the FDA designated Trappsol® Cyclo™ as an orphan drug for the treatment of NPC. We have also obtained Orphan Drug Designation for Trappsol® Cyclo™ in Europe. Trappsol® Cyclo™ has been administered to more than 20 NPC patients in compassionate use programs around the world, including in the U.S., Brazil and Spain. Patients participating in these compassionate use programs demonstrated one or more of the following benefits: a reduction in liver size; restoration of language skills; resolution of interstitial lung disease; improvement in fine and gross motor skills, improvement in behavioral aspects of the disease, and improvement in quality of life. The doctors and patients participating in these programs, including patients that have been administered Trappsol® Cyclo™ intravenously for more than five years, have made their data available to us, which we used to design our clinical studies in the U.S. and abroad, and which we published in a peer-reviewed journal with treating physicians as co-authors.

Our Clinical Studies

As set forth in greater detail below, to date, our clinical studies have preliminarily demonstrated that Trappsol® Cyclo™ is safe and efficacious in the treatment of NPC over a range of dose groups. When measuring efficacy in NPC patients, we utilized the NPC Clinical Severity Scale developed by the National Institutes of Health (NIH) which measures clinical signs and symptoms across “major domains” and “minor domains” as follows:

Nine major domains: ambulation, cognition, eye movement, fine motor, hearing, memory, seizures, speech, and swallowing.

Eight minor domains:– auditory brainstem response, behavior, gelastic cataplexy, hyperreflexia, incontinence, narcolepsy, psychiatric, and respiratory problems.

Major domains are scored on a scale of zero to five, with zero showing no disability, and minor domains add up to two points for severity of condition per domain.

European and Israeli Phase I/II Clinical Study

Our completed Phase I/II clinical study was approved by several European regulatory bodies, including those in the United Kingdom, Sweden and Italy, and in Israel. This study evaluated the safety, tolerability and efficacy of Trappsol® Cyclo™ through a range of clinical outcomes, including neurologic, and respiratory, in addition to measurements of cholesterol metabolism and markers of NPC, in three dose groups (1500 mg/kg, 2000 mg/kg and 2500 mg/kg). The first patient was dosed in this study in July 2017, and in February 2020, we announced completion of enrollment of 12 patients in this study. The efficacy outcome measures and results from this study are as follows:

Efficacy Outcome Measure 1: At least a one-point reduction (or improvement) in two or more of the 17 domains measured under the NPC Clinical Severity Scale.

Results:

| ● |

Six of seven patients met this endpoint (86% of those who completed). |

| ● |

Improvements seen in swallow, ambulation, ability to manage seizures, saccadic eye movements, fine motor skills, and cognition. (Individual patient profiles differed, i.e. patients improved differently.) |

| ● |

Patients not receiving any intervention beyond standard of care would be expected to worsen in total score by 1.5 points over one year. |

Efficacy Outcome Measure 2: Change from baseline in “Global Impression of Disease” at 48 weeks.

Results:

| ● |

Using the Clinician’s Global Impression of Improvement scale, five of seven patients who completed the trial improved, and the other 2 patients stabilized. |

| ● |

five of seven improved in at least one of these features: walking, speaking, swallowing, fine motor and cognition. These five features are determined by NPC patients and their caregivers to be the most important for quality of life. A composite in improvement in these five features will be the primary outcome measure for our pivotal Phase III trial. |

Additional Data:

| ● |

As a group, the first seven patients to complete the clinical trial meet both efficacy outcome measures for the study. |

| ● |

Individual patients showed improvements in all dose groups. |

| ● |

Trappsol® Cyclo™ demonstrated an acceptable observed safety and tolerability profile and an appropriate benefit risk. |

| ● |

Trappsol® Cyclo™ was shown to cross the blood brain barrier. |

| ● |

Successive administration of Trappsol® Cyclo™ decreased tau levels, suggesting neuroprotective benefit. |

| ● |

Trappsol® Cyclo™ improves neurological features of NPC, including ataxia, and quality of life for patients. |

| ● |

Based on data provided, we have selected the 2000 mg/kg dose for our pivotal Phase III trial. |

US Phase I Clinical Study

In September 2016, the FDA approved our Phase I clinical plans for a randomized, double blind, parallel group study in the U.S. The Phase I study evaluated the safety of Trappsol® Cyclo™ along with markers of cholesterol metabolism and markers of NPC during a 14-week treatment period of intravenous administration of Trappsol® Cyclo™ every two weeks to participants 18 years of age and older in two dose groups (1500 mg/kg and 2500 mg/kg). Enrollment in this study was completed in October 2019, and in May 2020 we announced Top Line data showing a favorable safety and tolerability profile for Trappsol® Cyclo™ in this study. Additional date from this study includes the following data:

| ● |

Liver biopsies and biochemical data on cholesterol homeostasis demonstrated that Trappsol® Cyclo™ removes trapped cholesterol from liver cells and impacts cholesterol homeostasis. |

| ● |

Tau decreased after seven doses in a majority of patients, suggesting that IV administration of Trappsol® Cyclo™ is preventing neurodegeneration in NPC patients. |

| ● |

Efficacy signals from Trappsol® Cyclo™ include neurological improvements, higher energy, and greater focus exhibited by the patient. |

| ● |

All eligible patients requested continuation of Trappsol® Cyclo™ administration in the extension protocol via home infusion. |

| ● |

In January we reported positive efficacy data on all eight patients participating in the protocol. |

Trappsol® Cyclo™ Removes Cholesterol from Liver Cells

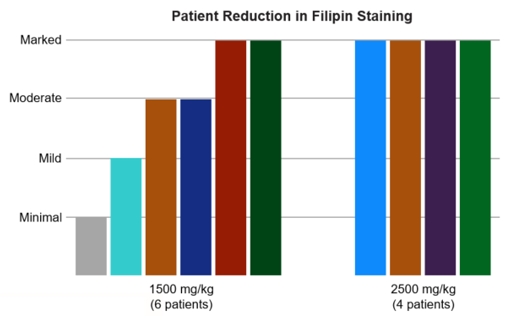

Cholesterol accumulates abnormally in the cells of NPC patients. Based on our clinical studies we believe that Trappsol® Cyclo™ can function like the NPC1 protein, allowing cholesterol to be moved normally through cells. The administration of both 1500 mg/kg and 2500 mg/kg dosages in our clinical trials demonstrated that Trappsol® Cyclo™ clears cholesterol from peripheral organs. Management believes this is evidence of a pathway to treat the systemic and neurologic manifestations of the disease. The reduction in cholesterol can be visualized directly in liver cells through biopsies and fillipin staining, as shown below.

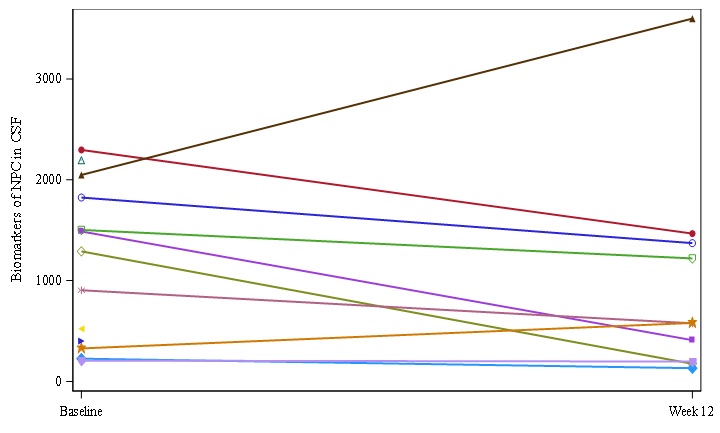

Trappsol® Cyclo™ Reduces Tau

Tau is a protein found in elevated levels in the cerebrospinal fluid (CSF) of NPC patients, as well as patients with other neurodegenerative diseases such as Alzheimer's disease and Parkinson’s disease. Data from our clinical studies demonstrate that Trappsol® Cyclo™ reduces tau levels. The chart below shows tau levels measured in the CSF of 10 NPC patients who had lumbar punctures prior to treatment with Trappsol® Cyclo™ and after seven doses over a 14-week period in our Phase I study, with six of 10 patients showing a reduction in tau levels, two remained stable, and two with increased levels of tau. Data from three patients in our Phase I/II study showed a similar pattern of tau reduction in all three patients at 24 weeks and 48 weeks.

| Tau (ng/L) |

|

Use of Cyclodextrins to Treat Alzheimer’s Disease

Because NPC and Alzheimer’s disease share many similar biological and clinical signs and symptoms, we have been exploring the treatment of Alzheimer’s disease with Trappsol® Cyclo™. In particular, both NPC and Alzheimer’s patients exhibit cognitive decline, increased levels of tau in CSF, and amyloid beta plaques in the brain, neurofibrillary tangles in the brain, and lysosomal enlargement in neurons in the brain.

Cell and animal studies using hydroxypropyl beta cyclodextrin (“HPBCD”) to treat Alzheimer’s disease have shown:

| ● |

HPBCD added to cells that over-express the precursor protein of amyloid beta, APP, lowers amyloid beta plaques; and |

| ● |

HPBCD given subcutaneously to a mouse that over-expresses APP: |

| ■ |

Reduces amyloid beta plaques by reducing cleavage of APP; |

| ■ |

Improves memory as shown in a standard water maze test; |

| ■ |

Reduces microgliosis (a marker of inflammation); and |

| ■ |

Up-regulates proteins (e.g. NPC1) involved in cholesterol transport and amyloid beta clearance. |

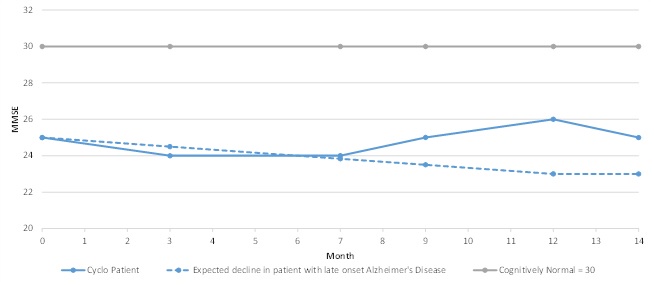

In January 2018, the FDA authorized a single patient IND expanded access program using Trappsol® Cyclo™ for the treatment of Alzheimer’s disease. Our partner and principal investigator for the trial was Diana R. Kerwin, MD, an award-winning recognized expert in Alzheimer’s disease. After 18 months of monthly intravenous infusions, the patient’s disease did not progress as measured with standard cognitive tools. The patient and family reported less volatility and greater word-finding ability, and the treating physician reported cognitive and neurologic stability in contrast to an expected measurable cognitive and functional decline that would have been expected over the treatment period. The patient withdrew from this treatment for reasons unrelated to the safety of Trappsol® Cyclo™. The table below measures the patient’s Mini Mental State Evaluation (an accepted and standardized clinical examination, widely used to assess cognitive function including in patients with Alzheimer’s disease) during the treatment period.

In October 2018, we filed a patent application with respect to the use of hydroxypropyl beta cyclodextrins in the treatment of Alzheimer’s disease. We prepared a synopsis for an early stage protocol using Trappsol® Cyclo™ intravenously to treat Alzheimer’s disease that was presented to the FDA in January of 2021. We received feedback from the FDA on this synopsis in April 2021 and incorporated the feedback into an IND for a Phase II study for the treatment of Alzheimer’s disease with Trappsol® Cyclo™ that we submitted to the FDA in November 2021. In December of 2021, we received IND clearance from the FDA, allowing us to proceed with our Phase II study of Trappsol® Cyclo™ for the treatment of Alzheimer’s disease. We expect to begin enrollment in this study during 2022.

Intellectual Property and Regulatory Exclusivities

We have a pending International patent application directed to the treatment of Alzheimer’s disease with cyclodextrins, and we expect to pursue one or more national or regional stage applications based on this International application. The terms of any patents resulting from these national or regional stage applications would be expected to expire in 2039 if all the requisite maintenance fees are paid. In addition, the designation of Trappsol® Cyclo™ as an orphan drug for the treatment of NPC by the FDA and European regulators would provide us with seven years, and 10 to 12 years, of market exclusivity, respectively, following regulatory approval. We also believe that our formulation and manufacturing process for Trappsol® Cyclo™ is protected by trade secrets. We have also protected our Trappsol® and Aquaplex® trademarks by registering them with the U.S. Patent and Trademark Office.

Competition

There is currently no known cure for NPC. Although we face competition in the commercialization of a drug product to treat NPC, we believe that we may be the only company with a drug candidate that treats both the systemic and neurological manifestations of NPC. Actelion, a subsidiary of Johnson & Johnson, has a drug, Miglustat, not approved in the US, which treats some of the neurologic symptoms of the disease in some patients. Orphazyme, a public company based in Denmark, has a drug candidate, Arimoclomal, in development and has initiated a rolling NDA submission with the FDA based on limited neurological benefit in sub-groups of the NPC population. In addition, IntraBio is developing a drug candidate for the treatment of NPC with preliminary reports of benefit to a sub-set of neurologic features, primarily ataxia. We believe our clinical progress, our close connections with patient advocacy groups in the U.S. and Europe, and the fact that we have a finished product currently in use in human patients all give us a competitive advantage over potential competitors.

We have also noted increased competition for the distribution of small quantities of cyclodextrins. Those we have examined are small operations or small offerings of a larger distributor that lack the focus and depth of expertise offered by us. They are also most often not price competitive with our products. We believe there is a perceived barrier to entry into the cyclodextrin industry because of the lack of general experience with cyclodextrins. We have established business relationships with many of the producers and consumers of cyclodextrins worldwide and, over more than 30 years, we have developed an unmatched experience database. We believe these relationships and market knowledge provide significant business advantages.

Research and Development

We are currently pursuing clinical programs globally, including in the U.S. and Europe, in an effort to gain market authorization of our bio-pharmaceutical product for the treatment of NPC. We have made a substantial investment in the research and development of our Trappsol® Cyclo™ product as we seek approval for marketing the product for the treatment of NPC. We are also exploring the use of cyclodextrins in the treatment of Alzheimer's disease. We will continue to expend substantial funds in support of these efforts with the progression of our clinical trials, which we commenced in 2017. Research and development expenses increased to approximately $9,154,000 in 2021, from $6,096,000 in 2020.

Government Regulation

The development, production and marketing of biopharmaceutical products, which include the proposed uses of Trappsol® Cyclo™ to treat disease, including NPC, are subject to regulation by governmental authorities in the United States, at the federal, state and local levels, and in other countries. These regulations govern, among other things, the research, development, testing, manufacture, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, and import and export of biopharmaceutical products. The processes for obtaining regulatory approvals in the United States and other countries, along with subsequent compliance with applicable statutes and regulations, require the expenditure of substantial time and financial resources.

United States Government Regulation

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or FDCA, and its implementing regulations and guidance. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and non-U.S. statutes, regulations and guidance requires the expenditure of substantial time and financial resources. Failure to comply with the applicable United States requirements at any time during the drug development process, including preclinical and clinical testing, the approval process or post-approval process, may subject an applicant to delays in conducting the preclinical study or clinical trial, regulatory review, approval, a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve a pending NDA, other applications, license suspension or revocation, withdrawal of an approval, imposition of a clinical hold, issuance of warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, civil or criminal investigations brought by the FDA, the DOJ and other government entities, including state agencies and associated civil or criminal penalties.

The process required by the FDA before a drug may be marketed in the United States generally involves:

| • |

completion of preclinical laboratory tests, animal studies and formulation studies in compliance with the FDA’s good laboratory practice regulations; |

|

| • |

completion of the manufacture, under cGMP conditions, of the drug substance and drug product that the sponsor intends to use in clinical trials along with required analytical and stability testing; |

|

| • |

submission to the FDA of an investigational new drug, or IND, application for clinical trials, which must become effective before human clinical trials may begin; |

|

| • |

approval by an independent institutional review board, or IRB, at each clinical site before each clinical trial may be initiated; |

|

| • |

performance of adequate and well-controlled clinical trials, in accordance with good clinical practice, or GCP, requirements to establish the safety, potency, purity and efficacy of the proposed drug for each proposed indication; |

|

| • |

payment of user fees; |

|

| • |

preparation and submission to the FDA of an NDA requesting marketing for one or more proposed indications, including submission of detailed information on the manufacture and composition of the product in clinical development and proposed labelling; |

|

| • |

satisfactory completion of an FDA advisory committee review, if applicable; |

|

| • |

satisfactory completion of an FDA inspection of the manufacturing facility or facilities, including those of third parties at which the product, or components thereof, are produced to assess compliance with cGMP requirements, and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; |

|

| • |

satisfactory completion of an FDA inspection of selected clinical sites to assure compliance with GCPs and the integrity of the clinical data; |

|

| • |

FDA review and approval of the NDA; and |

|

| • |

compliance with any post-approval requirements, including the potential requirement to implement a Risk Evaluation and Mitigation Strategy, or REMS, and any post-approval studies or other post-marketing commitments required by the FDA. |

Preclinical Studies

Preclinical studies include laboratory evaluation of product chemistry, toxicity and formulation, as well as animal studies to assess potential safety and efficacy. An IND sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data and any available clinical data or literature, among other things, to the FDA as part of an IND. Some preclinical testing may continue even after the IND is submitted. An IND is an exemption from the FDCA that allows an unapproved product candidate to be shipped in interstate commerce for use in an investigational clinical trial and a request for FDA authorization to administer such investigational product to humans. An IND automatically becomes effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to one or more proposed clinical trials and places the clinical trial on a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin.

As a result, submission of an IND may not result in the FDA allowing clinical trials to commence. If the FDA raises concerns or questions either during this initial 30-day period, or at any time during the IND process, it may choose to impose a partial or complete clinical hold. Clinical holds are imposed by the FDA whenever there is concern for patient safety and may be a result of new data, findings, or developments in clinical, preclinical, and/ or chemistry, manufacturing, and controls. This order issued by the FDA would delay either a proposed clinical trial or cause suspension of an ongoing trial, until all outstanding concerns have been adequately addressed and the FDA has notified the company that investigations may proceed. This could cause significant delays or difficulties in completing our planned clinical trial or future clinical trials in a timely manner.

Expanded Access to an Investigational Drug for Treatment Use

Expanded access, sometimes called “compassionate use,” is the use of investigational products outside of clinical trials to treat patients with serious or immediately life-threatening diseases or conditions when there are no comparable or satisfactory alternative treatment options. The rules and regulations related to expanded access are intended to improve access to investigational products for patients who may benefit from investigational therapies. FDA regulations allow access to investigational products under an IND by the company or the treating physician for treatment purposes on a case-by-case basis for: individual patients (single-patient IND applications for treatment in emergency settings and non-emergency settings); intermediate-size patient populations; and larger populations for use of the investigational product under a treatment protocol or treatment IND application.

When considering an IND application for expanded access to an investigational product with the purpose of treating a patient or a group of patients, the sponsor and treating physicians or investigators will determine suitability when all of the following criteria apply: patient(s) have a serious or immediately life threatening disease or condition, and there is no comparable or satisfactory alternative therapy to diagnose, monitor, or treat the disease or condition; the potential patient benefit justifies the potential risks of the treatment and the potential risks are not unreasonable in the context or condition to be treated; and the expanded use of the investigational drug for the requested treatment will not interfere initiation, conduct, or completion of clinical investigations that could support marketing approval of the product or otherwise compromise the potential development of the product.

There is no obligation for a sponsor to make its drug products available for expanded access; however, as required by the 21st Century Cures Act passed in 2016, if a sponsor has a policy regarding how it responds to expanded access requests, it must make that policy publicly available. Although these requirements were rolled out over time, they have now come into full effect. This provision requires drug companies to make publicly available their policies for expanded access for individual patient access to products intended for serious diseases. Sponsors are required to make such policies publicly available upon the earlier of initiation of a Phase II or Phase III clinical trial; or 15 days after the investigational drug receives designation as a breakthrough therapy, fast track product, or regenerative medicine advanced therapy.

In addition, on May 30, 2018, the Right to Try Act was signed into law. The law, among other things, provides a federal framework for certain patients to access certain investigational products that have completed a Phase I clinical trial and that are undergoing investigation for FDA approval. Under certain circumstances, eligible patients can seek treatment with an investigational product without enrolling in clinical trials and without obtaining FDA permission under the FDA expanded access program. There is no obligation for a manufacturer to make its investigational products available to eligible patients as a result of the Right to Try Act.

Clinical Trials

Clinical trials involve the administration of the investigational new drug to human subjects, including healthy volunteers or patients with the disease or condition to be treated, under the supervision of qualified investigators in accordance with GCP requirements, which include the requirement that all research subjects provide their informed consent in writing for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, inclusion and exclusion criteria, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND.

A sponsor who wishes to conduct a clinical trial outside the United States may, but need not, obtain FDA authorization to conduct the clinical trial under an IND. When a foreign clinical trial is conducted under an IND, all FDA IND requirements must be met unless waived. When a foreign clinical trial is not conducted under an IND, the sponsor must ensure that the trial complies with certain regulatory requirements of the FDA in order to use the clinical trial as support for an IND or application for marketing approval. Specifically, the FDA requires that such clinical trials be conducted in accordance with GCP, including review and approval by an independent ethics committee and informed consent from participants. The GCP requirements encompass both ethical and data integrity standards for clinical trials. The FDA’s regulations are intended to help ensure the protection of human subjects enrolled in non-IND foreign clinical trials, as well as the quality and integrity of the resulting data. They further help ensure that non-IND foreign trials are conducted in a manner comparable to that required for clinical trials in the United States.

In addition, an IRB at each institution participating in the clinical trial must review and approve the plan for any clinical trial before it commences at that institution, and the IRB must continue to oversee the clinical trial while it is being conducted. The IRB will consider, among other things, clinical trial design, patient informed consent, ethical factors, and the safety of human subjects. An IRB overseeing a clinical trial of an investigational product must operate in compliance with FDA regulations. The FDA, the IRB, or the clinical trial sponsor may suspend or discontinue a clinical trial at any time for various reasons, including a finding that the clinical trial is not being conducted in accordance with FDA requirements or that the participants are being exposed to an unacceptable health risk. Clinical testing also must satisfy extensive GCP rules and the requirements for informed consent. Information about certain clinical trials must be submitted within specific timeframes to the National Institutes of Health for public dissemination on their ClinicalTrials.gov website.

Human clinical trials are typically conducted in three sequential phases, which may overlap or be combined. Additional studies may be required after approval.

| • |

Phase I: The drug is initially introduced into a limited number of healthy human subjects or patients with the target disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an initial indication of its effectiveness. |

|

| • |

Phase II: The drug typically is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. Multiple Phase II clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more costly Phase II clinical trials. Once Phase II clinical trials demonstrate that a dose range of the product candidate is potentially effective and has an acceptable safety profile, it proceeds to Phase III clinical trials. |

|

| • |

Phase III: The drug is administered to an expanded patient population, generally at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate enough data to statistically evaluate the safety and efficacy of the product for approval, to establish the overall risk-benefit profile of the product and to provide adequate information for the labeling of the product. A well-controlled, statistically robust Phase III trial may be designed to deliver the data that regulatory authorities will use to decide whether or not to approve, and, if approved, how to appropriately label a drug; such Phase III studies are referred to as “pivotal.” |

|

| • |

Phase IV: In some cases, the FDA may conditionally approve an NDA for a product candidate on the sponsor’s agreement to conduct additional clinical trials after NDA approval. In other cases, a sponsor may voluntarily conduct additional clinical trials post-approval to gain more information about the drug. Such post-approval trials are typically referred to as Phase IV clinical trials. |

Progress reports detailing the results of the clinical trials must be submitted, at least annually, to the FDA, and more frequently if serious adverse events, or SAEs, occur. Phase I, Phase II and Phase III clinical trials may not be completed successfully within any specified period, or at all. Furthermore, the FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements, or if the drug has been associated with unexpected serious harm to patients.

Concurrent with clinical trials, companies usually complete additional animal studies and must also develop additional information about the chemistry and physical characteristics of the product and finalize a process for manufacturing the product in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the product candidate and, among other things, the manufacturer must develop methods for testing the identity, strength, quality and purity of the final product. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the product candidate does not undergo unacceptable deterioration over its shelf life.

Compliance with cGMP Requirements

Before approving an NDA, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in full compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. The Public Health Service Act emphasizes the importance of manufacturing control for products whose attributes cannot be precisely defined. Manufacturers and others involved in the manufacture and distribution of products must also register their establishments with the FDA and certain state agencies. Both domestic and foreign manufacturing establishments must register and provide additional information to the FDA upon their initial participation in the manufacturing process. Any product manufactured by or imported from a facility that has not registered, whether foreign or domestic, is deemed misbranded under the FDCA. Establishments may be subject to periodic unannounced inspections by government authorities to ensure compliance with cGMPs and other laws. Inspections must follow a “risk-based schedule” that may result in certain establishments being inspected more frequently. Manufacturers may also have to provide, on request, electronic or physical records regarding their establishments. Delaying, denying, limiting, or refusing inspection by the FDA may lead to a product being deemed to be adulterated.

Marketing Approval

Assuming successful completion of the required clinical testing, the results of the preclinical studies and clinical trials, together with detailed information relating to the product’s chemistry, manufacture, controls and proposed labeling, among other things, are submitted to the FDA as part of an NDA requesting approval to market the product for one or more indications. In most cases, the submission of an NDA is subject to a substantial application user fee. Under the PDUFA guidelines that are currently in effect, the FDA has a goal of ten months to review and act on a standard NDA and six months to review and act on a priority NDA, measured from the date of “filing” of a standard NDA for a NME. This review typically takes eight months from the date the NDA is submitted to the FDA because the FDA has approximately two months to make a “filing” decision, although timing is not certain, particularly with the FDA’s current focus on COVID-19.

In addition, under the Pediatric Research Equity Act of 2003, as amended an reauthorized, certain NDAs or supplements to an NDA must contain data that are adequate to assess the safety and effectiveness of the drug for the claimed indications in all relevant pediatric subpopulations, and to support dosing and administration for each pediatric subpopulation for which the product is safe and effective. Sponsors must also submit pediatric study plans prior to the assessment data. Those plans must contain an outline of the proposed pediatric study or studies the applicant plans to conduct, including study objectives and design, any deferral or waiver requests, and other information required by regulation. The applicant, the FDA, and the FDA’s internal review committee must then review the information submitted, consult with each other, and agree upon a final plan. The FDA or the applicant may request an amendment to the plan at any time.

For products intended to treat a serious or life-threatening disease or condition, the FDA must, upon the request of an applicant, meet to discuss preparation of the initial pediatric study plan or to discuss deferral or waiver of pediatric assessments. In addition, FDA will meet early in the development process to discuss pediatric study plans with sponsors and FDA must meet with sponsors by no later than the end-of-the Phase I meeting for serious or life-threatening diseases and by no later than 90 days after FDA’s receipt of the study plan.

The FDA may, on its own initiative or at the request of the applicant, grant deferrals for submission of some or all pediatric data until after approval of the product for use in adults, or full or partial waivers from the pediatric data requirements. Additional requirements and procedures relating to deferral requests and requests for extension of deferrals are contained in the Food and Drug Administration Safety and Innovation Act. Unless otherwise required by regulation, the pediatric data requirements do not apply to products with orphan designation.

The FDA also may require submission of a REMS plan to ensure that the benefits of the drug outweigh its risks. The REMS plan could include medication guides, physician communication plans, assessment plans, and/or elements to assure safe use, such as restricted distribution methods, patient registries or other risk minimization tools.

The FDA conducts a preliminary review of all NDAs within the first 60 days after submission, before accepting them for filing, to determine whether they are sufficiently complete to permit substantive review. The FDA may request additional information rather than accept an NDA for filing. In this event, the application must be resubmitted with the additional information. The resubmitted application is also subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review. The FDA reviews an NDA to determine, among other things, whether the drug is safe and effective and whether the facility in which it is manufactured, processed, packaged or held meets standards designed to assure the product’s continued safety, quality and purity.

The FDA may refer an application for a novel drug to an advisory committee. An advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Before approving an NDA, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA, the FDA will typically inspect one or more clinical trial sites to assure compliance with GCP requirements.

The FDA generally accepts data from foreign clinical trials in support of an NDA if the trials were conducted under an IND. If a foreign clinical trial is not conducted under an IND, the FDA nevertheless may accept the data in support of an NDA if the study was conducted in accordance with GCP requirements and the FDA is able to validate the data through an on-site inspection, if deemed necessary. Although the FDA generally requests that marketing applications be supported by some data from domestic clinical studies, the FDA may accept foreign data as the sole basis for marketing approval if the foreign data are applicable to the U.S.

The testing and approval process for an NDA requires substantial time, effort and financial resources, and takes several years to complete. Data obtained from preclinical and clinical testing are not always conclusive and may be susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. The FDA may not grant approval of an NDA on a timely basis, or at all.

After evaluating the NDA and all related information, including the advisory committee recommendation, if any, and inspection reports regarding the manufacturing facilities and clinical trial sites, the FDA may issue an approval letter, or, in some cases, a complete response letter. A complete response letter generally contains a statement of specific conditions that must be met in order to secure final approval of the NDA and may require additional clinical or preclinical testing, manufacturing or formulation modifications or other changes in order for the FDA to reconsider the application. Even with submission of this additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval. If and when those conditions have been met to the FDA’s satisfaction, the FDA will typically issue an approval letter. An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications.

Even if the FDA approves a product, it may limit the approved indications for use of the product, require that contraindications, warnings or precautions be included in the product labeling, require that post-approval studies, including Phase IV clinical trials, be conducted to further assess a drug’s safety after approval, require testing and surveillance programs to monitor the product after commercialization, or impose other conditions, including distribution and use restrictions or other risk management mechanisms under a REMS, which can materially affect the potential market and profitability of the product. The FDA may prevent or limit further marketing of a product based on the results of post-marketing studies or surveillance programs. After approval, some types of changes to the approved product, such as adding new indications, manufacturing changes, and additional labeling claims, are subject to further testing requirements and FDA review and approval.

Orphan Drug Designation

Trappsol® Cyclo™ has been granted orphan drug status by the FDA. It has been used by a limited number of physicians for the treatment of NPC under the supervision of a physician following an Investigational New Drug (IND) protocol approved by the FDA. Under the Orphan Drug Act, the FDA may grant orphan drug designation to a drug intended to treat a rare disease or condition, which is a disease or condition that affects fewer than 200,000 individuals in the United States, or if it affects more than 200,000, there is no reasonable expectation that sales of the drug in the United States will be sufficient to offset the costs of developing and making the drug available in the United States. Orphan drug designation must be requested before submitting an NDA. A product becomes an orphan when it receives orphan drug designation from the Office of Orphan Products Development at the FDA based on acceptable confidential requests made under the regulatory provisions. The product must then go through the review and approval process like any other product. Orphan drug designation does not convey any advantage in or shorten the duration of the regulatory review and approval process.

A sponsor may request orphan drug designation of a previously unapproved product or new orphan indication for an already marketed product. If the FDA approves a sponsor’s marketing application for a designated orphan drug for use in the rare disease or condition for which it was designated, the sponsor is eligible for tax credits and a seven-year period of marketing exclusivity, during which the FDA may not approve another sponsor’s marketing application for a drug with the same active moiety and intended for the same use or indication as the approved orphan drug, except in limited circumstances, such as if a subsequent sponsor demonstrates its product is clinically superior. During a sponsor’s orphan drug exclusivity period, competitors, however, may receive approval for drugs with different active moieties for the same indication as the approved orphan drug, or for drugs with the same active moiety as the approved orphan drug, but for different indications. Orphan drug exclusivity could block the approval of one of our products for seven years if a competitor obtains approval for a drug with the same active moiety intended for the same indication before we do, unless we are able to demonstrate that grounds for withdrawal of the orphan drug exclusivity exist, or that our product is clinically superior. Further, if a designated orphan drug receives marketing approval for an indication broader than the rare disease or condition for which it received orphan drug designation, it may not be entitled to exclusivity.

The period of exclusivity begins on the date that the marketing application is approved by the FDA and applies only to the indication for which the product has been designated. The FDA may approve a second application for the same product for a different use or a second application for a clinically superior version of the product for the same use. The FDA cannot, however, approve the same product made by another manufacturer for the same indication during the market exclusivity period unless it has the consent of the sponsor or the sponsor is unable to provide sufficient quantities.

Special FDA Expedited Review and Approval Programs; Priority Review Voucher

The FDA has various programs, including fast track designation, accelerated approval, priority review, and breakthrough therapy designation, which are intended to expedite or simplify the process for the development and FDA review of drugs that are intended for the treatment of serious or life threatening diseases or conditions and demonstrate the potential to address unmet medical needs. The purpose of these programs is to provide important new drugs to patients earlier than under standard FDA review procedures. In January 2017 the FDA granted Fast Track designation to Trappsol® Cyclo™ for the treatment of NPC.

To be eligible for a fast track designation, the FDA must determine, based on the request of a sponsor, that a product is intended to treat a serious or life-threatening disease or condition and demonstrates the potential to address an unmet medical need. The FDA will determine that a product will fill an unmet medical need if it will provide a therapy where none exists or provide a therapy that may be potentially superior to existing therapy based on efficacy or safety factors. The FDA may review sections of the NDA for a fast track product on a rolling basis before the complete application is submitted. If the sponsor provides a schedule for the submission of the sections of the NDA, the FDA agrees to accept sections of the NDA and determines that the schedule is acceptable, and the sponsor pays any required user fees upon submission of the first section of the NDA.

The FDA may give a priority review designation to drugs that are designed to treat serious conditions, and if approved, would provide a significant improvement in treatment, or provide a treatment where no adequate therapy exists. A priority review means that the goal for the FDA to review an application is six months, rather than the standard review of ten months under current PDUFA guidelines. Under the current PDUFA agreement, these six and ten month review periods are measured from the “filing” date rather than the receipt date for NDAs for new molecular entities, which typically adds approximately two months to the timeline for review and decision from the date of submission. Most products that are eligible for fast track designation may be considered appropriate to receive a priority review.

In addition, products studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit over existing treatments may be eligible for accelerated approval and may be approved on the basis of adequate and well-controlled clinical trials establishing that the drug product has an effect on a surrogate endpoint that is reasonably likely to predict clinical benefit, or on a clinical endpoint that can be measured earlier than irreversible morbidity or mortality, that is reasonably likely to predict an effect on irreversible morbidity or mortality or other clinical benefit, taking into account the severity, rarity or prevalence of the condition and the availability or lack of alternative treatments. As a condition of approval, the FDA may require a sponsor of a drug receiving accelerated approval to perform post-marketing studies to verify and describe the predicted effect on irreversible morbidity or mortality or other clinical endpoint, and the drug may be subject to accelerated withdrawal procedures.

Breakthrough therapy designation is for a drug that is intended, alone or in combination with one or more other drugs, to treat a serious or life-threatening disease or condition, and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. The FDA must take certain actions, such as holding timely meetings and providing advice, intended to expedite the development and review of an application for approval of a breakthrough therapy.

Even if a product qualifies for one or more of these programs, the FDA may later decide that the product no longer meets the conditions for qualification or decide that the time period for FDA review or approval will not be shortened. We may explore some of these opportunities for our product candidate as appropriate.

On December 1, 2017, the FDA designated NPC a Rare Pediatric Disease. Rare Pediatric Disease designation by FDA enables priority review voucher eligibility upon U.S. market approval of a designated drug for rare pediatric diseases. The rare pediatric disease-priority review voucher program is intended to encourage development of therapies to prevent and treat rare pediatric diseases. The voucher, which is awarded upon NDA approval to the sponsor of a designated rare pediatric disease can be sold or transferred to another entity and used by the holder to receive priority review for a future NDA submission, which reduces the FDA review time of such future submission from ten to six months.

Coverage and Reimbursement

The future commercial success of any approved product candidate will depend in part on the extent to which governmental payor programs at the federal and state levels, including Medicare and Medicaid, private health insurers and other third-party payors provide coverage for and establish adequate reimbursement levels for our product candidate. Government health administration authorities, private health insurers and other organizations generally decide which drugs they will pay for and establish reimbursement levels for healthcare. In particular, in the United States, private health insurers and other third-party payors often provide reimbursement for products and services based on the level at which the government, through the Medicare or Medicaid programs, provides reimbursement for such treatments. In the United States, the European Union, or EU, and other potentially significant markets for our product candidate, government authorities and third-party payors are increasingly attempting to limit or regulate the price of medical products and services, particularly for new and innovative products and therapies, which often has resulted in average selling prices lower than they would otherwise be. Further, the increased emphasis on managed healthcare in the United States and on country and regional pricing and reimbursement controls in the European Union will put additional pressure on product pricing, reimbursement and usage, which may adversely affect our future product sales and results of operations. These pressures can arise from rules and practices of managed care groups, judicial decisions and laws and regulations related to Medicare, Medicaid and healthcare reform, pharmaceutical coverage and reimbursement policies and pricing in general.

Impact of Healthcare Reform on our Business

The United States and some foreign jurisdictions are considering enacting or have enacted a number of additional legislative and regulatory proposals to change the healthcare system in ways that could affect our ability to sell our product candidate profitably, if approved. Among policy makers and payors in the United States and elsewhere, there is significant interest in promoting changes in healthcare systems with the stated goals of containing healthcare costs, improving quality and expanding access. In the United States, the pharmaceutical industry has been a particular focus of these efforts, which include major legislative initiatives to reduce the cost of care through changes in the healthcare system, including limits on the pricing, coverage, and reimbursement of pharmaceutical and biopharmaceutical products, especially under government-funded health care programs, and increased governmental control of drug pricing.

There have been several U.S. government initiatives over the past few years to fund and incentivize certain comparative effectiveness research, including creation of the Patient-Centered Outcomes Research Institute under the Patient Protection and Affordable Care Act of 2010, as amended by the Health Care and Education Reconciliation Act of 2010, or collectively the ACA. It is also possible that comparative effectiveness research demonstrating benefits in a competitor’s product could adversely affect the sales of our product candidate. If third-party payors do not consider our product candidate to be cost-effective compared to other available therapies, they may not cover our product candidate, once approved, as a benefit under their plans or, if they do, the level of payment may not be sufficient to allow us to sell our product on a profitable basis.

The ACA became law in March 2010 and substantially changed the way healthcare is financed by both governmental and private insurers. Among other measures that may have an impact on our business, the ACA established an annual, nondeductible fee on any entity that manufactures or imports specified branded prescription drugs and biologic agents; a new Medicare Part D coverage gap discount program; and a new formula that increases the rebates a manufacturer must pay under the Medicaid Drug Rebate Program. Additionally, the ACA extended manufacturers’ Medicaid rebate liability, expanded eligibility criteria for Medicaid programs, and expanded entities eligible for discounts under the Public Health Service pharmaceutical pricing program. There have been judicial and Congressional challenges to certain aspects of the ACA, as well as recent efforts by the current presidential administration to repeal or replace certain aspects of the ACA, and we expect such challenges and amendments to continue. Since January 2017, President Trump has signed Executive Orders designed to delay the implementation of any certain provisions of the ACA or otherwise circumvent some of the requirements for health insurance mandated by the ACA. One Executive Order directed federal agencies with authorities and responsibilities under the ACA to waive, defer, grant exemptions from, or delay the implementation of any provision of the ACA that would impose a fiscal or regulatory burden on states, individuals, healthcare providers, health insurers, or manufacturers of pharmaceuticals or medical devices. The second Executive Order terminated the cost-sharing subsidies that reimburse insurers under the ACA. Several state Attorneys General filed suit to stop the administration from terminating the subsidies, but their request for a restraining order was denied by a federal judge in California on October 25, 2017. In addition, CMS has recently proposed regulations that would give states greater flexibility in setting benchmarks for insurers in the individual and small group marketplaces, which may have the effect of relaxing the essential health benefits required under the ACA for plans sold through such marketplaces. In December 2018, CMS published a new final rule permitting further collections and payments to and from certain ACA qualified health plans and health insurance issuers under the ACA risk adjustment program in response to the outcome of the federal court litigation regarding the method CMS uses to determine this risk adjustment. On April 27, 2020, the U.S. Supreme Court reversed the Federal Circuit decision that previously upheld Congress’ denial of $12 billion in ACA risk corridor payments to certain ACA qualified health plans and health insurance issuers. The full effects of this gap in reimbursement on third-party payors, the viability of the ACA marketplace, providers, and potentially our business, are not yet known. In addition, in December 2019, a three-judge panel of the Fifth Circuit Court of Appeals partially affirmed a district court decision that had declared the entire ACA invalid. The ACA’s future continues to be uncertain as the law’s constitutionality has been challenged and will be considered by the U.S. Supreme Court in California v. Texas. This ongoing litigation challenges the ACA’s minimum essential coverage provision (known as the individual mandate) and raises questions about the entire law’s survival. The ACA remains in effect while the litigation is pending. However, if all or most of the law ultimately is struck down, it may have complex and far-reaching consequences for the nation’s health care system.

At the state level, legislatures are increasingly passing legislation and implementing regulations designed to control pharmaceutical and biological product pricing, including price or patient reimbursement constraints, discounts, restrictions on certain product access and marketing cost disclosure and transparency measures, and, in some cases, designed to encourage importation from other countries and bulk purchasing. In addition, regional healthcare authorities and individual hospitals are increasingly using bidding procedures to determine what biopharmaceutical products and which suppliers will be included in their prescription drug and other healthcare programs. These measures could reduce the ultimate demand for our products, once approved, or put pressure on our product pricing.

There have been, and likely will continue to be, additional legislative and regulatory proposals at the foreign, federal, and state levels directed at broadening the availability of healthcare and containing or lowering the cost of healthcare. Such reforms could have an adverse effect on anticipated revenues from product candidates that we may successfully develop and for which we may obtain marketing approval and may affect our overall financial condition and ability to develop product candidates.

Other Healthcare Laws

Outside the United States, our ability to market a product is contingent upon obtaining marketing authorization from the appropriate regulatory authorities. The requirements governing market authorization, pricing and reimbursement vary widely from country to country. In order to market any product outside of the United States, we would need to comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy and governing, among other things, clinical trials, marketing authorization, commercial sales and distribution of our product candidate. Whether or not we obtain marketing approval for a drug in the United States, we would need to obtain the necessary approvals by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the drug in those countries. The approval process varies from country to country and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from and be longer than that required to obtain approval in the United States. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may negatively impact the regulatory process in others.

Our Legacy Fine Chemical Business