SIXTH SUPPLEMENTAL INDENTURE March 25, 2024 between THE NARRAGANSETT ELECTRIC COMPANY (D/B/A RHODE ISLAND ENERGY), as Company and THE BANK OF NEW YORK MELLON, as Trustee, Paying Agent and Securities Registrar $500,000,000 5.350% Senior Notes due 2034 Exhibit 4.2

TABLE OF CONTENTS Page ARTICLE I DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION .......1 Section 1.1 Definitions................................................................................................................1 Section 1.2 Conflict with Trust Indenture Act ............................................................................4 Section 1.3 Effect of Headings and Table of Contents ...............................................................5 Section 1.4 Successors and Assigns............................................................................................5 Section 1.5 Separability Clause ..................................................................................................5 Section 1.6 Benefits of Sixth Supplemental Indenture ...............................................................5 Section 1.7 Governing Law ........................................................................................................5 Section 1.8 Execution in Counterparts........................................................................................5 Section 1.9 Recitals by the Company .........................................................................................5 Section 1.10 Ratification and Incorporation of Base Indenture ....................................................6 Section 1.11 Subsequent Amendments .........................................................................................6 Section 1.12 Electronic Communications .....................................................................................6 ARTICLE II AMENDMENTS TO THE BASE INDENTURE......................................................7 Section 2.1 Certain Terms Defined .............................................................................................7 Section 2.2 Addresses for Notices ..............................................................................................7 Section 2.3 Reports by the Company ..........................................................................................8 ARTICLE III DESIGNATED SECURITIES ..................................................................................9 Section 3.1 Creation of Designated Securities ............................................................................9 Section 3.2 Aggregate Principal Amount of Designated Securities ...........................................9 Section 3.3 Payment of Principal ..............................................................................................10 Section 3.4 Interest and Interest Rate .......................................................................................10 Section 3.5 Taxation .................................................................................................................11 Section 3.6 Paying Agent ..........................................................................................................11 Section 3.7 Place of Payment....................................................................................................14 Section 3.8 Denominations .......................................................................................................15 Section 3.9 Form; Terms...........................................................................................................15 Section 3.10 Transfer and Exchange ..........................................................................................16 Exhibit A Form of Designated Security....................................................................................1 Exhibit B Form of Certificate of Transfer ................................................................................1 Exhibit C Form of Certificate of Exchange ..............................................................................1

1 This Sixth Supplemental Indenture, dated as of March 25, 2024 (the “Sixth Supplemental Indenture”), between The Narragansett Electric Company (d/b/a Rhode Island Energy), a Rhode Island company (the “Company”), and The Bank of New York Mellon, a New York banking corporation duly organized and existing under the laws of the State of New York, as trustee (the “Trustee”), paying agent (the “Paying Agent”) and registrar (the “Securities Registrar”). Whereas: (A) the Company has heretofore entered into an Indenture, dated as of March 22, 2010 (the “Base Indenture”), a First Supplemental Indenture, dated as of March 22, 2010 (the “First Supplemental Indenture”), a Second Supplemental Indenture, dated as of March 22, 2010 (the “Second Supplemental Indenture”), a Third Supplemental Indenture, dated as of December 10, 2012 (the “Third Supplemental Indenture”), a Fourth Supplemental Indenture, dated as of July 27, 2018 (the “Fourth Supplemental Indenture”), and a Fifth Supplemental Indenture, dated as of April 9, 2020 (the “Fifth Supplemental Indenture”), with the Trustee; (B) the Company wishes to make certain changes to the Base Indenture as it relates to future issuances (including the Securities to be created under this Sixth Supplemental Indenture), and the Base Indenture, as supplemented by the First Supplemental Indenture, the Second Supplemental Indenture, the Third Supplemental Indenture, the Fourth Supplemental Indenture, the Fifth Supplemental Indenture and this Sixth Supplemental Indenture, is herein called the “Indenture”; (C) pursuant to Sections 3.1 and 10.1 of the Base Indenture, the Company proposes to create a new series of Securities under the Indenture; (D) the Company hereby resolves to issue the Designated Securities (as such term is defined in Section 3.1 hereof) in an aggregate principal amount of $500,000,000 and with the terms and conditions set forth in this Sixth Supplemental Indenture; and (E) all things necessary to make this Sixth Supplemental Indenture a valid agreement of the Company, in accordance with its terms, have been done; Now, therefore, for and in consideration of the premises and the purchases of the Designated Securities by the Holders thereof, it is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders of Designated Securities, as follows: ARTICLE I DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION Section 1.1 Definitions For all purposes of this Sixth Supplemental Indenture, except as otherwise expressly provided or unless the context otherwise requires: (a) the terms defined in this Article have the meanings assigned to them in this Article and include the plural as well as the singular;

2 (b) all other terms used herein which are defined in the Trust Indenture Act, either directly or by reference therein, have the meanings assigned to them therein; (c) unless the context otherwise requires, any reference to an “Article” or a “Section” refers to an Article or a Section, as the case may be, of this Sixth Supplemental Indenture; (d) the words “herein”, “hereof” and “hereunder” and other words of similar import refer to this Sixth Supplemental Indenture as a whole and not to any particular Article, Section or other subdivision; and (e) all terms used but not defined in this Sixth Supplemental Indenture, which are defined in the Base Indenture, shall have the meanings assigned to them in the Base Indenture. “Additional Designated Securities” has the meaning ascribed in Section 3.2. “Applicable Procedures” means, with respect to any transfer or exchange of or for beneficial interests in any Global Security, the rules and procedures of the Depository, Euroclear and/or Clearstream, Luxembourg that apply to such transfer or exchange. “Authorized Officer” has the meaning ascribed in Section 1.12. “Business Day” means each day which is not a Legal Holiday. “Clearstream, Luxembourg” means Clearstream Banking, S.A., and its successors. “Definitive Security” means a certificated Designated Security registered in the name of the Holder thereof and issued in accordance with Section 3.10 hereof, substantially in the form of Exhibit A hereto, except that such Designated Security shall not bear the Global Security Legend and shall not have the “Schedule of Exchanges of Interests in the Global Security” attached thereto. “Depository” means The Depository Trust Company and its successors. “Designated Securities” has the meaning ascribed in Section 3.1. “Electronic Means” shall mean the following communications methods: e-mail, secure electronic transmission containing applicable authorization codes, passwords and/or authentication keys issued by the Trustee, or another method or system specified by the Trustee as available for use in connection with its services hereunder. “Euroclear” means Euroclear Bank, SA/NV, as operator of the Euroclear System. “Global Security Legend” means the legend set forth in Section 3.10(f)(ii) hereof, which is required to be placed on all Global Securities issued under this Sixth Supplemental Indenture.

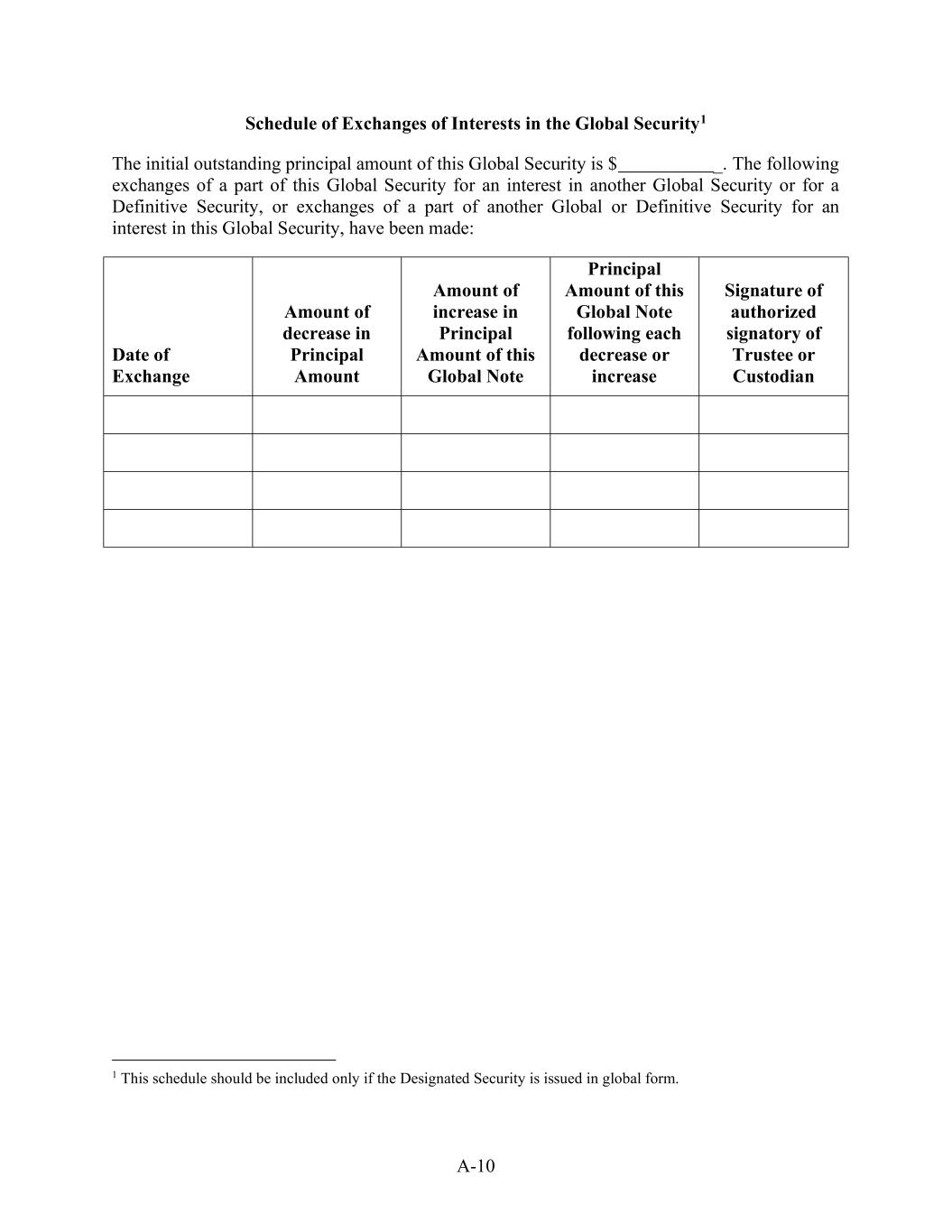

3 “Global Securities” means, individually and collectively, each of the Restricted Global Securities and the Unrestricted Global Securities deposited with or on behalf of and registered in the name of the Depository or its nominee, substantially in the form of Exhibit A hereto, and that bears the Global Security Legend and that has the “Schedule of Exchanges of Interests in the Global Security” attached thereto, issued in accordance with the Indenture. “Indirect Participant” means a Person who holds a beneficial interest in a Global Security through a Participant. “Initial Designated Securities” has the meaning ascribed in Section 3.2. “Instructions” has the meaning ascribed in Section 1.12. “Interest Payment Date” has the meaning ascribed in Section 3.4(b). “Issue Date” means March 25, 2024. “Legal Holiday” means a Saturday, a Sunday or a day on which commercial banking institutions are not required to be open in the State of New York. “Non-U.S. Person” means a Person who is not a U.S. Person. “Participant” means, with respect to the Depository, Euroclear or Clearstream, Luxembourg, a Person who has an account with the Depository, Euroclear or Clearstream, Luxembourg, respectively (and, with respect to DTC, shall include Euroclear and Clearstream, Luxembourg, as Indirect Participant). “Private Placement Legend” means the legend set forth in Section 3.10(f)(i) hereof. “QIB” means a “qualified institutional buyer” as defined in Rule 144A. “Regular Record Date” means, with respect to the applicable Interest Payment Date, the close of business on the preceding April 15 and October 15, as the case may be. “Regulation S” means Regulation S promulgated under the Securities Act. “Regulation S Global Security” means a Regulation S Temporary Global Security or Regulation S Permanent Global Security, as appropriate. “Regulation S Permanent Global Security” means a permanent Global Security in the form of Exhibit A hereto, bearing the Global Security Legend and the Private Placement Legend and deposited with or on behalf of and registered in the name of the Depository or its nominee, issued in a denomination equal to the outstanding principal amount of the Regulation S Temporary Global Security upon expiration of the Restricted Period. “Regulation S Temporary Global Security” means a temporary Global Security in the form of Exhibit A hereto, bearing the Global Security Legend, the Private Placement

4 Legend and the Regulation S Temporary Global Security Legend and deposited with or on behalf of and registered in the name of the Depository or its nominee, issued in a denomination equal to the outstanding principal amount of the Designated Securities initially sold in reliance on Rule 903. “Regulation S Temporary Global Security Legend” means the legend set forth in Section 3.10(f)(iii) hereof. “Restricted Definitive Security” means a Definitive Security bearing the Private Placement Legend. “Restricted Global Security” means a Global Security bearing the Private Placement Legend. “Restricted Period” means the 40-day distribution compliance period as defined in Regulation S. “Rule 144” means Rule 144 promulgated under the Securities Act. “Rule 144A” means Rule 144A promulgated under the Securities Act. “Rule 903” means Rule 903 promulgated under the Securities Act. “Rule 904” means Rule 904 promulgated under the Securities Act. “Sixth Supplemental Indenture” means this instrument as originally executed or as it may from time to time be supplemented or amended in accordance with the terms of the Base Indenture. “Stated Maturity” means May 1, 2034. “Unrestricted Definitive Security” means one or more Definitive Securities that do not bear and are not required to bear the Private Placement Legend. “Unrestricted Global Security” means a permanent Global Security, substantially in the form of Exhibit A hereto, that bears the Global Security Legend and that has the “Schedule of Exchanges of Interests in the Global Security” attached thereto, and that is deposited with or on behalf of and registered in the name of the Depository, representing Global Securities that do not bear and are not required to bear the Private Placement Legend. “U.S. Person” means a U.S. person as defined in Rule 902(k) promulgated under the Securities Act. Section 1.2 Conflict with Trust Indenture Act If and to the extent that any provision of this Sixth Supplemental Indenture limits, qualifies or conflicts with a provision of the Trust Indenture Act that is required under the Trust Indenture

5 Act to be a part of and govern this Sixth Supplemental Indenture, the latter provision shall control. If any provision of this Sixth Supplemental Indenture modifies or excludes any provision of the Trust Indenture Act that may be so modified or excluded, the former provision shall control. Section 1.3 Effect of Headings and Table of Contents The Article and Section headings herein and the Table of Contents are for convenience only and shall not affect the construction hereof. Section 1.4 Successors and Assigns All covenants and agreements in this Sixth Supplemental Indenture by the Company shall bind its successors and assigns, whether so expressed or not. Section 1.5 Separability Clause In case any provision in this Sixth Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby. Section 1.6 Benefits of Sixth Supplemental Indenture Nothing in the Indenture or the Designated Securities, express or implied, shall give to any Person, other than the parties hereto and their successors hereunder and the Holders of Designated Securities, any benefit or any legal or equitable right, remedy or claim under the Indenture. Section 1.7 Governing Law This Sixth Supplemental Indenture and the Designated Securities shall be governed by, and construed in accordance with, the laws of the State of New York. Section 1.8 Execution in Counterparts This Sixth Supplemental Indenture may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument, and signature pages may be delivered by facsimile, electronic mail (including any electronic signature complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transaction Act, the New York Electronic Signatures and Records Act (N.Y. State Tech. §§ 301-309), as amended from time to time, or other applicable law) or other transmission method. Section 1.9 Recitals by the Company The recitals in this Sixth Supplemental Indenture are made by the Company only and not by the Trustee, and all of the provisions contained in the Base Indenture in respect of the rights, privileges, immunities, powers and duties of the Trustee shall be applicable in respect of the

6 Designated Securities and of this Sixth Supplemental Indenture as fully and with like effect as if set forth herein in full. Section 1.10 Ratification and Incorporation of Base Indenture As supplemented hereby, the Base Indenture, as supplemented by the First Supplemental Indenture, the Second Supplemental Indenture, the Third Supplemental Indenture, the Fourth Supplemental Indenture and the Fifth Supplemental Indenture, is in all respects ratified and confirmed, and the Base Indenture, as supplemented by the First Supplemental Indenture, the Second Supplemental Indenture, the Third Supplemental Indenture, the Fourth Supplemental Indenture, the Fifth Supplemental Indenture, and this Sixth Supplemental Indenture shall be read, taken and construed as one and the same instrument. Section 1.11 Subsequent Amendments To the extent any provision of the Base Indenture, as previously amended prior to the date hereof, is amended or modified by this Sixth Supplemental Indenture, such amendment or modification shall supersede any amendment or modification to such provision effected by the First Supplemental Indenture, the Second Supplemental Indenture, the Third Supplemental Indenture, the Fourth Supplemental Indenture or the Fifth Supplemental Indenture in respect of any series of Securities issued under the Base Indenture on or after the date hereof. Section 1.12 Electronic Communications The Trustee shall have the right to accept and act upon instructions, including funds transfer instructions (“Instructions”) given pursuant to the Indenture, consistent with the Trustee’s internal practices and procedures and delivered using Electronic Means; provided, however, that the Company shall provide to the Trustee an incumbency certificate listing officers with the authority to provide such Instructions (“Authorized Officers”) and containing specimen signatures of such Authorized Officers, which incumbency certificate shall be amended by the Company whenever a person is to be added or deleted from the listing. If the Company elects to give the Trustee Instructions using Electronic Means and the Trustee in its reasonable discretion elects to act upon such Instructions, the Trustee’s understanding of such Instructions shall be deemed controlling. The Company understands and agrees that the Trustee cannot determine the identity of the actual sender of such Instructions and that, so long as such presumption is reasonable, the Trustee shall conclusively presume that directions that purport to have been sent by an Authorized Officer listed on the incumbency certificate provided to the Trustee have been sent by such Authorized Officer. The Company shall be responsible for ensuring that only Authorized Officers transmit such Instructions to the Trustee and that the Company and all Authorized Officers are solely responsible to safeguard the use and confidentiality of applicable user and authorization codes, passwords and/or authentication keys upon receipt by the Company. The Trustee shall not be liable for any losses, costs or expenses arising directly or indirectly from the Trustee’s reasonable reliance upon and compliance with such Instructions notwithstanding such directions conflict or are inconsistent with a subsequent written instruction, except for any such losses, costs or expenses due to the Trustee’s gross negligence or willful misconduct. The Company agrees: (i) to assume all risks arising out of the use of Electronic Means to submit Instructions to the Trustee, including without limitation the risk of the Trustee

7 acting on unauthorized Instructions, and the risk of interception and misuse by third parties, but excluding those arising from the Trustee’s gross negligence or willful misconduct; (ii) that it is fully informed of the protections and risks associated with the various methods of transmitting Instructions to the Trustee and that there may be more secure methods of transmitting Instructions than the method(s) selected by the Company; (iii) that the security procedures (if any) to be followed in connection with its transmission of Instructions provide to it a commercially reasonable degree of protection in light of its particular needs and circumstances; and (iv) to notify the Trustee immediately upon learning of any compromise or unauthorized use of the security procedures. Notwithstanding any other provision of this Indenture or any Security, where this Indenture or any Security provides for notice of any event or any other communication (including any notice of redemption or repurchase) to a holder of a Global Security (whether by mail or otherwise), such notice shall be sufficiently given if given to the Depository (or its designee) pursuant to the standing instructions from the Depository or its designee, including by electronic mail in accordance with accepted practices at the Depository. ARTICLE II AMENDMENTS TO THE BASE INDENTURE Section 2.1 Certain Terms Defined With respect to any series of Securities issued under the Base Indenture on or after the date hereof, including the Designated Securities, Section 1.1 of the Base Indenture is hereby amended in part to amend and restate the following definition in its entirety, which shall read as follows: Section 1.1 Certain Terms Defined “Corporate Trust Office” means the principal office of the Trustee at which at any particular time its corporate trust business shall be administered, which office, on the date of original execution of this Indenture, is located at The Bank of New York Mellon, 240 Greenwich Street, Floor 7-E, New York, New York 10286, Attention: Corporate Trust Administration—Rhode Island Energy 5.350% Senior Notes due 2034 or at any other time at such other address as the Trustee may designate from time to time by notice to the parties hereto, or at the principal corporate trust office of any successor trustee as to which such successor trustee may notify the parties hereto in writing. Section 2.2 Addresses for Notices With respect to any series of Securities issued under the Base Indenture on or after the date hereof, including the Designated Securities, Section 13.5 of the Base Indenture is hereby amended and restated in part to amend and restate the first paragraph in its entirety, which shall read as follows:

8 Section 13.5 Address for Notices Any notice or demand which by any provision of this Indenture is required or permitted to be given or delivered by the Trustee or by the Holders of Securities of any series on the Company may be given or served by registered mail or facsimile addressed (until another address is filed by the Company with the Trustee) as follows: The Narragansett Electric Company (d/b/a Rhode Island Energy), c/o PPL Services Corporation, Two North Ninth Street, Allentown, Pennsylvania, 18101-1179, Attention: Treasury, with a copy to Davis Polk & Wardwell LLP, 450 Lexington Avenue, New York, New York 10017; Attention: Michael Kaplan, Email (which shall not constitute notice): michael.kaplan@davispolk.com. Any notice, direction, request or demand by the Company or any Holders of Securities of any series to or upon the Trustee shall be deemed to have been sufficiently given or made, for all purposes, if received at the Corporate Trust Office of such Trustee. Section 2.3 Reports by the Company With respect to the Designated Securities, Section 5.3 of the Base Indenture is hereby amended and restated in its entirety, which shall read as follows: Section 5.3 Reports by the Company. Unless otherwise specified with respect to Securities of a particular series pursuant to Section 3.1, so long as any Securities of such series are outstanding, if not filed electronically with the SEC through the SEC’s Electronic Data Gathering, Analysis, and Retrieval System (or any successor system), the Company will furnish to the Trustee and, upon request to the Trustee, Holders of Securities of such series, within 180 days of the end of each fiscal year for annual reports and within 75 days of the end of each fiscal quarter for quarterly reports: (1) an annual report including solely the following information: annual consolidated financial statements of the Company (including balance sheets as of the end of the two most recent fiscal years and statements of earnings and statements of cash flows for the three most recent fiscal years) prepared in accordance with GAAP as in effect from time to time, and a report on the annual financial statements by the Company’s certified independent accountants; and (2) quarterly reports including solely the following information: quarterly consolidated financial statements of the Company (including a balance sheet as of the end of the most recent fiscal quarter and statements of earnings and statements of cash flows for the period from the end of the most recent fiscal year to the end of the most recent fiscal quarter, and for the corresponding interim period of the preceding fiscal year) prepared in accordance with GAAP as in effect from time to time. With respect to the information set forth in paragraphs (1) and (2) immediately above, the Company shall post copies of such information on PPL

9 Corporation’s website (or by similar publicly available means) for so long as any Securities of any particular series remain outstanding. Furthermore, so long as such information is so posted, the related delivery requirements set forth above shall be deemed satisfied. In addition, the Company will, for so long as any Securities of any particular series remain outstanding and during any period during which the Company is not subject to Section 13 or Section 15(d) of the Exchange Act, it will furnish to Holders of Securities of such series and to prospective purchasers of Securities of such series, upon their request, the information required to be delivered pursuant to Rule 144A(d)(4) under the Securities Act. The delivery of such reports, information and documents to the Trustee pursuant to this Section 5.3 is for informational purposes only and the Trustee's receipt of such shall not constitute actual or constructive notice or knowledge of any information contained therein or determinable from information contained therein, including the Company's compliance with any of its covenants hereunder (as to which the Trustee is entitled to rely exclusively on Officer’s Certificates) other than with respect to Section 7.2. ARTICLE III DESIGNATED SECURITIES Section 3.1 Creation of Designated Securities There is hereby created a new series of Securities to be issued under the Indenture, to be designated as “5.350% Senior Notes due 2034” (the “Designated Securities”). Section 3.2 Aggregate Principal Amount of Designated Securities The aggregate principal amount of the Designated Securities shall initially be limited to $500,000,000 (except for Designated Securities authenticated and delivered upon registration of transfer of, or in exchange for, or in lieu of, other Designated Securities pursuant to Sections 2.4, 3.6, 3.7, 3.10, 10.6 or 14.3 of the Base Indenture and except for any Designated Securities which, pursuant to Section 3.3 of the Base Indenture, are deemed never to have been authenticated and delivered under the Indenture) (the “Initial Designated Securities”).The Company may create and issue an unlimited amount of additional Designated Securities from time to time, without notice to or the consent of the Holders of the Designated Securities, having the same terms and conditions in all material respects as the related Initial Designated Securities (“Additional Designated Securities”). Any Additional Designated Securities shall be consolidated with and form a single class with the related Initial Designated Securities and have the same terms as to status, redemption or otherwise as the related Initial Designated Securities. Any Additional Designated Securities issued with the same CUSIP, ISIN or other identifying number as that of the related Initial Designated Securities shall be fungible for U.S. federal income tax purposes. The period of any resale restriction applicable to the Initial Designated Securities offered and sold in reliance on Rule 144A may be extended to the last day of the period of any resale restrictions imposed on any such Additional Designated Securities that are issued with the same

10 CUSIP as the Initial Designated Securities. Unless the context otherwise requires, references to “Designated Securities” for all purposes of this Sixth Supplemental Indenture include the Initial Designated Securities and any Additional Designated Securities actually issued. Section 3.3 Payment of Principal The principal of the Outstanding Designated Securities shall be due and payable at the Stated Maturity. Section 3.4 Interest and Interest Rate (a) The Designated Securities will bear interest at 5.350% per annum from the Issue Date until the Stated Maturity. (b) The Company will pay interest on the Designated Securities semi-annually in arrears on May 1 and November 1 of each year, commencing November 1, 2024, until the Stated Maturity, and at the Stated Maturity (each an “Interest Payment Date”). (c) Interest on the Designated Securities will be computed on the basis of a 360-day year comprised of twelve 30-day months. Except as described below for the first Interest Payment Date, on each Interest Payment Date, the Company will pay interest on the Designated Securities for the period commencing on and including the immediately preceding Interest Payment Date and ending on and excluding such Interest Payment Date. (d) On the first Interest Payment Date, the Company will pay interest for the period commencing on and including the Issue Date and ending on and excluding the first Interest Payment Date. (e) If any Interest Payment Date falls on a day that is not a Business Day, the interest payment shall be postponed to the next day that is a Business Day, without interest accruing on the amount then so payable from such day that is not a Business Day until such Business Day. (f) If the Stated Maturity of any Designated Security is not a Business Day, payment of principal, premium, if any, and interest on the applicable Designated Security will be made on the next succeeding day that is a Business Day, without interest accruing on the amount then so payable from such day that is not a Business Day until such Business Day. (g) Interest on each Designated Security will be paid only to the Person in whose name such Designated Security was registered at the close of business on the Regular Record Date for the applicable Interest Payment Date.

11 Section 3.5 Taxation All payments of principal and interest in respect of the Designated Securities by the Company will be made without withholding or deduction for or on account of any present or future taxes or duties of whatever nature imposed or levied by any governmental authority unless such withholding or deduction is required by law. If an amount in respect of any taxes is required by law to be deducted or withheld from interest, principal or other payments on the Designated Securities, no additional amounts shall be paid as a result of the deduction or withholding. In order to assist the Trustee and Paying Agent with its compliance with Section 1471 through 1474 of the U. S. Internal Revenue Code of 1986, as amended, and the rules and regulations thereunder (as in effect from time to time, collectively, the “Applicable Law”) the Company agrees that the Trustee and Paying Agent and any paying agent shall be entitled to make any withholding or deduction from payments under the Indenture and the Designated Securities to the extent necessary to comply with Applicable Law. Nothing in the immediately preceding sentence shall be construed as obligating the Company to make any “gross up” payment or similar reimbursement in connection with a payment in respect of which amounts are so withheld or deducted. Section 3.6 Paying Agent (a) Upon the terms and subject to the conditions contained herein, the Company hereby appoints The Bank of New York Mellon, as the initial Paying Agent under the Indenture for the purpose of performing the functions of the Paying Agent with respect to the Designated Securities. (b) The Paying Agent shall exercise due care in performing the functions of the Paying Agent for the Designated Securities. (c) The Paying Agent accepts its obligations set forth herein, upon the terms and subject to the conditions hereof, including the following, to all of which the Company agrees: (i) The Paying Agent shall be entitled to such compensation as may be agreed in writing with the Company for all services rendered by the Paying Agent, and the Company promises to pay such compensation and to reimburse the Paying Agent for the reasonable out-of-pocket expenses (including reasonable counsel fees and expenses) properly incurred by it in connection with the services rendered by it hereunder upon receipt of such invoices as the Company shall reasonably require. The Company agrees to indemnify the Paying Agent (which for purposes of this subsection shall include its directors, officers, employees and agents) for, and to hold it harmless against, any and all loss, liability, damage, claims or reasonable expenses (including the costs and expenses of defending against any claim of liability) properly incurred by the Paying Agent that arises out of or in connection with its appointment as Paying Agent or its acting as Paying Agent hereunder, except such as has been determined by

12 a court of competent jurisdiction in a final, non-appealable order, to have resulted from the negligence, willful misconduct or bad faith of the Paying Agent or any of its agents or employees. The Paying Agent shall incur no liability and shall be indemnified and held harmless by the Company for, or in respect of, any action taken or omitted by it in good faith in reliance upon written instructions from the Company. The provisions of this paragraph shall survive the termination of this Sixth Supplemental Indenture and the resignation or removal of the Paying Agent. (ii) In acting under the Indenture and in connection with the Designated Securities, the Paying Agent is acting solely as agent of the Company and does not assume any fiduciary duty towards any person or any obligations to, or relationship of agency or trust for or with, any of the Holders of the Designated Securities. (iii) The Paying Agent shall be protected and shall incur no liability for or in respect of any action taken or omitted to be taken or anything suffered by it in reliance upon the terms of the Designated Securities or any document, including any resolution, Officer’s Certificate or any other certificate, statement, instrument, opinion, report, notice, request, consent, order, bond, debenture, note, coupon or security (whether in original or facsimile form), believed by it to be genuine and to have been signed or presented by the proper party or parties. (iv) The duties and obligations of the Paying Agent shall be determined solely by the express provisions of the Indenture, and the Paying Agent shall not be liable except for the performance of such duties and obligations as are specifically set forth in the Indenture, and no implied covenants or obligations shall be read into the Indenture against the Paying Agent. (v) Unless herein otherwise specifically provided, any request, direction, order or demand of the Company mentioned herein shall be sufficiently evidenced by an Officer’s Certificate (unless other evidence in respect thereof be herein specifically prescribed). (vi) The Paying Agent may, upon obtaining the prior written consent of the Company (which consent shall not be unreasonably withheld) perform any duties hereunder either directly or by or through agents or attorneys not regularly in its employ, and the Paying Agent shall not be responsible for any misconduct or negligence on the part of any such agent or attorney appointed with due care by it hereunder. (vii) Sections 7.2(c), 7.2(e), 7.2(i) and 7.2(j) of the Base Indenture are also deemed applicable to the Paying Agent.

13 (viii) None of the provisions hereunder shall require the Paying Agent to expend or risk its own funds or otherwise incur personal financial liability in the performance of any of its duties or in the exercise of any of its rights or powers, if it shall have reasonable grounds for believing that the repayment of such funds or adequate indemnity against such liability is not reasonably assured to it. (ix) In no event shall the Paying Agent be responsible or liable for any failure or delay in the performance of its obligations under this Indenture arising out of or caused by, directly or indirectly, forces beyond its reasonable control, including, without limitation, strikes, work stoppages, accidents, acts of war or terrorism, civil or military disturbances, actual or threatened pandemics or epidemics, nuclear or natural catastrophes or acts of God, and interruptions, loss or malfunctions of utilities, communications or computer (software or hardware) services; it being understood that the Paying Agent shall use reasonable efforts which are consistent with accepted practices in the banking industry to resume performance as soon as practicable under the circumstances. (d) (i) The Paying Agent may at any time resign as Paying Agent by giving written notice to the Company of such intention on its part, specifying the date on which its desired resignation shall become effective; provided, however, that such date shall not be earlier than 60 days after the receipt of such notice by the Company, unless the Company agrees in writing to accept less notice. The Paying Agent may be removed (with or without cause) at any time by the filing with it of any instrument in writing signed on behalf of the Company by any proper officer or an authorized person thereof and specifying such removal and the date when it is intended to become effective (such date shall not be earlier than 60 days after the receipt of such instrument by the Paying Agent, unless otherwise agreed by the parties), subject to (if such Paying Agent is not also the Trustee) the written consent of the Trustee, which consent shall not be unreasonably withheld. Notwithstanding the provisions of this Section 3.6(d)(i), such resignation or removal shall take effect only upon the date of the appointment by the Company, as hereinafter provided, and the acceptance thereof, of a successor Paying Agent. If within 30 days after notice of resignation or removal has been received, a successor Paying Agent has not been appointed, the Paying Agent may petition a court of competent jurisdiction to appoint a successor Paying Agent at the Company’s cost, as per Section 3.6(c)(i) hereof. A successor Paying Agent shall be appointed by the Company by an instrument in writing signed on behalf of the Company by any proper officer or an authorized person thereof and the successor Paying Agent. Upon the appointment of a successor Paying Agent and acceptance by it of such appointment, the Paying Agent so succeeded shall cease to be such Paying Agent hereunder. Upon its resignation or removal, the Paying Agent shall be entitled to the payment by the Company of its compensation, if any is owed to it, for services rendered hereunder and to the reimbursement of all reasonable and properly incurred out-of-pocket expenses incurred in connection with the services rendered by it hereunder, in each case as per Section 3.6(c)(i) hereof.

14 (ii) Any successor Paying Agent appointed hereunder shall execute and deliver to its predecessor and to the Company an instrument accepting such appointment hereunder, and thereupon such successor Paying Agent, without any further act, deed or conveyance, shall become vested with all the authority, rights, powers, trusts, immunities, duties and obligations of such predecessor with like effect as if originally named as such Paying Agent hereunder, and such predecessor, upon payment by the Company of its charges and disbursements then unpaid, shall thereupon become obliged to transfer and deliver, and such successor Paying Agent shall be entitled to receive, copies of any relevant records maintained by such predecessor Paying Agent. (iii) Any Person into which the Paying Agent may be merged or converted or with which the Paying Agent may be consolidated, or any Person resulting from any merger, conversion or consolidation to which the Paying Agent shall be a party, or any Person succeeding to all or substantially all of the assets and business of the Paying Agent, or all or substantially all of the corporate trust business of the Paying Agent shall, to the extent permitted by applicable law and provided that it shall have an established place of business in New York, New York, be the successor Paying Agent under the Indenture without the execution or filing of any paper or any further act on the part of any of the parties hereto. Notice of any such merger, conversion, consolidation or sale shall be given to the Company as promptly as practicable following such merger, conversion, consolidation or sale. (iv) Any notice required to be given by the Paying Agent to any other Person hereunder shall be given in accordance with Section 13.5 of the Base Indenture. Any notice to be given to the Paying Agent shall be delivered in person, sent by first class mail or overnight air courier guaranteeing next day delivery or communicated by facsimile, to the following address (or to any other address of which the Paying Agent shall have notified the Company in writing): The Bank of New York Mellon, 240 Greenwich Street, Floor 7-E, New York, New York 10286, Attention: Corporate Trust Administration—Rhode Island Energy 5.350% Senior Notes due 2034. All notices shall be deemed to have been duly given: at the time delivered by hand, if personally delivered; five calendar days after being deposited in the mail, postage prepaid, if mailed by first-class mail; when receipt acknowledged, if sent by Electronic Means; and the next Business Day after timely delivery to the courier, if sent by overnight air courier guaranteeing next day delivery. Section 3.7 Place of Payment The place or places where, subject to the provisions of Section 4.2 of the Base Indenture, the principal of, premium, if any, and interest, if any, on the Designated Securities shall be payable, Designated Securities may be surrendered for registration, transfer or exchange and notices and

15 demands to or upon the Company in respect of the Designated Securities and the Indenture may be served shall be the Corporate Trust Office of the Trustee in the United States. Section 3.8 Denominations The Designated Securities shall be issued in denominations of $2,000 and integral multiples of $1,000 in excess thereof. Section 3.9 Form; Terms (a) The Designated Securities shall be substantially in the form of Exhibit A hereto. The Designated Securities may have notations, legends or endorsements required by law, stock exchange rules or usage. (b) Designated Securities issued in global form shall be substantially in the form of Exhibit A hereto (including the Global Security Legend thereon and the “Schedule of Exchanges of Interests in the Global Security” attached thereto). Designated Securities issued in definitive form shall be substantially in the form of Exhibit A hereto (but without, in each case, the Global Security Legend thereon and without the “Schedule of Exchanges of Interests in the Global Security” attached thereto). Each Global Security shall represent such of the outstanding Designated Securities as shall be specified in the “Schedule of Exchanges of Interests in the Global Security” attached thereto and each shall provide that it shall represent up to the aggregate principal amount of Designated Securities from time to time endorsed thereon and that the aggregate principal amount of outstanding Designated Securities represented thereby may from time to time be reduced or increased, as applicable, to reflect exchanges and redemptions. Any endorsement of a Global Security to reflect the amount of any increase or decrease in the aggregate principal amount of outstanding Designated Securities represented thereby shall be made by the Trustee, in accordance with instructions given by the Holder thereof as required by Section 3.10 hereof. (c) Designated Securities offered and sold in reliance on Rule 144A shall be issued initially in the form of the Rule 144A Global Note and bear the Restricted Legend and be deposited on behalf of the purchasers of the Designated Securities thereby with the Trustee as custodian for the Depository. The legend may be removed when the Company determines it is no longer required. Designated Securities offered and sold in reliance on Regulation S shall be issued initially in the form of the Regulation S Temporary Global Security, which shall be deposited on behalf of the purchasers of the Designated Securities represented thereby with the Trustee, as custodian for the Depository, and registered in the name of the Depository or the nominee of the Depository for the accounts of designated agents holding on behalf of Euroclear or Clearstream, Luxembourg, duly executed by the Company and authenticated by the Trustee as hereinafter provided. The Restricted Period shall be terminated upon the receipt by the Trustee of:

16 (i) a written certificate from the Depository (if available), together with copies of certificates from Euroclear and Clearstream, Luxembourg (if available) certifying that they have received certification of non-United States beneficial ownership of 100% of the aggregate principal amount of each Regulation S Temporary Global Security (except to the extent of any beneficial owners thereof who acquired an interest therein during the Restricted Period pursuant to another exemption from registration under the Securities Act and who shall take delivery of a beneficial ownership interest in a 144A Global Security bearing a Private Placement Legend, all as contemplated by Section 3.10(b) hereof); and (ii) an Officer’s Certificate from the Company. Following the termination of the Restricted Period, beneficial interests in each Regulation S Temporary Global Security shall be exchanged for beneficial interests in the Regulation S Permanent Global Security of the same series pursuant to the Applicable Procedures. Simultaneously with the authentication of the corresponding Regulation S Permanent Global Security, the Trustee shall cancel the corresponding Regulation S Temporary Global Security. The aggregate principal amount of a Regulation S Temporary Global Security and the Regulation S Permanent Global Security may from time to time be increased or decreased by adjustments made on the records of the Trustee and the Depository or its nominee, as the case may be, in connection with transfers of interest as hereinafter provided. (d) The terms and provisions contained in the Designated Securities shall constitute, and are hereby expressly made, a part of the Indenture, and the Company and the Trustee, by their execution and delivery of this Sixth Supplemental Indenture, expressly agree to such terms and provisions and to be bound thereby. However, to the extent any provision of any Designated Security conflicts with the express provisions of the Indenture, the provisions of the Indenture shall govern and be controlling. (e) The provisions of the “Operating Procedures of the Euroclear System” and “Terms and Conditions Governing Use of Euroclear” and the “General Terms and Conditions of Clearstream Banking” and “Customer Handbook” of Clearstream, Luxembourg shall be applicable to transfers of beneficial interests in the Regulation S Temporary Global Security and the Regulation S Permanent Global Securities that are held by Participants through Euroclear or Clearstream, Luxembourg. Section 3.10 Transfer and Exchange The transfer or exchange of Designated Securities shall be effected in accordance with Section 3.6 of the Base Indenture and this Section 3.10.

17 (a) Transfer and Exchange of Global Securities Except as otherwise set forth in this Section 3.10, a Global Security may be transferred, in whole and not in part, only to another nominee of the Depository or to a successor Depository or a nominee of such successor Depository. A beneficial interest in a Global Security may not be exchanged for a Definitive Security unless (i) the Depository (x) notifies the Company that it is unwilling or unable to continue as Depository for such Global Security or (y) has ceased to be a clearing agency registered under the Exchange Act and, in either case, a successor Depository is not appointed by the Company within 120 days or (ii) there shall have occurred and be continuing an Event of Default with respect to the Designated Securities. Upon the occurrence of any of the preceding events in (i) or (ii) above, Definitive Securities delivered in exchange for any Global Security or beneficial interests therein will be registered in the names, and issued in any approved denominations, requested by or on behalf of the Depository (in accordance with its customary procedures). Global Securities also may be exchanged or replaced, in whole or in part, as provided in Sections 3.7 and 3.10 of the Base Indenture. Every Designated Security authenticated and delivered in exchange for, or in lieu of, a Global Security or any portion thereof, pursuant to this Section 3.10 or Sections 3.7 or 3.10 of the Base Indenture, shall be authenticated and delivered in the form of, and shall be, a Global Security, except for Definitive Securities issued subsequent to any of the preceding events in (i) or (ii) above and pursuant to Section 3.10(c) hereof. A Global Security may not be exchanged for another Designated Security other than as provided in this Section 3.10(a); provided, however, beneficial interests in a Global Security may be transferred and exchanged as provided in Section 3.10(b), (c) or (d) hereof. (b) Transfer and Exchange of Beneficial Interests in the Global Securities The transfer and exchange of beneficial interests in the Global Securities shall be effected through the Depository, in accordance with the provisions of this Indenture and the Applicable Procedures. Beneficial interests in the Restricted Global Securities shall be subject to restrictions on transfer comparable to those set forth herein to the extent required by the Securities Act. Transfers of beneficial interests in the Global Securities also shall require compliance with either subparagraph (i) or (ii) below, as applicable, as well as one or more of the other following subparagraphs, as applicable: (i) Transfer of Beneficial Interests in the Same Global Security Beneficial interests in any Restricted Global Security may be transferred to Persons who take delivery thereof in the form of a beneficial interest in the same Restricted Global Security in accordance with the transfer restrictions set forth in the Private Placement Legend; provided, however, that prior to the expiration of the Restricted Period, transfers of beneficial interests in the Regulation S Temporary Global Security may not be made to a U.S. Person or for the account or benefit of a U.S. Person. Beneficial interests in any Unrestricted Global Security may be transferred to Persons who take delivery thereof in the form of a beneficial interest in an Unrestricted Global Security. No written orders

18 or instructions shall be required to be delivered to the Securities Registrar to effect the transfers described in this Section 3.10(b)(i). (ii) All Other Transfers and Exchanges of Beneficial Interests in Global Securities In connection with all transfers and exchanges of beneficial interests that are not subject to Section 3.10(b)(i) hereof, the transferor of such beneficial interest must deliver to the Securities Registrar either (A) both (1) a written order from a Participant or an Indirect Participant given to the Depository in accordance with the Applicable Procedures directing the Depository to credit or cause to be credited a beneficial interest in another Global Security in an amount equal to the beneficial interest to be transferred or exchanged and (2) instructions given in accordance with the Applicable Procedures containing information regarding the Participant account to be credited with such increase or (B) both (1) a written order from a Participant or an Indirect Participant given to the Depository in accordance with the Applicable Procedures directing the Depository to cause to be issued a Definitive Security of the same series in an amount equal to the beneficial interest to be transferred or exchanged and (2) instructions given by the Depository to the Securities Registrar containing information regarding the Person in whose name such Definitive Security shall be registered to effect the transfer or exchange referred to in (1) above; provided that in no event shall Definitive Securities be issued upon the transfer or exchange of beneficial interests in the Regulation S Temporary Global Security prior to (A) the expiration of the Restricted Period and (B) the receipt by the Securities Registrar of any certificates required pursuant to Rule 903. Upon satisfaction of all of the requirements for transfer or exchange of beneficial interests in Global Securities contained in this Indenture and the Designated Securities or otherwise applicable under the Securities Act, the Trustee shall adjust the principal amount of the relevant Global Securities pursuant to Section 3.10(g) hereof. (iii) Transfer of Beneficial Interests to Another Restricted Global Security A beneficial interest in any Restricted Global Security may be transferred to a Person who takes delivery thereof in the form of a beneficial interest in another Restricted Global Security if the transfer complies with the requirements of Section 3.10(b)(ii) hereof and the Securities Registrar receives the following: (A) if the transferee will take delivery in the form of a beneficial interest in a 144A Global Security, then the transferor must deliver a certificate in the form of Exhibit B hereto, including the certifications in item (1) thereof; or (B) if the transferee will take delivery in the form of a beneficial interest in the Regulation S Global Security, then the transferor

19 must deliver a certificate in the form of Exhibit B hereto, including the certifications in item (2) thereof. (iv) Transfer and Exchange of Beneficial Interests in a Restricted Global Security for Beneficial Interests in an Unrestricted Global Security A beneficial interest in any Restricted Global Security may be exchanged by any holder thereof for a beneficial interest in an Unrestricted Global Security or transferred to a Person who takes delivery thereof in the form of a beneficial interest in an Unrestricted Global Security if the exchange or transfer complies with the requirements of Section 3.10(b)(ii) hereof the Securities Registrar receives the following: (A) if the holder of such beneficial interest in a Restricted Global Security proposes to exchange such beneficial interest for a beneficial interest in an Unrestricted Global Security of the same series, a certificate from such Holder substantially in the form of Exhibit C hereto, including the certifications in item (1)(a) thereof; or (B) if the holder of such beneficial interest in a Restricted Global Security proposes to transfer such beneficial interest to a Person who shall take delivery thereof in the form of a beneficial interest in an Unrestricted Global Security of the same series, a certificate from such holder in the form of Exhibit B hereto, including the certifications in item (4) thereof; and, in each such case set forth in subparagraph (A) or (B), if the Securities Registrar so requests or if the Applicable Procedures so require, an Opinion of Counsel in form reasonably acceptable to the Securities Registrar to the effect that such exchange or transfer is in compliance with the Securities Act and that the restrictions on transfer contained herein and in the Private Placement Legend are no longer required in order to maintain compliance with the Securities Act. If any such transfer is effected pursuant to clause (iv) above at a time when an Unrestricted Global Security has not yet been issued, the Company shall issue and, upon receipt of a Company Order in accordance with Section 3.3 of the Base Indenture, the Trustee shall authenticate one or more Unrestricted Global Securities in an aggregate principal amount equal to the aggregate principal amount of beneficial interests transferred pursuant to subparagraph (A) or (B) above. Beneficial interests in an Unrestricted Global Security cannot be exchanged for, or transferred to Persons who take delivery thereof in the form of, a beneficial interest in a Restricted Global Security. (c) Transfer or Exchange of Beneficial Interests for Definitive Securities

20 (i) Beneficial Interests in Restricted Global Securities to Restricted Definitive Securities If any holder of a beneficial interest in a Restricted Global Security proposes to exchange such beneficial interest for a Restricted Definitive Security or to transfer such beneficial interest to a Person who takes delivery thereof in the form of a Restricted Definitive Security, then, upon the occurrence of any of the events in paragraph (i) or (ii) of Section 3.10(a) hereof and receipt by the Securities Registrar of the following documentation: (A) if the holder of such beneficial interest in a Restricted Global Security proposes to exchange such beneficial interest for a Restricted Definitive Security, a certificate from such holder substantially in the form of Exhibit C hereto, including the certifications in item (2)(a) thereof; (B) if such beneficial interest is being transferred to a QIB in accordance with Rule 144A, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (1) thereof; (C) if such beneficial interest is being transferred to a Non-U.S. Person in an offshore transaction in accordance with Rule 903 or Rule 904, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (2) thereof; (D) if such beneficial interest is being transferred pursuant to an exemption from the registration requirements of the Securities Act in accordance with Rule 144, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (3)(a) thereof; (E) if such beneficial interest is being transferred to the Company or any of its Restricted Subsidiaries, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (3)(b) thereof; or (F) if such beneficial interest is being transferred pursuant to an effective registration statement under the Securities Act, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (3)(c) thereof, the Trustee shall cause the aggregate principal amount of the applicable Global Security to be reduced accordingly pursuant to Section 3.10(g) hereof, and the Company shall execute and the Trustee shall authenticate and mail to the Person designated in the instructions a Definitive Security in the applicable principal amount. Any Definitive Security issued in exchange for a beneficial interest in a Restricted Global Security pursuant to this Section 3.10(c)(i) shall be registered in

21 such name or names and in such authorized denomination or denominations as the holder of such beneficial interest shall instruct the Securities Registrar through instructions from the Depository and the Participant or Indirect Participant. The Trustee shall mail such Definitive Securities to the Persons in whose names such Designated Securities are so registered at the address appearing in the Securities Register. Any Definitive Security issued in exchange for a beneficial interest in a Restricted Global Security pursuant to this Section 3.10(c)(i) shall bear the Private Placement Legend and shall be subject to all restrictions on transfer contained therein. (ii) Beneficial Interests in Regulation S Temporary Global Security to Definitive Securities Notwithstanding Sections 3.10(c)(i)(A) and (C) hereof, a beneficial interest in the Regulation S Temporary Global Security may not be exchanged for a Definitive Security or transferred to a Person who takes delivery thereof in the form of a Definitive Security prior to (A) the expiration of the Restricted Period and (B) the receipt by the Securities Registrar of any certificates required pursuant to Rule 903 of the Securities Act, except in the case of a transfer pursuant to an exemption from the registration requirements of the Securities Act other than Rule 903 or Rule 904. (iii) Beneficial Interests in Restricted Global Securities to Unrestricted Definitive Securities A holder of a beneficial interest in a Restricted Global Security may exchange such beneficial interest for an Unrestricted Definitive Security or may transfer such beneficial interest to a Person who takes delivery thereof in the form of an Unrestricted Definitive Security only upon the occurrence of any of the events in subsection (i) or (ii) of Section 3.10(a) hereof and if the Securities Registrar receives the following: (A) if the holder of such beneficial interest in a Restricted Global Security proposes to exchange such beneficial interest for an Unrestricted Definitive Security, a certificate from such holder substantially in the form of Exhibit C hereto, including the certifications in item (1)(b) thereof; or (B) if the holder of such beneficial interest in a Restricted Global Security proposes to transfer such beneficial interest to a Person who shall take delivery thereof in the form of an Unrestricted Definitive Security, a certificate from such holder substantially in the form of Exhibit B hereto, including the certifications in item (4) thereof; and, in each such case set forth in this subparagraph (A) or (B) above, if the Securities Registrar so requests or if the Applicable Procedures so require, an Opinion of Counsel in form reasonably acceptable to the Securities Registrar to the effect that such exchange or transfer is in compliance with the Securities Act

22 and that the restrictions on transfer contained herein and in the Private Placement Legend are no longer required in order to maintain compliance with the Securities Act. (iv) Beneficial Interests in Unrestricted Global Securities to Unrestricted Definitive Securities If any holder of a beneficial interest in an Unrestricted Global Security proposes to exchange such beneficial interest for a Definitive Security or to transfer such beneficial interest to a Person who takes delivery thereof in the form of a Definitive Security, then, upon the occurrence of any of the events in subsection (i) or (ii) of Section 3.10(a) hereof and satisfaction of the conditions set forth in Section 3.10(b)(ii) hereof, the Trustee shall cause the aggregate principal amount of the applicable Global Security to be reduced accordingly pursuant to Section 3.10(g) hereof, and the Company shall execute and the Trustee shall authenticate and mail to the Person designated in the instructions a Definitive Security in the applicable principal amount. Any Definitive Security issued in exchange for a beneficial interest pursuant to this Section 3.10(c)(iv) shall be registered in such name or names and in such authorized denomination or denominations as the holder of such beneficial interest shall instruct the Securities Registrar through instructions from or through the Depository and the Participant or Indirect Participant. The Trustee shall mail such Definitive Securities to the Persons in whose names such Securities are so registered. Any Definitive Security issued in exchange for a beneficial interest pursuant to this Section 3.10(c)(iv) shall not bear the Private Placement Legend. (d) Transfer and Exchange of Definitive Securities for Beneficial Interests (i) Restricted Definitive Securities to Beneficial Interests in Restricted Global Securities If any Holder of a Restricted Definitive Security proposes to exchange such Designated Security for a beneficial interest in a Restricted Global Security or to transfer such Restricted Definitive Security to a Person who takes delivery thereof in the form of a beneficial interest in a Restricted Global Security, then, upon receipt by the Securities Registrar of the following documentation: (A) if the Holder of such Restricted Definitive Security proposes to exchange such Designated Security for a beneficial interest in a Restricted Global Security, a certificate from such Holder substantially in the form of Exhibit C hereto, including the certifications in item (2)(b) thereof; (B) if such Restricted Definitive Security is being transferred to a QIB in accordance with Rule 144A, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (1) thereof;

23 (C) if such Restricted Definitive Security is being transferred to a Non-U.S. Person in an offshore transaction in accordance with Rule 903 or Rule 904, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (2) thereof; (D) if such Restricted Definitive Security is being transferred pursuant to an exemption from the registration requirements of the Securities Act in accordance with Rule 144, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (3)(a) thereof; (E) if such Restricted Definitive Security is being transferred to the Company or any of its Restricted Subsidiaries, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (3)(b) thereof; or (F) if such Restricted Definitive Security is being transferred pursuant to an effective registration statement under the Securities Act, a certificate substantially in the form of Exhibit B hereto, including the certifications in item (3)(c) thereof, the Trustee shall cancel the Restricted Definitive Security, increase or cause to be increased the aggregate principal amount of, in the case of clause (A) above, the applicable Restricted Global Security, in the case of clause (B) above, the applicable 144A Global Security, and in the case of clause (C) above, the applicable Regulation S Global Security. (ii) Restricted Definitive Securities to Beneficial Interests in Unrestricted Global Securities A Holder of a Restricted Definitive Security may exchange such Designated Security for a beneficial interest in an Unrestricted Global Security or transfer such Restricted Definitive Security to a Person who takes delivery thereof in the form of a beneficial interest in an Unrestricted Global Security only if the Securities Registrar receives the following: (A) if the Holder of such Definitive Securities proposes to exchange such Designated Securities for a beneficial interest in the Unrestricted Global Security, a certificate from such Holder substantially in the form of Exhibit C hereto, including the certifications in item (1)(c) thereof; or (B) if the Holder of such Definitive Securities proposes to transfer such Designated Securities to a Person who shall take delivery thereof in the form of a beneficial interest in the Unrestricted Global Security, a certificate from such Holder substantially in the form of Exhibit B hereto, including the certifications in item (4) thereof;

24 and, in each such case set forth in this subsection (A) or (B) above, if the Securities Registrar so requests or if the Applicable Procedures so require, an Opinion of Counsel in form reasonably acceptable to the Securities Registrar to the effect that such exchange or transfer is in compliance with the Securities Act and that the restrictions on transfer contained herein and in the Private Placement Legend are no longer required in order to maintain compliance with the Securities Act. Upon satisfaction of the conditions of any of the subparagraphs in this Section 3.10(d)(ii), the Trustee shall cancel the Definitive Securities and increase or cause to be increased the aggregate principal amount of the Unrestricted Global Security. (iii) Unrestricted Definitive Securities to Beneficial Interests in Unrestricted Global Securities A Holder of an Unrestricted Definitive Security may exchange such Designated Security for a beneficial interest in an Unrestricted Global Security or transfer such Definitive Securities to a Person who takes delivery thereof in the form of a beneficial interest in an Unrestricted Global Security at any time. Upon receipt of a request for such an exchange or transfer, the Trustee shall cancel the applicable Unrestricted Definitive Security and increase or cause to be increased the aggregate principal amount of one of the Unrestricted Global Securities. If any such exchange or transfer from a Definitive Security to a beneficial interest is effected pursuant to clauses (ii) or (iii) above at a time when an Unrestricted Global Security has not yet been issued, the Company shall issue and, upon receipt of a Company Order in accordance with Section 3.3 of the Base Indenture, the Trustee shall authenticate one or more Unrestricted Global Securities in an aggregate principal amount equal to the principal amount of Definitive Securities so transferred. (e) Transfer and Exchange of Definitive Securities for Definitive Securities Upon request by a Holder of Definitive Securities and such Holder’s compliance with the provisions of this Section 3.10(e), the Securities Registrar shall register the transfer or exchange of Definitive Securities. Prior to such registration of transfer or exchange, the requesting Holder shall present or surrender to the Securities Registrar the Definitive Securities duly endorsed or accompanied by a written instruction of transfer in form satisfactory to the Securities Registrar duly executed by such Holder or by its attorney, duly authorized in writing. In addition, the requesting Holder shall provide any additional certifications, documents and information, as applicable, required pursuant to the following provisions of this Section 3.10(e): (i) Restricted Definitive Securities to Restricted Definitive Securities Any Restricted Definitive Security may be transferred to and registered in the name of Persons who take delivery thereof in the form of a Restricted Definitive Security if the Securities Registrar receives the following:

25 (A) if the transfer will be made to a QIB in accordance with Rule 144A, then the transferor must deliver a certificate in the form of Exhibit B hereto, including the certifications in item (1) thereof; (B) if the transfer will be made pursuant to Rule 903 or Rule 904, then the transferor must deliver a certificate in the form of Exhibit B hereto, including the certifications in item (2) thereof; or (C) if the transfer will be made pursuant to any other exemption from the registration requirements of the Securities Act, then the transferor must deliver a certificate in the form of Exhibit B hereto, including the certifications required by item (3) thereof, if applicable. (ii) Restricted Definitive Securities to Unrestricted Definitive Securities Any Restricted Definitive Security may be exchanged by the Holder thereof for an Unrestricted Definitive Security or transferred to a Person or Persons who take delivery thereof in the form of an Unrestricted Definitive Security if the Securities Registrar receives the following: (A) if the Holder of such Restricted Definitive Securities proposes to exchange such Designated Securities for an Unrestricted Definitive Security, a certificate from such Holder substantially in the form of Exhibit C hereto, including the certifications in item (1)(d) thereof; or (B) if the Holder of such Restricted Definitive Securities proposes to transfer such Designated Securities to a Person who shall take delivery thereof in the form of an Unrestricted Definitive Security, a certificate from such Holder substantially in the form of Exhibit B hereto, including the certifications in item (4) thereof; and, in each such case set forth in this subsection (A) or (B) above, if the Securities Registrar so requests, an Opinion of Counsel in form reasonably acceptable to the Securities Registrar to the effect that such exchange or transfer is in compliance with the Securities Act and that the restrictions on transfer contained herein and in the Private Placement Legend are no longer required in order to maintain compliance with the Securities Act. (iii) Unrestricted Definitive Securities to Unrestricted Definitive Securities A Holder of Unrestricted Definitive Securities may transfer such Designated Securities to a Person who takes delivery thereof in the form of an Unrestricted Definitive Security. Upon receipt of a request to register such a transfer, the Securities Registrar shall register the

26 Unrestricted Definitive Securities pursuant to the instructions from the Holder thereof. (f) Legends The following legends shall appear on the face of all Global Securities and Definitive Securities issued under this Indenture unless specifically stated otherwise in the applicable provisions of this Indenture: (i) Private Placement Legend (A) Except as permitted by subparagraph (B) below, each Global Security and each Definitive Security (and all Designated Securities issued in exchange therefor or substitution therefor) shall bear the legend in substantially the following form: “THIS SECURITY HAS NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS EXCEPT AS SET FORTH BELOW. BY ITS ACQUISITION HEREOF, THE HOLDER (1) REPRESENTS THAT (A) IT IS A “QUALIFIED INSTITUTIONAL BUYER” (AS DEFINED IN RULE 144A UNDER THE SECURITIES ACT) OR (B) IT IS NOT A U.S. PERSON AND IS ACQUIRING THIS SECURITY IN AN OFFSHORE TRANSACTION IN COMPLIANCE WITH RULE 904 UNDER THE SECURITIES ACT, (2) AGREES THAT IT WILL NOT RESELL OR OTHERWISE TRANSFER THIS SECURITY EXCEPT (A) TO THE NARRAGANSETT ELECTRIC COMPANY OR ANY SUBSIDIARY THEREOF, (B) INSIDE THE UNITED STATES TO A QUALIFIED INSTITUTIONAL BUYER IN COMPLIANCE WITH RULE 144A UNDER THE SECURITIES ACT, (C) INSIDE THE UNITED STATES TO AN ACCREDITED INVESTOR (AS DEFINED IN RULE 501(a)(1), (2), (3), OR (7) UNDER THE SECURITIES ACT, AN “ACCREDITED INVESTOR”) THAT, PRIOR TO SUCH TRANSFER, FURNISHES (OR HAS FURNISHED ON ITS BEHALF BY A U.S. BROKER- DEALER) TO THE TRUSTEE A SIGNED LETTER CONTAINING CERTAIN REPRESENTATIONS AND AGREEMENTS RELATING TO THE RESTRICTIONS ON TRANSFER OF THIS SECURITY (THE FORM OF WHICH LETTER CAN BE OBTAINED FROM THE TRUSTEE FOR THIS SECURITY), (D) OUTSIDE THE UNITED STATES IN AN OFFSHORE TRANSACTION IN COMPLIANCE WITH RULE 904 UNDER THE SECURITIES ACT (IF AVAILABLE), (E) PURSUANT TO THE EXEMPTION

27 FROM REGISTRATION PROVIDED BY RULE 144 UNDER THE SECURITIES ACT (IF AVAILABLE), (F) IN ACCORDANCE WITH ANOTHER EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT (AND BASED UPON AN OPINION OF COUNSEL IF THE NARRAGANSETT ELECTRIC COMPANY SO REQUESTS), OR (G) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND (3) AGREES THAT IT WILL GIVE TO EACH PERSON TO WHOM THIS SECURITY IS TRANSFERRED A NOTICE SUBSTANTIALLY TO THE EFFECT OF THIS LEGEND. NO REPRESENTATION CAN BE MADE AS TO THE AVAILABILITY OF THE EXEMPTION PROVIDED BY RULE 144 FOR RESALE OF THE SECURITY EVIDENCED HEREBY. IN CONNECTION WITH ANY TRANSFER OF THIS SECURITY WITHIN ONE YEAR AFTER THE ORIGINAL ISSUANCE OF THIS SECURITY, IF THE PROPOSED TRANSFEREE IS AN ACCREDITED INVESTOR, THE HOLDER MUST, PRIOR TO SUCH TRANSFER, FURNISH TO THE TRUSTEE AND THE NARRAGANSETT ELECTRIC COMPANY SUCH CERTIFICATIONS, LEGAL OPINIONS OR OTHER INFORMATION AS ANY OF THEM MAY REASONABLY REQUIRE TO CONFIRM THAT SUCH TRANSFER IS BEING MADE PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. AS USED HEREIN, THE TERMS “OFFSHORE TRANSACTION,” “UNITED STATES” AND “U.S. PERSON” HAVE THE MEANING GIVEN TO THEM BY REGULATION S UNDER THE SECURITIES ACT.” (B) Notwithstanding the foregoing, any Global Security or Definitive Security issued pursuant to subparagraph (b)(iv), (c)(iii), (c)(iv), (d)(ii), (d)(iii), (e)(ii) or (e)(iii) of this Section 3.10 (and all Designated Securities issued in exchange therefor or substitution thereof) shall not bear the Private Placement Legend. (ii) Global Security Legend Each Global Security shall bear a legend in substantially the following form: “THIS GLOBAL SECURITY IS HELD BY THE DEPOSITORY (AS DEFINED IN THE INDENTURE GOVERNING THIS SECURITY) OR ITS NOMINEE IN CUSTODY FOR THE BENEFIT OF THE BENEFICIAL OWNERS HEREOF, AND IS NOT TRANSFERABLE TO ANY PERSON UNDER ANY CIRCUMSTANCES EXCEPT THAT

28 (I) THE TRUSTEE MAY MAKE SUCH NOTATIONS HEREON AS MAY BE REQUIRED PURSUANT TO SECTION 3.10(g) OF THE SIXTH SUPPLEMENTAL INDENTURE, (II) THIS GLOBAL SECURITY MAY BE EXCHANGED IN WHOLE BUT NOT IN PART PURSUANT TO SECTION 3.10(a) OF THE SIXTH SUPPLEMENTAL INDENTURE, (III) THIS GLOBAL SECURITY MAY BE DELIVERED TO THE TRUSTEE FOR CANCELLATION PURSUANT TO SECTION 3.9 OF THE BASE INDENTURE AND (IV) THIS GLOBAL SECURITY MAY BE TRANSFERRED TO A SUCCESSOR DEPOSITORY WITH THE PRIOR WRITTEN CONSENT OF THE COMPANY. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR SECURITIES IN DEFINITIVE FORM, THIS GLOBAL SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITORY TO A NOMINEE OF THE DEPOSITORY OR BY A NOMINEE OF THE DEPOSITORY TO THE DEPOSITORY OR ANOTHER NOMINEE OF THE DEPOSITORY OR BY THE DEPOSITORY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITORY OR A NOMINEE OF SUCH SUCCESSOR DEPOSITORY. UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY (55 WATER STREET, NEW YORK, NEW YORK) (“DTC”) TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR SUCH OTHER NAME AS MAY BE REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR SUCH OTHER ENTITY AS MAY BE REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.” (iii) Regulation S Temporary Global Security Legend The Regulation S Temporary Global Security shall bear a legend in substantially the following form: “BY ITS ACQUISITION HEREOF, THE HOLDER HEREOF REPRESENTS THAT IT IS NOT A U.S. PERSON, NOR IS IT PURCHASING FOR THE ACCOUNT OF A U.S. PERSON, AND IS ACQUIRING THIS SECURITY IN AN OFFSHORE TRANSACTION IN ACCORDANCE WITH REGULATION S UNDER THE SECURITIES ACT.”