Table of Contents

As filed with the Securities and Exchange Commission on August 10, 2016

Registration Nos. 333-208054, 333-208054-01 and 333-208054-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM SF-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| CITIBANK CREDIT CARD ISSUANCE TRUST | CITIBANK CREDIT CARD MASTER TRUST I | |

| (Issuing Entity in respect of the Notes) | (Issuing Entity in respect of the Collateral Certificate) | |

| CITIBANK, N.A. | ||

| (Sponsor and Depositor) | ||

(Exact name of registrant as specified in its charter)

| United States of America | 13-5266470 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Commission File Number of depositor: 333-145220-03

Central Index Key Number of depositor: 0001522616

Citibank, N.A.

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor: 0001522616

Citibank, N.A.

(Exact name of sponsor as specified in its charter)

Citibank, N.A.

388 Greenwich Street

New York, New York 10013

(212) 559-1000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CHRISTOPHER R. BECKER, ESQ.

Assistant General Counsel—Capital Markets and Corporate Reporting

Citigroup Inc.

One Court Square

Long Island City, New York 11120

(212) 559-1000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| SUSAN WEBSTER, ESQ. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 (212) 474-1000 |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective as determined by market conditions.

If any of the securities being registered on this Form SF-3 are to be offered pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form SF–3 is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form SF–3 is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be (a)(b) |

Proposed maximum per unit (c) |

Proposed maximum aggregate offering price (c) |

Amount of registration fee | ||||

| Notes |

$25,158,018,962 | 100% | $25,158,018,962 | $2,533,412.51 (d) | ||||

| Collateral Certificate (e) |

$25,158,018,962 | — | — | — | ||||

| (a) | With respect to any securities issued with original issue discount, the amount to be registered is calculated based on the initial public offering price thereof. |

| (b) | With respect to any securities denominated in any foreign currency, the amount to be registered shall be the U.S. dollar equivalent thereof based on the prevailing exchange rate at the time such security is first offered. |

| (c) | Estimated solely for the purpose of calculating the registration fee. |

| (d) | The entire $2,533,412.51 registration fee for this Registration Statement is being offset, pursuant to Rule 457(p) of the General Rules and Regulations under the Securities Act of 1933, as amended, by the registration fees previously paid in connection with unsold Asset-Backed Notes or Asset-Backed Certificates registered by the registrant or certain of its affiliates under previously-filed registration statements, as follows: (i) $223,444.50 in registration fees previously paid in connection with unsold Asset-Backed Notes registered by Citibank, N.A. (as successor to Citibank (South Dakota), N.A.), as Depositor, under Registration Statement No. 333-171055 and 333-171055-03 with an initial filing date of December 9, 2010, (ii) $1,629,885 in registration fees previously paid in connection with unsold Asset-Backed Certificates registered by Citicorp Mortgage Securities, Inc., an indirect, wholly-owned subsidiary of Citibank, N.A., as Depositor, under Registration Statement No. 333-170683 with an initial filing date of November 18, 2010, and (iii) $680,083.01 in registration fees previously paid in connection with unsold Asset-Backed Certificates registered by Citicorp Residential Mortgage Securities, Inc., a wholly-owned subsidiary of Citibank, N.A., as Depositor, under Registration Statement No. 333-171329 with an initial filing date of December 21, 2010. |

| (e) | This Registration Statement and the prospectus included herein also relate to a Collateral Certificate, which is pledged as security for the Notes, and which, pursuant to Commission regulations, is deemed to constitute part of any distribution of the Notes. No additional consideration will be paid by the purchasers of the Notes for the Collateral Certificate and, pursuant to Rule 457(t) under the Securities Act, no separate registration fee for the Collateral Certificate is required to be paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

INTRODUCTORY NOTE

This Registration Statement includes a representative form of prospectus relating to the offering by Citibank Credit Card Issuance Trust of a subclass of asset-backed notes of a multiple issuance series.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated [·] [·], 201[·]

Prospectus Dated [·] [·], 201[·]

Citibank Credit Card Issuance Trust

Issuing Entity (CIK: 0001108348)

$[· ] [Floating Rate] [[·]%] Class 201[·]-[· ][·] Notes of [·] 20[·]

(Legal Maturity Date [·] 20[·])

Citibank, N.A.

Sponsor and Depositor (CIK: 0001522616)

| The issuance trust will issue and sell | Class 201[·]-[·][ ·] Notes | |

| Principal amount |

$[·] | |

| Interest rate |

[[·]% per annum] [LIBOR [plus] [minus] [·] per annum] | |

| Interest payment dates |

[·] day of each [month or list specific month[s] depending on interest payment frequency], beginning 20[·] | |

| Expected principal payment date |

[·], 20[·] | |

| Legal maturity date |

[·], 20[·] | |

| Expected issuance date |

[·], 20[·] | |

| Price to public |

$[·] (or [·]%) | |

| Underwriting discount |

$[·] (or [·]%) | |

| Proceeds to the issuance trust |

[[·]% per annum] [LIBOR [plus] [minus] [·] per annum] |

The Class 201[·]-[·][·] notes will be paid from the issuance trust’s assets consisting primarily of an interest in credit card receivables arising in a portfolio of revolving credit card accounts.

The Class 201[·]-[·][·] notes are a subclass of Class [·] notes of the Citiseries.

[Credit Enhancement: [Principal payments on Class B notes of the Citiseries, including these Class 201[·]-B[·] notes, are subordinated to payments on Class A notes of that series.] [Principal payments on Class C notes of the Citiseries, including these Class 201[·]-C[·] notes, are subordinated to payments on Class A notes and Class B notes of the Citiseries. The Class 201[·]-C[·] notes will have the benefit of a Class C Reserve Account as described in this prospectus.] [The Class 201[·]-[·][·] notes will have the benefit of an interest rate swap provided by [Name of Provider], as derivative counterparty, as described in this prospectus.]]

[See page S-[·] for a description of how LIBOR is determined.]

You should review and consider the discussion under “Risk Factors” beginning on page [37] of this prospectus before you purchase any notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved the notes or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The notes are obligations of Citibank Credit Card Issuance Trust only and are not obligations of or interests in any other person. The notes of all series are secured by a shared security interest in the collateral certificate and the collection account, but each subclass of notes is entitled to the benefits of only that portion of the assets allocated to it under the indenture and applicable indenture supplement. Noteholders will have no recourse to any other assets of Citibank Credit Card Issuance Trust for the payment of the notes.

The notes are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality.

Underwriters

[· ]

Table of Contents

Information Presented in this Prospectus

Citibank Credit Card Issuance Trust will issue notes in series and we expect that most series will consist of multiple classes and that most classes will consist of multiple subclasses. As of the date of this prospectus, the Citiseries is the only issued and outstanding series of Citibank Credit Card Issuance Trust. The Class 201[·]-[·][·] notes are a subclass of the Class [·] notes of the Citiseries. This prospectus describes the specific terms of your series, class and subclass of notes and also provides general information about other series, classes and subclasses of notes that have been and may be issued from time to time. Other series, classes and subclasses of Citibank Credit Card Issuance Trust notes, including other subclasses of notes that are included in the Citiseries as a part of the Class [·] notes or other notes that are included in the Class 201[·]-[·][·] subclass, may be issued by Citibank Credit Card Issuance Trust in the future without the consent of, or prior notice to, any noteholders. No series, class or subclass of notes, other than the Class 201[·]-[·][·] notes, is being offered pursuant to this prospectus.

The primary asset of Citibank Credit Card Issuance Trust is the collateral certificate, Series 2000, which represents an undivided interest in Citibank Credit Card Master Trust I. In May 2009, Citibank Credit Card Master Trust I also issued the Series 2009 certificate to Citibank, N.A., as seller, in order to provide credit enhancement to the collateral certificate and the notes. Citibank Credit Card Master Trust I may issue other series of certificates and any such series may consist of one or more classes. As of the date of this prospectus, the collateral certificate and the Series 2009 certificate are the only master trust investor certificate issued pursuant to Series 2000 and Series 2009, respectively, of the master trust certificates. This prospectus describes the specific terms of the collateral certificate and the Series 2009 certificate and also provides general information about other series of certificates that may be issued from time to time. Other series of Citibank Credit Card Master Trust I certificates may be issued by Citibank Credit Card Master Trust I from time to time without the consent of, or prior notice to, any noteholders or certificateholders. No such series of certificates is being offered pursuant to this prospectus.

See “Risk Factors—Issuance of additional notes or master trust investor certificates may affect the timing and amount of payments to you” for a discussion of the potential impact that the issuance of additional notes or certificates could have on the Class 201[·]-[·][·] notes.

You should rely only on the information provided in this prospectus, including the information incorporated by reference. We have not authorized anyone to provide you with different information. We do not claim the accuracy of the information in this prospectus as of any date other than the date stated on its cover.

We are not offering the Class 201[·]-[·][·] notes in any state where the offer is not permitted.

Information regarding certain entities that are not affiliates of Citibank, N.A. has been provided in this prospectus. See in particular “The Issuance Trust—The Issuance Trust Trustee”, “—[Name of Asset Representations Reviewer]”, and “Sources of Funds to Pay the Notes—The Indenture Trustee” and “The Master Trust—The Master Trust Trustee.” The

Table of Contents

information contained in those sections of this prospectus was prepared solely by the party described in that section without the involvement of Citibank, N.A. or any of their affiliates.

We include cross-references in this prospectus to captions in these materials where you can find further related discussions. The Table of Contents in this prospectus provides the pages on which these captions are located.

Parts of this prospectus use defined terms. You can find a listing of defined terms in the “Glossary of Defined Terms” beginning on page [181].

These Class 201[·]-[·][ ·] notes are offered subject to receipt and acceptance by the underwriters and to their right to reject any order in whole or in part and to withdraw, cancel or modify the offer without notice.

Compliance with the Capital Requirements Regulation

Articles 404-410 of Regulation (EU) No. 575/2013 of the European Parliament and of the Council of 26 June 2013, known as the Capital Requirements Regulation (the CRR), place certain conditions on investments in asset-backed securities by credit institutions and investment firms (together referred to as institutions) regulated in European Union (EU) member states and in other countries in the European Economic Area (EEA) and by certain affiliates of those institutions. These Articles, effective January 1, 2014, replace and in some respects amend Article 122a of Directive 2006/48/EC (as amended by Directive 2009/111/EC), known as Article 122a of the Capital Requirements Directive or CRD Article 122a. The CRR has direct effect in EU member states and is expected to be implemented by national legislation or rulemaking in the other EEA countries.

None of Citibank, N.A., Citibank Credit Card Master Trust I, Citibank Credit Card Issuance Trust, the master trust trustee, the indenture trustee, the issuance trust trustee or any affiliate makes any representation or agreement that it is undertaking or will have undertaken to comply with the requirements of the CRR or any corresponding rules applicable to EEA-regulated investors. Noteholders are responsible for analyzing their own regulatory position and are advised to consult with their own advisors regarding the suitability of the notes for investment and compliance with the CRR or any corresponding rules applicable to EEA-regulated investors.

Table of Contents

Certain Volcker Rule Considerations

The issuance trust is not now, and immediately following the issuance of these Class 201[·]-[·][·] notes and the application of the proceeds thereof will not be, a “covered fund” for purposes of regulations adopted under Section 13 of the Bank Holding Company Act of 1956, as amended, commonly known as the “Volcker Rule.”

In reaching this conclusion, the issuance trust has relied primarily on the determinations that:

| • | the issuance trust may rely on the exclusion from the definition of “investment company” set forth in Rule 3a-7 under the Investment Company Act of 1940, and accordingly, |

| • | the issuance trust may rely on the exclusion from the definition of a “covered fund” under the Volcker Rule of an issuer that may rely on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940 other than the exclusions contained in Sections 3(c)(1) and 3(c)(7) of that Act. |

Table of Contents

Forward-Looking Statements

This prospectus and the information incorporated by reference in this prospectus include forward-looking statements within the meaning of the rules and regulations of the Securities and Exchange Commission. Generally, forward-looking statements are not based on historical facts but instead represent only our beliefs regarding future events. Such statements may be identified by words such as “believe”, “expect”, “anticipate”, “intend”, “estimate”, “may increase”, “may fluctuate” and similar expressions, or future or conditional verbs such as “will”, “should”, “would” and “could”. Forward-looking statements are based on our current expectations and are subject to uncertainties and changes in circumstances. Actual results may differ materially from those included in these statements as a result of certain risks and uncertainties including, but not limited to, changes in business, political and economic conditions, unemployment levels, consumer bankruptcies and inflation; competitive product and pricing pressures; technological change; the impact of current, pending or future legislation and regulation (including the Dodd-Frank Wall Street Reform and Consumer Protection Act and regulatory changes affecting the securitization market); the costs, effects and outcomes of litigation; changes in fiscal, monetary, regulatory, accounting and tax policies; as well as other risks and uncertainties including, but not limited to, those described in “Risk Factors” in this prospectus. You should not put undue reliance on any forward-looking statements, which speak only as of the date on which they were made. We undertake no obligation to update forward-looking statements to reflect subsequent circumstances or events.

Table of Contents

| Page |

||||

| THE CLASS 201[·]-[·][·] NOTES |

1 | |||

| 1 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount of Notes |

23 | |||

| 25 | ||||

| Sources of Funds to Pay the Class 201[·]-[· ][·] Notes |

26 | |||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 62 | ||||

| 63 | ||||

| Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount of Notes |

63 | |||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 73 | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| 76 | ||||

| 76 | ||||

| 77 | ||||

| 82 | ||||

| Acquisition and Cancellation of Notes by the Issuance Trust and Citibank |

82 | |||

| 83 | ||||

| 83 | ||||

| 87 | ||||

| 87 | ||||

| Limited Recourse to the Issuance Trust; Security for the Notes |

89 | |||

| 89 | ||||

(i)

Table of Contents

| Page |

||||

| 92 | ||||

| 92 | ||||

| 93 | ||||

| Targeted Deposits of Finance Charge Collections to the Interest Funding Account |

94 | |||

| Payments Received from Derivative Counterparties for Interest |

96 | |||

| 96 | ||||

| Deposits of Withdrawals from the Class C Reserve Account to the Interest Funding Account |

97 | |||

| 97 | ||||

| 98 | ||||

| Targeted Deposits of Principal Collections to the Principal Funding Account |

99 | |||

| Payments Received from Derivative Counterparties for Principal |

101 | |||

| Deposits of Withdrawals from the Class C Reserve Account to the Principal Funding Account |

101 | |||

| 101 | ||||

| Reallocation of Funds on Deposit in the Principal Funding Subaccounts |

101 | |||

| 103 | ||||

| 104 | ||||

| 105 | ||||

| Limit on Repayments of Subordinated Classes of Single Issuance Series |

108 | |||

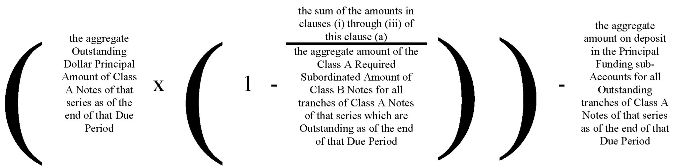

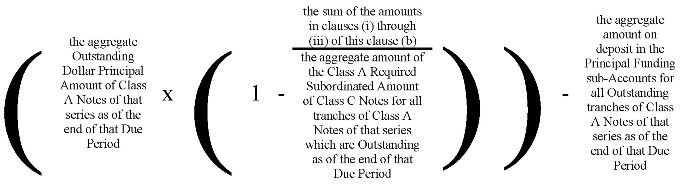

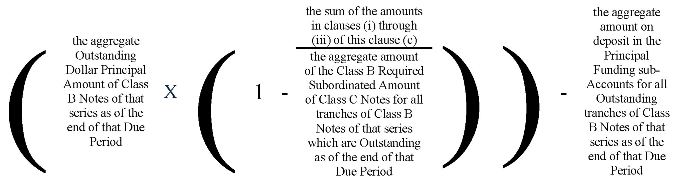

| Limit on Repayments of Subordinated Classes of Multiple Issuance Series |

108 | |||

| Limit on Allocations of Principal Collections of All Classes or Subclasses of Notes |

111 | |||

| 111 | ||||

| 112 | ||||

| 112 | ||||

| 115 | ||||

| 115 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 119 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| 122 | ||||

| 123 | ||||

| 123 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 125 | ||||

| 125 | ||||

| 125 | ||||

| 126 | ||||

| 127 | ||||

| 128 | ||||

(ii)

Table of Contents

| Page |

||||

| 129 | ||||

| 129 | ||||

| 132 | ||||

| 132 | ||||

| 137 | ||||

| 139 | ||||

| 139 | ||||

| 143 | ||||

| 145 | ||||

| 145 | ||||

| 147 | ||||

| Optional Termination; Final Payment of Master Trust Investor Certificates |

148 | |||

| 148 | ||||

| 149 | ||||

| 149 | ||||

| 156 | ||||

| 159 | ||||

| 160 | ||||

| 160 | ||||

| 161 | ||||

| 161 | ||||

| 162 | ||||

| 165 | ||||

| 169 | ||||

| 169 | ||||

| 169 | ||||

| 171 | ||||

| 171 | ||||

| 172 | ||||

| 175 | ||||

| 177 | ||||

| 178 | ||||

| 178 | ||||

| 180 | ||||

| AI-1 | ||||

| AII-1 | ||||

| AII-1 | ||||

| AII-2 | ||||

| AII-3 | ||||

| ANNEX III: DIAGRAM OF ALLOCATION OF FINANCE CHARGE COLLECTIONS |

AIII-1 | |||

| AIV-1 | ||||

| ANNEX V: FEES AND EXPENSES PAYABLE FROM FINANCE CHARGE COLLECTIONS |

AV-1 | |||

(iii)

Table of Contents

(iv)

Table of Contents

THE CLASS 201[·]-[· ][·] NOTES

Because this is a summary, it does not contain all the information you may need to make an informed investment decision. You should read the entire prospectus before you purchase any of these Class 201[·]-[·][·] notes.

Only the Class 201[·]-[·][ ·] notes are being offered through this prospectus. Other series, classes and subclasses of Citibank Credit Card Issuance Trust notes, including other subclasses of notes that are included in the Citiseries as a part of the Class [·] notes or other notes that are included in the Class 201[·]-[·][·] subclass, may be issued by Citibank Credit Card Issuance Trust from time to time without the consent of, or prior notice to, any noteholders.

There is a glossary beginning on page [181] where you will find the definitions of some terms used in this prospectus.

Transaction Parties

| Issuing Entity of the Notes |

Citibank Credit Card Issuance Trust (issuing entity) |

| Issuing Entity of the Collateral Certificate |

Citibank Credit Card Master Trust I (master trust) |

| Sponsor, Servicer, Originator and Depositor |

Citibank, N.A. |

| Master Trust Trustee, Indenture Trustee |

Deutsche Bank Trust Company Americas |

| Issuance Trust Trustee |

BNY Mellon Trust of Delaware |

| Asset Representations Reviewer |

[Name of Asset Representations Reviewer] |

| [Derivative Counterparty] |

[Name of Counterparty] |

| Securities Offered |

$[·] [Floating Rate] [[·]%] Class 201[·]-[·][·] Notes of [·] 20[·] (legal maturity date [·] 20[·]). |

| These Class 201[·]-[·][·] notes are part of a multiple issuance series of notes called the Citiseries. The Citiseries consists of Class A notes, Class B notes and Class C notes. These Class 201[·]-[·][·] notes are a subclass of Class [·] notes of the Citiseries. |

1

Table of Contents

| These Class 201[·]-[·][·] notes are issued by, and are obligations of, Citibank Credit Card Issuance Trust. The issuance trust has issued and expects to issue other classes and subclasses of notes of the Citiseries with different interest rates, payment dates, legal maturity dates and other characteristics. The issuance trust may also issue additional Class 201[·]-[·][·] notes in the future. Holders of these Class 201[·]-[·][·] notes will not receive notice of, or have the right to consent to, any subsequent issuance of notes, including any issuance of additional Class 201[·]-[·][·] notes. See “The Notes—Issuances of New Series, Classes and Subclasses of Notes” in this prospectus. |

| Multiple Issuance Series |

The Class 201[·]-[· ][·] notes are a subclass of notes of the Citiseries. The Citiseries is a multiple issuance series. A multiple issuance series is a series of notes consisting of three classes: Class A, Class B and Class C. Each class may consist of multiple subclasses. Notes of any subclass can be issued on any date so long as there are enough outstanding subordinated notes to provide the necessary subordination protection for outstanding and newly issued senior notes. The expected principal payment dates and legal maturity dates of the senior and subordinated classes of a multiple issuance series may be different, and subordinated notes may have expected principal payment dates and legal maturity dates earlier than some or all senior notes of the same series. Subordinated notes will generally not be paid before their legal maturity date, unless, after payment, the remaining subordinated notes provide the required amount of subordination protection for the senior notes of that series. |

| All of the subordinated notes of a multiple issuance series provide subordination protection to the senior notes of the same series to the extent of the required subordinated amount, regardless of whether the subordinated notes are issued before, at the same time as, or after the senior notes of that series. |

| [Asset Backed Securities][Other Interests] Not Offered]] |

[Description of [asset backed securities][other interests] not offered by this prospectus.] |

2

Table of Contents

[The following relates to fixed-rate notes:]

| Interest |

These Class 201[·]-[·][·] notes will accrue interest at the rate of [·]% per annum. |

| Interest on these Class 201[·]-[·][·] notes will accrue from the issuance date and will be calculated on the basis of a 360-day year of twelve 30-day months. |

| The issuance trust will make interest payments on these Class 201[·]-[·][·] notes on the [·] day of each [month or list specific month[s] depending on interest payment frequency], beginning [·] 20[·]. If an event of default or early redemption event occurs with respect to these Class 201[·]-[·][·] notes, or if these Class 201[·]-[·][·] notes are not paid in full on the expected principal payment date, the issuance trust will begin making interest payments on the [·] day of every month. Interest payments due on a day that is not a business day in New York and South Dakota will be made on the following business day. |

| The payment of accrued interest on a class of notes of the Citiseries from finance charge collections is not senior to or subordinated to payment of interest on any other class of notes of the Citiseries. |

[The following relates to floating

-rate notes:]

| Interest |

These Class 201[·]-[·][·] notes will accrue interest at a per annum rate equal to the [·]-month LIBOR rate for U.S. dollar deposits for the applicable interest period [plus] [minus] a margin of [·]%. [However, the interest rate for these Class 201[·]-[·][·] notes for the initial interest period will be determined on [·] [·], 20[·] by reference to a straight-line interpolation—based on the actual number of days in the initial interest period—between [·] and [·] LIBOR.] |

| Interest on these Class 201[·]-[·][·] notes will accrue from [·] and will be calculated on the basis of the actual number of days in the year divided by a 360-day year. |

3

Table of Contents

| The LIBOR rate for each interest period will be determined by the issuance trust two business days before the beginning of that interest period. For purposes of determining LIBOR, a business day is any day on which dealings in deposits in U.S. dollars are transacted in the London interbank market. The applicable LIBOR rate will be the rate for deposits in U.S. dollars for the applicable interest period which appears on the Reuters Screen LIBOR01 Page (successor to Telerate Page 3750)—or any other page as may replace that page on that service or any successor service for the purpose of displaying comparable rates or prices—as of 11:00 a.m., London time, on that date. |

| If the LIBOR rate does not appear on the Reuters Screen LIBOR01 Page (successor to Telerate Page 3750)—or any other page as may replace that page on that service or any successor service for the purpose of displaying comparable rates or prices—the LIBOR rate for the applicable interest period will be determined on the basis of the rate at which deposits in U.S. dollars are offered by four major banks in the London interbank market, selected by the issuance trust, at approximately 11:00 a.m., London time, on that day to prime banks in the London interbank market for the applicable interest period. |

| The issuance trust will request the principal London office of each reference bank to provide a quotation of its LIBOR rate for the applicable interest period. If at least two quotations are provided as requested, the applicable LIBOR rate will be the arithmetic mean of the quotations. If fewer than two quotations are provided as requested, the applicable LIBOR rate will be the arithmetic mean of the rates quoted by major banks in New York City, selected by the issuance trust, at approximately 11:00 a.m., New York City time, on that day for loans in U.S. dollars to leading European banks for the applicable interest period. |

| The payment of accrued interest on a class of notes of the Citiseries from finance charge collections is not senior to or subordinated to payment of interest on any other class of notes of the Citiseries. |

4

Table of Contents

| The issuance trust will make interest payments on these Class 201[·]-[·][·] notes on the [·] day of each [month or list specific month[s] depending on interest payment frequency], beginning [·]. Interest payments due on a day that is not a business day in New York and South Dakota will be made on the following business day. |

| Principal |

The issuance trust expects to pay the stated principal amount of these Class 201[·]-[·][· ] notes in one payment on [·] [·], 20[·], which is the expected principal payment date, and is obligated to do so if funds are available for that purpose. However, if the stated principal amount of these Class 201[·]-[·][·] notes is not paid in full on the expected principal payment date, noteholders will not have any remedies against the issuance trust until [·] [·], 20[·], the legal maturity date of these Class 201[·]-[·][· ] notes. |

| If the stated principal amount of these Class 201[·]-[·][·] notes is not paid in full on the expected principal payment date, then subject to the principal payment rules described below under “Subordination,” principal and interest payments on these Class 201[·]-[· ][·] notes will be made monthly until they are paid in full or the legal maturity date occurs, whichever is earlier. However, if the nominal liquidation amount of these Class 201[·]-[·][·] notes has been reduced, the amount of principal collections and finance charge collections available to pay principal of and interest on these Class 201[·]-[·][·] notes will be reduced. The nominal liquidation amount of a class of notes corresponds to the portion of the invested amount of the collateral certificate that is allocable to support that class of notes. |

| The initial nominal liquidation amount of these Class 201[·]-[·][·] notes is $[·]. If this amount is reduced [by reallocations of principal of these Class [B][C] notes to pay interest on a senior class, or] as a result of charge-offs to the principal receivables in the master trust, and not reimbursed as described in this prospectus, not all of the principal of these Class 201[·]-[·][·] notes will be repaid. For a more detailed discussion of nominal liquidation amount, see “The Notes—Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount of Notes” in this prospectus. |

5

Table of Contents

| Principal of these Class 201[·]-[·][·] notes may be paid earlier than the expected principal payment date if an early redemption event or an event of default occurs with respect to these notes. See “Covenants, Events of Default and Early Redemption Events—Early Redemption Events” and “—Events of Default” in this prospectus. |

| If principal payments on these Class 201[·]-[·][·] notes are made earlier or later than the expected principal payment date, the monthly principal date for principal payments will be the [·] day of each month, or if that day is not a business day, the following business day. |

[the following heading will

be

included only in prospectuses for

Class A subclasses]

| Monthly Accumulation Amount |

$[·]. This amount is one-twelfth of the initial dollar principal amount of these Class 201[·]-A[·] notes, and is targeted to be deposited in the principal funding subaccount for these Class 201[·]-A[·] notes each month beginning with the twelfth month before the expected principal payment date of these Class 201[·]-A[·] notes. This amount will be increased if the date for beginning the budgeted deposits is postponed, as described under “Deposit and Application of Funds—Targeted Deposits of Principal Collections to the Principal Funding Account—Budgeted Deposits” in this prospectus. |

| [Outstanding Dollar Principal Amount] |

$[·]. [Include only for foreign currency notes.] |

| Subordination; [Credit Enhancement] |

No payment of principal will be made on any Class B note of the Citiseries[, including these Class 201[·]-B[·] notes,] unless, following the payment, the remaining available subordinated amount of Class B notes of this series is at least equal to the required subordinated amount for the outstanding Class A notes of this series. |

| Similarly, no payment of principal will be made on any Class C note of the Citiseries[, including these Class 201[·]-C[·] notes,] unless, following the payment, the remaining available subordinated amount of Class C |

6

Table of Contents

| notes of this series is at least equal to the required subordinated amounts for the outstanding Class A notes and Class B notes of this series. However, there are some exceptions to this rule. See “The Notes—Subordination of Principal” and “Deposit and Application of Funds—Limit on Repayments of Subordinated Classes of Multiple Issuance Series” in this prospectus. |

| [The maximum amount of principal of Class B notes of the Citiseries that may be applied to provide subordination protection to these Class 201[·]-A[·] notes is $[·] ([·]% of the initial principal amount of these Class 201[·]-A[·] notes). The maximum amount of principal of Class C notes of the Citiseries that may be applied to provide subordination protection to these Class 201[·]-A[·] notes is $[·] ([·]% of the initial principal amount of these Class 201[·]-A[·] notes). This amount of principal of Class C notes may also be applied to provide subordination protection to the Class B notes of the Citiseries.] [This language is only for issuance of Class A subclasses.] |

| [At least $[·] of principal of Class C notes of the Citiseries must be outstanding and available to provide subordination protection to these Class 201[·]-B[·] notes at the time these Class 201[·]-B[·] notes are issued. The maximum amount of principal of Class C notes that may be applied to provide subordination protection to these Class 201[·]-B[·] notes is $[·]. This amount of principal of Class C notes may also be applied to provide subordination protection to the Class A notes of the Citiseries. However, that maximum amount of Class C notes may not be outstanding unless they are required to be issued to provide subordination protection for Class A notes of the Citiseries. See “The Notes—Issuances of New Series, Classes and Subclasses of Notes—Required Subordination Protection in Multiple Issuance Series” and “—Required Subordinated Amount” in this prospectus.] [This language is only for issuances of Class B subclasses.] |

| [The principal of these Class C notes may be applied to provide subordination protection to the Class A notes and Class B notes of the Citiseries.] [This language is only for issuance of Class C subclasses.] |

7

Table of Contents

| The issuance trust may at any time change the amount of subordination required or available for any class of notes of the Citiseries, [including these Class 201[·]-[· ][·] notes], or the method of computing the amounts of that subordination without the consent of any noteholders so long as the issuance trust has received confirmation from the rating agencies that have rated any outstanding notes of the Citiseries that the change will not result in the rating assigned to any outstanding notes of the Citiseries to be withdrawn or reduced, and the issuance trust has received the tax opinions described in “The Notes—Required Subordinated Amount” in this prospectus. |

| [See “Deposit and Application of Funds” in this prospectus for a description of the subordination protection of these Class 201[·]-[·][·] notes.] |

[the following heading will be

included

only in prospectuses for Class C subclasses]

| [Class C Reserve Account |

The issuance trust will establish an unfunded Class C reserve subaccount to provide credit enhancement solely for the holders of these Class 201[·]-C[·] notes. The Class C reserve subaccount will not be funded unless and until surplus finance charge collections fall below the levels described in the table below or an early redemption event or event of default occurs. For a discussion of surplus finance charge collections, see the definition of “Surplus Finance Charge Collections” in the glossary to this prospectus. |

| The Class C reserve subaccount will be funded each month, as necessary, from finance charge collections allocated to the collateral certificate that month after payment of fees and expenses of the master trust servicer and the indenture trustee, targeted deposits to the interest funding account, reimbursement of charge-offs of principal receivables in the master trust that are allocated to the collateral certificate and reimbursement of any deficits in the nominal liquidation amounts of the notes. |

In addition, if a new issuance of notes of the Citiseries results in an increase in the funding deficit of the Class C

8

Table of Contents

reserve subaccount, the issuance trust will make a cash deposit to the Class C reserve subaccount in the amount of that increase. See “The Notes—Issuances of New Series, Classes and Subclasses of Notes” in this prospectus.

| Funds on deposit in the Class C reserve subaccount will be available to holders of these Class 201[·]-C[·] notes to cover shortfalls of interest payable on interest payment dates. Funds on deposit in the Class C reserve subaccount will also be available to holders of these Class 201[·]-C[·] notes on any day when principal is payable, but only to the extent that the nominal liquidation amount of these Class 201[·]-C[·] notes plus other funds being held by the indenture trustee for payment of principal to holders of these Class 201[·]-C[·] notes is less than the outstanding dollar principal amount of these Class 201[·]-C[·] notes. The nominal liquidation amount of a class of notes corresponds to the portion of the invested amount of the collateral certificate that is allocable to support that class of notes. |

| No funds will be deposited into the Class C reserve subaccount on the date these Class 201[·]-C[·] notes are issued. The Class C reserve subaccount will be funded if surplus finance charge collections fall below the levels described below. The left column of the table below gives the level of surplus finance charge collections, expressed as a percentage of principal receivables in the master trust allocable to the collateral certificate. The right column gives the percentage of the aggregate outstanding dollar principal amount of notes of the Citiseries that, when multiplied by the ratio which the nominal liquidation amount of these Class 201[·]-C[·] notes bears to the aggregate nominal liquidation amount of all Class C notes of the Citiseries, will be required to be deposited in the Class C reserve subaccount. |

| Percentage of surplus finance charge collections, averaged over the three most recent months |

Percentage of aggregate outstanding dollar principal amount of notes of the Citiseries |

|||

| The amount targeted to be in the Class C reserve subaccount will be adjusted monthly to the percentages |

9

Table of Contents

| specified in the table as the surplus finance charge collections rise and fall. If an early redemption event or event of default occurs with respect to these Class 201[·]-C[·] notes, the targeted Class C reserve subaccount amount will be the greater of [·] % of the aggregate outstanding dollar principal amount of notes of the Citiseries and $[·], multiplied by the ratio which the nominal liquidation amount of these Class 201[·]-C[·] notes bears to the aggregate nominal liquidation amount of all Class C notes of the Citiseries. |

| See “Deposit and Application of Funds—Targeted Deposits to the Class C Reserve Account” in this prospectus.” |

| Monthly reports concerning the performance of the credit card receivables in the master trust will be filed with the Securities and Exchange Commission. The level of surplus finance charge collections will be included in these publicly-available reports.] |

[the following heading will be included

only in prospectuses with interest

rate swaps]

| The Interest Rate Swap |

In order to manage interest rate risk, the issuance trust intends to enter into an interest rate swap with [·], a [·], as swap counterparty. [The swap counterparty provides a wide range of business and banking services, including [·]]. The swap counterparty is rated “[·]” or its equivalent by [at least [·] nationally recognized rating [agency][agencies]]. [If the swap counterparty is Citibank, N.A., include the following: The swap counterparty is the sole owner of the beneficial interest in the issuance trust.] |

| The interest rate swap will have a notional amount equal to the outstanding dollar principal amount of these Class 201[·]-[·][·] notes and will terminate on the expected principal payment date of these Class 201[·]-[·][·] notes. |

| Under the interest rate swap, the issuance trust will pay interest monthly to the swap counterparty on the notional amount [at a fixed rate of [·]%][based on a floating rate |

10

Table of Contents

| of interest equal to [·]-month LIBOR plus a margin of 0.[·]% per annum] and the swap counterparty will pay interest monthly to the issuance trust on the notional amount based on the rate of interest applicable to these Class 201[·]-[·][·] notes. |

| The issuance trust’s net swap payments will be paid out of funds available in the interest funding subaccount for these Class 201[·]-[·][·] notes. Net swap receipts from the swap counterparty will be deposited into the interest funding subaccount for these Class 201[·]-[·][·] notes and will be available to pay interest on these Class 201[·]-[·][·] notes. |

| Neither a rating downgrade or a default by the swap counterparty nor a termination of the interest rate swap will constitute an early redemption event or an event of default with respect to these Class 201[·]-[·][·] notes, nor affect the obligation of the issuance trust to apply interest and principal on the Class 201[·]-[·][·] notes. |

| Based on a reasonable good faith estimate of maximum probable exposure, the significance percentage of the interest rate swap is [less than 10%][[·]%]. |

| [If the significance percentage of the interest rate swap is 10% or more, but less than 20%, include selected financial data complying with Item 1115(b)(1) of Regulation AB in this prospectus.] |

| [If the significance percentage of the interest rate swap is 20% or more, include financial statements complying with Item 1115(b)(2) of Regulation AB in this prospectus.] |

| Optional Redemption by the Issuance Trust |

The issuance trust has the right, but not the obligation, to redeem these Class 201[·]-[·][· ] notes in whole but not in part on any day on or after the day on which the aggregate nominal liquidation amount of these Class 201[·]-[·][·] notes is reduced to less than 5% of its initial dollar principal amount. This repurchase option is referred to as a clean-up call. [However, the issuance trust will not redeem subordinated notes[, including these |

11

Table of Contents

| Class 201[·]-B[·] notes,] [, including these Class 201[·]-C[·] notes,] if those notes are required to provide subordination protection for senior classes of notes of the Citiseries.] |

| If the issuance trust elects to redeem these Class 201[·]-[·][·] notes, it will notify the registered holders of the redemption at least 30 days prior to the redemption date. The redemption price of a note so redeemed will equal 100% of the outstanding dollar principal amount of that note, plus accrued but unpaid interest on the note to but excluding the date of redemption. |

| If the issuance trust is unable to pay the redemption price in full on the redemption date, monthly payments on these Class 201[·]-[·][·] notes will thereafter be made[, subject to the principal payment rules described above under “Subordination[;Credit Enhancement],”] until the outstanding dollar principal amount of these Class 201[·]-[·][·] notes, plus all accrued and unpaid interest, is paid in full or the legal maturity date occurs, whichever is earlier. Any funds in the principal funding subaccount and interest funding subaccount [and Class C reserve subaccount] for these Class 201[·]-[· ][·] notes will be applied to make the principal and interest payments on these Class 201[·]-[·][·] notes on the redemption date. |

| Security for the Notes |

These Class 201[·]-[· ][·] notes are secured by a shared security interest in the collateral certificate and the collection account, but are entitled to the benefits of only that portion of those assets allocated to them under the indenture. These Class 201[·]-[·][·] notes are also secured by a security interest in the applicable principal funding subaccount and the applicable interest funding subaccount[, payments received from the swap counterparty under the interest rate swap,] [and the applicable Class C reserve subaccount]. See “Sources of Funds to Pay the Notes—The Collateral Certificate” and “—The Trust Accounts” in this prospectus. |

12

Table of Contents

| Limited Recourse to the Issuance Trust |

The sole source of payment for principal of or interest on these Class 201[·]-[·][·] notes is provided by: |

| • | the portion of the principal collections and finance charge collections received by the issuance trust under the collateral certificate and available to these Class 201[·]-[·][·] notes after giving effect to all allocations and reallocations; and |

| • | funds in the applicable trust accounts for these Class 201[·]-[·][·] notes; [and |

| • | payments received from the swap counterparty under the interest rate swap.] |

| Class 201[·]-[·][·] noteholders will have no recourse to any other assets of the issuance trust or any other person or entity for the payment of principal of or interest on these Class 201[·]-[·][·] notes. |

| Master Trust Assets and Receivables |

The collateral certificate, which is the issuance trust’s primary source of funds for the payment of principal of and interest on all of the notes issued by the issuance trust, including these 201[·]-[· ][·] notes, is an investor certificate issued by Citibank Credit Card Master Trust I. The collateral certificate represents an undivided interest in the assets of the master trust. The master trust assets include credit card receivables from selected MasterCard, VISA and American Express revolving credit card accounts that meet the eligibility criteria for inclusion in the master trust. These eligibility criteria are discussed in this prospectus under “The Master Trust—Master Trust Assets.” |

| The credit card receivables in the master trust consist of principal receivables and finance charge receivables. Principal receivables include amounts charged by cardholders for merchandise and services and amounts advanced to cardholders as cash advances. Finance charge receivables include periodic finance charges, annual membership fees, cash advance fees, late charges and some other fees billed to cardholders, as well as amounts representing a discount from the face amount of principal receivables. |

13

Table of Contents

| The aggregate amount of credit card receivables in the master trust as of [·] [·], 20[·] was $[·], of which $[·] were principal receivables and $[·] were finance charge receivables. Citibank may from time to time execute substantial lump removals of credit card receivables in excess of the required seller’s interest (as determined by the pooling and servicing agreement and the rating agencies). See “The Master Trust Receivables and Accounts” in Annex I of this prospectus for more detailed financial information on the receivables and the accounts. |

| In addition: |

| • | Citibank may at its option designate additional credit card accounts to the master trust, and the receivables arising in those accounts will then be transferred daily to the master trust. |

| • | If the amount of receivables in the master trust falls below a required minimum amount, Citibank is required to designate additional accounts to the master trust. |

| • | Citibank may also designate newly originated accounts to the master trust. The number of newly originated accounts that may be designated to the master trust is limited to quarterly and yearly maximums. |

| • | Citibank may remove receivables from the master trust by ending the designation of the related account to the master trust. |

| All additions and removals of accounts are subject to additional conditions. See “The Master Trust—Master Trust Assets” in this prospectus for a fuller description. |

| The Citiseries |

As of [·] [·], 20[·], there were [·] subclasses of notes of the Citiseries outstanding, with an aggregate outstanding dollar principal amount of $[·], consisting of: |

| Class A notes $[·] |

| Class B notes $[·] |

| Class C notes $[·] |

14

Table of Contents

| As of [·] [·], 20[·], the weighted average interest rate payable by the issuance trust in respect of the outstanding subclasses of notes of the Citiseries was [·]% per annum, consisting of: |

| Class A notes [·]% per annum |

| Class B notes [·]% per annum |

| Class C notes [·]% per annum |

| The weighted average interest rate calculation takes into account: |

| • | the actual rate of interest in effect on floating rate notes at the time of calculation; and |

| • | all net payments to be made or received under performing derivative agreements. |

| No series of issuance trust notes other than the Citiseries is currently outstanding. |

| For a list and description of each outstanding subclass of notes of the Citiseries, see the issuance trust’s monthly reports filed with the Securities and Exchange Commission on Form 10-D. |

| Other Master Trust Series |

The collateral certificate is a certificate of beneficial ownership issued by the master trust. Pursuant to an amended and restated supplement to the pooling and servicing agreement dated May 1, 2009, as amended and restated as of August 9, 2011, as further amended as of July 10, 2012, the master trust issued a new certificate of beneficial interest—the Series 2009 certificate—to the seller in order to provide credit enhancement to the collateral certificate and the notes. The Series 2009 certificate has a fluctuating principal amount which will generally equal 7.66865% of the invested amount of the collateral certificate (which equals the aggregate nominal liquidation amount of all of the issuance trust’s notes). For a description of the Series 2009 certificate, see “The Master Trust—The Series 2009 Certificate” in this prospectus. |

| In addition to the collateral certificate and the Series 2009 certificate, other master trust certificates may be issued |

15

Table of Contents

| from time to time. See “The Master Trust—Allocation of Collections, Losses and Fees” in this prospectus. |

| No master trust certificates other than the collateral certificate and the Series 2009 certificate are currently outstanding. |

| Participation with Other Classes of Notes |

Each class of notes of the Citiseries, including these Class 201[·]-[·][·] notes, will be included in “[Group 1].” In addition to the Citiseries, the issuance trust may issue other series of notes that are included in [Group 1]. |

| Collections of finance charge receivables allocable to each class of notes in [Group 1] will be aggregated and shared by each class of notes in [Group 1] pro rata based on the applicable interest rate of each class. See “Deposit and Application of Funds—Allocation to Interest Funding Subaccounts” in this prospectus. Under this system, classes of notes in [Group 1] with high interest rates take a larger proportion of the collections of finance charge receivables allocated to [Group 1] than classes of notes with low interest rates. Consequently, the issuance of later classes of notes with high interest rates can have the effect of reducing the finance charge collections available to pay interest on your notes, or available to reimburse reductions in the nominal liquidation amount of your notes. |

| [Stock Exchange Listing |

Application will be made to the Irish Stock Exchange for these Class 201[·]-[·][·] notes to be admitted to the Official List and trading on its regulated market. The issuance trust cannot guarantee that the application for the listing will be accepted. You should consult with Arthur Cox Listing Services Limited, the Irish listing agent for these Class 201[·]-[·][·] notes, Earlsfort Centre, Earlsfort Terrace, Dublin, Ireland, phone number: 353-1-618-0000, to determine whether these Class 201[·]-[·][·] notes have been listed on the Irish Stock Exchange.] |

| [No Listing |

The Class 201[·]-[· ][·] notes will not be listed on any stock exchange.] |

16

Table of Contents

| Denominations |

These Class 201[·]-[· ][·] notes will be issued in minimum denominations of $[100,000] and multiples of $[1,000] in excess of that amount. |

| Ratings |

The issuance trust will issue these Class 201[·]-[·][·] notes only if they are rated [at least] “[·]” or its equivalent by at least one nationally recognized rating agency. See “Risk Factors—If the ratings of the notes are lowered or withdrawn, or if an unsolicited rating is issued, the market value of the notes could decrease” in this prospectus. Citibank expects at least one nationally recognized rating agency to monitor these Class 201[·]-[·][·] notes as long as they are outstanding. |

17

Table of Contents

This summary does not contain all the information you may need to make an informed investment decision. You should read this prospectus in its entirety before you purchase any notes.

There is a glossary beginning on page [181] where you will find the definitions of some terms used in this prospectus.

| The issuance trust may periodically offer notes in one or more series, class or subclasses. The notes will be issued pursuant to an indenture between the issuance trust and Deutsche Bank Trust Company Americas, as indenture trustee. References to the “notes” in this summary and elsewhere in this prospectus refer to the notes offered by this prospectus, unless the context requires otherwise. |

| The issuance trust is offering only the Class 201[·]-[·][·] notes by means of this prospectus. The Class 201[·]-[·][·] notes are part of the series of notes called the Citiseries. As of the date of this prospectus, the Citiseries is the only issued and outstanding series of the issuance trust. The Class 201[·]-[·][·] notes are a subclass of Class [·] notes of the Citiseries. When issued, the Class 201[·]-[· ][·] notes will be issued by, and obligations of, Citibank Credit Card Issuance Trust. |

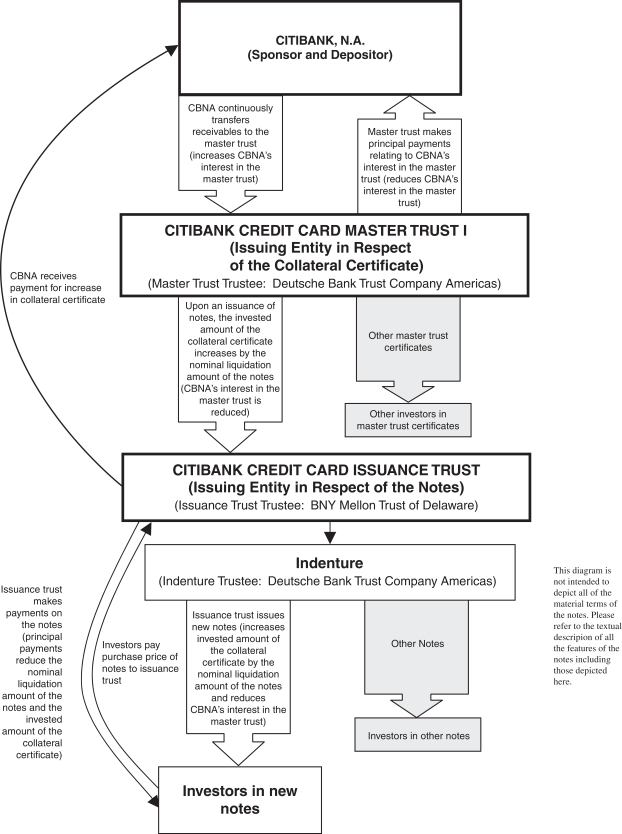

| Citibank Credit Card Issuance Trust, a Delaware statutory trust, is the issuing entity in respect of the notes. The issuance trust’s primary asset is the collateral certificate issued by the master trust. The address of the issuance trust is Citibank Credit Card Issuance Trust, c/o Citibank, N.A., as managing beneficiary, 701 East 60th Street, North, Mail Code 1251, Sioux Falls, South Dakota 57117. Its telephone number is (605) 331-1567. |

| Citibank Credit Card Master Trust I is the issuing entity in respect of the collateral certificate, which is the primary asset of the issuance trust. For a description of the collateral certificate, see “Sources of Funds to Pay the Notes—The Collateral Certificate.” The master trust’s assets consist primarily of credit card receivables arising in a portfolio of revolving credit card accounts. For a description of the master trust, see “The Master Trust.” |

18

Table of Contents

| Citibank, N.A., a national banking association, is the sponsor and depositor of the master trust and the issuance trust. |

| Citibank (South Dakota), National Association and Citibank (Nevada), National Association formed the master trust and the issuance trust, and transferred the credit card receivables to the master trust. On October 1, 2006, Citibank (Nevada) merged with and into Citibank (South Dakota), with Citibank (South Dakota) as the surviving entity. On July 1, 2011, Citibank (South Dakota) merged with and into Citibank, with Citibank as the surviving entity. References to “Citibank” in this summary and elsewhere in this prospectus include Citibank’s predecessors, Citibank (South Dakota) and Citibank (Nevada), unless the context requires otherwise. |

| Citibank is the manager of the issuance trust, and is responsible for making determinations with respect to the issuance trust and allocating funds received by the issuance trust. Citibank does not receive a fee for its activities as manager of the issuance trust. |

| Citibank is the servicer of the credit card accounts and the master trust, and is responsible for servicing, managing and making collections on the credit card receivables in the master trust, and making determinations with respect to the master trust and allocating funds received by the master trust. For each series of master trust investor certificates, the servicer receives monthly compensation equal to 0.37% per annum of the invested amount of the investor certificates of that series so long as Citibank or an affiliate is the servicer, or 0.77% per annum if there is a different servicer, plus, the investor certificateholders’ portion of finance charge collections that is attributable to interchange up to a maximum amount equal to 1.50% per annum of the invested amount of the investor certificates of that series. The servicer’s fee is paid from finance charge collections allocated to each series of master trust certificates before the finance charge collections are allocated to the collateral certificate or the notes. |

19

Table of Contents

| Deutsche Bank Trust Company Americas, a New York banking corporation, is the trustee of the master trust under the pooling and servicing agreement and the trustee under the indenture for the notes. See “The Master Trust Trustee” and “The Indenture Trustee.” |

| BNY Mellon Trust of Delaware, a Delaware banking corporation, is the trustee of the issuance trust. Under the terms of the trust agreement that established the issuance trust, the role of the issuance trust trustee is limited. See “The Issuance Trust Trustee.” |

| [Name of Asset Representations Reviewer]. See “The Issuance Trust—[Name of Asset Representations Reviewer].” |

| The notes will be issued in series. Each series will be either a single issuance series or a multiple issuance series. |

| Single Issuance Series. A single issuance series is a series of notes consisting of three classes, Class A, Class B and Class C, issued on or about a single date. The expected principal payment dates and legal maturity dates of the subordinated classes of a single issuance series will either be the same as or later than those of the senior classes of that series. No new notes will be issued as part of a single issuance series after the initial issuance date. |

| The subordinated notes of a single issuance series provide subordination only to the senior notes of that series. |

| Multiple Issuance Series. A multiple issuance series is a series of notes consisting of three classes: Class A, Class B and Class C. Each class may consist of multiple subclasses. These Class 201[·]-[·][·] notes are a subclass of the Citiseries Class [·] notes. The Citiseries is a multiple issuance series. Notes of any subclass can be issued on any date so long as there are enough outstanding subordinated notes to provide the necessary subordination protection for outstanding and newly issued senior notes. See “The Notes—Issuances of New Series, Classes and Subclasses of Notes.” The expected principal payment |

20

Table of Contents

| dates and legal maturity dates of the senior and subordinated classes of a multiple issuance series may be different, and subordinated notes may have expected principal payment dates and legal maturity dates earlier than some or all senior notes of the same series. |

| Subordinated notes will not be paid before their legal maturity date, unless, after payment, the remaining subordinated notes provide the required amount of subordination protection for the senior notes of that series. |

| All of the subordinated notes of a multiple issuance series provide subordination protection to the senior notes of that series to the extent of the required subordinated amount of the senior notes of that series, regardless of whether the subordinated notes are issued before, at the same time as, or after the senior notes of that series. |

| [These Class 201[·]-[·][·] notes will accrue interest at a per annum rate equal to the [·]-month LIBOR rate for U.S. dollar deposits for the applicable interest period [plus][minus] a margin of [·].[·]%. However, the interest rate for these Class 201[·]-[·][·] notes for the initial interest period will be determined on [·] [·], [201·] by reference to a straight-line interpolation—based on the actual number of days in the initial interest period—between [·]-month and [·]-month LIBOR.] |

| Interest on these Class 201[·]-[·][·] notes will accrue from the issuance date and will be calculated on the basis of the actual number of days in the year divided by a 360-day year. |

| The LIBOR rate for each interest period will be determined by the issuance trust two business days before the beginning of that interest period. For purposes of determining LIBOR, a business day is any day on which dealings in deposits in U.S. dollars are transacted in the London interbank market. The applicable LIBOR rate will be the rate for deposits in U.S. dollars for the applicable interest period which appears on the Reuters Screen LIBOR01 Page (successor to Telerate Page 3750)—or any other page as may replace that page on that service or any successor service for the purpose of displaying comparable rates or prices—as of 11:00 a.m., London time, on that date. |

21

Table of Contents

| If the LIBOR rate does not appear on the Reuters Screen LIBOR01 Page (successor to Telerate Page 3750)—or any other page as may replace that page on that service or any successor service for the purpose of displaying comparable rates or prices—the LIBOR rate for the applicable interest period will be determined on the basis of the rate at which deposits in U.S. dollars are offered by four major banks in the London interbank market, selected by the issuance trust, at approximately 11:00 a.m., London time, on that day to prime banks in the London interbank market for the applicable interest period. |

| The issuance trust will request the principal London office of each reference bank to provide a quotation of its LIBOR rate for the applicable interest period. If at least two quotations are provided as requested, the applicable LIBOR rate will be the arithmetic mean of the quotations. If fewer than two quotations are provided as requested, the applicable LIBOR rate will be the arithmetic mean of the rates quoted by major banks in New York City, selected by the issuance trust, at approximately 11:00 a.m., New York City time, on that day for loans in U.S. dollars to leading European banks for the applicable interest period. |

| The issuance trust will make interest payments on these Class 201[·]-[·][·] notes on the [·] day of each month, beginning [·] [·], [·]. Interest payments due on a day that is not a business day in New York and South Dakota will be made on the following business day. The payment of accrued interest on a class of notes of the Citiseries from finance charge collections is not senior to or subordinated to payment of interest on any other class of notes of the Citiseries. |

| [These Class A notes will accrue interest at the rate of [·].[·]% per annum. Interest on these Class A notes will accrue from the issuance date and will be calculated on the basis of a 360-day year of twelve 30-day months. The issuance trust will make interest payments on these Class 201[·]-[·][·] notes on the [·] day of each [·] and [·], beginning [·], [201·]. If an event of default or early redemption event occurs with respect to these Class 201[·]-[·][·] notes, or if these Class 201[·]-[·][·] |

22

Table of Contents

| notes are not paid in full on the expected principal payment date, the issuance trust will begin making interest payments on the [·] day of every month. Interest payments due on a day that is not a business day in New York and South Dakota will be made on the following business day. The payment of accrued interest on a class of notes of the Citiseries from finance charge collections is not senior to or subordinated to payment of interest on any other class of notes of the Citiseries.] |

| The issuance trust expects to pay the stated principal amount of each Class 201[·]-[·][· ] note in one payment on its expected principal payment date. The expected principal payment date of a note is two years before its legal maturity date. The legal maturity date is the date on which a note is legally required to be fully paid. The expected principal payment date and legal maturity date for the Class 201[·]-[·][· ] notes are specified on the cover of this prospectus. |

| The issuance trust is obligated to pay the stated principal amount of each Class 201[·]-[·][·] note on its expected principal payment date specified on the cover page of this prospectus, or upon the occurrence of an early redemption event or event of default only to the extent that funds are available for that purpose and, in the case of subordinated notes [like the Class 201[·]-[B][C] notes], that payment is permitted by the subordination provisions of the senior notes of the same Citiseries. The remedies a noteholder may exercise following an event of default and acceleration or on the legal maturity date are described in “Covenants, Events of Default and Early Redemption Events—Events of Default” and “Deposit and Application of Funds—Sale of Credit Card Receivables.” |

| • | Stated Principal Amount. The stated principal amount of a note is the amount that is stated on the |

23

Table of Contents

| face of the note to be payable to the holder. It can be denominated in U.S. dollars or a foreign currency. |

| • | Outstanding Dollar Principal Amount. For U.S. dollar notes, the outstanding dollar principal amount will be the same as the stated principal amount, less principal payments to noteholders. For foreign currency notes, the outstanding dollar principal amount will be the U.S. dollar equivalent of the stated principal amount of the notes at the time of issuance, less dollar payments to derivative counterparties with respect to principal. |

| • | Nominal Liquidation Amount. The nominal liquidation amount of a note is a U.S. dollar amount based on the outstanding dollar principal amount of the note, but after deducting |

| — | all reallocations of principal of that note to pay interest on senior classes of notes of the same series; |

| — | allocations of that note’s proportionate share of the charge-offs of principal receivables in the master trust; |

| — | amounts on deposit in the principal funding subaccount for that note after giving effect to all reallocations to or from that subaccount; |

| and adding back all reimbursements, from excess finance charge collections allocated to that note, of reallocations of principal collections to pay interest on senior classes of notes or charge-offs of principal receivables in the master trust. Excess finance charge collections are the finance charge collections that remain after the payment of interest and other required payments under the master trust and with respect to the notes. For more information, see the definition of “Excess Finance Charge Collections” in the glossary. |

| The nominal liquidation amount of a class of notes corresponds to the portion of the invested amount of the collateral certificate that is allocated to support that class of notes. |

24

Table of Contents

| The aggregate nominal liquidation amount of all of the notes is equal to the invested amount of the collateral certificate. The invested amount of the collateral certificate corresponds to the amount of principal receivables in the master trust that is allocated to support the collateral certificate. For a more detailed discussion, see “Invested Amount” in the glossary. Anything that increases or reduces the invested amount of the collateral certificate will also increase or reduce the aggregate nominal liquidation amount of the notes. |

| See page [(vi)] of this prospectus for a diagram that illustrates the relationship of the seller’s interest, the invested amount of the collateral certificate and the nominal liquidation amount of the notes. |

| Upon a sale of credit card receivables held by the master trust directed by a class of notes following an event of default and acceleration, or on that class’s legal maturity date, as described in “Deposit and Application of Funds—Sale of Credit Card Receivables,” the nominal liquidation amount of that class will be reduced to zero. |

| For a detailed discussion of nominal liquidation amount, see “The Notes—Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount of Notes.” |

| Principal payments on the Class B notes of the Citiseries [(including these Class 201[·]-B[·] notes)] are subordinated to payments on the Class A notes of the Citiseries [(including the Class 201[·]-A[·] notes)]. Principal payments on the Class C notes of the Citiseries [(including the Class 201[·]-C[·] notes)] are subordinated to payments on the Class A notes of the Citiseries [(including the Class 201[·]-A[·] notes)] and Class B notes of the Citiseries [(including the Class 201[·]-B[·] notes)]. See “The Notes—Subordination of Principal” and “Deposit and Application of Funds” for a discussion of the extent, manner and limitations of the subordination of Class B and Class C notes. |

25

Table of Contents

| The issuance trust will have the following sources of funds to pay principal and interest on the notes (including the Class 201[·]-[·][·] notes): |

| • | The collateral certificate issued by Citibank Credit Card Master Trust I. The collateral certificate is an investor certificate issued by the master trust to the issuance trust. It represents an undivided interest in the assets of the master trust. The master trust owns primarily credit card receivables arising in selected MasterCard, VISA and American Express revolving credit card accounts. Citibank transfers the credit card receivables to the master trust in accordance with the terms of a pooling and servicing agreement between Citibank, as seller and servicer, and Deutsche Bank Trust Company Americas, as trustee. Both principal collections and finance charge collections on the receivables will, in general, be allocated pro rata among holders of interests in the master trust—including the collateral certificate—based on the investment in credit card receivables of each interest in the master trust. If collections of receivables allocable to the collateral certificate are less than expected, payments of principal of and interest on the notes could be delayed or remain unpaid. |

| • | Derivative Agreements. Some classes of notes may have the benefit of interest rate or currency swaps, caps or collars with various counterparties. Citibank or any of its affiliates may be counterparties to a derivative agreement. [The Class 201[·]-[·][·] notes [do not] have the benefit of an [interest rate] [currency] [swap] [cap] [collar].] |

| • | The Trust Accounts. The issuance trust has established a collection account for the purpose of receiving payments of finance charge collections and principal collections from the master trust payable under the collateral certificate. |

| The issuance trust has also established a principal funding account, an interest funding account and a Class C reserve account. Each one of those accounts will have |

26

Table of Contents

| subaccounts for a class or subclass of notes of a series. With respect to the Class 201[·]-[·][·] notes, there will be a principal funding subaccount [and][,] interest funding subaccount [and a Class C reserve subaccount]. The issuance trust may also establish supplemental accounts for any series, class or subclass of notes. |

| Each month, distributions on the collateral certificate will be deposited into the collection account. Those deposits will then be reallocated to |

| • | the principal funding account; |

| • | the interest funding account; |

| • | the Class C reserve account; |

| • | any supplemental account; |

| • | payments under any applicable derivative agreements; and |

| • | the other purposes as specified in “Deposit and Application of Funds.” |

| Funds on deposit in the principal funding account and the interest funding account will be used to make payments of principal of and interest on the notes. |

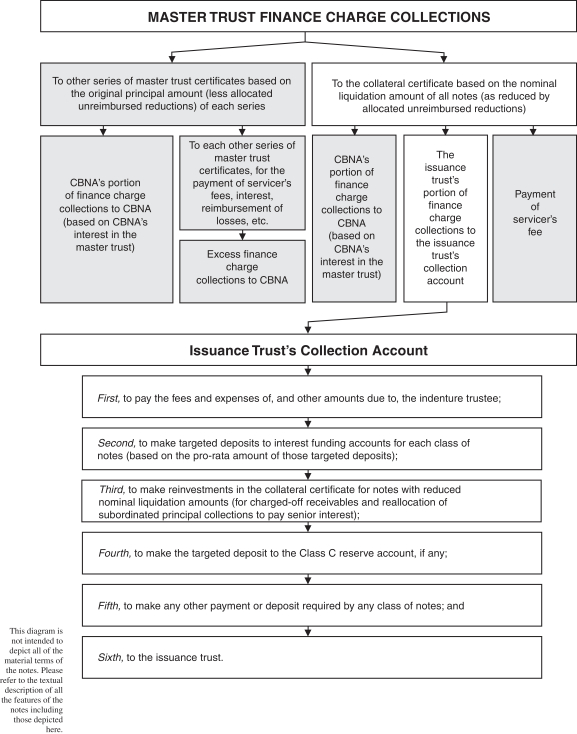

Allocations of Finance Charge Collections

| Finance charge collections allocable to the collateral certificate are applied as follows: |

| • | first, to pay the fees and expenses of, and other amounts due to, the indenture trustee; |

| • | second, to pay interest on notes or to make payments under any applicable derivative agreements; |

| • | third, to reimburse certain reductions in the nominal liquidation amount of notes; |

| • | fourth, to make deposits to the Class C reserve account; |

| • | fifth, to make any other required payment or deposit; and |

| • | sixth, to the issuance trust. |

27

Table of Contents

| See “Deposit and Application of Funds—Allocation of Finance Charge Collections to Accounts” for a fuller description of the application of finance charge collections, and Annex III to this prospectus for a diagram of the allocation of finance charge collections. |

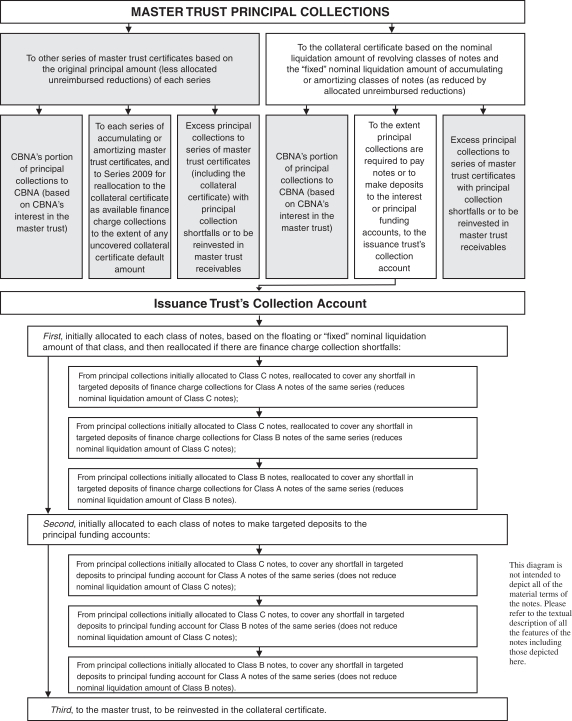

| Principal collections allocable to the collateral certificate are applied as follows: |

| • | first, from principal collections that would be allocated to subordinated classes of notes, to pay any interest on senior classes of notes that cannot be paid from finance charge collections; |

| • | second, to make targeted deposits to the principal funding account; and |

| • | third, to the master trust, to be reinvested in the collateral certificate. |

| See “Deposit and Application of Funds—Allocation of Principal Collections to Accounts” for a fuller description of the application of principal collections, and Annex IV to this prospectus for a diagram of the allocation of principal collections. |

| The Class C reserve account will initially not be funded. If the finance charge collections generated by the master trust fall below a level specified [under “The Class 201[·]-[· ][·] Notes—Summary of Terms” in the prospectus][in the prospectus relating to a subclass of the Class C notes], the Class C reserve account will be funded as described under “Deposit and Application of Funds—Targeted Deposits to the Class C Reserve Account.” |