Exhibit 99.1

|

News Announcement

|

|

Conference Call, Webcast & Management PowerPoint Presentation

Conference Call: Friday, November 16, 2012 at 8:30 a.m. ET

Dial-in number: 212/271-4657

Webcast: www.pngaming.com (select “Investors” / “Events”)

Presentation: www.pngaming.com (select “Investors” / “Presentations”)

Replay details provided below

|

CONTACT: |

|

|

William J. Clifford |

Joseph N. Jaffoni, Richard Land |

|

Chief Financial Officer |

JCIR |

|

610/373-2400 |

212/835-8500 or penn@jcir.com |

PENN NATIONAL GAMING ANNOUNCES INTENT TO PURSUE THE

SEPARATION OF ITS REAL ESTATE ASSETS FROM ITS OPERATING ASSETS

- First Gaming Company to Split its Businesses into Two Separate Publicly

Traded Companies, a Gaming Focused REIT and a Gaming Operator -

- REIT Would Own 17 Casino Facilities Encompassing Over 3,200 Acres of Land,

6.9 Million Square Feet of Building Space and 20,000 Structured Parking Spaces -

- Establishes 2013 Full Year Guidance for Penn National Gaming as well as

Pro Forma Guidance for the Operating Entity, Penn National Gaming,

and Publicly Traded Real Estate Investment Trust -

Wyomissing, Penn., (November 15, 2012) — Penn National Gaming, Inc. (PENN: Nasdaq) (“PENN”) announced today that it intends to pursue a plan to separate its gaming operating assets and real property assets into two publicly traded companies including an operating entity, Penn National Gaming (“PNG”), and, through a tax-free spin-off of its real estate assets to holders of PENN common stock, a newly formed, publicly traded real estate investment trust (“REIT”) (“PropCo”), subject to required gaming regulatory body approvals.

HIGHLIGHTS

· Creation of the first gaming focused REIT

· Initially, rent will equal approximately $450 million, which represents approximately half of PNG’s projected 2013 adjusted EBITDA

· Through a tax-free dividend, PENN shareholders will receive PropCo common stock. PropCo will subsequently declare a taxable dividend of approximately $1.4 billion of accumulated earnings and profits equivalent to approximately $15.40 per PENN share comprised of approximately $487 million of cash, or an approximately $5.35 cash dividend per PENN share, with the remainder comprised of PropCo shares

· PropCo shareholders to be entitled to ordinary dividend which, based on pro forma 2013 guidance, would be $2.36 per PENN share

· Non-binding agreement reached to exchange $975 million of Series B Redeemable Preferred Stock (“Preferred Stock”) at $67 per share into approximately 14.6 million non-voting PENN common shares or equivalents

· Exchange will reduce PENN diluted common shares outstanding by approximately 7.1 million shares

· Following the exchange, PENN has the right to purchase up to an estimated $417.5 million of the non-voting PENN common stock or equivalents (approximately 6.2 million of the 14.6 million non-voting PENN common shares or equivalents at $67 per share) which may reduce PENN diluted common shares outstanding by up to approximately 6.2 million additional shares

· PENN has received a Private Letter Ruling from the IRS with respect to certain tax matters regarding the transaction and the qualification of PropCo as a REIT

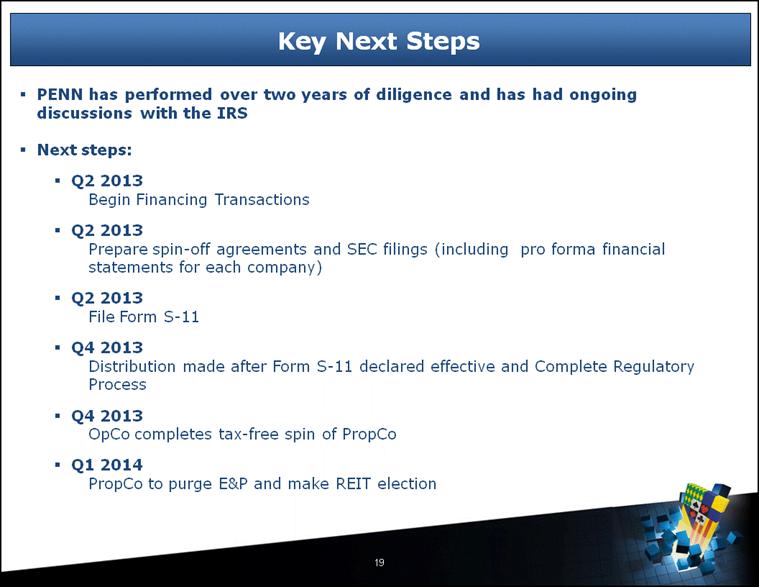

· Spin-off of PropCo shares to PENN shareholders expected to occur in the second half of 2013 with REIT election effective by January of 2014

TRANSACTION DETAILS

Under the plan, PropCo will initially own substantially all of PENN’s real property assets and will lease back most of those assets to PNG for use by its subsidiaries, under a “triple net” 35 year Master Lease agreement (including extensions). It is expected that PNG would pay approximately $450 million to PropCo in rent, which would result in a rent coverage ratio of approximately 2.0 times earnings before interest, taxes, depreciation, amortization and rent (“EBITDAR”). After the proposed separation, PNG would operate the leased gaming facilities and own and operate other assets, which include a casino management contract, a 50% joint venture interest in Hollywood Casino at Kansas Speedway, gaming licenses, seven non-casino racetracks and gaming equipment.

Based on PENN’s current real estate portfolio, PropCo is expected to initially own 17 casino facilities, which have a total of over 3,200 acres of land, 6.9 million square feet of building space and 20,000 structured parking spaces, as well as two new facilities to be constructed in Ohio. Through its rent structure, which is partially based on the performance of the facilities, PropCo would expect to grow organically by participating in PNG’s growing revenue base. In addition, PropCo would

focus on expanding its gaming and leisure sector real estate portfolio through acquisitions, and thereby diversify its asset base and tenant base over time.

After the proposed spin-off of PropCo shares to PENN shareholders, PropCo will declare a dividend to its shareholders to distribute any accumulated earnings and profits attributable to any pre-REIT years to comply with certain REIT qualification requirements. PENN estimates that the dividend will total approximately $1.4 billion. The dividend will be paid in a combination of cash and PropCo stock, which PENN expects will consist of approximately 35% cash and 65% PropCo stock. In addition, going forward, PENN expects that PropCo will distribute at least 90% of its annual taxable income as dividends. Based on pro forma 2013 guidance (provided below), the dividend would be $2.36 per share.

PENN has received a private letter ruling from the Internal Revenue Service (the “IRS”) relating to the tax treatment of the separation and the qualification of PropCo as a REIT. The private letter ruling is subject to certain qualifications and based on certain representations and statements made by PENN. If such representations and statements are untrue or incomplete in any material respect (including as a result of a material change in the proposed transaction or other relevant facts), PENN may not be able to rely on the private letter ruling.

Prior to the spin-off, PENN anticipates refinancing its existing debt obligations and PNG and PropCo are expected to enter into new credit facilities.

Peter M. Carlino, Chairman and Chief Executive Officer of Penn National Gaming commented, “This proposed transaction would be transformational for Penn National and its shareholders and presents a direct path toward unlocking the tremendous value of our real estate asset portfolio. Our plan is to create two well capitalized companies with strong free cash flow that are positioned for growth in the gaming and REIT sectors. The transaction and new ownership structure would permit both companies to best address market and growth opportunities in their respective industries through access to a lower blended cost of capital, fewer regulatory license ownership restrictions, a new capital funding source for the gaming industry by creating an industry specific REIT, and potential opportunities to diversify in the future beyond the gaming industry. The REIT is a highly efficient vehicle for providing consistent and growing income distributions to shareholders as PENN generates substantial and growing free cash flow from existing and future operations.

“The operating entity, PNG, will continue to benefit from its strong and diversified regional presence, proven management team, property development capabilities, strong balance sheet, proven operating discipline, highly regarded Hollywood Casino brand, and robust customer database. PNG will retain its existing growth pipeline while pursuing additional near- and long-term domestic and international growth opportunities that can be highly impactful for its shareholders. In addition, the new structure is expected to allow PNG to operate additional facilities in certain gaming jurisdictions that have ownership limitations.

“We have already begun the process of working with gaming regulators and look forward to updating shareholders on developments related to this value building transaction which is expected to be completed in 2013.”

PENN anticipates filing a registration statement relating to the proposed transaction with the U.S. Securities and Exchange Commission in the second quarter of 2013. The completion of the proposed transaction is contingent on receipt of regulatory approvals, which PENN anticipates could occur over the next nine to twelve months, the receipt of final approval by the Penn National Gaming Board of Directors, execution of definitive documentation and approval of the transaction by certain holders of the Preferred Stock, the receipt of legal and accounting opinions, and other customary conditions. PENN may, at any time and for any reason until the proposed separation is complete, abandon the separation or modify or change the terms of the separation.

RE-ALIGNMENT OF INVESTMENTS BY FORTRESS INVESTMENT GROUP AND CARLINO FAMILY TO SATISFY CERTAIN REIT QUALIFICATION REQUIREMENTS

In general, amounts received by a REIT from any person in which the REIT owns directly, indirectly or constructively 10% or more of the total combined voting power or value do not qualify as “rents from real property” for purposes of the REIT qualification requirements (the “Related-Party Rent Rule”). Absent a re-alignment of the investments by Fortress Investment Group and the Carlino Family, PropCo would be deemed to own constructively 10% or more of the voting power or value of PNG following the spin-off for the purposes of the Related-Party Rent Rule. Although Fortress Investment Group and the Carlino Family have each entered into non-binding agreements to re-align their investments to ensure compliance with the Related-Party Rent Rule, there can be no assurance that they will execute the required definitive agreements.

Fortress Investment Group, owners of approximately $975 million or 79.4% of the outstanding Series B Redeemable Preferred Stock (“Preferred Stock”), has entered into a non-binding agreement to reduce their aggregate interest in PENN prior to the spin-off such that Fortress Investment Group would own in the aggregate less than a 10% interest in PropCo following the spin-off. Pursuant to the non-binding agreement, PENN has agreed with Fortress Investment Group to exchange their Preferred Stock for non-voting PENN common stock or equivalents at a price of $67 per share or 14.6 million non-voting common shares or equivalents. The non-voting common shares or equivalents would convert to PENN voting common shares upon sale to a third party.

Prior to the spin-off, the timing of the exchange into non-voting common shares or equivalents at $67 per share will be at Fortress’ discretion. If Fortress doesn’t fully exercise the exchange right prior to the spin-off, any remaining Preferred Stock will automatically be converted into PENN non-voting common shares or equivalents. The effect of the above would reduce PENN’s diluted share count by at least 7.1 million shares.

Following the exchange, Fortress Investment Group may either divest 6.2 million of the 14.6 million non-voting PENN common shares or equivalents prior to the spin-off, or, if it does not, PENN has the right to repurchase the undisposed shares for $67 per share. This agreement may further reduce PENN’s diluted share count by up to 6.2 million shares. In total, reflecting the exchange and

potential repurchase and assuming Fortress Investment Group does not divest any of its non-voting common shares or equivalents to third parties, PENN would reduce its diluted share count by up to 13.3 million shares.

Current Series B Redeemable Preferred Stock Ownership

($ in millions)

|

Fortress |

|

$ |

975.0 |

|

|

Others |

|

252.5 |

| |

|

Total Preferred Stock |

|

$ |

1,227.5 |

|

Impact on Diluted Share Count of Fortress Agreement to Convert Preferred Stock to PENN Non-Voting Common Shares or Equivalents and Agreement to Repurchase a Portion of Fortress’ Common Stock Ownership

(in millions, except conversion/exchange price)

|

|

|

Impact of |

|

Impact of PENN |

|

Reduction in PENN |

| |||

|

Fortress Preferred Stock Balance |

|

$ |

975.0 |

|

$ |

(417.5 |

) |

$ |

557.5 |

|

|

Conversion/Exchange Price |

|

$ |

67.00 |

|

$ |

67.00 |

|

$ |

67.00 |

|

|

Fortress Holdings of Non-Voting PENN Common Shares or Equivalents Post Exchange |

|

14.6 |

|

(6.2 |

) |

8.4 |

| |||

|

Current Impact of Fortress Preferred Stock Ownership on PENN Diluted Share Count |

|

21.7 |

|

|

|

21.7 |

| |||

|

Reduction in PENN Diluted Share Count |

|

(7.1 |

) |

(6.2 |

) |

(13.3 |

) | |||

(1) Would occur prior to the spin-off.

(2) Would occur if PENN purchases all of Fortress’s shares in excess of 9.9% ownership at $67.00. Such reductions will not occur if Fortress sells the excess shares to a third party.

Holders of the remaining Preferred Stock will have the option to retain their Preferred Stock positions or convert their Preferred Stock to PENN non-voting common shares or equivalents at $67 per share. In the spin-off, holders of Preferred Stock will receive a distribution of PropCo common stock on an as-converted basis at the $67 ceiling price contemplated by the original terms of the Preferred Stock.

The Carlino Family group has agreed to receive a non-pro rata distribution as part of the PropCo spin-off, whereby they would receive additional shares of PropCo stock in the spin-off in exchange for PENN stock, based on the fair value of PENN and PropCo stock. As a result, to ensure compliance with the Related Party Rent Rule, the Carlino Family will re-align their investment so that they would collectively own no more than 9.9% of PNG following the spin-off.

SHAREHOLDERS AND EMPLOYEES

As currently contemplated, PENN common shareholders will receive one share of PropCo stock for every PENN share owned on the record date of the spin-off. PENN employees who currently hold employee stock options in PENN will receive one option in PropCo for every option they own in PENN with no change in the option’s intrinsic value.

PropCo and PNG would have independent executive management teams. Peter M. Carlino, who presently serves as PENN’s Chairman and Chief Executive Officer, would assume those same roles at PropCo and will serve as Chairman of the Board at PNG. Tim Wilmott, who currently serves as President and Chief Operating Officer at PENN, would assume the position and responsibilities of Chief Executive Officer at PNG.

Tim Wilmott commented, “In its eighteen years as a public company, Penn National Gaming has established a proven record for acquiring and developing leading gaming assets, driving efficiencies and generating growing financial results. The transaction creates a structure whereby Penn National Gaming can compete even more effectively for new opportunities including strategic acquisitions and greenfield developments. Penn National Gaming’s customers will continue to enjoy our market leading amenities driven by our employees’ commitment to deliver quality guest services.”

2013 FINANCIAL GUIDANCE FOR PENN NATIONAL GAMING, INC. (PENN)

The following table sets forth guidance targets for 2013 full year financial results, based on the following assumptions:

· Excludes costs associated with the proposed transaction (including tender costs, financing fees and consulting fees, which are estimated to be less than $125 million, with the majority still to be incurred);

· A full year of Harrah’s St. Louis operations (currently being re-branded as Hollywood Casino St. Louis), inclusive of the proposed property tax increase of approximately $7.7 million;

· New video lottery terminal operations in Dayton and Youngstown, Ohio do not open until 2014;

· Horseshoe Cincinnati opens in the first quarter of 2013;

· Operators in Maryland begin offering table games in April of 2013;

· No disruptions to Penn National’s Argosy Casino Sioux City facility arising from the ongoing negotiations with the City of Sioux City or the facility’s charitable sponsor or any related litigation or regulatory proceedings;

· Depreciation and amortization charges in 2012 of $250.0 million and $306.0 million in 2013;

· Estimated non-cash stock compensation expenses of $29.4 million for 2012 and $30.6 million in 2013;

· LIBOR is based on the forward curve;

· A blended 2012 and 2013 income tax rate of 39%;

· A diluted share count of approximately 105.8 million and 107.4 million shares for the full year 2012 and 2013, respectively, which does not assume a reduction of the fully diluted weighted average shares related to the terms of the Preferred Stock if Penn National Gaming’s stock price exceeds $45; and

· There will be no material changes in applicable legislation, regulatory environment, world events, weather, recent consumer trends, economic conditions, or other circumstances beyond our control that may adversely affect the Company’s results of operations.

Penn National Gaming, Inc. (PENN)

|

|

|

Full Year Ending December 31, |

| |||||||

|

(in millions, except per share data) |

|

2013 |

|

2012 |

|

2011 |

| |||

|

Net revenues |

|

$ |

3,201.6 |

|

$ |

2,938.1 |

|

$ |

2,742.3 |

|

|

Adjusted EBITDA (1) |

|

905.1 |

|

741.5 |

|

730.2 |

| |||

|

Less: Impact of stock compensation, insurance recoveries and deductible charges, depreciation and amortization, gain/loss on disposal of assets, interest expense - net, income taxes, loss on early extinguishment of debt, and other expenses |

|

(624.0 |

) |

(514.6 |

) |

(487.8 |

) | |||

|

Net income |

|

$ |

281.1 |

|

$ |

226.9 |

|

$ |

242.4 |

|

|

Diluted earnings per common share |

|

$ |

2.62 |

|

$ |

2.15 |

|

$ |

2.26 |

|

* Penn National Gaming’s 2012 adjusted EBITDA, net income and diluted earnings per share guidance includes Maryland lobbying costs in the 2012 fourth quarter of $23.8 million. The company’s prior guidance disclosed on October 18, 2012 excluded Maryland lobbying costs.

(1) Adjusted EBITDA is income (loss) from operations, excluding the impact of stock compensation, insurance recoveries and deductible charges, depreciation and amortization, and gain or loss on disposal of assets, and is inclusive of gain or loss from unconsolidated affiliates.

PRO FORMA 2013 FINANCIAL GUIDANCE FOR PROPCO REIT

Reflecting the assumptions below and the 2013 financial guidance for PENN above, PropCo is expected to generate adjusted EBITDA of $459.1 million and Adjusted Funds From Operations (AFFO) of $269.2 million:

· PropCo to receive rent payments under the Master Lease equal to approximately $450 million in 2013;

· The rent payments from the Master Lease agreement with PNG, with the exception of Hollywood Casino Toledo and Hollywood Casino Columbus, are fixed for five years. The rent for Hollywood Casino Toledo and Hollywood Casino Columbus is 20% of annual net revenue;

· The planned Dayton and Youngstown video lottery terminal facilities are subject to the Master Lease;

· The Master Lease includes a building rent escalator of 2.0% annually subject to minimum rent coverage of 1.8 times;

· The Master Lease contains standard covenants that are designed prevent either party from taking action that impairs either entity’s financial viability;

· Overhead, including corporate expenses and land lease payments, of approximately $25 million;

· These costs are inclusive of costs pursuant to a two year transition services agreement with PNG;

· PropCo will make a one-time payment of accumulated earnings and profits equivalent to $1.4 billion comprised of cash and stock;

· For a three year period, PropCo will make annual payments of approximately $38.5 million, in lieu of dividends on employee options;

· PropCo expects to establish a capital structure comprised of bank debt and subordinated debt;

· Following the spin-off and after the initial dividend distribution by PropCo, PropCo will have total leverage (total debt to EBITDA) of approximately 5.5x; and

· 95.9 million fully diluted common shares outstanding (for both 2012 and 2013), which excludes the impact of the pro rata share distribution associated with the one-time dividend to

shareholders of accumulated earnings and profits and assumes Fortress sells the exchanged 6.2 million of non-voting common stock to PENN.

PropCo

|

|

|

Full Year Ending December 31, |

| ||||||

|

(in millions, except per share data) |

|

2013 |

|

2012 |

|

% Variance |

| ||

|

Net revenues |

|

$ |

608.3 |

|

$ |

556.2 |

|

9.4 |

% |

|

Adjusted EBITDA (1) |

|

459.1 |

|

376.8 |

|

21.8 |

% | ||

|

Less: Interest Expense and maintenance CAPEX, Option holder payments and income taxes |

|

(189.9 |

) |

(199.6 |

) |

(4.9 |

)% | ||

|

AFFO (2) |

|

269.2 |

|

177.2 |

|

51.9 |

% | ||

|

Less: Impact of stock compensation, depreciation and amortization |

|

|

|

|

|

|

| ||

|

Plus: Add-back of maintenance cap-ex |

|

(157.0 |

) |

(130.6 |

) |

20.2 |

% | ||

|

Net income |

|

$ |

112.2 |

|

$ |

46.6 |

|

140.8 |

% |

|

|

|

|

|

|

|

|

| ||

|

Diluted earnings per common share |

|

$ |

1.17 |

|

$ |

0.49 |

|

138.8 |

% |

|

|

|

|

|

|

|

|

| ||

|

Dividend Per Outstanding Share |

|

$ |

2.36 |

|

$ |

1.56 |

|

51.3 |

% |

(1) Adjusted EBITDA is income (loss) from operations, excluding the impact of stock compensation, insurance recoveries and deductible charges, depreciation and amortization, and gain or loss on disposal of assets, and is inclusive of gain or loss from unconsolidated affiliates.

(2) AFFO, or Adjusted Funds From Operations is net income, excluding gains or losses from sales of property, adding back depreciation and stock compensation expense and subtracting maintenance capex

PRO FORMA 2013 FINANCIAL GUIDANCE FOR PENN NATIONAL GAMING (PNG) POST SPIN-OFF

Reflecting the assumptions below and the 2013 financial guidance for PENN above:

· PNG will generate approximately $432.1 million of EBITDA in 2013;

· PNG’s rent coverage ratio will be approximately 2.0x EBITDAR with actual total leverage (total debt to adjusted EBITDA) of approximately 2.9x and implied total adjusted debt leverage (inclusive of PNG’s obligation under the Master Lease) of 5.5x;

· PNG expects to establish a capital structure comprised of bank debt and subordinated debt;

· All existing outstanding debt of PENN will be redeemed at the consummation of the proposed transaction;

· The $1.2275 billion Preferred Stock will be reduced by $975 million due to the Fortress exchange for common shares. In addition, the guidance assumes Fortress did not divest any of the 6.2 million of the 14.6 million non-voting PENN common shares or equivalents and PENN repurchased them for $67 per share prior to the spin-off to ensure that Fortress’ ownership in PropCo is less than 10%. Centerbridge Partners LP and Wells Fargo Securities, LLC, the holders of the remaining $252.5 million of Preferred Stock, will have a right to exchange their holdings for PENN common stock at $67 per share. If Centerbridge Partners LP and Wells Fargo Securities, LLC elect to retain their Preferred Stock holdings, the liquidation value of the instrument will be reduced by the PropCo share distribution multiplied by the PropCo stock price;

· The new floor and ceiling price of the Preferred Stock will be $67.00 and $45.00, respectively, less the price of PropCo common stock over the same measurement period;

· PNG will redeem any remaining shares of Preferred Stock with shares of PNG common stock in 2015;

· The diluted share count will be reduced by 13.3 million shares from the pre-announcement level assuming the Fortress exchange and PENN’s repurchase of the 6.2 million non-voting PENN common shares or equivalents;

· 89.3 million fully diluted common shares outstanding; and

· Pursuant to the Master Lease, PNG will lease and operate all of the real property now wholly-owned by PENN (other than Hollywood Casino Baton Rouge and Hollywood Casino Perryville) that will be owned by PropCo immediately after the proposed transaction.

Penn National Gaming (PNG)

|

|

|

Full Year Ending December 31, |

| ||||||

|

(in millions, except per share data) |

|

2013 |

|

2012 |

|

Variance % |

| ||

|

Net revenues |

|

$ |

3,042.6 |

|

$ |

2,724.2 |

|

11.7 |

% |

|

Adjusted EBITDAR (2) |

|

881.4 |

|

693.7 |

|

27.1 |

% | ||

|

Rent Expense |

|

(449.3 |

) |

(342.3 |

) |

31.2 |

% | ||

|

Adjusted EBITDA (1) |

|

432.1 |

|

351.4 |

|

23.0 |

% | ||

|

Less: Impact of stock compensation, insurance recoveries and deductible charges, depreciation and amortization, gain/loss on disposal of assets, interest expense - net, income taxes, loss on early extinguishment of debt, and other expenses |

|

(316.5 |

) |

(262.6 |

) |

20.5 |

% | ||

|

Net income |

|

$ |

115.6 |

|

$ |

88.8 |

|

30.2 |

% |

|

|

|

|

|

|

|

|

| ||

|

Diluted earnings per common share |

|

$ |

1.29 |

|

$ |

1.00 |

|

29.0 |

% |

(1) Adjusted EBITDA is income (loss) from operations, excluding the impact of stock compensation, insurance recoveries and deductible charges, depreciation and amortization, and gain or loss on disposal of assets, and is inclusive of gain or loss from unconsolidated affiliates.

(2) Adjusted EBITDAR is adjusted EBITDA less rent.

SUPPLEMENTAL INFORMATION

Pro Forma Property Information

PROPERTIES OWNED BY PROPCO AND LEASED TO PNG

|

Property |

|

Location |

|

Hollywood Casino at Charles Town Races |

|

Charles Town, WV |

|

Hollywood Casino Lawrenceburg |

|

Lawrenceburg, IN |

|

Hollywood Casino at Penn National Race Course |

|

Grantville, PA |

|

Hollywood Casino Aurora |

|

Aurora, IL |

|

Hollywood Casino Joliet |

|

Joliet, IL |

|

Argosy Casino Alton |

|

Alton, IL |

|

Argosy Casino Riverside |

|

Riverside, MO |

|

Hollywood Casino Tunica |

|

Tunica, MS |

|

Hollywood Casino Bay St. Louis |

|

Bay St. Louis, MS |

|

Boomtown Biloxi |

|

Biloxi, MS |

|

Argosy Casino Sioux City |

|

Sioux City, IA |

|

Hollywood Slots Hotel and Raceway |

|

Bangor, ME |

|

Zia Park Casino |

|

Hobbs, NM |

|

M Resort |

|

Henderson, NV |

|

Hollywood Casino Toledo |

|

Toledo, OH |

|

Hollywood Casino Columbus |

|

Columbus, OH |

|

Hollywood Casino St. Louis |

|

St. Louis, MO |

|

Youngstown development (pending approval) |

|

Youngstown, OH |

|

Dayton development (pending approval) |

|

Dayton, OH |

PROPERTIES OWNED BY PROPCO AND HELD IN A TAXABLE REIT SUBSIDIARY

|

Property |

|

Location |

|

Hollywood Casino Baton Rouge |

|

Baton Rouge, LA |

|

Hollywood Casino Perryville |

|

Perryville, MD |

PROPERTIES / INTERESTS OWNED BY PNG

|

Property |

|

Location |

|

Sanford-Orlando Kennel Club |

|

Longwood, FL |

|

Rosecroft Raceway |

|

Oxon Hill, MD |

|

Bullwhackers Casino |

|

Black Hawk, CO |

|

Casino Rama management contract |

|

Orillia, Ontario (Canada) |

|

Freehold Raceway (joint venture) |

|

Freehold, NJ |

|

Sam Houston Race Park (joint venture) |

|

Houston, TX |

|

Valley Race Park (joint venture) |

|

Harlingen, TX |

|

Hollywood Casino at Kansas Speedway (joint venture) |

|

Kansas City, KS |

Summary of Master Lease Terms

|

Lease Structure: |

|

· “Triple Net” Master Lease: PNG will be responsible for maintenance capital expenditures, property taxes, insurance and other expenses · All properties subject to the lease will be cross-defaulted / guaranteed · PNG will remain responsible for acquisition, maintenance, operation and disposition of all (including gaming) FF&E and personal property required for operations |

|

|

|

|

|

Term and Termination: |

|

· 15 years, with four 5-year extensions at PNG’s option · Causes for termination by lessor include lease payment default, bankruptcy and/or loss of gaming licenses · At the end of lease term, PNG will be required to transfer the gaming assets (including the gaming licenses) to successor tenant for fair market value, subject to regulatory approval · Provisions for orderly auction-based transition to new operator at the end of the lease term if not extended |

|

|

|

|

|

Rent: |

|

· Fixed base rent component with annual escalators (subject to minimum rent coverage of 1.8x) plus: · Fixed percentage rent component for the facilities (other than Hollywood Casino Toledo and Hollywood Casino Columbus) reset every 5 years to equal 4% of the excess (if any) of the average net revenue for such facilities for the trailing 5 years over a baseline · Ohio’s (Toledo and Columbus) performance components will be established monthly with land rent set at 20% of monthly net revenues |

|

|

|

|

|

Maintenance; Capital Expenditures: |

|

· PNG will be required to maintain properties and spend a minimum of 1% of net revenues on maintenance capital (including FF&E and capitalized personal property required for operations) annually · Structural projects will generally require PropCo consent |

|

|

|

|

|

Other: |

|

· Obligations under the Master Lease will be guaranteed by PNG and certain of its subsidiaries · Certain rights of first refusal / first offer as well as radius restrictions on competition |

Wells Fargo Securities and Banc of America Merrill Lynch are serving as financial advisors to Penn National Gaming in the transaction. Wachtell, Lipton, Rosen & Katz is serving as legal advisor to Penn National Gaming and Skadden, Arps, Slate, Meagher & Flom LLP is also advising with respect to certain tax matters.

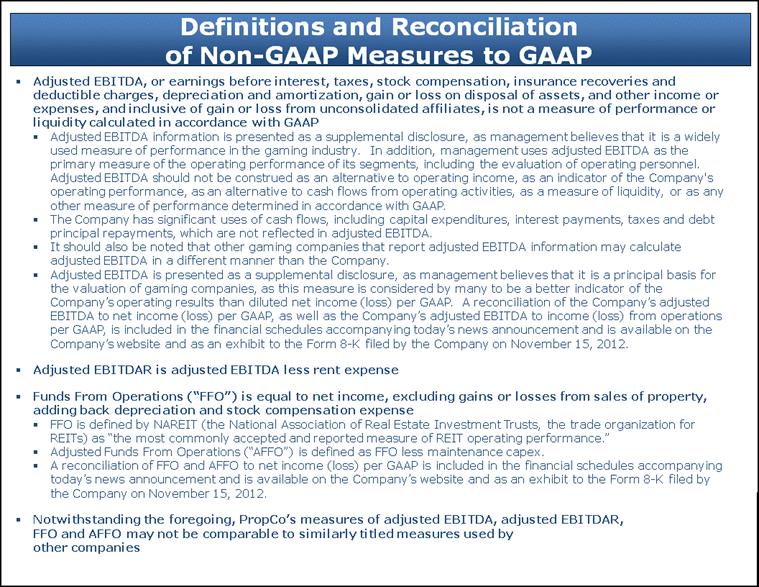

Definitions and Reconciliation of Non-GAAP Measures to GAAP

Adjusted EBITDA, or earnings before interest, taxes, stock compensation, insurance recoveries and deductible charges, depreciation and amortization, gain or loss on disposal of assets, and other income or expenses, and inclusive of gain or loss from unconsolidated affiliates, is not a measure of performance or liquidity calculated in accordance with GAAP. Adjusted EBITDA information is presented as a supplemental disclosure, as management believes that it is a widely used measure of performance in the gaming industry. In addition, management uses adjusted EBITDA as the primary measure of the operating performance of its segments, including the evaluation of operating personnel. Adjusted EBITDA should not be construed as an alternative to operating income, as an indicator of the Company’s operating performance, as an alternative to cash flows from operating activities, as a measure of liquidity, or as any other measure of performance determined in accordance with GAAP. The Company has significant uses of cash flows, including capital expenditures, interest payments, taxes and debt principal repayments, which are not reflected in adjusted EBITDA. It should also be noted that other gaming companies that report adjusted EBITDA information may calculate adjusted EBITDA in a different manner than the Company. Adjusted EBITDA is presented as a supplemental disclosure, as management believes that it is a principal basis for the valuation of gaming companies, as this measure is considered by many to be a better indicator of the Company’s operating results than diluted net income (loss) per GAAP. A reconciliation of the Company’s adjusted EBITDA to net income (loss) per GAAP, as well as the Company’s adjusted EBITDA to income (loss) from operations per GAAP, is included in the accompanying financial schedules.

Adjusted EBITDAR is adjusted EBITDA less rent expense.

Funds From Operations (“FFO”), is defined by NAREIT (the National Association of Real Estate Investment Trusts, the trade organization for REITs) as “the most commonly accepted and reported measure of REIT operating performance.” FFO is equal to net income, excluding gains or losses from sales of property, adding back depreciation and stock compensation expense. Adjusted Funds From Operations (“AFFO”) is defined as FFO less maintenance capex. A reconciliation of FFO and AFFO to net income (loss) per GAAP is included in the accompanying financial schedules. Notwithstanding the foregoing, PropCo’s measures of adjusted EBITDA, adjusted EBITDAR, FFO and AFFO may not be comparable to similarly titled measures used by other companies.

Conference Call, Webcast and Replay Details

Penn National Gaming is hosting a conference call and simultaneous webcast with management presentation at 5:00 p.m. ET today, both of which are open to the general public. The conference call number is 212/271-4657 please call five minutes in advance to ensure that you are connected prior to the presentation. Questions will be reserved for call-in analysts and investors. Interested parties may also access the live call on the Internet at www.pngaming.com (select “Investors” / “Events”); allow 15 minutes to register and download and install any necessary software. During the conference call and webcast, management will review a presentation summarizing the proposed transaction which can be accessed at www.pngaming.com (select “Investors” / “Presentations”). A replay of the call can be accessed for thirty days at www.pngaming.com.

This press release, which includes financial information to be discussed by management during the conference call and disclosure and reconciliation of non-GAAP financial measures, is available on the Company’s web site, www.pngaming.com in the “Investors” section (select link for “Press Releases”).

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests in gaming and racing facilities with a focus on slot machine entertainment. The company presently operates twenty-nine facilities in nineteen jurisdictions, including Colorado, Florida, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Maryland, Mississippi, Missouri, Nevada, New Jersey, New Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario. In aggregate, Penn National’s operated facilities currently feature approximately 36,800 gaming machines, approximately 850 table games, 2,900 hotel rooms and approximately 1.6 million square feet of gaming floor space.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may vary materially from expectations. Although Penn National Gaming, Inc. and its subsidiaries (collectively, the “Company” or “PENN”) believe that our expectations are based on reasonable assumptions within the bounds of our knowledge of our business and operations, there can be no assurance that actual results will not differ materially from our expectations. Meaningful factors that could cause actual results to differ from expectations include, but are not limited to, risks related to the following: the proposed separation of PropCo from PENN, including our ability to receive, or delays in obtaining, all necessary consents and approvals, the anticipated timing of the proposed separation, the expected tax treatment of the proposed transaction, the ability of each of the Company (post-spin) and PropCo to conduct and expand their respective businesses following the proposed spin-off, and the diversion of management’s attention from regular business concerns; our ability to receive, or delays in obtaining, the regulatory approvals required to own, develop and/or operate our facilities, or other delays or impediments to completing our planned acquisitions or projects, including favorable resolution of any related litigation, including the recent appeal by the Ohio Roundtable addressing the legality of video lottery terminals in Ohio; our ability to secure state and local permits and approvals necessary for construction; construction factors, including delays, unexpected remediation costs, local opposition and increased cost of labor and materials; our ability to successfully integrate Harrah’s St. Louis into our existing business; our ability to reach agreements with the thoroughbred and harness horseman in Ohio and to otherwise maintain agreements with our horseman, pari-mutuel clerks and other organized labor groups; the passage of state, federal or local legislation (including referenda) that would expand, restrict, further tax, prevent or negatively impact operations in or adjacent to the jurisdictions in which we do or seek to do business (such as a smoking ban at any of our facilities); the effects of local and national economic, credit, capital market, housing, and energy conditions on the economy in general and on the gaming and lodging industries in particular; the activities of our competitors and the emergence of new competitors (traditional and internet based); increases in the effective rate of taxation at any of our properties or at the corporate level; our ability to identify attractive acquisition and development opportunities and to agree to terms with partners for such transactions; the costs and risks involved in the pursuit of such opportunities and our ability to complete the acquisition or development of, and achieve the expected returns from, such opportunities; our expectations for the continued availability and cost of capital; the outcome of pending legal proceedings; changes in accounting standards; our dependence on key personnel; the impact of terrorism and other international hostilities; the impact of weather; and other factors as discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as filed with the SEC. The Company does not intend to update publicly any forward-looking statements except as required by law.

# # #