UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /X/

Filed by a Party other than the Registrant / /

Check the appropriate box:

/ /

Preliminary Proxy Statement

/ /

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

/X/

Definitive Proxy Statement

/ /

Definitive Additional Materials

/ /

Soliciting Material Pursuant to Section 240.14a-12

____________KENNETH COLE PRODUCTIONS, INC.___________

(Name of Registrant as Specified in Its Charter)

_________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/X/

No fee required.

/ /

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

/ /

Fee paid previously with preliminary materials.

/ /

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

Kenneth Cole

New York

Kenneth Cole Productions, Inc.

603 West 50th Street

New York, NY 10019

April 17, 2009

To our Shareholders:

On behalf of the Board of Directors and management of Kenneth Cole Productions, Inc. (the “Company”), I cordially invite you to the Annual Meeting of Shareholders to be held on Thursday, May 28, 2009 at 10:00 A.M. at the Company’s principal administrative offices, 400 Plaza Drive, 3rd Floor, Secaucus, New Jersey 07094.

At the Annual Meeting, shareholders will be asked to:

•

elect seven directors

•

approve an amendment to the Kenneth Cole Productions, Inc. Employee Stock Purchase Plan to increase the number of authorized shares of Class A Common Stock by 150,000 shares

•

approve the Kenneth Cole Productions, Inc. 2009 Pay for Performance Bonus Plan

•

approve an amendment to the Kenneth Cole Productions, Inc. 2004 Stock Incentive Plan to increase the number of authorized shares of Class A Common Stock for issuance by 3,000,000 shares

•

approve the selection of the Company’s independent registered public accounting firm.

These matters are fully described in the accompanying notice of Annual Meeting and Proxy Statement.

It is important that your shares be represented whether or not you are able to be present at the Annual Meeting. I am gratified by our shareholders’ continued interest in Kenneth Cole Productions, Inc. and urge you to vote promptly.

Sincerely,

/s/ Kenneth D. Cole

Kenneth D. Cole

Chairman of the Board of Directors

TABLE OF CONTENTS

Page | |

|

|

Notice of Annual Meeting of Shareholders | 3 |

|

|

Proxy Statement for Annual Meeting of Shareholders | 4 |

|

|

Proposal One: Election of Directors | 7 |

|

|

Named Executive Officers | 8 |

|

|

Board of Directors and Board Committees | 9 |

|

|

Director Nomination Process | 10 |

|

|

Shareholder Communications to Directors | 10 |

|

|

Director Attendance at Annual Meeting of Shareholders | 10 |

|

|

Director Presiding at Executive Sessions | 10 |

|

|

Other Corporate Governance Policies | 10 |

|

|

Transactions with Related Parties | 11 |

|

|

Director Nominee and Officer Stock Ownership | 12 |

|

|

Person Owning More Than 5% of Common Stock | 13 |

|

|

Section 16(a) Beneficial Ownership Reporting Compliance | 13 |

|

|

Compensation Discussion and Analysis | 14 |

|

|

Compensation Committee Report | 18 |

|

|

Summary Compensation Table | 19 |

|

|

Grants of Plan-Based Awards | 20 |

|

|

Outstanding Equity Awards | 21 |

|

|

Option Exercises and Stock Vested | 22 |

|

|

Nonqualified Deferred Compensation | 22 |

|

|

Director Compensation | 24 |

|

|

Report of the Audit Committee | 25 |

|

|

Proposal Two: Amendment to Employee Stock Purchase Plan | 26 |

|

|

Proposal Three: 2009 Pay for Performance Bonus Plan | 28 |

|

|

Proposal Four: Amendment to 2004 Stock Incentive Plan | 30 |

|

|

Proposal Five: Selection of Auditors | 34 |

|

|

Shareholder Proposals for the 2010 Annual Meeting | 35 |

|

|

Forward-Looking Statements | 35 |

|

|

Other Matters | 35 |

2

KENNETH COLE PRODUCTIONS, INC.

603 West 50th Street

New York, NY 10019

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 28, 2009

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of Kenneth Cole Productions, Inc. (the “Company”), a New York corporation, will be held on Thursday, May 28, 2009 at 10:00 A.M. at the Company’s principal administrative offices, 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094 for the following purposes, or as more fully described in the Proxy Statement accompanying this Notice:

1.

To elect seven directors to serve for a term of one year;

2.

To approve an amendment to the Kenneth Cole Productions, Inc. Employee Stock Purchase Plan to increase the number of shares of Class A Common Stock authorized for issuance by 150,000 shares;

3.

To approve the Kenneth Cole Productions, Inc. 2009 Pay for Performance Bonus Plan;

4.

To approve an amendment to the Kenneth Cole Productions, Inc. 2004 Stock Incentive Plan to increase the number of shares of Class A Common Stock authorized for issuance by 3,000,000 shares;

5.

To ratify the appointment of Ernst & Young LLP as independent registered public accounting firm of the Company to serve for the 2009 fiscal year; and

6.

To transact such other business as may properly be brought before the Annual Meeting or any adjournment, postponement or rescheduling thereof in connection with the foregoing or otherwise.

Shareholders of record at the close of business on April 8, 2009 are entitled to notice of and to vote at the meeting and any adjournment thereof.

It is important that your shares be represented at the Annual Meeting. If you have received a Notice of Internet Availability of Proxy Materials, you should follow the instructions for voting provided in that notice. If you requested a hard copy of the Proxy Statement, fill in, date and sign the enclosed proxy card and mail it promptly in the envelope provided. Any shareholder attending the Annual Meeting may vote in person even if he or she previously voted by proxy.

We encourage you to read the attached Proxy Statement carefully. In addition, you may obtain information about the Company from the Annual Report on Form 10-K for the year ended December 31, 2008 included with this notice and from documents that we have filed with the Securities and Exchange Commission.

By Order of the Board of Directors,

/s/ Michael F. Colosi

New York, New York

Michael F. Colosi

April 17, 2009

Secretary

IMPORTANT

A self-addressed envelope is enclosed for your convenience. No postage is required if mailed within the United States.

3

KENNETH COLE PRODUCTIONS, INC.

603 West 50th Street

New York, NY 10019

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

May 28, 2009

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors of Kenneth Cole Productions, Inc., a New York corporation (“KCP” or the “Company”), of proxies to be used at the Annual Meeting of Shareholders (the “Annual Meeting”), to be held at the Company’s principal administrative offices, located at 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094, on Thursday, May 28, 2009 at 10:00 A.M. and at any adjournment, postponement or rescheduling thereof. The approximate date on which the Notice of Annual Meeting of Shareholders was given to shareholders was on or about April 17, 2009.

General Information about the Meeting

Who may vote

Each shareholder of record at the close of business on April 8, 2009 will be entitled to vote.

On April 8, 2009, the Company had outstanding 9,888,480 shares of Class A Common Stock, par value $.01 per share (the “Class A Common Stock”) and 8,010,497 shares of Class B Common Stock, par value $.01 per share (the “Class B Common Stock”). All of the issued and outstanding shares of Class B Common Stock are owned directly or indirectly by Kenneth D. Cole, Chairman of the Board of the Company.

Except as otherwise provided in the Company’s Restated Certificate of Incorporation or By-laws, the holders of the Class A Common Stock and the Class B Common Stock vote together as a single class on all matters to be voted upon at the Annual Meeting and any adjournment, postponement or rescheduling thereof, with each record holder of Class A Common Stock entitled to one vote per share of Class A Common Stock, and each record holder of Class B Common Stock entitled to ten votes per share of Class B Common Stock. The Company’s Restated Certificate of Incorporation provides that the holders of the Class A Common Stock vote separately as a class to elect 25%, but not less than two directors, of the Company’s Board of Directors.

Voting your proxy

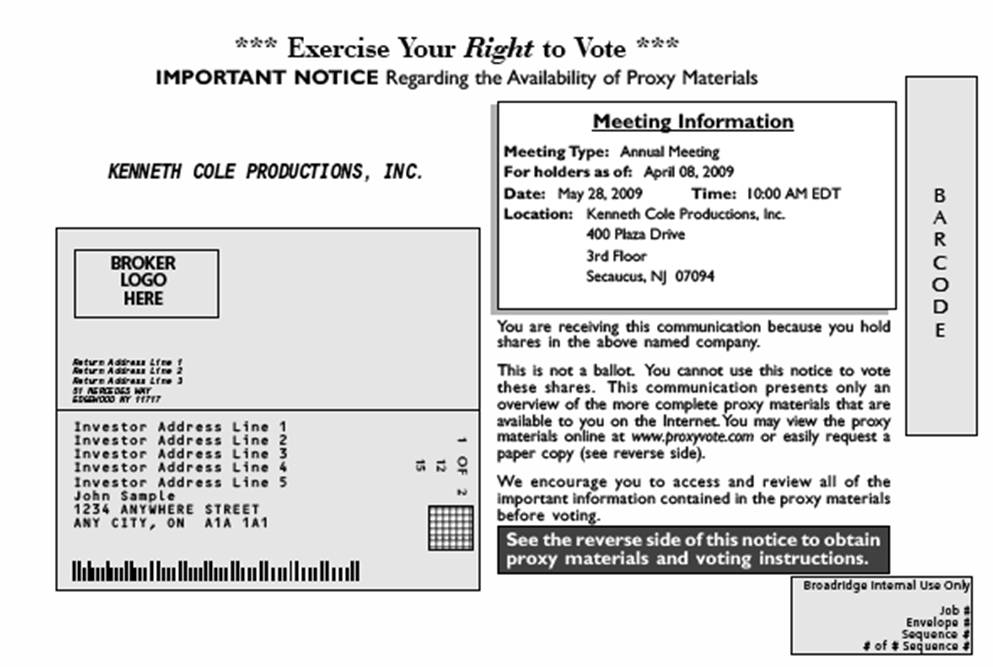

If you have received a Notice of Internet Availability of Proxy Materials, you will not receive a proxy card and should follow the instructions for voting provided in that notice. These instructions allow for online voting at www.proxyvote.com.

If you have requested and received a proxy card along with this document, you are requested to fill in, date and sign the proxy card and mail it promptly in the envelope provided.

Whether you hold shares in your name or through a broker, bank or other nominee, you may vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares held through a broker, bank or other nominee, by submitting voting instructions to that nominee.

See “Delivery of Voting Materials,” “Counting the votes” and “Vote required” below for further information.

Votes needed to hold the meeting

In accordance with New York law and the Company’s By-laws, the Annual Meeting will be held if a majority of the Company’s outstanding shares entitled to vote is present or represented by proxy at the meeting. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the Annual Meeting (an “abstention”), if you:

- are present and vote in person at the Annual Meeting; or

- have properly voted by proxy based on the instructions provided to you.

In addition, shares that are present or represented by proxy at the Annual Meeting will be counted for purposes of determining if there is a quorum regardless of whether a broker with authority fails to exercise its authority to vote on some or all of the proposals at the Annual Meeting (a “broker non-vote”).

4

Counting the votes

In the election of Directors, you may vote “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. For the approval of the amendment to the Kenneth Cole Productions, Inc. Employee Stock Purchase Plan, approval of the Kenneth Cole Productions, Inc. 2009 Pay for Performance Bonus Plan, approval of the amendment to the Kenneth Cole Productions, Inc. 2004 Stock Incentive Plan and the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm, you may vote “FOR,” “AGAINST” or “ABSTAIN.” Abstentions and broker non-votes will not be included in the tabulation of the votes cast on any of the proposals at the Annual Meeting.

Vote required

In the election of Directors, the affirmative vote of a plurality of the shares voting, in person or by proxy, at the Annual Meeting is required to elect each nominee director. All other proposals require the affirmative vote of a majority of the shares voting, in person or by proxy, at the Annual Meeting.

Matters to be voted on at the Annual Meeting

There are five proposals that will be presented for your consideration at the meeting:

·

Election of the Board of Directors

·

Approval of an amendment to the Kenneth Cole Productions, Inc. Employee Stock Purchase Plan to increase the number of shares of Class A Common Stock authorized for issuance by 150,000 shares

·

Approve the Kenneth Cole Productions, Inc. 2009 Pay for Performance Bonus Plan

·

Approval of an amendment to the Kenneth Cole Productions, Inc. 2004 Stock Incentive Plan to increase the number of shares of Class A Common Stock authorized for issuance by 3,000,000 shares

·

Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm

Our voting recommendations

Our Board of Directors recommends that you vote:

·

“FOR” each of management’s nominees to the Board of Directors

·

“FOR” the approval of the amendment to the Kenneth Cole Productions, Inc. Employee Stock Purchase Plan to increase the number of shares of Class A Common Stock authorized for issuance by 150,000 shares

·

“FOR” the approval of the Kenneth Cole Productions, Inc. 2009 Pay for Performance Bonus Plan

·

“FOR” the approval of the amendment to the Kenneth Cole Productions, Inc. 2004 Stock Incentive Plan to increase the number of shares of Class A Common Stock authorized by 3,000,000 shares

·

“FOR” ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm

Cost of this proxy solicitation

The Company has hired Georgeson, Inc. to assist in the solicitation of beneficial owners for a fee not to exceed $1,500, plus out-of-pocket expenses. The Company may also reimburse brokerage firms and other persons representing beneficial owners, such as banks and trustees, of shares for their reasonable expenses in forwarding the voting materials to their customers who are beneficial owners of shares of Class A Common Stock and obtaining their voting instructions. The cost of this proxy solicitation will be borne by the Company.

Attending the Annual Meeting

You may vote shares held directly in your name in person at the Annual Meeting. If you choose to attend the Annual Meeting, please bring the enclosed proxy card and proof of identification for entrance to the Annual Meeting. If you want to vote shares that you hold in street name at the Annual Meeting, you must request a legal proxy from your broker, bank or other nominee that holds your shares.

Changing your vote

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may do this by signing a new proxy card with a later date or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy; you must specifically revoke your proxy. In addition, you can also change your vote prior to the meeting by resubmitting instructions via telephone or internet with your unique control number located in your Notice of Internet Availability of Proxy Materials or by contacting your broker to request a new vote instruction form. See “Voting your proxy” above for further instructions.

5

Voting results

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be published in our quarterly report on Form 10-Q for the second quarter of fiscal year 2009.

Delivery of voting materials

In 2007, the Securities and Exchange Commission adopted amendments to the proxy rules under the Securities Exchange Act of 1934 (the “Exchange Act”) to provide shareholders with the ability to choose the means by which they access proxy materials. As such, the Company is choosing to follow the “notice only” option for shareholders, which requires that only a “Notice of Internet Availability of Proxy Materials” be mailed to shareholders. Shareholders who receive the Notice of Internet Availability of Proxy Materials and wish to receive hard copies of the proxy materials may receive such copies by making a request on-line at www.investorEconnect.com. To reduce the expenses of delivering duplicate voting materials to our shareholders who may have more than one Company stock account and do not receive the Notice of Internet Availability of Proxy Materials, we are taking advantage of rules that permit us to deliver only one set of voting materials, meaning the Proxy Statement, proxy card and the 2008 annual report to shareholders, to shareholders who share an address unless otherwise requested.

How to obtain a separate set of voting materials

If you share an address with another shareholder and have received only one set of voting materials, you may write, e-mail or call us using the contact information set forth below to request a separate copy of these materials at no cost to you. The Company undertakes to deliver promptly to you, upon your request, a separate copy of these materials. For future annual meetings, you may request separate voting materials, or request that the Company send only one set of voting materials to you if you are receiving multiple copies, by e-mailing the Company at investorrelations@kennethcole.com or writing us at Kenneth Cole Productions, Inc., 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094, Attn: Investor Relations or calling us at (201) 864-8080 extension 28451.

6

PROPOSAL ONE: ELECTION OF DIRECTORS

Seven directors are to be elected at the Annual Meeting to serve for a term of one year and until their respective successors have been elected and shall qualify. Each proxy received will be voted FOR the election of the nominees named below unless otherwise specified in the proxy. If any nominee shall, prior to the Annual Meeting, become unavailable for election as a director, the persons named in the accompanying form of proxy will vote in their discretion for a nominee, if any, that may be recommended by the Board of Directors, or the Board of Directors may reduce the number of directors to eliminate the vacancy. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve. There are no arrangements or understandings between any director or nominee and any other person pursuant to which such person was selected as a director or nominee.

Nominees for Director

The Board of Directors has nominated seven directors to be elected to the Board of Directors at the Annual Meeting: Kenneth D. Cole, Jill Granoff, Michael J. Blitzer, Martin E. Franklin, Robert C. Grayson, Denis F. Kelly and Philip R. Peller.

Philip R. Peller and Michael J. Blitzer are the nominees for director for election by the holders of the Class A Common Stock. The other nominees for director will be elected by the vote of the holders of the Class A Common Stock and the holders of the Class B Common Stock voting together as a single class. All nominees, except for Mr. Blitzer, are currently directors. Each nominee has agreed to be named in this Proxy Statement and to serve as a director if elected.

Certain information concerning the nominees is set forth below:

Name | Age | Principal Occupation |

Year Became |

Kenneth D. Cole | 55 | Chairman of the Board and Chief Creative Officer | 1982 |

Jill Granoff | 47 | Chief Executive Officer | 2008 |

Michael J. Blitzer | 59 | Principal, Portsmouth Partners, LLC | -- |

Martin E. Franklin | 44 | Chairman and Chief Executive Officer of Jarden Corporation | 2005 |

Robert C. Grayson | 64 | President, Robert C. Grayson & Associates, Inc. | 1996 |

Denis F. Kelly | 59 | Managing Partner, Scura, Rise & Partners, LLC | 1994 |

Philip R. Peller | 69 | Independent Business Consultant; Retired Partner, Arthur Andersen LLP | 2005 |

|

|

|

|

Kenneth D. Cole has served as the Company’s Chairman of the Board since its inception in 1982 and was also President until February 2002 and Chief Executive Officer until May 2008. Prior to founding Kenneth Cole Productions, Inc., Mr. Cole was a founder and, from 1976 through 1982, a senior executive of El Greco, Inc., a shoe manufacturing and design company which manufactured Candies women’s shoes. Mr. Cole is the Chairman of the Board of Directors of the Foundation for AIDS Research (“amfAR”). In addition, he is on the Board of Trustees of the Sundance Institute and the Council of Fashion Designers of America.

Jill Granoff joined the Company as its Chief Executive Officer in May 2008. Ms. Granoff was previously Executive Vice President of Liz Claiborne Inc. (“Liz Claiborne”) where she had global responsibility for Juicy Couture, Lucky Brand Jeans, Kate Spade and its Outlet and E-Commerce businesses. Prior to joining Liz Claiborne, Ms. Granoff was President and Chief Operating Officer of Victoria Secret Beauty, a division of Limited Brands, where she worked from 1999 to 2006. From 1990 to 1999, Ms. Granoff held various executive positions at The Estee Lauder Companies. Ms. Granoff is a member of the Executive Committee of the Board of Governors of Cosmetic Executive Women and The Women’s Forum.

Michael J. Blitzer is a Principal of Portsmouth Partners, LLC, an advisory firm that provides operational and strategic services to private equity groups that focus on retail, wholesale and consumer industries since 2005. Previously, Mr. Blitzer served as the Vice Chairman of Phillips-Van Heusen Corporation, one of the world’s largest apparel companies, from September 1997 until he retired in November 2002. Mr. Blitzer spent over 30 years at Phillips-Van Heusen Corporation and at Macy’s in various executive merchandising positions in Women’s and Menswear, Accessories and Footwear. Mr. Blitzer has also worked with a variety of companies in both apparel and accessories including Neiman Marcus Group and Liz Claiborne Inc. Mr. Blitzer has served on the boards of Kate Spade, LLC and LeSportsac Inc. and currently serves on the boards of Charlotte Russe Holdings, Inc. and Modell’s Sporting Goods.

Martin E. Franklin has served as the Chairman and Chief Executive Officer of Jarden Corporation since 2001. Previously Mr. Franklin served as Executive Chairman of Bollé Inc. from 1997 to 2000. He also held the position of Chairman and CEO of Lumen Technologies, Inc. from 1996 to 1998, and its predecessor, Benson Eyecare Corporation, from 1992 to 1996. Mr. Franklin

7

has served as the Chairman of Liberty Acquisitions Holdings, Corp and Liberty Acquisition Holdings (International) Company since 2007. He also serves on the Board of Directors of GLG Partners, Inc.

Robert C. Grayson is the founder of Robert C. Grayson & Associates (d.b.a. The Grayson Company), a broad-based consulting practice for the consumer goods sector. From 1992 to 1996, Mr. Grayson served initially as an outside consultant to Tommy Hilfiger Corp., a wholesaler and retailer of men’s sportswear and boyswear, and later accepted titles of Chairman of Tommy Hilfiger Retail, Inc. and Vice Chairman of Tommy Hilfiger Corp. From 1970 to 1992, Mr. Grayson served in various capacities for Limited Inc., including President and CEO of Lerner New York from 1985 to 1992, and President and CEO of Limited Stores from 1982 to 1985. He also serves as a director of St. John Knits, Lillian August Inc., U-Food, and Stax Incorporated.

Denis F. Kelly is a Managing Partner of Scura, Rise & Partners, LLC as well as Chairman of Ashburn Hill Corp, a manufacturer of fire resistant (FR) garments. From July 1993 to December 2000, Mr. Kelly was the head of the Mergers and Acquisitions Department at Prudential Securities Incorporated. From 1991 to 1993, Mr. Kelly was President of Denbrook Capital Corp., a merchant-banking firm. Mr. Kelly was at Merrill Lynch from 1980 to 1991, where he served as Managing Director, Mergers & Acquisitions from 1984 to 1986, and then as a Managing Director, Merchant Banking, from 1986 to 1991. Mr. Kelly is a director of MSC Industrial Direct, Inc.

Philip R. Peller was employed by Arthur Andersen LLP for 39 years. Prior to his retirement from Arthur Andersen in 1999, he served as Managing Partner of Practice Protection and Partner Matters for Andersen Worldwide SC, the coordinating entity for the activities of Arthur Andersen and Andersen Consulting, from 1996 to 1999. Prior to that appointment, Mr. Peller served as the Managing Director - Quality, Risk Management and Professional Competence for the worldwide audit practice. Mr. Peller joined Arthur Andersen in 1960 and was promoted to Audit Partner in 1970. Mr. Peller is a Certified Public Accountant. Mr. Peller is currently a member of the Board of Directors and Chair of the Audit Committee of MSC Industrial Direct Co., Inc. and serves as a consultant to other companies.

There are no family relationships among any directors or executive officers of the Company.

The Board of Directors recommends a vote “FOR” all nominees.

Named Executive Officers

Jill Granoff, the Company’s Principal Executive Officer, David P. Edelman, the Company’s Principal Financial Officer, and the Company’s three other most highly compensated executive officers, Kenneth D. Cole, Douglas Jakubowski and Michael DeVirgilio are considered the Named Executive Officers of the Company as of December 31, 2008.

David P. Edelman, age 47, was appointed as the Chief Financial Officer in July 2004. He joined the Company in January 1995 and served as the Company’s Senior Vice President of Finance since April 2000. Before joining the Company, Mr. Edelman was Chief Financial Officer of a women’s suit wholesaler, and he was employed for 10 years as a Certified Public Accountant with Ernst & Young (“E&Y”) in various specialty groups including E&Y’s National Consulting Office and its Retail and Apparel Audit Group. Mr. Edelman serves on the Board of Directors of the American Apparel and Footwear Association.

Douglas Jakubowski, age 45, was named Chief Merchandising Officer in February 2009. Mr. Jakubowski previously served as President of Apparel and Corporate Relations from October 2007 to February 2009. Prior to that, he served as President of the Kenneth Cole Reaction brand and Senior Vice President of Reaction from July 2005 to October 2007. Prior to joining the Company, Mr. Jakubowski served as President of Perry Ellis Menswear from 2003 to 2005. From 1997 to 2003, he served as Executive Vice President of Merchandising and Design for Perry Ellis Sportswear. Prior to joining Perry Ellis, Mr. Jakubowski held various management positions including Vice President of Sales and Marketing at International News, and Director of Marketing and Sales at Koral Industries.

Michael DeVirgilio, age 41, was named President of Licensing and International in February 2009. Mr. DeVirgilio previously served as Executive Vice President of Business Development from January 2006 to February 2009. He served as Senior Vice President of Licensing from May 2005 to January 2006. Prior to that, he served as Corporate Vice President of Licensing and Design Services from March 2002 to May 2005. From 1999 to 2001, Mr. DeVirgilio served as Divisional Vice President of Licensing. Mr. DeVirgilio joined the Company as Director of Licensing in 1997. Prior to joining the Company, Mr. DeVirgilio was Director of Merchandising for the Joseph & Feiss Company (a division of Hugo Boss, USA).

8

Board of Directors and Board Committees

The Board of Directors (the “Board”) met five times in 2008. The standing committees of the Board include the Audit Committee, Compensation Committee and Corporate Governance/Nominating Committee. Because more than 50% of the voting power of the Company is controlled by Mr. Cole, the Company is a “controlled company” under the New York Stock Exchange (“NYSE”) listing standards. Accordingly, the Company is exempt from the provisions of the NYSE listing standards requiring: (i) a board consisting of a majority of directors who have been determined to be “independent” under the criteria set forth in the NYSE listing standards; (ii) a nominating committee composed entirely of such independent directors; and (iii) a compensation committee composed entirely of such independent directors. However, notwithstanding this exemption, the Company has decided to follow these provisions, as described more fully below, and has a Board consisting entirely of directors determined to be independent in accordance with the listing standards of the NYSE, with the exception of Mr. Cole and Ms. Granoff, and an Audit, Compensation and Corporate Governance/Nominating Committees composed entirely of independent directors.

As required by applicable NYSE listing standards, the Board has adopted charters for the Audit, Compensation and Corporate Governance/Nominating Committees. These charters are available on the Company’s website at www.kennethcole.com. Shareholders may also contact Investor Relations, 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094 or call (201) 864-8080 extension 28451 to obtain a copy of the charters without charge.

Each director attended more than 75% of the meetings held by the Board of Directors and related Committees.

Audit Committee

The Audit Committee, currently composed of Mr. Peller (Chairman), Mr. Grayson and Mr. Kelly, met five times during 2008. In addition, the Chairman of the Audit Committee participated in additional conference calls with members of management and the independent registered public accounting firm during 2008 to review earnings press releases and the Company’s filings on Form 10-Q and Form 10-K. The Audit Committee assists the Board in fulfilling its oversight responsibilities to shareholders, the investment community and others for monitoring (1) the quality and integrity of the financial statements of the Company; (2) the Company’s compliance with ethical policies contained in the Company’s Code of Conduct and legal and regulatory requirements; (3) the independence, qualification and performance of the independent registered public accounting firm; and (4) the performance of the internal auditors. The Audit Committee also selects, subject to shareholder approval, and engages the independent registered public accounting firm to audit the financial statements of the Company’s internal controls over financial reporting, reviews the scope of the audits, and reviews and approves internal audit programs of the Company. The Committee also pre-approves all audit and non-audit services provided by the independent registered public accounting firm. See “Audit Committee Report” for further information. Each Audit Committee member is an independent director and satisfies the financial literacy requirements of the NYSE. The Board has determined that Mr. Peller satisfies the requirements for an “audit committee financial expert” under the rules and regulations of the Securities and Exchange Commission and that he is independent, as defined in the NYSE Listing Standards.

Compensation Committee

The Compensation Committee, currently composed of Mr. Grayson (Chairman), Mr. Franklin, Mr. Kelly and Mr. Peller, is responsible for providing authority to the Board in ensuring that the Company’s officers, key executives and Board members are compensated in accordance with the Company’s total compensation objectives and executive compensation policies and strategies. During 2008, the Compensation Committee met four times. In fulfilling its duties, the Compensation Committee, among other things, will: (1) define and establish policies governing the total compensation of the Company’s executive officers; (2) review and recommend the compensation of the Company’s Chairman and Chief Creative Officer, Chief Executive Officer, Named Executive Officers and other key executives, including base salary level, bonus plan goals, long-term incentive opportunity levels, executive perquisites, employment agreements and benefits; (3) evaluate annually the Company’s Chairman and chief Creative Officer, Chief Executive Officer and other key executives’ compensation levels; (4) oversee the administration of the Company’s equity-based incentive plans; (5) submit a compensation committee report to the Company’s Board of Directors to be included in the Annual Proxy Statement; and (6) select independent compensation consultants to advise the committee, where deemed necessary.

Corporate Governance/Nominating Committee

The Corporate Governance/Nominating Committee is currently composed of Mr. Kelly (Chairman), Mr. Franklin, Mr. Grayson and Mr. Peller. The Corporate Governance/Nominating Committee assists the Board in fulfilling its responsibilities to ensure that the Company is governed in a manner consistent with the interests of the shareholders of the Company and acts in conjunction with the Company’s internal Business Standards Committee in fulfilling these responsibilities. The Corporate Governance/Nominating Committee advises the Board with respect to: (1) Board organization, membership and function; (2) committee structure, membership and operations (including any committee authority to delegate to subcommittees); (3) succession planning for the executive officers of the Company; (4) the Company’s Employee Code of Conduct, factory compliance, labor

9

compliance and other governance and compliance programs and policies and any modifications to such programs and policies; and (5) other matters relating to corporate governance and the rights and interests of the Company’s shareholders. During 2008, the Corporate Governance/Nominating Committee met three times.

Director Nomination Process

The Board, as assisted by its Corporate Governance/Nominating Committee, determines the nominees for director in accordance with the NYSE listing standards. The criteria used by the Board and the Corporate Governance/Nominating Committee are set forth in the Corporate Governance/Nominating Committee Charter and includes the following, among other criteria used to evaluate potential Board nominees: each director should be a person of integrity and honesty, be able to exercise sound, mature and independent business judgment in the best interests of the shareholders as a whole, be recognized as a leader in business or professional activity, have background and experience that will complement those of other Board members, be able to actively participate in Board and committee meetings and related activities, be available to remain on the Board long enough to make an effective contribution, and have no material relationship with competitors or other third parties that could present possibilities of conflict of interest or legal issues. The Board evaluates each new candidate for director and each incumbent director before recommending that the Board nominates or re-nominate such individual for election or reelection as a director. The Board will evaluate candidates recommended by shareholders in the same manner as candidates identified by the Board. Based on the Board’s evaluation, it recommends the Board nominee for election at each annual meeting of shareholders. A shareholder wishing to nominate a candidate should do so in accordance with the guidelines set forth below under “Shareholder Proposals for the 2010 Annual Meeting.”

Shareholder Communications to Directors

The Board has established a process whereby interested parties may communicate with the presiding director or the non-management directors as a group. If an interested party wishes to communicate with one or more members of the Company’s Board, the following options may be used:

E-Mail the Presiding Director: PresidingDirector@kennethcole.com

-or-

Write to the Board:

Name of Board Member(s)

c/o Corporate Secretary

Kenneth Cole Productions, Inc.

603 West 50th Street

New York, NY 10019

Concerns and communications will be referred by the Secretary of the Company to the entire Board or the designated Board member. Any complaint or concern can be reported anonymously or confidentially.

Director Attendance at Annual Meeting of Shareholders

It has been the longstanding practice of the Company for all directors to attend the Annual Meeting of Shareholders, if available. All directors who were elected to the Board at the last Annual Meeting were in attendance at the 2008 Annual Meeting of Shareholders.

Director Presiding at Executive Sessions

The Board schedules executive sessions without any management members present in conjunction with each regularly scheduled Board meeting. In the executive sessions, the non-management directors meet with the Company’s Senior Director of Internal Audit and representatives of the independent registered public accounting firm. Mr. Philip R. Peller, Chairman of the Audit Committee, presides at these executive sessions of non-management directors.

Other Corporate Governance Policies

Corporate Governance Policies. The Board has adopted Corporate Governance Policies to comply with the NYSE listing standards. These policies guide the Company and the Board on matters of corporate governance, including director responsibilities, Board committees and their charters, director independence, director qualifications, director compensation and evaluations, director

10

access to management, Board access to outside financial, business and legal advisors and management development. These policies are available on the Company’s website at www.kennethcole.com. Shareholders may also contact Investor Relations, 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094 or call (201) 864-8080 extension 28451 to obtain a copy of the policies without charge.

Committee Authority to Retain Independent Advisors. The Audit, Compensation and Corporate Governance/Nominating Committees have the authority to retain independent advisors and consultants, with all fees and expenses to be paid by the Company.

Code of Conduct. The Company has a Code of Conduct (the “Code”) that applies to all of the Company’s directors, executive officers and employees. The Code is available on the Company’s website at www.kennethcole.com. Shareholders may also contact Investor Relations, 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094 or call (201) 864-8080 extension 28451 to obtain a copy of the Code without charge.

Whistleblower Procedures. The Audit Committee has established procedures for (1) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and (2) the confidential and anonymous submission by the Company’s employees of concerns regarding questionable accounting or auditing matters. These procedures are available on the Company’s website at www.kennethcole.com. Shareholders may also contact Investor Relations, 400 Plaza Drive, 3rd Floor, Secaucus, NJ 07094 or call (201) 864-8080 extension 28451 to obtain a copy without charge.

No Executive Loans. The Company does not extend loans to executive officers or directors and has no such loans outstanding.

Transactions with Related Parties

The Company’s policy regarding related party transactions requires the Corporate Governance/Nominating Committee (the “Committee”) to review and either approve or disapprove of any related party transaction, as defined below, prior to entering into any such transaction. If advance approval of the related party transaction is not feasible, then the Committee must consider the transaction at its next meeting and determine whether to ratify the transaction.

The Company defines related party transactions as any transaction, arrangement or relationship or series of similar transactions, arrangements or relationships (including any indebtedness or guarantee of indebtedness) in which (1) the aggregate amount involved will or may be expected to exceed $120,000 in any calendar year, (2) the Company is a participant, and (3) any Related Person (as defined below) has or will have a direct or indirect interest (other than solely as a result of being a director or less than five-percent beneficial owner of the Company or another entity). A Related Person is any (a) person who is or was at any point during a fiscal year for which the Company filed a Form 10-K and proxy statement, an executive officer, director or nominee for election as a director, (b) any person who is greater than a five percent beneficial ownership of the Company’s common stock, (c) an immediate family member of any of the foregoing, which shall include a person’s spouse, parents, stepparents, children, stepchildren, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, and brothers- and sisters-in-law and anyone residing in such person’s home (other than a tenant or employee) or (d) any firm, corporation or other entity in which any of the foregoing persons is employed and which such person has a five percent or greater beneficial ownership interest.

In determining whether to approve or ratify a related party transaction, the Committee will take into account whether the transaction is in the best interests of the Company and its stockholders, on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, the extent of the Related Person’s interest in the transaction and other factors that it deems relevant. No director shall participate in any discussion or approval of a transaction for which he or she is a Related Person, except that the director will provide all material information to the Committee.

Under the Company’s policy, the following related party transactions will be deemed pre-approved under the terms of the Company’s policy:

·

any transaction with another company at which a Related Person’s only relationship is as an employee, director or beneficial owner of less than five percent of that company’s shares, if the aggregate amount involved does not exceed the greater of $100,000, or two percent of that company’s total revenues; and

·

any charitable contribution by the Company to a charitable organization where a Related Person is an employee, if the aggregate amount involved does not exceed the lesser of $25,000 or two percent of the charitable organization’s total annual receipts.

During 2008, the Company made payments of $595,000 to a third-party aviation company that manages and uses an aircraft partially owned by Emack LLC, a company that is wholly owned by Mr. Cole. Management believes that such transactions were made on terms and conditions similar to or more favorable than those available in the marketplace from unrelated parties.

11

The Company has an exclusive license agreement, as amended, with Iconix Brand Group, Inc., and its trademark holding company, IP Holdings, LLC (“Iconix”), to use the Bongo trademark in connection with worldwide manufacture, sale and distribution of women’s, men’s and children’s footwear in certain territories. The Chairman and Chief Executive Officer of Iconix is the brother of the Company’s Chairman and Chief Creative Officer. Management believes that the license agreement with Iconix was entered into at arm’s-length. The Company is obligated to pay Iconix a percentage of net sales based upon the terms of the agreement. Based on the agreement, the Company made payments of approximately $1,142,000 related to royalty and advertising expense for the year ended December 31, 2008. The Company terminated the license in 2009.

DIRECTOR NOMINEE AND OFFICER STOCK OWNERSHIP

The following table sets forth certain information as of April 8, 2009 with respect to the beneficial ownership of the Class A Common Stock and Class B Common Stock, by (i) each director and nominee for director of the Company who owns shares of any class of the Company’s voting securities, (ii) the Company’s Named Executive Officers and (iii) all directors and executive officers of the Company, as a group. Except as otherwise indicated, each person listed has sole voting power with respect to the shares beneficially owned by such person.

Class A Common Stock Class B Common Stock

Name of Beneficial Owner | Number of Shares | Percent |

| Number of Shares | Percent |

Kenneth D. Cole (1) | 9,718,846 | 54.3% | (2) | 8,010,497 | 100% |

Jill Granoff (1) | 235,851 | 1.3% | (3) |

|

|

David P. Edelman (1) | 65,515 | * | (4) |

|

|

Douglas Jakubowski (1) | 16,628 | * | (5) |

|

|

Michael DeVirgilio (1) | 22,487 | * | (6) |

|

|

Denis F. Kelly | 76,716 | * | (7) |

|

|

Robert C. Grayson | 65,000 | * | (8) |

|

|

Philip R. Peller (1) | 18,517 | * | (9) |

|

|

Martin E. Franklin | 16,667 | * | (10) |

|

|

All directors and executive officers as a group (15 persons)+ | 10,294,999 | 57.5% |

| 8,010,497 | 100% |

_________

* Less than 1.0%

+ Consists of the Board of Directors and all executive officers of the Company including Named Executive Officers.

(1)

The beneficial owner’s address is c/o Kenneth Cole Productions, Inc., 603 West 50th Street, New York, NY 10019.

(2)

Includes (a) 4,676,857 shares which Mr. Cole has the right to acquire within 60 days upon the conversion of 4,676,857 shares of Class B Common Stock, (b) 120,000 shares of Class B Common Stock held by the Kenneth Cole Foundation of which Mr. Cole is a co-trustee with his wife, which can be converted into Class A shares, (c) 187,500 shares of Class B Common Stock held by KMC Partners L.P. of which Mr. Cole is the living partner with 95% ownership, which can be converted into Class A shares, (d) 513,070 shares of Class B Common Stock held in the 2008 Kenneth D. Cole Grantor Remainder Annuity Trust, which can be converted into Class A shares, (e) 513,070 shares of Class B Common Stock held in the 2008 Kenneth D. Cole Family Grantor Remainder Annuity Trust, which can be converted into Class A shares, (f) 1,000,000 shares of Class B Common Stock held in the 2009 Kenneth D. Cole Grantor Remainder Annuity Trust, which can be converted into Class A shares (g) 1,000,000 shares of Class B Common Stock held in the 2009 Kenneth D. Cole Family Grantor Remainder Annuity Trust, which can be converted into Class A shares, (h) 150,000 shares of Class A Common Stock held by the Kenneth Cole 1994 Charitable Remainder Trust, of which Mr. Cole is the sole trustee, (i) 13,000 shares of Class A Common Stock held by the Kenneth Cole Foundation, (j) 236,387 shares of Class A Common Stock held by Mr. Cole, (k) 1,221,462 shares which Mr. Cole has the right to acquire within 60 days upon the exercise of options granted to him under the Company's 2004 Stock Incentive Plan, as amended, and (l) 87,500 of restricted shares that will vest within 60 days under the Company’s 2004 Stock Incentive Plan, as amended.

(3)

Includes 209,746 stock options with the right to acquire within 60 days upon exercise and 25,000 restricted shares that will vest within 60 days under the 2004 Stock Incentive Plan, as amended.

(4)

Includes 49,500 stock options with the right to acquire within 60 days upon exercise and 8,250 restricted shares that will vest within 60 days under the Company’s 2004 Stock Incentive Plan, as amended.

(5)

Includes 6,250 stock options with the right to acquire within 60 days upon exercise and 5,000 restricted shares that will vest within 60 days under the Company’s 2004 Stock Incentive Plan, as amended.

(6)

Includes 12,000 stock options with the right to acquire within 60 days upon exercise and 7,250 restricted shares that will vest within 60 days under the Company’s 2004 Stock Incentive Plan, as amended.

(7)

Includes 50,000 stock options which Mr. Kelly has the right to acquire within 60 days upon the exercise of options granted to him under the Company's 2004 Stock Incentive Plan, as amended. Mr. Kelly’s address is c/o Scura, Rise & Partners LLC, 1211 Avenue of the Americas, 27th Floor, New York, NY 10036.

(8)

Includes 50,000 stock options which Mr. Grayson has the right to acquire within 60 days upon the exercise of options granted to him under the Company’s 2004 Stock Incentive Plan, as amended. Mr. Grayson’s address is c/o Berglass Grayson, 399 Park Avenue, 39th Floor, New York, NY 10022.

(9)

Includes 17,500 stock options which Mr. Peller has the right to acquire within 60 days upon the exercise of options granted to him under the Company's 2004 Stock Incentive Plan, as amended.

(10)

Includes 16,667 stock options which Mr. Franklin has the right to acquire within 60 days upon the exercise of options granted to him under the Company's 2004 Stock Incentive Plan, as amended. Mr. Franklin’s address is c/o Jarden Corporation, 555 Theodore Fremd Avenue, Suite B302, Rye, NY 10580.

12

PERSON OWNING MORE THAN 5% OF COMMON STOCK

The following table sets forth certain information as of April 8, 2009 with respect to the beneficial ownership of the Class A Common Stock, by each beneficial holder of more than five percent of any class of the Company’s voting securities. Except as otherwise indicated, each person listed has sole voting power with respect to the shares beneficially owned by such person.

Class A Common Stock

Name of Beneficial Owner | Number of Shares | Percent |

|

Aria Partners GP LLC | 1,439,868 | 8.0% | (1) |

Wells Fargo & Company | 1,245,473 | 7.0% | (2) |

(1)

As reported on the Schedule 13G filed with the Securities and Exchange Commission on February 28, 2008. The address of Aria Partners GP LLC is 11150 Santa Monica Blvd., Suite 700, Los Angeles, CA 90025.

(2)

As reported on the Schedule 13G filed with the Securities and Exchange Commission on January 14, 2009. The address of Wells Fargo & Company is 420 Montgomery Street, San Francisco, CA 94163.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of the filings furnished to the Company pursuant to Rule 16a-3(e) promulgated under the Exchange Act and on written representations from its executive officers, directors and persons who beneficially own more than 10% of the Class A Common Stock, the Company believes that all filing requirements of Section 16(a) of the Act were complied with during the year ended December 31, 2008.

13

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis discusses the Company’s compensation objectives and policies with respect to its Named Executive Officers (“NEOs”) and members of executive management. The Compensation Committee is responsible for approval and administrative oversight of compensation and certain benefit programs, including short-term and long-term performance-based incentive programs for the NEOs and members of executive management. In making such compensation decisions, the Compensation Committee considers recommendations from the Chief Executive Officer with respect to compensation of the other NEOs and members of executive management. The Compensation Committee, from time to time, hires outside compensation consultants to provide relevant market data and alternatives to consider and assist it in making compensation decisions with respect to executive compensation.

The Company’s executive compensation program is designed to:

·

motivate the NEOs and key executives to help the Company accomplish certain long and short-term strategic and financial objectives.

·

align the NEOs and key executives financial interests with those of the Company’s shareholders;

·

provide compensation that is competitive with a group of peer companies; and

·

attract and retain highly qualified executives as the Company competes for talented executives in a highly competitive marketplace.

The Company’s executive compensation program is designed to balance fixed-base salaries with compensation that is performance-based and to reward annual performance while maintaining a focus on longer-term objectives. The Company strives to provide compensation incentives commensurate with individual management responsibilities and to reward past and future contributions to corporate objectives.

In 2008, the Compensation Committee engaged Towers Perrin, an outside consultant to do the following: (1) to assist the Compensation Committee in determining the Company’s peer group, (2) to assess the competitiveness of the Company’s Compensation levels, as well as its aggregate long-term incentive practices relative to its peer group and (3) to perform a compensation analysis for associates at the Company’s senior director level and above, inclusive of its NEOs. The companies included in the study consisted of a select group of publicly-traded companies that engage in specialty store retailing, wholesaling and licensing of footwear, apparel and accessories, as well as companies that compete with the Company for talent. The peer group companies benchmarked included:

American Eagle Outfitters Inc. |

Genesco Inc. |

Rocky Brands Inc. |

Ann Taylor Stores Corp. |

Guess ? Inc. |

Polo Ralph Lauren Corp |

Aeropostale Inc. |

G III Apparel Group Ltd. |

Steve Madden Ltd. |

Bebe Stores Inc |

Hartmarx Group |

Skechers U.S.A. Inc. |

Brown Shoe Co. Inc. |

J Crew Group Inc. |

The Timberland Co. |

Cache Inc. |

Jones Apparel Group Inc. |

Under Armour Inc. |

Chico’s FAS Inc. |

K-Swiss Inc. |

UNIFI Inc. |

Coach Inc. |

Liz Claiborne Inc. |

Urban Outfitters Inc. |

Crocs Inc. |

Movado Group Inc. |

Wolverine World Wide Inc. |

Deckers Outdoor Corp |

Perry Ellis International Inc. |

|

The Compensation Committee used this peer group as the baseline to review total compensation levels for each of the Company’s NEO’s and other executive members of management. The study concluded that overall, the Company’s positioning was 6% above the market median on total cash compensation and 13% below the market median on total direct compensation when including long-term incentive pay. The Company’s goal is to pay between the median and the 75th percentile.

Elements of Compensation

The Company’s executive compensation program consists of two principal components of compensation: (1) annual compensation and (2) long-term compensation. Annual compensation includes base salary and annual bonus. Long-term compensation consists primarily of equity awards subject to forfeiture restrictions.

Base Salary: Base salaries provide a fixed base level of compensation for services rendered during the year. The Compensation Committee determines the level of the NEOs salaries annually by considering the responsibilities associated with their positions, individual performance skills and experience required for the jobs, their individual performance, the Company’s overall business performance and labor market conditions, among other factors. There were no salary increases for the NEOs in 2008. In

14

addition, no merit increases were awarded to the NEOs or other executive members of management during the annual merit review in March 2009.

Bonus: The Company maintains an Annual Bonus Plan to provide for performance-based compensation set by the Compensation Committee annually under the Kenneth Cole Productions, Inc. 2004 Bonus Plan, as approved by the Company’s shareholders. The annual bonus, referred to as non-equity incentive plan compensation in the Summary Compensation Table, is designed to encourage and reward the achievement of corporate, divisional and individual goals that are measurable and tied to the performance of the Company. The annual bonuses for the NEOs, set as a percentage of their annual base salaries, are based upon the achievement of Company, individual and/or performance goals set at the beginning of each fiscal year. Corporate goals may include earnings per share, net income/operating profit, net revenues, return on investment, operating cash flow or a combination thereof. Divisional goals may include sales or revenues, gross margin and divisional operating results or any combination thereof. Individual goals may include executing strategies to support the Company’s vision, advancing organizational objectives and driving operational excellence or any combination thereof.

During 2008, the NEOs target bonus and performance goals percentages were as follows:

Named Executive Officer |

Target Bonus as a percentage of base salary (%) |

|

Performance Goals Percentage of Target Bonus | ||

|

|

|

Corporate (%) |

Divisional (%) |

Individual (%) |

|

|

|

|

|

|

Kenneth D. Cole |

200% |

|

50% |

-- |

50% |

Jill Granoff |

100% |

|

-- |

-- |

100% |

David P. Edelman |

50% |

|

50% |

-- |

50% |

Douglas Jakubowski |

50% |

|

33% |

34% |

33% |

Michael DeVirgilio |

50% |

|

33% |

34% |

33% |

For 2008, the corporate performance goal was based on the Company’s achievement, on a fully diluted basis, of certain levels of earnings per share (“EPS”). The EPS targets were set at $0.35, $0.62 and $0.95. Twenty percent (20%) of the target bonus percentage attributable to corporate performance goals was eligible to be paid out upon achievement of $0.35 EPS and one-hundred percent (100%) for the achievement of $0.62 EPS. No portion of the target bonus percentage for corporate goals was awarded as the Company did not achieve the minimum EPS target of at least $0.35 EPS. No corporate performance goals were established for Ms. Granoff as her ability to substantially impact quantitative performance during fiscal 2008 was limited due to her employment beginning in the middle of the fiscal year.

Divisional performance goals for 2008 were based on the specific divisions for which the NEO had responsibility. All divisional operating income is based on income before allocation of corporate general and administrative expenses. No divisional performance goals were established for Mr. Cole, Ms. Granoff or Mr. Edelman as their responsibilities were not directly tied to a specific division or operating unit. Mr. Jakubowski’s 2008 divisional performance goal was based on the achievement of sportswear divisional operating income. Mr. DeVirgilio’s 2008 divisional performance goal was based on the achievement of licensing and international operating income. No portion of the target bonus for divisional performance goals was awarded to Mr. Jakubowski or Mr. DeVirgilio as the minimum divisional operating income target goals were not met.

Individual performance goals for 2008 were based upon key initiatives to define and implement the Company’s strategic plan, develop talent, drive operational excellence or any combination thereof. The NEOs individual goals for 2008 were as follows:

Mr. Cole’s 2008 individual performance goals included hiring a Chief Executive Officer (“CEO”), transitioning into a new role as Chairman and Chief Creative Officer focused on design, marketing and public relations, collaborating with the CEO to attract top talent and supporting the CEO and executive management in developing the three-year strategic plan to be approved by the Board of Directors during 2008. Ms. Granoff’s 2008 individual performance goals included developing the three-year strategic plan, working with Mr. Cole and the Company’s Human Resources Department to define a new organizational structure and attract top talent, developing a communication plan for the future direction of the Company, developing a five year business plan for the Le Tigre lifestyle brand, improving Consumer Direct performance and relaunching the Company’s website. Mr. Edelman’s individual performance goals included assisting the CEO with the three-year strategic plan, identifying and implementing margin enhancement and expense reduction initiatives, improving the budget process, creating a new pay for performance compensation plan in collaboration with the Human Resources Department and assuming responsibility for information technology, customer service and warehousing/distribution for the Company. Mr. Jakubowski’s 2008 individual performance goals included redefining the brand

15

position of Kenneth Cole New York and Kenneth Cole Reaction, reengineering the product development process to improve speed to market, developing a three-year plan to grow sales and improve profitability of men’s apparel across all channels of distribution, developing a plan for the women’s apparel business and engaging key retail partners to discuss and define key initiatives to grow business. Mr. DeVirgilio’s 2008 individual performance goals included developing a three-year international strategic plan, recruiting an executive to lead the International Division, developing plans to maximize and develop each licensing business, growing the Le Tigre lifestyle brand and launching a duty-free retail strategy. All of the executive officers were awarded a portion of their target bonus by the Committee for their achievement of individual performance goals.

The Compensation Committee evaluated the performance of each NEO considering the achievement of corporate, divisional and individual goals and their respective weightings. On a combined basis, each NEO received the following bonus payout: Mr. Cole received 33%, Ms. Granoff received 100%, Mr. Edelman received 35%, Mr. Jakubowski received 17% and Mr. DeVirgilio received 24%. These amounts are included in the “Summary Compensation Table” under the “Non-Equity Incentive Plan Compensation” caption. Mr. Cole elected to receive 100% and Ms. Granoff elected to receive 50% of their 2008 performance bonus in stock options in lieu of a cash payment. In addition, the Compensation Committee awarded a discretionary one-time bonus to Mr. DeVirgilio in the amount of $50,000 for his efforts in the licensing segment.

Subsequent to year end, the Company implemented a 100% pay for performance bonus program based solely on the Company’s financial performance to better align associate goals with shareholders goals. In 2009, bonuses will be paid based on the achievement of corporate EPS and divisional EBITDA targets. In addition, Mr. Cole’s bonus percentage target will change from 200% of his base salary to 100%.

Equity-based Incentive Plan: The Company maintains the Kenneth Cole Productions, Inc. 2004 Stock Incentive Plan to provide for equity-based compensation. Awards under this plan are designed to:

·

align the financial interests of the NEOs and other members of executive management with those of the Company’s shareholders;

·

reward the NEOs and members of executive management for building shareholder value; and

·

encourage the NEOs and member of executive management to remain in the Company’s employ over the long term.

The Compensation Committee believes that stock ownership by management is beneficial to all shareholders and as such, over the years it has granted stock options and restricted stock to the NEOs and other key employees. The Compensation Committee administers all aspects of the plan and determines the amount of and terms applicable to any award under the plan.

In determining the number of stock options or restricted shares to be awarded to the NEOs and members of executive management, the Compensation Committee took into consideration each executive’s level of responsibility, leadership abilities, corporate collaboration, brand contribution, development of Company culture and commitment to the Company’s success. The Compensation Committee also considers the recommendations of Mr. Cole and Ms. Granoff (with respect to the NEOs other than themselves) and the individual performance of the executive. As a general practice, both the number of shares granted to any NEO as well as the proportion of these shares relative to the total number of shares granted increase as the executive’s responsibilities increase.

In 2008, the Compensation Committee granted stock options to its NEOs. The exercise price of stock options was set at the fair market value of the Company’s stock on the grant date to ensure that the NEOs were rewarded only to the extent that the Company’s stock price appreciated following the grant date of the options. Stock options typically vest three to five years from date of grant. This vesting schedule is intended to reward the NEOs for performance over multiple years and to encourage such individuals to remain in the Company’s employ during the vesting period.

The Compensation Committee also may award shares of restricted stock under the Company’s stock incentive plan. These shares are subject to certain restrictions and generally vest over a period of three to four years from the date of grant. This vesting schedule encourages sustained financial performance, retention and long-term investment in the Company by NEOs receiving such awards. The grants of restricted stock have some advantages as an equity compensation vehicle as shares of restricted stock have an intrinsic value when granted (as opposed to stock options). No shares of restricted stock were granted to NEOs during 2008 except for 100,000 shares issued to Ms. Granoff as defined in her employment agreement.

Executive Deferred Compensation Programs: The Company maintains three non-qualified Executive Deferred Compensation Programs that are in compliance with regulation 409a of the Internal Revenue Code which regulates deferred compensation. One deferred compensation program is exclusively for Mr. Cole (“KDC Plan”). A second program is designed for participation of the other NEOs and certain other U.S.-based eligible employees (“Nonqual Plan”). The Company has adopted these plans to allow executives to save for retirement or other needs on a tax advantaged basis and to be competitive with the Company’s

16

peer group. The Company also maintains a third non-qualified deferred compensation plan, in the form of a Supplemental Executive Retirement Plan (“SERP”), which serves as a long term retention initiative.

Under the KDC Plan, Mr. Cole may elect to defer his entire base salary and annual bonus. The investment of amounts deferred under the KDC Plan are self-directed by Mr. Cole. Under the Nonqual Plan, participants may elect to defer up to 80% of their base salary and their entire annual bonus. Employees have the right to select various investment options. Investment choices under this program are similar to those choices provided under the Company’s 401(k) Plan, which consist of mutual funds.

The SERP provides for the Company, at its discretion, to contribute to the SERP on behalf of qualified employees. The SERP does not allow for employee contributions. Contributions by the Company are vested based upon the respective participants’ years of service. Each employee may select various investment options, and the value of the assets associated with the employee will then be based upon the returns of those investments. The Company has the right to invest in any funds at its discretion. The participants in the SERP are subject to non-compete, non-solicitation and confidentiality provisions which serve as a retention vehicle for the Company. On January 1, 2008 the Company amended its SERP. Under the amended plan, benefits earned become 30% vested after 3 years of service, 60% vested after 6 years of service and 100% vested after 10 years of service or termination of service as a result of retirement, disability or death. (Refer to “All Other Compensation” in the Summary Compensation Table.)

Perquisites and Other Personal Benefits: The Company also provides the NEOs and key executives with certain perquisites and other personal benefits that the Compensation Committee believes are reasonable and consistent with the Company’s overall compensation program to better enable the Company to attract and retain superior employees for key positions. The Compensation Committee periodically reviews the levels of perquisites and other personal benefits provided to the NEOs, which include a car allowance for each NEO. Mr. Cole has a Company car and driver and Ms. Granoff is provided a car service. In addition, for security purposes, the Board has recommended that Mr. Cole use chartered aircraft for air travel. The costs to the Company associated with providing these benefits for the NEOs are reflected in the Summary Compensation Table under the “All Other Compensation” caption.

Employment, change in control and severance agreements: The Company provides employment agreements to certain NEOs. Mr. Cole and Mr. Edelman do not have employment agreements. The Company believes entering into non-competition and non-solicitation arrangements with the NEOs is important to protect the Company following the cessation of their employment and also believe that severance provisions help attract and retain top performing executive officers.

Jill Granoff, Chief Executive Officer of the Company, entered into a letter agreement dated April 13, 2008 and amended on December 31, 2008 to conform to the requirements of Section 409A of the Internal Revenue Code, which provides that her employment shall commence on May 5, 2008 and continue until May 4, 2012. The agreement is automatically extended by one year on May 5, 2012 and on each May 5th thereafter unless written notice of non-renewal is given either by Ms. Granoff or the Company at least one-hundred twenty days prior to May 5th. Ms. Granoff is entitled to receive an annual salary of $1,000,000 (subject to good faith review for possible increase annually) and a target bonus award equal to 100% of her base salary. In addition, in the event the Company exceeds its bonus plan targets, Ms. Granoff has the opportunity to receive an additional bonus up to an additional 100% of base salary based on earnings, as determined by the Compensation Committee. For fiscal year 2008 only, Ms. Granoff received a bonus award of $1,000,000, based upon her individual performance goals and the terms of her employment agreement. Ms. Granoff requested that this bonus be paid $500,000 in cash and $500,000 in stock options to demonstrate her long-term commitment to the company and driving shareholder value. The Compensation Committee of the Board fully endorsed and approved this request.

Ms. Granoff’s agreement also provides for a grant of 100,000 shares of restricted stock for 2008 and grants of 50,000 shares of restricted stock for each of the next three years. For each grant, the restrictions lapse over a three-year period from issuance. In addition, Ms. Granoff received a grant of 250,000 stock options which vest over a four-year period. Other benefits and perquisites provided by the agreement include the eligibility to participate in the 401(k) plan, SERP plan and basic health, life, accidental death and business accident insurance. In addition, the Company maintains a life insurance policy in the face amount of $7 million and a supplemental disability policy of at least $2 million. The agreement also provides for severance payments in the event she is terminated by the Company without cause or is she terminates her employment for good reason, or if her employment is terminated in connection with a change of control of the Company. See “Potential Payouts upon Termination or Change in Control.”

Douglas Jakubowski, Chief Merchandising Officer of the Company, entered into a letter agreement with the Company dated October 12, 2006, which provides that he is entitled to receive an annual salary of $500,000 (subject to good faith review for possible increase annually) and a target bonus award equal to 50% of the actual base salary paid for the prior fiscal year. In addition, in the event the Company exceeds its bonus plan targets, Mr. Jakubowski has the opportunity to receive an additional bonus up to an additional 50% of base salary based on earnings, as determined by the Compensation Committee. The agreement also provided for a grant of 40,000 shares of restricted stock on which the restrictions lapse at the end of a three-year period. Other benefits and perquisites provided by the agreement include the eligibility to participate in the 401(k) plan, SERP plan and basic health, life, accidental death and business accident insurance. Mr. Jakubowski’s agreement provides for severance in the event he is terminated

17

by the Company without cause or if he voluntarily terminates his employment within twelve months following a change in control of the Company. See “Potential Payouts upon Termination or Change in Control.”

Michael DeVirgilio, the Company’s President of Licensing and International, signed a letter agreement dated March 31, 2006, which provides that Mr. DeVirgilio is entitled to receive an annual salary of $450,000 (subject to good faith review for possible increase annually) and a target bonus award of 50% of the actual base salary paid for the prior fiscal year. Mr. DeVirgilio has the opportunity to receive an additional bonus up to an additional 50% of base salary based on earnings as determined by the Compensation Committee. The agreement also provided for an initial grant of 20,000 shares of restricted stock vesting over a four-year period. Other benefits and perquisites provided by the Company include the eligibility to participate in the 401(k) plan, SERP and basic health, life, accidental death and business accident insurance as well as a monthly auto allowance. The agreement provides for severance in the event he is terminated by the Company without cause. See “Potential Payouts upon Termination or Change in Control.”

Tax Implications

Deductibility of Executive Compensation: The Compensation Committee reviews and considers the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code, which provides generally that the Company may not deduct compensation of more than $1,000,000 that is paid to any of the NEOs and key executives. The Company believes that all compensation paid under its management incentive plans is generally fully deductible for federal income tax purposes. The Company’s annual bonus plan is designed to qualify under Section 162(m) and was approved by the Company’s shareholders in 2004. However, in certain situations, the Compensation Committee may approve compensation that will not meet these requirements, but the Committee believes to be in the best interest of its shareholders in order to ensure competitive levels of total compensation for the NEOs. All of the compensation paid to the NEOs and key executives for 2008 will be fully deductible.

Non-qualified Deferred Compensation: On October 22, 2004, the American Jobs Creation Act of 2004 was signed into law, changing the tax rules applicable to non-qualified deferred compensation arrangements. The Company has amended its non-qualified deferred compensation plans to comply with this new law, where necessary. The Company is in compliance with these regulations, which were effective as of December 31, 2008, and resulted in no material changes to the Company’s prior non-qualified deferred compensation plans.

Adjustment of Recovery of Awards

The Company has not adopted a formal or informal policy regarding the adjustment or recovery of awards in connection with a restatement or adjustment of financial statements that would otherwise have resulted in a reduction in the size of the award or payment. The Company has not experienced any situations or occasions that would result in a reduction in the size of the award or payment. If the Company were to experience such an adjustment in the future, the Compensation Committee would assess the circumstances relating to the adjustment and take such legally permissible actions as it believes to be appropriate.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis set forth above with the Company’s management. Based on such review and discussions, the Compensation Committee recommended to the Company’s Board of Directors that the Compensation Discussion and Analysis be included in these proxy materials.

THE COMPENSATION COMMITTEE

Robert C. Grayson (Chairman)

Martin E. Franklin

Denis F. Kelly

Philip R. Peller

Compensation Committee Interlocks and Insider Participation

The Company’s Board approves compensation decisions recommended by the Compensation Committee. The Compensation Committee is composed of Mr. Grayson (Chairman), Mr. Franklin, Mr. Kelly and Mr. Peller, none of whom served as an officer or employee during 2008. Kenneth D. Cole and Jill Granoff, executive officers and directors of the Company during 2008, participated in the Board’s deliberations regarding certain executive compensation matters, other than their own compensation.

18

Summary Compensation Table for Fiscal Year-End December 31, 2008

The following table sets forth the aggregate compensation awarded to, and earned by the Named Executive Officers, for services rendered in all capacities to the Company and its subsidiaries for the years ended December 31, 2008, 2007 and 2006:

Name and Principal Position |

Year |

Salary |

Bonus |

Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |