UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

For the fiscal year ended

OR

For the transition period from to .

Commission file number:

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

||

(Address of principal executive offices) |

|

(zip code) |

Registrant’s telephone number, including area code:

(

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

☑ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the Registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2022, was approximately $

The number of shares of common stock outstanding as of January 31, 2023 was

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”) incorporate information by reference from the definitive proxy statement for the registrant’s 2023 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than after 120 days after the end of the fiscal year covered by this Annual Report.

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

2 |

|

|

|

|

3 |

|

|

|

|

4 |

|

|

|

|

|

|

PART I |

|

|

|

6 |

|

|

|

|

|

Item 1. |

|

|

6 |

|

Item 1A. |

|

|

38 |

|

Item 1B. |

|

|

76 |

|

Item 2. |

|

|

76 |

|

Item 3. |

|

|

77 |

|

Item 4. |

|

|

77 |

|

|

|

|

|

|

|

|

|

78 |

|

|

|

|

|

|

Item 5. |

|

|

78 |

|

Item 6. |

|

|

79 |

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

80 |

Item 7A. |

|

|

102 |

|

Item 8. |

|

|

103 |

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

159 |

Item 9A. |

|

|

159 |

|

Item 9B. |

|

|

160 |

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

160 |

|

|

|

|

|

|

|

|

161 |

|

|

|

|

|

|

Item 10. |

|

|

161 |

|

Item 11. |

|

|

161 |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

161 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

161 |

Item 14. |

|

|

161 |

|

|

|

|

|

|

|

|

|

162 |

|

|

|

|

|

|

Item 15. |

|

|

162 |

|

Item 16. |

|

|

169 |

|

|

|

|

170 |

1

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the year ended December 31, 2022 (“Annual Report”) and the information incorporated herein by reference, particularly in the sections captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” contains forward-looking statements, which involve substantial risks and uncertainties. In this Annual Report, all statements other than statements of historical or present facts contained in this Annual Report, including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “contemplate,” “intend,” “target,” “project,” “should,” “plan,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements appear in a number of places throughout this Annual Report and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for roxadustat, pamrevlumab and our other product candidates, our intellectual property position, the potential safety, efficacy, reimbursement, convenience clinical and pharmaco-economic benefits of our product candidates, the potential markets for any of our product candidates, our ability to develop commercial functions, our ability to operate in the People’s Republic of China (“China”), expectations regarding clinical trial data, our results of operations, cash needs, spending of the proceeds from our initial public offering, financial condition, liquidity, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions described in the section of this Annual Report captioned “Risk Factors” and elsewhere in this Annual Report. A summary of these risk factors can be found in the following section, however, please refer to the full risk factors in Item 1A “Risk Factors.” These risks are not exhaustive. Other sections of this Annual Report may include additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. The forward-looking statements made in this Annual Report are based on circumstances as of the date on which the statements are made. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report or to conform these statements to actual results or to changes in our expectations.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

This Annual Report also contains market data, research, industry forecasts and other similar information obtained from or based on industry reports and publications, including information concerning our industry, our business, and the potential markets for our product candidates, including data regarding the estimated size and patient populations of those and related markets, their projected growth rates and the incidence of certain medical conditions, as well as physician and patient practices within the related markets. Such data and information involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

You should read this Annual Report with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

2

RISK FACTOR SUMMARY

The success of FibroGen will depend on a number of factors, many of which are beyond our control and involve risks, including but not limited to the following:

Risks Related to the Development and Commercialization of Our Product Candidates

Risks Related to Our Reliance on Third Parties

Risks Related to Our Intellectual Property

3

Risks Related to Government Regulation

Risks Related to Our International Operations

CHINA OPERATIONS AND RELATED RISKS

We are incorporated in the state of Delaware. We operate within the Chinese market through FibroGen (China) Medical Technology Development Co., Ltd. (“FibroGen Beijing”), a wholly-owned subsidiary established in Beijing. FibroGen Beijing consists of development and commercialization operations as well as a drug product manufacturing facility. FibroGen Beijing holds the regulatory licenses issued by the Chinese regulatory authorities in respect of roxadustat. FibroGen Beijing has two branch offices located in Shanghai and Cangzhou, China. The branch office in Cangzhou operates a drug substance manufacturing facility. FibroGen Beijing also owns 51.1% of Beijing Falikang Pharmaceutical Co. Ltd. (“Falikang”), a joint venture established by FibroGen and operated in conjunction with AstraZeneca Investment (China) Co., Ltd. for the purpose of distributing our sole drug product approved for sale in China, roxadustat. Falikang conducts distribution activities for roxadustat within China while AstraZeneca Investment (China) Co., Ltd., AstraZeneca AB (“AstraZeneca”) and AstraZeneca (Wuxi) Trading Co., Ltd. provide sales and marketing services in support of roxadustat. Thus, stockholders of FibroGen, Inc. have an ownership interest in the joint venture, Falikang, through the FibroGen, Inc. equity ownership in our subsidiaries, including FibroGen Beijing.

For a full discussion of our business in China, please see the section below titled “China - Roxadustat Commercial Program” as well as the sections titled “ANEMIA ASSOCIATED WITH MYELODYSPLASTIC SYNDROMES” and “CHEMOTHERAPY-INDUCED ANEMIA.” We summarize certain risks associated with our operations in China in this section, however, please refer also to the section of this Annual Report captioned “Item 1A. Risk Factors” for additional risks related to our international operations.

4

To operate our business in China, each of our Chinese subsidiaries (and our joint venture with AstraZeneca, Falikang) is required to and does obtain a business license from the local counterpart of the State Administration for Market Regulation. Such business licenses list the business activities we are authorized to carry out and we would be noncompliant if we act outside of the scope of business activities set forth under the relevant business license. Due to China’s regulatory framework in general and for the pharmaceutical industry specifically, we are required to apply for and maintain many approvals or permits specific to many of our business activities, including but not limited to manufacturing, distribution, environmental protection, workplace safety and cybersecurity, from both national and local government agencies. For certain of our clinical trials conducted in China, we need to obtain, through the clinical sites, permits from the Human Genetic Resource Administrative Commission to collect samples that include human genetic resources, such as blood samples. We may also be required to obtain certain approvals from Chinese authorities before transferring certain scientific data abroad or to foreign parties or entities established or actually controlled by them. If we are unable to obtain the necessary approvals or permissions in order to operate our business in China, or if we inadvertently conclude that such approvals or permissions are not required, or if we are subject to additional requirements, approvals, or permissions, it could have an adverse effect on our business, financial condition and results of operations, our ability to raise capital and the market price of our common stock.

Due to our operations in China and the United States (“U.S.”), any unfavorable government policies on cross-border relations and/or international trade (including increased scrutiny on companies with significant China-based operations, capital controls or tariffs) may affect the competitive position of our drug products, the hiring of personnel, the demand for our drug products, the import or export of products and product components, our ability to raise capital, the market price of our common stock, or prevent us from selling our drug products in certain countries. While we do not operate in an industry that is currently subject to foreign ownership limitations in China, China could decide to limit foreign ownership in our industry, in which case there could be a risk that we would be unable to do business in China as we are currently structured.

Cash flows from Falikang and cash flows into FibroGen Beijing are currently intended to remain onshore in China. Our long-term plans for distributing cash flows from FibroGen Beijing may involve any number of scenarios including keeping the money onshore to fund future expansion of our China operations and paying down certain debt obligations. To date, no such debt repayments have occurred, nor have there been any other payments or distributions from FibroGen Beijing to entities or investors outside of China. Our capital contributions to FibroGen Beijing and the liquidity position of FibroGen Beijing depend on many factors, including those set forth under Part I, Item 1A “Risk Factors” in this Annual Report.

Our independent registered public accounting firm, PricewaterhouseCoopers LLP, is headquartered in the U.S. and was not identified in the Public Company Accounting Oversight Board (“PCAOB”) report dated December 16, 2021 as a firm that the PCAOB was unable to inspect. Therefore, the Holding Foreign Companies Accountable Act does not apply to us.

5

PART I

ITEM 1. BUSINESS

OVERVIEW

FibroGen, Inc. is a leading biopharmaceutical company discovering, developing and commercializing a pipeline of first-in-class therapeutics. Our lead product candidate and product are pamrevlumab and roxadustat, respectively.

Pamrevlumab, a human monoclonal antibody targeting connective tissue growth factor, is in Phase 3 clinical development for the treatment of idiopathic pulmonary fibrosis, locally advanced unresectable pancreatic cancer, and Duchenne muscular dystrophy. To date, we have retained exclusive worldwide rights for pamrevlumab.

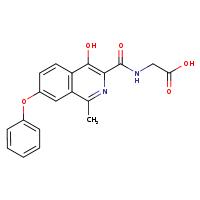

Roxadustat is an oral small molecule inhibitor of hypoxia-inducible factor prolyl hydroxylase (“HIF-PH”) activity. Roxadustat (爱瑞卓®, EVRENZOTM) is approved in China, Europe, Japan, and numerous other countries for the treatment of anemia in chronic kidney disease (“CKD”) for patients who are on dialysis and not on dialysis.

We are well positioned over the next 18 months to report topline results from seven pivotal clinical studies with two different drug candidates:

Our goal is to build a diversified pipeline with novel drugs that will address unmet patient needs in oncology, immunology, and fibrosis. We expect to file up to two INDs in the second half of 2023: one for an antibody targeting CCR8; and the other for an antibody targeting Galectin-9.

The following is an overview of our clinical and commercial programs.

6

PAMREVLUMAB FOR THE TREATMENT OF FIBROSIS AND CANCER

Our research and discovery work indicate that CTGF is a critical common element in the progression of serious diseases associated with fibrosis.

From our library of human monoclonal antibodies that bind to different parts of the CTGF protein and block various aspects of CTGF biological activity, we selected pamrevlumab, for which we have exclusive worldwide rights. In preclinical studies we demonstrated that pamrevlumab disrupts the fibrosis-promoting activity of CTGF, and based on those data believe that it can inhibit the central role of CTGF in causing diseases associated with fibrosis. Our data to date indicate that pamrevlumab is a promising and highly differentiated product candidate with broad potential to treat a number of fibrotic diseases and cancers.

We have sponsored clinical trials of pamrevlumab in IPF, pancreatic cancer, DMD, liver fibrosis, and diabetic kidney disease. In clinical studies involving more than 1,000 pamrevlumab-treated patients (approximately half of whom were dosed for more than six months), pamrevlumab has been well-tolerated across the range of doses studied, and there have been no dose-limiting toxicities seen thus far.

The U.S. Food and Drug Administration (“FDA”) has granted Fast Track and Orphan Drug designations to pamrevlumab for the treatment of IPF, LAPC, and DMD (with DMD also receiving Rare Pediatric Disease designation).

To date, we have retained exclusive worldwide rights for pamrevlumab. We are advancing our brand development activities for pamrevlumab in preparation for potential launches in IPF, LAPC and DMD.

In the next 18 months, we expect to report topline results from each of our five ongoing Phase 3 studies of pamrevlumab.

Overview of Fibrosis

Fibrosis is an aberrant response of the body to tissue injury that may be caused by trauma, inflammation, infection, cell injury, or cancer. The normal response to injury involves the activation of cells that produce collagen and other components of the extracellular matrix (“ECM”) that are part of the healing process. This healing process helps to fill in tissue voids created by the injury or damage, segregate infections or cancer, and provide strength to the recovering tissue. Under normal circumstances, where the cause of the tissue injury is limited, the scarring process is self-limited and the scar resolves to approximate normal tissue architecture. However, in certain disease states, this process is prolonged and excessive and results in progressive tissue scarring, or fibrosis, which can cause organ dysfunction and failure as well as, in the case of certain cancers, promote cancer progression.

Excess CTGF levels are associated with fibrosis. CTGF increases the abundance of myofibroblasts, a cell type that drives wound healing, and stimulates them to deposit ECM proteins such as collagen at the site of tissue injury. In the case of normal healing of a limited tissue injury, myofibroblasts eventually die by programmed cell death, or apoptosis, and the fibrous scarring process recedes.

Multiple proteins and signaling pathways have been implicated in the fibrotic process, many of which converge on CTGF, a central mediator of fibrosis. In the case of cancer, tumor-associated fibrotic tissue can promote tumor cell survival and metastasis. CTGF is a secreted glycoprotein produced by fibroblasts, endothelium, mesangial cells and other cell types, including cancers, and is induced by a variety of regulatory modulators, including TGF-ß and VEGF. CTGF expression has been demonstrated to be up-regulated in fibrotic tissues. Thus, we focused on targeting CTGF to block or inhibit its activity to mitigate, stop or reverse tissue fibrosis. In addition, since CTGF is implicated in nearly all forms of fibrosis, we believe pamrevlumab has the potential to provide clinical benefit in a wide range of clinical indications that are characterized by fibrosis.

Until recently, it was believed that fibrosis was an irreversible process. It is now generally understood that the process is dynamic and potentially amenable to reversal. Based on studies in animal models of fibrosis of the liver, kidney, muscle and cardiovascular system, it has been shown that fibrosis can be reversed. It has also been demonstrated in humans that fibrosis caused by hepatitis virus can be reversed (Chang et al. Hepatology (2010)). Additionally, we generated data in human and animal studies suggesting that lung fibrosis progression can be slowed, arrested, or possibly reversed in some instances upon treatment with pamrevlumab.

7

IDIOPATHIC PULMONARY FIBROSIS

Understanding IPF and Current Therapies

IPF is a form of progressive pulmonary fibrosis, or abnormal scarring, which destroys the structure and function of the lungs. As tissue scarring progresses in the lungs, transfer of oxygen into the bloodstream is increasingly impaired. Average life expectancy at the time of confirmed diagnosis of IPF is estimated to be between three to five years, with approximately two-thirds of patients dying within five years of diagnosis. Thus, the survival rates are comparable to some of the most deadly cancers. The cause of IPF is unknown but is believed to be related to injury to the alveolar epithelial cells, inflammation and fibrosis.

Patients with IPF experience debilitating symptoms, including shortness of breath and difficulty performing routine functions, such as walking and talking. Other symptoms include chronic dry, hacking cough, fatigue, weakness, discomfort in the chest, loss of appetite, and weight loss. Over the last decade, refinements in diagnosis criteria and enhancements in high-resolution computed tomography imaging technology (“quantitative HRCT”) have enabled more reliable diagnosis of IPF without the need for a lung biopsy.

Based on numerous sources, we estimate the U.S. prevalence and incidence of IPF to be approximately 120,000 cases, and 30,000 new cases per year, respectively, and the global prevalence of IPF to be 330,000 cases (including the major regions of U.S., Europe, Japan, and China. We believe that with the availability of technology to enable more accurate diagnoses, the number of individuals diagnosed per year with IPF will continue to increase.

There are currently two anti-fibrotic therapies approved to treat IPF in Europe and the U.S., pirfenidone and nintedanib, which have shown the commercial potential in IPF with over $4 billion in worldwide sales in 2021. Hoffmann-La Roche (“Roche”) reported worldwide sales of approximately $1.12 billion in 2021 for Esbriet (pirfenidone). Boehringer Ingelheim Pharma GmbH & Co. KG (“Boehringer Ingelheim”) reported total sales of approximately $2.9 billion for Ofev (nintedanib) in 2021.

Phase 3 Clinical Trials of Pamrevlumab in IPF

We are conducting two Phase 3 trials of pamrevlumab in IPF patients, ZEPHYRUS-1 and ZEPHYRUS-2.

Similar to PRAISE, our randomized and completed Phase 2 trial in 101 IPF patients described below, both of these Phase 3 studies are double-blind, placebo-controlled trials with a primary efficacy endpoint of change in forced vital capacity (“FVC”) at 48 weeks. FVC is a lung function test measuring the volume of air exhaled by a patient.

We amended the ZEPHYRUS-2 protocol to harmonize the primary endpoint between the U.S. and Europe as change in FVC. Previously the primary endpoint for Europe was disease progression (as defined below), with change in FVC as a key secondary endpoint. This change makes the primary endpoint for both studies consistent with other recent pivotal trials in IPF that formed the basis of regulatory approval in the U.S. and Europe.

Secondary efficacy endpoints for each study include disease progression (defined by a decline in FVC percent predicted of greater than or equal to 10% or death), acute IPF exacerbation, and quantitative changes in lung fibrosis volume from baseline.

We have completed enrollment of ZEPHYRUS-1, our first Phase 3 trial of pamrevlumab in 356 IPF patients, and we expect topline data from ZEPHYRUS-1 in mid-2023.

We continue to enroll patients in ZEPHYRUS-2, our second Phase 3 trial of pamrevlumab in approximately 340 IPF patients, and we expect topline data from ZEPHYRUS-2 in mid-2024.

Phase 2 Clinical Trial of Pamrevlumab in IPF

Positive results from PRAISE were published in The Lancet Respiratory Medicine (September 2019). PRAISE was designed to evaluate the safety and efficacy of pamrevlumab in patients with mild-to-moderate IPF (baseline FVC percentage predicted of 55%), as well as topline results from two sub-studies that were added to evaluate the safety of combining pamrevlumab with approved IPF therapies.

8

In the double-blind, placebo-controlled 48-week portion of this study, 103 patients were randomized (1:1) to receive either 30mg/kg of pamrevlumab or placebo intravenously every three weeks. Lung function assessments were conducted at baseline and at Weeks 12, 24, 36 and 48. Quantitative HRCT assessments of lung fibrosis volume were performed at baseline and at Weeks 24 and 48.

Pamrevlumab met the primary efficacy endpoint of change of FVC percent predicted, a measure of a patient’s lung volume as a percentage of what would be expected for such patient’s age, race, sex and height. The average decline (least squares mean) in FVC percent predicted from baseline to Week 48 was 2.9 in the pamrevlumab arm (n=50) as compared to an average decline of 7.2 in the placebo arm (n=51), a statistically significant difference of 4.33 (p=0.033).

FVC Change by Visit

Pamrevlumab-treated patients had an average decrease (least squares mean) in FVC of 129 ml at Week 48 compared to an average decrease of 308 ml in patients receiving placebo, a statistically significant difference of 178 ml (p=0.0249, using a linear slope analysis in the intent-to-treat population). This represents a 57.9% relative difference. In addition, the pamrevlumab-treated arm had a lower proportion of patients (10%) who experienced disease progression (defined by a decline in FVC percent predicted of greater than or equal to 10% or death), than did the placebo arm (31.4%) at Week 48 (p=0.0103).

Proportion of Patients with Decline in Percentage of Predicted FVC of 10% or Greater, or Death, by Visit

9

In this study, we measured change in quantitative lung fibrosis (“QLF”) from baseline to Week 24 and Week 48 using quantitative HRCT. The pamrevlumab arm achieved a statistically significant reduction in the rate of progression of lung fibrosis compared to placebo using HRCT to measure QLF. The change in QLF volume from baseline to Week 24 for pamrevlumab-treated patients was 24.8 ml vs. 86.4 ml for placebo, with a treatment difference of -61.6 ml (p=0.009). The change in QLF volume from baseline to 48 weeks was 75.4 ml in pamrevlumab-treated patients vs. 151.5 ml in patients on placebo, with a treatment difference of -76.2 ml (p=0.038).

Change from Baseline in Volume of Quantitative Lung Fibrosis (mL) in the Intention-to-Treat Population

As in our previous open label Phase 2 study, a correlation between FVC percent predicted and QLF was confirmed at both Weeks 24 and 48 in this study.

We are not aware of any other IPF therapies that have shown a statistically significant effect on lung fibrosis as measured by quantitative HRCT analysis.

The treatment effects of pamrevlumab were demonstrated not only on change in FVC, a measure of pulmonary function and IPF disease progression, and change in fibrosis using quantitative HRCT, but pamrevlumab-treated patients also showed a trend of clinically meaningful improvement in a measure of health-related quality of life using the St. George’s Respiratory Questionnaire vs. a reduction in quality of life seen in placebo patients over the 48 weeks of treatment. The St. George’s Respiratory Questionnaire quality of life measurement has been validated in chronic obstructive pulmonary disease. In the subgroup of patients that were evaluated by the UCSD Shortness of Breath Questionnaire, pamrevlumab-treated patients had a significant attenuation of their worsening dyspnea in comparison to placebo patients.

Pamrevlumab was well-tolerated in the placebo-controlled study. The treatment-emergent adverse events were comparable between the pamrevlumab and placebo arms and the adverse events in the pamrevlumab arm were consistent with the known safety profile of pamrevlumab. In this study, as compared with the placebo group, fewer pamrevlumab patients were hospitalized, following an IPF-related or respiratory treatment-emergent adverse event, or died for any reason.

Open-Label Phase 2 Clinical Trial of Pamrevlumab in IPF

Our completed open-label extension of Study 049, a Phase 2 open-label, dose-escalation study to evaluate the safety, tolerability, and efficacy of pamrevlumab in 89 patients with IPF, was consistent with the results from our randomized, double-blind, placebo-controlled Phase 2 clinical trial PRAISE. We presented data from our open-label Phase 2 IPF extension study (049) at the International Colloquium on Lung and Airway Fibrosis in November 2016, reporting that no safety issues were observed during prolonged treatment with pamrevlumab.

10

PANCREATIC CANCER

Understanding Pancreatic Cancer and Current Therapies

Certain solid malignant tumors have a prominent fibrosis component consisting mostly of ECM that contributes to metastasis and progressive disease. ECM is the connective tissue framework of an organ or tissue.

Pancreatic ductal adenocarcinoma, or pancreatic cancer, is the third leading cause of cancer deaths in the U.S. According to the American Cancer Society, approximately 64,500 people will be diagnosed with pancreatic cancer in the U.S. in 2023, and approximately 50,500 people will die of pancreatic cancer. Of all people diagnosed with pancreatic cancer in the U.S. between 2011 and 2017, the 5-year survival rate was 11%. Globally, an estimated 495,000 people were diagnosed with pancreatic cancer in 2020 and an estimated 466,000 people worldwide died from the disease. Because pancreatic cancer is difficult to diagnose, over 50% of new cased are metastatic, with a five-year survival rate of approximately 3%. An additional 15-20% of new pancreatic cancer patients are diagnosed with localized resectable tumors, with the remaining 30-35% of newly diagnosed patients having localized, unresectable tumors. For those with resectable tumors, 50% survive 17 to 27 months post-diagnosis and ~20% achieve five-year survival. In its report of December 2017, Decision Resources Group estimated that the major market sales (U.S., Europe and Japan) of pancreatic cancer drugs would grow from $1.3 billion in 2016 to approximately $3.7 billion in 2026.

Pancreatic cancer is aggressive and typically not diagnosed until it is largely incurable. Most patients are diagnosed after the age of 45, and according to the American Cancer Society, 94% of patients die within five years from diagnosis. The majority of patients are treated with chemotherapy, but pancreatic cancer is highly resistant to chemotherapy. Approximately 15% to 20% of patients are treated with surgery; however, even for those with successful surgical resection, the median survival is approximately two years, with a five-year survival rate of 15% to 20% (Neesse et al. Gut (2011)). Radiation treatment may be used for locally advanced diseases, but it is not curative.

The duration of effect of approved anti-cancer agents to treat pancreatic cancer is limited. Gemcitabine demonstrated improvement in median overall survival from approximately four to six months, and erlotinib in combination with gemcitabine demonstrated an additional ten days of survival. Nab-paclitaxel in combination with gemcitabine was approved by the FDA in 2013 for the treatment of pancreatic cancer, having demonstrated median survival of 8.5 months. The combination of folinic acid, 5-fluorouracil, irinotecan and oxaliplatin (FOLFIRINOX) was reported to increase survival to 11.1 months from 6.8 months with gemcitabine. These drugs illustrate that progress in treatment for pancreatic cancer has been modest, and there remains a need for substantial improvement in patient survival and quality of life.

The approved chemotherapeutic treatments for pancreatic cancer target the cancer cells themselves. Tumors are composed of cancer cells and associated non-cancer tissue, or stroma, of which ECM is a major component. In certain cancers such as pancreatic cancer, both the stroma and tumor cells produce CTGF which in turn promotes the proliferation and survival of stromal and tumor cells. CTGF also induces ECM deposition that provides advantageous conditions for tumor cell adherence and proliferation, promotes blood vessel formation, or angiogenesis, and promotes metastasis, or tumor cell migration, to other parts of the body.

Pancreatic cancers are generally resistant to powerful chemotherapeutic agents, and there is now growing interest in the use of an anti-fibrotic agent to diminish the supportive role of stroma in tumor cell growth and metastasis. The anti-tumor effects observed with pamrevlumab in preclinical models indicate that it has the potential to inhibit tumor expansion through effects on tumor cell proliferation and apoptosis as well as reduce metastasis.

Phase 3 Clinical Trial in Locally Advanced Unresectable Pancreatic Cancer

LAPIS is our double-blind placebo-controlled Phase 3 clinical program for pamrevlumab as a therapy for LAPC. We completed enrollment of 284 patients, randomized at a 1:1 ratio to receive either pamrevlumab or placebo, in each case in combination with chemotherapy (either FOLFIRINOX or gemcitabine plus nab-paclitaxel). We expect topline data for the primary endpoint of overall survival in the first half of 2024.

11

Clinical Development in Metastatic Pancreatic Cancer

In June 2021, the Pancreatic Cancer Action Network’s (PanCAN) Precision PromiseSM adaptive trial platform included pamrevlumab in combination with standard of care chemotherapy treatments for pancreatic cancer (gemcitabine and Abraxane®), in its study for patients with metastatic pancreatic cancer. The pamrevlumab portion of the trial is still ongoing. Drug candidates in the Precision Promise study will continue to progress (including from Phase 2 to Phase 3) unless stopped sooner for safety or futility. The pamrevlumab combination therapy is offered to patients as either a first- or second-line treatment option. Pamrevlumab was the first experimental treatment arm to be offered as a first-line treatment in PanCAN’s innovative Precision Promise trial. The objective of Precision Promise is to expedite the study and approval of promising therapies for pancreatic cancer by bringing multiple stakeholders together, including academic, industry and regulatory entities.

Completed Phase 1/2 Clinical Trial in Locally Advanced Unresectable Pancreatic Cancer

We completed an open-label, randomized (2:1) Phase 1/2 trial (FGC004C-3019-069) of pamrevlumab combined with gemcitabine plus nab-paclitaxel chemotherapy vs. the chemotherapy regimen alone in patients with inoperable LAPC that has not been previously treated. We enrolled 37 patients in this study and completed the six-month treatment period and surgical assessment at the end of 2017. The overall goal of the trial was to determine whether the pamrevlumab combination can convert inoperable pancreatic cancer to operable, or resectable, cancer. Tumor removal is the only chance for cure of pancreatic cancer, but only approximately 15% to 20% of patients are eligible for surgery.

We reported updated results from this study at the American Society of Clinical Oncology Annual Meeting in June 2018. A higher proportion (70.8%) of pamrevlumab-treated patients whose tumors were previously considered unresectable became eligible for surgical exploration than patients who received chemotherapy alone (15.4%), based on pre-specified eligibility criteria at the end of six months of treatment. Furthermore, a higher proportion of pamrevlumab-treated patients (33.3%) achieved surgical resection than those who received chemotherapy alone (7.7%).

In addition, this data showed improved overall survival among patients whose tumors were resected vs. not resected (NE vs. 18.56 months, p-value=0.0141) and a trend toward improved overall survival in patients eligible for surgery vs. patients who were not (27.73 vs. 18.40 months, p-value=0.0766). No increase in serious adverse events was observed in the pamrevlumab arm and no delay in wound healing was observed post-surgery.

Patients with LAPC have a median survival of less than 12 months, only slightly better than patients with metastatic pancreatic cancer, whereas patients with resectable pancreatic cancer have a much better prognosis with median survival of approximately 23 months and some patients being cured. If pamrevlumab in combination with chemotherapy continues to demonstrate an enhanced rate of conversion from unresectable cancer to resectable cancer, it may support the possibility that pamrevlumab could provide a substantial survival benefit for LAPC patients.

Completed Phase 1/2 Clinical Trial in Pancreatic Cancer

We completed an open-label Phase 1/2 (FGCL-MC3019-028) dose finding trial of pamrevlumab combined with gemcitabine plus erlotinib in patients with previously untreated locally advanced (Stage 3) or metastatic (Stage 4) pancreatic cancer. These study results were published in the Journal of Cancer Clinical Trials (Picozzi et al., J Cancer Clin Trials 2017, 2:123). Treatment continued until progression of the cancer or the patient withdrew for other reasons. Patients were then followed until death.

Seventy-five patients were enrolled in this study with 66 (88%) having Stage 4 metastatic cancer. The study demonstrated a drug exposure-related increase in survival. At the lowest doses, no patients survived for even one year while at the highest doses up to 31% of patients survived one year.

12

A post-hoc analysis found that there was a significant relationship between survival and trough levels of plasma pamrevlumab measured immediately before the second dose (Cmin). Cmin greater than or equal to 150 µg/mL was associated with significantly improved progression-free survival (p=0.01) and overall survival (p=0.03) vs. those patients with Cmin less than 150 µg/mL. For patients with Cmin >150 µg/mL median survival was 9.0 months compared to median survival of 4.4 months for patients with Cmin <150 µg/mL. Similarly, 34.2% of patients with Cmin >150 µg/mL survived for longer than one year compared to 10.8% for patients with Cmin <150 µg/mL. These data suggest that sufficient blockade of CTGF requires pamrevlumab threshold blood levels of approximately 150 µg/mL in order to improve survival in patients with advanced pancreatic cancer.

In the study, the majority of adverse events were mild to moderate, and were consistent with those observed for erlotinib plus gemcitabine treatment without pamrevlumab. There were 99 treatment-emergent serious adverse events, six of which were assessed as possibly related to the investigational drug by the principal investigator, and 93 as not related to study treatment. After investigation, it was our determination that there is no causal relationship between pamrevlumab and the treatment-emergent serious adverse events deemed possibly related by the principal investigator. We did not identify any evolving dose-dependent pattern, and higher doses of pamrevlumab were not associated with higher numbers of serious adverse events or greater severity of the serious adverse events observed.

DUCHENNE MUSCULAR DYSTROPHY

Understanding DMD and Current Therapies

In the U.S., approximately one in every 5,000 boys have DMD, and approximately 20,000 children are diagnosed with DMD globally each year. There are currently no approved disease-modifying treatments. Despite taking steroids to mitigate progressive loss of muscle function, a majority of children with DMD are non-ambulatory by adolescence and median survival is age 25.

DMD is an inherited disorder of one of the dystrophin genes resulting in absence of the dystrophin protein and abnormal muscle structure and function, leading to progressively diminished mobility as well as pulmonary function and cardiac function, which result in early death. Constant myofiber breakdown results in persistent activation of myofibroblasts and altered production of ECM resulting in extensive fibrosis in skeletal muscles of DMD patients. Desguerre et al. (2009) showed that muscle fibrosis was the only myo-pathologic parameter that significantly correlated with poor motor outcome as assessed by quadriceps muscle strength, manual muscle testing of upper and lower limbs, and age at ambulation loss. Numerous pre-clinical studies including those in the mdx model of DMD suggest that CTGF contributes to the process by which muscle is replaced by fibrosis and fat and that CTGF may also impair muscle cell differentiation during muscle repair after injury.

Phase 3 Clinical Trial of Pamrevlumab

Non-Ambulatory DMD Patients

LELANTOS-1 is our double-blind, placebo-controlled Phase 3 clinical trial evaluating pamrevlumab as a treatment for DMD, in combination with systemic corticosteroids. LELANTOS-1 completed enrollment of 99 non-ambulatory DMD patients randomized at a 1:1 ratio to pamrevlumab or placebo for a treatment period of 52 weeks. The primary endpoint will assess change in upper limb function from baseline to Week 52 and additional endpoints will include pulmonary, cardiac, performance, and fibrosis assessments. We expect topline data from this study in the second quarter of 2023.

Ambulatory DMD Patients

LELANTOS-2 is our double-blind, placebo-controlled Phase 3 trial evaluating pamrevlumab in DMD, in combination with systemic corticosteroids. We completed enrollment of 73 ambulatory patients aged 6-12, randomized at a 1:1 ratio to pamrevlumab or placebo for a treatment period of 52 weeks. The primary efficacy endpoint will assess ambulatory function, measured by the change in North Star Ambulatory Assessment from baseline to Week 52. We expect topline data from this study in the third quarter of 2023.

13

Phase 2 Open-Label Clinical Trial of Pamrevlumab in DMD

In June 2019 at the Parent Project Muscular Dystrophy meeting, we reported topline results from this 21-patient open-label single-arm trial in non-ambulatory DMD patients. This one-year administrative analysis compared our Phase 2 data to previously published natural disease history studies of DMD patients. While we cannot make direct comparisons between our trial and previously published data due to, among other things, differences in subject numbers, baseline characteristics, inclusion/exclusion criteria, treatment protocols, and analysis methods, pamrevlumab was well tolerated and compares favorably to published studies for FVC percent predicted and other clinical outcomes.

In pulmonary function tests, the results from our study indicate a potential reduction in the one-year decline in FVC percent predicted from baseline for pamrevlumab-treated patients when compared to FVC data of DMD patients (whether such patients were taking steroids or not) published in 2019 by Ricotti. In addition, pamrevlumab showed less decline in both percent predicted forced expiratory volume as compared to previously published study results of Meier in 2016, and in percent predicted peak expiratory flow rate, compared to what was observed in the study by Ricotti in 2019.

In muscle function tests, the majority of the results of this Phase 2 study showed the mean change from baseline in pamrevlumab-treated patients appeared to be more favorable than previously published data. Our results showed a mean increase in grip-strength score in both dominant and non-dominant hands at one year of treatment with pamrevlumab, while earlier results from a 2015 study by Seferian showed a decline at one year as expected.

ROXADUSTAT FOR THE TREATMENT OF ANEMIA

CHRONIC KIDNEY DISEASE

In collaboration with our partners Astellas Pharma Inc. (“Astellas”) and AstraZeneca, we have completed 16 Phase 3 studies worldwide in over 11,000 patients to support our marketing approvals of roxadustat (爱瑞卓®️, EVRENZOTM) to treat CKD anemia in China, Europe, Japan and numerous other countries.

Roxadustat Mechanism of Action

Roxadustat is an orally administered reversible inhibitor of HIF-PH. Inhibition of prolyl hydroxylase stabilizes HIF, which then forms a complex that initiates transcription of a number of genes involved in the erythropoietic process. This in turn stimulates a coordinated response that includes the increase of plasma endogenous erythropoietin (“EPO”) levels and reduction of hepcidin, a key regulator of iron homeostasis, ultimately resulting in increased oxygen delivery to tissues.

In anemia of CKD, roxadustat temporarily inhibits HIF-PH, stimulating a coordinated erythropoietic response.

Patients taking roxadustat typically have a transient increase in circulating endogenous EPO levels at peak concentration within or near the physiologic range naturally experienced by humans adapting to hypoxic conditions such as at high altitude, following blood donation, or impaired lung function, such as pulmonary edema.

By contrast, erythropoiesis stimulating agents (“ESAs”) act only to stimulate erythroid maturation without a corresponding increase in iron availability, and are typically dosed at well above the natural physiologic range of EPO. The sudden demand for iron stimulated by ESA-induced erythropoiesis can lead to functional or absolute iron deficiency. In addition, the lack of a coordinated increase in iron availability with ESAs may explain the hyporesponsiveness of patients with inflammation to this class of drugs. It also explains why patients taking ESAs need more IV iron supplementation and red blood cell transfusions than patients taking roxadustat do. Not only are IV iron and blood transfusions more costly than oral iron, but both are also associated with increased risk of hospitalization and death.

The differentiated mechanism of action of roxadustat, which involves induction of the body’s own natural pathways to achieve a more complete erythropoiesis, has the potential to provide a safe and effective treatment for anemia, including in the presence of inflammation, which normally limits iron availability.

14

Background of Anemia in Chronic Kidney Disease

CKD is a progressive disease characterized by gradual loss of kidney function that may eventually lead to kidney failure or end-stage renal disease requiring dialysis or a kidney transplant to survive. CKD affects 12% to 14% of the global adult population. CKD is more prevalent in developed countries but is also growing rapidly in emerging markets such as China.

Anemia is a complication of CKD and can be a serious medical condition in which patients have insufficient red blood cells and low levels of hemoglobin, a protein in red blood cells that carries oxygen to cells throughout the body. Anemia becomes increasingly common as kidney function declines and is associated with increased risk of hospitalization, cardiovascular complications and death, and frequently causes significant fatigue, cognitive dysfunction, and considerable reduction of quality of life.

China – Roxadustat Commercial Program

Since the launch of roxadustat (tradename: 爱瑞卓®) in 2019, the anemia of CKD market has expanded significantly. Roxadustat has captured a majority of this growth, benefiting from inclusion in the 2019 and 2021 National Reimbursement Drug Lists.

In 2022, roxadustat sales volume grew over 80% and it was the top CKD anemia brand in China with a 34% value share within the segment of ESAs and HIF-PH inhibitors. Roxadustat remains the only HIF-PH inhibitor currently on the market in China and we have seen broad adoption across the three segments of hemodialysis, peritoneal dialysis, and non-dialysis.

In 2023, we expect continued and robust growth of roxadustat sales in China due to continued adoption by patients and doctors. Multiple treatment guidelines and expert consensus in China describe or recommend HIF-PH inhibitors as a treatment for CKD anemia - and roxadustat specifically. We believe this increased awareness and confidence in the class will provide strong support for continued expansion of roxadustat sales.

We have established significant clinical experience and market leadership in treating CKD anemia in China, and we believe roxadustat has become the standard of care for the treatment of anemia in CKD in China. In 2023, we will focus on expanding the population treated with roxadustat, as well as duration of treatment which we believe is important to managing the risks associated with anemia in CKD.

Europe - Roxadustat Commercial Program

In Europe, our partner Astellas continues the commercial launch of EVRENZO® (roxadustat). EVRENZO is approved for the treatment of anemia associated with CKD in both non-dialysis and dialysis patients. EVRENZO is the only HIF-PH inhibitor currently on the market in Europe. In 2023, we expect sales of roxadustat for CKD anemia in Europe to accelerate due to reimbursement and launches in additional European countries.

Japan - Roxadustat Commercial Program

In Japan, our partner Astellas continues the commercial launch of EVRENZO (roxadustat), targeting healthcare providers that care for approximately 330,000 dialysis patients across Japan. EVRENZO is approved for the treatment of anemia associated with CKD in both non-dialysis and dialysis patients. The supplemental NDA for the use of roxadustat in patients with anemia of CKD not on dialysis was approved in November 2020 by the Pharmaceuticals and Medical Devices Agency. EVRENZO is one of five HIF-PH inhibitors currently on the market in Japan.

United States - Roxadustat Development

There are approximately 39 million CKD patients in the U.S., an estimated six million of whom have anemia.

When ESAs were introduced in 1989, they dramatically reduced the need for blood transfusions in CKD patients, which was a material development since transfusions reduce the patient’s opportunity for a kidney transplant and increase the risk of infections and complications such as heart failure and allergic reactions. However, multiple randomized clinical trials with ESAs suggested safety risks of ESA therapies, and as a result, the anemia guidelines and approved labels have changed to more restrictive use of ESAs.

15

In the dialysis-dependent population, most patients start receiving ESAs when the patient is transitioning to dialysis care. As of the end of 2018, there were over 550,000 CKD patients on dialysis in the U.S., a large majority of whom required anemia therapy.

There were approximately 127,000 incident dialysis patients in 2018. Despite the higher risk of blood transfusions, cardiovascular events, and hospitalization in patients with anemia, only 14.6% of patients in 2018 were treated with ESAs prior to initiating dialysis notwithstanding a mean hemoglobin level of 9.3 g/dL at the time of dialysis initiation. These treatment figures at the time of dialysis initiation demonstrate how undertreated CKD anemia is currently in non-dialysis patients.

In August 2021, the U.S. FDA issued a CRL regarding roxadustat’s NDA for the treatment of anemia due to CKD in adult patients, stating that it could not be approved in its present form.

ANEMIA ASSOCIATED WITH MYELODYSPLASTIC SYNDROMES

MDS is a diverse group of bone marrow disorders characterized by ineffective production of healthy blood cells and premature destruction of blood cells in the bone marrow, leading to anemia. In most MDS patients, the cause of the disease is unknown.

The prevalence of MDS in the U.S. is estimated to be between 60,000 and 170,000, and continues to rise as more therapies become available and patients are living longer with MDS. Annual incidence rates are estimated to be 4.9/100,000 adults in the U.S., and 1.51/100,000 adults in China.

Anemia is the most common clinical presentation in MDS, seen in approximately 80% of MDS patients, and producing symptoms, including fatigue, weakness, exercise intolerance, shortness of breath, dizziness, and cognitive impairment.

Limitations of the Current Standard of Care for Anemia in Myelodysplastic Syndromes

Stem cell transplant is the only potentially curative therapy for MDS, but it is not feasible in most patients due to their advanced age and frailty. The high rate of severe anemia leaves recurring red blood cell transfusions as the mainstay of care in MDS patients. Transfusion can result in direct organ damage through transfusional iron overload. Transfusion dependent MDS patients suffer higher rates of cardiac events, infections and transformation to acute leukemia, and a decreased overall survival rate when compared with non-transfused patients with MDS, and decreased survival compared to an age-matched elderly population. Patients receiving red blood cell transfusions may require an iron chelator in order to address toxic elements of iron overload such as lipid peroxidation and cell membrane, protein, DNA, and organ damage.

Lower-risk MDS patients represent approximately 77% of the total diagnosed MDS population. Most national and international guidelines recommend use of ESAs for anemia only in lower-risk MDS patients presenting with symptomatic anemia with serum EPO levels at or below 500 mU/mL.

Even among the eligible subpopulation, the effectiveness of ESAs in treating anemia in MDS remains limited, with the best clinical study results showing 40% to 60% erythroid response rates, in studies where significantly high doses of ESAs were used, enrolled patients had low serum EPO levels, and in lower-risk categories. New strategies to broaden the eligible population, improve anemia and maintain adequate iron balance, as well as avoidance of transfusions, are highly desired in managing patients with MDS.

Market Opportunity for Roxadustat in Myelodysplastic Syndromes

We believe there is a significant need for a safer, more effective, and more convenient option to address anemia in patients with lower-risk MDS. Roxadustat, our orally administered small molecule HIF-PH inhibitor, stimulates the body’s natural mechanism of red blood cell production and iron hemostasis based on cellular-level oxygen-sensing and iron-regulation mechanisms. Unlike ESAs which are limited to providing exogenous EPO, roxadustat activates a coordinated erythropoietic response in the body that includes the stimulation of red blood cell progenitors, an increase in the body’s production of endogenous EPO, and an increase in iron availability for hemoglobin synthesis, which we believe is important in a broad range of MDS patients. Moreover, in anemia of CKD, roxadustat has demonstrated the ability in clinical trials to increase and maintain hemoglobin levels in the presence of inflammation as measured by CRP, where ESAs have shown limited effect. We believe that roxadustat has the potential to replicate this result in MDS anemia patients, where it is not uncommon for patients to present with autoimmune and inflammatory conditions.

16

Phase 3 Clinical Trial in Myelodysplastic Syndromes

We completed enrollment of the Phase 3 arm of MATTERHORN, our Phase 2/3 placebo-controlled, double-blind clinical trial of roxadustat for the treatment of anemia in MDS in the U.S. and Europe. The Phase 3 portion of this trial is studying roxadustat in 140 transfusion-dependent, lower-risk MDS patients, in which subjects are randomized 3:2 to receive roxadustat or placebo three-times-weekly. The primary endpoint is the proportion of patients who achieve transfusion independence for 56 consecutive days within the first 28 weeks with secondary endpoints and safety evaluated at 52 weeks. We expect topline 28-Week data from this study in the second quarter of 2023.

CHEMOTHERAPY-INDUCED ANEMIA

As blood cell production in bone marrow is highly prolific, it is particularly vulnerable to the cytotoxic effects of chemotherapy used to treat cancer patients. Many chemotherapy agents directly impair hematopoiesis in bone marrow, including disruption of red blood cell production. The nephrotoxic effects of some cytotoxic agents, such as platinum-containing agents, can also result in decreased production of erythropoietin by the kidneys, further contributing to reduced red blood cell production. Radiation therapy has also been associated with hematologic toxicity.

Approximately 40% of total solid tumor cancer patients, or approximately 6.8 million people, undergo chemotherapy each year globally, including 3.2 million in China. Between 60% and 80% of these patients develop anemia. The incidence and severity of CIA depend on a variety of factors, including the tumor type or the level of toxicity of the therapy, and further increases with each successive chemotherapy round. We believe the addressable population is approximately 500,000 in China.

ESAs have been recommended for patients experiencing CIA with the desirable goals of improvement in anemia-related symptoms and the avoidance of blood transfusion, which increases risk of infections and the risk of complications such as heart failure and allergic reactions. However, not all CIA patients respond to ESA therapy, which may be due to the etiology of their CIA or inflammatory comorbidity. ESA use also has associated toxicities, including increased thrombotic events, possible decreased survival and accelerated tumor progression, as published from randomized clinical trials and meta-analyses, that led to label restrictions and boxed warnings in the U.S. for ESAs in cancer populations in 2007, followed by the ESA Risk Evaluation and Mitigation Strategy program.

Market Opportunity for Roxadustat in Chemotherapy-Induced Anemia

China has 4-5 million solid tumor patients, of which approximately 75% receive chemotherapy. Of that population, an estimated 50% (over 1.5 million patients) become anemic, and among them, 40% are considered moderate to severe, defined as Hb < 10 g/dL. This addressable population is largely untreated, with an ESA usage rate of under 10%. We further estimate that the population where anemia has led to chemotherapy dose reduction or delay is around 20-25%.

We believe this population could benefit from treatment with roxadustat, and the oral administration of HIF-PH inhibitors for this very sick population could be a particularly attractive feature over ESAs.

Phase 3 Clinical Trial in Chemotherapy-Induced Anemia

We have completed enrollment of our active-controlled Phase 3 clinical trial in China of roxadustat in CIA for non-myeloid malignancies. The primary efficacy endpoint is the mean change in hemoglobin level from baseline to the level averaged over Weeks 9-13. This trial has enrolled 159 subjects and we expect topline data from this study in the second quarter of 2023.

Phase 2 Clinical Trial in Chemotherapy-Induced Anemia

The results of WHITNEY, the Phase 2 clinical trial of roxadustat in CIA in the U.S., was published by the American Journal of Hematology in January 2023. This study provided the basis for the study design for the China Phase 3 study.

17

RESEARCH AT FIBROGEN

Our research programs at FibroGen are grounded in our three areas of expertise: HIF biology, 2-oxoglutarate enzymology, and CTGF biology. More recently, we added two immuno-oncology programs via a partnership with HiFiBiO Therapeutics (“HiFiBiO”) and are actively working to further expand the preclinical pipeline in our therapeutic focus areas of oncology, immunology, and fibrosis.

We have applied our expertise in the field of HIF-PH inhibition to develop an understanding of other areas of HIF biology with important therapeutic implications. This consistent progression of discovery has led to findings relating to HIF-mediated effects associated with inflammatory pathways, various aspects of iron metabolism, insulin sensitivity and glucose and fat metabolism, neurological disease, and ischemic injury. There are at least three different HIF-PH enzymes that are known to regulate the stability of HIF — these enzymes are commonly referred to in the scientific literature as PHD1, PHD2 and PHD3. Studies of genetically modified mice, in which the individual HIF-PH enzymes have been deleted, have revealed that PHD2 plays the major role in regulation of erythropoiesis by HIF. In contrast, PHD1 and PHD3 appear to play less important roles in HIF-mediated erythropoiesis, but instead have been implicated in other important biological pathways. We believe that both pan-PHD and PHD-selective inhibitors could have important therapeutic applications beyond anemia.

The HIF-PH enzymes that are the targets of roxadustat belong to a broader family of enzymes known as 2-oxoglutarate (“2OG”)-dependent oxygenases. In humans, this family comprises more than 60 members that play important roles in a diverse range of biological processes including collagen biosynthesis, oxygen sensing, epigenetic regulation, nucleic acid modification/repair, and lipid metabolism. The first members of this enzyme family to be characterized were the collagen prolyl hydroxylases, which play a critical role in the biosynthesis of collagen and as a result, are potential targets for the treatment of fibrotic disease. Other members of the 2OG-dependent oxygenase family with relevance to human disease include the Jumonji domain-containing histone demethylases, which are emerging cancer targets.

The fact that all members of the 2OG-dependent oxygenase enzyme family use 2OG as a co-substrate makes them viable targets for small molecule inhibitors that compete with 2OG. FibroGen has been a leader in inhibition of enzymes belonging to this family, and our internal medicinal chemistry efforts generated a library of novel compounds designed to target the 2OG-dependent oxygenase family.

We are also applying our knowledge of CTGF to investigate new clinical opportunities for pamrevlumab. We are exploring additional indications in which CTGF-driven fibrosis has been implicated in disease progression and mortality, as well as expanded cancer subtypes for which CTGF biology has been shown to support tumor survival and metastasis.

More recently we in-licensed two preclinical immuno-oncology assets. The first is FG-3165, an antibody that inhibits Galectin-9, a secreted protein implicated in suppression of anti-tumor immune response in multiple solid tumors, and shown to be a driver of cancer progression in acute myeloid leukemia. The other is FG-3163, an antibody targeting the CCR8 protein designed to deplete immune suppressive T regulatory cells from the tumor microenvironment. Multiple preclinical studies demonstrated that depletion of T regulatory cells in solid tumors results in enhanced immune response and reduction in tumor size, particularly when combined with immune checkpoint inhibition. We expect to file INDs for up to two of these programs in the second half of 2023.

18

COLLABORATIONS

Collaboration Partnerships for Roxadustat

Our revenue to date has been generated primarily from our collaboration agreements with Astellas and AstraZeneca for the development and commercialization of roxadustat. In addition, we started roxadustat commercial sales in China in 2019. For the fiscal year ended December 31, 2022, 40% of our revenue was related to our collaboration agreements, and 59% of our revenue was from roxadustat commercial sales in China. For the fiscal year ended December 31, 2021, 76% of our revenue was related to our collaboration agreements, and 20% of our revenue was from roxadustat commercial sales in China. For the fiscal year ended December 31, 2020, 59% of our revenue was related to our collaboration agreements, and 41% of our revenue was from roxadustat commercial sales in China.

Astellas

We have two agreements with Astellas for the development and commercialization of roxadustat, one for Japan, and one for Europe, the Commonwealth of Independent States, the Middle East and South Africa. Under these agreements, we provided Astellas the right to develop and commercialize roxadustat for anemia in these territories.

We share responsibility with Astellas for clinical development activities required for U.S. and Europe regulatory approval of roxadustat, and equally share those development costs under the agreed development plan for such activities. Astellas will be responsible for clinical development activities and all associated costs required for regulatory approval in all other countries in the Astellas territories. Astellas will hold and have responsibility for regulatory filings in its territories. We are responsible, either directly or through our contract manufacturers, for the manufacture and supply of all quantities of roxadustat to be used in development and commercialization under the agreements, other than roxadustat drug product for Japan. Astellas is responsible for roxadustat commercialization activities in the Astellas territories.

AstraZeneca

We have two agreements with AstraZeneca for the development and commercialization of roxadustat for anemia, one for China (the “AstraZeneca China Agreement”), and one for the U.S. and all other countries not previously licensed to Astellas (the “AstraZeneca U.S./RoW Agreement”). Under these agreements, we provided AstraZeneca the right to develop and commercialize roxadustat for anemia in these territories. We share responsibility with AstraZeneca for clinical development activities required for U.S. regulatory approval of roxadustat, and FibroGen will transfer the U.S. NDA to AstraZeneca upon approval. AstraZeneca will hold the equivalent regulatory filings in the other licensed countries.

Under the AstraZeneca China Agreement, which is conducted through FibroGen China Anemia Holdings, Ltd., FibroGen Beijing, and FibroGen International (Hong Kong) Limited (collectively, “FibroGen China”), the commercial collaboration was structured as a 50/50 profit share, which was amended by the AstraZeneca China Amendment in the third quarter of 2020, as discussed and defined below.

In 2020, we entered into Master Supply Agreement under the AstraZeneca U.S./RoW Agreement to define general forecast, order, supply and payment terms for AstraZeneca to purchase roxadustat bulk drug product from FibroGen in support of commercial supplies.

In July 2020, FibroGen China and AstraZeneca entered into an amendment, effective July 1, 2020, to the AstraZeneca China Agreement, relating to the development and commercialization of roxadustat in China (the “AstraZeneca China Amendment”).

Under the AstraZeneca China Amendment, in September 2020, FibroGen Beijing and AstraZeneca completed the establishment of a jointly owned entity, Beijing Falikang Pharmaceutical Co. Ltd. (“Falikang”), which performs roxadustat distribution, as well as conduct sales and marketing through AstraZeneca.

FibroGen Beijing manufactures and supplies commercial product to Falikang based on an agreed upon transfer price, which includes a gross transfer price, net of a calculated profit share. Revenue is recognized upon the transfer of control of commercial products to Falikang in an amount that reflects the allocation of transaction price of the China manufacturing and supply obligation to the performance obligation satisfied during the reporting period.

19

Additional Information Related to Collaboration Agreements

Additional information related to our collaboration agreements is set forth in Item 7 of this Annual Report, and Note 3, Collaboration Agreements, License Agreement and Revenues, to our consolidated financial statements under Item 8 of this Annual Report. Information about collaboration partners that accounted for more than 10% of our total revenue or accounts receivable for the last three fiscal years is set forth in Note 15, Segment and Geographic Information, to our consolidated financial statements under Item 8 of this Annual Report.

HiFiBiO

In June 2021, we entered into an exclusive license and option agreement with HiFiBiO, pursuant to which we exclusively licensed from HiFiBiO all product candidates in HiFiBiO’s Galectin-9 program and subsequently exclusively licensed all product candidates in HiFiBiO’s CCR8 program. In addition to the upfront payments we previously paid, HiFiBiO may receive up to a total of $345 million in future clinical, regulatory, and commercial milestone payments for each program. HiFiBiO will also be eligible to receive tiered royalties based upon worldwide net sales. We expect to file INDs for up to two of these programs in the second half of 2023.

Licensing Activities

Exclusive License with Eluminex

In July 2021, we exclusively licensed to Eluminex Biosciences (Suzhou) Limited (“Eluminex”) global rights to our investigational biosynthetic cornea derived from recombinant human collagen type III. FibroGen may receive up to a total of $64.0 million in future manufacturing, clinical, regulatory, and commercial milestone payments for the biosynthetic cornea program, as well as $36.0 million in commercial milestones for the first recombinant collagen III product that is not the biosynthetic cornea. FibroGen will be eligible to receive mid-single-digit to low double-digit royalties based upon worldwide net sales of cornea products, and low single-digit to mid-single-digit royalties based on worldwide net sales of other recombinant human collagen type III products that are not cornea products.

We received an $8.0 million upfront payment from Eluminex in 2022 and have billed a $3.0 million milestone in the first quarter of 2023 based on Eluminex implanting a biosynthetic cornea in the first patient of its clinical trial in China. Additional information related to the Eluminex license revenue is set forth in Note 3, Collaboration Agreements, License Agreement and Revenues, to our consolidated financial statements under Item 8 of this Annual Report.

Strategic Financing Agreement

On November 4, 2022, we entered into a revenue interest financing agreement (“RIFA”) with an affiliate of NovaQuest Capital Management (“NovaQuest”) with respect to our revenues from Astellas’ sales of roxadustat in Europe, Japan and the other Astellas territories.

Pursuant to the RIFA, we received $49.8 million from NovaQuest, representing the gross proceeds of $50.0 million net of initial issuance costs, in consideration for a portion of future revenues we will receive from Astellas. For additional details about this financing transaction, see Note 8, Liability Related to Sale of Future Revenues, to the consolidated financial statements.

COMPETITION

The pharmaceutical and biotechnology industries are highly competitive, particularly in some of the indications of our developing drug candidates, including anemia in CKD, IPF, pancreatic cancer, and DMD. We face competition from multiple other pharmaceutical and biotechnology companies, many of which have significantly greater financial, technical and human resources and experience in product development, manufacturing and marketing. These potential advantages of our competitors are particularly a risk in IPF, pancreatic cancer, and DMD, where we do not currently have a development or commercialization partner.

We expect any products that we develop and commercialize to compete based on, among other things, efficacy, safety, convenience of administration and delivery, price, the level of generic competition, and the availability of reimbursement from government and other third-party payors.

20

When any of our product candidates are approved, they will compete with currently marketed products, and product candidates that may be approved for marketing in the future, for treatment of the indications described below.

In addition, we will likely face competition from other companies developing treatments of other anemia indications that we may also seek to pursue in the future or that may be sold in indications we are pursuing but for which they are not yet approved. We may face competition for patient recruitment, enrollment for clinical trials, and potentially in commercial sales. There may also be new therapies for renal-related diseases that could limit the market or level of reimbursement available for roxadustat.

Roxadustat

Approved Medicines

Drugs that will compete with roxadustat are expected to include ESAs, particularly in those patient segments where ESAs are used. Currently available ESAs include epoetin alfa (EPOGEN®, marketed by Amgen Inc. in the U.S., Procrit® and Erypo®/Eprex®, marketed by Johnson & Johnson, Inc., and Espo® marketed by Kyowa Hakko Kirin in Japan and China), darbepoetin (Amgen/Kyowa Hakko Kirin’s Aranesp® and NESP®) and Mircera® marketed by Roche outside the U.S. and by Vifor Pharma, a Roche licensee, in the U.S. and Puerto Rico, as well as biosimilar versions of these currently marketed ESA products. ESAs have been used in the treatment of anemia in CKD for more than 30 years, serving a significant majority of dialysis patients. While non-dialysis CKD anemia patients who are not under the care of nephrologists, including those with diabetes and hypertension, do not typically receive ESAs and are often left untreated, some non-dialysis patients under nephrology or hematology care may be receiving ESA therapy. It may be difficult to encourage healthcare providers and patients to switch to roxadustat from products with which they have become familiar.

Biosimilars

The first biosimilar ESA, Pfizer’s Retacrit® (epoetin zeta), entered the U.S. market in November 2018. Market penetration of Retacrit and the potential addition of other biosimilar ESAs currently under development may alter the competitive and pricing landscape of anemia therapy in CKD patients on dialysis under the end-stage renal disease bundle. The patents for Amgen’s EPOGEN® (epoetin alfa) expired in 2004 in Europe, and the final material patents in the U.S. expired in May 2015. Several biosimilar versions of currently marketed ESAs are available for sale in Europe, China and other territories. In the U.S., a few ESA biosimilars are currently under development. Sandoz, a division of Novartis, markets Binocrit® (epoetin alfa) in Europe and may file a biosimilar Biologics License Application in the U.S.

Product Candidates in Development