UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

The Southern Company

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

|

|

|

|

| Investor Fact Sheet | |

| One of America’s Premier Energy Companies |

| — |

46,000 megawatts of electric generating capacity and 1,500 billion cubic feet of combined natural gas consumption and throughput volume serving approximately 9.0 million electric and gas customers through 11 premier state-regulated utilities, a competitive generation company serving wholesale customers across America and a nationally-recognized provider of customized energy solutions. |

| — |

Consistently listed among the top U.S. electric service providers by American Customer Satisfaction Index. |

| — |

Ranked among best employers for minorities and veterans. |

| — |

Goal to maximize long-term value to stockholders through a customer, community and relationship-focused business model that produces sustainable levels of return on energy infrastructure. |

|

Financial Integrity |

| — |

Goal of achieving an attractive risk-adjusted return, supported by a simple, transparent business model and sound financial policy. |

| — |

Experienced management focused on creating and delivering value. |

| — |

Goal of supporting a strong credit profile and preserving the ability to invest in additional value-accretive projects. |

| Dividend Objective: Regular, Predictable and Sustainable Growth |

| — |

68 consecutive years of dividends equal to or greater than the previous year. |

| — |

15 years of consecutive dividend increases. |

| Dividends Per Share Paid |

|

| 2016 Energy Mix for Southern Company |

|

| What Distinguishes Southern Company |

Electric Operating Companies

| — |

Only electric utility system in the U.S. committed to developing the full portfolio of generation resources – natural gas, 21st century coal, nuclear and renewables such as wind and solar – together with an emphasis on energy efficiency. |

Southern Company Gas

| — |

Largest natural gas distribution operator in the U.S. with seven state-regulated local distribution companies (LDCs), serving over 4.5 million customers. Midstream operations include investments in six pipelines, including Southern Natural Gas. Gas marketing services complement LDCs and midstream investments. |

Southern Power

| — |

America’s premier wholesale energy partner investing in clean energy solutions serving municipalities, electric cooperatives, investor-owned utilities and other energy customers. |

PowerSecure

| — |

Provides energy technologies and services to electric utilities and large industrial, commercial, institutional and municipal customers. Customer solutions include distributed generation systems, utility infrastructure solutions and energy efficiency products and services. |

Growth in Renewables

| — |

Approximately 4,000 megawatts of renewable capacity announced or added since 2012, including the largest voluntary utility solar portfolio in the U.S. at Georgia Power. |

Research and Development

| — |

Industry leader in conducting robust research, development and deployment of new, innovative energy technologies. |

| — |

Major focus on greenhouse gas emissions reduction and a record of technology advancement dating back to the 1960s. |

| Letter to Stockholders | |

Thomas A.

Fanning

Chairman, President and

Chief Executive Officer

|

There is no doubt the world is rapidly changing on many fronts. At Southern Company we are not merely adapting to this changing environment – we have the energy to lead the change.” |

Dear Fellow Stockholders:

You are invited to attend the 2017 Annual Meeting of Stockholders at 10:00 a.m., ET on Wednesday, May 24, 2017, at The Lodge Conference Center at Callaway Gardens, Pine Mountain, Georgia.

2016 was a year of great growth and change as we continued to fill in the energy value chain to sustain growth.

| — |

We proudly welcomed more than 6,000 new colleagues and over 4.5 million customers with the addition of Southern Company Gas (formerly AGL Resources Inc.). |

| — |

Our wholesale electric subsidiary, Southern Power Company (Southern Power), continued to acquire solar, wind and natural gas generation facilities, investing over $4.5 billion. |

| — |

We acquired a 50% equity interest in the Southern Natural Gas pipeline system. |

| — |

With the acquisition of PowerSecure International, Inc. (PowerSecure) and its strategic alliance with Bloom Energy for the deployment of fuel cell and battery storage technologies, we’re developing behind-the-meter infrastructure for customers across the country. |

These decisions were all designed to help meet customers’ current and future energy needs with a focus on the continued execution of our customer-focused business model supporting constructive regulatory environments with healthy capital spending and returns on our investment. We now own and operate 11 premier state-regulated electric and gas utilities that are complemented by energy assets under long-term contract, including natural gas and renewable generation, interstate natural gas pipelines and behind-the-meter infrastructure. We aim to continue to deliver a superior, risk-adjusted total shareholder return (TSR) supported by regular, predictable and sustainable earnings and dividends.

I am also proud to report that we were recognized by DiversityInc as one of the “Top 50 Companies for Diversity” in 2016. DiversityInc also ranked Southern Company number one on its list of “Top 10 Companies for Opportunity.” This is especially meaningful because it testifies that we were recognized not only for cultivating a diverse workplace, but that we are also considered the number one company in America in which the individuals who comprise that diverse workforce are afforded the opportunity to advance their careers. In addition, we earned a perfect score from the Human Rights Campaign on their Corporate Equality Index for 2017.

We are taking advantage of the notice and access rules of the Securities and Exchange Commission (SEC) that allow us to furnish our proxy materials to you over the internet instead of mailing paper copies to each stockholder. We are mailing a Notice of Internet Availability of Proxy Materials beginning on or about April 7, 2017 to certain of our stockholders. The Notice contains instructions on how to access the proxy materials and vote your proxy. We believe this approach allows us to provide stockholders with a timely and convenient way to receive proxy materials and vote, while lowering the costs of delivery and reducing the environmental impact of the annual meeting.

Your vote is important. We urge you to vote promptly, even if you plan to attend the annual meeting.

Thank you for your continued support of Southern Company.

Thomas A. Fanning

|

Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting of Stockholders to be held on May 24, 2017: The proxy statement and the annual report are available at investor.southerncompany.com. |

investor.southerncompany.com 3

| Notice of Annual Meeting of Stockholders of Southern Company | |

Date and Time

Wednesday, May 24, 2017 at 10:00 a.m., ET

Place

The Lodge Conference Center at Callaway Gardens, Highway 18, Pine Mountain, Georgia 31822

Items of Business

Stockholders are being asked to vote on six agenda items at the 2017 annual meeting.

| 1 |

Elect 15 Directors |

| 2 |

Approve an amendment to the Certificate of Incorporation to reduce the supermajority vote requirement to a majority vote |

| 3 |

Conduct an advisory vote to approve executive compensation, often referred to as a Say on Pay |

| 4 |

Conduct an advisory vote to approve the frequency of future advisory votes on executive compensation, often referred to as a Say on Frequency |

| 5 |

Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2017 |

| 6 |

Consider a stockholder proposal, if properly presented at the meeting |

Record Date

Stockholders of record at the close of business on March 27, 2017 are entitled to attend and vote at the annual meeting. On that date, there were 995,225,310 shares of common stock of The Southern Company (Southern Company, the Company, we, us or our) outstanding and entitled to vote.

By Order of the Board of Directors.

April 7, 2017

|

EVERY VOTE IS IMPORTANT TO We have created an annual meeting website to make it easy to access our 2017 annual meeting materials. | |

| |

|

www.southerncompanyannualmeeting.com |

|

|

At the annual meeting website you can find an overview of the items to be voted, the proxy statement and the annual report to read online or to download, as well as a link to vote your shares. Even if you plan to attend the annual meeting in person, please vote as soon as possible by internet or by telephone or, if you received a paper copy of the proxy form by mail, by signing and returning the proxy form. | |

|

Vote by Internet or Telephone Voting by internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated. | ||

|

www.proxyvote.com |

|

|

1-800-690-6903 |

|

|

Vote by Mail | ||

|

If you received a paper copy of the proxy form by mail, you can mark, sign, date and return the proxy form in the enclosed, postage-paid envelope. | |

4 Southern Company 2017 Proxy Statement

| Proxy Summary | |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

|

Item 1 |

Elect 15 Directors |

— |

Each nominee holds or has held senior executive positions, maintains the highest degree of integrity and ethical standards and complements the needs of the Company. | ||

| — |

Through their positions, responsibilities, skills and perspectives, which span various industries and organizations, these nominees represent a Board of Directors (Board) that is diverse and possesses appropriate collective knowledge and experience in accounting, finance, leadership, business operations, risk management, corporate governance and our industry and key subsidiaries’ service territories. | ||||

|

The Board recommends a vote FOR each Director nominee. | ||||

|

See page 15 for further information. | ||||

Director Nominees |

|

Juanita

Powell Baranco Executive Vice President and Chief Operating Officer of Baranco Automotive Group |

|

Jon A. Boscia Founder and President, Boardroom Advisors LLC |

|

Henry A. “Hal” Clark III Senior Advisor of Evercore (retired) | ||

|

Age: 68

Director since: 2006

Independent Director:

Yes

Current Committees:

Audit |

Age: 64

Director since: 2007

Independent Director:

Yes

Current Committees:

Audit |

Age: 67

Director since: 2009

Independent Director:

Yes

Current Committees:

Compensation and Management Succession

(Chair), Finance | |||||

|

Thomas A. Fanning Chairman of the Board, President and Chief Executive Officer (CEO), Southern Company |

|

David J. Grain Founder and Managing Partner of Grain Management LLC |

|

Veronica M. Hagen Chief Executive Officer, Polymer Group, Inc. (retired) | ||

|

Age: 60

Director since: 2010

Independent Director:

No

Current Committees:

None |

Age: 54

Director since: 2012

Independent Director:

Yes

Current Committees:

Compensation and Management Succession,

Finance (Chair) |

Age: 71

Director since: 2008

Independent Director:

Yes

Current Committees:

Governance (Chair),

Nuclear/Operations | |||||

|

Warren A. Hood, Jr. Chairman and Chief Executive Officer, Hood Companies Inc. |

|

Linda P. Hudson Founder, Chairman and Chief Executive Officer, The Cardea Group |

|

Donald M. James Chairman and Chief Executive Officer, Vulcan Materials Company (retired) | ||

|

Age: 65

Director since: 2007

Independent Director:

Yes

Current Committees:

Audit |

Age: 66

Director since: 2014

Independent Director:

Yes

Current Committees:

Governance, Nuclear/Operations, Business

Security Subcommittee (Chair) |

Age: 68

Director since: 1999

Independent Director:

Yes

Current Committees:

Compensation and Management Succession,

Finance | |||||

investor.southerncompany.com 5

|

Proxy Summary |

|

John D. Johns Chairman and Chief Executive Officer, Protective Life Corporation |

|

Dale E. Klein Associate Vice Chancellor of Research, University of Texas System |

|

William G. Smith, Jr. Chairman, President and Chief Executive Officer, Capital City Bank Group, Inc. | ||

|

Age: 65

Director since: 2015

Independent Director: Yes

Current Committees: Audit (Chair) |

Age: 69

Director since: 2010

Independent Director: Yes

Current Committees: Compensation and Management Succession,

Nuclear/Operations, Business Security

Subcommittee |

Age: 63

Director since: 2006

Independent Director: Yes

Current Committees: Finance,

Governance | |||||

|

Steven R. Specker Chief Executive Officer, Tri Alpha Energy, Inc. |

|

Larry D. Thompson John A. Sibley Professor of Corporate and Business Law, The University of Georgia School of Law |

|

E. Jenner Wood III Corporate Executive Vice President – Wholesale Banking, SunTrust Banks, Inc. (retired) | ||

|

Age: 71

Director since: 2010

Independent Director: Yes

Current Committees: Compensation and Management Succession,

Nuclear/Operations (Chair) |

Age: 71

Director since: 2014

Independent Director: Yes, Lead Independent Director

Current Committees: Finance, Governance |

Age: 65

Director since: 2012

Independent Director: Yes

Current Committees: Governance,

Nuclear/Operations | |||||

|

Qualifications, Attributes, Skills and Experience of the Board as a Whole | ||

|

CEO or senior executive leadership experience | |

|

Diversity of race, ethnicity, gender, age, cultural background or professional experience | |

|

Electric or gas utility experience or nuclear operations experience | |

|

Engineering, innovation or technology experience | |

|

Federal, state or local government or regulatory experience | |

|

Financial, banking or investment experience | |

|

Knowledge of the traditional electric operating companies or Southern Company Gas | |

|

Risk oversight or risk management experience | |

|

Board Independence All Director nominees are independent except the CEO

|

|

Board Diversity  |

6 Southern Company 2017 Proxy Statement

| Proxy Summary |  |

|

Key Corporate Governance Practices |

We seek to establish corporate governance standards and practices that create long-term value for our stockholders and positive influences on the governance of the Company. Our key corporate governance practices include:

| — |

Annual election of Directors |

| — |

Majority voting for Directors, with a director resignation policy |

| — |

10% threshold for stockholders to request a special meeting |

| — |

Adoption of proxy access bylaw that provides stockholders (up to group of 20) that have maintained ownership of 3% of shares for three years the ability to nominate the greater of two nominees or 20% of Directors |

| — |

14 of 15 Directors are independent with an average tenure of independent Directors of seven years |

| — |

Strong Lead Independent Director |

| — |

All Board committees are comprised of independent Directors |

| — |

Annual Board and committee self-evaluations |

| — |

Proactive stockholder engagement |

| — |

Clawback policy under our Omnibus Plan |

| — |

Strong stock ownership guidelines |

| — |

Annual management succession planning review |

| — |

Anti-hedging and anti-pledging provisions |

|

Board Tenure Tenure of Independent Directors Average Tenure of Independent

Directors: 7

years |

|

|

|

Recent and Proposed Governance and Disclosure Enhancements |

| — |

Adopted a proxy access right for stockholders |

| — |

Continued our stockholder engagement efforts |

| — |

Added five new Directors to the Board in the past five years |

| — |

Included disclosure about Board refreshment, Board and committee self-evaluations and management succession planning |

| — |

Included a message from the Lead Independent Director |

| — |

Eliminated the “fair price” anti-takeover provision in the Certificate of Incorporation |

| — |

Proposed an amendment to the Certificate of Incorporation to eliminate the supermajority vote requirement |

|

Item 2 |

Approve an Amendment to the Certificate of Incorporation to Reduce the Supermajority Vote Requirement to a Majority Vote |

— | A supermajority vote requirement like the one contained in Article Eleventh of the Certificate of Incorporation, as amended (Certificate of Incorporation or Certificate), historically has been intended to facilitate corporate governance stability and provide protection against self-interested action by large stockholders by requiring broad stockholder consensus to make certain fundamental changes. | ||

| — | As corporate governance standards have evolved, many stockholders and commentators now view a supermajority requirement as limiting the Board’s accountability to stockholders and the ability of stockholders to effectively participate in corporate governance. | ||||

|

The Board recommends a vote FOR approval of an amendment to the Certificate to reduce the supermajority vote requirement to a majority vote. | ||||

|

See page 39 for further information. | ||||

investor.southerncompany.com 7

|

Proxy Summary |

|

Item 3 |

Advisory Vote to Approve Executive Compensation (Say on Pay) |

— | We believe our compensation program provides the appropriate mix of fixed and “at-risk” compensation. Our short- and long-term performance-based compensation program ties pay to Company performance, rewards achievement of financial and operational goals and relative TSR, encourages individual performance that is in-line with our strategy, is aligned with stockholder interests and remains competitive with our industry peers. | ||

|

The Board recommends a vote FOR approval of executive compensation. | ||||

|

See page 78 for further information. | ||||

Compensation Highlights |

We target the total direct compensation for our executives at market median and place a significant portion of that target compensation “at risk” – subject to achieving both short-term and long-term performance goals. In fact, only the base salary portion of executive compensation is fixed.

|

CEO Target Pay |

||||

|

89% At Risk-Subject to Performance Goals |

||||

|

Salary |

Annual

Cash |

Long-Term Equity

Incentive Award |

||

We have continued with the same compensation program structure for 2016, tying a significant majority of executive compensation to performance. The key performance based elements are the annual cash incentive award and the long-term equity incentive award.

| Annual Cash Incentive Award | |

| — |

Awards under our Performance Pay Program (PPP) are earned based on the achievement of performance goals over a one-year performance period. |

| — |

Performance goals for 2016 include financial goals (earnings per share (EPS) and business unit net income), operational goals and individual performance goals intended to drive performance that we believe will lead to long-term success for the Company. |

| — |

Payout is made in cash after the end of the performance period. |

| Long-Term Equity Incentive Award | |

| — |

Awards under our Performance Share Program (PSP) are granted in the form of performance share units that are earned based on the achievement of performance goals over a three-year performance period. |

| — |

Performance goals for the 2016 to 2018 performance period include a cumulative three-year EPS goal (25% weighting), an equity-weighted return on equity (ROE) goal (25% weighting) and a relative TSR performance goal (50% weighting). |

| — |

Payout is made in shares of common stock after the end of the three-year performance period. |

|

2016 Financial and Operational Performance |

2016 was a successful year for us with our adjusted EPS exceeding our guidance range for the year. We expanded our reach while continuing the strong financial performance of our traditional electric operating companies and our electric wholesale subsidiary, Southern Power. We also demonstrated strong operational performance for the year.

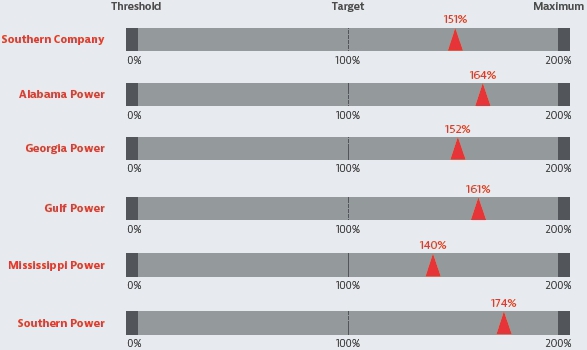

Financial Goals and Achievement for 2016 Performance Pay Program

We exceeded the financial goals for the year set by the Compensation and Management Succession Committee under our 2016 Performance Pay Program. Financial measures tied to compensation performance goals included EPS for Southern Company and net income for our various business units.

Operational Goal Achievement for 2016 Performance Pay Program

Operating performance was strong across the Southern Company system for 2016. Operational measures for the 2016 Performance Pay Program included customer satisfaction, reliability, availability, nuclear plant operations, major projects, safety and culture. Measures and weightings vary among the operating companies.

8 Southern Company 2017 Proxy Statement

| Proxy Summary |  |

| Incentive Compensation Earned for Performance Periods Ended in 2016 |

The compensation earned by our named executive officers (NEOs) demonstrates our commitment to pay for performance.

Annual Cash Incentive Plan – 2016 Performance Pay Program

Our Performance Pay Program rewards annual financial and operational performance as well as individual NEO performance. We had strong financial and operational performance for 2016, exceeding our overall targets for the year. The Compensation and Management Succession Committee also believed the 2016 individual performance contributions by our NEOs were strong. Accordingly, payouts for all participants in the program, including the NEOs, were above target. For the NEOs, payouts ranged from 167% to 174% of target.

Long-Term Equity Incentive Program – 2014-2016 Performance Share Program

In 2014, 60% of the target value of our long-term equity incentive program was granted in the form of performance shares under our Performance Share Program. For the three-year performance period of 2014 through 2016, performance shares could be earned based on a relative TSR performance goal. Our three-year TSR performance relative to the utility peer group was below the threshold performance level, resulting in a payout at 0% for the Performance Share Program awards for all participants, including the NEOs.

| Compensation Governance Overview |

| ✓ | 89% of CEO target pay is “at risk” based on achievement of performance goals | |

| ✓ | Performance shares subject to achievement of three performance measures over a three-year period: cumulative EPS, ROE and relative TSR | |

| ✓ | Clawback provision for performance-based pay | |

| ✓ | Independent compensation consultant | |

| ✓ | Policy against hedging and pledging | |

| ✓ | Dividends on stock awards received only if underlying award is earned | |

| ✓ | Annual charter review and self-evaluation by the Compensation and Management Succession Committee | |

| ✓ | Strong stock ownership requirements | |

| ✓ | Annual pay risk assessment | |

| ✓ | Change-in-control severance payouts require double-trigger of change in control and termination of employment | |

| ✓ | Annual review of tally sheets | |

| ✓ | Ongoing stockholder engagement | |

| ✓ | Regular updates on best practices to the Compensation and Management Succession Committee from the independent compensation consultant |

| What We Don’t Do | ||||

| ✕ | No tax gross ups for NEOs (except on certain relocation-related expenses) | |||

| ✕ | NEOs receive limited ongoing perquisites that make up a small portion of total compensation | |||

| ✕ | No employment agreements with our executives | |||

| ✕ | No stock option repricing without stockholder approval | |||

| ✕ | No excise tax gross-ups on change-in-control severance arrangements | |||

| ✕ | Granting of equity awards are not timed to coincide with the release of material, non-public information | |||

|

Changes to Long-Term Equity Incentive Program Based on feedback from investors and input from our independent compensation consultant, along with our ongoing evaluation of best practices, the makeup of our long-term equity incentive program has changed over the past five years. |

|||||

|

— | 60% performance shares with a relative TSR performance measure over a three-year performance period and 40% stock options | |||

|

— | 100% performance shares with three performance measures over a three-year performance period: cumulative EPS, equity-weighted ROE and relative TSR | |||

investor.southerncompany.com 9

|

Proxy Summary |

|

Item 4 |

Advisory Vote to Approve the Frequency of Future Advisory Votes on Executive Compensation (Say on Frequency) |

— | We are required to hold an advisory vote on the frequency of the advisory vote to approve executive compensation (Say on Frequency) at least once every six years. In 2011, the Board recommended and the stockholders voted overwhelmingly in favor of an annual Say on Pay vote. The Board continues to believe that the Say on Pay vote should be held every year (on an annual basis). | ||

|

The Board recommends a vote for the frequency of the advisory vote on executive compensation every ONE YEAR (on an annual basis). | ||||

|

See page 78 for further information. | ||||

|

Item 5 |

Ratify the Independent Registered Public Accounting Firm for 2017 |

— | The Audit Committee has appointed Deloitte & Touche LLP (Deloitte & Touche) as our independent registered public accounting firm for 2017. | ||

| — | This appointment is being submitted to stockholders for ratification. | ||||

|

The Board recommends a vote FOR ratification of the appointment of Deloitte & Touche as our independent registered public accounting firm for 2017. | ||||

|

See page 79 for further information. | ||||

Stockholder Proposal

|

Item 6 |

Vote on a Stockholder Proposal |

— | We have been advised that a stockholder proposal is intended to be submitted at the annual meeting. | ||

|

The Board recommends a vote AGAINST the stockholder proposal. | ||||

|

See page 84 for further information. | ||||

10 Southern Company 2017 Proxy Statement

| Table of Contents | |

investor.southerncompany.com 11

| FAQs about Voting and the Annual Meeting | |

The following table summarizes the Board’s voting recommendations for each proposal, the vote required for each proposal to pass and the effect of abstentions and uninstructed shares on each proposal.

| Item | Board Recommendation |

Voting Standard | Abstentions | Uninstructed Shares | ||||

| Item 1 – Election of Directors | ✓ FOR | Majority of votes cast for each Director | No effect | No effect | ||||

| Item 2 – Approval of an amendment to the Certificate to reduce the supermajority vote requirement to a majority vote | ✓ FOR | At least two-thirds of issued and outstanding shares | Count as a vote against | Count as a vote against | ||||

| Item 3 – Advisory vote to approve executive compensation (Say on Pay) | ✓ FOR | Majority of votes cast | No effect | No effect | ||||

| Item 4 – Advisory vote to approve the frequency of future advisory votes on executive compensation (Say on Frequency) | ✓ FOR | Plurality of the votes cast | No effect | No effect | ||||

| Item 5 – Ratification of the appointment of Deloitte & Touche as the independent registered public accounting firm for 2017 | ✓ FOR | Majority of votes cast | No effect | Discretionary voting by broker permitted | ||||

| Item 6 – Stockholder Proposal | ✕ AGAINST | Majority of votes cast | No effect | No effect |

| Q: | Who is entitled to vote? | |

| A: | All stockholders of record at the close of business on the record date of March 27, 2017 may vote. | |

| Q: | Can I attend the annual meeting? | |

| A: |

All stockholders are invited to the annual meeting. Attendees need to bring photo identification, such as a driver’s license, and proof of ownership to gain admission to the annual meeting. If you are a holder of record, the top half of your proxy card is your proof of ownership. If you hold your shares in street name, you will need proof of ownership to be admitted to the annual meeting. Examples of proof of ownership are a recent brokerage statement or a letter from your bank or broker. Please note that cameras, sound or video recording equipment, cellular telephones, smartphones or other similar equipment and electronic devices are not permitted to be used during the annual meeting. Large bags or backpacks may not be brought into the annual meeting. If you hold your shares in street name and you want to give voting instructions at the annual meeting, you must get a legal proxy in your name from the broker, bank or other nominee that holds your shares. | |

| Q: | What is notice and access? | |

| A: |

The SEC’s “notice and access” rule allows companies to deliver a Notice of Internet Availability of Proxy Materials (Notice) to stockholders in lieu of a paper copy of the proxy statement and annual report. The Notice provides instructions as to how stockholders can access the proxy statement and the annual report online, contains a listing of matters to be considered at the annual meeting and sets forth instructions as to how shares can be voted. Instructions for requesting a paper copy of the proxy statement and the annual report are set forth on the Notice. Shares must be voted by internet, by phone or by completing and returning a proxy form. Shares cannot be voted by marking, writing on and/or returning the Notice. Any Notices that are returned will not be counted as votes. | |

| Q: | How do I give voting instructions? | |

| A: |

You may attend the annual meeting and give instructions in person or give instructions by internet, by phone or, if you received a printed proxy form, by mail. Information for giving voting instructions is on the Notice or form of proxy and trustee voting instruction form (proxy form). For those investors whose shares are held by a broker, bank or other nominee, you must complete and return the voting instruction form provided by your broker, bank or nominee in order to instruct your broker, bank or nominee on how to vote. | |

| Q: | What shares are included on the proxy form? | |

| A: |

If you are a stockholder of record, you will receive only one Notice or proxy form for all the shares of common stock you hold in certificate form, in book-entry form and in any Company benefit plan. Please vote proxies for all accounts to ensure that all of your shares are voted. If you wish to consolidate multiple registered accounts, contact Wells Fargo Shareowner Services at 1-800-554- 7626 or at www.shareowneronline.com. | |

12 Southern Company 2017 Proxy Statement

| FAQs about Voting and the Annual Meeting |  |

| Q: | Will my shares be voted if I do not vote by internet, by telephone or by signing and returning my proxy form? |

| A: | If you are a holder of record and you do not vote, then your shares will not count in deciding the matters presented for stockholder consideration at the annual meeting. With respect to certain matters, your failure to vote will have the same effect as a vote against the matter. |

| If you are a current or former Southern Company system employee or other individual who holds shares of common stock in the Southern Company Employee Savings Plan (ESP), AGL Resources Inc. Retirement Savings Plus Plan (RSP) or Nicor Gas Thrift Plan (Nicor Plan) and you do not provide the trustee of the relevant plan (Trustee) with timely voting instructions, the following will occur in accordance with the applicable plan provision and/or policy for unvoted shares: |

| — |

ESP: The Pension Fund Investment

Review Committee may direct the Trustee how to vote these

shares. | |

| — |

RSP: The plan’s Investment Committee

will direct the Trustee how to vote these

shares. | |

| — |

Nicor Plan: The Trustee may vote these shares in the same proportion as it votes shares owned by Nicor Plan participants who voted their shares. |

| Procedures are in place to

safeguard the confidentiality of your voting instructions.

If you are a beneficial owner, you will receive voting instruction information from the bank, broker or other nominee through which you own your shares of common stock. If your shares are held through a bank, broker or other nominee, your broker may vote your shares under certain limited circumstances if you do not provide voting instructions before the annual meeting. These circumstances include voting your shares on “routine matters” under New York Stock Exchange (NYSE) rules, such as the ratification of the appointment of our independent registered public accounting firm described in Item 5 of this proxy statement. With respect to Item 5, if you do not vote your shares, your bank or broker may vote your shares on your behalf or leave your shares unvoted. The remaining proposals are not considered “routine matters” under NYSE rules. When a proposal is not a routine matter and the brokerage firm has not received voting instructions, the brokerage firm cannot vote the shares on that proposal. We encourage you to provide instructions to your broker or bank by voting your proxy so that your shares will be voted at the annual meeting in accordance with your wishes. |

| Q: | What if I am a stockholder of record and do not specify a choice for a matter when returning a proxy form? |

| A: | Stockholders should specify their choice for each matter on the proxy form. If no specific instructions are given, proxies which are signed and returned will be voted in accordance with the Board’s recommendations. |

| Q: | Can I change my vote? |

| A: | Yes. If you are a holder of record, you may change your vote by submitting a subsequent proxy, by written request received by the Corporate Secretary prior to the meeting or by attending the annual meeting and voting your shares. |

| If your shares are held through a broker, bank or other nominee, you must follow the instructions of your broker, bank or other nominee to revoke your voting instructions. | |

| Q: | How are votes counted? |

| A: | Each share counts as one vote. |

| Q: | How many votes do you need to hold the annual meeting? |

| A: | A quorum is required to transact business at the annual meeting. Stockholders of record holding shares of stock constituting a majority of the shares entitled to be cast shall constitute a quorum. |

| Abstentions that are marked on the proxy form and broker non-votes are included for the purpose of determining a quorum, but shares that otherwise are not voted are not counted toward a quorum. | |

| Q: | What are broker non-votes? |

| A: | Broker non-votes occur on a matter up for vote when a broker, bank or other holder of shares you own in “street name” is not permitted to vote on that particular matter without instructions from you, you do not give such instructions and the broker, bank or other nominee indicates on its proxy form, or otherwise notifies us, that it does not have authority to vote its shares on that matter. Whether a broker has authority to vote its shares on uninstructed matters is determined by NYSE rules. |

| Q: | Can the proxy statement be accessed from the internet? |

| A: | Yes. You can access the proxy statement on our website at investor.southerncompany.com. |

| Q: | Can I request a copy of the Company’s 2016 Annual Report on Form 10-K? |

| A: | Yes. A copy of our 2016 Annual Report on Form 10-K including financial statements, as filed with the SEC, may be obtained without charge upon written request to the Corporate Secretary, Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308. You can also access the document on our website at investor.southerncompany.com. |

investor.southerncompany.com 13

|

FAQs about Voting and the Annual Meeting |

| Q: | Does the Company offer electronic delivery of proxy materials? |

| A: | Yes. Most stockholders can elect to receive an email that will provide an electronic link to the proxy statement, annual report and proxy voting site. Opting to receive your proxy materials on- line saves us the cost of producing and mailing documents. |

| You may sign up for electronic delivery when you vote your proxy via the internet or by visiting www.icsdelivery.com/so. Once you enroll for electronic delivery, you will receive proxy materials electronically as long as your account remains active or until you cancel your enrollment. If you consent to electronic access, you will be responsible for your usual internet-related charges (e.g., on-line fees and telephone charges) in connection with electronic viewing and printing of the proxy statement and annual report. We will continue to distribute printed materials to stockholders who do not consent to access these materials electronically. | |

| Q: | What is “householding?” |

| A: | Stockholders sharing a single address may receive only one copy of the proxy statement and annual report or the Notice, unless the transfer agent, broker, bank or other nominee has received contrary instructions from any owner at that address. This practice — known as householding — is designed to reduce printing and mailing costs. If a stockholder of record would like to either participate or cancel participation in householding, he or she may contact Wells Fargo Shareowner Services at 1-800-554-7626. If you own indirectly through a broker, bank or other nominee, please contact your financial institution. |

| Q: | Could any additional proposals be raised at the annual meeting? |

| A: | We do not know of any items, other than those referred to in the Notice of Annual Meeting of Stockholders, which may properly come before the annual meeting. As to any other item or proposal that may properly come before the annual meeting, including voting on a proposal omitted from this proxy statement pursuant to the rules of the SEC, it is intended that proxies will be voted in accordance with the discretion of the proxy holders. |

| Q: | When are stockholder proposals due for the 2018 annual meeting of stockholders? |

| A: | The deadline for the receipt of stockholder proposals to be considered for inclusion in our proxy materials for the 2018 annual meeting is December 8, 2017. Proposals must be submitted in writing to Corporate Secretary, Southern Company, 30 Ivan Allen Jr. Boulevard NW, Atlanta, Georgia 30308. The proxy solicited by the Board of Directors for the 2018 annual meeting will confer discretionary authority to vote on any stockholder proposal presented at that meeting that is not included in our proxy materials unless we are provided written notice of such proposal no later than February 21, 2018. |

| Q: | Who is soliciting my proxy and who pays the expense of such solicitations? |

| A: | Your proxy is being solicited on behalf of the Board. |

| We pay the cost of soliciting proxies. We have retained Georgeson Inc. to assist with the solicitation of proxies for a fee of $12,500, plus additional fees for telephone and other solicitation of proxies or other services, if needed, and reimbursement of out-of-pocket expenses. Our officers or other employees may solicit proxies to have a larger representation at the meeting. None of these officers or other employees will receive any additional compensation for these services. Upon request, we will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of the common stock. | |

14 Southern Company 2017 Proxy Statement

| Corporate Governance at Southern Company | |

Company Organization

Southern Company is a holding company managed by a core group of officers and governed by a Board that is currently comprised of 15 members. Directors are elected annually.

The Board has adopted and operates under a set of Corporate Governance Guidelines which are available on our website at investor.southerncompany.com under Corporate Governance.

|

Board of Directors Overview |

|

The Board oversees, counsels and directs management in the long-term interests of Southern Company and its stockholders. The Board’s major responsibilities include: —Overseeing the conduct of our business and assessing our business

and other enterprise risks;

—Reviewing and approving our key financial objectives, strategic

and operating plans and other significant

actions;

—Overseeing our processes for maintaining the integrity of our

financial statements and other public disclosures and our compliance with

law and ethics;

—Evaluating CEO and senior management performance and

determining executive compensation;

—Planning for CEO succession and monitoring management’s

succession planning for other key executive officers;

and

—Establishing an effective governance structure,

including appropriate Board composition and planning for Board

succession. |

| Nominees for Election as Directors |

| — |

Each nominee holds or has held senior executive positions, maintains the highest degree of integrity and ethical standards and complements the needs of the Company. |

| — |

Through their positions, responsibilities, skills and perspectives, which span various industries and organizations, these nominees represent a Board that is diverse and possesses appropriate collective knowledge and experience in accounting, finance, leadership, business operations, risk management, corporate governance and our industry and subsidiaries’ service territories. |

| — |

Each nominee, if elected, will serve until the 2018 annual meeting of stockholders. |

| — | The proxies named on the proxy form will vote each properly executed proxy form for the election of the 15 Director nominees, unless otherwise instructed. |

| — |

If any named nominee becomes unavailable for election, the Board may substitute another nominee. In that event, the proxy would be voted for the substitute nominee unless instructed otherwise on the proxy form. |

investor.southerncompany.com 15

|

Corporate Governance at Southern Company |

|

Juanita Powell Baranco | |||

Age: 68 Director since: 2006 Board committee: Audit |

|||

|

Executive Vice President and Chief Operating Officer of Baranco Automotive Group, automobile sales |

Director highlights: Ms. Baranco’s particular expertise in business operations, her significant familiarity with Georgia Power Company (Georgia Power or GPC) and her civic involvement are valuable to the Board. | ||

—Ms. Baranco had a successful legal career, which

included serving as Assistant Attorney General for the State of Georgia,

before she and her husband founded the first Baranco automobile dealership

in Atlanta in 1978.

—She served as a Director of Georgia Power, the largest

subsidiary of the Company, from 1997 to 2006. During her tenure on the

Georgia Power Board, she was a member of the Controls and Compliance,

Diversity, Executive and Nuclear Operations Overview

Committees.

—She served on the Federal Reserve Bank of Atlanta Board

for a number of years and also on the Boards of Directors of John H.

Harland Company and Cox Radio, Inc.

—An active leader in the Atlanta community, she serves on

the Board of Trustees for Clark Atlanta University and on the Advisory

Council for the Catholic Foundation of North Georgia. Ms. Baranco is also

on the Board of the Commerce Club, the Woodruff Arts Center and the

Buckhead Coalition. She is also past Chair of the Board of Regents for the

University System of Georgia and past Board Chair for the Sickle Cell

Foundation of Georgia.

Other public company directorships: None (formerly a Director of Cox Radio, Inc., John H. Harland Company and Georgia Power) | |||

|

Jon A. Boscia | |||

Age: 64 Director since: 2007 Board committee: Audit |

|||

|

Founder and President, Boardroom Advisors LLC, board governance consulting firm |

Director highlights: Mr. Boscia’s extensive background in finance, investment management, information technology and corporate governance is valuable to the Board. | ||

—From September 2008 until March 2011, Mr. Boscia served

as President of Sun Life Financial Inc. In this capacity, Mr. Boscia

managed a portfolio of the company’s operations with ultimate

responsibility for the United States, United Kingdom and Asia business

groups and directed the global marketing and investment management

functions.

—Previously, Mr. Boscia served as Chairman of the Board

and Chief Executive Officer of Lincoln Financial Group, a diversified

financial services organization, until his retirement in 2007. Mr. Boscia

became the Chief Executive Officer of Lincoln Financial Group in 1998.

During his time at Lincoln Financial Group, the company earned a

reputation for its stellar performance in making major

acquisitions.

—Mr. Boscia is a past member of the Board of PHH

Corporation, where he was Chair of the Audit Committee and a member of the

Regulatory Oversight Committee, past member of the Board of Sun Life

Financial Inc., where he was a member of the Investment Oversight

Committee and the Risk Review Committee, and past member of the Board of

The Hershey Company, where he chaired the Corporate Governance Committee

and served on the Executive Committee.

—In addition, Mr. Boscia has served in leadership

positions on other public company Boards as well as not-for-profit and

industry Boards.

Other public company directorships: None (formerly a Director of PHH Corporation, Sun Life Financial Inc., Armstrong World Industries, Lincoln Financial Group, Georgia Pacific Corporation and The Hershey Company) | |||

16 Southern Company 2017 Proxy Statement

| Corporate Governance at Southern Company |  |

|

Henry A. “Hal” Clark III | |||

Age: 67 Director since: 2009 Board committees: Compensation and Management Succession (Chair), Finance |

|||

| Senior Advisor of Evercore (retired), corporate finance advisory firm | Director highlights: Mr. Clark’s utility global financial and utility industry expertise as well as his expertise in capital market transactions are valuable to the Board. | ||

—Mr. Clark was a Senior Advisor with Evercore (formerly

Evercore Partners Inc.) from July 2009 until his retirement in December 2016. As a

Senior Advisor, Mr. Clark was primarily focused on expanding advisory

activities in North America with a particular focus on the power and utilities

sectors.

—With more than 30 years of experience in the global

financial and the utility industries, Mr. Clark brings a wealth of experience

in finance and risk management to his role as a Director.

—Prior to joining Evercore Partners Inc., Mr. Clark was

Group Chairman of Global Power and Utilities at Citigroup, Inc. from 2001

to 2009.

—His work experience includes numerous capital markets

transactions of debt, equity, bank loans, convertible securities and

securitization, as well as advice in connection with mergers and

acquisitions. He also has served as policy advisor to numerous clients on

capital structure, cost of capital, dividend strategies and various

financing strategies.

—He has served as Chair of the Wall Street Advisory Group

of the Edison Electric Institute.

Other public company directorships: None | |||

|

Thomas A. Fanning | |||

Age: 60 Director since: 2010 Board committee: None |

|||

| Chairman of the Board, President and Chief Executive Officer of the Company | Director highlights: Mr. Fanning’s knowledge of our business and the utility industry, understanding of the complex regulatory structure of the industry and experience in strategy development and execution uniquely qualify him to be the Chairman of the Board. | ||

—Mr. Fanning has held numerous leadership positions

across the Southern Company system during his more than 30 years with the

Company. He served as Executive Vice President and Chief Operating Officer

of the Company from 2008 to 2010, leading the Company’s generation and

transmission, engineering and construction services, research and

environmental affairs, system planning and competitive generation business

units. He served as the Company’s Executive Vice President and Chief

Financial Officer from 2003 to 2008, where he was responsible for the

Company’s accounting, finance, tax, investor relations, treasury and risk

management functions. In those roles, he also served as the chief risk

officer and had responsibility for corporate strategy.

—Mr. Fanning is on the Board of Southern Power, a

subsidiary of Southern Company.

—Mr. Fanning is a Director of Vulcan Materials Company,

serving as a member of the Audit Committee and the Compensation Committee,

and the Federal Reserve Bank of Atlanta, serving as Chairman of the

Board.

Other public company directorships: Vulcan Materials Company (formerly a Director of The St. Joe Company) | |||

investor.southerncompany.com 17

|

Corporate Governance at Southern Company |

|

David J. Grain | |||

Age: 54 Director since: 2012 Board committees: Compensation and Management Succession, Finance (Chair) |

|||

| Founder and Managing Partner, Grain Management, LLC, private equity firm | Director highlights: Mr. Grain’s background in finance, investment management and wireless communications infrastructure, leadership and civic involvement are valuable to the Board. | ||

—Mr. Grain is the founding member and managing partner of

Grain Management, LLC (Grain Management), a private equity firm focused on

investments in the media and communications sectors, which he founded in

2006. With offices in Sarasota, Florida and Washington, D.C., the firm

manages funds for a number of the country’s leading academic institutions,

endowments and public pension funds. Grain Management also builds, owns

and operates wireless infrastructure assets across North

America.

—Mr. Grain also founded and was Chief Executive Officer

of Grain Communications Group, Inc.

—Prior to founding Grain Management, he served as

President of Global Signal, Inc., Senior Vice President of AT&T

Broadband’s New England Region and Executive Director in the High Yield

Finance Department at Morgan Stanley.

—Mr. Grain was appointed by President Obama in 2011 to

the National Infrastructure Advisory Council.

—He previously served as Chairman of the Florida State

Board of Administration Investment Advisory Council as an appointee of the

former Governor Charlie Crist.

—He is currently a Director at Gateway Bank of Southwest

Florida and a Trustee of the College of the Holy Cross and serves on the

Investment Committee of the United States Tennis Association.

Other public company directorships: None | |||

|

Veronica M. Hagen | |||

Age: 71 Director since: 2008 Board committees: Governance (Chair), Nuclear/Operations |

|||

| Chief Executive Officer, Polymer Group, Inc. (retired), engineered materials | Director highlights: Ms. Hagen’s global operational management experience and commercial business leadership are valuable to the Board. | ||

—From 2007 until her retirement in 2013, Ms. Hagen served

as Chief Executive Officer of Polymer Group, Inc. and served from 2007 to

2015 as a Director. Ms. Hagen also served as President of Polymer Group,

Inc. from January 2011 until her retirement in 2013. Polymer Group, Inc.

is a leading producer and marketer of engineered materials.

—Prior to joining Polymer Group, Inc., Ms. Hagen was the

President and Chief Executive Officer of Sappi Fine Paper, a division of

Sappi Limited, the South African-based global leader in the pulp and paper

industry, from November 2004 until 2007.

—She also served as Vice President and Chief Customer

Officer at Alcoa Inc. and owned and operated Metal Sales Associates, a

privately-held metal business.

—She serves on the Compensation Committee and the

Nominating/Corporate Governance Committee of the Board of Directors of

American Water Works Company, Inc. Ms. Hagen also serves as the Chair of

the Compensation Committee and a member of the Nominating and Governance

Committee of the Board of Directors of Newmont Mining

Corporation.

Other public company directorships: American Water Works Company, Inc., Newmont Mining Corporation | |||

18 Southern Company 2017 Proxy Statement

| Corporate Governance at Southern Company |  |

|

Warren A. Hood, Jr. | |||

Age: 65 Director since: 2007 Board committee: Audit |

|||

| Chairman of the Board and Chief Executive Officer of Hood Companies, Inc., packaging and construction products | Director highlights: Mr. Hood’s business operations, risk management and financial experience, civic involvement and significant familiarity with Mississippi Power Company (Mississippi Power or MPC) are valuable to the Board. | ||

—Mr. Hood is the Chairman and Chief Executive Officer of

Hood Companies, Inc. which he established in 1978. Hood Companies, Inc.

consists of four separate corporations with 74 manufacturing and

distribution sites throughout the United States, Canada and Mexico. Hood

Companies, Inc.’s products are currently marketed in North America, the

Caribbean and Western Europe.

—Mr. Hood previously served on the Board of the Company’s

subsidiary, Mississippi Power, where he was also a member of the

Compensation Committee.

—Mr. Hood has long been recognized for his leadership

role in the State of Mississippi. He serves or has served on numerous

corporate, community and philanthropic boards, including Boy Scouts of

America Pine Burr Area Council, Governor Phil Bryant’s Mississippi Works

Committee and The Governor’s Commission on Rebuilding, Recovery and

Renewal, which was formed following Hurricane Katrina in

2005.

—He serves on the Board of BancorpSouth, Inc., where he

is a member of the Audit Committee.

Other public company directorships: BancorpSouth, Inc. (formerly a Director of Mississippi Power) | |||

|

Linda P. Hudson | |||

Age: 66 Director since: 2014 Board committees: Governance, Nuclear/ Operations, Business Security Subcommittee (Chair) |

|||

| Founder, Chairman and Chief Executive Officer, The Cardea Group, business management consulting firm, and former Chief Executive Officer of BAE Systems, Inc. (BAE Systems), defense, aerospace and security |

Director highlights: Ms. Hudson’s experience leading

a large, highly-regulated, complex business and expertise in engineering,

technology, operations and risk management are valuable to the

Board. | ||

—Ms. Hudson is the Founder, Chairman and Chief Executive

Officer of The Cardea Group, a business management consulting firm she

founded in 2014.

—From October 2009 through February 2014, Ms. Hudson

served as the President and Chief Executive Officer of BAE Systems, a

U.S.-based global defense, aerospace and security company. BAE Systems is

a wholly-owned subsidiary of London-based BAE Systems plc. Previously, Ms.

Hudson served as President of BAE Systems’ Land & Armaments operating

group, the world’s largest military vehicle and equipment

business.

—Before joining BAE Systems in 2006, she served as Vice

President of General Dynamics Corporation and President of General

Dynamics Armament and Technical Products.

—Ms. Hudson is a member of Bank of America Corporation’s

Board of Directors, where she serves on the Compensation and Enterprise

Risk Committee and the Credit Committee. She is also a member of the Board

of Directors of Ingersoll Rand, Inc., where she serves on the Audit and

Finance Committees.

—She is a Director of the University of Florida

Foundation.

Other public company directorships: Bank of America Corporation, Ingersoll Rand, Inc. | |||

investor.southerncompany.com 19

|

Corporate Governance at Southern Company |

|

Donald M. James | |||

Age: 68 Director since: 1999 Board committees: Compensation and Management Succession, Finance |

|||

| Chairman of the Board and Chief Executive Officer of Vulcan Materials Company (retired), construction materials | Director highlights: Mr. James’ leadership of a large public company, his legal expertise and his civic involvement are valuable to the Board. | ||

—Mr. James retired from his position as Chief Executive

Officer of Vulcan Materials Company in July 2014 and Executive Chairman in

January 2015. He retired in December 2015 as Chairman of the Board of

Directors of Vulcan Materials Company. Mr. James joined Vulcan Materials

Company in 1992 as Senior Vice President and General Counsel and then

became President of the Southern Division and then Senior Vice President

of the Construction Materials Group and then President and Chief Executive

Officer.

—Prior to joining Vulcan Materials Company, Mr. James was

a partner at the law firm of Bradley, Arant, Rose & White for 10

years.

—Mr. James serves on the Finance and the Human Resources

Committees of Wells Fargo & Company’s Board of Directors.

—Mr. James is a Trustee of the UAB Health System and

Children’s of Alabama, where he serves on the Executive

Committee.

Other public company directorships: Wells Fargo & Company (formerly a Director of Vulcan Materials Company and Protective Life Corporation) | |||

|

John D. Johns | |||

Age: 65 Director since: 2015 Board committee: Audit (Chair) |

|||

| Chairman and Chief Executive Officer of Protective Life Corporation (Protective Life), insurance | Director highlights: Mr. Johns’ management and leadership experience, his significant familiarity with Alabama Power Company (Alabama Power or APC) and his civic involvement are valuable to the Board. | ||

—Mr. Johns has served as Chairman and Chief Executive

Officer of Protective Life since 2002 and President from 2002 to January

2016. He joined Protective Life in 1993 as Executive Vice President and

Chief Financial Officer.

—Before his tenure at Protective Life, Mr. Johns served

as general counsel of Sonat, Inc., a diversified energy

company.

—Prior to joining Sonat, Inc., Mr. Johns was a founding

partner of the law firm Maynard, Cooper & Gale, P.C.

—He previously served on the Board of Directors of

Alabama Power from 2004 to 2015. During his tenure on the Alabama Power

Board, he was a member of the Executive Committee.

—He is a member of the Board of Directors of Regions

Financial Corporation, where he serves on the Risk Committee, and Genuine

Parts Company, where he serves on the Compensation, Nominating and

Governance Committee and the Executive Committee.

—Mr. Johns has served on the Executive Committee of the

Financial Services Roundtable in Washington, D.C. and is the immediate

past chairman of the American Council of Life Insurers.

—Mr. Johns has served as the Chairman of the Business

Council of Alabama, the Birmingham Business Alliance, the Greater Alabama

Council, Boy Scouts of America and Innovation Depot, Alabama’s leading

business and technology incubator.

Other public company directorships: Genuine Parts Company, Protective Life and Regions Financial Corporation (formerly a Director of Alabama Power) | |||

20 Southern Company 2017 Proxy Statement

| Corporate Governance at Southern Company |  |

|

Dale E. Klein | |||

Age: 69 Director since: 2010 Board committees: Compensation and Management Succession, Nuclear/Operations, Business Security Subcommittee |

|||

| Associate Vice Chancellor of Research of the University of Texas System and Associate Director of the Energy Institute at The University of Texas at Austin and former Commissioner and Chairman, U.S. Nuclear Regulatory Commission, energy | Director highlights: Dr. Klein’s expertise in nuclear

energy regulation and operations, technology and safety is valuable to the

Board. | ||

—Dr. Klein was Commissioner from 2009 to 2010 and

Chairman from 2006 through 2009 of the U.S. Nuclear Regulatory Commission.

He also served as Assistant to the Secretary of Defense for Nuclear,

Chemical and Biological Defense Programs from 2001 through 2006.

—Dr. Klein has more than 35 years of experience in the

nuclear energy industry.

—Dr. Klein began his career at the University of Texas in

1977 as a professor of mechanical engineering which included a focus on

the university’s nuclear program. He spent nearly 25 years in various

teaching and leadership positions including Director of the nuclear

engineering teaching laboratory, Associate Dean for research and

administration in the College of Engineering and Vice Chancellor for

special engineering programs.

—He serves on the Audit and Nuclear and Operating

Committees of Pinnacle West Capital Corporation, an Arizona energy

company, and is a member of the Board of Pinnacle West Capital

Corporation’s principal subsidiary, Arizona Public Service

Company.

Other public company directorships: Pinnacle West Capital Corporation, Arizona Public Service Company | |||

|

William G. Smith, Jr. | |||

Age: 63 Director since: 2006 Board committees: Finance, Governance |

|||

| Chairman of the Board, President and Chief Executive Officer of Capital City Bank Group, Inc., banking | Director highlights: Mr. Smith’s experience in

finance, business operations and risk management is valuable to the

Board. | ||

—Mr. Smith began his career at Capital City Bank in 1978,

where he worked in a number of positions of increasing responsibility

before being elected President and Chief Executive Officer of Capital City

Bank Group, Inc. in January 1989. He was elected Chairman of the Board of

the Capital City Bank Group, Inc. in 2003. He is also the Chairman and

Chief Executive Officer of Capital City Bank.

—He previously served on the Board of Directors of the

Federal Reserve Bank of Atlanta.

—Mr. Smith is the former Federal Advisory Council

Representative for the Sixth District of the Federal Reserve System and

past Chair of Tallahassee Memorial HealthCare and the Tallahassee Area

Chamber of Commerce.

Other public company directorships: Capital City Bank Group, Inc. | |||

investor.southerncompany.com 21

|

Corporate Governance at Southern Company |

|

Steven R. Specker | |||

Age: 71 Director since: 2010 Board committees: Compensation and Management Succession, Nuclear/ Operations (Chair) |

|||

| Chief Executive Officer, Tri Alpha Energy Inc., energy | Director highlights: Dr. Specker’s

keen understanding of the electric industry and insights in innovation and

technology development are valuable to the Board. | ||

—Dr. Specker currently serves as Chief Executive Officer

of Tri Alpha Energy Inc., a position he has held since October 2016. Tri

Alpha Energy is an international private fusion company focusing on clean

fusion energy technology.

—Dr. Specker served as President and Chief Executive

Officer of the Electric Power Research Institute (EPRI) from 2004 until

2010.

—Prior to joining EPRI, Dr. Specker founded Specker

Consulting, LLC, a private consulting firm, which provided operational and

strategic planning services to technology companies serving the global

electric power industry.

—Dr. Specker also served in a number of leadership

positions during his 30-year career at General Electric Company (GE),

including serving as President of GE’s nuclear energy business, President

of GE digital energy and Vice President of global marketing.

—He is also a member of the Board of Trilliant

Incorporated, a leading provider of Smart Grid communication solutions,

and serves as a member of the Board of Tri Alpha Energy Inc.

Other public company directorships: None | |||

|

Larry D. Thompson | |||

Age: 71 Director since: 2014 (previously served from 2010 to 2012) Board committees: Finance, Governance |

|||

| John A. Sibley Professor of Corporate and Business Law, The University of Georgia School of Law, and former Executive Vice President, Government Affairs, General Counsel and Corporate Secretary, PepsiCo Inc., food and beverage | Director highlights: Mr. Thompson’s

government experience and corporate governance and legal expertise are

valuable to the Board. | ||

—Mr. Thompson has served on the faculty of The University

of Georgia School of Law as the John A. Sibley Chair of Corporate and

Business Law since 2014.

—From 2012 until his retirement in 2014, Mr. Thompson

served as Executive Vice President, Government Affairs, General Counsel

and Corporate Secretary for PepsiCo Inc., one of the world’s largest

packaged food and beverage companies. From 2004 to 2011, he served as

Senior Vice President of Government Affairs, General Counsel and Corporate

Secretary of PepsiCo Inc. At PepsiCo Inc., Mr. Thompson was responsible

for its worldwide legal function, its government affairs organization and

its charitable foundation, where he served on the Board.

—His government career includes serving as Deputy

Attorney General in the U.S. Department of Justice and leading the

National Security Coordination Council. In 2002, President George W. Bush

named Mr. Thompson to head the Department of Justice’s Corporate Fraud

Task Force.

—Mr. Thompson is an Independent Trustee of various

investment companies in the Franklin Templeton group of mutual funds and a

Director and a member of the Compensation Committee of Graham Holdings

Company (formerly The Washington Post Company).

—He also serves as an Advisory Director of the Georgia

Justice Project.

—Mr. Thompson served as a Director of Southern Company

from 2010 to 2012 and was a member of the Audit Committee.

Other public company directorships: Franklin, Templeton Series Mutual Funds, Graham Holdings Company (formerly a Director of Cbeyond, Inc.) | |||

22 Southern Company 2017 Proxy Statement

| Corporate Governance at Southern Company |  |

|

E.

Jenner Wood III | |||

Age: 65 Director since: 2012 Board committees: Governance, Nuclear/Operations |

|||

| Corporate Executive Vice President – Wholesale Banking, SunTrust Banks, Inc. (retired), banking | Director highlights: Mr. Wood’s

leadership experience and extensive background in finance, his involvement

in the community and his significant familiarity with Georgia Power are

valuable to the Board. | ||

—Mr. Wood served as Corporate Executive Vice President –

Wholesale Banking of SunTrust Banks, Inc. from October 2015 until his

retirement in December 2016. Prior to that, he served as Chairman and

Chief Executive Officer of the Atlanta Division of SunTrust Bank from 2001

to 2015. He began his career with SunTrust Banks, Inc. in 1975 and has

advanced through various management positions including Chairman of the

Board, President and Chief Executive Officer of the Georgia/North Florida

Division and Chairman, President and Chief Executive Officer of SunTrust’s

Central Group with responsibility over Georgia and Tennessee.

—He served as a member of the Board of Georgia Power from

2002 until May 2012. During his tenure on the Georgia Power Board, he

served as a member of the Compensation, Executive and Finance Committees.

—Mr. Wood is a Director of Oxford Industries, Inc., where

he serves as Presiding Director and as a member of the Executive

Committee, and a Director of Genuine Parts Company, where he serves on the

Audit Committee and the Compensation, Nominating and Governance Committee.

—He is active in numerous civic and community

organizations, serving as the Chairman of the Metro Atlanta Chamber of

Commerce and as a Vice Chairman of the Robert W. Woodruff Foundation, the

Joseph B. Whitehead Foundation and the Lettie Pate Evans Foundation. Mr.

Wood also serves as a Trustee of the Sartain Lanier Family Foundation,

Camp-Younts Foundation and the Jesse Parker Williams

Foundation.

Other public company directorships: Genuine Parts Company, Oxford Industries, Inc. (formerly a Director of Crawford & Company and Georgia Power) | |||

| Majority Voting for Directors and Director Resignation Policy |

Since 2010, we have had a majority vote standard for Director elections, which requires that a nominee for Director in an uncontested election receive a majority of the votes cast at a stockholder meeting in order to be elected to the Board. The Board believes that the majority vote standard in uncontested Director elections strengthens the Director nomination process and enhances Director accountability.

The Board believes this standard for uncontested elections is a more equitable standard than a plurality vote standard. A plurality vote standard guarantees the election of a Director in an uncontested election; however, a majority vote standard means that nominees in uncontested elections are only elected if a majority of the votes cast are voted in their favor.

We also have a Director resignation policy, which requires any nominee for election as a Director to submit an irrevocable letter of resignation as a condition to being named as such nominee, which would be tendered in the event that nominee fails to receive the affirmative vote of a majority of the votes cast in an uncontested election at a meeting of stockholders. Such resignation would be considered by the Board, and the Board would be required to either accept or reject such resignation within 90 days from the certification of the election results.

investor.southerncompany.com 23

|

Corporate Governance at Southern Company |

| Director Independence Standards |

No Director will be deemed to be independent unless the Board affirmatively determines that the Director has no material relationship with the Company directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. The Board has adopted categorical guidelines which provide that a Director will not be deemed to be independent if within the preceding three years:

| — |

The Director was employed by the

Company or the Director’s immediate family member was an executive officer

of the Company. |

| — |

The Director has received, or the

Director’s immediate family member has received, during any 12-month

period, direct compensation from the Company of more than $120,000, other

than Director and committee fees. (Compensation received by an immediate

family member for service as a non-executive employee of the Company need

not be considered.) |

| — |

The Director was affiliated with or

employed by, or the Director’s immediate family member was affiliated with

or employed in a professional capacity by, a present or former external

auditor of the Company and personally worked on the Company’s

audit. |

| — | The Director was employed, or the Director’s

immediate family member was employed, as an executive officer of a company

where any member of the Company’s present executive officers at the same

time served on that company’s compensation committee. |

| — | The Director is a current employee, or the

Director’s immediate family member is a current executive officer, of a

company that has made payments to, or received payments from, the Company

for property or services in an amount which, in any year, exceeds the

greater of $1,000,000 or 2% of that company’s consolidated gross

revenues. |

| — | The Director or the Director’s spouse serves as an executive officer of a charitable organization to which the Company made discretionary contributions which, in any year, exceeds the greater of $1,000,000 or 2% of the organization’s consolidated gross revenues. |

| Director Independence Review Process |

At least annually, the Board receives a report on all commercial, consulting, legal, accounting, charitable or other business relationships that a Director or the Director’s immediate family members have with the Company. This report includes all ordinary course transactions with entities with which the Directors are associated.

The Board determined that the Company and its subsidiaries followed our procurement policies and procedures, that the amounts reported were well under the thresholds contained in the Director independence requirements and that no Director had a direct or indirect material interest in the transactions included in the report.

The Board reviewed all contributions made by the Company and its subsidiaries to charitable organizations with which the Directors are associated. The Board determined that the contributions were consistent with other contributions by the Company and its subsidiaries to charitable organizations and none were approved outside the Company’s normal procedures.