UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

|

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

|

For the transition period from _________________ to _______________________

Commission file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of | (I.R.S. Employer Identification Number) |

incorporation or organization) | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company as defined in Rule 12b-2 of the Exchange Act. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

The number of shares of the registrant’s Common Stock, par value $0.01 per share, outstanding as of May 5, 2023 was

TABLE OF CONTENTS

Page | ||

PART I. FINANCIAL INFORMATION | ||

Item 1. | Financial Statements (unaudited) | |

6 | ||

| ||

7 | ||

| ||

8 | ||

9 | ||

| ||

10 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 | |

27 | ||

27 | ||

28 | ||

|

| |

28 | ||

|

| |

28 | ||

|

| |

57 | ||

|

| |

57 | ||

|

| |

57 | ||

|

| |

57 | ||

|

| |

57 | ||

|

| |

59 | ||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) and certain information incorporated herein by reference contain forward-looking statements, which are provided under the “safe harbor” protection of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, results or to our future financial performance and involve known and unknown risks, uncertainties, and other factors which may cause our actual results, performance, or events to be materially different from any future results, performance, or events expressed or implied by the forward-looking statements. Forward-looking statements in this Quarterly Report include, but are not limited to, statements regarding:

● | our estimates regarding anticipated operating losses, capital requirements and needs for additional funds; |

● | our ability to raise additional capital when needed and to continue as a going concern; |

● | our ability to manufacture, or otherwise secure the manufacture of, sufficient amounts of our product candidates for our preclinical studies and clinical trials; |

● | our clinical development plans, including planned clinical trials; |

● | our research and development plans, including our clinical development plans; |

● | our ability to select combinations of phages to formulate our product candidates; |

● | our development of bacteriophage-based therapies; |

● | the potential use of bacteriophages to treat bacterial infections; |

● | the potential future of antibiotic resistance; |

● | our ability for bacteriophage therapies to disrupt and destroy biofilms and restore sensitivity to antibiotics; |

● | our planned development strategy, presenting data to regulatory agencies and defining planned clinical studies; |

● | the expected timing of additional clinical trials, including Phase 1b/Phase 2 or registrational clinical trials; |

● | our ability to manufacture and secure sufficient quantities of our product candidates for clinical trials; |

● | the drug product candidates to be supplied by us for clinical trials; |

● | the potential for bacteriophage technology being uniquely positioned to address the global threat of antibiotic resistance; |

● | the safety and efficacy of our product candidates; |

● | our anticipated regulatory pathways for our product candidates; |

● | the activities to be performed by specific parties in connection with clinical trials; |

● | our ability to successfully complete preclinical and clinical development of, and obtain regulatory approval of our product candidates and commercialize any approved products on our expected timeframes or at all; |

● | our pursuit of additional indications; |

● | the content and timing of submissions to and decisions made by the U.S. Food and Drug Administration (the “FDA”) and other regulatory agencies; |

● | our ability to leverage the experience of our management team and to attract and retain management and other key personnel; |

● | the capacities and performance of our suppliers, manufacturers, contract research organizations (“CROs”) and other third parties over whom we have limited control; |

● | our ability to staff and maintain our Marina del Rey production facility under fully compliant current Good Manufacturing Practices (“cGMP”); |

● | the actions of our competitors and success of competing drugs or other therapies that are or may become available; |

● | our expectations with respect to future growth and investments in our infrastructure, and our ability to effectively manage any such growth; |

● | the size and potential growth of the markets for any of our product candidates, and our ability to capture share in or impact the size of those markets; |

● | the benefits of our product candidates; |

● | potential market growth and market and industry trends; |

● | maintaining collaborations with third parties including our partnerships with the Cystic Fibrosis Foundation (“CFF”), and the U.S. Department of Defense (the “DoD”); |

● | potential future collaborations with third parties and the potential markets and market opportunities for product candidates; |

● | our ability to achieve our vision, including improvements through engineering and success of clinical trials; |

● | our ability to meet anticipated milestones in the development and testing of the relevant product; |

● | our ability to be a leader in the development of phage-based therapeutics; |

● | the expected use of proceeds from the $16.3 million DoD grant; |

● | the effects of government regulation and regulatory developments, and our ability and the ability of the third parties with whom we engage to comply with applicable regulatory requirements; |

● | the accuracy of our estimates regarding future expenses, revenues, capital requirements and need for additional financing; |

● | our expectations regarding future planned expenditures; |

● | our ability to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act; |

● | our ability to obtain, maintain and successfully enforce adequate patent and other intellectual property protection of any of our products and product candidates; |

● | our ability to protect our intellectual property, including pending and issued patents; |

● | our ability to operate our business without infringing the intellectual property rights of others; |

● | our ability to advance our clinical development programs, which could be impacted by the ongoing COVID-19 pandemic; |

● | the expected impact of the ongoing COVID-19 pandemic on our operations and any statements of assumptions underlying any of the items mentioned; and |

● | statements of belief and any statement of assumptions underlying any of the foregoing. |

In some cases, you can identify these statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of those terms, and similar expressions. These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this Quarterly Report and are subject to risks and uncertainties. We discuss many of these risks in greater detail in the section hereof entitled “Risk Factors” and in our Annual Report on Form 10-K for the year ended December 31, 2022. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain. Given these uncertainties, you should not place undue reliance on any of the forward-looking statements included in this Quarterly Report. In addition, this Quarterly Report also contains estimates, projections, and other information concerning our industry, our business, and the markets for our product candidates, as well as data regarding market research, estimates, and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. These statements are based upon information available to us as of the date of this Quarterly Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, whether as a result of new information, future events, or otherwise.

This Quarterly Report includes trademarks and registered trademarks of Armata Pharmaceuticals, Inc. Products or service names of other companies mentioned in this Quarterly Report may be trademarks or registered trademarks of their respective owners.

As used in this Quarterly Report, unless the context requires otherwise, the “Company,” “we,” “us,” and “our” refer to Armata Pharmaceuticals, Inc. and its wholly owned subsidiaries.

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

Armata Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

| March 31, 2023 |

| December 31, 2022 |

| |||

(unaudited) | |||||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | $ | | $ | | |||

Awards receivable | | | |||||

Prepaid expenses and other current assets |

| |

| | |||

Total current assets |

| |

| | |||

Restricted cash | | | |||||

Property and equipment, net |

| |

| | |||

Operating lease right-of-use asset |

| |

| | |||

In-process research and development | | | |||||

Goodwill | | | |||||

Other assets |

| |

| | |||

Total assets | $ | | $ | | |||

Liabilities and shareholders’ equity |

|

|

|

| |||

Current liabilities |

|

|

|

| |||

Accounts payable and accrued liabilities | $ | | $ | | |||

Accrued compensation | | | |||||

Current portion of operating lease liabilities | | | |||||

Convertible debt | | — | |||||

Total current liabilities |

| |

| | |||

Operating lease liabilities, net of current portion | | | |||||

Deferred tax liability | | | |||||

Total liabilities |

| |

| | |||

Shareholders’ equity |

|

|

|

| |||

Common stock, $ |

| |

| | |||

Additional paid-in capital |

| |

| | |||

Accumulated deficit |

| ( |

| ( | |||

Total shareholders’ equity |

| |

| | |||

Total liabilities and shareholders’ equity | $ | | $ | | |||

See accompanying notes to condensed consolidated financial statements.

6

Armata Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

Three Months Ended | |||||||

March 31, | |||||||

| 2023 |

| 2022 |

| |||

Grant revenue | $ | | $ | | |||

Operating expenses | |||||||

Research and development |

| | | ||||

General and administrative |

| | | ||||

Total operating expenses | | | |||||

Loss from operations |

| ( |

| ( | |||

Other income (expense) |

|

|

|

| |||

Interest income | | | |||||

Change in fair value of convertible debt | ( | — | |||||

Total other income (expense), net |

| ( |

| | |||

Net loss | $ | ( | $ | ( | |||

Per share information: |

|

|

|

| |||

Net loss per share, basic and diluted | $ | ( | $ | ( | |||

Weighted average shares outstanding, basic and diluted | | | |||||

See accompanying notes to condensed consolidated financial statements.

7

Armata Pharmaceuticals, Inc.

Condensed Consolidated Statements of Shareholders’ Equity

Three Months Ended March 31, 2023 and 2022

(unaudited)

Shareholders’ Equity | ||||||||||||||

Common Stock | ||||||||||||||

Additional | Total | |||||||||||||

Paid-in | Accumulated | Shareholders’ | ||||||||||||

| Shares |

| Amount |

| Capital |

| Deficit |

| Equity | |||||

Balances, December 31, 2021 |

| | | $ | | $ | ( | $ | | |||||

Sale of common stock, net of issuance costs | | | | — | | |||||||||

Forfeiture of restricted stock awards |

| ( | — | — | — |

| — | |||||||

Share-based compensation |

| — | — | | — |

| | |||||||

Net loss |

| — | — | — | ( |

| ( | |||||||

Balances, March 31, 2022 |

| | $ | | $ | | $ | ( | $ | | ||||

Shareholders’ Equity | ||||||||||||||

Common Stock | ||||||||||||||

Additional | Total | |||||||||||||

Paid-in | Accumulated | Shareholders’ | ||||||||||||

Shares |

| Amount |

| Capital |

| Deficit |

| Equity | ||||||

Balances, December 31, 2022 |

| | $ | | $ | | $ | ( | $ | | ||||

Share-based compensation | — | — | | — | | |||||||||

Net loss |

| — | — | — | ( |

| ( | |||||||

Balances, March 31, 2023 |

| | $ | | $ | | $ | ( | $ | | ||||

See accompanying notes to condensed consolidated financial statements.

8

Armata Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

Three Months Ended March 31, | ||||||

| 2023 |

| 2022 | |||

Operating activities: | ||||||

Net loss | $ | ( | $ | ( | ||

Adjustments required to reconcile net loss to net cash used in operating activities: | ||||||

Depreciation |

| |

| | ||

Share-based compensation | | | ||||

Change in fair value of convertible debt | | — | ||||

Changes in operating assets and liabilities: |

|

| ||||

Award receivable | | | ||||

Accounts payable and accrued liabilities |

| ( |

| | ||

Accrued compensation | ( | | ||||

Operating lease right-of-use asset and liability, net | ( | | ||||

Prepaid expenses and other current assets |

| ( |

| | ||

Net cash used in operating activities |

| ( |

| ( | ||

Investing activities: |

|

|

|

| ||

Purchases of property and equipment | ( | ( | ||||

Net cash used in investing activities |

| ( |

| ( | ||

Financing activities: |

|

|

|

| ||

Proceeds from issuance of convertible debt, net of issuance costs | | — | ||||

Proceeds from sale of common stock, net of offering costs | — | | ||||

Net cash provided by financing activities |

| |

| | ||

Net increase in cash, cash equivalents and restricted cash |

| |

| | ||

Cash, cash equivalents and restricted cash, beginning of period |

| |

| | ||

Cash, cash equivalents and restricted cash, end of period | $ | | $ | | ||

Supplemental disclosure of cash flow information: |

|

|

|

| ||

Paycheck Protection Program loan forgiveness | $ | — | $ | | ||

Unpaid debt issuance costs | $ | | $ | — | ||

Property and equipment included in accounts payable | $ | | $ | | ||

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the consolidated balance sheets that sum to the total of the same amounts shown in the consolidated statement of cash flows:

Three Months Ended March 31, | ||||||

2023 |

| 2022 | ||||

Cash and cash equivalents | $ | | $ | | ||

Restricted cash | | | ||||

Cash, cash equivalents and restricted cash | $ | | $ | | ||

See accompanying notes to condensed consolidated financial statements.

9

Armata Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization and Description of the Business

Armata Pharmaceuticals, Inc. (“Armata”), and together with its subsidiaries, is referred to herein as, the “Company”) is a clinical-stage biotechnology company focused on the development of pathogen-specific bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat bacterial infections using its proprietary bacteriophage-based technology. Armata’s common stock is traded on the NYSE American exchange under the ticker symbol “ARMP”.

2. Liquidity

On January 10, 2023, the Company entered into, as borrower, a secured convertible credit and security agreement (the “Credit Agreement”) with Innoviva Strategic Opportunities LLC, a wholly‐owned subsidiary of Innoviva, Inc. (Nasdaq: INVA) (collectively, “Innoviva”), a principal shareholder of the Company. The Credit Agreement provides for a secured term loan facility in an aggregate amount of $

The Credit Agreement provides that if a Qualified Financing (as defined in the Credit Agreement) occurs, the outstanding principal amount of, and all accrued and unpaid interest on, the Loan shall be converted into shares of the Company’s common stock, par value $

On February 9, 2022, the Company entered into a securities purchase agreement (“February 2022 Securities Purchase Agreement”) to sell its Common Stock and warrants to Innoviva. Pursuant and subject to the terms and conditions of the February 2022 Securities Purchase Agreement and related agreements, Innoviva agreed to purchase

10

of the transaction on March 30, 2022, Innoviva purchased

As of March 31, 2023, the Company had cash and cash equivalents of $

Management plans to raise additional capital through equity offerings, debt financings, or other capital sources, including potential collaborations, licenses and other similar arrangements. While management believes this plan to raise additional funds will alleviate the conditions that raise substantial doubt about the Company’s ability to continue as a going concern, these plans are not entirely within its control and cannot be assessed as being probable of occurring. The Company’s ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to, and volatility in, financial markets in the United States and worldwide. The Company may not be able to secure additional financing in a timely manner or on favorable terms, if at all. Furthermore, if the Company issues equity securities to raise additional funds, its existing shareholders may experience dilution, and the new equity securities may have rights, preferences and privileges senior to those of the Company’s existing shareholders. If the Company raises additional funds through collaboration, licensing or other similar arrangements, it may be necessary to relinquish valuable rights to its potential products on terms that are not favorable to the Company. If the Company is unable to raise capital when needed or on attractive terms, it would be forced to delay, reduce or eliminate its research and development programs or other operations. If any of these events occur, the Company’s ability to achieve the development and commercialization goals would be adversely affected.

3. Significant Accounting Policies

Basis of Presentation

The condensed consolidated financial statements include the accounts of Armata and its wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated. The accompanying unaudited condensed consolidated financial statements of the Company should be read in conjunction with the audited financial statements and accompanying notes thereto as of and for the year ended December 31, 2022 included in the Company’s Form 10-K, filed with the SEC on March 16, 2023. The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial statements. Any reference in the Notes to applicable guidance is meant to refer to authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Update (“ASU”) of the Financial Accounting Standards Board (“FASB”).

In the opinion of management, the accompanying condensed consolidated financial statements include all adjustments that are of a normal and recurring nature and that are necessary for the fair presentation of the Company’s financial position and the results of its operations and cash flows for the periods presented. Interim results are not necessarily indicative of results for the full year or any future period.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in its condensed consolidated financial statements and accompanying notes. On an ongoing basis, management evaluates these estimates and judgments, which are based on historical and anticipated results and trends, and on various other assumptions that management believes to be reasonable under the circumstances. By their nature, estimates are subject to an inherent degree of uncertainty and, as such, actual results may differ from management’s estimates.

11

Fair Value of Financial Instruments

The carrying amounts of cash equivalents, other current assets, accounts payable, and accrued liabilities approximate fair value because of the short-term nature of these instruments.

In-Process Research and Development (“IPR&D”)

IPR&D assets are intangible assets with indefinite lives and are not subject to amortization. The Company’s IPR&D assets represent capitalized incomplete research projects acquired by the Company, which is related to the development of natural phage combinations for the treatment of Staphylococcus aureus infections (“S. aureus”), examples of which comprise AP-SA01 and AP-SA02. Such assets are initially measured at their acquisition-date fair values and are subject to impairment testing at least annually until completion or abandonment of research and development efforts associated with the projects. Upon successful completion of each project, the Company makes a determination as to the then remaining useful life of the intangible asset and begins amortization.

Goodwill

Goodwill, which has an indefinite useful life, represents the excess of purchase consideration over fair value of net assets acquired. Goodwill is not subject to amortization and is required to be tested for impairment at least on an annual basis. The Company tests goodwill for impairment as of December 31 of each year. The Company determines whether goodwill may be impaired by comparing the carrying value of the single reporting unit, including goodwill, to the fair value of the reporting unit. If the fair value is less than the carrying amount, a more detailed analysis is performed to determine whether goodwill is impaired. The impairment loss, if any, is measured as the excess of the carrying value of the goodwill over the implied fair value of the goodwill and is recorded in the Company’s consolidated statements of operations.

Basic and Diluted Net Loss per Share

Net earnings or loss per share (“EPS”) is calculated in accordance with the applicable accounting guidance provided in ASC 260, Earnings per Share. The Company uses the two-class method for the computation and presentation of net income (loss) per common share attributable to common shareholders. The two-class method is an earnings allocation formula that calculates basic and diluted net income (loss) per common share for each class of common stock separately based on dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. Under the two-class method, warrants issued to Innoviva are assumed to participate in undistributed earnings on an as-exercised basis, in accordance with the warrant agreements. Undistributed net losses are allocated entirely to common shareholders since the participating security has no contractual obligation to share in the losses.

Accordingly, basic income or loss per share is calculated by dividing net income or loss by the weighted-average number of common shares outstanding, or using the two-class method, whichever is more dilutive. Diluted net income or loss per share is computed using the more dilutive of the treasury stock method which reflects the potential dilution that would occur if securities or other contracts to issue common stock were exercised or converted to common stock, or the two-class method.

The calculation of diluted loss per share requires that, to the extent the average market price of the underlying shares for the reporting period exceeds the exercise price of liability classified warrants, and the presumed exercise of such securities are dilutive to net loss per share for the period, an adjustment to net loss available to common shareholders used in the calculation is required to remove the change in fair value of the warrants from the numerator for the period. Likewise, an adjustment to the denominator is required to reflect the related dilutive shares, if any, under the treasury stock method.

Grants and Awards

In applying the provisions of ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”), Armata has determined that grants and awards are out of the scope of ASC 606 because the funding entities do not meet the

12

definition of a “customer”, as defined by ASC 606, as there is not considered to be a transfer of control of goods or services. With respect to each grant or award, the Company determines if it has a collaboration in accordance with ASC Topic 808, Collaborative Arrangements (“ASC 808”). To the extent the grant or award is within the scope of ASC 808, the Company recognizes the award upon achievement of certain milestones as credits to research and development expenses. For grant and awards outside the scope of ASC 808, the Company applies ASC 606 or International Accounting Standards No. 20, Accounting for Government Grants and Disclosure of Government Assistance, by analogy, and revenue is recognized when the Company incurs expenses related to the grants for the amount the Company is entitled to under the provisions of the contract.

Armata also considers the guidance in ASC Topic 730, Research and Development (“ASC 730”), which requires an assessment, at the inception of the grant or award, of whether the agreement is a liability. If Armata is obligated to repay funds received regardless of the outcome of the related research and development activities, then Armata is required to estimate and recognize that liability. Alternatively, if Armata is not required to repay the funds, then payments received are recorded as revenue or contra-expense as the expenses are incurred.

Deferred grant or award liability represents award funds received or receivable for which the allowable expenses have not yet been incurred as of the balance sheet date.

Leases

The Company determines if an arrangement contains a lease at inception. The Company currently only has operating leases. The Company recognizes a right-of-use operating lease asset and associated short and long-term operating lease liability on its condensed consolidated balance sheet for operating leases greater than one year. The right-of-use assets represent the Company’s right to use an underlying asset for the lease term and the lease liabilities represent the Company’s obligation to make lease payments arising from the lease arrangements. Right-of-use operating lease assets and lease liabilities are recognized based on the present value of the future minimum lease payments, including noncash lease payments, the Company will pay over the lease term. The Company determines the lease term at the inception of each lease, which includes renewal options only if the Company concludes that such options are reasonably certain to be exercised.

As the Company’s leases do not provide an interest rate implicit in the lease, the Company uses its incremental borrowing rate, based on the information available on the date of adoption of Topic 842, Leases, as of the lease inception date or at the lease option extension date in determining the present value of future payments. The Company recognizes rent expense for the minimum lease payments on a straight-line basis over the expected term of the leases. The Company recognizes period expenses, such as common area maintenance expenses, in the period such expenses are incurred.

Research and Development Expenses

Research and development (“R&D”) costs consist primarily of direct and allocated salaries, incentive compensation, share-based compensation and other personnel-related costs, facility costs, and third-party services. Third-party services include studies and clinical trials conducted by clinical research organizations. R&D activities are expensed as incurred. The Company records accruals for estimated ongoing clinical trial expenses. When evaluating the adequacy of the accrued liabilities, the Company analyzes progress of the studies, including the phase or completion of events, invoices received and contracted costs. Judgments and estimates are made in determining the accrued balances at the end of the reporting period.

Recent Accounting Pronouncements Not Yet Adopted

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments. The standard amends the impairment model by requiring entities to use a forward-looking approach based on expected losses to estimate credit losses for most financial assets and certain other instruments that aren’t measured at fair value through net income. For available-for-sale debt securities, entities will be required to recognize an allowance for credit losses rather than a reduction in carrying value of the asset. Entities will no

13

longer be permitted to consider the length of time that fair value has been less than amortized cost when evaluating when credit losses should be recognized. This new guidance became effective for calendar-year smaller reporting public entities in the first quarter of 2023. The Company adopted this ASU as of January 1, 2023 which did not have an impact on its consolidated financial statements or related disclosures.

In August 2020, the FASB issued ASU 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40) (“ASU 2020-06”). ASU 2020-06 eliminates the beneficial conversion and cash conversion accounting models for convertible instruments. It also amends the accounting for certain contracts in an entity’s own equity that are currently accounted for as derivatives because of specific settlement provisions. In addition, ASU 2020-06 modifies how particular convertible instruments and certain contracts that may be settled in cash or shares impact the diluted EPS computation. The amendments in ASU 2020-06 are effective for the Company as of January 1, 2024. Early adoption is permitted. The Company is currently evaluating the impact of ASU 2020-06 on its financial statements and does not expect the adoption of this ASU to have a material impact on the Company’s consolidated financial statements.

4. Net Loss per Share

The following outstanding securities as of March 31, 2023 and 2022 have been excluded from the computation of diluted weighted average shares outstanding, as they would have been anti-dilutive:

| March 31, 2023 |

| March 31, 2022 |

| |

Options |

| |

| | |

Unvested restricted stock units | | | |||

Restricted stock awards |

| |

| |

|

Warrants | | | |||

Total |

| |

| |

|

5. Balance Sheet Details

Property and Equipment

Property and equipment as of March 31, 2023 and December 31, 2022 consisted of the following:

| March 31, 2023 |

| December 31, 2022 | |||

Laboratory equipment | $ | | $ | | ||

Furniture and fixtures | | | ||||

Office and computer equipment |

| |

| | ||

Leasehold improvements |

| |

| | ||

Total | | | ||||

Less: accumulated depreciation |

| ( |

| ( | ||

Property and equipment, net | $ | | $ | | ||

Depreciation expense totaled $

6. Convertible Debt

As described in Note 2, on January 10, 2023, the Company received a Loan of $

14

The Credit Agreement provides that if a Qualified Financing occurs, which is defined in the Credit Agreement as a financing from new investors of at least $

The Company evaluated authoritative guidance for accounting for the Loan and concluded that the Loan should be accounted for at fair value under ASC 480, Distinguish Liabilities from Equity, due to the fact that the Loan will predominately be settled with the Company’s Common Stock. Consequently, the Company recorded the Loan in its entirety at fair value on its balance sheet, with changes in fair value recorded as other income (expenses) in the statement of operations during each reporting period.

The Company estimates the fair value of the Loan using a weighted probability of various scenario of the Loan during its term, utilizing significant assumptions and estimates such as volatility and risk-free interest rates, which are level 3 fair value inputs unobservable from active markets.

The following table presents the Company’s fair value measurements using level 3 inputs during the three months ended March 31, 2023.

Fair Value | ||

Balance at December 31, 2022 | $ | |

Net issuance of the Loan | | |

Change in fair value |

| |

Balance at March 31, 2023 | $ | |

7. Shareholders’ Equity

Private Investment

February 2022 Private Placement

On February 9, 2022, the Company entered into the February 2022 Securities Purchase Agreement to sell its Common Stock and warrants to Innoviva. Pursuant and subject to the terms and conditions of the February 2022 Securities Purchase Agreement and related agreements, Innoviva agreed to purchase

Warrants issued to Innoviva expire

15

Warrants

On March 31, 2023, outstanding warrants to purchase shares of Common Stock are as follows:

Shares Underlying Outstanding Warrants |

| Exercise Price |

| Expiration Date | |

| $ | | |||

| $ | | |||

| $ | | |||

| $ | | |||

| $ | | |||

| $ | | |||

| $ | | |||

| $ | | None | ||

|

|

|

| ||

8. Equity Incentive Plans

Stock Award Plans

The Company maintains a 2016 Equity Incentive Plan (the “2016 Plan”), which provides for the issuance of incentive share awards in the form of non-qualified and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock unit awards and performance-based stock awards. The awards may be granted by the Company’s Board of Directors to its employees, directors and officers and to consultants, agents, advisors and independent contractors who provide services to the Company or to a subsidiary of the Company. The exercise price for stock options must not be less than the fair market value of the underlying shares on the date of grant. Stock options expire no later than

The Company has issued restricted stock awards (“RSAs”) under certain legacy option plans that generally vest to

Share-based Compensation

The Company estimates the fair value of stock options with performance and service conditions using the Black-Scholes valuation model (“Black-Scholes”). Compensation expense related to stock options granted is measured at the grant date based on the estimated fair value of the award and is recognized on the accelerated attribution method over the requisite service period.

The assumptions used in the Black-Scholes model during the three months ended March 31, 2023 are presented below. There were no stock options granted during the three months ended March 31, 2022.

Three months ended | |||

| March 31, 2023 | ||

Risk-free interest rate | |||

Expected volatility | |||

Expected term (in years) | |||

Expected dividend yield | |||

The risk-free interest rate is based on the U.S. Treasury yield for a period consistent with the expected term of the option in effect at the time of the grant. Expected volatility is based on the historical volatility of Armata and peer companies’ common stock. The expected term represents the period that the Company expects its stock options to be outstanding. The expected term assumption is estimated using the simplified method set forth in the SEC Staff

16

Accounting Bulletin 110, which is the mid-point between the option vesting date and the expiration date. For stock options granted to parties other than employees or directors, the Company elects, on a grant-by-grant basis, to use the expected term or the contractual term of the option award. The Company has never declared or paid dividends on its Common Stock and has no plans to do so in the foreseeable future. Forfeitures are recognized as a reduction of share-based compensation expense as they occur.

The tables below summarize the total share-based compensation expense included in the Company’s consolidated statements of operations for the periods presented:

Three Months Ended March 31, | |||||||

| 2023 |

| 2022 |

| |||

Research and development | $ | | $ | | |||

General and administrative |

| |

| | |||

Total share-based compensation | $ | | $ | | |||

Stock option transactions during the three months ended March 31, 2023 are presented below:

Options Outstanding | ||||||||||

Weighted | ||||||||||

Average | ||||||||||

Weighted | Remaining | |||||||||

Average | Contractual | Aggregate | ||||||||

Exercise | Term | Intrinsic | ||||||||

| Shares |

| Price |

| (Years) |

| Value | |||

Outstanding at December 31, 2022 |

| | $ | |

| |||||

Granted |

| |

| |

|

| ||||

Exercised | — | — | $ | — | ||||||

Forfeited/Cancelled |

| ( |

| |

|

| ||||

Outstanding at March 31, 2023 |

| | $ | |

| $ | | |||

Vested and expected to vest at March 31, 2023 |

| | $ | |

| $ | | |||

Exercisable at March 31, 2023 |

| | $ | |

| $ | — | |||

There were

The aggregate intrinsic value of options at March 31, 2023 is based on the Company’s closing stock price on that date of $

Shares Reserved for Future Issuance

As of March 31, 2023, the Company had reserved shares of its Common Stock for future issuance as follows:

| Shares Reserved | |

Stock options outstanding |

| |

Unvested restricted stock units | | |

Employee stock purchase plan |

| |

Available for future grants under the 2016 Plan |

| |

Warrants outstanding |

| |

Total shares reserved |

| |

17

9. Income Taxes

The Company did

10. Commitments and Contingencies

Operating Leases

The Company leases office and research and development space under a non-cancelable operating lease in Marina del Rey, CA. The lease commenced January 1, 2012 and in April 2020, the Company amended the lease (“2020 Lease Amendment”) which, among other things, extended the lease term through December 31, 2031. Base annual rent for calendar year 2022, the first year under the Lease Amendment extended term, will be approximately $

Concurrent with the Company’s execution of the 2020 Lease Amendment, an irrevocable letter of credit in the amount of $

On October 28, 2021, the Company entered into a lease for office and research and development space under a non-cancellable lease in Los Angeles, CA (the “2021 Lease”). The 2021 Lease payment start date is May 1, 2022 and the total lease term is for

In connection with the 2021 Lease, the Company delivered an irrevocable standby letter of credit in the total amount of $

Legal Proceedings

From time to time, the Company may be involved in disputes, including litigation, relating to claims arising out of operations in the normal course of business. Any of these claims could subject the Company to costly legal expenses and, while management generally believes that there is adequate insurance to cover many different types of liabilities, the Company’s insurance carriers may deny coverage or policy limits may be inadequate to fully satisfy any damage awards or settlements. If this were to happen, the payment of any such awards could have a material adverse effect on the Company’s consolidated results of operations and financial position. Additionally, any such claims, whether or not successful, could damage the Company’s reputation and business. The Company is currently not a party to any legal proceedings, the adverse outcome of which, in management’s opinion, individually or in the aggregate, would have a material adverse effect on our consolidated results of operations or financial position.

18

11. Grants and Awards

MTEC Grant

On June 15, 2020, the Company entered into a Research Project Award agreement (the “MTEC Agreement”) with the Medical Technology Enterprise Consortium (“MTEC”), pursuant to which the Company received a $

Upon license or commercialization of intellectual property developed with the funding from the MTEC Agreement, additional fees will be due to MTEC. The Company will elect whether to (a) pay a fixed royalty amount, which is subject to a cap based upon total funding received, or (b) pay an additional assessment fee, which would also be subject to a cap based upon a percentage of total funding received.

The MTEC Agreement is effective through October 30, 2024. The MTEC Agreement may be terminated in whole or in part, 30 calendar days following the written notice from the Company to MTEC. In addition, MTEC has the right to terminate the MTEC Agreement upon material breach by the Company.

The Company determined that the MTEC Agreement is not in the scope of ASC 808 or ASC 606. Applying ASC 606 by analogy the Company recognizes proceeds received under the MTEC Agreement as grant revenue on the statement of operations when related costs are incurred. The Company recognized $

CFF Therapeutics Development Award

On March 13, 2020, the Company entered into an award agreement (the “Award Agreement”) with CFF, pursuant to which the Company received a Therapeutics Development Award of up to $

The first payment under the Award Agreement, in the amount of $

If the Company ceases to use commercially reasonable efforts directed to the development of AP-PA02, or any other Product (as defined in the Award Agreement), for a period of

Upon commercialization by the Company of any Product, the Company will owe a fixed royalty amount to CFF, which is to be paid in installments determined, in part, based on commercial sales volumes of the Product. The Company

19

will be obligated to make an additional fixed royalty payment upon achieving specified sales milestones. The Company may also be obligated to make a payment to CFF if the Company transfers, sells or licenses the Product in the CF Field, or if the Company enters into a change of control transaction.

The term of the Award Agreement commenced on March 10, 2020 and expires on the earlier of the date on which the Company has paid CFF all of the fixed royalty payments set forth therein, the effective date of any license granted to CFF following an Interruption, or upon earlier termination of the Award Agreement. Either CFF or the Company may terminate the Award Agreement for cause, which includes the Company’s material failure to achieve certain development milestones. The Company’s payment obligations survive the termination of the Award Agreement.

The Company concluded that the CFF Award is in the scope of ASC 808. Accordingly, as discussed in Note 3, the Company recognizes the award upon achievement of certain milestones as credits to research and development expenses. No credits were recognized during the three months ended March 31, 2023 or 2022. In addition, the Company concluded under the guidance in ASC 730 that it does not have an obligation to repay funds received once related research and development expenses are incurred.

20

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes included in this Quarterly Report, and our audited financial statements and notes thereto as of and for the year ended December 31, 2022 included in our Annual Report on Form 10-K filed on March 16, 2023 with the U.S. Securities and Exchange Commission (the “SEC”).

On May 9, 2019, our predecessor company, C3J Therapeutics, Inc. (“C3J”) completed a reverse merger with AmpliPhi Biosciences Corporation, a bacteriophage development stage company (“AmpliPhi”), where Ceres Merger Sub, Inc., a wholly-owned subsidiary of AmpliPhi, merged with and into C3J (the “Merger”). Immediately prior to the Merger, AmpliPhi changed its name to Armata Pharmaceuticals, Inc.

Our common stock is traded on the NYSE American exchange under the symbol “ARMP.” We are headquartered in Marina del Rey, CA, in a 35,000 square-foot research and development facility built for product development to support advancing phage products from the bench to the clinic. In addition to microbiology, synthetic biology, formulation, chemistry and analytical laboratories, the facility is equipped with two licensed current good manufacturing practice (“cGMP”) drug manufacturing suites enabling the production, testing and release of clinical material.

Statements contained in this Quarterly Report that are not statements of historical fact are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without limitation, statements concerning product development plans, commercialization of our products, the expected market opportunity for our products, the use of bacteriophages and synthetic phages to kill bacterial pathogens, having resources sufficient to fund our operations into the third quarter of 2023, future funding sources, general and administrative expenses, clinical trial and other research and development expenses, costs of manufacturing, costs relating to our intellectual property, capital expenditures, the expected benefits of our targeted phage therapies strategy, the potential market for our products, tax credits and carry-forwards, and litigation-related matters. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “will,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements necessarily contain these identifying words. These statements are subject to risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, filed on March 16, 2023 with the SEC, and under Item 1A, “Risk Factors” and elsewhere in this Quarterly Report. These forward-looking statements speak only as of the date on which they were made, and we undertake no obligation to update any forward-looking statements.

Overview

We are a clinical-stage biotechnology company focused on the development of pathogen-specific bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat bacterial infections using our proprietary bacteriophage-based technology. Bacteriophages or “phages” have a powerful and highly differentiated mechanism of action that enables binding to and killing specific bacteria, in contrast to traditional broad-spectrum antibiotics. We believe that phages represent a promising means to treat bacterial infections, especially those that have developed resistance to current standard of care therapies, including the so-called multidrug-resistant or “superbug” strains of bacteria. We are a leading developer of phage therapeutics and are uniquely positioned to address the growing worldwide threat of antibiotic-resistant bacterial infections.

We are combining our proprietary approach and expertise in identifying, characterizing and developing both naturally-occurring and engineered (synthetic) bacteriophages with our proprietary phage-specific cGMP capabilities to advance a broad pipeline of high-quality bacteriophage product candidates.

We are developing and advancing our lead clinical phage candidate for Pseudomonas aeruginosa (“P. aeruginosa”). On October 14, 2020, we received the approval to proceed from the FDA for our IND application for AP-PA02. In the

21

first quarter of 2023, Armata announced positive topline results from the completed “SWARM-P.a.” study – a Phase 1b/2a, multicenter, double-blind, randomized, placebo-controlled, single ascending dose (“SAD”) and multiple ascending dose (“MAD”) clinical trial to evaluate the safety and tolerability of inhaled AP-PA02 in subjects with cystic fibrosis (“CF”) and chronic pulmonary P. aeruginosa infection. Data indicate that AP-PA02 was well-tolerated with a treatment emergent adverse event (TEAE) profile similar to placebo. Only mild, self-limited adverse events possibly related to study drug were reported in a few subjects. PK findings confirm that AP-PA02 can be effectively delivered to the lungs through nebulization with minimal systemic exposure. Single ascending doses (SAD) and multiple ascending doses (MAD) resulted in a proportional increase in exposure as measured in induced sputum. Additionally, achieved exposures were relatively consistent from subject to subject. Bacterial levels of P. aeruginosa in the sputum were measured at several time points and compared to baseline levels prior to study drug administration. Trends suggest improvement in bacterial load reduction for subjects treated with AP-PA02 at end of treatment as compared to placebo after ten days of dosing. Importantly, for subjects with the highest average exposure of susceptible phage, there was durability of approximately two-log reduction from end of treatment to end of study (day 28 post dose). PK/PD analysis indicates significant microbiological impacts in the subjects with highest exposures. This study is supported by the Cystic Fibrosis Foundation (“CFF”), which granted Armata a Therapeutics Development Award of up to $5.0 million.

We are also developing a phage product candidate for Staphylococcus aureus (“S. aureus”) for the treatment of S. aureus bacteremia, AP-SA02. On June 15, 2020, the Company entered into a Research Project Award agreement (the “MTEC Agreement”) with the Medical Technology Enterprise Consortium (“MTEC”), pursuant to which the Company received a $15.0 million grant and entered into a three-year program administered by the U.S. Department of Defense (the “DoD”) through MTEC with funding from the Defense Health Agency and Joint Warfighter Medical Research Program. On September 29, 2022, the MTEC Agreement was modified to increase the total award by $1.3 million to $16.3 million and extend the term into the third quarter of 2024. The MTEC funds are to partially fund a Phase 1b/2a, multi-center, randomized, double-blind, placebo- controlled dose escalation study that will assess the safety, tolerability, and efficacy of our phage-based candidate, AP-SA02, for the treatment of adults with complicated S. aureus bacteremia. On November 17, 2021, Armata announced that it had received from the FDA the approval to proceed for our Investigational New Drug application for AP-SA02, and in May 2022, the Company dosed the first patient in the Phase 1b/2a trial (“diSArm” trial).

On February 22, 2022, Armata announced that it had received from the FDA the approval to proceed for our IND application for AP-PA02, in a second indication, NCFB (non-cystic fibrosis bronchiectasis). The Company initiated a Phase 2 trial (“Tailwind”) in NCFB in 2022 and reported first patient dosing in the first quarter of 2023. The "Tailwind” study is a Phase 2, multicenter, double-blind, randomized, placebo-controlled study to evaluate the safety, phage kinetics, and efficacy of inhaled AP-PA02 phage therapeutic in subjects with NCFB and chronic pulmonary Pseudomonas aeruginosa infection.

On August 1, 2022, Armata announced that it had received from the FDA the approval to proceed for our IND application for AP-SA02, in a second indication, PJI (periprosthetic joint infection). The Company plans to initiate a Phase 1b/2a trial in 2023, which will assess the safety and tolerability of intravenous and intra-articular AP-SA02 as an adjunct to standard of care antibiotics in adults undergoing debridement, antibiotics, and implant retention for the treatment of periprosthetic joint infections caused by S. aureus.

We are committed to conducting randomized controlled clinical trials required for FDA approval in order to move toward the commercialization of alternatives to traditional antibiotics and provide a potential method of treating patients suffering from drug-resistant and difficult-to-treat bacterial infections.

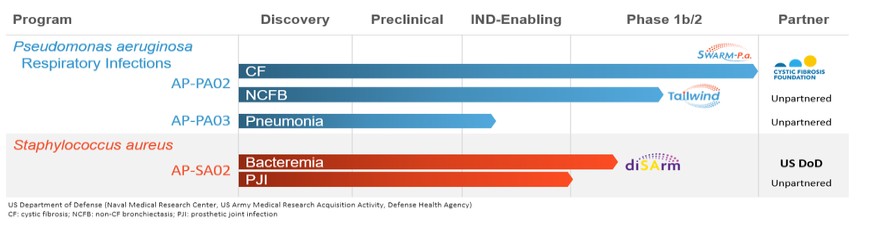

The following chart summarizes the status of our phage product candidate development programs and partners.

22

We have generally incurred net losses since our inception and our operations to date have been primarily limited to research and development and raising capital. As of March 31, 2023, we had an accumulated deficit of $254.3 million. We anticipate that a substantial portion of our capital resources and efforts in the foreseeable future will be focused on completing the development and seeking to obtain regulatory approval of our product candidates.

We currently expect to use our existing cash and cash equivalents for the continued research and development of our product candidates and for working capital and other general corporate purposes. We expect to continue to incur significant and increasing operating losses at least for the next several years. We do not expect to generate product revenue unless and until we successfully complete development and obtain marketing approval for at least one of our product candidates.

We may also use a portion of our existing cash and cash equivalents for the potential acquisition of, or investment in, product candidates, technologies, formulations or companies that complement our business, although we have no current understandings, commitments or agreements to do so. Our existing cash and cash equivalents will not be sufficient to enable us to complete all necessary development of any potential product candidates. Accordingly, we will be required to obtain further funding through one or more other public or private equity offerings, debt financings, collaboration, strategic financing, grants or government contract awards, licensing arrangements or other sources. Our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and potential disruptions to, and volatility in, financial markets in the United States and worldwide. Adequate additional funding may not be available to us on acceptable terms, or at all. If we are unable to raise capital when needed or on acceptable terms, we may be required to defer, reduce or eliminate significant planned expenditures, restructure, curtail or eliminate some or all of our development programs or other operations, dispose of assets, enter into arrangements that may require us to relinquish rights to certain of our product candidates, technologies or potential markets, file for bankruptcy or cease operations altogether. Any of these events could have a material adverse effect on our business, financial condition and results of operations and result in a loss of investment by our shareholders.

Recent Events

2023 Credit Agreement

On January 10, 2023, we entered into, as borrower, a secured convertible credit and security agreement (the “Credit Agreement”) with Innoviva Strategic Opportunities LLC, a wholly owned subsidiary of Innoviva, Inc., our principal shareholder. The Credit Agreement provides for a secured term loan facility in an aggregate amount of $30 million (the “Loan”) at an interest rate of 8.0% per annum, and has a maturity date of January 10, 2024. Repayment of the Loan is required to be guaranteed by our domestic subsidiaries and foreign material subsidiaries, and the Loan is secured by substantially all of our assets and the subsidiary guarantors.

The Credit Agreement provides that if a Qualified Financing, as defined in the Credit Agreement, occurs, the outstanding principal amount of, and all accrued and unpaid interest on, the Loan shall be converted into shares of our common stock, par value $0.01 per share (“Common Stock”) at a price per share equal to a 15.0% discount to the lowest price per share for Common Stock paid by investors in a Qualified Financing (which price paid by investors in a Qualified Financing may not be less than a 15.0% discount to the closing price of Common Stock immediately prior to the consummation of a Qualified Financing event). The Credit Agreement also required us to file a registration statement

23

(the “Registration Statement”) for the resale of all securities issued to the lender in connection with any conversion under the Credit Agreement, which the Company originally filed on February 13, 2023 and which was declared effective by the SEC on April 6, 2023. The Credit Agreement also confers upon the lender the option to convert any outstanding Loan amount, including all accrued and unpaid interest thereon, may be converted at the lender’s option, into shares of Common Stock at a price per share equal to the greater of book value or market value per share of Common Stock on the date immediately preceding the effective date of the Credit Agreement, which was $1.52 (as may be appropriately adjusted for any stock split, combination or similar act).

Results of Operations

Comparison of three months ended March 31, 2023 and 2022

March 31, | Change | |||||||||||

| 2023 |

| 2022 |

| Amount |

| % | |||||

Grant revenue | $ | 796,000 | $ | 1,236,000 | $ | (440,000) | (35.6)% | |||||

Operating expenses | ||||||||||||

Research and development |

| 9,604,000 | 8,028,000 |

| 1,576,000 | 19.6% | ||||||

General and administrative |

| 2,538,000 | 1,983,000 |

| 555,000 | 28.0% | ||||||

Total operating expenses | 12,142,000 | 10,011,000 | 2,131,000 | 21.3% | ||||||||

Loss from operations |

| (11,346,000) |

| (8,775,000) |

| (2,571,000) |

| 29.3% | ||||

Other income (expense) |

|

|

|

|

|

|

|

| ||||

Interest income | 18,000 | 1,000 |

| 17,000 |

| 1700.0% | ||||||

Change in fair value of convertible debt | (3,162,000) | — | (3,162,000) | 100.0% | ||||||||

Total other income (expense), net |

| (3,144,000) |

| 1,000 |

| (3,145,000) |

| (314,500)% | ||||

Net loss | $ | (14,490,000) | $ | (8,774,000) | $ | (5,716,000) |

| 65.1% | ||||

Grant Revenue

The Company recognized $0.8 million and $1.2 million of grant revenue during each of the three months ended March 31, 2023 and 2022, respectively, which represents MTEC’s share of the costs incurred for the Company’s AP-SA02 program for the treatment of Staphylococcus aureus bacteremia.

Research and Development

Research and development expenses for the three months ended March 31, 2023 and 2022 were $9.6 million and $8.0 million, respectively. The net increase of $1.6 million was primarily related to an increase of $0.4 million related to increased clinical trial activities and laboratory supplies expenses, $0.7 million in personnel costs, and $0.4 million in lease expenses.

General and Administrative

General and administrative expenses were $2.5 million for the three months ended March 31, 2023 and $2.0 million for the same period of 2022. The increase of $0.5 million is primarily related to $0.4 million increase in legal and profession expenses, and $0.1 million of increase in lease expenses.

Other Income (Expense)

For the three months ended March 31, 2023, we recorded the change of fair value of our Loan from Innoviva, which is recorded at fair value in its entirety of $3.2 million.

24

Income Taxes

There was no income tax expense or benefit for the three months ended March 31, 2023 and 2022.

Operating Activities

Net cash used in operating activities for the three months ended March 31, 2023 was $17.6 million, as compared to $3.5 million for the three months ended March 31, 2022. The increase of $14.1 million was primarily due to a $5.7 million increase in net loss, an increase of $11.9 million in cash used for operating assets and liabilities, and offset by increases of $3.5 million related to non-cash reconciling items from net loss to cash used in operating activities.

Investing Activities

Net cash used in investing activities was $2.0 million and $0.2 million for the three months ended March 31, 2023 and 2022, respectively, and primarily related to capital equipment purchases.

Financing Activities

Net cash provided by financing activities was $29.6 million for the three months ended March 31, 2023, which was primarily comprised of $29.6 million of proceeds raised from the convertible debt issued to Innoviva, net of issuance costs.

Net cash provided by financing activities was $44.6 million for the three months ended March 31, 2022, which was comprised of net proceeds raised from the February 2022 private placement transactions with Innoviva.

Liquidity, Capital Resources and Financial Condition

We have prepared our condensed consolidated financial statements on a going concern basis, which assumes that we will realize our assets and satisfy our liabilities in the normal course of business. However, we have incurred net losses since our inception and have negative operating cash flows. These circumstances raise substantial doubt about our ability to continue as a going concern. The accompanying condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the outcome of the uncertainty concerning our ability to continue as a going concern. While management believes this plan to raise additional funds will alleviate the conditions that raise substantial doubt, these plans are not entirely within its control and cannot be assessed as being probable of occurring. We may not be able to secure additional financing in a timely manner or on favorable terms, if at all.

As of March 31, 2023, we had unrestricted cash and cash equivalents of $25.1 million. Considering our current cash resources, management believes our existing resources will be sufficient to fund our planned operations into the third quarter of 2023. For the foreseeable future, our ability to continue our operations is dependent upon our ability to obtain additional capital.

In light of recent bank failures and related concerns regarding the financial condition of certain banking institutions with exposure to certain types of depositors and large portfolios of investment securities, the Company transferred cash and cash equivalents previously held at regional banks to larger financial institutions. The Company held funds on deposit at First Republic Bank (“First Republic”) when the Federal Deposit Insurance Company placed First Republic into receivership and then sold it to JP Morgan Chase, National Association (“JP Morgan Chase”) on May 1, 2023. Approximately $4.6 million of the funds exceeded FDIC insurance limits, and included funds in the form of a certificate of deposit held in trust as collateral for a letter of credit issued by First Republic for the benefit of the Company’s McConnell facility landlord, which letter of credit was included in the sale of assets to JP Morgan Chase. The Company currently has full access to all of our bank accounts, including those with First Republic, and has been able to transact business in the ordinary course. While we believe the Company is not exposed to significant credit risk due to the financial strength of these depository institutions or investments and do not anticipate any material impact on our financial condition or operations as a result of the recent bank failures, the failure or collapse of one or more of these

25

depository institutions or default on these investments could materially adversely affect our ability to recover these assets and/or materially harm our financial condition.

Future Capital Requirements

We will need to raise additional capital in the future to continue to fund our operations. Our future funding requirements will depend on many factors, including:

| ● | the costs and timing of our research and development activities; |

| ● | the progress and cost of our clinical trials and other research and development activities; |

| ● | manufacturing costs associated with our targeted phage therapies strategy and other research and development activities; |

| ● | the terms and timing of any collaborative, licensing, acquisition or other arrangements that we may establish; |

| ● | whether and when we receive future Australian tax rebates, if any; |

| ● | the costs and timing of seeking regulatory approvals; |

| ● | the costs of filing, prosecuting and enforcing any patent applications, claims, patents and other intellectual property rights; and |

| ● | the costs of potential lawsuits involving us or our product candidates. |

We may seek to raise capital through a variety of sources, including:

| ● | the public equity market; |

| ● | private equity financings; |

| ● | collaborative arrangements, government grants or strategic financings; |

| ● | licensing arrangements; and |

| ● | public or private debt. |

Any additional fundraising efforts may divert our management team from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates. Our ability to raise additional funds will depend, in part, on the success of our product development activities, including our targeted phage therapies strategy and any clinical trials we initiate, regulatory events, our ability to identify and enter into in-licensing or other strategic arrangements, and other events or conditions that may affect our value or prospects, as well as factors related to financial, economic and market conditions, many of which are beyond our control. We cannot be certain that sufficient funds will be available to us when required or on acceptable terms. If we are unable to secure additional funds on a timely basis or on acceptable terms, we may be required to defer, reduce or eliminate significant planned expenditures, restructure, curtail or eliminate some or all of our development programs or other operations, dispose of technology or assets, pursue an acquisition of our company by a third party at a price that may result in a loss on investment for our shareholders, enter into arrangements that may require us to relinquish rights to certain of our product candidates, technologies or potential markets, file for bankruptcy or cease operations altogether. Any of these events could have a material adverse effect on our business, financial condition and results of operations. Moreover, if we are unable to obtain additional funds on a timely basis, there will be substantial doubt about our ability to continue as a going concern and increased risk of insolvency and loss of investment by our shareholders. To the extent that additional capital is raised

26

through the sale of equity or convertible debt securities, the issuance of such securities could result in dilution to our existing shareholders. Our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to, and volatility in, financial markets in the United States and worldwide.

Off-Balance Sheet Arrangements

As of March 31, 2023, we did not have off-balance sheet arrangements.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of financial condition and results of operations are based upon our condensed consolidated financial statements, which have been prepared in accordance with U.S. GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to fair value of our convertible debt, the allowance for doubtful accounts, useful lives of intangible assets, recoverability of the carrying amounts of goodwill and intangible assets, share-based compensation and income tax provision. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Refer to Note 3 to the condensed consolidated financial statements contained elsewhere in this report. During the three months ended March 31, 2023, there were no material changes to our critical accounting policies from those described in our Annual Report on Form 10-K filed with the SEC on March 16, 2023.

Item 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and are not required to provide the information required under this item.

Item 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer (our Principal Executive Officer) and then Vice President of Finance (our then Principal Financial and Accounting Officer), of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, as of the end of the period covered by this quarterly report on Form 10-Q. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable and not absolute assurance of achieving the desired control objectives and management necessarily applies its judgment in evaluating the cost benefit relationship of possible controls and procedures. Based on this evaluation, our Chief Executive Officer and then Vice President of Finance concluded that our disclosure controls and procedures were effective at the reasonable assurance level as of March 31, 2023.

Changes in Internal Control over Financial Reporting

An evaluation was also performed under the supervision and with the participation of our management, including our Chief Executive Officer and our former Vice President of Finance (and then Principal Financial and Accounting Officer), of any change in our internal control over financial reporting that occurred during our last fiscal quarter and that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting. That evaluation did not identify any change in our internal control over financial reporting that occurred during our latest fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial

27

reporting; however, that evaluation, with the participation of our current Chief Financial Officer, is ongoing and because of its ongoing nature, there can be no assurance that we will not identify any change that would materially affect, or be reasonably likely to materially affect, our internal control over financial reporting.

Inherent Limitations on Effectiveness of Controls

Our management, including our Chief Executive Officer and our Chief Financial Officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected.

PART II. OTHER INFORMATION

Item 1. LEGAL PROCEEDINGS

From time to time, we are a party to certain litigation that is either judged to be not material or that arises in the ordinary course of business. We intend to vigorously defend our interests in these matters. We expect that the resolution of these matters will not have a material adverse effect on our business, financial condition or results of operations. However, due to the uncertainties inherent in litigation, no assurance can be given as to the outcome of these proceedings.

Item 1A. RISK FACTORS