UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

⌧ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

|

For the quarterly period ended March 31, 2021

OR

◻ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

|

For the transition period from _________________ to _______________________

Commission file number: 001-37544

ARMATA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Washington | 91-1549568 |

(State or other jurisdiction of | (I.R.S. Employer Identification Number) |

incorporation or organization) | |

4503 Glencoe Avenue | |

Marina del Rey, CA | 90292 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (310) 665-2928

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value per share | ARMP | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company as defined in Rule 12b-2 of the Exchange Act. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ | Accelerated filer ◻ |

Non-accelerated filer ⌧ | Smaller reporting company ⌧ |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ◻ No ⌧

The number of shares of the registrant’s Common Stock, par value $0.01 per share, outstanding at May 7, 2021 was 24,940,442.

TABLE OF CONTENTS

Page | ||

PART I. FINANCIAL INFORMATION | ||

| | |

Item 1. | Financial Statements (unaudited) | |

| | |

| 3 | |

| | |

4 | ||

| | |

| 5 | |

| | |

6 | ||

| | |

7 | ||

| | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 | |

| | |

23 | ||

| | |

23 | ||

| | |

24 | ||

|

| |

24 | ||

|

| |

24 | ||

|

| |

49 | ||

|

| |

49 | ||

|

| |

49 | ||

|

| |

49 | ||

|

| |

50 | ||

|

| |

51 | ||

Armata Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

|

| March 31, 2021 |

| December 31, 2020 |

| ||

| | (unaudited) | | | | | |

Assets | | | | | | | |

Current assets | | | | | | | |

Cash and cash equivalents | | $ | 22,455,000 | | $ | 9,649,000 | |

Awards receivable | | | 1,125,000 | | | 561,000 | |

Prepaid expenses and other current assets | |

| 459,000 | |

| 636,000 | |

Total current assets | |

| 24,039,000 | |

| 10,846,000 | |

Restricted cash | | | 1,200,000 | | | 1,200,000 | |

Property and equipment, net | |

| 2,115,000 | |

| 2,047,000 | |

Operating lease right-of-use asset | |

| 10,696,000 | |

| 10,790,000 | |

In-process research and development | | | 10,256,000 | | | 10,256,000 | |

Goodwill | | | 3,490,000 | | | 3,490,000 | |

Other assets | |

| 1,049,000 | |

| 887,000 | |

Total assets | | $ | 52,845,000 | | $ | 39,516,000 | |

| | | | | | | |

Liabilities and stockholders’ equity | |

|

| |

|

| |

Current liabilities | |

|

| |

|

| |

Accounts payable and accrued liabilities | | $ | 1,756,000 | | $ | 1,929,000 | |

Accrued compensation | | | 893,000 | | | 563,000 | |

Current portion of operating lease liabilities | | | 1,608,000 | | | 1,551,000 | |

PPP Loan | | | 724,000 | | | 722,000 | |

Deferred asset acquisition consideration | | | — | | | 1,940,000 | |

Total current liabilities | |

| 4,981,000 | |

| 6,705,000 | |

Operating lease liabilities, net of current portion | | | 10,775,000 | | | 10,877,000 | |

Deferred tax liability | | | 3,077,000 | | | 3,077,000 | |

Total liabilities | |

| 18,833,000 | |

| 20,659,000 | |

| | | | | | | |

Stockholders’ equity | |

|

| |

|

| |

Common stock, $0.01 par value; 217,000,000 shares authorized; 24,940,442 and 18,688,461 shares issued and outstanding at March 31, 2021 and December 31, 2020, respectively | |

| 249,000 | |

| 187,000 | |

Additional paid-in capital | |

| 218,960,000 | |

| 198,372,000 | |

Accumulated deficit | |

| (185,197,000) | |

| (179,702,000) | |

Total stockholders’ equity | |

| 34,012,000 | |

| 18,857,000 | |

Total liabilities and stockholders’ equity | | $ | 52,845,000 | | $ | 39,516,000 | |

See accompanying notes to condensed consolidated financial statements.

3

Armata Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations

| | Three Months Ended | | ||||

| | March 31, | | ||||

|

| 2021 |

| 2020 |

| ||

| | | (unaudited) | | | (unaudited) | |

Grant revenue | | $ | 1,066,000 | | $ | — | |

Operating expenses | | | | | | | |

Research and development | |

| 4,350,000 | |

| 2,750,000 | |

General and administrative | |

| 2,151,000 | |

| 2,171,000 | |

Total operating expenses | | | 6,501,000 | | | 4,921,000 | |

Loss from operations | |

| (5,435,000) | |

| (4,921,000) | |

Other income (expense) | |

|

| |

|

| |

Interest income | | | 2,000 | |

| 2,000 | |

Interest expense | | | (62,000) | | | (159,000) | |

Total other income (expense), net | |

| (60,000) | |

| (157,000) | |

Net loss | |

| (5,495,000) | |

| (5,078,000) | |

Per share information: | |

|

| |

|

| |

Net loss per share, basic and diluted | | $ | (0.27) | | $ | (0.49) | |

Weighted average shares outstanding, basic and diluted | | | 20,458,355 | | | 10,451,746 | |

See accompanying notes to condensed consolidated financial statements.

4

Armata Pharmaceuticals, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

Three Months Ended March 31, 2021 and 2020

| | Stockholders’ Equity | ||||||||||||

| | Common Stock | | | | | | | | | | |||

| | | | | | | Additional | | | | Total | |||

| | | | | | | Paid-in | | Accumulated | | Stockholders’ | |||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Equity | ||||

Balances, December 31, 2019 |

| 9,922,758 | | $ | 99,000 | | $ | 172,015,000 | | $ | (157,521,000) | | $ | 14,593,000 |

Sale of common stock, net of issuance costs | | 8,710,800 | | | 87,000 | | | 22,755,000 | | | | | | 22,842,000 |

Forfeiture of restricted stock awards |

| (3,329) | | | — | | | — | | | — | |

| — |

Exercise of warrants | | 14,464 | | | — | | | 81,000 | | | | | | 81,000 |

Stock-based compensation |

| — | | | — | | | 1,044,000 | | | — | |

| 1,044,000 |

Net loss |

| — | | | — | | | — | | | (5,078,000) | |

| (5,078,000) |

Balances, March 31, 2020 |

| 18,644,693 | | $ | 186,000 | | $ | 195,895,000 | | $ | (162,599,000) | | $ | 33,482,000 |

| | | | | | | | | | | | | | |

Balances, December 31, 2020 |

| 18,688,461 | | $ | 187,000 | | $ | 198,372,000 | | $ | (179,702,000) | | $ | 18,857,000 |

Sale of common stock, net of issuance costs | | 6,153,847 | | | 61,000 | | | 19,302,000 | | | — | | | 19,363,000 |

Exercises of stock options | | 46,134 | | | — | | | 154,000 | | | — | | | 154,000 |

Exercises of warrants | | 52,000 | | | 1,000 | | | 290,000 | | | — | | | 291,000 |

Stock-based compensation | | — | | | — | | | 842,000 | | | — | | | 842,000 |

Net loss |

| — | | | — | | | — | | | (5,495,000) | |

| (5,495,000) |

Balances, March 31, 2021 |

| 24,940,442 | | $ | 249,000 | | $ | 218,960,000 | | $ | (185,197,000) | | $ | 34,012,000 |

See accompanying notes to condensed consolidated financial statements.

5

Armata Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows

| | Three Months Ended March 31, | ||||

|

| 2021 |

| 2020 | ||

| | (unaudited) | | (unaudited) | ||

Operating activities: | | | | | | |

Net loss | | $ | (5,495,000) | | $ | (5,078,000) |

Adjustments required to reconcile net loss to net cash used in operating activities: | | | | | | |

Depreciation | |

| 281,000 | |

| 295,000 |

Stock-based compensation | | | 842,000 | | | 1,044,000 |

Non-cash interest expense | |

| 62,000 | |

| 159,000 |

Payment of accreted interest for deferred consideration for asset acquisition | | | (586,000) | | | — |

Changes in operating assets and liabilities: | |

| | |

| |

Award receivable | | | (564,000) | | | (1,000,000) |

Accounts payable and accrued liabilities | |

| (409,000) | |

| (195,000) |

Accrued compensation | | | 330,000 | | | (114,000) |

Operating lease right-of-use asset and liability, net | | | 49,000 | | | (122,000) |

Deferred award liability | | | — | | | 859,000 |

Prepaid expenses and other current assets | |

| 15,000 | |

| (80,000) |

Net cash used in operating activities | |

| (5,475,000) | |

| (4,232,000) |

Investing activities: | |

|

| |

|

|

Purchases of property and equipment | | | (298,000) | | | (104,000) |

Net cash (used in) provided by investing activities | |

| (298,000) | |

| (104,000) |

Financing activities: | |

|

| |

|

|

Principal payment of deferred consideration for asset acquisition | | | (1,414,000) | | | (1,000,000) |

Proceeds from sale of common stock, net of offering costs | | | 19,548,000 | | | 23,331,000 |

Proceeds from exercise of warrants and stock options | | | 445,000 | | | 81,000 |

Net cash provided by financing activities | |

| 18,579,000 | |

| 22,412,000 |

Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 12,806,000 | |

| 18,076,000 |

Cash, cash equivalents and restricted cash, beginning of period | |

| 10,849,000 | |

| 6,733,000 |

Cash, cash equivalents and restricted cash, end of period | | $ | 23,655,000 | | $ | 24,809,000 |

Supplemental schedule of non-cash investing and financing activities: | |

|

| |

|

|

Unpaid offering costs | | $ | 185,000 | | $ | 471,000 |

Property and equipment included in accounts payable | | $ | 51,000 | | $ | 9,000 |

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the consolidated balance sheets that sum to the total of the same amounts shown in the consolidated statement of cash flows:

| | Three Months Ended March 31, | ||||

| | 2021 |

| 2020 | ||

Cash and cash equivalents | | $ | 22,455,000 | | $ | 24,209,000 |

Restricted cash | | | 1,200,000 | | | 600,000 |

Cash, cash equivalents and restricted cash | | $ | 23,655,000 | | $ | 24,809,000 |

See accompanying notes to condensed consolidated financial statements.

6

Armata Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization and Description of the Business

Armata Pharmaceuticals, Inc. (“Armata”, and together with its subsidiaries referred to herein as, the “Company”) is a clinical-stage biotechnology company focused on the development of precisely targeted bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat bacterial infections using its proprietary bacteriophage-based technology. The Company was created as a result of a business combination between C3J Therapeutics, Inc. (“C3J”), a Washington corporation, and AmpliPhi Biosciences Corporation (“AmpliPhi”) that closed on May 9, 2019, where Ceres Merger Sub, Inc., a wholly owned subsidiary of AmpliPhi, merged with and into C3J (the ”Merger”), with C3J surviving the Merger as a wholly owned subsidiary of AmpliPhi. Immediately prior to the closing of the Merger, AmpliPhi changed its name to Armata Pharmaceuticals, Inc. Armata’s common stock is traded on the NYSE American exchange under the ticker symbol “ARMP”.

2. Liquidity

The Company has prepared its consolidated financial statements on a going concern basis, which assumes that the Company will realize its assets and satisfy its liabilities in the normal course of business. However, the Company has incurred net losses since its inception and has negative operating cash flows. These circumstances raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the outcome of the uncertainty concerning the Company’s ability to continue as a going concern.

On January 26, 2021, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Innoviva Strategic Opportunities LLC, a wholly-owned subsidiary of Innoviva, Inc. (Nasdaq: INVA) (collectively, “Innoviva”), pursuant to which the Company agreed to issue and sell to Innoviva, in a private placement, up to 6,153,847 newly issued shares of common stock, par value $0.01 per share (the “Shares”), and warrants (the “Common Warrants”) to purchase up to 6,153,847 shares of our common stock, with an exercise price per share of $3.25 (the “2021 Private Placement”).

The 2021 Private Placement closed in two tranches. On January 26, 2021 and concurrently with entering into the Securities Purchase Agreement, the Company completed the first tranche (the “First Closing”) of the 2021 Private Placement. At the First Closing, Innoviva purchased 1,867,912 Shares and Common Warrants to purchase 1,867,912 shares of common stock, for an aggregate purchase price of approximately $6.1 million.

At the closing of the second tranche (the “Second Closing”), which was approved by the Company’s stockholders, Innoviva purchased 4,285,935 Shares and Common Warrants to purchase 4,285,935 shares of common stock for an aggregate purchase price of $13.9 million. The Second Closing was completed on March 17, 2021.

On March 27, 2020, the Company completed a private placement transaction and sold to Innoviva Inc. 8,710,800 newly issued shares of the Company’s common stock and warrants to purchase 8,710,800 shares of common stock, with an exercise price per share of $2.87 (the “Private Placement”). Each share of common stock was sold together with one common warrant granting the warrant holder the right to purchase an additional share of common stock at $2.87 per share. The Private Placement was closed in two tranches raising total gross proceeds of $25.0 million.

As of March 31, 2021, the Company had cash and cash equivalents of $22.5 million. Considering the Company’s current cash resources, management believes the Company’s existing resources will be sufficient to fund the Company’s planned operations into the first quarter of 2022. For the foreseeable future, the Company’s ability to continue its operations is dependent upon its ability to obtain additional capital.

7

Management plans to raise additional capital through equity offerings, debt financings, or other capital sources, including potential collaborations, licenses and other similar arrangements. While management believes this plan to raise additional funds will alleviate the conditions that raise substantial doubt, these plans are not entirely within its control and cannot be assessed as being probable of occurring. The Company’s ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to, and volatility in, financial markets in the United States and worldwide resulting from the ongoing COVID-19 pandemic. The Company may not be able to secure additional financing in a timely manner or on favorable terms, if at all. Furthermore, if the Company issues equity securities to raise additional funds, its existing stockholders may experience dilution, and the new equity securities may have rights, preferences and privileges senior to those of the Company’s existing stockholders. If the Company raises additional funds through collaboration, licensing or other similar arrangements, it may be necessary to relinquish valuable rights to its potential products on terms that are not favorable to the Company. If the Company is unable to raise capital when needed or on attractive terms, it would be forced to delay, reduce or eliminate its research and development programs or other operations. If any of these events occur, the Company’s ability to achieve the development and commercialization goals would be adversely affected.

3. Significant Accounting Policies

Basis of Presentation

The consolidated financial statements include the accounts of Armata and its wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated. The accompanying unaudited condensed consolidated financial statements of the Company should be read in conjunction with the audited financial statements and accompanying notes thereto as of and for the year ended December 31, 2020 included in the Company’s Form 10-K, filed with the U.S. Securities and Exchange Commission on March 18, 2021. The accompanying unaudited financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial statements. Any reference in the Notes to applicable guidance is meant to refer to authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Update (“ASU”) of the Financial Accounting Standards Board (“FASB”).

In the opinion of management, the accompanying consolidated financial statements include all adjustments that are of a normal and recurring nature and that are necessary for the fair presentation of the Company’s financial position and the results of its operations and cash flows for the periods presented. Interim results are not necessarily indicative of results for the full year or any future period.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in its consolidated financial statements and accompanying notes. On an ongoing basis, management evaluates these estimates and judgments, which are based on historical and anticipated results and trends, and on various other assumptions that management believes to be reasonable under the circumstances. By their nature, estimates are subject to an inherent degree of uncertainty and, as such, actual results may differ from management’s estimates.

Fair Value of Financial Instruments

The carrying amounts of cash equivalents, other current assets, accounts payable, and accrued liabilities approximate fair value because of the short-term nature of these instruments.

In-Process Research and Development (“IPR&D”)

IPR&D assets are intangible assets with indefinite lives and are not subject to amortization. The Company’s IPR&D assets represent capitalized incomplete research projects that the Company acquired through the Merger, which is related to the development of AP-SA01, a phage combination for the treatment of Staphylococcus aureus infections (“S. aureus”). Such assets are initially measured at their acquisition-date fair values and are subject to impairment testing at

8

least annually until completion or abandonment of research and development efforts associated with the projects. Upon successful completion of each project, the Company makes a determination as to the then remaining useful life of the intangible asset and begins amortization.

Goodwill

Goodwill, which has an indefinite useful life, represents the excess of purchase consideration over fair value of net assets acquired. Goodwill is not subject to amortization and is required to be tested for impairment at least on an annual basis. The Company tests goodwill for impairment as of December 31 of each year. The Company determines whether goodwill may be impaired by comparing the carrying value of the single reporting unit, including goodwill, to the fair value of the reporting unit. If the fair value is less than the carrying amount, a more detailed analysis is performed to determine whether goodwill is impaired. The impairment loss, if any, is measured as the excess of the carrying value of the goodwill over the implied fair value of the goodwill and is recorded in the Company’s consolidated statements of operations.

Settlement of Zero-coupon Debt Instrument

The Company’s deferred purchase consideration arrangement with Synthetic Genomics (Note 11) does not have a stated interest rate. Upon repayment of deferred purchase consideration, the Company classifies the portion attributable to accreted interest as a cash outflow for operating activities, and the portion relating to principal as a cash outflow for financing activities.

Basic and Diluted Net Loss per Share

Net earnings or loss per share (“EPS”) is calculated in accordance with the applicable accounting guidance provided in ASC 260, Earnings per Share. The Company uses the two-class method for the computation and presentation of net income (loss) per common share attributable to common stockholders. The two-class method is an earnings allocation formula that calculates basic and diluted net income (loss) per common share for each class of common stock separately based on dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. Under the two-class method, warrants issued to Innoviva in connection with the Private Placement (Note 2) is assumed to participate in undistributed earnings on an as-exercised basis, in accordance with the warrant agreement. Undistributed net losses are allocated entirely to common shareholders since the participating security has no contractual obligation to share in the losses.

Accordingly, basic income or loss per share is calculated by dividing net income or loss by the weighted-average number of common shares outstanding, or using the two-class method, whichever is more dilutive. Diluted net income or loss per share is computed using the more dilutive of the treasury stock method which reflects the potential dilution that would occur if securities or other contracts to issue common stock were exercised or converted to common stock, or the two-class method.

The calculation of diluted loss per share requires that, to the extent the average market price of the underlying shares for the reporting period exceeds the exercise price of liability classified warrants, and the presumed exercise of such securities are dilutive to net loss per share for the period, an adjustment to net loss available to common stockholders used in the calculation is required to remove the change in fair value of the warrants from the numerator for the period. Likewise, an adjustment to the denominator is required to reflect the related dilutive shares, if any, under the treasury stock method.

Grants and Awards

In applying the provisions of ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”), Armata has determined that grants and awards are out of the scope of ASC 606 because the funding entities do not meet the definition of a “customer”, as defined by ASC 606, as there is not considered to be a transfer of control of goods or services. With respect to each grant or award, the Company determines if it has a collaboration in accordance with ASC Topic 808, Collaborative Arrangements (“ASC 808”). To the extent the grant or award is within the scope of ASC 808,

9

the Company recognizes amounts received as a contra-expense or grant revenue on the consolidated statement of operations when the related research and development expenses are incurred. For grant and awards outside the scope of ASC 808, the Company applies ASC 606 or International Accounting Standards No. 20, Accounting for Government Grants and Disclosure of Government Assistance, by analogy, and revenue is recognized when the Company incurs expenses related to the grants for the amount the Company is entitled to under the provisions of the contract.

Armata also considers the guidance in ASC Topic 730, Research and Development (“ASC 730”), which requires an assessment, at the inception of the grant or award, of whether the agreement is a liability. If Armata is obligated to repay funds received regardless of the outcome of the related research and development activities, then Armata is required to estimate and recognize that liability. Alternatively, if Armata is not required to repay the funds, then payments received are recorded as revenue or contra-expense as the expenses are incurred.

Deferred grant or award liability represents award funds received or receivable for which the allowable expenses have not yet been incurred as of the balance sheet date.

Research and Development Expenses

Research and development (“R&D”) costs consist primarily of direct and allocated salaries, incentive compensation, stock-based compensation and other personnel-related costs, facility costs, and third-party services. Third-party services include studies and clinical trials conducted by clinical research organizations. R&D activities are expensed as incurred. The Company records accruals for estimated ongoing clinical trial expenses. When evaluating the adequacy of the accrued liabilities, the Company analyzes progress of the studies, including the phase or completion of events, invoices received and contracted costs. Judgments and estimates are made in determining the accrued balances at the end of the reporting period.

Recent Accounting Pronouncements Not Yet Adopted

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments. The standard amends the impairment model by requiring entities to use a forward-looking approach based on expected losses to estimate credit losses for most financial assets and certain other instruments that aren’t measured at fair value through net income. For available-for-sale debt securities, entities will be required to recognize an allowance for credit losses rather than a reduction in carrying value of the asset. Entities will no longer be permitted to consider the length of time that fair value has been less than amortized cost when evaluating when credit losses should be recognized. This new guidance is effective for calendar-year smaller reporting public entities in the first quarter of 2023. The Company is currently evaluating the impact of this ASU and does not expect that adoption of this standard will have a material impact on its consolidated financial statements or related disclosures.

In August 2020, the FASB issued ASU No. 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40) (“ASU 2020-06”). ASU 2020-06 eliminates the beneficial conversion and cash conversion accounting models for convertible instruments. It also amends the accounting for certain contracts in an entity’s own equity that are currently accounted for as derivatives because of specific settlement provisions. In addition, ASU 2020-06 modifies how particular convertible instruments and certain contracts that may be settled in cash or shares impact the diluted EPS computation. The amendments in ASU 2020-06 are effective for smaller reporting companies as defined by the SEC for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020. The Company is currently evaluating the impact of ASU 2020-06 on its financial statements and does not expect the adoption of this ASU to have a material impact on the Company’s consolidated financial statements.

10

Recently Adopted Accounting Standards

In December 2019, the FASB issued ASU 2019-12, Income Taxes (“ASC 740”), which simplifies the accounting for income taxes by eliminating certain exceptions to the guidance in ASC 740 related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. The new guidance also simplifies aspects of the accounting for franchise taxes and enacted changes in tax laws or rates and clarifies the accounting for transactions that result in a step-up in the tax basis of goodwill. The guidance became effective for the Company on January 1, 2021 and the adoption did not have a material impact on its consolidated financial statements or related disclosures.

4. Net Loss per Share

The following outstanding securities at March 31, 2021 and 2020 have been excluded from the computation of diluted weighted average shares outstanding for the three months ended March 31, 2021 and 2020, as they would have been anti-dilutive:

| | Three Months Ended | ||

|

| March 31, 2021 |

| March 31, 2020 |

Options | | 2,166,943 |

| 1,365,764 |

Restricted stock awards |

| 322,756 |

| 340,164 |

Warrants | | 16,647,219 | | 10,547,363 |

Total |

| 19,136,918 |

| 12,253,291 |

5. Balance Sheet Details

Property and Equipment

Property and equipment as of March 31, 2021 and December 31, 2020 consisted of the following:

|

| March 31, 2021 |

| December 31, 2020 | ||

Laboratory equipment | | $ | 6,870,000 | | $ | 6,547,000 |

Furniture and fixtures | | | 740,000 | | | 719,000 |

Office and computer equipment | |

| 418,000 | |

| 413,000 |

Leasehold improvements | |

| 3,423,000 | |

| 3,423,000 |

Total | | | 11,451,000 | | | 11,102,000 |

Less: accumulated depreciation | |

| (9,336,000) | |

| (9,055,000) |

Property and equipment, net | | $ | 2,115,000 | | $ | 2,047,000 |

Depreciation expense totaled $0.3 million for each of the three months ended March 31, 2021 and 2020, respectively.

6. Paycheck Protection Program Loan

In April 2020, the Company received loan proceeds of $717,000 (“PPP Loan”) under the Paycheck Protection Program (“PPP”). The PPP, established as part of the Coronavirus Aid, Relief and Economic Security Act, provides for loans to qualifying businesses for amounts up to 2.5 times the average monthly payroll expenses of the qualifying business, calculated as provided under the PPP. The PPP provides a mechanism for forgiveness of up to the full amount borrowed after twenty-four weeks as long as the borrower uses the loan proceeds during the twenty-four week period after the loan origination for eligible purposes, including payroll costs, certain benefits costs, rent and utilities costs or other permitted purposes, and maintains its payroll levels, subject to certain other requirements and limitations. The amount of loan forgiveness is subject to reduction, among other reasons, if the borrower terminates employees or reduces salaries during the measurement period. The Company will submit its application for loan forgiveness in 2021 and anticipates that the

11

loan will be forgiven based on the current guidelines. The Company cannot provide any assurance that it will be eligible for loan forgiveness or that any amount of the PPP loan will ultimately be forgiven.

The PPP Loan is unsecured, evidenced by a promissory note (the “Note”) given by the Company as borrower through its bank, serving as the lender. The interest rate on the Note is 1.0% per annum. Payments of principal and interest are deferred until August 2021 (the “Deferral Period”). Any unforgiven portion of the PPP Loan is payable over the two-year term, with payments deferred during the Deferral Period. The Company is permitted to prepay the Note at any time without payment of any premium.

7. Stockholders’ Equity

Private Investment

On January 26, 2021, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Innoviva, pursuant to which the Company agreed to issue and sell to Innoviva, in a private placement, up to 6,153,847 newly issued shares of common stock, par value $0.01 per share (the “Shares”), and warrants (the “Common Warrants”) to purchase up to 6,153,847 shares of our common stock, with an exercise price per share of $3.25 (the “2021 Private Placement”).

The 2021 Private Placement closed in two tranches. On January 26, 2021 and concurrently with entering into the Securities Purchase Agreement, the Company completed the first tranche (the “First Closing”) of the 2021 Private Placement. At the First Closing, Innoviva purchased 1,867,912 Shares and Common Warrants to purchase 1,867,912 shares of common stock, for an aggregate purchase price of approximately $6.1 million.

At the closing of the second tranche (the “Second Closing”), which was approved by the Company’s stockholders, Innoviva purchased 4,285,935 Shares and Common Warrants to purchase 4,285,935 shares of common stock for an aggregate purchase price of $13.9 million. The Second Closing was completed on March 17, 2021.

On January 27, 2020, the Company entered into the Securities Purchase Agreement with Innoviva, pursuant to which the Company agreed to issue and sell to Innoviva, in a Private Placement, 8,710,800 newly issued shares of the Company’s common stock and warrants to purchase 8,710,800 shares of common stock, with an exercise price per share of $2.87. Each share of common stock was sold together with one common warrant granting the warrant holder the right to purchase an additional share of common stock at $2.87 per share. The Private Placement occurred in two tranches. The first closing occurred on February 12, 2020, at which time Innoviva purchased 993,139 Common Units in exchange for an aggregate gross cash payment of approximately $2.8 million. On March 27, 2020, the second closing occurred subsequent to shareholder approval, at which time Innoviva purchased 7,717,661 Common Units in exchange for aggregate gross proceeds of $22.2 million.

The warrants issued to Innoviva during 2021 and 2020 expire five years from the issuance date. The Company reviewed the authoritative accounting guidance and determined that the warrants meet the criteria to be accounted for as permanent equity.

12

Warrants

At March 31, 2021, outstanding warrants to purchase shares of common stock are as follows:

Shares Underlying Outstanding Warrants |

| Exercise Price |

| Expiration Date | |

597,881 | | $ | 21.00 | | May 10, 2022 |

1,183,491 | | $ | 5.60 | | October 16, 2023 |

993,139 | | $ | 2.87 | | February 12, 2025 |

7,717,661 | | $ | 2.87 | | March 27, 2025 |

1,867,912 | | $ | 3.25 | | January 25, 2026 |

4,285,935 | | $ | 3.25 | | March 17, 2026 |

1,200 | | $ | 1,680.00 | | None |

16,647,219 | |

|

| |

|

8. Equity Incentive Plans

Stock Award Plans

The Company maintains a 2016 Equity Incentive Plan (the “2016 Plan”), which provides for the issuance of incentive share awards in the form of non-qualified and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock unit awards and performance-based stock awards. The awards may be granted by the Company’s Board of Directors to its employees, directors and officers and to consultants, agents, advisors and independent contractors who provide services to the Company or to a subsidiary of the Company. The exercise price for stock options must not be less than the fair market value of the underlying shares on the date of grant. Stock options expire no later than ten years from the date of grant and generally vest and typically become exercisable over a four-year period following the date of grant. Under the 2016 Plan, the number of shares authorized for issuance automatically increases annually beginning January 1, 2017 and through January 1, 2026.

In connection with the Merger, the Company assumed the C3J Jian, Inc. Amended 2006 Stock Option Plan (the “Assumed 2006 Plan”) and the C3J Therapeutics, Inc. 2016 Stock Plan (the “Assumed 2016 Plan”). These plans provided for stock option and restricted stock awards (“RSAs”) to C3J employees in years prior to the merger with AmpliPhi. The number of shares subject to each outstanding stock option and RSA under those assumed plans, along with the exercise price of stock options, were equitably adjusted pursuant to the terms of the plans to reflect the impact of the Merger and the one-for-fourteen reverse stock split, in each case in a manner intended to preserve the then-current intrinsic value of the awards. No additional awards will be made under either plan. The assumed C3J stock options were substantially vested and expensed as of the merger date. Vesting of the assumed C3J RSAs is based on the occurrence of a public liquidity event, or a change in control. In the event of a public liquidity event, service or milestone based vesting schedules begins. Service periods are generally two to four years. In the event of a change in control, 100% vesting occurs upon the closing of such an event. The merger with AmpliPhi constituted a public liquidity event and triggered the start of vesting of RSAs.

Stock-based Compensation

The Company estimates the fair value of stock options with performance and service conditions using the Black-Scholes valuation model. Compensation expense related to stock options granted is measured at the grant date based on the estimated fair value of the award and is recognized on the accelerated attribution method over the requisite service period.

13

The assumptions used in the Black-Scholes model are presented below:

| Three Months Ended | ||

| March 31, 2021 | | March 31, 2020 |

Risk-free interest rate | 0.93% -- 1.29% | | 1.48% -- 1.51% |

Expected volatility | 93.37% | | 90.43% |

Expected term (in years) | 5.50 to 7.00 | | 5.75 to 6.25 |

Expected dividend yield | 0% | | 0% |

The risk-free interest rate is based on the U.S. Treasury yield for a period consistent with the expected term of the option in effect at the time of the grant. Expected volatility is based on the historical volatility of Armata and peer companies’ common stock. The expected term represents the period that the Company expects its stock options to be outstanding. The expected term assumption is estimated using the simplified method set forth in the SEC Staff Accounting Bulletin 110, which is the mid-point between the option vesting date and the expiration date. For stock options granted to parties other than employees or directors, the Company elects, on a grant by grant basis, to use the expected term or the contractual term of the option award. The Company has never declared or paid dividends on its common stock and has no plans to do so in the foreseeable future. Forfeitures are recognized as a reduction of stock-based compensation expense as they occur.

The tables below summarize the total stock-based compensation expense included in the Company’s consolidated statements of operations for the periods presented:

| | Three Months Ended March 31, | | ||||

|

| 2021 |

| 2020 |

| ||

| | | | | | | |

Research and development | | $ | 353,000 | | $ | 337,000 | |

General and administrative | |

| 489,000 | |

| 707,000 | |

Total stock-based compensation | | $ | 842,000 | | $ | 1,044,000 | |

Stock option transactions during the three months ended March 31, 2021 are presented below:

| | Options Outstanding | ||||||||

| | | | | | | Weighted | | | |

| | | | | | | Average | | | |

| | | | Weighted | | Remaining | | | | |

| | | | Average | | Contractual | | Aggregate | ||

| | | | Exercise | | Term | | Intrinsic | ||

|

| Shares |

| Price |

| (Years) |

| Value | ||

Outstanding at December 31, 2020 |

| 1,668,926 | | $ | 6.30 |

| 8.32 | | | — |

Granted |

| 549,750 | |

| 5.14 |

| — |

| | — |

Exercised | | (46,134) | | | 3.34 | | — | | $ | 82,000 |

Forfeited/Cancelled |

| (5,599) | |

| 94.92 |

| — |

| | — |

Outstanding at March 31, 2021 |

| 2,166,943 | | $ | 5.84 |

| 8.56 | | $ | 2,311,000 |

Vested and expected to vest at March 31, 2021 |

| 2,166,943 | | $ | 5.84 |

| 8.56 | | $ | 2,311,000 |

Exercisable at March 31, 2021 |

| 435,646 | | $ | 13.83 |

| 6.60 | | $ | 452,000 |

There were no grants, cancellations or vesting of the Company’s restricted stock award during the three months ended March 31, 2021. As of March 31, 2021 and December 31, 2020, there were 322,756 unvested restricted stock awards outstanding with weighted average grant date fair value of $19.55.

The aggregate intrinsic value of options at March 31, 2021 is based on the Company’s closing stock price on that date of $4.78 per share. As of March 31, 2021, there was $4.7 million of total unrecognized compensation expense related to unvested stock options and RSAs, which the Company expects to recognize over the weighted average remaining period of approximately 2.05 years.

14

Shares Reserved for Future Issuance

As of March 31, 2021, the Company had reserved shares of its common stock for future issuance as follows:

|

| Shares Reserved |

Stock options outstanding |

| 2,166,943 |

Unvested restricted stock units | | 70,000 |

Employee stock purchase plan |

| 9,748 |

Available for future grants under the 2016 Plan |

| 527,947 |

Warrants outstanding |

| 16,647,219 |

Total shares reserved |

| 19,421,857 |

9. Commitments and Contingencies

The Company leases office and research and development space under a non-cancelable operating lease in Marina del Rey, CA. The lease commenced January 1, 2012 and in April 2020, the Company amended the lease (“Lease Amendment”) which, among other things, extended the lease term through December 31, 2031. Base annual rent for calendar year 2022, the first year under the Lease Amendment extended term, will be approximately $1.9 million, and base rent increases by 3% annually and will be $2.5 million by the end of the amended term. In addition, the Company received a six month rent abatement in 2020. The Company is entitled to use an allowance for tenant improvements of $0.8 million during calendar year of 2021, with any unused tenant improvement amount as of December 31, 2021 to offset future payments. In accordance with authoritative guidance, the Company re-measured the lease liability to be $11.7 million and related right of use asset of $11.0 million as of the Lease Amendment date with an incremental borrowing rate of 12.89%.

From time to time, the Company may be involved in disputes, including litigation, relating to claims arising out of operations in the normal course of business. Any of these claims could subject the Company to costly legal expenses and, while management generally believes that there is adequate insurance to cover many different types of liabilities, the Company’s insurance carriers may deny coverage or policy limits may be inadequate to fully satisfy any damage awards or settlements. If this were to happen, the payment of any such awards could have a material adverse effect on the consolidated results of operations and financial position. Additionally, any such claims, whether or not successful, could damage the Company’s reputation and business. The Company is currently not a party to any legal proceedings, the adverse outcome of which, in management’s opinion, individually or in the aggregate, would have a material adverse effect on our consolidated results of operations or financial position.

10. Grants and Awards

MTEC Grant

On June 15, 2020, the Company entered into a Research Project Award agreement (the “MTEC Agreement”) with the Medical Technology Enterprise Consortium (“MTEC”), pursuant to which the Company will receive a $15.0 million grant and entered into a three-year program administered by the U.S. Department of Defense through MTEC with funding from the Defense Health Agency and Joint Warfighter Medical Research Program. The Company plans to use the grant to partially fund a Phase 1b/2, randomized, double-blind, placebo-controlled, dose escalation clinical study of Armata's therapeutic phage-based candidate, AP-SA02, for the treatment of complicated Staphylococcus aureus bacteremia infections. The MTEC Agreement specifies that the grant will be paid to the Company through a cost reimbursable model, based on agreed upon cost share percentages, and the grant money received is not refundable to MTEC.

Upon license or commercialization of intellectual property developed with the funding from the MTEC Agreement, additional fees will be due to MTEC. The Company will elect whether to (a) pay a fixed royalty amount, which is subject to a cap based upon total funding received, or (b) pay an additional assessment fee, which would also be subject to a cap based upon a percentage of total funding received.

15

The MTEC Agreement will be effective through January 25, 2024. The MTEC Agreement may be terminated in whole or in part, 30 calendar days following the written notice from the Company to MTEC. In addition, MTEC has the right to terminate the MTEC Agreement upon material breach by the Company.

The Company determined that the MTEC Agreement is not in the scope of ASC 808 or ASC 606. Applying ASC 606 by analogy the Company recognizes proceeds received under the MTEC Agreement as grant revenue on the statement of operations when related costs are incurred. The Company recognized $1.1 million in grant revenue from the MTEC Agreement during the three months ended March 31, 2021.

CFF Therapeutics Development Award

On March 13, 2020, the Company entered into an award agreement (the “Agreement”) with Cystic Fibrosis Foundation (“CFF”), pursuant to which it received a Therapeutics Development Award of up to $5.0 million (the “Award”). The Award will be used to fund a portion of the Company’s Phase 1b/2 clinical trial of the Pseudomonas aeruginosa (“P. aeruginosa”) phage candidate, AP-PA02, as a treatment for Pseudomonas airway infections in people with cystic fibrosis (“CF”).

The first payment under the Agreement, in the amount of $1.0 million, became due upon signing the Agreement and was received in April 2020. The remainder of the Award will be paid to the Company incrementally in installments upon the achievement of certain milestones related to the development program and progress of the Phase 1b/2 clinical trial of AP-PA02, as set forth in the Agreement.

If the Company ceases to use commercially reasonable efforts directed to the development of AP-PA02, or any other Product (as defined in the Agreement), for a period of 360 days (an “Interruption”) and fails to resume the development of the Product after receiving from CFF notice of an Interruption, then the Company must either repay the amount of the Award actually received by the Company, plus interest, or grant to CFF (1) an exclusive (even as to the Company), worldwide, perpetual, sublicensable license under technology developed under the Agreement that covers the Product for use in treating infections in CF patients (the “CF Field”), and (2) a non-exclusive, worldwide, perpetual, sublicensable license under certain background intellectual property covering the Product, to the extent necessary to commercialize the Product in the CF Field.

Upon commercialization by the Company of any Product, the Company will owe a fixed royalty amount to CFF, which is to be paid in installments determined, in part, based on commercial sales volumes of the Product. The Company will be obligated to make an additional fixed royalty payment upon achieving specified sales milestones. The Company may also be obligated to make a payment to CFF if the Company transfers, sells or licenses the Product in the CF Field, or if the Company enters into a change of control transaction.

The term of the Agreement commenced on March 10, 2020 and expires on the earlier of the date on which the Company has paid CFF all of the fixed royalty payments set forth therein, the effective date of any license granted to CFF following an Interruption, or upon earlier termination of the Agreement. Either CFF or the Company may terminate the agreement for cause, which includes the Company’s material failure to achieve certain development milestones. The Company’s payment obligations survive the termination of the Agreement.

The Company concluded that the CFF award is in the scope of ASC 808. Accordingly, as discussed in Note 3, award amounts received from CFF upon achievement of certain milestones are recognized as credits to research and development expenses in the period the expenses are incurred. During the three months ended March 31, 2021 and 2020, the Company did not recognize any credits to research and development expenses related to the CFF award. In addition, the Company concluded under the guidance in ASC 730 that it does not have an obligation to repay funds received once related research and development expenses are incurred.

11. Synthetic Genomics Asset Acquisition

On February 28, 2018, C3J completed an acquisition of certain synthetic phage assets (the “synthetic phage assets”) from Synthetic Genomics, Inc. (“SGI”) for consideration consisting of $8.0 million in cash and $27.0 million in equity.

16

The cash payments consisted of: $1.0 million paid at closing on February 28, 2018, $1.0 million at one year from closing, $1.0 million at two years from closing, and $5.0 million at three years from closing (the payments due on the one, two, three year anniversary are collectively the “time-based payment obligation”). The equity payment (the “equity payment” and, together with the time-based payment obligation, the “deferred purchase price arrangement”) was due upon the earlier of the initial public offering of shares of C3J’s common stock pursuant to an effective registration statement under the Securities Act of 1933, as amended, the sale of all or substantially all of C3J’s assets to a third party, or a consolidation or merger into a third party. On December 20, 2018, in contemplation of the Merger (see Note 1), the deferred purchase price arrangement was amended. Under the amended agreement, the purchase consideration consisted of (i) closing consideration of $1.0 million paid on February 28, 2018, (ii) cash payments of $1.0 million on January 31, 2019, $1.0 million on January 31, 2020, and $2.0 million on January 31, 2021, (iii) an issuance of that number of shares of C3J’s common stock equal to ten percent of C3J’s fully-diluted capitalization, excluding options and restricted stock awards, immediately prior to the closing of the Merger, and (iv) potential milestone payments of up to $39.5 million related to the development and relevant regulatory approval of products utilizing bacteriophage from the synthetic phage assets acquired from SGI (the “milestone payment obligation”).

The equity payment was settled on May 9, 2019, the date of the Merger (Note 1).

The present value of the time-based payment obligations was included in the Company’s balance sheet, with interest accreted to the maturity date. The Company paid the last installment of the time-based payment obligation in the amount of $2.0 million during the three months ended March 31, 2021. For three months ended March 31, 2021 and 2020, the Company recognized $60,000 and $159,000 of interest expense related to the time-based payment obligations.

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited consolidated financial statements and related notes included in this Quarterly Report on Form 10-Q, our audited financial statements and notes thereto as of and for the year ended December 31, 2020 included in our Form 10-K filed on March 18, 2021 with the U.S. Securities and Exchange Commission (the “SEC”).

Our predecessor, C3 Jian, Inc., was incorporated under the laws of the State of California on November 4, 2005. On February 26, 2016, as part of a reorganization transaction, C3 Jian, Inc. merged with a wholly owned subsidiary of C3J Therapeutics, Inc. (“C3J”), and as part of this process, C3 Jian, Inc. was converted to a limited liability company organized under the laws of the State of California named C3 Jian, LLC. On May 9, 2019, C3J completed a reverse merger with AmpliPhi Biosciences Corporation, a bacteriophage development stage company (“AmpliPhi”), where Ceres Merger Sub, Inc., a wholly-owned subsidiary of AmpliPhi, merged with and into C3J (the “Merger”). Following the completion of the Merger, and a $10.0 million concurrent private placement financing, the former C3J shareholders owned approximately 76% of our common stock and the former AmpliPhi shareholders owned approximately 24% of our common stock.

Immediately prior to the Merger, AmpliPhi completed a 1-for-14 reverse stock split and changed its name to Armata Pharmaceuticals, Inc. Our common stock is traded on the NYSE American exchange under the symbol “ARMP.” We are headquartered in Marina del Rey, CA, in a 35,000 square-foot research and development facility built for product development with capabilities spanning from bench to clinic. In addition to microbiology, synthetic biology, formulation, chemistry and analytical laboratories, the facility is equipped with two licensed GMP drug manufacturing suites enabling the production, testing and release of clinical material.

Statements contained in this Quarterly Report on Form 10-Q that are not statements of historical fact are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without limitation, statements concerning product development plans, commercialization of our products, the expected market opportunity for our products, the use of bacteriophages and synthetic phages to kill bacterial pathogens, having resources sufficient to fund our operations into the first quarter of 2022, future funding sources, general and administrative expenses, clinical trial and other research and development expenses, costs of

17

manufacturing, costs relating to our intellectual property, capital expenditures, the expected benefits of our targeted phage therapies strategy, the potential market for our products, tax credits and carry-forwards, and litigation-related matters. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “will,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements necessarily contain these identifying words. These statements are subject to risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under Item 1A, “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q. These forward-looking statements speak only as of the date on which they were made, and we undertake no obligation to update any forward-looking statements.

Overview

We are a clinical-stage biotechnology company focused on the development of pathogen-specific bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat bacterial infections using our proprietary bacteriophage-based technology. Bacteriophages or “phages” have a powerful and highly differentiated mechanism of action that enables binding to and killing specific bacteria, in contrast to traditional broad-spectrum antibiotics. We believe that phages represent a promising means to treat bacterial infections, especially those that have developed resistance to current standard of care therapies, including the so-called multidrug-resistant or “superbug” strains of bacteria. We are a leading developer of phage therapeutics which are uniquely positioned to address the growing worldwide threat of antibiotic-resistant bacterial infections.

We are combining our proprietary approach and expertise in identifying, characterizing and developing both naturally-occurring and engineered (synthetic) bacteriophages with our proprietary phage-specific current good manufacturing practice regulation (“cGMP”) manufacturing capabilities to advance a broad pipeline of high-quality bacteriophage product candidates. We believe that synthetic phage, engineered using advances in sequencing and synthetic biology techniques, represent a promising means to advance phage therapy, including phage-based diagnostics and improving upon the ability of natural phage to treat bacterial infections, especially those that have developed resistance to current antibiotic therapies, including the multidrug-resistant or “superbug” bacterial pathogens.

We are developing and advancing our lead clinical phage candidate for Pseudomonas aeruginosa. On October 14, 2020, Armata received the approval to proceed from the U.S. Food and Drug Administration (“FDA”) for its Investigational New Drug application for AP-PA02. We plan to continue to advance the “SWARM-P.a.” study – a Phase 1b/2a, multicenter, double-blind, randomized, placebo-controlled, single ascending dose (SAD) and multiple ascending dose (MAD) clinical trial to evaluate the safety and tolerability of inhaled AP-PA02 in subjects with CF and chronic pulmonary P. aeruginosa infection, provided that the impacts of COVID-19 do not impede our ability to enroll subjects in this clinical trial. This study is supported by the CFF, which granted us a Therapeutics Development Award of up to $5.0 million.

We are also developing a phage product candidate for Staphylococcus aureus for the treatment of S. aureus bacteremia. On June 15, 2020, we entered into an agreement (the “MTEC Agreement”) with the Medical Technology Enterprise Consortium (“MTEC”), pursuant to which we will receive a $15.0 million grant and entered into a three-year program administered by the DoD through MTEC with funding from the Defense Health Agency and Joint Warfighter Medical Research Program. We expect to use the grant to partially fund a Phase 1/2, multi-center, randomized, double-blind, placebo- controlled dose escalation study, provided that the COVID-19 pandemic has been reduced to the point that clinical trials in patients are enrolling, that will assess the safety, tolerability, and efficacy of this development program in 2021, using our phage-based candidate, AP-SA02, for the treatment of adults with S. aureus bacteremia.

In partnership with Merck & Co., known as Merck Sharp & Dohme outside of the United States and Canada (“Merck”), we are developing proprietary synthetic phage candidates to target undisclosed infectious disease agents. Our proprietary phage engineering platform serves to enhance the clinical and commercial prospects of phage therapy.

18

These attributes include expanded host range, improved potency which is a fundamental drug property that can translate into improved clinical efficacy, and importantly, biofilm disruption, which is a critical aspect of serious infections that needs to be addressed.

In addition to our more advanced pipeline programs, we have phage discovery efforts underway to target other major pathogens of infectious disease (including ESKAPE pathogens) and preventable infectious disease of the microbiome.

We are committed to conducting randomized controlled clinical trials required for FDA approval in order to move toward commercialization of alternatives to traditional antibiotics and provide a potential method of treating patients suffering from drug-resistant and difficult-to-treat bacterial infections.

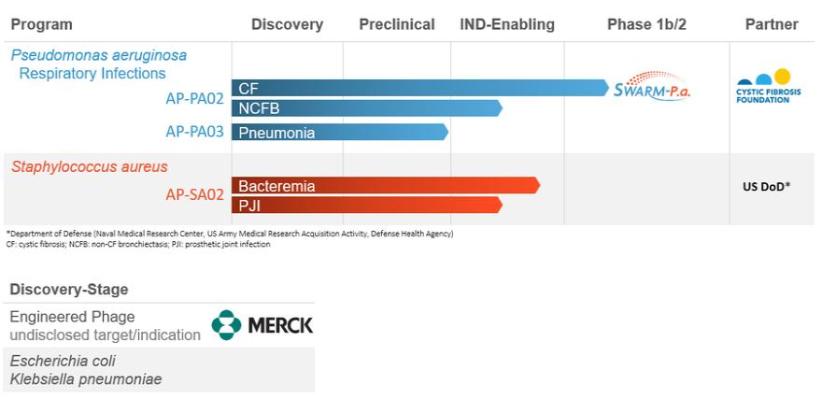

The following chart summarizes the status of our phage product candidate development programs and partners.

We have generally incurred net losses since our inception and our operations to date have been primarily limited to research and development and raising capital. As of March 31, 2021, we had an accumulated deficit of $185.2 million. We anticipate that a substantial portion of our capital resources and efforts in the foreseeable future will be focused on completing the development and seeking to obtain regulatory approval of our product candidates.

We currently expect to use our existing cash and cash equivalents for the continued research and development of our product candidates, including through our targeted phage therapies strategy, and for working capital and other general corporate purposes. We expect to continue to incur significant and increasing operating losses at least for the next several years. We do not expect to generate product revenue unless and until we successfully complete development and obtain marketing approval for at least one of our product candidates.

We may also use a portion of our existing cash and cash equivalents for the potential acquisition of, or investment in, product candidates, technologies, formulations or companies that complement our business, although we have no current understandings, commitments or agreements to do so. Our existing cash and cash equivalents will not be sufficient to enable us to complete all necessary development of any potential product candidates. Accordingly, we will be required to obtain further funding through one or more other public or private equity offerings, debt financings, collaboration, strategic financing, grants or government contract awards, licensing arrangements or other sources. Our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to, and volatility in, financial markets in the United States and worldwide resulting from the ongoing COVID-19 pandemic. Adequate additional funding may not be available to us on acceptable terms, or at all. If we are unable to raise capital when needed or on acceptable terms, we may be required to defer, reduce or eliminate significant planned expenditures, restructure, curtail or eliminate some or all of our development programs or other operations,

19

dispose of assets, enter into arrangements that may require us to relinquish rights to certain of our product candidates, technologies or potential markets, file for bankruptcy or cease operations altogether. Any of these events could have a material adverse effect on our business, financial condition and results of operations and result in a loss of investment by our stockholders.

Business Update Regarding COVID-19

On January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus originating in Wuhan, China (the “COVID-19 outbreak”) and the risks to the international community as the virus spreads globally beyond its point of origin. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure globally.

The COVID-19 pandemic has directly and indirectly impacted our business, results of operations and financial condition and is expected to continue to impact our business. For example, the COVID-19 pandemic has resulted in delays in our clinical trials due to the implementation of COVID-19 protocols at investigator sites, which resulted in longer than anticipated site identification and initiation activities. In addition, while we currently do not anticipate any interruptions in our supply chain, it is possible that the COVID-19 pandemic and response efforts may have a future impact on our third-party suppliers and partners. It is possible that due to the increasing emphasis on the development of vaccines for COVID-19, certain basic supply chain materials such as resins, vessels, vials and stoppers may be in high demand by the pharmaceutical companies developing vaccines and our ability to obtain these materials for our development activities could be negatively impacted. We have experienced some delays of this nature in the first quarter of 2021.

The full extent of the COVID-19 pandemic impact will depend on future developments that are highly uncertain and cannot be accurately predicted, including new information that may emerge concerning COVID-19, the actions taken to contain it or treat its impact, the development and distribution of vaccines and the economic impact on local, regional, national and international markets. Management continues to actively monitor the developments regarding the pandemic and the impact that the pandemic could have on our financial condition, liquidity, ability to enroll patients in our contemplated clinical trials, manufacturing and research and development operations, suppliers to our operations and suppliers to our outside clinical trial organizations, biotech industry overall, and importantly the health and safety of our workforce. Given the continuing evolution of the COVID-19 outbreak and the global responses to curb its spread, we are not able to estimate the effects of the COVID-19 outbreak on its results of operations, financial condition, or liquidity for the remainder of fiscal year 2021 or 2022. Any recovery from negative impacts to our business and related economic impact due to the COVID-19 outbreak may also be slowed or reversed by a number of factors, including the current widespread resurgence in COVID-19 infections, combined with the seasonal flu.

Results of Operations

Comparison of three months ended March 31, 2021 and 2020

Grant revenue

The Company recognized $1.1 million of grant revenue during the three months ended March 31, 2021, which represents MTEC’s share of the costs incurred for the Company’s AP-SA02 program for the treatment of Staphylococcus aureus bacteremia infections. These amounts have been invoiced to MTEC.

Research and Development

Research and development expenses for the three months ended March 31, 2021 and 2020 were $4.4 million and $2.8 million, respectively. The net increase of $1.6 million was primarily related to an increase of $0.9 million in payroll and related personnel costs due to increased headcount in the three months ended March 31, 2021 compared to the same period in 2020, an increase of $0.9 million in clinical trial and laboratory expenses as we ramp up clinical trial activities, and an increase of $0.2 million of lease related expenses. The increases were offset by a $0.4 million reduction in credits to research and development expenses, as the Company received a $0.6 million tax rebate in cash from the Australian

20

government in the three months ended March 31, 2021, and a credit of $0.2 million related to our award agreement with CFF during the three months ended March 31, 2020.

General and Administrative

General and administrative expenses were $2.2 million for each of the three months ended March 31, 2021 and 2020. There was an increase of $0.1 million in payroll and related personnel costs and an increase of $0.1 million in professional services costs, offset by a $0.2 million reduction in stock-based compensation expenses for the three months ended March 31, 2021 compared to the same period in 2020.

Other Income (Expense)

For each of the three months ended March 31, 2021 and 2020, we recorded noncash interest expense of $0.1 million and $0.2 million, respectively, as a result of interest accretion on the time-based cash payments due in connection with the asset acquisition transaction with Synthetic Genomics, Inc. (“SGI”).

Income Taxes

There was no income tax expense or benefit for the three months ended March 31, 2021 and 2020.

Operating activities

Net cash used in operating activities for the three months ended March 31, 2021 was $5.5 million, as compared to $4.2 million for the three months ended March 31, 2020. The increase of $1.3 million was due to a $0.4 million increase to net loss, and a $0.9 million net decrease in non-cash adjustments to cash used in operating activities.

Investing activities

Net cash used in investing activities was $0.3 million and $0.1 million for the three months ended March 31, 2021 and 2020, respectively, primarily related to capital equipment purchases.

Financing activities

Net cash provided by financing activities was $18.6 million for the three months ended March 31, 2021, which was primarily comprised of $19.5 million net proceeds raised from the private placement transaction with Innoviva, and $0.4 million proceeds received from stock option exercises, offset by a principal payment of $1.4 million in deferred consideration related to the time-based payment obligation in connection with the SGI asset acquisition. Net cash provided by financing activities for the three months ended March 31, 2020 was comprised of net cash proceeds of $23.3 million net proceeds raised from the private placement transaction with Innoviva, offset in part by a payment of $1.0 million in deferred consideration related to the time-based payment obligation in connection with the SGI asset acquisition.

Liquidity, Capital Resources and Financial Condition

We have prepared our consolidated financial statements on a going concern basis, which assumes that we will realize our assets and satisfy our liabilities in the normal course of business. However, we have incurred net losses since our inception and have negative operating cash flows. These circumstances raise substantial doubt about our ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the outcome of the uncertainty concerning our ability to continue as a going concern. While management believes this plan to raise additional funds will alleviate the conditions that raise substantial doubt, these plans are not entirely within its control and cannot be assessed as being probable of occurring. The Company may not be able to secure additional financing in a timely manner or on favorable terms, if at all.

21

As of March 31, 2021, we had unrestricted cash and cash equivalents of $22.5 million. Considering our current cash resources, management believes our existing resources will be sufficient to fund our planned operations into the first quarter of 2022. For the foreseeable future, our ability to continue its operations is dependent upon our ability to obtain additional capital.

Future Capital Requirements

We will need to raise additional capital in the future to continue to fund our operations. Our future funding requirements will depend on many factors, including:

| ● | the effects of the continuing COVID-19 pandemic on our clinical programs and business, including delays or difficulties in enrolling patients in our clinical trials, shortage in supply chain materials, and changes in local, state or federal regulations as part of a response to the COVID-19 pandemic; |

| the costs and timing of our research and development activities; |

| ● | the progress and cost of our clinical trials and other research and development activities; |

| ● | manufacturing costs associated with our targeted phage therapies strategy and other research and development activities; |

| ● | the terms and timing of any collaborative, licensing, acquisition or other arrangements that we may establish; |

| ● | manufacturing costs associated with our targeted phage therapies strategy and other research and development activities; |

| ● | the terms and timing of any collaborative, licensing, acquisition or other arrangements that we may establish; |

| ● | whether and when we receive future Australian tax rebates, if any; |

| ● | the costs and timing of seeking regulatory approvals; |

| ● | the costs of filing, prosecuting and enforcing any patent applications, claims, patents and other intellectual property rights; and |

| ● | the costs of lawsuits involving us or our product candidates. |

We may seek to raise capital through a variety of sources, including:

| ● | the public equity market; |

| ● | private equity financings; |

| ● | collaborative arrangements, government grants or strategic financings; |

| ● | licensing arrangements; and |

| ● | public or private debt. |

Any additional fundraising efforts may divert our management team from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates. Our ability to raise additional funds will depend, in part, on the success of our product development activities, including our targeted phage therapies strategy

22

and any clinical trials we initiate, regulatory events, our ability to identify and enter into in-licensing or other strategic arrangements, and other events or conditions that may affect our value or prospects, as well as factors related to financial, economic and market conditions, many of which are beyond our control. We cannot be certain that sufficient funds will be available to us when required or on acceptable terms. If we are unable to secure additional funds on a timely basis or on acceptable terms, we may be required to defer, reduce or eliminate significant planned expenditures, restructure, curtail or eliminate some or all of our development programs or other operations, dispose of technology or assets, pursue an acquisition of our company by a third party at a price that may result in a loss on investment for our stockholders, enter into arrangements that may require us to relinquish rights to certain of our product candidates, technologies or potential markets, file for bankruptcy or cease operations altogether. Any of these events could have a material adverse effect on our business, financial condition and results of operations. Moreover, if we are unable to obtain additional funds on a timely basis, there will be substantial doubt about our ability to continue as a going concern and increased risk of insolvency and loss of investment by our stockholders. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of such securities could result in dilution to our existing stockholders. Our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to, and volatility in, financial markets in the United States and worldwide resulting from the ongoing COVID-19 pandemic.

Off-Balance Sheet Arrangements

As of March 31, 2021, we did not have off-balance sheet arrangements.

Recent Accounting Pronouncements

Refer to Note 3 of the condensed consolidated notes to the consolidated financial statements contained elsewhere in this report.

Item 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and are not required to provide the information required under this item.

Item 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, as of the end of the period covered by this quarterly report on Form 10-Q. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable and not absolute assurance of achieving the desired control objectives and management necessarily applies its judgment in evaluating the cost benefit relationship of possible controls and procedures. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective at the reasonable assurance level as of March 31, 2021.

Changes in Internal Control over Financial Reporting