UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-37544

AMPLIPHI BIOSCIENCES CORPORATION

(Exact name of registrant as specified in its charter)

| Washington | 91-1549568 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation and organization) |

3579 Valley Centre Drive

San Diego, California 92130

(Address of principal executive offices, including zip code)

(858) 800-4868

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company x | |

| (Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, the aggregate market value of voting stock held by non-affiliates of the Registrant, based on the closing price of the Common Stock on June 30, 2015 (the last business day of the Registrant’s most recently completed second quarter) as quoted on the OTCQB, was approximately $37,554,000.

As of March 25, 2016, 5,883,503 shares of the Registrant’s Common Stock were outstanding.

TABLE OF CONTENTS

AMPLIPHI BIOSCIENCES CORPORATION

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report and certain information incorporated herein by reference contain forward-looking statements, which are provided under the “safe harbor” protection of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, results or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or events to be materially different from any future results, performance or events expressed or implied by the forward-looking statements. Forward-looking statements in this report include, but are not limited to, statements regarding:

| · | our estimates regarding anticipated operating losses, capital requirements and needs for additional funds; | |

| · | the impact of our disagreement with one of our principal stockholders on our ability to raise additional capital and the ultimate outcome of that disagreement; | |

| · | our ability to manufacture, or otherwise secure the manufacture of, sufficient amounts of our product candidates for our preclinical studies and clinical trials; | |

| · | our clinical development plans, including planned clinical trials; | |

| · | our research and development plans, including our plans to initiate a clinical trial of AB-SA01 for the treatment of wounds infected with S. aureus in the first half of 2016; | |

| · | our ability to select combinations of phages to formulate our product candidates; | |

| · | the safety and efficacy of our product candidates; | |

| · | the anticipated regulatory pathways for our product candidates; | |

| · | our ability to successfully complete preclinical and clinical development of, and obtain regulatory approval of our product candidates and commercialize any approved products on our expected timeframes or at all; | |

| · | the content and timing of submissions to and decisions made by the U.S. Food and Drug Administration, or FDA, and other regulatory agencies; | |

| · | our ability to leverage the experience of our management team; | |

| · | our ability to attract and keep management and other key personnel; | |

| · | the capacities and performance of our suppliers, manufacturers, contract research organizations, or CROs, and other third parties over whom we have limited control; | |

| · | the actions of our competitors and success of competing drugs that are or may become available; | |

| · | our expectations with respect to future growth and investments in our infrastructure, and our ability to effectively manage any such growth; | |

| · | the size and potential growth of the markets for any of our product candidates, and our ability to capture share in or impact the size of those markets; | |

| · | the benefits of our product candidates; | |

| · | market and industry trends; | |

| · | the effects of government regulation and regulatory developments, and our ability and the ability of the third parties with whom we engage to comply with applicable regulatory requirements; | |

| · | the accuracy of our estimates regarding future expenses, revenues, capital requirements and need for additional financing; | |

| · | our expectations regarding future planned expenditures; | |

| · | our ability to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act; | |

| our expectations regarding the period during which we qualify as an emerging growth company under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act; | ||

| · | our ability to obtain, maintain and successfully enforce adequate patent and other intellectual property protection of any of our products and product candidates; and | |

| · | our ability to operate our business without infringing the intellectual property rights of others. |

In some cases, you can identify these statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or the negative of those terms, and similar expressions. These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this Annual Report and are subject to risks and uncertainties. We discuss many of these risks in greater detail in the section entitled “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

This Annual Report on Form 10-K includes trademarks and registered trademarks of AmpliPhi Biosciences Corporation. Products or service names of other companies mentioned in this Annual Report on Form 10-K may be trademarks or registered trademarks of their respective owners.

As used in this Annual Report, unless the context requires otherwise, the “Company,” “we,” “us” and “our” refer to AmpliPhi Biosciences Corporation and its wholly-owned subsidiaries.

| 3 |

EXPLANATORY NOTE

Note Regarding Restatement of Previously Issued Consolidated Financial Statements

In this Annual Report on Form 10-K, we have restated historical financial statements for the year ended, December 31, 2014, three and six months ended June 30, 2014, three and nine months ended September 30, 2014 and three months ended June 30, 2015 to reflect a revision in accounting for basic and diluted earnings per share.

The error relates to the misapplication of Accounting Standards Codification No. 260, “Earnings Per Share,” or ASC 260, for two matters.

First, we did not properly consider the fact that outstanding shares of our Series B redeemable convertible preferred stock, in certain limited circumstances, have the right to receive additional dividends beyond their accruing dividends, which makes them participating securities. Therefore, consideration of this component of the preferred stock terms is included in computing basic earnings per share pursuant to the two-class method. The Company failed to make such adjustments to the basic income (loss) per share calculations for the prior periods discussed above.

Second, we did not properly account for the adjustments required to net income (loss) attributable to common stockholders in the calculation of diluted net income (loss) per share. The calculation of diluted net income (loss) per share requires that, to the extent that such securities are dilutive to income (loss) per share for the period, an adjustment to net income (loss) used in the calculation is required to remove the change in fair value of the liability classified warrants from the numerator for the period. Likewise, an adjustment to the denominator is required to reflect the related dilutive shares. Similarly, the diluted income (loss) per share calculation also requires an adjustment to net income (loss) used in the calculation to remove the change in the fair value of the Series B redeemable convertible preferred stock embedded derivative (if the Series B redeemable convertible preferred stock is dilutive), including any applicable accretion, and an adjustment to the denominator is required to reflect the related dilutive securities. The Company failed to make such adjustments to the diluted income (loss) per share calculations for the prior periods discussed above.

During the preparation process for this Annual Report on Form 10-K, we recomputed the basic and diluted income (loss) per share amounts for all periods to conform with the provisions of ASC 260.

In connection with this restatement, we revised our consolidated statement of operations for the year ended December 31, 2014, and applicable interim periods in 2014 and 2015 to reflect revised basic and diluted income (loss) per share. This adjustment had no impact on our balance sheets, reported loss from operations, net income (loss) attributable to common stockholders, statements of redeemable convertible preferred stock and stockholders’ equity, or our statements of cash flows and our cash and cash equivalents balances are unchanged for such periods.

Throughout this Annual Report on Form 10-K, amounts presented from current periods and prior period comparisons have been revised and labeled as “restated” and reflect the amounts on a restated basis.

Tables summarizing the effect of the restatement on the specific line items presented in our historical financial statements for the periods indicated are included in Note 3 – Significant Accounting Policies and Note 17 – Quarterly Financial Data of the notes to our consolidated financial statements included with this Annual Report on Form 10-K.

| 4 |

| Item 1. | BUSINESS |

Company History

We were incorporated under the laws of the State of Washington in March 1989 as a wholly owned subsidiary of Immunex Corporation and began operations as an independent company in 1992 as Targeted Genetics Corporation.

In January 2011, we completed the acquisition of Biocontrol Ltd, which we refer to as Biocontrol, an antimicrobial biotechnology company based in the United Kingdom, with the goal of developing their phage therapy programs using funding from the sale of our legacy gene therapy assets.

On February 22, 2011, we changed our name to “AmpliPhi Biosciences Corporation.”

In November 2012, we completed the acquisition of Special Phage Holdings Pty Ltd, a company based in Australia, which we refer to as SPH, with the goal of combining SPH’s research on addressing the rapidly escalating problem of antibiotic resistance through the development of a series of bacteriophage-based treatments into our own development program.

In November 2015, our board of directors approved a plan for us to reincorporate as AmpliPhi Biosciences Corporation in the State of Delaware, subject to the approval of our stockholders. We may decide to abandon our plan to reincorporate in the State of Delaware at our election.

Company Overview

We are a biotechnology company focused on the discovery, development and commercialization of novel phage therapeutics. Phage therapeutics use bacteriophages, a family of viruses, to kill pathogenic bacteria. Phages have powerful and highly selective mechanisms of action that permit them to target and kill specific bacteria. We believe that phages represent a promising means to treat bacterial infections, especially those that have developed resistance to current therapies, including the so-called multi-drug-resistant or “superbug” strains of bacteria.

Our goal is to be the leading developer of phage therapeutics. We are combining our expertise in the manufacture of drug-quality bacteriophages and our proprietary approach and expertise in identifying, characterizing and developing naturally occurring bacteriophages with that of our collaboration partners in bacteriophage biology, synthetic biology and manufacturing, to develop second-generation bacteriophage products.

The extensive use of antibiotics since their discovery in the 1940s has resulted in drug resistance among many disease-causing bacteria. According to the U.S. Centers for Disease Control and Prevention, or CDC, resistance to antibiotics threatens to reverse many of the key medical advances of the last half-century. Examples of clinically important microbes that are rapidly developing resistance to available antimicrobials include bacteria that cause skin, bone, lung and bloodstream infections (e.g., S. aureus and methicillin-resistant S. aureus, or MRSA), pneumonia and lung infections in both community and hospital settings and cystic fibrosis patients (e.g., A. baumanii, P. aeruginosa, and K. pneumoniae), meningitis (e.g., S. pneumonia), urinary tract and gastrointestinal infections (e.g., E. coli and C. difficile). As phages kill bacteria in ways entirely unlike the mechanisms used by traditional antibiotics, we believe that multi-drug resistant bacteria will be susceptible to phage therapy. Furthermore, should resistant bacteria emerge, we believe it will remain possible to identify phages that can effectively kill these resistant bacteria.

Our lead product candidate is AB-SA01, for the treatment of S. aureus infections, including MRSA. We also have another product candidate in earlier stage development, AB-PA01 for the treatment of P. aeruginosa infections, and an additional discovery program, AB-CD01 for the treatment of C. difficile infections.

We are developing our phage product candidates using a proprietary discovery and development platform, which is designed for rapid identification, characterization and manufacturing of multiple phage therapeutics. Each product candidate combines several carefully chosen phages, which target a specific disease-causing bacterial pathogen such as S. aureus, P. aeruginosa, and C. difficile. We believe that the combination of our platform, our manufacturing capability, our understanding of the regulatory and development requirements of bacteriophage therapeutics, and the clinical and scientific expertise of our collaboration partners may enable the rapid advancement of phage therapeutics through the clinic and the regulatory approval process.

In March 2013, we entered into an exclusive channel collaboration with Intrexon Corporation, or Intrexon, directed towards the research, development and commercialization of new bacteriophage-based therapies for the treatment of bacterial infections caused by P. aeruginosa and C. difficile.

In September 2013, we entered into a license agreement, or the Leicester License Agreement, with the University of Leicester to develop a phage therapy to kill certain types of C. difficile. Pursuant to the Leicester License Agreement, we may be obligated to pay the University of Leicester a single digit royalty and an aggregate of up to £575,000 in milestone payments.

| 5 |

In June 2013, we entered into a cooperative research and development agreement, or CRADA, with the United States Army Medical Research and Materiel Command focusing on developing bacteriophage therapeutics to treat S. aureus, E. coli and P. aeruginosa infections. Under this CRADA we plan to initiate a clinical trial of AB-SA01 for the treatment of wounds infected with S. aureus in the first half of 2016.

In November 2015, our Australian subsidiary, AmpliPhi Australia Pty Ltd, entered into a clinical trial research agreement with the University of Adelaide and the Queen Elizabeth Hospital, both of Adelaide, SA, Australia, to conduct a Phase 1 clinical trial titled “A Phase 1 Investigator Initiated Study to Evaluate the Safety, Tolerability and Preliminary Effectiveness of AB-SA01 in Patients with Chronic Rhinosinusitis Associated with S. aureus infection”. The University of Adelaide will sponsor the clinical trial while we will supply AB-SA01 and control the trial protocol. This study will primarily measure the safety and tolerability of AB-SA01 and will secondarily examine the presence of S. aureus and symptoms assessed by the patient as well as by the physician using standard questionnaires used by physicians to assess treatment efficacy. We plan to enroll nine patients, divided into three cohorts. The first cohort will receive a twice daily dose of AB-SA01 for seven days. The second cohort will receive the same dose twice daily for 14 days. The third cohort will receive a higher dose of AB-SA01 twice daily for 14 days. Patients will be monitored an additional 30 days following their last day of treatment. Patient screening for this clinical trial commenced in late 2015 the first patient was dosed in January 2016. We expect data from this first clinical trial in the second half of 2016 and are planning to initiate a second clinical trial of AB-SA01 by the first half of 2017.

In January 2016, we entered into an Asset Purchase Agreement with Novolytics Ltd., which we refer to as the Novolytics Purchase Agreement, to purchase certain tangible and intangible assets. Pursuant to the Novolytics Purchase Agreement, we acquired all rights, title and interest to three families of patents. The first family is titled “Bacteriophages useful for therapy and prophylaxis of bacterial infections.” This patent has been granted in the United Kingdom, certain other European countries and India. The second patent family is titled “Anti-bacterial compositions” and has been granted in Australia with prosecution pending in multiple countries including the United States. The last patent family is titled “Novel bacteriophages” and the prosecution is pending in many countries including the United States. We also received clinical isolates for S. aureus which will bolster our libraries of clinically relevant strains. Additionally, we received know-how relating to certain formulation processes. We also have access to all previous dialogue between Novolytics and various regulatory organizations including the United Kingdom Medicines and Healthcare Products Regulatory Agency, or MHRA

At December 31, 2015, we had cash and cash equivalents of $9.4 million. The independent registered public accounting firm that audited our 2015 consolidated financial statements has included in their report an explanatory paragraph referring to our recurring losses and expressing substantial doubt in our ability to continue as a going concern. Our ability to continue as a going concern depends on our ability to raise substantial additional funds through public or private equity offerings, collaborative or licensing arrangements and/or debt financing. We may not be able to raise sufficient capital when required or on acceptable terms.

We have a disagreement with one of our principal stockholders, Third Security, LLC, regarding the interpretation of our Amended and Restated Articles of Incorporation. The disagreement relates to whether it is technically possible for us to satisfy the requirements for automatic conversion of our outstanding shares of Series B redeemable convertible preferred stock (Series B Preferred) pursuant to an underwritten public offering (a Qualified Public Offering). In the fourth quarter of 2015, Third Security informed us that, under its interpretation of our Amended and Restated Articles of Incorporation, the Qualified Public Offering conditions set forth in Article 4 of our Amended and Restated Articles of Incorporation can never be satisfied because our stock is publicly traded on the NYSE MKT, and that the only way all outstanding Series B Preferred can be converted into shares of our common stock (Common Shares) is by obtaining the requisite consent of the Series B Preferred stockholders. We disagree with Third Security’s interpretation. Our Amended and Restated Articles of Incorporation also contain various other ambiguities, such as in the provisions relating to the conversion rate for converting Series B Preferred into Common Shares and the stated value of the Series B Preferred following our 50:1 reverse split of our Common Shares in August 2015. The stated value of the Series B Preferred affects other provisions of our Amended and Restated Articles of Incorporation, including the anti-dilution rights for the Series B Preferred as well as the minimum public offering price per share necessary for a public offering to satisfy one of the Qualified Public Offering conditions. These ambiguities, as well as Third Security’s interpretation of the Qualified Public Offering conditions, create uncertainty around our capital structure, which may adversely affect our ability to raise capital. If adequate funds are not available on a timely basis on acceptable terms, we may be required to significantly reduce, delay or refocus our research and development programs, sell or relinquish rights to our products, technologies or other assets or merge all or a portion of our business with another entity, any of which could delay the time to market of our product candidates and have a material adverse effect on our business, financial condition and results of operations. This uncertainty around our ability to secure additional financing creates substantial doubt about our ability to continue as a going concern. In order to resolve our disagreement with Third Security, we may also agree to settlement terms that cause significant dilution to holders of our Common Shares and require us to pay significant consideration, or engage in expensive and time-consuming litigation where our interpretation of the Qualified Public Offering conditions may not prevail or the matter may otherwise be resolved in a manner unfavorable to us. For additional information, see “Risk Factors—We have a disagreement with one of our principal stockholders regarding the interpretation of our Amended and Restated Articles of Incorporation” under Item 1A of this Annual Report.

The Need for New Anti-Infective Therapies

The rapid and continuous emergence of antibiotic-resistant bacteria has become a global crisis. Despite this crisis, the number of novel anti-infective therapies currently in development is at historically-low levels. The CDC estimates that more than two million people in the United States acquire an antibiotic-resistant infection each year and more than 23,000 of these prove fatal. It is estimated that 50% of hospital-acquired infections are resistant to first-line anti-infective therapies. The cumulative annual cost for treating resistant bacterial infections in the United States alone is estimated to be $20 billion, while the global antibiotics market opportunity is estimated to be $40.3 billion in 2015.

| 6 |

The CDC’s latest report on the matter, Antibiotic Resistance Threats in the United States, 2013, notes that there are “potentially catastrophic consequences of inaction” and ranks C. difficile as belonging to the highest tier of threat, or “Urgent Threats.” Despite the potential market opportunity, only two New Drug Applications, or NDAs, for antibacterial drugs were approved by the FDA between 2010 and 2012 compared to 18 in the period between 1980 and 1984. One of the primary recommendations of the CDC is the development of new antimicrobials to diversify treatment options.

Product Candidates

AB-SA01: Infections Caused by S. aureus

By screening our proprietary library of phage samples against a panel of S. aureus bacteria, collected from around the world, we have selected a phage product candidate mix that has demonstrated, in in vitro studies, greater than 92% efficacy with high overlap against a global diversity panel that includes some of the most virulent isolates of S. aureus, including MRSA isolates. The three phage constituents of AB-SA01 were selected for their ability to target the greatest number of bacterial isolates in the collection and maximal complementation. Complementation, defined as the percentage of S. aureus isolates susceptible to more than one phage, is emphasized in product selection to reduce risk of the emergence of bacterial resistance.

In conjunction with our CRADA with the U.S. Army Medical Research and Materiel Command, we are developing AB-SA01 to treat acute and chronic infections caused by S. aureus, including infections caused by MRSA strains of the same bacterium. MRSA infections are one of the most common causes of hospital-acquired (nosocomial) infections. The CDC estimates that more than 850,000 patients were treated for S. aureus infections of the skin or soft tissue in 2013 and, due to failure of first line treatment, more than 50% of these patients required a second-line treatment and approximately 35% of them required a third-line treatment. Global Data estimates the market for MRSA infection treatments alone was more than $2.7 billion in 2007. This market is forecasted to grow to more than $3.5 billion by 2019.

In connection with our CRADA with the US Army, we submitted a Pre-IND briefing package to the FDA to obtain their feedback on our Chemistry Manufacturing and Control, or CMC, program and plans for our first human clinical trial of AB-SA01 for the treatment of S. aureus infections of wound and skin. The FDA concurred with our plan for progressing this bacteriophage product candidate into clinical trials, specifically agreeing with the manufacturing process, product specifications and the absence of any need for non-clinical toxicology data to initiate our first Phase 1 clinical trial. We plan to initiate the Phase 1 clinical trial in the second half of 2016. We are also planning to initiate a second Phase 1 clinical trial in healthy volunteers in the second half of 2016.

Furthermore, in December 2015, we opened a clinical trial at the University of Adelaide Queen Elizabeth Hospital to evaluate the safety and preliminary efficacy of AB-SA01 in chronic rhinosinusitis patients infected with S. aureus. The first patient in this clinical trial was dosed in January 2016 and we have continued to dose additional patients through the first quarter of 2016. We expect data from this first clinical trial in the second half of 2016.

AB-PA01: Lung Infections in Cystic Fibrosis (CF) Patients Caused by P. aeruginosa

We are initially developing AB-PA01 for the treatment of P. aeruginosa, the most prevalent bacterial infection in cystic fibrosis, or CF, patients and the one that leads to the highest mortality and is the primary cause of lung infection in approximately 80% of CF patients ages 25 to 34, causing an estimated 450 deaths per year in the United States. To develop our product candidates, we have created a global diversity panel of relevant clinical isolates (bacteria isolated from patients) from clinics around the globe. These diversity panels have been screened against our phage libraries, which are isolated and characterized according to our set of proprietary discovery protocols. We have demonstrated, in in vitro and in vivo studies, that our proprietary phage mix is able to effectively kill targeted bacteria. Furthermore, our phage mixes are selected to exhibit a high degree of overlap, defined as the number of bacteria targeted by more than one phage in the product. We believe that high overlap is an important factor in preventing bacteria from developing resistance to our phage product candidates.

Similar to work described above for S. aureus, we have tested over 400 clinical P. aeruginosa clinical isolates. As an example, initial host range testing was performed with a reference panel of 67 CF isolates. AB-PA01 showed an activity of 95.5% (64/67) with 87.5% (56/64) of the positives isolates hit by more than one phage in the mix.

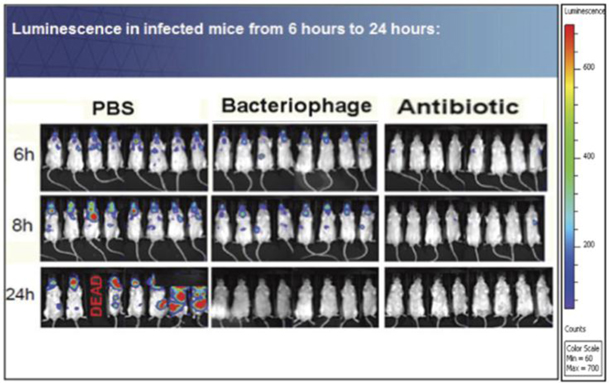

In collaboration with Institut Pasteur (Paris, France) and also with the Brompton Hospital, Imperial College (London, United Kingdom), we have demonstrated in the preclinical studies, some of which are described below, that phages can effectively treat infections in animal models of acute P. aeruginosa lung infections. The graphic below shows the three groups from a study conducted at the Institute Pasteur. Each group consisted of eight mice. Group 1 was treated with placebo, or PBS; Group 2 was treated with our phage mix; and Group 3 was treated with an antibiotic (note the model was optimized for this antibiotic). The colored regions, measured by light intensity, or luminescence, demonstrate where the P. aeruginosa infection is active and the bacteria are actively replicating. By the 24th hour, the surviving untreated animals (Group 1) are sacrificed as the infection has spread and in some cases has already proved lethal whereas the two treatment groups (Group 2, phage and Group 3, antibiotic) showed effective reduction of the active infection.

| 7 |

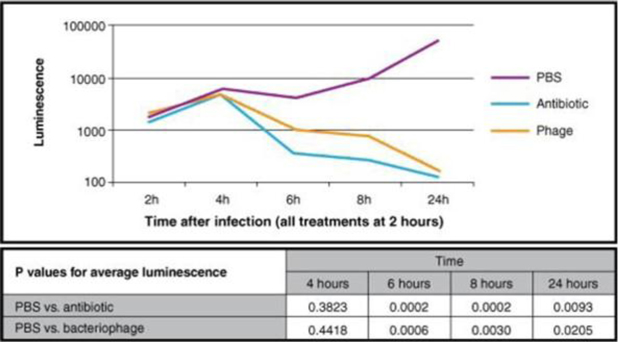

Average luminescence, representing bacteria that remain alive, for each group is shown below:

Bacterial counts and the number of bacteriophage infection units detected by assay, or phage titers, were measured in these animals after 24 hours, and the results demonstrated that our phage mix effectively lowered the bacterial counts, or CFU, in the mouse lung to levels comparable to antibiotic treatment (PBS vs. antibiotic, p=0.0003; PBS vs. bacteriophage, p=0.0003). A p-value is a statistical measure of the probability that the difference in two values could have occurred by chance. The smaller the p-value, the lower the likelihood is that the difference occurred by chance, or the greater our confidence is that the results are statistically significant. Furthermore, it was evident that phage replicated to high levels in the infected lung.

An additional preclinical study conducted at the Institut Pasteur in mice (12 mice in each of the treatment and control groups) demonstrated the ability of our phage mix to reach the lung within two hours of being delivered by oral administration. The phage levels increased between two and six hours post-treatment, and the results were statistically significant (p-value <0.001). These results demonstrate that when orally administered in mice, phages not only reached the lungs, but were also able to infect and multiply in target bacteria.

In a separate in vivo study of acute P. aeruginosa infection of the mouse lung conducted at the Brompton Clinic, results demonstrated that our phage mix reduced CFU levels upon simultaneous intranasal administration (six mice in each of the treatment and control groups) and also when administered 24 hours post-bacterial infection (seven mice in the treatment group and eight mice in the control group) using a standard strain of P. aeruginosa, Pa01.

| 8 |

We were granted an advisory meeting with the MHRA in the first quarter of 2014 to discuss our plans and intend to move the AB-PA01 compound into additional preclinical testing in preparation for a Phase 1/2 clinical trial in CF patients. We also sought advice and comment that our CMC plans were acceptable. The MHRA concurred with our approach and plans as presented, including a first-in-man dose ranging clinical trial in CF patients. We expect to continue product candidate selection and formulation work into mid-2016 and to submit a Clinical Trial Application, or CTA, to the MHRA in the first half of 2017 and we plan to initiate the first clinical trial shortly thereafter.

If we achieve successful proof of concept in this initial clinical indication we may consider developing this compound for the treatment of other acute and chronic lung infections, such as ventilator associated bacterial pneumonia, or VABP, and chronic obstructive pulmonary disease, or COPD. P. aeruginosa is the predominant pathogen in both of these indications. We are also currently evaluating our phages in preclinical animal models of chronic rhinosinusitis in collaboration with the University of Adelaide.

AB-CD01: Gastrointestinal (GI) Infection Caused by C. difficile, or CDI

From 2000 through 2007, deaths in the United States from CDI increased over 400%. Over 90% of such deaths occur in hospitalized or confined patients over the age of 65. Global Data estimates that the major European Union and United States markets for CDI therapies grew to more than $314 million in 2011 and they are expected to grow to more than $500 million by 2019.

According to the CDC almost 250,000 people each year require hospitalization for CDI and at least 14,000 people die each year in the United States from CDI. The CDC also estimates that 20-40% of CDI recurs with standard antibiotic treatment. We are actively working with researchers at the University of Leicester to develop a phage therapeutic that targets and kills C. difficile. We believe that orally delivered phages are well suited to treat CDI. Within this collaboration, researchers at the University of Leicester have discovered phages that have been shown to be effective against clinically-relevant strains of C. difficile isolated from around the world. We are also collaborating with Intrexon to develop second generation phages with improved biological characteristics. While current therapies against C. difficile are not yet antibiotic-resistant, the CDC has categorized C. difficile as an urgent threat and has stated that CDI requires urgent and aggressive action. We believe that there is a significant market opportunity for our product in treating this infection.

Preclinical studies are underway to select and optimize our phage cocktail and manufacturing strains as well as evaluate efficacy in animal models.

Prior Clinical Development

In 2010, the Company’s wholly owned subsidiary, Biocontrol Ltd, reported a double-blind placebo-controlled, randomized Phase 1/2 clinical trial targeting chronic ear infections (otitis) caused by antibiotic-resistant P. aeruginosa. To our knowledge, this was the first randomized placebo-controlled efficacy trial of bacteriophage therapy. Results were published demonstrating decreasing levels of P. aeruginosa in the ear and improvement of clinical condition with a single input dose of 2.4 nanograms of bacteriophage preparation. While this was a small trial (n=24), changes from baseline at the end of the trial in the test group (n=12) were statistically significant for both clinical condition (p=0.001) and bacterial load (p=0.016). No significant changes were seen in the control group (n=12) compared to baseline at the end of the trial. Difference between test and control groups was statistically significant by analysis by covariance, or ANCOVA, on day 21 for bacterial count (p=0.0365). These results will need to be validated in larger well-controlled trials.

Anti-Infective Therapeutics Market

The market opportunity for antibiotics is large, with the market estimated to reach $40.3 billion in annual sales globally in 2015. Almost one in every five deaths worldwide occurs as a result of infection and, according to the World Health Organization, or WHO, many bacterial infections will become difficult or impossible to cure as the efficacy of current antibiotic drugs wanes. Despite the advances in antimicrobial and vaccine development, infectious diseases still remain as the third-leading cause of death in the United States and the second-leading cause of death worldwide.

The number of new antibiotics approved by the FDA and other global regulatory authorities has declined consistently over the last two decades. According to the Infectious Diseases Society of America, as of early 2013, only two new antibiotics have been approved by the FDA since 2009 and only seven new antibiotics targeting multi-drug-resistant Gram-negative bacilli were in either Phase 2 or Phase 3 clinical trials. This dramatic decrease in productivity is evidenced by only two classes of antibiotics oxazolidinones and cyclic lipopeptides having been developed and launched in the last 30 years. At the same time, the evolution of antibiotic-resistant bacteria has led to an increasing number of infections for which there are no current treatments available.

Hospital-acquired (nosocomial) infections are a major healthcare problem throughout the world, affecting developed countries as well as resource-poor countries. The WHO reports that hospital-acquired infections are among the major causes of death and increased morbidity among hospitalized patients and estimates that more than 1.4 million people per year worldwide suffer from infectious complications from a hospital stay.

A recent CDC report also cites that in the United States, between 5 and 10% of all patients admitted to a hospital will be affected by a hospital-acquired infection during their stay, typically requiring extended stays and additional care. There is also a significant risk of death from such infections. In the United States, the CDC estimates that approximately 99,000 people die from hospital-acquired infections each year. The Cystic Fibrosis Foundation estimates that P. aeruginosa accounts for 10% of all hospital-acquired infections.

| 9 |

Compounding the above situations is the alarming and continuing rise in the prevalence of antibiotic-resistant bacterial infections. This, coupled with the lack of new antibiotics in current discovery and development pipelines, has generated a significant clinical management problem worldwide, leading to increases in morbidity and mortality due to these antibiotic-resistant bacteria as well as increases in healthcare costs.

The first of these antibiotic-resistant infections to reach epidemic proportions was caused by the Gram-positive bacterium S. aureus. S. aureus resistance to a broad range of antibiotics has necessitated the use of expensive and potentially toxic “drugs of last resort”, most notably vancomycin. Antibiotic-resistant forms of S. aureus, usually termed MRSA, VISA (vancomycin-intermediate S. aureus), or VRSA (vancomycin-resistant S. aureus), can be extremely challenging to treat. Although several antibiotics targeting S. aureus have been developed, rapidly developing bacterial resistance has been noted for all of these including linezolid, daptomycin and tigecycline. On the basis of historical evidence, resistance to these existing products is likely to increase over time, and this picture is further complicated by the reduced efficacy of conventional antibiotics against Staphylococcus biofilms.

Typically, S. aureus infection causes a variety of suppurative (pus-forming) infections and toxinoses (lesions) in humans. It causes superficial skin lesions such as boils, styes and furuncles; more serious infections such as pneumonia, mastitis, phlebitis, meningitis and urinary tract infections; and deep-seated infections, such as osteomyelitis and endocarditis. S. aureus is the leading cause of wound infections, in particular, hospital-acquired (nosocomial) infection of surgical wounds and infections associated with indwelling medical devices. S. aureus is the leading pathogen in healthcare-associated infections in the United States as a whole, accounting for 30.4% of surgical site infections, or SSI, and 15.6% of such infections overall.

Infections also occur in connection with CF, which is a genetic disease affecting primarily Caucasians of northern European descent. According to the Cystic Fibrosis Foundation, there are approximately 50,000 cases of CF in North America and Europe. P. aeruginosa opportunistically infects the mucous membranes, primarily the lungs, of CF patients and quickly grows out of control, resulting in pneumonia. P. aeruginosa infections are notoriously resistant to known antibiotics, and treatment may be further complicated by the formation of biofilms. Biofilms are organized structures of microorganisms growing on solid surfaces (such as lung tissue) and often limit access of antibiotics to the covered tissues. Since phages attack bacteria in a manner independent of chemical antibiotic resistance mechanisms and can infect bacteria growing in biofilms, we believe that P. aeruginosa infection among CF patients represents a compelling indication to pursue. The availability of Pseudomonas-specific phages along with validated animal models of P. aeruginosa lung infections has contributed to the development of our bacteriophage program in CF.

Anti-Infective Treatments with Bacteriophages

Background

The dramatic rise in antibiotic resistance, the appearance of an increasing number of new “superbugs” and the lack of new antibiotics in the pipeline has prompted calls to action from many of the world’s major health bodies such as the CDC and the WHO, who warn of an “antibiotic cliff” and a “post-antibiotic era.” In 2009, the European Antimicrobial Resistance Surveillance System, or EARSS, concluded that “the loss of effective antimicrobial therapy increasingly threaten[s] the delivery of crucial health services in hospitals and in the community.” This conclusion was reinforced by The Antimicrobial Availability Task Force, or AATF, of the Infectious Diseases Society of America, or IDSA, and the European Centre for Disease Prevention and Control, or ECDC, in conjunction with the European Medicine Agency, or EMA. Clearly, there is a pressing need to find alternative antibacterial therapies.

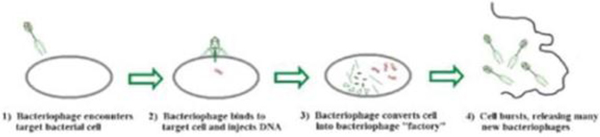

Bacteriophage therapy has the potential to be an alternative method of treating bacterial infection. Phages are ubiquitous environmental viruses that grow only within bacteria. The name “bacteriophage” translates as “eaters of bacteria” and reflects the fact that as they grow, phages kill the bacterial host by multiplying inside and then bursting through the cell membrane in order to release the next generation of phages. Phages can differ substantially in morphology and each phage is active against a specific range of a given bacterial species. Phages were first discovered in 1915 at the Institut Pasteur and were shown to kill bacteria taken from patients suffering from dysentery. Furthermore, it was noted that phage numbers rose as patients recovered from infection, suggesting a direct association.

Life Cycle of a Bacteriophage

Until the discovery of effective antibiotics, phages were used as an effective means of combating bacterial infection. When broad-spectrum antibiotics came into common use in the early 1940s, phages were considered unnecessary, with antibiotics being seen for many years as the answer to bacterial disease. This attitude persisted until the development of the wide-ranging, and in some cases total, resistance to antibiotics seen within the last 10 years.

| 10 |

Phages have the potential to provide both an alternative to, and a synergistic approach with, antibiotic therapy. Since they use different mechanisms of action, phages are unaffected by resistance to conventional antibiotics. Phages containing certain enzymes also have the ability to disrupt bacterial biofilms, thus potentiating the effect of chemical antibiotics when used in combination with them.

Our Strategy

Our strategy is to use techniques of modern biotechnology and current state-of-the-art practices for drug development in concert with existing regulatory guidance to develop a pipeline of bacteriophage products that will destroy bacteria such as MRSA, which are resistant to antibiotics. Our business strategy will apply state-of-the-art techniques in molecular biology and in clinical trial design to build upon the long successful history of using phages therapeutically to treat and cure infections.

We supplement our internal resources with world-class scientific and medical collaborations throughout the world. For example, through a collaboration with The University of Adelaide in Australia we conducted preclinical studies showing the ability of S. aureus phage preparations to kill clinical isolates from 61 patients demonstrating efficacy of greater than 90%. Furthermore, a S. aureus mixture was shown to be safe and efficacious in a preclinical sheep model of chronic rhinosinusitis. This program continues to progress and a clinical trial of patients at the University of Adelaide’s Queen Elizabeth Hospital with treatment refractory chronic rhinosinusitis patients infected with S. aureus commenced in late 2015 and the first patient was dosed in January 2016.

In collaboration with the U.S. Army, we plan to initiate a clinical trial in 2016 that will support the development of a treatment for S. aureus infections for wound and skin infections.

We collaborate with the Royal Brompton Hospital in London where we have demonstrated that a candidate phage product can survive nebulization, was effective in killing over 83% of recent clinical isolates from London patients, and in preclinical mouse models demonstrated that a phage mixture dose-dependently clears Pseudomonas infection from the lung and reduced inflammation.

We expect to continue product selection and formulation work for AB-PA01, and in conjunction with the Brompton Hospital, we would expect to conduct a Phase 1/2 study using AB-PA01 to treat CF patients with P. aeruginosa lung infections.

Through our collaborations with the University of Leicester and Intrexon, we are also continuing to develop and identify candidate C. difficile phages to treat patients suffering from serious gastrointestinal infections.

Acquisitions

In January 2011, we completed the acquisition of Biocontrol Ltd, with the goal of developing their phage therapy programs using funding from the sale of our legacy gene therapy assets. Under the terms of our acquisition of Biocontrol Ltd, we issued 456,344 shares of our common stock to the shareholders of Biocontrol Ltd with a total fair value of approximately $8.6 million as of January 6, 2011, resulting in Biocontrol’s former shareholders owning approximately 50% of our outstanding equity securities at the time. As a condition to closing the acquisition, Biocontrol Ltd raised approximately £200,000 (US$310,000) in working capital for use by us.

In November 2012, we acquired SPH pursuant to our offer to acquire all outstanding shares of SPH from its shareholders under the terms of a Shareholder Sale Agreement and a Managers Warranty Deed, collectively referred to as the SPH Agreements, in exchange for up to 800,000 shares of our common stock.

In connection with our acquisition of SPH, we entered into certain other arrangements, including the repayment under a Loan Repayment Deed (as amended) of a $770,000 loan originally made by Cellabs Pty Ltd, or Cellabs, an Australian company affiliated with Dr. Smithyman, to SPH, a consulting agreement with Dr. Smithyman and the payment of $3,017 per month to Cellabs for our laboratory space in Australia through December 31, 2015. Under the terms of the Loan Repayment Deed, the loan from Cellabs to SPH was to be repaid and fully satisfied partly in cash and partly by issuing 40,000 shares of our common stock to Cellabs. As of December 31, 2015, $350,000 has been paid by us to Cellabs and all 40,000 shares have been issued. We paid the remaining balance of $200,000 under the terms of the Loan Repayment Deed in December 2013. The SPH acquisition also included several phage therapy projects which had reached the pre-clinical or animal study stage, including the Brompton Hospital CF study, the Adelaide University MRSA chronic rhinosinusitis study and the University of Leicester C. difficile project. We believe that acquisition of SPH brought substantial phage scientific expertise and know-how to the Company.

In January 2016, we entered into an Asset Purchase Agreement with Novolytics Limited, which we refer to as the Novolytics Purchase Agreement, to purchase certain tangible and intangible assets. Pursuant to the Novolytics Purchase Agreement, we receive all rights, title and interest to three families of patents. The first family is titled “Bacteriophages useful for therapy and prophylaxis of bacterial infections.” This patent has been granted in the United Kingdom, certain other European countries and India. The second patent family is titled “Anti-bacterial compositions” and has been granted in Australia with prosecution pending in multiple countries including the U.S. The last patent family is titled “Novel bacteriophages” and the prosecution is pending in many countries including the U.S. We also received clinical isolates for S. aureus which will bolster our libraries of clinically relevant strains. Additionally, we received know-how relating to certain formulation processes. We also have access to all previous dialogue between Novolytics and various regulatory organizations including the MHRA.

In connection with the Novolytics Purchase Agreement, we paid cash to Novolytics to cover expenses incurred in connection with winding up its phage-related business, as well as warrants to the shareholders of Novolytics to purchase up to an aggregate of 170,000 shares of our common stock, each with an exercise price of $12.00 per share. Pursuant to the terms of the Novolytics Purchase Agreement, we have granted certain registration rights covering the resale of the shares of common stock underlying such warrants.

| 11 |

Strategic Alliances and Research Agreements

As discussed below, we have established collaborations with Intrexon, the U.S. Army and the University of Leicester, which provide us with access to the considerable scientific, developmental, and regulatory capabilities of our collaborators. We believe that our collaborations contribute to our ability to rapidly advance our product candidates, build our product platform and concurrently progress a wide range of discovery and development programs.

Exclusive Channel Collaboration with Intrexon

In March 2013, we entered into an exclusive channel collaboration agreement with Intrexon, or the Exclusive Channel Collaboration, that governs a collaboration arrangement in which we use Intrexon’s technologies directed towards the research, development and commercialization of new bacteriophage-based therapies to target specific antibiotic-resistant infections. We believe that combining the broadest and most advanced synthetic biology platform with our phage capabilities may lead to the development of innovative second-generation phage product candidates. The Exclusive Channel Collaboration establishes committees comprised of representatives of us and Intrexon that govern activities related to the bacteriophage programs in the areas of project establishment and prioritization, as well as budgets and their approval, chemistry, manufacturing and controls, clinical and regulatory matters, commercialization efforts and intellectual property.

Under the terms of the Exclusive Channel Collaboration, the Company will receive an exclusive, worldwide license to utilize Intrexon’s proprietary technology and expertise for the standardized design and production of genetically modified bacteriophages, which we refer to collectively as the Bacteriophage Program. The Exclusive Channel Collaboration seeks to develop bacteriophage-containing human therapeutics, other than AB-PA01, for use in the treatment of bacterial infections associated with P. aeruginosa infections and the treatment of infections of C. difficile, which we collectively refer to as AmpliPhi Product candidates. The Exclusive Channel Collaboration grants the Company a worldwide license to use patents and other intellectual property of Intrexon in connection with the research, development, use, importing, manufacture, sale and offer for sale of AmpliPhi Product candidates. Such license is exclusive with respect to any clinical development, selling, offering for sale or other commercialization of AmpliPhi Product candidates, and otherwise is non-exclusive. Subject to limited exceptions, we may not sublicense the rights to Intrexon’s technology without Intrexon’s written consent.

Under the Exclusive Channel Collaboration, and subject to certain exceptions, we are responsible for, among other things, the performance of the Bacteriophage Program, including development, commercialization and certain aspects of manufacturing AmpliPhi Product candidates. Intrexon is responsible for the costs of establishing manufacturing capabilities and facilities, subject to certain exceptions, for the bulk manufacture of products developed under the Bacteriophage Program, certain other aspects of manufacturing and costs of basic-stage research with respect to Intrexon’s channel technology and Intrexon’s materials, such as platform improvements and costs of filing, prosecution and maintenance of Intrexon’s patents.

Subject to certain expense allocations and other offsets provided in the Exclusive Channel Collaboration, we agreed to pay Intrexon, on a quarterly basis, tiered royalties on net sales derived in that quarter from the sale of AmpliPhi Product candidates, which are based on or incorporate Intrexon’s technology, calculated on a product-by-product basis. If we sublicense a product developed under the collaboration with Intrexon, we have also agreed to pay Intrexon, on a quarterly basis, a certain percentage of revenues received from the sublicensee. Pursuant to the Exclusive Channel Collaboration, Intrexon received 480,000 shares of our common stock as an upfront technology access fee. We may also pay Intrexon up to $7.5 million in aggregate milestone payments for each product, payable either in cash or equity upon the achievement of certain events. Intrexon is also entitled to tiered royalties as a percentage in the upper-single digits of the net product sales of a product developed under the Exclusive Channel Collaboration. No milestones have been achieved under the Exclusive Channel Collaboration through December 31, 2015.

The Exclusive Channel Collaboration is effective until terminated by either Intrexon or us. Intrexon may terminate the Exclusive Channel Collaboration if we fail to use diligent efforts to develop and commercialize AmpliPhi Product candidates or if we elect not to pursue the development of an AmpliPhi Program identified by Intrexon that is a “Superior Therapy” as defined in the Exclusive Channel Collaboration. We have the right to terminate the Exclusive Channel Collaboration upon 90 days’ written notice to Intrexon at any time. Both we and Intrexon have the right to terminate the Exclusive Channel Collaboration upon written notice to the other party if the other party commits a material breach of the agreement and fails to cure such breach within 60 days following written notice.

Upon termination of the Exclusive Channel Collaboration, we may continue to develop and commercialize any AmpliPhi Product Candidate that, at the time of termination:

| · | is being commercialized by us; | |

| · | has received regulatory approval; | |

| · | is a subject of an application for regulatory approval that is pending before the applicable regulatory authority; | |

| · | is the subject of an ongoing Phase 2 or completed Phase 3 clinical trial in the field; or | |

| · | if we terminate the Exclusive Channel Collaboration for cause, is the subject of an effective investigational new drug application with the FDA, or for which we have commenced at least one authorized in vivo good laboratory practices animal study that is expected to be used for filing an investigational new drug application for such AmpliPhi Product Candidate. |

| 12 |

Our obligation to pay royalties described above with respect to these “retained” products will survive termination of the Exclusive Channel Collaboration.

We incurred expenses for services under the Exclusive Channel Collaboration of $178,000 and $862,000 for the years ended December 31, 2015 and 2014, respectively.

Global R&D Agreement with U.S. Army

In June 2013, we entered into a CRADA with the U.S. Army Medical Research and Materiel Command. The CRADA will focus on developing bacteriophage therapeutics to treat at least three types of infections: S. aureus, E. coli and P. aeruginosa. The initial indication will be wounds and skin infections from S. aureus, which is the leading pathogen in healthcare-associated infections in the United States as a whole, accounting for 30.4% of surgical site infections.

We retain global regulatory ownership and commercial rights to all products developed by us under the CRADA. The U.S. Army Medical Research and Materiel Command will have the right to retain a non-exclusive license to use any products developed by or on behalf of the U.S. Government for non-commercial uses. We also have the rights to exclusively license any intellectual property developed by the U.S. Army Medical Research and Materiel Command under the collaboration on terms to be agreed upon.

The CRADA expires in June 2018 and can be terminated by either the U.S. Army Medical Research and Materiel Command or us upon 60 days’ written notice to the other party at any time.

University of Leicester Development Agreements

In April and September 2013, we entered into a collaboration agreement and a license agreement, respectively, with the University of Leicester to develop a phage therapy that targets and kills C. difficile.

Under these agreements, which we refer to collectively as the Leicester Development Agreements, we are funding the University of Leicester to carry out in vitro studies and animal model development work to identify bacteriophage to resolve C. difficile infections. We have licensed related patents, materials and know-how from the University of Leicester. Under the Leicester Development Agreements, the University of Leicester will provide the bacteriophage and act as overall project coordinator for preclinical studies. All rights, title and interest to any intellectual property developed under the Leicester Development Agreements belong to us. Under the Leicester License Agreement, we have exclusive rights to certain patents and materials owned by the University of Leicester, as well as non-exclusive licenses to related know-how.

The collaboration agreement expires in November 2018 and is terminable by either party upon (a) material breach by the other party, subject to a 90-day cure period, (b) the inability of the principal investigator to continue the collaboration or (c) our bankruptcy or winding up of our operations or, commencing on November 13, 2016, with 180 days’ notice.

Pursuant to the Leicester License Agreement, we paid an up-front fee and will pay the University of Leicester royalties based on product sales and make certain milestone payments based on product development. We are also required to pay minimum annual fees, which reduce future milestone payments. In the event that we sublicense a product created under the Leicester Development Agreements, we have agreed to pay the University of Leicester certain milestone payments or a certain percentage of any sublicense revenue received by us for the attainment of such milestone, as well as a certain percentage of all royalty payments we receive from any sublicensees.

The license agreement expires on the later of the expiration of the licensed patents or September 2028, and is terminable by us at any time upon 60 days’ notice, by the University of Leicester (a) if we legally challenge the validity or ownership of any of the licensed patents, (b) if we fail to pay the fees, milestones or royalties due under the license agreement or (c) if we fail to make substantial commercial process and agree with Leicester that we will be unable to do so. The license agreement is also terminable by either party upon the material breach by the other party (subject to a 30-day cure period) or upon the other party’s bankruptcy or insolvency.

License Agreement with United Kingdom Secretary of State for the Department of Health

In January 2011, upon completion of our acquisition of Biocontrol Ltd., we assumed a license agreement entered into in March 2007 between Biocontrol Ltd. and the Health Protection Agency, Centre for Emergency Preparedness and Response, to use certain intellectual property rights to develop treatments for bacterial biofilm infections. The agreement was subsequently assigned to the United Kingdom Secretary of State for the Department of Health, or DoH.

Under the license agreement, we have obtained exclusive rights to a patent portfolio related to the use of bacteriophages combined with biofilm-disrupting agents in treating biofilm infections. In consideration for the exclusive license, we may be required to pay to the DoH certain milestone payments in the aggregate of up to £10,000 per product, as well as single digit percentage royalty on net sales of products incorporating licensed intellectual property.

The license agreement shall remain in full force and effect until the expiration of the last patent exclusively licensed under the license agreement. If we default on any milestone or royalty payments, or upon breach by us of certain other terms of the license agreement, the DoH may either terminate the license agreement immediately upon written notice or modify the license to be non-exclusive upon 30 days’ written notice.

| 13 |

Intellectual Property

General

Our goal is to obtain, maintain and enforce patent protection for our product candidates, formulations, processes, methods and any other proprietary technologies, preserve our trade secrets and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries. Our policy is to actively seek to obtain, where appropriate, the broadest intellectual property protection possible for our current product candidates and any future product candidates, proprietary information and proprietary technology through a combination of contractual arrangements and patents, both in the United States and abroad. However, patent protection may not afford us with complete protection against competitors who seek to circumvent our patents.

We also depend upon the skills, knowledge, experience and know-how of our management and research and development personnel, as well as that of our advisors, consultants and other contractors. To help protect our proprietary know-how, which is not patentable, and for inventions for which patents may be difficult to enforce, we currently and will in the future rely on trade secret protection and confidentiality agreements to protect our interests. To this end, we require all of our employees, consultants, advisors and other contractors to enter into confidentiality agreements that prohibit the disclosure of confidential information and, where applicable, require disclosure and assignment to us of the ideas, developments, discoveries and inventions important to our business.

As of March 30, 2016, we owned or had exclusive license rights to five U.S. patents and 27 foreign patents, expiring on various dates between 2024 and 2029. These patents relate to the therapeutic uses of bacteriophages, bacteriophage compositions, the sequential use of bacteriophages in combination with conventional antibiotics, genetic sequence variations, biofilm disrupting agents, methods to reduce antibiotic resistance, and methods to design therapeutic combination panels of bacteriophage.

US 7758856 and national patents within the EU deriving from PCT WO2004062677; Bacteriophage for the treatment of bacterial biofilms

Under an existing license from the United Kingdom Secretary of State for the Department of Health (DoH), we have exclusive rights to a patent portfolio related to the use of bacteriophages combined with biofilm-disrupting agents in treating biofilm infections. This portfolio includes one issued patent in the United States (U.S.) and a patent granted in Europe (EP1587520 is validated in France, Germany, Netherlands, Switzerland/Liechtenstein and the United Kingdom). Claims issued in these patents include those directed to compositions and methods related to agents that are able to facilitate the penetration of biofilms, and their combination with therapeutic bacteriophage preparations. The U.S. patent is expected to expire in November 2026 (absent any extensions). The foreign patents are expected to expire in January 2024 (absent any extensions).

US 7807149, US 8105579, US 8388946, continuation application and national filings deriving from PCT WO2005009451; Bacteriophage containing therapeutic agents

Through our wholly owned subsidiary, Biocontrol Ltd, we own three granted U.S. patents and one pending U.S. continuation patent application (US14/919,672) with claims directed generally to bacteriophage compositions, therapeutic methods of using bacteriophages, and methods of treating bacterial infections by sequentially administering bacteriophages in combination with conventional antibiotics. The pending U.S. continuation application relates generally to panels of bacteriophages with different strain specificities for bacterial infections. Corresponding patents have been granted in Australia (AU2004258731), Europe (EP1663265 and EP2570130), Japan (JP5731727 and JP5856556) and Canada (CA2533352). Claims issued in these patents include those directed to therapeutic and non-therapeutic applications of bacteriophage and the sequential use of antibiotics to treat bacterial infections. U.S. patents are expected to expire from July 2024 to March 2027 (absent any extensions). The foreign patents are expected to expire in July 2024 to March 2027 (absent any extensions).

US 8475787, continuation application and national filings deriving from PCT WO2008110840; Beneficial effects of bacteriophage treatment

Through our wholly owned subsidiary, Biocontrol Ltd, we own one granted U.S. patent, and one pending continuation application related to bacteriophage-induced induction of antibiotic sensitivity for Pseudomonas aeruginosa. The granted U.S. patent is expected to expire in July 2029 (absent any extensions). The U.S. continuation application is directed to bacteriophage-induced antibiotic sensitivity for other bacterial species. A corresponding patent has granted in Australia (AU2008224651), and related applications are under examination in Canada, Europe and Japan. Foreign patents in this family are expected to expire in March 2028 (absent any extensions).

PCT WO2013/16464 (United Kingdom priority filing 1207910.9); Therapeutic bacteriophage compositions

Through our wholly owned subsidiary, Biocontrol Ltd, we own a PCT application relating to the design of effective combinations of bacteriophages. The PCT application published on November 7, 2013, and national phase applications are currently pending in the U.S., Canada, Europe, Japan, and Australia. Patents issuing from this PCT, if any, are expected to expire in May 2023 (absent any extensions).

PCT WO2009/044163 (United Kingdom priority filing 0719438.4); Anti-bacterial compositions

Pursuant to the terms of the Asset Purchase Agreement with Novolytics Ltd., we own one U.S. patent application (14/686315), which has been refiled as a continuation application, relating to certain phages targeting MRSA via bacteriophage K and bacteriophage P68. A corresponding patent has been granted in Australia (AU2008306626) and China (CN200880110119.7) and related applications are pending in India, Japan, Canada and Europe. The granted foreign patents are expected to expire October 2028 (absent any extensions).

| 14 |

PCT WO2013/068743 (United Kingdom priority filing 0800149.7); Novel bacteriophage

Pursuant to the terms of the Asset Purchase Agreement with Novolytics Ltd., we own one U.S. patent application (14/356869). This application again relates to the MRSA therapeutic target area via Phage K mutants and the methods of using bacteriophage K. Related applications are also pending in Australia, China, Canada, India, Japan and Europe. Any potential applications would expire in November 2032.

Our success in preserving market exclusivity for our product candidates relies on patent protection, including extensions to this where appropriate, and on data exclusivity relating to an approved biologic. This may be extended by orphan drug and/or pediatric use protection where appropriate. Once any regulatory period of data exclusivity expires, depending on the status of our patent coverage, we may not be able to prevent others from marketing and selling biosimilar versions of our product candidates. We are also dependent upon the diligence of our appointed agents in national jurisdictions, acting for and on behalf of the Company, which manage the prosecution of pending domestic and foreign patent applications and maintain granted domestic and foreign patents.

Competition

We operate in highly competitive segments of the biotechnology and biopharmaceutical markets. We face competition from many different sources, including commercial pharmaceutical and biotechnology enterprises, academic institutions, government agencies and private and public research institutions all seeking to develop novel treatment modalities for bacterial infections. Many of our competitors have significantly greater financial, product development, manufacturing and marketing resources than we do. Large pharmaceutical companies have extensive experience in clinical development and obtaining regulatory approval for drugs. In addition, many universities and private and public research institutes are active in antibacterial research, some in direct competition with us. We also may compete with these organizations to recruit scientists and clinical development personnel.

There are a handful of small biotechnology companies developing bacteriophage products to treat human diseases. Other than our ongoing clinical trials there is, to our knowledge, one corporate-sponsored clinical trial currently enrolling. A French biotechnology company, Pherecydes Pharma, is acting as clinical trial sponsor of a Phase 1/2 clinical trial in Europe of a phage therapy for the treatment of burn wounds infected with E. coli and P. aeruginosa, referred to as PhagoBurn. This clinical trial is a randomized, multi-center open label study to assess tolerance and efficacy of local treatment with a bacteriophage cocktail. A multi-center clinical trial also sponsored by Pherecydes Pharma evaluating a bacteriophage cocktail versus placebo for diabetic foot ulcers, is listed on clinicaltrials.gov as active but not yet enrolling. To our knowledge, a small number of biotechnology companies, including Synthetic Genomics and LytPhage, Inc., as well as academic institutions, have earlier stage discovery programs utilizing synthetic biology approaches to genetically modify bacteriophages to remove or input genes to improve therapeutic properties such as increases to the bacterial host range to infect a larger number of bacterial strains and decrease the need for using multiple phages in a product.

A related approach to treating Staphylococcus infections is being pursued by Contrafect Corporation using a bacteriophage lysin (a hydrolytic enzyme produced by bacteriophages) to treat S. aureus bacteremia (infection in the blood). Contrafect has recently completed a Phase 1 intravenous single dose escalation study in healthy volunteers.

Our bacteriophage programs may compete with or be synergistic with currently approved antibiotics, and experimental approaches such as novel antibiotics, antimicrobial peptides, antimicrobial vaccines, metals, antisense, monoclonal antibodies and possibly microbiome manipulation. For example, Seres Therapeutics is developing a single-dose capsule (SER-109) consisting of bacterial spores to treat recurrent CDI (Clostridium difficile infection). In May 2015, Seres initiated a multi-center, randomized, placebo-controlled Phase 2 clinical trial, to assess the efficacy and safety of SER-109. SER-109, or similar products that may be in development by third parties, could prove to be competitive to or used in conjunction with a bacteriophage therapeutic approach.

Manufacturing and Supply

We have developed our own manufacturing capabilities at a facility in Ljubljana, Slovenia that is leased by our wholly-owned subsidiary, AmpliPhi, Biotehnološke Raziskave in Razvoj, d.o.o. Our facility complies with applicable cGMP regulations, which require, among other things, quality control and quality assurance as well as the corresponding maintenance of records and documentation. Pharmaceutical product manufacturers and other entities involved in the manufacture and distribution of approved pharmaceutical products are required to register their establishments with the FDA, and certain state agencies, including the applicable government agency where the facility is located, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP and other laws.

After conducting a global search, we elected to proceed with establishing a wholly-owned cGMP compliant manufacturing facility in Ljubljana, Slovenia. Upon final product selection, we plan to manufacture each of our product candidates in this facility. We have been able to access and hire highly skilled process development and phage manufacturing expertise and believe that we have control of our proprietary platform from phage identification through final product fill and finish. Our facility is comprised of approximately 4,000 sq. ft. of laboratory and office space, where we produce cGMP clinical trial supplies for our current and planned preclinical studies and clinical trials. We believe this facility could be sufficient to meet our manufacturing needs through initial Phase 3 clinical trials. Our current formulation for AB-SA01 is intended for sinonasal or topical delivery via a nasal wash solution or dressed bandage. We plan to further optimize future formulations of our product candidates for delivery to patients with wound and skin infections.

| 15 |

Our facility in Ljubljana, Slovenia is subject to inspection and regulation by JAZMP, the Slovenian agency that regulates and supervises pharmaceutical products in Slovenia. Discovery of problems with a product after approval may result in restrictions on a product, manufacturer or holder of an approved New Drug Application/Biologics License Application, including withdrawal of the product from the market. In addition, changes to the manufacturing process generally require prior regulatory approval before being implemented and other types of changes to the approved product, such as adding new indications and additional labeling claims, are also subject to further regulatory review and approval, including approval by the FDA.

Commercialization and Marketing

We have full worldwide commercial rights to all of our phage-based product candidates to treat drug-resistant bacterial infections, including our product candidates: AB-PA01 for the treatment of CF patients with P. aeruginosa lung infections; AB-SA01, for the treatment of S. aureus infections; and AB-CD01 for the prevention or treatment of C. difficile infections. We believe we can maximize the value of our company by retaining substantial global commercialization rights to these product candidates and, where appropriate, entering into partnerships to develop and commercialize our other product candidates. We plan to build a successful commercial enterprise using a sales team in the United States and possibly other major markets and with partners in other territories.

We have not yet established a sales, marketing or product distribution infrastructure because our lead candidates are still in early clinical development. We generally expect to retain commercialization and co-commercialization rights in the United States for all of our product candidates for which we receive marketing approvals. Subject to receiving marketing approvals, we intend to explore building the necessary marketing and sales infrastructure to market and sell our current product candidates. We also intend to explore the use of a variety of distribution agreements and commercial partnerships in those territories where we do not establish a sales force for any of our product candidates that obtain marketing approval.

Government Regulation and Product Approval