May 22, 2014

BY EDGAR

Jeffrey Riedler

Assistant Director Healthcare and Insurance

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

| Re: | AmpliPhi Biosciences Corporation |

Amendment No. 2 to Registration Statement on Form 10

Filed April 15, 2014

File No. 000-23930

Dear Mr. Riedler:

This letter is submitted by AmpliPhi Biosciences Corporation (the “Company”) in response to the comments of the staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Staff”) with respect to Amendment No. 2 to the Company’s Form 10-12G filed April 15, 2014 (File No. 000-23930), as set forth in your letter dated May 8, 2014. We also enclose with this letter clean and marked copies of Amendment No. 3 to the Form 10, as amended and filed on May 22, 2014 (“Amendment No. 3”). Below are responses to each of the Staff’s comments. The text of each comment contained in the Staff’s letter is set forth in italics below, followed by the Company’s response.

Anti-Infective Treatments with Bacteriophages, page 13

| 1. | We note your response to prior comment 2. Please revise this section to clarify that your conclusion that these studies suggest that phage therapy shows promise for treating infectious diseases is based on limited available information regarding these studies. |

RESPONSE:

We acknowledge the Staff’s comment and have adjusted the disclosure on page 13 of Amendment No. 3.

Form 10-12G Amendment No. 2

Management’s Discussion and Analysis

General and Administrative, page 51

| 2. | You indicate that general and administrative expenses were higher in 2013 than in 2012 due to placement agent fees associated with the June 2013 Series B Preferred Shares placement and the December 2013 common stock private placement, higher legal expenses due to preparation to become a public company, and staffing expenses. |

| · | Revise your disclosure in Form 10/A to quantify each of the reasons cited that caused an increase in expense. |

| US: 4870 Sadler Rd, Suite 300, Glen Allen, VA 23060 |

| AU: Unit 7 27 Dale Street, Brookvale 2100 NSW |

RESPONSE:

We acknowledge the Staff’s comment and have adjusted the disclosure on page 51 of Amendment No. 3.

| · | Tell us why the placement agent fees related to the preferred and common stock offerings were expensed rather than netted against proceeds received in the offerings. |

RESPONSE:

While ASC 340-10-S99-1 indicates that the appropriate treatment of the issuance costs would be to net the costs against the proceeds received, in the June 2013 Series B Preferred Shares placement, of the approximately $7 million in proceeds received, only $100,000 was attributed to equity. The remainder was attributed to derivative liabilities for the preferred shares and warrants. As such, we felt that the $100,000 booked to reflect the par value of the Series B shares was immaterial to the transaction, as the purchase truly resulted in derivative liabilities. As the derivative liabilities were booked at fair value, offsetting the proceeds against the derivative liabilities would only have resulted in immediately writing the derivative liabilities back up to fair value, which we believed to be inconsistent with the intent of the ASC. Therefore, we felt that the only reasonable alternative under these circumstances would be to expense the transaction fees for this transaction.

For the December 2013 common stock private placement, we have restated our previously issued December 31, 2013 financial statements and included the restated December 31, 2013 financials as part of Amendment No. 3. The financial statements have been restated to net investment fees paid as part of the December financing against the proceeds received. As a result of this correction, we reduced general and administrative expenses and additional paid in capital by $2,550,000. The Company’s net loss decreased $2,550,000 to $55,820,000. The net loss per share decreased by $0.02 per share to ($0.64) per share.

Item 15. Financial Statements and Exhibits

AmpliPhi Biosciences Corporation

Notes to Consolidated Financial Statements For The Years Ended December 31, 2013 and 2012

7. Preferred Shares, page F-12

| 2 |

| 3. | You state that “In connection with the private placement of Series B Convertible Preferred Stock, the Company recorded a liability for the conversion feature that contains a provision that protect holders from a decline in the issue price of the Company’s common stock (“down-round” provision). The Company estimates the fair values of the conversion feature using a Black Scholes valuation model. The Company measured the fair value of the conversion feature on June 26, 2013 and July 15, 2013 and recorded the initial liability as part of the private placement proceeds. The Company re-measured the fair value of the conversion feature and recorded $30,422,000 in total charges to record the liabilities associated with the conversion feature at their estimated fair value totaling $33,510,000 as of December 31, 2013.” We have the following comments: |

| · | Please provide us, citing specific authoritative literature, your detailed analysis that supports your conclusion that the Series B Convertible Preferred Stock contains an embedded derivative that required bifurcation. Tell us the feature of the conversion option that triggers liability classification and if you concluded that the preferred stock is an equity host or a debt host and the basis for your conclusion. |

RESPONSE:

We used ASC Section 815-15-25-1 to determine that the Series B Convertible Preferred Stock contains an embedded derivative that requires bifurcation. It states:

“An embedded derivative shall be separated from the host contract and accounted for as a derivative instrument pursuant to Subtopic 815-10: if and only if all of the following criteria are met:

a. The economic characteristics and risks of the embedded derivative are not clearly and closely related to the economic characteristics and risks of the host contract.

b. The hybrid instrument is not remeasured at fair value under otherwise applicable generally accepted accounting principles (GAAP) with changes in fair value reported in earnings as they occur.

c. A separate instrument with the same terms as the embedded derivative would, pursuant to Section 815-10-15:, be a derivative instrument subject to the requirements of this Subtopic. (The initial net investment for the hybrid instrument shall not be considered to be the initial net investment for the embedded derivative.)”

Criterion A – Section 4.4.4(f)(iv) of the Designation of Preferences, Rights and Limitations of Series B Preferred Stock states that if on any date after the preferred shares are issued any common stock shares are issued for “consideration per share less than the Current Conversion Price” then the conversion rate of the preferred shares would be adjusted. This would imply that the settlement amount is not fixed and therefore the preferred shares are not indexed to the Company’s own stock.

In this case, the embedded derivative is not clearly and closely related to the economic characteristics and risk of the host contract because the terms of the embedded feature provide for potential adjustment. In order to evaluate the “clearly and closely related criterion” we first looked to whether the derivative feature was considered indexed to the entity’s own stock. Although the guidance for evaluating whether an instrument is considered indexed to an entity’s own stock under ASC 815-40-15-5 through 15-8 is not required to be used in the assessment of clearly and closely related under ASC 815-15-25-1(a), we felt it provided additional evidence for evaluating the clearly and closely related criterion.

| 3 |

Step 2 in ASC 815-40-15-7C, states that an “instrument (or embedded feature) shall be considered indexed to an entity's own stock if its settlement amount will equal the difference between the following:

a. The fair value of a fixed number of the entity's equity shares

b. A fixed monetary amount or a fixed amount of a debt instrument issued by the entity.”

Due to the variable number of shares, we feel that the derivative is not clearly and closely related.

Criterion B – As the host instrument is preferred stock, it is not remeasured at fair value and therefore meets criterion B.

Criterion C – ASC 815-10-15-83, Definition of Derivative Instrument, defines a derivative instrument as “a financial instrument or other contract with all of the following characteristics:

a. Underlying, notional amount, payment provision. The contract has both of the following terms, which determine the amount of the settlement or settlements, and, in some cases, whether or not a settlement is required:

1. One or more underlyings

2. One or more notional amounts or payment provisions or both.

b. Initial net investment. The contract requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors.

c. Net settlement. The contract can be settled net by any of the following means:

1. Its terms implicitly or explicitly require or permit net settlement.

2. It can readily be settled net by a means outside the contract.

3. It provides for delivery of an asset that puts the recipient in a position not substantially different from net settlement.”

| 4 |

Free standing instruments with down-round price protection features are considered to be derivatives as they are a future promise to exchange a variable number of shares due to the down-round price protection. As such, the feature would independently be considered a derivative and meets Criteria C. The underlying is the fair value of the preferred share and the notional amount/payment provision is the face amount of the preferred shares. The preferred shares were purchased for an amount the Company believes to be the fair value of the preferred shares and not for the down-round protection, which equates to little to no initial net investment. Net settlement is done outside of the contract as the conversion is to common shares which are readily convertible to cash.

As the preferred stock’s conversion rate would be adjusted if the company issued equity at a price below the conversion price (“down-round” provisions), the feature is not solely indexed to the entity’s own stock and thus liability classification was deemed appropriate.

| · | Tell us why you believe the Black-Scholes valuation model appropriately valued the possible exercise price adjustments (“down-round” provision) features of the conversion feature. We believe that the potential exercise price revisions render single-path option pricing models, such as Black-Scholes, inappropriate. |

RESPONSE:

The methodology employed included a subjective assessment as to the likelihood of a “down” round of financing by the Company. We believe the probability for a down-round of financing by the Company, or issuing future shares at less than $0.14 per share, is minimal and close to zero. We understand that an open-form model, either a lattice model, binomial, or a Monte Carlo simulation may be better suited for situations where the probability of price adjustments associated to down-round financing is different than zero. However, we considered a close-form model such as Black-Scholes-Merton model, with a zero probability of down-round financing based on our professional judgment, to result in a reasonable estimate of fair value and consistent with GAAP as described in ASC 820. Furthermore, we believe that the use of alternate methodologies would not yield a result that would be materially different from that performed.

Multiple valuation methodologies are available, some more complex than others, in estimating fair value for a given asset or liability. We believe the selection of methodology is a function of:

| · | The complexity of the underlying parameters that need to be modeled and the availability of information to support those parameters | |

| · | The materiality of the ultimate result (as a function of those underlying parameters) | |

| · | The cost and effort entailed in employing a specific methodology |

| 5 |

We understand that multiple methodologies were at our disposal for valuing the conversion options, warrants or other type of derivatives — e.g., option pricing (Black-Scholes), simulation, and binomial lattice. Based on the considerations listed above, and the minimal probability of down-round financing, we believe that the more simplified methodology (Black-Scholes analysis) provided an adequate basis for reaching a fair value conclusion for the subject conversion features and warrants, even though the warrants are not “plain vanilla”. A more complex valuation methodology (such as a simulation model) would have suggested a level of “precision” where we believe none actually exists. We believe the incremental effort required for a more precise methodology such as a simulation analysis or binomial lattice did not justify the undue cost and effort required in using these methodologies when the estimated probability for a down-round of financing by the Company is minimal and close to zero.

Based on our belief that the differences in valuation models would most likely not be material and our belief that the probability of a down-round financing is minimal or close to zero, we believe our fair value estimates are reasonable.

| · | Your computation of the fair value of the conversion feature at inception and at December 31, 2013. |

RESPONSE:

The fair value computation of the conversion feature is set forth in Exhibit A.

| · | Disclose in Form 10/A how the $7 million proceeds was recorded. The statement of Stockholders’ Equity (Deficit) shows $50,000 and your disclosure appears to indicate a $3,088,000 liability was recognized ($30,510,000 - $30,422,000). Disclose in Form 10/A how the remaining $3,862,000 was recognized. |

RESPONSE:

Our disclosure in Amendment No. 3 has been updated to include the following:

On June 26, 2013, the Company issued 4,999,999 shares of the Company’s newly-created Series B Convertible Preferred Stock and warrants to purchase 12,499,996 shares of common stock at an exercise price of $0.14 per share for an aggregate purchase price of $6,999,998. The value of the derivative liability related to the warrants was $1,892,499 and the value of the derivative liability related to the preferred shares was $4,999,999. In addition, a beneficial conversion (deemed dividend) was booked for $2,892,499.

Note that during the year, 1.16 million preferred shares were converted to common shares and thus the amount attributed to the derivative liability of the preferred differs from the Staff’s calculation above. The additional disclosure related to these conversions is included in our response to the Staff’s next comment.

| 6 |

Below are the journal entries booked for the issuance:

| Dr. | Cr. | |||

| Cash | 6,999,998.60 | |||

| Preferred Shares | 100,160.80 | |||

| Derivative Liab - Warrant (cash shares) | 1,892,499.39 | |||

| Derivative Liab - Preferred (cash shares) | 4,999,999.00 | |||

| Convertible Loan Notes | 5,137,017.00 | |||

| Convertible Loan Note Interest | 346,658.59 | |||

| Derivative Liab - Warrant (CLN conversion) | 1,649,478.62 | |||

| Derivative Liab - Preferred (CLN conversion) | 3,841,536.38 | |||

| To Book June 26th Issuance of Shares | ||||

| Dr. | Cr. | |||

| Deemed Dividend | 2,892,499.19 | |||

| APIC - BCF | 2,892,499.19 | |||

| To Book Beneficial Conversion for cash shares | ||||

| Dr. | Cr. | |||

| Deemed Dividend | 3,131,161.22 | |||

| APIC - BCF | 3,131,161.22 | |||

| To Book Beneficial Conversion for CLN conversion |

| · | Disclose in Form 10/A the amount reclassified from liability to equity upon conversion of some of the preferred shares to common stock and when the conversion from preferred to common stock occurred. |

RESPONSE:

Our disclosure in Amendment No. 3 has been updated to include the following:

On July 25, 2013, 1,132,875 preferred shares were converted into 11,328,750 shares of common stock. In connection with the conversion, a loss on derivative of 4,395,555 was recorded in relation to the conversion. $5,664,375 was reclassified from the derivative liability to equity due to conversion.

On October 17, 2013, 23,227 preferred shares were converted into 232,270 shares of common stock. In connection with the conversion, a gain on the derivative liability was recorded in the amount of $1,625. Due to this conversion, $92,908 was reclassified out of the derivative liability account and into equity.

Below are the journal entries we recorded:

| 7/25 MTM | Debit | Credit | ||

| Loss on Derivative | 4,395,555.00 | |||

| Derivative Liability | 4,395,555.00 | |||

| 7 |

| 7/25 Conversion | Debit | Credit | ||

| Derivative Liability | 5,664,375.00 | |||

| Common Stock | 113,287.50 | |||

| APIC - CS | 5,551,087.50 |

| 10/17 MTM | Debit | Credit | ||

| gain on derivative | 1,625.89 | |||

| Derivative Liability | 1,625.89 | |||

| 10/17 Conversion | Debit | Credit | ||

| Derivative Liability | 92,908.00 | |||

| Common Stock | 2322.7 | |||

| APIC - CS | 90,585.30 |

8. Stock Options and Warrants, page F-13

| 4. | Please tell us why you believe the Black-Scholes valuation model appropriately valued the possible exercise price adjustments (“down-round” provision) features of the warrants. We believe that the potential exercise price revisions render single-path option pricing models, such as Black-Scholes, inappropriate. |

RESPONSE:

The methodology employed included a subjective assessment as to the likelihood of a “down” round of financing by the Company. We believe the probability for a down-round of financing by the Company, issuing future shares at less than $0.25 for the December warrants or $0.14 per share for the June and July 2013 warrants, is minimal and close to zero. We understand that an open-form model, either a lattice model, binomial, or a Monte Carlo simulation may be better suited for situations where the probability of price adjustments associated to down-round financing is different than zero. However, we considered a close-form model such as Black-Scholes-Merton model, with a zero probability of down-round financing based on our professional judgment, to result in a reasonable estimate of fair value and consistent with GAAP as described in ASC 820. Furthermore, we believe that the use of alternate methodologies would not yield a result that would be materially different from that performed.

| 8 |

Multiple valuation methodologies are available, some more complex than others, in estimating fair value for a given asset or liability. We believe the selection of methodology is a function of:

| · | The complexity of the underlying parameters that need to be modeled and the availability of information to support those parameters |

| · | The materiality of the ultimate result (as a function of those underlying parameters) |

| · | The cost and effort entailed in employing a specific methodology |

We understand that multiple methodologies were at our disposal for valuing the conversion options, warrants or other type of derivatives — e.g., option pricing (Black-Scholes), simulation, and binomial lattice. Based on the considerations listed above, and the minimal probability of down-round financing, we believe that the more simplified methodology (Black-Scholes analysis) provided an adequate basis for reaching a fair value conclusion for the subject conversion features and warrants, even though the warrants are not “plain vanilla”. A more complex valuation methodology (such as a simulation model) would have suggested a level of “precision” where we believe none actually exists. We believe the incremental effort required for a more precise methodology such as a simulation analysis or binomial lattice did not justify the undue cost and effort required in using these methodologies when the estimated probability for a down-round of financing by the Company is minimal and close to zero.

Based on our belief that the differences in valuation models would most likely not be material and our belief that the probability of a down-round financing is minimal or close to zero, we believe our fair value estimates are reasonable.

9. Business Combinations, page F-15

| 5. | In order to help us understand whether the patent and phage and bacterial banks do in fact have an indefinite life, please tell us whether: |

| · | the acquired company had ongoing R&D projects at the acquisition date and whether you actively pursued those R&D projects after the acquisition. |

RESPONSE:

Yes. Both acquired entities had ongoing R&D projects at the acquisition date and we pursued those projects after the acquisition and continue to do so.

| · | the patents and phage and bacterial banks were recognized finite life intangible assets in the pre-acquisition financial statements of the acquired business. |

RESPONSE:

No. Neither acquired business recognized the patents and phage and bacterial banks as finite life intangible assets in their pre-acquisition financial statements.

| 9 |

| · | (A) the patents and phage and bacterial banks lack the characteristic of incompleteness (i.e. whether they are complete), (B) they are intended to be used in not only existing R&D projects of the combined company, but also in currently identified future R&D projects, (C) they are being used in the manner they were intended, and (D) there are legal, regulatory or other factors that limit their life. If the characteristics in (A) through (D) exist, please help us understand why you believe it is appropriate to assign an indefinite life. |

RESPONSE:

(A)

The Accounting & Valuation Guide “Assets Acquired to be Used in Research and Development Activities” prepared by the IPR&D Task Force and updated as of May 1, 2013 (the “IPR&D Guide”) defines incompleteness as:

“Incompleteness means there are remaining risks (for example, technological or engineering) or certain remaining regulatory approvals at the date of acquisition. Overcoming those risks or obtaining the approvals requires that additional R&D costs are expected to be incurred.”

At the time of the identification of the phage and bacterial stocks, they were relevant to the circulating pathogens seen in the target infections in the targeted geographies. Our regulatory interactions have confirmed that we will consistently need to test the phage banks against currently circulating bacteria, as well as the existing banks of bacteria. Our ability to isolate and characterize relevant and effective phage will require that we build upon and use the acquired banks of phage and bacteria to finalize product selection for clinical development and eventual commercialization. There have been no bacteriophage therapies approved for human use and we anticipate additional R&D expenditures to finalize our final product selection.

The patents can be an important enhancement to our R&D activities as they highlight the potential of bacteriophage to enhance subsequent treatment using traditional antibiotics. The development of biofilm is one of the bacterial targets innate defense mechanisms. We plan to initially test and gain regulatory approval for bacteriophage as an additive to existing antibacterial therapies.

(B)

The current patents and phage and bacterial banks are only being used in existing R&D projects.

(C)

The intended use of the phage and bacteria bank and patented technology is to produce an FDA-approved treatment of bacteriophage preparations.

| 10 |

(D)

The phage and bacteria banks do not have any legal, regulatory or other factors that limit their life.

According to section 2.37 of the IPR&D Guide:

“[T]he task force believes that to the extent that individually completed intangible assets are solely and directly related to IPR&D projects that are still in development (for example, in the pharmaceutical industry, a patent on a compound that has not yet been approved), such assets may be aggregated with other intangible assets used in R&D activities. That is, an acquirer would recognize one asset for each IPR&D project, which would comprise all the intangible assets used exclusively in that project, and that asset would be assigned an indefinite useful life.”

In summary, we considered that the acquired phage and bacterial banks are solely and directly related to IPR&D projects that involve a planned search and critical investigation aimed at discovery of new knowledge with the hope that such knowledge will be useful in developing bacteriophage therapeutic programs for the treatment of a broad range of infections toward full FDA approval. As such, we considered section 2.37 of the IPR&D guide to apply and as such the acquired patents and phage and bacterial banks were recognized as part of the IPR&D project.

| · | the patent and phage and bacterial banks represent assets resulting from research and development and the reasons why or why not. |

RESPONSE:

Yes. The patent and phage and bacterial banks represent assets resulting from research and development. The phage and bacteria were internally identified, isolated, and characterized to develop the proprietary banks of phage and bacteria and continue to be developed.

12. Convertible Loan Notes, page F-16

| 6. | Disclose in Form 10/A related to the $2,630,000 amortization of note discount expense recognized in 2013 the amount related to warrants separately from the amount related to the beneficial conversion feature. Provide us your computation of the beneficial conversion feature. |

RESPONSE:

Our computation for the beneficial conversion feature is set forth in detail in Exhibit B.

| 11 |

The following disclosure has also been included in Amendment No. 3:

The cash proceeds from the notes payable was allocated between the note payable, a debt discount, APIC and the beneficial conversion feature as follows:

| February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | |||||||||||||

| Cash | $ | 2,437,016 | $ | 500,000 | $ | 500,000 | $ | 500,000 | ||||||||

| Note Payable | -2,437,016 | -500,000 | -500,000 | -500,000 | ||||||||||||

| Debt Discount | 1,915,737 | 154,771 | 92,076 | 473,698 | ||||||||||||

| APIC – Warrant | -696,760 | -104,171 | -92,076 | -156,492 | ||||||||||||

| APIC - BCF | -1,218,977 | 50,600 | 0 | -317,206 | ||||||||||||

* * *

The Company acknowledges that:

| (1) | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| (2) | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| (3) | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We appreciate your time and attention to the Company’s response to the Staff’s comments. Please contact the undersigned at (650) 888-2422 with any further comments or questions you may have.

| Sincerely, | ||

| AMPLIPHI BIOSCIENCES | ||

| CORPORATION. | ||

| /s/ Philip J. Young | ||

| Philip J. Young | ||

| President and Chief Executive Officer | ||

| AmpliPhi Biosciences Corporation | ||

| cc: | Amy Reischauer |

Bryan Pitko

Stephen Thau, Morrison & Foerster LLP

| 12 |

EXHIBIT A

Summary of Terms - Series B Preferred Stock Conversion Feature1

| Date of Issuance | June 26, 2013 | July 15, 2013 |

| Expected Life | Management has indicated that the Expected Life of the Conversion Feature is to be 1 year from the Date of Issuance |

| Conversion Price | The initial Conversion Price shall mean $1.40 and shall be adjusted each time there is an adjustment in the Series B Preferred Conversion Ratio to equal the Conversion Price Divided by the Conversion Ratio. |

| Conversion Ratio | The initial Series B Preferred Conversion rate shall be 10 shares of common stock per each share of preferred stock. |

| Calculation of Exercise Price | $1.40 | = | $0.14 |

| 10 |

| Number of Preferred shares issued | June 26, 2013 | July 15, 2013 | ||

| 5,000,000 | 5,000,000 |

Footnotes:

[1] Sourced from “Designation of Preferences, Rights, and Limitations of Series B Convertible Preferred Stock”.

| A-1 |

Black-Scholes Option Pricing Model

| Maturity Date: | |

| First Closing | June 26, 2014 |

| Second Closing | July 15, 2014 |

| June 26, 2013 | June 30, 2013 | July 15, 2013 | September 30, 2013 | December 31, 2013 | ||||||||||||||||||||||||

| Input Variables | First Closing | First Closing | Second Closing | First Closing | Second Closing | First Closing | Second Closing | |||||||||||||||||||||

| Stock closing price1 | $ | 0.16 | $ | 0.18 | $ | 0.40 | $ | 0.51 | $ | 0.51 | $ | 0.50 | $ | 0.50 | ||||||||||||||

| Exercise price2 | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | $ | 0.14 | ||||||||||||||

| Expected Life3 | 1.00 | 0.99 | 1.00 | 0.74 | 0.79 | 0.48 | 0.54 | |||||||||||||||||||||

| Volatility4 | 168 | % | 168 | % | 169 | % | 170 | % | 170 | % | 165 | % | 165 | % | ||||||||||||||

| Discount Rate5 | 0.15 | % | 0.15 | % | 1.40 | % | 0.07 | % | 0.07 | % | 0.10 | % | 0.10 | % | ||||||||||||||

| Call Price per Black-Scholes | $ | 0.10 | $ | 0.11 | $ | 0.32 | $ | 0.40 | $ | 0.41 | $ | 0.38 | $ | 0.38 | ||||||||||||||

| times: 10 common per each preferred | 10 | 10 | 10 | 10 | 10 | 10 | 10 | |||||||||||||||||||||

| Conversion FV per Preferred Share | $ | 1.000 | $ | 1.120 | $ | 3.150 | $ | 4.040 | $ | 4.070 | $ | 3.780 | $ | 3.810 | ||||||||||||||

| x | ||||||||||||||||||||||||||||

| Number of Series B Convertible Preferred St | 9,357,935 | |||||||||||||||||||||||||||

| Fair Value of Conversion Option | $ | 9,357,935 | ||||||||||||||||||||||||||

Footnotes:

[1] Stock Closing Price sourced from S&P Capital IQ

[2] The Exercise Price sourced from "Designation of Preferences, Rights, and Limitations of Series B Convertible Preferred Stock".

[3] Although the optional redemption term if 5 years per section 4.4.5. of the "Designation of Preferences, Rights, and Limitations of Series B Convertible Preferred Stock", Management has indicated that the Expected Life of the Conversion Feature is to be 1 year from the Date of Issuance

[4] Volatility calculated as shown on Schedule 3

[5] Discount Rate calculated as shown on Schedule 4

| A-2 |

Annualized Volatility

| Company Name | June 26, 2013 | June 30, 2013 | July 15, 2013 | September 30, 2013 | December 31, 2013 | |||||||||||||||||||||||

| First Closing | First Closing | Second Closing | First Closing | Second Closing | First Closing | Second Closing | ||||||||||||||||||||||

| Expected Life1 | 1.00 | 0.99 | 1.00 | 0.74 | 0.79 | 0.48 | 0.54 | |||||||||||||||||||||

| AmpliPhi Biosciences Corporation (OTCPK:APHB) | 168 | % | 168 | % | 169 | % | 170 | % | 170 | % | 165 | % | 165 | % | ||||||||||||||

| Synthetic Biologics Inc. (AMEX:SYN) | 146 | % | 146 | % | 146 | % | 144 | % | 144 | % | 131 | % | 131 | % | ||||||||||||||

| Nutra Pharma Corporation (OTCPK:NPHC) | 217 | % | 217 | % | 218 | % | 217 | % | 217 | % | 214 | % | 214 | % | ||||||||||||||

| Keryx Biopharmaceuticals Inc. (NasdaqCM:KERX) | 126 | % | 126 | % | 126 | % | 125 | % | 125 | % | 108 | % | 108 | % | ||||||||||||||

| Low | 126 | % | 126 | % | 126 | % | 125 | % | 125 | % | 108 | % | 108 | % | ||||||||||||||

| Mean | 164 | % | 164 | % | 165 | % | 164 | % | 164 | % | 154 | % | 154 | % | ||||||||||||||

| Median | 157 | % | 157 | % | 157 | % | 157 | % | 157 | % | 148 | % | 148 | % | ||||||||||||||

| High | 217 | % | 217 | % | 218 | % | 217 | % | 217 | % | 214 | % | 214 | % | ||||||||||||||

Footnotes:

[1] We calculated the volatility of the historical prices for the 12 month period for the valuation dates June through September. For December 31, 2013 we calcualted volatility using the 6 month historical prices.

Source: S&P Capital IQ

Annualized Volatility calculated on a daily basis based on historical data.

We calculated the volatility of similar companies to test the reasonableness of the volatility calculated for AmpliPhi Biosciences Corporation.

| A-3 |

Risk Free Rate

|

|

| Valuation Date | June 26, 2013 | June 30, 2013 | July 15, 2013 | September 30, 2013 | December 31, 2013 | |||||||||||||||||||||||

| First Closing | First Closing | Second Closing | First Closing | Second Closing | First Closing | Second Closing | ||||||||||||||||||||||

| Expected Life1 | 1.00 | # | 0.99 | # | 1.00 | # | 0.74 | # | 0.79 | # | 0.48 | # | 0.54 | |||||||||||||||

| 6 Month Risk Free Rate | 0.11 | % | 0.10 | % | 0.07 | % | 0.04 | % | 0.04 | % | 0.10 | % | 0.10 | % | ||||||||||||||

| 1 Year Risk Free Rate | 0.150 | % | 0.15 | % | 0.11 | % | 0.10 | % | 0.10 | % | 0.13 | % | 0.13 | % | ||||||||||||||

| Selected Risk Free Rate | 0.15 | % | 0.15 | % | 0.11 | % | 0.07 | % | 0.07 | % | 0.10 | % | 0.10 | % | ||||||||||||||

Footnotes:

[1] We matched the Expected life to the date ranges used in

our volatility calculation.

Source: https://www.federalreserve.gov/releases/h15/data.htm

| A-4 |

EXHIBIT B

Summary of Terms - Convertible Promissory Notes1

| Issuer | AmpliPhi Biosciences Corporation |

| Lender | Pendinas Limited |

| Date of Issuance | February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | ||||||||||||

| Maturity Date | February 4, 2014 | March 12, 2014 | April 12, 2014 | May 13, 2014 | ||||||||||||

| Interest Rate | 10.00 | % | 10.00 | % | 10.00 | % | 10.00 | % | ||||||||

| Convertible Shares @ $0.14 per Share2 | 17,407,254 | 3,571,429 | 3,571,429 | 3,571,429 | ||||||||||||

| Principal Amount | $ | 2,437,016 | $ | 500,000 | $ | 500,000 | $ | 500,000 | ||||||||

| Fair Value of Warrants3 | 696,760 | 104,171 | 92,076 | 156,492 | ||||||||||||

| Balance Allocated to Note Payables | $ | 1,740,256 | $ | 395,829 | $ | 407,924 | $ | 343,508 | ||||||||

| Effective Conversion Price4 | 0.10 | 0.11 | 0.11 | 0.10 | ||||||||||||

| Stock price per share5 | 0.17 | 0.13 | 0.11 | 0.19 | ||||||||||||

| Intrinsic Value per Share6 | 0.07 | 0.01 | - | 0.09 | ||||||||||||

| Fair Value of Beneficial Conversion Feature (BCF)7 | 1,218,977 | 50,600 | - | 317,206 | ||||||||||||

| Allocation of proceeds | ||||||||||||||||

| Cash | $ | 2,437,016 | $ | 500,000 | $ | 500,000 | $ | 500,000 | ||||||||

| Notes Payable | 521,278 | 345,229 | 407,924 | 26,303 | ||||||||||||

| Additional Paid-in Capital - Warrant | 696,760 | 104,171 | 92,076 | 156,492 | ||||||||||||

| Additional Paid-in Capital - BCF | 1,218,977 | 50,600 | - | 317,206 | ||||||||||||

| Note Discount that would need to be Amortized | $ | 1,915,737 | $ | 154,771 | $ | 92,076 | $ | 473,697 | ||||||||

Footnotes:

[1] Unless noticed otherwise the information regarding the convertible promissory notes was derived from the Note Agreements provided by Management.

[2] The Convertibles Shares = Principal Amount ÷ $0.14 conversion price

[3] Refer to schedule 3 for Fair Value of warrants

[4] Effective Conversion price = Balance Allocated to Notes payables ÷ Convertible Shares

[5] Stock price per share sourced from S&P Capital IQ as shown on Schedule 4

[6] Intrinsic Value per Share = Stock Price - Effective Conversion Price

[7] Beneficial Conversion Feature = Intrinsic Value per Share x Convertible Shares

| B-1 |

WARRANT SUMMARY OF TERMS

Summary of Terms - Common Stock Purchase Warrant

| Issuer1 | AmpliPhi Biosciences Corporation |

| Holder1 | Pendinas Limited |

| Date of Issuance1 | February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | ||||||||||||

| Maturity Date1 | February 4, 2018 | March 12, 2018 | April 12, 2018 | May 13, 2018 | ||||||||||||

| The warrants and the right to purchase securities upon exercise shall terminate 5 years from the date of issuance. The warrants may be exercised by the holder at any time leading up to the maturity date. | ||||||||||||||||

| Conversion Shares1 | 4,351,816 | 892,857 | 892,857 | 892,857 | ||||||||||||

| Exercise Price1 | $ | 0.140 | $ | 0.140 | $ | 0.140 | $ | 0.140 | ||||||||

| Risk Free Rate2 | 0.850 | % | 0.880 | % | 0.700 | % | 0.830 | % | ||||||||

| Footnotes: |

[1] Information relating to the terms of the warrants derived from the Common Stock Purchase Agreement for each of the dates of issuance.

[2] Risk free rate for each valuation date derived from the market yield on U.S. Treasury Securities at 5 year constant maturity as shown on Schedule 5.

| B-2 |

| BLACK SCHOLES MODEL-WARRANT VALUATION |

| Black-Scholes Option Pricing Model |

| Date of Issuance | February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | ||||||||||||

| Input Variables | ||||||||||||||||

| Stock price per share1 | $ | 0.170 | $ | 0.125 | $ | 0.111 | $ | 0.185 | ||||||||

| Exercise price2 | $ | 0.140 | $ | 0.140 | $ | 0.140 | $ | 0.140 | ||||||||

| Expected Life2 | 5.00 | 5.00 | 5.00 | 5.00 | ||||||||||||

| Volatility3 | 164.68 | % | 165.44 | % | 165.45 | % | 167.00 | % | ||||||||

| Discount rate4 | 0.850 | % | 0.880 | % | 0.700 | % | 0.830 | % | ||||||||

| Call Price per Black-Scholes | $ | 0.1601 | $ | 0.1167 | $ | 0.1031 | $ | 0.1753 | ||||||||

| Fair value per warrant share | $ | 0.1601 | $ | 0.1167 | $ | 0.1031 | $ | 0.1753 | ||||||||

| x | x | x | x | |||||||||||||

| Warrant shares issued | 4,351,816 | 892,857 | 892,857 | 892,857 | ||||||||||||

| Fair value of warrant shares | $ | 696,760 | $ | 104,171 | $ | 92,076 | $ | 156,492 | ||||||||

| Footnotes: |

[1] Stock price per share sourced from S&P Capital IQ as shown on Schedule 3

[2] Sourced from the Common Stock Purchase Warrant for each of the dates of issuance.

[3] Volatility calculated as shown on Schedule 4.

[4] Discount Rate calculated as shown on Schedule 5

| B-3 |

| STOCK PRICE |

| Stock Price as of Date of Issuance |

| February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | |||||||||||

| Stock Price | 0.1700 | Stock Price | 0.1250 | Stock Price | 0.1110 | Stock Price | 0.1850 | |||||||

| Feb-04-2013 | 0.1700 | Mar-12-2013 | 0.1250 | Apr-12-2013 | 0.1110 | May-13-2013 | 0.1850 | |||||||

| Feb-01-2013 | 0.1350 | Mar-11-2013 | 0.1250 | Apr-11-2013 | 0.1140 | May-10-2013 | 0.1750 | |||||||

| Jan-31-2013 | 0.1400 | Mar-08-2013 | 0.1300 | Apr-10-2013 | 0.1140 | May-09-2013 | 0.1750 | |||||||

| Jan-30-2013 | 0.1400 | Mar-07-2013 | 0.1300 | Apr-09-2013 | 0.1100 | May-08-2013 | 0.1550 | |||||||

| Jan-29-2013 | 0.1400 | Mar-06-2013 | 0.1250 | Apr-08-2013 | 0.1047 | May-07-2013 | 0.1501 | |||||||

| Footnotes: |

| Source: S&P Capital IQ |

| B-4 |

| VOLATILITY CALCULATION |

Annualized Volatility

| Company Name | February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | ||||||||||||

| AmpliPhi Biosciences Corporation (OTCPK:APHB) | 165 | % | 165 | % | 165 | % | 167 | % | ||||||||

Synthetic Biologics Inc. (AMEX:SYN) | 148 | % | 147 | % | 146 | % | 146 | % | ||||||||

Nutra Pharma Corporation (OTCPK:NPHC) | 217 | % | 216 | % | 217 | % | 217 | % | ||||||||

Keryx Biopharmaceuticals Inc. (NasdaqCM:KERX) | 165 | % | 128 | % | 127 | % | 127 | % | ||||||||

| Low | 148 | % | 128 | % | 127 | % | 127 | % | ||||||||

| Mean | 174 | % | 164 | % | 164 | % | 164 | % | ||||||||

| Median | 165 | % | 156 | % | 156 | % | 157 | % | ||||||||

| High | 217 | % | 216 | % | 217 | % | 217 | % |

Footnotes:

Source: S&P Capital IQ

Annualized Volatility calculated on a daily basis based on a 5 year historical data.

We calculated the volatility of similar companies to test the reasonableness of the volatility calculated for AmpliPhi Biosciences Corporation.

| B-5 |

| RISK FREE RATE |

Risk Free Rate

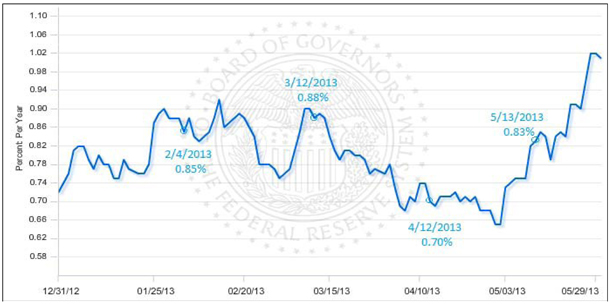

The Board of Governors of the Federal Reserve System publishes weekly the H.15 release. The H.15 release contains daily interest rates for selected U.S. Treasury and private money market and capital market instruments.

Risk free rates for each date of issuance derived from the market yield on U.S. Treasury Securities at a 5 year constant maturity as found in the H.15 release, quoted on an investment basis.

| Date of Issuance | February 4, 2013 | March 12, 2013 | April 12, 2013 | May 13, 2013 | ||||||||||||

| Market yield on U.S. Treasury securities at 5-year constant maturity | 0.850 | % | 0.880 | % | 0.700 | % | 0.830 | % | ||||||||

Footnotes:

Source: https://www.federalreserve.gov/releases/h15/data.htm

| B-6 |