SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No.)

Check the appropriate box:

☐ | Preliminary Information Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

☒ | Definitive Information Statement |

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

SOUTHERN CALIFORNIA GAS COMPANY

NOTICE OF

ANNUAL SHAREHOLDERS MEETING

The Southern California Gas Company (SoCalGas or the company) 2024 annual meeting of shareholders (Annual Shareholders Meeting) will be held on May 30, 2024, at 10 a.m., local time, at 488 8th Avenue, San Diego, California. SoCalGas is an indirect subsidiary of Sempra.

The Annual Shareholders Meeting will be held for the following purposes:

(1) | To elect the four director nominees named in the accompanying Information Statement. |

(2) | To transact any other business that may properly come before the meeting. |

The Annual Shareholders Meeting will be a business-only meeting. It will not include any presentations by management and the company does not encourage shareholder attendance. Additional information about the company is included in the 2023 Annual Report to Shareholders, which is being mailed to shareholders together with this Notice of Annual Shareholders Meeting and the accompanying Information Statement.

Shareholders of record at the close of business on April 1, 2024, are entitled to notice of, to vote at and to attend the Annual Shareholders Meeting and any adjournment or postponement thereof. Shareholders who decide to attend the meeting and own shares registered in their names will be admitted upon verification of record share ownership. Shareholders who decide to attend the meeting and own shares through banks, brokers or other nominees must present proof of beneficial share ownership (such as the most recent account statement prior to April 1, 2024) to be admitted.

Jennifer A. DeMarco

Corporate Secretary

Important Notice Regarding the Availability of Information Statement Materials for the

Annual Shareholders Meeting to be Held on May 30, 2024.

The Information Statement

and the Annual Report to Shareholders are available on the Internet at

https://www.edocumentview.com/SoCalGas.

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

Southern California Gas Company is providing this Information Statement in connection with the 2024 annual meeting of its shareholders (Annual Shareholders Meeting) to be held on May 30, 2024, at 10 a.m., local time, at 488 8th Avenue, San Diego, California. The Notice of Annual Shareholders Meeting, this Information Statement and the 2023 Annual Report to Shareholders are being sent or given to shareholders beginning on or about April 25, 2024.

THE COMPANY

Southern California Gas Company, which we refer to as SoCalGas, the company, we, us or our, is an indirect subsidiary of Sempra. SoCalGas’ principal executive offices are located at 555 West 5th Street, Los Angeles, California 90013. Its telephone number is (213) 244-1200.

Additional information about the company is included in the 2023 Annual Report to Shareholders (2023 Annual Report) jointly produced by Sempra and SoCalGas, which is being mailed to shareholders together with this Information Statement. The 2023 Annual Report includes the company’s Annual Report on Form 10-K for the year ended December 31, 2023 (2023 Form 10-K), which has been filed with the U.S. Securities and Exchange Commission (SEC) jointly by Sempra, SoCalGas and Sempra’s other indirect subsidiary with U.S. publicly traded securities, San Diego Gas & Electric Company (SDG&E). These documents, as well as other documents SoCalGas files with the SEC, can be viewed on the Internet on the SEC’s website at www.sec.gov and are available on the Sempra website at www.sempra.com under the “Investors” and “SEC Filings” tabs. The company also will furnish a copy of its 2023 Form 10-K (excluding exhibits, except those that are specifically requested) without charge to any shareholder who so requests by writing to the company’s Corporate Secretary at 488 8th Avenue, San Diego, California 92101.

All website references in this Information Statement are inactive textual references, and the information on, or that can be accessed through, such websites does not constitute a part of this Information Statement.

OUTSTANDING SHARES AND VOTING RIGHTS

The SoCalGas Board of Directors has fixed April 1, 2024, as the record date for determining the shareholders of SoCalGas entitled to notice of and to vote at the Annual Shareholders Meeting and any adjournment or postponement thereof. On that date, SoCalGas’ outstanding shares consisted of 91,300,000 shares of common stock and 862,043 shares of preferred stock. All SoCalGas common stock and 50,970 shares of SoCalGas preferred stock are owned by Pacific Enterprises (PE), a wholly owned direct subsidiary of Sempra.

In electing directors, each share is entitled to one vote on each of the four director positions. Shareholders will be entitled to cumulate votes for the election of directors if any shareholder gives notice of an intention to do so at the meeting and prior to the voting. If that notice is given, all shareholders may cast all of their votes for any one director candidate whose name has been placed in nomination prior to the voting or may distribute their votes among two or more such candidates in such proportions as they may determine. In voting on any other matters that may be considered at the Annual Shareholders Meeting and any adjournment or postponement thereof, each share is entitled to one vote. The company does not expect there to be any broker non-votes at the Annual Shareholders Meeting. However, if there are any broker non-votes, each will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Shareholders Meeting and any adjournment or postponement thereof, but will not be considered a vote cast with respect to the election of directors or any other proposal for which it occurs.

The shares of SoCalGas owned by PE and indirectly owned by Sempra represent over 99% of SoCalGas’ outstanding shares and the number of votes entitled to be cast on the matters to be considered at the Annual Shareholders Meeting and any adjournment or postponement thereof. PE has advised SoCalGas that it intends to vote “FOR” each of the four nominees named in this Information Statement for election to the SoCalGas Board of Directors.

1 |

GOVERNANCE OF THE COMPANY

Generally, the business and affairs of SoCalGas are managed and all corporate powers are exercised by or under the direction of its Board of Directors in accordance with California General Corporation Law and SoCalGas’ Restated Articles of Incorporation and Bylaws, as amended.

Board of Directors

Board Meetings; Annual Shareholders Meeting

During 2023, the Board of Directors of SoCalGas held 16 meetings and each incumbent director attended at least 75% of the aggregate number of such meetings and of each committee of which the director was a member (in each case during the periods when he or she was a member).

The Annual Shareholders Meeting will be a business-only meeting without presentations by management. The company does not encourage attendance at the meeting by public shareholders. The Board of Directors encourages all nominees standing for election as directors to attend the Annual Shareholders Meeting. All directors in office as of the SoCalGas 2023 annual shareholders meeting attended that meeting. You may request directions to the location of the Annual Shareholders Meeting if you choose to attend in person by contacting the company’s Corporate Secretary at 488 8th Avenue, San Diego, California 92101.

Leadership Structure

Trevor I. Mihalik, Sempra’s Executive Vice President and Group President responsible for overseeing Sempra’s California utility businesses, serves as non-executive Chairman of our board. The board does not have an independent lead director. As a subsidiary of Sempra with none of its classes of stock listed on a national securities exchange, SoCalGas is not subject to stock exchange listing standards requiring independent directors and various board committees and, accordingly, has not established independence standards for its directors. All of the directors of the company are also officers of the company or of Sempra and, as a result, none qualifies as an independent director under the standards established by the New York Stock Exchange (NYSE) or any other national securities exchange for boards of directors or committees thereof.

Two standing committees, a Compensation Committee and a Safety Committee, assist the board in carrying out its responsibilities. In 2024, the SoCalGas Board of Directors established a Compensation Committee to assist the board in discharging its responsibilities relating to oversight of the evaluation and compensation of the company’s executives. The Compensation Committee operates under a written charter adopted by the board, a copy of which is set forth as Appendix A to this Information Statement. The duties of the Safety Committee are described below. The SoCalGas Board of Directors does not maintain an audit or nominating committee.

Nominees for election as directors are determined by the SoCalGas Board of Directors, and the board will not consider director candidates recommended by shareholders other than its direct and indirect parent companies. The board currently consists of Scott D. Drury, Chief Executive Officer (CEO) of SoCalGas, and three officers of Sempra with broad professional and business expertise. The board has nominated the four current directors for reelection to the board at the Annual Shareholders Meeting. Although Sempra and SoCalGas promote diversity in hiring employees and in the appointment of their officers, diversity is not further considered in selecting the individuals who serve as directors of SoCalGas.

All but one of the members of Sempra’s Board of Directors is an independent director under NYSE independence standards, and the Audit, Compensation and Talent Development, Corporate Governance and Safety, Sustainability and Technology Committees of Sempra’s Board of Directors are all entirely composed of independent directors. The Sempra Board of Directors also has adopted a Code of Business Conduct and Ethics for Directors and Principal and Executive Officers that applies to some of the current directors and certain of the executive officers of SoCalGas, and all directors and officers of SoCalGas also are subject to a Code of Business Conduct that applies to all employees of SoCalGas and Sempra. If either (i) a provision of such Code of Business Conduct and Ethics for Directors and Principal and Executive Officers is amended and the amendment relates to any element of the code of ethics definition set forth in Item 406(b) of SEC Regulation S-K or (ii) a waiver, including an implicit waiver, from a provision of such Code of Business Conduct and Ethics for Directors and Principal and Executive Officers is granted to our principal executive officer, principal financial officer or principal accounting officer or controller and the waiver relates to one or more of the elements of the code of ethics definition set forth in Item 406(b) of SEC Regulation S-K, then we intend to describe on our website under the “About Us” and “Management Team” tabs the date and nature of any such amendment or waiver and, if applicable, the name of the person to whom the waiver was granted, or if we do not make such disclosure on our website, we will include it in a current report on Form 8-K filed with the SEC.

Board Role in Risk Oversight

Assessing and monitoring risks and risk management are among the functions of the SoCalGas Board of Directors. SoCalGas’ management, including the company’s Vice President, Chief Risk & Compliance Officer, is responsible for identifying and assessing risk, and monitoring and reporting to the SoCalGas Board of Directors on the company’s plans to manage risk. Risk oversight at the management level is governed by the Enterprise Risk Management Committee, which is composed of senior management and chaired by the Chief Risk & Compliance Officer and is responsible for establishing, overseeing, periodically reviewing and working to improve upon enterprise risk management policies and practices across SoCalGas. Other management-level governing bodies also are tasked with reviewing, monitoring and mitigating risk, including SoCalGas’

2 |

Energy Procurement Risk Management Committee, which is composed of members of senior management and chaired by the Chief Financial Officer and is responsible for the adoption, oversight, periodic review and enforcement of a comprehensive risk management framework governing energy trading activities conducted by the company’s gas acquisition department.

The SoCalGas Board of Directors has ultimate responsibility for risk oversight. The board fulfills its risk oversight function by, among other things, reviewing and overseeing the company’s strategic, financial and operating plans; receiving and reviewing other direct reports from management and discussing major risk categories with management on at least an annual basis or as needed due to changes in risk profiles; receiving periodic updates from the Chief Risk & Compliance Officer; and staying informed about developments in our industry and other current events that may impact the company. Additionally, the board may utilize committees to focus on specific risk areas. For example, the board has established a Safety Committee whose purpose is to advise and assist the board in the oversight of safety matters that affect the company, including matters related to employee, contractor, public and infrastructure safety, and with responsibilities that include, among other things, reviewing and monitoring the company’s safety culture, goals, and risks; the company’s risk management and oversight programs related to such safety matters; safety-related incidents and the measures and strategies taken by management to prevent, mitigate or respond to such incidents; and the company’s safety performance metrics. The board also believes that its leadership structure, with Sempra’s Executive Vice President and Group President responsible for overseeing Sempra’s California utility businesses serving as Chairman of our Board of Directors, supports the board’s risk oversight function by facilitating the allocation of risk-related functions between the board and management, with management having responsibility for implementing and supervising risk management processes and the board having responsibility for overseeing these matters.

Compensation Committee Interlocks and Insider Participation

During 2023, the SoCalGas Board of Directors was responsible for determining executive compensation for the company. Scott D. Drury, CEO of SoCalGas, and Lisa Larroque Alexander and Diana L. Day, each former officers of SoCalGas prior to 2023, are members of the board and participated in the board’s deliberations concerning executive compensation. Mr. Drury did not determine or approve any element or component of his own compensation, nor was he present during the board’s deliberations regarding his compensation.

In 2024, the SoCalGas Board of Directors delegated responsibility for executive compensation to the Compensation Committee of the board. The members of the Compensation Committee are Ms. Day, Mr. Drury and Trevor I. Mihalik. Other than Ms. Day, a former officer of SoCalGas, and Mr. Drury, a current officer of SoCalGas, none of the members of the Compensation Committee is currently, or has at any time been, an officer or employee of SoCalGas. None of the company’s executive officers currently serves, or has served during the past fiscal year, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has one or more executive officers serving as a member of the SoCalGas Board of Directors or the Compensation Committee of the board.

Related Person Transactions

SEC rules require that SoCalGas describe any transaction since the beginning of 2023 or any currently proposed transaction, in each case involving more than $120,000, in which the company was or will be a participant and any of its directors, director nominees, executive officers, persons or entities known by the company to be a beneficial owner of more than 5% of the company’s common stock, or any member of their respective immediate families, had or will have a direct or indirect material interest. The SoCalGas Board of Directors has adopted a written policy that requires the board to review and approve any such “related person transaction” that is required to be disclosed. When evaluating any such transaction, the board focuses on a variety of factors on a case-by-case basis, which may include, among other things, the identity of the related person, the nature and terms of the transaction, the interest of the related person in the transaction and the dollar amount involved.

There have been no transactions requiring such review since the beginning of 2023.

Communications with the Board

Shareholders and other interested parties who wish to communicate with the SoCalGas Board of Directors or any individual director may do so by writing to the company’s Corporate Secretary at 488 8th Avenue, San Diego, California 92101 and addressing the communication to the SoCalGas Board of Directors or the individual director.

Compensation of Directors

All of our directors are employees of SoCalGas or Sempra and are not otherwise compensated for their service on the SoCalGas Board of Directors.

3 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Representatives of Deloitte & Touche LLP, the independent registered public accounting firm for SoCalGas, are expected to attend the Annual Shareholders Meeting. They will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from shareholders. Deloitte & Touche LLP or its predecessors have served as the independent registered public accounting firm for SoCalGas or its parent company continuously since 1937. Deloitte & Touche LLP also serves as the independent registered public accounting firm for Sempra and SDG&E.

The following table shows fees paid to Deloitte & Touche LLP for services provided to SoCalGas for 2023 and 2022:

| | | 2023 | | | 2022 | |||||||

(Dollars in Thousands) | | | Fees | | | % of Total | | | Fees | | | % of Total |

Audit fees | | | | | | | | | ||||

Financial statements and internal controls audit | | | $3,970 | | | | | $3,549 | | | ||

Regulatory filings and related services | | | 85 | | | | | 130 | | | ||

Total audit fees | | | 4,055 | | | 90% | | | 3,679 | | | 92% |

Audit-related fees | | | | | | | | | ||||

Employee benefit plan audits | | | 304 | | | | | 287 | | | ||

Other audit-related services(A) | | | 115 | | | | | — | | | ||

Total audit-related fees | | | 419 | | | 9% | | | 287 | | | 7% |

Tax fees(B) | | | 46 | | | 1% | | | 17 | | | 1% |

All other fees | | | — | | | | | — | | | ||

Total fees | | | $4,520 | | | 100% | | | $3,983 | | | 100% |

(A) | Other audit-related services primarily relate to statutory audits and agreed upon procedures. |

(B) | Tax fees relate to tax consulting and compliance services. |

The Audit Committee of Sempra’s Board of Directors is directly responsible for the appointment, compensation, retention and oversight, including the oversight of the audit fee negotiations, of the independent registered public accounting firm for Sempra and its subsidiaries, including SoCalGas. As a matter of good corporate governance, the SoCalGas Board of Directors also reviewed the performance of Deloitte & Touche LLP and concurred with the determination by Sempra’s Audit Committee to retain the firm as its independent registered public accounting firm for 2024. Sempra’s Board of Directors has determined that each member of its Audit Committee is an independent director and is financially literate and that Jack T. Taylor, who chairs the committee, is an audit committee financial expert as defined by the rules of the SEC.

Except where pre-approval is not required by SEC rules, Sempra’s Audit Committee pre-approves all audit, audit-related and permissible non-audit services provided by Deloitte & Touche LLP for Sempra and its subsidiaries, including SoCalGas, which includes all services provided by Deloitte & Touche LLP for SoCalGas in 2023 and 2022. The committee’s pre-approval policies and procedures provide for the general pre-approval of specific types of services and give detailed guidance to management as to the services that are eligible for general pre-approval, and they require specific pre-approval of all other permitted services. For both types of pre-approval, the committee considers whether the services to be provided are consistent with maintaining the firm’s independence. The committee’s policies and procedures also delegate authority to the Chair of the committee to address any requests for pre-approval of services between committee meetings, with any pre-approval decisions to be reported to the committee at its next scheduled meeting.

4 |

AUDIT REPORT

The Board of Directors of SoCalGas has reviewed and discussed with the company’s management the audited financial statements of the company for the year ended December 31, 2023.

Sempra’s Audit Committee has discussed with Deloitte & Touche LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the U.S. Securities and Exchange Commission. Sempra’s Audit Committee also has received from Deloitte & Touche LLP the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding its communications with Sempra’s Audit Committee concerning Deloitte & Touche LLP’s independence, and Sempra’s Audit Committee has discussed Deloitte & Touche LLP’s independence with the firm.

Based on these considerations, the Board of Directors of SoCalGas directed that the audited financial statements of SoCalGas be included in its Annual Report on Form 10-K for the year ended December 31, 2023, for filing with the U.S. Securities and Exchange Commission.

BOARD OF DIRECTORS

Trevor I. Mihalik, Chair

Diana L. Day

Scott D. Drury

Lisa Larroque Alexander

5 |

SHARE OWNERSHIP

All of the outstanding shares of SoCalGas’ common stock are owned by PE and all of the outstanding shares of PE’s common stock are owned by Sempra. None of the directors or officers of SoCalGas owns any shares of SoCalGas’ preferred stock, and SoCalGas is unaware of any person, other than PE, who beneficially owns more than 5% of its outstanding shares of preferred stock.

The following table shows the number of shares of Sempra common stock beneficially owned as of April 1, 2024, by each director of SoCalGas, by each executive officer of SoCalGas named in the executive compensation tables in this Information Statement (named executive officers), and by all directors and executive officers of SoCalGas as of the date of this Information Statement as a group. The shares of common stock beneficially owned by each of our directors and named executive officers and by our directors and executive officers as a group in each case total less than 1% of Sempra’s outstanding shares of common stock. In calculating these percentages, shares under the heading “Phantom Shares” are not included because these phantom shares (i) cannot be voted and (ii) may only be settled for cash or cannot be settled for shares of Sempra common stock within 60 days after April 1, 2024. As of April 1, 2024, 632,606,408 shares of Sempra common stock were outstanding.

Name | | | Shares of Sempra Common Stock(A) | | | Shares Subject to Exercisable Options(B) | | | Total Shares Beneficially Owned | | | Phantom Shares(C) | | | Total Shares Beneficially Owned Plus Phantom Shares |

David J. Barrett | | | 5,458 | | | — | | | 5,458 | | | 327 | | | 5,785 |

Maryam S. Brown | | | 5,369 | | | — | | | 5,369 | | | 4,343 | | | 9,712 |

Jimmie I. Cho | | | 1,257 | | | — | | | 1,257 | | | 10,218 | | | 11,475 |

Diana L. Day | | | 8,636 | | | — | | | 8,636 | | | 693 | | | 9,329 |

Mia L. DeMontigny | | | 6,295 | | | — | | | 6,295 | | | — | | | 6,295 |

Scott D. Drury | | | 7,618 | | | — | | | 7,618 | | | 2,590 | | | 10,208 |

Lisa Larroque Alexander | | | 4,540 | | | — | | | 4,540 | | | — | | | 4,540 |

Trevor I. Mihalik | | | 8,875 | | | 218,112 | | | 226,987 | | | 64,462 | | | 291,449 |

Directors and Executive Officers as a Group (8 persons) | | | 48,048 | | | 218,112 | | | 266,160 | | | 82,633 | | | 348,793 |

(A) | None of our directors or executive officers beneficially owned any shares of Sempra’s 4.875% Fixed-Rate Reset Cumulative Redeemable Perpetual Preferred Stock, Series C, as of April 1, 2024; therefore, no such shares are shown in this table. |

(B) | Shares that may be acquired through the exercise of stock options that currently are exercisable or will become exercisable within 60 days after April 1, 2024. |

(C) | Phantom shares represent deferred compensation deemed invested in shares of Sempra common stock. These phantom shares track the performance of Sempra common stock but cannot be voted and may only be settled for cash, except for 10,218 phantom shares deferred by Mr. Cho, 495 phantom shares deferred by Ms. Day, and 10,627 phantom shares deferred by Mr. Mihalik, in each case in connection with the vesting of certain performance-based restricted stock units, which also cannot be voted but may only be settled for shares of Sempra common stock following separation of service from the company. All phantom shares are either fully vested or will vest within 60 days after April 1, 2024. |

6 |

Based on a review through April 1, 2024 of filings made under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended (Exchange Act), the following table shows each person or entity known by us to be a beneficial owner of more than 5% of Sempra common stock:

Name and Address of Beneficial Owner | | | Shares of Sempra Common Stock | | | Percent of Class(E) |

BlackRock, Inc.(A) 50 Hudson Yards New York, NY 10001 | | | 63,318,735 | | | 10.0% |

The Vanguard Group(B) 100 Vanguard Blvd. Malvern, PA 19355 | | | 61,166,858 | | | 9.7% |

Capital International Investors, division of Capital Research and Management Company(C) 333 South Hope Street, 55th Floor Los Angeles, CA 90071 | | | 56,098,217 | | | 8.9% |

State Street Corporation(D) State Street Financial Center 1 Congress Street, Suite 1 Boston, MA 02114 | | | 34,247,325 | | | 5.4% |

(A) | The information regarding BlackRock, Inc. is based solely on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on January 24, 2024 reflecting shares of Sempra common stock beneficially owned as of December 31, 2023 (the BlackRock 13G/A). According to the BlackRock 13G/A, includes sole voting power with respect to 58,054,302 shares and sole dispositive power with respect to 63,318,735 shares. |

(B) | The information regarding The Vanguard Group is based solely on a Schedule 13G/A filed by The Vanguard Group with the SEC on February 13, 2024 reflecting shares of Sempra common stock beneficially owned as of December 29, 2023 (the Vanguard 13G/A). According to the Vanguard 13G/A, includes shared voting power with respect to 1,084,351 shares, sole dispositive power with respect to 58,183,289 shares and shared dispositive power with respect to 2,983,569 shares. |

(C) | The information regarding Capital International Investors, a division of Capital Research and Management Company, as well as certain of its investment management subsidiaries and affiliates (Capital), is based solely on a Schedule 13G/A filed by Capital with the SEC on February 9, 2024 reflecting shares of Sempra common stock beneficially owned as of December 29, 2023 (the Capital 13G/A). According to the Capital 13G/A, includes sole voting power with respect to 55,764,521 shares and sole dispositive power with respect to 56,098,217 shares. |

(D) | The information regarding State Street Corporation is based solely on a Schedule 13G/A filed by State Street Corporation with the SEC on January 30, 2024 reflecting shares of Sempra common stock beneficially owned as of December 31, 2023 (the State Street 13G/A). According to the State Street 13G/A, includes shared voting power with respect to 21,709,425 shares and shared dispositive power with respect to 34,147,957 shares. |

(E) | The percentages are calculated based on (i) the number of shares of Sempra common stock reflected as being beneficially owned by each beneficial owner as of December 29 or December 31, 2023, as applicable, in its filing made under Section 13(g) of the Exchange Act as described in the other footnotes to this table, and (ii) 632,606,408 shares of Sempra common stock outstanding as of April 1, 2024. |

7 |

PROPOSAL 1: ELECTION OF THE FOUR DIRECTOR NOMINEES NAMED IN THIS INFORMATION STATEMENT

At the Annual Shareholders Meeting, four directors will be elected to serve in office until the next annual shareholders meeting and until their respective successors have been elected and qualified or until their earlier resignation or removal. The four director candidates receiving the highest number of affirmative votes will be elected as directors of the company. Abstentions and votes against any director, if any, will have no effect on the outcome of the election of directors (but if you indicate “ABSTAIN” on any or all nominees, your vote will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Shareholders Meeting and any adjournment or postponement thereof).

The following sets forth information, as of the mailing date of this Information Statement, regarding the four director nominees named in this Information Statement for election at the Annual Shareholders Meeting. This information includes biographical information, business experience and service on other public company boards. In addition, we discuss below the specific experience, qualifications, attributes and skills that make each director candidate a well-qualified and valuable board member.

| | | Diana L. Day, 59, became a director of SoCalGas in October 2022. She has been Chief Legal Counsel of Sempra since January 2024 and previously had served as a Deputy General Counsel of Sempra since October 2022. She served as Senior Vice President and General Counsel of SDG&E from August 2020 to October 2022, Vice President and General Counsel of SDG&E from January 2019 to August 2020, and Chief Risk Officer of SDG&E from August 2019 to October 2022. Prior to that, she was Acting General Counsel of SDG&E from September 2017 to January 2019, and Vice President – Enterprise Risk Management and Compliance for SDG&E and SoCalGas from 2014 to January 2019. Ms. Day has held various other leadership positions since she joined the Sempra family of companies in 1997. Ms. Day’s extensive expertise in governance matters and other aspects of business and corporate law makes her a valuable member of our board. |

| | | Scott D. Drury, 59, became CEO and a director of SoCalGas in August 2020. From January 2017 to July 2020, he served as President of SDG&E. Mr. Drury was SDG&E’s Chief Energy Supply Officer from 2015 to 2016 and was SDG&E’s Vice President, Diversity and Inclusion from 2011 to 2015. Prior to that, he held several other senior-level positions during his more than 35-year tenure with the Sempra family of companies. Mr. Drury has served our company and its affiliates in a broad range of management roles. His extensive and comprehensive management experience makes him a valuable member of our board. |

| | | Lisa Larroque Alexander, 50, became a director of SoCalGas in March 2019. She has been Senior Vice President, Corporate Affairs and Chief Sustainability Officer of Sempra since April 2020. Before that, Ms. Larroque Alexander served as Vice President–Corporate Communications and Sustainability of Sempra from May 2018 to April 2020, Vice President–Customer Solutions, Communications and Environmental Strategy of SoCalGas from April 2018 to May 2018, Vice President–Customer Solutions and Communications of SoCalGas from May 2016 to April 2018, and in several other positions since joining SoCalGas in 2011. Previously, Ms. Larroque Alexander was a management consultant to the energy and utilities sector and, prior to that, held leadership positions in strategy, marketing and consulting. Ms. Larroque Alexander has served our company and its affiliates in a broad range of roles and her extensive experience and in-depth understanding of the company’s business make her a valuable member of our board. |

| | | Trevor I. Mihalik, 57, became a director and the non-executive Chairman of SoCalGas in January 2024. He has been Executive Vice President and Group President of Sempra since January 2024. Prior to that, he was Executive Vice President and Chief Financial Officer of Sempra from May 2018 to December 2023 and served as Sempra’s Senior Vice President from December 2013 until April 2018 and as its Controller and Chief Accounting Officer from July 2012 until April 2018. Mr. Mihalik has served as an officer, manager, or member of the board of directors of various Sempra subsidiaries or entities in which Sempra holds an equity interest, including serving on the board of directors of each of SDG&E and Oncor Electric Delivery Company LLC. Mr. Mihalik rejoined the board of directors and became non-executive Chairman of SDG&E in January 2024. In addition, since December 2019, he has served on the board of directors of WD-40 Company, a global marketing organization that develops and sells maintenance, homecare and cleaning products. Mr. Mihalik has served our company and its affiliates in a broad range of management roles. His extensive and comprehensive management and corporate governance experience makes him a valuable member of our board. |

8 |

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

What information is provided in this section of the Information Statement?

In this Compensation Discussion and Analysis, we:

• | Outline our compensation philosophy and program goals |

• | Discuss how the SoCalGas Compensation Committee determines executive pay |

• | Describe each element of executive pay, including base salaries, short-term and long-term incentives and executive benefits |

• | Describe the rationale for each element of executive pay in the context of our compensation philosophy and program goals |

All information about Sempra shares of common stock in this Compensation Discussion and Analysis and the following Compensation Tables reflects the two-for-one split of Sempra’s common stock in the form of a 100% stock dividend that was distributed to its shareholders on August 21, 2023.

Who are the named executive officers?

This Compensation Discussion and Analysis focuses on the compensation of the following individuals, who we collectively refer to as our named executive officers:

Named Executive Officer | | | Title |

Scott D. Drury | | | Chief Executive Officer |

Maryam S. Brown | | | President |

Jimmie I. Cho | | | Chief Operating Officer |

David J. Barrett | | | Senior Vice President and General Counsel |

Mia L. DeMontigny | | | Senior Vice President, Chief Financial Officer, Chief Accounting Officer and Treasurer |

Table 1

What is our executive compensation philosophy and what are the goals of our executive compensation program?

Our Compensation Committee sets the company’s executive pay philosophy, which emphasizes:

• | Performance-based incentives aligned with shareholder value creation |

• | Alignment of pay with short-term and long-term company performance |

• | Balance between short-term and long-term incentives |

• | More pay tied to performance at higher levels of responsibility |

Our executive compensation program goals include:

• | Aligning executive compensation with the interests of shareholders and other stakeholders |

• | Linking executive compensation to both annual and long-term business and individual performance |

• | Motivating executives to achieve superior performance |

• | Attracting and retaining executives with outstanding ability and experience who demonstrate high standards of integrity and ethics |

Elements of our 2023 executive pay program that exemplify our pay-for-performance philosophy and goals include:

• | More than 70% of our CEO’s target total direct pay is in “at-risk” compensation in the form of a performance-based annual bonus and long-term equity-based incentives |

• | Performance measures for the performance-based annual bonus are directly linked to the financial and operational performance of SoCalGas and Sempra |

• | Long-term incentive compensation is primarily delivered through performance-based restricted stock units. The performance measures for the annual performance-based restricted stock unit awards are based on Sempra’s relative total shareholder return (TSR) and earnings per common share (EPS) growth |

We believe this compensation philosophy enables us to attract, motivate and retain key executive talent and promote strong, sustainable long-term performance.

What compensation governance measures are in place?

We believe our compensation practices, which are highlighted below, reflect our pay-for-performance philosophy and program goals and our commitment to sound corporate governance.

9 |

What We Do:

• | We use multiple, and complementary, performance measures in our annual and long-term incentive plans to link pay to performance and shareholder interests |

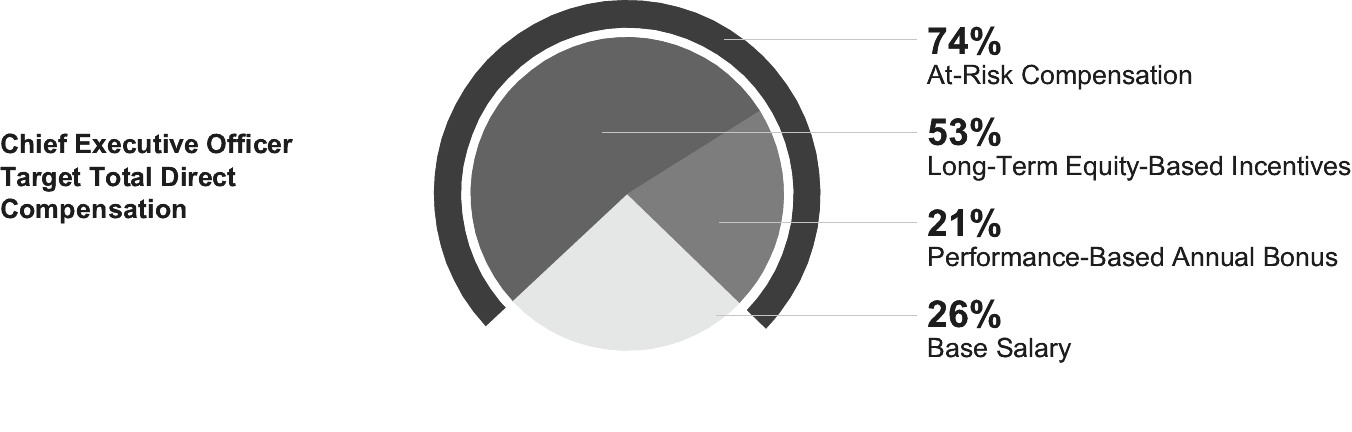

• | Our performance-based annual bonuses are based on performance measures related to safety and safety management systems, customer service and other stakeholder goals, as well as Sempra’s and SoCalGas’ earnings (as adjusted for annual bonus purposes, which is referred to as EICP Earnings, a non-GAAP financial measure) (see “Compensation Components—Performance-Based Annual Bonuses” below for additional information) |

• | We use Sempra’s relative TSR and Sempra’s EPS growth as the primary performance measures for long-term equity- based incentives |

• | We review external market data when making compensation decisions |

• | An independent advisor has conducted a risk assessment of our executive compensation program |

• | Our clawback policy requires the recovery of certain incentive compensation received by the Chief Executive Officer, as required under the Sarbanes-Oxley Act of 2002, in the event of certain qualifying accounting restatements, and provides that the Compensation and Talent Development Committee of the Sempra Board of Directors may require the recovery of compensation from awards made under the Sempra 2019 Long-Term Incentive Plan (Sempra 2019 LTIP), including time-based awards and annual incentive awards, if the recipient of such an award’s fraudulent or intentional misconduct materially affected the operations or financial results of Sempra or its subsidiaries, including SoCalGas, even if such misconduct did not result in an accounting restatement |

• | Officers are subject to share ownership guidelines ranging from three times base pay for SoCalGas’ CEO, President, and Chief Operating Officer to one times base pay for SoCalGas’ vice presidents (see “Share Ownership Guidelines” below for additional information) |

• | The Sempra 2019 LTIP, in which SoCalGas employees participate, includes “double-trigger” equity vesting upon a change in control of Sempra (see “Severance and Change in Control Arrangements” below for additional information) |

What We Don’t Do:

• | Long-term incentive plan awards are granted from a Sempra shareholder-approved plan that prohibits stock option repricing (at this time, no executive officer has any outstanding stock options) and cash buyouts without shareholder approval |

• | All employees and directors are prohibited from engaging in any hedging transaction with respect to any Sempra or SoCalGas equity securities, and all officers and directors are prohibited from pledging any Sempra or SoCalGas securities |

• | No excise tax gross-ups are provided for in our named executive officers’ severance or equity award agreements, and no named executive officers received any excise tax gross-ups in 2023 |

• | No “single-trigger” cash severance benefits are provided upon a change in control (see “Severance and Change in Control Arrangements” below for additional information) |

• | None of the named executive officers has an employment contract |

• | None of the named executive officers receives uncapped incentives |

• | No executive officer, including SoCalGas’ CEO, participates in decisions regarding his or her own compensation |

• | No excessive perquisites; all have a specific business rationale |

DETERMINING EXECUTIVE PAY

How is external market data used in determining pay?

External pay data is used to help align executive compensation levels with the labor market. The SoCalGas Compensation Committee views the labor market for our most senior positions as a nationwide, broad cross-section of companies in various industries, and recognizes that this labor market varies by position. The committee reviews general industry and utility industry market pay data from multiple surveys. Information about specific surveys or specific companies in the survey data is not provided to the committee.

What is the role of internal equity in determining pay?

Internal pay equity principles are used to determine the compensation for positions that are unique or difficult to compare to market data. Internal equity is also considered in establishing compensation for positions considered to be equivalent in responsibilities and importance, especially where precise external data is not available.

What is the SoCalGas Compensation Committee’s role in determining pay?

The primary role of the SoCalGas Compensation Committee, which was established in January 2024, is to assist the board in discharging the board’s responsibilities relating to oversight of the evaluation and compensation of SoCalGas’ executive officers and other officers, if any, and other matters as directed by the board. The committee’s responsibilities include evaluating the performance of officers, determining officer annual salaries and awards under the company’s incentive compensation plans; and making recommendations for officer awards under Sempra’s long-term incentive plans (LTIP) and nominations of non-officer employees for participation in these LTIPs.

The Compensation Committee expects to hold at least three regularly scheduled meetings each year and additional meetings when needed. The committee’s Chair approves the agenda prior to each meeting. Three directors currently sit on the committee.

10 |

The Compensation Committee:

• | Sets its regular meeting dates and standing agenda items annually |

• | Considers standing agenda items and other topics at each meeting |

• | Recommends changes to its charter for approval by the board as needed |

• | Provides regular updates to the full board regarding its proceedings, recommendations and decisions |

The Compensation Committee’s charter is attached to this Information Statement as Appendix A.

Except as otherwise expressly stated or as indicated by the context, this Compensation Discussion and Analysis reflects the role and responsibilities of the Compensation Committee as of the date of this Information Statement. Because the Compensation Committee was not established until January 2024, all roles and responsibilities described herein as being held by the committee were held by the full SoCalGas Board of Directors at all relevant times prior to the committee’s establishment.

What is SoCalGas management’s role in determining pay?

SoCalGas’ CEO is a member of the Compensation Committee and, as such, he attends each SoCalGas Compensation Committee meeting. Our human resources department assists the committee by preparing compensation information and analyses for its consideration. Our accounting, finance and law departments also support the committee with respect to compensation-related matters as needed. The committee members generally receive presentation materials in advance of committee meetings.

Our executive officers do not determine or approve any element or component of their own compensation, nor are they present during the committee’s deliberations regarding their own compensation. This includes base salary, performance-based annual bonus, long-term equity-based incentives and all other aspects of compensation. The committee seeks our CEO’s views on the performance of our other executive officers, and he makes pay recommendations for these officers.

Are the results of the most recent shareholder advisory vote on executive compensation considered in determining executive pay?

Our shareholders presently have the opportunity to cast an advisory vote on our executive compensation, or a “say-on-pay” vote, once every three years at our annual shareholders meetings. At the 2023 annual meeting of our shareholders, which was the last time a say-on-pay vote occurred prior to the Annual Shareholders Meeting, the say-on-pay proposal received approval from every share that was voted on the proposal at the meeting, which were all voted by PE, our controlling shareholder. The Compensation Committee believes this approval affirms our controlling shareholder’s support for our approach to executive compensation, and therefore has not significantly altered our compensation policies or practices since 2023.

MANAGING RISK IN COMPENSATION PLANS

How does the SoCalGas Compensation Committee seek to mitigate risk in the company’s executive compensation program?

The SoCalGas Compensation Committee seeks to mitigate risk in our executive compensation program by balancing short-term and long-term incentives and linking a higher proportion of total compensation to long-term incentives. Risk is also managed through incentive plan design and the selection of performance measures.

Our compensation risk management is further strengthened by our clawback policy, our anti-hedging and pledging policies and our executive share ownership guidelines, each of which is discussed in further detail elsewhere in this Compensation Discussion and Analysis.

An independent consultant, Exequity, conducted a risk assessment of our 2023 compensation programs. Exequity’s findings concluded that our compensation programs do not create risks that are likely to have a material adverse impact on the company.

What are some of the risk mitigation features in the company’s executive compensation programs?

Specific examples of safeguards and risk mitigation features found in our executive compensation programs are listed below. Our 2023 performance-based annual bonuses include the following risk mitigation features:

• | Limiting the payout at the maximum performance level to 200% of target |

• | Using company financial performance measures that are based on the earnings reported in our financial statements, with certain adjustments that are limited and predefined and the potential for others related to unplanned or unforeseen items, all of which are made only after thoughtful consideration |

• | Incorporating performance measures important to our business operations, including safety and safety management systems and customer service and other stakeholder goals, in addition to the company financial performance measures |

• | Providing the SoCalGas Compensation Committee with discretion over certain incentive plan payouts |

11 |

Our 2023 long-term equity-based incentives include the following risk mitigation features:

• | Using a balanced mix of multiple types of awards and performance measures, consisting of a market-based performance measure (Sempra’s relative TSR), a financial performance measure (Sempra’s long-term EPS growth) and a service-based measure (service-based restricted stock units) |

• | Measuring Sempra’s TSR against the S&P 500 Index and the S&P 500 Utilities Index(1) rather than against peer groups selected by Sempra, which reduces subjectivity in the determination of peer groups |

• | Using multi-year performance periods to promote a longer-term performance horizon |

• | Providing zero payouts for performance-based awards if performance is below the 25th percentile threshold level |

• | Limiting the maximum payout level for performance-based restricted stock unit awards to 200% of the target number of units (including reinvested dividend equivalents) |

PAY MIX

What is “pay mix”?

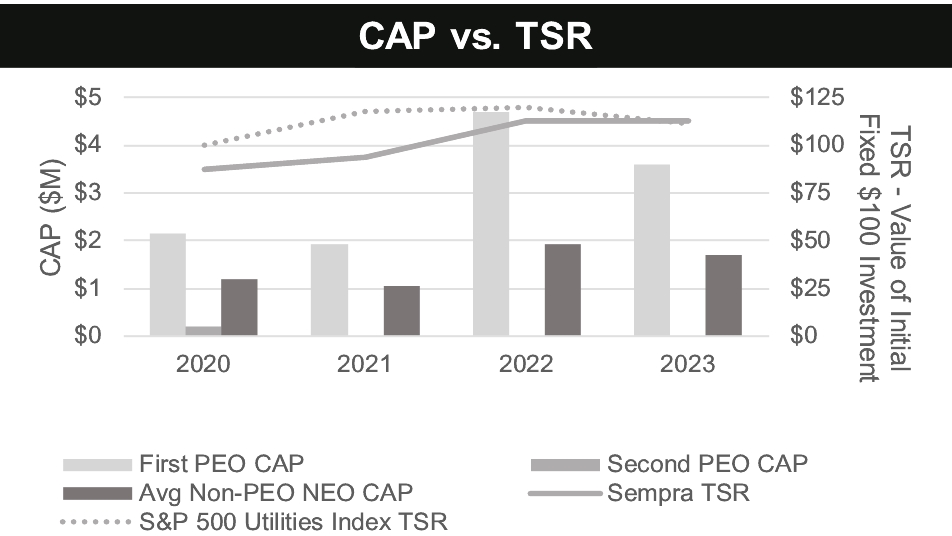

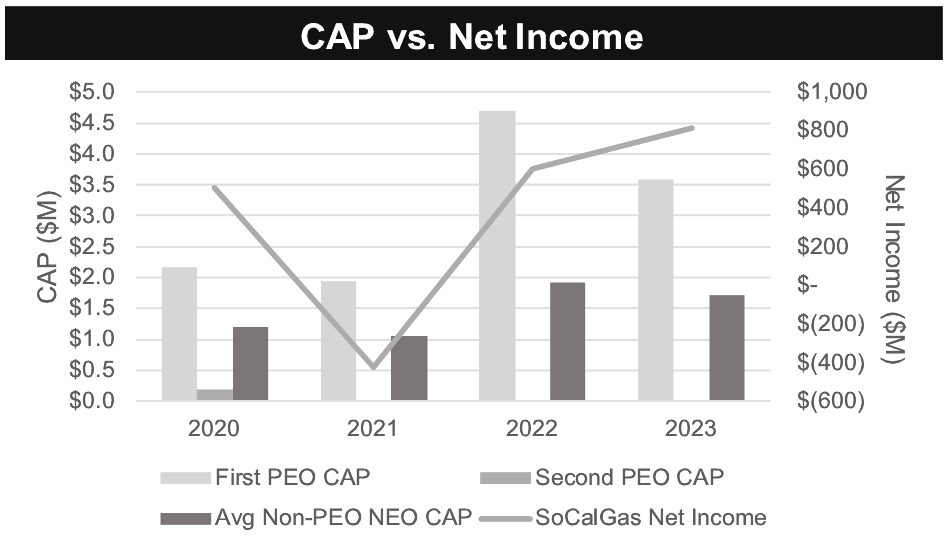

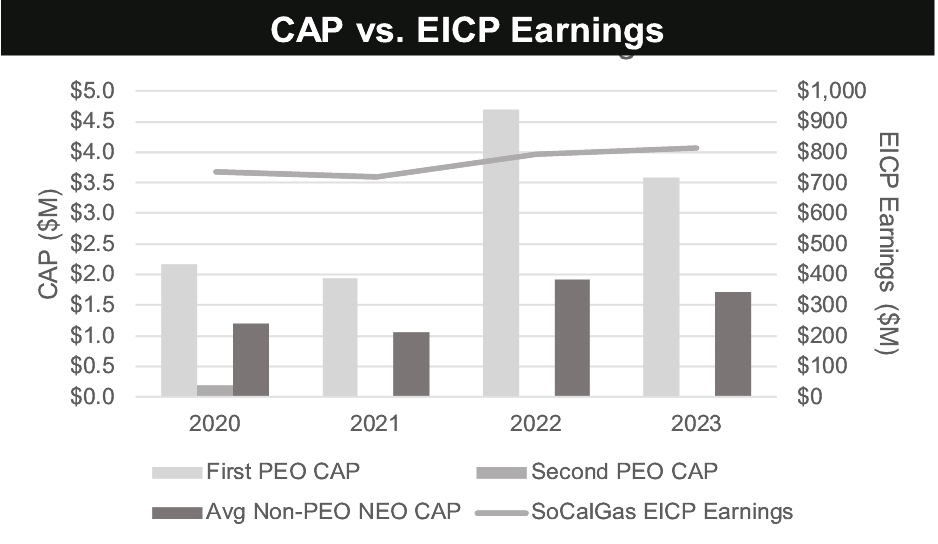

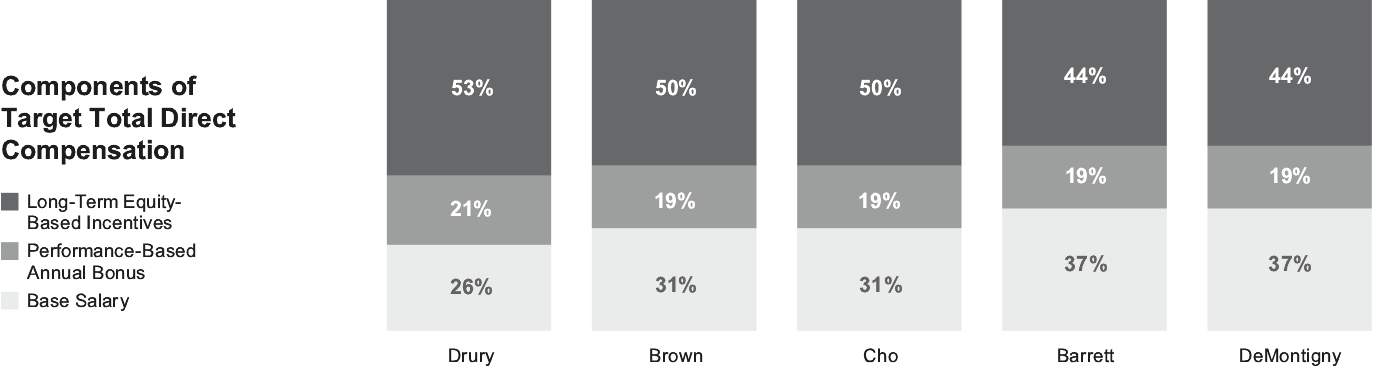

Pay mix is the relative value of a named executive officer’s total direct pay opportunity for each of the three components of total direct compensation at target company performance. Figure 1 shows the 2023 pay mix for our CEO.

Figure 1

Note: Based on the CEO’s annual base salary as of December 31, 2023, 2023 target performance-based annual bonus and the target grant date value of 2023 long-term equity-based incentives.

Why is pay mix important?

Our pay mix is designed to align the interests of executives with the interests of shareholders and other stakeholders by providing a greater proportion of target annual compensation through performance-based annual bonuses and long-term equity-based incentives rather than base salary. This means that most pay is intended to be variable and increase or decrease based on company performance. As shown in Figure 1, more than half of Mr. Drury’s target total direct pay opportunity in 2023 was in the form of long-term equity-based incentives and more than 70% was in the form of at-risk variable incentive pay.

Actual pay mix may vary substantially from target pay mix. This may occur as a result of company performance, which greatly affects annual bonuses and payout percentages for EPS growth-based LTIP awards, and Sempra common stock performance, which significantly impacts payout percentages for TSR-based LTIP awards and the ultimate value realized for all equity awards.

Figure 2 shows the percentage of each component of the total 2023 direct pay opportunity as of December 31, 2023 at target company performance for each of our named executive officers.

(1) | For purposes of long-term equity-based incentive awards, all references to the S&P 500 Utilities Index refer to the companies constituting the S&P 500 Utilities Index, excluding water companies. |

12 |

Figure 2

Note: Based on annual base salary and target performance-based annual bonus as of December 31, 2023 and the target grant date value of 2023 long-term equity-based incentives (excluding any special awards) for each named executive officer.

COMPENSATION COMPONENTS

What are the primary components of SoCalGas’ executive compensation program?

The primary components of our executive compensation program, which also comprise the three components of each named executive officer’s total direct compensation, are:

• | Base salaries |

• | Performance-based annual bonuses |

• | Long-term equity-based incentive awards granted by Sempra |

Additional benefits include participation in health and welfare programs and retirement and savings plans, as well as personal benefits and severance pay agreements.

All of our named executive officers generally participate in the same compensation program. However, compensation levels for named executive officers vary substantially based on the roles and responsibilities of the individual officers.

1. Base Salaries

What is the role of base salaries in SoCalGas’ executive compensation program, and how are base salaries determined and reviewed?

Our executive compensation program emphasizes performance-based pay. This includes annual cash bonuses and long-term equity-based incentives. However, base salaries remain a common and necessary element of compensation for attracting and retaining outstanding employees at all levels.

The SoCalGas Compensation Committee annually reviews base salaries for executive officers. The committee considers the following factors, among others, in its review:

• Market salary data from multiple surveys | | | • Retention needs |

• Individual contributions and performance | | | • Reporting relationships |

• Labor market conditions | | | • Internal pay equity |

• Complexity of roles and responsibilities | | | • Experience |

• Succession planning | | |

Base salaries also may be reviewed and adjusted during the year (between annual reviews) for various reasons, including in the event of promotions or other job title changes, modifications to reporting relationships or job functions, or changes to any of the other factors described above or other circumstances considered relevant.

13 |

What base salary adjustments were made in 2023?

In January 2023, Mr. Drury received a salary increase of 5.8%, Mss. Brown and DeMontigny received salary increases of 6.0% and Messrs. Cho and Barrett received salary increases of 5.0%.

2. Performance-Based Annual Bonuses

How are potential bonus opportunities determined?

Each year the SoCalGas Board of Directors establishes performance measures and dollar guidelines for performance-based cash bonus payments under the SoCalGas Executive Incentive Compensation Plan (the EICP). The safety measures and measures related to safety management systems are also reviewed by the board’s Safety Committee. Consistent with our pay-for-performance philosophy, the performance measures do not provide for any bonus payment unless the company meets the threshold (minimum) performance level for the year. Bonus opportunities increase from 14% of target for performance at the threshold level to 200% of target for performance at the maximum level.

The board may apply discretion in determining the results of performance measures and the committee may apply discretion in determining awards, in each case by taking into consideration the contributions of each named executive officer or other factors deemed relevant.

What were the potential bonus opportunities for each named executive officer for 2023 performance?

Potential bonus opportunities at target company performance as of December 31, 2023 are expressed as a percentage of each named executive officer’s base salary as of December 31, 2023 and as a dollar value below.

Named Executive Officer | | | Target % | | | Target Value |

Scott D. Drury | | | 80% | | | $560,000 |

Maryam S. Brown | | | 60% | | | $295,100 |

Jimmie I. Cho | | | 60% | | | $290,900 |

David J. Barrett | | | 50% | | | $196,900 |

Mia L. DeMontigny | | | 50% | | | $193,500 |

Table 2

What were the 2023 annual bonus performance goals for the named executive officers?

The 2023 performance measures for the SoCalGas EICP consisted of (i) safety measures and measures related to safety management systems, (ii) customer service and other stakeholder-focused measures, and (iii) SoCalGas and Sempra earnings adjusted for EICP purposes (EICP Earnings). The relative weights of these measures as a percentage of the overall target were 60%, 13% and 27%, respectively.

How were the 2023 EICP Earnings goals determined?

The SoCalGas EICP Earnings target of $780 million was based on SoCalGas’ financial plan with certain adjustments for incentive plan purposes. Targets for the operational measures were based on safety and safety management systems, and customer service and other stakeholder-focused goals.

EICP Earnings for SoCalGas and Sempra may be higher or lower than earnings reported in the companies’ financial statements due to certain predefined adjustments.

Consistent with the approach taken in prior years, it was determined at the beginning of the year that the calculation of SoCalGas earnings and Sempra earnings for EICP purposes would be adjusted as shown below. In addition, the SoCalGas Board of Directors has, but did not use, discretion to adjust earnings for other unplanned or unforeseen items that may occur during the course of the year.

• | Exclude the impact of any unplanned changes in tax laws or regulations and accounting rule changes |

• | Exclude certain nonrecurring items at the discretion of the Compensation and Talent Development Committee of the Sempra Board of Directors, provided that such items do not have a material adverse impact on Sempra’s common stock price, also as determined by the Compensation and Talent Development Committee. Such items would include but not be limited to: |

• | the pro forma earnings impact of any acquisition or divestiture to the extent the earnings impact of such acquisition or divestiture or related transaction and integration cost is not included in the EICP Earnings target |

• | nonrecurring gains or losses related to RBS Sempra Commodities, which was sold in four separate transactions completed in 2010 and 2011 (does not impact SoCalGas EICP Earnings) |

• | Exclude any realized impacts from the Port Arthur final investment decision-contingent interest rate hedge (does not impact SoCalGas EICP Earnings) |

• | Exclude the variance from plan of the foreign exchange gains or losses, net of inflation, including any associated cost of hedging (does not impact SoCalGas EICP Earnings) |

• | Exclude mark-to-market gains or losses |

14 |

• | Exclude gains or losses related to legacy litigation matters |

• | Exclude 90% of any gains or losses related to asset sales and impairments in connection with a sale to the extent the earnings impact of such item is not included in the EICP Earnings target |

• | Exclude items that are required to be excluded from annual bonus compensation under the SDG&E and/or SoCalGas General Rate Case decisions |

• | Exclude any earnings impact associated with the decommissioning of the San Onofre Nuclear Generating Station (does not impact SoCalGas EICP Earnings) |

• | Exclude the variance from plan of the liability insurance expense not recoverable through balancing accounts |

• | Exclude the variance from plan of any impairments of the California Assembly Bill 1054 Wildfire Fund (does not impact SoCalGas EICP Earnings) |

• | Exclude the variance from plan of the impact of material, pending regulatory matters, such as the California Cost of Capital and U.S. Federal Energy Regulatory Commission Independent System Operator adder |

• | Exclude one-time nonqualified pension settlement charges and LTIP tax windfall or shortfall to the extent such items are not included in the EICP Earnings target |

• | Limit impact of rabbi trust results (net of deferred compensation) to +/-5% (percentage points) of the EICP Earnings result as calculated without such gains or losses (does not impact SoCalGas EICP Earnings) |

• | Exclude the impact of authorized decisions of the SoCalGas Board of Directors that could impact earnings including, but not limited to, issuing debt or preferred stock securities exceeding planned amounts to fund dividends, legal settlements or other strategic expenses approved by the board (does not impact Sempra EICP Earnings) |

• | At the discretion of the SoCalGas Board of Directors, exclude the after-tax effect of the difference between the actual and planned intercompany allocations from Sempra and SDG&E for shared services charges, including performance-based annual bonus allocations (does not impact Sempra EICP Earnings) |

15 |

What were the performance results for the 2023 Executive Incentive Compensation Plan?

Overall company performance on the 2023 SoCalGas EICP performance measures was at 166.09% of target performance. Details of the plan metrics and results are provided below.

2023 SoCalGas Executive Incentive Compensation Plan Performance Measures | | | Weight | | | Performance Goals(1) | | | Actual | | | % of Target Achieved | ||||||

| | Threshold | | | Target | | | Maximum | | ||||||||||

Safety and Safety Management Systems | | | | | | | | | | | | | ||||||

Employee Safety–Lost Time Incident Rate | | | 4% | | | 0.76 | | | 0.66 | | | 0.56 | | | 0.93 | | | 0% |

Employee Safety–Near Miss/Stop the Job Reports | | | 4% | | | 400 | | | 500 | | | 600 | | | 1,672 | | | 200% |

Employee Safety–Environmental and Safety Compliance Management Program Corrective Action Completion Percentage | | | 4% | | | 95% | | | 99% | | | 100% | | | 100% | | | 200% |

Employee Safety–Driving Observation Rate | | | 4% | | | 90% | | | 95% | | | 100% | | | 99.83% | | | 197% |

Customer, Public & System Safety A1 Gas Leak Order Response Time | | | 6% | | | 92.6% | | | 93.0% | | | 93.5% | | | 93.59% | | | 200% |

Customer, Public & System Safety–Damage Prevention: Damages per USA Ticket Rate | | | 6% | | | 2.53 | | | 2.30 | | | 2.19 | | | 2.11 | | | 200% |

Customer, Public & System Safety–Gas System Methane Emissions Reductions–Percent of Planned High-Pressure Blow-down Events Releasing Less Than or Equal to 1 Million Cubic Feet and Achieve at least 90% Emissions Reduction per Event | | | 6% | | | 85% | | | 90% | | | 95% | | | 96% | | | 200% |

Customer, Public & System Safety–Pipeline Safety Enhancement Program Pipeline Miles Remediated | | | 6% | | | 25 | | | 35 | | | 50 | | | 27 | | | 20% |

Customer, Public & System Safety–Distribution Integrity Management Program–Miles of Vintage Mains and Services Replaced | | | 6% | | | 144 | | | 152 | | | 160 | | | 155 | | | 138% |

Customer, Public & System Safety–Average Time to Repair Non-Hazardous Leaks | | | 6% | | | 10 Months | | | 9 Months | | | 8 Months | | | 7.7 Months | | | 200% |

Cybersecurity–Annual Average Phishing Report Rate | | | 2% | | | 67% | | | 71% | | | 75% | | | 80.53% | | | 200% |

Safety Culture Enhancements–Complete Initiatives Identified in the Safety Culture Improvement Plan | | | 6% | | | 4 Initiatives | | | 5 Initiatives | | | 6 Initiatives | | | 5 Initiatives | | | 100% |

Subtotal: Safety and Safety Management Systems | | | 60% | | | | | | | | | | | 152% | ||||

Customer Service and Other Stakeholders | | | | | | | | | | | | | ||||||

Execute Clean Energy Transition Plan | | | 3% | | | 3 Projects | | | 4 Projects | | | 5 Projects | | | 6 Projects | | | 200% |

Advance Renewable Natural Gas Interconnection Milestones on SoCalGas System | | | 2% | | | 3 | | | 4 | | | 5 | | | 5 | | | 200% |

Touchpoint Action Program (TAP): Ease of Doing Business with SoCalGas | | | 2% | | | 55.1 | | | 56.5 | | | 57.9 | | | 46.6 | | | 0% |

Purchasing-Supplier Diversity | | | 2% | | | 38% | | | 40% | | | 43% | | | 44.05% | | | 200% |

Execute Diversity, Equity & Inclusion Priorities | | | 2% | | | 4 Action Items | | | 5 Action Items | | | 6 Action Items | | | 6 Action Items | | | 200% |

New Business Customer Experience: Payout % based on average of (1) and (2) below: | | | 2% | | | | | | | | | | | 200% | ||||

(1) Gas Distribution On-Time Performance | | | | | 85% | | | 90% | | | 94% | | | 95% | | | ||

(2) New Construction Status Tracker–Overall Satisfaction with New Construction Projects | | | | | 45.6% | | | 52.1% | | | 58.5% | | | 64.7% | | | ||

Subtotal: Customer Service and Other Stakeholders | | | 13% | | | | | | | | | | | 169% | ||||

Financial | | | | | | | | | | | | | ||||||

SoCalGas EICP Earnings | | | 20% | | | $753 | | | $780 | | | $807 | | | $813 | | | 200% |

Sempra EICP Earnings | | | 7% | | | $2,561 | | | $2,784 | | | $3,007 | | | $2,977 | | | 187% |

Subtotal: Financial | | | 27% | | | | | | | | | | | 197% | ||||

Total | | | 100% | | | | | | | | | | | 166.37% | ||||

Table 3

(1) | The payout scale ranges from 0% below threshold performance to 200% for maximum performance, with threshold performance paying out at (i) 0% for safety measures and measures related to safety management systems and customer service and other stakeholder-focused measures and (ii) 50% for financial measures, and target performance paying out at 100%. |

16 |

What adjustments were applied to GAAP earnings to determine EICP Earnings?

Reconciliations of 2023 SoCalGas and Sempra earnings computed in accordance with generally accepted accounting principles in the United States of America (GAAP) to EICP Earnings are provided below.

SoCalGas Earnings (Dollars in Millions) | | | Reconciliation |

GAAP Earnings | | | $811 |

Predefined Adjustments: | | | |

Exclude differences between actual and planned intercompany allocations for shared services charges from Sempra and SDG&E and liability insurance expense not recoverable through balancing accounts | | | 2 |

EICP Earnings | | | $ 813 |

Table 4

Sempra Earnings (Dollars in Millions) | | | Reconciliation |

GAAP Earnings | | | $3,030 |

Predefined Adjustments: | | | |

Exclude variance from plan of foreign exchange gains or losses, unrealized mark-to-market gains/losses on certain derivatives at Sempra Infrastructure, the net loss associated with an interest rate contingent swap, a change in accounting methodology, unplanned rabbi trust investment returns (related to nonqualified pension and deferred compensation) in excess of specified limits, California Assembly Bill 1054 wildfire fund impairments, impact associated with decommissioning the San Onofre Nuclear Generating Station (SONGS), and an unplanned LTIP tax shortfall | | | (57) |

Exclude the impact of an unplanned Oncor regulatory disallowance | | | 44 |

Exclude gains or losses related to legacy litigation matters related to RBS Sempra Commodities | | | (40) |

EICP Earnings | | | $2,977 |

Table 5

What were the Executive Incentive Compensation Plan payouts to the named executive officers for 2023 performance?

As shown in Table 3 above, the overall performance results on the 2023 SoCalGas EICP performance measures was at 166.37% of target performance. Based on this 2023 performance, including the review by the board’s Safety Committee of the performance on safety measures and measures related to safety management systems, as well as consideration of the contributions of each named executive officer in 2023, the SoCalGas Board of Directors approved the performance results under the EICP and the Compensation Committee approved the payment of the annual bonuses shown in Table 6.

Named Executive Officer | | | Bonus |

Scott D. Drury | | | $931,700 |

Maryam S. Brown | | | $490,900 |

Jimmie I. Cho | | | $483,900 |

David J. Barrett | | | $327,600 |

Mia L. DeMontigny | | | $321,900 |

Table 6

3. Long-Term Equity-Based Incentives

How much of each named executive officer’s target total direct compensation package is from long-term equity-based incentives, and who grants these incentives?

Long-term equity-based incentives are a large component of each named executive officer’s target total direct compensation package. See Figure 2 for these percentages. Long-term equity-based incentives are granted to our executives by the Compensation and Talent Development Committee of the Sempra Board of Directors based on the recommendations of the SoCalGas Compensation Committee.

17 |

What type of equity is granted?

In accordance with our pay-for-performance philosophy, two-thirds of the 2023 annual LTIP award for each of our named executive officers was in the form of performance-based restricted stock units. The remaining one-third was in the form of service-based restricted stock units. The 2023 performance-based restricted stock units are subject to vesting at the end of three years and the service-based restricted stock units vest ratably over three years.

Why is this type of equity used?

This equity award structure was approved after considering many variables, including alignment with shareholder interests, retention, plan expense, share usage, market trends and feedback from Sempra’s shareholder engagement.

What are the general practices with respect to equity award grants?

Typically, each named executive officer receives one LTIP award annually, divided into three components as described below. In granting the 2023 annual LTIP awards:

• | A target dollar value (based on a percentage of base salary) and other terms were specified for each named executive officer’s award; and |

• | The number of shares underlying the award was calculated based on the specified target dollar value for each named executive officer, as opposed to using a fixed number of shares. |

This approach allows maintenance of a pay mix the committee believes to be optimal, as described above.

On the grant date, we calculated the precise number of shares underlying the award to be granted to each named executive officer by dividing the target dollar value of each named executive officer’s award by the grant date closing price of Sempra common stock. These target grant values are presented in Table 7 below and differ from the values reported in “Compensation Tables—Summary Compensation Table” and “Compensation Tables—Grants of Plan-Based Awards” with respect to awards based on relative TSR, which are reported in those compensation tables based on a Monte Carlo valuation that is used to calculate the grant date fair value.

Are other equity awards granted in addition to the annual LTIP awards?

In addition to the annual LTIP awards, special equity awards also may be granted with the approval of the Compensation and Talent Development Committee of the Sempra Board of Directors based on the recommendation of the SoCalGas Compensation Committee. Special equity awards may be granted upon the hiring or promotion of named executive officers or to reward extraordinary performance or promote retention. In January 2023, Ms. Brown received a special award of service-based restricted stock units, valued at $200,000, to recognize exemplary performance and promote retention.

What were the target values for the 2023 annual LTIP awards?

Table 7 illustrates the target values for the 2023 annual LTIP awards.

Named Executive Officer | | | Target Value of 2023 Annual LTIP Award |

Scott D. Drury | | | $1,400,000 |

Maryam S. Brown | | | $786,720 |

Jimmie I. Cho | | | $775,520 |

David J. Barrett | | | $472,560 |

Mia L. DeMontigny | | | $464,280 |

Table 7

The actual amounts realized by equity award recipients will depend on future stock price performance, common stock dividend payouts and EPS performance and the degree to which the established performance measures are achieved. The amounts ultimately realized will not necessarily align with the target values at grant.

What were the performance goals for the 2023 performance-based restricted stock units?

The 2023 annual LTIP awards included two Sempra performance measures—relative TSR and EPS growth, each weighted at one-third of the total target award value. The portion of the award linked to Sempra’s relative TSR is equally weighted between Sempra’s TSR relative to the S&P 500 Utilities Index and Sempra’s TSR relative to the S&P 500 Index.

18 |

1. Relative TSR

Each TSR-based performance-based restricted stock unit represents the right to receive between zero and two shares of Sempra common stock based on Sempra’s three-year cumulative TSR compared to the S&P 500 Utilities Index or the S&P 500 Index, as applicable.

If Sempra’s performance is at the target performance level (the 50th percentile of the applicable index), participants will earn one share for each restricted stock unit. Participants have the opportunity to earn up to two shares for each restricted stock unit if performance exceeds the target performance level. Participants earn a partial share for performance between the threshold and target performance levels and between one and two shares for performance between target and maximum performance levels, as shown below. No shares are earned for performance below the 25th percentile of the applicable index.

Cumulative TSR Percentile Rank vs. S&P 500 Utilities Index or S&P 500 Index (Measured Independently in Separate Award Components) | | | Sempra Common Stock Shares Received for Each Restricted Stock Unit(1) |

90th Percentile or higher (Maximum) | | | 2.0 |

70th Percentile | | | 1.5 |

50th Percentile (Target) | | | 1.0 |

40th Percentile | | | 0.7 |

30th Percentile | | | 0.4 |

25th Percentile (Threshold) | | | 0.25 |

Below 25th Percentile | | | 0.0 |

Table 8

(1) | Participants also receive additional shares for dividend equivalents, which are reinvested to purchase additional units that become subject to the same vesting conditions as the restricted stock units to which the dividends relate. |

Note: If performance falls between the tiers shown in Table 8, the payout is calculated using linear interpolation.

2. EPS Growth

The 2023 annual LTIP awards also included a performance-based restricted stock unit award linked to relative EPS growth. The award measures the compound annual growth rate (CAGR) of Sempra’s EPS for the three-year period ending on December 31, 2025. The payout scale is based on the December 31, 2022 analyst consensus three-year EPS growth estimates for S&P 500 Utilities Index companies. The target payout level is based on the 50th percentile of the analyst consensus estimates and the threshold and maximum payout levels are based on the 25th and 90th percentiles, respectively. The awards include a provision that excludes the impact of share repurchases not contemplated in the financial plans publicly communicated prior to the grant date of the awards.

If Sempra’s EPS CAGR is at the 50th percentile of the analyst consensus estimates for the S&P 500 Utilities Index, participants will earn one share for each restricted stock unit. Participants have the opportunity to earn up to two shares for each restricted stock unit if performance exceeds the 50th percentile. Participants earn a partial share for performance between the 25th and 50th percentiles and between one and two shares for performance between the 50th and 90th percentiles of the analyst consensus estimates, as shown below. No shares are earned for performance below the 25th percentile of the analyst consensus estimates.

Percentile of Analyst Consensus Estimates for S&P 500 Utilities Index EPS CAGR | | | Sempra Common Stock Shares Received for Each Restricted Stock Unit(1) |

90th Percentile or higher (9.1% or higher) | | | 2.0 |

75th Percentile (7.9%) | | | 1.5 |

50th Percentile (6.5%) | | | 1.0 |

25th Percentile (6.2%) | | | 0.25 |

Below 25th Percentile (Below 6.2%) | | | 0.0 |

Table 9

(1) | Participants also receive additional shares for dividend equivalents, which are reinvested to purchase additional units that become subject to the same vesting conditions as the restricted stock units to which the dividends relate. |

Note: If performance falls between the tiers shown in Table 9, the payout is calculated using linear interpolation.

For purposes of the 2023 annual LTIP awards, the calculation of EPS may, at the discretion of the Compensation and Talent Development Committee of the Sempra Board of Directors, include the same types of adjustments made to EICP Earnings, as described above under “How were the 2023 EICP Earnings goals determined?”, as well as adjustments related to, among other things, other unusual or non-operating items.

19 |

What were the results for the 2021-2023 performance-based restricted stock unit award cycle?

The performance period of the 2021-2023 award cycle concluded on January 2, 2024 (for the TSR-based awards, which collectively were weighted at one-third of the award value) and December 31, 2023 (for the EPS growth-based awards, which were weighted at one-third of the award value).

Sempra’s 2021-2023 relative TSR was at the 67.8th percentile of the S&P 500 Utilities Index, resulting in vesting at 144.50% of target for the S&P 500 Utilities Index-based award component. Sempra’s relative TSR was at the 53.5th percentile of the S&P 500 Index, resulting in vesting at 108.75% of target for the S&P 500 Index-based award component.

The 2021-2023 awards based on Sempra’s EPS growth vested at 200% of target based on an EPS CAGR (as adjusted for LTIP purposes) of 9.6%. The table below shows the predefined adjustments to GAAP EPS used to calculate EPS growth for purposes of the 2021 annual LTIP award, as well as an additional adjustment to exclude the impact of a $300 million share repurchase in 2021 and an additional $450 million of share repurchases in the first and second quarters of 2022. For additional information, see “Compensation Tables—Outstanding Equity Awards at Year-End” and “Compensation Tables—Option Exercises and Stock Vested” below.

Sempra EPS Growth (Diluted) for 2021-2023 Award Cycle | | | 2020 | | | 2023 |

GAAP EPS | | | $6.44 | | | $4.79 |

Excluding $300 million share repurchase in 2021, $450 million of share repurchases in 2022, IEnova tender offers impact and $144 million in net proceeds from the sale of common stock in November 2023 pursuant to the exercise of the underwriters’ overallotment option(1) | | | (0.03) | | | 0.04 |

Predefined Adjustments: | | | | | ||