Exhibit 99.1

Information Statement dated May 27, 2016

Pointer Telocation Ltd.

Ordinary Shares, par value NIS 3 per share

Pointer Telocation Ltd. ("Pointer" or the "Company") is furnishing this information statement in connection with its spin-off (the "Spin-off") of Shagrir Group Vehicle Services Ltd. (“Shagrir”). Pointer intends to effect the Spin-off by way of a distribution of approximately 97.36% of its holdings of Shagrir to the holders of the ordinary shares of Pointer (the "Distribution"). Of the remaining shares of Shagrir, approximately 1.72% will be held by the employees of Shagrir and approximately 0.92% will be transferred to Barak Capital Underwriters Ltd., for sale to the public over the 12 month period following the Distribution.

Pointer currently owns approximately 98% of the outstanding ordinary shares of Shagrir. Shagrir is a provider of primary services to subscribers of insurance companies such as roadside assistance services (including towing services, temporary vehicle replacement services, mobile automobile repair services, as well as vehicle body work and replacement parts installation services), services to homes such as plumbing and electricity repairs and car sharing. After the completion of the Spin-off, Pointer will no longer hold any Shagrir ordinary shares.

In connection with the Spin-off, approximately 97.36% of the ordinary shares of Shagrir held by Pointer will be distributed to holders of record of the ordinary shares of Pointer on June 7, 2016 (the "Distribution Record Date"). Holders of Pointer ordinary shares ("Pointer Shareholders") will be entitled to receive one Shagrir ordinary shares for each Pointer ordinary share held on the Distribution Record Date subject to withholding tax. The distribution will be on a 1 to 1 basis such that one ordinary share of Shagrir will be distributed to each Pointer Shareholder for each ordinary share of Pointer that they hold. Pointer Shareholders will not be required to pay any consideration for the Shagrir ordinary shares that they will be entitled to receive in the Distribution or to surrender or exchange Pointer ordinary shares in order to be entitled to receive Shagrir ordinary shares. Pointer is not asking you for a proxy and you are requested not to send Pointer a proxy.

The Spin-off is subject to the conditions described under "The Spin-off" in this information statement.

| 1 |

Currently, Shagrir is a private company and there is no trading market for Shagrir ordinary shares. The Shagrir ordinary shares are expected to be listed on the Tel Aviv Stock Exchange (the "TASE") under the stock symbol "SHGR" on or about June 23, 2016. Admission to listing and trading is subject to the approval of the TASE. The Shagrir ordinary shares will not be listed on any securities exchange in the United States or quoted on any automated inter-dealer quotation system in the United States. An active trading market for Shagrir ordinary shares is not expected to develop in the United States.

The Distribution may be treated as a taxable transaction for U.S. federal income tax purposes and withholding taxes will apply to Shagrir ordinary shares issued outside of Israel in accordance with Israeli law and a ruling received from the Israel Tax Authority. See "Certain Material Tax Consequences" on page IS-22 of this information statement.

You should carefully consider the risks described under "Risk Factors Relating to the Distribution" beginning on page IS-17 of this information statement and under "Risk Factors" on pages F-58 and F-86 of the Shagrir prospectus, which is incorporated into this information statement.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Shagrir ordinary shares or passed upon the accuracy or adequacy of this information statement. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

This information statement is first being made available to Pointer Shareholders on May 27, 2016 by means of a Current Report on Form 6-K filed with the U.S. Securities and Exchange Commission.

| 2 |

TABLE OF CONTENTS

Information Statement

| Page | ||

| About this Information Statement | 5 | |

| Shareholder Inquiries | 6 | |

| Enforceability of Civil Liabilities | 6 | |

| Forward-Looking Statements | 7 | |

| Summary | 8 | |

| The Spin-off | 9 | |

| Historical Financial Information | 12 | |

| Risk Factors Relating to the Distribution | 17 | |

| Exchange Rate Information | 19 | |

| Capitalization | 20 | |

| Market Information | 21 | |

| The Tel Aviv Stock Exchange | 21 | |

| Certain Information Concerning Pointer | 21 | |

| Certain Material Tax Consequences | 22 | |

| Experts | 29 | |

| Annual Audited Consolidated Financial Statements | F1-F79 | |

| Annual Financial Data from Consolidated Financial Statements | SF1-SF30 | |

| First Quarter Interim Consolidated Financial Statements | See pages Exhibit D11-27 of the Prospectus | |

| First Quarter Financial Data From the Interim Consolidated Financial Statements | See pages Exhibit D28-D41 of the prospectus |

| 3 |

Shagrir Prospectus

| Chapter A | Introduction | A-1 - A-3 |

| Chapter B | Description of the Distribution in Kind contemplated by this Prospectus | B-1 - B-17 |

| Chapter C | Capital of the Company | C-1 - C-10 |

| Chapter D | Rights Attached to the Company's Shares | D-1 - D-7 |

| Chapter E | Issuance Consideration and Designation | E-1 |

| Chapter F | Description of the Company's Business | F-1 - F-69 |

| The Board of Directors Report | F-70-88 | |

| Chapter G | Management of the Company | G-1 - G-9 |

| Chapter H | Company Interested Parties | H-1 - H-17 |

| Chapter I | Audited Financial Statements for 31 December, 2015

|

See pages F-1 to F-80 and SF-1 to SF-30 of this information statement |

| Statement of Events | ||

| Valuations added to the financial statements: | ||

| Evaluation of the Company's Goodwill Impairment | ||

| Shareholders' Loan Valuation | ||

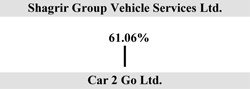

| Goodwill Impairment Test associated with the Purchase of Car2Go Ltd. | ||

| Chapter J | Additional Details | J-1 - J-3 |

| Exhibit A | Company Valuation | |

| Exhibit B | Approval from the Israel Tax Authority | |

| Exhibit C | Company Compensation Policy | |

| Exhibit D | Q1 2016 Financial statements | |

| Chapter K | Signatures | K-1 |

| 4 |

ABOUT THIS INFORMATION STATEMENT

This information statement incorporates a free translation of the Hebrew language prospectus filed by Shagrir in Israel (the "Shagrir Prospectus") for the listing of the Shagrir ordinary shares on the Tel Aviv Stock Exchange.

The unaudited financial statements included in Exhibit 4 of the Shagrir Prospectus under “The Interim Consolidated Financial Statements Attributable to the Company” and “Financial Data From the Interim Consolidated Financial Statements” were prepared and included in the Shagrir Prospectus in accordance with the Israeli Securities Law and regulations (the "ISL"). The form and content of the unaudited financial statements were prepared in accordance with International. Financial Reporting Standards and conform to the requirements of the ISL. The unaudited financial information are based upon a number of assumptions and estimates that, while considered by us to be reasonable, are inherently subject to significant business, economic and other uncertainties and contingencies. You are urged not to place any undue reliance on the unaudited pro forma financial information.

This information statement should be read in conjunction with the Shagrir Prospectus, and is qualified in its entirety by the more detailed information contained in the Shagrir Prospectus. Terms used but not defined herein shall have the meanings given to them in the Shagrir Prospectus incorporated herein.

This information statement is being furnished solely to provide information to existing Pointer Shareholders who will be entitled to receive Shagrir ordinary shares in connection with the Spin-off. This information statement is not an offer to sell or a solicitation of any offer to buy any securities. The Spin-off and listing of the Shagrir ordinary shares on the TASE do not involve any offering of any ordinary shares or any other securities of Shagrir, and no proceeds will be raised.

The Shagrir ordinary shares to be distributed to you by Pointer in connection with the Distribution have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"). In addition, the Shagrir ordinary shares are not being registered under the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"). Instead, Shagrir will publish the information required under Rule 12g3-2(b) of the Exchange Act. As such, Shagrir will publish on its website (www.shagrir.co.il), in English, all material information that it has disclosed under the laws of Israel, that it has filed with the TASE, and that it has otherwise distributed to security holders.

No person has been authorized to give any information or to make any representations other than those contained in this information statement and, if given or made, such information or representations must not be relied upon as having been authorized. The information in this information statement is only accurate as of the date hereof. Nothing in this information statement may be relied upon as a promise or representation as to future results or events, and the delivery of this information statement does not imply that there has been no change in the affairs of Shagrir or Pointer or that the information in this information statement is correct as of any date subsequent to the date hereof.

| 5 |

You should not construe the contents of this information statement as investment, legal or tax advice and should consult with your own counsel, accountants and other advisors as to legal, tax, business, financial and related aspects of receiving Shagrir ordinary shares.

In this information statement, unless the context otherwise requires, when the terms "we", "us", or "our" are used reference is being made to Pointer.

References in this information statement to "US$" and "U.S. dollars" are to United States dollars and references to "NIS" are to New Israeli Shekels.

Unless otherwise stated in this information statement, NIS amounts have been translated into U.S. dollars at the rate of NIS 3.855 to US$1.00 which was the exchange rate as published by the Bank of Israel on May 25, 2016.

Any discrepancies in any table or elsewhere in this information statement between totals and sums of amounts listed herein are due to rounding.

The financial information in this information statement, including the Shagrir Prospectus, has been prepared in accordance with the International Financial Reporting Standards ("IFRS") issued by the International Accounting Standards Board (the "IASB"), which differ in certain respects from accounting principles generally accepted in certain other countries, including generally accepted accounting principles in the United States.

SHAREHOLDER INQUIRIES

Pointer Shareholders with questions relating to the Spin-off may contact Zvi Fried, our Chief Financial Officer, at +972-3-572-3111 during normal business hours in Israel or D.F. King, & Co, Inc., Pointer's Information Agent, at (800) 334-0384 (Toll-Free) or (212) 493-3918 from 8.30 a.m. to 5.30 p.m. EST, Monday to Friday. You may also request copies of this information statement by contacting DF King.

ENFORCEABILITY OF CIVIL LIABILITIES

Shagrir is a company incorporated in and under the laws of Israel, and all of Shagrir's directors and officers reside outside the United States and all or a substantial portion of the assets of Shagrir and of such persons are located outside the United States. As a result, it may not be possible for shareholders to effect service of process within the United States upon Shagrir or such persons, or to enforce against Shagrir or such persons judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the federal securities laws of the United States.

| 6 |

FORWARD-LOOKING STATEMENTS

This information statement contains forward-looking statements. All statements other than statements of historical fact contained in this information statement, including, without limitation, statements relating to Shagrir's strategies, plans, objectives, goals and targets, its future financial, business or other performance and development, the future development of our industry, the general economy of Shagrir's key markets and globally, are intended to identify forward-looking statements. The words "aim", "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "going forward", "intend", "may", "plan", "potential", "predict", "project", "ought to", "seek", "should", "will", "would" and similar expressions are used to identify forward-looking statements.

These forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors, some of which are beyond Shagrir's control. In addition, these forward-looking statements reflect Shagrir's current views with respect to future events and are not a guarantee of future performance. Important factors that could materially affect Shagrir's actual results, performance or achievements include the risk factors set forth in "Risk Factors" in the Shagrir Prospectus and the following:

| · | Adverse changes in the economy; |

| · | Increases in competition; |

| · | Changes in applicable legislation and/or regulation; |

| · | Increases in the price of fuel; |

| · | Damage to Pointer's reputation; |

| · | Loss of licenses required for operations; |

| · | Reliance on large customers; |

| · | Fixed price subscription plans could result in reduced profitability in the event of extreme weather conditions; and |

| · | Changes in labor laws. |

These forward-looking statements are based on current plans and estimates, which speak only as of the date they are made, and numerous assumptions regarding our present and future business strategy and the environment in which Shagrir will operate in the future. Subject to the requirements of applicable laws, rules and regulations, Neither Pointer nor Shagrir has any obligation to update or otherwise revise any forward-looking statements in this information statement, whether as a result of new information, future events or otherwise.

Due to these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this information statement might not occur in the way Shagrir expects, or at all. Accordingly, you should not place undue reliance on any forward-looking information. All forward-looking statements contained in this information statement are qualified by reference to this cautionary statement.

| 7 |

SUMMARY

The following summary highlights information contained in, and is qualified in its entirety by, the more detailed information (including our consolidated financial information and the notes thereto) appearing elsewhere in this information statement. Since the following is a summary, it does not contain all of the information relevant to the Spin-off. Accordingly, you are urged to read the entire information statement, including the Shagrir prospectus.

OVERVIEW

Shagrir has two areas of activity: (a) services to insurance companies; and (b) the car sharing and rental field.

Services to the insurance companies

Shagrir provides various services including road services, services to homes, and services provided by auto service centers. These services are provided directly by Shagrir to insurance company customers and/or additional customers that purchase these services from Shagrir directly (not through the insurance companies).

Field of car sharing and rental

Shagrir provides private and commercial car rental services to customers from the general public for short periods of time (car sharing). Currently, these services are provided via vehicles in Israel primarily throughout Tel Aviv, as well as Givatayim, Raanana, Ramat Gan and Herzliya.

BUSINESS STRATEGIES

Shagrir aims to grow its business by focusing on the following strategies:

| · | expand the variety of its services while increasing the sales of the existing services. |

| · | increase the deployment of Shagrir service centers to additional locations in Israel. |

| · | examine additional marketing channels and additional ways of using the "Shagrir" brand. |

| 8 |

THE SPIN-OFF

The following is a brief summary of certain information contained elsewhere in this information statement and the Shagrir Prospectus. This summary is qualified in its entirety by the more detailed information set forth in this information statement and the Shagrir Prospectus.

| Distributed Company | Shagrir Group Vehicle Services Ltd., a company incorporated in Israel on November 25, 2014. Immediately prior to the Distribution, Pointer held approximately 7,792,444, or 98% of the outstanding shares of Shagrir and the remaining ordinary shares of Shagrir are held by employees of Shagrir. | |

| Distributing Company | Pointer Telocation Ltd., a company incorporated in Israel on July 17, 1991. | |

| Listing and Trading of Shagrir Ordinary Shares |

There is currently no public market for the Shagrir ordinary shares. Shagrir ordinary shares are expected to be listed on the Tel Aviv Stock Exchange under the stock symbol SHGR" on or about June 23, 2016. The proposed listing does not involve an offering of new shares or any other securities and no proceeds will be raised pursuant to the listing. Admission to listing and trading is subject to the approval of the TASE. Shagrir ordinary shares will not be listed on any securities exchange in the United States or quoted on any automated inter-dealer quotation system in the United States. | |

| The Distribution and Spin-off |

On March 29, 2016, our board of directors authorized a conditional special dividend to the Pointer Shareholders to be satisfied by means of a distribution of the share capital of Shagrir which it holds (less approximately 0.92% of the ordinary shares of Shagrir which will be transferred to a certain broker (Barak Capital Underwriters Ltd.) in Israel, for the purpose of their sale to the public over the 12 month period following the Distribution). | |

| Pointer Shareholders will be entitled to receive one Shagrir ordinary share for each Pointer ordinary share held on the Distribution Record Date subject to withholding tax deductions. Pointer Shareholders will not be required to pay any consideration for the Shagrir ordinary shares that they will be entitled to receive in the Distribution or to surrender or exchange Pointer ordinary shares in order to be entitled to receive Shagrir ordinary shares and do not need to take any other action in connection with the Distribution (unless they hold shares at a broker or dealer outside of Israel that cannot take delivery of Israeli shares). After the completion of the Distribution, Pointer will no longer hold any shares in Shagrir. | ||

| The listing of and trading in Shagrir ordinary shares on the TASE is expected to commence on or about June 25, 2016. |

| 9 |

| Record Holders | ||

| Shareholders who are record holders will receive instructions mailed to them at the address on file at Pointer's transfer agent, American Stock Transfer & Trust Company ("AST"). These shareholders will be instructed to (i) move their shares into a brokerage account at an Israeli brokerage account (a "TASE Member") or (ii) move their shares to a US bank/broker that is able to effect settlement of Israeli shares (an "Eligible US Broker"). If neither of these steps is taken, the Shagrir ordinary shares will be deposited in a segregated escrow account managed by ESOP Management & Trust Services Ltd., a company incorporated under Israeli law (the "Unidentified Shareholder Escrow Account") pending receipt of proper settlement instructions See "Unidentified Shareholder Escrow Agent" below. | ||

| Note that stock certificates for Shagrir ordinary shares cannot be issued to individual holders as Israeli TASE-only companies do not issue stock certificates. Instead, all outstanding shares of Shagrir will be represented by one global share certificate which will be deposited on the distribution date with the nominee company ("Hevra Lerishumim"), in accordance with TASE bylaws and regulations. | ||

| Beneficial Holders | ||

| As the Shagrir ordinary shares will not be listed on a U.S. stock exchange, only a broker, bank, nominee, or other institution that is able to effect settlement of a foreign (Israeli) security shall be able to credit the Shagrir ordinary shares to shareholders that hold Pointer ordinary shares through the NASDAQ. Beneficial Pointer Shareholders should therefore contact their bank or broker to confirm if their bank or broker is able to receive and hold such shares. | ||

| Shareholders that hold Pointer ordinary shares with a broker, bank, nominee, or other institution that is not able to effect settlement of foreign securities will, prior to the record date, be required to: (i) open an account with an Eligible US Broker; (ii) open a brokerage account with a TASE Member in Israel; or (iii) provide settlement instructions to your US broker for delivery of the Shagrir ordinary shares to a TASE Member. If none of these steps is taken, the Shagrir ordinary shares will be deposited in a segregated escrow account pending proper settlement instructions. See "Unidentified Shareholder Escrow Agent" below. | ||

| Note for Beneficial Pointer Shareholders | ||

| Pointer Shareholders who are holding Pointer ordinary shares through a bank, broker, dealer, financial institution or other custodian or nominee ("Beneficial Pointer Shareholders") are not registered holders of Pointer ordinary shares and therefore do not appear on the register of members of Pointer. As Shagrir ordinary shares will be distributed under the Distribution to those Pointer Shareholders of record on the Distribution Record Date, there is no assurance that Beneficial Pointer Shareholders will be able to receive Shagrir ordinary shares on or prior to the Listing Date, because the timing and manner of delivery of the Shagrir ordinary shares will depend on specific arrangements with their respective intermediaries. Beneficial Pointer Shareholders should therefore contact their respective intermediaries to coordinate the delivery of Shagrir ordinary shares under the Distribution. |

| 10 |

| Unidentified Shareholder Escrow Agent | ||

| We will deposit with the Unidentified Shareholder Escrow Agent the Shagrir ordinary shares net of any Shagrir ordinary shares required to be sold to cover the applicable tax, for any Pointer Shareholder for which details of a TASE Member or a US bank/broker that is able to effect settlement of Israeli shares, were not provided to the Company's Information Agent by June 17, 2016. Each record holder of Pointer ordinary shares and/or Beneficial Pointer Holder (collectively, the "Holders") whose Shagrir ordinary share were deposited with the Unidentified Shareholder Escrow Agent will be required to contact the Escrow Agent at esop-helpdesk@esop.co.il in order to claim or sell the Shagrir ordinary shares attributed to such Holder. Each Holder will be required to follow the identification and Know Your Clients process as shall be instructed by the Unidentified Shareholder Escrow Agent. The release of Shagrir ordinary shares from the Unidentified Shareholder Escrow Agent will be exempt of commission and if a sale is required the sale commission will be 0.1% from the sale proceeds in addition to wire commission. The Unidentified Shareholder Escrow Agent will continue to act for seven (7) years from the Distribution Record Date (the "Escrow Termination"). Unless a Holder has requested that the Unidentified Shareholder Escrow Agent continue to hold some or all of the Shagrir ordinary shares, subject to a new agreement between the Unidentified Shareholder Escrow Agent and the holder, at the end of the Escrow Termination, the Unidentified Shareholder Escrow Agent will sell the remaining Shagrir ordinary shares and will wire the sale proceeds to Pointer. | ||

| For further information, see "Manner of Performing the Distribution of the Distribution Shares as Dividend in Kind" at Section 2.5 of the Shagrir Prospectus. | ||

Conditions to the Distribution |

The Distribution is conditional on the TASE granting registration approval for the Shagrir ordinary shares to trade on the TASE which requires, among other things, that Shagrir have a public float of at least NIS 40 million as of December 31, 2015, subject to certain adjustments made in accordance with the TASE bylaws. | |

| Distribution Record Date | June 7, 2016. | |

| In order to be entitled to receive Shagrir ordinary shares in the Distribution, Pointer Shareholders must be holders of record of Pointer ordinary shares on the Distribution Record Date. | ||

| Risks Associated with the Distribution and Shagrir |

There are certain risks associated with the Distribution and Shagrir. See "Risk Factors Relating to the Distribution" beginning on page IS-17 of this information statement and "Discussion of Risk Factors" in Section 6.26.4 and Section 6.47.4 of the Shagrir Prospectus. |

| 11 |

| No Pointer Shareholder Approval Required | No Pointer shareholder approval for the Distribution is not required or sought. Pointer is not asking you for a proxy and you are requested not to send a proxy to Pointer. | |

| No Appraisal Rights | Pointer shareholders have no appraisal rights in connection with the Distribution. | |

| Certain Relationships Among DBSI, Pointer and Shagrir After the Distribution |

Immediately after the Distribution, DBSI, the controlling shareholder of Pointer, will directly and indirectly own approximately 30% of the ordinary shares of Shagrir. For a discussion of certain continuing relationships among DBSI, Pointer and Shagrir, see "Transactions with the Company's Controlling Shareholder" at "Section 8.5 of the Shagrir prospectus. | |

| Certain Material Tax Consequences |

Pointer intends to treat the Distribution as a taxable transaction for U.S. federal income tax purposes. The distribution may be subject to Israeli withholding tax in which case 25% of the Shagrir ordinary shares that a Pointer Shareholder is entitled to receive will be withheld and sold by a trustee on the TASE to satisfy the tax obligation relating to the Distribution. For a discussion of certain material income tax consequences, see "Risk Factors Relating to the Distribution" and "Certain Material Tax Consequences" and in this information statement. |

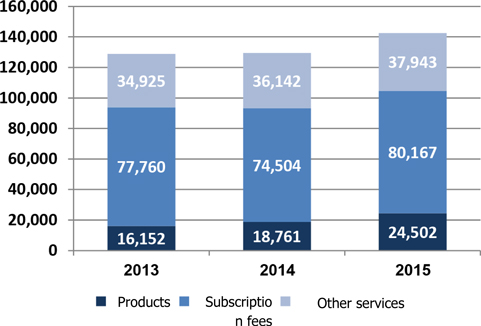

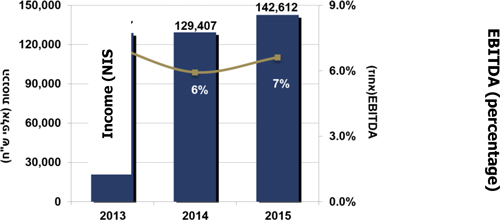

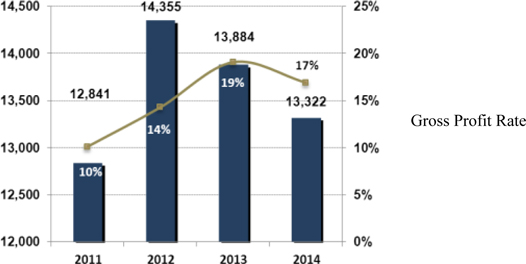

HISTORICAL FINANCIAL INFORMATION

The following tables set forth, for the periods and as of the dates indicated, the consolidated financial data of Shagrir. You should read the following information together with the more detailed information contained in Shagrir’s consolidated financial statements and the related notes included elsewhere in this information statement. The historical consolidated income statements for the years ended December 31, 2015, 2014 and 2013 and the consolidated statements of financial position as of December 31, 2015 and 2014 are included in Shagrir’s audited consolidated financial statements included elsewhere in this information statement. The consolidated income statements for the three months ended March 31, 2016 and 2015 and the consolidated statements of financial position as of March 31, 2016 and 2015 are included in Shagrir’s unaudited consolidated financial statements appearing in this information statement and have been prepared on the same basis as the audited consolidated financial statements. In the opinion of management of Shagrir, the unaudited data reflects all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information in those statements. Shagrir’s historical results are not necessarily indicative of the results that should be expected in the future, and results for the three months ended March 31, 2016 are not necessarily indicative of the results to be expected for the full year ending December 31, 2016.

| 12 |

| Consolidated Income Statements | For year ending on December 31 | |||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| NIS thousands | ||||||||||||

| Revenue from sales | 24,642 | 19,149 | 16,621 | |||||||||

| Revenues from services | 131,981 | 120,695 | 122,691 | |||||||||

| Total revenue | 156,623 | 139,844 | 139,312 | |||||||||

| Cost of sales | 13,847 | 10,776 | 9,082 | |||||||||

| Cost of providing services | 123,205 | 113,878 | 114,327 | |||||||||

| Total cost of sales and services | 137,052 | 124,654 | 123,409 | |||||||||

| Gross profit | 19,571 | 15,190 | 15,903 | |||||||||

| Marketing and sale expenses | 7,976 | 7,029 | 7,682 | |||||||||

| Management and general expenses | 9,987 | 9,627 | 8,079 | |||||||||

| Impairment and intangible assets | - | 2,567 | 900 | |||||||||

| 17,963 | 19,223 | 16,661 | ||||||||||

| Operating profit (loss) | 1,608 | (4,033 | ) | (758 | ) | |||||||

| Net financing expenses | 8,218 | 238 | 173 | |||||||||

| Loss before income tax | 6,610 | 4,271 | 931 | |||||||||

| Tax benefit | 860 | 141 | 265 | |||||||||

| Loss | 5,750 | 4,130 | 666 | |||||||||

| Other total loss after tax impact: | ||||||||||||

| Amounts not reclassified later to profit and loss: | ||||||||||||

| Profit from re-measurement of defined benefit plans | ||||||||||||

| 40 | 59 | 39 | ||||||||||

| Total components not classified thereafter to profit or loss | 40 | 59 | 39 | |||||||||

| Total other comprehensive income | 40 | 59 | 39 | |||||||||

| Total comprehensive loss | 5,710 | 4,071 | 627 | |||||||||

| Net profit (loss) attributable to: | ||||||||||||

| Shareholders of the Shagrir | (5,472 | ) | (2,526 | ) | 90 | |||||||

| Non-controlling interests | (278 | ) | (1,604 | ) | (756 | ) | ||||||

| (5,750 | ) | (4,130 | ) | (666 | ) | |||||||

| Total comprehensive profit (loss) attributable to: | ||||||||||||

| Shareholders of Shagrir | (5,433 | ) | (2,466 | ) | 136 | |||||||

| Non-controlling interests | (277 | ) | (1,605 | ) | (763 | ) | ||||||

| (5,710 | ) | (4,071 | ) | (627 | ) | |||||||

| Net profit per share attributed to Shagrir's shareholders (in NIS)[1] | ||||||||||||

| Net basic profit (loss) | (0.7 | ) | (0.32 | ) | 0.01 | |||||||

| Diluted profit (loss) | (0.68 | ) | (0.32 | ) | 0.01 | |||||||

1For number of shares used in calculation of net profits attributed to Shagrir’s shareholders, see Note 21 to the Financial Statements included in this information statement.

| 13 |

Consolidated Income Statements | Three months ended March 31, | Year ended December 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Unaudited | Audited | |||||||||||

| NIS in thousands | ||||||||||||

| Revenues from sales | 7,348 | 5,129 | 24,642 | |||||||||

| Revenues from provision of services | 35,033 | 32,171 | 131,981 | |||||||||

| Total revenues | 42,381 | 37,300 | 156,623 | |||||||||

| Cost of sales | 4,097 | 3,002 | 13,847 | |||||||||

| Cost of services | 31,323 | 29,609 | 123,205 | |||||||||

| Total cost of sales and services | 35,420 | 32,611 | 137,052 | |||||||||

| Gross profit | 6,961 | 4,689 | 19,571 | |||||||||

| Operating expenses: | ||||||||||||

| Selling and marketing expenses | 2,015 | 1,714 | 7,976 | |||||||||

| General and administrative expenses | 2,767 | 1,840 | 9,987 | |||||||||

| Total operating expenses | 4,782 | 3,554 | 17,963 | |||||||||

| Operating income | 2,179 | 1,135 | 1,608 | |||||||||

| Finance expenses, net | 174 | 1,921 | 8,218 | |||||||||

| Income (loss) before taxes on income | 2,005 | (786 | ) | (6,610 | ) | |||||||

| Taxes on income (tax benefit) | (659 | ) | 127 | 860 | ||||||||

| Net income (loss) | 1,346 | (659 | ) | (5,750 | ) | |||||||

| Other comprehensive income (loss) (net of tax effect): | ||||||||||||

| Items not to be reclassified to profit or loss in subsequent periods: | ||||||||||||

| Gain (loss) from remeasurement of defined benefit plans | (82 | ) | 28 | 40 | ||||||||

| Total items not to be reclassified to profit or loss in subsequent periods | (82 | ) | 28 | 40 | ||||||||

| Total other comprehensive income (loss) | (82 | ) | 28 | 40 | ||||||||

| Total comprehensive income (loss) | 1,264 | (631 | ) | (5,710 | ) | |||||||

| Net income (loss) attributable to: | ||||||||||||

| Equity holders of the Company | 1,242 | (606 | ) | (5,472 | ) | |||||||

| Non-controlling interests | 104 | (53 | ) | (278 | ) | |||||||

| 1,346 | (659 | ) | (5,750 | ) | ||||||||

| Total comprehensive income (loss) attributable to: | ||||||||||||

| Equity holders of the Company | 1,160 | (578 | ) | (5,433 | ) | |||||||

| Non-controlling interests | 104 | (53 | ) | (277 | ) | |||||||

| 1,264 | (631 | ) | (5,710 | ) | ||||||||

| Net earnings (loss) per share attributable to equity holders of the Company (in NIS):2 | ||||||||||||

| Basic net earnings (loss) | 0.16 | (0.08 | ) | (0.70 | ) | |||||||

| Diluted net earnings (loss) | 0.15 | (0.08 | ) | (0.68 | ) | |||||||

2 For number of shares used in calculation of net profits attributed to Shagrir’s shareholders, see Note 5 to the Financial Statements included in this information statement.

| 14 |

Consolidated Statements of Financial Position

| As of December 31 | As of January 1 | |||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| NIS thousands | ||||||||||||

| Current assets | ||||||||||||

| Cash and cash equivalents | 8,176 | 36 | 828 | |||||||||

| Customers | 34,766 | 31,461 | 23,522 | |||||||||

| Accounts receivable | 1,758 | 2,915 | 2,783 | |||||||||

| Inventory | 654 | 588 | 636 | |||||||||

| Real estate held for sale | 1,101 | 4,000 | - | |||||||||

| 46,455 | 39,000 | 27,769 | ||||||||||

| Non-current assets | ||||||||||||

| Long-term receivables | - | - | 376 | |||||||||

| Fixed assets | 22,379 | 21,139 | 30,053 | |||||||||

| Other intangible assets | 1,843 | 2,528 | 5,536 | |||||||||

| Goodwill | 60,083 | 60,083 | 62,872 | |||||||||

| Deferred taxes | 118 | - | - | |||||||||

| 84,423 | 83,750 | 98,837 | ||||||||||

| 130,878 | 122,750 | 126,606 | ||||||||||

| Current liabilities | ||||||||||||

| Credit from bank corporations, Pointer and others | 326 | 65,269 | - | |||||||||

| Liabilities to suppliers and service providers | 27,655 | 20,943 | 17,236 | |||||||||

| Income in advance | 21,091 | 22,448 | 24,440 | |||||||||

| Accounts payable | 11,062 | 11,943 | 8,838 | |||||||||

| 60,134 | 120,603 | 50,514 | ||||||||||

| Non-current liabilities | ||||||||||||

| Long-term deferred revenues | 1,816 | - | - | |||||||||

| Loans from shareholders and others | 6,796 | 1,011 | 630 | |||||||||

| Liabilities and assets for employee benefits, net | 1,310 | 1,119 | 1,026 | |||||||||

| Deferred taxes | - | 123 | 205 | |||||||||

| 9,922 | 2,253 | 1,861 | ||||||||||

| Contingent liabilities and commitments | ||||||||||||

| Share capital attributed to shareholders of Shagrir | ||||||||||||

| Share capital | 95 | - | - | |||||||||

| Share premium | 76,179 | - | - | |||||||||

| Capital reserve for controlling shareholders | - | 5,649 | 77,831 | |||||||||

| Loss balance | (9,497 | ) | - | - | ||||||||

| Capital reserve for transactions with non-controlling right holders. | (1,945 | ) | (1,945 | ) | (1,945 | ) | ||||||

| Reserve for re-measurement of defined benefit plans | 783 | 744 | 638 | |||||||||

| 65,615 | 4,448 | 76,524 | ||||||||||

| Non-controlling interests | (4,793 | ) | (4,554 | ) | (2,293 | ) | ||||||

| Total capital (capital deficit) | 60,822 | (106 | ) | 74,231 | ||||||||

| 130,878 | 122,750 | 126,606 | ||||||||||

| 15 |

| Consolidated Statements of Financial Position | March 31, | December 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Unaudited | Audited | |||||||||||

| NIS in thousands | ||||||||||||

| ASSETS | ||||||||||||

| CURRENT ASSETS: | ||||||||||||

| Cash and cash equivalents | 6,639 | 3,595 | 8,176 | |||||||||

| Trade receivables | 43,768 | 36,549 | 34,766 | |||||||||

| Other accounts receivable | 2,654 | 2,077 | 1,758 | |||||||||

| Inventories | 632 | 599 | 654 | |||||||||

| ASSETS HELD FOR SALE | 185 | 3,347 | 1,101 | |||||||||

| 53,878 | 46,167 | 46,455 | ||||||||||

| NON-CURRENT ASSETS: | ||||||||||||

| Property, plant and equipment | 25,197 | 19,924 | 22,379 | |||||||||

| Other intangible assets | 1,807 | 2,324 | 1,843 | |||||||||

| Goodwill | 60,083 | 60,083 | 60,083 | |||||||||

| Deferred taxes | - | 98 | 118 | |||||||||

| 87,087 | 82,429 | 84,423 | ||||||||||

| 140,965 | 128,596 | 130,878 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||

| CURRENT LIABILITIES: | ||||||||||||

| Credit from banks, the parent company and others | 452 | 67,406 | 326 | |||||||||

| Trade payables | 30,963 | 23,480 | 27,655 | |||||||||

| Accrued income | 26,588 | 26,492 | 21,091 | |||||||||

| Other accounts payable | 10,083 | 9,675 | 11,062 | |||||||||

| 68,086 | 127,053 | 60,134 | ||||||||||

| NON-CURRENT LIABILITIES: | ||||||||||||

| Long-term accrued income | 1,589 | - | 1,816 | |||||||||

| Loans from shareholders and others | 3,756 | 959 | 6,796 | |||||||||

| Employee benefit liabilities, net | 1,489 | 1,121 | 1,310 | |||||||||

| Deferred taxes | 176 | - | - | |||||||||

| 7,010 | 2,080 | 9,922 | ||||||||||

| EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY: | ||||||||||||

| Share capital | 97 | 95 | 95 | |||||||||

| Share premium | 80,678 | 93 | 76,179 | |||||||||

| Capital reserve from transactions with controlling shareholder | - | 5,649 | - | |||||||||

| Accumulated deficit | (8,973 | ) | (606 | ) | (9,497 | ) | ||||||

| Capital reserve from transactions with non-controlling interests | (1,782 | ) | (1,945 | ) | (1,945 | ) | ||||||

| Capital reserve from remeasurement of defined benefit plans | 701 | 772 | 783 | |||||||||

| 70,721 | 4,058 | 65,615 | ||||||||||

| Non-controlling interests | (4,852 | ) | (4,595 | ) | (4,793 | ) | ||||||

| Total equity (deficit) | 65,869 | (537 | ) | 60,822 | ||||||||

| 140,965 | 128,596 | 130,878 | ||||||||||

| 16 |

RISK FACTORS RELATING TO THE DISTRIBUTION

You should carefully consider the risks described below and under "Discussion of Risk Factors" in Section 6.26 in the Shagrir Prospectus.

The combined market value of the outstanding Pointer ordinary shares and Shagrir ordinary shares after the Spin-off may be less than the market value of the Pointer outstanding ordinary shares prior to the Spin-off.

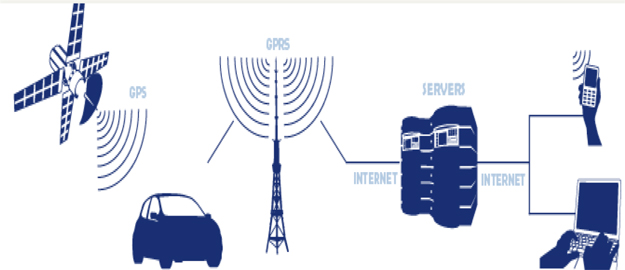

We have currently three business segments: (i) Cellocator, (ii) mobile resource management ("MRM") products and (iii) roadside assistance ("RSA") which is operated through Shagrir.

After the completion of the Distribution, we will no longer hold any Shagrir ordinary shares and, accordingly, it will only retain its Cellocator and MRM businesses. Until the market has fully evaluated our business without Shagrir, as well as the business of Shagrir on a stand-alone basis, the trading price of the ordinary shares of Pointer and the ordinary shares of Shagrir may fluctuate significantly. In particular, the combined market value of Pointer ordinary shares and Shagrir ordinary shares after the Spin-off may be significantly less than the market value of the Pointer ordinary shares prior to the Spin-off.

The Distribution may be treated as a taxable transaction for U.S. Federal income tax purposes.

It is not clear whether the Distribution would qualify as a tax-free spin-off under Section 355 of the U.S. Internal Revenue Code of 1986, as amended (the "Code"). If we are required to report the Distribution to the IRS, we intend to treat the Distribution as a taxable transaction to our shareholders for U.S. federal income tax purposes. Under this treatment, as explained in "Certain Material Tax Consequences — United States Federal Income Taxation" in this information statement, U.S. holders of Pointer ordinary shares would be subject to tax on the fair market value of the Shagrir ordinary shares they receive. Holders should consult their own tax advisers concerning the U.S. federal, state, local and other tax consequences of the Distribution in light of their particular circumstances.

Holders of the Shagrir ordinary shares located in the United States may not be able to participate in rights offerings or elect to receive dividends in the form of Shagrir ordinary shares and may experience dilution of their holdings.

Shagrir may, from time to time, distribute rights to its shareholders, including rights to acquire additional securities. Shagrir may not offer or sell securities in the United States unless Shagrir registers those securities under the Securities Act or an exemption from the registration requirements of the Securities Act is available. Shagrir cannot assure you that it will be able to establish an exemption from registration under the Securities Act, and it is are under no obligation to file a registration statement with respect to these rights or underlying securities or to endeavor to have a registration statement declared effective. Accordingly, holders of the Shagrir ordinary shares located in the United States may be unable to participate in rights offerings and may experience dilution of their holdings as a result.

| 17 |

Shagrir may offer, from time to time, a share dividend election to all its shareholders, subject to applicable securities laws, in respect of future dividends. It will, however, not permit its shareholders to exercise such election unless the issuance of its ordinary shares pursuant to such election is either exempt from registration under the Securities Act or registered under the provisions of the Securities Act. There can be no assurance that Shagrir will be able to establish an exemption from registration under the Securities Act, and Shagrir is under no obligation to file a registration statement with respect to shares issuable pursuant to these elections or to endeavor to have a registration statement declared effective under the Securities Act. In addition, Shagrir may choose not to offer such election to some shareholders, and may instead offer those shareholders dividends in the form of cash only. Accordingly, Shagrir's shareholders may be unable to elect to receive dividends in the form of its ordinary shares rather than cash and, as a result may experience dilution of their holdings.

Shareholders outside of Israel will be subject to Israeli Withholding Tax on the Distribution.

The distribution of Shagrir ordinary shares in the Spin-Off to holders of Pointer ordinary shares which are traded on the NASDAQ Capital Market, will be subject to Israeli backup withholding tax at a rate of 25%.

In respect of those record holders of Pointer ordinary shares and Beneficial Pointer Shareholders, which are traded on the NASDAQ Capital Market, we will satisfy our backup withholding obligation by depositing 25% of the Shagrir ordinary shares to which they are entitled (the "Withholding Shares"), into a segregated tax escrow account in Israel (also managed by ESOP Management & Trust Services Ltd.) (the "Tax Escrow Agent"). The Tax Escrow Agent will sell, over a 180 day period following the commencement of the trading of the Shagrir ordinary shares on the TASE, such number of Withholding Shares which will yield proceeds (the "Withholding Amount") equal to an amount calculated by multiplying 25% of the Shagrir ordinary shares to which each applicable holder is entitled by the average closing price of the Shagrir ordinary shares (the "Average PPS") during the three (3)-trading days immediately following the commencement of trade of the Shagrir ordinary shares on the TASE (the "Assessment Period"), and any remaining Shagrir ordinary shares will be paid into the Unidentified Shareholder Escrow Account, where the Holder will be entitled to reclaim them subject to provision of evidence to the satisfaction of the Unidentified Shareholder Escrow Agent. Any shortfall in withholding taxes to be paid, will be covered by Pointer.

Notwithstanding the foregoing, for record holders of Pointer ordinary shares and Beneficial Pointer Shareholders, which are traded on the NASDAQ Capital Market, to which Shagrir ordinary shares were distributed to a TASE Member on behalf of the Eligible US Broker (the "Applicable TASE Member"), such Applicable TASE Member will be entitled to provide the Tax Escrow Agent prior to the Distribution Date, with a declaration stating that it will withhold the applicable withholding tax and upon receipt of such declaration, the Tax Escrow Agent will release to the Applicable TASE Member a number of Shagrir ordinary shares equal to the Holder's applicable number of Withholding Shares. In such an event, unless the Holder can provide a valid Israeli withholding tax exemption certificate (an "Exemption Certificate"), the Applicable TASE Member will be required to pay to the Israel Tax Authority an amount equal to the Withholding Amount, and will sell such number of Withholding Shares (and if necessary additional Shagrir ordinary shares) held by the Holder, or take such other action agreed upon between the Holder and the TASE Member, as is necessary to cover the tax liability. We will not be responsible for any shortfall in withholding taxes in these circumstances.

| 18 |

For further information, see "Manner of Withholding Tax at Source for Distribution Shares" at Section 2.9 of the Shagrir Prospectus.

It may be difficult and costly to enforce a judgment issued in the United States against Pointer or Shagrir, the executive officers and directors of Pointer or Shagrir, or to assert United States securities laws claims in Israel or serve process on the officers and directors of Pointer or Shagrir.

Both Pointer and Shagrir are incorporated and headquartered in Israel. Service of process upon directors and officers of both Pointer and Shagrir and the Israeli experts named herein, all of who reside outside the United States, may be difficult to effect within the United States. Furthermore, since the majority of the assets of Pointer and Shagrir are located outside the United States, any judgment obtained against Shagrir or Pointer in the United States may not be enforceable within the United States. Additionally, it may be difficult for you to enforce civil liabilities under United States federal securities laws in original actions instituted in Israel.

As a result of all of the above, public shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling shareholders of Pointer or Shagrir than they would as shareholders of a U.S. company.

EXCHANGE RATE INFORMATION

The average exchange rate, using the average of the exchange rates on the last day of each month during the period, for each of the five most recent fiscal years, as published by the Bank of Israel, was as follows:

| Period | Exchange Rate | |

| January 1, 2011 – December 31, 2011 | 3.5781 NIS/$1 | |

| January 1, 2012 – December 31, 2012 | 3.8559 NIS/$1 | |

| January 1, 2013 – December 31, 2013 | 3.6108 NIS/$1 | |

| January 1, 2014 – December 31, 2014 | 3.5779 NIS/$1 | |

| January 1, 2015 – December 31, 2015 | 3.8839 NIS/$1 |

| 19 |

CAPITALIZATION

The following table sets forth Shagrir's capitalization as of December 31, 2015. This table should be read in conjunction with Shagrir's consolidated financial statements beginning on page F-1 of this information statement.

| As of December 31, 2015 | ||||

| (NIS, in thousands) | ||||

| Cash and cash equivalents | 8,176 | |||

| Short-term credit from bank corporations, the Parent Company and others | 326 | |||

| Long-term loans from shareholders and others | 6,796 | |||

| Share capital attributed to shareholders of the Company | ||||

| Share capital | 95 | |||

| Share premium | 76,179 | |||

| Capital reserve for controlling shareholders | - | |||

| Loss balance | (9,497 | ) | ||

| Capital reserve for transactions with non-controlling right holders. | (1,945 | ) | ||

| Reserve for re-measurement of defined benefit plans | 783 | |||

| 65,615 | ||||

| Non-controlling interests | (4,793 | ) | ||

| Total capital (capital deficit) | 60,822 | |||

| 20 |

MARKET INFORMATION

Currently, there is no trading market for Shagrir ordinary shares. Shagrir is seeking the approval of the ISA and the TASE for the listing of its ordinary shares on the TASE. See "The Spin-off" in this information statement. The Shagrir ordinary shares are expected to be listed on the TASE under the stock symbol "SHGR" on or about June 25, 2016. The proposed listing does not involve an offering of new shares or any other securities and no new proceeds will be raised pursuant to the listing. There can be no assurance as to the establishment or continuity of any trading market for the Shagrir ordinary shares. The Shagrir ordinary shares will not be listed on any securities exchange in the United States or quoted on any automated inter-dealer quotation system in the United States.

THE TEL AVIV STOCK EXCHANGE

The Tel Aviv Stock Exchange promulgates its own rules governing share trading. Disclosure of information to shareholders and investors is governed by the Israeli Securities Laws and the ISA decisions. Companies listed on the Tel Aviv Stock Exchange are required to comply with the provisions of the Israeli Securities Laws, which provide for, among other things, the issuance of interim and audited annual accounts to shareholders and the making of immediate public reports of material events and developments.

The Tel Aviv Stock Exchange imposes a requirement on listed companies to keep the Tel Aviv Stock Exchange and shareholders informed as soon as reasonably practicable of any information relating to such companies, including information which applies to material events regarding the business and affairs of the Company and related party transactions.

There are also requirements under the listing rules for listed companies to obtain prior shareholders' approval and/or to disclose to shareholders details of certain acquisitions or disposal of assets and connected transactions.

CERTAIN INFORMATION CONCERNING POINTER

Pointer was incorporated under the laws of the State of Israel on July 17, 1991 under the name Nexus Telecommunications Systems Ltd., which was changed to Nexus Telocation Systems Ltd. in December 1997 and to Pointer Telocation Ltd. in January 2006. The principal legislation under which Pointer operates is the Israeli Companies Law, 5759-1999, as amended. The telephone number of Pointer is (+972) 3 572 3111.

Following the Distribution, Pointer will continue to engage in its Cellocator and MRM businesses.

| 21 |

Directors and Management

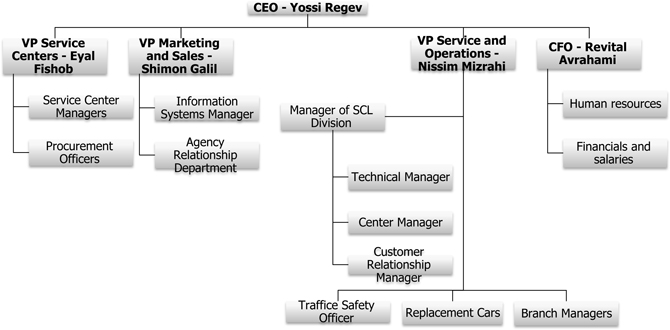

Upon the completion of the Spin-off, the following will serve as the executive officers and directors of Shagrir:

| Name | Age | Position with Company |

|

Yossi Ben Shalom |

60 |

Chairman of the Board of Directors |

| Yossi Regev | 56 | CEO |

| Nir Cohen | 43 | Director |

| Kinneret Yaari | 31 | Director |

| Shimon Galil | 54 | VP, Sales and Marketing |

| Revital Avrahami | 45 | Chief Financial Officer |

| Eyal Fishov | 46 | VP, Service Centers |

| Nissim Mizrachi | 58 | VP, Operations and Service |

| Gil Lazer | 38 | CEO Car2Go (through Gil Lazar Ltd.) |

Yossi Ben Shalom and Nir Cohen currently serve as the chairman of the board of directors, and a member of the board of directors of Pointer, respectively. They will continue to serve on the board of directors of Pointer following the Spin-Off.

For more information on the directors and executive officers of Shagrir, see "The Board of Directors of the Company" at section 7.1 and "Senior Officers of the Company" at section 7.2, of the Shagrir Prospectus.

Agreements with Shagrir

After the Spin-off, Pointer will have a commercial relationship with Shagrir but will not be a "related party" of Shagrir under the Israeli Companies Law. See "Transactions with Controlling Shareholder” at section 8.5 of the Shagrir prospectus.

CERTAIN MATERIAL TAX CONSEQUENCES

The following discussion of the material Israeli and United States federal income tax consequences of the Distribution is based upon laws and relevant interpretations thereof in effect as of the date of this information statement, all of which are subject to change. This discussion does not address all possible tax consequences relating to the Distribution ordinary shares, including the tax consequences under United States state and local tax laws. Pointer Shareholders are urged to consult their own tax advisers concerning the overall tax consequences to them, including consequences arising under United States state and local or other tax laws.

| 22 |

Israeli Taxation

Manner of Withholding Tax at Source for Distribution Shares

On May 16, 2016, we received a tax ruling from the Israel Tax Authority ("ITA") with respect to the manner of withholding tax at source for the Distribution ("Approval of the Tax Authority"). The Approval of the Tax Authority is attached as Appendix 2 to the Shagrir Prospectus.

The following describes some of the principles set forth in the Approval of the Tax Authority:

The value of the dividend in kind will be determined in accordance with the product of the number of the Shagrir ordinary shares distributed in the Spin-Off by the average closing price of Shagrir's ordinary shares in the first three trading days following the commencement of trade on the TASE (the "Dividend Value").

We will publish the Dividend Value at the end of the said three-day trading period on the TASE. The purchase date of the ordinary shares distributed to each holder will be deemed to be the date of the Distribution and the value of the Shagrir ordinary shares distributed to each holder will be calculated on the basis of such holder's relative portion out of the Dividend Value. Holders of Pointer ordinary shares which were traded on the TASE on the Record Date will have withholding tax deducted at source by the relevant TASE Member, calculated on the basis of their relative portion out of the Dividend Value, in accordance with Regulation 2 of the Income Tax Regulations (Withholding from Interest, Dividend and Certain Profits), 5766-2005.

For information on Israeli taxation of the holders of Pointer ordinary shares which are traded on the NASDAQ Capital Market on the Record Date, see "Shareholders outside of Israel will be subject to Israeli Withholding Tax on the Distribution" in this Information Statement and "Manner of Tax Withholding of the Distribution Shares" at Section 2.9 of the Shagrir Prospectus.

Taxation of the Shagrir Ordinary Shares Distributed in the Spin-Off

In accordance with Section 91 of the Israel Tax Ordinance (the "Ordinance"), a real capital gain on the sale of securities by an Israeli-resident individual, where the income from the sale of the securities does not constitute income from a "business" or "occupation" and the individual does claim financing expenses, is liable to tax at the marginal rate applying to the individual under Section 121 of the Ordinance, subject to a maximum of 25%, and the capital gain will be regarded as the highest bracket in the scale of his taxable income. Such tax excludes the sale of securities by an individual who is a "substantial shareholder" in a company, i.e. who holds, directly or indirectly, alone or jointly with another, at least 10% of one or more types of means of control in the company on the date of the sale of the securities or at any time during the 12 months prior to such sale, while the tax rate on a real capital gain in such instance will not be greater than 30% ( "Substantial Shareholder").

| 23 |

Furthermore, where an individual claims real interest expenses and linkage differences on securities, the capital gain on the sale of the securities, is liable to tax at a rate of 30%, until the determination of provisions and conditions for the deduction of real interest expenses in accordance with Sections 101A(a)(9) and101A(b) of the Ordinance. This tax rate would not apply to an individual whose income from the sale of securities constitutes "business" income or income from an "occupation," in and he will be liable for marginal tax as set forth in Section 121 of the Ordinance.

On August 13, 2012, the Law to Reduce the Deficit and Change the Tax Burden (Legislative Amendments), 5772-2012 was published. In accordance with the aforesaid law, as of January 1, 2013, additional tax will be applied at a rate of 2% on part of the taxable income of an individual that exceeds NIS 803,520 (as of 2016).

A body of persons shall be liable to tax on real capital gains on the sale of securities at the corporate tax rate (25% as of 2016).

In general, a foreign resident (individual or body of persons), as defined in the Ordinance, is exempt from tax on capital gains upon the sale of securities traded on the Stock Exchange in Israel, pursuant to Section 97(b2) of the Ordinance (excluding Israeli treasury bills and short-term bonds in accordance with Amendment 186 to the Ordinance), provided that the capital gain is not derived from his permanent enterprise in Israel and if the purchase of the security was covered by a prospectus or purchased thereafter, and in accordance with the conditions and limitations of Section 97(b2) of the Ordinance. The foregoing shall not apply to a foreign-resident body of persons or, in the event that Israeli residents are controlling shareholders or beneficiaries entitled to 25% or more of the income or profits of the foreign-resident body of persons, directly or indirectly, alone or jointly with another, or together with another resident of Israel as provided in Section 68A of the Ordinance. It is noted that in the event that such exemption does not apply, the exemption provisions of the tax treaty (if any exists) between Israel and the country of residence of the foreign resident may apply, subject to the submission in advance of confirmation of an exemption from withholding tax at source from the ITA.

An exempt mutual fund as well as provident funds and entities exempt from tax under section 9(2) of the Ordinance are exempt from tax on capital gains from the sale of securities, as stated, in accordance with and subject to the conditions of that section. The taxable income of a taxable mutual fund from the sale of securities is subject to the tax rate applying to the income of an individual that does not constitute income from a "business" or "profession," unless explicitly determined otherwise. In the absence of a special tax rate for the income, the income will be liable to tax at the maximum rate determined in Section 121 of the Ordinance.

Withholding Tax on Capital Gains from Securities

With regard to the withholding tax from real capital gains on the sale of the Shagrir ordinary shares, in accordance with Sections 164-243 of the Ordinance and the provisions of the Income Tax Regulations (Deduction from Proceeds, Payment or Capital Gain on the Sale of Securities, Sale of a Mutual Fund Unit or a Future Transaction), 5763-2002 (the "Regulations"), a "liable person" (as this term is defined in such regulations) who pays the seller consideration for the sale of Securities, is required to withhold tax at a rate of 25% from the real capital gain, and in the case of a security that is not linked to the index as defined in Section 91 of the Ordinance, at a rate of 15% from the capital gain when the seller is an individual, and at a corporate tax rate as defined in Section 126(a) of the Ordinance (25% in 2016), when the seller is a body of persons. This is subject to a tax exemption (or a reduced rate), from withholding tax, issued in advance by the tax assessor and subject to offsetting losses that the withholder may perform at source. Additionally, tax will not be withheld for a provident fund, mutual funds and other entities exempt from withholding tax under law. It is noted that if at the time of the sale the full withholding tax was not deducted from the real capital gain, Section 91(d) of the Ordinance and the provisions pursuant thereto regarding reporting and prepayment in respect of such a sale will apply.

| 24 |

Tax will not be withheld from a foreign resident as stated in accordance with certain conditions set forth in the Regulations.

Trust funds, provident funds and other funds listed in the addendum to the Income Tax Regulations (Withholding of Interest, Dividends and Certain Profits), 5766-2005 (hereinafter: the "Withholding on Interest Regulations") are exempt from withholding tax under law.

Should the securities offered in the Prospectus be delisted from the TASE, withholding tax that will be deducted at the time of their sale (after the delisting) will be at a rate of 30% of the consideration, to such extent that a certificate from the tax assessor specifying another rate for withholding tax (including an exemption from withholding tax) has not been provided.

Set-off of losses from the Sale of the Shagrir ordinary shares

In general, capital losses from the sale of the Shagrir ordinary shares will be permitted for set-off in instances in which, had profits been created, these would have been liable for tax.

In the tax year in which loss was generated from the sale of the Shagrir ordinary shares, during which, if there were capital gains, they would have been subject to tax, it will be possible to set-off against real capital gains and real estate betterment that arises from the sale of any asset, based on the principles set forth in Section 92 of the Ordinance. Whether the income was generated from an asset in Israel or external thereto (excluding taxable inflationary capital gains that is offset with a ratio of 1 to 3.5).

Capital loss in the tax year from the sale of securities may be offset against income from interest or dividend received in the same tax year for the security or against income from interest or dividend from other securities received in the same tax year, provided that the tax rate applicable to the interest or dividend from the other security as stated does not exceed 25%.

Losses that cannot be offset, in whole or in part, in a given tax year as stated above, may be offset against capital gains and land betterment only as stated in Section 92(b) of the Ordinance in the tax years that follow one another, after the year in which the loss occurred, provided that a report is submitted to the tax assessor for the tax year in which the loss occurred.

With respect to offsetting losses from traded securities that were created before 2006, there are additional limitations regarding the manner of offset, determined in the applicability provisions for Section 92 of the Ordinance before amendment 147. In accordance with the provisions of Section 94c of the Ordinance, in the sale of a share by a body of persons, dividends received due to the share during the 24 months that preceded the sale, but not more than the loss amount, will be reduced from the capital loss amount created from the sale of the share, excluding dividends on which tax was paid (excluding tax paid outside of Israel) at a rate of at least 15%.

| 25 |

The Tax Rate Applicable to Income from Dividend on Shagrir Shares

Dividends derived from shares of Shagrir will be taxable generally when held by an individual Israeli resident at a rate of 25%, unless the shareholder is a Substantial Shareholder of Shagrir upon receipt of the dividend or any date in the 12 preceding months, in which case the tax rate will be 30%.

In general, dividends received by Israeli resident companies will not be considered taxable income, provided that the source of the dividend is not income generated or produced outside of Israel and is not from dividends originating in an "approved" or "benefitted" enterprise, as defined in the Capital Investments Encouragement Law, 5719-1959 (the "Capital Investments Encouragement Law").

Dividends received by a family company will be taxable at a rate of 25%, unless the representative taxpayer, as defined in Section 64a of the Ordinance, is a Substantial Shareholder, directly or indirectly, in the company that paid the dividends, in which case the tax rate will be 30%.

A foreign resident will be subject to dividends tax at a rate of 25%, excluding a foreign resident who is a Substantial Shareholder on the date on which the dividends were received or any date in the 12 preceding months, in which case the tax rate will be 30%, subject to the provisions of a double tax prevention treaty (if any) formed between the State of Israel and the country of residence of the foreign resident, and subject to providing in advance confirmation of exemption from withholding tax at source from the ITA.

Dividends originating in shares of Shagrir by an exempt mutual fund, provident fund or other entities exempt from tax under Section 9(2) of the Ordinance, and which meet the special exemption conditions for dividends under the same section, will be exempt from tax. For a taxable mutual fund, the applicable tax rate is the tax rate that applies to income of an individual whose income does not constitute income from a "business" or "profession," unless explicitly determined otherwise by law.

Withholding Tax on Dividends

Shagrir will withhold tax on dividends in accordance with the Withholding on Interest Regulations. In accordance with the Withholding on Interest Regulations, the withholding of tax on dividends for a company's shares, where the shares are listed for trade on the TASE and held with a TASE nominee company, to an individual who is a resident of Israel or a foreign resident (individual /group of persons) will be at a rate of 25%. The foregoing also applies with respect to an individual and foreign resident who is a Substantial Shareholder of a company on the date of the receipt of the dividends or any date in the 12 preceding months. Withholding tax that is paid by a body of persons that is a resident of Israel whose shares are listed for trade on the TASE for the shares held by a TASE nominee company will be through a financial institution.

According to the Withholding on Interest Regulations, in the event that dividends are paid to a resident of Israel, in respect of whom a limited tax rate has been determined the tax will be withheld based on that determined amount. Regarding a foreign resident, the rate of withholding at source will be subject to the provisions of a double tax prevention treaty (if any) formed between the State of Israel and the country of residence of the recipient, and subject to advance confirmation to exempt from tax at source from the Tax Authority.

Tax will not be withheld at source for a provident fund, mutual funds and other entities exempt from withholding tax at source under law.

| 26 |

United States Federal Income Taxation

The following discussion summarizes certain material United States ("U.S.") federal income tax considerations arising from the Spin-Off that are applicable to U.S. Holders (as defined below) of Pointer ordinary shares. This summary is for general information purposes only and does not purport to consider all aspects of U.S. federal income taxation that might be relevant to a U.S. Holder (as defined below). The summary is based on current provisions of the Internal Revenue Code of 1986, as amended, (the "Code"), existing and temporary Treasury Regulations promulgated thereunder, rulings, administrative pronouncements, judicial decisions, and the income tax treaty between the Israel and the United States (the "Treaty") all as in effect on the date hereof, and all of which are subject to change or differing interpretations. Any such change, or differing interpretation, which may or may not be retroactive, could alter the U.S. federal income tax consequences described herein.

U.S. Holders of Pointer ordinary shares should be aware that this summary is not comprehensive. This discussion only addresses U.S. Holders who hold Pointer's ordinary shares as a capital asset (within the meaning of Section 1221 of the Code). Additionally, the discussion below does not address any tax consequences applicable to Pointer ordinary shareholders (i) who are dealers in securities or foreign currency, (ii) who are financial institutions or insurance companies, (iii) who are mutual funds, (iv) who hold Pointer ordinary shares through individual retirement or other tax-deferred accounts, (v) who are tax-exempt organizations, (vi) who hold their shares as "qualified small business stock" pursuant to Section 1202 of the Code, (vii) who are partnerships, S corporations or other pass-through entities (or are treated as such for U.S. federal income tax purposes), (viii) who acquired their Pointer ordinary shares in connection with stock option or stock purchase plans or other employee plans or compensatory arrangements, (ix) whose functional currency is not the U.S. dollar, (x) who hold Pointer ordinary shares as part of an integrated investment, a "straddle," pledge against currency risk, "constructive" sale or "conversion" transaction, comprised of Pointer ordinary sharers and one or more other positions, (xi) who are U.S. expatriates, or (xii) who may have acquired Pointer ordinary shares in a transaction subject to the gain rollover provisions of Section 1045 of the Code. In addition, this summary does not address the alternative minimum tax provisions of the Code, the U.S. federal estate or gift tax consequences of the Spin-Off, or the consequences of the Spin-Off under U.S. state, local or non-U.S. tax laws.

No ruling from the Internal Revenue Service ("IRS") and no opinion of counsel will be requested in connection with the Spin-Off. Accordingly, the discussion below neither binds the IRS nor precludes it from adopting a contrary position.

IN VIEW OF THE FOREGOING AND BECAUSE THE FOLLOWING DISCUSSION IS INTENDED AS A GENERAL SUMMARY ONLY, EACH U.S. HOLDER OF POINTER ORDINARY SHARES SHOULD CONSULT HIS, HER OR ITS OWN TAX ADVISOR REGARDING THE APPLICABLE U.S. FEDERAL, STATE, LOCAL, NON-U.S. INCOME AND OTHER TAX CONSEQUENCES AND ANY TAX REPORTING REQUIREMENTS OF THE SPIN-OFF IN LIGHT OF HIS, HER OR ITS OWN TAX SITUATION.

| 27 |

The following discussion is limited to beneficial owners of Pointer ordinary shares that are U.S. Holders. For purposes of this discussion, a "U.S. Holder" means a beneficial owner of Pointer ordinary shares that is, for U.S. federal income tax purposes:

● an individual who is a citizen or resident of the United States;

● a corporation (or any other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

● an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

● a trust (i) if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons (within the meaning of the Code) have the authority to control all substantial decisions of the trust or (ii) that has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person (within the meaning of the Code).

If a partnership or other pass-through entity for U.S. federal income tax purposes holds Pointer ordinary shares, the tax treatment of a partner of such partnership or member of such other pass-through entity will generally depend upon the status of the partner or member and the activities of the partnership or other pass-through entity. Partnerships and other pass-through entities holding Pointer ordinary shares, and any person who is a partner or member of such entities, should consult their own tax advisors regarding the tax consequences of the Spin-off.

Consequences of the Spin-Off to U.S. Holders

For U.S. federal income tax purposes, the Spin-Off will likely constitute a fully taxable transaction for a U.S. Holder. Accordingly, each Pointer ordinary shareholder who receives ordinary shares of Shagrir in the Spin-Off will likely be treated as receiving a taxable distribution in an amount equal to the fair market value of the ordinary shares of Shagrir received (the "Distribution Proceeds"). In such a case, each U.S. Holder will be taxed on the full value of the Distribution Proceeds received in the Distribution as a dividend for U.S. federal income tax purposes.

Subject to certain limitations, "qualified dividend income" received by a non-corporate U.S. Holder will be subject to tax at a reduced maximum tax rate of 20%. Distributions taxable as dividends paid on the Pointer ordinary shares should qualify for the 20% rate, provided that either: (i) we are entitled to benefits under the Treaty or (ii) the Pointer ordinary shares are readily tradable on an established securities market in the United States and certain other requirements are met. We believe that we are entitled to benefits under the Treaty and that the Pointer ordinary shares currently are readily tradable on an established securities market in the United States. However, no assurance can be given that the Pointer ordinary shares will remain readily tradable. The rate reduction does not apply unless certain holding period requirements are satisfied. With respect to the Pointer ordinary shares, the U.S. Holder must have held such shares for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date. The rate reduction also does not apply to dividends received from a passive foreign investment company ("PFIC"), see discussion below, or in respect of certain hedged positions or in certain other situations. The legislation enacting the reduced tax rate on qualified dividends contains special rules for computing the foreign tax credit limitation of a taxpayer who receives dividends subject to the reduced tax rate. U.S. Holders of Pointer ordinary shares should consult their own tax advisors regarding the effect of these rules in their particular circumstances.

| 28 |

Subject to applicable limitations that vary depending upon a U.S. Holder's particular circumstances, Israeli taxes withheld from dividends at a rate not exceeding the applicable rate provided by the Treaty may be creditable against the U.S. Holder's U.S. federal income tax liability. Israeli taxes withheld in excess of the applicable rate allowed by the Treaty will not be eligible for credit against a U.S. Holder's federal income tax liability. The limitation on foreign taxes credit is calculated separately with respect to specific classes of income. Instead of claiming a credit, a U.S. Holder may, at the U.S. Holder's election, deduct the otherwise creditable foreign taxes in computing the taxable income for the year, subject to generally applicable limitations under U.S. law. An election to deduct foreign taxes instead of claiming foreign tax credits applies to all foreign taxes paid or accrued in the taxable year. The rules governing foreign tax credits are complex and U.S. Holders should consult their tax advisors regarding the availability of foreign tax credits and the deductibility of foreign taxes in their particular circumstances.

Additional Tax on Investment Income

In addition to the income taxes described above, U.S. Holders that are individuals, estates or trusts and whose income exceeds certain thresholds will be subject to a 3.8% Medicare contribution tax on net investment income, which includes dividends.

Passive Foreign Investment Companies

If we were to be classified as a PFIC in any taxable year, a U.S. Holder would be subject to special rules generally intended to reduce or eliminate any benefits from the deferral of U.S. federal income tax that a U.S. Holder could otherwise derive from investing in a non-U.S. company that does not distribute all of its earnings on a current basis. We will be considered a PFIC, for any taxable year in which either (i) 75% or more of our gross income is passive income or (ii) at least 50% of the average value of all of our assets for the taxable year produce or are held for the production of passive income. For this purpose, passive income generally includes dividends, interest, royalties, rents, annuities and the excess of gains over losses from the disposition of assets that produce passive income. Included in the calculation of our income and assets is our proportionate share of the income and assets of each corporation in which we own, directly or indirectly, at least a 25% interest, by value. If we were determined to be a PFIC for U.S. federal income tax purposes, unfavorable and highly complex rules would apply to U.S. Holders owning ordinary shares directly or indirectly. Accordingly, you are urged to consult your tax advisors regarding the application of such rules.