UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of November 3, 2020, there were

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

LA JOLLA PHARMACEUTICAL COMPANY

Condensed Consolidated Balance Sheets

(in thousands, except par value and share amounts)

|

|

|

September 30, |

|

|

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

|

|

2019 |

|

||

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

|

|

$ |

|

|

|

Accounts receivable, net |

|

|

|

|

|

|

|

|

|

|

|

Inventory, net |

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

|

|

|

|

|

|

Right-of-use lease assets |

|

|

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

|

|

|

|

|

|

|

|

|

Intangible assets, net |

|

|

|

|

|

|

|

|

- |

|

|

Goodwill |

|

|

|

|

|

|

|

|

- |

|

|

Total assets |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

|

|

|

|

|

$ |

|

|

|

Accrued expenses |

|

|

|

|

|

|

|

|

|

|

|

Accrued payroll and related expenses |

|

|

|

|

|

|

|

|

|

|

|

Lease liabilities, current portion |

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

|

|

|

Lease liabilities, less current portion |

|

|

|

|

|

|

|

|

|

|

|

Deferred royalty obligation, net |

|

|

|

|

|

|

|

|

|

|

|

Other noncurrent liabilities |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

|

|

|

|

|

$ |

|

|

|

Commitments and contingencies (Note 6) |

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ deficit: |

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $ |

|

|

|

|

|

|

|

|

|

|

|

Series C-12 Convertible Preferred Stock, $ |

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

|

|

Accumulated deficit |

|

|

( |

) |

|

|

|

|

( |

) |

|

Total shareholders’ deficit |

|

|

( |

) |

|

|

|

|

( |

) |

|

Total liabilities and shareholders’ deficit |

|

$ |

|

|

|

|

|

$ |

|

|

See accompanying notes to the condensed consolidated financial statements.

1

LA JOLLA PHARMACEUTICAL COMPANY

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except per share amounts)

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

||||

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net product sales |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Total revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income—related party |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

Other income (expense) |

|

|

|

|

|

|

- |

|

|

|

( |

) |

|

|

- |

|

|

Total other income (expense), net |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Net loss per share, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Weighted-average common shares outstanding, basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the condensed consolidated financial statements.

2

LA JOLLA PHARMACEUTICAL COMPANY

Condensed Consolidated Statements of Shareholders’ (Deficit) Equity

(Unaudited)

(in thousands)

|

|

|

Series C-12 Convertible Preferred Stock |

|

|

Series F Convertible Preferred Stock |

|

|

Common Stock |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Total Shareholders' (Deficit) |

|

||||||||||||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||||

|

Balance at December 31, 2019 |

|

|

|

|

|

$ |

|

|

|

|

- |

|

|

$ |

- |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under 2013 Equity Plan |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under ESPP |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at March 31, 2020 |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under 2013 Equity Plan |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under ESPP |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at June 30, 2020 |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under ESPP |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at September 30, 2020 |

|

|

|

|

|

$ |

|

|

|

|

- |

|

|

$ |

- |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

3

|

|

|

Series C-12 Convertible Preferred Stock |

|

|

Series F Convertible Preferred Stock |

|

|

Common Stock |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Total Shareholders' (Deficit) |

|

||||||||||||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||||

|

Balance at December 31, 2018 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

|

|

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under ESPP |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock for conversion of Series F Preferred Stock |

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

Cumulative-effect adjustment from adoption of ASU 2018-07 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

|

|

|

|

- |

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at March 31, 2019 |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under ESPP |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at June 30, 2019 |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Share-based compensation expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Issuance of common stock under ESPP |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

( |

) |

|

|

( |

) |

|

Balance at September 30, 2019 |

|

|

|

|

|

$ |

|

|

|

|

- |

|

|

$ |

- |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

( |

) |

|

$ |

( |

) |

See accompanying notes to the condensed consolidated financial statements.

4

LA JOLLA PHARMACEUTICAL COMPANY

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

|

|

|

Nine Months Ended |

|

|||||

|

|

|

September 30, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net loss to net cash used for operating activities: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

|

|

|

|

|

|

|

Inventory fair value step-up adjustment included in cost of product sales |

|

|

|

|

|

|

- |

|

|

Amortization of intangible assets |

|

|

|

|

|

|

- |

|

|

Amortization of right-of-use lease assets |

|

|

|

|

|

|

|

|

|

Non-cash interest expense |

|

|

|

|

|

|

|

|

|

Loss on short-term investments |

|

|

|

|

|

|

- |

|

|

Loss on disposal of property and equipment, net of gain on lease termination |

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

|

|

|

|

( |

) |

|

Inventory, net |

|

|

( |

) |

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

( |

) |

|

|

( |

) |

|

Accrued expenses |

|

|

( |

) |

|

|

( |

) |

|

Accrued payroll and related expenses |

|

|

( |

) |

|

|

( |

) |

|

Lease liabilities |

|

|

( |

) |

|

|

( |

) |

|

Net cash used for operating activities |

|

|

( |

) |

|

|

( |

) |

|

Investing activities |

|

|

|

|

|

|

|

|

|

Acquisition of Tetraphase, net of cash, cash equivalents and restricted cash acquired |

|

|

( |

) |

|

|

- |

|

|

Proceeds from the sale of property and equipment |

|

|

|

|

|

|

- |

|

|

Purchases of property and equipment |

|

|

- |

|

|

|

( |

) |

|

Proceeds from the sale of short-term investments |

|

|

|

|

|

|

- |

|

|

Purchases of short-term investments |

|

|

( |

) |

|

|

- |

|

|

Net cash used for investing activities |

|

|

( |

) |

|

|

( |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

|

Net proceeds from issuance of common stock under 2013 Equity Plan |

|

|

|

|

|

|

- |

|

|

Net proceeds from issuance of common stock under ESPP |

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

|

|

|

|

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

( |

) |

|

Cash, cash equivalents and restricted cash, beginning of period |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash, end of period |

|

$ |

|

|

|

$ |

|

|

|

Supplemental disclosure of non-cash investing and financing activities |

|

|

|

|

|

|

|

|

|

Conversion of Series F Convertible Preferred Stock into common stock |

|

$ |

- |

|

|

$ |

|

|

|

Cumulative-effect adjustment from adoption of ASU 2018-07 |

|

$ |

- |

|

|

$ |

( |

) |

|

Initial recognition of right-of-use lease asset |

|

$ |

- |

|

|

$ |

|

|

|

Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

|

|

|

$ |

|

|

|

Restricted cash |

|

|

|

|

|

|

|

|

|

Total cash, cash equivalents and restricted cash |

|

$ |

|

|

|

$ |

|

|

See accompanying notes to the condensed consolidated financial statements.

5

LA JOLLA PHARMACEUTICAL COMPANY

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

1. Business

La Jolla Pharmaceutical Company (collectively with its wholly owned subsidiaries, “La Jolla” or the “Company”) is dedicated to the development and commercialization of innovative therapies that improve outcomes in patients suffering from life-threatening diseases. GIAPREZATM (angiotensin II) for injection is approved by the U.S. Food and Drug Administration (“FDA”) as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. XERAVATM (eravacycline) for injection is a novel fluorocycline of the tetracycline class of antibacterials that is approved by the FDA for the treatment of complicated intra-abdominal infections (“cIAI”) in patients 18 years of age and older.

On July 28, 2020, La Jolla completed its acquisition of Tetraphase Pharmaceuticals, Inc. (“Tetraphase”), a biopharmaceutical company focused on commercializing XERAVA, for $

As of September 30, 2020 and December 31, 2019, the Company had cash and cash equivalents of $

2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation and Use of Estimates

The preparation of the Company’s condensed consolidated financial statements requires management to make estimates and assumptions that impact the reported amounts of assets, liabilities, revenue and expenses and the disclosure of contingent assets and liabilities in the Company’s condensed consolidated financial statements and the accompanying notes. Actual results may differ materially from these estimates. Certain amounts previously reported in the financial statements have been reclassified to conform to the current year presentation. Such reclassifications did not affect net loss, shareholders’ (deficit) equity or cash flows. The results of operations for the three and nine months ended September 30, 2020 are not necessarily indicative of the results to be expected for the full year or any future interim periods. The accompanying condensed consolidated balance sheet as of December 31, 2019 has been derived from the audited consolidated balance sheet as of December 31, 2019 contained in the Form 10-K.

Summary of Significant Accounting Policies

During the nine months ended September 30, 2020, other than the short-term investments, business combinations, intangible assets and goodwill policies described below, there have been no changes to the Company’s significant accounting policies as described in the Form 10-K.

6

Short-term investments

Short-term investments are comprised of marketable equity securities that are “available-for-sale,” as such term is defined by the Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification (“ASC”) Topic 320. Marketable equity securities are classified as current assets. Short-term investments are measured at fair value, and unrealized gains and losses are recorded in other income (expense), net in the consolidated statements of operations. Overnight sweep accounts are classified as cash and cash equivalents.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentration of credit risk consist of cash and accounts receivable. The Company maintains its cash in checking and savings accounts at federally insured financial institutions in excess of federally insured limits.

During the nine months ended September 30, 2020,

|

|

|

U.S. Net Product Sales |

|

|

Accounts Receivable |

|

||||||

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

|

||

|

|

|

September 30, 2020 |

|

|

September 30, 2020 |

|

|

As of September 30, 2020 |

|

|||

|

Customer A |

|

|

|

% |

|

|

|

% |

|

|

|

% |

|

Customer B |

|

|

|

% |

|

|

|

% |

|

|

|

% |

|

Customer C |

|

|

|

% |

|

|

|

% |

|

|

|

% |

|

Total |

|

|

|

% |

|

|

|

% |

|

|

|

% |

Revenue Recognition

The Company has adopted FASB ASC Topic 606—Revenue from Contracts with Customers (“ASC 606”). Under ASC 606, the Company recognizes revenue when its Customers obtain control of the Company’s product, which typically occurs on delivery. Revenue is recognized in an amount that reflects the consideration that the Company expects to receive in exchange for those goods. To determine revenue recognition for contracts with Customers within the scope of ASC 606, the Company performs the following 5 steps: (i) identify the contract(s) with a Customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the entity satisfies the relevant performance obligations. There have been no contract assets or liabilities recorded to date relating to product sales.

Revenue from product sales is recorded at the transaction price, net of estimates for variable consideration consisting of chargebacks, discounts, returns and administrative fees. Variable consideration is estimated using the expected-value amount method, which is the sum of probability-weighted amounts in a range of possible consideration amounts. Actual amounts of consideration ultimately received may differ from the Company’s estimates. If actual results vary materially from the Company’s estimates, the Company will adjust these estimates, which will affect revenue from product sales and earnings in the period such estimates are adjusted. These items include:

|

|

• |

Chargebacks—Chargebacks are discounts the Company provides to distributors in the event that the sales prices to end users are below the distributors’ acquisition price. This may occur due to a direct contract with a health system, a group purchasing organization (“GPO”) agreement or a sale to a government facility. Chargebacks are estimated based on known chargeback rates and recorded as a reduction of revenue on delivery to Customers. |

7

|

|

• |

Discounts—The Company offers Customers various forms of incentives and consideration, including prompt-pay and other discounts. The Company estimates discounts primarily based on contractual terms. These discounts are recorded as a reduction of revenue on delivery to Customers. |

|

|

• |

Returns—The Company offers Customers a limited right of return, generally for damaged or expired product. The Company estimates returns based on an internal analysis, which includes actual experience. The estimates for returns are recorded as a reduction of revenue on delivery to Customers. |

|

|

• |

Administrative Fees—The Company pays administrative fees to GPOs for services and access to data. Additionally, the Company pays an Industrial Funding Fee as part of the U.S. General Services Administration’s Federal Supply Schedules program. These fees are based on contracted terms and are paid after the quarter in which the product was purchased by the applicable GPO or government agency. |

The Company will continue to assess its estimates of variable consideration as it accumulates additional historical data and will adjust these estimates accordingly.

Business Combinations

The Company accounts for business combinations using the acquisition method pursuant to FASB ASC Topic 805. This method requires, among other things, that results of operations of acquired companies are included in La Jolla's financial results beginning on the respective acquisition dates, and that assets acquired and liabilities assumed are recognized at fair value as of the acquisition date. Intangible assets acquired in a business combination are recorded at fair value using a discounted cash flow model. The discounted cash flow model requires assumptions about the timing and amount of future net cash flows, the cost of capital and terminal values from the perspective of a market participant. Any excess of the fair value of consideration transferred (the “Purchase Price”) over the fair values of the net assets acquired is recognized as goodwill. Contingent consideration liabilities are recognized as part of the Purchase Price at the estimated fair value on the acquisition date. Subsequent changes to the fair value of contingent consideration liabilities will be included in other income (expense), net in the consolidated statements of operations. The fair value of assets acquired and liabilities assumed in certain cases may be subject to revision based on the final determination of fair value during a period of time not to exceed 12 months from the acquisition date. Legal costs, due diligence costs, business valuation costs and all other acquisition-related costs are expensed when incurred.

Intangible Assets

Intangible assets acquired in a business combination are initially recorded at fair value. Intangible assets with a definite useful life are amortized on a straight-line basis over the estimated useful life of the related assets. Intangible assets with an indefinite useful life are not amortized.

The Company reviews its intangible assets for impairment at least annually or whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. If such circumstances are determined to exist, an estimate of undiscounted future cash flows produced by the asset, including its eventual residual value, is compared to the carrying value to determine whether impairment exists. In the event that such cash flows are not expected to be sufficient to recover the carrying amount of the assets, the assets are written down to their estimated fair values. Fair value is estimated through discounted cash flow models to project cash flows from the asset.

Goodwill

Goodwill represents the excess of the Purchase Price over the fair value of the net assets acquired as of the acquisition date. Goodwill has an indefinite useful life and is not amortized.

The Company reviews its goodwill for impairment at least annually or whenever events or changes in circumstances indicate that the carrying amount of the Company may exceed its fair value. The Company first assesses qualitative factors to determine whether it is more likely than not that the fair value of the Company is less than its carrying amount, including goodwill. If that is not the case, the Company has completed its goodwill impairment test and does not recognize an impairment charge. However, if that is the case, the Company performs a quantitative impairment test, and, if the carrying amount of the Company exceeds its fair value, then the Company will recognize an impairment charge for the amount by which its carrying amount exceeds its fair value, not to exceed the carrying amount of the goodwill.

8

Recent Accounting Pronouncements

Management has considered all recent accounting pronouncements and has concluded that there are no recently issued accounting pronouncements that may have a material effect on the Company’s results of operations, financial condition or cash flows based on current information.

3. Net Loss per Share

Basic net loss per share is calculated by dividing net loss by the weighted-average number of common shares outstanding during the period, without consideration of potential common shares. Diluted net loss per share is calculated by dividing net loss by the weighted-average number of common shares outstanding plus potential common shares. Convertible preferred stock and stock options are considered potential common shares and are included in the calculation of diluted net loss per share using the treasury stock method when their effect is dilutive. Potential common shares are excluded from the calculation of diluted net loss per share when their effect is anti-dilutive. As of September 30, 2020 and 2019, there were

4. Balance Sheet Details

Restricted Cash

Restricted cash as of September 30, 2020 consists of: (i) a $

Inventory, Net

Inventory, net consisted of the following (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

Raw materials |

|

$ |

|

|

|

$ |

- |

|

|

Work-in-process |

|

|

|

|

|

|

|

|

|

Finished goods |

|

|

|

|

|

|

|

|

|

Total inventory, net |

|

$ |

|

|

|

$ |

|

|

As of September 30, 2020, inventory, net includes $

Property and Equipment, Net

Property and equipment, net consisted of the following (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

Software |

|

$ |

|

|

|

$ |

|

|

|

Furniture and fixtures |

|

|

|

|

|

|

|

|

|

Leasehold improvements |

|

|

|

|

|

|

|

|

|

Computer hardware |

|

|

|

|

|

|

|

|

|

Lab equipment |

|

|

- |

|

|

|

|

|

|

Total property and equipment, gross |

|

|

|

|

|

|

|

|

|

Accumulated depreciation and amortization |

|

|

( |

) |

|

|

( |

) |

|

Total property and equipment, net |

|

$ |

|

|

|

$ |

|

|

9

The Company recorded a loss of approximately $

Intangible Assets, Net

Intangible assets, net consisted of the following (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

Technology |

|

$ |

|

|

|

$ |

- |

|

|

Trade name |

|

|

|

|

|

|

- |

|

|

Total intangible assets, gross |

|

|

|

|

|

|

- |

|

|

Accumulated amortization |

|

|

( |

) |

|

|

- |

|

|

Total intangible assets, net |

|

$ |

|

|

|

$ |

- |

|

The intangible assets were recorded in connection with the acquisition of Tetraphase (see Note 12).

Accrued Expenses

Accrued expenses consisted of the following (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

Accrued interest expense |

|

$ |

|

|

|

$ |

|

|

|

Accrued manufacturing costs |

|

|

|

|

|

|

|

|

|

Accrued clinical study costs |

|

|

|

|

|

|

|

|

|

Accrued other |

|

|

|

|

|

|

|

|

|

Total accrued expenses |

|

$ |

|

|

|

$ |

|

|

Other Noncurrent Liabilities

Other noncurrent liabilities consisted of the following (in thousands):

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

Accrued interest expense |

|

$ |

|

|

|

$ |

|

|

|

Fair value of CVRs (see Note 12) |

|

|

|

|

|

|

- |

|

|

Paycheck Protection Program loan |

|

|

|

|

|

|

- |

|

|

Total other noncurrent liabilities |

|

$ |

|

|

|

$ |

|

|

5. Deferred Royalty Obligation

In May 2018, the Company closed a $

10

On receipt of the $

Under the terms of the Royalty Agreement, La Jolla Pharma, LLC has certain obligations, including the obligation to use commercially reasonable and diligent efforts to commercialize GIAPREZA. If La Jolla Pharma, LLC is held to not have met these obligations, HCR would have the right to terminate the Royalty Agreement and demand payment from La Jolla Pharma, LLC of either $

6. Commitments and Contingencies

Lease Commitments

San Diego Lease

On December 29, 2016, the Company entered into an agreement with BMR-Axiom LP (the “Landlord”) to lease office and laboratory space as its corporate headquarters located at 4550 Towne Centre Court, San Diego, California (the “San Diego Lease”) for a period of

The Company provided a standby letter of credit for $

As of September 30, 2020, there was

11

Watertown Lease

On November 16, 2006, Tetraphase entered into an agreement with ARE-480 Arsenal Street, LLC, to lease office and laboratory space as its corporate headquarters located at 480 Arsenal Way, Watertown, Massachusetts (the “Watertown Lease”). The Watertown Lease originally provided for an expiration on November 30, 2019

Tetraphase provided a standby letter of credit for $

Future minimum lease payments, excluding Lease Operating Costs, under the Watertown Lease as of September 30, 2020 are as follows (in thousands):

|

2020 |

|

$ |

|

|

|

2021 |

|

|

|

|

|

2022 |

|

|

|

|

|

Thereafter |

|

|

- |

|

|

Total future minimum lease payments |

|

|

|

|

|

Less: discount |

|

|

( |

) |

|

Total lease liabilities |

|

$ |

|

|

As of July 28, 2020, the Company recorded a lease liability for the Watertown Lease based on the present value of the lease payments over the remaining Lease Term, discounted using the Company’s incremental borrowing rate. The Company recorded a corresponding right-of-use lease asset based on the lease liability. Subsequent to July 28, 2020 and through September 30, 2020, lease expense for the Watertown Lease was $

Contingencies

From time to time, the Company may become subject to claims and litigation arising in the ordinary course of business. The Company is not a party to any material legal proceedings, nor is it aware of any material pending or threatened litigation.

7. Shareholders’ Equity

Preferred Stock

As of September 30, 2020 and December 31, 2019,

8. Equity Incentive Plans

2013 Equity Incentive Plan

A total of

12

2018 Employee Stock Purchase Plan

A total of

Equity Awards

The activity related to equity awards, which are comprised of stock options and inducement grants, during the nine months ended September 30, 2020 is summarized as follows:

|

|

|

Equity Awards |

|

|

Weighted-average Exercise Price per Share |

|

|

Weighted-average Remaining Contractual Term (years) |

|

|

Aggregate Intrinsic Value |

|

||||

|

Outstanding at December 31, 2019 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Granted |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Exercised |

|

|

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Cancelled/forfeited |

|

|

( |

) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Outstanding at September 30, 2020 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

- |

|

|

Exercisable at September 30, 2020 |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

- |

|

Share-based Compensation Expense

The classification of share-based compensation expense is summarized as follows (in thousands):

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

||||

|

Research and development |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Selling, general and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total share-based compensation expense |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

As of September 30, 2020, total unrecognized share-based compensation expense related to unvested equity awards was $

9. Other Income—Related Party

The Company has a non-voting profits interest in a related party, which provides the Company with the potential to receive a portion of the future distributions of profits, if any. Investment funds affiliated with the Chairman of the Company’s board of directors have a controlling interest in the related party. During the nine months ended September 30, 2020, the Company received distributions of $

10. License Agreements

In-license Agreements

George Washington University License

In December 2014, the Company entered into a patent license agreement with George Washington University (“GW”), which was subsequently amended and restated (the “GW License”) and assigned to La Jolla Pharma, LLC. Pursuant to the GW License, GW exclusively licensed to the Company certain intellectual property rights relating to GIAPREZA, including the exclusive rights to certain issued patents and patent applications covering GIAPREZA. Under the GW License, the Company is obligated to use commercially reasonable efforts to develop, commercialize, market and sell GIAPREZA. The Company has paid a one-time license initiation fee, annual maintenance fees, an amendment fee, additional payments following the achievement of certain development and regulatory milestones and royalties. As a result of the European Commission’s approval of

13

GIAPREZA in August 2019, the Company made a milestone payment to GW in the amount of $

Harvard University License

In August 2006, Tetraphase entered into a license agreement with Harvard University (“Harvard”), which was subsequently amended and restated (the “Harvard License”). Pursuant to the Harvard License, Harvard exclusively licensed to the Company certain intellectual property rights relating to tetracycline-based products, including XERAVA, including the exclusive rights to certain issued patents and patent applications covering such products. Under the Harvard License, the Company is obligated to use commercially reasonable efforts to develop, commercialize, market and sell tetracycline-based products, including XERAVA. For each product covered by the Harvard License, the Company is obligated to make certain payments totaling up to approximately $

Paratek Pharmaceuticals, Inc. License

In March 2019, Tetraphase entered into a license agreement with Paratek Pharmaceuticals, Inc. (“Paratek”), which was subsequently amended and restated (the “Paratek License”). Pursuant to the Paratek License, Paratek non-exclusively licensed to the Company certain intellectual property rights relating to XERAVA, including non-exclusive rights to certain issued patents and patent applications covering XERAVA. Under the Paratek License, the Company is obligated to use commercially reasonable efforts to develop, commercialize, market and sell XERAVA. The Company is obligated to pay Paratek royalties at a low single digit percent based on net sales of XERAVA in the U.S. The obligation to pay royalties under this agreement extends through the last-to-expire patent covering XERAVA. Subsequent to July 28, 2020 and through September 30, 2020, the Company paid $

Out-license Agreement

Everest Medicines Limited License

In February 2018, Tetraphase entered into a license agreement with Everest Medicines Limited (“Everest”), which was subsequently amended and restated (the “Everest License”). Pursuant to the Everest License, Tetraphase granted Everest an exclusive license to develop and commercialize XERAVA for the treatment of cIAI and other indications in mainland China, Taiwan, Hong Kong, Macau, South Korea, Singapore, the Malaysian Federation, the Kingdom of Thailand, the Republic of Indonesia, the Socialist Republic of Vietnam and the Republic of the Philippines (collectively, the “Territory”). The Company is eligible to receive up to an aggregate of $

14

2020 and through September 30, 2020, the Company has

11. Company-wide Realignments

On December 2, 2019, the Board of Directors of the Company approved a restructuring plan (the “2019 Realignment”) that reduced the Company’s headcount. The 2019 Realignment did not result in any reductions in headcount in the Company’s commercial organization supporting its products. For the year ended December 31, 2019, total expense was comprised of $

On May 28, 2020, the Board of Directors of the Company approved a restructuring plan (the “2020 Realignment”) to align its organization with the Company’s sole focus on the commercialization of its products. The 2020 Realignment reduced the Company’s headcount. For the nine months ended September 30, 2020, total expense was comprised of $

In connection with the acquisition of Tetraphase, the Company incurred one-time charges related to a reduction in the combined Company’s headcount. For the three and nine months ended September 30, 2020, total expense was comprised of $

12. Acquisition of Tetraphase Pharmaceuticals, Inc.

On

The acquisition of Tetraphase was accounted for as a business combination using the acquisition method pursuant to FASB ASC Topic 805. As the acquirer for accounting purposes, La Jolla has estimated the Purchase Price, assets acquired and liabilities assumed as of the acquisition date, with the excess of the Purchase Price over the fair value of net assets acquired recognized as goodwill. The estimated fair value of assets acquired and liabilities assumed in certain cases may be subject to revision based on the final determination of fair value.

The Purchase Price is comprised of the upfront cash of $

15

The Purchase Price allocation as of the acquisition date is presented as follows (in thousands):

|

|

|

July 28, |

|

|

|

|

|

2020 |

|

|

|

Cash |

|

$ |

|

|

|

Fair value of CVRs |

|

|

|

|

|

Total Purchase Price |

|

$ |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

Accounts receivable |

|

|

|

|

|

Inventory |

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

Property and equipment |

|

|

|

|

|

Right-of-use lease assets |

|

|

|

|

|

Restricted cash |

|

|

|

|

|

Identifiable intangible assets |

|

|

|

|

|

Goodwill |

|

|

|

|

|

Accounts payable |

|

|

( |

) |

|

Accrued expenses |

|

|

( |

) |

|

Lease liabilities, current portion |

|

|

( |

) |

|

Lease liabilities, less current portion |

|

|

( |

) |

|

Other noncurrent liabilities |

|

|

( |

) |

|

Total Purchase Price |

|

$ |

|

|

The estimated fair value of potential future cash payments pursuant to the CVRs was based on a Monte Carlo simulation and is classified as Level 3 in the ASC Topic 820-10, three-tier fair value hierarchy.

The Company recorded a $

Identifiable intangible assets consist of certain technology and trade names acquired from Tetraphase, and include the value of the Harvard, Paratek and Everest Licenses (see Note 10). The acquired intangible assets have definite useful lives and are being amortized on a straight-line basis over an estimated useful life of

Goodwill represents the excess of the Purchase Price over the fair value of the net assets acquired as of the acquisition date. Goodwill represents the value of the stronger platform to increase patient access to the Company’s commercial products and the operational synergies of the combined Company. Goodwill has an indefinite useful life and is not amortized. The goodwill is only deductible for tax purposes if the Company makes a U.S. Internal Revenue Code Section 338 (“Section 338”) election. The Company is currently evaluating whether to make a Section 338 election.

Subsequent to July 28, 2020 and through September 30, 2020, XERAVA U.S. net sales were $

Acquisition-related expenses, which were comprised primarily of legal fees, were $

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and the related notes and other financial information included elsewhere in this Quarterly Report on Form 10-Q and our audited financial statements and the related notes and other financial information included in our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 2, 2020 (the “Form 10-K”).

Forward-looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the federal securities laws, and such statements may involve substantial risks and uncertainties. All statements, other than statements of historical facts included in this Quarterly Report on Form 10-Q, including statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, future expenses, financing needs, plans or intentions relating to acquisitions, business trends and other information referred to under this section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan,” “anticipate,” “target,” “forecast” or the negative of these terms and similar expressions intended to identify forward-looking statements. Forward-looking statements are not historical facts and reflect our current views with respect to future events. Forward-looking statements are also based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this Quarterly Report on Form 10-Q. Such risks, uncertainties and other factors are described under “Risk Factors” in Item 1A of our Form 10-K for the year ended December 31, 2019 and under “Risk Factors” in Item 1A of this Quarterly Report on Form 10-Q. We caution you that these risks, uncertainties and other factors may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this Quarterly Report on Form 10-Q apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Quarterly Report on Form 10-Q. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Business Overview

La Jolla Pharmaceutical Company is dedicated to the development and commercialization of innovative therapies that improve outcomes in patients suffering from life-threatening diseases. GIAPREZATM (angiotensin II) for injection is approved by the U.S. Food and Drug Administration (“FDA”) as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. XERAVATM (eravacycline) for injection is a novel fluorocycline of the tetracycline class of antibacterials that is approved by the FDA for the treatment of complicated intra-abdominal infections (“cIAI”) in patients 18 years of age and older.

On July 28, 2020, La Jolla completed its acquisition of Tetraphase Pharmaceuticals, Inc. (“Tetraphase”), a biopharmaceutical company focused on commercializing XERAVA, for $43 million in upfront cash plus potential future cash payments of up to $16 million. Financial results for periods ending September 30, 2020 and beyond include Tetraphase’s financial results subsequent to the acquisition closing date of July 28, 2020.

For the three months ended September 30, 2020, GIAPREZA U.S. net sales were $7.2 million, up 24% from the three months ended June 30, 2020 and up 26% from the three months ended September 30, 2019. For the nine months ended September 30, 2020, GIAPREZA U.S. net sales were $20.6 million, up 30% from the same period in 2019.

Subsequent to July 28, 2020 and through September 30, 2020, XERAVA U.S. net sales were $1.9 million. For the three months ended September 30, 2020, XERAVA U.S. net sales were $2.7 million, up 80% from the three months ended June 30, 2020 and up 170% from the three months ended September 30, 2019. For the nine months ended September 30, 2020, XERAVA U.S. net sales were $5.9 million, up 181% from the same period in 2019.

17

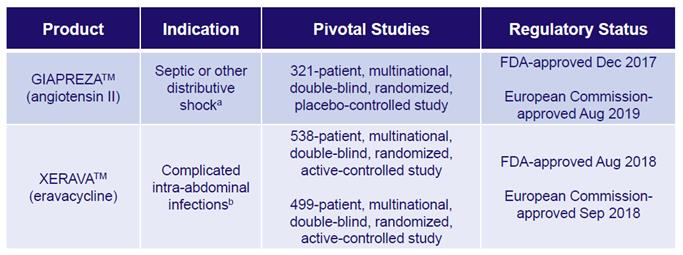

Product Portfolio

|

a |

U.S.: GIAPREZA is a vasoconstrictor to increase blood pressure in adults with septic or other distributive shock |

European Union: GIAPREZA is indicated for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies

|

b |

U.S.: XERAVA is a fluorocycline of the tetracycline class of antibacterials for the treatment of complicated intra-abdominal infections (“cIAI”) in patients 18 years of age and older |

European Union: XERAVA is indicated for the treatment of cIAI in adults

GIAPREZATM (angiotensin II)

GIAPREZATM (angiotensin II) for injection is approved by the FDA as a vasoconstrictor indicated to increase blood pressure in adults with septic or other distributive shock. GIAPREZA is approved by the European Commission (“EC”) for the treatment of refractory hypotension in adults with septic or other distributive shock who remain hypotensive despite adequate volume restitution and application of catecholamines and other available vasopressor therapies. GIAPREZA mimics the body’s endogenous angiotensin II peptide, which is central to the renin-angiotensin-aldosterone system, which in turn regulates blood pressure. GIAPREZA is marketed in the U.S. by La Jolla Pharmaceutical Company on behalf of La Jolla Pharma, LLC, its wholly owned subsidiary.

XERAVATM (eravacycline)

XERAVATM (eravacycline) for injection is a novel fluorocycline of the tetracycline class of antibacterials that is approved by the FDA for the treatment of cIAI in patients 18 years of age and older. XERAVA is approved by the EC for the treatment of cIAI in adults. XERAVA is marketed in the U.S. by Tetraphase Pharmaceuticals, Inc., a wholly owned subsidiary of La Jolla.

Product Candidates

In connection with the acquisition of Tetraphase, we acquired the following product candidates that are in early-stage clinical or preclinical development: (1) TP-6076, a fully-synthetic fluorocycline derivative for the treatment of certain multidrug-resistant gram-negative bacteria; (2) TP-271, a fully-synthetic fluorocycline for the treatment of respiratory disease caused by bacterial biothreat and antibiotic-resistant public health pathogens, as well as bacterial pathogens associated with community-acquired bacterial pneumonia; and (3) TP-2846, a tetracycline for the treatment of acute myeloid leukemia. At this time, there are no active studies nor anticipated future studies for any of these product candidates. We intend to seek out-licensing opportunities for these product candidates, however, at this time, we are unable to predict the likelihood of successfully out-licensing any of these product candidates.

18

Components of Our Results of Operations

The following table summarizes our results of operations for each of the periods below (in thousands):

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

Change |

|

|

2020 |

|

|

2019 |

|

|

Change |

|

||||||

|

Net product sales |

|

$ |

9,072 |

|

|

$ |

5,706 |

|

|

$ |

3,366 |

|

|

$ |

22,468 |

|

|

$ |

15,804 |

|

|

$ |

6,664 |

|

|

Cost of product sales |

|

|

2,489 |

|

|

|

554 |

|

|

|

1,935 |

|

|

|

4,013 |

|

|

|

1,605 |

|

|

|

2,408 |

|

|

Research and development expense |

|

|

3,617 |

|

|

|

21,182 |

|

|

|

(17,565 |

) |

|

|

21,581 |

|

|

|

64,469 |

|

|

|

(42,888 |

) |

|

Selling, general and administrative expense |

|

|

12,493 |

|

|

|

10,782 |

|

|

|

1,711 |

|

|

|

29,322 |

|

|

|

34,425 |

|

|

|

(5,103 |

) |

|

Other income (expense), net |

|

|

(2,233 |

) |

|

|

(2,362 |

) |

|

|

129 |

|

|

|

(3,495 |

) |

|

|

(6,580 |

) |

|

|

3,085 |

|

|

Net loss |

|

$ |

(11,760 |

) |

|

$ |

(29,174 |

) |

|

$ |

17,414 |

|

|

$ |

(35,943 |

) |

|

$ |

(91,275 |

) |

|

$ |

55,332 |

|

Financial results for periods ending September 30, 2020 and beyond include Tetraphase’s financial results subsequent to the acquisition closing date of July 28, 2020. Net loss for the three and nine months ended September 30, 2020 includes purchase price accounting adjustments of $1.5 million. Net loss for the three and nine months ended September 30, 2020 also includes $0.3 million and $0.9 million of one-time acquisition-related expenses. We expect our research and development expense and selling, general and administrative expense to decrease in the near term as we realize the benefits from integrating the operations of La Jolla and Tetraphase.

Net Product Sales

Net product sales consist solely of revenue recognized from sales of GIAPREZA and XERAVA to hospitals in the U.S. through a network of specialty and wholesaler distributors (“Customers”). GIAPREZA U.S. net sales were $7.2 million and $20.6 million for the three and nine months ended September 30, 2020, respectively, compared to $5.7 million and $15.8 million, respectively, for the same periods in 2019. Subsequent to July 28, 2020 and through September 30, 2020, XERAVA U.S. net sales were $1.9 million. XERAVA U.S. net sales were $2.7 million and $5.9 million for the three and nine months ended September 30, 2020, respectively, compared to $1.0 million and $2.1 million, respectively, for the same periods in 2019.

Cost of Product Sales

Cost of product sales consists primarily of expense associated with: (i) royalties payable to George Washington University, Harvard University and Paratek Pharmaceuticals, Inc.; (ii) the inventory fair value step-up adjustment recorded in connection with the acquisition of Tetraphase; (iii) manufacturing; (iv) regulatory fees; and (v) shipping and distribution. Cost of product sales was $2.5 million and $4.0 million for the three and nine months ended September 30, 2020, respectively, compared to $0.6 million and $1.6 million, respectively, for the same periods in 2019. Subsequent to July 28, 2020 and through September 30, 2020, cost of product sales includes $1.2 million of the inventory fair value step-up adjustment recorded in connection with the acquisition of Tetraphase.

19

Research and Development Expense

Research and development expense consists of non-personnel and personnel expenses. The following table summarizes these expenses for each of the periods below (in thousands):

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

Change |

|

|

2020 |

|

|

2019 |

|

|

Change |

|

||||||

|

Non-personnel expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GIAPREZA |

|

$ |

832 |

|

|

$ |

1,641 |

|

|

$ |

(809 |

) |

|

$ |

3,675 |

|

|

$ |

4,662 |

|

|

$ |

(987 |

) |

|

XERAVA |

|

|

511 |

|

|

|

- |

|

|

|

511 |

|

|

|

511 |

|

|

|

- |

|

|

|

511 |

|

|

LJPC-0118 |

|

|

9 |

|

|

|

424 |

|

|

|

(415 |

) |

|

|

926 |

|

|

|

1,559 |

|

|

|

(633 |

) |

|

LJPC-401 |

|

|

- |

|

|

|

4,552 |

|

|

|

(4,552 |

) |

|

|

1,531 |

|

|

|

13,347 |

|

|

|

(11,816 |

) |

|

Other programs |

|

|

28 |

|

|

|

1,204 |

|

|

|

(1,176 |

) |

|

|

28 |

|

|

|

5,047 |

|

|

|

(5,019 |

) |

|

Facility |

|

|

312 |

|

|

|

1,879 |

|

|

|

(1,567 |

) |

|

|

2,872 |

|

|

|

5,455 |

|

|

|

(2,583 |

) |

|

Other |

|

|

198 |

|

|

|

1,089 |

|

|

|

(891 |

) |

|

|

672 |

|

|

|

3,007 |

|

|

|

(2,335 |

) |

|

Total non-personnel expense |

|

$ |

1,890 |

|

|

$ |

10,789 |

|

|

$ |

(8,899 |

) |

|

$ |

10,215 |

|

|

$ |

33,077 |

|

|

$ |

(22,862 |

) |

|

Personnel expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, bonuses and benefits |

|

|

1,036 |

|

|

|

6,224 |

|

|

|

(5,188 |

) |

|

|

8,148 |

|

|

|

19,330 |

|

|

|

(11,182 |

) |

|

Share-based compensation expense |

|

|

691 |

|

|

|

4,169 |

|

|

|

(3,478 |

) |

|

|

3,218 |

|

|

|

12,062 |

|

|

|

(8,844 |