Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended DECEMBER 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-24274

LA JOLLA PHARMACEUTICAL COMPANY

(Exact name of registrant as specified in its charter)

| California | 33-0361285 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

4660 La Jolla Village Drive, Suite 1070, San Diego, CA 92122

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (858) 207-4264

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2012 totaled approximately $741,731. As of March 22, 2013, there were 18,881,242 shares of the Company’s common stock, $0.0001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

Table of Contents

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “intends,” “expects,” “suggests,” “may,” “should,” “potential,” “designed to,” “will” and similar references. Such statements include, but are not limited to, statements about: our ability to successfully develop GCS-100, LJPC-501 and our other product candidates; the future success of our clinical trials with GCS-100 and LJPC-501; the timing for the commencement and completion of clinical trials; and our ability to implement cost-saving measures. Forward-looking statements are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others: the risk that our clinical trials with GCS-100 and LJPC-501 may not be successful in evaluating the safety and tolerability of GCS-100 and LJPC-501 or providing preliminary evidence of efficacy; the successful and timely completion of clinical trials; uncertainties regarding the regulatory process; the availability of funds and resources to pursue our research and development projects, including our clinical trials with GCS-100 and LJPC-501; general economic conditions; and those identified in this Annual Report on Form 10-K under the heading “Risk Factors” and in other filings the Company periodically makes with the Securities and Exchange Commission. Forward-looking statements contained in this Annual Report on Form 10-K speak as of the date hereof and the Company does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this Annual Report on Form 10-K.

Table of Contents

In this report, all references to “we,” “our,” “us” and “the Company” refer to La Jolla Pharmaceutical Company, a California corporation, our wholly-owned subsidiary, SL JPC Sub, Inc., and our formerly wholly-owned subsidiary, Jewel Merger Sub, Inc.

Overview

La Jolla Pharmaceutical Company is a biopharmaceutical company focused on the discovery, development and commercialization of innovative therapeutics for chronic organ failure and cancer. Our drug development efforts are focused on two product candidates: GCS-100 and LJPC-501. GCS-100 targets the galectin-3 protein, which, when overproduced by the human body, has been associated with chronic organ failure and cancer. In January 2013, we initiated a Phase 1/2 clinical trial with GCS-100 for the treatment of chronic kidney disease (“CKD”). LJPC-501 is a peptide agonist of the renin-angiotensin system, which is designed to help restore kidney function in patients with hepatorenal syndrome (“HRS”). We plan to file an Investigational New Drug Application (“IND”) with the Food and Drug Administration (“FDA”) for LJPC-501 in the third quarter of 2013 and initiate a Phase 1 clinical trial in HRS by the end of 2013. We also plan to evaluate other opportunities for potential product candidates for the treatment of unmet medical needs.

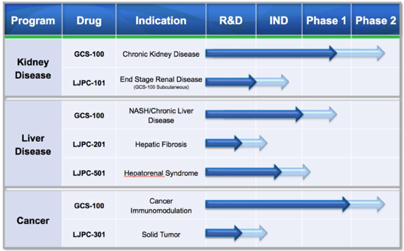

Product Portfolio

We have a broad product portfolio consisting of both development-stage and discovery-stage products. We strive to maintain a robust pipeline of products to bring through development and to the market.

Our products, their target indications and their development status are summarized in the table below:

Some of our product candidates may prove to be beneficial in disease indications beyond those we are now pursuing. We may out-license our product candidates to third parties or in-license other product candidates that are synergistic with our current programs.

1

Table of Contents

GCS-100

Scientific Background

GCS-100 is a complex polysaccharide derived from pectin that binds to, and blocks the activity of galectin-3, a type of galectin. Galectins are a member of a family of proteins in the body called lectins. These proteins interact with carbohydrate sugars located in, on the surface of, and in-between cells. This interaction causes the cells to change behavior, including cell movement, multiplication, and other cellular functions. The interactions between lectins and their target carbohydrate sugars occur via a carbohydrate recognition domain, or CRD, within the lectin. Galectins are a subfamily of lectins that have a CRD that bind specifically to ß-galactoside sugar molecules. Galectins have a broad range of functions, including regulation of cell survival and adhesion, promotion of cell-to-cell interactions, growth of blood vessels, regulation of the immune response and inflammation.

Over-expression of galectin-3 has been implicated in a number of human diseases, including chronic organ failure and cancer. This makes modulation of the activity of galectin-3 an attractive target for therapy in these diseases.

Chronic Kidney Disease

The initial clinical focus of our development program for GCS-100 is CKD. The United States Renal Data System estimated that, in 2010, approximately 49 million adults in the United States suffered from CKD, 547,982 were being treated for end-stage renal disease (“ESRD”), and 88,630 died as a result of CKD. It was estimated that CKD costs the United States health care system $41 billion per year for Medicare patients alone. There are no FDA-approved therapies for CKD.

Several recent studies have shown that increased circulating levels of galectin-3 are associated with poorer outcomes in patients with chronic organ failure, including kidney disease. Additionally, a number of preclinical studies using multiple animal models have demonstrated a direct, causal role of galectin-3 expression and secretion in the scar formation (tissue fibrosis) leading to kidney failure. Specifically, animals that have been genetically engineered to lack galectin-3 produce less harmful scar formation after kidney injury or transplantation and have reduced inflammatory cytokine expression and better kidney function. By blocking the activity of galectin-3 pharmacologically, GCS-100 has the potential to reduce the tissue fibrosis that leads to the worsening of kidney function.

Chronic Liver Disease

GCS-100 also has the potential to treat various forms of chronic liver disease also characterized by tissue fibrosis. In 2006, The National Institute of Diabetes and Digestive and Kidney Diseases (“NIDDK”) estimated that NASH affects between two and five percent of Americans. In 2004, NIDDK estimated that 5.5 million Americans had chronic liver disease or cirrhosis, and that $1.6 billion was spent annually on the treatment for chronic liver disease and cirrhosis. Chronic liver disease and cirrhosis were estimated to be the 12th leading cause of death in the United States, accounting for approximately 27,000 deaths annually.

In December 2012, the Company announced the results of a preclinical study that examined the effect of GCS-100 on liver fibrosis in mice. The study, which was performed in collaboration with the Stelic Institute, was conducted in an established, benchmark preclinical model for non-alcoholic steatohepatitis-hepatocellular carcinoma, or NASH-HCC. When compared to placebo-treated control animals, GCS-100-treated animals showed a statistically significant reduction in liver fibrosis and a statistically significant improvement in the score of non-alcoholic fatty liver disease (“NAFLD”). A statistically significant improvement in liver function was also observed, as measured by the liver enzyme alanine transaminase (“ALT”), which in some cases returned to near normal levels.

Cancer

By modulating galectin-3’s effects on cell survival, blood vessel growth and the immune response, GCS-100 has the potential to treat various forms of cancer. The American Cancer Society estimated that, in 2013, approximately 1.7 million new cases of cancer are expected to be diagnosed in the United States, and cancer will be the cause of death of approximately 600,000 Americans.

A number of preclinical studies have demonstrated the positive effects of GCS-100 as a potential anticancer agent. For example, in November 2012, a study published in the journal Blood demonstrated the mechanism by which GCS-100 improves the response to chemotherapy in lymphoma, a type of blood cancer. In this study conducted by researchers at UCLA entitled, “Galectin-3 binds to CD45 on diffuse large B cell lymphoma cells to regulate susceptibility to cell death,” it was demonstrated that galectin-3 binds to an enzyme on the surface of lymphoma cells called CD45, and that it is this protein-enzyme combination that regulates the susceptibility of the cells to chemotherapy drugs. The researchers showed that treating the lymphoma cells with GCS-100 can inhibit the protective effect of galectin-3, thus allowing the cancer cells to be killed effectively by chemotherapy agents such as dexamethasone, rituximab and etoposide.

2

Table of Contents

In a Phase 2 clinical study investigating the safety and activity of GCS-100 administered as a single agent in 24 patients with relapsed, chronic lymphocytic leukemia (“CLL”), GCS-100 was shown to be safe and well tolerated. In addition, 25% of these patients experienced a clinical benefit as measured by a partial reduction in their tumor burden. The results of this study were presented at the American Society of Clinical Oncology 2009 Annual Meeting.

Current Clinical Study

In December 2012, we announced that the FDA’s Division of Cardiovascular and Renal Products had accepted our IND, which included a clinical trial protocol designed to study GCS-100 in patients with CKD. In January 2013, we initiated a Phase 1/2 clinical trial with GCS-100 in patients with CKD. The trial is designed in two parts. Part A (Phase 1) will evaluate the safety of single, ascending doses of GCS-100 and determine a maximum tolerated dose. Part B (Phase 2), will evaluate the safety and activity of multiple doses of GCS-100. Part B is designed to measure activity and will include various markers of kidney function. The trial is currently enrolling patients in Part A.

LJPC-501

LJPC-501 is a peptide agonist of the renin-angiotensin system that acts to help the kidneys balance body fluids and electrolytes. Studies have shown that LJPC-501 may improve renal function in patients with HRS. HRS is a life-threatening form of progressive renal failure in patients with liver cirrhosis or fulminant liver failure. In these patients, the diseased liver secretes vasodilator substances (e.g., nitric oxide and prostaglandins) into the bloodstream that cause under-filling of blood vessels. This low-blood-pressure state causes a reduction in blood flow to the kidneys. As a means to restore systemic blood pressure, the kidneys induce both sodium and water retention, which contribute to ascites, a major complication associated with HRS.

HRS is categorized into two types, based on the rapidity of the progression of renal failure as measured by marker called serum creatinine. Type 1 HRS is the more rapidly progressing type and is characterized by a 100% increase in serum creatinine to > 2.5 mg/dL within two weeks. Fewer than 10% of people with Type 1 HRS survive hospitalization, and the median survival is only a few weeks. Type 2 HRS is slower progressing, with serum creatinine rising gradually; however, patients with Type 2 HRS can develop sudden renal failure and progress to Type 1 HRS. Although ascites occurs in both Type 1 and Type 2 HRS, recurrent ascites is a major clinical characteristic of Type 2 HRS patients, and median survival is only four to six months. We estimate that HRS affects an estimated 90,000 people in the United States, and most of these patients will die from this disease.

In February 2013, we conducted a meeting with the FDA to discuss the design for a clinical trial studying LJPC-501 in patients suffering from HRS. Based on feedback from this meeting, we plan to file an IND by the end of the third quarter of 2013 and initiate a Phase 1 clinical trial with LJPC-501 in HRS by the end of 2013.

Other Product Candidates

In addition to GCS-100 and LJPC-501, we have several product candidates in the early development stage. These product candidates include LJPC-101, a subcutaneous formulation of GCS-100, LJPC-201, an oral galectin-3 inhibitor and LJPC-301, a monoclonal antibody designed to neutralize galectin-3. We continuously evaluate opportunities to efficiently and effectively advance new product candidates into development for significant unmet medical needs.

3

Table of Contents

Financial Condition

At December 31, 2012, we had $3.4 million in cash and equivalents and positive working capital of $3.2 million. We believe that our current cash resources are sufficient to fund planned operations for at least the next 12 months.

Patents and Proprietary Technologies

As of March 22, 2013, the Company had: (i) three issued patents, one allowed patent and three pending patent applications in the United States; (ii) two pending patent applications in Canada; and (iii) one pending patent application in Europe. The issued and allowed patents provide, and if issued, the pending patent applications will provide, protection for our lead drug candidate GCS-100, including claims for compositions of modified pectin solutions, methods for manufacturing modified pectins and modified pectin solutions, and compositions and uses of galectin antagonists. The issued and allowed patents expire between 2025 and 2028, not taking into account any potential patent-term extensions that may be available in the future.

In addition to the above, we plan to file additional patent applications that, if issued, would provide further protection for GCS-100 and LJPC-501.

Competition

The biotechnology and pharmaceutical industries are subject to rapid technological change. Competition from domestic and foreign biotechnology companies, large pharmaceutical companies and other institutions is intense and expected to increase. A number of companies are pursuing the development of pharmaceuticals in our targeted areas. These include companies that are conducting preclinical studies and clinical trials in the field of galectin mediation, including Galectin Therapeutics Inc. and Galecto Biotech AB.

In addition, there are a number of pharmaceutical companies, biotechnology companies and academic institutions engaged in activities relating to the research and development of potential treatments for chronic organ failure and cancer, as well as galectin regulation as a potential target for therapy. Most of these companies and institutions have substantially greater facilities, resources, research and development capabilities, regulatory compliance expertise, and manufacturing and marketing capabilities than we do. In addition, other technologies in the future may be the basis of competitive products. There can be no assurance that our competitors will not develop or obtain regulatory approval for products more rapidly than we can, or develop and market technologies and products that are more effective than those we are developing or that would render our technology and proposed products obsolete or noncompetitive.

Government Regulation

United States

Our research and development activities and the future manufacturing and marketing of any products we develop are subject to significant regulation by numerous government authorities in the United States and other countries. In the United States, the Federal Food, Drug and Cosmetic Act and the Public Health Service Act govern the testing, manufacture, safety, efficacy, labeling, storage, record keeping, approval, advertising and promotion, and distribution of our drug candidates and any products we may develop. In addition, this regulatory framework is subject to changes that may adversely affect approval, delay an application or require additional expenditures.

The steps required before a pharmaceutical compound may be marketed in the United States include: preclinical laboratory and animal testing; submission of an IND to the FDA, which must become effective before clinical trials may commence; conducting adequate and well-controlled clinical trials to establish the safety and efficacy of the drug; submission of a New Drug Application (“NDA”) or Biologics License Application (“BLA”) for biologics to the FDA; satisfactory completion of an FDA preapproval inspection of the manufacturing facilities to assess compliance with current good manufacturing practices (“cGMP”); and FDA approval of the NDA or BLA prior to any commercial sale or shipment of the drug. In addition to obtaining FDA approval for each product, each drug-manufacturing establishment used must be registered with the FDA and be operated in conformity with cGMP. Drug product manufacturing facilities may also be subject to state and local regulatory requirements.

4

Table of Contents

Preclinical testing includes laboratory evaluation of product chemistry and animal studies to assess the safety and efficacy of the product and its formulation. The results of preclinical testing are submitted to the FDA as part of an IND, and, unless the FDA objects, the IND becomes effective 30 days following its receipt by the FDA.

Clinical trials involve administration of the drug to healthy volunteers and to patients diagnosed with the condition for which the drug is being tested under the supervision of qualified clinical investigators. Clinical trials are conducted in accordance with protocols that detail the objectives of the study, the parameters to be used to monitor safety, and the efficacy criteria to be evaluated. Each protocol is submitted to the FDA as part of the IND. Each clinical trial is conducted under the auspices of an independent Institutional Review Board (“IRB”) in the United States, or Ethics Committee (“EC”) outside the United States, for each trial site. The IRB or EC considers, among other matters, ethical factors and the safety of human subjects.

Clinical trials are typically conducted in three sequential phases, but the phases may overlap or be repeated. In Phase 1 clinical trials, the drug is initially introduced into healthy human subjects or patients and is tested for adverse effects, dosage tolerance, metabolism, distribution, excretion and clinical pharmacology. Phase 2 clinical trials involve the testing of a limited patient population in order to characterize the actions of the drug in targeted indications, in order to determine drug tolerance and optimal dosage and to identify possible adverse side effects and safety risks. When a compound appears to be effective and have an acceptable safety profile in Phase 2 clinical trials, Phase 3 clinical trials are undertaken to further evaluate and confirm clinical efficacy and safety within an expanded patient population at multiple clinical trial sites. The FDA reviews the clinical plans and monitors the results of the trials and may discontinue the trials at any time if significant safety issues arise. Similarly, an IRB or EC may suspend or terminate a trial at a study site that is not being conducted in accordance with the IRB or EC’s requirements or that has been associated with unexpected serious harm to subjects.

The results of preclinical testing and clinical trials are submitted to the FDA for marketing approval in the form of an NDA or BLA. The submission of an NDA or BLA also requires the payment of user fees, but a waiver of the fees may be obtained under specified circumstances. The testing and approval process is likely to require substantial time, effort and resources and there can be no assurance that any approval will be granted on a timely basis, if at all, or that conditions of any approval, such as warnings, contraindications, or scope of indications will not materially impact the potential market acceptance and profitability of the drug product. Data obtained from clinical trials are not always conclusive, and the FDA may interpret data differently than we interpret the same data. The FDA may refer the application to an advisory committee for review, evaluation and recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it generally follows such recommendations. The approval process is affected by a number of factors, including the severity of the disease, the availability of alternative treatments, and the risks and benefits of the product demonstrated in clinical trials.

Additional preclinical testing or clinical trials may be requested during the FDA review period and may delay any marketing approval. After FDA approval for the initial indications, further clinical trials may be necessary to gain approval for the use of the product for additional indications. In addition, after approval, some types of changes to the approved product, such as manufacturing changes, are subject to further FDA review and approval. The FDA mandates that adverse effects be reported to the FDA and may also require post-marketing testing to monitor for adverse effects, which can involve significant expense. Adverse effects observed during the commercial use of a drug product or which arise in the course of post-marketing studies can result in the need for labeling revisions, including additional warnings and contraindications, and, if the findings significantly alter the risk/benefit assessment, the potential withdrawal of the drug from the market.

Among the conditions for FDA approval is the requirement that the prospective manufacturer’s quality control and manufacturing procedures conform to the FDA’s cGMP requirements. Domestic manufacturing facilities are subject to biannual FDA inspections and foreign manufacturing facilities are subject to periodic inspections by the FDA or foreign regulatory authorities. If the FDA finds that a company is not operating in compliance with cGMPs, the continued availability of the product can be interrupted until compliance is achieved and, if the deficiencies are not corrected within a reasonable time frame, the drug could be withdrawn from the market. In addition, the FDA strictly regulates labeling, advertising and promotion of drugs. Failure to conform to requirements relating to licensing, manufacturing, and promoting drug products can result in informal or formal sanctions, including warning letters, injunctions, seizures, civil and criminal penalties, adverse publicity and withdrawal of approval.

5

Table of Contents

Foreign

We are also subject to numerous and varying foreign regulatory requirements governing the design and conduct of clinical trials and marketing approval for pharmaceutical products to be marketed outside of the United States. The approval process varies among countries and regions and can involve additional testing, and the time required to obtain approval may differ from that required to obtain FDA approval.

The steps to obtain approval to market a pharmaceutical compound in the European Union include: preclinical laboratory and animal testing; conducting adequate and well controlled clinical trials to establish safety and efficacy; submission of a Marketing Authorization Application (the “MAA”); and the issuance of a product marketing license by the European Commission prior to any commercial sale or shipment of drug. In addition to obtaining a product marketing license for each product, each drug manufacturing establishment must be registered with the European Medicines Agency (the “EMA”), must operate in conformity with European good manufacturing practice and must pass inspections by the European health authorities.

Upon receiving the MAA, the Committee for Human Medicinal Products (the “CHMP”), a division of the EMA, will review the MAA and may respond with a list of questions or objections. Answers to questions posed by the CHMP may require additional tests to be conducted. Responses to the list of questions or objections must be provided to and deemed sufficient by the CHMP within a defined timeframe. Ultimately, a representative from each of the European Member States will vote whether to approve the MAA.

Foreign regulatory approval processes include all of the risks associated with obtaining FDA approval, and approval by the FDA does not ensure approval by the health authorities of any other country.

Employees

As of March 22, 2013, we employed four regular full-time employees, three of whom are engaged in research and clinical development activities, two of whom have an M.D. and/or a Ph.D., and one working in finance, information technology, human resources and administration.

We consider our relations with our employees to be good. None of our employees are covered by a collective bargaining agreement.

Corporate History

We were incorporated in 1989 in Delaware and reincorporated in California in 2012. We were historically focused on the development and testing of Riquent, a drug candidate being studied for the treatment of lupus nephritis, an antibody-mediated disease. From August 2004 to February 2009, Riquent was being studied in a double-blinded multicenter Phase 3 clinical trial, which was determined to be futile in February 2009. Accordingly, the development of Riquent was discontinued in 2009. In May 2010, we entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant to which we issued various series of preferred stock, which have been subsequently exchanged for preferred stock designated in a different series. A summary of the preferred stock issuances and subsequent exchanges is set forth in Note 4 of the notes to the consolidated financial statements included elsewhere in this annual report. In March 2011, we acquired rights to certain compounds known as Regenerative Immunophilin Ligands. Following the acquisition of these compounds, we initiated a confirmatory preclinical animal study, which was completed in May 2011 and showed that the predetermined study endpoints were not met. Accordingly, we halted the further development of those compounds at that time and sold them back to the party from whom we had initially purchased them, for a return of the same consideration initially paid.

In January 2012, we acquired the worldwide exclusive rights to GCS-100 from privately held Solana Therapeutics, Inc. (“Solana”). Solana is wholly owned by our largest holder of Series C-12 Convertible Preferred Stock, and we paid only nominal consideration for the assets. As a result of our acquisition of these assets, we are now focused on the development of therapeutic agents that inhibit the activity of galectins as a means of treating human diseases such as chronic organ failure and cancer.

6

Table of Contents

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed with or furnished to the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge through our website at www.ljpc.com as soon as reasonably practicable after we electronically file or furnish the reports with or to the Securities and Exchange Commission.

I. RISK FACTORS RELATING TO THE COMPANY AND THE INDUSTRY IN WHICH WE OPERATE.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information before deciding to invest in our common stock. The risks described below are not the only ones facing our company. Additional risks not presently known to us or that we currently consider immaterial may also adversely affect our business. We have attempted to identify below the major factors that could cause differences between actual and planned or expected results, but we cannot assure you that we have identified all of those factors.

If any of the following risks actually happen, our business, financial condition and operating results could be materially adversely affected. In this case, the trading price of our common stock could decline, and you could lose all or part of your investment.

We have only limited assets.

As of December 31, 2012, we had no revenue sources, an accumulated deficit of $447.4 million and available cash and cash equivalents of $3.4 million. Although we acquired the GCS-100 patent estate in January 2012 for nominal consideration, the values of these assets are highly uncertain. As a result, we have only limited assets available to operate and develop our business. We are utilizing our existing cash balances to conduct clinical studies of GCS-100 and to evaluate whether or not GCS-100 should be developed further. If we determine that GCS-100 does not warrant further development, we would have only limited cash and would likely be forced to liquidate the Company. In that event, the funds resulting from the liquidation of our assets, net of amounts payable, would likely return only a small amount, if anything, to our stockholders. We believe that our current cash resources are sufficient to fund planned operations for at least the next 12 months.

The technology underlying our compounds is uncertain and unproven.

The development efforts for GCS-100 and LJPC-501 are based on unproven technologies and therapeutic approaches that have not been widely tested or used. To date, no products that use the GCS-100 or LJPC-501 technology have been approved or commercialized. Application of our technology to treat chronic organ failure and cancer is in early stages. Preclinical studies and future clinical trials of GCS-100 and LJPC-501 may be viewed as a test of our entire approach to developing chronic organ failure and cancer therapeutics. If GCS-100 or LJPC-501 do not work as intended, or if the data from our future clinical trials indicate that GCS-100 or LJPC-501 are not safe and effective, the applicability of our technology for successfully treating chronic organ failure or cancer will be highly uncertain. As a result, there is a significant risk that our therapeutic approaches will not prove to be successful, and there can be no guarantee that our drug technologies will result in any commercially successful products.

7

Table of Contents

Our ability to raise additional capital and enter into strategic transactions requires the approval of our preferred stockholders.

The terms of our Articles of Incorporation (the “Articles”) impose certain restrictions on the Company and our ability to engage in selected actions that may be out of the ordinary course of business. For example, the Articles provide that without the approval from holders of at least 80% of the then-outstanding preferred stock, the Company may not: issue capital stock; enter into a definitive agreement that, if consummated, would effect a change of control; amend the Articles; or take corporate action that, if consummated, would represent a strategic transaction. Accordingly, even if we identify an opportunity to further develop GCS-100, LJPC-501 or another drug candidate, our ability to enter into an appropriate arrangement to continue our operations may be more difficult than in the absence of these restrictions. We may be prohibited from developing a partnership to further develop GCS-100 or LJPC-501, or entering into an agreement to acquire rights to another drug candidate for development, if we do not receive approval from the requisite investors. If we cannot develop a product candidate, our resources will continue to be depleted and our ability to continue operations will be adversely affected.

Results from any future clinical trials we may undertake may not be sufficient to obtain regulatory approvals to market our drug candidates in the United States or other countries on a timely basis, if at all.

Drug candidates are subject to extensive government regulations related to development, clinical trials, manufacturing and commercialization. In order to sell any product that is under development, we must first receive regulatory approval. To obtain regulatory approval, we must conduct clinical trials and toxicology studies that demonstrate that our drug candidates are safe and effective. The process of obtaining FDA and foreign regulatory approvals is costly, time consuming, uncertain and subject to unanticipated delays.

The FDA and foreign regulatory authorities have substantial discretion in the approval process and may not agree that we have demonstrated that our drug candidates are safe and effective. If our drug candidates are ultimately not found to be safe and effective, we would be unable to obtain regulatory approval to manufacture, market and sell them. We can provide no assurances that the FDA or foreign regulatory authorities will approve GCS-100 or LJPC-501, or, if approved, what the approved indication for GCS-100 or LJPC-501 might be.

Future clinical trials that we may undertake may be delayed or halted.

Any clinical trials of our drug candidates that we may conduct in the future may be delayed or halted for various reasons, including:

| • | we do not have sufficient financial resources; |

| • | supplies of drug product are not sufficient to treat the patients in the studies; |

| • | patients do not enroll in the studies at the rate we expect; |

| • | the products are not effective; |

| • | patients experience negative side effects or other safety concerns are raised during treatment; |

| • | the trials are not conducted in accordance with applicable clinical practices; |

| • | there is political unrest at foreign clinical sites; or |

| • | there are natural disasters at any of our clinical sites. |

If any future trials are delayed or halted, we may incur significant additional expenses, and our potential approval of our drug candidates may be delayed, which could have a severe negative effect on our business.

8

Table of Contents

If the third-party manufacturers upon which we rely fail to produce our drug candidates that we require on a timely basis, or to comply with stringent regulations applicable to pharmaceutical drug manufacturers, we may face delays in the trials, regulatory submissions, required approvals or commercialization of our drug candidates.

We do not manufacture our drug candidates nor do we plan to develop any capacity to do so. We plan to contract with third-party manufacturers to manufacture GCS-100 and LJPC-501. The manufacture of pharmaceutical products requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. Manufacturers of pharmaceutical products often encounter difficulties in production, which include difficulties with production costs and yields, quality control and assurance and shortages of qualified personnel, as well as compliance with strictly enforced federal, state and foreign regulations. The third-party manufacturers we may contract with may not perform as agreed or may terminate their agreements with us.

In addition to product approval, any facility in which GCS-100 or LJPC-501 is manufactured or tested for its ability to meet required specifications must be approved by the FDA and/or the EMA before a commercial product can be manufactured. Failure of such a facility to be approved could delay the approval of GCS-100 and LJPC-501.

Any of these factors could cause us to delay or suspend any future clinical trials, regulatory submissions, required approvals or commercialization of GCS-100 and LJPC-501, entail higher costs and result in our being unable to effectively commercialize products.

Our success in developing and marketing our drug candidates depends significantly on our ability to obtain patent protection. In addition, we will need to successfully preserve our trade secrets and operate without infringing on the rights of others.

We depend on patents and other unpatented intellectual property to prevent others from improperly benefiting from products or technologies that we may have developed or acquired. Our patents and patent applications cover various technologies and drug candidates, including GCS-100. There can be no assurance, however, that any additional patents will be issued, that the scope of any patent protection will be sufficient to protect us or our technology, or that any current or future issued patent will be held valid if subsequently challenged. There is a substantial backlog of biotechnology patent applications at the United States Patent and Trademark Office that may delay the review and issuance of any patents. The patent position of biotechnology firms like ours is highly uncertain and involves complex legal and factual questions, and no consistent policy has emerged regarding the breadth of claims covered in biotechnology patents or the protection afforded by these patents. Additionally, a recent U.S. Supreme Court opinion further limits the scope of patentable inventions in the life sciences space and has added increased uncertainty around the validity of certain patents that have been issued or may be the subject of pending patent applications. We intend to continue to file patent applications as we believe is appropriate to obtain patents covering both our products and processes. However, there can be no assurance that patents will be issued from any of these applications, or that the scope of any issued patents will protect our technology.

We do not necessarily know if others, including competitors, have patents or patent applications pending that relate to compounds or processes that overlap or compete with our intellectual property or which may affect our freedom to operate.

There can be no assurance that patents will not ultimately be found to impact the advancement of our drug candidates, including GCS-100 and LJPC-501. If the United States Patent and Trademark Office or any foreign counterpart issues or has issued patents containing competitive or conflicting claims, and if these claims are valid, the protection provided by our existing patents or any future patents that may be issued could be significantly reduced, and our ability to prevent competitors from developing products or technologies identical or similar to ours could be negatively affected. In addition, there can be no guarantee that we would be able to obtain licenses to these patents on commercially reasonable terms, if at all, or that we would be able to develop or obtain alternative technology. Our failure to obtain a license to a technology or process that may be required to develop or commercialize one or more of our drug candidates may have a material adverse effect on our business. In addition, we may have to incur significant expense and management time in defending or enforcing our patents.

We also rely on unpatented intellectual property, such as trade secrets and improvements, know-how, and continuing technological innovation. While we seek to protect these rights, it is possible that:

| • | others, including competitors, will develop inventions relevant to our business; |

9

Table of Contents

| • | our confidentiality agreements will be breached, and we may not have, or be successful in obtaining, adequate remedies for such a breach; or |

| • | our trade secrets will otherwise become known or be independently discovered by competitors. |

We could incur substantial costs and devote substantial management time in defending suits that others might bring against us for infringement of intellectual property rights or in prosecuting suits that we might bring against others to protect our intellectual property rights.

Because a number of companies compete with us, many of which have greater resources than we do, and because we face rapid changes in technology in our industry, we cannot be certain that our products will be accepted in the marketplace or capture market share.

Competition from domestic and foreign biotechnology companies, large pharmaceutical companies and other institutions is intense and is expected to increase. A number of companies and institutions are pursuing the development of pharmaceuticals in our targeted areas. Many of these companies are very large, and have financial, technical, sales and distribution and other resources substantially greater than ours. The greater resources of these competitors could enable them to develop competing products more quickly than we are able to, and to market any competing product more quickly or effectively so as to make it extremely difficult for us to develop a share of the market for our products. These competitors also include companies that are conducting clinical trials and preclinical studies in the field of cancer therapeutics. Our competitors may develop or obtain regulatory approval for products more rapidly than we do. Also, the biotechnology and pharmaceutical industries are subject to rapid changes in technology. Our competitors may develop and market technologies and products that are more effective or less costly than those we are developing or that would render our technology and proposed products obsolete or noncompetitive.

II. RISK FACTORS RELATED SPECIFICALLY TO OUR STOCK.

We currently have 18.8 million shares of common stock outstanding and currently may be required to issue up to 4.5 billion shares of common stock upon conversion of existing preferred stock and preferred stock warrants. Such an issuance would be significantly dilutive to our existing common stockholders.

As of December 31, 2012, there were 5,792 shares of Series C-12 Preferred Stock, 500 shares of Series C-22 Preferred Stock and 4,615 shares of Series D-12 Preferred Stock issued and outstanding. In light of the conversion rate of our preferred stock (213,083 shares of common stock are issuable upon the conversion of one share of Series C-12 Preferred Stock, Series C-22 Preferred Stock and Series D-12 Preferred Stock), the presence of such a large number of preferred shares may dilute the ownership of our existing stockholders and provide the preferred investors with a sizeable interest in the Company.

Giving effect to the potential exercise of the outstanding preferred warrants, and assuming the conversion of all preferred stock into common stock at the current conversion rate, we would have approximately 4.5 billion shares of common stock issued and outstanding, although the issuance of the common stock upon the conversion of our preferred stock is limited by a 9.999% beneficial ownership cap for each preferred stockholder. With approximately 18.8 million shares of common stock issued and outstanding as of the date of this report, the issuance of this number of shares of common stock underlying the preferred stock would represent approximately 99% dilution to our existing stockholders. It is possible that our current stock price does not reflect our fully diluted and as-converted capital structure, which means that the conversion of preferred stock into common stock could significantly reduce our stock price.

10

Table of Contents

Our stock has only limited trading volume, which may adversely impact the ability of stockholders to sell shares at a desired price, or to fully liquidate their holdings.

Our stock currently trades on the OTC Markets Group, Inc.’s OTCQB tier. As a result, the market liquidity of our common stock may be adversely affected, as certain investors may not trade in securities that are quoted on the OTCQB, due to considerations including low price, illiquidity, and the absence of qualitative and quantitative listing standards.

In addition, our stockholders’ ability to trade or obtain quotations on our shares may be severely limited because of lower trading volumes and transaction delays. These factors may contribute to lower prices and larger spreads in the bid and ask price for our common stock. Specifically, you may not be able to resell your shares at or above the price you paid for such shares or at all.

The price of our common stock has been, and will be, volatile and may continue to decline.

Our stock has historically experienced significant price and volume volatility and could continue to be volatile. Market prices for securities of biotechnology and pharmaceutical companies, including ours, have historically been highly volatile, and the market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. The following factors, among others, can have a significant effect on the market price of our securities:

| • | significant conversions of preferred stock into common stock and sales of those shares of common stock; |

| • | results from our preclinical studies and clinical trials; |

| • | limited financial resources; |

| • | announcements regarding financings, mergers or other strategic transactions; |

| • | future sales of significant amounts of our capital stock by us or our stockholders; |

| • | developments in patent or other proprietary rights; |

| • | developments concerning potential agreements with collaborators; and |

| • | general market conditions and comments by securities analysts. |

The realization of any of the risks described in these “Risk Factors” could have a negative effect on the market price of our common stock. In addition, class action litigation is sometimes instituted against companies whose securities have experienced periods of volatility in market price. Any such litigation brought against us could result in substantial costs and a diversion of management’s attention and resources, which could hurt our business, operating results and financial condition.

11

Table of Contents

Our common stock is considered a “penny stock” and does not qualify for exemption from the “penny stock” restrictions, which may make it more difficult for you to sell your shares.

Our common stock is classified as a “penny stock” by the SEC and is subject to rules adopted by the SEC regulating broker-dealer practices in connection with transactions in “penny stocks.” The SEC has adopted regulations which define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, these rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule relating to the penny stock market. Disclosure is also required to be made about current quotations for the securities and about commissions payable to both the broker-dealer and the registered representative. Finally, broker-dealers must send monthly statements to purchasers of penny stocks disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. As a result of our shares of common stock being subject to the rules on penny stocks, the liquidity of our common stock may be adversely affected.

Item 1B. Unresolved Staff Comments.

None.

On March 15, 2013, we entered into a lease agreement for 1,954 square feet at 4660 La Jolla Village Dr., Suite 1070, San Diego, CA 92122. This lease commences on April 12, 2013 and will continue until March 31, 2018. Annual rent expense for the facilities is approximately $62,856. Until March 31, 2013, we maintained our operations in a temporary space under a short-term arrangement.

We are not currently a party to any legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable.

12

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Information about Our Common Stock

Our common stock trades on the OTC Markets Group, Inc.’s OTCQB tier, under the symbol “LJPC.” Set forth below are the high and low sales prices for our common stock for each full quarterly period within the two most recent fiscal years, adjusted to reflect the two 1-for-100 reverse splits of our common stock, which were implemented on April 14, 2011 and February 17, 2012.

| Prices | ||||||||

| High | Low | |||||||

| Year Ended December 31, 2012 |

||||||||

| First Quarter |

$ | 1.00 | $ | 0.03 | ||||

| Second Quarter |

0.09 | 0.038 | ||||||

| Third Quarter |

0.14 | 0.05 | ||||||

| Fourth Quarter |

0.07 | 0.04 | ||||||

| Year Ended December 31, 2011 |

||||||||

| First Quarter |

$ | 420 | $ | 200 | ||||

| Second Quarter |

315 | 0.55 | ||||||

| Third Quarter |

2.90 | 0.20 | ||||||

| Fourth Quarter |

0.42 | 0.20 | ||||||

We have never paid dividends on our common stock and we do not anticipate paying dividends in the foreseeable future. The number of shares of common stock outstanding as of March 22, 2013 was 18,881,242. As of March 22, 2013, there were approximately 171 holders of record of our common stock.

Item 6. Selected Financial Data

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

13

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

Management’s discussion and analysis of financial condition and results of operations is provided as a supplement to the accompanying consolidated financial statements and footnotes to help provide an understanding of our financial condition, the changes in our financial condition and our results of operations. Our discussion is organized as follows:

| • | Overview and recent developments. This section provides a general description of our business, operating history, recent events and significant transactions that we believe are important in understanding our financial condition and results of operations. |

| • | Critical accounting policies and estimates. This section contains a discussion of the accounting policies that we believe are important to our financial condition and results of operations and that require significant judgment and estimates on the part of management in their application. In addition, all of our significant accounting policies, including the critical accounting policies and estimates, are summarized in Note 1 to the accompanying consolidated financial statements. |

| • | Results of operations. This section provides an analysis of our results of operations presented in the accompanying consolidated statements of comprehensive loss by comparing the results for the year ended December 31, 2012, to the results for the year ended December 31, 2011. |

| • | Liquidity and capital resources. This section provides an analysis of our historical cash flows as well as our future capital requirements. |

Overview and Recent Developments

We are a biopharmaceutical company focused on the discovery, development and commercialization of innovative therapeutics for chronic organ failure and cancer. Our drug development efforts are focused on two product candidates: GCS-100 and LJPC-501. GCS-100 targets the galectin-3 protein, which, when overproduced by the human body, has been associated with chronic organ failure and cancer. In January 2013, we initiated a Phase 1/2 clinical trial with GCS-100 for the treatment of CKD. LJPC-501 is a peptide agonist of the renin-angiotensin system, which is designed to help restore kidney function in patients with HRS. We plan to file an IND with the FDA for LJPC-501 in the third quarter of 2013 and initiate a Phase 1 clinical trial in HRS by the end of 2013. We also plan to evaluate other opportunities for potential product candidates for the treatment of unmet medical needs.

In January 2012, we acquired rights to GCS-100 from privately held Solana. The GCS-100 compound was acquired pursuant to an asset purchase agreement for nominal consideration. As a result of this acquisition, we began to incur expenses related to preclinical and clinical development of GCS-100, which such expenses are expected to continue for the foreseeable future.

At the same time of the acquisition of GCS-100, we also entered into a Consent and Amendment Agreement (the “Third Amendment Agreement”) with certain of our Series C-11 Convertible Preferred Stock holders to amend the terms of the Securities Purchase Agreement, dated as of May 24, 2010 (the “Securities Purchase Agreement”), and the forms of Cash Warrants and Cashless Warrants (as defined in the Securities Purchase Agreement), as well as to adopt the Certificate of Designations, Preferences and Rights of Series C-12 Convertible Preferred Stock (the “Series C-12 Stock”), Series C-22 Convertible Preferred Stock (the “Series C-22 Stock”), Series D-12 Convertible Preferred Stock (the “Series D-12 Stock”) and Series D-22 Convertible Preferred Stock (the “Series D-22 Stock”) (the “Series C/D Certificate”). Under the Third Amendment Agreement, the termination date of the Cash Warrants and Cashless Warrants was amended to extend the termination date to the date that is three years following the closing of the acquisition of GCS-100 (i.e., January 19, 2015).

On February 17, 2012, we amended our Certificate of Incorporation to effect a 1-for-100 reverse split of our outstanding common stock.

14

Table of Contents

Effective December 31, 2012, we entered into a Consent, Waiver and Amendment Agreement (the “Second Waiver Agreement”) with our preferred stockholders. Pursuant to the Second Waiver Agreement, the preferred stockholders waived their redemption rights for the Series C-12 Stock and Series C-22 Stock, removed the “full-ratchet” anti-dilution from the Series C-12 Stock Series C-22 Stock and Series D-12 Stock and relinquished their right to receive warrants to purchase Series D-22 Stock (the “Series D-22 Warrants”) upon the exercise of the warrants to purchase Series C-22 Stock (the “Series C-22 Warrants”). Our preferred stockholders also exercised a portion of their Series C-22 Warrants, which resulted in us receiving $500,000 in net proceeds and the preferred stockholders receiving 500 shares of Series C-22 Stock.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements, which have been prepared in accordance with the United States generally accepted accounting principles (“GAAP”). The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We evaluate our estimates on an ongoing basis. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ materially from these estimates under different assumptions or conditions.

We believe the following critical accounting policies involve significant judgments and estimates used in the preparation of our consolidated financial statements (see also Note 1 to our consolidated financial statements included in Part IV).

Share-based compensation

Share-based compensation expense for the years ended December 31, 2012 and 2011 was approximately $8.6 million and $0.3 million, respectively. As of December 31, 2012, there was approximately $27.8 million of total unrecognized compensation cost related to non-vested share-based payment awards granted under our equity compensation plans. Share-based compensation expense recognized for fiscal years 2012 and 2011 is based on awards ultimately expected to vest, net of estimated forfeitures, if any. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. Total unrecognized compensation cost will be adjusted for future changes in estimated forfeitures. We expect to recognize that cost over a weighted-average period of 1.2 years.

Option-pricing models were developed for use in estimating the value of traded options that have no vesting or hedging restrictions and are fully transferable. Because the employee and director stock options granted by us have characteristics that are significantly different from traded options, and because changes in the subjective assumptions can materially affect the estimated value, in our opinion, the existing valuation models may not provide an accurate measure of the fair value of the employee and director stock options granted by us. Although the fair value of the employee and director stock options granted by us is determined using an option-pricing model, that value may not be indicative of the fair value observed in a willing-buyer/willing-seller market transaction.

Derivative Liabilities

In conjunction with the financing we closed in May 2010 (the “May 2010 Financing”), we issued Series C-1 Preferred Stock that contained certain embedded derivative features, as well as warrants that were accounted for as derivative liabilities (see Note 4 to our consolidated financial statements included in Part IV). These derivative liabilities were determined to be ineligible for equity classification due to provisions of the underlying preferred stock, which were also ineligible for equity classification because redemption was outside our sole control. As of December 31, 2012, the derivative liabilities are no longer present in the Series C2 Stock and Series D2 Stock.

These derivative liabilities were initially recorded at their estimated fair value on the date of issuance and were subsequently adjusted to reflect the estimated fair value at each period end, with any decrease or increase in the estimated fair value being recorded as other income or expense, accordingly. The fair value of these liabilities was estimated using option pricing models that are based on the individual characteristics of the common stock and preferred stock, the derivative liability on the valuation date, probabilities related to our operations and clinical development (based on industry data), as well as assumptions for volatility, remaining expected life, risk-free interest rate and, in some cases, credit spread. The option pricing models of our derivative liabilities are estimates and are sensitive to changes to certain inputs used in the options pricing models. To better estimate the fair value of the derivative liabilities at each reporting period, the binomial option pricing models and their inputs were refined based on information available to the Company. Such changes did not have a significant impact on amounts recorded in previous interim reporting periods.

15

Table of Contents

New Accounting Pronouncements

Effective January 1, 2012, we adopted Financial Accounting Standards Board’s (“FASB”) Accounting Standards Update (“ASU”) No. 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income and ASU No. 2011-12, Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income in ASU No. 2011-5. In these updates, an entity has the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both choices, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. ASU No. 2011-05 eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity. The amendments in ASU No. 2011-05 do not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income. The amendments in these updates are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The adoption of ASU Nos. 2011-05 and 2011-12 did not have a material impact on our consolidated financial position or results of operations. We have presented comprehensive loss in the Company’s consolidated statements of comprehensive loss.

Effective January 1, 2012, we prospectively adopted FASB’s ASU No. 2011-04, “Fair Value Measurement (Topic 820) — Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS”. The amendments in ASU 2011-04 result in common fair value measurement and disclosure requirements in GAAP and International Financial Reporting Standards (“IFRS”). Consequently, the amendments change the wording used to describe many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value measurements. This pronouncement is effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. The adoption of ASU No. 2011-04 did not have a material effect on the Company’s consolidated financial position or results of operations.

Results of Operations

Years Ended December 31, 2012 and 2011

Revenue. There was no revenue for the years ended December 31, 2012 and 2011.

Research and Development Expense. During the year ended December 31, 2012, we incurred $1.4 million in research and development expense, which was primarily related to $0.8 million in stock compensation expense and costs associated with the preclinical study of GCS-100, compared to $0.2 million in research and development expense during the year ended December 31, 2011, which was primarily related to costs associated with the preclinical study of LJP1485. We expect research and development expenditures to continue to increase going forward as we continue to develop GCS-100 and commence clinical studies of LJPC-501.

General and Administrative Expense. During the year ended December 31, 2012, general and administrative expense increased to $9.4 million, compared with $2.1 million for the year ended December 31, 2011. The increase is primarily due to an $7.6 million increase in stock compensation expense, which was partially offset by lower salaries of $0.2 million.

Non-Operating Income and Expense. During the year ended December 31, 2012, non-operating income as a result of adjustments to the fair value of derivative liabilities was $3.0 million. This decrease in value was recorded as non-operating income for the year ended December 31, 2012. All derivative liabilities were removed effective December 31, 2012. The removal of the derivative liabilities was due to the removal of the redemption features, removal of the full-ratchet anti-dilution features of the Series C-12 Stock, Series C-22 Stock and the Series D-12 Stock and the relinquishment of the Series D-22 Warrants.

16

Table of Contents

Non-operating expense as a result of adjustments to the estimated fair value of derivative liabilities was $9.5 million for the year ended December 31, 2011. The derivative liabilities issued in the May 2010 Financing were remeasured to their estimated fair value as of December 31, 2011, resulting in a net increase in value of $9.5 million for the year ended December 31, 2011. This increase in value was recorded as non-operating expense for the year ended December 31, 2011. The increase was primarily due to changes in variables and underlying shares for revaluation in our binomial pricing models.

The non-operating income and expense recorded as a result of adjustments to the estimated fair value of derivative liabilities is non-cash income and expense. Accounting rules require that our derivative instruments be adjusted to their fair values at each reporting date. Prior results may not be indicative of future results. As a result of the Second Waiver Agreement, we do not expect to generate non-operating income or expense relating to these derivative liabilities in the foreseeable future.

Other Income/Expense. Other income and other expense, net, decreased to $4,000 for the year ended December 31, 2012, compared to $0.2 million of income for the same period in 2011. The income in 2011 was due to reclassification of $0.2 million received from the preferred stockholders in April 2011 to miscellaneous income, as a result of the failure of the preclinical study of LJP1485 in May 2011.

Preferred Stock Dividend. We paid dividends in-kind of $0.4 million and $0.1 million in November 2012 and 2011, respectively, and $0.4 million in May 2012, on the outstanding Series C-12 Stock issued in the May 2010 Financing. As of December 31, 2012 and 2011, we accrued dividends payable in-kind on the outstanding Series C-12 Stock of $0.1 million.

Net Operating Loss and Research Tax Credit Carryforwards. At December 31, 2012, we had federal and California income tax net operating loss carryforwards of approximately $354.0 million and $292.6 million, respectively. In addition, we had federal and California research and development tax credit carryforwards of $21.2 million and $11.2 million, respectively. These income tax net operating loss carryforwards and research and development tax credit carryforwards are subject to annual limitations under Section 382/383 of the Internal Revenue Code of 1986, as amended (the “IRC”). In February 2009 and May 2010, we experienced changes in ownership at times when our enterprise value was minimal. As a result of these ownership changes and the low enterprise value, our federal and California net operating loss carryforwards and federal research and development credit carryforwards as of December 31, 2012 will be subject to annual limitations under IRC Section 382/383 and, more likely than not, will expire unused.

Liquidity and Capital Resources

From inception through December 31, 2012, we have incurred a cumulative net loss of approximately $447.4 million and have financed our operations through public and private offerings of securities, revenues from collaborative agreements, equipment financings and interest income on invested cash balances. From inception through December 31, 2012, we have raised approximately $418.0 million in net proceeds from sales of equity securities.

At December 31, 2012, we had $3.4 million in cash, as compared to $5.0 million of cash at December 31, 2011. At December 31, 2012 we had positive working capital of $3.2 million, compared to negative working capital of $10.4 million at December 31, 2011. Our working capital has largely been driven by our derivative liability obligations, which have been eliminated entirely as of December 31, 2012. The decrease in cash resulted from the use of our financial resources to fund our general corporate operations.

17

Table of Contents

In March 2011, we received funding of approximately $0.2 million from certain of our preferred investors to help defray the costs of a confirmatory preclinical study of LJP1485. In addition, we preserved cash through a temporary reduction in the salaries of our former officers.

In February 2013, we signed a lease agreement for office space. From June 2011 until March 2013, we had a short-term lease for temporary office space. No notes payable, purchase commitments, capital leases or other material operating leases existed as of December 31, 2012.

Effective December 31, 2012, our preferred stockholders exercised a portion of their Series C-22 Warrants, which resulted in the Company receiving $500,000 in net proceeds.

We believe that our current cash resources are sufficient to fund planned operations for at least the next 12 months.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our consolidated financial condition, changes in our consolidated financial condition, expenses, consolidated results of operations, liquidity, capital expenditures or capital resources.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 8. Financial Statements and Supplementary Data.

The financial statements required by this item are set forth at the end of this Report beginning on page F-2 and are incorporated herein by reference. We are not required to provide the supplementary data required by this item as we are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

(a) Disclosure Controls and Procedures; Changes in Internal Control Over Financial Reporting

Our management, with the participation of our principal executive and principal financial officer, has evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”)) as of December 31, 2012. Based on this evaluation, our principal executive and principal financial officer concluded that our disclosure controls and procedures were effective as of December 31, 2012.

(b) Management Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and Rule 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, our principal executive and principal financial officer and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

18

Table of Contents

| • | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; |

| • | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| • | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2012. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework.

Based on our assessment, management concluded that, as of December 31, 2012, our internal control over financial reporting was effective based on those criteria.

There was no change in our internal control over financial reporting during the quarter ended December 31, 2012 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

On March 28, 2013, we entered into a Consent, Waiver and Amendment Agreement (the “Agreement”) with certain holders of our preferred stock, as set forth in the Agreement (the “Holders”).

Pursuant to the Agreement, the Holders irrevocably waived their right to the redemption features of the Series C-12 Convertible Preferred Stock and the Series C-22 Convertible Preferred Stock (the “Series C-22 Stock”) such that Article IV(d)(6) of our Articles of Incorporation (the “Articles”) no longer has any force or effect. In light of the waiver of the redemption features, the Holders also irrevocably waived the provisions set forth under Article IV(d)(9)(E) of the Articles. The Holders also irrevocably waived the anti-dilution protections set forth in Article IV(d)(9)(F) of the Articles. By virtue of such consent and waiver, the provisions of Article IV(d)(9)(F) of the Articles no longer have any force or effect.

Pursuant to the Agreement, the Holders also agreed to amend the warrants to purchase the Series C-22 Stock (the “Series C-22 Warrants”) to relinquish the warrants to purchase Series D-22 Convertible Preferred Stock that are issuable upon exercise of the Series C-22 Warrants.

Finally, the Holders agreed to partially exercise the Series C-22 Warrants, which resulted in $500,000 net proceeds to us.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which is attached as an exhibit to this report and is incorporated herein by reference.

19

Table of Contents

Item 10. Directors, Executive Officers, Key Employees and Corporate Governance.

Our directors, executive officers and key employees and their ages as of March 22, 2013 are set forth below.

| Name |

Age | Position | ||||

| George Tidmarsh, M.D., Ph.D. |

53 | President, Chief Executive Officer, Secretary and Director | ||||

| Saiid Zarrabian |

60 | Director | ||||

| James Rolke |

44 | Senior Director of Research and Development | ||||

| Stacey Ruiz, Ph.D. |

34 | Director of Research and Development | ||||

| Chester Zygmont, III |