Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

PART IV

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2012 |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-32722

INVESTMENT TECHNOLOGY GROUP, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE (State of incorporation) |

95-2848406 (IRS Employer Identification No.) |

|

380 Madison Avenue, New York, New York (Address of principal executive offices) |

10017 (Zip Code) |

|

| (212) 588-4000 (Registrant's telephone number, including area code) |

||

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT: |

||

Common Stock, $0.01 par value (Title of class) |

New York Stock Exchange (Name of exchange on which registered) |

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT: None |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act)

Yes o No ý

| Aggregate market value of the voting stock held by non-affiliates of the Registrant at June 30, 2012: $349,526,796 |

Number of shares outstanding of the Registrant's Class of common stock at February 19, 2013: 37,239,869 |

DOCUMENTS INCORPORATED BY REFERENCE:

Proxy Statement relating to the 2013 Annual Meeting of Stockholders (incorporated, in part, in Form 10-K Part III)

2012 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

Investment Technology Group, ITG, the ITG logo, AlterNet, ITG Algorithms, ITG List-Based Algorithms, ITG Net, ITG Single-Stock Algorithms, ITG TCA, POSIT, POSIT Alert, POSIT Marketplace and Triton are registered trademarks or service marks of the Investment Technology Group, Inc. companies. ITG Derivatives, ITG Smart Router and MATCH Now are trademarks or service marks of the Investment Technology Group, Inc. companies.

i

PRELIMINARY NOTES

When we use the terms "ITG," the "Company," "we," "us" and "our," we mean Investment Technology Group, Inc. and its consolidated subsidiaries.

In addition to the historical information contained throughout this Annual Report on Form 10-K, there are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the Private Securities Litigation Reform Act of 1995. All statements regarding our expectations related to our future financial position, results of operations, revenues, cash flows, dividends, financing plans, business and product strategies, competitive positions, as well as the plans and objectives of management for future operations, and all expectations concerning securities markets, client trading and economic trends are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as "may," "might," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue" and the negative of these terms and other comparable terminology.

Although we believe our expectations reflected in such forward-looking statements are based on reasonable assumptions and beliefs, and on information currently available to our management, there can be no assurance that such expectations will prove to have been correct. Important factors that could cause actual results to differ materially from the expectations reflected in the forward-looking statements herein include, among others, general economic, business, credit and financial market conditions, both internationally and domestically, financial market volatility, fluctuations in market trading volumes, effects of inflation, adverse changes or volatility in interest rates, fluctuations in foreign exchange rates, evolving industry regulations, changes in tax policy or accounting rules, the actions of both current and potential new competitors, changes in commission pricing, the volatility of our stock price, rapid changes in technology, errors or malfunctions in our systems or technology, cash flows into or redemptions from equity mutual funds, ability to meet liquidity requirements related to the clearing of our customers' trades, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate companies we have acquired, our ability to attract and retain talented employees and our ability to achieve cost savings from our cost reduction plans.

Certain of these factors, and other factors, are more fully discussed in Item 1A, Risk Factors, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Item 7A, Quantitative and Qualitative Disclosures about Market Risk, in this Annual Report on Form 10-K, which you are encouraged to read.

We disclaim any duty to update any of these forward-looking statements after the filing of this report to conform our prior statements to actual results or revised expectations and we do not intend to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the filing of this report.

ii

Investment Technology Group, Inc. was formed as a Delaware corporation on July 22, 1983. Its principal subsidiaries include: (1) ITG Inc., AlterNet Securities, Inc. ("AlterNet") and ITG Derivatives LLC ("ITG Derivatives"), institutional broker-dealers in the United States ("U.S."), (2) Investment Technology Group Limited ("ITGL" or "ITG Europe"), an institutional broker-dealer in Europe, (3) ITG Australia Limited ("ITG Australia"), an institutional broker-dealer in Australia, (4) ITG Canada Corp. ("ITG Canada"), an institutional broker-dealer in Canada, (5) ITG Hong Kong Limited ("ITG Hong Kong"), an institutional broker-dealer in Hong Kong, (6) ITG Software Solutions, Inc., our intangible property, software development and maintenance subsidiary in the U.S., and (7) ITG Solutions Network, Inc., a holding company for ITG Analytics, Inc., a provider of pre-and post- trade analysis, fair value and trade optimization services, ITG Investment Research, Inc. ("ITG Investment Research"), a provider of independent data-driven investment research, and The Macgregor Group, Inc., a provider of trade order management technology and network connectivity services for the financial community.

ITG is an independent execution and research broker that partners with global portfolio managers and traders to provide unique data-driven insights throughout the investment process. From investment decision through to settlement, ITG helps clients understand market trends, improve performance, mitigate risk and navigate increasingly complex markets. A leader in electronic trading since launching the POSIT crossing network in 1987, ITG takes a consultative approach in delivering the highest quality institutional liquidity, execution services, analytical tools and proprietary research. The firm is headquartered in New York with offices in North America, Europe, and the Asia Pacific region.

Our reportable operating segments are: U.S. Operations, Canadian Operations, European Operations and Asia Pacific Operations (see Note 23, Segment Reporting, to the consolidated financial statements, which also include financial information about geographic areas). The U.S. Operations segment provides electronic and high-touch trade execution, trade order and execution management, network connectivity, analytical products and investment research services. The Canadian and Asia Pacific Operations segments provide electronic and high-touch trade execution, trade execution management, network connectivity, analytical products and investment research services. The European Operations segment provides electronic and high-touch trade execution, trade order and execution management, network connectivity and analytical products and includes a technology research and development facility in Israel.

Products and Services

ITG offers a wide range of solutions for asset managers in the areas of electronic brokerage, research sales and trading, trading platforms and analytics. These offerings include trade execution services and solutions for portfolio management, as well as investment research, pre-trade analytics and post-trade analytics and processing, summarized below. Each product is offered in the U.S. and certain other jurisdictions, as further described in the section entitled Non-U.S. Operations.

Electronic Brokerage

ITG electronic brokerage services include self-directed trading using algorithms, smart routing and matching through POSIT in cash equities (including single stocks and portfolio lists), futures and options.

1

ITG Algorithms and ITG Smart Router

ITG Algorithms and ITG Smart Router offer portfolio managers and traders a way to trade orders quickly, comprehensively and cost-efficiently from any ITG Execution Management System ("EMS") or ITG Order Management System ("OMS") and most third-party trading platforms. The algorithms execute orders anonymously and discreetly, thereby potentially lowering market impact costs and improving overall performance. ITG Algorithms employ ITG Transaction Cost Analysis to enhance execution quality. ITG Algorithms help users pursue best execution through two suites: ITG Single Stock Algorithms and ITG List-Based Algorithms.

ITG Smart Router offers an alternative to routing trades that can help capture liquidity with a combination of speed and confidentiality. These routers continuously scan markets for liquidity with an emphasis on trading without displaying the order. ITG Smart Router uses proprietary techniques to quickly execute at the best available prices.

POSIT

POSIT was launched in 1987 as a point-in-time electronic crossing network. POSIT operates as an Alternative Trading System ("ATS"), providing anonymous continuous and scheduled crossing of non-displayed (or dark) equity orders and price improvement opportunities within the National Best Bid and Offer ("NBBO").

POSIT Alert is a buyside-only block crossing mechanism within POSIT. POSIT Alert scans uncommitted shares from participating clients. When a crossing opportunity is detected, POSIT Alert notifies the relevant users that a matching opportunity exists.

POSIT Marketplace provides access to POSIT liquidity, the dark pools of other ATSs, and certain exchange hidden order types. POSIT Marketplace is a dark pool aggregator that provides clients with access to a large range of liquidity destinations. POSIT Marketplace uses advanced quantitative techniques in an effort to protect clients from gaming and to interact with quality liquidity.

ITG Derivatives

ITG Derivatives provides electronic-listed futures and options trading, including algorithmic trading and direct market access. ITG offers advanced options features for traders employing volatility or delta-neutral strategies and also provides low-latency application programming interfaces.

Commission Management Services

ITG offers guidance, administration, and consolidation of client commission arrangements across the range of preferred brokerage and research providers of our clients using ITG Commission Manager, a robust, multi-asset web-based commission management portal.

Securities Lending Services

Through stock borrow and stock loan transactions, ITG facilitates shortened or extended settlement periods to help clients meet their internal cash flow needs. ITG also locates and borrows securities for clients to accommodate short sales and reduce fails.

Research Sales & Trading

ITG Investment Research

ITG provides unique, unbiased, data-driven equity research through its ITG Investment Research subsidiary. This offering has expanded ITG's client relationships beyond the trading desk to chief investment officers, portfolio managers and analysts. Through the use of innovative data mining and

2

analysis, as well as detailed analysis of energy asset plays, ITG Investment Research identifies the key metrics that may influence a company's future performance. ITG Investment Research currently provides research on more than 300 companies.

ITG Market Research

ITG Market Research offers market research capabilities to corporate clients within the healthcare and telecom industries. The healthcare market research practice combines survey results with proprietary empirical data to deliver innovative syndicated and custom reporting capabilities. The telecom research practice triangulates multiple proprietary data sources to provide insights into the mobile handset market in North America.

High-Touch Trading

ITG provides high-touch sales trading and portfolio trading for institutional clients. ITG's high-touch trading desk is staffed with experienced trading professionals who provide ITG clients with execution expertise and also convey trading ideas based on ITG Investment Research.

Trading Platforms

Execution Management and Order Management

ITG EMSs are designed to meet the needs of disparate trading styles. Triton is ITG's award winning, multi-asset and broker-neutral EMS, which brings a complete set of integrated execution and analytical tools to the user's desktop for global, list-based and single stock trading, as well as futures and options capabilities. Triton Derivatives is a broker-neutral direct access EMS that provides traders with access to scalable, low-latency, multi-asset trading opportunities.

ITG OMS combines portfolio management, compliance functionality (ITG Compliance Monitoring System), trading and post-trade processing (ITG Trade Operations Outsourcing), and a fully integrated and supported financial services communications network (ITG Net) with a consolidated, outsourced service for global trade matching and settlement (ITG Trade Operations Outsourcing) that provides connectivity to the industry's post-trade utilities, support for multiple, flexible settlement communications methods and a real-time process monitor.

ITG Net

ITG Net is a global financial communications network that provides secure, reliable and fully supported connectivity between buy-side and sell-side firms for order routing and indication-of-interest messages from ITG and third-party trading platforms. ITG Net supports approximately 9,000 billable connections to more than 500 unique brokerage firms and execution venues worldwide. ITG Net also integrates the trading products of third-party brokers and ATSs into our OMS and EMS platforms.

ITG Single Ticket Clearing

ITG's commitment to best execution platforms also extends to broker-neutral operational services to help ensure that trades clear and settle efficiently, and to significantly lower the transaction costs associated with trade tickets. ITG Single Ticket Clearing is a broker-neutral service that aggregates executions across multiple destinations for settlement purposes. ITG Single Ticket Clearing helps reduce the number of trade tickets and resulting charges imposed by custodians, reducing the growing costs of trade processing due to market fragmentation.

3

Analytics

ITG Trading Analytics

The ITG Smart Trading Analytics suite enables portfolio managers and traders to improve execution performance before the trade happens (pre-trade) and during trading (real-time) by providing reliable portfolio analytics and risk models that help them perform predictive analyses, manage risk, change strategy and reduce trading costs. Trading costs are affected by multiple factors, such as execution strategies, time horizon, volatility, spread, volume and order size. ITG Smart Trading Analytics gauges the effects of these factors and aids in the understanding of the trade-off between market impact and opportunity cost.

ITG Transaction Cost Analysis ("TCA") offers unique measurement and reporting capabilities to analyze costs and performance across the trading continuum. ITG TCA assesses trading performance and implicit costs under various market conditions, so users can adjust strategies, and potentially reduce costs and boost investment performance. ITG TCA is also available for foreign exchange (ITG TCA for FX).

ITG Alpha Capture Reporting measures cost at every point of the investment process and provides portfolio managers with quarterly analytical reviews, written interpretations and on-site consultative recommendations to enhance performance.

ITG Portfolio Analytics

ITG provides market-leading tools to assist asset managers with portfolio decision-making tasks from portfolio construction and optimization to the enterprise challenges of global, real-time portfolio compliance monitoring and the fair valuation of securities.

ITG Portfolio Fair Value Service helps mutual fund managers meet their obligations to investors and regulators to fairly price the securities within their funds, and helps minimize the impact of market timing.

ITG Portfolio Optimization System allows portfolio managers to develop new portfolio construction strategies and solve complex optimization problems. ITG Portfolio Optimization System allows users to accurately model tax liability, transaction costs and long/short objectives, while adhering to diverse portfolio-specific constraints.

Non-U.S. Operations

ITG has established a strong and growing presence in key financial centers around the world to serve the needs of global institutional investors. In addition to its New York headquarters and its Boston, Chicago, Los Angeles and San Francisco offices in the U.S., ITG has additional North American offices in Toronto and Calgary. In Europe, ITG has offices in London, Dublin and Paris. ITG also has a development center in Tel Aviv. In Asia Pacific, ITG has offices in Sydney, Melbourne, Hong Kong and Singapore. Local representation in regional markets provides an important competitive advantage for ITG. ITG also provides electronic and high-touch trading for Latin American equities, including algorithms for Brazil and Mexico, from its New York headquarters.

Canadian Operations

ITG Canada was founded in 2000 and ranks in the Top 10 investment dealers in Canada. ITG Canada provides electronic brokerage services, including ITG Algorithms, ITG Smart Router and the POSIT suite, as well as high-touch agency execution and portfolio trading services. In addition, ITG Canada provides Triton, Triton Derivatives, connectivity services, ITG Single Ticket Clearing, ITG Portfolio Optimization System, ITG Smart Trading Analytics, ITG TCA and investment research

4

services. ITG Canada also engages in principal trading activities. ITG Canada's customers primarily consist of asset and investment managers, broker-dealers and hedge funds.

In July 2007, ITG Canada launched MATCH Now, an alternative marketplace for Canadian-listed equities, operated by ITG's wholly-owned subsidiary, TriAct Canada Marketplace LP ("TriAct"). MATCH Now is Canada's largest anonymous crossing system, offering continuous execution opportunities within a fully confidential non-displayed book at the mid-point of the Canadian NBBO.

European Operations

ITG Europe was established as a broker-dealer in 1998. Today, ITG Europe focuses on trading European, Middle Eastern and African equities as well as providing ITG's technologies to its clients. ITG Europe provides electronic brokerage services including ITG Algorithms, ITG Smart Router, and the POSIT suite, as well as high-touch agency execution and portfolio trading services. ITG Europe also provides ITG OMS, Triton, connectivity services, ITG Single Ticket Clearing, ITG TCA, ITG Alpha Capture Reporting and ITG Smart Trading Analytics.

Asia Pacific Operations

Australia

In 1997, ITG launched ITG Australia, an institutional brokerage firm specializing in execution and analytics for Australia and New Zealand equities. ITG provides institutional investors with a range of ITG's products and services including trade execution, trade execution management through Triton, connectivity services and pre-and post-trade analysis through ITG TCA and ITG Smart Trading Analytics. Trade execution services include electronic brokerage products such as ITG Algorithms and the POSIT suite, and high-touch agency trading.

Hong Kong

In 2001, ITG formed ITG Hong Kong, an institutional broker-dealer focused on developing and applying ITG's technologies across the Asian markets. Execution services are provided through electronic brokerage products such as ITG Algorithms and the POSIT suite and through an experienced high-touch agency trading services team. Other trading tools provided by ITG Hong Kong include Triton, connectivity services, ITG TCA and ITG Smart Trading Analytics.

Singapore

In 2010, ITG Singapore Pte Limited ("ITG Singapore") obtained a Capital Markets Services License from the Monetary Authority of Singapore. ITG Singapore provides institutional investors in Singapore with a range of ITG's products and services including electronic and high-touch execution services, trade execution management through Triton and trading analysis through ITG TCA and ITG Smart Trading Analytics.

Competition

The financial services industry generally, and the institutional securities brokerage business in which we operate, are extremely competitive, and we expect them to remain so for the foreseeable future. Our full suite of products does not directly compete with a particular firm; however, individual products compete with various firms and consortia:

- •

- Our trading analytics compete with offerings from several sell side-affiliated and independent companies.

- •

- POSIT competes with various national and regional securities exchanges, ATSs, Electronic Communications Networks, Multilateral Trading Facilities ("MTFs"), and systematic internalizers for trade execution services. These destinations have proliferated in recent years.

5

- •

- Our EMSs, OMS and connectivity services compete with offerings from independent vendors, agency-only firms and

other sell-side firms.

- •

- Our algorithmic and smart routing products as well as our high-touch agency execution and portfolio trading

services compete with agency-only and other sell-side firms.

- •

- Our ITG Investment Research offering competes with the research divisions of large and regional investment banks as well as a number of independent research firms.

Regulation

Certain of our U.S. and non-U.S. subsidiaries are subject to various securities regulations and capital adequacy requirements promulgated by the regulatory and exchange authorities of the countries in which they operate. In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws, with the regulation of broker-dealers primarily delegated to self-regulatory organizations ("SROs"), principally the Financial Industry Regulatory Authority ("FINRA") as well as other national securities exchanges. In addition to federal and SRO oversight, securities firms are also subject to regulation by state securities administrators in those states in which they conduct business. Furthermore, our non-U.S. subsidiaries are subject to regulation by central banks and regulatory bodies in those jurisdictions where each subsidiary is authorized to do business, as further discussed below. The SROs, central banks and regulatory bodies conduct periodic examinations of our broker-dealer subsidiaries in accordance with the rules they have adopted and amended from time to time.

ITG's principal regulated subsidiaries are listed below. The principal self-regulator of all our U.S. broker-dealers is FINRA.

- •

- ITG Inc. is a U.S. broker-dealer registered with the SEC, FINRA, The NASDAQ Stock Market ("NASDAQ"), New York Stock

Exchange, NYSE Arca, Inc. ("ARCA"), NYSE MKT LLC ("NYSE MKT"), BATS Y-Exchange, Inc. ("BYX"), BATS Z-Exchange, Inc. ("BZX"), Chicago Stock

Exchange Inc., EDGA Exchange, Inc. ("EDGA"), EDGX Exchange, Inc. ("EDGX"), NASDAQ OMX BX, Inc. ("NASDAQ BX"), NASDAQ OMX PHLX, Inc. ("NASDAQ OMX PHLX"), National

Stock Exchange, National Futures Association ("NFA"), Ontario Securities Commission ("OSC"), all 50 states, Puerto Rico and the District of Columbia.

- •

- ITG Derivatives is a U.S. broker-dealer registered with the SEC, FINRA, NYSE MKT, ARCA, BYX, BZX, BOX Options

Exchange LLC, EDGA, EDGX, Chicago Board Options Exchange, C2 Options Exchange Incorporated, International Securities Exchange, NASDAQ, NASDAQ BX, NASDAQ OMX PHLX, Commodities and Futures

Trading Commission, Miami International Securities Exchange, the NFA and 28 states.

- •

- AlterNet is a U.S. broker-dealer registered with the SEC, FINRA, NASDAQ, EDGA, EDGX and 14 states.

- •

- ITG Canada is a Canadian broker-dealer registered as an investment dealer with the Investment Industry Regulatory Organization of Canada ("IIROC"), the OSC, the Autorité Des Marchés Financiers in Quebec, Alberta Securities Commission, British Columbia Securities Commission, Manitoba Securities Commission, New Brunswick Securities Commission, Nova Scotia Securities Commission and Saskatchewan Financial Services Commission. ITG Canada is also registered as a Futures Commission Merchant in Ontario and Manitoba and Derivatives Dealer in Quebec. ITG Canada is a member of the Toronto Stock Exchange ("TSX"), TSX Venture Exchange, the Canadian National Stock Exchange and the Montreal Exchange. TriAct operates MATCH Now, an ATS under National Instrument 21-101 and is registered as an investment dealer with IIROC, the OSC and the Alberta Securities Commission.

6

- •

- ITG Australia is a market participant of the Australian Securities Exchange ("ASX") and Chi-X Australia

Limited. It is also a holder of an Australian Financial Services License issued by the Australian Securities and Investments Commission ("ASIC"). ITG Australia's principal regulators are the ASX and

ASIC.

- •

- Our European operations include ITG Ventures Limited, ITGL and/or its wholly-owned subsidiary Investment Technology Group

Europe Limited ("ITGEL"). ITGL and ITGEL are authorized and regulated by the Central Bank of Ireland ("CBoI") under the European Communities (Markets in Financial Instruments)

Regulations 2007. ITGL is a member of the main national European exchanges, including the London Stock Exchange, Deutsche Börse and Euronext, as well as most of the

European-domiciled MTFs. It also operates the POSIT crossing system in Europe as a MTF under the Markets in Financial Instruments Directive ("MiFID"). ITGEL's London Branch is

registered with the Financial Services Authority and ITGEL's Paris branch is registered with the Banque de France.

- •

- ITG Hong Kong is a participating organization of the Hong Kong Stock Exchange and a holder of a securities dealer's

license issued by the Securities and Futures Commission of Hong Kong ("SFC"), with the SFC acting as its principal regulator.

- •

- ITG Singapore is a holder of a Capital Markets Services License from the Monetary Authority of Singapore ("MAS"), with the MAS acting as its principal regulator.

Broker-dealers are subject to regulations covering all aspects of the securities trading business, including sales methods, trade practices, investment research distribution, use and safekeeping of clients' funds and securities, capital structure, record-keeping and conduct of directors, officers and employees. Additional legislation, changes in the interpretation or enforcement of existing laws and rules may directly affect the mode of operation and profitability of broker-dealers. The SEC, SROs, state securities commissions and foreign regulatory authorities may conduct administrative proceedings or commence judicial actions, which can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer, its directors, officers or employees. The principal purpose of regulation and discipline of broker-dealers is the protection of investors and the securities markets, rather than the protection of creditors and stockholders of broker-dealers.

ITG Inc., AlterNet, and ITG Derivatives are required by law to belong to the Securities Investor Protection Corporation ("SIPC"). In the event of a U.S. broker-dealer's insolvency, the SIPC fund provides protection for client accounts up to $500,000 per customer, with a limitation of $250,000 on claims for cash balances. ITG Canada and TriAct are required by Canadian law to belong to the Canadian Investors Protection Fund ("CIPF"). In the event of a Canadian broker-dealer's insolvency, CIPF provides protection for client accounts up to CAD $1 million per customer. ITGL and ITGEL are required to be members of the Investor Compensation Protection Schemes which provides compensation to retail investors in the event of certain stated defaults by an investment firm. ITG Hong Kong is regulated by the SFC. The SFC operates the Investor Compensation Fund which provides compensation to retail investors. ITG Australia is obligated to contribute to the ACH Clearing Fund and/or the National Guarantee Fund if and when requested by ASIC. In the past twelve months, no such requests have been made of ITG Australia.

Regulation ATS

Regulation ATS permits "alternative trading systems" such as POSIT to match orders submitted by buyers and sellers without having to register as a national securities exchange. Accordingly, POSIT is not registered with the SEC as an exchange. We continue to review and monitor POSIT's systems and procedures to ensure compliance with Regulation ATS.

7

Net Capital Requirement

ITG Inc., AlterNet and ITG Derivatives are subject to the Uniform Net Capital Rule (Rule 15c3-1) under the Exchange Act, which requires the maintenance of minimum net capital.

ITG Inc. has elected to use the alternative method permitted by Rule 15c3-1, which requires that ITG Inc. maintain minimum net capital equal to the greater of $1.0 million or 2% of aggregate debit balances arising from customer transactions. AlterNet and ITG Derivatives have elected to use the basic method permitted by Rule 15c3-1, which requires that they maintain minimum net capital equal to the greater of 62/3% of aggregate indebtedness or $100,000 and in the case of ITG Derivatives, $1 million, which is due to the fact that ITG Derivatives is a registered Futures Commission Merchant pursuant to Commodity Futures Trading Commission ("CFTC") Regulation 1.17.

For further information on our net capital position, see Note 18, Net Capital Requirement, to the consolidated financial statements.

Research and Product Development

We devote a significant portion of our resources to the development and improvement of technology-based services. Important aspects of our research and development efforts include enhancements of existing software, the ongoing development of new software and services and investment in technology to enhance our efficiency.

The amounts expensed for research and development costs for the years ended December 31, 2012, 2011 and 2010 are estimated at $44.6 million, $47.5 million and $49.1 million, respectively.

Intellectual Property

Patents and other proprietary rights are important to our business. We also rely upon trade secrets, know-how, continuing technological innovations, and licensing opportunities to maintain and improve our competitive position.

We own a portfolio of patents that principally relate to financial services. We also own and maintain a portfolio of trademarks. Patents for individual products extend for varying periods according to the date of patent filing or grant and the legal term of patents in the various countries where patent protection is obtained. The extent and duration of trademark rights are dependent upon national laws and use of the trademarks.

While we consider our patents and trademarks to be valued assets, we do not believe that our competitive position is dependent on patent or trademark protection or that our operations are dependent upon any single patent or group of related patents.

It is our practice to enter into confidentiality and intellectual property ownership agreements with our clients, employees, independent contractors and business partners, and to control access to, and distribution of, our intellectual property.

Clients

For the years ended December 31, 2012, 2011 and 2010, no single client accounted for more than 5% of our consolidated revenue.

Employees

As of December 31, 2012, the Company employed 1,047 staff globally, of which 726, 82, 143 and 96 staff were employed by the U.S., Canadian, European and Asia Pacific Operations, respectively.

8

Website and Availability of Public Reports

Our website can be found at http://www.itg.com. We are not including the information contained on our website as part of, or incorporating it by reference into, this Annual Report on Form 10-K.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, together with any amendments to those reports, are available without charge on our website at http://investor.itg.com. We make this information available on our website as soon as reasonably practicable after we electronically file such information with, or furnish it to, the SEC. You may also obtain copies of our reports without charge by writing to: ITG, 380 Madison Avenue, New York, NY 10017, Attn: Investor Relations.

Certain Factors That May Affect Our Financial Condition and Results of Operations

While our management's long-term expectations are optimistic, we face risks or uncertainties that may affect our financial condition and results of operations. The following conditions, among others, should be considered in evaluating our business and growth outlook.

Decreases in equity trading activity by active fund managers and declining securities prices could harm our business and profitability.

Declines in the trading activity of active fund managers would generally result in lower revenues from our trading solutions, which generate the majority of our revenues globally. In addition, securities' price declines would adversely affect our non-North American trading commissions, which are based on the value of transactions. The demand for our trading solutions is directly affected by factors such as economic, regulatory and political conditions that may lead to decreased trading activity and prices in the securities markets in the U.S. and in all of the foreign markets we serve. Over the past several years, global trading activity has declined significantly and may continue to do so. Increased risk aversion brought about by the impact of the financial crisis of 2008, ongoing concerns over sovereign debt levels and lower confidence in the functioning of financial markets has resulted in a significant flow of funds out of actively-managed equity funds, thereby curtailing their trading activity, which has weighed heavily on our buy-side trading volumes and the use of our higher value services. While there is a historical correlation between recovering share prices and the flow of money back into equity funds, there is uncertainty as to when a real, sustainable recovery in institutional equity activity will materialize, as well as the extent to which it will recover.

Decreases in our commission rates and other transactional revenues could adversely affect our operating results.

Commission rates on institutional trading activity have declined historically and we anticipate a continuation of the competitive pricing environment for the foreseeable future. In addition, reduced activity from our active fund manager clients has resulted in a shift in the mix of our business to include an increased portion from higher-turnover lower-rate clients, particularly sell-side firms. A further decrease in commission rates or revenue capture from further mix shifts or from rate reductions within client segments could materially reduce our margins and harm our financial condition and operating results.

Our fixed costs may result in reduced profitability or losses.

We incur significant operating and capital expenditures to support our business that do not vary directly, at least in the short term, with fluctuations in executed transaction volumes or revenues. In addition, changes in market practices have required us, and may require us in the future, to invest in

9

additional infrastructure to increase capacity levels without a corresponding increase in revenues. To ensure that we have the capacity to process projected increases in trade orders and executed transaction volumes, we have historically made substantial infrastructure investments in advance of such projected increases, including during periods of low revenues. We have also made substantial investments in our research products to attract additional trade flows from our buy-side clients. In the event of further reductions in trade executions and/or revenues, we may not be able to reduce such expenses quickly and, as a result, we could experience reduced profitability or losses. If the growth in executed volumes does not occur or we are not able to successfully implement and monetize our investments, including by failing to accurately forecast the demand for new products and by failing to effectively deploy new products and decommission legacy products, the expenses related to such investments could cause reduced profitability or losses.

The price of our common stock may be volatile, which may impact our ability to attract and retain clients and limit the amount of strategic investments we can make.

The periodic reporting of earnings and associated disclosures in this challenging environment for our business may result in significant fluctuations in the price of our stock and limit the extent to which our clients want to rely on us for core trading infrastructure and services. In addition, our ability to grow the Company through acquisitions and strategic initiatives may be negatively impacted by the dilutive effect of a low stock price and the need to preserve short-term profitability levels that are acceptable to stockholders.

A failure in the design, operation or configuration of our technology could adversely affect our profitability and reputation.

A technological failure or error of one or more of our products or systems, including but not limited to POSIT, our algorithms, smart routers, and order and execution management systems, could result in lost revenues and/or significant market losses. We operate complex trading systems, algorithms and analytical products that may fail to correctly model interacting or conflicting trading objectives, unusual market conditions, available trading venues and other factors, which may cause unintended results. Similarly, the operation and configuration of our systems can be quite complex and departure from standard procedures can result in adverse trading outcomes. Such problems could cause us to incur trading losses, lose clients or experience other reputational harm resulting in lost revenues and profits. Our quality assurance testing cannot test for all potential scenarios or ensure that the technology will function as designed and intended in all cases.

If we fail to keep up with rapid changes in technology and continue to seek to provide leading products and services to our customers, our results of operations could be negatively impacted.

The institutional brokerage industry is subject to rapid technological change and evolving industry standards. Our customers' demands become greater and more sophisticated as the dissemination of products and information to customers increases. If we are unable to anticipate and respond to the demand for new services, products and technologies, innovate in a timely and cost-effective manner and adapt to technological advancements and changing standards, we may be unable to compete effectively, which could have a material adverse effect on our business. Many of our competitors have significantly greater resources than we do to fund such technological advances. Moreover, the development of technology-based services is a complex and time-consuming process. New products and enhancements to existing products can require long development and testing periods. Budgetary constraints on funding new product initiatives in the current environment, significant delays in new product releases, failure to meet key deadlines or significant problems in creating new products could negatively impact our revenues and profits.

10

Insufficient system capacity, system operating failures, disasters or security breaches could materially harm our reputation, financial position and profitability.

Our business relies heavily on the computer and communications systems supporting our operations, which must monitor, process and support a large volume of transactions across numerous execution venues in many countries and multiple currencies. As our business expands, we will need to expand our systems to accommodate an increasing volume of transactions across a larger client base and more geographical locations. In addition, certain changes in market practices may require us to invest in infrastructure to increase capacity levels. Unexpectedly high volumes or times of unusual market volatility could cause our systems to operate slowly, decrease output or even fail for periods of time, as could general power or telecommunications failures, natural disasters or other business disruptions. The presence of computer viruses can also cause failure within our systems. If any of our systems do not operate properly, are disabled, breached or attacked by hackers or other disruptive problems, we could incur financial loss, liability to clients, regulatory intervention or reputational damage. System failure, degradation, breach or attack could adversely affect our ability to effectuate transactions and lead our customers to file formal complaints with industry regulatory organizations, initiate regulatory inquiries or proceedings, file lawsuits against us, trade less frequently through us or cease doing business with us.

Our corporate headquarters and largest concentration of employees and technology is in the New York metropolitan area. Our other offices are also located in major cities around the globe. If a business system disruption were to occur, especially in New York, for any reason including widespread health emergencies, natural disasters or terrorist activities, and we were unable to execute our disaster recovery plan, it could have a material effect on our business. Moreover, we have varying levels of disaster recovery plan coverage among our non-U.S. subsidiaries.

Our business relies on the secure storage, processing and transmission of data, including our clients' confidential data, in our internal systems and through our vendor networks and communications infrastructure. Third parties who are able to breach or disrupt our, or our vendors', security systems may be able to cause system damage or failures or perform unauthorized trading that could result in significant losses. There is no guarantee that our systems can prevent all unauthorized access or that our third party vendors will be able to secure their networks and systems. If our or one of our vendors' security is breached and unauthorized access is obtained to the confidential information of our clients, it could cause us reputational harm and our clients may then reduce or cease their use of our services, which would adversely impact our results of operations.

Any system, operational or security failure or breach could result in regulatory or legal claims. We could incur significant costs in defending such regulatory or legal claims, even those without merit. Moreover, such failures could result in the need to remediate issues and repair or expand our networks and systems. Any obligation to expend significant resources to defend claims or repair and expand infrastructure could have an adverse effect on our financial condition and results of operations.

We are dependent on certain third party vendors for key services.

We depend on a number of third parties to supply elements of our trading systems, computers, market and research data, data centers, FIX connectivity, communication network infrastructure, other equipment and related support and maintenance. We cannot be certain that any of these providers will be willing or able to continue to provide these services in an efficient and cost-effective manner or to meet our evolving needs. Moreover, we are dependent on our communications network providers for interconnectivity with our clients, markets and clearing agents to service our customers and operate effectively. If our vendors fail to meet their obligations, provide poor, inaccurate or untimely service, or we are unable to make alternative arrangements for the supply of these services, we may fail, in turn,

11

to provide our services or to meet our obligations to our customers and our business, financial condition and our operating results could be materially harmed.

Our securities and clearing business exposes us to material liquidity risk.

We self-clear equity transactions in the U.S., Hong Kong and Australia. In those markets, we may be required to provide considerable additional capital to regulatory agencies or increase margin deposits with clearing and settlement organizations, such as the National Securities Clearing Corporation or Depository Trust and Clearing Corporation in the U.S., especially during periods of high market volatility. In addition, regulatory agencies may require these clearing and settlement organizations to increase the level of margin deposit requirements. We rely on our excess cash and certain established credit facilities to meet those demands. While we have historically met requests for additional margin deposits, there is no guarantee that our excess cash and our established credit facilities will be sufficient for future needs, particularly if there is an increase in requirements. There is also no guarantee that these established credit facilities will be extended beyond their expiration.

In addition, each of our broker-dealer subsidiaries worldwide is subject to regulatory capital requirements promulgated by the applicable regulatory and exchange authorities of the countries in which they operate. The failure by any of these subsidiaries to maintain its required regulatory capital may lead to suspension or revocation of its broker-dealer registration and its suspension or expulsion by its regulatory body. Historically, all regulatory capital needs of our broker-dealers have been provided by cash from operations. However, if cash from operations, together with existing financing facilities are not sufficient, we may not be able to obtain additional financing.

Our business exposes us to credit risk that could affect our operating results and profitability.

We are exposed to credit risk from third parties that owe us money, securities or other obligations, including our customers and trading counterparties. These parties may default on their obligations to us due to bankruptcy, lack of liquidity, operational failure or other reasons, and we could be held responsible for such defaults. In addition, client trading errors which they are unable to cover may cause us to incur financial losses. Volatile securities markets, credit markets and regulatory changes may increase our exposure to our customers' credit profiles, which could adversely affect our financial condition and operating results. While our broker-dealer subsidiaries that are not self-clearing have clearing agreements with their clearing brokers who review the credit risk of trading counterparties, we have no assurances that those reviews or our own are adequate to provide sufficient protection from this risk.

We may incur material losses on foreign exchange transactions entered into on behalf of clients and be exposed to material liquidity risk due to counterparty defaults or errors.

We enable clients to settle cross-border equity transactions in their local currency through the use of foreign exchange contracts. These arrangements typically involve the delivery of securities or cash to a counterparty that is not processed through a central clearing facility in exchange for a simultaneous receipt of cash or securities. We may operate as either a principal or agent in these transactions. As a result, a default by one of our counterparties prior to the settlement of their obligation could materially impact our liquidity and have a material adverse affect on our financial condition and results of operations.

In addition, we are exposed to operational risk. Employee and technological errors in executing, recording or reporting foreign exchange transactions may result in material losses due to the large size of such transactions and the underlying market risk in correcting such errors.

12

As a clearing member firm in certain jurisdictions we are subject to significant default risk.

We are required to finance our clients' unsettled positions from time to time and we could be held responsible for the defaults of our clients. Default by our clients may also give rise to our incurring penalties imposed by execution venues, regulatory authorities and settlement systems. Although we regularly review our credit exposure, default risk may arise from events or circumstances that may be difficult to detect or foresee. In addition, concerns about, or a default by, one institution could lead to significant liquidity problems, losses or defaults by other institutions that could in turn adversely affect us.

Our equity trading operations in jurisdictions other than the U.S., Hong Kong and Australia are dependent on their clearing agents and any failures by such clearing agents could materially impact our business and operating results.

Certain of our international operations are dependent on agents for the clearance and settlement of securities transactions. If our agents fail to properly facilitate the clearance and settlement of our customer trades, we could be subject to financial, legal and regulatory risks and costs that may impact our business and operating results. In addition, it could cause our clients to reduce or cease their trading with us, which would adversely affect our revenues and financial results.

Moreover, certain of our agreements with clearing agents may be terminated upon short notice. There is no guarantee that we could obtain alternative services in a timely manner and any interruption of the normal course of our trading and clearing operations could have a material impact on our business and results of operations.

We incur limited principal trading risk.

A limited portion of our revenues is derived from principal trading in our Canadian Operations, including arbitrage trading and the net spread on foreign exchange contracts executed to facilitate equity trades by clients in different currencies. As a result of this trading, we may incur losses relating to the purchase or sale of securities for our own account. Although we attempt to close out all of our positions by the end of the day, we bear the risk of market fluctuations and we may incur losses due to changes in the prices of such securities. Any principal gains or losses resulting from these positions could have a disproportionate effect, positive or negative, on our revenues and profits.

Our risk management policies and procedures may not be effective and may leave us exposed to unidentified or unexpected risks.

We seek to monitor and control our risk exposure through a risk and control framework encompassing a variety of separate but complementary financial, credit, operational, technological, compliance and legal reporting systems, internal controls, management review processes and other mechanisms. Our policies, procedures and practices used to identify, monitor and control a variety of risks may fail to be effective. As a result, we face the risk of losses, including, for example, losses resulting from trading errors, customer defaults, fraud and money-laundering. Our risk management methods rely on a combination of technical and human controls and supervision that are subject to error and failure.

Internal control over financial reporting, no matter how well designed, has inherent limitations. Therefore, internal control over financial reporting determined to be effective can provide only reasonable assurance with respect to financial statement preparation and may not prevent or detect all misstatements. Moreover, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. As such, we could lose investor confidence

13

in the accuracy and completeness of our financial reports, which may have a material adverse effect on our stock price.

The business in which we operate is extremely competitive worldwide.

Many of our competitors have substantially greater financial, technical, marketing and other resources than we do, which, among other things, enable them to compete with the services we provide on the basis of price, including lowering prices for certain of our key services to gain business in their higher margin areas, and a willingness to commit their firms' capital to service their clients' trading needs on a principal, rather than on an agency basis. In addition, many of our competitors bundle multiple services as part of their equity trading offering. To the extent we seek to unbundle any of our products or services, we may lose clients which would also result in a loss of revenues and profits. Many of them offer a wider range of services, have broader name recognition, and have larger customer bases than we do. Some of our competitors have long-standing, well-established relationships with their clients, and also hold dominant positions in their trading markets. Moreover, new entrants may enter the market with alternative methods of providing trade execution and related services, and existing competitors often launch new initiatives. Many of our competitors have undertaken measures to link various electronic trading systems and platforms in an effort to attract order flow to off-exchange venues and increase internal executions.

Although we believe that our products and services have established certain competitive advantages, our ability to maintain these advantages will require continued enhancements to our products, investment in the development of our services, additional marketing activities and enhanced customer support services. There can be no assurance that we will have sufficient resources to continue to make this investment, that our competitors will not devote significantly more resources to competing services or that we will otherwise be successful in maintaining our market position. If competitors offer superior services, our market share would be affected and this would adversely impact our business and results of operations.

We face certain challenges and risks to our international business that may adversely affect our strategy.

Global client coverage is a key component of our business plan. We have invested significant resources in our foreign operations and the globalization of our products and services. However, there are certain risks inherent in the operation of our business outside of the U.S., including but not limited to, additional regulatory capital requirements, less developed technology and infrastructure and higher costs for infrastructure. These risks may limit our ability to provide services to clients in certain markets. There also may be difficult processes for obtaining regulatory approvals. This could result in delays in our global business plans, difficulties in staffing foreign operations and adapting our products to foreign markets, practices and languages, exchange rate risks and the need to meet foreign regulatory requirements. Each of these could force us to alter our operational plans and this may adversely impact our strategy.

We incur risks related to our international business due to currency exchange rate fluctuations that could impact our financial results and financial position.

A significant amount of our business is conducted in foreign currencies. Conducting business in currencies other than the U.S. Dollar subjects us to exchange rate fluctuations. These fluctuations can materially impact our financial results.

14

We are dependent on certain major customers and a decline in their use of our services could materially impact our revenues.

Our customers may discontinue their use of our trading services at any time. The loss of any significant customer could have a material adverse effect on our results of operations.

The chart below sets forth our dependence on our three largest clients individually, as well as on our ten largest clients in the aggregate, expressed as a percentage of total revenues:

| |

% of Total Consolidated Revenue | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2012 | 2011 | 2010 | |||||||

Largest customer |

2.4 | % | 2.9 | % | 2.8 | % | ||||

Second largest customer |

2.1 | % | 2.0 | % | 2.0 | % | ||||

Third largest customer |

1.9 | % | 1.7 | % | 1.7 | % | ||||

Ten largest customers |

14.9 | % | 15.4 | % | 15.8 | % | ||||

The securities markets and the brokerage industry in which we operate globally are subject to extensive, evolving regulation that could materially impact our business.

We currently operate POSIT in the U.S. under Regulation ATS, our European operations are subject to MiFID and we must comply with the requirements of the U.S. PATRIOT Act and its foreign equivalents for monitoring our customers and suspicious transactions. Moreover, most aspects of our broker-dealer operations are highly regulated, such as sales and reporting practices, operational compliance, capital requirements and licensure of employees. Accordingly, we face the risk of significant intervention by regulatory authorities in all jurisdictions in which we conduct business, such as the SEC and FINRA in the U.S. and their equivalents in other countries. As we expand our business, we may be exposed to increased and different types of regulatory requirements and it may be difficult for us to determine the exact requirements of local laws in every market.

In the future, we may become subject to new regulations or changes in the interpretation or enforcement of existing regulations, which may adversely affect our business. Also, regulatory changes that impact how our customers conduct their business may impact our business and results of operations. The current U.S. administration and other members of the U.S. federal government and other governments outside of the United States have indicated that they are considering new regulatory requirements for the financial services industry. We cannot predict the extent to which any future regulatory changes would affect our business.

In July 2011, the SEC approved Securities Exchange Act Rule 13h-1 ("Large Trader Rule"), which partially went into effect on November 30, 2012 and is scheduled for full implementation on May 1, 2013. The Large Trader Rule imposes new filing requirements on market participants that conduct substantial trading activity in exchange-listed securities, and new record keeping, reporting, and monitoring requirements on broker-dealers. Furthermore, in June 2012, the SEC approved the Plan to Address Extraordinary Market Volatility (Limit Up—Limit Down Plan) and changes to the Market Wide Circuit Breakers that were proposed by national securities exchanges and FINRA in an effort to reduce volatility in the U.S. equity markets following the May 6, 2010 Flash Crash. Moreover, in July 2012, the SEC adopted the Consolidated Audit Trail rule that it proposed on May 26, 2010, which requires SROs to establish an order trail reporting system that would enable regulators to track, within 24 hours of the trade date, information related to trading orders received and executed across the securities markets.

In addition, new regulatory obligations have been proposed and adopted pertaining to markets outside of the United States which may have a material impact upon our business model. In Europe, these include proposed changes to MiFID (MiFID II) and financial transaction taxes that were imposed in 2012 by the French and Italian governments, and another equivalent tax that is being

15

proposed at the European Union level. With regard to Canada, in 2012, the Investment Industry Regulatory Organization of Canada and the Canadian Securities Administrator's adopted new regulations that require certain minimum price improvement in dark liquidity pools. Similarly, in Australia, new regulations that are scheduled to take effect in May 2013 will require dark liquidity pools to offer meaningful price improvement over displayed market prices. Accordingly, Australian dark pool operators will be required to provide executions at the midpoint of the current NBBO for un-displayed orders. Compliance with certain of these adopted laws, rules or regulations of the various jurisdictions in which we operate could result in the loss of revenue and has caused us, and could cause us, to incur significant costs.

In addition, on October 2, 2012, the SEC invited representatives from exchanges, broker-dealers, consulting companies, and academic institutions to participate in a Market Technology Roundtable (the "Roundtable") that discussed the relationship between the operational stability and integrity of the securities markets and the ways that market participants design, implement, and manage complex and interconnected trading technologies. The Roundtable was held primarily in response to certain trading technology and systems issues that arose during the initial public offerings of common stock in BATS Global Markets Inc. and Facebook, Inc. on March 23, 2012 and May 18, 2012 respectively, and certain erroneous trading activity by Knight Capital Group, Inc. on August 1, 2012. As a result of these incidents and the issues and concerns raised during the Roundtable discussions, the SEC could propose new regulations and/or rules that require market participants to implement additional policies, procedures, and controls to improve their processes for: (1) preventing trading system and technology malfunctions; (2) detecting erroneous orders and transactions on a real-time basis and (3) responding to technology and/or trading errors. Such measures could include more stringent testing standards and requirements for trading systems, registration of trading systems with regulators, and "Kill Switches" that cut off a market participant's access to external markets if certain transaction thresholds are breached. Finally, on January 9, 2013, FINRA announced that it was planning to heighten its scrutiny over dark pools and high-speed trading.

If any regulatory obligations stemming from these developments are implemented, ITG and other market participants could incur significant costs to establish the appropriate processes, systems, and/or controls.

If we are unable to obtain sources of data to create our differentiated research product, we could see a reduction in revenues and profitability.

Our investment research product leverages data derived from, among other sources, industry data providers and Web harvesting technology. If there is a limitation on the availability of data from these sources or if new regulations or laws restrict their use in investment research products, the quality of our research product could be negatively impacted along with the amount of revenue and profitability we derive from this offering.

We could be subject to challenges by U.S. and foreign tax authorities that could result in additional taxes and penalties.

We are subject to income and other taxes in each jurisdiction in which we operate. We are also subject to reviews and audits by U.S. and foreign tax authorities. Our determination of our tax obligations in each jurisdiction requires us and our advisers to make judgment calls and estimations. Our determination may differ, even materially, from the judgment of the tax authorities and therefore cause us to incur additional taxes and related interest and penalties, which could impact our financial results.

16

Inability to protect our intellectual property may result in increased competition, loss of business or other negative results on our business and financial condition.

Our success is dependent, in part, upon our proprietary intellectual property. We generally rely upon patents, copyrights, trademarks and trade secrets to establish and protect our rights in our proprietary technology, methods, products and services. We cannot assure that any of the rights granted under any patent, copyright or trademark that we may obtain will protect our competitive advantages. A third party may still try to challenge, invalidate or circumvent the protective mechanisms that we select. In addition, the laws of some foreign countries do not protect our proprietary rights to the same extent as the laws of the U.S., so we cannot predict our ability to properly protect our intellectual property in those jurisdictions. Third parties operating in jurisdictions in which we have not filed for protection may obtain rights in intellectual property that we have protected in the U.S. and other jurisdictions or may be able to misappropriate our intellectual property with impunity.

There can be no assurance that we will be able to protect our proprietary intellectual property from improper disclosure or use, or that others will not develop technologies that are similar or superior to our technology without violating our intellectual property. Violations of our intellectual property by third parties could have an adverse effect on our competitiveness and business. In addition, the cost of seeking to enforce our intellectual property rights could have an adverse effect on our financial results.

If we were to unknowingly infringe third party intellectual property or be accused of doing so without merit, we would bear significant costs of defense and litigation, which could impact our financial results.

In the past several years, there has been a proliferation of patents applicable to the computer and financial services industries. Under current law, U.S. patent applications remain secret for 18 months and may, depending on how they are prosecuted, remain secret until the issuance of a patent. In light of these factors, it is not always possible to determine in advance whether any of our products or services may infringe the present or future patent rights of others. From time to time, we may receive notices from others of claims or potential claims of intellectual property infringement or we may be called upon to defend our product, customer, vendee or licensee against such third party claims. Responding to these kinds of claims, regardless of merit, could consume valuable time and result in costly litigation that could have a material adverse effect on us. Such claims could also result in our entering into royalty or licensing agreements with the third parties claiming infringement on terms that could have a material impact on our profitability.

Financial and operational problems with our acquisitions and strategic initiatives could have a material impact on our results of operation.

Over the last several years, we have undertaken several strategic acquisitions, including the acquisitions of RedSky Financial, LLC (now ITG Derivatives), Majestic Research Corp. and Ross Smith Energy Group, Ltd. (together now ITG Investment Research), as well as various organic strategic initiatives. We may elect to pursue strategic acquisitions and strategic initiatives in the future. Acquisitions entail numerous risks, including but not limited to difficulties in valuing the acquired businesses, combining personnel and firm cultures, integrating acquired products, services and operations, achieving anticipated synergies that were inherent in our valuation assumptions, the assumption of unknown material liabilities of acquired companies and the potential loss of key clients or employees of acquired companies. Similarly, strategic initiatives may be important to our business prospects and we may not be able to successfully execute such initiatives. In either case, we may have clients, with whom we have established trading relationships that seek to negatively bundle our products or services without increasing the amount of revenue they pay us resulting in loss revenues and profits. If we are unable to successfully complete acquisitions and integrate the acquired businesses, if we suffer a material loss due to an acquired business or if we fail to execute strategic initiatives, we

17

may not achieve appropriate levels of return on these significant investments, which may have a material effect on our operating results.

Our business could be adversely affected by our inability to attract and retain talented employees, including sales, technology and development professionals.

Our business operations require highly specialized knowledge of the financial industry and of technological innovation as it applies to the financial industry. If we are unable to hire or retain the services of talented management, sales, research, technology and development professionals, we would be at a competitive disadvantage. In addition, recruitment and retention of qualified staff could result in substantial additional costs.

Misconduct and errors of our employees could cause us reputational and financial harm.

Employee errors in recording or executing transactions for customers can cause us to enter into transactions that customers may disavow and refuse to settle. These transactions expose us to risk of loss, which can be material, until we detect the errors in question and unwind or reverse the transactions. As with any unsettled transaction, adverse movements in the prices of the securities involved in these transactions before we unwind or reverse them can increase this risk. We may incur losses as a result of these transactions that could materially impact our financial results.

In addition to trading errors, other employee errors or misconduct could subject us to financial losses or regulatory sanctions and seriously harm our reputation. It is not always possible to prevent employee errors or misconduct, and the precautions we take to prevent and detect this activity may not be effective in all cases. Misconduct by our employees could include hiding unauthorized activities from us, improper or unauthorized activities on behalf of customers or improper use of confidential information. Such misconduct could result in losses, litigation or other material adverse effects on the Company.

Our inability to effectively manage any management structure changes could create uncertainty regarding our ability to execute our future business plans.

We have recently undertaken a review of our businesses in each region to measure our performance by product or service offering. Our inability to effectively manage any management structure changes related to this undertaking could challenge our ability to execute our business plans which could materially impact our financial results.

Item 1B. Unresolved Staff Comments

None

U.S. Operations

Our principal offices are located at 380 Madison Avenue in New York, New York, where approximately 101,000 square feet of office space is currently being leased pursuant to coterminous leases expiring in January 2014. We occupy an additional 11,000 square feet of office space in New York City pursuant to a lease agreement expiring in May 2013. We are currently building out our new headquarters located in lower Manhattan, where we will occupy approximately 132,000 square feet pursuant to a lease agreement expiring January 2029.

We maintain a facility in Los Angeles, California where we occupy approximately 54,000 square feet of office space pursuant to a lease agreement expiring in December 2016. This facility is used primarily for technology research and development and support services.

18

We have a regional office in Boston, Massachusetts where approximately 54,000 square feet of office space is occupied pursuant to a lease expiring in May 2021.

We also have additional regional offices in Chicago, Illinois where we occupy approximately 10,300 square feet under a lease agreement expiring in October 2013, and in San Francisco, California where we occupy approximately 3,900 square feet under a lease agreement expiring in June 2018.

Canadian Operations

ITG Canada has an office in Toronto where we occupy approximately 19,900 square feet of office space pursuant to a lease expiring in December 2016. We also have an office in Calgary where we occupy approximately 9,600 square feet pursuant to a lease expiring in March 2015.

European Operations

ITG Europe has offices in Dublin and London where we occupy approximately 6,200 and 9,000 square feet of office space, respectively. The Dublin space is leased pursuant to an agreement that expires in November 2017, and the London space is leased pursuant to an agreement that expires in September 2013. ITG Europe also leases office space for its regional office in Paris, France.

We also have a technology research and development facility in Tel Aviv where approximately 13,500 square feet of office space is occupied pursuant to a lease agreement that expires in February 2014.

Asia Pacific Operations

ITG Australia has offices in Melbourne and Sydney, where we occupy approximately 5,600 and 3,400 square feet of office space, respectively pursuant to leases that expired or are expiring in February 2013 and June 2017. We are currently negotiating an extension of the Melbourne lease.

ITG Hong Kong occupies approximately 7,500 square feet of office space in Hong Kong pursuant to a lease that expires in September 2015. We also lease space for our regional office in Singapore.

We are not a party to any pending legal proceedings other than claims and lawsuits arising in the ordinary course of business. In addition, our broker-dealers are regularly involved in reviews, inquiries, examinations, investigations and proceedings by government agencies and self-regulatory organizations regarding our business, which may result in judgments, settlements, fines, penalties, injunctions or other relief. Although there can be no assurances, at this time the Company believes, based on information currently available, that the outcome of any such proceeding, review, inquiry, examination and investigation will not have a material adverse effect on our consolidated financial position or results of operations.

Item 4. Mine Safety Disclosures

Not applicable

19

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock Data

Our common stock trades on the NYSE under the symbol "ITG".

The following table sets forth, for the periods indicated, the range of the high and low closing sales prices per share of our common stock as reported on the NYSE.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

2011: |

|||||||

First Quarter |

19.75 | 16.32 | |||||

Second Quarter |

18.73 | 13.38 | |||||

Third Quarter |

14.10 | 9.79 | |||||

Fourth Quarter |

12.12 | 9.24 | |||||

2012: |

|||||||

First Quarter |

12.24 | 10.35 | |||||

Second Quarter |

11.85 | 8.34 | |||||

Third Quarter |

9.28 | 7.72 | |||||

Fourth Quarter |

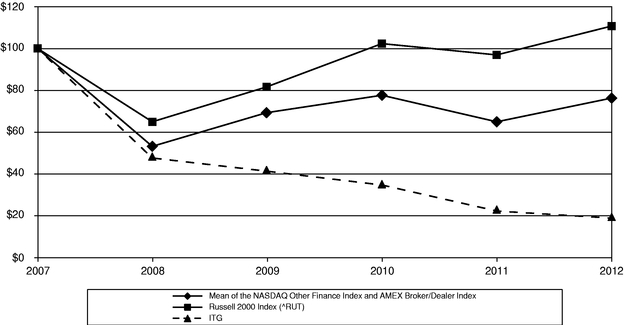

9.63 | 7.85 | |||||