Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

Commission file number 1-12551

CENVEO, INC.

(Exact name of Registrant as specified in its charter.)

|

| | |

COLORADO | | 84-1250533 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

200 FIRST STAMFORD PLACE | | |

STAMFORD, CT | | 06902 |

(Address of principal executive offices) | | (Zip Code) |

| | |

203-595-3000 |

(Registrant’s telephone number, including area code) |

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of July 2, 2016, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $46.8 million based on the closing sale price as reported on the New York Stock Exchange.

As of February 22, 2017, the registrant had 8,553,167 shares of common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part II (Item 5) and Part III of this form (Items 11, 12, 13 and 14, and part of Item 10) is incorporated by reference from the Registrant’s Proxy Statement to be filed pursuant to Regulation 14A with respect to the Registrant’s Annual Meeting of Shareholders to be held on or about April 27, 2017.

CENVEO, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

| | |

| PART I | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART III | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART IV | |

| | |

| | |

PART I

Item 1. Business

Overview

Cenveo, Inc. ("Cenveo," the "Company," "we," "our," or "us") is a diversified manufacturing company focused on print-related products. Our broad portfolio of products includes envelope converting, commercial printing, and label manufacturing. We operate an extensive network of strategically located manufacturing facilities, serving a diverse base of customers. We operate our business in three complementary reportable segments: envelope, print and label.

Envelope. We are the largest envelope manufacturer in North America. Our envelope segment had net sales of $865.2 million and $908.7 million and operating income of $60.7 million and $66.4 million for the years ended 2016 and 2015, respectively. Total assets for our envelope segment were $403.2 million and $445.4 million as of the years ended 2016 and 2015, respectively. Our envelope segment represented approximately 52.1% of our consolidated net sales for the year ended 2016.

Our envelope segment offers direct mail products used for customer solicitations and transactional envelopes used for billing and remittance by end users including financial institutions, insurance and telecommunications companies. We also produce a broad line of specialty and stock envelopes which are sold through wholesalers, distributors and national catalogs for the office product markets and office product superstores.

Print. We are one of the leading commercial printers in North America. Our print segment had net sales of $493.5 million and $511.0 million and operating income of $17.6 million and $15.1 million for the years ended 2016 and 2015, respectively. Total assets for our print segment were $256.9 million and $266.1 million as of the years ended 2016 and 2015, respectively. Our print segment represented approximately 29.7% of our consolidated net sales for the year ended 2016.

Our print segment primarily caters to the consumer products, automotive, travel and leisure and telecommunications industries. We provide a wide array of print offerings to our customers including electronic prepress, digital asset archiving, direct-to-plate technology, high-quality color printing on web and sheet-fed presses, digital printing and content management. The broad selection of print products we produce includes car brochures, annual reports, direct mail products, advertising literature, corporate identity materials and brand marketing materials. Our content management business offers complete solutions, including: editing, content processing, content management, electronic peer review, production, distribution and reprint marketing.

Label. We are a leading label manufacturer and one of the largest North American prescription label manufacturers for retail pharmacy chains. Our label segment had net sales of $301.4 million and $322.1 million and operating income of $30.5 million and $39.5 million for the years ended 2016 and 2015, respectively. Total assets for our label segment were $216.6 million and $223.5 million as of the years ended 2016 and 2015, respectively. Our label segment represented approximately 18.2% of our consolidated net sales for the year ended 2016.

Our label segment produces a diverse line of custom labels for a broad range of industries including manufacturing, warehousing, packaging, food and beverage, and health and beauty, which we sell through extensive networks within the resale channels. We provide direct mail and overnight packaging labels, food and beverage labels, and shelf and scale labels for national and regional customers. We produce pressure-sensitive prescription labels for the retail pharmacy chain market.

The primary methods of distribution of the principal products for our three segments are by freight carriers, direct shipment via express mail and the United States postal system.

Acquisitions and Divestitures

Acquisitions

On August 7, 2015, we acquired certain assets of Asendia USA, Inc., which we refer to as Asendia. The acquired assets provide letter shop, data processing, bindery and digital printing offerings.

We may, from time to time, complete acquisitions in areas we believe will strengthen our manufacturing platform, improve our operating margin performance or provide additional product offerings.

See Note 2 to our consolidated financial statements for further discussion regarding our acquisitions.

Divestitures

During 2015, we began actively moving forward with our plan to review and potentially divest certain non-strategic assets that did not fit within our long-term strategy. As a result of this strategic review, during the first quarter of 2016, we completed the sale of our folded carton and shrink sleeve packaging businesses, along with our top-sheet lithographic print operation, which we refer to as the Packaging Business. The financial results of the Packaging Business have been accounted for as discontinued operations. Our historical, consolidated financial statements have been retroactively adjusted to give recognition to the discontinued operations for all periods presented. See Note 3 to our consolidated financial statements for further discussion regarding our discontinued operations.

Our Business Strategy

Our business strategy has been, and continues to be, focused on improving our operating margins, improving our capital structure and providing quality product offerings to our customers. We also are continuing to review options for our non-strategic assets and product lines. We also continue to make strategic investments and focused capital expenditures. The strategic investments focus on improving our e-commerce customer experience. Our focused capital expenditures in label equipment included two new digital presses added in both 2016 and 2015 and the initiation of a multi-phased, multi-year plan to reinvest into state-of-the-art labeling equipment, which should significantly increase our capabilities, minimize machine downtime and allow for margin expansion within our label operations.

Improving Operating Margins

In 2014, we substantially completed our integration of certain assets of National Envelope Corporation, which we refer to as National, which allowed us to focus on profitability improvement and other cost reduction actions in our envelope platform throughout 2015 and into early 2016. We believe the accelerated integration plan we completed during 2014 has provided meaningful improvements in our envelope segment's operating results during 2015 and 2016, as we realized significant increases in gross profit and operating income, as compared to 2014.

During 2016, we experienced significant sales volume decline and increased price pressures within our office product envelope and related wholesale envelope product lines due to measures undertaken by our customers in those product lines as a result of a regulatory decision mid-way through our 2016 fiscal year. In reaction to this decline and other continued marketplace challenges within our industry, we initiated a two year $50 million cost savings and profitability plan, which we refer to as the 2017 Profitability Improvement Plan, to offset the impact of these marketplace challenges and continue to improve our operating margins. With this plan, we expect higher restructuring, impairment and other charges primarily resulting from severance expense, facility rationalization costs and impairments associated with equipment footprint reductions. We believe these incremental charges will ultimately be offset by improved gross profit margins and lower selling, general and administrative expenses as we operate through 2017 and into 2018; however, this cannot be assured. These actions are aimed to reduce our fixed cost infrastructure, back office headcount and further streamline our geographic footprint. We believe that despite the facility rationalization, we will still be able to serve our national customer base with less facilities at the same or improved service levels that they are used to receiving from us.

Improving our Capital Structure

Since the beginning of 2012, we have been focused on improving our capital structure through a number of initiatives including working capital improvements, exiting underperforming or non-strategic businesses, and taking advantage of strategic refinancing opportunities and attractive leveraged loan and high yield debt market conditions. We have been able to accomplish this while reinvesting cash into our businesses via three acquisitions and focused capital expenditures. In connection with these activities, through the end of 2016, we continued to successfully reduce our outstanding debt and weighted average interest rate, which we believe will result in annual cash interest savings of approximately $40 million in 2017 as compared to 2012. Additionally, we have called for redemption during the first quarter of 2017 the remaining $20.5 million of our 11.5% senior notes due 2017, which we refer to as the 11.5% Notes. That addresses all but $5.5 million of our debt maturing in 2017. We expect that remaining $5.5 million of our 7% senior exchangeable notes due 2017, which we refer to as the 7% Notes, will be addressed prior to or at maturity in May of 2017. These redemptions or retirements will be made using cash flow from operations or availability under our asset-based revolving credit facility due 2021, which we refer to as the ABL Facility.

Provide Quality Product Offerings

We conduct regular reviews of our product offerings, manufacturing processes and distribution methods to ensure that they meet the changing needs of our customers. We are also investing in digital and variable technology in particular, as we have seen increased customer demand for these technologies. Additionally, we have expanded our managed services portfolio and integrated customer supply chain capabilities via strategic investments in information technology and knowledge product specialists. By expanding our product offerings, we intend to increase cross-selling opportunities to our existing customer base and mitigate the impact of any decline in a given market or product.

Our Industry

The overall industry for print-related products is highly fragmented with excess capacity. We face price sensitivity and price pressures in many of our businesses. In the envelope market, we compete primarily with a few multi-plant and many single-plant companies servicing regional and local markets. In the commercial printing market, we compete against a few large, diversified and financially stronger printing companies, as well as smaller regional and local commercial printers, many of which are capable of competing with us on volume, price and production quality.

The information set forth below is applicable to the operating environments within all our segments.

Raw Materials

The primary materials used in our businesses are paper, ink, film, offset plates and chemicals, with paper accounting for the majority of total material costs. We purchase these materials from a number of key suppliers and have not experienced any significant difficulties in obtaining the raw materials necessary for our operations. However, in times of limited supply, we have occasionally experienced minor delays in delivery. We believe we purchase our materials and supplies at competitive prices, primarily due to the size and scope of our purchasing power; however, our businesses are sensitive to pressure related to increases in the cost of materials used in the production of our products.

Patents, Trademarks and Trade Names

Our sales do not materially depend upon any single patent or group of related patents; however, we do market products under a number of trademarks and trade names. We also hold or have rights to use various patents relating to our businesses. Our patents expire between 2018 and 2032 and our trademarks expire between 2017 and 2030.

Seasonality

Our envelope market and certain segments of the direct mail market have historically experienced seasonality with a higher percentage of volume of products sold to these markets during the third and fourth quarters of the year, primarily related to back-to-school campaigns and holiday purchases.

Our print plants experience seasonal variations. Revenues associated with consumer publications, such as holiday catalogs and automobile brochures tend to be concentrated from July through October. Revenues associated with the educational and scholastic market and promotional materials tend to decline in the summer. As a result of these seasonal variations, some of our print operations operate at or near capacity at certain times throughout the year.

Our custom label business has historically experienced a seasonal increase in net sales during the first and second quarters of the year, primarily resulting from the release of our product catalogs to the trade channel customers and our customers’ spring advertising campaigns. Our prescription label business has historically experienced seasonality in net sales due to cold and flu seasons, generally concentrated in the fourth and first quarters of the year. As a result of these seasonal variations, some of our label operations operate at or near capacity at certain times throughout the year.

Backlog

Backlog generally is not considered a significant factor in our business due to the relatively short delivery periods and frequent inventory turnover many of our businesses experience. Our backlog of customer orders to be produced or shipped was approximately $87.4 million and $104.9 million as of the years ended 2016 and 2015, respectively.

Competition

We compete with a few multi-plant and many single-plant companies which primarily service regional and local markets in selling our envelope products. We also face competition from alternative sources of communication and information transfer such as electronic mail, the internet, interactive television and electronic retailing. Although these sources of communication and advertising may eliminate some domestic envelope sales in the future, we believe we will experience continued demand for envelope products due to: (i) the ability of our customers to obtain a relatively low-cost information delivery vehicle that may be customized with text, color, graphics and action devices to achieve the desired presentation effect; (ii) the ability of our direct mail customers to penetrate desired markets as a result of the widespread delivery of mail to residences and businesses through the United States Postal Service; and (iii) the ability of our direct mail customers to include return materials inside their mailings. Principal competitive factors in the envelope business are quality, service and price. Although all three factors are equally important, various customers may emphasize one or more over the others.

In selling our commercial print product offerings, we compete with large multinational commercial printing companies, as well as regional and local printers. The commercial printing industry continues to have excess capacity, and is highly competitive in most of our product categories and geographic regions. This excess capacity has resulted in a competitive pricing environment, in which companies have focused on reducing costs in order to preserve operating margins. Competition is based largely on price, quality and servicing the special requirements of customers. We believe this environment, combined with recent economic trends, will continue to lead to more consolidation within the commercial print industry as companies seek economies of scale, broader customer relationships, geographic coverage and product breadth to overcome or offset excess industry capacity and pricing pressures.

In selling our printed labels products, we compete with other label manufacturers with nationwide locations as well as regional and local printers that typically sell within a few hundred mile radius of their plants. Printed labels competition is based mainly on quick-turn customization, quality of products, pricing and customer service levels.

Employees

We employed approximately 7,300 people worldwide as of the year ended 2016, approximately 23% of whom were members of various local labor unions. Collective bargaining agreements, each of which cover the workers at a particular facility, expire from time to time and are negotiated separately. Accordingly, we believe no single collective bargaining agreement is material to our operations as a whole.

Environmental Regulations

Our operations are subject to federal, state, local and foreign environmental laws and regulations, including those relating to air emissions, waste generation, handling, management and disposal, and remediation of contaminated sites. We have implemented environmental programs designed to ensure that we operate in compliance with the applicable laws and regulations governing environmental protection. We believe we are in substantial compliance with applicable laws and regulations relating to environmental protection, and we do not anticipate material capital expenditures will be required to achieve or maintain compliance with environmental laws and regulations. However, there can be no assurance that newly discovered conditions, or new laws and regulations or stricter interpretations of existing laws and regulations, will not result in increased compliance or remediation costs.

Executive Officers

The following presents a list of our executive officers, their age, present position, the year elected to their present position and other positions they have held during the past five years. Robert G. Burton, Jr. and Michael G. Burton are the sons of Robert G. Burton, Sr. There are no undisclosed arrangements or understandings pursuant to which any person was selected as an officer. This information is presented as of the date of the Form 10-K filing.

|

| | | | | | | |

Name | | Age | | Position | | Year Elected to Present Position |

Robert G. Burton, Sr. | | 76 |

| | Chairman and Chief Executive Officer | | 2005 |

Robert G. Burton, Jr. | | 41 |

| | President | | 2011 |

Scott J. Goodwin | | 39 |

| | Chief Financial Officer | | 2012 |

Michael G. Burton | | 39 |

| | Chief Operating Officer | | 2014 |

Ian R. Scheinmann | | 48 |

| | Senior Vice President, Legal Affairs and Corporate Secretary | | 2010/2015 |

Robert G. Burton, Sr. Mr. Burton, 76, has been Cenveo’s Chairman and Chief Executive Officer since September 2005. In January 2003, he formed Burton Capital Management, LLC, a company which invests in manufacturing companies, and has been its Chairman, Chief Executive Officer and sole managing member since its formation. From December 2000 through December 2002, Mr. Burton was the Chairman, President, and Chief Executive Officer of Moore Corporation Limited, a leading printing company with over $2.0 billion in revenue for fiscal year 2002. Preceding his employment at Moore, Mr. Burton was Chairman, President, and Chief Executive Officer of Walter Industries, Inc., a diversified holding company. From April 1991 through October 1999, he was the Chairman, President, and Chief Executive Officer of World Color Press, Inc., a $3.0 billion diversified printing company. From 1981 through 1991, he held a series of senior executive positions at Capital Cities/ABC, including President of ABC Publishing. Mr. Burton was also employed for 10 years as a senior executive of SRA, the publishing division of IBM.

Robert G. Burton, Jr. Mr. Burton, Jr., 41, has served as Cenveo’s President since August 2011. From December 2010 to August 2011, Mr. Burton was President of Corporate Operations, with a primary focus on Mergers and Acquisitions, Treasury, Information Technology, Human Resources, Legal and Investor Relations. From September 2005 to December 2010, Mr. Burton was Executive Vice President of Investor Relations, Treasury, Human Resources and Legal at Cenveo. He has been a member of the Chairman’s Executive Committee since joining Cenveo. From 2004 to 2005, Mr. Burton was also President of Burton Capital Management, LLC and was the primary investment officer before he joined Cenveo on September 2005. Mr. Burton has over 16 years of business experience as an Investor Relations, Mergers and Acquisitions, and financial professional. Mr. Burton also served as the Senior Vice President, Investor Relations and Corporate Communications for Moore Wallace Incorporated (and its predecessor, Moore Corporation) from December 2001 to May 2003. Mr. Burton served as Vice President, Investor Relations of Walter Industries in 2000. From 1996 through December 1999, Mr. Burton held various management positions at World Color Press, Inc., including Vice President, Investor Relations. Mr. Burton earned a B.A. degree from Vanderbilt University.

Scott J. Goodwin. Mr. Goodwin, 39, has served as Cenveo's Chief Financial Officer since August 2012 and was Chief Accounting Officer from April 2012 to August 2012. From June 2009 to April 2012, Mr. Goodwin served as Cenveo's Corporate Controller. Mr. Goodwin joined Cenveo as its Assistant Corporate Controller in June 2006. Prior to joining Cenveo, Mr. Goodwin spent seven years in public accounting at Deloitte & Touche LLP. Mr. Goodwin is a Certified Public Accountant and received his degree in accounting from The Citadel.

Michael G. Burton. Mr. Burton, 39, has served as Cenveo’s Chief Operating Officer since July 2014. From July 2013 to July 2014, Mr. Burton served as President, Print, Label and Packaging Group. In November 2010 Mr. Burton became President of the Label division and subsequently became responsible for the Packaging division in January 2012. From September 2005 to November 2010, Mr. Burton was Senior Vice President, Operations with a primary focus on, Procurement, Information Technology, Environmental Health and Safety, and Human Resources. From 2003 to 2005, Mr. Burton was also Executive Vice President, Operations of Burton Capital Management, LLC. He was a founding member of this group before he joined Cenveo on September 2005. Mr. Burton was previously Vice President of Commercial and Subsidiary Operations, a $600 million division of Moore Corporation Limited. Mr. Burton received his B.A. degree from the University of Connecticut where he was captain of the football team.

Ian R. Scheinmann. Mr. Scheinmann, 48, has served as Cenveo’s Senior Vice President, Legal Affairs since August 2010. From May 2010 until August 2010, he served as Cenveo’s in-house real estate counsel. He has also served as Cenveo’s Corporate Secretary since June 2015. Prior to joining Cenveo, Mr. Scheinmann was Cenveo’s outside real estate counsel as a member of Rudoler & DeRosa, LLC where his practice covered a wide range of real estate and business transactions. Prior to joining Rudoler & DeRosa, Mr. Scheinmann was a real estate shareholder with Greenberg Traurig, LLP from August 2002 until March 2009. From 1995 until 2002, he was engaged in private practice with (i) Dilworth Paxson, LLP (September 2000 until July 2002); (ii) Anderson, Kill and Olick, P.C. (November 1996 until May 2000); and (iii) Weiner Lesniak (October 1995 until October

1996). Mr. Scheinmann received his B.S.B.A. from the John M. Olin School of Business at Washington University, St. Louis, Missouri and his J.D. with honors from Seton Hall University School of Law.

Cautionary Statements

Certain statements in this report, particularly statements found in "Risk Factors," "Business" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations," may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, we or our representatives have made or continue to make forward-looking statements, orally or in writing, in other contexts. These forward-looking statements generally can be identified by the use of terminology such as "may," "will," "expect," "intend," "estimate," "anticipate," "plan," "foresee," "believe" or "continue" and similar expressions, or as other statements which do not relate solely to historical facts. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict or quantify. Management believes these statements to be reasonable when made. However, actual outcomes and results may differ materially from what is expressed or forecasted in these forward-looking statements. As a result, these statements speak only as of the date they were made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In view of such uncertainties, investors should not place undue reliance on our forward-looking statements.

Such forward-looking statements involve known and unknown risks, including, but not limited to, those identified in "Risk Factors," along with changes in general economic, business and labor conditions. More information regarding these and other risks can be found below under "Risk Factors" in Item 1A, "Business," "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and other sections of this report.

Available Information

Our internet address is: www.cenveo.com. References to our website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, as soon as reasonably practicable after such documents are filed electronically with the Securities and Exchange Commission, which we refer to as the SEC. Our Code of Business Conduct and Ethics is also posted on our website. In addition, our earnings conference calls are archived for replay on our website. In August 2016, we submitted to the New York Stock Exchange, which we refer to as the NYSE, a certificate of our Chief Executive Officer certifying he is not aware of any violation by us of NYSE corporate governance listing standards. See further discussion in "Risk Factors" in Item 1A. We also filed as exhibits to our annual report on Form 10-K for our year ended 2015 certificates of the Chief Executive Officer and Chief Financial Officer as required under Section 302 of the Sarbanes-Oxley Act.

The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Many factors which affect our business and operations involve risks and uncertainties. The factors described below are some of the risks that could materially harm our business, financial conditions, results of operations or prospects.

Our substantial level of indebtedness could materially adversely affect our financial condition, liquidity and ability to service or refinance our debt, and prevent us from fulfilling our business obligations.

We currently have a substantial amount of outstanding indebtedness, which requires significant principal and interest payments. Approximately $30 million of this indebtedness matures in the next six months. As of our year ended 2016, our total indebtedness was approximately $1.0 billion, principally comprised of $20.5 million outstanding principal amount of 11.5% Notes; $5.5 million outstanding principal amount of 7% Notes; $540.0 million outstanding principal amount of 6.000% senior priority secured notes due 2019, which we refer to as the 6.000% Secured Notes; $81.7 million outstanding principal amount under the ABL Facility; $50.0 million outstanding principal amount of 4% senior secured notes due 2021, which we refer to as the 4% Secured Notes; $241.0 million outstanding principal amount of 8.500% junior priority secured notes due 2022, which we refer to as the 8.500% Notes; and $104.5 million outstanding principal amount of 6.000% senior unsecured notes due 2024, which we refer to as the 6.000% Unsecured Notes.

Our substantial level of indebtedness and the maturities thereof could also materially adversely affect our future operations, by, for example:

| |

• | requiring a substantial portion of our cash flow from operations to be dedicated to the payment of principal and interest on indebtedness thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other business purposes; |

| |

• | making it more difficult for us to satisfy all of our debt obligations, thereby increasing the risk of triggering a cross-default provision; |

| |

• | increasing our vulnerability to economic downturns or other adverse developments relative to less leveraged competitors; |

| |

• | limiting our ability to obtain additional financing for working capital, capital expenditures, acquisitions or other corporate purposes in the future; |

| |

• | increasing our cost of borrowing to satisfy business needs; or |

| |

• | requiring refinancing, the successful completion of which cannot be assured. |

Our ability to pay the principal of, or to reduce or refinance, our outstanding indebtedness depends on many factors.

The 11.5% Notes and 7% Notes are scheduled to mature in May 2017, the 6.000% Secured Notes are scheduled to mature in August 2019, the ABL Facility is scheduled to mature in June 2021 (with a springing maturity of May 2019 in the event that more than $10 million of the 6.000% Secured Notes remain outstanding at such time), the 4% Secured Notes are scheduled to mature in December 2021, the 8.500% Notes are scheduled to mature in September 2022, and the 6.000% Unsecured Notes are scheduled to mature in May 2024. As noted above, we have called the remaining 11.5% Notes for redemption during the first quarter of 2016 and expect that the remaining $5.5 million of our 7% Notes will be addressed prior to or at maturity in May of 2017, all of which will be made using cash flow from operations or availability under our ABL Facility. Our ability to make scheduled payments on, or to reduce or refinance, our indebtedness will depend on our future financial and operating performance, and prevailing market conditions. Further, the use of cash for redemptions and maturities noted above reduces the availability of that cash for ongoing operations and future debt service, which increases the risk that at any time our available cash may be inadequate as needed, which risk would be exacerbated by a downturn in results of operations and cash flow. Our future performance will be affected by the impact of general economic, financial, competitive and other factors beyond our control, including the availability of financing in bank and capital markets. We cannot be certain our business will generate sufficient cash flow from operations in an amount necessary to service our debt. If we are unable to meet our debt obligations or to fund our other liquidity needs, we may be required to restructure or refinance all, or a portion of, our debt to avoid defaulting on our debt obligations or to meet other business needs. Such a refinancing of our indebtedness could result in higher interest rates, could require us to comply with more onerous covenants further restricting our business operations, could be restricted by another one of our debt instruments outstanding, or refinancing opportunities may not be available at all.

In connection with improving our capital structure through a number of initiatives, including working capital improvements, exiting underperforming, non-strategic or other businesses, and taking advantage of strategic refinancing opportunities and attractive leveraged loan and high yield debt market conditions, through the end of 2016 we reduced our outstanding debt and weighted average interest rate, which we believe will result in annual cash interest savings of approximately $40 million in 2017 as compared to 2012. There can be no assurances that these or other expected savings will be realized or that intervening developments will not occur to offset these savings.

The terms of our indebtedness impose significant restrictions on our operating and financial flexibility.

The agreements governing our outstanding indebtedness contain a number of significant restrictions and covenants which limit our ability (subject in each case to limited exceptions) to, among other things:

| |

• | incur or guarantee additional indebtedness; |

| |

• | make restricted payments, including dividends and prepaying indebtedness; |

| |

• | create or permit certain liens; |

| |

• | enter into business combinations and asset sale transactions; |

| |

• | make investments, including capital expenditures; |

| |

• | amend organizational documents and change accounting methods; |

| |

• | enter into transactions with affiliates; and |

| |

• | enter into new businesses. |

These restrictions could limit our ability to obtain future financing, make acquisitions or incur needed capital expenditures, withstand a future downturn in our business or the economy in general, conduct operations or otherwise take advantage of business

opportunities which may arise.

The ABL Facility also contains a negative covenant restricting dispositions, including dispositions the aggregate book value of which exceeds $35.0 million. Such dispositions are permitted, however, if within 360 days after the receipt of any net proceeds from such dispositions, we apply all of the net proceeds thereof: (i) to be reinvested in our business; (ii) to repay obligations under the ABL Facility under certain circumstances; or (iii) to make an offer to purchase the 6.000% Secured Notes. Each of the indentures governing the 6.000% Secured Notes, 8.500% Notes, 11.5% Notes and 6.000% Unsecured Notes and the indenture and note purchase agreement governing the 4% Secured Notes also contains a negative covenant requiring us to apply any net proceeds from an asset sale: (i) to be reinvested in our business; (ii) to repay certain of our indebtedness; or (iii) to make an offer to purchase the 6.000% Secured Notes, 8.500% Notes, 11.5% Notes, 6.000% Unsecured Notes or 4% Secured Notes, respectively. On January 19, 2016, we completed the sale of our Packaging Business, realizing total net cash proceeds of approximately $89.6 million. We have satisfied the reinvestment requirements set forth in our debt agreements with respect to such net cash proceeds.

In addition, the ABL Facility contains a minimum consolidated fixed charge coverage ratio with which, under certain circumstances, we must comply on a quarterly basis. Our ability to meet such fixed charge coverage ratio may be affected by events beyond our control, such as further deterioration in general economic conditions. We are also required to provide certain financial information on a quarterly basis. Our failure to maintain the fixed charge coverage ratio or effective internal controls could, in certain circumstances, prevent us from borrowing additional amounts, and could result in a default under the ABL Facility. Such a default could cause the indebtedness outstanding under the ABL Facility, and, by reason of cross-acceleration or cross-default provisions, the 6.000% Secured Notes, the 8.500% Notes, the 11.5% Notes, the 6.000% Unsecured Notes, the 4% Secured Notes and the 7% Notes, and any other indebtedness we may then have, to become immediately due and payable for which we would not have sufficient resources to satisfy.

If any such defaults occur and if we are unable to repay those amounts, the lenders under the ABL Facility, the indentures governing the 6.000% Secured Notes and 8.500% Notes and the indenture and note purchase agreement governing the 4% Secured Notes could initiate a bankruptcy or liquidation proceeding, or proceed against the collateral granted to them which secures that indebtedness. If the lenders under the ABL Facility and/or indentures governing the 6.000% Secured Notes and/or 8.500% Notes and/or the indenture and note purchase agreement governing the 4% Secured Notes were to accelerate the repayment of outstanding borrowings, we would not have sufficient resources to repay our indebtedness.

If we are able to incur additional borrowings, such borrowings could further exacerbate our risk exposure from debt.

Our 8.500% Notes indenture, 6.000% Secured Notes indenture, 6.000% Unsecured Notes indenture, 4% Secured Notes indenture and note purchase agreement, credit agreement governing our ABL Facility and our other debt instruments limit, but do not prohibit, us from incurring additional debt. If we are able to incur additional borrowings, the risks associated with our substantial leverage would increase.

United States and global economic conditions have adversely affected us and could continue to adversely affect us.

The United States and global economic conditions affect our results of operations and financial position. A significant part of our business relies on our customers’ printing spend. A prolonged downturn in the global economy and an uncertain economic outlook could further reduce the demand for printed materials and related offerings that we provide our customers. Consequently, reductions or delays in our customers’ spending could adversely impact our results of operations, financial position and cash flows. We believe any extended economic uncertainty will impact our operating results.

To the extent that we make select acquisitions, we may not be able to successfully integrate the acquired businesses into our business.

In the past, we have grown rapidly through acquisitions. We intend to continue to pursue select acquisition opportunities within our core and niche businesses. To the extent we seek to pursue additional acquisitions, we cannot be certain target businesses will be available on favorable terms or that, if we are able to acquire businesses on favorable terms, we will be able to successfully integrate or profitably manage them. Successfully integrating an acquisition involves minimizing disruptions and efficiently managing substantial changes, some of which may be beyond our control. An acquisition always carries the risk that such changes, including facility and equipment location, management and employee base, policies, philosophies and procedures, could have unanticipated effects, could require more resources than intended and could cause customers to temporarily or permanently seek alternate suppliers. A failure to realize acquisition synergies and savings could negatively impact the results of both our acquired and existing operations. Further, our ability to make acquisitions in the future will be limited by the availability to us of cash for that purpose.

A decline in our consolidated profitability or profitability within one of our individual reporting units could result in the impairment of assets, including goodwill and other long-lived assets.

We have material amounts of goodwill and other long-lived assets on our consolidated balance sheet. A decline in expected profitability, particularly the impact of an extended uncertainty in the United States and global economies, could call into question the recoverability of our related goodwill and other long-lived assets and require us to write down or write-off these assets.

The industries in which we operate our business are highly competitive and extremely fragmented.

The industries in which we compete are highly competitive and extremely fragmented. In the envelope market, we compete primarily with a few multi-plant and many single-plant companies servicing regional and local markets. In the commercial printing market, we compete against a few large, diversified and financially stronger printing companies, as well as smaller regional and local commercial printers, many of which are capable of competing with us on volume, price and production quality. We believe there currently is excess capacity in the industries in which we operate, which has resulted in substantial price competition which may continue as customers put product work out for competitive bid. We are constantly seeking ways to reduce our costs, become more efficient and attract customers. We cannot, however, be certain these efforts will be successful or our competitors will not be more successful in their similar efforts. If we fail to reduce costs and increase productivity, or to meet customer demand for new value-added products, services or technologies, we may face decreased revenues and profit margins in markets where we encounter price competition, which in turn could reduce our cash flow and profitability.

The printing business we compete in generally does not have long-term customer agreements, and our printing operations may be subject to quarterly and cyclical fluctuations.

The printing industry in which we compete is generally characterized by individual orders from customers or short-term contracts. A significant portion of our customers are not contractually obligated to purchase products or services from us. Most customer orders are for specific printing jobs, and repeat business largely depends on our customers’ satisfaction with our work product. Although our business does not depend on any one customer or group of customers, we cannot be sure that any particular customer will continue to do business with us for any period of time. In addition, the timing of particular jobs or types of jobs at particular times of year may cause significant fluctuations in the operating results of our operations in any given quarter. We depend to some extent on sales to certain industries, such as the financial services, advertising, pharmaceutical, automotive and office products industries. To the extent these industries experience downturns, the results of our operations may be adversely affected.

Factors affecting the United States Postal Service can impact demand for our products.

Postal costs are a significant component of many of our customers’ cost structure. Historically, increases in postal rates have resulted in reductions in the volume of mail sent, including direct mail, which is a meaningful portion of our envelope volume. As postal rate increases in the United States are outside our control, we can provide no assurance that any future increases in United States postal rates will not have a negative effect on the level of mail sent or the volume of envelopes purchased.

Factors other than postal rates which affect the volume of mail sent through the United States postal system may also negatively affect our business. Congress enacted a federal "Do Not Call" registry in response to consumer backlash against telemarketers. If similar legislation becomes enacted for direct mail advertisers, our business could be adversely affected. Additionally, the United States Postal Service has also indicated the potential need to reduce delivery days. We can provide no assurance that such a change would not impact our customers’ decisions to use direct mail products, which may in turn cause a decrease in our revenues and profitability; however, we do not expect such an impact.

The availability of the internet and other electronic media may adversely affect our business.

Our business is highly dependent upon the demand for envelopes sent through the mail. Such demand comes from utility companies, banks and other financial institutions, among other companies. Our printing business also depends upon demand for printed advertising among other products. Consumers increasingly use the internet and other electronic media to purchase goods and services, and for other purposes, such as paying bills and obtaining electronic versions of printed product. The level of acceptance of electronic media by consumers as well as the extent that consumers are replacing traditional printed reading materials with internet hosted media content or e-reading devices is difficult to predict. Advertisers use the internet and other electronic media for targeted campaigns directed at specific electronic user groups. We cannot be certain the acceleration of the trend towards electronic media will not cause a decrease in the demand for our products. If demand for our products decreases, our cash flow or profitability could materially decrease.

Increases in paper costs and any decreases in the availability of our raw materials could have a material effect on our business.

Paper costs represent a significant portion of our cost of materials. Changes in paper pricing generally do not affect the operating margins of our commercial printing business, because the transactional nature of the business allows us to pass on most announced increases in paper prices to our customers. However, our ability to pass on increases in paper prices is dependent upon the competitive environment at any given time. Paper pricing also affects the operating margins of our envelope business. We have historically been less successful in immediately passing on such paper price increases due to several factors, including contractual restrictions in certain cases and the inability to quickly update catalog prices in other instances. Moreover, rising paper costs, and their consequent impact on our pricing, could lead to a decrease in demand for our products.

We depend on the availability of paper in manufacturing most of our products. During periods of tight paper supply, many paper producers allocate shipments of paper based on the historical purchase levels of customers. In the past, we have occasionally experienced minor delays in delivery. Any future delay in availability could negatively impact our cash flow and profitability.

Increases in energy and transportation costs could have a material effect on our business.

Energy and transportation costs represent a large portion of our overall cost structure. Increases in the costs of these inputs may increase our overall costs. We may not be able to pass these costs on to our customers through higher prices. Increases in the cost of materials may adversely impact our customers’ demand for our products.

We depend on good labor relations.

As of our year ended 2016, we employed approximately 7,300 people worldwide, approximately 23% of whom were members of various local labor unions. If our unionized employees were to engage in a concerted strike or other work stoppage, or if other employees were to become unionized, we could experience a disruption of operations, higher labor costs or both. A lengthy strike could result in a material decrease in our cash flow or profitability.

Environmental laws may affect our business.

Our operations are subject to federal, state, local and foreign environmental laws and regulations, including those relating to air emissions, wastewater discharge, waste generation, handling, management and disposal, and remediation of contaminated sites. Currently unknown environmental conditions or matters at our existing and prior facilities, new laws and regulations, or stricter interpretations of existing laws and regulations could result in increased compliance or remediation costs which, if substantial, could have a material effect on our business or operations in the future.

We are dependent on key management personnel.

Our success will depend to a significant degree on our executive officers and other key management personnel. We cannot be certain we will be able to retain our executive officers and key personnel, or attract additional qualified management in the future. In addition, the success of any acquisitions we may pursue may depend, in part, on our ability to retain management personnel of the acquired companies. We do not carry key person insurance on any of our managerial personnel.

Our business could be materially adversely affected by any failure, interruption or security lapse of our information technology systems.

We are increasingly dependent on information technology systems to process transactions, manage inventory, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. We use information systems to support decision making and to monitor business performance. Our information technology systems depend on global communications providers, telephone systems, hardware, software and other aspects of internet infrastructure which can experience significant system failures and outages. Our systems are susceptible to outages due to fire, floods, power loss, telecommunications failures and similar events. Despite the implementation of network security measures, our systems are vulnerable to computer viruses and similar disruptions from unauthorized tampering with our systems. In addition, cybersecurity threats are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data, denial of service attacks and other electronic security breaches which could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information and corruption of data. The occurrence of these or other events could disrupt or damage our information technology systems and inhibit internal operations, the ability to provide customer service or provide management with accurate financial and operational information essential for making decisions at various levels of management.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We currently occupy 44 manufacturing facilities within our continuing operations, primarily in North America, of which 14 are owned and 30 are leased. We lease our corporate headquarters space in Stamford, Connecticut and we lease additional facilities for our sales and support teams. We believe we have adequate facilities to conduct our current and future operations.

Item 3. Legal Proceedings

From time to time we may be involved in claims or lawsuits that arise in the ordinary course of business. Accruals for claims or lawsuits have been provided for to the extent losses are deemed probable and estimable. Although the ultimate outcome of these claims or lawsuits cannot be ascertained, on the basis of present information and advice received from counsel, it is our opinion that the disposition or ultimate determination of such claims or lawsuits will not have a material effect on our consolidated financial statements.

In the case of administrative proceedings related to environmental matters involving governmental authorities, we do not believe that any imposition of monetary damages or fines would be material.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

The certificate of incorporation, as amended, of Cenveo states that the total authorized capital stock is 15 million shares of common stock, $0.01 par value per share, which we refer to as Common Stock. Each share of voting Common Stock is entitled to one vote in respect of each share of Cenveo voting Common Stock held of record on all matters submitted to a vote of stockholders.

On July 8, 2016, we announced a reverse split of our Common Stock, at a ratio of 1-for-8, effective July 13, 2016, which we refer to as the Reverse Stock Split. The Common Stock began trading on a split-adjusted basis on July 14, 2016. The Reverse Stock Split was approved by our stockholders at the annual meeting of the stockholders held on May 26, 2016. As a result of the Reverse Stock Split, each eight pre-split shares of Common Stock outstanding were automatically combined into one new share of Common Stock without any action on the part of the respective holders, and the number of outstanding common shares on the date of the split was reduced from approximately 68.5 million shares to approximately 8.5 million shares. The Reverse Stock Split also applied to Common Stock issuable upon the exchange of our outstanding 7% Notes and upon the exercise of our outstanding warrants. Additionally, the Reverse Stock Split applied to our outstanding stock options, restricted share units, which we refer to as RSUs, and performance share units, which we refer to as PSUs; collectively which we refer to as the Equity Awards. In addition, the authorized Common Stock was initially increased from 100 million to 120 million shares and then adjusted in the Reverse Stock Split from 120 million to 15 million shares. Our historical consolidated financial statements have been retroactively adjusted to give recognition to the Reverse Stock Split for all periods presented.

Our Common Stock is traded on the NYSE under the symbol "CVO." As of January 26, 2017, there were 318 shareholders of record and, as of that date, we estimate there were approximately 8,253 beneficial owners holding stock in nominee or "street" name. The following table sets forth, for the periods indicated, the range of the high and low closing prices for our Common Stock as reported by the NYSE:

|

| | | | | | | |

2016 | High | | Low |

First Quarter | $ | 7.20 |

| | $ | 2.88 |

|

Second Quarter | 8.96 |

| | 2.96 |

|

Third Quarter | 9.80 |

| | 5.52 |

|

Fourth Quarter | 8.32 |

| | 6.66 |

|

| | | |

2015 | High | | Low |

First Quarter | $ | 17.44 |

| | $ | 14.80 |

|

Second Quarter | 20.64 |

| | 15.68 |

|

Third Quarter | 17.76 |

| | 12.24 |

|

Fourth Quarter | 16.24 |

| | 6.80 |

|

We have not paid a dividend on our Common Stock since our incorporation and do not anticipate paying dividends in the foreseeable future as the instruments governing a portion of our debt obligations limit our ability to pay Common Stock dividends.

For each of the years ended 2016 and 2015, we had 25,000 shares of preferred stock authorized, of which no shares were issued or outstanding.

See Note 12 to our consolidated financial statements for information regarding our stock-based compensation plans. Compensation information required by Item 11 will be presented in our 2017 definitive proxy statement, which is incorporated herein by reference.

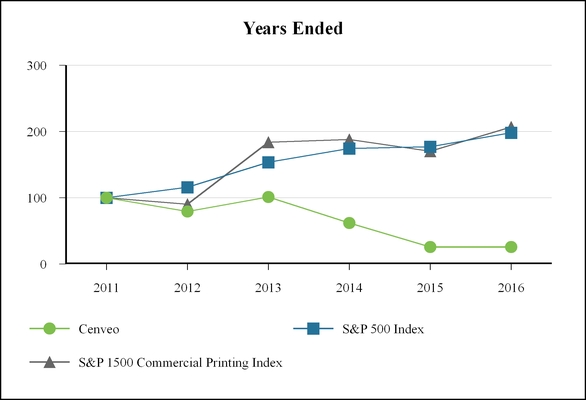

The graph below compares five-year returns of our Common Stock with those of the S&P 500 Index and the S&P 1500 Commercial Printing Index. The graph assumes that $100 was invested as of our year ended 2011 in each of our Common Stock, the S&P 500 Index, and the S&P 1500 Commercial Printing Index and that all dividends were reinvested. The S&P 1500 Commercial Printing Index is a capitalization weighted index designed to measure the performance of all NYSE-traded stocks in the commercial printing sector.

|

| | | | | | | | | | | | | | | | | | |

| Years Ended |

| 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | |

Cenveo | 100.00 |

| | 79.41 |

| | 101.18 |

| | 61.77 |

| | 25.63 |

| | 25.70 |

| |

S&P 500 Index | 100.00 |

| | 116.00 |

| | 153.57 |

| | 174.60 |

| | 177.01 |

| | 198.18 |

| |

S&P 1500 Commercial Printing Index | 100.00 |

| | 90.39 |

| | 183.77 |

| | 188.15 |

| | 170.18 |

| | 206.87 |

| |

Item 6. Selected Financial Data

The following table sets forth our selected financial and operating data for the years ended December 31, 2016, January 2, 2016, December 27, 2014, December 28, 2013 and December 29, 2012, which we refer to as the years ended 2016, 2015, 2014, 2013 and 2012, respectively.

The following consolidated selected financial data has been derived from, and should be read in conjunction with, the related consolidated financial statements, either elsewhere in this report or in reports we have previously filed with the SEC. Additionally, it reflects the retroactive adjustment of amounts to give recognition to the discontinued operations for all periods presented for our Packaging Business, our Custom Envelope Group, our San Francisco manufacturing facility, our documents and forms business, and our wide-format papers business.

CENVEO, INC. AND SUBSIDIARIES (in thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | |

| Years Ended |

Statement of Operations: | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

Net sales | $ | 1,660,001 |

| | $ | 1,741,779 |

| | $ | 1,761,315 |

| | $ | 1,588,702 |

| | $ | 1,544,073 |

|

Restructuring and other charges | 11,954 |

| | 12,576 |

| | 21,526 |

| | 12,586 |

| | 26,066 |

|

Impairment of intangible assets | — |

| | — |

| | — |

| | 24,493 |

| | — |

|

Operating income | 76,032 |

| | 83,793 |

| | 42,774 |

| | 32,041 |

| | 80,214 |

|

(Gain) loss on early extinguishment of debt, net (1) | (82,481 | ) | | 1,252 |

| | 27,449 |

| | 11,324 |

| | 12,487 |

|

Income (loss) from continuing operations (3) | 70,846 |

| | (19,461 | ) | | (95,053 | ) | | (86,276 | ) | | (94,321 | ) |

(Loss) income from discontinued operations, net of taxes (2)(4)(5) | (2,897 | ) | | (11,390 | ) | | 11,190 |

| | 17,490 |

| | 14,434 |

|

Net income (loss) (1)(2)(3)(4)(5) | 67,949 |

| | (30,851 | ) | | (83,863 | ) | | (68,786 | ) | | (79,887 | ) |

Income (loss) per share from continuing operations: | | | | | | | | | |

Basic | 8.31 |

| | (2.30 | ) | | (11.36 | ) | | (10.69 | ) | | (11.87 | ) |

Diluted | 7.63 |

| | (2.30 | ) | | (11.36 | ) | | (10.69 | ) | | (11.87 | ) |

(Loss) income per share from discontinued operations: | | | | | | | | | |

Basic | (0.34 | ) | | (1.34 | ) | | 1.34 |

| | 2.17 |

| | 1.82 |

|

Diluted | (0.31 | ) | | (1.34 | ) | | 1.34 |

| | 2.17 |

| | 1.82 |

|

Net income (loss) per share: | | | | | | | | | |

Basic | 7.97 |

| | (3.64 | ) | | (10.02 | ) | | (8.52 | ) | | (10.05 | ) |

Diluted | 7.32 |

| | (3.64 | ) | | (10.02 | ) | | (8.52 | ) | | (10.05 | ) |

| | | | | | | | | |

| | | | | | | | | |

Balance Sheet data: | | | | | | | | | |

Total assets | $ | 912,959 |

| | $ | 1,082,026 |

| | $ | 1,135,721 |

| | $ | 1,195,316 |

| | $ | 1,179,156 |

|

Total long-term debt, including current maturities | 1,018,666 |

| | 1,208,623 |

| | 1,210,380 |

| | 1,166,784 |

| | 1,160,835 |

|

__________________________

| |

(1) | During the year ended 2016, we completed several transactions which resulted in a net gain on early extinguishment of debt. See further detail in Note 8 to our consolidated financial statements. |

| |

(2) | In connection with the sale of the Packaging Business, we recorded a gain on sale of $1.4 million for the year ended 2016 and a loss on sale of $5.0 million for the year ended 2015. Additionally, we recorded a non-cash goodwill impairment charge of $9.9 million related to this transaction for the year ended 2015. |

| |

(3) | Includes $40.6 million and $56.5 million valuation allowance charges related to deferred tax assets for the years ended 2013 and 2012, respectively. |

| |

(4) | Includes $14.9 million gain on sale of discontinued operations, net of tax expense of $10.7 million for the year ended 2013. |

| |

(5) | Includes $6.3 million loss on sale of discontinued operations, net of tax benefit of $2.6 million for the year ended 2012. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our consolidated financial statements included in Item 8 of this Annual Report on Form 10-K, which we refer to as the Form 10-K. Cenveo, Inc. and its subsidiaries are referred to herein as "Cenveo," the "Company," "we," "our," or "us."

Certain statements we make in this report constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. See Cautionary Statements regarding forward-looking statements in Item 1, and "Risk Factors" in Item 1A.

Factors which could cause actual results to differ materially from management’s expectations include, without limitation: (i) our substantial level of indebtedness could materially adversely affect our financial condition, liquidity and ability to service or refinance our debt, and prevent us from fulfilling our business obligations; (ii) our ability to pay the principal of, or to reduce or refinance, our outstanding indebtedness; (iii) the terms of our indebtedness imposing significant restrictions on our operating and financial flexibility; (iv) additional borrowings available to us could further exacerbate our risk exposure from debt; (v) United States and global economic conditions have adversely affected us and could continue to adversely affect us; (vi) our ability to successfully integrate acquired businesses with our business; (vii) a decline in our consolidated profitability or profitability within one of our individual reporting units could result in the impairment of our assets, including goodwill and other long-lived assets; (viii) the industries in which we operate our business are highly competitive and extremely fragmented; (ix) a general absence of long-term customer agreements in our industry, subjecting our business to quarterly and cyclical fluctuations; (x) factors affecting the United States postal services impacting demand for our products; (xi) the availability of the Internet and other electronic media adversely affecting our business; (xii) increases in paper costs and decreases in the availability of raw materials; (xiii) increases in energy and transportation costs; (xiv) our labor relations; (xv) our compliance with environmental laws; (xvi) our dependence on key management personnel; and (xvii) any failure, interruption or security lapse of our information technology systems. This list of factors is not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that would impact our business. Additional information regarding these and other factors can be found elsewhere in this report, and in our other filings with the Securities and Exchange Commission, which we refer to as the SEC.

Introduction and Executive Overview

We are a diversified manufacturing company focused on print-related products. Our broad portfolio of products includes envelope converting, commercial printing, and label manufacturing. We operate a global network of strategically located manufacturing facilities, serving a diverse base of customers ranging from Fortune 100 companies to individual consumers. Our business strategy has been, and continues to be, focused on improving our operating margins, improving our capital structure and providing quality product offerings to our customers. We operate our business in three complementary reportable segments: the envelope segment, the print segment and the label segment.

See Part 1, Item 1 of this Form 10-K for a more complete description of our business.

2016 Overview and 2017 Outlook

Generally, print-related industries remain highly fragmented and extremely competitive due to over-capacity and pricing pressures. We believe these factors, combined with uncertain economic conditions in the United States, will continue to impact our results of operations. However, we believe the diversification of our revenue and operating income along with the market dynamics that exist within certain markets in which we operate will provide an opportunity for us to have operating trends that perform better than certain other print dynamic markets.

Our current management focus is on the following areas:

Improving Operating Margins

In 2014, we substantially completed our integration of certain assets of National Envelope Corporation, which we refer to as National, which allowed us to focus on profitability improvement and other cost reduction actions in our envelope platform throughout 2015 and into early 2016. We believe the accelerated integration plan we completed during 2014 has provided meaningful improvements in our envelope segment's operating results during 2015 and 2016, as we realized significant increases in gross profit and operating income, as compared to 2014.

During 2016, we experienced significant sales volume decline and increased price pressures within our office product envelope and related wholesale envelope product lines due to measures undertaken by our customers in those product lines as a result of inventory management initiatives and continued closure of distribution centers and retail store fronts. We believe this

was accelerated during 2016 as a result of a regulatory decision mid-way through our 2016 fiscal year. The decline in our sales and operating income in these product lines were partially offset by increased demand for direct mail envelopes which contributed mid-single digit growth compared to prior year and increased operating income. Our commercial printing operations performed generally in line with our expectations in regards to both sales and operating income. Our label segment experienced sales declines primarily driven by our decision to exit our coating operation combined with lower sales in our long-run label product line due to decisions to exit lower margin product sets and lower than expected sales within our high margin custom label product sets. The operating margin of our label segment decreased primarily due to the lower sales volume in our high margin custom label business being partially offset by the benefits of the 2016 Label Transaction, as discussed further below.

With the decline in our office product envelope and related wholesale envelope product lines and other continued marketplace challenges within our industry, we initiated a two year $50 million cost savings and profitability plan, which we refer to as the 2017 Profitability Improvement Plan, to offset the impact of these marketplace challenges and continue to improve our consolidated operating margins. With this plan, we expect higher restructuring, impairment and other charges primarily resulting from severance expense, facility rationalization costs and impairments associated with equipment footprint reductions. We believe these incremental charges will ultimately be offset by improved gross profit margins and lower selling general and administrative expenses as we operate through 2017 and into 2018; however, this cannot be assured. These actions are aimed to reduce our fixed cost infrastructure, back office headcount and further streamline our geographic footprint. We believe that despite the facility rationalization, we will still be able to serve our national customer base with less facilities at the same or improved service levels that they are used to receiving from us.

During 2017, we expect sales in our envelope segment will continue to see similar direct mail growth trends consistent with the past several years, which will be offset by lower sales due to reduced purchasing patterns within our office product envelope and wholesale envelope product lines. We expect our commercial print sales to decline at a consistent rate similar to the past several years. We expect our label segment sales will decline slightly as we reach the anniversary of our decision to exit our coating operation, which we expect will be offset by increased sales within both our custom label and long-run label product lines.

Improving our Capital Structure

Since the beginning of 2012, we have been focused on improving our capital structure through a number of initiatives including working capital improvements, exiting underperforming or non-strategic businesses, and taking advantage of strategic refinancing opportunities and attractive leveraged loan and high yield debt market conditions. In connection with these activities, through the end of 2016, we continued to successfully reduce our outstanding debt and weighted average interest rate, which will result in annual cash interest savings of approximately $40 million in 2017 as compared to 2012. We have been able to accomplish this while reinvesting cash into our businesses via three acquisitions and focused capital expenditures.

Our continued operational improvements have provided us greater flexibility to address our higher interest rate debt instruments in 2016. During the first quarter of 2016, we extinguished $34.5 million of our 7% senior exchangeable notes due 2017, which we refer to as the 7% Notes, and $10.0 million of our 11.5% senior notes due 2017, which we refer to as the 11.5% Notes.

During the second quarter of 2016, we closed on an exchange offer, which we refer to as the Exchange Offer, whereby approximately 80% of our 11.5% Notes were exchanged for newly issued 6.000% senior unsecured notes due 2024, which we refer to as the 6.000% Unsecured Notes, and warrants, which we refer to as the Warrants, to purchase shares of common stock, par value $0.01 per share, of Cenveo, Inc., which we refer to as the Common Stock, representing 16.6% of our outstanding Common Stock as of June 10, 2016. Each Warrant is currently exercisable for 0.125 shares of Common Stock (as adjusted as a result of the Company’s recent reverse stock split). For each $1,000 principal amount of 11.5% Notes exchanged, the holder received $700 aggregate principal amount of 6.000% Unsecured Notes and Warrants to purchase 9.25 shares of Common Stock. Upon closing the Exchange Offer, we emerged with lower overall debt, stronger cash flow due to significantly lower future interest expense, and no significant scheduled debt maturities until August 2019.

During the third quarter of 2016, we completed the last transactions contemplated by the Support Agreement, dated as of May 10, 2016, pursuant to which Allianz Global Investors U.S. LLC, which we refer to as Allianz, agreed to, among other things, tender and sell to us all of the 7% Notes owned by Allianz, which we refer to as the 7% Note Purchases, in the aggregate principal amount of $37.5 million, which we refer to as the Allianz 7% Note Purchase, in exchange for: (a) payment in cash in an amount equal to (i) the aggregate principal amount of such 7% Notes multiplied by 0.6 plus (ii) an amount of interest on the amount payable pursuant to the immediately preceding clause (i) at an annual interest rate of 7% per annum, such interest accruing from June 10, 2016 until (and including) the closings of the purchases and computed based on a year of 360 days; (b) payment in cash of interest that shall have accrued in respect of such 7% Notes in accordance with the indenture relating to such 7% Notes but remained unpaid at the closings of the purchases; and (c) delivery to Allianz of Warrants to purchase Common Stock, representing in the aggregate 3.3% of the outstanding Common Stock as of June 10, 2016.

In connection with such agreement, during 2016 we repurchased an aggregate of $37.5 million of our 7% Notes for $22.5 million and issued an aggregate of 2,239,827 Warrants.

Concurrent with the above transactions, we amended our asset-based revolving credit facility, which we refer to as the ABL Facility, to, among other things, extend its term to 2021 and reduce the commitments thereunder by $50 million to $190 million, which we refer to as the ABL Amendment No. 4. The ABL Facility now matures in June 2021, with a springing maturity of May 2019 ahead of our existing 6.000% senior priority secured notes due 2019, which we refer to as the 6.000% Secured Notes, in the event that more than $10 million of the 6.000% Secured Notes remain outstanding at such time. On the same date, we entered into a secured indenture and note purchase agreement with Allianz pursuant to which we issued new secured notes in an aggregate principal amount of $50.0 million bearing interest at 4% per annum, which we refer to as the 4% Secured Notes. We applied the proceeds to reduce the outstanding principal amount under the ABL Facility. The 4% Secured Notes mature in December 2021.

Subsequent to the completion of the Exchange Offer and the Allianz 7% Note Purchase, during the fourth quarter of 2016, we repurchased $20.0 million of our 11.5% Notes and $5.7 million of our 7% Notes at par. After these transactions, approximately $20.5 million and $5.5 million aggregate principal amount of our 11.5% Notes and 7% Notes, respectively, remain outstanding. Additionally, we repurchased $7.0 million of our 8.500% junior priority secured notes due 2022, which we refer to as the 8.500% Notes, for $4.6 million.

On January 13, 2017, we filed a notice of redemption calling the $20.5 million remaining principal balance of our 11.5% Notes at par. We intend to redeem the full outstanding principal balance of our 11.5% Notes during the first quarter of 2017. With the completion of our call notice on the remaining portion of our 11.5% Notes we will have addressed all but $5.5 million of our debt maturing in 2017. We expect the remaining $5.5 million will be addressed prior to or at maturity in May of 2017 using cash flow from operations or availability under our ABL Facility.

Provide Quality Product Offerings