|  | |||||||

| CONTACT: | FOR IMMEDIATE RELEASE | ||||

| Bryan R. McKeag | July 26, 2021 | ||||

| Executive Vice President | |||||

| Chief Financial Officer | |||||

| (563) 589-1994 | |||||

| BMcKeag@htlf.com | |||||

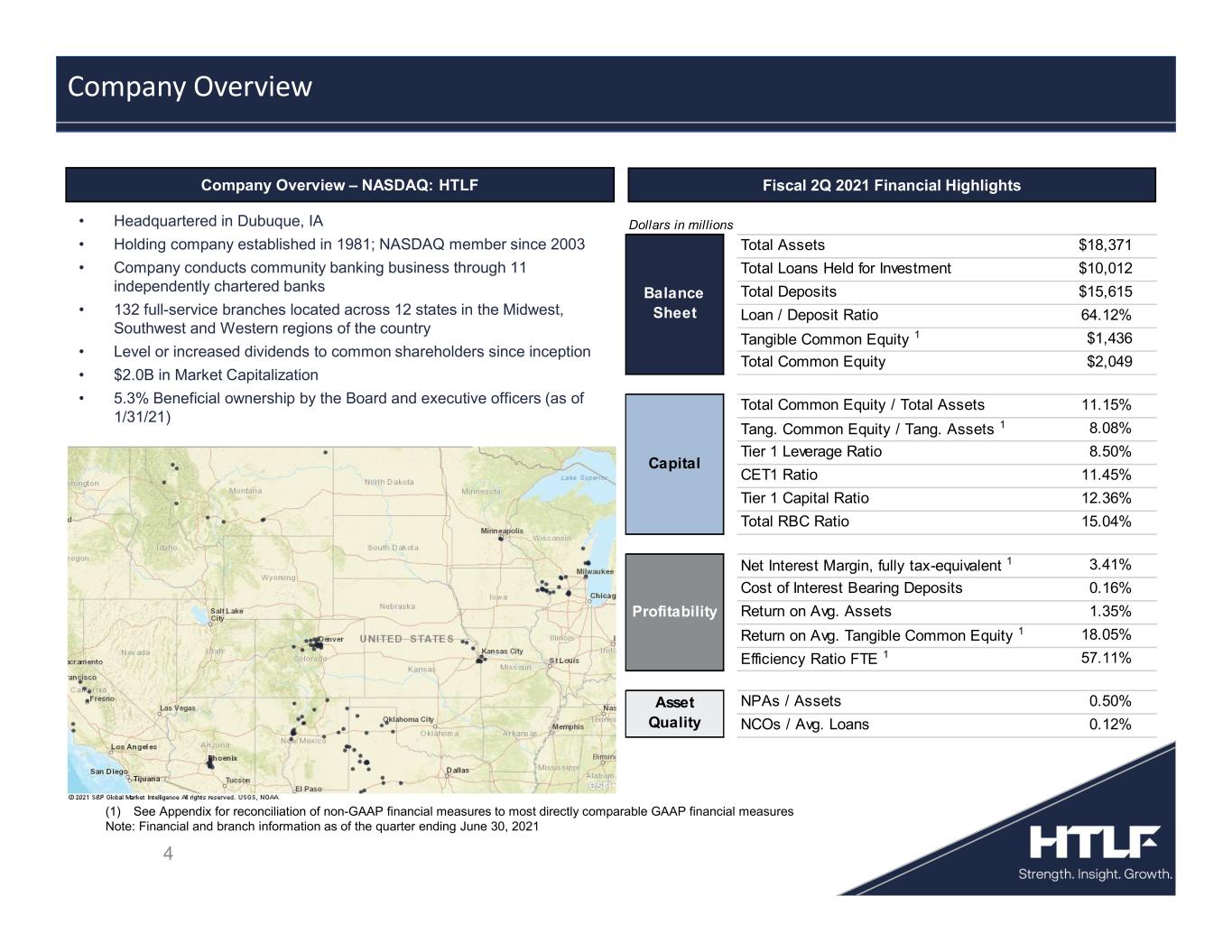

HEARTLAND FINANCIAL USA, INC. ("HTLF") REPORTS RECORD QUARTERLY AND YEAR TO DATE RESULTS AS OF JUNE 30, 2021

Highlights and Developments

| § | Net income available to common stockholders of $59.6 million compared to $30.1 million for the second quarter of 2020, an increase of $29.5 million or 98% | |||||||

| § | Net income available to common stockholders of $110.4 million compared to $50.2 million for the six months ended June 30, 2020, an increase of $60.2 million or 120% | |||||||

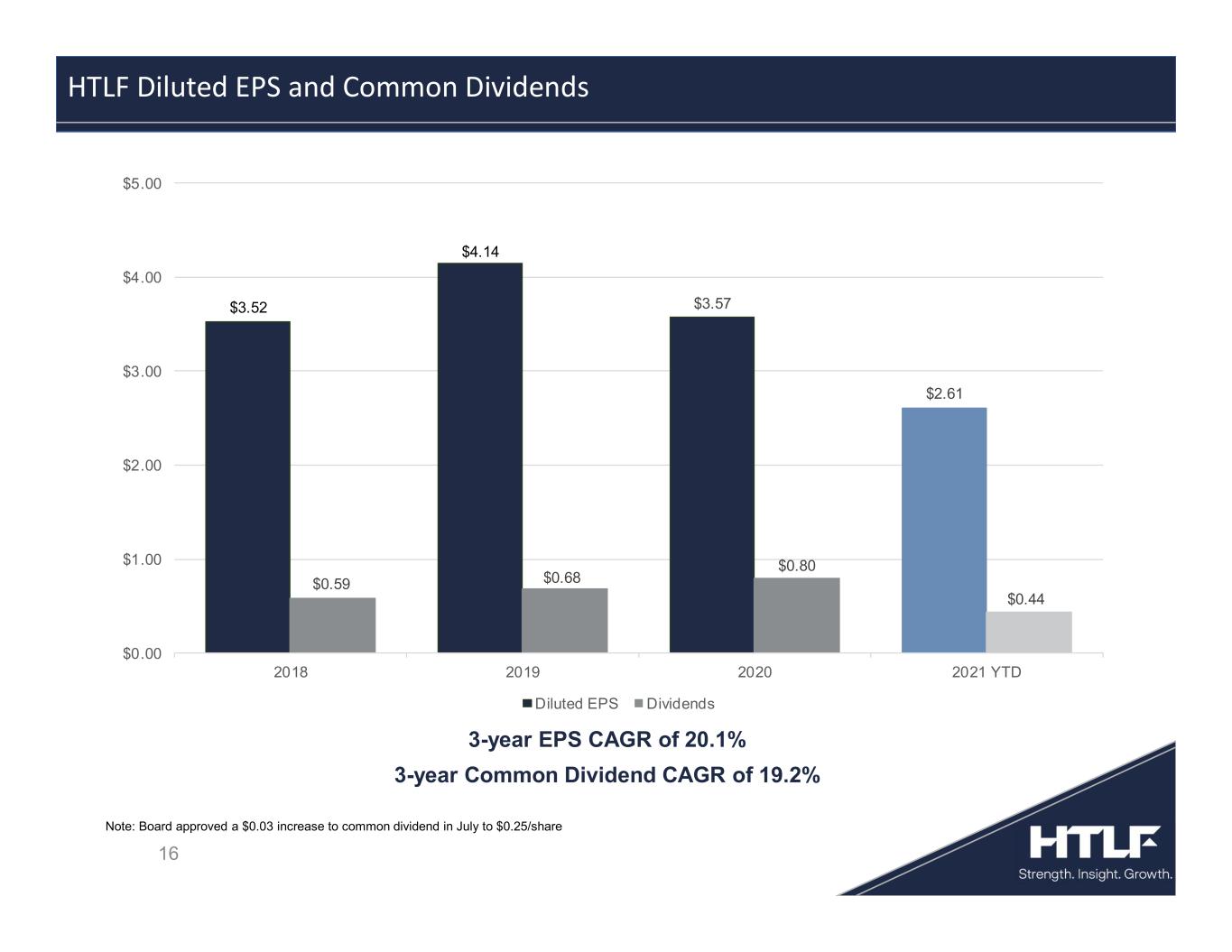

| § | Diluted earnings per common share of $1.41 compared to $0.82 for the second quarter of the prior year, an increase of $0.59 or 72% | |||||||

| § | Quarterly loan growth was $287.7 million or 13% annualized, exclusive of Paycheck Protection Program ("PPP") loans | |||||||

| § | Non-time deposit growth of $133.3 million or 1% for the second quarter of 2021 and $780.0 million or 6% for the six months ended June 30, 2021 | |||||||

| § | Annualized net charge off ratio of 0.12%, nonperforming assets to total assets of 0.50%, and 30-89 day loan delinquencies of 0.17% | |||||||

| § | Announced a 14% increase in the regular quarterly dividend to $0.25 per common share | |||||||

| Quarter Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net income available to common stockholders (in millions) | $ | 59.6 | $ | 30.1 | $ | 110.4 | $ | 50.2 | |||||||||||||||

| Diluted earnings per common share | 1.41 | 0.82 | 2.61 | 1.36 | |||||||||||||||||||

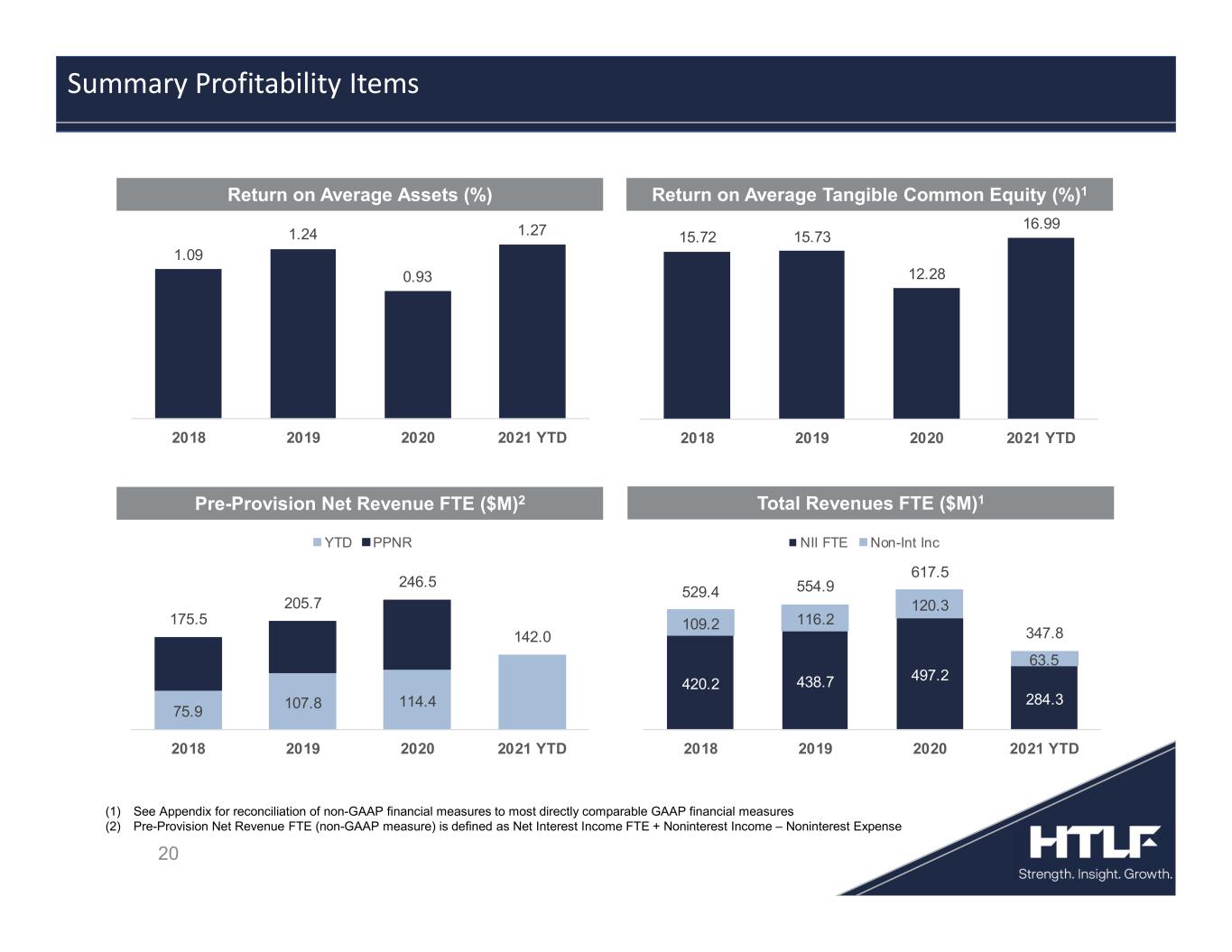

| Return on average assets | 1.35 | % | 0.84 | % | 1.27 | % | 0.73 | % | |||||||||||||||

| Return on average common equity | 12.07 | 7.69 | 11.29 | 6.32 | |||||||||||||||||||

Return on average tangible common equity (non-GAAP)(1) | 18.05 | 11.97 | 16.99 | 9.95 | |||||||||||||||||||

| Net interest margin | 3.37 | 3.81 | 3.40 | 3.81 | |||||||||||||||||||

Net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.41 | 3.85 | 3.45 | 3.85 | |||||||||||||||||||

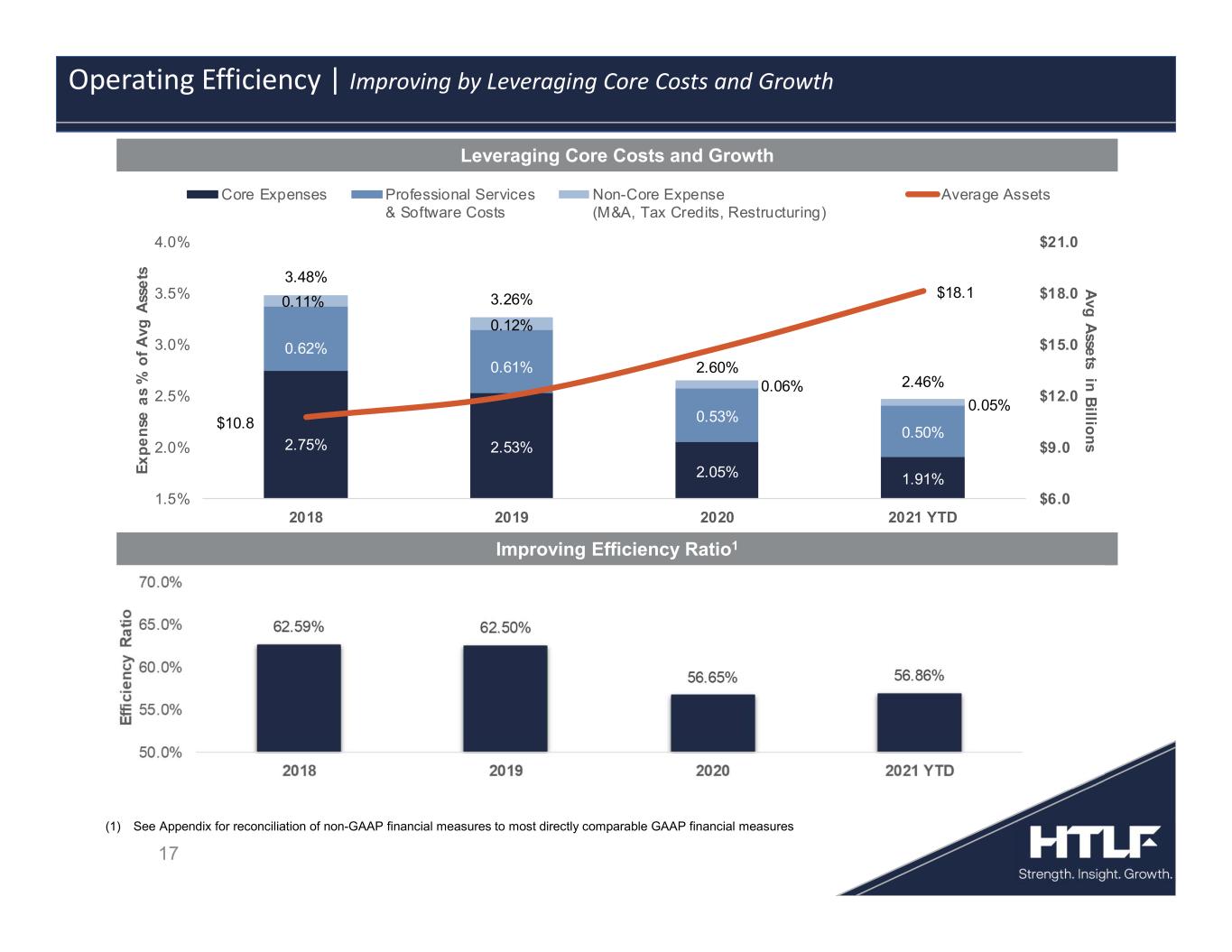

Efficiency ratio, fully-tax equivalent (non-GAAP)(1) | 57.11 | 55.75 | 56.86 | 58.64 | |||||||||||||||||||

(1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to the financial tables for reconciliations to the most directly comparable GAAP measures.

| "HTLF's second quarter 2021 financial performance was strong. Net income available to common stockholders totaled $59.6 million, which was a 98% increase over the same quarter last year. Loan growth, excluding PPP loans, non-time deposit growth and improved credit quality all contributed to our success this quarter." | ||

| Bruce K. Lee, president and chief executive officer, HTLF | ||

Dubuque, Iowa, Monday, July 26, 2021-Heartland Financial USA, Inc. (NASDAQ: HTLF) today reported the following results for the quarter ended June 30, 2021 compared to the quarter ended June 30, 2020:

•Net income available to common stockholders of $59.6 million compared to $30.1 million, an increase of $29.5 million or 98%.

•Earnings per diluted common share of $1.41 compared to $0.82, an increase of $0.59 or 72%.

•Net interest income of $141.2 million compared to $124.1 million, an increase of $17.1 million or 14%.

•Return on average common equity was 12.07% and return on average assets was 1.35% compared to 7.69% and 0.84%.

•Return on average tangible common equity (non-GAAP) was 18.05% compared to 11.97%.

HTLF report the following results for the six months ended June 30, 2021 compared to the six months ended June 30, 2020:

•Net income available to common stockholders of $110.4 million compared to $50.2 million, an increase of $60.2 million or 120%.

•Earnings per diluted common share of $2.61 compared to $1.36, an increase of $1.25 or 92%

•Net interest income of $280.8 million compared to $236.7 million, an increase of $44.2 million or 19%.

•Return on average common equity was 11.29% and return on average assets was 1.27% compared to 6.32% and 0.73%.

•Return on average tangible common equity (non-GAAP) was 16.99% compared to 9.95%.

"HTLF's second quarter 2021 financial performance was strong. Net income available to common stockholders totaled $59.6 million, which was a 98% increase over the same quarter last year. Loan growth, excluding PPP loans, non-time deposit growth and improved credit quality also contributed to our success this quarter," said Bruce K. Lee, president and chief executive officer of HTLF.

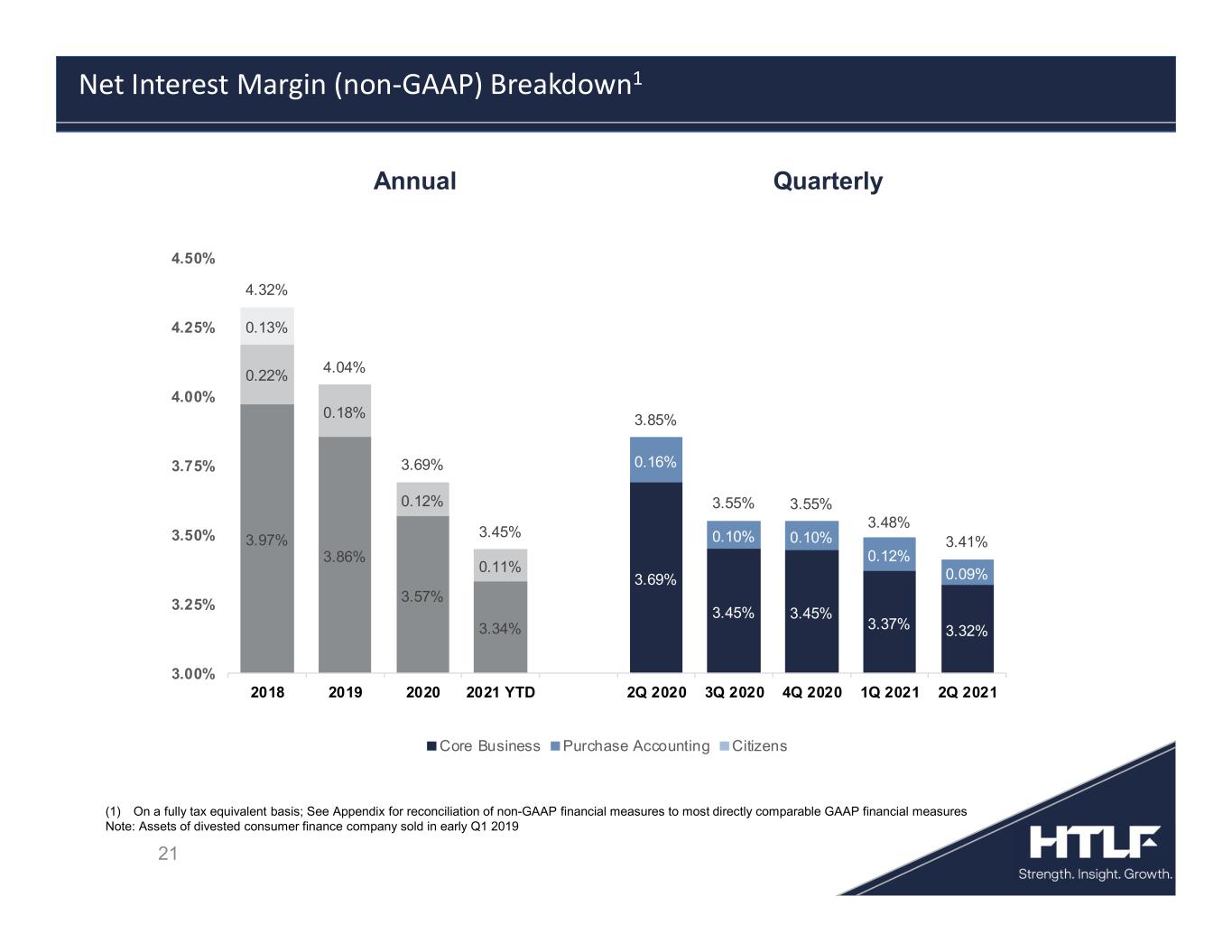

Net Interest Income and Net Interest Margin

Net interest margin, expressed as a percentage of average earning assets, was 3.37% (3.41% on a fully tax-equivalent basis, non-GAAP) during the second quarter of 2021, compared to 3.44% (3.48% on a fully tax-equivalent basis, non-GAAP) during the first quarter of 2021 and 3.81% (3.85% on a fully tax-equivalent basis, non-GAAP) during the second quarter of 2020.

Total interest income and average earning asset changes for the second quarter of 2021 compared to the second quarter of 2020 were:

•Total interest income was $148.1 million, which was an increase of $14.3 million or 11% from $133.8 million and primarily attributable to an increase in average earning assets partially offset by lower yields.

•Total interest income on a tax-equivalent basis (non-GAAP) was $149.8 million, which was an increase of $14.7 million or 11% from $135.2 million.

•Average earning assets increased $3.72 billion or 28% to $16.82 billion compared to $13.10 billion, which was primarily attributable to recent acquisitions and loan growth, including PPP loans.

•The average rate on earning assets decreased 58 basis points to 3.57% compared to 4.15%, which was primarily due to recent decreases in market interest rates and a shift in earning asset mix. Total average securities were 39% of total earning average assets compared to 29%.

Total interest expense and average interest bearing liability changes for the second quarter of 2021 compared to the second quarter of 2020 were:

•Total interest expense was $6.9 million, a decrease of $2.8 million or 29% from $9.6 million, based on a decrease in the average interest rate paid, which was partially offset by an increase in average interest bearing liabilities.

•The average interest rate paid on interest bearing liabilities decreased to 0.28% compared to 0.47%, which was primarily due to recent decreases in market interest rates.

•Average interest bearing deposits increased $1.62 billion or 21% to $9.41 billion from $7.79 billion which was primarily attributable to recent acquisitions and deposit growth, including deposits related to government stimulus payments and other COVID-19 relief programs.

•The average interest rate paid on interest bearing deposits decreased 16 basis points to 0.16% compared to 0.32%.

•Average borrowings increased $97.0 million or 26% to $465.9 million from $368.9 million, which was primarily attributable to outstanding advances from the PPP lending fund used to fund PPP loans to borrowers. The average interest rate paid on borrowings was 2.65% compared to 3.80%.

Net interest income increased for the second quarter of 2021 compared to the second quarter of 2020:

•Net interest income totaled $141.2 million compared to $124.1 million, which was an increase of $17.1 million or 14%.

•Net interest income on a tax-equivalent basis (non-GAAP) totaled $143.0 million compared to $125.6 million, which was an increase of $17.4 million or 14%.

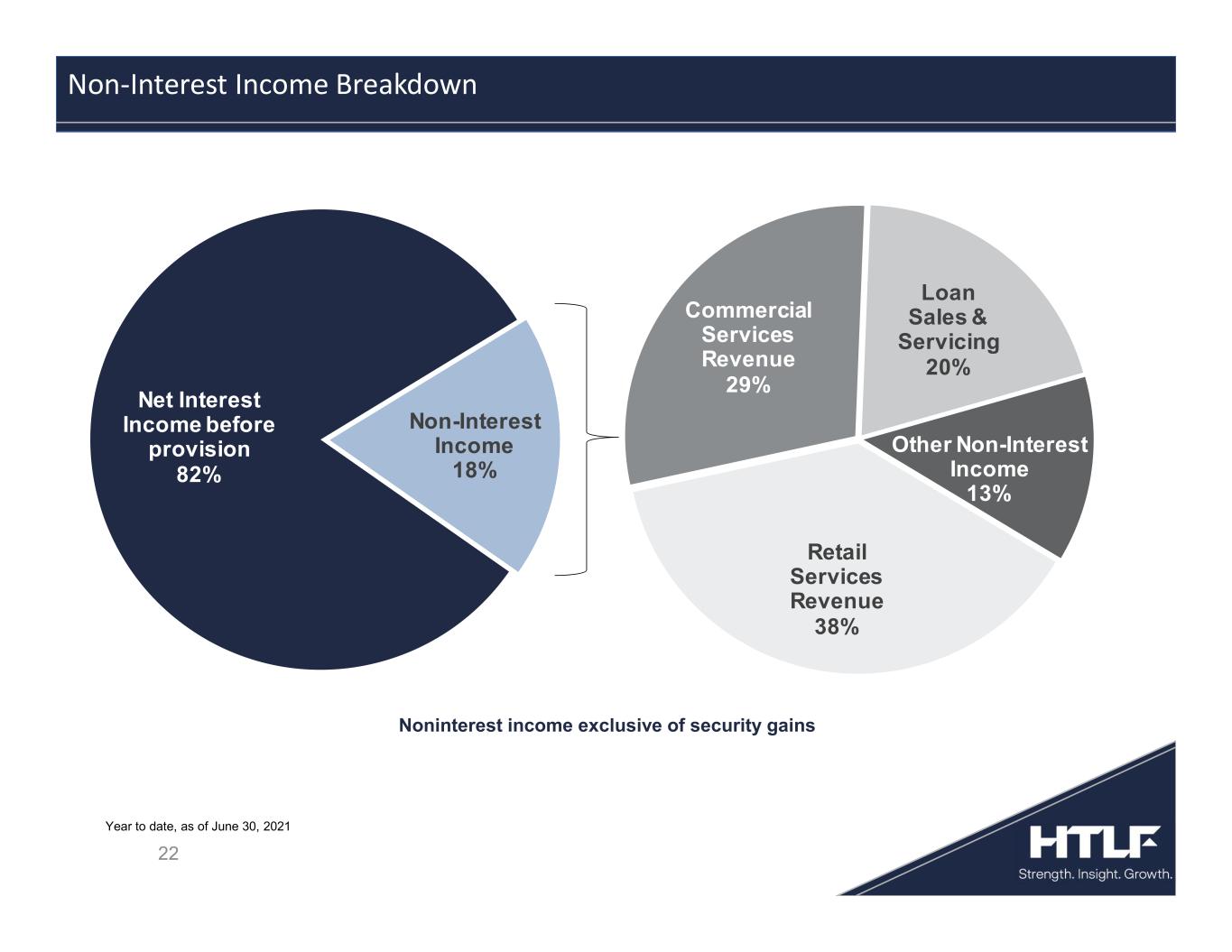

Noninterest Income and Noninterest Expense

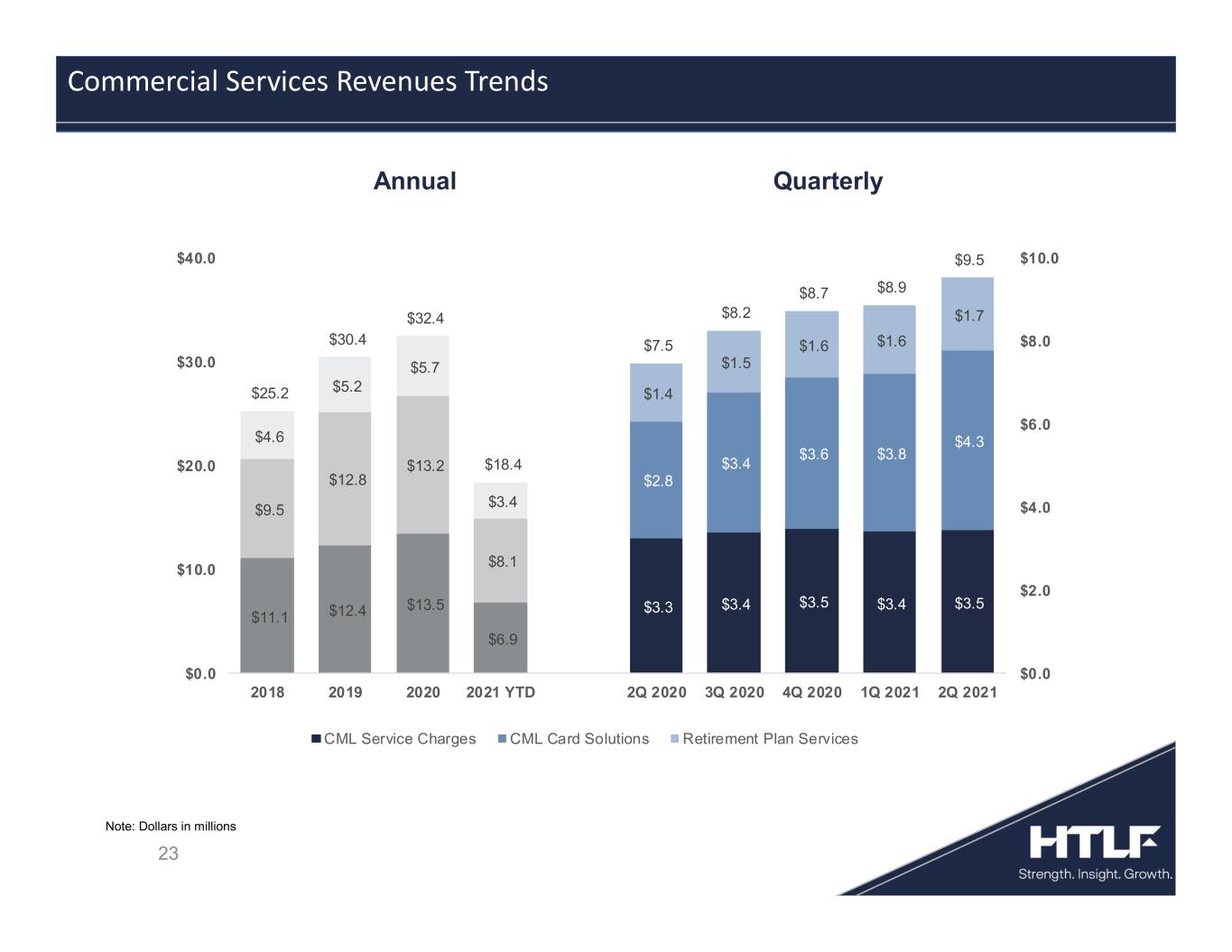

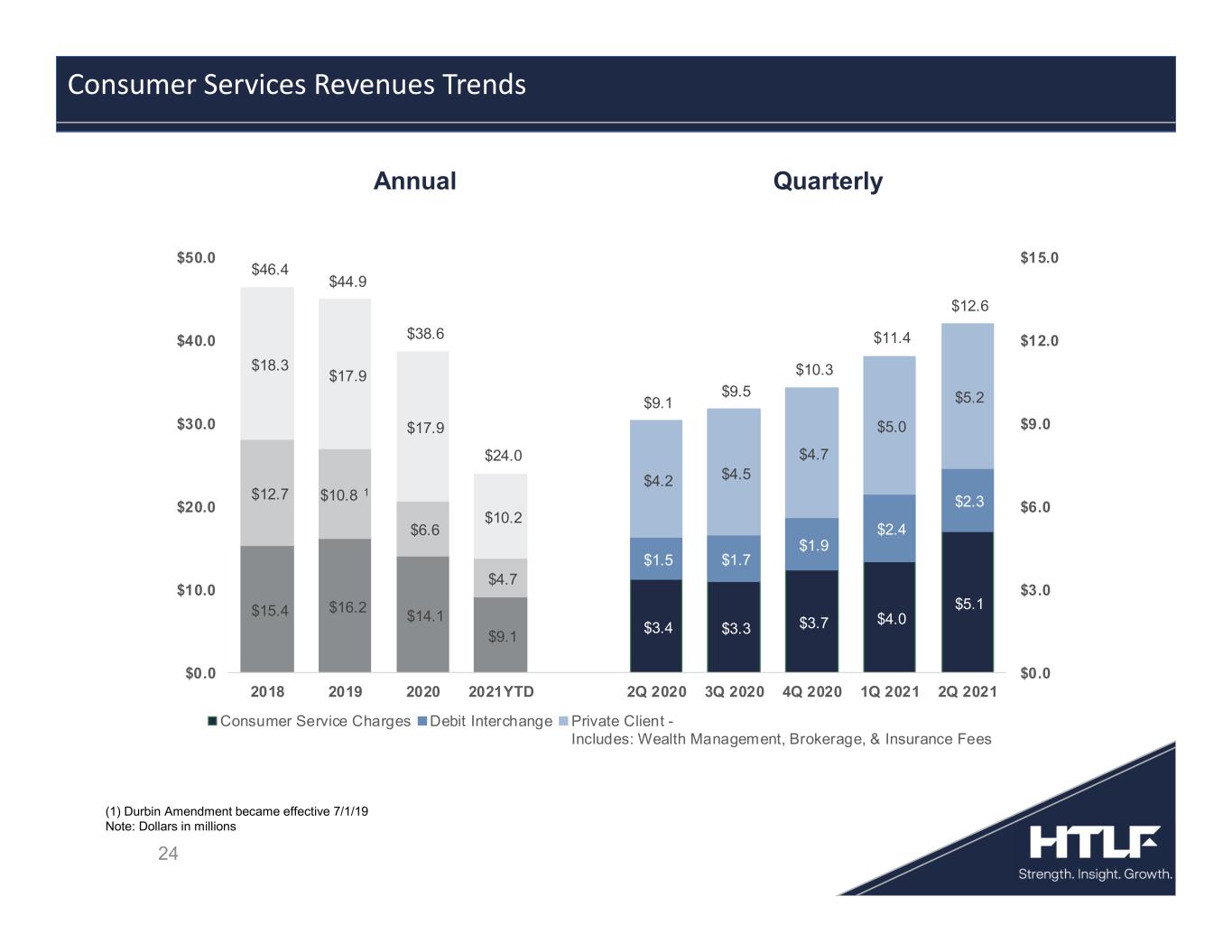

Total noninterest income was $33.2 million during the second quarter of 2021 compared to $30.6 million during the second quarter of 2020, an increase of $2.5 million or 8%. Significant changes within the noninterest income category for the second quarter of 2021 compared to the second quarter of 2020 were:

•Service charges and fees increased $4.2 million or 38% to $15.1 million from $11.0 million. Service charges and fees on retail and small business accounts increased $2.5 million to $7.3 million from $4.9 million. During the second quarter of 2020, HTLF was waiving service charges and fees due to the COVID-19 pandemic.

•Trust fees increased $1.1 million or 21% to $6.0 million from $5.0 million. The increase was primarily attributable to an increase in market value of trust assets under management.

•Net gains on sales of loans held for sale totaled $4.8 million compared to $7.9 million, which was a decrease of $3.1 million or 40% and was primarily attributable to a decrease of loans sold to the secondary market.

Total noninterest expense was $103.4 million during the second quarter of 2021 compared to $90.4 million during the second quarter of 2020, which was an increase of $12.9 million or 14%. Significant changes within the noninterest expense category for the second quarter of 2021 compared to the second quarter of 2020 were:

•Salaries and employee benefits totaled $57.3 million compared to $50.1 million, which was an increase of $7.2 million or 14%. Full-time equivalent employees increased 270 to 2,091 compared to 1,821 which was primarily attributable to the acquisitions completed in the fourth quarter of 2020.

•Professional fees increased $2.6 million or 19% to $16.2 million compared to $13.7 million, which was primarily attributable to utilization of specialized resources to support automation and technology projects, including the customer service call center.

•Other noninterest expenses increased $1.6 million or 14% to $12.7 million compared to $11.1 million. The increase was primarily attributable to the acquisitions completed in the fourth quarter of 2020.

The effective tax rate was 21.11% for the second quarter of 2021 compared to 19.75% for the second quarter of 2020. The following items impacted the second quarter 2021 and 2020 tax calculations:

•Solar energy tax credits of $1.3 million compared to $798,000.

•Federal low-income housing tax credits of $135,000 compared to $195,000.

•New markets tax credits of $75,000 in each quarterly calculation.

•Historic rehabilitation tax credits of $123,000 compared to $0.

•Tax-exempt interest income as a percentage of pre-tax income of 8.49% compared to 14.19%.

•Tax benefit of $150,000 compared to tax expense of $66,000 resulting from the vesting of restricted stock unit awards.

Total Assets, Total Loans and Total Deposits

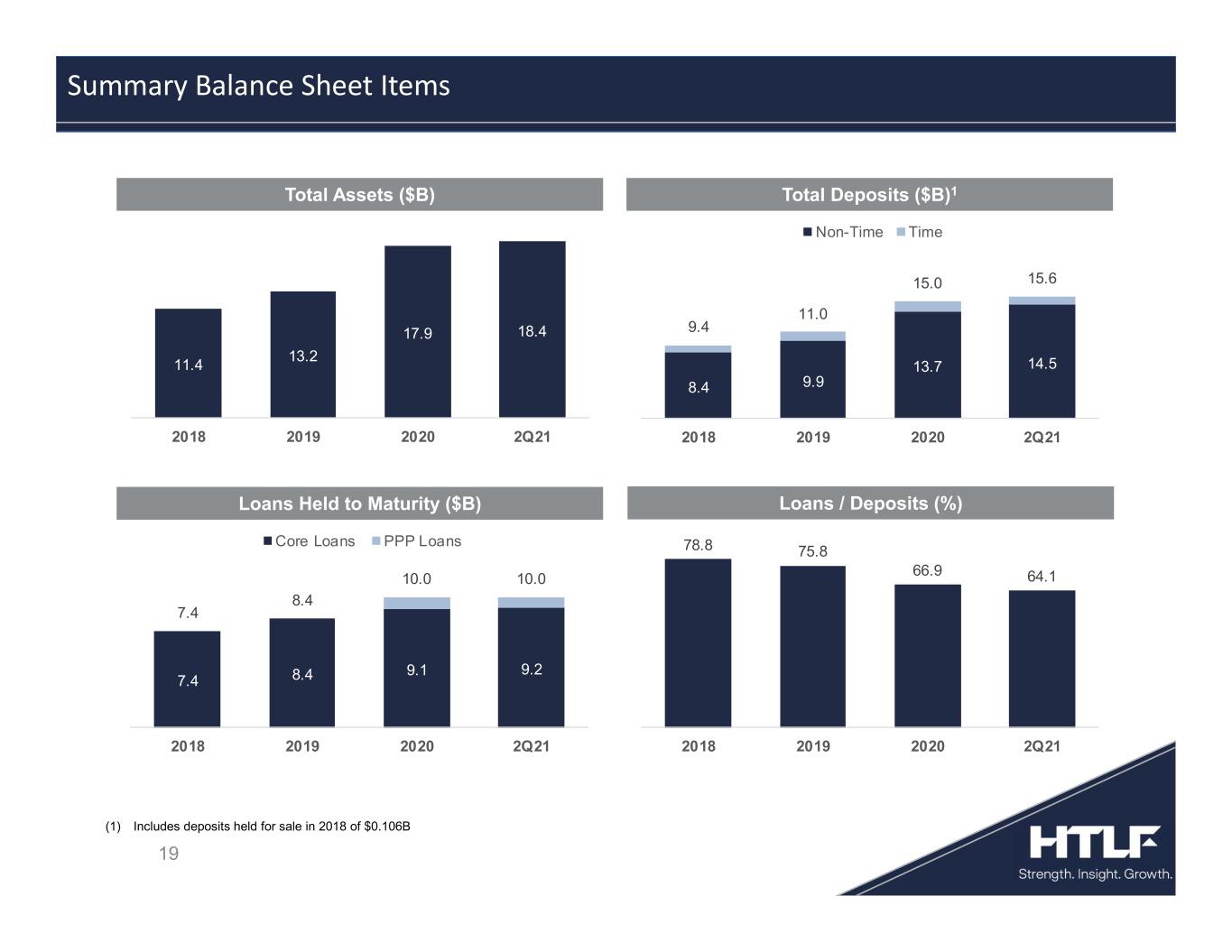

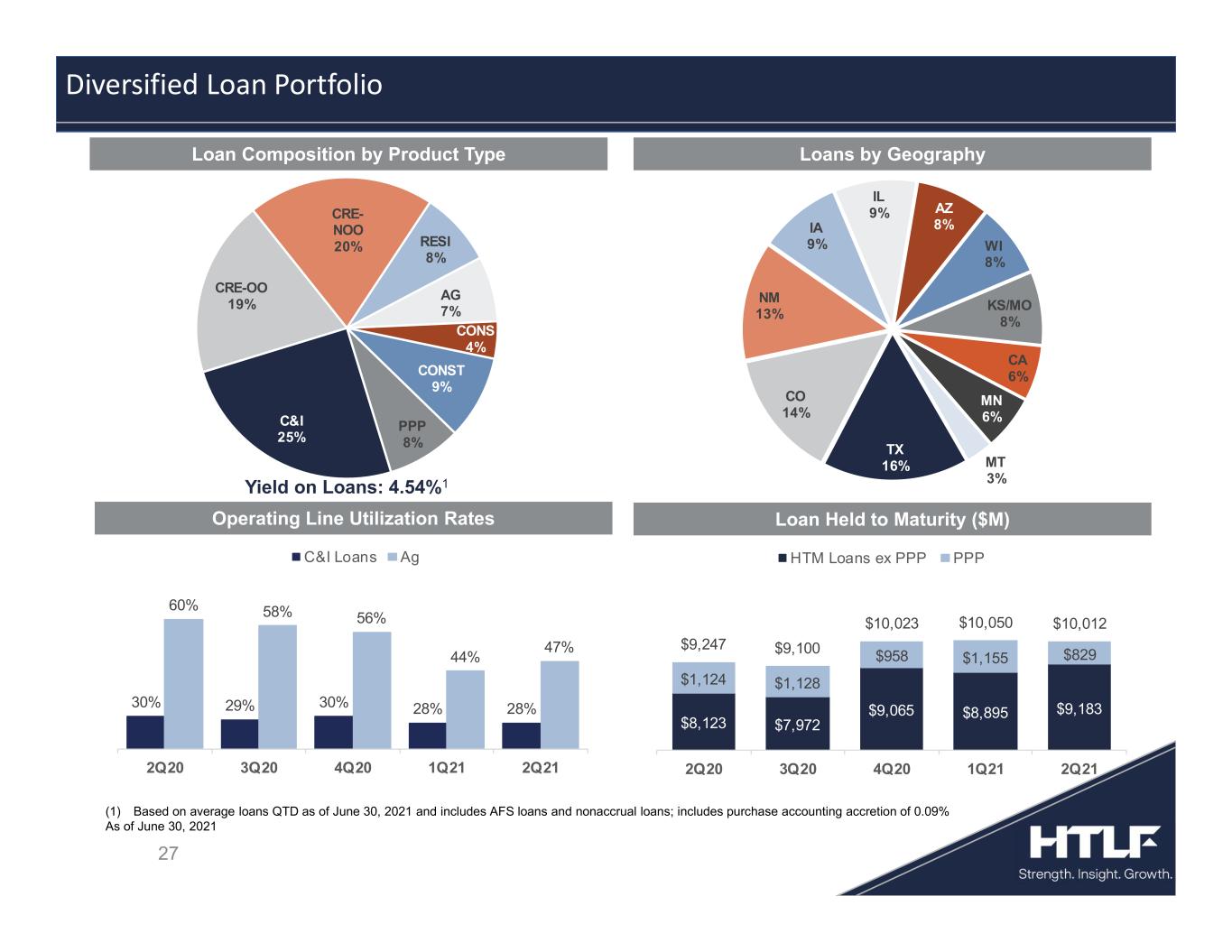

Total assets were $18.37 billion at June 30, 2021, an increase of $462.7 million or 3% from $17.91 billion at year-end 2020. Securities represented 37% and 35% of total assets at June 30, 2021, and December 31, 2020, respectively.

Total loans held to maturity were $10.01 billion at June 30, 2021, $10.05 billion at March 31, 2021, and $10.02 billion at December 31, 2020. Excluding total PPP loans, loans increased $287.7 million or 13% annualized during the second quarter of 2021 and $117.6 million or 2.6% annualized since year-end 2020.

Significant changes by loan category at June 30, 2021 compared to March 31, 2021 included:

•Commercial and business lending, which includes commercial and industrial, PPP and owner occupied commercial real estate loans, decreased $125.9 million or 2% to $5.29 billion compared to $5.41 billion.

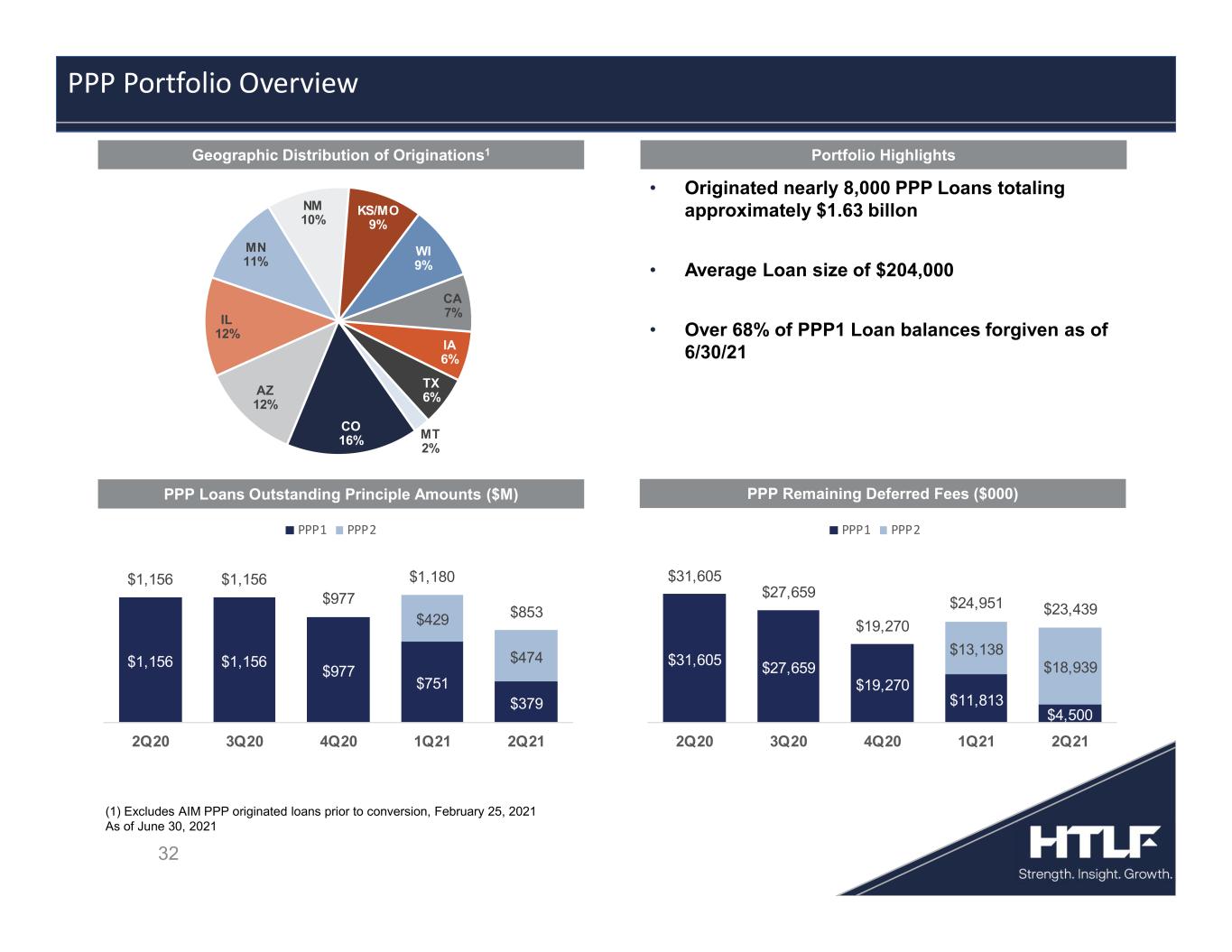

•PPP loans originated in 2020 ("PPP I") decreased $365.4 million or 49%. PPP loans originated in 2021 ("PPP II") increased $39.2 million or 9%.

•Excluding total PPP loans, commercial and business lending increased $200.2 million or 5% to $4.46 billion from $4.29 billion.

•Commercial real estate lending, which includes non-owner occupied commercial real estate and construction loans, increased $78.5 million or 3% to $2.84 billion compared to $2.76 billion.

Significant changes by loan category at June 30, 2021 compared to December 31, 2020, included:

•Commercial and business lending, which includes commercial and industrial, PPP and owner occupied commercial real estate loans, increased $19.2 million or less than 1%, to $5.29 billion compared to $5.27 billion.

•PPP I loans decreased $583.6 million or 61%. PPP II loans totaled $455.0 million.

•Excluding total PPP loans, commercial and business lending increased $147.8 million or 3% to $4.46 billion from $4.31 billion.

•Commercial real estate lending, which includes non-owner occupied commercial real estate and construction loans, increased $57.0 million or 2% to $2.84 billion compared to $2.78 billion.

•Residential mortgage loans decreased $39.5 million or 5% to $800.9 million compared to $840.4 million.

•Agriculture and agricultural real estate loans decreased $34.9 million or 5% to $679.6 million compared to $714.5 million.

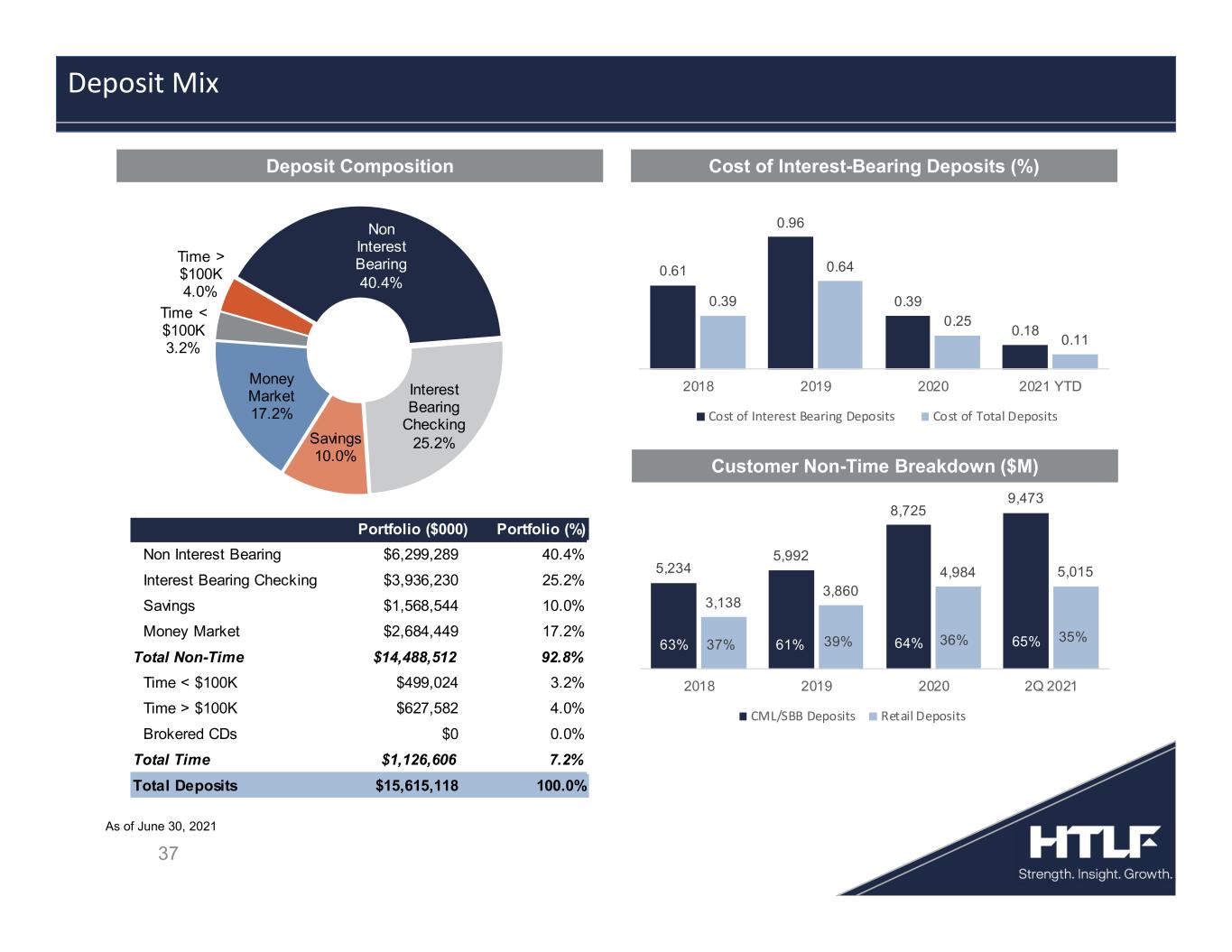

Total deposits were $15.62 billion as of June 30, 2021, $15.56 billion as of March 31, 2021 and $14.98 billion at year-end 2020. Significant deposit changes by category at June 30, 2021 compared to March 31, 2021 included:

•Demand deposits increased $123.3 million or 2% to $6.30 billion compared to $6.18 billion.

•Time deposits decreased $77.2 million or 6% to $1.13 billion from $1.20 billion.

Significant deposit changes by category at June 30, 2021 compared to December 31, 2020 included:

•Demand deposits increased $610.5 million or 11% to $6.30 billion compared to $5.69 billion.

•Time deposits decreased $144.8 million or 11% to $1.13 billion from $1.27 billion.

Growth in demand deposits during the second quarter and first six months of 2021 was positively impacted by payments related to federal government stimulus programs and other COVID-19 relief programs.

Provision and Allowance

Provision and Allowance for Credit Losses for Loans

Provision benefit for credit losses for loans for the second quarter of 2021 was $6.5 million, which was a decrease of $31.5 million from provision expense of $25.0 million recorded in the second quarter of 2020. The provision benefit for the second quarter of 2021 was impacted by several factors, including:

•increases in balances of loans held to maturity of $287.7 million during the second quarter, excluding total PPP loans;

•modest improvements in credit quality marked by a decrease in nonperforming loans of $6.5 million to $85.4 million and nonpass loans of 10.37% of total loans for the second quarter compared to nonperforming loans of $91.9 million and nonpass loans of 11.47% of total loans at March 31, 2021, and

•improved macroeconomic factors compared to previous quarters.

The allowance for credit losses for loans totaled $120.7 million and $131.6 million at June 30, 2021, and December 31, 2020, respectively. The following items have impacted the allowance for credit losses for loans for the six months ended June 30, 2021:

•Provision benefit for the six months ended June 30, 2021, totaled $6.5 million.

•Net charge offs of $4.4 million were recorded for the first six months of 2021.

Provision and Allowance for Credit Losses for Unfunded Commitments

The allowance for unfunded commitments totaled $14.0 million at June 30, 2021, which was a decrease of $1.3 million from $15.3 million at December 31, 2020. Unfunded commitments increased $186.1 million to $3.43 billion at June 30, 2021 compared to $3.25 billion at December 31, 2020.

Total Provision and Allowance for Lending Related Credit Losses

The total provision benefit for lending related credit losses was $7.1 million for the second quarter of 2021 compared to provision expense of $26.9 million for the second quarter of 2020. The total allowance for lending related credit losses was $134.7 million at June 30, 2021, which was 1.35% of total loans as of June 30, 2021, compared to $146.9 million or 1.47% of total loans as of December 31, 2020. Excluding PPP loans, the allowance for lending related credit losses as a percentage of total loans was 1.47% and 1.62% as of June 30, 2021, and December 31, 2020, respectively.

Nonperforming Assets

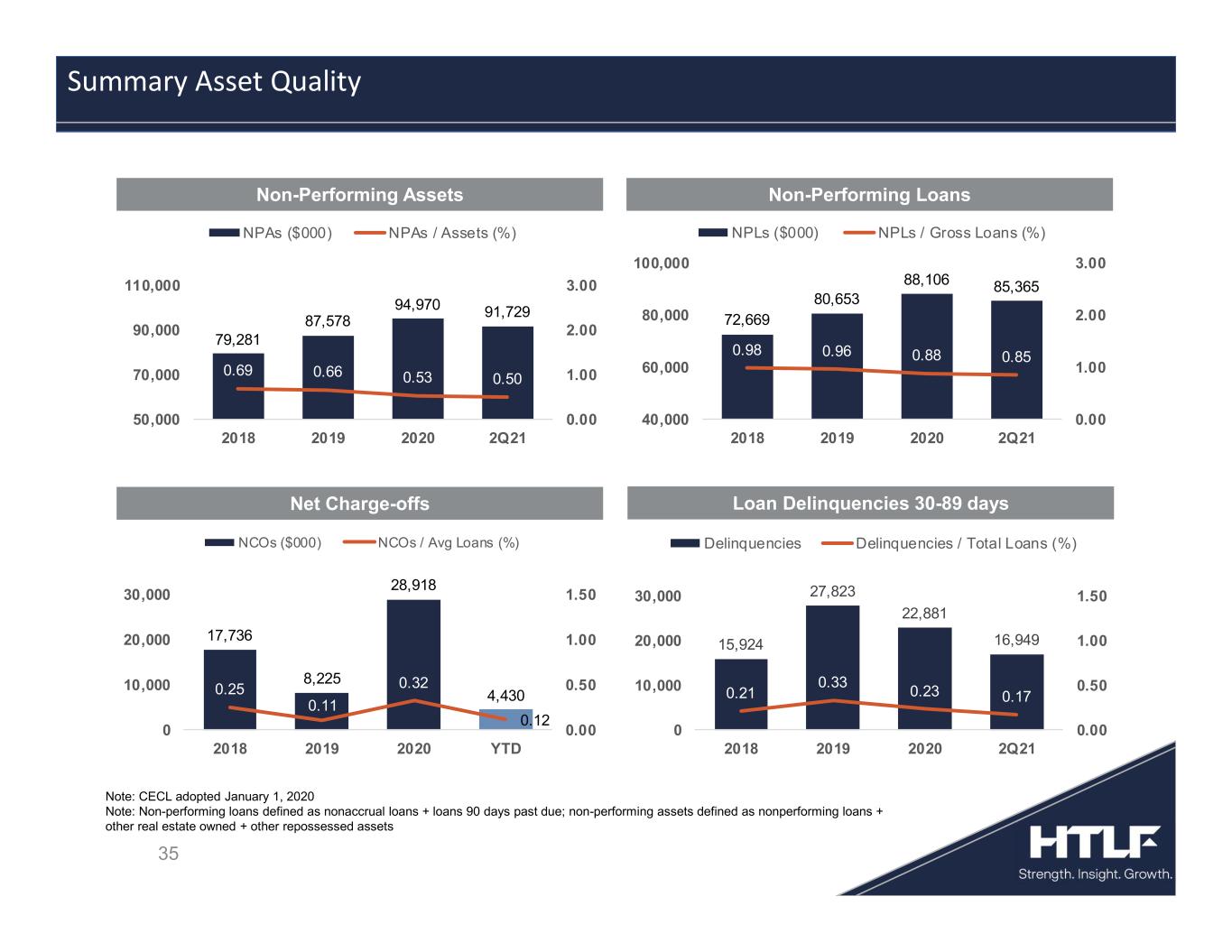

Nonperforming assets decreased $3.2 million or 3% to $91.7 million or 0.50% of total assets at June 30, 2021, compared to $95.0 million or 0.53% of total assets at December 31, 2020. Nonperforming loans were $85.4 million or 0.85% of total loans at June 30, 2021, compared to $88.1 million or 0.88% of total loans at December 31, 2020. At June 30, 2021, loans delinquent 30-89 days were 0.17% of total loans compared to 0.23% of total loans at December 31, 2020.

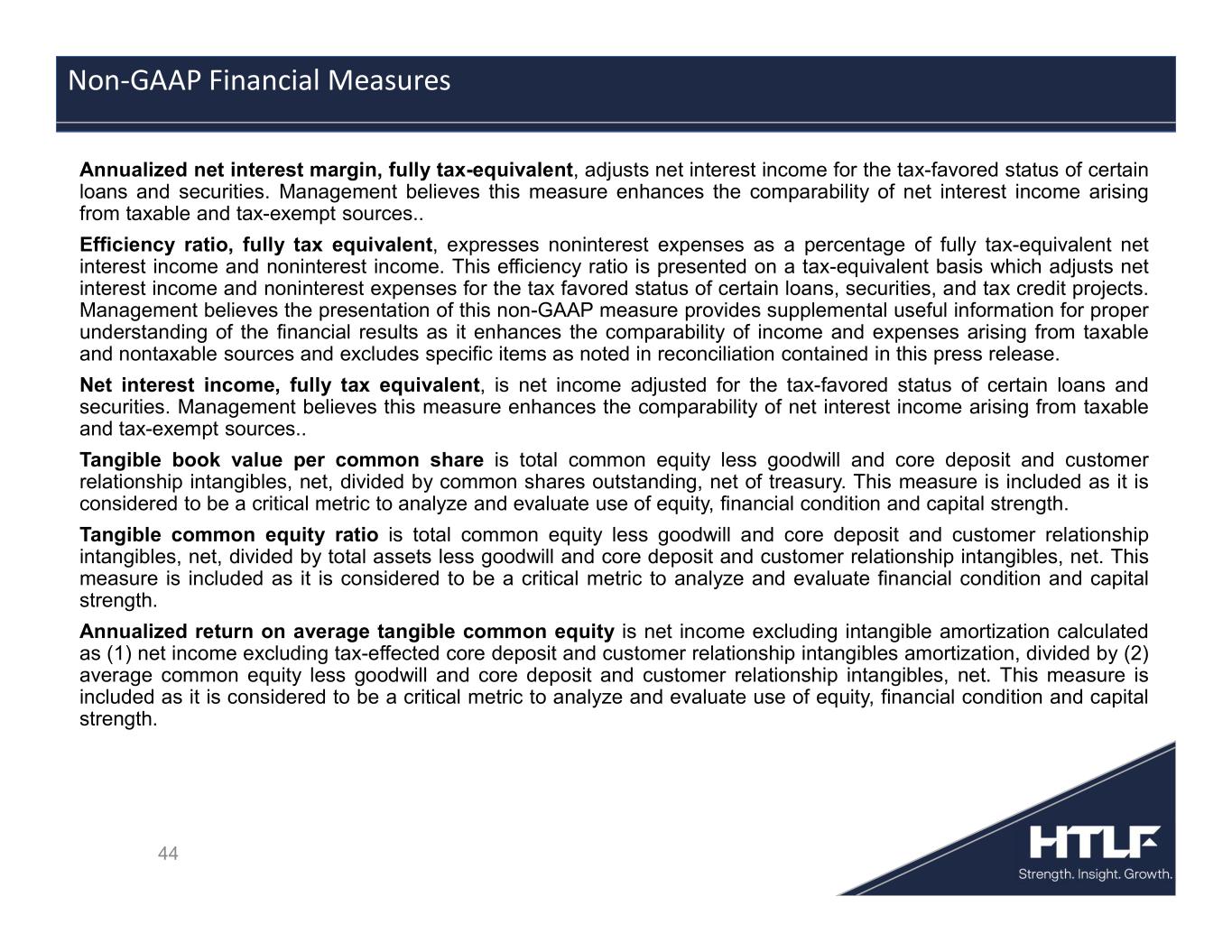

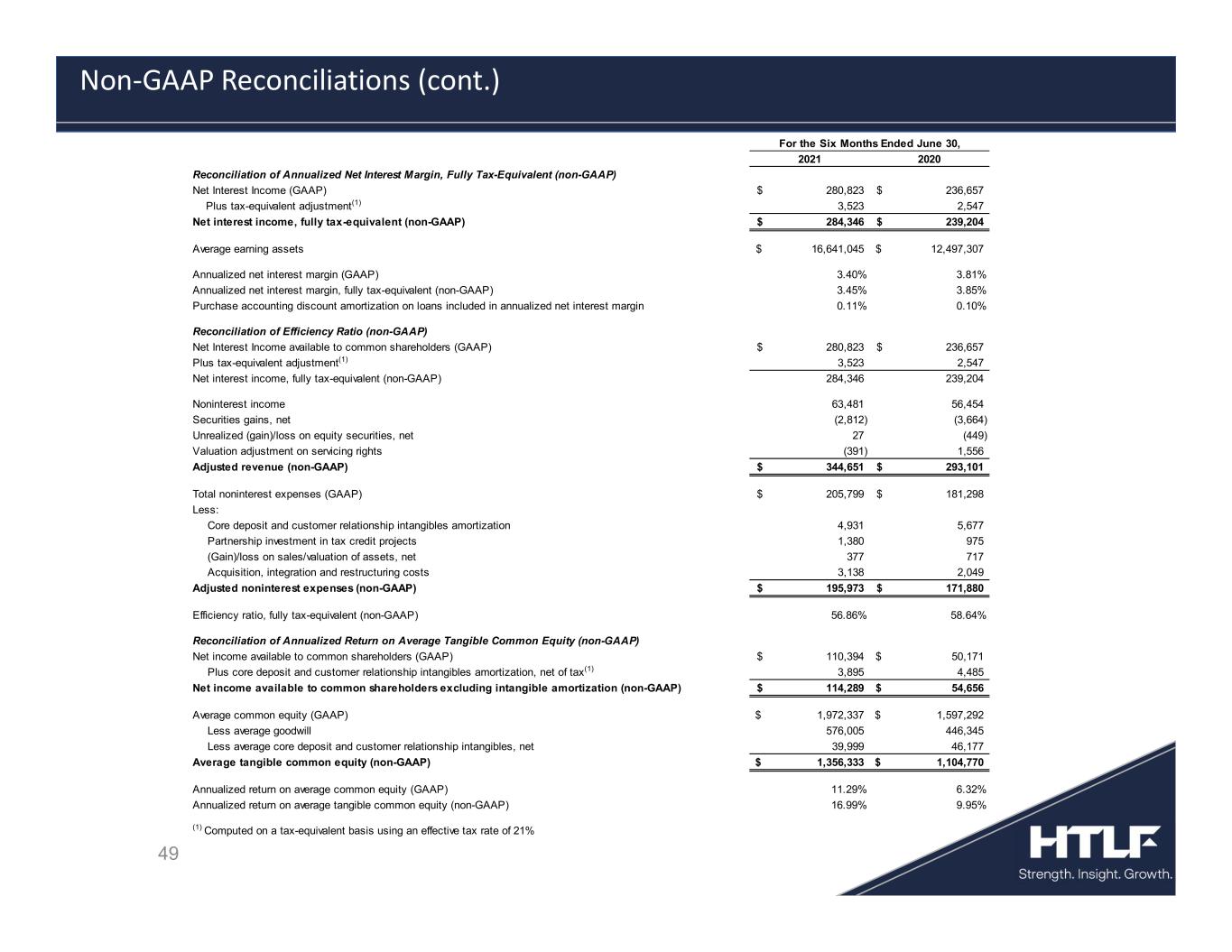

Non-GAAP Financial Measures

This earnings release contains references to financial measures which are not defined by generally accepted accounting principles ("GAAP"). Management believes the non-GAAP measures are helpful for investors to analyze and evaluate the company's financial condition and operating results. However, these non-GAAP measures have inherent limitations and should not be considered a substitute for operating results determined in accordance with GAAP. Additionally, because non-GAAP measures are not standardized, it may not be possible to compare the non-GAAP measures in this earnings release with other companies' non-GAAP measures. Reconciliations of each non-GAAP measure to the most directly comparable GAAP measure may be found in the financial tables in this earnings release.

Below are the non-GAAP measures included in this earnings release, management's reason for including each measure and the method of calculating each measure:

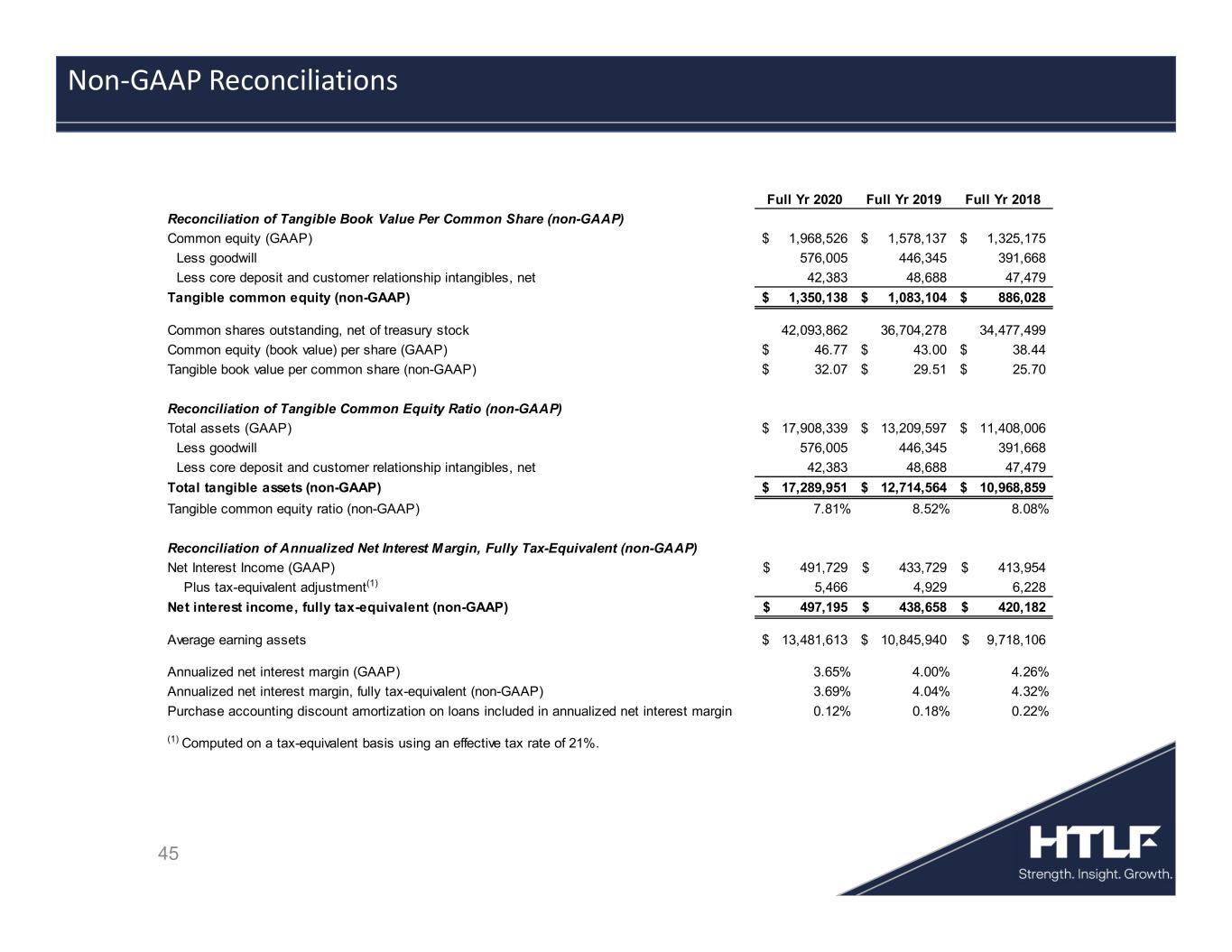

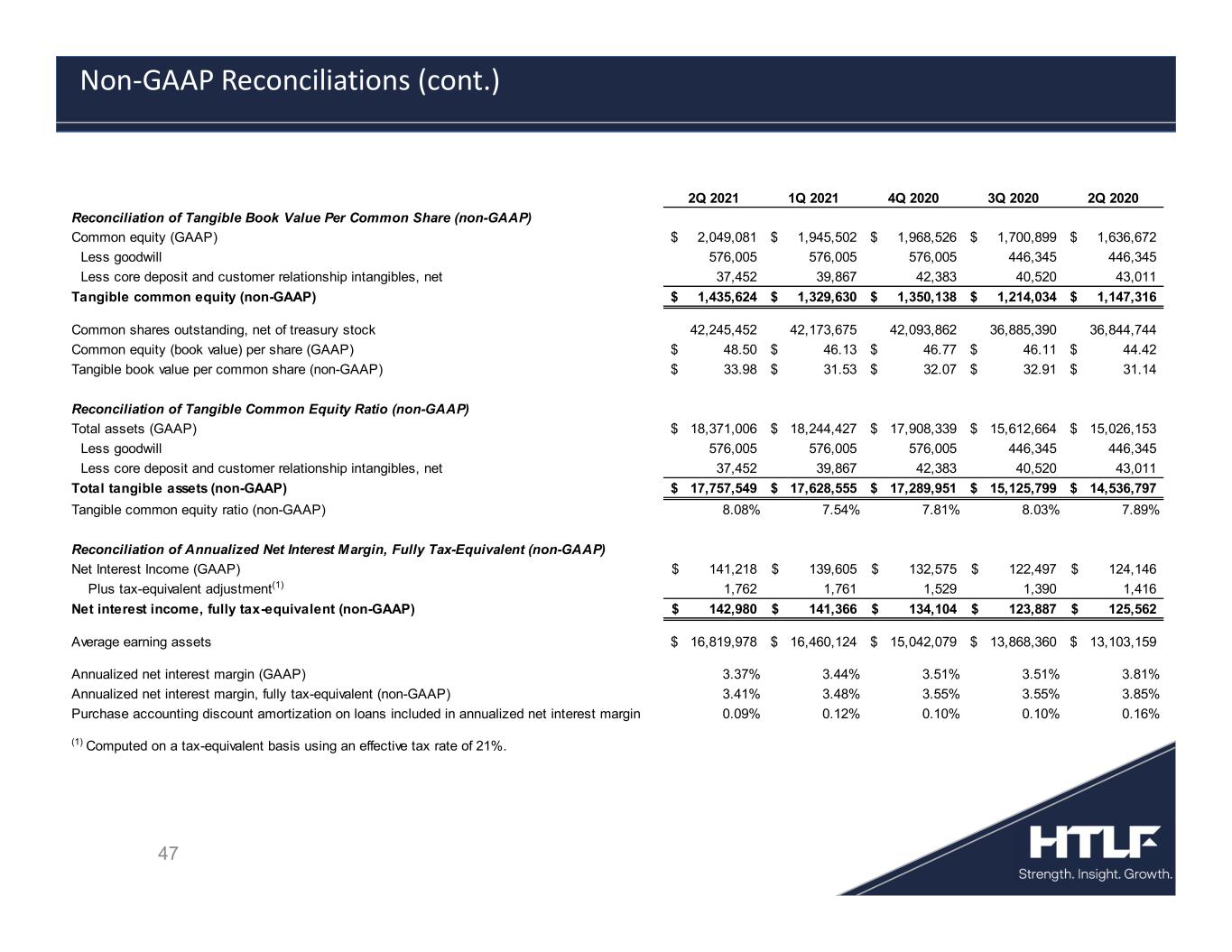

•Annualized net interest margin, fully tax-equivalent, adjusts net interest income for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources.

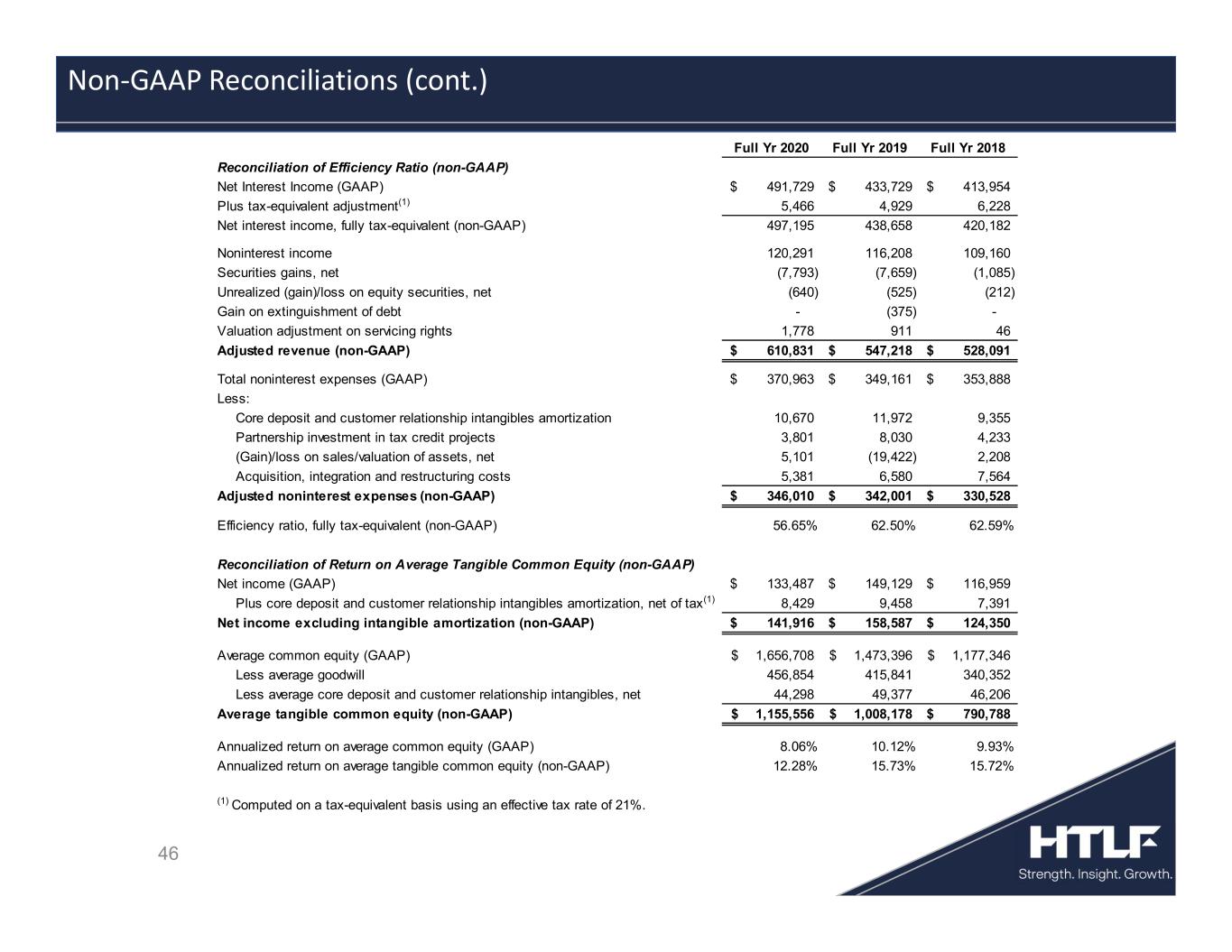

•Efficiency ratio, fully tax equivalent, expresses noninterest expenses as a percentage of fully tax-equivalent net interest income and noninterest income. This efficiency ratio is presented on a tax-equivalent basis which adjusts net interest income and noninterest expenses for the tax favored status of certain loans, securities, and tax credit projects. Management believes the presentation of this non-GAAP measure provides supplemental useful information for proper understanding of the financial results as it enhances the comparability of income and expenses arising from taxable and nontaxable sources and excludes specific items as noted in reconciliation contained in this earnings release.

•Net interest income, fully tax equivalent, is net income adjusted for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources.

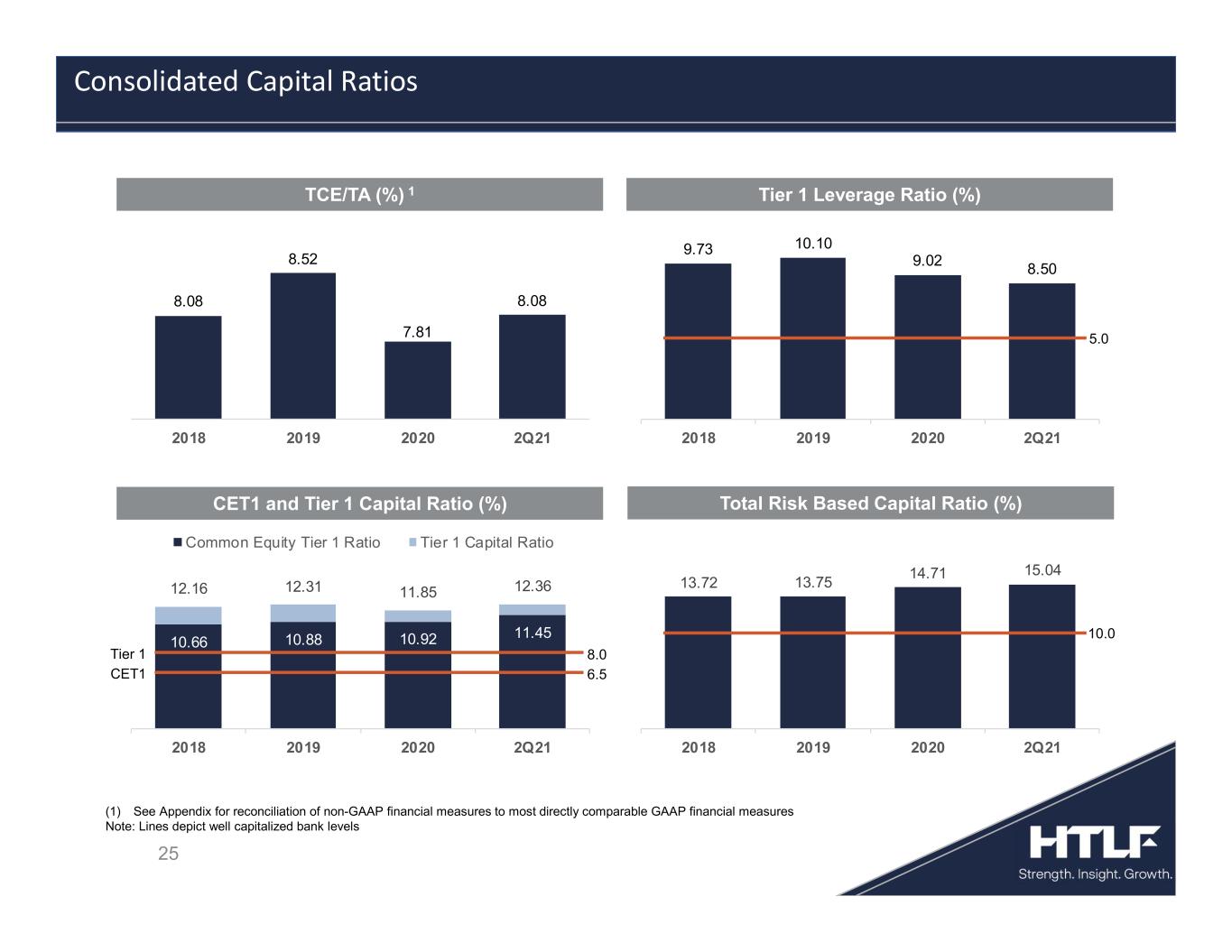

•Tangible book value per common share is total common equity less goodwill and core deposit and customer relationship intangibles, net, divided by common shares outstanding, net of treasury. This measure is included as it is considered to be a critical metric to analyze and evaluate use of equity, financial condition and capital strength.

•Tangible common equity ratio is total common equity less goodwill and core deposit and customer relationship intangibles, net, divided by total assets less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate financial condition and capital strength.

•Annualized return on average tangible common equity is net income excluding intangible amortization calculated as (1) net income excluding tax-effected core deposit and customer relationship intangibles amortization, divided by (2) average common equity less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate use of equity, financial condition and capital strength.

Conference Call Details

HTLF will host a conference call for shareholders, analysts and other interested parties at 5:00 p.m. EDT today. To join, please register in advance of the conference using the link provided below. Upon registering, participant dial-in numbers, Direct Event passcode and unique registrant ID will be provided. Direct Event online registration can be found at: http://www.directeventreg.com/registration/event/3970348. In the 10 minutes prior to the call start time, participants need to use the conference access information provided in the email received at the point of registering. A replay will be available until July 25, 2022, by logging on to www.htlf.com.

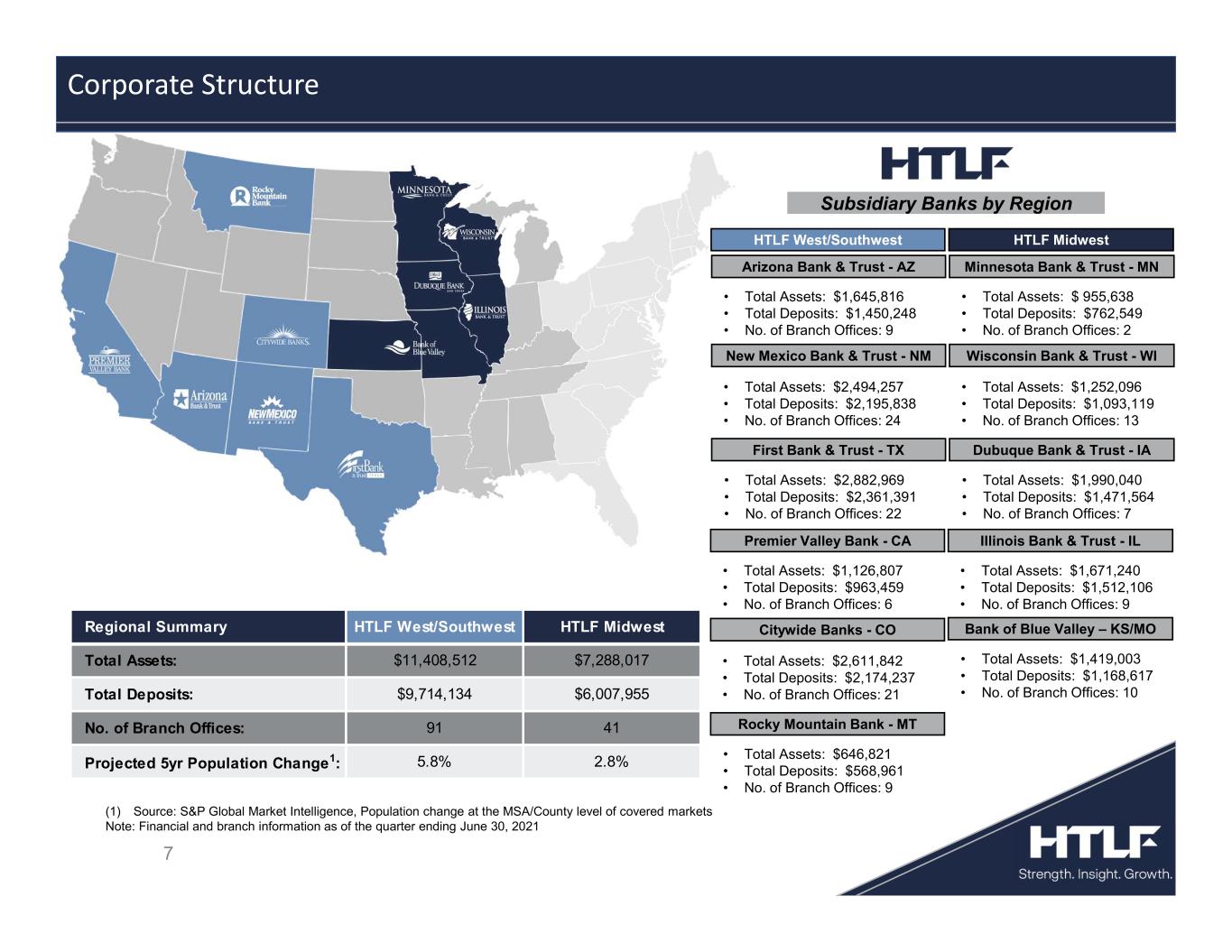

About HTLF

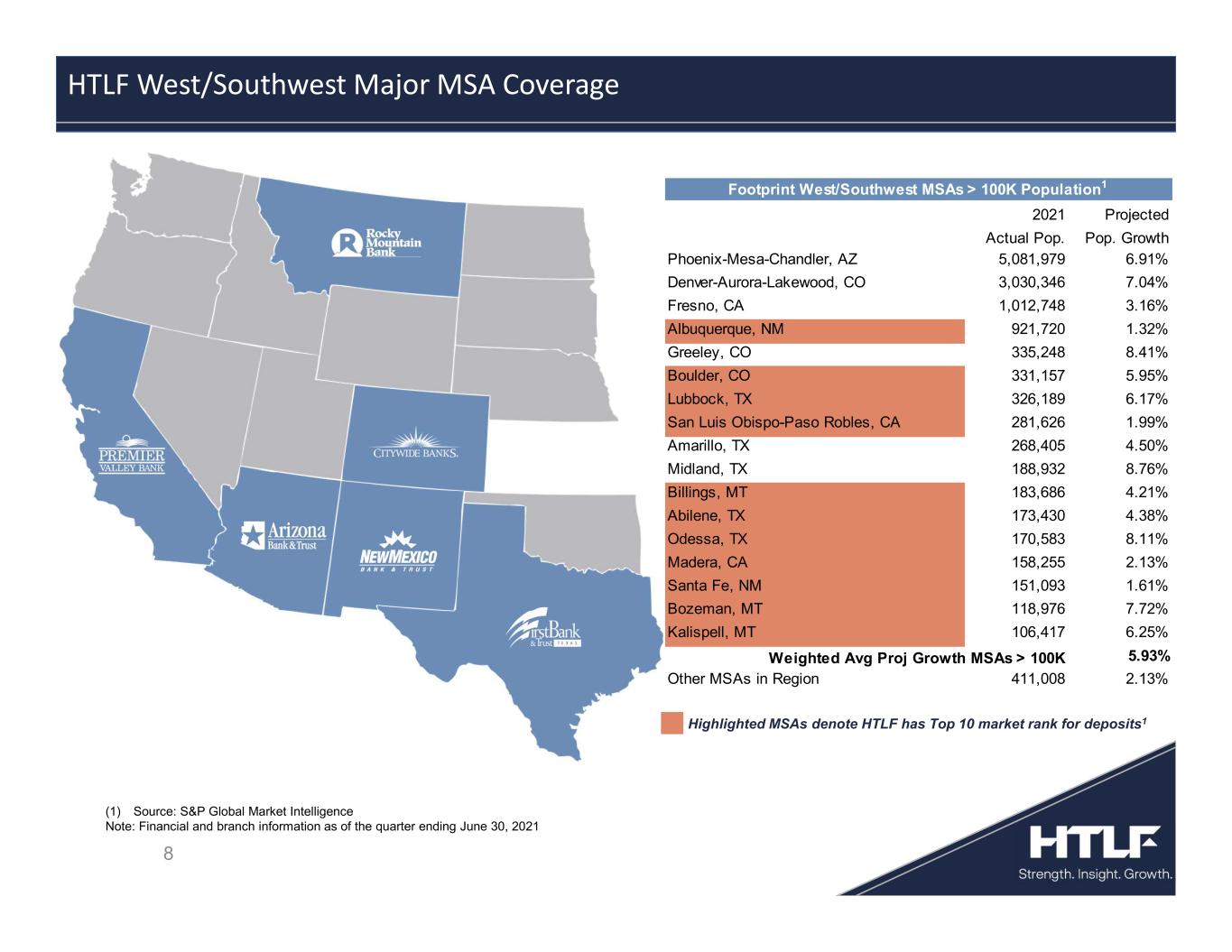

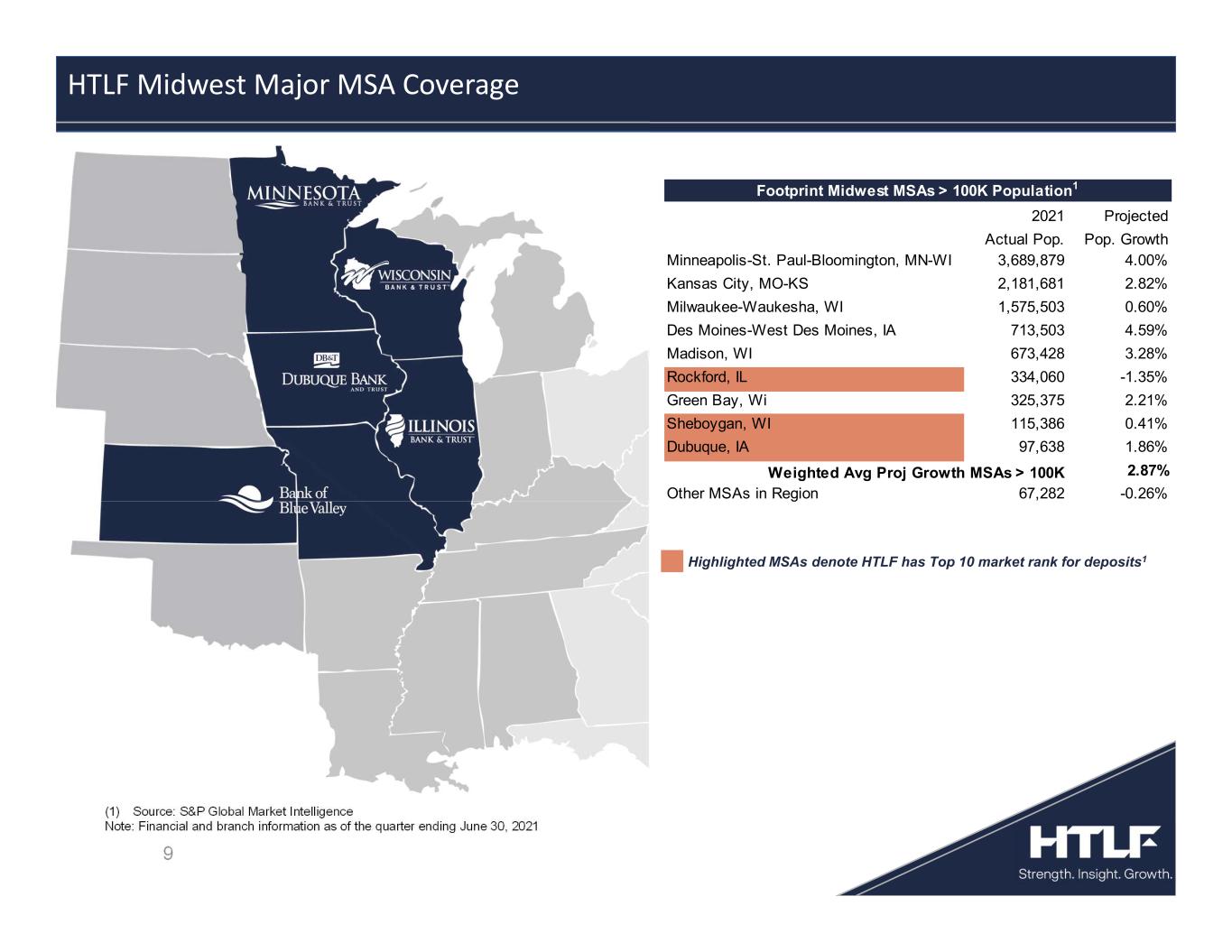

Heartland Financial USA, Inc., operating under the brand name HTLF, is a financial services company with assets of $18.37 billion. HTLF has banks serving communities in Arizona, California, Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Montana, New Mexico, Texas and Wisconsin. HTLF is committed to its core commercial business, supported by a strong retail operation, and provides a diversified line of financial services including treasury management, residential mortgage, wealth management, investment and insurance. Additional information is available at www.htlf.com.

Safe Harbor Statement

This release (including any information incorporated herein by reference), and future oral and written statements of the company and its management, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the business, financial condition, results of operations, plans, objectives and future performance of HTLF.

Any statements about the company's expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Forward-looking statements may include information about possible or assumed future results of the company's operations or performance. These forward-looking statements are generally identified by the use of the words such as "believe", "expect", "intent", "anticipate", "plan", "intend", "estimate", "project", "may", "will", "would", "could", "should", "may", "view", "opportunity", "potential", or similar or negative expressions of these words or phrases that are used in this release, and future oral and written statements of the company and its management. Although the company may make these statements based on management’s experience, beliefs, expectations, assumptions and best estimate of future events, the ability of the company to predict results or the actual effect or outcomes of plans or strategies is inherently uncertain, and there may be events or factors that management has not anticipated. Therefore, the accuracy and achievement of such forward-looking statements and estimates are subject to a number of risks, many of which are beyond the ability of management to control or predict, that could cause actual results to differ materially from those in its forward-looking statements. These factors, which the company currently believes could have a material effect on its operations and future prospects, are detailed below and in the risk factors in HTLF's reports filed with the Securities and Exchange Commission ("SEC"), including the "Risk Factors" section under Item 1A of Part I of the company’s Annual Report on Form 10-K for the year ended December 31, 2020, include, among others:

•COVID-19 Pandemic Risks, including risks related to the ongoing COVID-19 pandemic and measures enacted by the U.S. federal and state governments and adopted by private businesses in response to the COVID-19 pandemic;

•Economic and Market Conditions Risks, including risks related to changes in the U.S. economy in general and in the local economies in which HTLF conducts its operations and future civil unrest, natural disasters, terrorist threats or acts of war;

•Credit Risks, including risks of increasing credit losses due to deterioration in the financial condition of HTLF's borrowers, changes in asset and collateral values and climate and other borrower industry risks which may impact the provision for credit losses and net charge-offs;

•Liquidity and Interest Rate Risks, including the impact of capital market conditions and changes in monetary policy on our borrowings and net interest income;

•Operational Risks, including processing, information systems, cybersecurity, vendor, business interruption, and fraud risks;

•Strategic and External Risks, including competitive forces impacting our business and strategic acquisition risks;

•Legal, Compliance and Reputational Risks, including regulatory and litigation risks; and

•Risks of Owning Stock in HTLF, including stock price volatility and dilution as a result of future equity offerings and acquisitions.

There can be no assurance that other factors not currently anticipated by HTLF will not materially and adversely affect the company’s business, financial condition and results of operations. In addition, many of these risks and uncertainties are currently amplified by and may continue to be amplified by the COVID-19 pandemic and the impact of varying governmental responses that affect the company’s customers and the economies where they operate. Additionally, all statements in this release, including forward-looking statements speak only as of the date they are made. The company does not undertake and specifically disclaims any obligation to publicly release the results of any revisions which may be made to or correct or update any forward-looking statement to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events or to otherwise update any statement in light of new information or future events. Further information concerning HTLF and its business, including additional factors that could materially affect the company’s financial results, is included in the company’s filings with the SEC.

-FINANCIAL TABLES FOLLOW-

###

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||

| For the Quarter Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||

| Interest and fees on loans | $ | 111,915 | $ | 107,005 | $ | 224,354 | $ | 213,419 | |||||||||||||||

| Interest on securities: | |||||||||||||||||||||||

| Taxable | 31,546 | 23,362 | 61,989 | 45,093 | |||||||||||||||||||

| Nontaxable | 4,561 | 3,344 | 9,064 | 5,527 | |||||||||||||||||||

| Interest on federal funds sold | — | — | 1 | — | |||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 60 | 54 | 126 | 775 | |||||||||||||||||||

| Total Interest Income | 148,082 | 133,765 | 295,534 | 264,814 | |||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||

| Interest on deposits | 3,790 | 6,134 | 8,185 | 20,716 | |||||||||||||||||||

| Interest on short-term borrowings | 98 | 61 | 250 | 357 | |||||||||||||||||||

| Interest on other borrowings | 2,976 | 3,424 | 6,276 | 7,084 | |||||||||||||||||||

| Total Interest Expense | 6,864 | 9,619 | 14,711 | 28,157 | |||||||||||||||||||

| Net Interest Income | 141,218 | 124,146 | 280,823 | 236,657 | |||||||||||||||||||

| Provision (benefit) for credit losses | (7,080) | 26,796 | (7,728) | 48,316 | |||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 148,298 | 97,350 | 288,551 | 188,341 | |||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||

| Service charges and fees | 15,132 | 10,972 | 28,803 | 22,993 | |||||||||||||||||||

| Loan servicing income | 873 | 379 | 1,711 | 1,342 | |||||||||||||||||||

| Trust fees | 6,039 | 4,977 | 11,816 | 9,999 | |||||||||||||||||||

| Brokerage and insurance commissions | 865 | 595 | 1,718 | 1,328 | |||||||||||||||||||

| Securities gains/(losses), net | 2,842 | 2,006 | 2,812 | 3,664 | |||||||||||||||||||

| Unrealized gain/ (loss) on equity securities, net | 83 | 680 | (27) | 449 | |||||||||||||||||||

| Net gains on sale of loans held for sale | 4,753 | 7,857 | 11,173 | 12,517 | |||||||||||||||||||

| Valuation adjustment on servicing rights | (526) | 9 | 391 | (1,556) | |||||||||||||||||||

| Income on bank owned life insurance | 937 | 1,167 | 1,766 | 1,665 | |||||||||||||||||||

| Other noninterest income | 2,166 | 1,995 | 3,318 | 4,053 | |||||||||||||||||||

| Total Noninterest Income | 33,164 | 30,637 | 63,481 | 56,454 | |||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||

| Salaries and employee benefits | 57,332 | 50,118 | 116,394 | 100,075 | |||||||||||||||||||

| Occupancy | 7,399 | 6,502 | 15,317 | 12,973 | |||||||||||||||||||

| Furniture and equipment | 3,501 | 2,993 | 6,594 | 6,101 | |||||||||||||||||||

| Professional fees | 16,237 | 13,676 | 29,727 | 26,149 | |||||||||||||||||||

| Advertising | 1,649 | 995 | 3,118 | 3,200 | |||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 2,415 | 2,696 | 4,931 | 5,677 | |||||||||||||||||||

| Other real estate and loan collection expenses, net | 414 | 203 | 549 | 537 | |||||||||||||||||||

| Loss on sales/valuations of assets, net | 183 | 701 | 377 | 717 | |||||||||||||||||||

| Acquisition, integration and restructuring costs | 210 | 673 | 3,138 | 2,049 | |||||||||||||||||||

| Partnership investment in tax credit projects | 1,345 | 791 | 1,380 | 975 | |||||||||||||||||||

| Other noninterest expenses | 12,691 | 11,091 | 24,274 | 22,845 | |||||||||||||||||||

| Total Noninterest Expense | 103,376 | 90,439 | 205,799 | 181,298 | |||||||||||||||||||

| Income Before Income Taxes | 78,086 | 37,548 | 146,233 | 63,497 | |||||||||||||||||||

| Income taxes | 16,481 | 7,417 | 31,814 | 13,326 | |||||||||||||||||||

| Net Income | 61,605 | 30,131 | 114,419 | 50,171 | |||||||||||||||||||

| Preferred dividends | (2,012) | — | (4,025) | — | |||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 59,593 | $ | 30,131 | $ | 110,394 | $ | 50,171 | |||||||||||||||

| Earnings per common share-diluted | $ | 1.41 | $ | 0.82 | $ | 2.61 | $ | 1.36 | |||||||||||||||

| Weighted average shares outstanding-diluted | 42,359,873 | 36,915,630 | 42,357,133 | 36,919,555 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 111,915 | $ | 112,439 | $ | 108,865 | $ | 102,657 | $ | 107,005 | |||||||||||||||||||

| Interest on securities: | |||||||||||||||||||||||||||||

| Taxable | 31,546 | 30,443 | 28,154 | 25,016 | 23,362 | ||||||||||||||||||||||||

| Nontaxable | 4,561 | 4,503 | 3,735 | 3,222 | 3,344 | ||||||||||||||||||||||||

| Interest on federal funds sold | — | 1 | — | — | — | ||||||||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 60 | 66 | 77 | 72 | 54 | ||||||||||||||||||||||||

| Total Interest Income | 148,082 | 147,452 | 140,831 | 130,967 | 133,765 | ||||||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||

| Interest on deposits | 3,790 | 4,395 | 4,609 | 4,962 | 6,134 | ||||||||||||||||||||||||

| Interest on short-term borrowings | 98 | 152 | 175 | 78 | 61 | ||||||||||||||||||||||||

| Interest on other borrowings | 2,976 | 3,300 | 3,472 | 3,430 | 3,424 | ||||||||||||||||||||||||

| Total Interest Expense | 6,864 | 7,847 | 8,256 | 8,470 | 9,619 | ||||||||||||||||||||||||

| Net Interest Income | 141,218 | 139,605 | 132,575 | 122,497 | 124,146 | ||||||||||||||||||||||||

| Provision (benefit) for credit losses | (7,080) | (648) | 17,072 | 1,678 | 26,796 | ||||||||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 148,298 | 140,253 | 115,503 | 120,819 | 97,350 | ||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||

| Service charges and fees | 15,132 | 13,671 | 12,725 | 11,749 | 10,972 | ||||||||||||||||||||||||

| Loan servicing income | 873 | 838 | 997 | 638 | 379 | ||||||||||||||||||||||||

| Trust fees | 6,039 | 5,777 | 5,506 | 5,357 | 4,977 | ||||||||||||||||||||||||

| Brokerage and insurance commissions | 865 | 853 | 779 | 649 | 595 | ||||||||||||||||||||||||

| Securities gains/(losses), net | 2,842 | (30) | 2,829 | 1,300 | 2,006 | ||||||||||||||||||||||||

| Unrealized gain/ (loss) on equity securities, net | 83 | (110) | 36 | 155 | 680 | ||||||||||||||||||||||||

| Net gains on sale of loans held for sale | 4,753 | 6,420 | 7,104 | 8,894 | 7,857 | ||||||||||||||||||||||||

| Valuation adjustment on servicing rights | (526) | 917 | (102) | (120) | 9 | ||||||||||||||||||||||||

| Income on bank owned life insurance | 937 | 829 | 1,021 | 868 | 1,167 | ||||||||||||||||||||||||

| Other noninterest income | 2,166 | 1,152 | 1,726 | 1,726 | 1,995 | ||||||||||||||||||||||||

| Total Noninterest Income | 33,164 | 30,317 | 32,621 | 31,216 | 30,637 | ||||||||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 57,332 | 59,062 | 51,615 | 50,978 | 50,118 | ||||||||||||||||||||||||

| Occupancy | 7,399 | 7,918 | 6,849 | 6,732 | 6,502 | ||||||||||||||||||||||||

| Furniture and equipment | 3,501 | 3,093 | 3,913 | 2,500 | 2,993 | ||||||||||||||||||||||||

| Professional fees | 16,237 | 13,490 | 15,117 | 12,802 | 13,676 | ||||||||||||||||||||||||

| Advertising | 1,649 | 1,469 | 1,107 | 928 | 995 | ||||||||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 2,415 | 2,516 | 2,501 | 2,492 | 2,696 | ||||||||||||||||||||||||

| Other real estate and loan collection expenses, net | 414 | 135 | 468 | 335 | 203 | ||||||||||||||||||||||||

| Loss on sales/valuations of assets, net | 183 | 194 | 2,621 | 1,763 | 701 | ||||||||||||||||||||||||

| Acquisition, integration and restructuring costs | 210 | 2,928 | 2,186 | 1,146 | 673 | ||||||||||||||||||||||||

| Partnership investment in tax credit projects | 1,345 | 35 | 1,899 | 927 | 791 | ||||||||||||||||||||||||

| Other noninterest expenses | 12,691 | 11,583 | 10,993 | 9,793 | 11,091 | ||||||||||||||||||||||||

| Total Noninterest Expense | 103,376 | 102,423 | 99,269 | 90,396 | 90,439 | ||||||||||||||||||||||||

| Income Before Income Taxes | 78,086 | 68,147 | 48,855 | 61,639 | 37,548 | ||||||||||||||||||||||||

| Income taxes | 16,481 | 15,333 | 9,046 | 13,681 | 7,417 | ||||||||||||||||||||||||

| Net Income | 61,605 | 52,814 | 39,809 | 47,958 | 30,131 | ||||||||||||||||||||||||

| Preferred dividends | (2,012) | (2,013) | (2,014) | (2,437) | — | ||||||||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 59,593 | $ | 50,801 | $ | 37,795 | $ | 45,521 | $ | 30,131 | |||||||||||||||||||

| Earnings per common share-diluted | $ | 1.41 | $ | 1.20 | $ | 0.98 | $ | 1.23 | $ | 0.82 | |||||||||||||||||||

| Weighted average shares outstanding-diluted | 42,359,873 | 42,335,747 | 38,534,082 | 36,995,572 | 36,915,630 | ||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 208,702 | $ | 198,177 | $ | 219,243 | $ | 175,284 | $ | 211,429 | |||||||||||||||||||

| Interest bearing deposits with other banks and short-term investments | 240,426 | 269,685 | 118,660 | 156,371 | 242,149 | ||||||||||||||||||||||||

| Cash and cash equivalents | 449,128 | 467,862 | 337,903 | 331,655 | 453,578 | ||||||||||||||||||||||||

| Time deposits in other financial institutions | 3,138 | 3,138 | 3,129 | 3,129 | 3,128 | ||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||

| Carried at fair value | 6,543,978 | 6,370,495 | 6,127,975 | 4,950,698 | 4,126,351 | ||||||||||||||||||||||||

| Held to maturity, at cost, less allowance for credit losses | 85,439 | 85,293 | 88,839 | 88,700 | 90,579 | ||||||||||||||||||||||||

| Other investments, at cost | 76,809 | 74,935 | 75,253 | 35,940 | 35,902 | ||||||||||||||||||||||||

| Loans held for sale | 33,248 | 43,037 | 57,949 | 65,969 | 54,382 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Held to maturity | 10,012,014 | 10,050,456 | 10,023,051 | 9,099,646 | 9,246,830 | ||||||||||||||||||||||||

| Allowance for credit losses | (120,726) | (130,172) | (131,606) | (103,377) | (119,937) | ||||||||||||||||||||||||

| Loans, net | 9,891,288 | 9,920,284 | 9,891,445 | 8,996,269 | 9,126,893 | ||||||||||||||||||||||||

| Premises, furniture and equipment, net | 226,358 | 225,047 | 226,094 | 200,028 | 198,481 | ||||||||||||||||||||||||

| Goodwill | 576,005 | 576,005 | 576,005 | 446,345 | 446,345 | ||||||||||||||||||||||||

| Core deposit and customer relationship intangibles, net | 37,452 | 39,867 | 42,383 | 40,520 | 43,011 | ||||||||||||||||||||||||

| Servicing rights, net | 6,201 | 6,953 | 6,052 | 5,752 | 5,469 | ||||||||||||||||||||||||

| Cash surrender value on life insurance | 189,619 | 188,521 | 187,664 | 173,111 | 172,813 | ||||||||||||||||||||||||

| Other real estate, net | 6,314 | 6,236 | 6,624 | 5,050 | 5,539 | ||||||||||||||||||||||||

| Other assets | 246,029 | 236,754 | 281,024 | 269,498 | 263,682 | ||||||||||||||||||||||||

| Total Assets | $ | 18,371,006 | $ | 18,244,427 | $ | 17,908,339 | $ | 15,612,664 | $ | 15,026,153 | |||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Demand | $ | 6,299,289 | $ | 6,175,946 | $ | 5,688,810 | $ | 5,022,567 | $ | 4,831,151 | |||||||||||||||||||

| Savings | 8,189,223 | 8,179,251 | 8,019,704 | 6,742,151 | 6,810,296 | ||||||||||||||||||||||||

| Time | 1,126,606 | 1,203,854 | 1,271,391 | 1,002,392 | 1,067,252 | ||||||||||||||||||||||||

| Total deposits | 15,615,118 | 15,559,051 | 14,979,905 | 12,767,110 | 12,708,699 | ||||||||||||||||||||||||

| Short-term borrowings | 152,563 | 140,597 | 167,872 | 306,706 | 88,631 | ||||||||||||||||||||||||

| Other borrowings | 271,244 | 349,514 | 457,042 | 524,045 | 306,459 | ||||||||||||||||||||||||

| Accrued expenses and other liabilities | 172,295 | 139,058 | 224,289 | 203,199 | 174,987 | ||||||||||||||||||||||||

| Total Liabilities | 16,211,220 | 16,188,220 | 15,829,108 | 13,801,060 | 13,278,776 | ||||||||||||||||||||||||

| Stockholders' Equity | |||||||||||||||||||||||||||||

| Preferred equity | 110,705 | 110,705 | 110,705 | 110,705 | 110,705 | ||||||||||||||||||||||||

| Common stock | 42,245 | 42,174 | 42,094 | 36,885 | 36,845 | ||||||||||||||||||||||||

| Capital surplus | 1,066,765 | 1,063,497 | 1,062,083 | 847,377 | 844,202 | ||||||||||||||||||||||||

| Retained earnings | 883,484 | 833,171 | 791,630 | 761,211 | 723,067 | ||||||||||||||||||||||||

| Accumulated other comprehensive income | 56,587 | 6,660 | 72,719 | 55,426 | 32,558 | ||||||||||||||||||||||||

| Total Equity | 2,159,786 | 2,056,207 | 2,079,231 | 1,811,604 | 1,747,377 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 18,371,006 | $ | 18,244,427 | $ | 17,908,339 | $ | 15,612,664 | $ | 15,026,153 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||

| Assets | $ | 18,293,756 | $ | 17,964,723 | $ | 16,401,152 | $ | 15,167,225 | $ | 14,391,856 | |||||||||||||||||||

| Loans, net of unearned | 10,072,071 | 9,952,152 | 9,366,430 | 9,220,666 | 9,186,913 | ||||||||||||||||||||||||

| Deposits | 15,576,345 | 15,044,561 | 13,518,020 | 12,650,822 | 12,288,378 | ||||||||||||||||||||||||

| Earning assets | 16,819,978 | 16,460,124 | 15,042,079 | 13,868,360 | 13,103,159 | ||||||||||||||||||||||||

| Interest bearing liabilities | 9,871,302 | 9,917,159 | 9,053,855 | 8,320,123 | 8,155,753 | ||||||||||||||||||||||||

| Common equity | 1,980,904 | 1,963,674 | 1,769,575 | 1,661,381 | 1,574,902 | ||||||||||||||||||||||||

| Total stockholders' equity | 2,091,609 | 2,074,379 | 1,880,280 | 1,772,086 | 1,580,997 | ||||||||||||||||||||||||

Tangible common equity (non-GAAP)(1) | 1,366,285 | 1,346,270 | 1,238,691 | 1,172,891 | 1,083,834 | ||||||||||||||||||||||||

| Key Performance Ratios | |||||||||||||||||||||||||||||

| Annualized return on average assets | 1.35 | % | 1.19 | % | 0.97 | % | 1.26 | % | 0.84 | % | |||||||||||||||||||

| Annualized return on average common equity (GAAP) | 12.07 | 10.49 | 8.50 | 10.90 | 7.69 | ||||||||||||||||||||||||

Annualized return on average tangible common equity (non-GAAP)(1) | 18.05 | 15.90 | 12.77 | 16.11 | 11.97 | ||||||||||||||||||||||||

| Annualized ratio of net charge-offs to average loans | 0.12 | 0.06 | 0.01 | 0.92 | 0.11 | ||||||||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.37 | 3.44 | 3.51 | 3.51 | 3.81 | ||||||||||||||||||||||||

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.41 | 3.48 | 3.55 | 3.55 | 3.85 | ||||||||||||||||||||||||

Efficiency ratio, fully tax-equivalent (non-GAAP)(1) | 57.11 | 56.61 | 54.93 | 54.67 | 55.75 | ||||||||||||||||||||||||

| For the Quarter Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||

| Assets | $ | 18,293,756 | $ | 14,391,856 | $ | 18,130,148 | $ | 13,770,015 | |||||||||||||||

| Loans, net of unearned | 10,072,071 | 9,186,913 | 10,012,443 | 8,775,566 | |||||||||||||||||||

| Deposits | 15,576,345 | 12,288,378 | 15,311,921 | 11,629,785 | |||||||||||||||||||

| Earning assets | 16,819,978 | 13,103,159 | 16,641,045 | 12,497,307 | |||||||||||||||||||

| Interest bearing liabilities | 9,871,302 | 8,155,753 | 9,894,103 | 7,998,847 | |||||||||||||||||||

| Common equity | 1,980,904 | 1,574,902 | 1,972,337 | 1,597,292 | |||||||||||||||||||

| Total stockholders' equity | 2,091,609 | 1,580,997 | 2,083,042 | 1,600,340 | |||||||||||||||||||

| Tangible common stockholders' equity | 1,366,285 | 1,083,834 | 1,356,333 | 1,104,770 | |||||||||||||||||||

| Key Performance Ratios | |||||||||||||||||||||||

| Annualized return on average assets | 1.35 | % | 0.84 | % | 1.27 | % | 0.73 | % | |||||||||||||||

| Annualized return on average common equity (GAAP) | 12.07 | 7.69 | 11.29 | 6.32 | |||||||||||||||||||

Annualized return on average tangible common equity (non-GAAP)(1) | 18.05 | 11.97 | 16.99 | 9.95 | |||||||||||||||||||

| Annualized ratio of net charge-offs to average loans | 0.12 | 0.11 | 0.09 | 0.17 | |||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.37 | 3.81 | 3.40 | 3.81 | |||||||||||||||||||

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.41 | 3.85 | 3.45 | 3.85 | |||||||||||||||||||

Efficiency ratio, fully tax-equivalent (non-GAAP)(1) | 57.11 | 55.75 | 56.86 | 58.64 | |||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||

| Book value per common share | $ | 48.50 | $ | 46.13 | $ | 46.77 | $ | 46.11 | $ | 44.42 | |||||||||||||||||||

Tangible book value per common share (non-GAAP)(1) | $ | 33.98 | $ | 31.53 | $ | 32.07 | $ | 32.91 | $ | 31.14 | |||||||||||||||||||

| Common shares outstanding, net of treasury stock | 42,245,452 | 42,173,675 | 42,093,862 | 36,885,390 | 36,844,744 | ||||||||||||||||||||||||

Tangible common equity ratio (non-GAAP)(1) | 8.08 | % | 7.54 | % | 7.81 | % | 8.03 | % | 7.89 | % | |||||||||||||||||||

| Other Selected Trend Information | |||||||||||||||||||||||||||||

| Effective tax rate | 21.11 | % | 22.50 | % | 18.52 | % | 22.20 | % | 19.75 | % | |||||||||||||||||||

| Full time equivalent employees | 2,091 | 2,131 | 2,013 | 1,827 | 1,821 | ||||||||||||||||||||||||

| Loans Held to Maturity | |||||||||||||||||||||||||||||

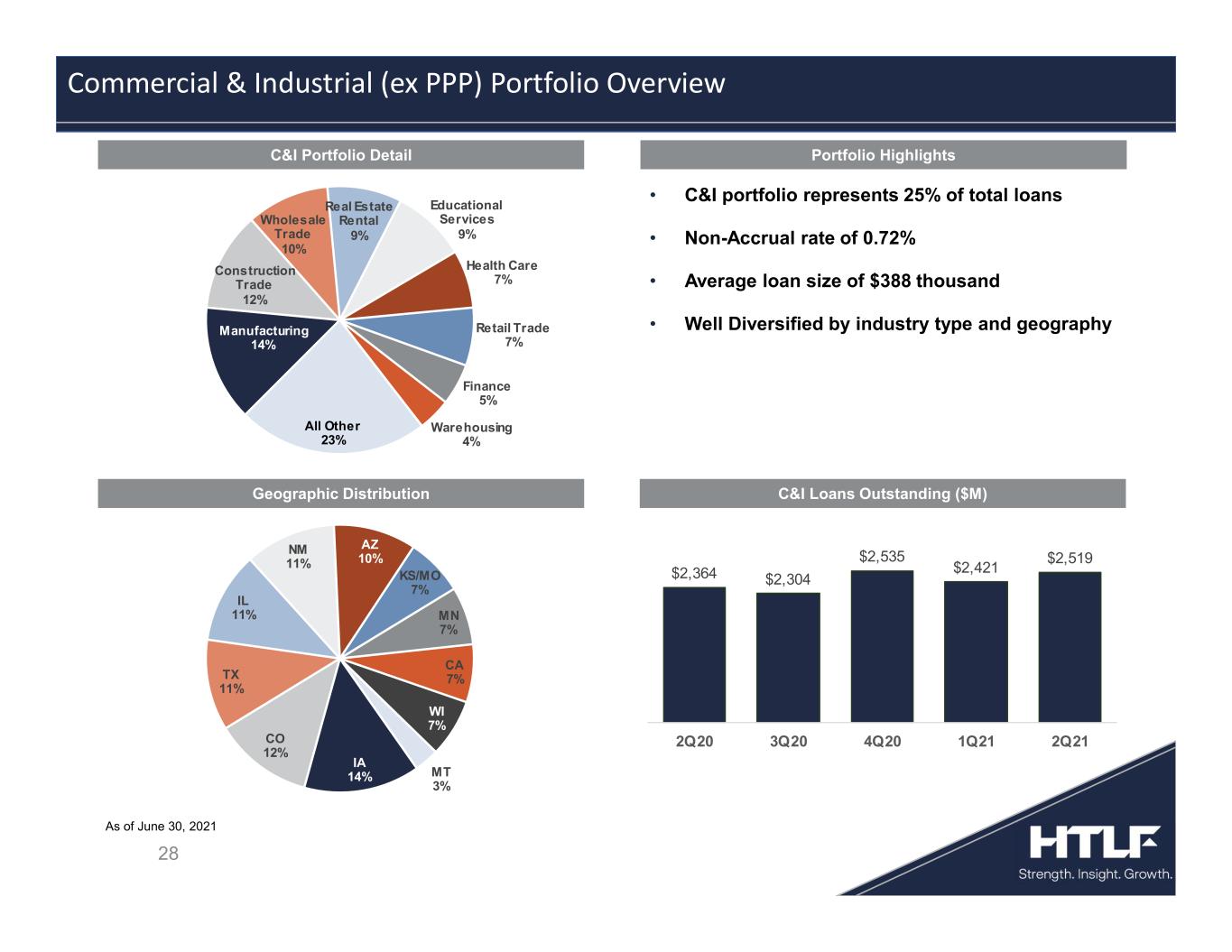

| Commercial and industrial | $ | 2,518,908 | $ | 2,421,260 | $ | 2,534,799 | $ | 2,303,646 | $ | 2,364,400 | |||||||||||||||||||

| Paycheck Protection Program ("PPP") | 829,175 | 1,155,328 | 957,785 | 1,128,035 | 1,124,430 | ||||||||||||||||||||||||

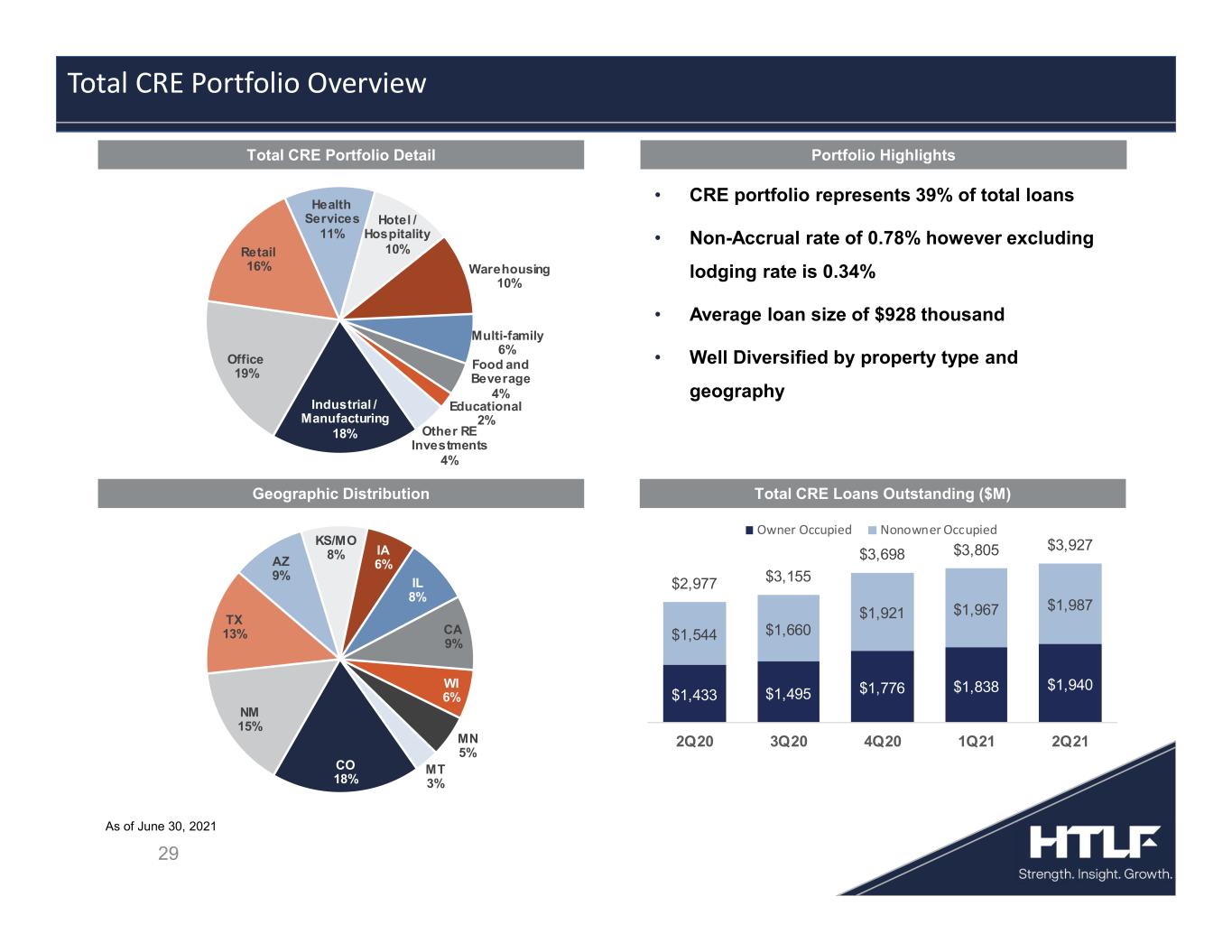

| Owner occupied commercial real estate | 1,940,134 | 1,837,559 | 1,776,406 | 1,494,902 | 1,433,271 | ||||||||||||||||||||||||

| Commercial and business lending | 5,288,217 | 5,414,147 | 5,268,990 | 4,926,583 | 4,922,101 | ||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 1,987,369 | 1,967,183 | 1,921,481 | 1,659,683 | 1,543,623 | ||||||||||||||||||||||||

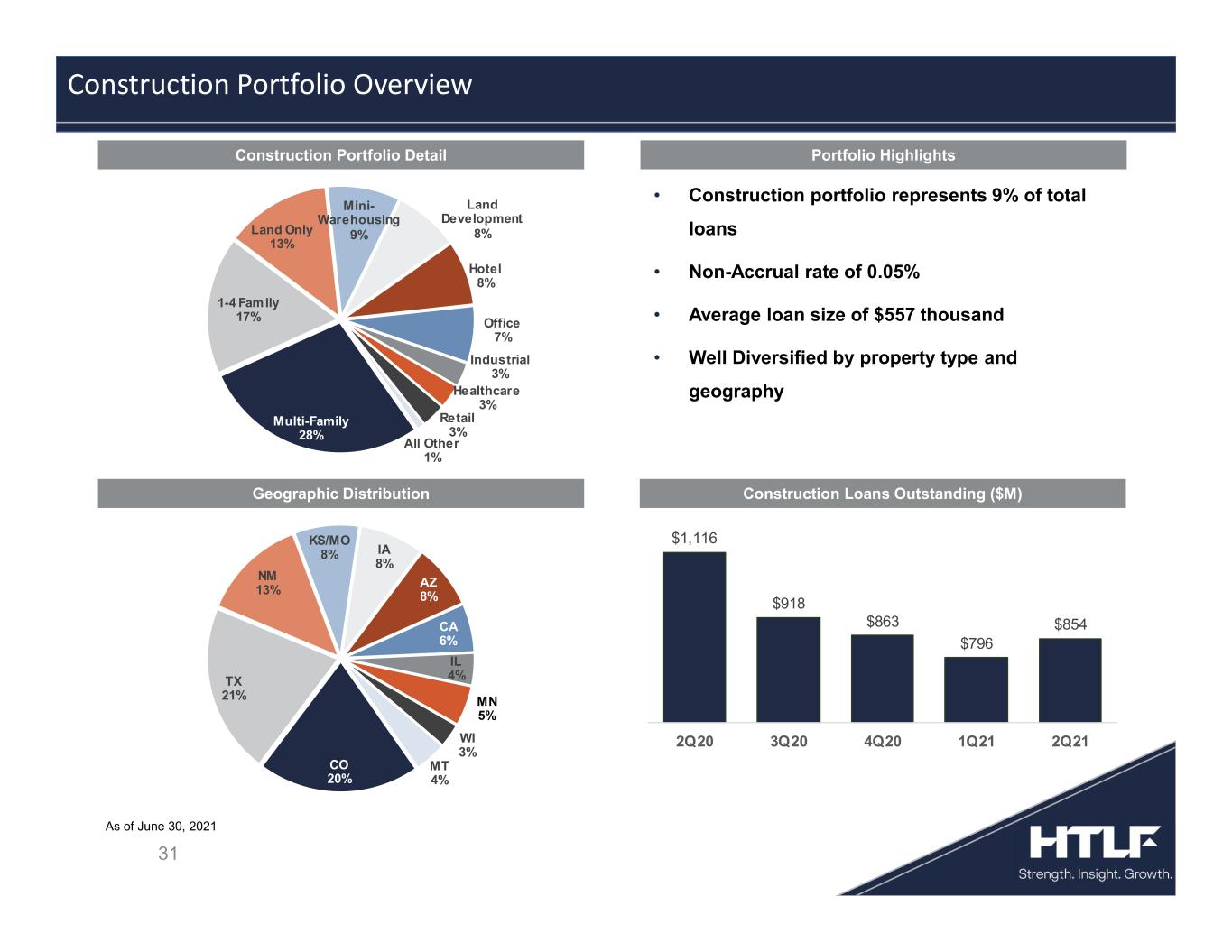

| Real estate construction | 854,295 | 796,027 | 863,220 | 917,765 | 1,115,843 | ||||||||||||||||||||||||

| Commercial real estate lending | 2,841,664 | 2,763,210 | 2,784,701 | 2,577,448 | 2,659,466 | ||||||||||||||||||||||||

| Total commercial lending | 8,129,881 | 8,177,357 | 8,053,691 | 7,504,031 | 7,581,567 | ||||||||||||||||||||||||

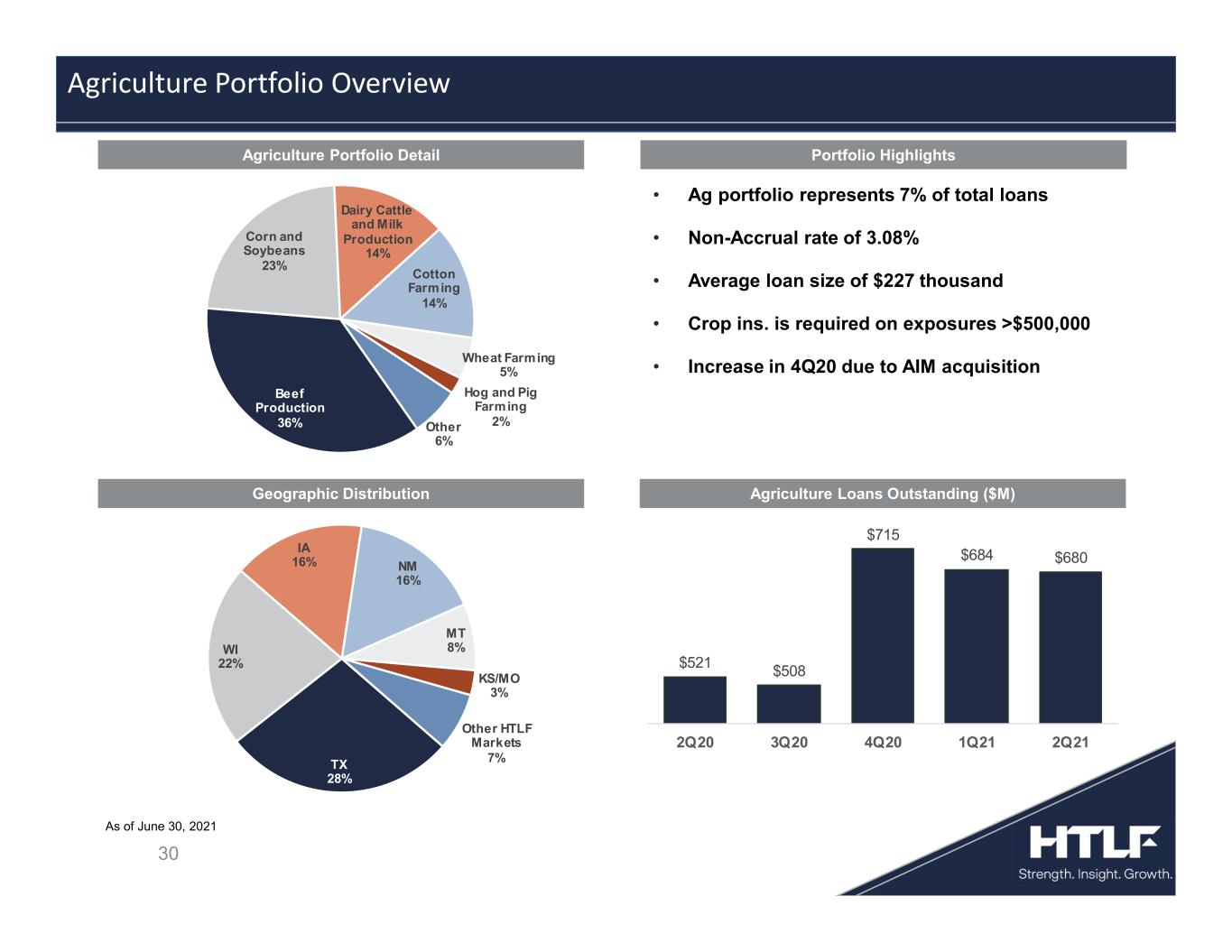

| Agricultural and agricultural real estate | 679,608 | 683,969 | 714,526 | 508,058 | 520,773 | ||||||||||||||||||||||||

| Residential mortgage | 800,884 | 786,994 | 840,442 | 701,899 | 735,762 | ||||||||||||||||||||||||

| Consumer | 401,641 | 402,136 | 414,392 | 385,658 | 408,728 | ||||||||||||||||||||||||

| Total loans held to maturity | $ | 10,012,014 | $ | 10,050,456 | $ | 10,023,051 | $ | 9,099,646 | $ | 9,246,830 | |||||||||||||||||||

| Total unfunded loan commitments | $ | 3,433,062 | $ | 3,306,042 | $ | 3,246,953 | $ | 2,980,484 | $ | 3,065,283 | |||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Allowance for Credit Losses-Loans | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 130,172 | $ | 131,606 | $ | 103,377 | $ | 119,937 | $ | 97,350 | |||||||||||||||||||

| Allowance for acquired purchased credit deteriorated loans | — | — | 12,313 | — | — | ||||||||||||||||||||||||

| Provision (benefit) for credit losses | (6,466) | 16 | 16,132 | 4,741 | 25,007 | ||||||||||||||||||||||||

| Charge-offs | (3,497) | (2,126) | (1,104) | (21,753) | (3,564) | ||||||||||||||||||||||||

| Recoveries | 517 | 676 | 888 | 452 | 1,144 | ||||||||||||||||||||||||

| Balance, end of period | $ | 120,726 | $ | 130,172 | $ | 131,606 | $ | 103,377 | $ | 119,937 | |||||||||||||||||||

| Allowance for Unfunded Commitments | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 14,619 | $ | 15,280 | $ | 14,330 | $ | 17,392 | $ | 15,468 | |||||||||||||||||||

| Provision (benefit) for credit losses | (617) | (661) | 950 | (3,062) | 1,924 | ||||||||||||||||||||||||

| Balance, end of period | $ | 14,002 | $ | 14,619 | $ | 15,280 | $ | 14,330 | $ | 17,392 | |||||||||||||||||||

| Allowance for lending related credit losses | $ | 134,728 | $ | 144,791 | $ | 146,886 | $ | 117,707 | $ | 137,329 | |||||||||||||||||||

| Provision for Credit Losses | |||||||||||||||||||||||||||||

| Provision (benefit) for credit losses-loans | $ | (6,466) | $ | 16 | $ | 6,572 | $ | 4,741 | $ | 25,007 | |||||||||||||||||||

| Provision for credit losses-acquired loans | — | — | 9,560 | — | — | ||||||||||||||||||||||||

| Provision (benefit) for credit losses-unfunded commitments | (617) | (661) | (1,372) | (3,062) | 1,924 | ||||||||||||||||||||||||

| Provision for credit losses-acquired unfunded commitments | — | — | 2,322 | — | — | ||||||||||||||||||||||||

| Provision (benefit) for credit losses-held to maturity securities | 3 | (3) | (10) | (1) | (135) | ||||||||||||||||||||||||

| Total provision (benefit) for credit losses | $ | (7,080) | $ | (648) | $ | 17,072 | $ | 1,678 | $ | 26,796 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Asset Quality | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 85,268 | $ | 91,718 | $ | 87,386 | $ | 79,040 | $ | 91,609 | |||||||||||||||||||

| Loans past due ninety days or more | 97 | 171 | 720 | 1,681 | 1,360 | ||||||||||||||||||||||||

| Other real estate owned | 6,314 | 6,236 | 6,624 | 5,050 | 5,539 | ||||||||||||||||||||||||

| Other repossessed assets | 50 | 239 | 240 | 130 | 29 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 91,729 | $ | 98,364 | $ | 94,970 | $ | 85,901 | $ | 98,537 | |||||||||||||||||||

| Performing troubled debt restructured loans | $ | 2,122 | $ | 2,394 | $ | 2,370 | $ | 11,818 | $ | 2,636 | |||||||||||||||||||

| Nonperforming Assets Activity | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 98,364 | $ | 94,970 | $ | 85,901 | $ | 98,537 | $ | 85,371 | |||||||||||||||||||

| Net loan charge offs | (2,980) | (1,450) | (216) | (21,301) | (2,420) | ||||||||||||||||||||||||

| New nonperforming loans | 7,989 | 14,936 | 8,664 | 11,834 | 26,857 | ||||||||||||||||||||||||

| Acquired nonperforming assets | — | — | 12,781 | — | — | ||||||||||||||||||||||||

Reduction of nonperforming loans(1) | (10,948) | (8,884) | (10,811) | (1,994) | (9,911) | ||||||||||||||||||||||||

| Net OREO/repossessed assets sales proceeds and losses | (696) | (1,208) | (1,349) | (1,175) | (1,360) | ||||||||||||||||||||||||

| Balance, end of period | $ | 91,729 | $ | 98,364 | $ | 94,970 | $ | 85,901 | $ | 98,537 | |||||||||||||||||||

| Asset Quality Ratios | |||||||||||||||||||||||||||||

| Ratio of nonperforming loans to total loans | 0.85 | % | 0.91 | % | 0.88 | % | 0.89 | % | 1.01 | % | |||||||||||||||||||

| Ratio of nonperforming loans and performing trouble debt restructured loans to total loans | 0.87 | 0.94 | 0.90 | 1.02 | 1.03 | ||||||||||||||||||||||||

| Ratio of nonperforming assets to total assets | 0.50 | 0.54 | 0.53 | 0.55 | 0.66 | ||||||||||||||||||||||||

| Annualized ratio of net loan charge-offs to average loans | 0.12 | 0.06 | 0.01 | 0.92 | 0.11 | ||||||||||||||||||||||||

| Allowance for loan credit losses as a percent of loans | 1.21 | 1.30 | 1.31 | 1.14 | 1.30 | ||||||||||||||||||||||||

| Allowance for lending related credit losses as a percent of loans | 1.35 | 1.44 | 1.47 | 1.29 | 1.49 | ||||||||||||||||||||||||

| Allowance for loan credit losses as a percent of nonperforming loans | 141.42 | 141.66 | 149.37 | 128.07 | 129.01 | ||||||||||||||||||||||||

| Loans delinquent 30-89 days as a percent of total loans | 0.17 | 0.16 | 0.23 | 0.17 | 0.22 | ||||||||||||||||||||||||

| (1) Includes principal reductions, transfers to performing status and transfers to OREO. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2021 | March 31, 2021 | June 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest | Rate | Average Balance | Interest | Rate | Average Balance | Interest | Rate | |||||||||||||||||||||||||||||||||||||||||||||

| Earning Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 5,862,683 | $ | 31,546 | 2.16 | % | $ | 5,693,097 | $ | 30,443 | 2.17 | % | $ | 3,375,245 | $ | 23,362 | 2.78 | % | |||||||||||||||||||||||||||||||||||

Nontaxable(1) | 740,601 | 5,773 | 3.13 | 730,565 | 5,700 | 3.16 | 433,329 | 4,233 | 3.93 | ||||||||||||||||||||||||||||||||||||||||||||

| Total securities | 6,603,284 | 37,319 | 2.27 | 6,423,662 | 36,143 | 2.28 | 3,808,574 | 27,595 | 2.91 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 271,891 | 60 | 0.09 | 204,488 | 66 | 0.13 | 210,347 | 54 | 0.10 | ||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold | — | — | — | 14,020 | 1 | 0.03 | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

Loans:(2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial and industrial(1) | 2,469,742 | 28,562 | 4.64 | 2,500,250 | 28,222 | 4.58 | 2,453,066 | 30,759 | 5.04 | ||||||||||||||||||||||||||||||||||||||||||||

| PPP loans | 1,047,559 | 11,186 | 4.28 | 992,517 | 10,149 | 4.15 | 916,405 | 6,017 | 2.64 | ||||||||||||||||||||||||||||||||||||||||||||

| Owner occupied commercial real estate | 1,858,891 | 20,097 | 4.34 | 1,778,829 | 19,565 | 4.46 | 1,426,019 | 17,670 | 4.98 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 1,980,374 | 21,734 | 4.40 | 1,937,564 | 22,121 | 4.63 | 1,540,958 | 19,055 | 4.97 | ||||||||||||||||||||||||||||||||||||||||||||

| Real estate construction | 815,738 | 9,212 | 4.53 | 806,315 | 9,698 | 4.88 | 1,100,514 | 12,589 | 4.60 | ||||||||||||||||||||||||||||||||||||||||||||

| Agricultural and agricultural real estate | 672,560 | 7,267 | 4.33 | 681,279 | 8,051 | 4.79 | 532,668 | 6,171 | 4.66 | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 827,291 | 9,255 | 4.49 | 849,923 | 9,830 | 4.69 | 795,149 | 9,586 | 4.85 | ||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 399,916 | 5,152 | 5.17 | 405,475 | 5,367 | 5.37 | 422,134 | 5,685 | 5.42 | ||||||||||||||||||||||||||||||||||||||||||||

| Less: allowance for credit losses-loans | (127,268) | — | — | (134,198) | — | — | (102,675) | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net loans | 9,944,803 | 112,465 | 4.54 | 9,817,954 | 113,003 | 4.67 | 9,084,238 | 107,532 | 4.76 | ||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 16,819,978 | 149,844 | 3.57 | % | 16,460,124 | 149,213 | 3.68 | % | 13,103,159 | 135,181 | 4.15 | % | |||||||||||||||||||||||||||||||||||||||||

| Nonearning Assets | 1,473,778 | 1,504,599 | 1,288,697 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 18,293,756 | $ | 17,964,723 | $ | 14,391,856 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest Bearing Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 8,234,151 | $ | 2,233 | 0.11 | % | $ | 8,032,308 | $ | 2,430 | 0.12 | % | $ | 6,690,504 | $ | 2,372 | 0.14 | % | |||||||||||||||||||||||||||||||||||

| Time deposits | 1,171,266 | 1,557 | 0.53 | 1,233,682 | 1,965 | 0.65 | 1,096,386 | 3,762 | 1.38 | ||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 169,822 | 98 | 0.23 | 240,037 | 152 | 0.26 | 82,200 | 61 | 0.30 | ||||||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 296,063 | 2,976 | 4.03 | 411,132 | 3,300 | 3.26 | 286,663 | 3,424 | 4.80 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 9,871,302 | 6,864 | 0.28 | % | 9,917,159 | 7,847 | 0.32 | % | 8,155,753 | 9,619 | 0.47 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest Bearing Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | 6,170,928 | 5,778,571 | 4,501,488 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Accrued interest and other liabilities | 159,917 | 194,614 | 153,618 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 6,330,845 | 5,973,185 | 4,655,106 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | 2,091,609 | 2,074,379 | 1,580,997 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 18,293,756 | $ | 17,964,723 | $ | 14,391,856 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) | $ | 142,980 | $ | 141,366 | $ | 125,562 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread(1) | 3.29 | % | 3.36 | % | 3.68 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) to total earning assets | 3.41 | % | 3.48 | % | 3.85 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities to earning assets | 58.69 | % | 60.25 | % | 62.24 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||||||||||||||||||||

| For the Six Months Ended | |||||||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest | Rate | Average Balance | Interest | Rate | ||||||||||||||||||||||||||||||

| Earning Assets | |||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||

| Taxable | $ | 5,778,333 | $ | 61,989 | 2.16 | % | $ | 3,253,675 | $ | 45,093 | 2.79 | % | |||||||||||||||||||||||

Nontaxable(1) | 735,636 | 11,473 | 3.15 | 360,932 | 6,996 | 3.90 | % | ||||||||||||||||||||||||||||

| Total securities | 6,513,969 | 73,462 | 2.27 | 3,614,607 | 52,089 | 2.90 | |||||||||||||||||||||||||||||

| Interest bearing deposits with other banks and other short-term investments | 238,376 | 126 | 0.11 | 195,833 | 775 | 0.80 | |||||||||||||||||||||||||||||

| Federal funds sold | 6,971 | 1 | 0.03 | — | — | — | |||||||||||||||||||||||||||||

Loans:(2) | |||||||||||||||||||||||||||||||||||

Commercial and industrial(1) | 2,485,210 | 56,784 | 4.61 | 2,530,349 | 63,213 | 5.02 | % | ||||||||||||||||||||||||||||

| PPP loans | 1,020,190 | 21,335 | 4.22 | 458,202 | 6,017 | 2.64 | % | ||||||||||||||||||||||||||||

| Owner occupied commercial real estate | 1,818,932 | 39,662 | 4.40 | 1,429,560 | 36,251 | 5.10 | % | ||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 1,958,938 | 43,855 | 4.51 | 1,506,583 | 38,585 | 5.15 | % | ||||||||||||||||||||||||||||

| Real estate construction | 811,053 | 18,910 | 4.70 | 1,073,175 | 25,434 | 4.77 | % | ||||||||||||||||||||||||||||

Agricultural and agricultural real estate | 676,895 | 15,318 | 4.56 | 542,818 | 13,210 | 4.89 | % | ||||||||||||||||||||||||||||

| Residential mortgage | 838,545 | 19,085 | 4.59 | 807,440 | 20,007 | 4.98 | % | ||||||||||||||||||||||||||||

| Consumer | 402,680 | 10,519 | 5.27 | 427,439 | 11,780 | 5.54 | % | ||||||||||||||||||||||||||||

| Less: allowance for credit losses-loans | (130,714) | — | — | (88,699) | — | — | |||||||||||||||||||||||||||||

| Net loans | 9,881,729 | 225,468 | 4.60 | 8,686,867 | 214,497 | 4.97 | |||||||||||||||||||||||||||||

| Total earning assets | 16,641,045 | 299,057 | 3.62 | % | 12,497,307 | 267,361 | 4.30 | % | |||||||||||||||||||||||||||

| Nonearning Assets | 1,489,103 | 1,272,708 | |||||||||||||||||||||||||||||||||

| Total Assets | $ | 18,130,148 | $ | 13,770,015 | |||||||||||||||||||||||||||||||

Interest Bearing Liabilities | |||||||||||||||||||||||||||||||||||

| Savings | $ | 8,133,787 | $ | 4,663 | 0.12 | % | $ | 6,484,016 | $ | 12,454 | 0.39 | % | |||||||||||||||||||||||

| Time deposits | 1,202,301 | 3,522 | 0.59 | % | 1,121,502 | 8,262 | 1.48 | ||||||||||||||||||||||||||||

| Short-term borrowings | 204,735 | 250 | 0.25 | % | 112,004 | 357 | 0.64 | ||||||||||||||||||||||||||||

| Other borrowings | 353,280 | 6,276 | 3.58 | % | 281,325 | 7,084 | 5.06 | ||||||||||||||||||||||||||||

| Total interest bearing liabilities | 9,894,103 | 14,711 | 0.30 | % | 7,998,847 | 28,157 | 0.71 | % | |||||||||||||||||||||||||||

Noninterest Bearing Liabilities | |||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | 5,975,833 | 4,024,267 | |||||||||||||||||||||||||||||||||

| Accrued interest and other liabilities | 177,170 | 146,561 | |||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 6,153,003 | 4,170,828 | |||||||||||||||||||||||||||||||||

| Stockholders' Equity | 2,083,042 | 1,600,340 | |||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $ | 18,130,148 | $ | 13,770,015 | |||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) | $ | 284,346 | $ | 239,204 | |||||||||||||||||||||||||||||||

Net interest spread(1) | 3.32 | % | 3.59 | % | |||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) to total earning assets | 3.45 | % | 3.85 | % | |||||||||||||||||||||||||||||||

| Interest bearing liabilities to earning assets | 59.46 | % | 64.00 | % | |||||||||||||||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||||||||

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. | |||||||||||||||||||||||||||||||||||

| (3) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||

| SELECTED FINANCIAL DATA - SUBSIDIARY BANKS (Unaudited) | |||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||

| As of and For the Quarter Ended | |||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||

| Total Assets | |||||||||||||||||

| First Bank & Trust | $ | 2,882,969 | $ | 2,991,053 | $ | 3,171,961 | $ | 1,289,187 | $ | 1,256,710 | |||||||

| Citywide Banks | 2,611,842 | 2,632,199 | 2,628,963 | 2,639,516 | 2,546,942 | ||||||||||||

| New Mexico Bank & Trust | 2,494,257 | 2,356,918 | 2,032,637 | 2,002,663 | 1,899,194 | ||||||||||||

| Dubuque Bank and Trust Company | 1,990,040 | 1,932,234 | 1,853,078 | 1,838,260 | 1,849,035 | ||||||||||||

| Illinois Bank & Trust | 1,671,240 | 1,584,561 | 1,525,503 | 1,500,012 | 1,470,000 | ||||||||||||

| Arizona Bank & Trust | 1,645,816 | 1,614,740 | 1,529,800 | 1,039,253 | 970,775 | ||||||||||||

| Bank of Blue Valley | 1,419,003 | 1,425,434 | 1,376,080 | 1,424,261 | 1,380,159 | ||||||||||||

| Wisconsin Bank & Trust | 1,252,096 | 1,264,009 | 1,267,488 | 1,262,069 | 1,203,108 | ||||||||||||

| Premier Valley Bank | 1,126,807 | 1,062,607 | 1,076,615 | 1,042,437 | 1,031,899 | ||||||||||||

| Minnesota Bank & Trust | 955,638 | 995,692 | 1,000,168 | 1,007,548 | 951,236 | ||||||||||||

| Rocky Mountain Bank | 646,821 | 620,800 | 616,157 | 617,169 | 590,764 | ||||||||||||

| Total Deposits | |||||||||||||||||

| First Bank & Trust | $ | 2,361,391 | $ | 2,427,920 | $ | 2,622,716 | $ | 936,366 | $ | 959,886 | |||||||

| Citywide Banks | 2,174,237 | 2,231,320 | 2,181,511 | 2,163,051 | 2,147,642 | ||||||||||||

| New Mexico Bank & Trust | 2,195,838 | 2,077,304 | 1,749,963 | 1,747,527 | 1,698,584 | ||||||||||||

| Dubuque Bank and Trust Company | 1,471,564 | 1,565,782 | 1,456,908 | 1,591,561 | 1,496,559 | ||||||||||||

| Illinois Bank & Trust | 1,512,106 | 1,426,426 | 1,338,677 | 1,307,513 | 1,318,866 | ||||||||||||

| Arizona Bank & Trust | 1,450,248 | 1,453,888 | 1,357,158 | 886,174 | 865,430 | ||||||||||||

| Bank of Blue Valley | 1,168,617 | 1,178,114 | 1,138,264 | 1,142,910 | 1,138,818 | ||||||||||||

| Wisconsin Bank & Trust | 1,093,119 | 1,067,735 | 1,057,369 | 1,011,843 | 1,050,766 | ||||||||||||

| Premier Valley Bank | 963,459 | 896,715 | 836,984 | 855,913 | 869,165 | ||||||||||||

| Minnesota Bank & Trust | 762,549 | 813,693 | 789,555 | 804,045 | 820,199 | ||||||||||||

| Rocky Mountain Bank | 568,961 | 549,894 | 538,012 | 533,429 | 519,029 | ||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Reconciliation of Annualized Return on Average Tangible Common Equity (non-GAAP) | |||||||||||||||||||||||||||||

| Net income available to common stockholders (GAAP) | $ | 59,593 | $ | 50,801 | $ | 37,795 | $ | 45,521 | $ | 30,131 | |||||||||||||||||||

Plus core deposit and customer relationship intangibles amortization, net of tax(1) | 1,907 | 1,988 | 1,975 | 1,969 | 2,130 | ||||||||||||||||||||||||

| Net income available to common stockholders excluding intangible amortization (non-GAAP) | $ | 61,500 | $ | 52,789 | $ | 39,770 | $ | 47,490 | $ | 32,261 | |||||||||||||||||||

| Average common equity (GAAP) | $ | 1,980,904 | $ | 1,963,674 | $ | 1,769,575 | $ | 1,661,381 | $ | 1,574,902 | |||||||||||||||||||

| Less average goodwill | 576,005 | 576,005 | 488,151 | 446,345 | 446,345 | ||||||||||||||||||||||||

| Less average core deposit and customer relationship intangibles, net | 38,614 | 41,399 | 42,733 | 42,145 | 44,723 | ||||||||||||||||||||||||

| Average tangible common equity (non-GAAP) | $ | 1,366,285 | $ | 1,346,270 | $ | 1,238,691 | $ | 1,172,891 | $ | 1,083,834 | |||||||||||||||||||

| Annualized return on average common equity (GAAP) | 12.07 | % | 10.49 | % | 8.50 | % | 10.90 | % | 7.69 | % | |||||||||||||||||||

| Annualized return on average tangible common equity (non-GAAP) | 18.05 | % | 15.90 | % | 12.77 | % | 16.11 | % | 11.97 | % | |||||||||||||||||||

| Reconciliation of Annualized Net Interest Margin, Fully Tax-Equivalent (non-GAAP) | |||||||||||||||||||||||||||||

| Net Interest Income (GAAP) | $ | 141,218 | $ | 139,605 | $ | 132,575 | $ | 122,497 | $ | 124,146 | |||||||||||||||||||

Plus tax-equivalent adjustment(1) | 1,762 | 1,761 | 1,529 | 1,390 | 1,416 | ||||||||||||||||||||||||

| Net interest income, fully tax-equivalent (non-GAAP) | $ | 142,980 | $ | 141,366 | $ | 134,104 | $ | 123,887 | $ | 125,562 | |||||||||||||||||||

| Average earning assets | $ | 16,819,978 | $ | 16,460,124 | $ | 15,042,079 | $ | 13,868,360 | $ | 13,103,159 | |||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.37 | % | 3.44 | % | 3.51 | % | 3.51 | % | 3.81 | % | |||||||||||||||||||

| Annualized net interest margin, fully tax-equivalent (non-GAAP) | 3.41 | 3.48 | 3.55 | 3.55 | 3.85 | ||||||||||||||||||||||||

| Net purchase accounting discount amortization on loans included in annualized net interest margin | 0.09 | 0.12 | 0.10 | 0.10 | 0.16 | ||||||||||||||||||||||||

| Reconciliation of Tangible Book Value Per Common Share (non-GAAP) | |||||||||||||||||||||||||||||

| Common equity (GAAP) | $ | 2,049,081 | $ | 1,945,502 | $ | 1,968,526 | $ | 1,700,899 | $ | 1,636,672 | |||||||||||||||||||

| Less goodwill | 576,005 | 576,005 | 576,005 | 446,345 | 446,345 | ||||||||||||||||||||||||

| Less core deposit and customer relationship intangibles, net | 37,452 | 39,867 | 42,383 | 40,520 | 43,011 | ||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 1,435,624 | $ | 1,329,630 | $ | 1,350,138 | $ | 1,214,034 | $ | 1,147,316 | |||||||||||||||||||

| Common shares outstanding, net of treasury stock | 42,245,452 | 42,173,675 | 42,093,862 | 36,885,390 | 36,844,744 | ||||||||||||||||||||||||

| Common equity (book value) per share (GAAP) | $ | 48.50 | $ | 46.13 | $ | 46.77 | $ | 46.11 | $ | 44.42 | |||||||||||||||||||

| Tangible book value per common share (non-GAAP) | $ | 33.98 | $ | 31.53 | $ | 32.07 | $ | 32.91 | $ | 31.14 | |||||||||||||||||||

| Reconciliation of Tangible Common Equity Ratio (non-GAAP) | |||||||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 1,435,624 | $ | 1,329,630 | $ | 1,350,138 | $ | 1,214,034 | $ | 1,147,316 | |||||||||||||||||||

| Total assets (GAAP) | $ | 18,371,006 | $ | 18,244,427 | $ | 17,908,339 | $ | 15,612,664 | $ | 15,026,153 | |||||||||||||||||||

| Less goodwill | 576,005 | 576,005 | 576,005 | 446,345 | 446,345 | ||||||||||||||||||||||||

| Less core deposit and customer relationship intangibles, net | 37,452 | 39,867 | 42,383 | 40,520 | 43,011 | ||||||||||||||||||||||||

| Total tangible assets (non-GAAP) | $ | 17,757,549 | $ | 17,628,555 | $ | 17,289,951 | $ | 15,125,799 | $ | 14,536,797 | |||||||||||||||||||

| Tangible common equity ratio (non-GAAP) | 8.08 | % | 7.54 | % | 7.81 | % | 8.03 | % | 7.89 | % | |||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| Reconciliation of Efficiency Ratio (non-GAAP) | For the Quarter Ended | ||||||||||||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 141,218 | $ | 139,605 | $ | 132,575 | $ | 122,497 | $ | 124,146 | |||||||||||||||||||

Tax-equivalent adjustment(1) | 1,762 | 1,761 | 1,529 | 1,390 | 1,416 | ||||||||||||||||||||||||

| Fully tax-equivalent net interest income | 142,980 | 141,366 | 134,104 | 123,887 | 125,562 | ||||||||||||||||||||||||

| Noninterest income | 33,164 | 30,317 | 32,621 | 31,216 | 30,637 | ||||||||||||||||||||||||

| Securities (gains)/losses, net | (2,842) | 30 | (2,829) | (1,300) | (2,006) | ||||||||||||||||||||||||

| Unrealized (gain)/loss on equity securities, net | (83) | 110 | (36) | (155) | (680) | ||||||||||||||||||||||||

| Valuation adjustment on servicing rights | 526 | (917) | 102 | 120 | (9) | ||||||||||||||||||||||||

| Adjusted revenue (non-GAAP) | $ | 173,745 | $ | 170,906 | $ | 163,962 | $ | 153,768 | $ | 153,504 | |||||||||||||||||||

| Total noninterest expenses (GAAP) | $ | 103,376 | $ | 102,423 | $ | 99,269 | $ | 90,396 | $ | 90,439 | |||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 2,415 | 2,516 | 2,501 | 2,492 | 2,696 | ||||||||||||||||||||||||

| Partnership investment in tax credit projects | 1,345 | 35 | 1,899 | 927 | 791 | ||||||||||||||||||||||||

| Loss on sales/valuation of assets, net | 183 | 194 | 2,621 | 1,763 | 701 | ||||||||||||||||||||||||

| Acquisition, integration and restructuring costs | 210 | 2,928 | 2,186 | 1,146 | 673 | ||||||||||||||||||||||||

| Adjusted noninterest expenses (non-GAAP) | $ | 99,223 | $ | 96,750 | $ | 90,062 | $ | 84,068 | $ | 85,578 | |||||||||||||||||||

| Efficiency ratio, fully tax-equivalent (non-GAAP) | 57.11 | % | 56.61 | % | 54.93 | % | 54.67 | % | 55.75 | % | |||||||||||||||||||

| Acquisition, integration and restructuring costs | |||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 44 | $ | 534 | $ | 232 | $ | — | $ | 122 | |||||||||||||||||||

| Occupancy | 1 | 9 | — | — | — | ||||||||||||||||||||||||

| Furniture and equipment | 41 | 607 | 423 | 496 | 15 | ||||||||||||||||||||||||

| Professional fees | 63 | 670 | 1,422 | 476 | 505 | ||||||||||||||||||||||||

| Advertising | 6 | 156 | 42 | 8 | 4 | ||||||||||||||||||||||||

| Other noninterest expenses | 55 | 952 | 67 | 166 | 27 | ||||||||||||||||||||||||

| Total acquisition, integration and restructuring costs | $ | 210 | $ | 2,928 | $ | 2,186 | $ | 1,146 | $ | 673 | |||||||||||||||||||

After tax impact on diluted earnings per common share(1) | $ | — | $ | 0.05 | $ | 0.04 | $ | 0.02 | $ | 0.01 | |||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||

| For the Quarter Ended June 30, | For the Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Reconciliation of Annualized Return on Average Tangible Common Equity (non-GAAP) | |||||||||||||||||||||||

| Net income available to common stockholders (GAAP) | $ | 59,593 | $ | 30,131 | $ | 110,394 | $ | 50,171 | |||||||||||||||

Plus core deposit and customer relationship intangibles amortization, net of tax(1) | 1,907 | 2,130 | 3,895 | 4,485 | |||||||||||||||||||

| Net income available to common stockholders excluding intangible amortization (non-GAAP) | $ | 61,500 | $ | 32,261 | $ | 114,289 | $ | 54,656 | |||||||||||||||

| Average common equity (GAAP) | $ | 1,980,904 | $ | 1,574,902 | $ | 1,972,337 | $ | 1,597,292 | |||||||||||||||

| Less average goodwill | 576,005 | 446,345 | 576,005 | 446,345 | |||||||||||||||||||

| Less average core deposit and customer relationship intangibles, net | 38,614 | 44,723 | 39,999 | 46,177 | |||||||||||||||||||

| Average tangible common equity (non-GAAP) | $ | 1,366,285 | $ | 1,083,834 | $ | 1,356,333 | $ | 1,104,770 | |||||||||||||||

| Annualized return on average common equity (GAAP) | 12.07 | % | 7.69 | % | 11.29 | % | 6.32 | % | |||||||||||||||

| Annualized return on average tangible common equity (non-GAAP) | 18.05 | % | 11.97 | % | 16.99 | % | 9.95 | % | |||||||||||||||

| Reconciliation of Annualized Net Interest Margin, Fully Tax-Equivalent (non-GAAP) | |||||||||||||||||||||||

| Net Interest Income (GAAP) | $ | 141,218 | $ | 124,146 | $ | 280,823 | $ | 236,657 | |||||||||||||||

Plus tax-equivalent adjustment(1) | 1,762 | 1,416 | 3,523 | 2,547 | |||||||||||||||||||

| Net interest income, fully tax-equivalent (non-GAAP) | $ | 142,980 | $ | 125,562 | $ | 284,346 | $ | 239,204 | |||||||||||||||

| Average earning assets | $ | 16,819,978 | $ | 13,103,159 | $ | 16,641,045 | $ | 12,497,307 | |||||||||||||||

| Annualized net interest margin (GAAP) | 3.37 | % | 3.81 | % | 3.40 | % | 3.81 | % | |||||||||||||||

| Annualized net interest margin, fully tax-equivalent (non-GAAP) | 3.41 | 3.85 | 3.45 | 3.85 | |||||||||||||||||||

| Purchase accounting discount amortization on loans included in annualized net interest margin | 0.09 | 0.16 | 0.11 | 0.10 | |||||||||||||||||||