|  | |||||||

| CONTACT: | FOR IMMEDIATE RELEASE | ||||

| Bryan R. McKeag | January 25, 2021 | ||||

| Executive Vice President | |||||

| Chief Financial Officer | |||||

| (563) 589-1994 | |||||

| bmckeag@htlf.com | |||||

HEARTLAND FINANCIAL USA, INC. REPORTS ANNUAL EARNINGS AND FOURTH QUARTER RESULTS AS OF DECEMBER 31, 2020

Highlights

| § | Quarterly net income available to common stockholders of $37.8 million or $0.98 per diluted common share | |||||||

| § | Annual net income available to common stockholders of $133.5 million or $3.57 per diluted common share | |||||||

| § | Net interest margin of 3.51%, fully tax-equivalent (non-GAAP)(1) of 3.55% for the fourth quarter | |||||||

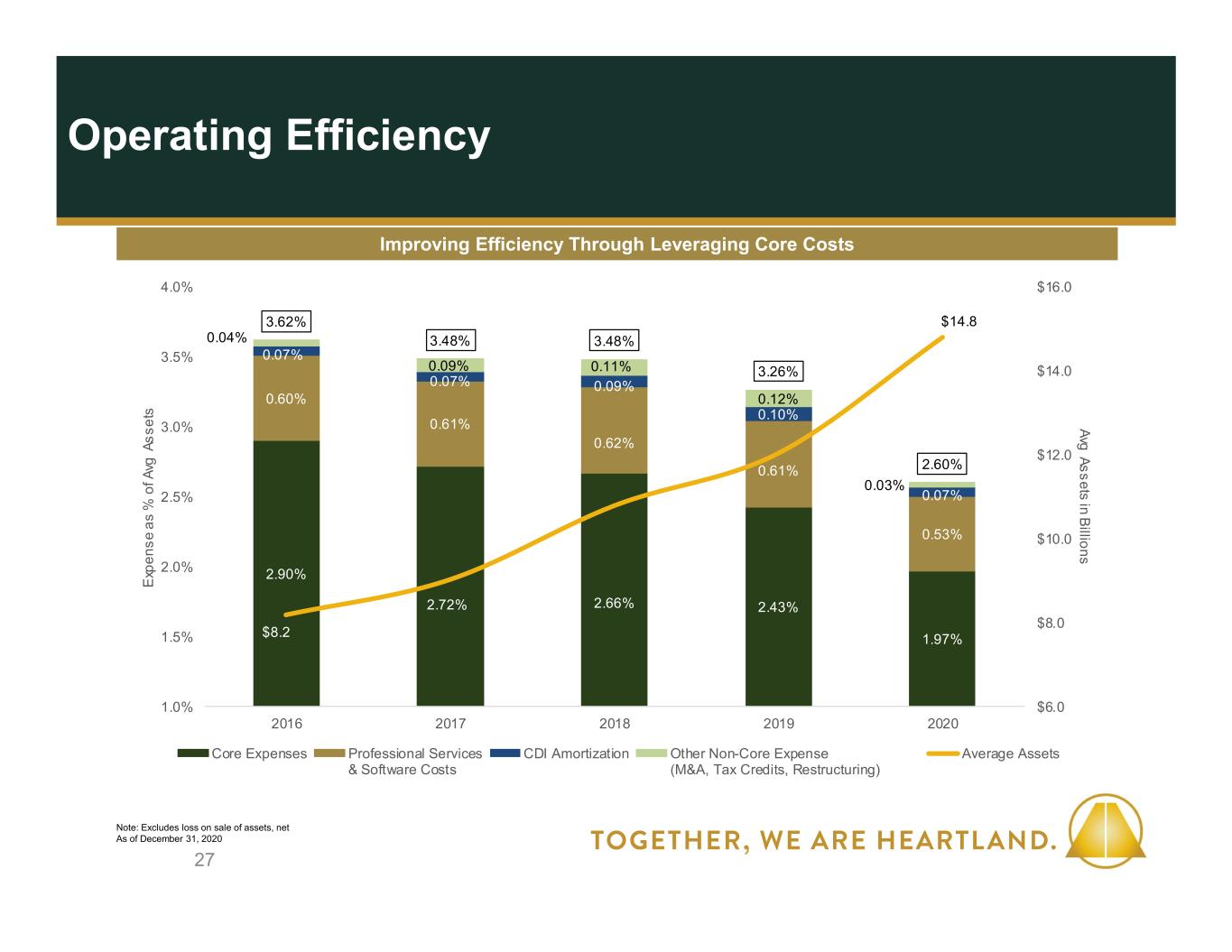

| § | Efficiency ratio (non-GAAP)(1) for the fourth quarter of 2020 of 54.93% and 56.65% for the year | |||||||

| § | Nonperforming assets as a percentage of total assets of 0.53% and net charge-offs for the quarter of $216,000 | |||||||

| § | Completed the acquisition of AimBank, Heartland's largest acquisition to date, which had assets at fair value of $1.97 billion | |||||||

| § | Completed the purchase and assumption of substantially all of the deposits, which totaled $415.5 million, and other certain assets and liabilities of Johnson Bank's Arizona operations | |||||||

| § | Approved a 10% increase in quarterly dividend to $.22 per share at the January 19, 2021 board meeting | |||||||

| Quarter Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Net income available to common stockholders (in millions) | $ | 37.8 | $ | 37.9 | $ | 133.5 | $ | 149.1 | |||||||||||||||

| Diluted earnings per common share | 0.98 | 1.03 | 3.57 | 4.14 | |||||||||||||||||||

| Return on average assets | 0.92 | % | 1.17 | % | 0.90 | % | 1.24 | % | |||||||||||||||

| Return on average common equity | 8.50 | 9.56 | 8.06 | 10.12 | |||||||||||||||||||

Return on average tangible common equity (non-GAAP)(1) | 12.77 | 14.65 | 12.28 | 15.73 | |||||||||||||||||||

| Net interest margin | 3.51 | 3.86 | 3.65 | 4.00 | |||||||||||||||||||

Net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.55 | 3.90 | 3.69 | 4.04 | |||||||||||||||||||

Efficiency ratio, fully-tax equivalent (non-GAAP)(1) | 54.93 | 60.31 | 56.65 | 62.50 | |||||||||||||||||||

(1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to the financial tables for reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||

"Heartland successfully navigated a challenging year with net income available to common stockholders of $133.5 million, or $3.57 per diluted common share. Our success was highlighted by an improved efficiency ratio of 56.65%, strong net interest margin of 3.69% and stable credit quality." | ||

| Bruce K. Lee, president and chief executive officer, Heartland Financial USA, Inc. | ||

Dubuque, Iowa, Monday, January 25, 2021-Heartland Financial USA, Inc. (NASDAQ: HTLF) today reported the following results for the quarter ended December 31, 2020 compared to the quarter ended December 31, 2019:

•Net income available to common stockholders of $37.8 million, or $0.98 per diluted common share compared to $37.9 million, or $1.03 per diluted common share.

•Excluding tax-effected acquisition, integration and restructuring costs, adjusted net income available to common stockholders (non-GAAP) was $39.5 million, or $1.03 of adjusted earnings per diluted common share (non-GAAP) compared to $38.3 million or $1.04.

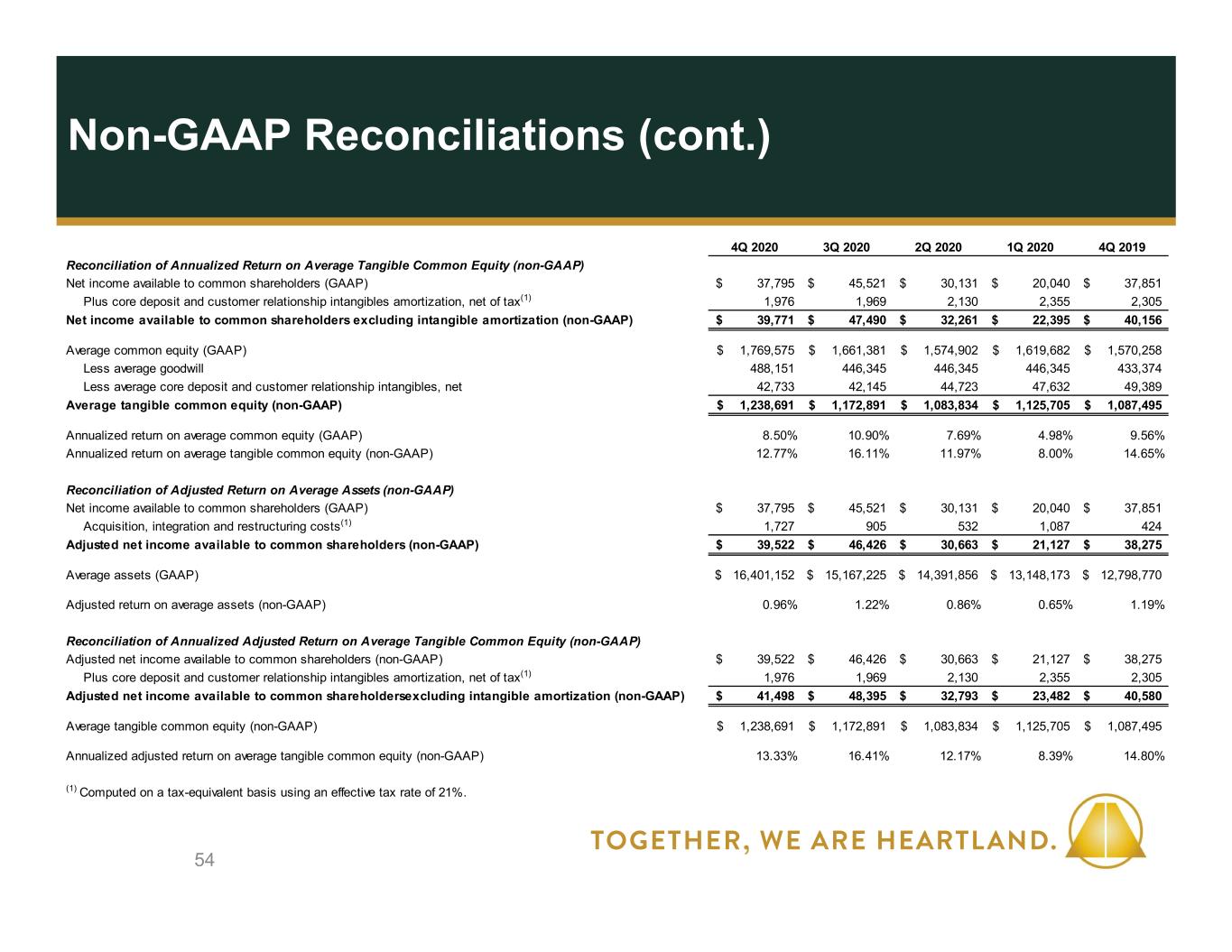

•Return on average common equity was 8.50% and return on average assets was 0.92% compared to 9.56% and 1.17%, respectively.

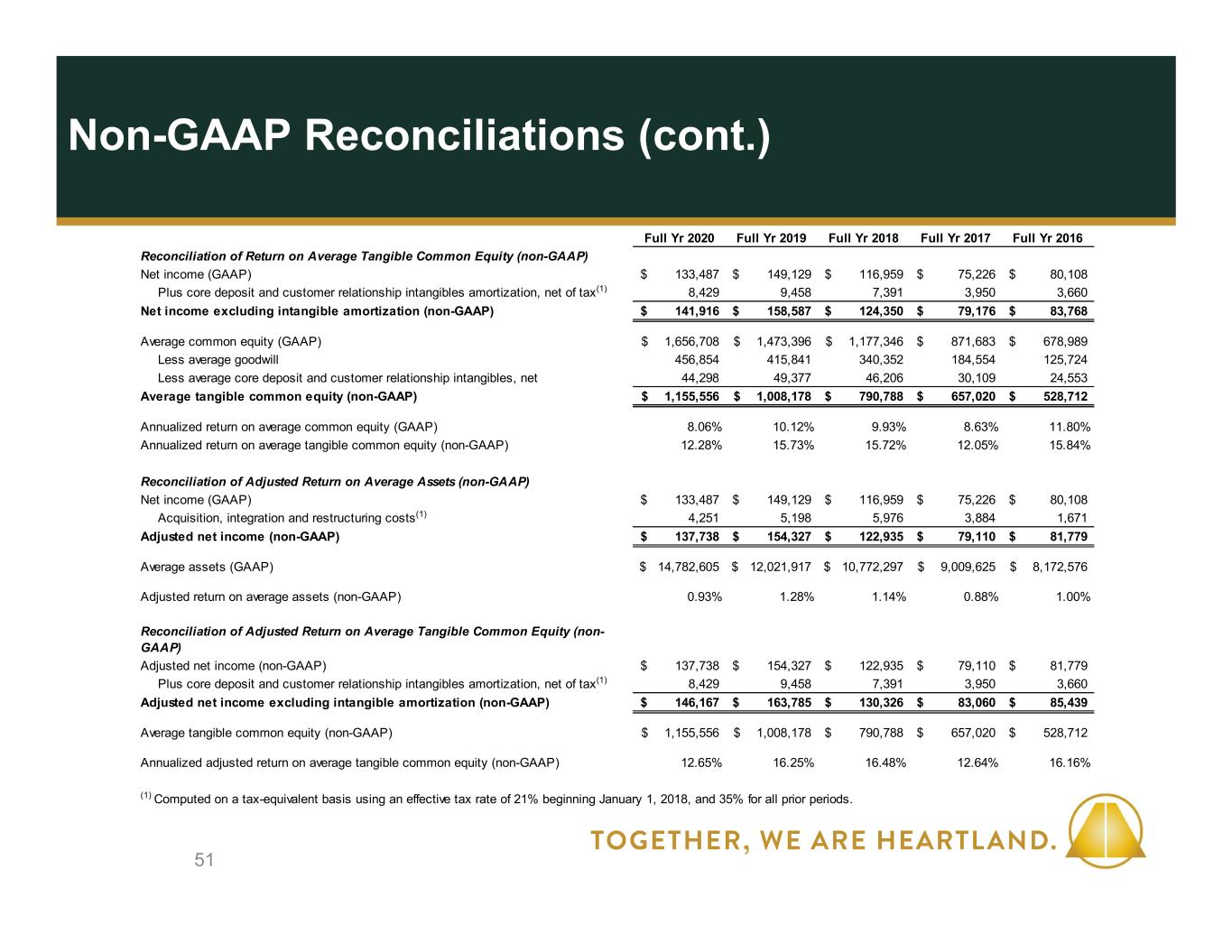

•Return on average tangible common equity (non-GAAP) was 12.77% and excluding tax-affected acquisition, integration and restructuring costs, adjusted return on average tangible common equity (non-GAAP) was 13.33% compared to 14.65% and 14.80%, respectively.

Heartland reported the following annual results for the year ended December 31, 2020 compared to the year ended December 31, 2019:

•Net income available to common stockholders of $133.5 million or $3.57 per diluted common share compared to $149.1 million or $4.14 per diluted common share.

•Excluding tax-effected acquisition, integration and restructuring costs, adjusted net income available to common stockholders (non-GAAP) was $137.7 million, or $3.69 of adjusted earnings per diluted common share (non-GAAP), compared to $154.3 million, or $4.28.

•Return on average common equity was 8.06% and return on average assets was 0.90% compared to 10.12% and 1.24%, respectively.

•Return on average tangible common equity (non-GAAP) of 12.28% and excluding tax-affected acquisition, integration and restructuring costs, adjusted return on average tangible common equity (non-GAAP) of 12.65% compared to 15.73% and 16.25%, respectively.

Commenting on Heartland’s 2020 results, Bruce K. Lee, Heartland’s president and chief executive officer, said, "Heartland successfully navigated a challenging year with net income available to common stockholders of $133.5 million, or $3.57 per diluted common share. Our success was highlighted by an improved efficiency ratio of 56.65%, strong net interest margin of 3.69% and stable credit quality."

Responses to COVID-19

In the first quarter of 2020, Heartland implemented and continues to operate under its pandemic management plan. While the measures described below remain in effect, Heartland’s pandemic management plan continues to evolve in response to the recent developments relating to the COVID-19 pandemic. To assure workplace and employee safety and business resiliency while providing relief and support to customers and communities facing challenges from the impacts of the pandemic, the following measures are in place:

•employees who can work from home continue to do so, and those employees who are working in bank offices have been placed on rotating teams to limit potential exposure to COVID-19;

•all in-person events and large meetings are canceled and have effectively transitioned to virtual meetings;

•employees receive an increase in time off and enhanced health care coverage related to testing and treatments for COVID-19;

•Heartland has installed and requires the use of personal protective equipment in bank offices;

•Heartland implemented a 20% wage premium for certain customer-facing employees through August 2020, and pandemic pay for employees unable to work due to exposure or contraction of the virus;

•Heartland has provided direct guaranteed loans from the U.S. Small Business Administration (the "SBA") to customers through Heartland’s participation in the Coronavirus Aid, Relief and Economic Security Act (the "CARES Act") and originated $1.2 billion of loans under the Paycheck Protection Program ("PPP");

•Heartland has participated in the CARES Act SBA loan payment and deferral program for existing SBA loans; and

•Heartland has contributed $1.5 million to support communities served by Heartland and its subsidiary banks, including donations of $260,000 to local schools.

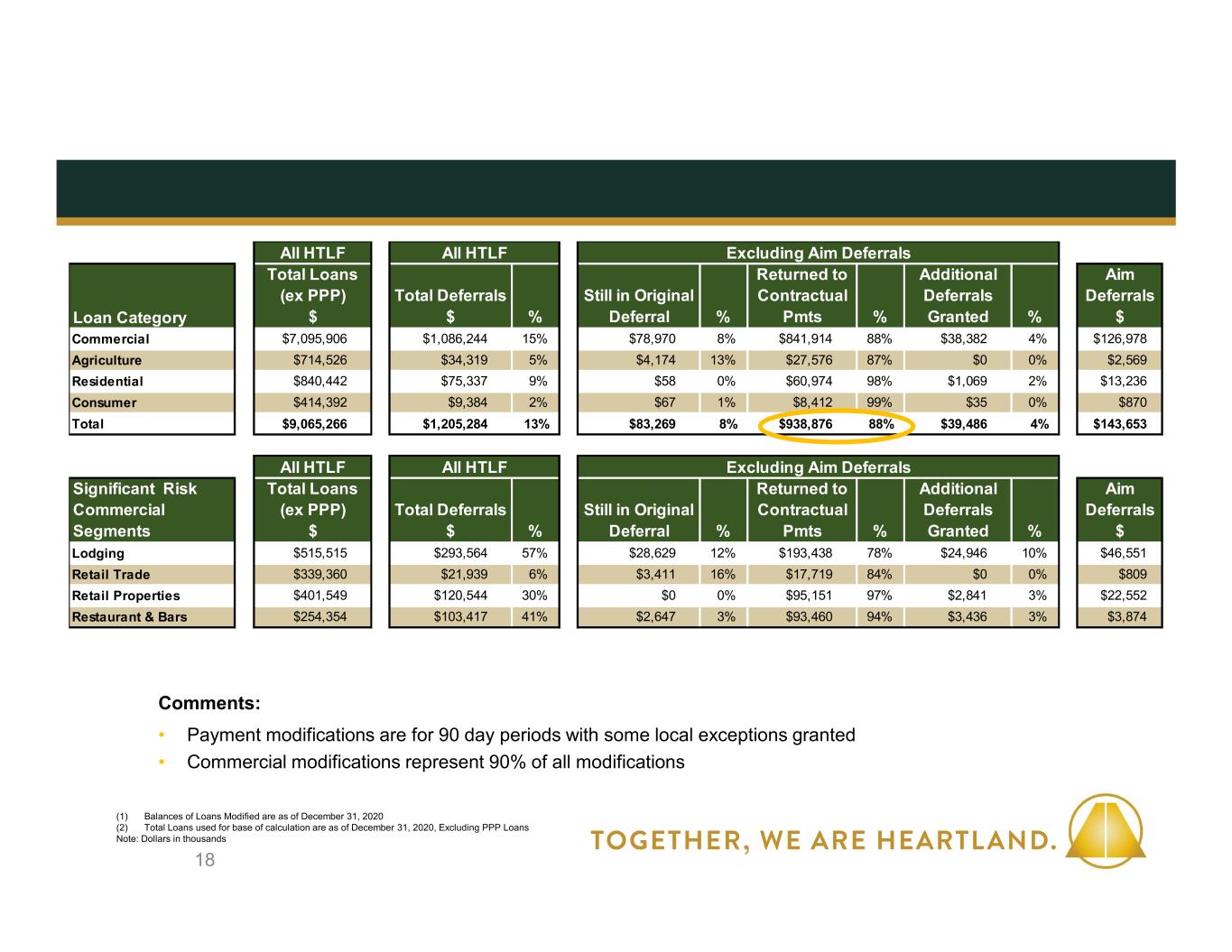

The continued economic disruption resulting from the COVID-19 pandemic will make it difficult for some customers to repay the principal and interest on their loans, and Heartland's subsidiary banks have been working with customers to modify the terms of certain existing loans.

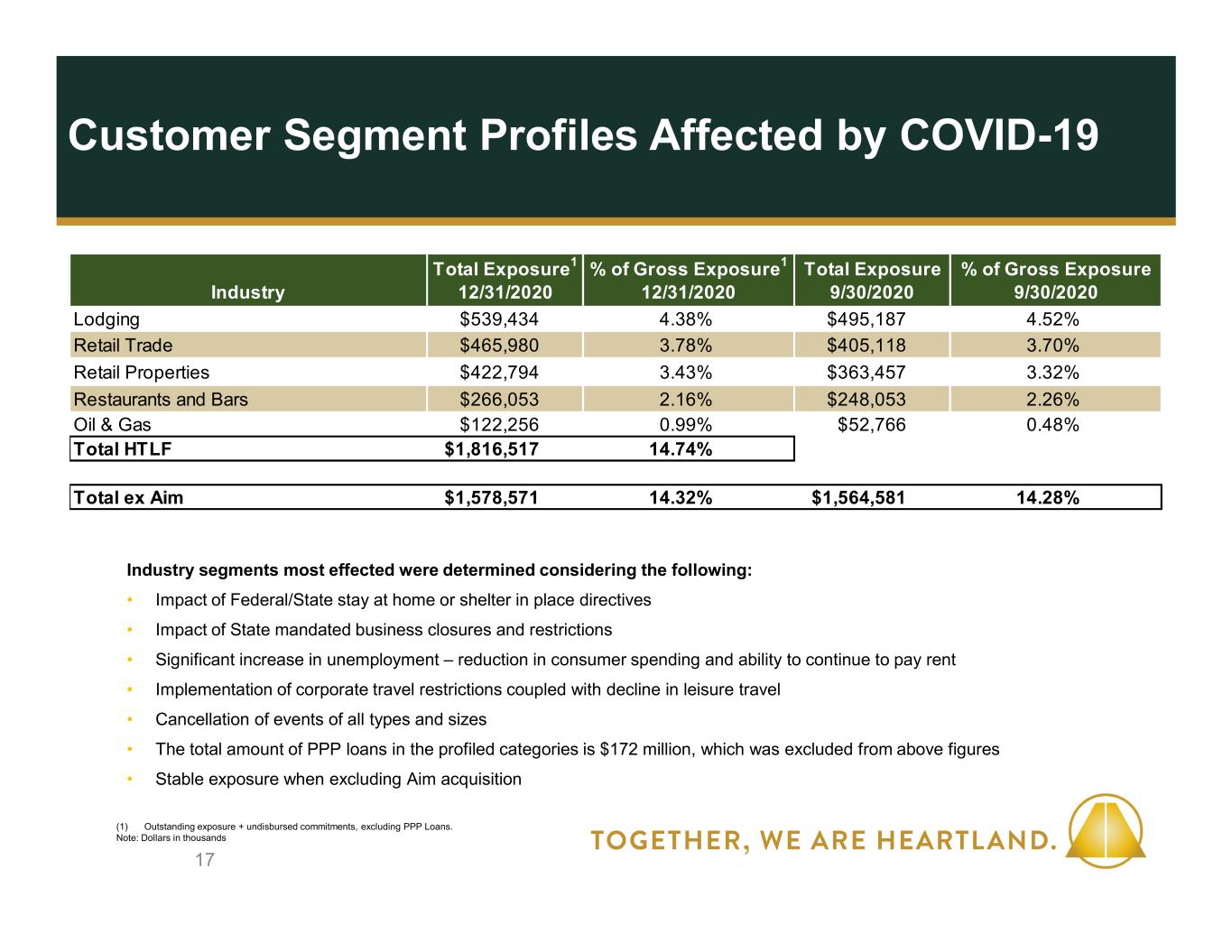

The following table shows the total loan exposure as of the end of each quarter in 2020 to customer segment profiles that Heartland currently believes will be more heavily impacted by COVID-19, dollars in thousands. The increases in total exposure at December 31, 2020 are primarily attributable to loans acquired in the fourth quarter of 2020.

| As of the Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | ||||||||||||||||||||||||||||||||||||||||||||

| Industry | Total Exposure(1) | % of Gross Exposure(2) | Total Exposure | % of Gross Exposure(2) | Total Exposure | % of Gross Exposure(2) | Total Exposure | % of Gross Exposure(2) | |||||||||||||||||||||||||||||||||||||||

| Lodging | $ | 539,434 | 4.38 | % | $ | 495,187 | 4.52 | % | $ | 490,475 | 4.38 | % | $ | 498,596 | 4.47 | % | |||||||||||||||||||||||||||||||

| Retail trade | 465,980 | 3.78 | 405,118 | 3.70 | 407,030 | 3.64 | 367,727 | 3.30 | |||||||||||||||||||||||||||||||||||||||

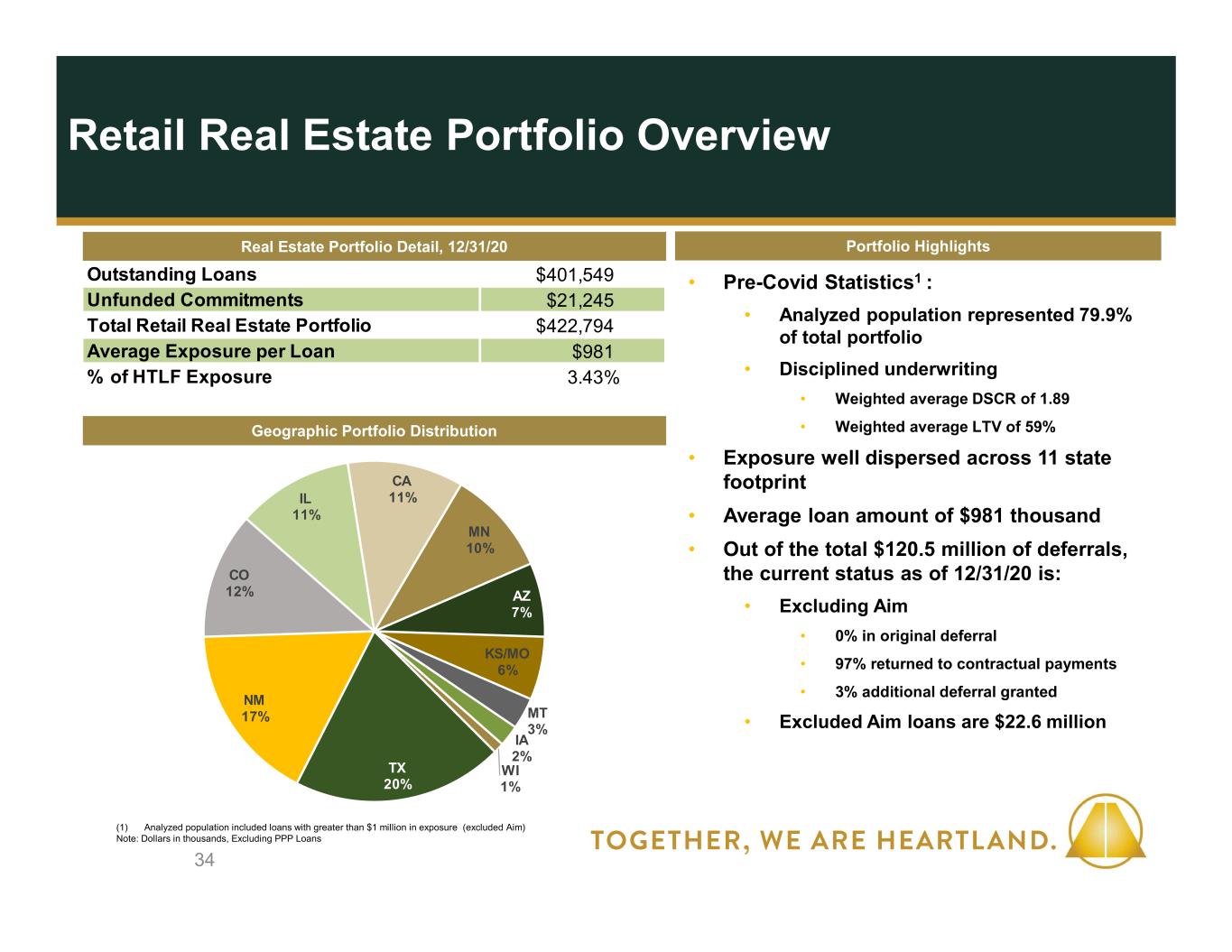

| Retail properties | 422,794 | 3.43 | 363,457 | 3.32 | 369,782 | 3.31 | 408,506 | 3.66 | |||||||||||||||||||||||||||||||||||||||

| Restaurants and bars | 266,053 | 2.16 | 248,053 | 2.26 | 255,701 | 2.29 | 247,239 | 2.22 | |||||||||||||||||||||||||||||||||||||||

| Oil and gas | 122,256 | 0.99 | 52,766 | 0.48 | 63,973 | 0.57 | 56,302 | 0.50 | |||||||||||||||||||||||||||||||||||||||

| Total | $ | 1,816,517 | 14.74 | % | $ | 1,564,581 | 14.28 | % | $ | 1,586,961 | 14.19 | % | $ | 1,578,370 | 14.15 | % | |||||||||||||||||||||||||||||||

| (1) The increases in total exposure at December 31, 2020 are primarily attributable to loans acquired in the fourth quarter of 2020. | |||||||||||||||||||||||||||||||||||||||||||||||

| (2) Total loans outstanding and unfunded commitments excluding PPP loans | |||||||||||||||||||||||||||||||||||||||||||||||

The ultimate impact of the COVID-19 pandemic on Heartland's financial condition and results of operations will depend on the severity and duration of the pandemic, related restrictions on business and consumer activity, roll-out and distribution of vaccines and the availability of government programs to alleviate the economic stress of the pandemic. See Heartland's "Safe Harbor Statement" below.

2020 Developments

Adoption of ASU 2016-13, "Financial Instruments - Credit Losses (Topic 326)"

On January 1, 2020, Heartland adopted ASU 2016-13, "Financial Instruments - Credit Losses (Topic 326)," commonly referred to as "CECL." The impact of Heartland's adoption of CECL resulted in the following:

•an increase of $12.1 million to the allowance for credit losses related to loans, which included a reclassification of $6.0 million of purchased credit impaired loan discount on previously acquired loans, and a cumulative-effect adjustment to retained earnings totaling $4.6 million, net of taxes of $1.5 million;

•an increase of $13.6 million to the allowance for unfunded commitments and a cumulative-effect adjustment to retained earnings totaling $10.2 million, net of taxes of $3.4 million, and

•established an allowance for credit losses for Heartland's held to maturity debt securities of $158,000 and a cumulative-effect adjustment to retained earnings totaling $118,000, net of taxes of $40,000.

Completed the Acquisition of AimBank

On December 4, 2020, Heartland completed the acquisition of AimBank, headquartered in Levelland, Texas. Based on Heartland's closing common stock price of $41.89 on December 4, 2020, the aggregate consideration paid to AimBank common shareholders was $264.5 million, which was paid by delivery of common stock of $217.2 million and cash of $47.3 million, subject to certain hold-back provisions of the merger agreement relating to the cash consideration. AimBank was merged with and into Heartland's wholly-owned Texas subsidiary, First Bank and Trust, and the combined entity operates as First Bank and Trust. As of the closing date, AimBank had, at fair value, total assets of $1.97 billion, which included gross loans of $1.09 billion, and deposits of $1.67 billion. The systems conversion for this transaction is expected to occur in the first quarter of 2021.

Completed the Purchase and Assumption of Johnson Bank's Arizona Operations

On December 4, 2020, Arizona Bank & Trust (“AB&T”), a wholly-owned subsidiary of Heartland headquartered in Phoenix, Arizona, completed its acquisition of certain assets and assumed substantially all of the deposits and certain other liabilities of Johnson Bank’s Arizona operations, which includes four banking centers. Johnson Bank is a wholly-owned subsidiary of Johnson Financial Group, Inc. headquartered in Racine, Wisconsin. As of the closing date, AB&T acquired, at fair value, total assets of $420.1 million, which included gross loans of $150.7 million, and deposits of $415.5 million. The systems conversion occurred simultaneously with the closing of the transaction.

"The acquisition of AimBank is the largest transaction in our history and adds sizable market share in the West Texas region. The addition of the Johnson Bank branches is a great expansion of our footprint in the Phoenix market," said Lynn B. Fuller, Heartland's executive operating chairman.

Branch Optimization

In the second half of 2020, Heartland's member banks approved plans to consolidate eight branch locations, which includes two branches in the Midwest region, five branches in the Western region and one in the Southwestern region, and resulted in $1.2 million and $2.3 million of fixed asset write-downs in the third and fourth quarters of 2020, respectively. The branch consolidations are expected to be completed in early 2021. Heartland continues to review its branch network for optimization and consolidation opportunities, which may result in additional write-downs of fixed assets in future periods.

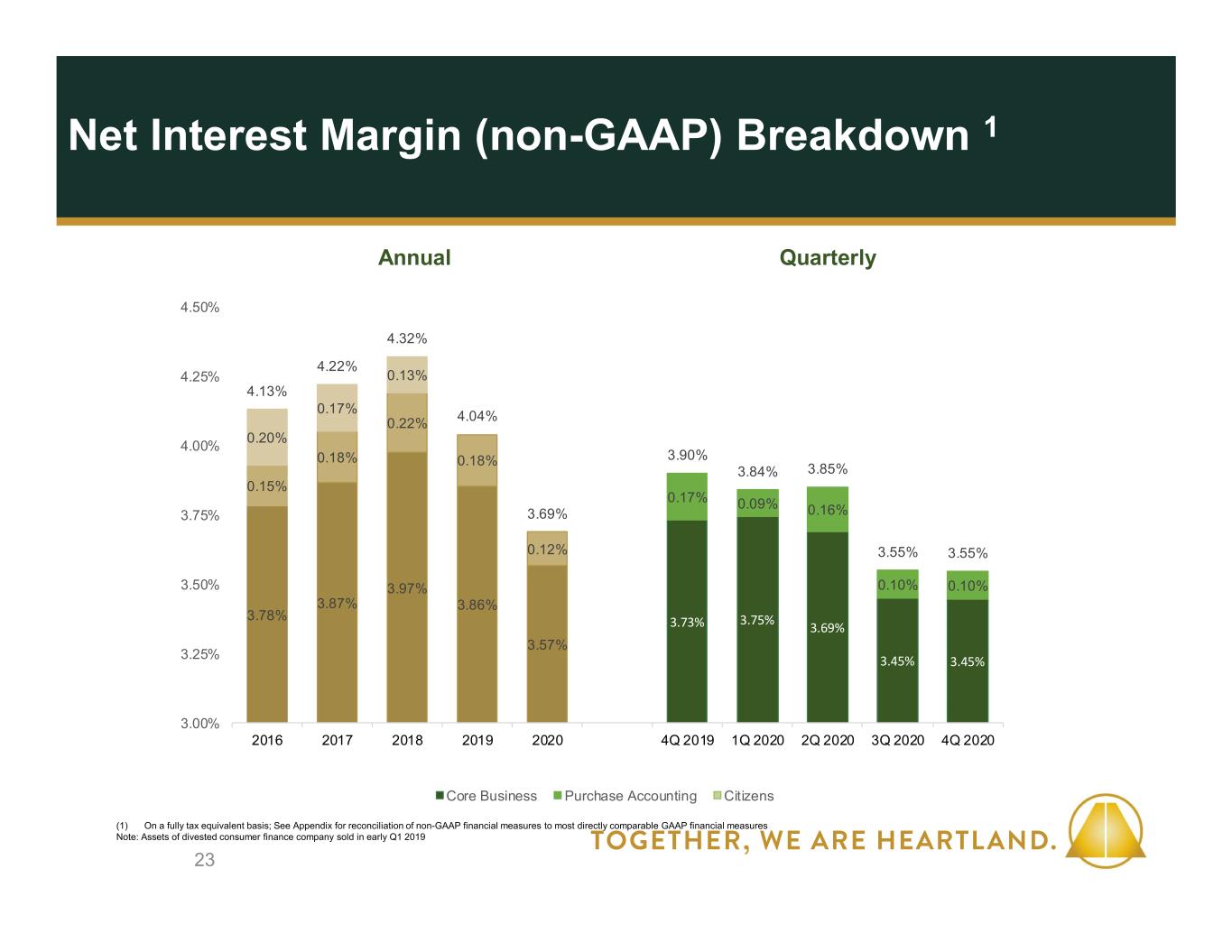

Net Interest Income Increases and Net Interest Margin Decreases from Fourth Quarter of 2019

Net interest margin, expressed as a percentage of average earning assets, was 3.51% (3.55% on a fully tax-equivalent basis, non-GAAP) during the fourth quarter of 2020, compared to 3.86% (3.90% on a fully tax-equivalent basis, non-GAAP) during the fourth quarter of 2019.

Total interest income and average earning asset changes for the fourth quarter of 2020 compared to the fourth quarter of 2019 were:

•Heartland recorded $140.8 million of total interest income, which was an increase of $7.6 million or 6% from $133.2 million, based on an increase in average earning assets, which was partially offset by a decrease in the average rate on earning assets.

•Total interest income on a tax-equivalent basis was $142.4 million, which was an increase of $8.0 million or 6% from $134.3 million.

•Average earning assets increased $3.46 billion or 30% to $15.04 billion compared to $11.58 billion, which was primarily attributable to recent acquisitions and loan growth, including PPP loans.

•The average rate on earning assets decreased 83 basis points to 3.77% compared to 4.60%, which was primarily due to recent decreases in market interest rates.

Total interest expense and average interest bearing liability changes for the fourth quarter of 2020 compared to the fourth quarter of 2019 were:

•Total interest expense was $8.3 million, a decrease of $12.2 million or 60% from $20.5 million, based on a decrease in the average interest rate paid, which was partially offset by an increase in average interest bearing liabilities.

•The average interest rate paid on Heartland's interest bearing liabilities decreased to 0.36% compared to 1.08%, which was primarily due to recent decreases in market interest rates.

•Average interest bearing deposits increased $1.13 billion or 16% to $8.25 billion from $7.12 billion which was primarily attributable to recent acquisitions and deposit growth, including deposits from government stimulus payments and other COVID-19 relief programs.

•The average interest rate paid on Heartland's interest bearing deposits decreased 69 basis points to 0.22% compared to 0.91%.

•Average borrowings increased $409.9 million to $802.5 million from $392.7 million. The average interest rate paid on Heartland's borrowings was 1.81% compared to 4.10%.

Net interest income increased for the fourth quarter of 2020 compared to the fourth quarter of 2019:

•Net interest income totaled $132.6 million compared to $112.7 million, which was an increase of $19.8 million or 18%.

•Net interest income on a tax-equivalent basis (non-GAAP) totaled $134.1 million compared to $113.9 million, which was an increase of $20.3 million or 18%.

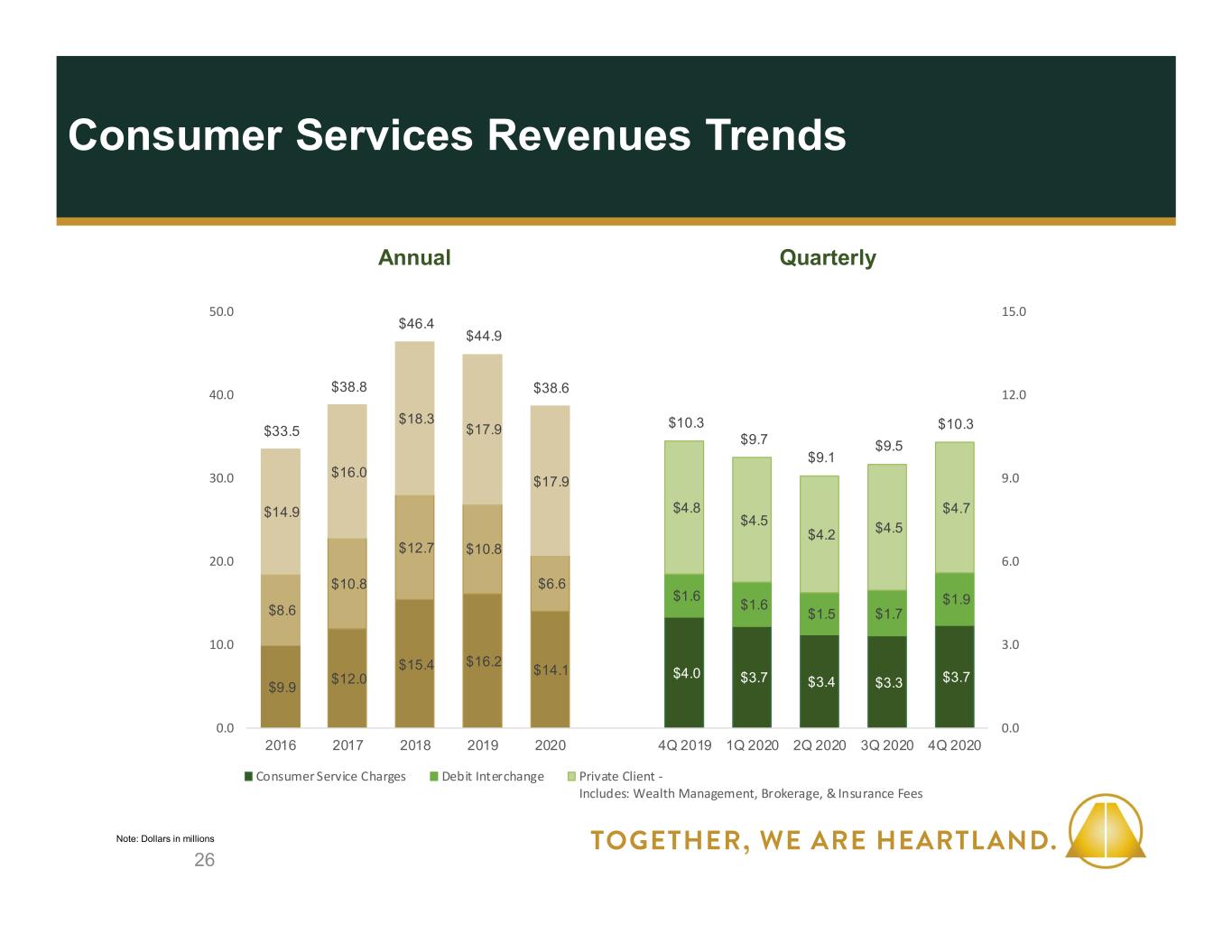

Noninterest Income and Noninterest Expense Increase from Fourth Quarter of 2019

Total noninterest income was $32.6 million during the fourth quarter of 2020 compared to $28.0 million during the fourth quarter of 2019, an increase of $4.6 million or 16%. Significant changes by noninterest income category for the fourth quarter of 2020 compared to the fourth quarter of 2019 were:

•Net securities gains totaled $2.8 million compared to $491,000, which was an increase of $2.3 million.

•Net gains of sales of loans held for sale increased $3.7 million to $7.1 million compared to $3.4 million, primarily due to an increase in residential mortgage loan activity in response to the recent declines in mortgage interest rates.

•Other noninterest income totaled $1.7 million compared to $2.9 million, which was a decrease of $1.1 million or 40%. Included in other noninterest income for the fourth quarter of 2019 was $891,000 related to proceeds on life insurance policies, and there was no similar income in the fourth quarter of 2020.

Total noninterest expense for the fourth quarter of 2020 was $99.3 million compared to $92.9 million for the same quarter of 2019, which was an increase of $6.4 million or 7%. Significant changes by noninterest expense category were:

•Salaries and employee benefits totaled $51.6 million compared to $50.2 million, which was an increase of $1.4 million or 3% and primarily attributable to an increase in full time equivalent employees from recent acquisitions.

•Professional fees totaled $15.1 million compared to $11.1 million, which was an increase of $4.0 million or 36%. Included in professional fees for the fourth quarter of 2020 were FDIC insurance assessments of $1.8 million compared to $0 for the fourth quarter of 2019. The remainder of the increase was primarily attributable to recent technology and process improvement projects.

•Advertising expense totaled $1.1 million compared to $2.3 million, which was a decrease of $1.2 million or 51%. The decrease was primarily attributable to a reduction of in-person customer events and overall reduction in marketing spend.

•Net losses on sales/valuation of assets totaled $2.6 million compared to $1.5 million. The losses recorded in the fourth quarter of 2020 included $2.3 million of write-downs on fixed assets associated with branch optimization activities. Net losses on sales/valuation of assets in the fourth quarter of 2019 included write-downs on fixed assets and buildings held for sale totaling $2.4 million, which was partially offset by an additional gain of $1.2 million associated with the re-evaluation of remaining contingencies from the mortgage servicing rights sale.

•Acquisition, integration and restructuring costs totaled $2.2 million compared to $537,000, which was an increase of $1.6 million and primarily attributable to the acquisitions completed in the fourth quarter of 2020.

•Partnership investment in tax credit projects totaled $1.9 million compared to $3.0 million, which was a decrease of $1.1 million or 37%. Fewer tax credit projects were placed in service in the fourth quarter of 2020 compared to the same quarter of the prior year.

•Other noninterest expenses totaled $11.0 million compared to $11.9 million, which was a decrease of $892,000 or 8%. The reduction was primarily attributable to reduced travel expenses and customer entertainment activities because meetings have transitioned to virtual formats.

Heartland's effective tax rate was 18.52% for the fourth quarter of 2020 compared to 11.99% for the fourth quarter of 2019. The following items impacted Heartland's fourth quarter 2020 and 2019 tax calculations:

•solar energy tax credits of $461,000 and $764,000;

•federal low-income housing tax credits of $195,000 and $281,000;

•new markets tax credits of $75,000 compared to $0;

•historic rehabilitation tax credits of $1.1 million and $1.8 million;

•tax-exempt interest income as a percentage of pre-tax income of 11.82% compared to 10.08%; and

•tax benefits of $617,000 and $1.9 million related to the release of valuation allowances on deferred tax assets.

For the years ended December 31, 2020 and 2019, Heartland's effective tax rate was 20.72% and 19.00%, respectively.

Loans and Deposits Increase Since December 31, 2019

Total assets were $17.91 billion at December 31, 2020, an increase of $4.70 billion or 36% from $13.21 billion at year-end 2019. Excluding $1.97 billion of assets acquired at fair value in the AimBank transaction and $420.1 million of assets acquired at fair value in the Johnson Bank branch transaction, total assets increased $2.31 billion or 17% since year-end 2019. Securities represented 35% and 26% of total assets at December 31, 2020, and December 31, 2019, respectively.

Total loans held to maturity were $10.02 billion at December 31, 2020, compared to $8.37 billion at year-end 2019, an increase of $1.66 billion or 20%. This change includes $1.24 billion of total loans held to maturity acquired at fair value in the AimBank and Johnson Bank branch transactions. Excluding loans acquired in the fourth quarter of 2020 and PPP loans, total loans held to maturity organically decreased $487.3 million or 6% since December 31, 2019. Loan changes by category were:

•Total commercial and business lending, which includes commercial and industrial ("C&I"), PPP, and owner occupied commercial real estate loans, increased $1.27 billion or 32% to $5.27 billion at December 31, 2020, compared to $4.00 billion at December 31, 2019.

•C&I and owner occupied commercial real estate loans increased $307.7 million or 8% to $4.31 billion at December 31, 2020, compared to $4.00 billion at December 31, 2019. Excluding $368.9 million of C&I and owner occupied commercial real estate loans acquired in the fourth quarter of 2020, C&I and owner occupied commercial real estate loans organically decreased $61.2 million or 2% since year-end 2019.

•PPP loans totaled $957.8 million at December 31, 2020, compared to $0 at year-end 2019. Excluding $53.1 million of PPP loans acquired in the fourth quarter of 2020, PPP loans increased $904.7 million since year-end 2019.

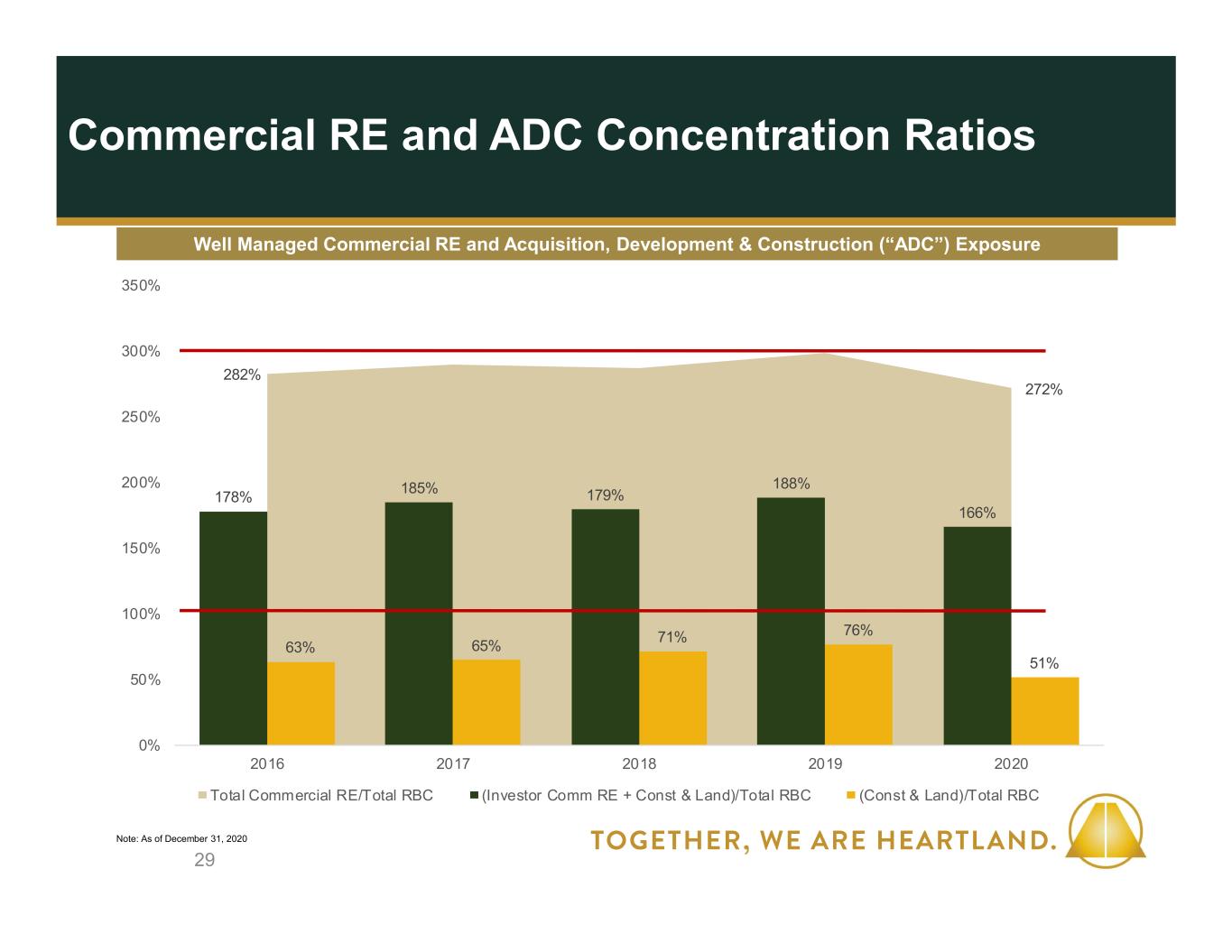

•Commercial real estate lending, which includes non-owner occupied commercial real estate and real estate construction loans, increased $261.7 million or 10% to $2.78 billion at December 31, 2020 from $2.52 billion at year-end 2019. Excluding $319.6 million of commercial real estate loans acquired in the fourth quarter of 2020, total commercial real estate loans organically decreased $57.8 million or 2% since year-end 2019.

•Agricultural and agricultural real estate loans totaled $714.5 million at December 31, 2020, compared to $565.8 million at December 31, 2019, which was an increase of $148.7 million or 26%. Excluding $247.5 million of loans acquired in the fourth quarter of 2020, agricultural and agricultural real estate loans organically decreased $98.8 million or 17% since year-end 2019, which was primarily attributable to scheduled paydowns.

•Residential mortgage loans increased $8.2 million or 1% to $840.4 million at December 31, 2020, from $832.3 million at December 31, 2019. Excluding $197.3 million of loans acquired in the fourth quarter of 2020, residential mortgage loans organically decreased $189.2 million or 23% since year-end 2019, primarily as a result of customers refinancing loans due to the recent decreases in residential mortgage interest rates.

•Consumer loans decreased $28.9 million or 7% to $414.4 million at December 31, 2020, compared to $443.3 million at December 31, 2019. Excluding $51.4 million of loans acquired in the fourth quarter of 2020, consumer loans organically decreased $80.3 million or 18% since year-end 2019, primarily as a result of customers refinancing loans due to the recent decreases in residential mortgage interest rates.

Total deposits were $14.98 billion as of December 31, 2020, compared to $11.04 billion at year-end, which was an increase of $3.94 billion or 36%. This increase includes $2.09 billion of deposits acquired at fair value in the AimBank and Johnson Bank branch transactions. Excluding the deposits acquired at fair value in the fourth quarter of 2020, total deposits organically increased $1.85 billion or 17% since December 31, 2019. Deposit changes by category were:

•Demand deposits increased $2.14 billion or 61% to $5.69 billion at December 31, 2020, compared to $3.54 billion at December 31, 2019. Excluding $776.8 million of demand deposits acquired in the fourth quarter of 2020, demand deposits organically increased $1.37 billion or 39% since year-end 2019.

•Savings deposits increased $1.71 billion or 27% to $8.02 billion at December 31, 2020, from $6.31 billion at December 31, 2019. Excluding savings deposits of $976.3 million acquired in the fourth quarter of 2020, savings deposits organically increased $736.0 million or 12% since year-end 2019.

•Time deposits increased $78.3 million or 7% to $1.27 billion at December 31, 2020 from $1.19 billion at December 31, 2019. Excluding time deposits of $332.9 million acquired in the fourth quarter of 2020, time deposits organically decreased $254.5 million or 21% since year-end 2019.

Growth in non-time deposits was positively impacted by federal government stimulus payments and other COVID-19 relief programs.

Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of organic loan growth and organic deposit growth, which are non-GAAP measures.

Provision and Allowance for Credit Losses

Provision and Allowance for Credit Losses for Loans

Provision expense for credit losses for loans for the fourth quarter of 2020 was $16.1 million, which was an increase of $11.4 million from $4.7 million recorded in the prior quarter and an increase of $11.2 million from $4.9 million recorded in the fourth quarter of 2019. The provision expense for the fourth quarter of 2020 was impacted by several factors, including:

•Provision expense of $9.6 million was recorded for purchased non-credit deteriorated ("non-PCD") loans acquired in the fourth quarter.

•An increase of $3.8 million in reserves for nonaccrual loans compared to the third quarter of 2020.

•Decreases in loan balances, excluding PPP loans and acquired loans, of $91.0 million during the quarter.

•Consistent macroeconomic outlook compared to the third quarter of 2020.

•Net charge offs of $216,000 or 0.01% of average loans.

Heartland's allowance for credit losses for loans totaled $131.6 million at December 31, 2020, compared to $103.4 million at September 30, 2020, and $70.4 million at December 31, 2019, respectively. The following items have impacted Heartland's allowance for credit losses for loans for the year ended December 31, 2020:

•The allowance for credit losses for loans increased $12.1 million after the adoption of CECL on January 1, 2020.

•Allowance for credit losses for loans of $12.3 million was recorded in the fourth quarter associated with the purchased credit deteriorated ("PCD") loans in the AimBank and Johnson Bank transactions.

•Provision expense for the year ended December 31, 2020, totaled $65.7 million.

•Net charge offs of $28.9 million were recorded for the year or 0.32% of average loans.

Heartland expects that net charge offs could be elevated in future periods as customers’ ability to repay loans is adversely impacted by economic disruptions caused by the COVID-19 pandemic.

Provision and Allowance for Credit Losses for Unfunded Commitments

Heartland's allowance for unfunded commitments totaled $15.3 million and $13.9 million at December 31, 2020 and after the adoption of CECL on January 1, 2020, respectively. The following changes impacted Heartland's allowance for credit losses for unfunded commitments during 2020:

•Provision expense for unfunded commitments totaled $1.4 million for the year, which included $2.3 million of provision expense recorded for unfunded commitments acquired in the fourth quarter of 2020.

•Unfunded commitments increased $273.2 million or 9% to $3.25 billion at December 31, 2020 compared to $2.97 billion at December 31, 2019, which was primarily attributable to the acquisitions in the fourth quarter of 2020.

Total Provision and Allowance for Lending Related Credit Losses

The total provision for lending related credit losses was $17.1 million for the fourth quarter of 2020, which included $11.9 million of provision expense for acquired non-PCD loans and unfunded commitments. The total allowance for lending related credit losses was $146.9 million at December 31, 2020, which was 1.47% of loans as of December

31, 2020, compared to $70.4 million or 0.84% of total loans as of December 31, 2019. Excluding PPP loans, which are fully guaranteed, the total allowance for lending related credit losses was 1.62% of loans at December 31, 2020.

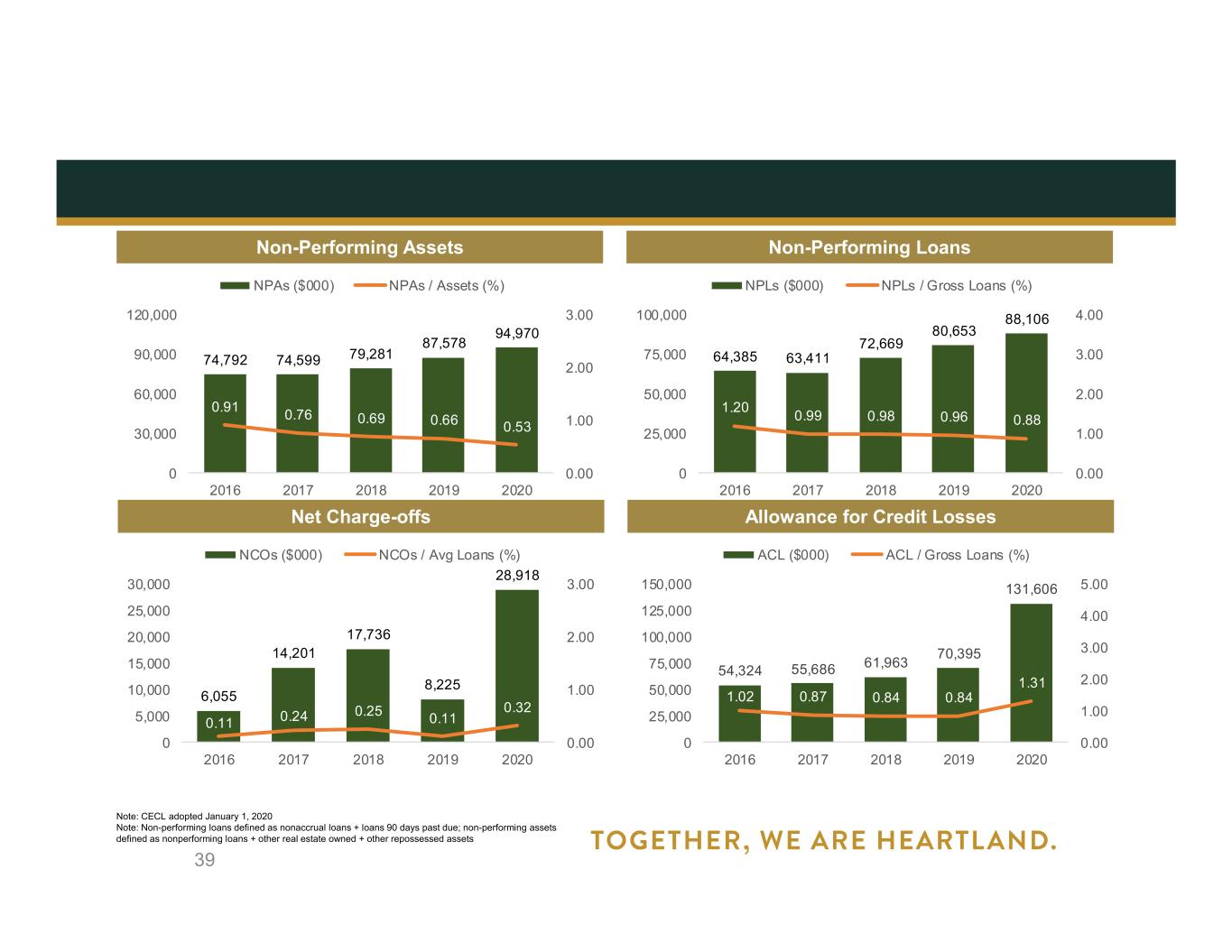

Nonperforming Assets as a Percentage of Total Assets Decreases Since December 31, 2019

Nonperforming assets increased $7.4 million or 8% to $95.0 million, which was 0.53% of total assets at December 31, 2020, compared to $87.6 million or 0.66% of total assets at December 31, 2019. Nonperforming loans were $88.1 million or 0.88% of total loans at December 31, 2020, compared to $80.7 million or 0.96% of total loans at December 31, 2019. At December 31, 2020, loans delinquent 30-89 days were 0.23% of total loans compared to 0.33% of total loans at December 31, 2019. COVID-19 payment deferral and loan modification programs could delay the recognition of net charge-offs, delinquencies and nonaccrual status for loans that would have otherwise moved into past due or nonaccrual status.

Non-GAAP Financial Measures

This earnings release contains references to financial measures which are not defined by generally accepted accounting principles ("GAAP"). Management believes the non-GAAP measures are helpful for investors to analyze and evaluate Heartland's financial condition and operating results. However, these non-GAAP measures have inherent limitations and should not be considered a substitute for operating results determined in accordance with GAAP. Additionally, because non-GAAP measures are not standardized, it may not be possible to compare the non-GAAP measures in this earnings release with other companies' non-GAAP measures. Reconciliations of each non-GAAP measure to the most directly comparable GAAP measure may be found in the financial tables in this earnings release.

Below are the non-GAAP measures included in this earnings release, management's reason for including each measure and the method of calculating each measure:

•Annualized net interest margin, fully tax-equivalent, adjusts net interest income for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources.

•Efficiency ratio, fully tax equivalent, expresses noninterest expenses as a percentage of fully tax-equivalent net interest income and noninterest income. This efficiency ratio is presented on a tax-equivalent basis which adjusts net interest income and noninterest expenses for the tax favored status of certain loans, securities, and tax credit projects. Management believes the presentation of this non-GAAP measure provides supplemental useful information for proper understanding of the financial results as it enhances the comparability of income and expenses arising from taxable and nontaxable sources and excludes specific items as noted in reconciliation contained in this earnings release.

•Net interest income, fully tax equivalent, is net income adjusted for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources.

•Tangible book value per common share is total common equity less goodwill and core deposit and customer relationship intangibles, net, divided by common shares outstanding, net of treasury. This measure is included as it is considered to be a critical metric to analyze and evaluate use of equity, financial condition and capital strength.

•Tangible common equity ratio is total common equity less goodwill and core deposit and customer relationship intangibles, net, divided by total assets less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate financial condition and capital strength.

•Annualized return on average tangible common equity is net income excluding intangible amortization calculated as (1) net income excluding tax-effected core deposit and customer relationship intangibles amortization, divided by (2) average common equity less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate use of equity, financial condition and capital strength.

•Adjusted net income, adjusted return on average tangible common equity and adjusted diluted earnings per share exclude tax-effected acquisition, integration and restructuring costs. Management believes the presentation of these non-GAAP measures are useful to compare net income, return on average tangible common equity and earnings per share results excluding the variability of acquisition, integration and restructuring costs.

•Annualized adjusted return on average assets is net income available to common stockholders plus acquisition, integration and restructuring costs, net of tax, divided by average assets. Management believes this measure is useful to compare the return on average assets excluding the variability of acquisition, integration and restructuring costs.

•Organic deposit growth is exclusive of deposits obtained through acquisitions. Management believes that this measure provides a more complete understanding of underlying trends in deposit growth notwithstanding dispositions and acquisitions.

•Organic loan growth is exclusive of loans obtained through acquisitions and PPP loans. Management believes that this measure provides a more complete understanding of underlying trends in loan growth notwithstanding dispositions and acquisitions.

Conference Call Details

Heartland will host a conference call for investors at 5:00 p.m. EDT today. To participate, dial 866-928-9948 at least five minutes before start time. A replay will be available until January 24, 2022, by logging on to www.htlf.com.

About Heartland Financial USA, Inc.

Heartland Financial USA, Inc. is a diversified financial services company with assets of $17.91 billion. The company provides banking, mortgage, private client, investment, insurance and consumer finance services to individuals and businesses. As of December 31, 2020, Heartland had 142 banking locations serving 102 communities in Iowa, Illinois, Wisconsin, New Mexico, Arizona, Montana, Colorado, Minnesota, Kansas, Missouri, Texas and California. Additional information about Heartland Financial USA, Inc. is available at www.htlf.com.

Safe Harbor Statement

This release, and future oral and written statements of Heartland and its management, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Any statements about Heartland’s expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These forward-looking statements include information about possible or assumed future results of Heartland’s operations or performance. These forward-looking statements are generally identified by the use of the words ‘‘believe”, “expect’’, ‘‘intent”, “anticipate’’, ‘‘plan”, “estimate’’, ‘‘project”, ‘‘will”, ‘‘would”, ‘‘could”, ‘‘should’’, “may”, “view”, “opportunity”, “potential”, or similar expressions that are used in this release, and future oral and written statements of Heartland and its management. Although Heartland has made these statements based on management’s experience and best estimate of future events, the ability of Heartland to predict results or the actual effect of plans or strategies is inherently uncertain, and there may be events or factors that management has not anticipated. Therefore, the accuracy and achievement of such forward-looking statements and estimates are subject to a number of risks, many of which are beyond the ability of management to control or predict, that could cause actual results to differ materially from those in its forward-looking statements. These factors, which are detailed below and in the risk factors in Heartland's reports filed with the Securities and Exchange Commission (“SEC”), include, among others:

•The impact of the COVID-19 pandemic on Heartland and U.S. and global financial markets;

•Measures enacted by the U.S. federal and state governments and adopted by private businesses in response to the COVID-19 pandemic;

•The deterioration of the U.S. economy in general and in the local economies in which Heartland conducts its operations;

•Increasing credit losses due to deterioration in the financial condition of its borrowers, based on declining oil prices and asset and collateral values, which may continue to increase the provision for credit losses and net charge-offs of Heartland;

•Civil unrest in the communities that Heartland serves;

•Levels of unemployment in the geographic areas in which Heartland operates;

•Real estate market values in these geographic areas;

•Future natural disasters and increases to flood insurance premiums;

•The effects of past and any future terrorist threats and attacks, acts of war or threats thereof;

•The level of prepayments on loans and mortgage-backed securities;

•Legislative and regulatory changes affecting banking, tax, securities, insurance and monetary and financial matters;

•Monetary and fiscal policies of the U.S. Government including policies of the U.S. Department of Treasury and the Federal Reserve Board;

•The quality or composition of the loan and investment portfolios of Heartland;

•Demand for loan products and financial services, deposit flows and competition in Heartland’s market areas;

•Changes in accounting principles and guidelines;

•The timely development and acceptance of products and services, including products and services offered through alternative delivery channels such as the Internet;

•The ability of Heartland to implement technological changes as planned and to develop and maintain secure and reliable electronic delivery systems;

•Heartland’s ability to retain key executives and employees; and

•The ability of Heartland to successfully consummate acquisitions and integrate acquired operations.

The COVID-19 pandemic is adversely affecting Heartland and its customers, counterparties, employees and third-party service providers. The COVID-19 pandemic’s severity, its duration and the extent of its impact on Heartland’s business, financial condition, results of operations, liquidity and prospects remain uncertain. The deterioration in general business and economic conditions and turbulence in domestic and global financial markets caused by the COVID-19 pandemic have negatively affected Heartland’s net income, total equity and book value per common share, and continued economic deterioration could adversely affect the value of its assets and liabilities, reduce the availability of funding to Heartland, lead to a tightening of credit and increase stock price volatility. Some economists and investment banks believe that a recession or depression may result from the continued spread of COVID-19 and the economic consequences.

These risks and uncertainties should be considered in evaluating forward-looking statements made by Heartland or on its behalf, and undue reliance should not be placed on these statements. There can be no assurance that other factors not currently anticipated by Heartland will not materially and adversely affect Heartland’s business, financial condition and results of operations. In addition, many of these risks and uncertainties are currently amplified by and may continue to be amplified by the COVID-19 pandemic and the impact of varying governmental responses that affect Heartland’s customers and the economies where they operate. Please take into account that forward-looking statements speak only as of the date they are made, and except as required by applicable law, Heartland does not undertake any obligation to publicly correct or update any forward-looking statement. Further information concerning Heartland and its business, including additional factors that could materially affect Heartland’s financial results, is included in Heartland’s filings with the SEC.

-FINANCIAL TABLES FOLLOW-

###

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||

| For the Quarter Ended December 31, | For the Year Ended December 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||

| Interest and fees on loans | $ | 108,865 | $ | 107,566 | $ | 424,941 | $ | 424,615 | |||||||||||||||

| Interest on securities: | |||||||||||||||||||||||

| Taxable | 28,154 | 22,581 | 98,263 | 73,147 | |||||||||||||||||||

| Nontaxable | 3,735 | 2,102 | 12,484 | 9,868 | |||||||||||||||||||

| Interest on federal funds sold | — | — | — | 4 | |||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 77 | 953 | 924 | 6,695 | |||||||||||||||||||

| Total Interest Income | 140,831 | 133,202 | 536,612 | 514,329 | |||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||

| Interest on deposits | 4,609 | 16,401 | 30,287 | 63,734 | |||||||||||||||||||

| Interest on short-term borrowings | 175 | 271 | 610 | 1,748 | |||||||||||||||||||

| Interest on other borrowings | 3,472 | 3,785 | 13,986 | 15,118 | |||||||||||||||||||

| Total Interest Expense | 8,256 | 20,457 | 44,883 | 80,600 | |||||||||||||||||||

| Net Interest Income | 132,575 | 112,745 | 491,729 | 433,729 | |||||||||||||||||||

| Provision for credit losses | 17,072 | 4,903 | 67,066 | 16,657 | |||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 115,503 | 107,842 | 424,663 | 417,072 | |||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||

| Service charges and fees | 12,725 | 12,368 | 47,467 | 52,157 | |||||||||||||||||||

| Loan servicing income | 997 | 955 | 2,977 | 4,843 | |||||||||||||||||||

| Trust fees | 5,506 | 5,141 | 20,862 | 19,399 | |||||||||||||||||||

| Brokerage and insurance commissions | 779 | 1,062 | 2,756 | 3,786 | |||||||||||||||||||

| Securities gains, net | 2,829 | 491 | 7,793 | 7,659 | |||||||||||||||||||

| Unrealized gain on equity securities, net | 36 | 11 | 640 | 525 | |||||||||||||||||||

| Net gains on sale of loans held for sale | 7,104 | 3,363 | 28,515 | 15,555 | |||||||||||||||||||

| Valuation adjustment on servicing rights | (102) | 668 | (1,778) | (911) | |||||||||||||||||||

| Income on bank owned life insurance | 1,021 | 1,117 | 3,554 | 3,785 | |||||||||||||||||||

| Other noninterest income | 1,726 | 2,854 | 7,505 | 9,410 | |||||||||||||||||||

| Total Noninterest Income | 32,621 | 28,030 | 120,291 | 116,208 | |||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||

| Salaries and employee benefits | 51,615 | 50,234 | 202,668 | 200,341 | |||||||||||||||||||

| Occupancy | 6,849 | 5,802 | 26,554 | 25,429 | |||||||||||||||||||

| Furniture and equipment | 3,913 | 3,323 | 12,514 | 12,013 | |||||||||||||||||||

| Professional fees | 15,117 | 11,082 | 54,068 | 47,697 | |||||||||||||||||||

| Advertising | 1,107 | 2,274 | 5,235 | 9,825 | |||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 2,501 | 2,918 | 10,670 | 11,972 | |||||||||||||||||||

| Other real estate and loan collection expenses, net | 468 | 261 | 1,340 | 1,035 | |||||||||||||||||||

| (Gain)/loss on sales/valuations of assets, net | 2,621 | 1,512 | 5,101 | (19,422) | |||||||||||||||||||

| Acquisition, integration and restructuring costs | 2,186 | 537 | 5,381 | 6,580 | |||||||||||||||||||

| Partnership investment in tax credit projects | 1,899 | 3,038 | 3,801 | 8,030 | |||||||||||||||||||

| Other noninterest expenses | 10,993 | 11,885 | 43,631 | 45,661 | |||||||||||||||||||

| Total Noninterest Expense | 99,269 | 92,866 | 370,963 | 349,161 | |||||||||||||||||||

| Income Before Income Taxes | 48,855 | 43,006 | 173,991 | 184,119 | |||||||||||||||||||

| Income taxes | 9,046 | 5,155 | 36,053 | 34,990 | |||||||||||||||||||

| Net Income | 39,809 | 37,851 | 137,938 | 149,129 | |||||||||||||||||||

| Preferred dividends | (2,014) | — | (4,451) | — | |||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 37,795 | $ | 37,851 | $ | 133,487 | $ | 149,129 | |||||||||||||||

| Earnings per common share-diluted | $ | 0.98 | $ | 1.03 | $ | 3.57 | $ | 4.14 | |||||||||||||||

| Weighted average shares outstanding-diluted | 38,534,082 | 36,840,519 | 37,356,524 | 36,061,908 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | |||||||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 108,865 | $ | 102,657 | $ | 107,005 | $ | 106,414 | $ | 107,566 | |||||||||||||||||||

| Interest on securities: | |||||||||||||||||||||||||||||

| Taxable | 28,154 | 25,016 | 23,362 | 21,731 | 22,581 | ||||||||||||||||||||||||

| Nontaxable | 3,735 | 3,222 | 3,344 | 2,183 | 2,102 | ||||||||||||||||||||||||

| Interest on federal funds sold | — | — | — | — | — | ||||||||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 77 | 72 | 54 | 721 | 953 | ||||||||||||||||||||||||

| Total Interest Income | 140,831 | 130,967 | 133,765 | 131,049 | 133,202 | ||||||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||

| Interest on deposits | 4,609 | 4,962 | 6,134 | 14,582 | 16,401 | ||||||||||||||||||||||||

| Interest on short-term borrowings | 175 | 78 | 61 | 296 | 271 | ||||||||||||||||||||||||

| Interest on other borrowings | 3,472 | 3,430 | 3,424 | 3,660 | 3,785 | ||||||||||||||||||||||||

| Total Interest Expense | 8,256 | 8,470 | 9,619 | 18,538 | 20,457 | ||||||||||||||||||||||||

| Net Interest Income | 132,575 | 122,497 | 124,146 | 112,511 | 112,745 | ||||||||||||||||||||||||

| Provision for credit losses | 17,072 | 1,678 | 26,796 | 21,520 | 4,903 | ||||||||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 115,503 | 120,819 | 97,350 | 90,991 | 107,842 | ||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||

| Service charges and fees | 12,725 | 11,749 | 10,972 | 12,021 | 12,368 | ||||||||||||||||||||||||

| Loan servicing income | 997 | 638 | 379 | 963 | 955 | ||||||||||||||||||||||||

| Trust fees | 5,506 | 5,357 | 4,977 | 5,022 | 5,141 | ||||||||||||||||||||||||

| Brokerage and insurance commissions | 779 | 649 | 595 | 733 | 1,062 | ||||||||||||||||||||||||

| Securities gains, net | 2,829 | 1,300 | 2,006 | 1,658 | 491 | ||||||||||||||||||||||||

| Unrealized gain on equity securities, net | 36 | 155 | 680 | (231) | 11 | ||||||||||||||||||||||||

| Net gains on sale of loans held for sale | 7,104 | 8,894 | 7,857 | 4,660 | 3,363 | ||||||||||||||||||||||||

| Valuation adjustment on servicing rights | (102) | (120) | 9 | (1,565) | 668 | ||||||||||||||||||||||||

| Income on bank owned life insurance | 1,021 | 868 | 1,167 | 498 | 1,117 | ||||||||||||||||||||||||

| Other noninterest income | 1,726 | 1,726 | 1,995 | 2,058 | 2,854 | ||||||||||||||||||||||||

| Total Noninterest Income | 32,621 | 31,216 | 30,637 | 25,817 | 28,030 | ||||||||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 51,615 | 50,978 | 50,118 | 49,957 | 50,234 | ||||||||||||||||||||||||

| Occupancy | 6,849 | 6,732 | 6,502 | 6,471 | 5,802 | ||||||||||||||||||||||||

| Furniture and equipment | 3,913 | 2,500 | 2,993 | 3,108 | 3,323 | ||||||||||||||||||||||||

| Professional fees | 15,117 | 12,802 | 13,676 | 12,473 | 11,082 | ||||||||||||||||||||||||

| Advertising | 1,107 | 928 | 995 | 2,205 | 2,274 | ||||||||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 2,501 | 2,492 | 2,696 | 2,981 | 2,918 | ||||||||||||||||||||||||

| Other real estate and loan collection expenses, net | 468 | 335 | 203 | 334 | 261 | ||||||||||||||||||||||||

| (Gain)/loss on sales/valuations of assets, net | 2,621 | 1,763 | 701 | 16 | 1,512 | ||||||||||||||||||||||||

| Acquisition, integration and restructuring costs | 2,186 | 1,146 | 673 | 1,376 | 537 | ||||||||||||||||||||||||

| Partnership investment in tax credit projects | 1,899 | 927 | 791 | 184 | 3,038 | ||||||||||||||||||||||||

| Other noninterest expenses | 10,993 | 9,793 | 11,091 | 11,754 | 11,885 | ||||||||||||||||||||||||

| Total Noninterest Expense | 99,269 | 90,396 | 90,439 | 90,859 | 92,866 | ||||||||||||||||||||||||

| Income Before Income Taxes | 48,855 | 61,639 | 37,548 | 25,949 | 43,006 | ||||||||||||||||||||||||

| Income taxes | 9,046 | 13,681 | 7,417 | 5,909 | 5,155 | ||||||||||||||||||||||||

| Net Income | 39,809 | 47,958 | 30,131 | 20,040 | 37,851 | ||||||||||||||||||||||||

| Preferred dividends | (2,014) | (2,437) | — | — | — | ||||||||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 37,795 | $ | 45,521 | $ | 30,131 | $ | 20,040 | $ | 37,851 | |||||||||||||||||||

| Earnings per common share-diluted | $ | 0.98 | $ | 1.23 | $ | 0.82 | $ | 0.54 | $ | 1.03 | |||||||||||||||||||

| Weighted average shares outstanding-diluted | 38,534,082 | 36,995,572 | 36,915,630 | 36,895,591 | 36,840,519 | ||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of | |||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 219,243 | $ | 175,284 | $ | 211,429 | $ | 175,587 | $ | 206,607 | |||||||||||||||||||

| Interest bearing deposits with other banks and other short-term investments | 118,660 | 156,371 | 242,149 | 64,156 | 172,127 | ||||||||||||||||||||||||

| Cash and cash equivalents | 337,903 | 331,655 | 453,578 | 239,743 | 378,734 | ||||||||||||||||||||||||

| Time deposits in other financial institutions | 3,129 | 3,129 | 3,128 | 3,568 | 3,564 | ||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||

| Carried at fair value | 6,127,975 | 4,950,698 | 4,126,351 | 3,488,621 | 3,312,796 | ||||||||||||||||||||||||

| Held to maturity, at cost | 88,839 | 88,700 | 90,579 | 91,875 | 91,324 | ||||||||||||||||||||||||

| Other investments, at cost | 75,253 | 35,940 | 35,902 | 35,370 | 31,321 | ||||||||||||||||||||||||

| Loans held for sale | 57,949 | 65,969 | 54,382 | 22,957 | 26,748 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Held to maturity | 10,023,051 | 9,099,646 | 9,246,830 | 8,374,236 | 8,367,917 | ||||||||||||||||||||||||

| Allowance for credit losses | (131,606) | (103,377) | (119,937) | (97,350) | (70,395) | ||||||||||||||||||||||||

| Loans, net | 9,891,445 | 8,996,269 | 9,126,893 | 8,276,886 | 8,297,522 | ||||||||||||||||||||||||

| Premises, furniture and equipment, net | 226,094 | 200,028 | 198,481 | 200,960 | 200,525 | ||||||||||||||||||||||||

| Goodwill | 576,005 | 446,345 | 446,345 | 446,345 | 446,345 | ||||||||||||||||||||||||

| Core deposit and customer relationship intangibles, net | 42,383 | 40,520 | 43,011 | 45,707 | 48,688 | ||||||||||||||||||||||||

| Servicing rights, net | 6,052 | 5,752 | 5,469 | 5,220 | 6,736 | ||||||||||||||||||||||||

| Cash surrender value on life insurance | 187,664 | 173,111 | 172,813 | 172,140 | 171,625 | ||||||||||||||||||||||||

| Other real estate, net | 6,624 | 5,050 | 5,539 | 6,074 | 6,914 | ||||||||||||||||||||||||

| Other assets | 281,024 | 269,498 | 263,682 | 259,043 | 186,755 | ||||||||||||||||||||||||

| Total Assets | $ | 17,908,339 | $ | 15,612,664 | $ | 15,026,153 | $ | 13,294,509 | $ | 13,209,597 | |||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Demand | $ | 5,688,810 | $ | 5,022,567 | $ | 4,831,151 | $ | 3,696,974 | $ | 3,543,863 | |||||||||||||||||||

| Savings | 8,019,704 | 6,742,151 | 6,810,296 | 6,366,610 | 6,307,425 | ||||||||||||||||||||||||

| Time | 1,271,391 | 1,002,392 | 1,067,252 | 1,110,441 | 1,193,043 | ||||||||||||||||||||||||

| Total deposits | 14,979,905 | 12,767,110 | 12,708,699 | 11,174,025 | 11,044,331 | ||||||||||||||||||||||||

| Short-term borrowings | 167,872 | 306,706 | 88,631 | 121,442 | 182,626 | ||||||||||||||||||||||||

| Other borrowings | 457,042 | 524,045 | 306,459 | 276,150 | 275,773 | ||||||||||||||||||||||||

| Accrued expenses and other liabilities | 224,289 | 203,199 | 174,987 | 169,178 | 128,730 | ||||||||||||||||||||||||

| Total Liabilities | 15,829,108 | 13,801,060 | 13,278,776 | 11,740,795 | 11,631,460 | ||||||||||||||||||||||||

| Stockholders' Equity | |||||||||||||||||||||||||||||

| Preferred equity | 110,705 | 110,705 | 110,705 | — | — | ||||||||||||||||||||||||

| Common stock | 42,094 | 36,885 | 36,845 | 36,807 | 36,704 | ||||||||||||||||||||||||

| Capital surplus | 1,062,083 | 847,377 | 844,202 | 842,780 | 839,857 | ||||||||||||||||||||||||

| Retained earnings | 791,630 | 761,211 | 723,067 | 700,298 | 702,502 | ||||||||||||||||||||||||

| Accumulated other comprehensive income/(loss) | 72,719 | 55,426 | 32,558 | (26,171) | (926) | ||||||||||||||||||||||||

| Total Equity | 2,079,231 | 1,811,604 | 1,747,377 | 1,553,714 | 1,578,137 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 17,908,339 | $ | 15,612,664 | $ | 15,026,153 | $ | 13,294,509 | $ | 13,209,597 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | |||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||

| Assets | $ | 16,401,152 | $ | 15,167,225 | $ | 14,391,856 | $ | 13,148,173 | $ | 12,798,770 | |||||||||||||||||||

| Loans, net of unearned | 9,366,430 | 9,220,666 | 9,186,913 | 8,364,220 | 8,090,476 | ||||||||||||||||||||||||

| Deposits | 13,518,020 | 12,650,822 | 12,288,378 | 10,971,193 | 10,704,643 | ||||||||||||||||||||||||

| Earning assets | 15,042,079 | 13,868,360 | 13,103,159 | 11,891,455 | 11,580,295 | ||||||||||||||||||||||||

| Interest bearing liabilities | 9,053,855 | 8,320,123 | 8,155,753 | 7,841,941 | 7,513,701 | ||||||||||||||||||||||||

| Common equity | 1,769,575 | 1,661,381 | 1,574,902 | 1,619,682 | 1,570,258 | ||||||||||||||||||||||||

| Total stockholders' equity | 1,880,280 | 1,772,086 | 1,580,997 | 1,619,682 | 1,570,258 | ||||||||||||||||||||||||

Tangible common equity (non-GAAP)(1) | 1,238,691 | 1,172,891 | 1,083,834 | 1,125,705 | 1,087,495 | ||||||||||||||||||||||||

| Key Performance Ratios | |||||||||||||||||||||||||||||

| Annualized return on average assets | 0.92 | % | 1.19 | % | 0.84 | % | 0.61 | % | 1.17 | % | |||||||||||||||||||

Annualized adjusted return on average assets (non-GAAP)(1) | 0.96 | 1.22 | 0.86 | 0.65 | 1.19 | ||||||||||||||||||||||||

| Annualized return on average common equity (GAAP) | 8.50 | 10.90 | 7.69 | 4.98 | 9.56 | ||||||||||||||||||||||||

Annualized return on average tangible common equity (non-GAAP)(1) | 12.77 | 16.11 | 11.97 | 8.00 | 14.65 | ||||||||||||||||||||||||

Annualized adjusted return on average tangible common equity (non-GAAP)(1) | 13.33 | 16.41 | 12.17 | 8.39 | 14.80 | ||||||||||||||||||||||||

| Annualized ratio of net charge-offs to average loans | 0.01 | 0.92 | 0.11 | 0.24 | 0.04 | ||||||||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.51 | 3.51 | 3.81 | 3.81 | 3.86 | ||||||||||||||||||||||||

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.55 | 3.55 | 3.85 | 3.84 | 3.90 | ||||||||||||||||||||||||

Efficiency ratio, fully tax-equivalent (non-GAAP)(1) | 54.93 | 54.67 | 55.75 | 61.82 | 60.31 | ||||||||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||

| For the Quarter Ended December 31, | For the Year Ended December 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||

| Assets | $ | 16,401,152 | $ | 12,798,770 | $ | 14,782,605 | $ | 12,021,917 | |||||||||||||||

| Loans, net of unearned | 9,366,430 | 8,090,476 | 9,035,973 | 7,761,091 | |||||||||||||||||||

| Deposits | 13,518,020 | 10,704,643 | 12,361,077 | 10,030,629 | |||||||||||||||||||

| Earning assets | 15,042,079 | 11,580,295 | 13,481,613 | 10,845,940 | |||||||||||||||||||

| Interest bearing liabilities | 9,053,855 | 7,513,701 | 8,344,798 | 7,048,607 | |||||||||||||||||||

| Common equity | 1,769,575 | 1,570,258 | 1,656,708 | 1,473,396 | |||||||||||||||||||

| Total stockholders' equity | 1,880,280 | 1,570,258 | 1,713,878 | 1,473,396 | |||||||||||||||||||

Tangible common equity (non-GAAP)(1) | 1,238,691 | 1,087,495 | 1,155,556 | 1,008,178 | |||||||||||||||||||

| Key Performance Ratios | |||||||||||||||||||||||

| Annualized return on average assets | 0.92 | % | 1.17 | % | 0.90 | % | 1.24 | % | |||||||||||||||

Annualized adjusted return on average assets (non-GAAP)(1) | 0.96 | 1.19 | 0.93 | 1.28 | |||||||||||||||||||

| Annualized return on average common equity (GAAP) | 8.50 | 9.56 | 8.06 | 10.12 | |||||||||||||||||||

Annualized return on average tangible common equity (non-GAAP)(1) | 12.77 | 14.65 | 12.28 | 15.73 | |||||||||||||||||||

Annualized adjusted return on average tangible common equity (non-GAAP)(1) | 13.33 | 14.80 | 12.65 | 16.25 | |||||||||||||||||||

| Annualized ratio of net charge-offs to average loans | 0.01 | 0.04 | 0.32 | 0.11 | |||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.51 | 3.86 | 3.65 | 4.00 | |||||||||||||||||||

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.55 | 3.90 | 3.69 | 4.04 | |||||||||||||||||||

Efficiency ratio, fully tax-equivalent(1) | 54.93 | 60.31 | 56.65 | 62.50 | |||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | |||||||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||

| Book value per common share | $ | 46.77 | $ | 46.11 | $ | 44.42 | $ | 42.21 | $ | 43.00 | |||||||||||||||||||

Tangible book value per common share (non-GAAP)(1) | $ | 32.07 | $ | 32.91 | $ | 31.14 | $ | 28.84 | $ | 29.51 | |||||||||||||||||||

| Common shares outstanding, net of treasury stock | 42,093,862 | 36,885,390 | 36,844,744 | 36,807,217 | 36,704,278 | ||||||||||||||||||||||||

Tangible common equity ratio (non-GAAP)(1) | 7.81 | % | 8.03 | % | 7.89 | % | 8.29 | % | 8.52 | % | |||||||||||||||||||

| Other Selected Trend Information | |||||||||||||||||||||||||||||

| Effective tax rate | 18.52 | % | 22.20 | % | 19.75 | % | 22.77 | % | 11.99 | % | |||||||||||||||||||

| Full time equivalent employees | 2,013 | 1,827 | 1,821 | 1,817 | 1,908 | ||||||||||||||||||||||||

Loans Held to Maturity(2) | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 2,534,799 | $ | 2,303,646 | $ | 2,364,400 | $ | 2,550,490 | $ | 2,530,809 | |||||||||||||||||||

| Paycheck Protection Program ("PPP") | 957,785 | 1,128,035 | 1,124,430 | — | — | ||||||||||||||||||||||||

| Owner occupied commercial real estate | 1,776,406 | 1,494,902 | 1,433,271 | 1,431,038 | 1,472,704 | ||||||||||||||||||||||||

| Commercial and business lending | 5,268,990 | 4,926,583 | 4,922,101 | 3,981,528 | 4,003,513 | ||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 1,921,481 | 1,659,683 | 1,543,623 | 1,551,787 | 1,495,877 | ||||||||||||||||||||||||

| Real estate construction | 863,220 | 917,765 | 1,115,843 | 1,069,700 | 1,027,081 | ||||||||||||||||||||||||

| Commercial real estate lending | 2,784,701 | 2,577,448 | 2,659,466 | 2,621,487 | 2,522,958 | ||||||||||||||||||||||||

| Total commercial lending | 8,053,691 | 7,504,031 | 7,581,567 | 6,603,015 | 6,526,471 | ||||||||||||||||||||||||

| Agricultural and agricultural real estate | 714,526 | 508,058 | 520,773 | 550,107 | 565,837 | ||||||||||||||||||||||||

| Residential mortgage | 840,442 | 701,899 | 735,762 | 792,540 | 832,277 | ||||||||||||||||||||||||

| Consumer | 414,392 | 385,658 | 408,728 | 428,574 | 443,332 | ||||||||||||||||||||||||

| Total loans held to maturity | $ | 10,023,051 | $ | 9,099,646 | $ | 9,246,830 | $ | 8,374,236 | $ | 8,367,917 | |||||||||||||||||||

| Total unfunded loan commitments | $ | 3,246,953 | $ | 2,980,484 | $ | 3,065,283 | $ | 2,782,679 | $ | 2,973,732 | |||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||

| (2) In conjunction with the adoption of ASU 2016-13, Heartland reclassified loan balances to more closely align with FDIC codes. All prior period balances have been adjusted. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | |||||||||||||||||||||||||

| Allowance for Credit Losses-Loans | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 103,377 | $ | 119,937 | $ | 97,350 | $ | 70,395 | $ | 66,222 | |||||||||||||||||||

| Impact of ASU 2016-13 adoption | — | — | — | 12,071 | — | ||||||||||||||||||||||||

| Allowance for acquired purchased credit deteriorated loans | 12,313 | — | — | — | — | ||||||||||||||||||||||||

| Provision for credit losses | 16,132 | 4,741 | 25,007 | 19,865 | 4,903 | ||||||||||||||||||||||||

| Charge-offs | (1,104) | (21,753) | (3,564) | (6,301) | (2,018) | ||||||||||||||||||||||||

| Recoveries | 888 | 452 | 1,144 | 1,320 | 1,288 | ||||||||||||||||||||||||

| Balance, end of period | $ | 131,606 | $ | 103,377 | $ | 119,937 | $ | 97,350 | $ | 70,395 | |||||||||||||||||||

Allowance for Unfunded Commitments(1) | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 14,330 | $ | 17,392 | $ | 15,468 | $ | 248 | $ | — | |||||||||||||||||||

| Impact of ASU 2016-13 adoption | — | — | — | 13,604 | — | ||||||||||||||||||||||||

| Provision for credit losses | 950 | (3,062) | 1,924 | 1,616 | — | ||||||||||||||||||||||||

| Balance, end of period | $ | 15,280 | $ | 14,330 | $ | 17,392 | $ | 15,468 | $ | — | |||||||||||||||||||

| Allowance for lending related credit losses | $ | 146,886 | $ | 117,707 | $ | 137,329 | $ | 112,818 | $ | 70,395 | |||||||||||||||||||

| Provision for Credit Losses | |||||||||||||||||||||||||||||

| Provision for credit losses-loans | $ | 6,572 | $ | 4,741 | $ | 25,007 | $ | 19,865 | $ | 4,903 | |||||||||||||||||||

| Provision for credit losses-acquired loans | 9,560 | — | — | — | — | ||||||||||||||||||||||||

| Provision for credit losses-unfunded commitments | (1,372) | (3,062) | 1,924 | 1,616 | — | ||||||||||||||||||||||||

| Provision for credit losses-acquired unfunded commitments | 2,322 | — | — | — | — | ||||||||||||||||||||||||

Provision for credit losses-held to maturity securities(2) | (10) | (1) | (135) | 39 | — | ||||||||||||||||||||||||

| Total provision for credit losses | $ | 17,072 | $ | 1,678 | $ | 26,796 | $ | 21,520 | $ | 4,903 | |||||||||||||||||||

| (1) Prior to the adoption of ASU 2016-13, the allowance for unfunded commitments was immaterial and therefore prior periods have not been shown in this table. | |||||||||||||||||||||||||||||

| (2) Prior to the adoption of ASU 2016-13, there was no requirement to record provision for credit losses for held to maturity securities. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 12/31/2020 | 9/30/2020 | 6/30/2020 | 3/31/2020 | 12/31/2019 | |||||||||||||||||||||||||

| Asset Quality | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 87,386 | $ | 79,040 | $ | 91,609 | $ | 79,280 | $ | 76,548 | |||||||||||||||||||

| Loans past due ninety days or more | 720 | 1,681 | 1,360 | — | 4,105 | ||||||||||||||||||||||||

| Other real estate owned | 6,624 | 5,050 | 5,539 | 6,074 | 6,914 | ||||||||||||||||||||||||

| Other repossessed assets | 240 | 130 | 29 | 17 | 11 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 94,970 | $ | 85,901 | $ | 98,537 | $ | 85,371 | $ | 87,578 | |||||||||||||||||||

| Performing troubled debt restructured loans | $ | 2,370 | $ | 11,818 | $ | 2,636 | $ | 2,858 | $ | 3,794 | |||||||||||||||||||

| Nonperforming Assets Activity | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 85,901 | $ | 98,537 | $ | 85,371 | $ | 87,578 | $ | 78,686 | |||||||||||||||||||

| Net loan charge offs | (216) | (21,301) | (2,420) | (4,981) | (730) | ||||||||||||||||||||||||

| New nonperforming loans | 8,664 | 11,834 | 26,857 | 15,796 | 13,751 | ||||||||||||||||||||||||

| Acquired nonperforming assets | 12,781 | — | — | — | 3,262 | ||||||||||||||||||||||||

Reduction of nonperforming loans(1) | (10,811) | (1,994) | (9,911) | (11,937) | (5,859) | ||||||||||||||||||||||||

| OREO/Repossessed assets sales proceeds | (1,349) | (1,175) | (1,360) | (1,085) | (1,532) | ||||||||||||||||||||||||

| Balance, end of period | $ | 94,970 | $ | 85,901 | $ | 98,537 | $ | 85,371 | $ | 87,578 | |||||||||||||||||||

| Asset Quality Ratios | |||||||||||||||||||||||||||||

| Ratio of nonperforming loans to total loans | 0.88 | % | 0.89 | % | 1.01 | % | 0.95 | % | 0.96 | % | |||||||||||||||||||

| Ratio of nonperforming loans and performing trouble debt restructured loans to total loans | 0.90 | % | 1.02 | % | 1.03 | % | 0.98 | % | 1.01 | % | |||||||||||||||||||

| Ratio of nonperforming assets to total assets | 0.53 | % | 0.55 | % | 0.66 | % | 0.64 | % | 0.66 | % | |||||||||||||||||||

| Annualized ratio of net loan charge-offs to average loans | 0.01 | % | 0.92 | % | 0.11 | % | 0.24 | % | 0.04 | % | |||||||||||||||||||

| Allowance for loan credit losses as a percent of loans | 1.31 | % | 1.14 | % | 1.30 | % | 1.16 | % | 0.84 | % | |||||||||||||||||||

Allowance for lending related credit losses as a percent of loans(2) | 1.47 | % | 1.29 | % | 1.49 | % | 1.35 | % | 0.84 | % | |||||||||||||||||||

| Allowance for loan credit losses as a percent of nonperforming loans | 149.37 | % | 128.07 | % | 129.01 | % | 122.79 | % | 87.28 | % | |||||||||||||||||||

| Loans delinquent 30-89 days as a percent of total loans | 0.23 | % | 0.17 | % | 0.22 | % | 0.38 | % | 0.33 | % | |||||||||||||||||||

| (1) Includes principal reductions, transfers to performing status and transfers to OREO. | |||||||||||||||||||||||||||||

| (2) Prior to the adoption of ASU 2016-13, the reserve for unfunded commitments was immaterial. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | September 30, 2020 | December 31, 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest | Rate | Average Balance | Interest | Rate | Average Balance | Interest | Rate | |||||||||||||||||||||||||||||||||||||||||||||

| Earning Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 4,957,680 | $ | 28,154 | 2.26 | % | $ | 4,125,700 | $ | 25,016 | 2.41 | % | $ | 3,033,480 | $ | 22,581 | 2.95 | % | |||||||||||||||||||||||||||||||||||

Nontaxable(1) | 543,845 | 4,728 | 3.46 | 429,710 | 4,078 | 3.78 | 271,792 | 2,661 | 3.88 | ||||||||||||||||||||||||||||||||||||||||||||

| Total securities | 5,501,525 | 32,882 | 2.38 | 4,555,410 | 29,094 | 2.54 | 3,305,272 | 25,242 | 3.03 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest on deposits with other banks and other short-term investments | 292,436 | 77 | 0.10 | 215,361 | 72 | 0.13 | 251,599 | 953 | 1.50 | ||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold | 427 | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

Loans:(2)(3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial and industrial(1) | 2,357,056 | 27,523 | 4.65 | 2,331,467 | 27,777 | 4.74 | 2,444,961 | 32,006 | 5.19 | ||||||||||||||||||||||||||||||||||||||||||||

| PPP loans | 1,064,863 | 11,806 | 4.41 | 1,128,488 | 7,462 | 2.63 | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Owner occupied commercial real estate | 1,597,446 | 18,605 | 4.63 | 1,463,538 | 17,359 | 4.72 | 1,416,338 | 19,241 | 5.39 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 1,756,443 | 20,733 | 4.70 | 1,589,073 | 18,860 | 4.72 | 1,388,677 | 18,952 | 5.41 | ||||||||||||||||||||||||||||||||||||||||||||

| Real estate construction | 859,941 | 9,723 | 4.50 | 1,023,490 | 11,628 | 4.52 | 1,003,797 | 13,645 | 5.39 | ||||||||||||||||||||||||||||||||||||||||||||

| Agricultural and agricultural real estate | 554,596 | 6,535 | 4.69 | 514,442 | 5,968 | 4.62 | 566,419 | 7,314 | 5.12 | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 785,852 | 9,288 | 4.70 | 774,850 | 8,915 | 4.58 | 830,277 | 10,454 | 5.00 | ||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 390,233 | 5,188 | 5.29 | 395,318 | 5,222 | 5.26 | 440,007 | 6,504 | 5.86 | ||||||||||||||||||||||||||||||||||||||||||||

| Less: allowance for credit losses-loans | (118,739) | — | — | (123,077) | — | — | (67,052) | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net loans | 9,247,691 | 109,401 | 4.71 | 9,097,589 | 103,191 | 4.51 | 8,023,424 | 76,110 | 5.35 | ||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 15,042,079 | 142,360 | 3.77 | % | 13,868,360 | 132,357 | 3.80 | % | 11,580,295 | 134,311 | 4.60 | % | |||||||||||||||||||||||||||||||||||||||||

| Nonearning Assets | 1,359,073 | 1,298,865 | 1,218,475 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 16,401,152 | $ | 15,167,225 | $ | 12,798,770 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest Bearing Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 7,176,563 | $ | 2,166 | 0.12 | % | $ | 6,723,962 | $ | 1,940 | 0.11 | % | $ | 5,986,007 | $ | 11,790 | 0.78 | % | |||||||||||||||||||||||||||||||||||

| Time deposits | 1,074,746 | 2,443 | 0.90 | 1,035,715 | 3,022 | 1.16 | 1,135,025 | 4,611 | 1.61 | ||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 268,464 | 175 | 0.26 | 128,451 | 78 | 0.24 | 115,680 | 271 | 0.93 | ||||||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 534,082 | 3,472 | 2.59 | 431,995 | 3,430 | 3.16 | 276,989 | 3,785 | 5.42 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 9,053,855 | 8,256 | 0.36 | % | 8,320,123 | 8,470 | 0.40 | % | 7,513,701 | 20,457 | 1.08 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest Bearing Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | 5,266,711 | 4,891,145 | 3,583,611 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Accrued interest and other liabilities | 200,306 | 183,871 | 131,200 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 5,467,017 | 5,075,016 | 3,714,811 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | 1,880,280 | 1,772,086 | 1,570,258 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 16,401,152 | $ | 15,167,225 | $ | 12,798,770 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(4) | $ | 134,104 | $ | 123,887 | $ | 113,854 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread(1) | 3.41 | % | 3.40 | % | 3.52 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP) to total earning assets(4) | 3.55 | % | 3.55 | % | 3.90 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities to earning assets | 60.19 | % | 59.99 | % | 64.88 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) In conjunction with the adoption of ASU 2016-1, Heartland reclassified loan balances to more closely align with FDIC codes. All prior period balances have been adjusted. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||||||||||||||||||||

| For the Year Ended | |||||||||||||||||||||||||||||||||||

| December 31, 2020 | December 31, 2019 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest | Rate | Average Balance | Interest | Rate | ||||||||||||||||||||||||||||||

| Earning Assets | |||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||

| Taxable | $ | 3,901,202 | $ | 98,263 | 2.52 | % | $ | 2,522,365 | $ | 73,147 | 2.90 | % | |||||||||||||||||||||||

Nontaxable(1) | 424,199 | 15,802 | 3.73 | 313,197 | 12,491 | 3.99 | |||||||||||||||||||||||||||||

| Total securities | 4,325,401 | 114,065 | 2.64 | 2,835,562 | 85,638 | 3.02 | |||||||||||||||||||||||||||||

| Interest bearing deposits with other banks and other short-term investments | 225,024 | 924 | 0.41 | 313,373 | 6,695 | 2.14 | |||||||||||||||||||||||||||||

| Federal funds sold | 107 | — | — | 138 | 4 | 2.90 | |||||||||||||||||||||||||||||

Loans:(2)(3) | |||||||||||||||||||||||||||||||||||

Commercial and industrial(1) | 2,437,183 | 118,513 | 4.86 | 2,445,552 | 127,796 | 5.23 | |||||||||||||||||||||||||||||

| PPP loans | 779,183 | 25,285 | 3.25 | — | — | — | |||||||||||||||||||||||||||||