QuickLinks -- Click here to rapidly navigate through this document

Amended and Restated Offer to Purchase for Cash

All Outstanding Shares of Common Stock

(Including the Associated Preferred Share Purchase Rights)

of

Jos. A. Bank Clothiers, Inc.

at

$63.50 Net Per Share

by

Java Corp.

A Wholly Owned Subsidiary of

The Men's Wearhouse, Inc.

THE OFFER AND WITHDRAWAL RIGHTS EXPIRE AT 5:00 P.M., NEW YORK CITY TIME,

ON MARCH 12, 2014, UNLESS THE OFFER IS EXTENDED.

Java Corp. (the "Purchaser"), a Delaware corporation and a wholly owned subsidiary of The Men's Wearhouse, Inc., a Texas corporation ("MW"), is offering to purchase all outstanding shares of common stock, par value $0.01 per share (together with the associated preferred share purchase rights, the "Shares"), of Jos. A. Bank Clothiers, Inc., a Delaware corporation ("JOSB"), at a price of $63.50 per share, net to the seller in cash, without interest and less any required withholding taxes, upon the terms and subject to the conditions set forth in this Amended and Restated Offer to Purchase (as may be subsequently amended and supplemented from time to time, the "Offer to Purchase") and the related letter of transmittal that accompanies this Offer to Purchase (the "Letter of Transmittal") (which, together with any amendments or supplements thereto, collectively constitute the "Amended Offer"). The Amended Offer amends and restates the Offer to Purchase dated January 6, 2014 and the related letter of transmittal that accompanied such Offer to Purchase (which together constituted the "Initial Offer" and as amended by the Amended Offer, the "Offer").

Consummation of the Offer is conditioned upon, among other things, (i) the Membership Interest Purchase Agreement (the "Eddie Bauer Purchase Agreement"), dated as of February 13, 2014, by and among JOSB, Everest Topco LLC ("Golden Gate"), a portfolio company of Golden Gate Private Equity, Inc., and Everest Holdings LLC, being terminated in accordance with its terms or such other terms as may be satisfactory to MW in its reasonable discretion, (ii) the board of directors of JOSB (the "JOSB Board") having redeemed the preferred share purchase rights associated with the Shares or the Purchaser being satisfied, in its sole discretion, that such preferred share purchase rights have been invalidated or are otherwise inapplicable to the Offer and the acquisition of JOSB by MW by means of a second-step merger of Purchaser and JOSB (the "Proposed Merger"), with JOSB surviving as a wholly owned subsidiary of MW, as described herein, (iii) there being validly tendered and not withdrawn before the expiration of the Offer a number of Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee) which, together with the Shares then owned by MW and its subsidiaries, represents at least ninety percent (90%) of the total number of Shares outstanding on a fully diluted basis, (iv) the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the "HSR Act"), and any necessary approvals or waiting periods under the laws of any foreign jurisdictions applicable to the purchase of Shares pursuant to the Offer having expired or been terminated or obtained, as applicable, without any actions or proceedings having been threatened or commenced by any federal, state or foreign government, governmental authority or agency seeking to challenge the Offer or the Proposed Merger on antitrust grounds, as described herein, and (v) JOSB not being a party to any agreement or transaction having the effect of impairing, in the reasonable judgment of the Purchaser, the Purchaser's or MW's ability to acquire the Shares or JOSB or otherwise diminishing the expected value to MW of the acquisition of JOSB.

Consummation of the Offer is not conditioned upon any financing arrangements or subject to a financing condition.

MW and the Purchaser are seeking to negotiate a definitive agreement for the acquisition of JOSB by MW and are prepared to begin such negotiations immediately; however, execution of such an agreement is not a condition to the Amended Offer. If MW and the Purchaser are able to conduct limited due diligence on JOSB (subject to an appropriate confidentiality agreement), with access to JOSB's management team, the Purchaser could potentially increase the offer price for the Offer up to $65.00 per Share. In addition, MW and the Purchaser are willing to discuss with JOSB and the JOSB Board a possible alternative to an all-cash structure that would allow JOSB shareholders to participate in the upside of the combined company by offering to JOSB stockholders the option to elect to receive a portion of the consideration for such an acquisition in shares of common stock of MW. Furthermore, if JOSB is able to terminate the Eddie Bauer Purchase Agreement, as described above, and the termination fee incurred by JOSB in respect of such termination is less than $48 million, MW and the Purchaser will increase the aggregate consideration to be paid to the JOSB stockholders in such a negotiated transaction between MW and JOSB by the amount of such difference (less any other expense or fee reimbursements paid by JOSB in connection with such termination).

Subject to applicable law, MW and the Purchaser reserve the right to amend the Offer in any respect (including amending the offer price and the consideration to be offered in a merger, including the Proposed Merger). In addition, in the event that MW enters into a merger agreement with JOSB and such merger agreement does not provide for a tender offer, MW and the Purchaser reserve the right to terminate the Offer, in which case the Shares would, upon consummation of such merger, be converted into the consideration negotiated by MW, the Purchaser and JOSB and specified in such merger agreement.

This transaction has not been approved or disapproved by the Securities and Exchange Commission ("SEC") or any state securities commission, nor has the SEC or any state securities commission passed upon the fairness or merits of this transaction or upon the accuracy or adequacy of the information contained in this document. Any representation to the contrary is a criminal offense.

This Offer to Purchase and the related Letter of Transmittal contain important information, and you should carefully read both in their entirety before making a decision with respect to the Offer.

The Dealer Managers for the Offer are:

| J.P. Morgan | BofA Merrill Lynch |

February 24, 2014

Any stockholder of JOSB who desires to tender all or a portion of such stockholder's Shares in the Offer should either (i) complete and sign the accompanying Letter of Transmittal or a facsimile thereof in accordance with the instructions in the Letter of Transmittal, and mail or deliver the Letter of Transmittal together with the certificates representing tendered Shares and all other required documents to American Stock Transfer & Trust Company, LLC, the depositary for the Offer, or tender such Shares pursuant to the procedure for book-entry transfer set forth in "The Offer—Section 3—Procedure for Tendering Shares" or (ii) request that such stockholder's broker, dealer, commercial bank, trust company or other nominee effect the transaction for such stockholder. Stockholders whose Shares are registered in the name of a broker, dealer, commercial bank, trust company or other nominee must contact such person if they desire to tender their Shares. The associated preferred share purchase rights are currently evidenced by the certificates representing the Shares, and by tendering Shares, a stockholder will also tender the associated preferred share purchase rights. If a Distribution Date (as defined in "The Offer—Section 8—Certain Information Concerning JOSB—Preferred Share Purchase Rights") with respect to the Rights occurs, stockholders will be required to tender one associated preferred share purchase right for each Share tendered in order to effect a valid tender of such Share.

Any stockholder who desires to tender Shares and whose certificates representing such Shares are not immediately available, or who cannot comply with the procedures for book-entry transfer on a timely basis, may tender such Shares pursuant to the guaranteed delivery procedure set forth in "The Offer—Section 3—Procedure for Tendering Shares."

Any stockholder who has previously tendered Shares pursuant to the Offer and has not withdrawn such Shares need not take any further action in order to receive the offer price of $63.50 per Share, net to the seller in cash, without interest and less any required withholding taxes, if Shares are accepted for payment and paid for by the Purchaser pursuant to the Offer, except as may be required by the guaranteed delivery procedure, if such procedure was utilized.

Questions and requests for assistance may be directed to the Information Agent or to the Dealer Managers at their respective addresses and telephone numbers set forth on the back cover of this Offer to Purchase. Requests for copies of this Offer to Purchase, the related Letter of Transmittal, the Notice of Guaranteed Delivery and all other related materials may be directed to the Information Agent or brokers, dealers, commercial banks and trust companies, and copies will be furnished promptly at Purchaser's expense. Additionally, this Offer to Purchase, the related Letter of Transmittal and other materials relating to the Offer may be found at http://www.sec.gov.

SUMMARY TERM SHEET |

1 | |||

INTRODUCTION |

9 |

|||

THE OFFER |

12 |

|||

1. |

Terms of the Offer |

12 | ||

2. |

Acceptance for Payment and Payment for Shares |

13 | ||

3. |

Procedure for Tendering Shares |

14 | ||

4. |

Withdrawal Rights |

17 | ||

5. |

Certain U.S. Federal Income Tax Consequences |

18 | ||

6. |

Price Range of Shares; Dividends |

20 | ||

7. |

Possible Effects of the Offer on the Market for the Shares; Stock Exchange Listing; Registration Under the Exchange Act; Margin Regulations |

21 | ||

8. |

Certain Information Concerning JOSB |

22 | ||

9. |

Certain Information Concerning the Purchaser and MW |

26 | ||

10. |

Source and Amount of Funds |

28 | ||

11. |

Background of the Offer; Other Transactions with JOSB |

28 | ||

12. |

Purpose of the Offer and the Proposed Merger; Plans for JOSB; Statutory Requirements; Approval of the Proposed Merger |

32 | ||

13. |

Dividends and Distributions |

35 | ||

14. |

Conditions of the Offer |

36 | ||

15. |

Certain Legal Matters; Regulatory Approvals; Appraisal Rights |

40 | ||

16. |

Legal Proceedings |

42 | ||

17. |

Fees and Expenses |

44 | ||

18. |

Miscellaneous |

44 | ||

Schedule I—DIRECTORS AND EXECUTIVE OFFICERS OF MW AND THE PURCHASER |

||||

i

Java Corp. (the "Purchaser"), a Delaware corporation and a wholly owned subsidiary of The Men's Wearhouse, Inc., a Texas corporation ("MW"), is offering to purchase all outstanding shares of common stock, par value $0.01 per share (together with the associated preferred share purchase rights, the "Shares"), of Jos. A. Bank Clothiers, Inc., a Delaware corporation ("JOSB"), at a price of $63.50 per Share, net to the seller in cash, without interest and less any required withholding taxes, upon the terms and subject to the conditions set forth in this Amended and Restated Offer to Purchase (as may be subsequently amended and supplemented from time to time, the "Offer to Purchase") and the related letter of transmittal that accompanies this Offer to Purchase (the "Letter of Transmittal") (which, together with any amendments or supplements thereto, collectively constitute the "Amended Offer"). The Amended Offer amends and restates the Offer to Purchase dated January 6, 2014 and the related letter of transmittal that accompanied such Offer to Purchase (which together constituted the "Initial Offer" and as amended by the Amended Offer, the "Offer").

The following are some of the questions you, as a JOSB stockholder, may have and answers to those questions. You should carefully read this Offer to Purchase and the accompanying Letter of Transmittal in their entirety because the information in this summary term sheet is not complete and additional important information is contained in the remainder of this Offer to Purchase and the Letter of Transmittal. MW and the Purchaser have included cross-references in this summary term sheet to other sections of this Offer to Purchase where you will find more complete descriptions of the topics mentioned below.

The information concerning JOSB contained herein and elsewhere in this Offer to Purchase has been taken from or is based upon publicly available documents or records of JOSB on file with the Securities and Exchange Commission (the "SEC") or other public sources at the time of the Amended Offer. MW and the Purchaser have not independently verified the accuracy and completeness of such information. MW and the Purchaser have no knowledge that would indicate that any statements contained herein relating to JOSB taken from or based upon such documents and records filed with the SEC are untrue or incomplete in any material respect.

In this Offer to Purchase, unless the context requires otherwise, the terms "we," "our" and "us" refer to MW and its subsidiaries, collectively.

Who is offering to buy my securities?

The Purchaser, Java Corp., is a Delaware corporation formed for the purpose of making this Offer to acquire all of the outstanding Shares of JOSB. The Purchaser is a wholly owned subsidiary of MW. MW is one of North America's largest specialty retailers of men's apparel with approximately 1,133 stores (according to the most recent Quarterly Report on Form 10-Q for MW for the quarter ended November 2, 2013, filed by MW with the SEC on December 12, 2013). See "The Offer—Section 9—Certain Information Concerning the Purchaser and MW."

What securities are you offering to purchase?

We are offering to acquire all of the outstanding Shares, and the associated preferred share purchase rights, of JOSB. We refer to one share of JOSB common stock, together with the associated preferred share purchase right, as a "share" or "Share." See "Introduction."

How much are you offering to pay for my Shares and what is the form of payment?

We are offering to pay $63.50 per Share net to you, in cash, without interest and less any required withholding taxes. If you are the record owner of your Shares and you directly tender your Shares to us in the Offer, you will not be required to pay brokerage fees or similar expenses. If you own your

1

Shares through a broker, dealer, commercial bank, trust company or other nominee, and your broker, dealer, commercial bank, trust company or other nominee tenders your Shares on your behalf, it may charge you a fee for doing so. You should consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply. See "Introduction."

Any stockholder who has previously tendered Shares pursuant to the Offer and has not withdrawn such Shares need not take any further action in order to receive the offer price of $63.50 per Share, net to the seller in cash, without interest and less any required withholding taxes, if Shares are accepted for payment and paid for by the Purchaser pursuant to the Offer, except as may be required by the guaranteed delivery procedure, if such procedure was utilized. If you have not already tendered your Shares, please disregard the materials previously delivered to you and use the materials accompanying this Amended and Restated Offer to Purchase. "The Offer—Section 3—Procedure for Tendering Shares."

Why are you making the Offer?

We are making the Offer because we want to acquire control of, and ultimately the entire equity interest in, JOSB. If the Offer is consummated, we intend to complete a second-step merger with JOSB in which JOSB will become a wholly owned subsidiary of MW and all outstanding Shares that are not purchased in the Offer (other than Shares held by MW and its subsidiaries or stockholders who perfect their appraisal rights) will be exchanged for an amount in cash per Share equal to the highest price paid per Share pursuant to the Offer (as further described herein, the "Proposed Merger"). See "The Offer—Section 12—Purpose of the Offer and the Proposed Merger; Plans for JOSB; Statutory Requirements; Approval of the Proposed Merger."

MW and the Purchaser are seeking to negotiate a definitive agreement for the acquisition of JOSB by MW and are prepared to begin such negotiations immediately; however, execution of such an agreement is not a condition to the Amended Offer. If MW and the Purchaser are able to conduct limited due diligence on JOSB (subject to an appropriate confidentiality agreement), with access to JOSB's management team, the Purchaser could potentially increase the offer price for the Offer up to $65.00 per Share. In addition, MW and the Purchaser are willing to discuss with JOSB and the JOSB Board a possible alternative to an all-cash structure that would allow JOSB shareholders to participate in the upside of the combined company by offering to JOSB stockholders the option to elect to receive a portion of the consideration for such an acquisition in shares of common stock of MW. Furthermore, if JOSB is able to terminate the Eddie Bauer Purchase Agreement and the termination fee incurred by JOSB in respect of such termination is less than $48 million, MW and the Purchaser will increase the aggregate consideration to be paid to the JOSB stockholders in such a negotiated transaction between MW and JOSB by the amount of such difference (less any other expense or fee reimbursements paid by JOSB in connection with such termination).

Why are the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery being amended and restated?

There have been developments relating to the Offer since it was commenced on January 6, 2014, all of which we have reported in amendments to our tender offer statement on Schedule TO that have been filed with the SEC (including this amended and restated Offer to Purchase). We have amended and restated the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery to reflect those developments. See "Introduction."

How long will it take to complete your proposed transaction?

The timing of completing the offer and the second-step merger will depend on, among other things, the number of Shares we acquire pursuant to the Offer, and if and when any necessary approvals or waiting periods under the laws of the U.S. or any foreign jurisdictions applicable to the

2

purchase of Shares pursuant to the Offer or the Proposed Merger expire or are terminated or obtained, as applicable, without any actions or proceedings having been threatened or commenced by any federal, state or foreign government, governmental authority or agency seeking to challenge the Offer or the Proposed Merger on antitrust grounds, as described herein.

Do you intend to replace any members of the JOSB Board or make any proposals at JOSB's 2014 annual meeting of shareholders?

On January 14, 2014, in accordance with JOSB's bylaws, we delivered formal notice of our intent to nominate John D. Bowlin and Arthur E. Reiner (the "Nominees") as independent director candidates to the JOSB Board at the JOSB 2014 annual meeting of shareholders (the "JOSB 2014 Annual Meeting"). The Offer does not constitute a solicitation of proxies, absent a purchase of shares, for any meeting of JOSB's shareholders. We intend to file a proxy statement and other relevant documents with the SEC in connection with our solicitation of proxies for the JOSB 2014 Annual Meeting, and you are urged to read the proxy statement carefully and in its entirety when it becomes available and any other related documents filed with the SEC because they will contain important information.

We are proposing to nominate and elect the Nominees to give you another direct voice with respect to the Offer. We believe that the election of the Nominees will demonstrate that JOSB shareholders support a combination with MW. If the Nominees are elected, they would be obligated to act in accordance with their duties as directors of JOSB and could take steps to try to persuade the other members of the JOSB Board to support and facilitate the Offer or to act against the Offer as the Nominees, as new directors, deem appropriate. The Nominees, even if elected, will not constitute a majority of the JOSB Board.

Do you have the financial resources to pay for the Shares?

We will need approximately $1.8 billion to purchase all outstanding Shares pursuant to the Offer and the Proposed Merger, and to pay related fees and expenses. As of February 1, 2014, MW and its subsidiaries had cash and cash equivalents in the amount of approximately $59.3 million. MW expects to obtain the necessary funds from existing cash balances and anticipated borrowings. The Offer is not conditioned on any financing arrangements or subject to a financing condition. See "The Offer—Section 10—Source and Amount of Funds."

Is your financial condition material to my decision to tender in the Offer?

We do not think that our financial condition is material to your decision whether to tender Shares and accept the Offer because:

- •

- the Offer is being made for all outstanding Shares solely for cash;

- •

- the Offer is not subject to any financing condition;

- •

- we, through our parent company, MW (in light of MW's financial capacity in relation to the amount of consideration

payable), will have sufficient funds available to purchase all Shares validly tendered in the Offer and not validly withdrawn; and

- •

- if we consummate the Offer, we will acquire all remaining Shares for the same cash price in the Proposed Merger and we, through our parent company, MW (in light of MW's financial capacity in relation to the amount of consideration payable), will have sufficient funds available to consummate the Proposed Merger.

See "The Offer—Section 10—Source and Amount of Funds."

3

What does the Board of Directors of JOSB think of the Offer?

On January 17, 2014, JOSB issued a press release and filed a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC in connection with the Initial Offer, announcing the JOSB Board's recommendation that holders of Shares reject the Initial Offer and not tender any of their Shares pursuant to the Initial Offer. We expect the JOSB Board will publish a statement on Schedule 14D-9 as to whether it recommends acceptance or rejection of the Amended Offer, that it has no opinion with respect to the Amended Offer or that it is unable to take a position with respect to the Amended Offer, and the reasons for any such position, in the coming days. See "The Offer—Section 11—Background of the Offer; Other Transactions with JOSB."

What are the Eddie Bauer Transactions?

On February 13, 2014, JOSB entered into a Membership Interest Purchase Agreement (the "Eddie Bauer Purchase Agreement") pursuant to which JOSB agreed to purchase from Everest Topco LLC ("Golden Gate"), a portfolio company of Golden Gate Private Equity, Inc., all of the outstanding limited liability company interests of Everest Holdings LLC ("Everest Holdings"). Everest Holdings is a holding company for the Eddie Bauer brand and its related businesses and operations. In connection with the Eddie Bauer Purchase Agreement, on February 13, 2014, JOSB and Golden Gate entered into a Standstill and Stockholder Agreement (the "Standstill and Stockholder Agreement" and together with the Eddie Bauer Purchase Agreement and any other agreements entered into therewith, the "Eddie Bauer Transaction Documents" and the transactions contemplated by the Eddie Bauer Transaction Documents, including, without limitation, JOSB's proposed issuer self-tender offer, the "Eddie Bauer Transactions"). The Offer is conditioned upon the Eddie Bauer Purchase Agreement being terminated in accordance with its terms or such other terms as may be satisfactory to MW in its reasonable discretion. See "The Offer—Section 8—Certain Information Concerning JOSB" and "The Offer—Section 11—Background of the Offer; Other Transactions with JOSB."

How long do I have to decide whether to tender in the Offer?

You have until the expiration date of the Offer to tender. The Offer currently is scheduled to expire at 5:00 p.m., New York City time, on March 12, 2014. We may, in our sole discretion, extend the Offer from time to time for any reason. If the Offer is extended, we will issue a press release announcing the extension at or before 9:00 a.m., New York City time, on the next business day after the date the Offer was scheduled to expire. See "The Offer—Section 1—Terms of the Offer."

We may elect to provide a "subsequent offering period" for the Offer. A subsequent offering period, if one is provided, will be an additional period of time beginning after we have purchased Shares tendered during the Offer, during which stockholders may tender, but not withdraw, their Shares and receive the Offer consideration. We do not currently intend to include a subsequent offering period, although we reserve the right to do so. See "The Offer—Section 1—Terms of the Offer."

What are the most significant conditions to the Offer?

Consummation of the Offer is conditioned upon, among other things, (i) the Eddie Bauer Purchase Agreement being terminated in accordance with its terms or such other terms as may be satisfactory to MW in its reasonable discretion, (ii) the JOSB Board having redeemed the preferred share purchase rights associated with the Shares or the Purchaser being satisfied, in its sole discretion, that such preferred share purchase rights have been invalidated or are otherwise inapplicable to the Offer and the Proposed Merger, as described herein, (iii) there being validly tendered and not withdrawn before the expiration of the Offer a number of Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such

4

guarantee) which, together with the Shares then owned by MW and its subsidiaries, represents at least ninety percent (90%) of the total number of Shares outstanding on a fully diluted basis, (iv) the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the "HSR Act"), and any necessary approvals or waiting periods under the laws of any foreign jurisdictions applicable to the purchase of Shares pursuant to the Offer having expired or been terminated or obtained, as applicable, without any actions or proceedings having been threatened or commenced by any federal, state or foreign government, governmental authority or agency seeking to challenge the Offer or the Proposed Merger on antitrust grounds, as described herein, and (v) JOSB not being a party to any agreement or transaction having the effect of impairing, in the reasonable judgment of the Purchaser, the Purchaser's or MW's ability to acquire the Shares or JOSB or otherwise diminishing the expected value to MW of the acquisition of JOSB. See "The Offer—Section 14—Conditions of the Offer" for a list of additional conditions to the Offer.

The consummation of the Offer is not conditioned upon any financing arrangements or subject to a financing condition.

How will I be notified if the Offer is extended?

If we decide to extend the Offer, we will inform American Stock Transfer & Trust Company, LLC, the depositary for the Offer (the "Depositary"), of that fact and will make a public announcement of the extension, no later than 9:00 a.m., New York City time, on the next business day after the date the Offer was scheduled to expire. See "The Offer—Section 1—Terms of the Offer."

How do I tender my Shares?

To tender Shares, you must deliver the certificates representing your Shares, together with a completed Letter of Transmittal and any other required documents, to the Depositary, or tender such Shares pursuant to the procedure for book-entry transfer set forth in "The Offer—Section 3—Procedure for Tendering Shares—Book-Entry Transfer," not later than the time the Offer expires. If your Shares are held in street name by your broker, dealer, bank, trust company or other nominee, only such nominee can tender your Shares for you. If you cannot deliver everything required to make a valid tender to the Depositary before the expiration of the Offer, you may have a limited amount of additional time by having a financial institution (including most banks, savings and loan associations and brokerage houses) that is a member of a recognized Medallion Program approved by The Securities Transfer Association Inc., including the Securities Transfer Agents Medallion Program (STAMP), the Stock Exchange Medallion Program (SEMP) and the New York Stock Exchange Medallion Signature Program (MSP), guarantee, pursuant to a Notice of Guaranteed Delivery, that the missing items will be received by the Depositary within three NASDAQ Global Select Stock Market ("NASDAQ") trading days. However, the Depositary must receive the missing items within that three-trading-day period. See "The Offer—Section 3—Procedure for Tendering Shares."

If a Distribution Date with respect to the Rights occurs, you also must tender one associated preferred share purchase right for each share of common stock tendered in order to validly tender such shares in the Offer. See "The Offer—Section 8—Certain Information Concerning JOSB—Preferred Share Purchase Rights."

Stockholders tendering their Shares according to the guaranteed delivery procedures may do so using either the initial Notice of Guaranteed Delivery circulated with the Initial Offer or the Amended and Restated Notice of Guaranteed Delivery circulated herewith.

If I already tendered my Shares in the Initial Offer, do I have to do anything now?

No. JOSB stockholders do not have to take any action regarding any Shares previously validly tendered and not withdrawn, except as may be required by the guaranteed delivery procedure, if such

5

procedure was utilized. If the Offer is completed, these shares will be accepted for payment and such stockholders will receive the offer price of $63.50 per Share, net to the seller in cash, without interest and less any required withholding taxes.

Until what time can I withdraw tendered Shares?

You can withdraw tendered Shares at any time before the Offer has expired, and, thereafter, you can withdraw them at any time until we accept such Shares for payment. You may not, however, withdraw Shares tendered during a subsequent offering period, if one is provided. See "The Offer—Section 4—Withdrawal Rights."

How do I withdraw tendered Shares?

To withdraw tendered Shares, you must deliver a written notice of withdrawal, or a facsimile of one, with the required information, to the Depositary while you have the right to withdraw the Shares. See "The Offer—Section 4—Withdrawal Rights."

When and how will I be paid for my tendered Shares?

Upon the terms and subject to the conditions of the Offer, we will pay for all validly tendered and not withdrawn Shares promptly after the later of the date of expiration of the Offer and the satisfaction or waiver of the conditions to the Offer set forth in "The Offer—Section 14—Conditions of the Offer."

We will pay for your validly tendered and not withdrawn Shares by depositing the purchase price with the Depositary, which will act as your agent for the purpose of receiving payments from us and transmitting such payments to you. In all cases, payment for tendered Shares will be made only after timely receipt by the Depositary of certificates for such Shares (including, if a Distribution Date with respect to the Rights occurs, certificates for the Rights) (or of a confirmation of a book-entry transfer of such Shares (including, if a Distribution Date with respect to the Rights occurs, such Rights) as described in "The Offer—Section 3—Procedures for Tendering Shares"), a properly completed, timely received and duly executed Letter of Transmittal (or facsimile thereof) or Agent's Message (as defined below) in lieu of a Letter of Transmittal and any other required documents for such Shares. See "The Offer—Section 2—Acceptance for Payment and Payment of Shares."

Will the Offer be followed by a merger if all Shares are not tendered in the Offer?

If the Offer is successful and, pursuant to the Offer, we accept for payment and pay for at least that number of Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee) that, when added to Shares then owned by MW or any of its subsidiaries, constitutes at least ninety percent (90%) of the outstanding Shares on a fully diluted basis, we will cause the second-step merger to be consummated with JOSB as a "short-form" merger pursuant to Section 253 of the General Corporation Law of the State of Delaware (the "DGCL"), pursuant to which JOSB will become a wholly owned subsidiary of MW. In the Proposed Merger, all Shares that were not purchased in the Offer will be exchanged for an amount in cash per Share equal to the highest price paid per Share pursuant to the Offer. If, after the offer is completed but prior to the consummation of the Proposed Merger, the aggregate ownership by MW or any of its subsidiaries of the outstanding Shares should fall below 90% for any reason, MW may decide to acquire additional Shares in the open market or during a subsequent offering period, pursuant to privately negotiated transactions or otherwise, to the extent required for such ownership to equal or exceed 90%. Any such purchases would be made at market prices or privately negotiated prices at the time of purchase, which may be higher or lower than, or the same as, $63.50.

If the Proposed Merger takes place, stockholders who did not validly tender Shares in the Offer (other than Shares held by MW or its subsidiaries (including, without limitation, the Purchaser) and

6

Shares owned by stockholders who properly perfect their appraisal rights under the DGCL) will receive the same amount of cash per Share that they would have received had they validly tendered their Shares in the Offer. See "The Offer—Section 12—Purpose of the Offer and the Proposed Merger; Plans for JOSB; Statutory Requirements; Approval of the Proposed Merger."

The treatment of your Shares if the Proposed Merger does take place and you properly perfect your appraisal rights is discussed in "The Offer—Section 15—Certain Legal Matters; Regulatory Approvals; Appraisal Rights."

If at least ninety percent (90%) of the Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee) outstanding are tendered and accepted for payment, and the other conditions to the consummation of the Offer have been satisfied, will JOSB continue as a public company?

As described above, we will, promptly following consummation of the Offer, seek to acquire all remaining Shares in the Proposed Merger. If the Proposed Merger takes place, JOSB will no longer be publicly owned. Even if the Proposed Merger does not take place, if we purchase all the tendered Shares, it is possible that there may be so few remaining stockholders and publicly held Shares that the Shares will no longer be eligible to be traded on a securities exchange, that there may not be an active or liquid public trading market for the Shares, and/or that JOSB may cease to make filings with the SEC or otherwise cease to be required to comply with the SEC rules relating to publicly held companies. See "The Offer—Section 7—Possible Effects of the Offer on the Market for the Shares; Stock Exchange Listing; Registration Under the Exchange Act; Margin Regulations."

Do I have to vote to approve the second-step merger?

No. If MW and the Purchaser can complete the Proposed Merger pursuant to Section 253 of the DGCL as a "short-form" second-step merger (as discussed above), your vote is not required to approve the second-step merger. You simply need to tender your Shares if you choose to do so. MW and the Purchaser intend to complete the Offer only if a sufficient number of Shares are tendered such that the minimum tender condition is satisfied, permitting MW and the Purchaser to complete the second-step merger as a "short-form" merger without the requirement of approval from the JOSB shareholders. See "The Offer—Section 12—Purpose of the Offer and the Proposed Merger; Plans for JOSB; Statutory Requirements; Approval of the Proposed Merger."

If I decide not to tender, how will the Offer affect my Shares?

As described above, if the Offer is consummated, we intend to complete a second-step merger with JOSB in which JOSB will become a wholly owned subsidiary of MW and all outstanding Shares that are not purchased in the Offer (other than Shares held by MW and its subsidiaries or stockholders who perfect their appraisal rights) will be exchanged for an amount in cash per Share equal to the highest price paid per Share pursuant to the Offer. If the Proposed Merger is consummated, stockholders who did not tender their Shares in the Offer (other than those properly exercising their appraisal rights) will receive cash in an amount equal to the price per Share paid in the Offer. If, however, the Offer is consummated and the Proposed Merger does not take place for any reason, your Shares may be affected, among other ways, as described above. See "The Offer—Section 7—Possible Effects of the Offer on the Market for the Shares; Stock Exchange Listing; Registration Under the Exchange Act; Margin Regulations."

Are appraisal rights available in the Offer or the Proposed Merger?

Appraisal rights are not available in the Offer. If the Proposed Merger is consummated, holders of Shares at the effective time of the Proposed Merger who do not vote in favor of, or consent to, the

7

Proposed Merger and who comply with Section 262 of the DGCL will have the right to demand appraisal of their Shares. Under Section 262 of the DGCL, stockholders who demand appraisal and comply with the applicable statutory procedures will be entitled to receive a judicial determination of the fair value of their Shares, exclusive of any element of value arising from the accomplishment or expectation of the Proposed Merger, and to receive payment of that fair value in cash, together with a fair rate of interest, if any. Any judicial determination of the fair value of Shares could be based upon factors other than, or in addition to, the price per share to be paid in the Proposed Merger or the market value of the Shares. The value so determined could be more or less than the price per share to be paid in the Proposed Merger. See "The Offer—Section 15—Certain Legal Matters; Regulatory Approvals; Appraisal Rights."

What is the market value of my Shares as of a recent date?

On October 8, 2013, the last full trading day before the first public announcement of a proposal by JOSB to acquire MW, the last sales price of the Shares reported on NASDAQ was $41.66 per Share and the 60-calendar day trailing average of the sales price of the Shares reported on NASDAQ was $42.26 per Share. On January 3, 2014, the last trading day before the commencement of the Initial Offer, the last reported sale price of the Shares on NASDAQ was $54.41 per Share. On February 21, 2014, the last trading day before the Amended Offer, the last reported sales price of the Shares on NASDAQ was $55.05 per Share. Please obtain a recent quotation for your Shares prior to deciding whether or not to tender. See "The Offer—Section 6—Price Range of Shares; Dividends."

What are the material U.S. federal income tax consequences of participating in the Offer?

In general, the receipt of cash in exchange for Shares pursuant to the Offer will be a taxable transaction for U.S. federal income tax purposes. See "The Offer—Section 5—Certain U.S. Federal Income Tax Consequences."

We recommend that you consult your own tax advisor to determine the tax consequences to you of participating in the Offer in light of your particular circumstances (including the application and effect of any state, local or non-U.S. income and other tax laws).

Who can I talk to if I have questions about the Offer?

You can call MacKenzie Partners, Inc., the information agent for the Offer, at (212) 929-5500 (collect) or (800) 322-2885 (toll-free). See the back cover of this Offer to Purchase.

8

To the Stockholders of Jos. A. Bank Clothiers, Inc.:

We, Java Corp. (the "Purchaser"), a Delaware corporation and a wholly owned subsidiary of The Men's Wearhouse, Inc., a Texas corporation ("MW"), are offering to purchase all outstanding shares of common stock, par value $0.01 per share (together with the associated preferred share purchase rights, the "Shares"), of Jos. A. Bank Clothiers, Inc., a Delaware corporation ("JOSB"), at a price of $63.50 per share, net to the seller in cash, without interest and less any required withholding taxes, upon the terms and subject to the conditions set forth in this Amended and Restated Offer to Purchase (as may be subsequently amended and supplemented from time to time, the "Offer to Purchase") and the related letter of transmittal that accompanies this Offer to Purchase (the "Letter of Transmittal") (which, together with any amendments or supplements thereto, collectively constitute the "Amended Offer"). The Amended Offer amends and restates the Offer to Purchase dated January 6, 2014 and the related letter of transmittal that accompanied such Offer to Purchase (which together constituted the "Initial Offer" and as amended by the Amended Offer, the "Offer"). Stockholders who have Shares registered in their own names and tender directly to American Stock Transfer & Trust Company, LLC, the depositary for the Offer (the "Depositary"), will not have to pay brokerage fees, commissions or similar expenses. Stockholders with Shares held in street name by a broker, dealer, bank, trust company or other nominee should consult with their nominee to determine whether such nominee will charge a fee for tendering Shares on their behalf. Except as set forth in Instruction 6 of the Letter of Transmittal, stockholders will not be obligated to pay transfer taxes on the sale of Shares pursuant to the Offer. We will pay all charges and expenses of J.P. Morgan Securities LLC ("J.P. Morgan") and Merrill Lynch, Pierce, Fenner & Smith Incorporated ("BofA Merrill Lynch") (J.P. Morgan and BofA Merrill Lynch each a "Dealer Manager" and, together, the "Dealer Managers"), the Depositary and MacKenzie Partners, Inc. (the "Information Agent") incurred in connection with their services in such capacities in connection with the Offer. See "The Offer—Section 17—Fees and Expenses."

Consummation of the Offer is conditioned upon, among other things, (i) the Membership Interest Purchase Agreement (the "Eddie Bauer Purchase Agreement"), dated as of February 13, 2014, by and among JOSB, Everest Topco LLC ("Golden Gate"), a portfolio company of Golden Gate Private Equity, Inc., and Everest Holdings LLC, being terminated in accordance with its terms or such other terms as may be satisfactory to MW in its reasonable discretion (the "Eddie Bauer Termination Condition"), (ii) the board of directors of JOSB (the "JOSB Board") having redeemed the preferred share purchase rights associated with the Shares or the Purchaser being satisfied, in its sole discretion, that such preferred share purchase rights have been invalidated or are otherwise inapplicable to the Offer and the acquisition of JOSB by MW by means of a second-step merger of Purchaser and JOSB (the "Proposed Merger"), with JOSB surviving as a wholly owned subsidiary of MW, as described herein (the "Rights Condition"), (iii) there being validly tendered and not withdrawn before the expiration of the Offer a number of Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee) which, together with the Shares then owned by MW and its subsidiaries, represents at least ninety percent (90%) of the total number of Shares outstanding on a fully diluted basis (the "Minimum Tender Condition"), (iv) the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the "HSR Act"), and any necessary approvals or waiting periods under the laws of any foreign jurisdictions applicable to the purchase of Shares pursuant to the Offer having expired or been terminated or obtained, as applicable, without any actions or proceedings having been threatened or commenced by any federal, state or foreign government, governmental authority or agency seeking to challenge the Offer or the Proposed Merger on antitrust grounds, as described herein (the "Antitrust Condition"), and (v) JOSB not being a party to any agreement or transaction having the effect of impairing, in the reasonable judgment of the Purchaser, the Purchaser's or MW's ability to acquire the Shares or JOSB or otherwise diminishing the expected value to MW of the acquisition of JOSB (the

9

"Impairment Condition"). See "The Offer—Section 14—Conditions of the Offer" for a list of additional conditions to the Offer.

Consummation of the Offer is not conditioned upon any financing arrangements or subject to a financing condition.

As of the date of this Offer to Purchase, MW and its subsidiaries beneficially own 100 Shares, representing less than one percent of the outstanding Shares. According to JOSB's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the "SEC") on December 5, 2013, as of November 27, 2013 there were 27,988,392 Shares issued and outstanding, and based on MW and Purchaser's review of JOSB's Annual Report on Form 10-K for the year ended February 2, 2013, filed with the SEC on April 3, 2013 (the "JOSB 10-K"), we believe as of February 2, 2013 there were approximately 77,000 unvested restricted stock units outstanding and no outstanding options to purchase Shares. Based upon the foregoing, there were approximately 28,065,392 Shares outstanding on a fully diluted basis on November 27, 2013. The purpose of the Offer is to acquire control of, and ultimately the entire equity interest in, JOSB. If the Offer is consummated, we intend to complete a second-step merger with JOSB in which JOSB will become a wholly owned subsidiary of MW and all outstanding Shares that are not purchased in the Offer (other than Shares held by MW and its subsidiaries or stockholders who perfect their appraisal rights) will be exchanged for an amount in cash per Share equal to the highest price paid per Share pursuant to the Offer. Under Section 253 of the General Corporation Law of the State of Delaware (the "DGCL"), if we acquire, pursuant to the Offer or otherwise, at least ninety percent (90%) of the outstanding Shares (excluding Shares tendered pursuant to guaranteed delivery procedures that have not yet been delivered in settlement or satisfaction of such guarantee), we would be able to consummate the Proposed Merger as a "short-form" second-step merger pursuant to Section 253 of the DGCL without a vote of the JOSB Board or other stockholders. If we waive the Minimum Tender Condition, consummate the Offer and do not acquire at least ninety percent (90%) of the outstanding Shares we would not be able to consummate the Proposed Merger as a short-form merger under Section 253 of the DGCL. We would instead have to enter into a definitive merger agreement with JOSB, which would require the approval of the JOSB Board and the JOSB shareholders. Approval of a merger pursuant to the DGCL requires the affirmative vote of holders of a majority of the outstanding Shares. In addition, if we waive the Minimum Tender Condition, consummate the Offer and acquire in the Offer ownership of fifteen percent (15%) or more, but less than eighty-five percent (85%), of the outstanding Shares, Section 203 of the DGCL could significantly delay our ability to consummate the Proposed Merger, unless the Offer or the Proposed Merger was approved by the JOSB Board prior to the consummation of the Offer or other exceptions to Section 203 were available. See "The Offer—Section 12—Purpose of the Offer and the Proposed Merger; Plans for JOSB; Statutory Requirements; Approval of the Proposed Merger."

No appraisal rights are available in connection with the Offer; however, stockholders may have appraisal rights, if properly exercised under the DGCL and not withdrawn, in connection with the Proposed Merger. See "The Offer—Section 15—Certain Legal Matters; Regulatory Approvals; Appraisal Rights."

MW and the Purchaser are seeking to negotiate a definitive agreement for the acquisition of JOSB by MW and are prepared to begin such negotiations immediately; however, execution of such an agreement is not a condition to the Amended Offer. If MW and the Purchaser are able to conduct limited due diligence on JOSB (subject to an appropriate confidentiality agreement), with access to JOSB's management team, the Purchaser could potentially increase the offer price for the Offer up to $65.00 per Share. In addition, MW and the Purchaser are willing to discuss with JOSB and the JOSB Board a possible alternative to an all-cash structure that would allow JOSB shareholders to participate in the upside of the combined company by offering to JOSB stockholders the option to elect to receive a portion of the consideration for such an acquisition in shares of common stock of

10

MW. Furthermore, if JOSB is able to terminate the Eddie Bauer Purchase Agreement and the termination fee incurred by JOSB in respect of such termination is less than $48 million, MW and the Purchaser will increase the aggregate consideration to be paid to the JOSB stockholders in such a negotiated transaction between MW and JOSB by the amount of such difference (less any other expense or fee reimbursements paid by JOSB in connection with such termination).

Subject to applicable law, MW and the Purchaser reserve the right to amend the Offer in any respect (including amending the offer price and the consideration to be offered in a merger, including the Proposed Merger). In addition, in the event that MW enters into a merger agreement with JOSB and such merger agreement does not provide for a tender offer, MW and the Purchaser reserve the right to terminate the Offer, in which case the Shares would, upon consummation of such merger, be converted into the consideration negotiated by MW, the Purchaser and JOSB and specified in such merger agreement.

In the event the Offer is terminated or not consummated, or after the expiration of the Offer and pending consummation of the Proposed Merger, we may purchase additional Shares not tendered in the Offer. Such purchases may be made in the open market or during a subsequent offering period, pursuant to privately negotiated transactions or otherwise. Any such purchases may be on the same terms as, or on terms more or less favorable to stockholders than, the terms of the Offer. Any possible future purchases by us will depend on many factors, including the results of the Offer, our business and financial position and general economic and market conditions.

After the expiration of the Offer, we may, in our sole discretion, but are not obligated to, provide a subsequent offering period of at least three business days to permit additional tenders of Shares (a "Subsequent Offering Period"). A Subsequent Offering Period would be an additional period of time, following the expiration of the Offer and the purchase of Shares in the Offer, during which stockholders may tender Shares not tendered in the Offer. A Subsequent Offering Period, if one is provided, is not an extension of the Offer, which already will have been completed.

This Offer to Purchase and the related Letter of Transmittal contain important information, and you should carefully read both in their entirety before you make a decision with respect to the Offer.

11

1. Terms of the Offer.

Upon the terms and subject to the conditions of the Offer (including, if we extend or amend the Offer, the terms and conditions of any such extension or amendment), we will accept for payment and pay for all Shares validly tendered prior to the Expiration Date (as defined below) and not previously withdrawn in accordance with "The Offer—Section 14—Conditions of the Offer." "Expiration Date" means 5:00 p.m., New York City time, on March 12, 2014, unless extended, in which event "Expiration Date" means the time and date at which the Offer, as so extended, shall expire.

The Offer is subject to the conditions set forth in "The Offer—Section 14—Conditions of the Offer," which include, among other things, satisfaction of the Eddie Bauer Termination Condition, the Rights Condition, the Minimum Tender Condition, the Antitrust Condition and the Impairment Condition. If any such condition is not satisfied, we may (i) terminate the Offer and return all tendered Shares to tendering stockholders, (ii) extend the Offer and, subject to withdrawal rights as set forth in "The Offer—Section 4—Withdrawal Rights," retain all such Shares until the expiration of the Offer as so extended, (iii) waive such condition and, subject to any requirement to extend the period of time during which the Offer is open, purchase all Shares validly tendered prior to the Expiration Date and not withdrawn or (iv) delay acceptance for payment or payment for Shares, subject to applicable law, until satisfaction or waiver of the conditions to the Offer.

Subject to any applicable rules and regulations of the SEC, we expressly reserve the right, but not the obligation, in our sole discretion, at any time and from time to time, to extend the period during which the Offer is open for any reason by giving oral or written notice of the extension to the Depositary and by making a public announcement of the extension. During any extension, all Shares previously tendered and not withdrawn will remain subject to the Offer and subject to the right of a tendering stockholder to withdraw Shares.

As of the date of this Offer to Purchase, the Rights do not trade separately. Accordingly, by tendering Shares you are automatically tendering a similar number of Rights. If, however, the Rights detach, tendering stockholders will be required to deliver Rights certificates with the Shares (or confirmation of book-entry transfer, if available, of such Rights).

If we decrease the percentage of Shares being sought or increase or decrease the consideration to be paid for Shares pursuant to the Offer and the Offer is scheduled to expire at any time before the expiration of a period of 10 business days from, and including, the date that notice of such increase or decrease is first published, sent or given in the manner specified below, the Offer shall be extended until the expiration of such period of 10 business days. If we make any other material change in the terms of or information concerning the Offer or waive a material condition of the Offer, we will extend the Offer, if required by applicable law, for a period sufficient to allow you to consider the amended terms of the Offer. In a published release, the SEC has stated that in its view an offer must remain open for a minimum period of time following a material change in the terms of such offer and that the waiver of a condition such as the Minimum Tender Condition is a material change in the terms of an offer. The release states that an offer should remain open for a minimum of five business days from the date the material change is first published, sent or given to stockholders, and that if material changes are made with respect to information that approaches the significance of price and number of shares tendered for, a minimum of 10 business days may be required to allow adequate dissemination and investor response.

"Business day" means any day other than Saturday, Sunday or a federal holiday, and shall consist of the time period from 12:01 a.m. through 12:00 midnight, Eastern time.

If we extend the Offer, are delayed in accepting for payment of or paying for Shares or are unable to accept for payment or pay for Shares pursuant to the Offer for any reason, then, without prejudice

12

to our rights under the Offer, the Depositary may retain all Shares tendered on our behalf, and such Shares may not be withdrawn except to the extent tendering stockholders are entitled to withdrawal rights as provided in "The Offer—Section 4—Withdrawal Rights." Our reservation of the right to delay acceptance for payment of or payment for Shares is subject to applicable law, which requires that we pay the consideration offered or return the Shares deposited by or on behalf of stockholders promptly after the termination or withdrawal of the Offer.

Any extension, delay, termination, waiver or amendment of the Offer will be followed as promptly as practicable by a public announcement thereof. In the case of an extension of the Offer, we will make a public announcement of such extension no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date.

After the expiration of the Offer, we may, in our sole discretion, but are not obligated to, provide a Subsequent Offering Period of at least three business days to permit additional tenders of Shares so long as, among other things, (i) the initial offering period of at least 20 business days has expired, (ii) we immediately accept and promptly pay for all securities validly tendered during the Offer, (iii) we announce the results of the Offer, including the approximate number and percentage of Shares deposited in the Offer, no later than 9:00 a.m., Eastern time, on the next business day after the Expiration Date and immediately begin the Subsequent Offering Period and (iv) we immediately accept and promptly pay for Shares as they are tendered during the Subsequent Offering Period. A Subsequent Offering Period would be an additional period of time, following the expiration of the Offer and the purchase of Shares in the Offer, during which stockholders may tender Shares not tendered in the Offer. A Subsequent Offering Period, if one is provided, is not an extension of the Offer, which already will have been completed. We do not currently intend to provide a Subsequent Offering Period, although we reserve the right to do so. If we elect to include or extend a Subsequent Offering Period, we will make a public announcement of such inclusion or extension no later than 9:00 a.m., Eastern time, on the next business day after the Expiration Date or date of termination of any prior Subsequent Offering Period.

No withdrawal rights apply to Shares tendered in a Subsequent Offering Period, and no withdrawal rights apply during a Subsequent Offering Period with respect to Shares previously tendered in the Offer and accepted for payment. The same price paid in the Offer will be paid to stockholders tendering Shares in a Subsequent Offering Period, if one is provided.

We have made a request to JOSB for its stockholder list and security position listings for the purpose of disseminating the Offer to holders of Shares. We will send this Offer to Purchase, the related Letter of Transmittal and other related documents to record holders of Shares and to brokers, dealers, banks, trust companies and other nominees whose names appear on the stockholder list or, if applicable, who are listed as participants in a clearing agency's security position listing for subsequent transmittal to beneficial owners of Shares.

2. Acceptance for Payment and Payment for Shares.

Upon the terms and subject to the conditions of the Offer (including, if we extend or amend the Offer, the terms and conditions of any such extension or amendment), we will accept for payment and pay for all Shares validly tendered before the Expiration Date and not withdrawn promptly after the Expiration Date. We expressly reserve the right, in our sole discretion, but subject to applicable laws, to delay acceptance for and thereby delay payment for Shares in order to comply with applicable laws or if any of the conditions referred to in "The Offer—Section 14—Conditions of the Offer" have not been satisfied or if any event specified in such Section has occurred. Subject to any applicable rules and regulations of the SEC, including Rule 14e-1(c) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we reserve the right, in our sole discretion and subject to applicable law, to delay the acceptance for payment or payment for Shares until satisfaction of all conditions to

13

the Offer. For a description of our right to terminate the Offer and not accept for payment or pay for Shares or to delay acceptance for payment or payment for Shares, see "The Offer—Section 14—Conditions of the Offer."

We will pay for Shares accepted for payment pursuant to the Offer by depositing the purchase price with the Depositary, which will act as your agent for the purpose of receiving payments from us and transmitting such payments to you. In all cases, payment for Shares accepted for payment pursuant to the Offer will be made only after timely receipt by the Depositary of (i) certificates for such Shares (including, if a Distribution Date with respect to the Rights occurs, certificates for the Rights) (or a confirmation of a book-entry transfer of such Shares (including, if a Distribution Date with respect to the Rights occurs, such Rights) into the Depositary's account at the Book-Entry Transfer Facility (as defined in "The Offer—Section 3—Procedure for Tendering Shares")), (ii) a properly completed and duly executed Letter of Transmittal (or facsimile thereof) or Agent's Message in lieu of a Letter of Transmittal and (iii) any other required documents. For a description of the procedure for tendering Shares pursuant to the Offer, see "The Offer—Section 3—Procedure for Tendering Shares." Accordingly, payment may be made to tendering stockholders at different times if delivery of the Shares and other required documents occurs at different times. Under no circumstances will we pay interest on the consideration paid for tendered Shares, regardless of any extension of or amendment to the Offer or any delay in making such payment.

For purposes of the Offer, we shall be deemed to have accepted for payment tendered Shares when, as and if we give oral or written notice of our acceptance to the Depositary.

We will pay the same per Share consideration pursuant to the Offer to all stockholders. The per Share consideration paid to any stockholder pursuant to the Offer will be the highest per Share consideration paid to any other stockholder pursuant to the Offer.

We reserve the right to transfer or assign, in whole or in part from time to time, to one or more of our affiliates the right to purchase Shares tendered pursuant to the Offer, but any such transfer or assignment will not relieve us of our obligations under the Offer or prejudice your rights to receive payment for Shares validly tendered and accepted for payment.

If any tendered Shares are not accepted for payment pursuant to the Offer for any reason, or if certificates are submitted for more Shares than are tendered, certificates for such unpurchased or untendered Shares will be returned (or, in the case of Shares tendered by book-entry transfer, such Shares will be credited to an account maintained at the Book-Entry Transfer Facility), without expense to you, as promptly as practicable following the expiration or termination of the Offer.

3. Procedure for Tendering Shares.

Valid Tender of Shares. In order for you to validly tender Shares pursuant to the Offer, either (i) the Depositary must receive at one of its addresses set forth on the back cover of this Offer to Purchase (a) a properly completed and duly executed Letter of Transmittal (or facsimile thereof) or Agent's Message (as defined below) in lieu of a Letter of Transmittal and any other documents required by the Letter of Transmittal and (b) certificates for the Shares (including, if a Distribution Date with respect to the Rights occurs, certificates for the Rights) to be tendered or delivery of such Shares (including, if a Distribution Date with respect to the Rights occurs, such Rights) pursuant to the procedures for book-entry transfer described below (and a confirmation of such delivery including an Agent's Message if the tendering stockholder has not delivered a Letter of Transmittal), in each case by the Expiration Date, or (ii) the guaranteed delivery procedure described below must be complied with.

The method of delivery of Shares, the Letter of Transmittal and all other required documents, including delivery through the Book-Entry Transfer Facility, is at your sole option and risk, and delivery of your Shares will be deemed made only when actually received by the Depositary (including,

14

in the case of a book-entry transfer, by book-entry confirmation). If certificates for Shares are sent by mail, we recommend registered mail with return receipt requested, properly insured, in time to be received on or prior to the Expiration Date.

The valid tender of Shares pursuant to any one of the procedures described above will constitute your acceptance of the Offer, as well as your representation and warranty that (i) you own the Shares being tendered within the meaning of Rule 14e-4 under the Exchange Act, (ii) the tender of such Shares complies with Rule 14e-4 under the Exchange Act, (iii) you have the full power and authority to tender, sell, assign and transfer the Shares tendered, as specified in the Letter of Transmittal and (iv) when the same are accepted for payment by the Purchaser, the Purchaser will acquire good and unencumbered title thereto, free and clear of all liens, restrictions, charges and encumbrances and not subject to any adverse claims.

Our acceptance for payment of Shares tendered by you pursuant to the Offer will constitute a binding agreement between us with respect to such Shares, upon the terms and subject to the conditions of the Offer.

Shares previously tendered pursuant to the Initial Offer dated January 6, 2014 and not withdrawn constitute valid tenders for purposes of the Offer as amended and restated hereby. Stockholders who have validly tendered and not withdrawn their Shares are not required to take any further action with respect to such Shares in order to receive the offer price of $63.50 per Share, net to the seller in cash, without interest and less any required withholding taxes, if Shares are accepted for payment pursuant to the Offer, except as may be required by the guaranteed delivery procedure if such procedure was utilized. If you have not already tendered your Shares, please disregard the materials previously delivered to you and use the materials accompanying this Amended and Restated Offer to Purchase.

Book-Entry Transfer. The Depositary will establish an account with respect to the Shares for purposes of the Offer at The Depository Trust Company (the "Book-Entry Transfer Facility") after the date of this Offer to Purchase. Any financial institution that is a participant in the Book-Entry Transfer Facility's system may make book-entry transfer of Shares by causing the Book-Entry Transfer Facility to transfer such Shares into the Depositary's account in accordance with the Book-Entry Transfer Facility's procedures for such transfer. However, although delivery of Shares may be effected through book-entry transfer, the Letter of Transmittal (or facsimile thereof), properly completed and duly executed, together with any required signature guarantees or an Agent's Message and any other required documents must, in any case, be transmitted to, and received by, the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase by the Expiration Date, or the guaranteed delivery procedure described below must be complied with. Delivery of the Letter of Transmittal and any other required documents to the Book-Entry Transfer Facility does not constitute delivery to the Depositary.

The term "Agent's Message" means a message, transmitted by the Book-Entry Transfer Facility to, and received by, the Depositary and forming a part of a book-entry confirmation stating that the Book-Entry Transfer Facility has received an express acknowledgment from the participant in the Book-Entry Transfer Facility tendering the Shares that such participant has received, and agrees to be bound by, the terms of the Letter of Transmittal and that we may enforce such agreement against such participant.

Signature Guarantees. All signatures on a Letter of Transmittal must be guaranteed by a financial institution (including most banks, savings and loan associations and brokerage houses) that is a member of a recognized Medallion Program approved by The Securities Transfer Association Inc., including the Securities Transfer Agents Medallion Program (STAMP), the Stock Exchange Medallion Program (SEMP) and the New York Stock Exchange Medallion Signature Program (MSP) or any other "eligible guarantor institution" (as such term is defined in Rule 17Ad-15 under the Exchange Act) (each an "Eligible Institution"), unless (i) the Letter of Transmittal is signed by the registered holder of the

15

Shares tendered therewith and such holder has not completed the box entitled "Special Payment Instructions" on the Letter of Transmittal or (ii) such Shares are tendered for the account of an Eligible Institution. See Instructions 1, 5 and 7 of the Letter of Transmittal. If the certificates for Shares are registered in the name of a person other than the signer of the Letter of Transmittal, or if payment is to be made or certificates for Shares not tendered or not accepted for payment are to be returned to a person other than the registered holder of the certificates surrendered, the tendered certificates must be endorsed or accompanied by appropriate stock powers, in either case signed exactly as the name or names of the registered holders or owners appear on the certificates, with the signatures on the certificates or stock powers guaranteed as aforesaid. See Instructions 1, 5 and 7 of the Letter of Transmittal.

Guaranteed Delivery. If you wish to tender Shares pursuant to the Offer and cannot deliver such Shares and all other required documents to the Depositary by the Expiration Date or cannot complete the procedure for delivery by book-entry transfer on a timely basis, you may nevertheless tender such Shares if all of the following conditions are met:

(i) such tender is made by or through an Eligible Institution;

(ii) a properly completed and duly executed Notice of Guaranteed Delivery in the form provided by us is received by the Depositary, as provided below, by the Expiration Date; and

(iii) the certificates for such Shares (or a confirmation of a book-entry transfer of such Shares into the Depositary's account at the Book-Entry Transfer Facility), together with a properly completed and duly executed Letter of Transmittal (or facsimile thereof) together with any required signature guarantee or an Agent's Message and any other required documents, are received by the Depositary within three NASDAQ Global Select Stock Market ("NASDAQ") trading days after the date of execution of the Notice of Guaranteed Delivery.

The Notice of Guaranteed Delivery may be delivered or transmitted by telegram, telex, facsimile transmission or mail to the Depositary and must include a guarantee by an Eligible Institution in the form set forth in such Notice of Guaranteed Delivery.

Stockholders tendering their Shares according to the guaranteed delivery procedures may do so using either the initial Notice of Guaranteed Delivery circulated with the Initial Offer or the Amended and Restated Notice of Guaranteed Delivery circulated herewith.

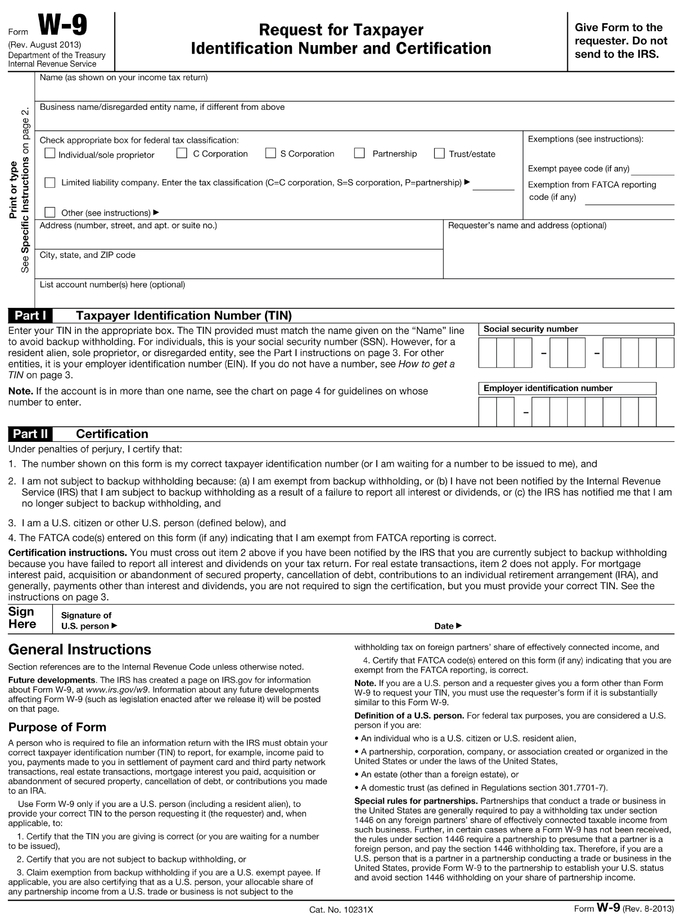

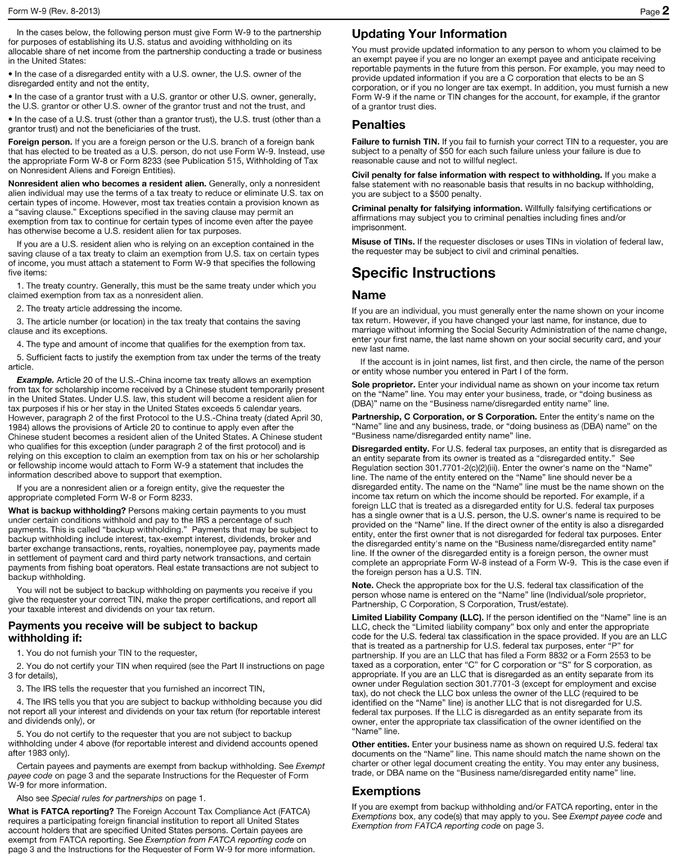

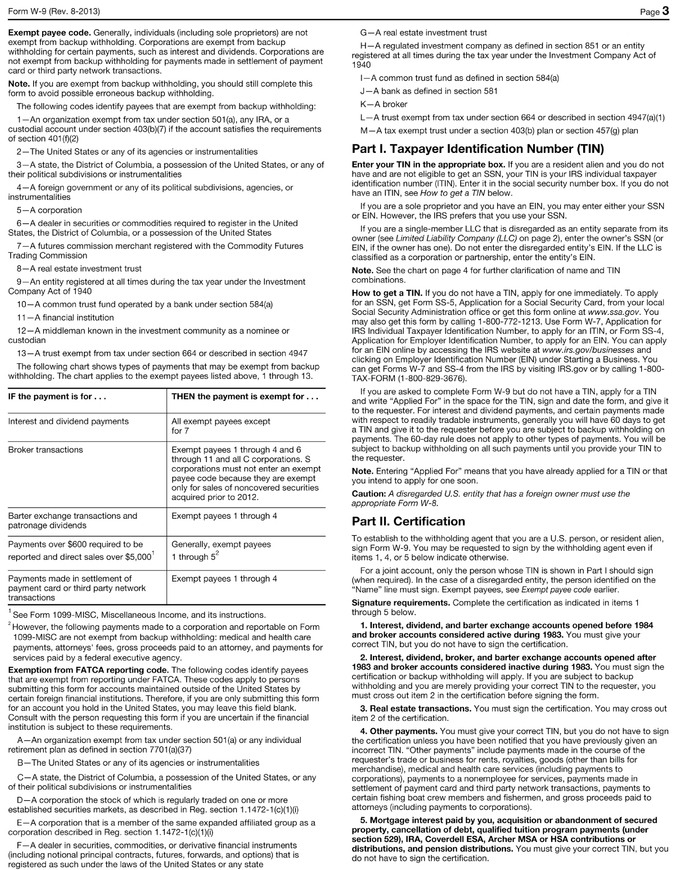

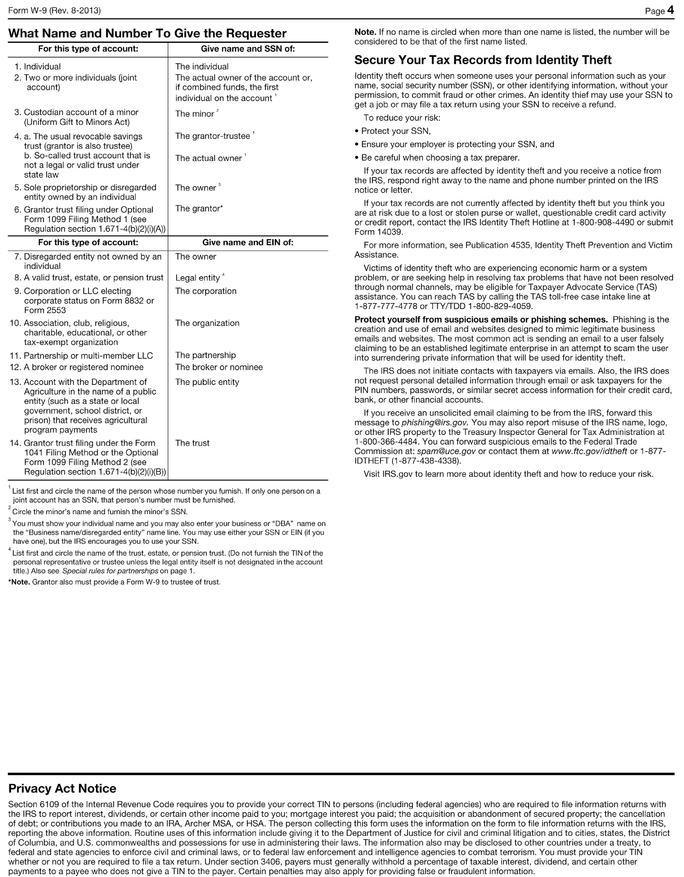

Backup Withholding. Under U.S. federal income tax laws, payments in connection with the Offer may be subject to "backup withholding" unless a tendering holder (1) provides a correct taxpayer identification number (which, for an individual, is the holder's social security number) and any other required information, or (2) is a corporation or comes within certain other exempt categories and, when required, demonstrates this fact, and otherwise complies with applicable requirements of the backup withholding rules. A holder that does not provide a correct taxpayer identification number may be subject to penalties imposed by the Internal Revenue Service. To avoid backup withholding of U.S. federal income tax on payments made pursuant to the Offer, each tendering U.S. Holder (as defined in "The Offer—Section 5—Certain U.S. Federal Income Tax Consequences") should complete and return the Internal Revenue Service ("IRS") Form W-9 included with the Letter of Transmittal. Each tendering Non-U.S. Holder (as defined in "The Offer—Section 5—Certain U.S. Federal Income Tax Consequences") should complete and submit IRS Form W-8BEN (or other applicable IRS Form W-8), which can be obtained from the Depositary or at http://www.irs.gov. For a more detailed discussion of backup withholding, see "The Offer—Section 5—Certain U.S. Federal Income Tax Consequences."

Appointment of Proxy. By executing a Letter of Transmittal (or facsimile thereof) or, in the case of a book-entry transfer, by delivery of an Agent's Message in lieu of a Letter of Transmittal, you irrevocably appoint our designees as your attorneys-in-fact and proxies in the manner set forth in the

16

Letter of Transmittal, each with full power of substitution, to the full extent of your rights with respect to the Shares (including the associated preferred share purchase rights) tendered and accepted for payment by us (and any and all other Shares or other securities issued or issuable in respect of such Shares (including the associated preferred share purchase rights) on or after the date of this Offer to Purchase). This power-of-attorney and proxy will be governed by and construed in accordance with the laws of the State of Delaware and applicable federal securities laws. All such powers-of-attorney and proxies are irrevocable and coupled with an interest in the tendered Shares (and such other Shares and securities (including the associated preferred share purchase rights)). Such appointment is effective only upon our acceptance for payment of such Shares (including the associated preferred share purchase rights). Upon such acceptance for payment, all prior powers-of-attorney, proxies and consents granted by you with respect to such Shares (and such other Shares and securities (including the associated preferred share purchase rights)) will, without further action, be revoked, and no subsequent powers-of-attorney, proxies or consents may be given (and, if previously given, will cease to be effective). Our designees will be empowered to exercise all your voting and other rights with respect to such Shares (and such other Shares and securities (including the associated preferred share purchase rights)) as they, in their sole discretion, may deem proper at any annual, special or adjourned meeting of JOSB's stockholders, or with respect to any actions by written consent in lieu of any such meeting or otherwise. We reserve the right to require that, in order for Shares (including the associated preferred share purchase rights) to be deemed validly tendered, immediately upon our acceptance for payment of such Shares (including the associated preferred share purchase rights), we or our designee must be able to exercise full voting, consent and other rights with respect to such Shares (and such other Shares and securities (including the associated preferred share purchase rights)) (including voting at any meeting of stockholders).

The foregoing proxies are effective only upon acceptance for payment of Shares (including the associated preferred share purchase rights) pursuant to the Offer. The Offer does not constitute a solicitation of proxies, absent a purchase of Shares (or the associated preferred share purchase rights), for any meeting of JOSB's stockholders.

Determination of Validity. MW will interpret the terms and conditions of the Offer (including the Letter of Transmittal and the instructions thereto). All questions as to the form of documents and the validity, form, eligibility (including time of receipt) and acceptance for payment of any tender of Shares will be determined by us, in our discretion. We reserve the absolute right to reject any and all tenders determined by us not to be in proper form or the acceptance of or payment for which may, in the opinion of our counsel, be unlawful. We also reserve the absolute right to waive any condition of the Offer to the extent permitted by applicable law or any defect or irregularity in the tender of any Shares of any particular stockholder, whether or not similar defects or irregularities are waived in the case of other stockholders. No tender of Shares will be deemed to have been validly made until all defects and irregularities have been cured or waived. None of the Purchaser, MW or any of their respective affiliates or assigns, the Dealer Managers, the Depositary, the Information Agent or any other person will be under any duty to give any notification of any defects or irregularities in tenders or incur any liability for failure to give any such notification.

4. Withdrawal Rights.

Except as otherwise provided in this Section 4, tenders of Shares are irrevocable. You may withdraw Shares that you have previously tendered pursuant to the Offer pursuant to the procedures set forth below at any time before the Expiration Date and, thereafter, you may withdraw such Shares at any time until such Shares have been accepted for payment as provided in this Offer to Purchase. If we extend the Offer, delay acceptance for payment or payment for Shares or are unable to accept for payment or pay for Shares pursuant to the Offer for any reason, then, without prejudice to our rights

17