ANNUAL INFORMATION FORM

For the year ended

December 31, 2017

Dated as of March 27, 2018

| Table of Contents |

ANNUAL INFORMATION FORM – December 31, 2017

| Preliminary Notes |

In this annual information form (“AIF”) reference to the Company or Nevsun or NRL means Nevsun Resources Ltd. and all of its wholly and majority owned subsidiaries, and except as otherwise noted herein, the information in this AIF is as of December 31, 2017. We prepare the financial statements referred to in the AIF in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board, and file the AIF with appropriate regulatory authorities in Canada and the United States. Information on our website is not part of this AIF or incorporated by reference. Filings on SEDAR are also not part of this AIF or incorporated by reference except as specifically stated herein. Additional financial and other information regarding the Company can be found in our consolidated financial statements for the year ended December 31, 2017, together with the auditors’ report thereon dated February 28, 2018 and our Management’s Discussion and Analysis (“MD&A”) for the year ended December 31, 2017.

All dollar amounts in this AIF are expressed in USD, unless otherwise indicated (“USD” denotes United States dollars and “CAD” denotes Canadian dollars). All capitalized terms in this AIF not otherwise defined in the text have meanings ascribed to those terms in the Glossary and Defined Terms section below unless the context requires otherwise.

Forward-Looking Statements

This AIF contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to herein as “forward-looking statements”). These forward-looking statements relate to future events or the Company’s future performance including anticipated developments in the Company’s continuing and future operations, and the adequacy of the Company’s financial resources and financial projections and its intentions for its Bisha Mine in Eritrea and its Timok Project in Serbia. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “budget” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” occur or be achieved. In addition, the Bisha Technical Reports and the Updated Timok PEA contain forward-looking statements related to the Bisha Property and the Timok Property respectively. Readers are cautioned that the scientific and technical information contained in this AIF may change and caution should be used by readers in relying upon forward looking information related to the Bisha Property and the Timok Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results or events to differ materially from those anticipated in such forward-looking statements. This is particularly the case with respect to forward-looking statements contained in the past Bisha Technical Reports and the Updated Timok PEA given the expected updated technical reports. These statements speak only as of the date of this AIF.

Forward-looking statements include, but are not limited to statements concerning:

- the business, prospects, and future activities of, and developments related to the Company and its Bisha Property and Timok Project;

- forecasts or outlook and guidance related to construction, exploration drilling programs and activities, production targets, timetables and estimates of capital and operating costs;

- the timing, nature and extent of future zinc, copper and gold production and recoveries, the estimation of mineral reserves and resources, methodologies and models used to prepare resource and reserve estimates as set out in the Bisha Technical Reports concerning the Bisha Property and the Updated Timok PEA concerning the Timok Project;

- estimates of the quantity, quality and the realization of mineral reserves and resources, the conversion of mineral properties to reserves and resources;

- interpretation of drill results as such information constitutes a prediction of what mineralization might be found to be present if and when a project is actually developed;

- statements based on certain assumptions that a mineral deposit can or may be economically exploited;

| 1 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

- dividends, goals, strategies, future growth,

- any pending litigation to which the Company is a party;

- resolution of metallurgical challenges from variable ore materials to produce concentrate and the ability to increase processing recovery rates of zinc and copper to initial design levels at the Bisha Mine;

- timing and achievement of any key milestones including, planned mineral movement at the Bisha Mine, the delivery of or timing for delivery of a Pre-Feasibility Study and a Feasibility Study on the Timok Project,

- the adequacy of financial resources and the ability of the Company to raise additional capital;

- the potential to expand resources, reserves and mine life;

- environmental, health and safety initiatives;

- future exploration budgets, plans, work programs and capital expenditures;

- integration or expansion of operations and requirements for additional capital;

- anticipated timing of grant of permits, licenses, land acquisition, construction, mining and development plans and activities;

- in-situ and ore feed grades, processing rates and net cash flows;

- metal prices and exchange rates;

- reclamation costs and unanticipated reclamation expenses;

- environmental risks;

- government regulation of mining operations and project development;

- political risks and uncertainties;

- general business and economic conditions; and

- other events or conditions that may occur in the future.

Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties, assumptions and other factors, including, without limitation, the risks more fully described under the Section titled “Risk Factors” in Schedule “B”.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that could cause actual results to differ from what is anticipated, estimated or intended. The Company’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made and the Company assumes no obligation to update such forward-looking statements in the future, except as required by law. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. For the reasons set forth above, readers should not place undue reliance on forward-looking statements.

Cautionary Note to US Readers Regarding Disclosure of Mineral Reserves and Resource Estimates

The disclosure in this AIF uses mineral resource and mineral reserve classification terms that comply with Canadian securities laws that differ in certain material respects from the requirements of United States securities laws. Disclosure has been made in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum’s Classification System. The NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the disclosure requirements of the Securities and Exchange Commission (“SEC”).

| 2 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” in documents filed with the SEC, unless such information is required to be disclosed by the law of the Company’s jurisdiction of incorporation or of a jurisdiction in which its securities are traded. Consequently, mineral resource and mineral reserve information contained in this AIF is not comparable to similar information that would generally be disclosed by US companies in accordance with the rules of the SEC.

The SEC’s Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of proven and probable reserves used in NI 43-101 differ from the definitions in Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Accordingly, mineral reserve estimates contained in this AIF may not qualify as “reserves” under SEC standards.

This AIF uses the terms “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” to comply with the reporting standards in Canada. The SEC’s Industry Guide 7 does not recognize these terms and US companies are generally not permitted to use these terms in documents they file with the SEC. Readers are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into SEC defined mineral “reserves.” Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically.

Therefore, readers are also cautioned not to assume that all or any part of an inferred mineral resource exists. In accordance with reporting standards in Canada, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in rare cases. In addition, disclosure of “contained ounces” in a mineral resource estimate is permitted disclosure under NI 43-101 provided that the grade or quality and the quantity of each category is stated; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. For the above reasons, information contained in this AIF containing descriptions of mineral resource and mineral reserve estimates is not comparable to similar information made public by US companies subject to the reporting and disclosure requirements of the SEC.

Non-GAAP performance measure

This document includes a non-GAAP performance measure that does not have a standardized meaning prescribed by IFRS. This performance measure may differ from those used by, and may not be comparable to such measures as reported by, other issuers. The Company believes that this performance measure is commonly used by certain investors, in conjunction with conventional GAAP measures, to enhance their understanding of the Company's performance. The Company uses this performance measure extensively in internal decision-making processes, including to assess how well the Bisha Mine is performing and to assist in the assessment of the overall efficiency and effectiveness of the mine site management team.

C1 cash cost per payable pound

C1 cash cost per payable pound sold is a non-GAAP measure and represents the cash cost incurred at each processing stage, from mining through to recoverable metal delivered to customers, less by-product credits. Royalties, depreciation, and depletion are excluded from the calculation of C1 cash cost per payable pound sold. The costs included in this definition comprise mine site operating and general and administrative costs, freight, treatment and refining charges, less by-product credits. By-product credits are an important factor in determining the C1 cash costs per pound. The Company produces byproduct metals, gold and silver, incidentally to zinc and copper production activities. Gold and silver are considered to be by-products as they generally represent less than 20% of revenues from concentrate. Additionally, copper metal may also be considered a by-product in relation to zinc sales given that revenue from sales of copper concentrate may range from 20% to 30% of total revenue. Therefore, the Company has presented its C1 cash cost per payable pound sold of zinc on both a co-product basis (with gold and silver as by-products), and on a byproduct basis (with gold, silver and copper as by-products). The presentation of both methods is intended to provide another illustrative representation of the net cost of zinc production at the Bisha Mine. Copper by-product credits are expected to vary period to period as sales quantities of copper concentrate may differ between quarters based on production quantities and the timing of shipments, and from metal prices movements. The cash cost per payable pound sold will vary depending on the volume of by-product credits and the relative price of the by-products. The C1 cash cost per payable pound sold is calculated by dividing the total costs, net of the by-product credits, by payable pounds of metal sold. The calculation method is consistent on a period to period basis for purposes of meaningful comparison.

| 3 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

Glossary and Defined Terms

| 2013 Technical Report: | the NI 43-101 technical report on the Bisha Mine titled “Bisha Mine NI 43-101 Technical Report” with an effective date of December 31, 2013 filed March 24, 2014. | |

| Ag: | silver. | |

| Au: | gold. | |

| Bisha Main: | a large precious metal (Au, Ag) and base metal rich (Cu, Zn) VMS deposit on the Bisha Property. | |

| Bisha Mining License: | the mining license issued to BMSC in 2008 which is valid for 20 years covering an area of 16.5 square kilometers over the Bisha Main and Northwest Zone deposits. | |

| Bisha Property: | the Company’s principal mineral property in Eritrea as more particularly described under the heading “Description of the Business”. | |

| Bisha Technical Reports: | means, collectively the 2013 Technical Report Bisha Mine, Eritrea, effective December 31, 2013; the December 31, 2015 Mineral Resource estimate effective December 31, 2015; the December 31, 2015 Mineral Reserve estimate for Bisha and Harena effective December 31, 2015; the December 31, 2016 Mineral Resource estimate effective December 31, 2016; and Independent Technical Report 2016 Resources and Bisha Mine, Eritrea effective December 31, 2016. | |

| BMSC: | Bisha Mining Share Company, an Eritrean entity that owns and operates the Bisha Mine and is a 60% owned indirect subsidiary of NRL with the 40% balance of the outstanding shares owned by ENAMCO. | |

| Board: | board of directors of Nevsun Resources Ltd. | |

| C1 cash cost: | C1 cash cost per pound is a non-GAAP measure and represents the cash cost incurred at each processing stage, from mining through to recoverable metal delivered to customers, less net by-product credits. | |

| CIM: | Canadian Institute of Mining, Metallurgy and Petroleum. | |

| CSAMT: | Controlled Source Audio Magneto-Telluric survey. | |

| Cu: | copper. | |

| EITI: | Extractive Industries Transparency Initiative. | |

| ENAMCO: | Eritrean National Mining Corporation, an Eritrean entity owned by the State of Eritrea. | |

| g/t: | grams per metric tonne (1,000 kilograms or 2,204 pounds). | |

| Harena Mining License: | a conditional license issued to BMSC in 2012 for the Harena deposit and valid for 10 years, covering an area of 7.5 square kilometers located approximately 10 kilometers from the Bisha Mine. | |

| HSE: | High Sulphidation Epithermal mineralization. | |

| IFC: | International Finance Corporation. | |

| 4 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| indicated mineral resource: | that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. | |

| inferred mineral resource: | that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. | |

| in-situ: | natural material in the ground prior to excavation, processing and transport. | |

| IP: | induced polarization survey. | |

| LG: | Lerchs-Grossmann, a method used to determine the optimal open pit limit within the ground including the mineralized material, founded in 3-dimensional graph theory and relying upon a regular system of blocks which defines the value (profit, loss) and type (ore, waste) of material contained in the blocks. | |

| LOM: | life of mine. | |

| measured mineral resource: | that part of a mineral resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. | |

| mineral reserve: | the economically mineable part of a measured mineral resource or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined. | |

| mineral resource: | a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal and industrial minerals in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. | |

| 5 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| Mining Agreement: | the mining agreement between BMSC and the Government of the State of Eritrea dated December 2007, as amended or supplemented from time to time, covering the future development and operations for the Bisha Property, including all substantive requirements of international financial institutions. | |

| Moz: | million ounces. | |

| Mt: | metric tonne. | |

| Mogoraib Exploration License: | the exploration license acquired by the Company in 2012 from Sanu Resources, a subsidiary of NGEx Resources, and subsequently materially expanded in 2016 to 630 square kilometers of area located to the west and north of the Bisha Mining License. | |

| NI 43-101: | a national instrument for the Standards of Disclosure for Mineral Projects within Canada involving a codified set of rules and guidelines for reporting and displaying information related to mineral properties. | |

| NRL: | Nevsun Resources Ltd. | |

| NSR: | net smelter return used in mineral resource and reserve calculations is the net value per tonne of ore, inclusive of all recoveries and costs outside the mine gate. It does not include operating costs inside the mine gate. | |

| probable mineral reserve: | the economically mineable part of an indicated mineral resource and, in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. | |

| QAQC: | quality assurance quality control. | |

| QP: | a qualified person as defined by National Instrument 43-101 (NI 43-101). | |

| reserve: | see “mineral reserve”. | |

| resource: | see “mineral resource”. | |

| Run of mine (ROM): | generally ore material excavated from a mine that has not been crushed or screened. | |

| SEC: | United States Securities and Exchange Commission. | |

| SEDAR: | the System for Electronic Document Analysis and Retrieval (SEDAR) is a filing system developed for the Canadian Securities Administrators to facilitate the electronic filing of securities information as required by Canadian Securities Administrator; allow for the public dissemination of Canadian securities information collected in the securities filing process; and provide electronic communication between electronic filers, agents and the Canadian Securities Administrator. | |

| SEIA: | Social and Environmental Impact Assessment. | |

| SEMP: | Social and Environmental Management Plan. | |

| Tabakin Exploration License: | an exploration license issued to BMSC in 2016 for a period of 10 years, covering an area of 184 square kilometers, located immediately between the Bisha Mining License and the Harena Mining License. | |

| Updated Timok PEA: | 2017 Updated Preliminary Economic Assessment of the Timok Project, Republic of Serbia effective September 1, 2017 and Technical Report. | |

| 6 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| Timok Project: | a copper-gold development asset in eastern Serbia focused on the Cukaru Peki deposit, which includes the high grade Upper Zone (characterized by massive and semi-massive sulphide mineralization) and the Lower Zone (characterized by porphyry-style mineralization). | |

| TMF: | tailings management facility, historically referred to as tails storage facilities or tailings ponds. | |

| TSX: | the Toronto Stock Exchange. | |

| VMS: | volcanogenic massive sulphides. | |

| VTEM: | Versatile Time-Domain Electromagnetic | |

| Zn: | zinc. | |

| 7 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| Corporate Structure |

Name, Address and Incorporation

NRL was incorporated under the laws of the Province of British Columbia under the Companies Act (British Columbia) on July 19, 1965 under the name of “Hogan Mines Ltd.” Since inception, it has undergone four name changes until December 19, 1991 when it adopted the name of “Nevsun Resources Ltd.” NRL is governed by the Business Corporations Act (British Columbia) and its Articles.

The head office of NRL is located at 1750 - 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1 and its registered and records office is located at 2600 - 595 Burrard Street, Vancouver, British Columbia, V7X 1L3 and its website address is http://www.nevsun.com.

Intercorporate Relationships

The following diagram explains the intercorporate relationships among NRL, and its wholly and partially owned subsidiaries, (collectively referred to as “Nevsun” or the “Company”); the name and place of incorporation of each subsidiary; and the percentage of voting securities legally and beneficially owned:

| 8 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| General Development of the Business |

Three Year History

The Company’s major achievements during the past three fiscal years include:

- completing the Updated Timok PEA for its Timok Project in Serbia;

- completing the Bisha zinc expansion project on time and under budget, declaring commercial production October 1, 2016;

- completing the acquisition of Reservoir Minerals Inc. (“Reservoir”), and its ownership interest in the high-grade Timok Project on June 23, 2016;

- completing the acquisition of significant additional exploration licenses in the Bisha District which now total 814 square kilometers, up 1,891% from the previous square kilometers;

- maintaining an industry leading safety performance record at Bisha;

- generating $958 million of after-tax operating cash flows since the commencement of commercial gold, copper and zinc production;

- declaring and paying industry-leading dividends to shareholders; and

- enhancing its corporate social responsibility programs.

2017 Significant Developments

Board and Management Changes

- The Company implemented a Chief Executive Officer (CEO) succession plan with the appointment of Peter Kukielski as the new CEO in May, 2017 and retirement of Cliff Davis;

- The Company completed a planned Board renewal to reflect the Company’s growth and strategic transformation with the appointment of five experienced new directors to replace retiring directors to form a board of seven directors;

- The Company appointed a new Chief Financial Officer, a new Vice President and Project Director, Timok Projects and a Vice-President Corporate Development.

Timok Project Activities

In September, 2017 the Company announced the results of the Updated Timok PEA on the Upper Zone confirming the Upper Zone as a world-class copper-gold deposit with positive economics highlighting: a 15 year mine life producing over 2.1 billion pounds or 0.96 million tonnes of payable copper; sub-level cave mining with 3.3 million tonnes per annum conventional plan producing copper concentrate; after-tax NAV of $1.5 billion at flat $3.00 per pound copper and 8% discount rate; $630 million in pre-production capital with 50% IRR and under 1.5 year payback; established mining jurisdiction supportive of new mining investment; strong project economics support a wide range of financing alternatives; upside potential from on-license exploration and gold in pyrite concentrate.

Key milestones achieved in 2017 at the Timok Project include the completion of three phases of metallurgical test work, an extensive infill drilling program totaling 30,000 meters and the first phase of condemnation drilling, key technical mining and environmental studies, and advancement of permitting and land acquisition. As of December 31, 2017, the Company has acquired 100% of the land required for development of the exploration decline and 40% of the required private land for construction of the project.

Bisha Mine Operations

During 2017 the Company produced 210.4 million pounds of zinc in zinc concentrate at C1 cash costs of $0.97 per payable zinc pound sold on a co-product basis and $0.88 per payable zinc pound sold on a by-product basis, using net margin from copper sales as a by-product. During 2017, the Company also produced 17.5 million pounds of copper in copper concentrate at C1 cash costs of $1.72 per payable copper pound sold on a co-product basis.

| 9 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

Since commissioning commenced in June 2016, the existing copper circuit and the new zinc circuit have produced approximately 320,000 dry metric tonnes (“DMT”) of commercially saleable zinc concentrate.

In the Mineral Resource estimate effective December 31, 2017, the Company updated the mineral resources and reserves for the Bisha Mine. Bisha and Harena proven and probable primary ore reserves as of December 31, 2017 declined to 8.5 million tonnes at 6.25 percent zinc, 1.07 percent copper, 0.72 g/t gold and 47 g/t silver (see Table 3.1). At a processing rate of 2.4 million tonnes per annum, the Bisha operation now has a reserve mine life to third quarter of 2021, up from the first quarter of 2021 at the last reserve estimate. The increase is due to a small increase of reserve in the Bisha main pit and also due to including long-term stockpiles. Bisha Main and Harena pits both have potential for expansion. Nevsun is working on the possibility of future expansion at the Bisha operation.

Exploration Activities

Timok Project (Serbia)

| Upper Zone |

| During 2017, the company completed the 30,000 meter infill drill program on the Upper Zone and provided an update on results. Highlight assay results from new massive and new semi-massive sulphide intersections included: |

|

| On October 26, the company provided an updated resource statement for the Upper Zone consisting of a Measured and Indicated resource of 28.7 million tonnes grading 3.7% Cu and 2.4g/t Au and an Inferred resource of 13.9 million tonnes grading 1.6% Cu and 0.9g/t Au. |

Exploration was also initiated for new zones on Upper Zone style mineralization on the B-M Permit.

| Lower Zone |

| During 2017, the company updated the progress on the $20 million drilling program on the Lower Zone. |

| Highlights of new porphyry copper intersections included: |

|

| 10 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

|

Bisha (Eritrea)

| Updated mineral resource estimates effective December 31, 2017 (see Tables 2.1, 2.2, 2.3, 2.4, 2.5, 2.6 and 2.7) for the Bisha, Harena and Asheli deposits included: |

|

| At Harena, drilling highlights included: |

|

During 2017, the company also completed a 6,386 line kilometer VTEM airborne survey over an 825 square area at Bisha that highlighted numerous new untested shallow drill targets. Field review, follow-up soil and ground EM surveys and diamond drilling of these targets were initiated in later half of the year and work continues.

Dividends

NRL declared an annualized dividend of $0.04 per share, the seventh consecutive year of dividend declarations since the start of commercial production at the Bisha Mine in 2011.

Legal Update

Please refer to the section titled “Legal Proceedings” on page 62 of this AIF for the update on current legal proceedings.

Corporate Social Responsibility

The Company released its 2016 Corporate Social Responsibility Report in May highlighting its safety record of no lost time injuries; ongoing implementation of Nevsun CSR policies and ethical standards into growing Timok development team and commenced environmental and social impact assessment baseline study work; increase of training for Eritrean workers by 19% over the prior year; continued progress on key human rights actions that reflect evolving international best practices; continued its focus on community and environmental management programs at Bisha; completed three community infrastructure projects near the Bisha Mine to enhance local water supply; taxes and royalties paid to the state of Eritrea and dividends paid to ENAMCO.

2016 Significant Developments

Acquisition

On June 23, 2016, the Company completed its acquisition of 100% of the issued and outstanding shares of Reservoir. The acquisition of Reservoir and its principal asset, its ownership interest in the Timok Project, located in eastern Serbia near the Bor Mining and Smelting complex, is the culmination of a long-term strategic objective of the Company to grow through merger and acquisition (“M&A”) transactions. The transaction fits the Company’s M&A criteria of a transformative, high quality, copper and gold project in a different geographical location. Additional benefits of the transaction include exploration potential in Serbia and Macedonia and the addition of both Freeport-McMoRan Exploration Corp. (“Freeport”) and Rio Tinto plc as major strategic partners.

| 11 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

The Timok Project is focused on the Cukaru Peki deposit, which includes the high grade Upper Zone (characterized by massive and semi-massive sulphide mineralization) and the Lower Zone (characterized by porphyry-style mineralization). The Upper Zone has an extremely high copper and gold content consisting of 1.7 million tonnes of indicated resource grading 13.5% copper and 10.4 g/t gold and 35.0 million tonnes of inferred resource grading 2.9% copper and 1.7 g/t gold.

The Timok Project is a joint venture between the Company and Freeport. The Company is the operator of the Timok Project until the occurrence of certain events and will advance the development of both the Upper Zone and the Lower Zone. The Company will fund 100% of the Upper Zone development costs and will solely fund the first $20 million of agreed Lower Zone work. The Company and Freeport will fund additional Lower Zone work based on their respective ownership interests in the Lower Zone. After delivery of a feasibility study on either the Upper Zone or the Lower Zone, Freeport’s ownership in the Lower Zone will increase to 54% and the Company will own 100% of the Upper Zone and 46% of the Lower Zone. The Company and Freeport will be entitled to their pro rata share of the economic benefits of the Lower Zone, and the Company will be entitled to 100% of the economic benefits of the Upper Zone.

The acquisition of Reservoir was completed under a plan of arrangement pursuant to an arrangement agreement dated April 22, 2016 as amended on June 16, 2016 (the “Arrangement Agreement”). Under the terms of the Arrangement Agreement, each issued and outstanding common share and restricted share unit of Reservoir was exchanged for two Nevsun common shares plus CAD$2.00 in cash. The Arrangement Agreement included $135 million of funding to Reservoir (via a private placement for 19.9% of the issued shares of Reservoir and an unsecured loan). The $135 million of funding allowed Reservoir to exercise its right of first offer (“ROFO”) with Freeport on May 3, 2016. After exercising the ROFO, Reservoir had increased its ownership in the Upper Zone of the Timok Project to 100% and in the Lower Zone to 60.4%. Upon completion of the plan of arrangement on June 23, 2016, Nevsun and Reservoir shareholders owned approximately 67% and 33% of the Company, respectively. The total purchase price for the acquisition was $512,554.

Bisha Mine Operations

During 2016 the Company produced 56 million pounds of copper at C1 cash costs of $1.04 per payable pound sold as well as 90 million pounds of zinc from primary ore, generating operating cash flows before taxes of $71 million. The Company completed its zinc expansion project on time and under budget with commercial production declared on October 1, 2016. Total project cost was approximately $78 million, compared to a budget of $100 million.

Exploration Activities

Timok Project (Serbia)

- Upper Zone – Ongoing drilling of the Upper Zone at the Timok Project confirms continuity and the high grade nature of this zone, which is part of an approximately 50,000 meter drill program for both resource infill drilling and technical drilling that will support delivery of a pre-feasibility study on the Upper Zone in September 2017.

- Lower Zone – The Company commenced an approximate 60,000 meter drill program to define higher grade areas at shallower depths and to further expand the mineralization footprint.

Bisha (Eritrea)

- During 2016 the Company announced a series of assay results for its Asheli prospect as part of its ongoing regional exploration at Bisha. New drill results demonstrated the continuity and high grade nature of the Asheli mineralization with further expansion potential.

- Based on the prospectivity of Bisha’s VMS District, BMSC increased its total land package of exploration licenses to 814 square kilometers, up from the previous 41 square kilometers. NRL funded its share of these newly acquired exploration licenses via a $22.6 million reduction in the amount receivable from ENAMCO.

| 12 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

Dividends

NRL declared an annualized dividend of $0.16 per share, the sixth consecutive year of dividend declarations since the start of commercial production at the Bisha Mine in 2011.

In September 2016, the Company adopted a Dividend Reinvestment Plan (“DRIP”) to offer shareholders an opportunity to increase their investment without additional transaction costs by reinvesting their cash dividends into additional common shares of the Company at a 3% discount to the prevailing market price. Participation in the DRIP is optional and shareholders holding approximately 13% of the outstanding shares of the Company are currently participating in the DRIP.

Legal Update

Please refer to the section titled “Legal Proceedings” on page 62 of this AIF for the update on current legal proceedings.

Corporate Social Responsibility

The Company released its 2015 Corporate Social Responsibility Report in May highlighting its safety record of only one lost time injury and over 6.1 million hours without an incident effective date of that report; second independent human rights audit progress; training mine security on the Voluntary Principles for Security and Human Rights; community infrastructure pilot projects; local employment and training; social and environmental programs at Bisha Mine and nearby communities; taxes and royalties paid to the state of Eritrea and dividends paid to ENAMCO.

2015 Significant Developments

In 2015, the Company produced 135.9 million pounds of copper in concentrate from the Bisha Mine at C1 cash costs of $1.31 per payable pound sold which lead to earnings and operating cash flows with year-end working capital of $462 million including $434 million in cash. NRL declared an annualized dividend of $0.16 per share, representing a fifth consecutive year of increased dividend declarations since the start of commercial production at the Bisha Mine in early 2011. The Company also advanced the zinc expansion project.

Exploration drilling results at the Harena deposit during 2015 continued to demonstrate continuity of mineralization down dip and plunge and as a result, the Company announced revised mineral resources for Harena on February 17, 2016. The Company announced that drilling at Harena added 0.5 million tonnes of indicated resource and 4.5 million tonnes of inferred resource. It further disclosed that the total indicated resource at Harena was now 3.7 million tonnes (including in-situ 70 million pounds copper, 258 million pounds zinc, 70,000 ounces gold and 3.3 million ounces silver) and the total inferred resource was 11.0 million tonnes (including in-situ 348 million pounds copper, 952 million pounds zinc, 360,000 ounces gold and 14.4 million ounces silver). The deposit remained open at depth with the grade and thickness of the massive sulphides increasing in the deepest tier of exploration holes.

In Q2, the Company announced the discovery of a new massive sulphide deposit at the greenfield Asheli prospect on the Mogoraib River Exploration License located 20 kilometers southwest of the Bisha processing plant. Highlight drill holes include:

- MX-052 which graded 2.29% Cu, 4.50% Zn, 0.45 g/t Au, 37 g/t Ag over 22.9 meters, including 3.67% Cu, 8.04% Zn, 0.68 g/t Au, 50 g/t Ag over 7.4 meters and 7.92% Cu, 3.89% Zn, 1.14 g/t Au, 101 g/t Ag over 2.9 meters; and

- MX-056 which graded 1.26% Cu, 6.08% Zn, 0.28 g/t Au, 26 g/t Ag over 20.9 meters including 1.71% Cu, 8.51% Zn, 0.37 g/t Au, 35 g/t Ag over 10.9 meters.

The deposit is associated with highly altered felsic volcanics and is open to expansion with numerous untested geochemical and geophysical targets occurring along at least 4 kilometers of similar stratigraphy.

The Company also provided an update on its human rights and reported that it commissioned an independent human rights impact assessment (HRIA) in 2013 which was completed in and published in April 2014 with cooperation from the State of Eritrea.

| 13 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

The Company released its 2014 Corporate Social Responsibility Report in April highlighting its safety record, community engagement efforts and local employment, successful environmental management and practices, and progress on independent human rights impact assessment follow-up recommendations in training and development.

On February 3, 2015 the Company announced the updated mineral resource estimate effective December 31, 2014 for the Bisha and Harena deposits. The Bisha primary indicated resource grew by 0.9 million tonnes and primary inferred resource grew by 0.6 million tonnes. This primary zone growth added indicated resources of 83 million pounds of zinc and 40 million pounds of copper, and inferred resources of 96 million pounds of zinc and 21 million pounds of copper. The Harena open pit indicated resource grew by 1.4 million tonnes adding 113 million pounds of zinc and 32 million pounds of copper, and primary inferred resources increased by 6.1 million tonnes for an addition of 408 million pounds of zinc and 156 million pounds of copper.

| Description of the Business |

The Company’s two material properties for the purposes of NI 43-101 are the Timok Project in Serbia which hosts the copper-gold Cukaru Peki deposit on the Brestovac-Metovnica Exploration Permit (the “B-M Permit”) and the Bisha Property in Eritrea which hosts the copper-zinc-gold-silver Bisha deposit and includes potential satellite VMS deposits at Harena, Northwest, Hambok and Asheli.

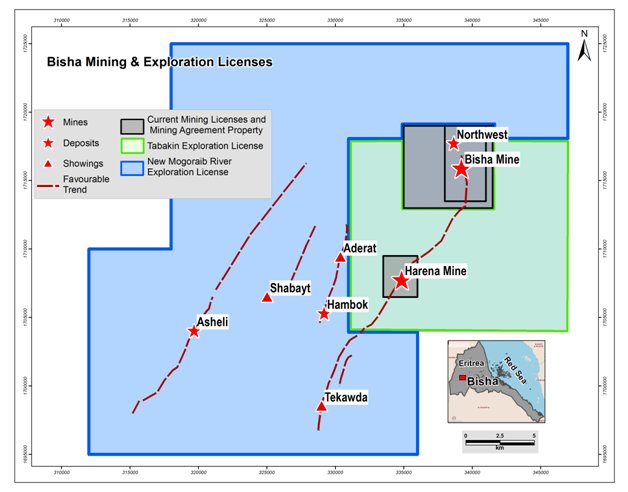

The Company’s principal mining operation is the Bisha Mine which is located on the Bisha Property and is owned and operated by BMSC. The Mining Agreement governs the development of the Bisha Property and covers an area of 46.5 square kilometers which contains the Bisha Mine and the Bisha Mining License and the Harena Mining License. In addition, the Company owns the Mogoraib River Exploration License which covers an area of 630 square kilometers and the Tabakin Exploration License covering 184 square kilometers both adjacent to the Bisha Mining License.

The Bisha Mine

The Bisha Mine, located on the Bisha Property, is owned and operated by BMSC. The Company is a 60% shareholder in BMSC with the remaining 40% interest held by ENAMCO. BMSC is governed under the terms of a shareholder agreement between the Company and ENAMCO. The Bisha Mine began commercial production of gold in February 2011 that allowed an early payback of gold phase capital and allowed for complete funding of both the copper and zinc phase expansions. The Bisha Mine transitioned from gold production to copper production in late H2 2013 and commenced commercial production of copper in December 2013 and commercial production of zinc in October 2016 following the completion of the zinc expansion project. Mining of the supergene copper ore continued until late Q2 2016 when the operation commenced processing primary ore. The primary phase ore contains a significant amount of zinc and copper.

The Timok Project

The Timok Project is located in eastern Serbia near the Bor Mining and Smelting complex. The Timok Project is focussed on the Cukaru Peki (“Timok”) deposit which includes the high grade Upper Zone (characterized by massive and semi-massive sulphide mineralization) and the Lower Zone (characterized by porphyry-style mineralization). The Upper Zone has a high copper and gold content consisting of 28.7 million tonnes of Measured and Indicated resource grading 3.7% copper and 2.4 g/t gold and 13.9 million tonnes of Inferred resource grading 1.6% copper and 0.9 g/t gold. The Timok Project is a joint venture between Nevsun and Freeport. Nevsun owns a 100% interest in the Upper Zone and currently a 60.4% interest in the Lower Zone and is the operator of the Timok Project. Nevsun’s ownership interest in the Lower Zone will decline to 46% once a feasibility study has been prepared for either the Timok Upper or Lower Zone.

| 14 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

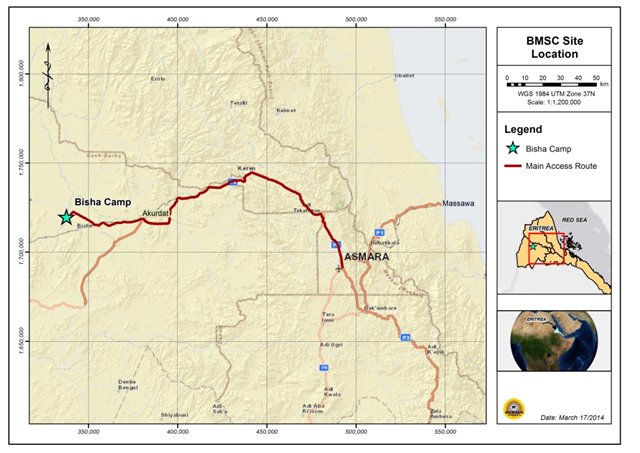

Metal Sales

There are numerous customers for the copper and zinc concentrates and by-product gold and silver, as well as for stockpiled gold material. Accordingly, the Company is not dependent upon any one customer. Copper and zinc concentrates as well as stockpiled material sold as Direct Ship Ore are produced at site and transported in country by truck and trailer to the port of Massawa and then loaded into ocean freighters for transport to customers in Europe and Asia.

Methods of Production

At Bisha, the Company began processing supergene copper ore in 2013 using selective flotation to recover copper as a sulphide concentrate. The commissioning of a zinc circuit was completed in October 2016, thereby enabling production of both high quality copper and zinc concentrates from primary ore. During 2016 the Company achieved commercial production of zinc, meeting guidance of 90 million pounds in concentrate but was not able to produce commercially viable copper concentrate from primary ore due to metallurgical challenges. During 2017, significant progress was made in solving the metallurgical issues and by year-end, saleable copper concentrate was being produced, alongside the zinc concentrate. Lack of availability of the mobile equipment fleet impacted the total material movement during 2017 and this was addressed through the replacement of older units with newer equipment. Maintenance practices were improved by engaging a highly skilled third party maintenance contractor and by year end, significant improvement was achieved. In 2017, 210.4 million pounds of zinc in zinc concentrate, were produced which was at the top end of revised guidance of 190-210 million pounds and 17.5 million pounds of copper in copper concentrate were produced which was below revised guidance of 20-30 million pounds.

Bisha and Harena proven and probable primary ore reserves as of December 31, 2016 declined to 9.6 million tonnes at 6.16 percent zinc, 1.05 percent copper, 0.69 g/t gold and 44.9 g/t silver. At a processing rate of 2.4 million tonnes per annum, the Bisha operation now has a reserve mine life to mid-2021, down from approximately 8 years at the last reserve estimate. The decrease is due to the decision to mine a smaller pit at Bisha. A larger capital investment to mine a larger pit was considered, however, the Company determined that on a risk-adjusted basis this alternative was not the most prudent allocation of capital at this time. Approximately 30% of previously written-down boundary ore stockpiles have been reversed as a viable processing route has been identified that allows economic recovery of zinc only from this ore.

Skill and Knowledge

BMSC has built a management team of skilled mining, processing, exploration, maintenance, environmental, financial, and administrative personnel located at and reporting to the General Manager at the Bisha Mine. The General Manager is in charge of mine production, the process plant and shipping facilities and exploration programs. The specialized knowledge and skills required in all areas of mining include mining, engineering, geology, metallurgy, environmental permitting, drilling, and exploration program planning and implementation is available on-site. The Bisha Mine was the first modern mining operation in Eritrea. Training of local staff to attain and maintain the requisite skills in all aspects of mining operations remains a high priority.

Employees

In Eritrea, BMSC directly employs approximately 1,300 Eritreans and 120 expatriates at the Bisha Mine and provides a safe and supportive working environment.

The Company strives to ensure that its presence has a positive social and economic impact in all jurisdictions that it operates.

Specifically with respect to Eritrea, the spin-off effects from local suppliers for certain goods and services required by the Bisha Mine have created meaningful employment for thousands of Eritreans. Compensation for Eritreans directly employed by BMSC is well above the average wage in Eritrea. Employees are provided food and accommodations, access to medical care at the mine’s health clinic, and commuting both locally and to Asmara, at company expense. These employees also receive training and have opportunities for advancement. The use of national service labour at Bisha is not permitted, and BMSC has strong practices and procedures which include the inspection of national service discharge documentation for all Eritrean workers as a condition of pre-employment at Bisha.

| 15 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

In Serbia, the newly acquired Rakita Explorations d.o.o. Bor (“Rakita”) (the legal entity that operates the Timok Project) employs approximately 97 Serbian staff and 54 expatriates at the Timok Project The Company plans to cultivate the same strong safety culture that has been successful at its Bisha Mine in Eritrea.

Corporate Social Responsibility

The Company’s objective is to generate sustainable prosperity through its business operations which means respecting the safety and health of its employees, protecting the environment, respecting the human rights of its employees and the residents of the communities in which it operates, and contributing to the sustainable development of those communities. The Social, Environmental, Health and Safety Committee established by the Board oversees the Company’s efforts in meeting these objectives.

While not a member of the EITI, the Company supports the goals of fiscal transparency and governance and has taken the approach of disclosing payments made to governments in countries in which it operates, whether or not the host government is a member of EITI.

The Company voluntarily releases a corporate social responsibility report annually that adheres to the Global Reporting Initiative (GRI) G4.0 Core requirements. The report addresses a hybrid of general and specific sectorial information about the Bisha Mine and its relevance to annualized corporate social responsibility objectives and preliminary information on the Timok Project in Serbia.

The Company has also undertaken an independent human rights impact assessments and a follow-up audit, and implemented numerous measures and safeguards to further advance human rights at the Bisha Mine and the surrounding communities. The Company has adopted a Human Rights Policy and has embedded mandatory training in human rights at all of its operations and development projects. Spot audits/validation on human rights compliance for the direct workforce, contractors, subcontractors and suppliers has also been embedded into standard operating procedures.

Social Responsibility

The Company recognizes that its activities have the potential to impact the human rights of individuals affected by its business operations. As such, the Company seeks to integrate human rights best practices into its business processes and conducts its business within a framework that promotes worker and community health and safety, environmental protection, community involvement, community benefits and quality of life for employees and their families. The Company is committed to responsible operations and practices at all of its operations and development projects, based on national and international standards of safety, environmental management, governance and human rights and strives to ensure that the Company’s presence has a positive socio-economic impact to the national economy and the nearby local communities. Some of the Company’s social responsibility commitments and practices include:

- actively promoting understanding by all employees of the culture, language and history of the communities, regions and countries in which it operates;

- working to protect cultural heritage resources potentially affected by the Company’s activities;

- conducting activities in a manner that respects traditional-use rights, cultures, customs and social values;

- promoting job equity and equal access to employment opportunities for women;

- maintaining formal human resources practices and procedures to ensure that national service labour is prohibited and inspection and audits of national service discharge are conducted;

- building capacity by sharing environmental and social experiences and solutions with local communities and regional and national governments;

- actively consulting with local communities to identify and resolve environmental and social issues;

| 16 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

- promoting the use of various grievance mechanisms to enable ongoing constructive feedback with workers and communities alike;

- procuring materials, goods and services in a manner that enhances local benefits and protects against unethical practices such as child labour and forced labour;

- investing in nearby community infrastructure projects to assist in local community development for the purposes of increasing the quality of life for its citizens;

- establishing social responsibility performance criteria; and

- monitoring and reporting performance to senior management through periodic audits.

| Health and Safety |

The Company recognizes that the safety and security of its employees and the communities in which it operates is an integral part of its business. The Company strives to maintain industry leading safety performance at Bisha and Timok in order for employees and contractors of the Company to operate injury-free, regardless of what role they perform. The Company likewise has advanced its corporate responsibility initiatives to reflect evolving international standards. The company had four lost time injuries (“LTI”) at Bisha during 2017. Bisha’s LTI Frequency Rate was 0.68 (LTI’s x 200,000/hours worked) at 31 December 2017. Timok experienced a single lost time injury in 2017.

To achieve its health and safety objectives, the Company is training employees to work in a safe and responsible manner. This includes:

- carrying out risk assessments for all construction and operational activities;

- conducting thorough investigations when incidents do occur to understand the underlying causes;

- taking the appropriate corrective actions to avoid recurrence of incidents;

- ensuring that health and safety performances comply with relevant legislation and regulation;

- adhering to local laws as well as international standards on law enforcement in securing its operations, particularly those that relate to the use of force; and

- carrying out risk assessments in relation to security issues at each of its project sites, ensuring that security is managed in a way that respects and protects human rights, avoids creating conflict, and addresses security threats in as peaceful a way as possible.

| Environment |

The Company is committed to achieving high standards of environmental responsibility in its operations and compliance with all applicable regulations and laws.

The Company is committed to devoting its resources to the goal of:

- complying with all host country environmental laws and regulations together with industry best practice standards or whichever is the more stringent of the two;

- ensuring the necessary resources are provided to support and implement the Company’s environmental policy;

- continual improvement in environmental performance by developing environmental indicators, monitoring and auditing performance, and by implementing corrective actions where needed;

- reporting externally on environmental performance and encouraging dialogue with employees, local communities and other stakeholders to promote environmental awareness;

- applying the principles of best available technology to environment management;

- reducing, re-using and recycling resources and implementing proper waste management practices;

- training, motivating and ensuring that all employees adhere to environmental protection and pollution prevention policies;

- incorporating an emergency preparedness and response system into standard operating practices; and

- monitoring and reporting on performance to senior management through periodic audits.

| 17 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| Mineral Properties |

The Company’s two material properties for the purpose of NI 43-101 are the Timok Project in Serbia, which hosts the copper-gold Cukaru Peki deposit contained within the B-M Permit; and the Bisha Property in Eritrea, which hosts the copper-zinc-gold Bisha deposit and includes satellite VMS deposits at Harena, Northwest, Hambok, Aderat and Asheli.

The Timok Project

The Timok Project, located in Serbia, is focused on the Cukaru Peki deposit, which includes the high grade Upper Zone (characterized by massive and semi-massive sulphide mineralization) and the Lower Zone (characterized by porphyry-style mineralization). Cukaru Peki is contained within the B-M Permit, held through Rakita Exploration d.o.o. (“Rakita”), a Serbian entity that is indirectly owned upstream by the Timok JVSA (BVI) Ltd., a joint venture that is owned 45% by Global Reservoir Minerals (BVI) Inc. (a 100% owned subsidiary of the Company) and 55% by Freeport International Holdings (BVI) Ltd. (a company with a dual share structure of A and B class shares, of which Global Reservoir Minerals (BVI) Inc. owns 100% of the Class A shares and 28% of the Class B shares). The Class A shares relate to the Upper Zone and the Class B shares relate to the Lower Zone. The Company effectively owns 100% of the Upper Zone and 60.4% of the Lower Zone through its indirect interests in both Timok JVSA (BVI) Ltd. and Freeport International Holdings (BVI) Ltd. Nevsun’s ownership interest in the Lower Zone will decline to 46% once a feasibility study has been prepared for either the Timok Upper or Lower Zones.

Unless otherwise stated, the relevant technical and scientific information included in this AIF concerning the Timok Project is derived from the Updated Timok PEA (the 2017 Preliminary Economic Assessment of the Cukaru Peki Upper Zone Deposit) prepared by Ray Walton, PEng PEng(Rakita Exploration d.o.o.), Robert Raponi, PEng (Ausenco Canada), Andrew Jennings, PEng (Conveyor Dynamics), Lucas Hekma, PEng (Interface LLC), Riley Devlin, PEng (Struthers Technical Solutions), Martin Pittuck, CEng (SRK Consulting (UK) Ltd.), Dan Stinnette, PEng, Neil Winkelmann, FAusIMM, Jarek Jakubec, CEng, Dylan MacGregor, PEng (SRK Consulting (Canada) Inc. ), David McKay, MAIG (Phreatic Zone Ltd.), Mihajlo Samoukovic, PEng (Knight Piésold Ltd.), Peter Manojlovic, PGeo (Nevsun Resources Ltd.), effective September 1, 2017. These authors are QPs within the meaning of NI 43-101. The Updated Timok PEA is available for review on SEDAR (www.sedar.com) and EDGAR (http://www.sec.gov/edgar.shtml).

The key 2018 milestones for the Timok Upper Zone are the completion of a prefeasibility study on the Tiomk Project in late March 2018 which remains on time and budget and decline development. The decline permit was granted on February 28, 2018 and the Company is commencing preparatory work and contracting for construction of the decline development. The Company has initiated the tendering process for the decline development during 2017.

Other key activities, including the Environmental Impact Assessment (EIA) and land acquisition, are progressing well.

The Bisha Property

The Bisha Property, located in Eritrea, hosts the Bisha Mine. The property is owned and operated by BMSC which in turn is controlled 60% by the Company and 40% by ENAMCO. BMSC is governed under the terms of a shareholder agreement between the Company and ENAMCO. Under Eritrean Mining Law, ENAMCO initially held a 10% free carried interest in BMSC. In October 2007, ENAMCO agreed to purchase an additional 30% interest in BMSC, the terms of which were finalized in 2011. In December 2007, BMSC concluded a Mining Agreement with the State of Eritrea. Royalties payable to the State of Eritrea include a 5.0% royalty on precious metals and a 3.5% royalty on base metals.

The Bisha Mine on the Bisha Property began commercial production in February 2011 with approximately 784,000 ounces of gold in doré being produced from oxide mineralization until late 2013. The Bisha Mine achieved commercial production of copper derived from supergene mineralization in December 2013 with the production of approximately 438 million pounds (198,800 tonnes) of copper during the supergene phase. The Company transitioned to production of both copper and zinc from the primary zone in Q2 2016, although challenges were encountered with copper production in a separate clean copper concentrate, the metallurgical recovery and quality of the copper concentrate produced continued to improve through 2017. Construction and commissioning of a zinc flotation circuit required for future zinc production from the primary sulphide zone was completed on time and under budget.

| 18 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

Unless otherwise stated, the relevant technical and scientific information included in this AIF concerning the Bisha Property is derived from: the 2013 Technical Report Bisha Mine, Eritrea, prepared by Paul Gribble, C. Eng., FIMMM, Chief Resource Geologist, BMSC; Jay Melnyk, P.Eng. AGP; and Peter Munro, BAppSc. Mineralurgy Pty. Ltd. effective December 31, 2013; the December 31, 2015 Mineral Resource estimate completed by Phillip Jankowski, MAusIMM (CP), (BMSC), effective December 31, 2015; the December 31, Mineral Reserve estimate for Bisha and Harena completed by Anoush Ebrahimi, P.Eng., PhD. (SRK Consulting Canada Inc.), effective December 31, 2015; the December 31, 2016 Mineral Resource estimate completed by Phillip Jankowski, MAusIMM (CP), (BMSC), effective December 31, 2016; the Independent Technical Report 2016 Resources and Reserves Update Bisha Mine, Eritrea by Phillip Jankowski, MAusIMM (CP), (BMSC), Anoush Ebrahimi, P.Eng., PhD, Adrian Dance, PhD, FAusIMM, Christopher Elliot, FAusIMM, Neil Winkelmann, FAusIMM, Cameron Scott, PEng (SRK Consulting (Canada) Inc. and Tom Whelan, CPA (Nevsun Resources Ltd.); (collectively the “Bisha Technical Reports”). These authors are QPs as defined by NI 43-101. These Technical Reports are available for review on SEDAR (www.sedar.com) and EDGAR (http://www.sec.gov/edgar.shtml).

| 19 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

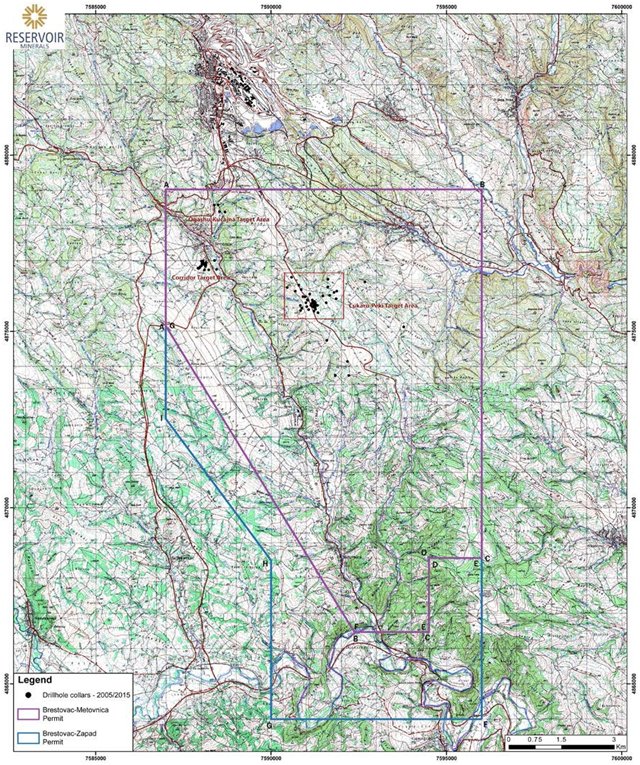

| Timok Project – Project Description and Location |

The Timok Project is located in eastern Serbia on a gently rolling plateau between 300 and 400 meters above sea level and has a moderate-continental climate. It is located 5 kilometers south of the town of Bor, which is a regional administrative and mining centre, located approximately 250 kilometers by road southeast of Belgrade, the capital of Serbia. The site is favourably located for mining infrastructure (road, rail, power, water) and nearby the recently upgraded copper smelter complex in Bor. The Universal Transverse Mercator System (UTM) coordinates (the World Geodetic System, 1984) of the Cukaru Peki deposit is 4874888 N and 590706 E (UTM zone 34).

| Figure 1 – Timok Project Location |

The original B-M Permit, exploration field no.1926, was granted to Rakita on February 28, 2012, under the terms of the 2011 Law on Mining and Geological Explorations. The Permit was originally valid until February 28, 2015 with any future extensions subject to approval by the Ministry of Natural Resources, Mining and Spatial Planning (the “Ministry of Mines”). On February 28, 2015, the B-M Permit was renewed and was valid until February 21, 2017. A second renewal of the B-M Permit was granted in March 2017, extending the B-M Permit to February 21, 2020. Future extensions will be subject to approval by the Ministry of Mines.

| 20 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

Under the terms of the 2011 Law on Mining and Geological Explorations, 25% of the original shape of the original B-M Permit was relinquished. The relinquished area forming the southwestern and southern fringe of the original area was re-applied for under a new Exploration Permit named Brestovac-Zapad. The Brestovac-Zapad Permit is due to expire on April 3, 2018. An application for an extension was submitted in early March 2018.

Land in the project area is mainly used for agricultural purposes, but it also includes municipal land, military land and the Bor Municipality airport. The land in the project area is divided into hundreds of small portions of land which will have to be acquired to develop the mine. Many of the land parcels are owned by the same families having been passed on through the generations.

Surface rights required for the Timok Project can be secured through property purchases, leases, easements, pre-agreements, and other contract/permission mechanisms. Purchasing properties is the preferred approach for Rakita to resolve property rights, but other mechanisms may be utilized when property purchase is not an option. The Land Acquisition Program began in 2015, and the resolution of all property rights is expected to be completed in 2019.

It is expected that surface rights will be obtained for the majority of properties prior submitting the application for the Exploitation Field Permit (aka Mining License), although not required for approval of the Mining License. Surface rights are required in advance of submitting an application for the Construction of Mining Facilities and/or Mining Works.

| 21 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| Figure 2 – Brestovac-Metovnica and Bretovac-Zapad Exploration Permits |

| 22 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

Agreements and Encumbrances

The Serbian government levies a royalty of 5% net smelter return (‘‘NSR’’) for metallic raw materials (status as of 2011, Guide for Investors, Ministry of Natural Resources, Mining and Spatial Planning). There are additional royalties which may be due; these are individually negotiated for each mineral license.

The Brestovac portion of the Brestovac-Metovnica property to the west of Cukaru Peki is subject to a 2% NSR royalty on gold and silver and a 1% NSR royalty on other minerals pursuant to a royalty agreement (‘‘Eurasian Agreement’’).

The Metovnica portion of the Brestovac-Metovnica property which contains the Cukaru Peki deposit is subject to a 0.5% NSR sliding royalty pursuant to a royalty agreement (“Euromax Agreement”). As the Metovnica property was previously owned by Freeport, who conducted geophysics and limited drilling, the NSR royalty will not apply to any interest owned by Freeport and does not apply to the interest purchased by Reservoir through the exercise of the ROFO.

For exploration, agreements have been reached with landowners of each drill site. The agreements cover compensation for disturbance and the requirement for full rehabilitation of the site. Drill sites are photographed before commencement of the drilling, and after completion of the rehabilitation.

Significant Factors That May Affect Access, Title, or the Ability to Work

In December 2015 the Serbian Government introduced a new Law on Mining and Geological Explorations. The new Law introduces the concept of mineral and other geological resources of strategic importance, including copper.

The Timok Project is among the first of the major new mining projects to be permitted in Serbia since the Yugoslav breakup. Serbian regulators have no recent relevant experience. Until late last year, the regulatory process had been untested. The permitting process, while understood, is not fully within a project’s control. Some of the factors and conditions affecting the permitting process include the timely review of applications, availability of technical studies and design information, land acquisition, community relations and politics. There is no certainty that all conditions and requirements will be satisfied for the granting of permits and that permits will be granted on a timely basis or at all, which could affect target dates and the conclusions in this Updated Timok PEA. Target dates for obtaining permits are estimates based on information available as of this study’s effective date and are subject to change.

The Timok Project permitting process is on two separate and parallel tracks. The first permitting track involves obtaining approval to start developing the exploration decline and the associated surface based supporting infrastructure at the portal site. The other permitting effort focuses on those permits required to develop and operate the balance of the project facilities, including the portion of the underground mine extending into the deposit, the mineral processing facilities and related supporting infrastructure.

Permitting for the decline development is granted by the Ministry of Mining and Energy under the Timok Project’s existing exploration license. The proposed decline and surface infrastructure around the portal are being permitted as exploration works, not mining (exploitation) facilities. This avoids various lengthy permitting cycles that would be triggered by development of full-fledged mineral exploitation related facilities, and gives the Project an estimated one-year advance start to begin driving the decline towards the deposit. The decline permit was granted on February 28, 2018 and the Company is commencing preparatory work and contracting for construction of the decline development.

The Timok Project has started permitting the planned non-decline facilities as well, including the portion of the underground mine extending into the deposit, the mineral processing facilities and supporting infrastructure. This comprises 22 additional permitting steps, including two that are completed and five more that are in progress.

| Accessibility, Climate, Infrastructure & Physiography |

| Accessibility |

The nearby municipality of Bor is connected to the capital, Belgrade, by the A1 motorway (part of the European E75 and Pan-European Corridor X route) and the international E-road E761, from Paraćin to Zaječar. Travel time from Belgrade to Bor and the Project by road is about three and a half hours.

Locally, the Timok Project is situated five kilometers south of Bor, on the south side of state road IB n° 37. There are numerous small agricultural and forestry tracks within the permit area that are suitable for four-wheel drive vehicles.

| 23 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

A regional bus service connects Bor with Belgrade and other cities and towns. Bor is integrated into the Serbian railway system and connects to Belgrade and the main lines. The line from Bor is primarily for freight, but there are regular passenger services to Belgrade. The site is also favourably situated for export freight logistics

| Climate |

The climate of Serbia is described as moderate-continental with local variations. The absolute maximum air temperatures are recorded in July and are in the range of 37 to 42°C for lower lying areas. The absolute minimum air temperatures are recorded in January, and range from -20 to -36°C for mountainous areas. The majority of Serbia has most rainfall during May and June, particularly in eastern Serbia, which is furthest from the influence of the Mediterranean precipitation patterns. Exploration drilling can continue throughout the year. Other field activities are constrained by snow cover during the winter months which can extend from December to April.

| Infrastructure |

Bor is an active mining town and contains a regional administrative centre possessing the facilities, services and experienced workforce required for advanced mineral exploration projects. Reliable power is available with power lines passing through the B-M Permit area. Rakita Exploration d.o.o., maintains an office in on the B-M Permit area as a technical base for exploration activities on the B-M Permit and other exploration permits in the Timok region.

In January 2011 Outotec signed a contract with SNC Lavalin International to design, supply and install a new copper flash smelting furnace and related services for Rudarsko toipioničarski basen Bor d.o.o. (“RTB Bor”) in central Serbia. RTB Bor has recently upgraded the smelter capacity at Bor, utilizing a loan from the Canadian Development Bank, guaranteed by the Serbian Government. The smelter was constructed by SNC Lavalin, and commissioning work was undertaken prior to its departure in late 2015. The smelter is currently treating a mixture of concentrates from the existing RTB Bor mining operations, alongside imported concentrates from overseas.

| Physiography |

The relief of the Timok Project area is marked by a gently rolling plateau with elevations approximately between 300 to 400 meters above sea level. The Cukaru Peki deposit itself is at an elevation of approximately 375 meters above sea level. The Crni Vrh hills to the west of the exploration permit rise to over 1,000 meters above sea level.

In the immediate Timok Project area there is plenty of accessible flat or gently undulating land to accommodate surface processing facilities and waste storage as necessary. There are a few river valleys which are of sufficient depth to provide the necessary volume of tailings storage.

Vegetation in the area comprises mostly arable crops, some grassland and deciduous woodland.

The Timok River is the major drainage system in the project area, with multiple tributaries such as the Brestovac, Bor and Borska. It originates in the north of the Svrljig Mountains in the Carpathian-Balkan region in eastern Serbia running 203 kilometers before discharging into the Danube River. Topographic elevation within the Timok catchment ranges from 142 meters above sea level at the Timok-Danube confluence, to 1,049 meters above sea level in the upper reaches of the catchment.

The Crni Vrh plateau is incised by the southeast-flowing drainage of the Brestovac River and its tributaries, and by the Bor River in the northeast of the B-M Permit area. The Brestovac River descends from about 280 meters in the northwest corner of the property perimeter to about 160 meters, where it flows across the south boundary of the exploration permit. The highest elevation is recorded as 464 meters on the eastern margin of the property.

Anthropogenic features related to the mining activity, including waste dumps, dominate the physiography to the north of the exploration permit. The Bor open pit, approximately 2 kilometers north of the northern perimeter of the B-M Permit, is approximately 300 meters deep and 1.0 kilometer long.

| 24 | Nevsun Resources Ltd. |

ANNUAL INFORMATION FORM – December 31, 2017

| Mineral Property History |

| Historical Exploration and Mining to 2004 |

The Cukaru Peki exploration site in the B-M Permit is located five kilometers south of the Bor mining complex. Exploitation of the surface outcrops, primarily for gold, of the massive sulphide mineralization at Coka Dulkan and Tilva Ros may have commenced during the Bronze Age and again by the Romans, who were active throughout the region. Serbian investors financed prospecting and exploration at Coka Dulkan and Tilva Ros during 1897-1902, and mine development during 1903-1905. Mining commenced in 1907, and the Serbian investors sold to a French group (Society of the Bor Mines) that controlled the mines until 1941. The mines and smelter were rehabilitated after the Second World War and have operated since then under the Yugoslav, and later Serbian, state-owned companies, RTB Bor Mining and Smelting Basin Bor.

Trial mining of copper and zinc mineralization south of Brestovac village, within the Timok Project area, was undertaken from an adit and blind shaft south of Brestovac by a French group in the 1930’s, however there are only incomplete records and no meaningful recorded production.

There are records of approximately 41 RTB Bor drill holes at various locations in and near the project area from 1975 to 1988. Most drilling took place in small clusters, and targeted gravity and other geophysical anomalies. The records are not complete, and no drill core was retained. Most holes were relatively shallow, with depths less than 500 meters. The Cukaru Peki mineralization was not intersected in any drill holes from this time and no discoveries were reported, other than one hole south of Brestovac village showing enhanced gold grades in altered andesite, for which the sampling and analytical records are incomplete. This hole was followed up by an exploration program in 2006 by Eurasian Minerals, Inc. (“Eurasian”).

No effective mineral exploration was undertaken in the period 1990-2002 due to the period of political uncertainties in the former Yugoslavia and Serbia at that time. Mineral exploration resumed when the Serbian government issued exploration permits and concessions after 2002.

| Historical Exploration 2004-2010 |