Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 10-Q

________________________________

CHECK ONE:

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended: March 31, 2018

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file No.: 1-12996

________________________________

Diversicare Healthcare Services, Inc.

(exact name of registrant as specified in its charter)

________________________________

|

| | |

Delaware | | 62-1559667 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

1621 Galleria Boulevard, Brentwood, TN 37027

(Address of principal executive offices) (Zip Code)

(615) 771-7575

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | |

Large accelerated filer | | ¨ | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨(do not check if a smaller reporting company) | Smaller reporting company | | ý |

| | | Emerging growth company | | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

6,451,495

(Outstanding shares of the issuer’s common stock as of April 30, 2018)

Part I. FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

INTERIM CONSOLIDATED BALANCE SHEETS

(in thousands)

|

| | | | | | | |

| March 31,

2018 | | December 31,

2017 |

| (Unaudited) | | |

CURRENT ASSETS: | | | |

Cash and cash equivalents | $ | 6,418 |

| | $ | 3,524 |

|

Receivables, less allowance for doubtful accounts and other contractual allowances of $15,129 and $14,235, respectively | 62,212 |

| | 64,929 |

|

Other receivables | 1,128 |

| | 375 |

|

Prepaid expenses and other current assets | 3,671 |

| | 3,248 |

|

Income tax refundable | 569 |

| | 537 |

|

Current assets of discontinued operations | 20 |

| | 45 |

|

Total current assets | 74,018 |

| | 72,658 |

|

PROPERTY AND EQUIPMENT, at cost | 133,754 |

| | 147,549 |

|

Less accumulated depreciation and amortization | (78,548 | ) | | (78,345 | ) |

Property and equipment, net | 55,206 |

| | 69,204 |

|

OTHER ASSETS: | | | |

Deferred income taxes, net | 15,020 |

| | 15,154 |

|

Deferred lease and other costs, net | 125 |

| | 137 |

|

Acquired leasehold interest, net | 6,595 |

| | 6,691 |

|

Assets held for sale | 13,228 |

| | — |

|

Other noncurrent assets | 3,656 |

| | 3,725 |

|

Total other assets | 38,624 |

| | 25,707 |

|

| $ | 167,848 |

| | $ | 167,569 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

INTERIM CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

(continued)

|

| | | | | | | |

| March 31,

2018 | | December 31,

2017 |

| (Unaudited) | | |

CURRENT LIABILITIES: | | | |

Current portion of long-term debt and capitalized lease obligations | $ | 12,913 |

| | $ | 13,065 |

|

Trade accounts payable | 13,775 |

| | 14,080 |

|

Current liabilities of discontinued operations | 462 |

| | 461 |

|

Accrued expenses: | | | |

Payroll and employee benefits | 18,890 |

| | 20,013 |

|

Self-insurance reserves, current portion | 9,134 |

| | 8,792 |

|

Other current liabilities | 8,859 |

| | 7,856 |

|

Total current liabilities | 64,033 |

| | 64,267 |

|

NONCURRENT LIABILITIES: | | | |

Long-term debt and capitalized lease obligations, less current portion and deferred financing costs, net | 75,669 |

| | 74,603 |

|

Self-insurance reserves, less current portion | 13,891 |

| | 13,458 |

|

Other noncurrent liabilities | 7,880 |

| | 8,779 |

|

Total noncurrent liabilities | 97,440 |

| | 96,840 |

|

COMMITMENTS AND CONTINGENCIES |

| |

|

SHAREHOLDERS’ EQUITY: | | | |

Common stock, authorized 20,000 shares, $.01 par value, 6,773 and 6,687 shares issued, and 6,542 and 6,455 shares outstanding, respectively | 68 |

| | 67 |

|

Treasury stock at cost, 232 shares of common stock | (2,500 | ) | | (2,500 | ) |

Paid-in capital | 22,890 |

| | 22,720 |

|

Accumulated deficit | (15,000 | ) | | (14,534 | ) |

Accumulated other comprehensive income | 917 |

| | 709 |

|

Total shareholders’ equity | 6,375 |

|

| 6,462 |

|

| $ | 167,848 |

| | $ | 167,569 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts, unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2017 |

PATIENT REVENUES, net | $ | 141,285 |

| | $ | 141,500 |

|

EXPENSES: | | | |

Operating | 112,278 |

| | 110,667 |

|

Lease and rent expense | 13,713 |

| | 13,743 |

|

Professional liability | 2,775 |

| | 2,670 |

|

General and administrative | 8,139 |

| | 8,973 |

|

Depreciation and amortization | 2,881 |

| | 2,487 |

|

Total expenses | 139,786 |

| | 138,540 |

|

OPERATING INCOME | 1,499 |

| | 2,960 |

|

OTHER INCOME (EXPENSE): | | | |

Gain on sale of investment in unconsolidated affiliate | — |

| | 733 |

|

Other income | 51 |

| | — |

|

Interest expense, net | (1,669 | ) | | (1,483 | ) |

Total other expense | (1,618 | ) | | (750 | ) |

INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | (119 | ) | | 2,210 |

|

BENEFIT (PROVISION) FOR INCOME TAXES | 38 |

| | (862 | ) |

INCOME (LOSS) FROM CONTINUING OPERATIONS | (81 | ) | | 1,348 |

|

LOSS FROM DISCONTINUED OPERATIONS: | | | |

Operating loss, net of tax benefit of $11 and $9, respectively | (22 | ) | | (15 | ) |

NET INCOME (LOSS) | $ | (103 | ) | | $ | 1,333 |

|

NET INCOME (LOSS) PER COMMON SHARE: | | | |

Per common share – basic | | | |

Continuing operations | $ | (0.01 | ) | | $ | 0.22 |

|

Discontinued operations | — |

| | — |

|

| $ | (0.01 | ) | | $ | 0.22 |

|

Per common share – diluted | | | |

Continuing operations | $ | (0.01 | ) | | $ | 0.21 |

|

Discontinued operations | — |

| | — |

|

| $ | (0.01 | ) | | $ | 0.21 |

|

COMMON STOCK DIVIDENDS DECLARED PER SHARE OF COMMON STOCK | $ | 0.055 |

| | $ | 0.055 |

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: | | | |

Basic | 6,314 |

| | 6,233 |

|

Diluted | 6,314 |

| | 6,440 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands and unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2017 |

NET INCOME (LOSS) | $ | (103 | ) | | $ | 1,333 |

|

OTHER COMPREHENSIVE INCOME: | | | |

Change in fair value of cash flow hedge, net of tax | 322 |

| | 254 |

|

Less: reclassification adjustment for amounts recognized in net income | (114 | ) | | (117 | ) |

Total other comprehensive income | 208 |

| | 137 |

|

COMPREHENSIVE INCOME | $ | 105 |

| | $ | 1,470 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands and unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2017 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

Net income (loss) | $ | (103 | ) | | $ | 1,333 |

|

Discontinued operations | (22 | ) | | (15 | ) |

Income from continuing operations | (81 | ) | | 1,348 |

|

Adjustments to reconcile income (loss) from continuing operations to net cash provided by (used in) operating activities: | | | |

Depreciation and amortization | 2,881 |

| | 2,487 |

|

Provision for doubtful accounts | — |

| | 1,970 |

|

Deferred income tax provision | — |

| | 354 |

|

Provision for self-insured professional liability, net of cash payments | 956 |

| | (83 | ) |

Stock-based compensation | 284 |

| | 241 |

|

Gain on sale of unconsolidated affiliate | — |

| | (733 | ) |

Provision for leases in excess of cash payments | (453 | ) | | (91 | ) |

Deferred bonus | — |

| | 500 |

|

Other | 140 |

| | 123 |

|

Changes in assets and liabilities affecting operating activities: | | | |

Receivables, net | 2,017 |

| | (6,518 | ) |

Prepaid expenses and other assets | (439 | ) | | 1,081 |

|

Trade accounts payable and accrued expenses | (86 | ) | | (1,468 | ) |

Net cash provided by (used in) continuing operations | 5,219 |

| | (789 | ) |

Discontinued operations | (474 | ) | | (67 | ) |

Net cash provided by (used in) operating activities | 4,745 |

| | (856 | ) |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

Purchases of property and equipment | (2,012 | ) | | (2,237 | ) |

Net cash used in continuing operations | (2,012 | ) | | (2,237 | ) |

Discontinued operations | — |

| | — |

|

Net cash used in investing activities | (2,012 | ) | | (2,237 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Repayment of debt obligations | (4,762 | ) | | (9,193 | ) |

Proceeds from issuance of debt | 5,651 |

| | 12,567 |

|

Financing costs | (132 | ) | | (10 | ) |

Issuance and redemption of employee equity awards | (78 | ) | | (94 | ) |

Payment of common stock dividends | (350 | ) | | (346 | ) |

Payment for preferred stock restructuring | (168 | ) | | (163 | ) |

Net cash provided by financing activities | 161 |

| | 2,761 |

|

Discontinued operations | — |

| | — |

|

Net cash provided by financing activities | $ | 161 |

| | $ | 2,761 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands and unaudited)

(continued)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2017 |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | $ | 2,894 |

| | $ | (332 | ) |

CASH AND CASH EQUIVALENTS, beginning of period | 3,524 |

| | 4,263 |

|

CASH AND CASH EQUIVALENTS, end of period | $ | 6,418 |

| | $ | 3,931 |

|

SUPPLEMENTAL INFORMATION: | | | |

Cash payments of interest | $ | 1,432 |

| | $ | 1,231 |

|

Cash payments (refunds) of income taxes | $ | (16 | ) | | $ | 6 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

DIVERSICARE HEALTHCARE SERVICES, INC. AND SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2018 AND 2017

(Dollars and shares in thousands, except per share data)

(Unaudited)

Diversicare Healthcare Services, Inc. (together with its subsidiaries, “Diversicare” or the “Company”) provides long-term care services to nursing center patients in ten states, primarily in the Southeast, Midwest, and Southwest. The Company’s centers provide a range of health care services to their patients and residents that include nursing, personal care, and social services. Additionally, the Company’s nursing centers also offer a variety of comprehensive rehabilitation services, as well as nutritional support services. The Company's continuing operations include centers in Alabama, Florida, Indiana, Kansas, Kentucky, Mississippi, Missouri, Ohio, Tennessee, and Texas.

As of March 31, 2018, the Company’s continuing operations consist of 76 nursing centers with 8,456 licensed nursing beds. The Company owns 18 and leases 58 of its nursing centers. Our nursing centers range in size from 48 to 320 licensed nursing beds. The licensed nursing bed count does not include 497 licensed assisted and residential living beds.

| |

2. | CONSOLIDATION AND BASIS OF PRESENTATION OF FINANCIAL STATEMENTS |

The interim consolidated financial statements include the operations and accounts of Diversicare Healthcare Services and its subsidiaries, all wholly-owned. All significant intercompany accounts and transactions have been eliminated in consolidation. The Company had one equity method investee, which was sold during the fourth quarter of 2016. The sale resulted in a $1,366 gain in the fourth quarter of 2016. Subsequently, the Company recognized an additional gain of $733 for the three-month period ended March 31, 2017, related to the liquidation of remaining assets affiliated with the partnership.

The interim consolidated financial statements for the three month periods ended March 31, 2018 and 2017, included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations. In the opinion of management of the Company, the accompanying interim consolidated financial statements reflect all normal, recurring adjustments necessary to present fairly the Company’s financial position at March 31, 2018, and the results of operations and cash flows for the three month periods ended March 31, 2018 and 2017. The Company’s balance sheet information at December 31, 2017, was derived from its audited consolidated financial statements as of December 31, 2017.

Effective January 1, 2018, we adopted the requirements of Accounting Standards Update ("ASU") No. 2014-09, Revenue from Contracts with Customers as discussed in Notes 3 and 4 to the interim consolidated financial statements. All amounts and disclosures set forth in this Form 10-Q have been updated to comply with the new standard.

The results of operations for the periods ended March 31, 2018 and 2017 are not necessarily indicative of the operating results that may be expected for a full year. These interim consolidated financial statements should be read in connection with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

| |

3. | RECENT ACCOUNTING GUIDANCE |

Recent Accounting Standards Adopted by the Company

In May 2014, the Financial Accounting Standards Board ("FASB") issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which outlines a single comprehensive model for recognizing revenue and supersedes most existing revenue recognition guidance, including guidance specific to the healthcare industry. Topic 606 is effective for annual and interim reporting periods beginning after December 15, 2017. The Company adopted the requirements of this standard effective January 1, 2018. The Company elected to apply the modified retrospective approach with the cumulative transition effect recognized in beginning retained earnings as of the date of adoption. The impact of the implementation to the consolidated financial statements for periods subsequent to adoption is not material. See Note 4, "Revenue Recognition" for a discussion regarding revenue recognition under the new standard.

In March 2016, the FASB issued ASU No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. The ASU was issued as part of the FASB Simplification Initiative and involves several aspects of accounting for share-based payment transactions, including the income tax consequences and classification on the statement

of cash flows. We adopted this standard as of January 1, 2017. The adoption did not have a material impact on our financial position, results of operations or cash flows.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230). The ASU provides clarification regarding how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The guidance addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice. The ASU is effective for annual and interim periods beginning after December 15, 2017, which required the Company to adopt these provisions in the first quarter of fiscal 2018 using a retrospective approach. The adoption did not have a material impact on our financial position, results of operations or cash flows.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, which requires that the Statement of Cash Flows explain the changes during the period of cash and cash equivalents inclusive of amounts categorized as Restricted Cash. As a result, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The standard is effective for periods beginning after December 15, 2017, which required the Company to adopt these provisions in the first quarter of fiscal 2018. The adoption did not have a material impact on our financial position, results of operations or cash flows.

In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805) - Clarifying the Definition of a Business, which provides guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The adoption is effective for annual and interim periods beginning after December 15, 2017. The Company will evaluate future acquisitions under this guidance, which may result in future acquisitions being accounted for as asset acquisitions.

In May 2017, the FASB issued ASU No. 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting. The amended standard specifies the modification accounting applicable to any entity which changes the terms or conditions of a share-based payment award. The new guidance is effective for all entities after December 15, 2017. The adoption did not have a material impact on our financial position, results of operations or cash flows.

Accounting Standards Recently Issued But Not Yet Adopted by the Company

In February 2016, the FASB issued ASU No. 2016-02, Leases. The new standard establishes a right-of-use (ROU) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. Disclosures will be required to meet the objective of enabling users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. We anticipate this standard will have a material impact on our consolidated financial position and results of operations. We have organized an implementation group of cross-functional departmental management to ensure the completeness of our lease information, analyze the appropriate classification of current leases under the new standard, and develop new processes to execute, approve and classify leases on an ongoing basis. We are continuing to evaluate the extent of this anticipated impact on our consolidated financial position and results of operations and the quantitative and qualitative factors that will impact the Company as part of the adoption.

In June 2016, the FASB issued ASU No. 2016-13, Measurement of Credit Losses on Financial Instruments. This update is intended to improve financial reporting by requiring timelier recognition of credit losses on loans and other financial instruments that are not accounted for at fair value through net income, including loans held for investment, held-to-maturity debt securities, trade and other receivables, net investment in leases and other such commitments. This update requires that financial statement assets measured at an amortized cost be presented at the net amount expected to be collected, through an allowance for credit losses that is deducted from the amortized cost basis. This standard is effective for the fiscal year beginning after December 15, 2019 with early adoption permitted. The Company is in the initial stages of evaluating the impact from the adoption of this new standard on the consolidated financial statements and related notes.

In August 2017, the FASB issued ASU No. 2017-12, Derivatives and Hedging - Targeted Improvements to Accounting for Hedging Activities, which is intended to simplify and amend the application of hedge accounting to more clearly portray the economics of an entity’s risk management strategies in its financial statements. The new guidance will make more financial and nonfinancial hedging strategies eligible for hedge accounting and reduce complexity in fair value hedges of interest rate risk. The new guidance also changes how companies assess effectiveness and amends the presentation and disclosure requirements. The new guidance eliminates the requirement to separately measure and report hedge ineffectiveness and generally the entire change in the fair value of a hedging instrument will be required to be presented in the same income statement line as the hedged item. The new guidance also eases certain documentation and assessment requirements and modifies the accounting for components excluded from the assessment of hedge effectiveness. The new guidance is effective for public entities for fiscal years beginning after December 15,

2018, including interim periods within those years. Early adoption is permitted in any interim period or fiscal year before the effective date. The Company is evaluating the effect this guidance will have on our consolidated financial statements and related disclosures.

In February 2018, the FASB issued ASU No. 2018-02, Income Statement- Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. The new guidance allows entities the option to reclassify stranded tax effects resulting from the Tax Cuts and Jobs Act from accumulated other comprehensive income (OCI) to retained earnings. The new guidance allows the option to apply the guidance retrospectively or in the period of adoption. The guidance is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted. The Company is evaluating the effect this guidance will have on our consolidated financial statements and related disclosures.

In March 2018, the FASB issued ASU No. 2018-05, Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118 which allowed SEC registrants to record provisional amounts in earnings for the year ended December 31, 2017 due to the complexities involved in accounting for the enactment of the Tax Cuts and Jobs Act. The Company recognized the estimated income tax effects of the Tax Cuts and Jobs Act in its 2017 Consolidated Financial Statements in accordance with SEC Staff Accounting Bulletin No. 118 ("SAB No. 118").

4. REVENUE RECOGNITION

On January 1, 2018, the Company adopted Accounting Standards Codification ("ASC") 606 using the modified retrospective method for all contracts as of the date of adoption. The reported results for 2018 reflect the application of ASC 606 guidance while the reported results for 2017 were prepared under the guidance of ASC 605, Revenue Recognition (ASC 605), which is also referred to herein as "legacy GAAP". The adoption of ASC 606 represents a change in accounting principle that will more closely align revenue recognition with the delivery of the Company's services. The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for these services. ASC 606 requires companies to exercise more judgment and recognize revenue in accordance with the standard's core principle by applying the following five steps:

Step 1: Identify the contract with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

Performance obligations are promises made in a contract to transfer a distinct good or service to the customer. A contract's transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. The Company has concluded that the contracts with patients and residents represent a bundle of distinct services that are substantially the same, with the same pattern of transfer to the customer. Accordingly, the promise to provide quality care is accounted for as a single performance obligation.

The Company performed analyses using the application of the portfolio approach as a practical expedient to group patient contracts with similar characteristics, such that revenue for a given portfolio would not be materially different than if it were evaluated on a contract-by-contract basis. These analyses incorporated consideration of reimbursements at varying rates from Medicaid, Medicare, Managed Care, Private Pay, Assisted Living, Hospice, and Veterans for services provided in each corresponding states. It was determined that the contracts are not materially different for the following groups: Medicaid, Medicare, Managed Care and Private Pay and other (Assisted Living, Hospice and Veterans).

In order to determine the transaction price, the Company estimates the amount of variable consideration at the beginning of the contract using the expected value method. The estimates consider (i) payor type, (ii) historical payment trends, (iii) the maturity of the portfolio, and (iv) geographic payment trends throughout a class of similar payors. The Company typically enters into agreements with third-party payors that provide for payments at amounts different from the established charges. These arrangement terms provide for subsequent settlement and cash flows that may occur well after the service is provided. The Company constrains (reduces) the estimates of variable consideration such that it is probable that a significant reversal of previously recognized revenue will not occur throughout the life of the contract. Changes in the Company's expectation of the amount it will receive from the patient or third-party payors will be recorded in revenue unless these is a specific event that suggests the patient or third-party payor no longer has the ability and intent to pay the amount due and , therefore, the changes in its estimate of variable consideration better represent and impairment, or bad debt. These estimates are re-assessed each reporting period, and any amounts allocated to a satisfied performance obligation are recognized as revenue or a reduction of revenue in the period in which the transaction price changes.

The Company satisfies its performance obligation by providing quality of care services to its patients and residents on a daily basis until termination of the contract. The performance obligation is recognized on a time elapsed basis, by day, for which the services are provided. For these contracts, the Company has the right to consideration from the customer in an amount that directly corresponds with the value to the customer of the Company's performance to date. Therefore, the Company recognizes revenue based on the amount billable to the customer in accordance with the practical expedient in ASC 606-10-55-18. Additionally, since the Company applied ASC 606 using certain practical expedients, the Company elected not to disclose the aggregate amount of the transaction price for unsatisfied, or partially unsatisfied, performance obligations for all contracts with an original expected length of one year or less.

The Company incurs costs related to patient/resident contracts, such as legal and advertising expenses. The contract costs are expensed as incurred. They are not expected to be recovered and are not chargeable to the patient/resident regardless of whether the contract is executed.

Financial Statement Impact of Adopting ASC 606

The Company adopted ASC 606 using the modified retrospective method. The cumulative effect of applying the new guidance to all contracts with customers as of January 1, 2018 was not material to the interim consolidated financial statements. As a result of applying the modified retrospective method to adopt ASC 606, the following adjustments were made to our operating results (dollar amounts in thousands):

|

| | | | | |

| Three Months Ended March 31, 2018 |

| As Reported | | Increase (Decrease) | | Balances as if the previous accounting guidance was in effect |

Patient Revenues, net | $141,285 | | 3,463 (256) 3,207 | (a) (b) | $144,492 |

Accounts Receivable, net | $62,212 | | (256) | (b) | $61,956 |

Accumulated Deficit | $(15,000) | | 256 (82) 174 | (b) (c)

| $(14,826) |

(a) Adjusts for the implicit price concession of bad debt expense.

(b) Adjusts for the implementation of ASC 606.

(c) Reflects the tax adjustment for the ASC 606 adjustment of $256.

Disaggregation of Revenue

The following table summarizes revenue from contracts with customers by payor source for the periods presented (dollar amounts in thousands):

|

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2018 | | 2017(1) |

| As reported | | As Adjusted to Legacy GAAP | | As reported |

Medicaid | $ | 63,886 |

| 45.2 | % | | $ | 73,214 |

| 50.7 | % | | $ | 72,873 |

| 51.5 | % |

Medicare | 29,751 |

| 21.1 | % | | 38,139 |

| 26.4 | % | | 38,011 |

| 26.9 | % |

Managed Care | 14,212 |

| 10.1 | % | | 12,092 |

| 8.4 | % | | 10,806 |

| 7.6 | % |

Private Pay and other | 33,436 |

| 23.6 | % | | 21,047 |

| 14.5 | % | | 19,810 |

| 14.0 | % |

Total | $ | 141,285 |

| 100.0 | % | | $ | 144,492 |

| 100.0 | % | | $ | 141,500 |

| 100.0 | % |

(1) As noted above, prior period amounts have not been adjusted under the application of the modified retrospective method.

| |

5. | LONG-TERM DEBT AND INTEREST RATE SWAP |

The Company has agreements with a syndicate of banks for a mortgage term loan ("Original Mortgage Loan") and the Company’s revolving credit agreement ("Original Revolver"). On February 26, 2016, the Company executed an Amended and Restated Credit Agreement (the "Credit Agreement") which modified the terms of the Original Mortgage Loan and the Original Revolver Agreements dated April 30, 2013. The Credit Agreement increased the Company's borrowing capacity to $100,000 allocated between a $72,500 Mortgage Loan ("Amended Mortgage Loan") and a $27,500 Revolver ("Amended Revolver"). The Amended Mortgage Loan consists of a $60,000 term loan facility and a $12,500 acquisition loan facility. Loan acquisition costs associated with the Amended Mortgage Loan and the Amended Revolver were capitalized in the amount of $2,162 and are being amortized over the five-year term of the agreements.

Under the terms of the amended agreements, the syndicate of banks provided the Amended Mortgage Loan with an original principal balance of $72,500 with a five-year maturity through February 26, 2021, and a $27,500 Amended Revolver through February 26, 2021. The Amended Mortgage Loan has a term of five years, with principal and interest payable monthly based on a 25-year amortization. Interest on the term and acquisition loan facilities is based on LIBOR plus 4.0% and 4.75%, respectively. A portion of the Amended Mortgage Loan is effectively fixed at 5.79% pursuant to an interest rate swap with an initial notional amount of $30,000. The Amended Mortgage Loan balance was $73,000 as of March 31, 2018, consisting of $64,000 on the term loan facility with an interest rate of 5.75% and $9,000 on the acquisition loan facility with an interest rate of 6.5%. The Amended Mortgage Loan is secured by eighteen owned nursing centers, related equipment and a lien on the accounts receivable of these centers. The Amended Mortgage Loan and the Amended Revolver are cross-collateralized and cross-defaulted. The Company’s Amended Revolver has an interest rate of LIBOR plus 4.0% and is secured by accounts receivable and is subject to limits on the maximum amount of loans that can be outstanding under the revolver based on borrowing base restrictions.

Effective October 3, 2016, the Company entered into the Second Amendment ("Second Revolver Amendment") to amend the Amended Revolver. The Second Revolver Amendment increased the Amended Revolver capacity from the $27,500 in the Amended Revolver to $52,250; provided that the maximum revolving facility be reduced to $42,250 on August 1, 2017. Subsequently, on June 30, 2017, the Company executed a Fourth Amendment (the "Fourth Revolver Amendment") to amend the Amended Revolver, which modifies the capacity of the revolver to remain at $52,250.

On December 29, 2016, the Company executed a Third Amendment ("Third Revolver Amendment") to amend the Amended Revolver. The Third Amendment modified the terms of the Amended Mortgage Loan Agreement by increasing the Company’s letter of credit sublimit from $10,000 to $15,000.

Effective June 30, 2017, the Company entered into a Second Amendment (the "Second Term Amendment") to amend the Amended Mortgage Loan. The Second Term Amendment amended the terms of the Amended Mortgage Loan Agreement by increasing the Company's term loan facility by $7,500.

Effective February 27, 2018, the Company executed a Fifth Amendment to the Amended Revolver and a Third Amendment to the Amended Mortgage Loan. Under the terms of the Amendments, the minimum fixed charge coverage ratio shall not be less than 1.01 to 1.00 as of March 31, 2018 and for each quarter thereafter.

As of March 31, 2018, the Company had $16,000 borrowings outstanding under the Amended Revolver compared to $16,000 outstanding as of December 31, 2017. The outstanding borrowings on the revolver were used primarily to compensate for accumulated Medicaid and Medicare receivables at recently acquired facilities as these facilities proceed through the change in ownership process with Centers for Medicare & Medicaid Services (“CMS”). Annual fees for letters of credit issued under the Amended Revolver are 3.0% of the amount outstanding. The Company has eleven letters of credit with a total value of $13,620 outstanding as of March 31, 2018. Considering the balance of eligible accounts receivable, the letters of credit, the amounts outstanding under the revolving credit facility and the maximum loan amount of $39,468 the balance available for borrowing under the Amended Revolver was $9,848 at March 31, 2018.

The Company’s debt agreements contain various financial covenants, the most restrictive of which relates to debt service coverage ratios. The Company is in compliance with all such covenants at March 31, 2018.

Interest Rate Swap Transaction

As part of the debt agreements entered into in April 2013, the Company entered into an interest rate swap agreement with a member of the bank syndicate as the counterparty. The Company designated its interest rate swap as a cash flow hedge and the earnings component of the hedge, net of taxes, is reflected as a component of other comprehensive income (loss). In conjunction with the February 26, 2016 amendment to the Credit Agreement, the Company amended the terms of its interest rate swap. The interest rate swap agreement has the same effective date and maturity date as the Amended Mortgage Loan, and has an amortizing notional amount that was $28,355 as of March 31, 2018. The interest rate swap agreement requires the Company to make fixed rate payments to the bank calculated on the applicable notional amount at an annual fixed rate of 5.79% while the bank is obligated to make payments to the Company based on LIBOR on the same notional amount.

The Company assesses the effectiveness of its interest rate swap on a quarterly basis, and at March 31, 2018, the Company determined that the interest rate swap was highly effective. The interest rate swap valuation model indicated a net asset of $492

at March 31, 2018. The fair value of the interest rate swap is included in “other noncurrent assets” on the Company’s interim consolidated balance sheet. The asset related to the change in the interest rate swap included in accumulated other comprehensive income at March 31, 2018 is $335 net of the income tax provision of $157. As the Company’s interest rate swap is not traded on a market exchange, the fair value is determined using a valuation based on a discounted cash flow analysis. This analysis reflects the contractual terms of the interest rate swap agreement and uses observable market-based inputs, including estimated future LIBOR interest rates. The interest rate swap valuation is classified in Level 2 of the fair value hierarchy, in accordance with the FASB guidance set forth in ASC 820, Fair Value Measurement.

6. COMMITMENTS AND CONTINGENCIES

Professional Liability and Other Liability Insurance

The Company has professional liability insurance coverage for its nursing centers that, based on historical claims experience, is likely to be substantially less than the claims that are expected to be incurred. Effective July 1, 2013, the Company established a wholly-owned, offshore limited purpose insurance subsidiary, SHC Risk Carriers, Inc. (“SHC”), to replace some of the expiring commercial policies. SHC covers losses up to specified limits per occurrence. All of the Company's nursing centers in Florida, and Tennessee are now covered under the captive insurance policies along with most of the nursing centers in Alabama, Kentucky, and Texas. The insurance coverage provided for these centers under the SHC policy provides coverage limits of at least $500 per medical incident with a sublimit per center of $1,000 and total annual aggregate policy limits of $5,000. All other centers within the Company's portfolio are covered through various commercial insurance policies which provide similar coverage limits per medical incident, per location, and on an aggregate basis for covered centers. The deductibles for these policies are covered through the insurance subsidiary.

Reserve for Estimated Self-Insured Professional Liability Claims

Because the Company’s actual liability for existing and anticipated professional liability and general liability claims will likely exceed the Company’s limited insurance coverage, the Company has recorded total liabilities for reported and estimated future claims of $20,536 as of March 31, 2018. This accrual includes estimates of liability for incurred but not reported claims, estimates of liability for reported but unresolved claims, actual liabilities related to settlements, including settlements to be paid over time, and estimates of legal costs related to these claims. All losses are projected on an undiscounted basis and are presented without regard to any potential insurance recoveries. Amounts are added to the accrual for estimates of anticipated liability for claims incurred during each period, and amounts are deducted from the accrual for settlements paid on existing claims during each period.

The Company evaluates the adequacy of this liability on a quarterly basis. Semi-annually, the Company retains a third-party actuarial firm to assist in the evaluation of this reserve. Since May 2012, Merlinos & Associates, Inc. (“Merlinos”) has assisted management in the preparation of the appropriate accrual for incurred but not reported general and professional liability claims based on data furnished as of May 31 and November 30 of each year. Merlinos primarily utilizes historical data regarding the frequency and cost of the Company's past claims over a multi-year period, industry data and information regarding the number of occupied beds to develop its estimates of the Company's ultimate professional liability cost for current periods.

On a quarterly basis, the Company obtains reports of asserted claims and lawsuits incurred. These reports, which are provided by the Company’s insurers and a third-party claims administrator, contain information relevant to the actual expense already incurred with each claim as well as the third-party administrator’s estimate of the anticipated total cost of the claim. This information is reviewed by the Company quarterly and provided to the actuary semi-annually. Based on the Company’s evaluation of the actual claim information obtained, the semi-annual estimates received from the third-party actuary, the amounts paid and committed for settlements of claims and on estimates regarding the number and cost of additional claims anticipated in the future, the reserve estimate for a particular period may be revised upward or downward on a quarterly basis. Any increase in the accrual decreases results of operations in the period and any reduction in the accrual increases results of operations during the period.

As of March 31, 2018, the Company is engaged in 73 professional liability lawsuits. Ten lawsuits are currently scheduled for trial or arbitration during the next twelve months, and it is expected that additional cases will be set for trial or hearing. The Company’s cash expenditures for self-insured professional liability costs from continuing operations were $1,093 and $2,071 for the three months ended March 31, 2018 and 2017, respectively.

The Company follows the FASB ASU, "Presentation of Insurance Claims and Related Insurance Recoveries," that clarifies that a health care entity should not net insurance recoveries against a related professional liability claim and that the amount of the claim liability should be determined without consideration of insurance recoveries. Accordingly, the estimated insurance recovery receivables are included within "Other Current Assets" on the Consolidated Balance Sheet. As of March 31, 2018 there are no estimated insurance recovery receivables.

Although the Company adjusts its accrual for professional and general liability claims on a quarterly basis and retains a third-party actuarial firm semi-annually to assist management in estimating the appropriate accrual, professional and general liability claims are inherently uncertain, and the liability associated with anticipated claims is very difficult to estimate. Professional liability cases have a long cycle from the date of an incident to the date a case is resolved, and final determination of the Company’s actual liability for claims incurred in any given period is a process that takes years. As a result, the Company’s actual liabilities may vary significantly from the accrual, and the amount of the accrual has and may continue to fluctuate by a material amount in any given period. Each change in the amount of this accrual will directly affect the Company’s reported earnings and financial position for the period in which the change in accrual is made.

Civil Investigative Demand ("CID")

In July 2013, the Company learned that the United States Attorney for the Middle District of Tennessee ("DOJ") had commenced a civil investigation of potential violations of the False Claims Act ("FCA").

In October 2014, the Company learned that the investigation was started by the filing under seal of a false claims action against the two centers that were subject of the original civil investigative demand ("CID"). In connection with this matter, between July 2013 and early February 2016, the Company received three civil investigative demands (a form of subpoena) for documents. The Company has responded to those demands and also provided voluntarily additional information requested by the DOJ. The DOJ has also taken testimony from current and former employees of the Company. The investigation relates to the Company’s practices and policies for rehabilitation, and other services, for preadmission evaluation forms ("PAEs") required by TennCare and for Pre-Admission Screening and Resident Reviews ("PASRRs") required by the Medicare program.

In June 2016, the Company received an authorized investigative demand (a form of subpoena) for documents in connection with a criminal investigation by the DOJ related to our practices with respect to PAEs and PASRRs, and the Company has provided documents responsive to this subpoena and continues to provide additional information as requested. The Company cannot predict the outcome of these investigations or the related lawsuits, and the outcome could have a materially adverse effect on the Company, including the imposition of treble damages, criminal charges, fines, penalties and/or a corporate integrity agreement. Additionally, the uncertainty regarding the outcome of this investigation makes it more difficult for the Company to pursue strategic possibilities, longer term initiatives or to make significant financial commitments outside of the normal course of its business. The Company is committed to provide caring and professional services to its patients and residents in compliance with applicable laws and regulations.

Other Insurance

With respect to workers’ compensation insurance, substantially all of the Company’s employees became covered under either a prefunded deductible policy or state-sponsored programs. The Company has been and remains a non-subscriber to the Texas workers’ compensation system and is, therefore, completely self-insured for employee injuries with respect to its Texas operations. From June 30, 2003 until June 30, 2007, the Company’s workers’ compensation insurance programs provided coverage for claims incurred with premium adjustments depending on incurred losses. For the period from July 1, 2007 until June 30, 2008, the Company is completely insured for workers' compensation exposure. From the period from July 1, 2008 through March 31, 2018, the Company is covered by a prefunded deductible policy. Under this policy, the Company is self-insured for the first $500 per claim, subject to an aggregate maximum of $3,000. The Company funds a loss fund account with the insurer to pay for claims below the deductible. The Company accounts for premium expense under this policy based on its estimate of the level of claims subject to the policy deductibles expected to be incurred. The liability for workers’ compensation claims is $802 at March 31, 2018. The Company has a non-current receivable for workers’ compensation policies covering previous years of $1,061 as of March 31, 2018. The non-current receivable is a function of payments paid to the Company’s insurance carrier in excess of the estimated level of claims expected to be incurred.

As of March 31, 2018, the Company is self-insured for health insurance benefits for certain employees and dependents for amounts up to $200 per individual annually. The Company provides reserves for the settlement of outstanding self-insured health claims at amounts believed to be adequate. The liability for reported claims and estimates for incurred but unreported claims is $1,687 at March 31, 2018. The differences between actual settlements and reserves are included in expense in the period finalized.

| |

7. | STOCK-BASED COMPENSATION |

Overview of Plans

In June 2008, the Company adopted the Advocat Inc. 2008 Stock Purchase Plan for Key Personnel (“Stock Purchase Plan”). The Stock Purchase Plan provides for the granting of rights to purchase shares of the Company's common stock to directors and officers. The Stock Purchase Plan allows participants to elect to utilize a specified portion of base salary, annual cash bonus, or director compensation to purchase restricted shares or restricted share units (“RSU's”) at 85% of the quoted market price of a share of the Company's common stock on the date of purchase. The restriction period under the Stock Purchase Plan is generally two years from the date of purchase and during which the shares will have the rights to receive dividends, however, the restricted share certificates will not be delivered to the shareholder and the shares cannot be sold, assigned or disposed of during the restriction period. In June 2016, our shareholders approved an amendment to the Stock Purchase Plan to increase the number of shares of our common stock authorized under the Plan from 150 shares to 350 shares. No grants can be made under the Stock Purchase Plan after April 25, 2028.

In April 2010, the Compensation Committee of the Board of Directors adopted the 2010 Long-Term Incentive Plan (“2010 Plan”), followed by approval by the Company's shareholders in June 2010. The 2010 Plan allows the Company to issue stock appreciation

rights, stock options and other share and cash based awards. In June 2017, our shareholders approved an amendment to the Long-Term Incentive Plan to increase the number of shares of our common stock authorized under the Plan from 380 shares to 680 shares. No grants can be made under the 2010 Plan after May 31, 2027.

Equity Grants and Valuations

During the three months ended March 31, 2018 and 2017, the Compensation Committee of the Board of Directors approved grants totaling approximately 90 and 88 shares of restricted common stock to certain employees and members of the Board of Directors, respectively. The fair value of restricted shares is determined as the quoted market price of the underlying common shares at the date of the grant. The restricted shares typically vest 33% on the first, second and third anniversaries of the grant date. Unvested shares may not be sold or transferred. During the vesting period, dividends accrue on the restricted shares, but are paid in additional shares of common stock upon vesting, subject to the vesting provisions of the underlying restricted shares. The restricted shares are entitled to the same voting rights as other common shares. Upon vesting, all restrictions are removed.

Prior to 2017, the Compensation Committee of the Board of Directors also approved grants of Stock Only Stock Appreciation Rights (“SOSARs”) and Stock Options at the market price of the Company's common stock on the grant date. The SOSARs and Options vest 33% on the first, second and third anniversaries of the grant date, and expire 10 years from the grant date.

In computing the fair value estimates using the Black-Scholes-Merton valuation method, the Company took into consideration the exercise price of the equity grants and the market price of the Company's stock on the date of grant. The Company used an expected volatility that equals the historical volatility over the most recent period equal to the expected life of the equity grants. The risk free interest rate is based on the U.S. treasury yield curve in effect at the time of grant. The Company used the expected dividend yield at the date of grant, reflecting the level of annual cash dividends currently being paid on its common stock.

Summarized activity of the equity compensation plans is presented below:

|

| | | | | | |

| | | Weighted |

| Options/ | | Average |

| SOSARs | | Exercise Price |

Outstanding, December 31, 2017 | 212 |

| | $ | 6.64 |

|

Granted | 30 |

| | 8.14 |

|

Exercised | — |

| | — |

|

Expired or cancelled | (15 | ) | | 10.88 |

|

Outstanding, March 31, 2018 | 227 |

| | $ | 6.56 |

|

| | | |

Exercisable, March 31, 2018 | 207 |

| | $ | 6.40 |

|

|

| | | | | | |

| | | Weighted |

| | | Average |

| Restricted | | Grant Date |

| Shares | | Fair Value |

Outstanding, December 31, 2017 | 164 |

| | $ | 9.95 |

|

Granted | 90 |

| | 8.14 |

|

Dividend Equivalents | 1 |

| | 7.52 |

|

Vested | (79 | ) | | 10.27 |

|

Cancelled | (1 | ) | | 10.17 |

|

Outstanding, March 31, 2018 | 175 |

| | $ | 8.85 |

|

Summarized activity of the Restricted Share Units for the Stock Purchase Plan is as follows:

|

| | | | | | |

| | | Weighted |

| | | Average |

| Restricted | | Grant Date |

| Share Units | | Fair Value |

Outstanding, December 31, 2017 | 44 |

| | $ | 9.59 |

|

Granted | 16 |

| | 8.14 |

|

Dividend Equivalents | 1 |

| | 7.52 |

|

Vested | (17 | ) | | 8.91 |

|

Outstanding, March 31, 2018 | 44 |

| | $ | 9.30 |

|

The SOSARs and Options were valued and recorded in the same manner, and will be settled with issuance of new stock for the difference between the market price on the date of exercise and the exercise price. The Company estimated the total recognized and unrecognized compensation related to SOSARs and stock options using the Black-Scholes-Merton equity grant valuation model.

In computing the fair value estimates using the Black-Scholes-Merton valuation model, the Company took into consideration the exercise price of the equity grants and the market price of the Company's stock on the date of grant. The Company used an expected volatility that equals the historical volatility over the most recent period equal to the expected life of the equity grants. The risk free interest rate is based on the U.S. treasury yield curve in effect at the time of grant. The Company used the expected dividend yield at the date of grant, reflecting the level of annual cash dividends currently being paid on its common stock.

The following table summarizes information regarding stock options and SOSAR grants outstanding as of March 31, 2018:

|

| | | | | | | | | | | | | | | | | | |

| | Weighted | | | | | | | | |

| | Average | | | | Intrinsic | | | | Intrinsic |

Range of | | Exercise | | Grants | | Value-Grants | | Grants | | Value-Grants |

Exercise Prices | | Prices | | Outstanding | | Outstanding | | Exercisable | | Exercisable |

$8.14 to $10.88 | | $ | 9.32 |

| | 60 |

| | $ | 56 |

| | 40 |

| | $ | 19 |

|

$2.37 to $6.21 | | $ | 5.56 |

| | 167 |

| | $ | 741 |

| | 167 |

| | $ | 741 |

|

| | | | 227 |

| | | | 207 |

| | |

Stock-based compensation expense is non-cash and is included as a component of general and administrative expense or operating expense based upon the classification of cash compensation paid to the related employees. The Company recorded total stock-based compensation expense of $284 and $241 in the three month periods ended March 31, 2018 and 2017, respectively.

| |

8. | EARNINGS (LOSS) PER COMMON SHARE |

Information with respect to basic and diluted net income (loss) per common share is presented below in thousands, except per share:

|

| | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2017 |

Net income (loss) | | | |

Income (loss) from continuing operations | $ | (81 | ) | | $ | 1,348 |

|

Loss from discontinued operations, net of income taxes | (22 | ) | | (15 | ) |

Net income (loss) | $ | (103 | ) | | $ | 1,333 |

|

|

| | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2017 |

Net income (loss) per common share: | | | |

Per common share – basic | | | |

Income (loss) from continuing operations | $ | (0.01 | ) | | $ | 0.22 |

|

Loss from discontinued operations | — |

| | — |

|

Net income (loss) per common share – basic | $ | (0.01 | ) | | $ | 0.22 |

|

Per common share – diluted | | | |

Income (loss) from continuing operations | $ | (0.01 | ) | | $ | 0.21 |

|

Loss from discontinued operations | — |

| | — |

|

Net income (loss) per common share – diluted | $ | (0.01 | ) | | $ | 0.21 |

|

Weighted Average Common Shares Outstanding: | | | |

Basic | 6,314 |

| | 6,233 |

|

Diluted | 6,314 |

| | 6,440 |

|

The effects of 30 and 46 SOSARs and options outstanding were excluded from the computation of diluted earnings per common share in the three months ended March 31, 2018 and 2017, respectively, because these securities would have been anti-dilutive.

| |

9. | BUSINESS DEVELOPMENTS AND OTHER SIGNIFICANT TRANSACTIONS |

2017 Acquisition

During the year ended December 31, 2017, the Company expanded its operations to acquire a center that complements its current portfolio. On June 8, 2017, the Company entered into an Asset Purchase Agreement (the "Purchase Agreement") with Park Place Nursing and Rehabilitation Center, LLC, Dunn Nursing Home, Inc., Wood Properties of Selma LLC, and Homewood of Selma, LLC to acquire a 103-bed skilled nursing center in Selma, Alabama, for an aggregate purchase price of $8,750. In connection with the funding of the acquisition, on June 30, 2017, the Company amended the terms of its Second Amended and Restated Term Loan Agreement to increase the facility by $7,500, which is described in Note 5 to the interim consolidated financial statements herein. The acquisition transaction closed on July 1, 2017. In accordance with ASC 805, this transaction was accounted for as a business combination, which resulted in the expensing of $140 of acquisition costs and a $925 recorded gain on bargain purchase for the Company for the year ended December 31, 2017. The operating results of the acquired center have been included in the Company's consolidated statement of operations since the acquisition date. Supplemental pro forma information regarding the acquisition is not material to the consolidated financial statements. The allocation of the purchase price to the net assets acquired is as follows:

|

| | | | |

| | Park Place |

Purchase Price | | $ | 8,750 |

|

Gain on bargain purchase | | 925 |

|

| | $ | 9,675 |

|

| | |

Allocation: | | |

Building | | $ | 8,435 |

|

Land | | 760 |

|

Land Improvements | | 145 |

|

Furniture, Fixtures and Equipment | | 335 |

|

| | $ | 9,675 |

|

2018 Assets Held for Sale

During the first quarter of 2018, three of the Company's skilled nursing facilities met the accounting criteria to be classified as held for sale, but did not meet the accounting criteria to be reported as discontinued operations. The Company is selling the property and equipment affiliated with these centers. The recorded values of these centers' assets are $13,228. The centers' assets are classified as held for sale in the accompanying interim consolidated balance sheets.

2017 Lease Termination

On September 30, 2017, the Company entered into an Agreement with Trend Health and Rehab of Carthage, LLC ("Trend Health") to terminate the lease and the Company's right of possession of the center in Carthage, Mississippi. In consideration of the early termination of the lease, Trend Health provided the Company with a $250 cash termination payment which is included in lease termination receipts in the accompanying interim consolidated statements of operations for the year ended December 31, 2017. For accounting purposes, this transaction was not reported as a discontinued operation as this disposal did not represent a strategic shift that has (or will have) a major effect on the Company's operations and financial results.

2016 Sale of Investment in Unconsolidated Affiliate

On October 28, 2016, the Company and its partners entered into an asset purchase agreement to sell the pharmacy joint venture. The sale resulted in a $1,366 gain in the fourth quarter of 2016. Subsequently, we recognized an additional gain of $733 in the first quarter of 2017, related to the final liquidation of remaining net assets affiliated with the partnership.

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Diversicare Healthcare Services, Inc. (together with its subsidiaries, “Diversicare” or the “Company”) provides long-term care services to nursing center patients in ten states, primarily in the Southeast, Midwest, and Southwest. The Company’s centers provide a range of health care services to their patients and residents that include nursing, personal care, and social services. Additionally, the Company’s nursing centers also offer a variety of comprehensive rehabilitation services, as well as nutritional support services. The Company's continuing operations include centers in Alabama, Florida, Indiana, Kansas, Kentucky, Mississippi, Missouri, Ohio, Tennessee, and Texas.

As of March 31, 2018, the Company’s continuing operations consist of 76 nursing centers with 8,456 licensed nursing beds. The Company owns 18 and leases 58 of its nursing centers. Our nursing centers range in size from 48 to 320 licensed nursing beds. The licensed nursing bed count does not include 497 licensed assisted living and residential beds.

Key Performance Metrics

Skilled Mix. Skilled mix represents the number of days our Medicare or Managed Care patients are receiving services at the skilled nursing facilities divided by the total number of days (less days from assisted living services) from all payor sources are receiving services as the skilled nursing facilities for any given period.

Average rate per day. Average rate per day is the revenue by primary payor source for a period at the skilled nursing facility divided by actual patient days for the revenue source for a given period.

Average daily skilled nursing census. Average daily skilled nursing census is the average number of patients who are receiving skilled nursing care as a percentage of total number of patient days.

Strategic Operating Initiatives

We identified several key strategic objectives to increase shareholder value through improved operations and business development. These strategic operating initiatives include: improving our facilities' quality metrics, improving skilled mix in our nursing centers, improving our average Medicare rate, implementing and maintaining Electronic Medical Records (“EMR”) to improve Medicaid capture, and completing strategic acquisitions and divestitures. We have experienced success in these initiatives and expect to continue to build on these improvements. In light of challenges facing the industry and the Company specifically, including the unresolved governmental investigation, we believe that now is not the time to attempt to engage in a company-wide strategic transaction.

Improving skilled mix and average Medicare rate:

Our strategic operating initiatives of improving our skilled mix and our average Medicare rate required investing in nursing and clinical care to treat more acute patients along with nursing center-based marketing representatives to attract these patients. These initiatives developed referral and Managed Care relationships that have attracted and are expected to continue to attract payor sources for patients covered by Medicare and Managed Care. The Company's skilled mix for the three months ended March 31, 2018 and 2017 was 16.1% and 15.7%, respectively. The graph below illustrates our success with increasing our average Medicare rate per day:

Utilizing Electronic Medical Records to improve Medicaid acuity capture:

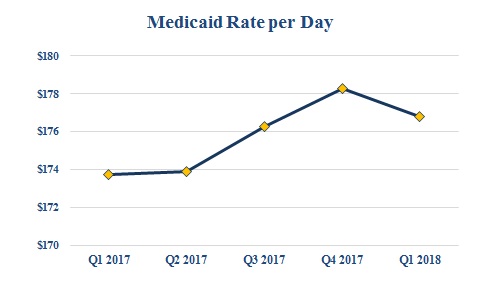

As another part of our strategic operating initiatives, we successfully completed a full implementation of EMR to improve Medicaid acuity capture, primarily in our states where the Medicaid payments are acuity based. We completed the implementation on time and under budget, and since implementation, have increased our average Medicaid rate despite rate cuts in certain acuity based states by accurate and timely capture of care delivery. The graph below illustrates our success with increasing our average Medicaid rate per day since implementation:

Completing strategic acquisitions and dispositions:

Our strategic operating initiatives include a renewed focus on completing strategic acquisitions and dispositions. We continue to pursue and investigate opportunities to acquire, lease or develop new centers, focusing primarily on opportunities within our existing geographic areas of operation. We expect to announce additional development projects in the near future.

Effective July 1, 2017, we acquired a 103-bed skilled nursing center in Selma, Alabama, for an aggregate purchase price of $8,750,000, pursuant to an Asset Purchase Agreement with Park Place Nursing and Rehabilitation Center, LLC, Dunn Nursing Home, Inc., Wood Properties of Selma LLC, and Homewood of Selma, LLC. This transaction is further discussed in Note 9 "Business Development and Other Significant Transactions" to the interim consolidated financial statements.

During the first quarter of 2018, three of the Company's skilled nursing facilities met the accounting criteria to be classified as held for sale, but did not meet the accounting criteria to be reported as discontinued operations. The Company is selling the property and equipment affiliated with these centers. The recorded values of these centers' assets are $13,228. The centers' assets are classified as held for sale in the accompanying interim consolidated balance sheets.

As part of our strategic efforts, we have also performed thorough analysis on our existing centers in order to determine whether continuing operations within certain markets or regions was in line with the short-term and long-term strategy of the business. As a result, we ceased operations at our Carthage, Mississippi, facility in September 2017 thus terminating our lease agreements with the lessor. This transaction was not reported as discontinued operations as described in Note 9 to the interim consolidated financial statements.

Basis of Financial Statements

Our patient revenues consist of the fees charged for the care of patients in the nursing centers we own and lease. Our operating expenses include the costs, other than lease, professional liability, depreciation and amortization expenses, incurred in the operation of the nursing centers we own and lease. Our general and administrative expenses consist of the costs of the corporate office and regional support functions. Our interest, depreciation and amortization expenses include all such expenses across the range of our operations.

Critical Accounting Policies and Judgments

A “critical accounting policy” is one which is both important to the understanding of our financial condition and results of operations and requires management’s most difficult, subjective or complex judgments often involving estimates of the effect of matters that are inherently uncertain. Actual results could differ from those estimates and cause our reported net income or loss to vary significantly from period to period. Our critical accounting policies are more fully described in our 2017 Annual Report on Form 10-K.

Revenue Sources

We classify our revenues from patients and residents into four major categories: Medicaid, Medicare, Managed Care, and Private Pay and other. Medicaid revenues are composed of the traditional Medicaid program established to provide benefits to those in need of financial assistance in the securing of medical services. Medicare revenues include revenues received under both Part A and Part B of the Medicare program. Managed Care revenues include payments for patients who are insured by a third-party entity, typically called a Health Maintenance Organization, often referred to as an HMO plan, or are Medicare beneficiaries who assign their Medicare benefits to a Managed Care replacement plan often referred to as Medicare replacement products. The Private Pay and other revenues are composed primarily of individuals or parties who directly pay for their services. Included in the Private Pay and other payors are patients who are hospice beneficiaries as well as the recipients of Veterans Administration benefits. Veterans Administration payments are made pursuant to renewable contracts negotiated with these payors.

The following table sets forth net patient and resident revenues related to our continuing operations by primary payor source for the periods presented (dollar amounts in thousands). The difference between 2018 revenue reported below and in the accompanying statements of operations is due to the implementation of ASC 606. Refer to Note 4 "Revenue Recognition" to the interim consolidated financial statements.

|

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2018 | | 2018 | | 2017 |

| As reported | | As Adjusted to Legacy GAAP | | As reported |

Medicaid | $ | 63,886 |

| 45.2 | % | | $ | 73,214 |

| 50.7 | % | | $ | 72,873 |

| 51.5 | % |

Medicare | 29,751 |

| 21.1 | % | | 38,139 |

| 26.4 | % | | 38,011 |

| 26.9 | % |

Managed Care | 14,212 |

| 10.1 | % | | 12,092 |

| 8.4 | % | | 10,806 |

| 7.6 | % |

Private Pay and other | 33,436 |

| 23.6 | % | | 21,047 |

| 14.5 | % | | 19,810 |

| 14.0 | % |

Total | $ | 141,285 |

| 100.0 | % | | $ | 144,492 |

| 100.0 | % | | $ | 141,500 |

| 100.0 | % |

The following table sets forth average daily skilled nursing census by primary payor source for our continuing operations for the periods presented:

|

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2018 | 2017 |

Medicaid | 4,589 |

| | 67.9 | % | | 4,649 |

| | 68.7 | % |

Medicare | 783 |

| | 11.6 |

| | 792 |

| | 11.7 |

|

Managed Care | 303 |

| | 4.5 |

| | 273 |

| | 4.0 |

|

Private Pay and other | 1,081 |

| | 16.0 |

| | 1,056 |

| | 15.6 |

|

Total | 6,756 |

| | 100.0 | % | | 6,770 |

| | 100.0 | % |

Consistent with the nursing home industry in general, changes in the mix of a facility’s patient population among Medicaid, Medicare, Managed Care, and Private Pay and other can significantly affect the profitability of the facility’s operations.

Health Care Industry

The health care industry is subject to regulation by numerous federal, state, and local governments. These laws and regulations include, but are not limited to, matters such as licensure, accreditation, government health care program participation requirements, reimbursement for patient services, quality of patient care and Medicare and Medicaid fraud and abuse. Over the last several years, government activity has increased with respect to investigations and allegations concerning possible violations by health care providers of a number of statutes and regulations, including those regulating fraud and abuse, false claims, patient privacy and quality of care issues. Violations of these laws and regulations could result in exclusion from government health care programs together with the imposition of significant fines and penalties, as well as significant repayments for patient services previously billed. Compliance with such laws and regulations is subject to ongoing government review and interpretation, as well as regulatory actions in which government agencies seek to impose fines and penalties. The Company is involved in regulatory actions of this type from time to time.

In recent years, the U.S. Congress and some state legislatures have considered and enacted significant legislation concerning health care and health insurance. The most prominent of these efforts, The Affordable Care Act affects how health care services are covered, delivered and reimbursed. As currently structured, the Affordable Care Act expands coverage through a combination of public program expansion and private sector reforms, provides for reduced growth in Medicare program spending, and promotes initiatives that tie reimbursement to quality and care coordination. Some of the provisions, such as the requirement that large

employers provide health insurance benefits to full-time employees, have increased our operating expenses. The Affordable Care Act expands the role of home-based and community services, which may place downward pressure on our sustaining population of Medicaid patients. Reforms that we believe may have a material impact on the long-term care industry and on our business include, among others, possible modifications to the conditions of qualification for payment, bundling of payments to cover both acute and post-acute care and the imposition of enrollment limitations on new providers. However, there is considerable uncertainty regarding the future of the Affordable Care Act. The Presidential administration and certain members of Congress have expressed their intent to repeal or make significant changes to the law, its implementation or its interpretation. For example, in 2017, Congress eliminated the financial penalty associated with the individual mandate, effective January 1, 2019.

Skilled nursing centers are required to bill Medicare on a consolidated basis for certain items and services that they furnish to patients, regardless of the cost to deliver these services. This consolidated billing requirement essentially makes the skilled nursing center responsible for billing Medicare for all care services delivered to the patient during the length of stay. CMS has instituted a number of test programs designed to extend the reimbursement and financial responsibilities under consolidating billing beyond the traditional discharge date to include a broader set of bundled services. Such examples may include, but are not exclusive to, home health, durable medical equipment, home and community based services, and the cost of re-hospitalizations during a specified bundled period. Currently, these test programs for bundled reimbursement are confined to a small set of clinical conditions, but CMS has indicated that it is developing additional bundled payment models. This bundled form of reimbursement could be extended to a broader range of diagnosis related conditions in the future. The potential impact on skilled nursing center utilization and reimbursement is currently unknown. The process for defining bundled services has not been fully determined by CMS and therefore is subject to change during the rule making process.