Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-23800

LaCrosse Footwear, Inc.

(Exact name of registrant as specified in its charter)

| Wisconsin | 39-1446816 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

17634 NE Airport Way

Portland, Oregon

(Address of principal executive offices)

97230

(Zip code)

Registrant’s telephone number, including area code: (503) 262-0110

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

Name of each exchange on which registered: | |

| Common Stock, $.01 par value per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by nonaffiliates of the registrant computed by reference to the closing price of the Company’s common stock on the NASDAQ Global Market as of June 25, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, was $70,820,171.

Number of shares of the registrant’s common stock outstanding at February 24, 2012: 6,508,562 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Company’s 2012 Annual Meeting of Shareholders have been incorporated by reference into Part III of this Form 10-K. The Proxy Statement is expected to be filed with the Commission within 120 days after December 31, 2011, the end of the Company’s fiscal year.

Table of Contents

| Page |

||||||

| PART I | ||||||

| ITEM 1. |

1 | |||||

| ITEM 1A. |

7 | |||||

| ITEM 1B. |

14 | |||||

| ITEM 2. |

15 | |||||

| ITEM 3. |

15 | |||||

| PART II | ||||||

| ITEM 5. |

16 | |||||

| ITEM 6. |

18 | |||||

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

19 | ||||

| ITEM 7A. |

26 | |||||

| ITEM 8. |

26 | |||||

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

26 |

||||

| ITEM 9A. |

26 | |||||

| ITEM 9B. |

29 | |||||

| PART III | ||||||

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS OF THE REGISTRANT, AND CORPORATE GOVERNANCE |

29 | ||||

| ITEM 11. |

29 | |||||

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

30 |

||||

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

30 | ||||

| ITEM 14. |

30 | |||||

| PART IV | ||||||

| ITEM 15. |

31 | |||||

| 32 | ||||||

| 35 | ||||||

| F-1 to F-23 | ||||||

Table of Contents

Forward-Looking Statements

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. LaCrosse Footwear, Inc. (“LaCrosse” or the “Company”) may also make forward-looking statements in other reports filed with the Securities Exchange Commission (“SEC”), in materials delivered to stockholders and in press releases. In addition, the Company’s representatives may from time to time make oral forward-looking statements.

Forward-looking statements relate to future events and typically address the Company’s expected future business and financial performance. Words such as “plan,” “expect,” “aim,” “believe,” “project,” “target,” “anticipate,” “intend,” “estimate,” “will,” “should,” “could” and other terms of similar meaning typically identify such forward-looking statements. In particular, these include statements about the Company’s strategy for growth, demand, product development, future performance or results of current or anticipated products, interest rates, foreign exchange rates, future financial results, our relationships with customers and suppliers, our ability to find alternative suppliers, future business volumes with the U.S. government, expectations concerning the growth of international sales, future capital expenditures, future cash dividend policies, future pension plan contributions, the adequacy of our existing resources and anticipated cash flows from operations to satisfy our working capital needs. The Company assumes no obligation to update or revise any forward-looking statements.

Forward-looking statements are based on certain assumptions and expectations of future events and trends that are subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those reflected in any such forward-looking statements depending on a variety of factors. Discussion of these factors is incorporated by reference from Part I, Item 1A, “Risk Factors,” and should be considered an integral part of Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Item 1. | Business |

Unless the context requires otherwise, references in this Annual Report to “we,” “us” or “our” refer collectively to LaCrosse Footwear, Inc. and its subsidiaries.

General

We are a leading developer and marketer of branded, premium and innovative footwear for work and outdoor users. Our trusted DANNER® and LACROSSE® brands are sold to a network of specialty retailers and distributors in North America, Europe and Asia. Work consumers include people in law enforcement, transportation, mining, oil and gas exploration and extraction, construction, government services and other occupations that require high-performance and protective footwear as a critical tool for the job. Outdoor consumers include people active in hunting, outdoor cross-training, hiking and other outdoor recreational activities.

Company History

We trace our roots back to 1897, with the founding of La Crosse Rubber Mills, a manufacturer of rubber and vinyl footwear. Located in La Crosse, Wisconsin, the original company was purchased from the founders in 1982 by George Schneider and the Schneider family. LaCrosse Footwear, Inc. was incorporated under the laws of Wisconsin on August 15, 1983. Shortly after incorporation we entered into an exclusive distribution agreement with a distributor in Japan and our relationship with that distributor continues today. In 1994, we

-1-

Table of Contents

expanded our brand portfolio through the acquisition of Danner Shoe Manufacturing, a premium maker of leather boots since 1932, located in Portland, Oregon. Danner developed a strong reputation among loggers, shipyard workers and outdoor enthusiasts.

In 2005, we opened our first international office in China to diversify our manufacturing capacity and ensure our high-quality standards are met. In 2006, we opened our Danner distribution center and corporate headquarters in Portland, Oregon. In 2008 LaCrosse Europe ApS was established in Copenhagen, Denmark, to acquire certain assets of our former European distributor and to strengthen LaCrosse’s direct sales and marketing support to customers in Europe. In 2009, we opened our Midwest distribution center for our LACROSSE® brand in Indianapolis, Indiana.

In 2010, we opened our Danner factory and factory store in Portland, Oregon. Our Danner factory significantly increases our capacity to meet worldwide demand from our customers in the work, military, law enforcement, outdoor recreation, hunting and lifestyle markets who depend on our U.S.-manufactured DANNER® footwear being crafted to the very highest standards and incorporating the rich heritage of the DANNER® brand. Additionally, we maintain a state-of-the-art product development center in the factory to increase our focus on innovation and speed-to-market. Our factory store serves to showcase a broad range of products, features onsite master craftsmen in our recrafting operation, and highlights the Danner story.

Products – Brands and Markets

Our branded footwear product offerings for the work and outdoor markets include the following brands:

Danner

The DANNER® brand is known for “crafting higher standards” in premium footwear, with rugged designs that exceed customer expectations for performance and quality, and with a classic outdoor heritage and authentic character. The brand represents the highest level of performance and features with a select line of high-quality, feature-driven footwear products at premium prices. Danner products consist of premium-quality work and outdoor boots with many features including our stitch-down manufacturing process, which provides outstanding support and built-in comfort. Danner was the first footwear manufacturer to include a waterproof, breathable GORE-TEX® liner in its leather boots. Danner’s product offerings include product categories such as uniform, hunting, work, hiking and our new STUMPTOWN™ line of lifestyle footwear products.

LaCrosse

The LACROSSE® brand builds products designed to enable the consumer to “dominate their ground” whether in work or recreation. Among our target consumers, the LACROSSE® brand is known for high performance in the field and on the job. Designed for durability and reliability, LaCrosse boots are built to satisfy specific end-user requirements, such as being protective against water, extreme cold, chemicals and other harsh environments. LaCrosse’s product offerings include product categories such as hunting, work, cold weather and new lifestyle products.

Work and Outdoor Markets

In 2011, 2010 and 2009 sales into the work market represented 59%, 63%, and 63% of our total net sales, respectively, and sales to the outdoor market represented 41%, 37%, and 37% of our total net sales, respectively.

-2-

Table of Contents

Product Design and Development

Our product design and development concepts originate from our staff and through communication with our customers and suppliers. We consistently communicate with our customers to understand consumer demand and trends. Product concepts are based upon perceived consumer needs and include new technological developments in footwear and materials.

Consumers, sales representatives and suppliers all provide information to our marketing and product development personnel during the concept, development and testing of new products. Our marketing and product development personnel, at times in conjunction with design consultants, determine the final aesthetics of the product. Once a product design is approved for production, responsibility is shared with our third-party manufacturers or with our domestic manufacturing facility for pattern development and commercialization. Our presence in Portland, Oregon provides access to a broad talent pool of footwear design professionals.

Customers, Sales, and Distribution Channels

We market our two brands, LACROSSE® and DANNER®, through four channels of distribution: (1) wholesale, (2) government, (3) direct, and (4) international.

Within the wholesale channel, the LACROSSE® and DANNER® brands are marketed primarily through our employee field and national accounts’ sales staff as well as certain independent distributors. Our wholesale channel includes sporting goods and outdoor retailers, general merchandise and independent shoe stores, wholesalers, and industrial distributors. Our wholesale customer base is diversified as to size and location of customers and markets served.

The government channel, which is exclusively served by the DANNER® brand, provides performance footwear built to meet the demands and specific requirements for multiple branches of the U.S. military as well as federal, state, and other government agencies. Many of these products are manufactured in our ISO 9001 certified manufacturing facility located in Portland, Oregon. In addition to receiving direct orders for these products from the respective branches of the military, Danner military products are also available through retail and exchange stores on U.S. Marine Corps, U.S. Army, and U.S. Air Force bases, and on Danner’s website (www.danner.com).

Through the direct channel of distribution, we currently operate Internet websites for use by consumers and retailers. The primary purposes of the consumer-oriented websites are to provide product and company information and to sell products to consumers who choose to purchase directly from us. From a direct channel standpoint, we believe each brand is positioned uniquely in the online marketplace to capitalize on differences in end-user expectations for performance, price, and function.

The direct channel also includes our flagship Danner factory store in Portland, Oregon. The factory store sells first quality products, factory seconds, and slow-moving merchandise for both DANNER® and LACROSSE® brands. Our factory store serves to showcase a broad range of products, features onsite master craftsmen in our recrafting operation, and highlights Danner’s rich heritage and authentic character.

The structure of our international sales channel depends upon the specific region outside of the U.S. Our European operations are supported by our sales office, which manages employee and independent sales representative agencies across Europe. In Japan, we reach our consumers through our long-standing distributor, Danner Japan. The Canadian market is a part of our North American operations and is served by independent sales agencies. Finally, our Asia sales operations are supported by our Asia sourcing office, which is charged with managing our independent contract manufacturers.

No customer individually accounted for more than 10% of net sales for the year ended December 31, 2011.

-3-

Table of Contents

Advertising and Promotion

We create customized advertising and marketing materials and programs for each brand and distribution channel, which allow us to emphasize relevant product features that have special appeal to the applicable targeted consumer.

We advertise and promote our products through a variety of methods including sponsorships, targeted regional print, broadcast and out-of-home advertising, social media public relations, point-of-sale displays, catalogues and packaging, online promotion and co-promotion with dealers and suppliers. Our largest marketing investments include:

| • | Marketing development funds that we provide to help our retail customers market and sell Danner and LaCrosse products through advertising, local retail partner events and similar activities; |

| • | Marketing material updates, website upgrades, campaign development and related advertising; and |

| • | Visual merchandising, which focuses on all branded point-of-sale development and production. |

We believe that as consumers understand the features and benefits of our products, they will be more likely to become loyal consumers. As such, we are committed to ensuring the benefits, features and advanced technologies of all our products are clearly articulated at our customers’ retail stores. We have established retail store education programs to train the sales associates of key retailers on our unique product attributes. We coordinate with retail store managers to improve product positioning and point-of-sale information displays.

Manufacturing and Sourcing

Manufacturing Overview

We source approximately two-thirds of the products we sell through a network of international contract manufacturers, primarily in Asia, with the remaining one-third manufactured domestically in our Portland, Oregon facility. In August 2010, we moved our Danner factory to a 59,000 square foot industrial building approximately one mile from our corporate headquarters. This facility enables us to meet domestic sourcing requirements applicable to our government customers while extending our great tradition of superior craftsmanship and significantly increasing our capacity to meet demand from customers in the work, military, law enforcement, outdoor recreation, hunting and Japanese markets who expect our U.S.-manufactured DANNER® footwear to be crafted to the very highest standards. Furthermore, this state-of-the-art facility allows us to continue to be innovative with new footwear designs and production processes by expanding our overall capabilities and capacity. It also improves our operating efficiencies by incorporating lean manufacturing techniques to meet at-once demand.

Sourcing Overview

LaCrosse International, Inc. (“LaCrosse International”) is a wholly-owned subsidiary of the Company with an office in Zhongshan, China. LaCrosse International has three primary functions:

| • | Work with our contract manufacturers to maintain our standards for high-quality products; |

| • | Locate and develop relationships with complementary sourcing alternatives; and |

| • | Increase speed to market for new products. |

We do not have any long-term contracts with our contract manufacturers, choosing instead to retain the flexibility to re-evaluate our sourcing and manufacturing base on an ongoing basis. Substantially all of our transactions with our foreign contract manufacturers are denominated in U.S. dollars. However, these U.S. dollar prices are impacted by foreign currency exchange rates and commodity prices. We regularly evaluate our vendors on the quality of their work, cost and ability to deliver on time.

-4-

Table of Contents

The raw materials used in production of our products are primarily leather and crude rubber. We have historically been able to recover increases in raw material costs as well as increases in direct labor costs through associated product price increases.

Both our contract manufacturers and our domestic manufacturing facility purchase GORE-TEX® waterproof fabric directly from W.L. Gore and Associates (“Gore”), for both LaCrosse and Danner footwear. GORE-TEX® is a registered trademark of Gore. Over 80% of Danner styles are lined with GORE-TEX®. While we believe that our relationship with Gore is good, our contracts with Gore are terminable by either party upon 180 days written notice. In the event the relationship with Gore was to terminate, we have identified other sources of products with similar characteristics. However, we believe our sales performance could be negatively impacted in the short term based on Gore’s strength in our market for reliability, durability, and consumer performance.

Competition

The categories of the footwear markets in which we operate are highly competitive. We compete with numerous other manufacturers and distributors, many of whom have substantially greater financial, distribution and marketing resources than we do. Because we have a broad product line, our competition varies by product category. We believe that we maintain a competitive position through the strength of our brands, attention to quality, delivery of value, position as an innovator, record of delivering products on a timely basis, strong customer relationships, and, in some cases, the breadth of our product line.

Some of our competitors in leather footwear categories have strong brand name recognition in the markets they serve and are the major competitors of our DANNER® and LACROSSE® leather product lines. Domestically manufactured DANNER® brand products are generally at a price disadvantage against lower-cost imported products. Danner focuses on the highest quality, premium price segment of the market in which product function, design, comfort, quality, continued technological improvements, brand awareness, and timeliness of product delivery are the overriding characteristics that consumers demand. By devoting attention to these factors, we believe the DANNER® footwear line has maintained a strong competitive position in our markets.

Several rubber boot marketers with strong brand recognition in their respective markets are competitors of the LACROSSE® brand. We occupy a favorable niche in the higher price segments of the work and outdoor rubber boot markets. Our history of supplying quality rubber boots, all of which are currently sourced from overseas suppliers, has provided a foundation to compete effectively. Other suppliers offer similar products, some at lower prices and quality levels, against which we must effectively compete. We believe that our superior quality products, innovation and design leadership, coupled with on-time delivery performance and customer support enables us to effectively compete in this market.

Employees

As of December 31, 2011, we had 390 employees located in the United States, 13 employees in China and 7 employees in Denmark. Substantially all employees are full time. Approximately 200 employees in our Portland, Oregon facilities are represented by the United Food & Commercial Workers Union (UFCW) under a collective bargaining agreement that expires on January 17, 2015.

Trademarks and Trade Names; Patents

We own United States federal registrations for several of our trademarks, including LACROSSE®, DANNER®, BURLY®, the stylized Indianhead design that serves as our logo, ICE KING®, ICEMAN®, TERRA FORCE®,

-5-

Table of Contents

HYPER-DRI®, CAMOHIDETM, ACADIA®, QUAD COMFORT®, PRONGHORN®, and TFX®. We rely on common law trademark rights for all unregistered brands. We believe consumer recognition of our brands is important to our success in the marketplace. We defend our key trademarks and trade names against infringement to the fullest extent practicable under the law. Each federally registered trademark is renewable indefinitely if the trademark is still in use at the time of renewal.

Pursuant to our agreements with Gore, we are permitted to use the GORE-TEX® mark to designate our footwear styles lined with GORE-TEX® waterproof fabric.

We also own several United States patents related to our footwear and have other technologies that are patent-pending at this time. Our portfolio of issued patents currently extends as far as 2027.

We apply to register the DANNER® and LACROSSE® trademarks in all jurisdictions where we do a significant volume of business. We apply to register other trademarks, and to register patents, in foreign jurisdictions where we determine that such registration would provide us with significant current and future value.

Seasonality

Sales have historically been higher during the second half of the year primarily due to greater consumer demand for our outdoor product offerings during the fall and winter months. Accordingly, the amount of our fixed operating expenses represents a larger percentage of our net sales in the first two quarters than in the last two quarters of each year. We expect this seasonality to continue in the coming periods.

We place orders for products sourced from overseas suppliers during the first quarter with anticipated deliveries starting late in the second quarter. As a result, our inventories generally peak early in the third quarter, and then trend down to the end of the year.

Factors other than seasonality could have a significant impact on our sales backlog. Our order backlog may experience cancellations or delays by our customers. Accordingly, our backlog at any point in time may not be indicative of future results.

The timing of receipt of large military contracts has historically caused fluctuations in our quarterly revenue patterns. During periods in which we receive fewer military contract sales, our fixed operating expenses will represent a larger percentage of net sales.

Foreign Operations and Sales Outside of the United States

As previously noted, we maintain offices in China and Denmark to support our contract manufacturers across Asia, our independent distributor network in Asia, and our European sales staff. We also conduct sales activities outside the U.S. through our largest distributor, Danner Japan, and through other sales agencies, distributors, and specialty retailers. We have recently received Chinese government approval for the establishment of a Wholly Foreign Owned Enterprise (“WFOE”) in China. This legal entity structure expands the scope of operations conducted by our Asia office staff from exclusively supporting our contract manufacturers to also allow activities related to developing and managing new distribution channel partners across China. Sales in jurisdictions outside the United States accounted for approximately 7%, 6%, and 5% of our net sales in 2011, 2010, and 2009, respectively. See Note 10 to our consolidated financial statements included in this report for information on our net sales by geographic region.

The net book value of fixed assets located outside of the U.S. totaled $1.2 million, $0.7 million, and $0.5 million at December 31, 2011, 2010, and 2009, respectively. Such assets consist primarily of manufacturing assets, office equipment and software.

-6-

Table of Contents

Environmental Matters

We are subject to environmental laws and regulations concerning emissions to the air, discharges to waterways and the generation, handling, storage, transportation, treatment and disposal of waste materials. Such laws and regulations are constantly evolving and it is difficult to accurately assess the effect they will have on our operations in the future.

Compliance with federal, state and local requirements regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, have not had, nor are they anticipated to have in the future, a material effect on our capital expenditures, earnings or competitive position.

Executive Officers of the Registrant

The following table lists the names, ages and titles of our executive officers. All executive officers serve at the discretion of our Board of Directors.

| Name |

Age | Position | ||

| Joseph P. Schneider | 52 | President, Chief Executive Officer and Director | ||

| David P. Carlson | 56 | Executive Vice President, Chief Financial Officer, and Secretary | ||

| Nina Palludan | 46 | Senior Vice President of Operations | ||

| C. Kirk Layton | 56 | Vice President of Finance and Assistant Secretary | ||

| Craig P. Cohen | 45 | Vice President of North American Wholesale Sales | ||

| Gregory S. Inman | 47 | Vice President of Administration |

Where You Can Find More Information

We file annual reports, quarterly reports, current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934 as amended (“Exchange Act”). Copies of our reports, proxy statements and other information filed with the SEC are available for inspection at the offices of the SEC’s Public Reference Room, 100 F Street NE, Washington, D.C. 20549 during official business days between the hours of 10 a.m. to 3 p.m. EST. The SEC may be contacted at 1-800-SEC-0330 for further information. The SEC maintains an Internet site at www.sec.gov where SEC filings can be obtained. We also make available on our corporate website at www.lacrossefootwearinc.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after they are filed electronically with the SEC. The information found on our website is not part of this Form 10-K. Our investor relations department can also be contacted for such reports at (800) 654-3517.

| Item 1A. | Risk Factors |

Special Note Regarding Forward-Looking Statements and Analyst Reports

The risk factors included here are not exhaustive. Other sections of this report may include additional factors which could adversely affect our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

-7-

Table of Contents

Investors should also be aware that while we do, from time to time, communicate with securities analysts, it is against our policy to disclose to them any material non-public information or other confidential commercial information. Accordingly, investors should not assume we agree with any statement or report issued by any analyst irrespective of the content of the statement or report. Furthermore, we have a policy against issuing or confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of management.

Sales to the U.S. Government, which in recent years have represented a significant portion of our net sales, declined in 2011 and may continue to decline as a result of government policies regarding troop deployments. Also, we may not be able to fill these orders when they are received due to manufacturing facility constraints. Additionally, we may continue to experience significant fluctuations in our quarterly revenue performance due to the timing of orders and requested shipment dates for U.S. government contract orders.

Our ability to continue to generate sales growth in the government channel is dependent upon a wide range of factors, some of which are outside of our ability to control. Such factors include the current U.S. government’s policies regarding troop deployments in various global regions requiring our specialized footwear, the potential for reductions in the U.S. budget, our ability to meet aggressive delivery schedules, and increased competition from other footwear suppliers who may compete more effectively on the basis of price. A withdrawal of military forces from areas of conflict could result in decreased sales, particularly for troops deployed in Afghanistan, from which combat troops are scheduled to be withdrawn by the end of 2014. Additionally, a substantial portion of our U.S. government sales must be produced by our domestic manufacturing facility. We may experience disruptions in manufacturing and shipping products to our customers. Any such delay or disruption would adversely affect our results of operations. Being unable to fill orders on a timely basis could cause us to lose future orders from these sources and other customers in the work, law enforcement, Japanese and other markets who depend on our U.S.-manufactured Danner footwear being crafted to the very highest standards and being delivered on schedule. Given that government orders can be sporadic, we may incur fixed costs associated with this operation even if the orders do not support such levels of fixed costs. If government orders continue to decline, or if we are unable to fill orders, it would have a negative impact on our earnings and results of operations.

For all of our distribution channels, including domestic retailers, a deterioration in the general business environment and lack of growth in consumer spending due to unfavorable economic and consumer credit conditions could create an environment of increasing price discounts which would negatively impact our revenues, gross profit and earnings.

Our success in generating sales of our products to consumers depends upon a number of factors, including economic factors impacting disposable consumer income. These economic factors include considerations such as employment levels, general business conditions, consumer confidence, prevailing interest rates and changes in tax laws. In addition, spending patterns of consumers may be affected by changes in the amount or severity of inclement weather, the acceptability of U.S. brands in international markets and the growth or decline of global footwear markets.

Reduced levels of consumer spending may negatively impact our wholesale partners, which would impact their financial operations and their access to capital to fund growth, which increases and concentrates our credit risk.

A contraction in consumer spending and tightening of credit markets creates an unfavorable business environment for our wholesale partners, especially those who use debt to finance their inventory purchases and other operating capital requirements. If our wholesale partners are unable to obtain financing for their inventory purchases and to fund their operations, it could result in delayed payment or non-payment of amounts owed to us and/or a reduction in the number of sales we make to such wholesale partners, either of which could have a material adverse effect on our results of operations.

-8-

Table of Contents

Changes in the price or availability of raw materials and labor in the global market, as well as currency fluctuation and other risks associated with international operations could disrupt our operations and adversely affect our financial results, particularly our gross margins.

Raw materials and component parts are purchased by us and our third-party manufacturers from various suppliers to be used in the manufacturing of our products. Changes in relationships with suppliers or increases in the costs of purchased raw materials or component parts could result in manufacturing interruptions, delays or inefficiencies and could affect our ability to successfully market our products. These occurrences would negatively affect our business, product gross margins and results of operations.

Our product costs are subject to risks associated with foreign currency fluctuations (particularly with respect to the Chinese Renminbi), rubber price increases, oil price increases, higher foreign labor costs and other variable costs associated with our operations including trade laws, duties and taxes, and other product sourcing costs. If we are unable to increase our selling prices to offset such cost increases, our revenues and earnings would be negatively impacted.

If petroleum costs were to increase, we may be required to pay significantly higher freight costs, as we rely on transport companies to deliver our products from abroad to our distribution centers, and in some cases directly to our customers. Increased petroleum costs also affect our manufacturing costs. Foreign currency fluctuations and increased labor costs abroad would be problematic given our dependence on manufacturing in Asia and distribution through our European subsidiary. Our profit margins may decrease if foreign currency rates fluctuate unfavorably, or the cost of prices of petroleum or foreign labor increases and we are unable to pass those costs on to our customers.

Failures in our information management systems would present significant business and financial risks.

Our information systems are used across our supply chain and within the operations of each of our sales channels, from product development to distribution and sales, and are used as a method of communication between employees, with our subsidiaries and liaison offices overseas, as well as with our customers. We also rely on our information systems to analyze our business, develop demand plans and forecast operating results. Relating to data security for our customers, business partners, and ourselves we strive to comply with all applicable standards, laws, and best practices for data storage and access, including, but not limited to, perimeter security, data segregation, virus detection, and intrusion vulnerabilities. Any interruption of critical business information systems could have a material adverse effect on our financial condition and results of operations.

Our primary enterprise resource planning system is highly customized to our business. We may experience difficulties as we transition to new systems planned for 2013. Difficulties in implementing our new information systems or significant system failures could disrupt our operations and have a material adverse effect on our financial condition and results of operations.

We are dependent on a few key raw materials suppliers for outsoles and leather, which presents overall risks in our supply base.

Interruptions in the supply of raw materials or increased costs for such raw materials could negatively impact the operations of our domestic manufacturing facility as well as our international manufacturing partners. Raw materials supply constraints or price increases could negatively impact our customer relationships, our ability to fill current and future orders and our results of operations.

-9-

Table of Contents

Our European subsidiary, LaCrosse Europe ApS, increases our exposure to risks associated with foreign operations and the outsourcing of our European distribution center.

Foreign operations through our European subsidiary increases our exposure to risks associated with foreign currency transactions and compliance with foreign laws. Also, our distribution center for Europe is owned and managed by an independent third party, which increases our risks associated with inventory management and timely and accurate customer shipments. Any negative outcome related to these risks would have an adverse impact on our results of operations.

Our profitability is significantly dependent upon future effective tax rates for federal, state and international taxing jurisdictions.

Tax rates on corporations could be increased in future periods. Higher effective federal, state and international tax rates would lower our earnings performance and restrict our ability to invest in various areas of our business. Future changes to rates of taxation in areas outside of the U.S. could also negatively impact our future earnings performance.

We conduct a significant portion of our manufacturing activities outside the U.S. and a portion of our net sales occurs outside the U.S.; therefore, we are subject to the risks of international commerce. Also, any adverse political conditions or governmental actions, including the imposition of duties and quotas, internally within China (where the majority of our third-party manufacturers are concentrated) or externally with NAFTA countries and the European Union could disrupt our supply of product to customers.

We use third-party manufacturers located in foreign countries, primarily in Asia, to manufacture the majority of our products, including all of our LACROSSE® branded products. Foreign manufacturing and sales activities are subject to numerous risks, including the following:

| • | delays associated with the manufacture, transportation and delivery of foreign-sourced products; |

| • | tariffs, import and export controls and other non-tariff barriers such as quotas and local content rules; |

| • | delays in the transportation and delivery of goods due to increased security concerns, labor disputes at various ports or other events; |

| • | foreign currency fluctuations (particularly with respect to the Chinese Renminbi), a risk which we do not currently seek to mitigate through hedging transactions; |

| • | restrictions on the transfer of funds; |

| • | changing economic conditions; |

| • | restrictions, due to privacy laws, on the handling and transfer of consumer and other personal information; |

| • | changes in governmental policies and regulations; |

| • | political unrest, terrorism or war, any of which can interrupt commerce; |

| • | work slowdowns, stoppages, strikes, expropriation or nationalization affecting our manufacturing partners; |

| • | difficulties in managing foreign operations effectively and efficiently from the U.S.; |

| • | difficulties in understanding and complying with local laws, regulations and customs in foreign jurisdictions; |

| • | limited capital of foreign distributors and the possibility that such distributors may terminate their operations or their relationships with us; and |

| • | concentration of credit risk, currency, and political risks associated with international distributors. |

Additionally, although net sales outside of the U.S. do not constitute a significant portion of our revenues, we expect our international sales will grow in the coming years. Our ability to continue to do business in

-10-

Table of Contents

international markets is subject to risks associated with international sales operations, as noted above, as well as the difficulties associated with promoting products in emerging markets. We are also subject to additional risk as some of our foreign distributors may not have adequate capital to continue operations over the long term. Our sales growth may be adversely affected if our relationships with those distributors were to deteriorate and we were unable to engage suitable alternatives in a timely manner.

Furthermore, many of our imported products are subject to duties, tariffs or quotas that affect the cost and quantity of various types of goods imported into NAFTA or European Union countries and into our other sales markets. The countries in which our products are produced or sold may adjust or impose new quotas, duties, tariffs or other restrictions, any of which could have a material adverse effect on us.

Because we depend on third-party manufacturers, we face challenges in maintaining a timely supply of goods to meet sales demand, and we may experience delay or interruptions in our supply chain. Any shortfall or delay in the supply of our products may decrease our sales and have an adverse impact on our customer relationships.

Third-party manufacturers located primarily in Asia produce approximately two-thirds of our footwear products. We depend on these manufacturers’ ability to finance the production of goods ordered and to maintain adequate manufacturing capacity. We do not exert direct control over the third-party manufacturers, so we may be unable to obtain timely delivery of acceptable products.

Due to various potential factors outside of our control, one or more of our third-party manufacturers may be unable to continue meeting our production requirements. Also, some of our third-party manufacturers have manufacturing arrangements with companies that are much larger than we are and whose production needs are much greater than ours. As a result, such manufacturers may choose to devote additional resources to the production of products other than ours if their capacity is limited.

In addition, we do not have long-term supply contracts with these third-party manufacturers, and any of them could unilaterally terminate their relationship with us at any time or seek to increase the prices they charge us. As a result, we are not assured of an uninterrupted supply of products of an acceptable quality and price from our third-party manufacturers. We may be unable to offset any interruption or decrease in supply of our products by increasing production in our company-operated manufacturing facility due to capacity constraints, and we may be unable to substitute suitable alternative third-party manufacturers in a timely manner or at acceptable prices. Any disruption in the supply of products from our third-party manufacturers may harm our business and could result in a loss of sales and an increase in production costs, which would adversely affect our results of operations.

Our business is substantially affected by weather conditions, and sustained periods of warm and/or dry weather can negatively impact our sales. Additionally, such weather conditions may negatively impact our inventory levels and subsequent period sales.

We sell our products into two primary markets, work and outdoor. For the year ended December 31, 2011, 41% of our annual revenues were to the outdoor market. This market category is highly seasonal and weather dependent. Sales of these products are largely dependent on the timing and severity of weather in the different regions of North America, Europe, and Asia. During sustained periods of warm and/or dry weather conditions, certain key categories in the outdoor market may be negatively impacted, including hunting, hiking and cold weather products, as consumers postpone purchases of our products pending the resumption of more conducive weather patterns. Additionally, given our advance ordering timelines, such reduced demand during normal outdoor market seasons may also negatively impact our inventory levels and subsequent period profits as such excess inventories are sold.

-11-

Table of Contents

If we do not accurately forecast consumer demand, we may have excess inventory to liquidate or have greater difficulty filling our customers’ orders, either of which could adversely affect our business.

The footwear industry is subject to cyclical variations and declines in performance, as well as fashion risks and rapid changes in consumer preferences, the effects of weather, general economic conditions and other factors affecting demand. Furthermore, the footwear industry has relatively long lead times for the design and manufacture of products. Consequently, we must commit to production based on our forecasts of consumer demand.

If we overestimate demand for our products, we may be forced to liquidate excess inventories at a discount to customers, resulting in markdowns and lower gross margins. Conversely, if we underestimate consumer demand, we could have inventory shortages, which can result in lost potential sales, delays in shipments to customers, strains on our relationships with customers and diminished brand loyalty. A decline in demand for our products, or any failure on our part to satisfy increased demand for our products, could adversely affect our business and results of operations.

Labor disruptions or disruptions due to natural disasters or casualty losses at one of our distribution facilities, our domestic manufacturing facility, or our third-party manufacturers could have a material adverse effect on our operations.

Some of our employees at our Danner distribution facility, manufacturing facility and factory store are organized in a labor union, the United Food and Commercial Workers Union. While we have recently renegotiated our contract with the union, our inability to renew, on favorable terms, the collective bargaining agreement between us and the union that represents our employees, or any strike, work stoppage or other labor disruption could impair our ability to adequately supply our customers and could have an adverse effect on our results of operations.

In addition, any natural disaster or other serious disruption at one of our facilities, including our distribution facility in Indianapolis, Indiana, and third-party manufacturers due to fire, earthquake, tornadoes, flood, terrorist attack or any other natural or manmade cause could damage a portion of our inventory or impair our ability to use our warehouse for our products. Any of these occurrences could impair our ability to adequately supply our customers and could have an adverse effect on our results of operations.

Our financial success may be limited by the strength of our relationships with our wholesale customers and by the success of such wholesale customers.

Our financial success is significantly related to the willingness of our wholesale customers to continue to carry our products and to the success of such customers in selling our products. We do not have long-term contracts with any of our wholesale customers. Sales to our wholesale customers are increasingly on an order-by-order basis and are subject to rights of cancellation and rescheduling by the customer. If we cannot fill our wholesale customers’ orders in a timely manner, the sales of our products and our relationships with those customers may suffer, and this could have a material adverse effect on our sales and ability to grow our product line.

If any of our major wholesale customers experience a significant downturn in its business or fails to remain committed to our products or brands, these customers may reduce or discontinue purchases from us in the future. In addition, we extend credit to our customers based on an evaluation of each customer’s financial condition. If a significant customer to whom we have extended credit experiences financial difficulties our bad debt expense may increase relative to revenues in the future, which would adversely impact our net income and cash flow.

-12-

Table of Contents

We face significant competition and if we are unable to compete effectively, sales of our products may decline and our business could be harmed.

The segments of the footwear industry in which we compete are highly competitive. Some of our competitors have products with similar characteristics, such as design and materials, with some of our products. In addition, access to offshore manufacturing is also making it easier for new companies to enter the markets in which we compete.

The footwear industry includes footwear manufacturers, fashion-oriented footwear marketers, vertically integrated specialty stores and retailers of private label products. Our principal competitive differentiators include product design, product performance, quality, brand image, marketing and promotion, customer support and service, the ability to meet delivery commitments to retailers, and others. Certain of our competitors have significantly greater financial resources and stronger brand recognition than we have. Additionally, they have greater distribution capabilities and a broader market presence in retail outlets, or have their own retail outlets. If we fail to compete successfully in the future, our sales and profits may decline and our financial condition may deteriorate.

We may be unable to anticipate changing consumer preferences and demands and to develop new products to meet those preferences and demands on a timely basis.

The footwear industry is subject to rapid changes in consumer preferences. Our success depends in large part on our ability to continuously develop, market and deliver innovative and functional products that are competitive with other brands in our market. In addition, we must design and manufacture products that appeal to many consumer markets at a range of price points. While we continually update our product line with new and innovative products, our products may not continue to be popular and new products we introduce may not achieve adequate consumer acceptance for us to recover development, manufacturing, marketing and other costs. Our failure to anticipate, identify and react to shifts in consumer preferences and maintain a strong brand image could adversely affect our sales and results of operations.

Our failure or inability to protect our intellectual property could significantly harm our competitive position and reduce future revenues.

Protecting our intellectual property is an important factor in maintaining our brand and our competitive position in the footwear industry. If we do not or are unable to adequately protect our intellectual property, our sales and profitability could be adversely affected. We currently hold a number of patents and trademarks and have patent and trademark applications pending. However, our efforts to protect our proprietary rights may be inadequate and applicable laws provide only limited protection. We have a number of licensing agreements, both for product, camouflage patterns and trademarks, which are significant to our business. If we are unable to renew the agreements, and suitable replacements are not available in a timely manner, our revenues could be negatively impacted.

We depend on a limited number of suppliers for key production materials, and any disruption in the supply of such materials could interrupt product manufacturing and increase product costs.

We depend on a limited number of sources for the primary materials used to make our footwear. For example, we (and our suppliers) purchase GORE-TEX® waterproof fabric directly from W.L. Gore and Associates (“Gore”), for both our LaCrosse and Danner footwear. Over 80% of Danner styles are GORE-TEX® lined.

While we consider our relationship with Gore to be good, the agreements with Gore are terminable by either party upon 180 days written notice. If Gore were to terminate our agreements, the time required to obtain substitute materials could interrupt our production cycle. Additionally, consumers may be unwilling to accept any such replacement material. Any termination or delay in our supply of GORE-TEX® waterproof fabric or

-13-

Table of Contents

the loss of our ability to use the GORE-TEX® mark in association with our products, or in the procurement of any other key product component, could result in lost potential sales, delays in shipments to customers, strained relationships with customers and diminished brand loyalty.

In order to be successful, we must retain and motivate key employees, and the failure to do so could have an adverse impact on our business.

Our future success will depend in part on the continued service of key personnel. Our future success will also depend on our ability to attract and retain key managers, product development engineers, sales and marketing staff, and others. We face competition for such individuals throughout the footwear and work and outdoor products industries. Not being able to attract or retain these employees could have a material adverse effect on our financial performance.

If we fail to comply with the covenants contained in our credit facility, we may be unable to maintain the availability of our financing arrangements, and repayment obligations on any outstanding indebtedness may be accelerated.

Our revolving credit facility contains financial and operating covenants with which we must comply. Our continued compliance with these covenants is dependent on our financial results, which are subject to fluctuation as described elsewhere in these risk factors. If we fail to comply with the covenants in the future or if our lender does not agree to waive any future non-compliance, we may be unable to borrow funds and any outstanding indebtedness could become immediately due and payable, which could harm our business. At December 31, 2011 we had outstanding borrowings of $16.9 million under this credit facility.

Our articles of incorporation, bylaws and Wisconsin corporate law each contain provisions that could delay, defer or prevent a change in control of our company or changes in our management.

Among other things, these provisions:

| • | classify our board of directors so that only some of our directors are elected each year; |

| • | do not permit cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates; and |

| • | establish advance notice and other procedural requirements for submitting nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a meeting. |

These provisions could discourage proxy contests and make it more difficult for our stockholders to elect directors and take other corporate actions, which may prevent a change of control and/or changes in our management that a stockholder might consider favorable. In addition, Subchapter XI of the Wisconsin Business Corporation Law includes provisions that may discourage, delay, or prevent a change in control. Any delay or prevention of a change of control or change in management that stockholders might otherwise consider to be favorable could cause the market price of our common stock to decline.

| Item 1B. | Unresolved Staff Comments |

None.

-14-

Table of Contents

| Item 2. | Properties |

The following table sets forth information, as of December 31, 2011, relating to our principal facilities.

| PROPERTIES | ||||||||

| Location |

Owned or Leased |

Approximate Floor Area in Square Feet |

Principal Uses | |||||

| Portland, OR | Leased (1) | 145,000 | Principal sales, marketing and executive offices and distribution facility | |||||

| Indianapolis, IN | Leased (2) | 380,000 | Distribution facility | |||||

| Zhongshan, China | Leased (3) | 1,400 | Office space | |||||

| Copenhagen, Denmark |

Leased (4) | 2,300 | Office space | |||||

| Portland, OR |

Leased (5) | 59,000 | Manufacturing operations | |||||

| Portland, OR | Leased (6) | 12,600 | Factory store | |||||

| Zhongshan, China | Leased (7) | 2,000 | Office space | |||||

| (1) | The lease term on the Single Tenant Industrial Lease is 120 months from August 1, 2006 and the lease provides for potential term extensions of up to 60 months after the original term. |

| (2) | In June 2008, we signed a Single Tenant Industrial Lease for 124 months beginning March 1, 2009. |

| (3) | The lease for this facility expires February 2012. |

| (4) | The lease for this facility expires September 2013. |

| (5) | The lease has an initial term of 64 months, and includes provision for three successive extension terms of five years each. The initial term of the lease commenced on May 1, 2010. |

| (6) | The lease has an initial term of 64 months and includes provision for three successive extension terms of five years each. The initial term of the lease commenced on March 1, 2010. |

| (7) | On December 1, 2011, we signed a lease to move our China office space to a new facility in Zhongshan. The lease has an initial term of 51 months starting December 1, 2011 and includes provision to renew the lease under the same terms when it expires. |

| Item 3. | Legal Proceedings |

From time to time, we become involved in ordinary, routine or regulatory legal proceedings incidental to our business. When a loss is deemed probable to occur and the amount of such loss can be reasonably estimated, a liability is recorded in our financial statements.

-15-

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Price Range of Common Stock

Our common stock is publicly traded on the NASDAQ Global Market under the ticker symbol BOOT. On February 24, 2012, the closing sale price of our common stock was $13.00 per share, as reported on the NASDAQ Global Market. The table below shows the high and low sales prices per share of our common stock as reported by the NASDAQ Global Market:

| 2011 | 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 18.92 | $ | 15.09 | $ | 17.42 | $ | 12.38 | ||||||||

| Second Quarter |

$ | 19.00 | $ | 12.82 | $ | 21.00 | $ | 14.95 | ||||||||

| Third Quarter |

$ | 14.80 | $ | 11.55 | $ | 19.32 | $ | 11.50 | ||||||||

| Fourth Quarter |

$ | 13.43 | $ | 12.00 | $ | 17.25 | $ | 13.52 | ||||||||

As of February 24, 2012, there were 194 shareholders of record and 1,856 beneficial owners of our common stock.

Dividends

In 2009, we paid quarterly dividends of $0.8 million, or $0.125 per common share, totaling $3.2 million.

During the first quarter of 2010, we paid a special dividend and a quarterly dividend totaling $7.2 million or $1.125 per common share. Subsequently, quarterly dividends totaling $2.4 million, in the amount of $0.125 per common share, were paid in the second, third and fourth quarters, respectively.

In 2011, we paid quarterly dividends of $0.8 million, or $0.125 per common share, totaling $3.3 million.

On February 2, 2012, we announced a first quarter cash dividend of twelve and one-half cents ($0.125) per share of common stock. This first quarter dividend will be paid on March 18, 2012 to shareholders of record as of the close of business on February 22, 2012. The total cash payment for this dividend will be approximately $0.8 million.

The Board of Directors, while not declaring future dividends, currently intends to continue its policy of declaring and paying quarterly dividends of twelve and one-half cents ($0.125) per share of common stock. However, future dividend policies and dividend payments, if any, will depend upon our earnings and financial condition, our need for funds for other projects, any limitations on payments of dividends in our current or future debt agreements and other factors.

Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

-16-

Table of Contents

Equity Compensation Plan Information

The information required by this item with respect to our equity compensation plans is contained in Part III, Item 11 of this Annual Report on Form 10-K.

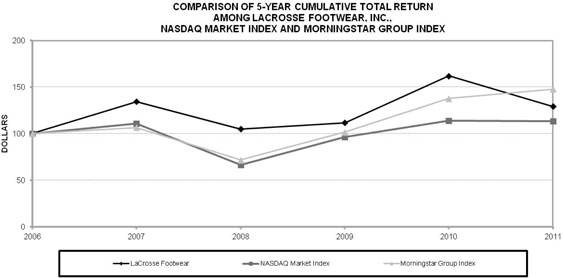

Market Price of the Registrant’s Common Equity

The following graph compares on a cumulative basis changes since December 31, 2006, in (a) the total shareholder return on our common stock with (b) the total return on the NASDAQ Global Market Index and (c) the total return on the Morningstar Textile-Apparel Footwear/Accessories Industry Group Index (the “Morningstar Group Index”). Such changes have been measured by dividing (a) the sum of (i) the amount of dividends for the measurement period, assuming dividend reinvestment, and (ii) the difference between the price per share at the end of and the beginning of the measurement period, by (b) the price per share at the beginning of the measurement period. The graph assumes $100 was invested on December 31, 2006 in LaCrosse Footwear, Inc. common stock, the NASDAQ Global Market Index and the Morningstar Group Index.

| 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | |||||||||||||||||||

| LaCrosse Footwear |

$ | 100 | $ | 134 | $ | 105 | $ | 112 | $ | 162 | $ | 129 | ||||||||||||

| NASDAQ Market Index |

$ | 100 | $ | 111 | $ | 66 | $ | 97 | $ | 114 | $ | 113 | ||||||||||||

| Morningstar Group Index |

$ | 100 | $ | 107 | $ | 72 | $ | 102 | $ | 138 | $ | 148 | ||||||||||||

-17-

Table of Contents

| Item 6. | Selected Financial Data |

Selected Income Statement Data

| Year Ended December 31 |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| (dollars in thousands, except per share data) | ||||||||||||||||||||

| Net sales |

$ | 131,321 | $ | 150,542 | $ | 139,152 | $ | 127,956 | $ | 118,179 | ||||||||||

| Operating income |

$ | 5,535 | $ | 11,430 | $ | 8,585 | $ | 10,120 | $ | 10,983 | ||||||||||

| Net income |

$ | 3,000 | $ | 6,881 | $ | 5,510 | $ | 6,167 | $ | 7,300 | ||||||||||

| Net income per common share |

||||||||||||||||||||

| Basic |

$ | 0.46 | $ | 1.07 | $ | 0.87 | $ | 0.99 | $ | 1.20 | ||||||||||

| Diluted |

$ | 0.45 | $ | 1.04 | $ | 0.86 | $ | 0.96 | $ | 1.15 | ||||||||||

| Weighted average common shares outstanding |

||||||||||||||||||||

| Basic |

6,499 | 6,429 | 6,303 | 6,215 | 6,087 | |||||||||||||||

| Diluted |

6,639 | 6,590 | 6,375 | 6,417 | 6,357 | |||||||||||||||

Selected Balance Sheet Data

| Year Ended December 31 |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| (dollars in thousands, except per share data) | ||||||||||||||||||||

| Cash and cash equivalents |

$ | 774 | $ | 4,274 | $ | 17,739 | $ | 13,683 | $ | 15,385 | ||||||||||

| Inventories |

$ | 48,648 | $ | 40,071 | $ | 27,031 | $ | 28,618 | $ | 27,131 | ||||||||||

| Total assets |

$ | 102,435 | $ | 97,270 | $ | 88,585 | $ | 84,565 | $ | 83,547 | ||||||||||

| Long-term debt, including current maturities |

$ | 138 | $ | 263 | — | — | $ | 394 | ||||||||||||

| Shareholders’ equity |

$ | 63,128 | $ | 64,448 | $ | 65,595 | $ | 61,412 | $ | 65,985 | ||||||||||

| Dividends paid |

$ | 3,251 | $ | 9,621 | $ | 3,154 | $ | 9,322 | $ | 914 | ||||||||||

| Dividends paid per common share |

$ | 0.50 | $ | 1.50 | $ | 0.50 | $ | 1.50 | $ | 0.15 | ||||||||||

| Inventory turns |

1.8 | 2.7 | 3.1 | 2.8 | 2.9 | |||||||||||||||

| Fourth quarter days sales outstanding |

47 | 39 | 46 | 57 | 62 | |||||||||||||||

-18-

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

Our mission is to maximize the work and outdoor experience for our consumers. To achieve this, we design, develop, manufacture and market premium-quality, high-performance footwear, supported by compelling marketing and superior customer service. Our trusted DANNER® and LACROSSE® brands are sold through four channels of distribution: (1) wholesale, (2) government, (3) direct and (4) international. We focus on two types of consumers for our footwear lines: work and outdoor. Work consumers include people in military services, law enforcement, transportation, mining, oil and gas exploration and extraction, construction and other occupations that require high-performance and protective footwear as a critical tool for the job. Outdoor consumers include people active in hunting, outdoor cross-training, hiking and other outdoor recreational activities as well as individuals buying our products in support of an urban lifestyle.

Weather, especially in the fall and winter, has been, and will likely continue to be, a significant contributing factor impacting our financial performance. Our sales are typically higher in the second half of the year due to stronger demand for our cold and wet weather outdoor product offerings. We augment these offerings by infusing innovative technology into all product categories with the intent to create additional demand in all four quarters of the year.

Our sales performance continues to be driven by the success of our new product lines, our ability to meet at-once demand, and our ability to diversify and strengthen our portfolio of sales channels. We also continually evaluate our portfolio of product offerings to ensure we are providing innovative and high-performance products to the marketplace. As a part of this evaluation process, during 2010 we decided to discontinue our offerings in the apparel business, which represented approximately $4.8 million of net sales in 2010.

We have experienced, and may continue to experience significant fluctuations in our quarterly revenue performance due to the timing and volume of orders for U.S. government contract purchases. Future U.S. government sales are dependent upon a wide range of factors, some of which are outside of our control, including the U.S. government’s policies regarding troop deployments in global regions requiring our specialized footwear, our ability to meet aggressive delivery schedules and increased competition from other footwear suppliers. Given the variability associated with timing and size of U.S. government contract orders, we are designing our operating model to improve profitability with or without such future military contracts.

-19-

Table of Contents

RESULTS OF OPERATIONS

Financial Summary – 2011 versus 2010

The following table sets forth selected financial information derived from our consolidated financial statements. The discussion that follows the table should be read in conjunction with the consolidated financial statements.

| ($ in millions) | 2011 | 2010 | $ Change | % Change | ||||||||||||

| Net Sales |

$ | 131.3 | $ | 150.5 | ($ | 19.2 | ) | (13 | %) | |||||||

| Gross Profit |

$ | 51.2 | $ | 59.1 | ($ | 7.9 | ) | (13 | %) | |||||||

| Gross Margin % |

39.0 | % | 39.3 | % | — | (30 bps | ) | |||||||||

| Selling and Administrative Expenses |

$ | 45.7 | $ | 47.7 | ($ | 2.0 | ) | (4 | %) | |||||||

| % of Net Sales |

34.8 | % | 31.7 | % | — | 310 bps | ||||||||||

| Non-Operating Expense, Net |

($ | 0.7 | ) | ($ | 0.2 | ) | ($ | 0.5 | ) | 201 | % | |||||

| Income Before Income Taxes |

$ | 4.8 | $ | 11.2 | ($ | 6.4 | ) | (57 | %) | |||||||

| Income Tax Provision |

$ | 1.8 | $ | 4.3 | ($ | 2.5 | ) | (58 | %) | |||||||

| Net Income |

$ | 3.0 | $ | 6.9 | ($ | 3.9 | ) | (56 | %) | |||||||

Consolidated Net Sales: Consolidated net sales for 2011 decreased 13%, to $131.3 million, from $150.5 million in 2010. Sales to the work market were $76.9 million for the full year of 2011, down 19% from $94.7 million in 2010. The decline in work market sales is primarily due to decreased sales to the U.S. government and associated suppliers and our exit of the commodity apparel business, partially offset by growth in the other areas of the work market. Excluding the contract military and the work apparel sales, work sales in 2011 increased 13% compared to 2010. Sales to the outdoor market for 2011 were $54.5 million, down 2% from $55.8 million in 2010. The decrease in outdoor sales is driven by a difficult retail market for our outdoor rubber products due primarily to unfavorable weather conditions.

Gross Margin: Gross margin for 2011 was 39.0% of consolidated net sales, compared to 39.3% in 2010. The year-over-year decrease in gross margin is primarily the result of domestic manufacturing inefficiencies related to production mix and volumes (60 basis points) and increased closeouts and other items (160 basis points) partially offset by changes in our channel sales mix (190 basis points).

Selling and Administrative Expenses: Selling and administrative expenses in 2011 decreased $2.0 million, or 4%, to $45.7 million from $47.7 million in 2010. Selling and administrative expenses as a percent of net sales increased to 34.8% in 2011 from 31.7% in 2010. The decrease in selling and administrative expenses primarily relates to lower incentive compensation expenses ($2.5 million), the net settlement of a legal proceeding ($0.6 million), which was partially offset by investments in product development and other items ($1.1 million).

Non-operating Expense, Net: The increase in 2011 of non-operating expense is primarily the result of increased interest expense, which resulted from an increase in short-term borrowings in 2011 compared to 2010.

Income Taxes: We recognized income tax expense at an effective rate of 37.7% in 2011 compared to an effective tax rate of 38.5% in 2010. The lower effective rate for 2011 was primarily due to the impact of increased research and experimentation credits in 2011.

Net Income: For 2011, net income was $3.0 million or $0.45 per diluted share, down 56% from $6.9 million or $1.04 per diluted share in 2010. The net income decrease of $3.9 million is attributable to the sales, gross profit, expense and tax rate changes discussed above.

-20-

Table of Contents

Financial Summary – 2010 versus 2009

The following table sets forth selected financial information derived from our consolidated financial statements. The discussion that follows the table should be read in conjunction with the consolidated financial statements.

| ($ in millions) | 2010 | 2009 | $ Change | % Change | ||||||||||||

| Net Sales |

$ | 150.5 | $ | 139.2 | $ | 11.3 | 8 | % | ||||||||

| Gross Profit |

$ | 59.1 | $ | 54.1 | $ | 5.0 | 9 | % | ||||||||

| Gross Margin % |

39.3 | % | 38.9 | % | — | 40 bps | ||||||||||

| Selling and Administrative Expenses |

$ | 47.7 | $ | 45.5 | $ | 2.2 | 5 | % | ||||||||

| % of Net Sales |

31.7 | % | 32.7 | % | — | (100 bps | ) | |||||||||

| Non-Operating Expense, net |

($ | 0.2 | ) | ($ | 0.4 | ) | $ | 0.2 | 36 | % | ||||||

| Income Before Income Taxes |

$ | 11.2 | $ | 8.2 | $ | 3.0 | 36 | % | ||||||||

| Income Tax Provision |

$ | 4.3 | $ | 2.7 | $ | 1.6 | 60 | % | ||||||||

| Net Income |

$ | 6.9 | $ | 5.5 | $ | 1.4 | 25 | % | ||||||||

Consolidated Net Sales: Consolidated net sales for 2010 increased 8%, to $150.5 million, from $139.2 million in 2009. Sales to the work market were $94.7 million for the full year of 2010, up 7% from $88.2 million in 2009. The growth in work sales reflects continued expansion into various areas of the U.S. government and growth in sales of occupational footwear to the wholesale market. Sales to the outdoor market for 2010 were $55.8 million, up 9% from $51.0 million in 2009. The growth in outdoor sales reflects a rebounding retail environment and several successful product introductions.

Gross Margin: Gross margin for 2010 was 39.3% of consolidated net sales, compared to 38.9% in 2009. The year-over-year increase in gross margin is primarily the result of a reduction of closeout sales (100 basis points) partially offset by Portland factory relocation costs (20 basis points), changes in our channel sales mix (20 basis points) and other items (20 basis points).

Selling and Administrative Expenses: Selling and administrative expenses in 2010 increased $2.2 million, or 5%, to $47.7 million from $45.5 million in 2009. Selling and administrative expenses as a percent of net sales decreased to 31.7% in 2010 from 32.7% in 2009. The increase in selling and administrative expenses primarily relates to investments in our Portland factory and factory store ($0.9 million), investments in marketing and product development ($2.2 million) and other items ($1.4 million). These items were partially offset by lower costs in our Midwest distribution center ($1.2 million) and our sales organizations in the U.S. and Europe ($1.1 million).

Non-operating Expense, Net: The decrease in non-operating expense is primarily the result of asset disposal costs during 2009.

Income Taxes: We recognized income tax expense at an effective rate of 38.5% in 2010 compared to an effective tax rate of 32.9% in 2009. The higher effective rate for 2010 was primarily due to non-recurring benefits in 2009, including a reduction in our reserve for uncertain tax positions as a result of the completion of an Internal Revenue Service examination.

Net Income: For 2010, net income was $6.9 million or $1.04 per diluted share, up 25% from $5.5 million or $0.86 per diluted share in 2009. The net income increase of $1.4 million is attributable to the sales, gross profit, expense and tax rate changes discussed above.

-21-

Table of Contents

LIQUIDITY AND CAPITAL RESOURCES

We have historically funded working capital requirements and capital expenditures with cash generated from operations and borrowings under a revolving line of credit agreement or other long-term lending arrangements. We require working capital to support fluctuating accounts receivable and inventory levels caused by our seasonal business cycle. Working capital requirements are generally the lowest in the first quarter and the highest during the third quarter.

On December 22, 2011, we entered into a 3-year extension of our previous line of credit agreement with Wells Fargo Bank, N.A, which expires May 1, 2015, unless renewed. Amounts borrowed under the agreement are secured by substantially all of our assets. The maximum aggregate principal amount of borrowings allowed from January 1 to May 31 is $22.5 million and from June 1 to December 31, the total available is $35 million. The credit agreement provides for an interest rate of LIBOR plus 1.75% and an annual commitment fee of 0.2% on the unused balance. The line of credit agreement contains financial covenants as well as restrictions on annual dividends and capital expenditures. There are no borrowing base limitations under the credit agreement. The Company is in compliance with all covenants as of December 31, 2011. At December 31, 2011 we had a $16.9 million outstanding balance on the line of credit, with $18.1 million of remaining availability. We had no outstanding balances due at December 31, 2010. The increase in our line of credit balance as of December 31, 2011 relates to higher inventory levels as compared to the same period in 2010, driven by increased finished goods to fulfill future at-once demand.