Semi-Annual Shareholder Report

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08360

(Exact name of registrant as specified in charter)

251 South Lake Avenue, Suite 800

Pasadena, CA 91101

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

James J. Atkinson, Jr.

251 South Lake Avenue, Suite 800

Pasadena, CA 91101

Registrant’s telephone number, including area code: (800-915-6566)

Date of fiscal year end: December 31

Date of reporting period:

Item 1. Report to Stockholders.

| (a) | The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

|

Semi-Annual Shareholder Report |

June 30, 2024

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson Alternative Energy Fund | $ |

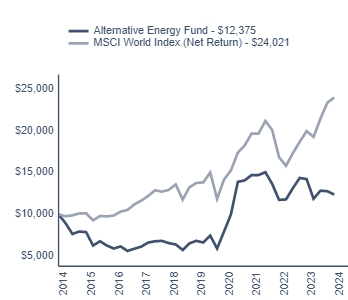

In the first half of 2024, the Guinness Atkinson Alternative Energy Fund produced a total return of -3.67% vs the MSCI World Index (net return) of 11.75%.

What affected the Fund's performance?

Fund performance can be attributed to the following.

Within the portfolio, the strongest performers included:

Our electrical equipment names Eaton, Hubbell, Schneider and Itron all performed strongly driven by an acceleration in global electrification activity and the resolution of supply chain issues which allowed them to pass on inflationary pressures and therefore maintain operating margins. Hubbell and Eaton delivered good earnings upgrades resulting from the re-industrialisation of the United States as well as the move to electrification. The positive order book inflection continues at Eaton.

Within displacement, Trane Technologies and Installed Building Products (IBP) delivered well. Trane was helped also by regulatory changes and its positioning with respect data centres.

In addition, First Solar shares were up 30.9% in 1H as the company was seen as a key beneficiary when local content IRA tax credit definitions were clarified while NextEra performed well after delivering an upbeat "Renewables Development Day" for investors.

Sectors and companies in the portfolio that were relatively weaker over the period included:

The electrification sub sector, with EV component and lithium-ion battery manufacturers suffering from delays in EV launch schedules, margin pressure and the threat of increasing Chinese competition.

Nibe shares were under pressure as the heat pump market remains overstocked at the distributor level.

Canadian Solar delivered negative contribution as module prices reached record lows while US residential solar companies continued to face a prolonged de-stocking headwind.

A number of our generation companies delivered negative contribution as interest rate cuts did not crystalise while Sunnova weakened through the period as the US residential solar business remained under pressure.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson Alternative Energy Fund |

- |

- |

|

|

| MSCI World Index (Net Return) |

|

|

|

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/alternative-energy-fund/#fund_performance.

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| Iberdrola SA | |

| Trane Technologies PLC | |

| Nextera Energy Inc. | |

| Schneider Electric SE | |

| Eaton Corp PLC | |

| Hubbell Inc | |

| Legrand SA | |

| Siemens AG | |

| NXP Semiconductors NV | |

| Owens Corning |

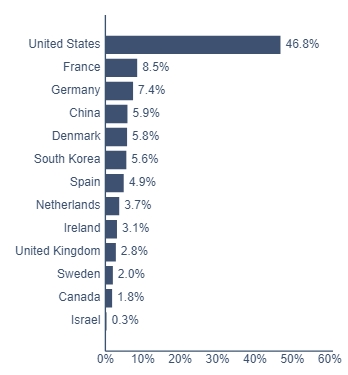

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Geographic Allocation exclude short-term holdings, if any.

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/alternative-energy-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

|

Semi-Annual Shareholder Report |

June 30, 2024

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson Asia Focus Fund | $ |

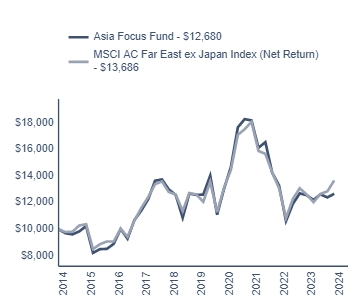

In the first half of 2024, the Guinness Atkinson Asia Focus Fund produced a total return of 0.34% vs the MSCI AC Far East ex Japan Index (net return) of 7.98%.

What affected the Fund's performance?

Fund performance can be attributed to the following:

Overall Fund performance was primarily driven by asset allocation, with overweighting to Information Technology and zero weighting to Real Estate and Materials driving the highest contributions to the Fund's total returns.

Overweighting in Health Care and Consumer Discretionary caused the largest drags to performance contribution. Communication Services was the third largest drag, although this was driven by stock selection (underweight Tencent and overweight Baidu) which more than offset positive asset allocation effects.

Stock selection in Health Care and Consumer Discretionary were also drags on performance, driven by China Medical Systems (-51.62% in USD), Corporate Travel Management (-32.90%), and Hanon Systems (-39.15%).

A positive stock selection effect was seen in Financials where China Merchants Bank (+30.34%) and DBS Group (+18.23%) both outperformed. Within Technology, we saw strong performances from TSMC (+54.88%), Applied Materials (+46.12%) and Broadcom (+44.90%). However, under allocation to TSMC caused a drag effect.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson Asia Focus Fund |

|

|

|

|

| MSCI AC Far East ex Japan Index (Net Return) |

|

|

|

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/asia-focus-fund/#fund_performance.

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| Broadcom Inc. | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | |

| Applied Materials Inc. | |

| Elite Material Co., Ltd. | |

| Samsung Electronics Co., Ltd. | |

| NetEase Inc. - ADR | |

| DBS Group Holdings | |

| NARI Technology Co., Ltd. | |

| Shenzhou International | |

| Autohome Inc. |

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any.

| Sector | % of Net Assets |

|---|---|

| Electronic Components - Semiconductor | |

| Commercial Banks | |

| Semiconductor Components - Integrated Circuits | |

| Electronic Component Miscellaneous | |

| E-Commerce/Services | |

| Entertainment Software | |

| Machinery - General Industries | |

| Textile - Apparel | |

| Building Products - Cement/Aggregates | |

| Photo Equipment & Supplies | |

| Internet Application Software | |

| Food - Dairy Products | |

| MRI/Medical Diagnostic Imaging | |

| E-Commerce/Products | |

| Machinery - Construction & Mining | |

| Computer Data Security | |

| Travel Services | |

| Medical Products | |

| Auto - Cars/Light Trucks | |

| Auto/Truck Parts & Equipment | |

| Insurance | |

| Batteries/Battery Systems | |

| Pharmaceuticals | |

| Internet & Direct Marketing Retail | |

| Metal Processors & Fabricators |

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/asia-focus-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

|

Semi-Annual Shareholder Report |

June 30, 2024

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson China & Hong Kong Fund | $ |

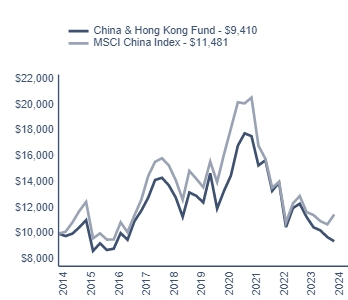

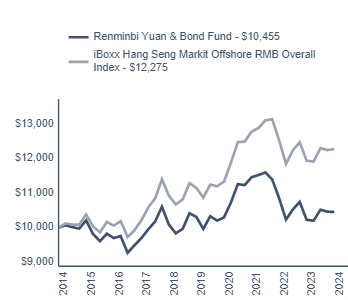

In the first half of 2024, the Guinness Atkinson China & Hong Kong Fund produced a total return of -8.16% vs the MSCI China Index (net return) of 4.74%.

What affected the Fund's performance?

Fund performance can be attributed to the following:

Areas which helped the Fund's performance were:

Individual stock returns, led by China Merchants Bank (total return +30.4%), Sany Heavy Industry (+18.7%) and Haier Smart Home (+18.4%).

Stock selection in the Real Estate sector, driven by China Overseas Land & Investment (+1.6%) compared to the sector which fell 11.4%.

Stock selection in the Consumer Staples sector, led by not holding names such as Kweichow Moutai (-15.2%), Mengniu Dairy (-30.6%) and JD Health (-45.6%).

Areas which detracted from the Fund's relative performance were:

Offshore stocks outperformed onshore stocks. As the Fund is underweight to the offshore market and overweight to A shares, it benefited from less of the rally in the offshore market.

The Fund has an overweight to mid-caps which, along with small caps, have significantly underperformed large caps.

Structural underweight to Tencent (total return +28.0%) which is the largest stock in the Index and so the Fund's relative performance benefited less.

Underweight to Financials, and more specifically the underweight to the large state-owned enterprise (SOE) banks. The Fund does not hold any of the large SOE banks which have been significant outperformers as a value play.

The combined underweight to Materials, Energy and Utilities which have been stronger sectors but where the Fund has no exposure.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson China & Hong Kong Fund |

- |

- |

- |

- |

| MSCI China Index (Net Return) |

|

- |

- |

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/china-hong-kong-fund/#fund_performance.

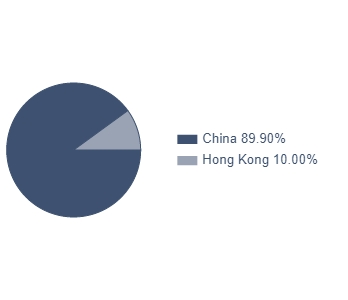

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| Tencent Holdings Ltd. | |

| NARI Technology Co., Ltd. | |

| Geely Automobile Holdings Ltd. | |

| China Merchants Bank Co., Ltd. - H Shares | |

| Weichai Power Co., Ltd. - H Shares | |

| Inner Mongolia Yili Industrial Group Co., Ltd. - A Shares | |

| Sany Heavy Industry Co., Ltd. - A Shares | |

| NetEase Inc. - ADR | |

| Shenzhou International Group Holdings Ltd. | |

| Hong Kong Exchanges & Clearing Ltd. |

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Geographic Allocation exclude short-term holdings, if any.

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/china-hong-kong-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

|

Semi-Annual Shareholder Report |

June 30, 2024

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson Global Energy Fund | $ |

In the first half of 2024, the Guinness Atkinson Global Energy Fund produced a total return of 10.19% vs the MSCI World Index (net return) of 11.75%.

What affected the Fund's performance?

Fund performance can be attributed to the following.

Within the portfolio, the strongest performers included:

Canadian integrateds: Holdings such as Canadian Natural Resources and Imperial Oil benefiting from operational leverage to rising oil prices, and a narrowing of the differential between Canadian and US oil benchmarks.

US exploration and production companies: Also with good leverage to rising oil prices, plus well received M&A for Diamondback Energy, as described above.

US refining: Tighter refining capacity, especially with outages in Russia, drove refining margins higher. Particular beneficiaries included Valero Energy and US major, Exxon.

Chinese majors: our holding in Petrochina performed particularly well, benefitting from lower gas prices (helping the company's gas import division) and stronger oil production.

Galp: exploration success offshore Namibia has boosted expectations of a material uplift in Galp's proven oil and gas reserves in the coming years.

Sectors in the portfolio that were relatively weaker over the period included:

International natural gas: Equinor, which supplies around one third of Northwest Europe's gas needs, was a notable laggard, reflecting the decline in European gas prices since the start of the year.

Services: Large cap diversified service companies Schlumberger and Baker Hughes underperformed, driven by a falling rig count in North America and a pullback in longer-term oil spending in Saudi.

Midstream: Pipeline companies Enbridge and Kinder Morgan underperformed, due to lower leverage to rising oil prices than most other parts of the portfolio.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson Global Energy Fund |

|

|

|

- |

| MSCI World Index (Net Return) |

|

|

|

|

| MSCI World Energy Index (Net Return) |

|

|

|

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/global-energy-fund/#fund_performance.

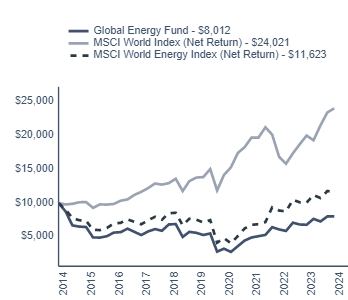

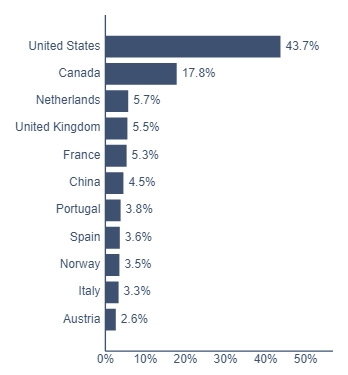

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| Shell PLC | |

| Exxon Mobil Corp. | |

| Chevron Corp. | |

| TotalEnergies SE | |

| BP PLC | |

| ConocoPhillips | |

| Valero Energy Corp. | |

| Imperial Oil Ltd. | |

| Diamondback Energy Inc. | |

| Suncor Energy Inc. |

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Geographic Allocation exclude short-term holdings, if any.

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/global-energy-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

|

Investor Class/

Semi-Annual Shareholder Report |

June 30, 2024

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson Global Innovators Fund - |

$ |

In the first half of 2024, the Guinness Atkinson Global Innovators Fund - Investor Class produced a total return of 18.35% vs the MSCI World Index (net return) of 11.75%.

What affected the Fund's performance?

Fund performance can be attributed to:

The Fund's overweight position to the Information Technology sector, and more specifically the benchmark's top performing Semiconductor industry, was the greatest tailwind to Fund outperformance, driven by both strong allocation and stock selection effects. Strength from Nvidia (+149.5% USD), off-benchmark name TSMC (+68.3% USD) and semi-cap equipment names Applied Materials (+46.1%), KLA (+42.4%) and Lam Research (+36.5%) all contributed positively to Fund outperformance.

The Fund also benefitted from strong stock selection within Industrials, where holdings ABB (+27.6% USD) and Schneider Electric (+21.3%) outperformed the broader MSCI World Industrials index by 20.1% and 13.8% respectively.

Whilst holding a relatively neutral position to both the Communication services and Healthcare sectors, strength from Meta (+42.7% USD), Alphabet (+30.3%) and Novo Nordisk (+40.5%) drove a strong stock selection effect within these sectors.

The Fund benefitted from a zero-weight allocation to Energy, Utilities, Consumer Staples, Materials and Real Estate, which all underperformed the broader benchmark.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson Global Innovators Fund - Investor Class |

|

|

|

|

| MSCI World Index (Net Return) |

|

|

|

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/global-innovators-fund/#fund_performance.

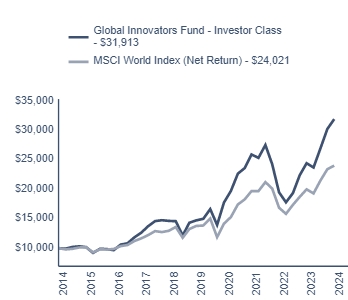

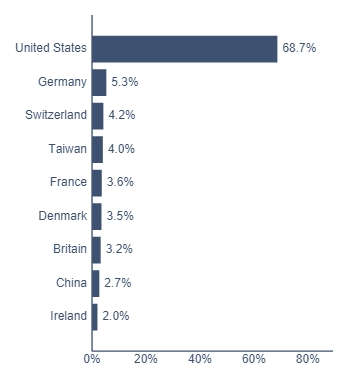

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| KLA-Tencor Corp. | |

| Amphenol Corporation | |

| Applied Materials Inc. | |

| ABB Ltd. | |

| Lam Research Corp. | |

| Microsoft Corp. | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | |

| Meta Platforms Inc. - Class A | |

| NVIDIA Corp. | |

| Schneider Electric SE |

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Geographic Allocation exclude short-term holdings, if any.

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/global-innovators-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

|

Institutional Class/

Semi-Annual Shareholder Report |

June 30, 2024

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson Global Innovators Fund - |

$ |

In the first half of 2024, the Guinness Atkinson Global Innovators Fund - Institutional Class produced a total return of 18.51% vs the MSCI World Index (net return) of 11.75%.

What affected the Fund's performance?

Fund performance can be attributed to:

The Fund's overweight position to the Information Technology sector, and more specifically the benchmark's top performing Semiconductor industry, was the greatest tailwind to Fund outperformance, driven by both strong allocation and stock selection effects. Strength from Nvidia (+149.5% USD), off-benchmark name TSMC (+68.3% USD) and semi-cap equipment names Applied Materials (+46.1%), KLA (+42.4%) and Lam Research (+36.5%) all contributed positively to Fund outperformance.

The Fund also benefitted from strong stock selection within Industrials, where holdings ABB (+27.6% USD) and Schneider Electric (+21.3%) outperformed the broader MSCI World Industrials index by 20.1% and 13.8% respectively.

Whilst holding a relatively neutral position to both the Communication services and Healthcare sectors, strength from Meta (+42.7% USD), Alphabet (+30.3%) and Novo Nordisk (+40.5%) drove a strong stock selection effect within these sectors.

The Fund benefitted from a zero-weight allocation to Energy, Utilities, Consumer Staples, Materials and Real Estate, which all underperformed the broader benchmark.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson Global Innovators Fund - Institutional Class |

|

|

|

|

| MSCI World Index (Net Return) |

|

|

|

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/global-innovators-fund/#fund_performance.

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| KLA-Tencor Corp. | |

| Amphenol Corporation | |

| Applied Materials Inc. | |

| ABB Ltd. | |

| Lam Research Corp. | |

| Microsoft Corp. | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | |

| Meta Platforms Inc. - Class A | |

| NVIDIA Corp. | |

| Schneider Electric SE |

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Geographic Allocation exclude short-term holdings, if any.

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/global-innovators-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

|

Semi-Annual Shareholder Report |

June 30, 2024

This report describes changes to the Fund that occurred during the reporting period.

| Fund (Class) | Costs of a $10,000 Investment | Costs Paid as a Percentage of a $10,000 Investment |

|---|---|---|

| Guinness Atkinson Renminbi Yuan & Bond Fund | $ |

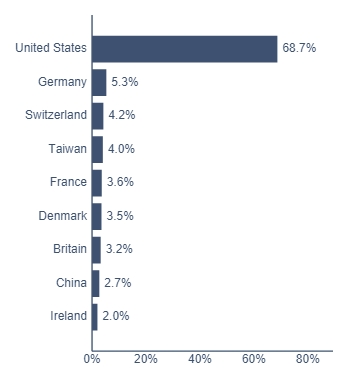

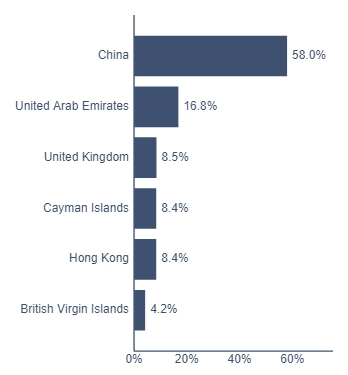

In the first half of 2024, the Guinness Atkinson Renminbi Yuan & Bond Fund produced a total return of -0.62% vs the Hang Seng Markit IBoxx Offshore RMB Overall Index of -0.21%.

What affected the Fund's performance?

Fund performance can be attributed to the following:

Overall Fund performance was primarily driven interest coupons and bonds price gains (+1.85%) but offset in dollar terms by a decline (-2.43%) in the value of the Renminbi vs the US Dollar.

The biggest contributor to performance was GLP China Holdings 4% 07/02/2024 (+26.7%). The bond had been exhibiting signs of distress, but the company has been raising liquidity and the price improved. The bond has since matured, on maturity date at par.

The macro environment in China has remained testing with consumer sentiment weak, inflation falling and the government very cautious about adding short-term stimulus.

6 Months (Actual) | 1 Year | 5 Years | 10 Years | |

|---|---|---|---|---|

| Guinness Atkinson Renminbi Yuan & Bond Fund |

- |

|

|

|

| Hang Seng Markit iBoxx Offshore RMB Overall Index (Net Return) |

- |

|

|

|

The graph and total returns reflect the reinvestment of distributions made by the Fund, if any.

For the most recent performance information, visit https://www.gafunds.com/our-funds/renminbi-yuan-bond-fund/#fund_performance.

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund, or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

| Net Assets ($) | $ |

| Number of Portfolio Holdings | |

| Portfolio Turnover Rate (%) |

| Top 10 | % of Net Assets |

|---|---|

| Yuan Renminbi Offshore | |

| First Abu Dhabi Bank, 3.400%, 08/18/25 | |

| Standard Chartered PLC 4.350%, 03/18/26 | |

| China Development Bank, 3.230%, 11/27/25 | |

| QNB Finance Ltd., 3.800%, 06/17/25 | |

| HSBC Holding, 3.400%, 06/29/27 | |

| Bank of China, 3.080%, 04/28/26 | |

| Agriculture Development Bank of China 3.400%, 11/06/24 | |

| Municipality of Shenzhen China, 2.900%, 10/19/26 | |

| QNB Finance Ltd., 3.900%, 06/17/25 |

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Geographic Allocation exclude short-term holdings, if any.

This is a summary of certain planned changes since the beginning of the reporting period. For more complete information, you may review the Fund's prospectus at https://www.gafunds.com/our-funds/renminbi-yuan-bond-fund/ or you may request this information by contacting us at (800) 915-6565.

On June 26, 2024, the Board of Trustees of the Fund approved a proposal to liquidate the Fund. Accordingly, effective on July 3, 2024, the Fund will no longer accept purchase orders and the Fund will be terminated on August 30, 2024.

There were no changes in or disagreements with the Fund's accountants during the reporting period.

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://www.gafunds.com/our-funds/renminbi-yuan-bond-fund/. You can also request this information by contacting us at (800) 915-6565.

To reduce expenses, the Trust may mail only one copy of Funds' prospectus and each annual and semi-annual report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 915-6565 (or contact your financial institution). The Trust will be sending you individual copies thirty days after receiving your request.

Distributed by Foreside Fund Services, LLC.

| (b) | Not applicable. |

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7 of this Form. |

| (b) | Not Applicable. |

Guinness Atkinson™ Funds

June 30, 2024

TABLE OF CONTENTS

Item 7. Financial Statements and Financial Highlights

| Schedule of Investments | |

| Alternative Energy Fund | 3 |

| Asia Focus Fund | 5 |

| China & Hong Kong Fund | 7 |

| Global Energy Fund | 9 |

| Global Innovators Fund | 11 |

| Renminbi Yuan & Bond Fund | 13 |

| Statements of Assets and Liabilities | 14 |

| Statements of Operations | 16 |

| Statements of Changes in Net Assets | 18 |

| Financial Highlights | 23 |

| Notes to Financial Statements | 30 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Guinness Atkinson Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective shareholder report and prospectus.

https://www.gafunds.com/

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 98.6% | Value | ||||||

| Electrification: 27.1% | ||||||||

| 10,338 | APTIV PLC* | $ | 728,002 | |||||

| 10,410 | Gentherm Inc.* | 513,421 | ||||||

| 22,239 | Infineon Technologies AG | 817,075 | ||||||

| 33,386 | Johnson Matthey PLC | 661,272 | ||||||

| 2,659 | LG Chem Ltd. | 665,733 | ||||||

| 3,280 | NXP Semiconductors NV | 882,615 | ||||||

| 11,144 | ON Semiconductor Corp.* | 763,921 | ||||||

| 2,639 | Samsung SDI Co., Ltd. | 676,981 | ||||||

| 19,883 | Sensata Technologies Holding | 743,425 | ||||||

| 6,452,445 | ||||||||

| Energy Efficiency: 19.5% | ||||||||

| 15,522 | Ameresco* | 447,189 | ||||||

| 2,746 | Hubbell Inc. | 1,003,608 | ||||||

| 3,533 | Installed Building Products Inc. | 726,667 | ||||||

| 114,741 | Nibe Industrier AB - B Shares | 486,592 | ||||||

| 4,900 | Owens Corning | 851,228 | ||||||

| 3,366 | Trane Technologies PLC | 1,107,178 | ||||||

| 4,622,462 | ||||||||

| Renewable Energy Generation: 19.2% | ||||||||

| 626,000 | China Longyuan Power Group Corp. - H Shares | 562,754 | ||||||

| 798,000 | China Suntien Green Energy Corp. Ltd. - H Shares | 361,754 | ||||||

| 89,277 | Iberdrola SA | 1,158,384 | ||||||

| 14,896 | Nextera Energy Inc. | 1,054,786 | ||||||

| 11,027 | Ormat Technologies Inc. | 790,636 | ||||||

| 12,148 | Orsted AS | 646,498 | ||||||

| 4,574,812 | ||||||||

| Renewable Equipment Manufacturing: 32.8% | ||||||||

| 29,446 | Canadian Solar Inc.* | 434,329 | ||||||

| 3,283 | Eaton Corp PLC | 1,029,385 | ||||||

| 4,096 | Enphase Energy Inc.* | 408,412 | ||||||

| 3,701 | First Solar Inc.* | 834,427 | ||||||

| 8,113 | Itron Inc.* | 802,863 | ||||||

| 9,798 | Legrand SA | 972,132 | ||||||

| 4,346 | Schneider Electric SE | 1,044,019 | ||||||

| 5,019 | Siemens AG | 933,806 | ||||||

| 3,091 | Solaredge Technologies Inc.* | 78,079 | ||||||

| 12,448 | TPI Composites Inc.* | 49,668 | ||||||

| 32,101 | Vestas Wind Systems A/S | 743,319 | ||||||

| 928,200 | Xinyi Solar Holdings Ltd. | 467,134 | ||||||

| 7,797,573 | ||||||||

The accompanying notes are an integral part of these financial statements.

| Page 3 |

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 98.6% | Value | ||||||

| Total Common Stocks (cost $28,114,906) | 23,447,292 | |||||||

| Total Investments in Securities (cost $28,114,906): 98.6% | $ | 23,447,292 | ||||||

| Other Assets less Liabilities: 1.4% | 337,682 | |||||||

| Net Assets: 100.0% | $ | 23,784,974 | ||||||

| * | Non-income producing security. |

PLC - Public Limited Company

The accompanying notes are an integral part of these financial statements.

| Page 4 |

GUINNESS ATKINSON ASIA FOCUS FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 99.8% | Value | ||||||

| Australia: 5.7% | ||||||||

| 28,819 | Corporate Travel Management Ltd. | $ | 254,926 | |||||

| 19,149 | Sonic Healthcare Ltd. | 335,964 | ||||||

| 590,890 | ||||||||

| China: 50.8% | ||||||||

| 22,600 | Alibaba Group Holding Ltd. | 204,035 | ||||||

| 1,700 | Alibaba Group Holding Ltd. - ADR | 122,400 | ||||||

| 15,120 | Autohome Inc. - ADR | 415,044 | ||||||

| 3,400 | Baidu Inc. - ADR* | 294,032 | ||||||

| 293,000 | China Medical System Holdings Ltd. | 248,389 | ||||||

| 66,500 | China Merchants Bank Co., Ltd. - H Shares | 301,888 | ||||||

| 205,000 | Geely Automobile Holdings Ltd. | 230,754 | ||||||

| 100,700 | Inner Mongolia Yili Industrial Group Co., Ltd. - A Shares | 356,445 | ||||||

| 380 | JD.com In. - CL A | 5,027 | ||||||

| 11,260 | JD.com Inc. - ADR | 290,958 | ||||||

| 800 | Meituan - Class B* | 11,382 | ||||||

| 132,909 | NARI Technology Co., Ltd. - A Shares | 454,433 | ||||||

| 5,200 | NetEase Inc. - ADR | 497,016 | ||||||

| 49,000 | Ping An Insurance Group Company of China Ltd. - H Shares | 222,130 | ||||||

| 114,600 | Sany Heavy Industry Co., Ltd. - A Shares | 259,024 | ||||||

| 44,300 | Shenzhou International | 433,699 | ||||||

| 417,000 | Sino Biopharmaceutical Ltd. | 142,579 | ||||||

| 8,000 | Tencent Holdings Ltd. | 381,511 | ||||||

| 108,400 | Venustech Group Inc. - A Shares | 256,296 | ||||||

| 71,960 | Wuxi Lead Intelligent Equipment Co., Ltd. - A Shares | 163,929 | ||||||

| 5,290,971 | ||||||||

| Singapore: 4.4% | ||||||||

| 17,318 | DBS Group Holdings Ltd. | 457,088 | ||||||

| South Korea: 7.9% | ||||||||

| 65,683 | Hanon Systems | 225,137 | ||||||

| 10,050 | Samsung Electronics Co., Ltd. | 593,550 | ||||||

| 818,687 | ||||||||

| Taiwan: 16.8% | ||||||||

| 41,000 | Elite Material Co., Ltd. | 599,065 | ||||||

| 4,800 | Largan Precision Co., Ltd. | 405,303 | ||||||

| 2 | Shin Zu Shing Co., Ltd. | 15 | ||||||

| 25,000 | Taiwan Semiconductor Manufacturing Co., Ltd. | 742,871 | ||||||

| 1,747,254 | ||||||||

The accompanying notes are an integral part of these financial statements.

| Page 5 |

GUINNESS ATKINSON ASIA FOCUS FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 99.8% | Value | ||||||

| United States: 14.2% | ||||||||

| 2,936 | Applied Materials Inc. | $ | 692,867 | |||||

| 490 | Broadcom Inc. | 786,710 | ||||||

| 1,479,577 | ||||||||

| Total Common Stocks (cost $8,560,979) | 10,384,467 | |||||||

| Total Investments in Securities (cost $8,560,979): 99.8% | 10,384,467 | |||||||

| Other Assets less Liabilities: 0.2% | 23,010 | |||||||

| Net Assets: 100.0% | $ | 10,407,477 | ||||||

| * | Non-income producing security. |

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

| Page 6 |

GUINNESS ATKINSON CHINA & HONG KONG FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 99.9% | Value | ||||||

| Appliances: 9.9% | ||||||||

| 238,800 | Haier Smart Home Co., Ltd. - H Shares | $ | 798,146 | |||||

| 93,700 | Midea Group Co., Ltd. | 827,886 | ||||||

| 118,309 | Zhejiang Supor Cookware - A Shares | 811,945 | ||||||

| 2,437,977 | ||||||||

| Application Software: 3.3% | ||||||||

| 686,000 | TravelSky Technology, Ltd. | 804,687 | ||||||

| Auto/Cars - Light Trucks: 4.0% | ||||||||

| 861,000 | Geely Automobile Holdings Ltd. | 969,169 | ||||||

| Auto/Truck Parts & Equipment: 3.8% | ||||||||

| 491,480 | Weichai Power Co., Ltd. - H Shares | 940,294 | ||||||

| Batteries/Battery System: 2.6% | ||||||||

| 284,540 | Wuxi Lead Intelligent Equipment Co., Ltd. - A Shares | 648,197 | ||||||

| Commercial Banks: 3.9% | ||||||||

| 213,000 | China Merchants Bank Co., Ltd. - H Shares | 966,948 | ||||||

| Computer Data Security: 2.5% | ||||||||

| 259,550 | Venustech Group Inc. - A Shares | 613,667 | ||||||

| E-Commerce/Services: 6.7% | ||||||||

| 24,500 | Alibaba Group Holding Ltd. | 221,188 | ||||||

| 9,510 | Alibaba Group Holding Ltd. - ADR | 684,720 | ||||||

| 1,352 | JD.com Inc. | 17,885 | ||||||

| 28,300 | JD.com Inc. - ADR | 731,272 | ||||||

| 1,655,065 | ||||||||

| Electronic Components: 2.2% | ||||||||

| 376,589 | Shenzhen H&T Intelligent Control Co., Ltd. - A Shares | 552,495 | ||||||

| Energy-Alternate: 5.5% | ||||||||

| 299,370 | Hangzhou First Applied Materials Co., Ltd. | 602,833 | ||||||

| 1,489,987 | Xinyi Solar Holdings Ltd. | 749,864 | ||||||

| 1,352,697 | ||||||||

| Finance: 3.5% | ||||||||

| 27,000 | Hong Kong Exchanges & Clearing Ltd. | 865,084 | ||||||

| Food-Dairy Products: 6.6% | ||||||||

| 416,130 | Chongqing Fuling Zhacai Group Co., Ltd. - A Shares | 698,291 | ||||||

| 260,900 | Inner Mongolia Yili Industrial Group Co., Ltd. - A Shares | 923,502 | ||||||

| 1,621,793 | ||||||||

| Home Furniture: 3.2% | ||||||||

| 375,700 | Suofeiya Home Collection - A Shares | 788,959 | ||||||

The accompanying notes are an integral part of these financial statements.

| Page 7 |

GUINNESS ATKINSON CHINA & HONG KONG FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 99.9% | Value | ||||||

| Insurance: 6.4% | ||||||||

| 114,000 | AIA Group Ltd. | $ | 773,728 | |||||

| 175,500 | Ping An Insurance Group Company of China Ltd. - H Shares | 795,587 | ||||||

| 1,569,315 | ||||||||

| Internet Application Software: 4.9% | ||||||||

| 25,200 | Tencent Holdings Ltd. | 1,201,760 | ||||||

| Internet Content - Entertainment: 3.6% | ||||||||

| 9,285 | NetEase Inc. - ADR | 887,460 | ||||||

| Machinery-General Industry: 10.9% | ||||||||

| 288,368 | NARI Technology Co., Ltd. - A Shares | 985,968 | ||||||

| 407,797 | Sany Heavy Industry Co., Ltd. - A Shares | 921,720 | ||||||

| 108,054 | Shenzhen Inovance Technology Co., Ltd. - A Shares | 759,328 | ||||||

| 2,667,016 | ||||||||

| Pharmaceuticals: 6.4% | ||||||||

| 1,024,400 | CSPC Pharmaceutical Group Ltd. | 815,957 | ||||||

| 2,183,500 | Sino Biopharmaceutical Ltd. | 746,572 | ||||||

| 1,562,529 | ||||||||

| Real Estate Operations/Development: 3.4% | ||||||||

| 476,000 | China Overseas Land & Investments Ltd. | 825,340 | ||||||

| Retail - Apparel/Shoe: 3.6% | ||||||||

| 90,000 | Shenzhou International Group Holdings Ltd. | 881,104 | ||||||

| Web Portals: 3.0% | ||||||||

| 8,510 | Baidu Inc. - ADR* | 735,945 | ||||||

| Total Common Stocks (cost $33,246,951) | 24,547,501 | |||||||

| Total Investments in Securities (cost $33,246,951): 99.9% | 24,547,501 | |||||||

| Other Assets less Liabilities: 0.1% | 10,128 | |||||||

| Net Assets: 100.0% | $ | 24,557,629 | ||||||

| * | Non-income producing security. |

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

| Page 8 |

GUINNESS ATKINSON GLOBAL ENERGY FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 99.3% | Value | ||||||

| Oil & Gas - Exploration & Production: 19.9% | ||||||||

| 12,144 | Canadian Natural Resources Ltd. | 432,522 | ||||||

| 4,767 | ConocoPhillips | 545,249 | ||||||

| 93,640 | Deltic Energy PLC* | 8,581 | ||||||

| 7,913 | Devon Energy Corp. | 375,076 | ||||||

| 2,270 | Diamondback Energy Inc. | 454,431 | ||||||

| 2,075 | Diversified Energy Co PLC | 27,539 | ||||||

| 213,942 | EnQuest PLC* | 36,723 | ||||||

| 3,223 | EOG Resources Inc. | 405,679 | ||||||

| 127,428 | Pharos Energy PLC | 37,046 | ||||||

| 5,221,570 | Reabold Resources PLC* | 4,455 | ||||||

| 2,327,301 | ||||||||

| Oil & Gas - Field Services: 9.8% | ||||||||

| 7,205 | Baker Hughes Company | 253,400 | ||||||

| 10,847 | Halliburton Company | 366,412 | ||||||

| 10,795 | Helix Energy Solutions Group, Inc.* | 128,892 | ||||||

| 8,387 | Schlumberger Ltd. | 395,699 | ||||||

| 1,144,403 | ||||||||

| Oil & Gas - Integrated: 57.9% | ||||||||

| 92,972 | BP PLC | 558,439 | ||||||

| 20,745 | Cenovus Energy Inc. | 407,713 | ||||||

| 4,116 | Chevron Corp. | 643,825 | ||||||

| 25,156 | Eni SpA | 386,727 | ||||||

| 14,410 | Equinor ASA | 410,253 | ||||||

| 5,754 | Exxon Mobil Corp. | 662,401 | ||||||

| 21,143 | Galp Energia Sgps Sa | 446,543 | ||||||

| 6,832 | Imperial Oil Ltd. | 465,786 | ||||||

| 7,017 | OMV AG | 305,568 | ||||||

| 312,000 | PetroChina Co., Ltd. - H Shares | 315,638 | ||||||

| 26,760 | Repsol SA | 422,305 | ||||||

| 18,490 | Shell PLC | 665,275 | ||||||

| 11,880 | Suncor Energy, Inc. | 452,815 | ||||||

| 9,287 | Total Energies SE | 619,958 | ||||||

| 6,763,246 | ||||||||

| Oil & Gas - Pipelines and Transportation: 5.5% | ||||||||

| 9,045 | Enbridge Inc. | 321,912 | ||||||

| 16,213 | Kinder Morgan Inc. | 322,152 | ||||||

| 644,064 | ||||||||

The accompanying notes are an integral part of these financial statements.

| Page 9 |

GUINNESS ATKINSON GLOBAL ENERGY FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 99.3% | Value | ||||||

| Oil Refining & Marketing: 6.2% | ||||||||

| 314,000 | China Petroleum & Chemical | $ | 203,464 | |||||

| 3,321 | Valero Energy, Corp. | 520,600 | ||||||

| 724,064 | ||||||||

| Total Common Stocks (cost $12,448,896) | 11,603,078 | |||||||

| Total Investments in Securities (cost $12,448,896): 99.3% | 11,603,078 | |||||||

| Other Assets less Liabilities: 0.7% | 75,596 | |||||||

| Net Assets: 100.0% | $ | 11,678,674 | ||||||

| * | Non-income producing security. |

PLC - Public Limited Company

The accompanying notes are an integral part of these financial statements.

| Page 10 |

GUINNESS ATKINSON GLOBAL INNOVATORS FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 97.2% | Value | ||||||

| Application Software: 10.7% | ||||||||

| 11,592 | Intuit Inc. | $ | 7,618,378 | |||||

| 19,542 | Microsoft Corp. | 8,734,297 | ||||||

| 26,432 | salesforce.com Inc. | 6,795,667 | ||||||

| 23,148,342 | ||||||||

| Athletic Footwear: 1.6% | ||||||||

| 47,392 | NIKE Inc. | 3,571,935 | ||||||

| Commercial Services: 2.3% | ||||||||

| 87,549 | PayPal Holdings, Inc.* | 5,080,468 | ||||||

| Computers: 2.9% | ||||||||

| 29,832 | Apple Inc. | 6,283,216 | ||||||

| Diversified Manufacturing Operations: 8.6% | ||||||||

| 25,334 | Danaher Corp. | 6,329,700 | ||||||

| 12,239 | Roper Industries, Inc. | 6,898,635 | ||||||

| 9,612 | Thermo Fisher Scientific Inc. | 5,315,436 | ||||||

| 18,543,771 | ||||||||

| E-Commerce: 3.0% | ||||||||

| 33,472 | Amazon.com Inc.* | 6,468,464 | ||||||

| Electronic Components - Semiconductor: 10.3% | ||||||||

| 142,336 | Amphenol Corporation | 9,589,176 | ||||||

| 133,048 | Infineon Technologies AG | 4,888,271 | ||||||

| 64,466 | NVIDIA Corp. | 7,964,130 | ||||||

| 22,441,577 | ||||||||

| Enterprise Software/Services: 2.5% | ||||||||

| 9,587 | Adobe Inc.* | 5,325,962 | ||||||

| Finance - Other Services: 12.3% | ||||||||

| 47,490 | Intercontinental Exchange, Inc. | 6,500,906 | ||||||

| 57,846 | London Stock Exchange Group PL | 6,873,030 | ||||||

| 15,772 | Mastercard Inc. | 6,957,976 | ||||||

| 24,518 | Visa Inc. | 6,435,239 | ||||||

| 26,767,151 | ||||||||

| Internet Content: 3.7% | ||||||||

| 15,977 | Meta Platforms Inc. - Class A | 8,055,923 | ||||||

The accompanying notes are an integral part of these financial statements.

| Page 11 |

GUINNESS ATKINSON GLOBAL INNOVATORS FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Shares | Common Stocks: 97.2% | Value | ||||||

| Machinery - Electric Utility: 4.2% | ||||||||

| 164,851 | ABB Ltd. | $ | 9,160,020 | |||||

| Medical Instrument: 5.0% | ||||||||

| 55,777 | Medtronic PLC | 4,390,208 | ||||||

| 113,749 | Siemens Healthineers AG | 6,554,194 | ||||||

| 10,944,402 | ||||||||

| Pharmaceutical: 3.5% | ||||||||

| 52,698 | Novo Nordisk A/S | 7,609,852 | ||||||

| Power Conversion/Supply Equipment: 3.7% | ||||||||

| 32,957 | Schneider Electric SE | 7,917,105 | ||||||

| Retail - Apparel: 2.7% | ||||||||

| 608,800 | ANTA Sports Products Ltd. | 5,847,137 | ||||||

| Semiconductor: 16.8% | ||||||||

| 39,188 | Applied Materials Inc. | 9,247,976 | ||||||

| 11,724 | KLA-Tencor Corp. | 9,666,555 | ||||||

| 8,349 | Lam Research Corp. | 8,890,433 | ||||||

| 49,555 | Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | 8,613,155 | ||||||

| 36,418,119 | ||||||||

| Web Portals: 3.4% | ||||||||

| 40,841 | Alphabet Inc. - A Shares* | 7,439,188 | ||||||

| Total Common Stocks (cost $101,328,563) | 211,022,632 | |||||||

| Total Investments in Securities (cost $101,328,563): 97.2% | 211,022,632 | |||||||

| Other Assets less Liabilities: 2.8% | 6,125,072 | |||||||

| Net Assets: 100.0% | $ | 217,147,704 | ||||||

| * | Non-income producing security. |

ADR - American Depository Receipt

PLC - Public Limited Company

The accompanying notes are an integral part of these financial statements.

| Page 12 |

GUINNESS ATKINSON RENMINBI YUAN & BOND FUND

Schedule of Investments

at June 30, 2024 (Unaudited)

| Principal Amount (CNH) | Corporate Bonds: 63.1% | Value | ||||||

| Commercial Banks: 37.9% | ||||||||

| 1,000,000 | Bank of China, 3.080%, 04/28/26 | 137,586 | ||||||

| 4,000,000 | First Abu Dhabi Bank, 3.400%, 08/18/25 | 549,795 | ||||||

| 1,000,000 | QNB Finance Ltd., 3.800%, 06/17/25 | 137,762 | ||||||

| 1,000,000 | QNB Finance Ltd., 3.900%, 06/17/25 | 137,377 | ||||||

| 2,000,000 | Standard Chartered PLC 4.350%, 03/18/26 | 276,651 | ||||||

| 1,239,171 | ||||||||

| Diversified Banks: 4.2% | ||||||||

| 1,000,000 | HSBC Holding, 3.400%, 06/29/27 | 137,739 | ||||||

| Export/Import Bank: 8.4% | ||||||||

| 1,000,000 | Agriculture Development Bank of China 3.400%, 11/06/24 | 137,401 | ||||||

| 1,000,000 | China Development Bank, 3.230%, 11/27/25 | 138,260 | ||||||

| 275,661 | ||||||||

| Municipal City: 4.2% | ||||||||

| 1,000,000 | Municipality of Shenzhen China, 2.900%, 10/19/26 | 137,382 | ||||||

| Real Estate Operator/Developer: 4.2% | ||||||||

| 1,000,000 | Sun Hung Kai Properties 3.200%, 08/14/27 | 136,820 | ||||||

| 1,000,000 | Zhenro Properties Group Ltd., 8.000%, 03/06/23 | 1,112 | ||||||

| 137,932 | ||||||||

| Storage/Warehousing: 4.2% | ||||||||

| 1,000,000 | GLP China Holding Ltd., 4.000%, 07/02/24 | 136,112 | ||||||

| Total Corporate Bonds (cost $2,410,231) | 2,063,997 | |||||||

| Total Investments in Securities (cost $2,410,231): 63.1% | 2,063,997 | |||||||

| China Yuan (Offshore): 41.2% | 1,346,038 | |||||||

| Liabilities less Other Assets: -4.3% | (139,760 | ) | ||||||

| Net Assets: 100.0% | $ | 3,270,275 | ||||||

CNH - The official currency of the People’s Republic of China.

The accompanying notes are an integral part of these financial statements.

| Page 13 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

at June 30, 2024 (Unaudited)

| Alternative Energy Fund | Asia Focus Fund | China & Hong Kong Fund | ||||||||||

| Assets | ||||||||||||

| Investments in securities, at cost | $ | 28,114,906 | $ | 8,560,979 | $ | 33,246,951 | ||||||

| Investments in securities, at value | $ | 23,447,292 | $ | 10,384,467 | $ | 24,547,501 | ||||||

| Cash | 329,357 | - | - | |||||||||

| Cash denominated in foreign currency (cost of $0, $27,033 and $245,577, respectively) | - | 26,976 | 244,779 | |||||||||

| Receivables: | ||||||||||||

| Securities sold | - | - | - | |||||||||

| Fund shares sold | 2,937 | - | 1,000 | |||||||||

| Dividends and interest | 82,910 | 31,510 | 156,054 | |||||||||

| Tax reclaim | 14,833 | - | - | |||||||||

| Due from Advisor, net | - | - | - | |||||||||

| Prepaid expenses | 13,338 | 11,525 | 9,613 | |||||||||

| Total Assets | 23,890,667 | 10,454,478 | 24,958,947 | |||||||||

| Liabilities | ||||||||||||

| Overdraft due to custodian bank | - | 697 | 317,576 | |||||||||

| Payable for Fund shares redeemed | 39,196 | - | - | |||||||||

| Due to Advisor, net | 4,901 | 5,298 | 21,728 | |||||||||

| Accrued administration fees | 2,529 | 739 | 2,772 | |||||||||

| Accrued shareholder servicing plan fees | 13,441 | 3,065 | 4,877 | |||||||||

| Audit fees | 9,422 | 12,546 | 12,700 | |||||||||

| CCO fees | 3,037 | 2,136 | 3,448 | |||||||||

| Custody fees | 4,264 | 3,809 | 5,468 | |||||||||

| Fund Accounting fees | 6,863 | 5,931 | 4,389 | |||||||||

| Legal fees | 7,823 | 2,644 | 10,450 | |||||||||

| Miscellaneous fees | 650 | 417 | 366 | |||||||||

| Printing fees | 6,282 | 3,898 | 5,023 | |||||||||

| Transfer Agent fees | 7,057 | 5,154 | 10,062 | |||||||||

| Trustee fees | 228 | 667 | 2,459 | |||||||||

| Total Liabilities | 105,693 | 47,001 | 401,318 | |||||||||

| Net Assets | $ | 23,784,974 | $ | 10,407,477 | $ | 24,557,629 | ||||||

| Composition of Net Assets | ||||||||||||

| Paid-in capital | $ | 56,645,899 | $ | 8,328,247 | $ | 33,087,573 | ||||||

| Total distributable earnings (loss) | (32,860,925 | ) | 2,079,230 | (8,529,944 | ) | |||||||

| Net Assets | $ | 23,784,974 | $ | 10,407,477 | $ | 24,557,629 | ||||||

| Number of shares issued and outstanding (unlimited shares authorized, no par value) | 4,313,041 | 699,627 | 2,077,722 | |||||||||

| Net asset value per share | $ | 5.51 | $ | 14.88 | $ | 11.82 | ||||||

The accompanying notes are an integral part of these financial statements.

| Page 14 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

at June 30, 2024 (Unaudited)

| Global Energy Fund | Global Innovators Fund | Renminbi Yuan & Bond Fund | ||||||||||

| Assets | ||||||||||||

| Investments in securities, at cost | $ | 12,448,896 | $ | 101,328,563 | $ | 2,410,231 | ||||||

| Investments in securities, at value | $ | 11,603,078 | $ | 211,022,632 | $ | 2,063,997 | ||||||

| Cash | 7,152 | 5,853,993 | - | |||||||||

| Cash denominated in foreign currency (cost of $8,998, $0, and $1,358,007, respectively) | 8,998 | - | 1,346,038 | |||||||||

| Receivables: | ||||||||||||

| Fund shares sold | 100 | 142,572 | - | |||||||||

| Dividends and interest | 24,104 | 130,567 | 27,125 | |||||||||

| Tax reclaim | 64,366 | 287,533 | - | |||||||||

| Due from Advisor, net | - | - | 4,807 | |||||||||

| Prepaid expenses | 14,215 | 32,787 | 11,334 | |||||||||

| Total Assets | 11,722,013 | 217,470,084 | 3,453,301 | |||||||||

| Liabilities | ||||||||||||

| Overdraft due to custodian bank | - | - | 159,612 | |||||||||

| Payable for Fund shares redeemed | 2,574 | 77,971 | - | |||||||||

| Due to Advisor, net | 1,310 | 130,050 | - | |||||||||

| Accrued administration fees | 1,489 | 15,301 | 927 | |||||||||

| Accrued shareholder servicing plan fees | 4,763 | 30,141 | 1,034 | |||||||||

| Audit fees | 12,967 | 12,702 | 6,203 | |||||||||

| CCO fees | 1,900 | 3,229 | 1,833 | |||||||||

| Custody fees | 1,844 | 6,511 | 1,146 | |||||||||

| Fund Accounting fees | 4,415 | 4,634 | 4,157 | |||||||||

| Legal fees | 5,747 | 21,252 | 1,636 | |||||||||

| Miscellaneous fees | 421 | 583 | 238 | |||||||||

| Printing fees | 2,294 | 6,550 | 1,541 | |||||||||

| Transfer Agent fees | 3,127 | 12,276 | 2,834 | |||||||||

| Trustee fees | 488 | 1,180 | 1,865 | |||||||||

| Total Liabilities | 43,339 | 322,380 | 183,026 | |||||||||

| Net Assets | $ | 11,678,674 | $ | 217,147,704 | $ | 3,270,275 | ||||||

| Composition of Net Assets | ||||||||||||

| Paid-in capital | $ | 37,903,301 | $ | 96,300,212 | $ | 7,944,716 | ||||||

| Total distributable earnings (loss) | (26,224,627 | ) | 120,847,492 | (4,674,441 | ) | |||||||

| Net Assets | $ | 11,678,674 | $ | 217,147,704 | $ | 3,270,275 | ||||||

| Number of shares issued and outstanding (unlimited shares authorized, no par value) | 453,763 | - | 293,835 | |||||||||

| Net asset value per share | $ | 25.74 | - | $ | 11.13 | |||||||

| Net asset value per share per Class: | ||||||||||||

| Investor Class shares: | ||||||||||||

| Net assets applicable to shares outstanding | $ | 162,742,402 | ||||||||||

| Shares of beneficial interest issued and outstanding | 2,631,287 | |||||||||||

| Net asset value per share | $ | 61.85 | ||||||||||

| Institutional Class shares: | ||||||||||||

| Net assets applicable to shares outstanding | $ | 54,405,302 | ||||||||||

| Shares of beneficial interest issued and outstanding | 863,542 | |||||||||||

| Net asset value per share | $ | 63.00 | ||||||||||

The accompanying notes are an integral part of these financial statements.

| Page 15 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF OPERATIONS

For the Six Months Ended June 30, 2024 (Unaudited)

| Alternative Energy Fund | Asia Focus Fund | China & Hong Kong Fund | ||||||||||

| Investment Income | ||||||||||||

| Dividends* | $ | 205,360 | $ | 125,456 | $ | 511,315 | ||||||

| Total income | 205,360 | 125,456 | 511,315 | |||||||||

| Expenses | ||||||||||||

| Advisory fees | 101,645 | 51,616 | 131,732 | |||||||||

| Shareholder servicing plan fees | 30,475 | 6,194 | 12,623 | |||||||||

| Transfer agent fees and expenses | 19,892 | 13,040 | 24,645 | |||||||||

| Fund accounting fee and expenses | 8,359 | 6,956 | 5,772 | |||||||||

| Administration fees | 7,624 | 2,477 | 6,904 | |||||||||

| Custody fees and expenses | 7,791 | 7,149 | 15,650 | |||||||||

| Audit fees | 9,125 | 12,465 | 12,465 | |||||||||

| Legal fees | 14,070 | 4,794 | 15,069 | |||||||||

| Registration fees | 10,969 | 8,776 | 10,969 | |||||||||

| Printing | 8,448 | 5,688 | 4,284 | |||||||||

| Trustees' fees and expenses | 4,762 | 3,890 | 5,143 | |||||||||

| Insurance | 1,068 | 630 | 2,171 | |||||||||

| CCO fees and expenses | 5,607 | 3,722 | 4,684 | |||||||||

| Miscellaneous | 3,120 | 2,442 | 2,565 | |||||||||

| Interest expense | 704 | 68 | 1,883 | |||||||||

| Total expenses | 233,659 | 129,907 | 256,559 | |||||||||

| Less: fees waived and expenses absorbed | (93,194 | ) | (27,640 | ) | - | |||||||

| Net expenses | 140,465 | 102,267 | 256,559 | |||||||||

| Net Investment Income (Loss) | 64,895 | 23,189 | 254,756 | |||||||||

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | ||||||||||||

| Net realized gain (loss) on: | ||||||||||||

| Investments | 998,122 | 342,605 | 658,737 | |||||||||

| Foreign currency | (1,280 | ) | (639 | ) | (97 | ) | ||||||

| 996,842 | 341,966 | 658,640 | ||||||||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||||||

| Investments | (2,113,029 | ) | (347,337 | ) | (3,215,939 | ) | ||||||

| Foreign currency | (701 | ) | (202 | ) | (713 | ) | ||||||

| (2,113,730 | ) | (347,539 | ) | (3,216,652 | ) | |||||||

| Net realized and unrealized gain on investments and foreign currency | (1,116,888 | ) | (5,573 | ) | (2,558,012 | ) | ||||||

| Net Increase (Decrease) in Net Assets from Operations | $ | (1,051,993 | ) | $ | 17,616 | $ | (2,303,256 | ) | ||||

| * | Net of foreign tax withheld of $15,265, $8,893, and $32,457, respectively. |

The accompanying notes are an integral part of these financial statements.

| Page 16 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF OPERATIONS

For the Six Months Ended June 30, 2024 (Unaudited)

| Global Energy Fund | Global Innovators Fund | Renminbi Yuan & Bond Fund | ||||||||||

| Investment Income | ||||||||||||

| Dividends* | $ | 256,165 | $ | 1,226,141 | $ | - | ||||||

| Interest | - | - | 41,396 | |||||||||

| Total income | 256,165 | 1,226,141 | 41,396 | |||||||||

| Expenses | ||||||||||||

| Advisory fees | 44,463 | 754,312 | 9,841 | |||||||||

| Shareholder servicing plan fees | 11,264 | - | 895 | |||||||||

| Investor Class | - | 135,392 | - | |||||||||

| Transfer agent fees and expenses | 10,583 | - | 8,324 | |||||||||

| Investor Class | - | 31,157 | - | |||||||||

| Institutional Class | - | 11,124 | - | |||||||||

| Fund accounting fee and expenses | 5,120 | 12,851 | 4,271 | |||||||||

| Administration fees | 2,846 | 44,643 | 1,359 | |||||||||

| Institutional Class | - | 17,555 | - | |||||||||

| Custody fees and expenses | 7,055 | 9,653 | 1,505 | |||||||||

| Audit fees | 12,465 | 12,465 | 6,483 | |||||||||

| Legal fees | 7,239 | 95,065 | 1,660 | |||||||||

| Registration fees | 8,976 | - | 9,224 | |||||||||

| Investor Class | - | 11,717 | - | |||||||||

| Institutional Class | - | 10,123 | - | |||||||||

| Printing | 4,838 | 9,774 | 3,492 | |||||||||

| Trustees' fees and expenses | 3,592 | 25,885 | 4,290 | |||||||||

| Insurance | 766 | 8,008 | 218 | |||||||||

| CCO fees and expenses | 3,982 | 19,650 | 2,948 | |||||||||

| Miscellaneous | 2,499 | 5,265 | 2,276 | |||||||||

| Interest expense | 476 | - | 541 | |||||||||

| Total expenses | 126,164 | 1,214,639 | 57,327 | |||||||||

| Less: fees waived and expenses absorbed | (39,726 | ) | (30,902 | ) | (40,682 | ) | ||||||

| Net expenses | 86,438 | 1,183,737 | 16,645 | |||||||||

| Net Investment Income (Loss) | 169,727 | 42,404 | 24,751 | |||||||||

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | ||||||||||||

| Net realized gain (loss) on: | ||||||||||||

| Investments | 306,162 | 11,065,160 | 46,589 | |||||||||

| Foreign currency | (620 | ) | (16,350 | ) | 4,271 | |||||||

| 305,542 | 11,048,810 | 50,860 | ||||||||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||||||

| Investments | 672,530 | 22,643,980 | (71,760 | ) | ||||||||

| Foreign currency | (1,546 | ) | (14,922 | ) | (25,411 | ) | ||||||

| 670,984 | 22,629,058 | (97,171 | ) | |||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency | 976,526 | 33,677,868 | (46,311 | ) | ||||||||

| Net Increase (Decrease) in Net Assets from Operations | $ | 1,146,253 | $ | 33,720,272 | $ | (21,560 | ) | |||||

| * | Net of foreign tax withheld of $26,899, $86,312, and $0, respectively. |

The accompanying notes are an integral part of these financial statements.

| Page 17 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| Alternative Energy Fund | Asia Focus Fund | |||||||||||||||

| Six Months Ended June 30, 2024† | Year Ended December 31, 2023 | Six Months Ended June 30, 2024† | Year Ended December 31, 2023 | |||||||||||||

| INCREASE/(DECREASE) IN NET ASSETS FROM: | ||||||||||||||||

| Operations | ||||||||||||||||

| Net investment income (loss) | $ | 64,895 | $ | (95,118 | ) | $ | 23,189 | $ | 47,650 | |||||||

| Net realized gain (loss) on: | ||||||||||||||||

| Investments | 998,122 | 1,538,656 | 342,605 | 103,513 | ||||||||||||

| Foreign currency | (1,280 | ) | (8,719 | ) | (639 | ) | (1,524 | ) | ||||||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||||||||||

| Investments | (2,113,029 | ) | (2,677,379 | ) | (347,337 | ) | 486,800 | |||||||||

| Foreign currency | (701 | ) | 1,105 | (202 | ) | 747 | ||||||||||

| Net increase (decrease) in net assets resulting from operations | (1,051,993 | ) | (1,241,455 | ) | 17,616 | 637,186 | ||||||||||

| Distributions to Shareholders | ||||||||||||||||

| Net dividends and distributions | - | - | - | (126,416 | ) | |||||||||||

| Total distributions to shareholders | - | - | - | (126,416 | ) | |||||||||||

| Capital Transactions | ||||||||||||||||

| Proceeds from shares sold | 2,345,858 | 11,709,728 | 7,944 | 190,960 | ||||||||||||

| Reinvestment of distributions | - | - | - | 104,208 | ||||||||||||

| Cost of shares redeemed | (6,054,413 | ) | (9,390,945 | ) | (513,215 | ) | (927,296 | ) | ||||||||

| Net change in net assets from capital transactions | (3,708,555 | ) | 2,318,783 | (505,271 | ) | (632,128 | ) | |||||||||

| Total increase (decrease) in net assets | (4,760,548 | ) | 1,077,328 | (487,655 | ) | (121,358 | ) | |||||||||

| Net Assets | ||||||||||||||||

| Beginning of period | 28,545,522 | 27,468,194 | 10,895,132 | 11,016,490 | ||||||||||||

| End of period | $ | 23,784,974 | $ | 28,545,522 | $ | 10,407,477 | $ | 10,895,132 | ||||||||

| Capital Share Activity | ||||||||||||||||

| Shares sold | 420,659 | 1,921,700 | 557 | 13,127 | ||||||||||||

| Shares issued on reinvestment | - | - | - | 7,454 | ||||||||||||

| Shares redeemed | (1,098,495 | ) | (1,619,638 | ) | (35,831 | ) | (63,069 | ) | ||||||||

| Net increase (decrease) in shares outstanding | (677,836 | ) | 302,062 | (35,274 | ) | (42,488 | ) | |||||||||

| † | Unaudited |

The accompanying notes are an integral part of these financial statements.

| Page 18 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| China & Hong Kong Fund | ||||||||

| Six Months Ended June 30, 2024† | Year Ended December 31, 2023 | |||||||

| INCREASE/(DECREASE) IN NET ASSETS FROM: | ||||||||

| Operations | ||||||||

| Net investment income | $ | 254,756 | $ | 124,083 | ||||

| Net realized gain (loss) on: | ||||||||

| Investments | 658,737 | (283,913 | ) | |||||

| Foreign currency | (97 | ) | (12,816 | ) | ||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||

| Investments | (3,215,939 | ) | (5,122,961 | ) | ||||

| Foreign currency | (713 | ) | 7,154 | |||||

| Net decrease in net assets resulting from operations | (2,303,256 | ) | (5,288,453 | ) | ||||

| Distributions to Shareholders | ||||||||

| Net dividends and distributions | - | (217,472 | ) | |||||

| Total distributions to shareholders | - | (217,472 | ) | |||||

| Capital Transactions | ||||||||

| Proceeds from shares sold | 336,598 | 428,509 | ||||||

| Reinvestment of distributions | - | 205,736 | ||||||

| Cost of shares redeemed | (2,092,260 | ) | (4,632,033 | ) | ||||

| Net change in net assets from capital transactions | (1,755,662 | ) | (3,997,788 | ) | ||||

| Total decrease in net assets | (4,058,918 | ) | (9,503,713 | ) | ||||

| Net Assets | ||||||||

| Beginning of period | 28,616,547 | 38,120,260 | ||||||

| End of period | $ | 24,557,629 | $ | 28,616,547 | ||||

| Capital Share Activity | ||||||||

| Shares sold | 26,872 | 28,554 | ||||||

| Shares issued on reinvestment | - | 16,498 | ||||||

| Shares redeemed | (173,275 | ) | (334,631 | ) | ||||

| Net decrease in shares outstanding | (146,403 | ) | (289,579 | ) | ||||

| † | Unaudited |

The accompanying notes are an integral part of these financial statements.

| Page 19 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| Global Energy Fund | ||||||||

| Six Months Ended June 30, 2024† | Year Ended December 31, 2023 | |||||||

| INCREASE/(DECREASE) IN NET ASSETS FROM: | ||||||||

| Operations | ||||||||

| Net investment income | $ | 169,727 | $ | 355,529 | ||||

| Net realized gain (loss) on: | ||||||||

| Investments | 306,162 | 488,787 | ||||||

| Foreign currency | (620 | ) | (5,773 | ) | ||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||

| Investments | 672,530 | (760,540 | ) | |||||

| Foreign currency | (1,546 | ) | 1,572 | |||||

| Net increase (decrease) in net assets resulting from operations | 1,146,253 | 79,575 | ||||||

| Distributions to Shareholders | ||||||||

| Net dividends and distributions | - | (503,890 | ) | |||||

| Total distributions to shareholders | - | (503,890 | ) | |||||

| Capital Transactions | ||||||||

| Proceeds from shares sold | 639,275 | 2,669,252 | ||||||

| Reinvestment of distributions | - | 479,183 | ||||||

| Cost of shares redeemed | (2,203,972 | ) | (6,846,920 | ) | ||||

| Net change in net assets from capital transactions | (1,564,697 | ) | (3,698,485 | ) | ||||

| Total increase (decrease) in net assets | (418,444 | ) | (4,122,800 | ) | ||||

| Net Assets | ||||||||

| Beginning of period | 12,097,118 | 16,219,918 | ||||||

| End of period | $ | 11,678,674 | $ | 12,097,118 | ||||

| Capital Share Activity | ||||||||

| Shares sold | 26,358 | 112,039 | ||||||

| Shares issued on reinvestment | - | 21,063 | ||||||

| Shares redeemed | (90,343 | ) | (297,297 | ) | ||||

| Net decrease in shares outstanding | (63,985 | ) | (164,195 | ) | ||||

| † | Unaudited |

The accompanying notes are an integral part of these financial statements.

| Page 20 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| Global Innovators Fund | ||||||||

| Six Months Ended June 30, 2024† | Year Ended December 31, 2023 | |||||||

| INCREASE/(DECREASE) IN NET ASSETS FROM: | ||||||||

| Operations | ||||||||

| Net investment loss | $ | 42,404 | $ | (381,497 | ) | |||

| Net realized gain (loss) on: | ||||||||

| Investments | 11,065,160 | 6,288,736 | ||||||

| Foreign currency | (16,350 | ) | 5,063 | |||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||

| Investments | 22,643,980 | 46,157,466 | ||||||

| Foreign currency | (14,922 | ) | 22,558 | |||||

| Net increase (decrease) in net assets resulting from operations | 33,720,272 | 52,092,326 | ||||||

| Distributions to Shareholders | ||||||||

| Net dividends and distributions: | ||||||||

| Investor Class | - | (5,090,318 | ) | |||||

| Institutional Class | - | (1,712,410 | ) | |||||

| Total distributions to shareholders | - | (6,802,728 | ) | |||||

| Capital Transactions | ||||||||

| Proceeds from shares sold: | ||||||||

| Investor Class | 9,272,876 | 11,892,338 | ||||||

| Institutional Class | 3,380,596 | 6,158,411 | ||||||

| Reinvestment of distributions: | ||||||||

| Investor Class | - | 4,925,474 | ||||||

| Institutional Class | - | 1,010,252 | ||||||

| Cost of shares redeemed: | ||||||||

| Investor Class | (9,268,693 | ) | (13,753,946 | ) | ||||

| Institutional Class | (3,846,761 | ) | (5,989,757 | ) | ||||

| Net change in net assets from capital transactions | (461,982 | ) | 4,242,772 | |||||

| Total increase (decrease) in net assets | 33,258,290 | 49,532,370 | ||||||

| Net Assets | ||||||||

| Beginning of period | 183,889,414 | 134,357,044 | ||||||

| End of period | $ | 217,147,704 | $ | 183,889,414 | ||||

| Capital Share Activity | ||||||||

| Shares sold: | ||||||||

| Investor Class | 161,698 | 244,865 | ||||||

| Institutional Class | 58,065 | 128,038 | ||||||

| Shares issued on reinvestment: | ||||||||

| Investor Class | - | 98,628 | ||||||

| Institutional Class | - | 19,887 | ||||||

| Shares redeemed: | ||||||||

| Investor Class | (162,925 | ) | (293,204 | ) | ||||

| Institutional Class | (66,388 | ) | (126,312 | ) | ||||

| Net decrease in shares outstanding | (9,550 | ) | 71,902 | |||||

| † | Unaudited |

The accompanying notes are an integral part of these financial statements.

| Page 21 |

GUINNESS ATKINSON™ FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| Renminbi Yuan & Bond Fund | ||||||||

| Six Months Ended June 30, 2024† | Year Ended December 31, 2023 | |||||||

| INCREASE/(DECREASE) IN NET ASSETS FROM: | ||||||||

| Operations | ||||||||

| Net investment income | $ | 24,751 | $ | 85,574 | ||||

| Net realized gain (loss) on: | ||||||||

| Investments | 46,589 | (233,328 | ) | |||||

| Foreign currency | 4,271 | (23,521 | ) | |||||

| Net change in unrealized appreciation (depreciation) on: | ||||||||

| Investments | (71,760 | ) | 147,559 | |||||

| Foreign currency | (25,411 | ) | 9,058 | |||||

| Net decrease in net assets resulting from operations | (21,560 | ) | (14,658 | ) | ||||

| Distributions to Shareholders | ||||||||

| Net dividends and distributions | - | (328 | ) | |||||

| Return of capital | - | (23,720 | ) | |||||

| Total distributions to shareholders | - | (24,048 | ) | |||||

| Capital Transactions | ||||||||

| Proceeds from shares sold | 7,472 | 308,641 | ||||||

| Reinvestment of distributions | - | 21,124 | ||||||

| Cost of shares redeemed | (496,573 | ) | (1,182,680 | ) | ||||

| Net change in net assets from capital transactions | (489,101 | ) | (852,915 | ) | ||||

| Total decrease in net assets | (510,661 | ) | (891,621 | ) | ||||

| Net Assets | ||||||||

| Beginning of period | 3,780,936 | 4,672,557 | ||||||

| End of period | $ | 3,270,275 | $ | 3,780,936 | ||||

| Capital Share Activity | ||||||||

| Shares sold | 670 | 26,692 | ||||||

| Shares issued on reinvestment | - | 1,888 | ||||||

| Shares redeemed | (44,484 | ) | (105,664 | ) | ||||

| Net decrease in shares outstanding | (43,814 | ) | (77,084 | ) | ||||

| † | Unaudited |

The accompanying notes are an integral part of these financial statements.

| Page 22 |

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout each period.

| Six Months Ended | Year Ended December 31, | |||||||||||||||||||||||

| Alternative Energy Fund | June 30, 2024† | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||

| Net asset value, beginning of period | $ | 5.72 | $ | 5.86 | $ | 6.71 | $ | 6.19 | $ | 3.32 | $ | 2.55 | ||||||||||||

| Income from investment operations: | ||||||||||||||||||||||||

| Net investment income (loss) | 0.02 | (0.02 | ) | (0.05 | ) | (0.06 | ) | (0.03 | ) | (0.01 | ) | |||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency | (0.23 | ) | (0.12 | ) | (0.80 | ) | 0.58 | 2.90 | 0.78 | |||||||||||||||

| Total from investment operations | (0.21 | ) | (0.14 | ) | (0.85 | ) | 0.52 | 2.87 | 0.77 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||||||

| From net investment income | - | - | - | - | - | - | ||||||||||||||||||

| Total distributions | - | - | - | - | - | - | ||||||||||||||||||

| Net asset value, end of period | $ | 5.51 | $ | 5.72 | $ | 5.86 | $ | 6.71 | $ | 6.19 | $ | 3.32 | ||||||||||||

| Total return | (3.67 | )%(1) | (2.39 | )% | (12.67 | %) | 8.40 | % | 86.45 | % | 30.20 | % | ||||||||||||

| Ratios/supplemental data: | ||||||||||||||||||||||||

| Net assets, end of period (millions) | $ | 23.8 | $ | 28.5 | $ | 27.5 | $ | 32.2 | $ | 26.9 | $ | 9.2 | ||||||||||||

| Ratio of expenses to average net assets: | ||||||||||||||||||||||||

| Before fee waived/recaptured | 1.84 | %(2) | 1.79 | % | 1.90 | % | 1.73 | % | 2.46 | % | 3.00 | % | ||||||||||||

| After fees waived/recaptured (3) | 1.11 | %(2)(4) | 1.48 | % | 1.98 | % | 1.98 | % | 1.98 | % | 1.98 | % | ||||||||||||

| Ratio of net investment income (loss) to average net assets: | ||||||||||||||||||||||||

| Before fees waived/recaptured | (0.22 | %)(2) | (0.62 | %) | (0.79 | %) | (0.61 | %) | (1.40 | %) | (1.15 | %) | ||||||||||||

| After fees waived/recaptured | 0.01 | (2) | (0.31 | %) | (0.87 | %) | (0.86 | %) | (0.92 | %) | (0.13 | %) | ||||||||||||

| Portfolio turnover rate | 11.04 | %(1) | 16.38 | % | 17.75 | % | 29.03 | % | 35.00 | % | 43.19 | % | ||||||||||||

| † | Unaudited |

| (1) | Not annualized |

| (2) | Annualized |

| (3) | The Advisor has contractually agreed to limit the operating expenses of the Fund to 1.10%, prior to June 1, 2023, the limit on operating expenses was 1.98%, excluding interest expense, expenses related to dividends on short positions, brokerage commissions, taxes and other extraordinary expenses. See Note 3. |

| (4) | If interest expense had been excluded, expenses would have been lowered by 0.01% for the period ended June 30, 2024. |

The accompanying notes are an integral part of these financial statements.

| Page 23 |

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout each period.

| Six Months Ended | Year Ended December 31, | |||||||||||||||||||||||

| Asia Focus Fund | June 30, 2024† | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||

| Net asset value, beginning of period | $ | 14.83 | $ | 14.17 | $ | 20.36 | $ | 23.76 | $ | 20.03 | $ | 16.58 | ||||||||||||

| Income from investment operations: | ||||||||||||||||||||||||

| Net investment income (loss) | 0.04 | 0.07 | 0.02 | (0.08 | ) | 0.01 | 0.21 | |||||||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency | 0.01 | 0.76 | (5.73 | ) | (1.46 | ) | 5.09 | 4.56 | ||||||||||||||||

| Total from investment operations | 0.05 | 0.83 | (5.71 | ) | (1.54 | ) | 5.10 | 4.77 | ||||||||||||||||