☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Pursuant to §240.14a-12 | |

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

May 17, 2024 |

|

|

Dear Fellow Stockholders:

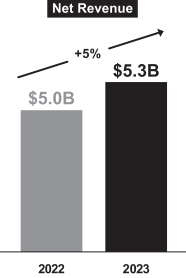

Fiscal 2023 was a strong year for AEO. We achieved record revenue of $5.3 billion. We also saw operating income of $223 million, and adjusted operating income(1) of $375 million, which increased 39% compared to Fiscal 2022. Our customer file reached an all-time high, underscoring the strength of our iconic brand portfolio and world-class operations.

I’m very proud of how our team delivered this year. We continued to lead with innovation, introducing exciting new merchandise collections and customer experiences, while embracing new technologies to further strengthen our operations.

It was also a pivotal year for the company. We initiated a comprehensive review of our |

business, as we seek to unlock stronger profitability and more consistent returns to stockholders. This work helped fuel a significant turnaround in revenue and profit in the second half of the year, contributing to our strong full-year results.

As I look back on the year, I am particularly proud of the following achievements:

| • |

Revenue of $5.3 billion rose 5%, marking a new record. We saw broad-based strength across brands and channels. |

| • |

Operating income of $223 million and $375 million in adjusted operating income.(1) Adjusted operating income increased 39% compared to Fiscal 2022, our second-highest result since 2012. |

| • |

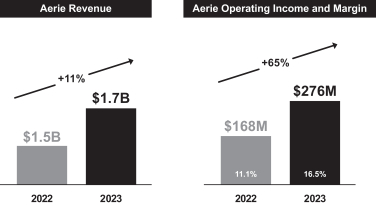

Aerie delivered exceptional growth and profit expansion. Record revenue of $1.7 billion rose 11% from Fiscal 2022, with operating income of $276 million, up 65%. We continued to expand our customer base and delivered a winning assortment across intimates, soft apparel and OFFLINE, our exciting activewear sub-brand. |

| • |

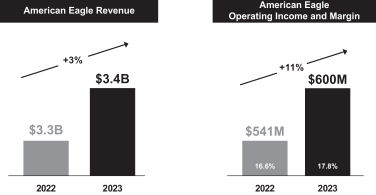

American Eagle expanded revenue while continuing to build profitability. Revenue of $3.4 billion was up 3% from Fiscal 2022, with operating margin expanding 120 basis points to 17.8%. We also grew American Eagle’s customer file, delivering early proof points of our focus on driving profitable growth. |

| • |

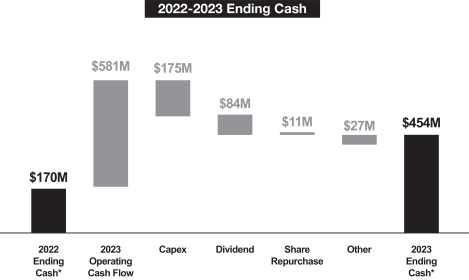

Strong operating cash flow of $581 million enabled us to invest in our brands and return $104 million in cash to stockholders. This included a 25% increase in our quarterly cash dividend and one million shares repurchased during the year. Additionally, we authorized 30 million shares for future repurchases. |

| • |

As we look to strengthen the organization and improve profitability, management took action to streamline business priorities. This included restructuring the company’s international operations and fulfillment network to focus on core capabilities that serve our brands and best customers. |

| • |

We welcomed new leadership to the organization. As part of our succession plan for our Chief Operations Officer transition, we established two new positions to focus on key areas of our business. Sarah Clarke joined as our Chief Supply Chain Officer, responsible for managing AEO’s global supply chain from sourcing through distribution. Valerie van Ogtrop was appointed as Head of Brand Operations, a newly created role designed to drive greater brand collaboration while fueling growth and profitability across American Eagle and Aerie. |

| • |

Furthering our commitment to transparency, we published our second “Building a Better World” report. This highlighted progress toward our Planet (environment), People (social) and Practices (governance) goals. Our commitment to continued transparency was rewarded by MSCI with an upgrade of our rating from “BBB” to “A.” |

| 2024 Proxy Statement

|

|

|

1

|

Building on our achievements and profit improvement work initiated in Fiscal 2023, in Fiscal 2024 we launched “Powering Profitable Growth,” our new long-term corporate strategy that aims to set AEO on a path to deliver consistent, profitable growth from here. Our plan is centered on three main pillars:

| • | Amplify our brands. |

| • | Execute with financial discipline. |

| • | Optimize our operations, structuring the company to grow revenue at a three to five percent compound annual growth rate (“CAGR”) and operating income at a mid-to-high teens CAGR through Fiscal 2026. |

We entered Fiscal 2024 well positioned with industry-leading brands, a solid balance sheet and best-in-class operations. American Eagle is the largest, most consistent youth brand—dressing generations of customers. Aerie has a powerful brand platform with an amazing community of customers and significant opportunity to grow brand awareness. We continue to deliver the best shopping experience across digital and stores.

As we embark on this next chapter, I could not be more excited about our future. We remain steadfast in operating the business with balance; staying agile and flexible to capitalize on demand opportunities, while optimizing profitability for the future. We believe that we are built to last and well positioned for success.

On a more somber note, I am deeply saddened by the recent passing of Thomas R. Ketteler, who was a member of AEO’s Board of Directors and an invaluable advisor from 1981 to 2021. He served as a member of the Audit, Compensation and Nominating, Governance and Corporate Social Responsibility Committees.

Tom’s financial expertise, keen ability to provide meaningful perspective and passion for the company were truly unrivaled. He was a cherished business partner to me for decades and was instrumental in growing AEO’s business from its earliest days. We will remember Tom with the highest regard and remain grateful for his incredible service, commitment and friendship.

On behalf of the Board of Directors and our entire team at AEO, thank you for your continued support.

Jay L. Schottenstein

Executive Chairman of the Board and Chief Executive Officer

| (1) | Adjusted operating income is a financial measure that is not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”), which is commonly referred to as a non-GAAP or adjusted measure. See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures. |

| 2

|

|

|

|

Notice of Annual Meeting of Stockholders of American Eagle Outfitters, Inc.

|

Meeting Time and Date: 11:00 a.m., Eastern Daylight Time on Thursday, June 27, 2024

Virtual Meeting Location: American Eagle Outfitters, Inc. (“AEO,” the “Company,” “us,” and “we”) will have a virtual-only meeting of stockholders in 2024 (the “2024 Annual Meeting”), conducted exclusively via live audiocast. There will not be a physical location for the 2024 Annual Meeting, and you will not be able to attend the meeting in person. See below for important information.

|

||||||||||

| To Our Stockholders: |

Vote Your Shares Right Away | |||||||||

| We will hold our 2024 Annual Meeting on Thursday, June 27, 2024. Stockholders will be asked to vote on the following proposals:

1. The election of Janice E. Page, David M. Sable and Noel J. Spiegel as Class II directors to serve until the 2027 Annual Meeting of Stockholders;

2. The ratification of the selection of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for Fiscal 2024;

3. A non-binding, advisory vote by stockholders of the Fiscal 2023 compensation of our named executive officers (“say on pay” vote); and

4. Such other business as may properly come before the meeting or any adjournment or postponement thereof.

The Board of Directors (“Board”) is soliciting proxies to be used at the 2024 Annual Meeting. We will first release the Proxy Statement and the form of proxy to stockholders beginning on May 17, 2024.

The 2024 Annual Meeting will be held exclusively online via live webcast. This format allows stockholders to attend from any location around the world, at no cost to them. While you will not be able to attend the meeting at a physical location, you will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting.

To participate in the 2024 Annual Meeting, you must first register at http://viewproxy.com/ae/2024/htype.asp. You will receive a meeting invitation by email with your unique join link, along with a password, prior to the meeting date. Whether you plan to virtually attend the 2024 Annual Meeting, we encourage you to vote and submit your proxy in advance of the meeting by one of the methods described to the right on this page. You also may vote online during the 2024 Annual Meeting by following the instructions provided on the meeting website during the 2024 Annual Meeting. For more information, please see page 77.

By order of the Board of Directors,

Jennifer B. Stoecklein Corporate Secretary May 17, 2024 |

HOW TO VOTE

Your vote is important. You are eligible to vote if you were a stockholder of record at the close of business on May 1, 2024.

Please read the Proxy Statement and vote right away using any of the following methods.

STOCKHOLDERS OF RECORD

|

|||||||||

| Vote by Internet |

www.AALvote.com/AEO

|

|||||||||

| Vote by Telephone |

1 (866) 804-9616

|

|||||||||

| Vote by Mail |

Mail your signed proxy card

|

|||||||||

|

BENEFICIAL STOCKHOLDERS

If you are a beneficial owner, you will receive instructions from your bank, broker or other nominee that you must follow in order for your shares to be voted. Many of these institutions offer telephone and online voting.

|

||||||||||

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING The Notice of Annual Meeting, the accompanying Proxy Statement, and our Annual Report for the fiscal year ended

|

| 2024 Proxy Statement

|

|

|

3

|

Forward-Looking Statements and Website Information

This Proxy Statement contains various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), including, without limitation, in our CEO’s letter to our stockholders and our Compensation Discussion and Analysis, which represent our expectations or beliefs concerning future events, including our forward-looking statements. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “strategy,” “targets,” “will,” “would,” or other words of similar meaning. Without limiting the generality of the foregoing, forward-looking statements contained in this proxy statement include expectations of future stock price performance as it relates to our compensation programs, our ability to successfully implement and execute our environmental, social and governance (“ESG”) initiatives and goals, and whether we are able to achieve the anticipated results of such initiatives and goals. These forward-looking statements rely on assumptions and involve risks and uncertainties, many of which are beyond our control, including, but not limited to, factors detailed herein and under Part I, “Item 1A. Risk Factors” and in other sections of our most recent Annual Report on Form 10-K and in our other filings with the Securities and Exchange Commission (“SEC”).

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on our forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and, except as required by law, we undertake no duty to update or revise any forward-looking statement.

This document includes several website addresses. The content of any websites and materials named, hyperlinked or otherwise referenced herein are not incorporated by reference into this Proxy Statement or in any other report or document we file with the SEC. These website addresses are intended to provide inactive, textual references only. The information on these websites is not part of this Proxy Statement.

| 4

|

|

|

|

Table of Contents

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 12 | ||||

| 13 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 17 | ||||

| 17 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 38 | ||||

| 39 | ||||

| PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 41 | |||

| 41 | ||||

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND SERVICES |

42 | |||

| PROPOSAL THREE: ADVISORY APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 43 | |||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| Fiscal 2023 Overview, Compensation Program Objectives and Philosophy |

46 | |||

| 46 | ||||

| 2024 Proxy Statement

|

|

|

5

|

| 6

|

|

|

|

| SUBMISSION OF DIRECTOR NOMINATIONS AND STOCKHOLDER PROPOSALS |

81 | |||

| 81 | ||||

| May I submit a stockholder proposal for next year’s Annual Meeting? |

81 | |||

| 82 | ||||

| 82 | ||||

| 82 | ||||

| A-1 | ||||

| A-1 | ||||

| 2024 Proxy Statement

|

|

|

7

|

PROXY SUMMARY

In this Proxy Statement, American Eagle Outfitters, Inc. (together with its subsidiaries) is referred to as “AEO,” the “Company,” “we,” “us” or “our.” References throughout this Proxy Statement to “Fiscal 2023” refer to our fiscal year ended February 3, 2024.

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) to vote your shares at the Annual Meeting of Stockholders to be held on June 27, 2024, at 11:00 a.m., Eastern Daylight time (“2024 Annual Meeting”), and at any adjournment or postponement thereof. This Proxy Statement is first being mailed or released to the stockholders on May 17, 2024.

This summary highlights information contained in this Proxy Statement. It does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting. Please see “Information about this Proxy Statement and the Annual Meeting” beginning on page 77.

In order to attend the 2024 Annual Meeting, you must register at http://viewproxy.com/ae/2024/htype.asp by 11:59 p.m. Eastern Daylight Time on June 24, 2024. On the day of the 2024 Annual Meeting, if you have properly registered, you may enter the meeting by clicking on the link provided and the password you received via email in your registration confirmations. There will not be a physical meeting location, and you will not be able to attend the meeting in person. Please see page 79 for important information.

| 2024 Annual Meeting of Stockholders

| ||||||

|

|

June 27, 2024 11:00 a.m., Eastern Daylight Time

|

|

Virtual Meeting Only Register at http://viewproxy.com/ae/2024/ htype.asp by 11:59 p.m. Eastern Daylight Time on June 24, 2024 in order to attend the meeting.

| |||

| Voting Matters

| ||||

| Your vote is very important to us and our business. Please cast your vote immediately on all of the proposals to ensure that your shares are represented.

| ||||

|

|

Board Recommendation |

For More Information | ||

| PROPOSAL 1 — Election of Class II Directors | FOR | See page 17 | ||

| The three Class II Director nominees possess the necessary qualifications and range of experience and expertise to provide effective oversight and advice to management |

|

| ||

| PROPOSAL 2 — Ratify the appointment of EY as the Company’s independent registered public accounting firm for Fiscal 2024 | FOR | See page 41 | ||

| The Board’s Audit Committee has approved the appointment of EY as the Company’s independent auditor for Fiscal 2024. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of EY |

|

| ||

| PROPOSAL 3 — Fiscal 2023 Say-on-Pay Vote | FOR | See page 43 | ||

| The Company’s executive compensation programs are designed to create a direct link between stockholders’ interests and those of management, with incentives specifically tailored to the achievement of financial, operational, and stock performance goals |

|

| ||

| 8

|

|

|

|

| PROXY STATEMENT SUMMARY |

Business Highlights Fiscal 2023: Overview

Fiscal 2023 was a strong year for AEO, with revenue increasing 5% to $5.3 billion. We saw operating income of $223 million, and adjusted operating income(1) of $375 million which increased 39% compared to Fiscal 2022. Performance was driven by results in the second half of the year as we began to see benefits stemming from our profit improvement initiative, which started early in the year.

Revenue across brands gained momentum, with sequential improvements throughout the year. In the fourth quarter, American Eagle and Aerie each delivered record sales and positive comparable sales. Strong merchandise collections, product innovation and brand growth initiatives fueled revenue. Sales trends across selling channels were also strong, with a continued focus on delivering an exceptional customer experience. For the year, Aerie brand revenue rose 11% to $1.7 billion and American Eagle brand revenue of $3.4 billion increased 3%.

Profit margins expanded significantly in Fiscal 2023, reflecting AEO’s comprehensive review of the business to strengthen profitability. Positive revenue growth and management’s focus on inventory management, cost controls, lower product costs and efficiency gains were major drivers of margin expansion. GAAP operating margin was 4.2%. Excluding impairment and restructuring charges, the adjusted operating margin(1) of 7.1% expanded 170 basis points driven by improvement across brands.

AEO generated strong cash flow and ended the year in a healthy financial position. Cash and investments more than doubled from last year, reaching $454 million at year end. Reflecting improved financial performance and a healthy balance sheet, in December 2023, we announced a 25% increase in our quarterly cash dividend. In January 2024, AEO repurchased one million shares and in February 2024 authorized 30 million shares for future repurchases. This underscores management’s confidence in the strength of the business and commitment to returning cash to stockholders.

Fiscal 2023 Key Operating Highlights:

Record Revenue

| • | Consolidated revenue increased 5% to a record $5.3 billion. Comparable sales increased 3%. Revenue was strong across brands and channels. |

| • | Aerie revenue grew 11% with comparable sales up 8%. American Eagle revenue rose 3% with comparable sales up 1% for the year. |

| • | Both store and digital revenue increased 6%, driven by positive traffic and higher transactions. |

| (1) | Adjusted operating income and adjusted operating margin are non-GAAP or adjusted measures. See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures. |

| 2024 Proxy Statement

|

|

|

9

|

| PROXY STATEMENT SUMMARY |

Meaningful Operating Income and Margin Recovery

| • | We delivered $223 million in operating income, reflecting a GAAP operating margin of 4.2%, and $375 million in adjusted operating income,(1) reflecting an adjusted operating margin(1) of 7.1%. This compared to operating income of $247 million and adjusted operating income of $269 million in Fiscal 2022, which reflected a GAAP operating margin of 5.0% and an adjusted operating margin of 5.4%. |

| • | The 39% growth in adjusted operating income(1) was driven by strong revenue growth as well as profit improvement initiatives launched in the early part of the year. |

| • | The profit improvement project involved a comprehensive review of business strategy and operations aimed at identifying areas to drive growth and strengthen margins. |

| • | These actions primarily impacted top line and the gross margin, which expanded 350 basis points, or 370 basis points on an adjusted basis,(1) in the year and drove the 170 basis point increase in the full-year adjusted operating margin. |

Aerie Delivered Exceptional Growth and Profit Expansion

| • | Aerie revenue of $1.7 billion rose 11% with comparable sales up 8%. Growth was led by soft apparel and OFFLINE, Aerie’s activewear sub-brand. |

| • | New store expansion continued to build greater awareness and Aerie approached a new milestone of 11 million customers. |

| • | Operating income of $276 million increased 65% to last year driven by lower markdowns, improved product and freight costs and product mix benefits from expansion in the soft apparel and OFFLINE businesses. |

| • | The operating margin expanded 540 basis points to 16.5%. |

American Eagle Expanded Revenue While Continuing to Build Profitability

| • | American Eagle revenue of $3.4 billion increased 3% with comparable sales growing 1%. Growth was led by women’s apparel reflecting strong merchandise collections across tops and bottoms as the brand pivoted to pursuing profitable growth. |

| • | Compelling marketing and customer engagement strategies supported expansion in the customer file to approximately 17 million. |

| • | Operating income of $600 million increased 11% to last year driven by lower markdowns, improved product and freight costs and product mix benefits from expansion in women’s tops. |

| • | The operating margin expanded 120 basis points to 17.8%. |

| (1) | Adjusted operating income and adjusted operating margin are non-GAAP or adjusted measures. See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures. |

| 10

|

|

|

|

| PROXY STATEMENT SUMMARY |

Improved Cash Flow Fueled Strong Returns to Stockholders

| • | AEO generated $581 million in cash flow from operations. Our cash and investments balance more than doubled to last year, reaching $454 million at year end. |

| • | Reflecting improved financial performance and a healthy balance sheet, in December 2023, the Company announced a 25% increase in its quarterly cash dividend. In January 2024, the Company repurchased one million shares, and in February 2024 authorized 30 million shares for future repurchases. This underscores management’s confidence in the strength of the business and commitment to returning cash to stockholders. |

| * | Includes short-term investments |

| 2024 Proxy Statement

|

|

|

11

|

| PROXY STATEMENT SUMMARY |

Our Look Forward

Powering Profitable Growth Strategy

Building on momentum and strong results achieved in Fiscal 2023, in March 2024, the Company unveiled its new Powering Profitable Growth strategic plan. The plan is structured to deliver mid-to-high teens annual operating income growth on 3%-5% annual revenue growth through Fiscal 2026, and an approximate 10% operating margin by Fiscal 2026.

Fueled by a shift in strategy, culture and focus to generate stronger profitability on continued growth, Powering Profitable Growth is centered around three key pillars:

| • | Amplify our brands, |

| • | Execute with financial discipline, and |

| • | Optimize operations. |

We expect to grow American Eagle, focusing on market leadership in denim and expanding into category adjacencies where the company believes it has a right to win. We also expect to continue to fuel Aerie’s expansion, by building brand awareness and accelerating activewear opportunities with OFFLINE. We are leveraging best-in-class operating capabilities to fuel our growth and profit roadmap and we believe we have structured the organization to deliver consistent profit growth and stockholder returns.

A Focused Playbook for Fiscal 2024

Entering Fiscal 2024, we believe that we are well positioned with industry leading brands, a solid balance sheet, best-in-class operations and a clear strategy to drive value for our stockholders. We remain steadfast in operating the business with balance and staying agile and flexible to capitalize on demand opportunities, while optimizing profitability for the foreseeable future.

| 12

|

|

|

|

| PROXY STATEMENT SUMMARY |

Board and Corporate Governance Highlights

Our Board believes that strong corporate governance is essential to achieving long-term stockholder value and we are committed to maintaining an effective governing framework. We continually evaluate our corporate governance policies and practices against emerging issues and prevailing best practices to ensure that we maintain a balance of ideas and individuals in the boardroom. We believe that this practice best serves the interests of our many stakeholders and helps to enable effective oversight of the Company’s strategy and management. Below are highlights of our corporate governance framework.

| • | Highly Talented, Skilled and Diverse Board of Directors. Our Board embodies a broad and diverse set of experiences, qualifications, attributes, skills and viewpoints that are vital to the success of our Company. The strength of our Board members, in turn, strengthens the Board’s ability to carry out its oversight role on behalf of our stockholders. See the table on page 28 for a summary of the range of skills and experiences that each director brings to the Board, and that we find to be relevant to our business. |

| • | Six of Our Seven Directors and All of Our Committee Members Are Independent. The Board is composed of seven directors, with only one non-independent director—our CEO, Jay Schottenstein, who has served in the current CEO role since 2015. Mr. Schottenstein has served as Chairman of our Board since 1992 and as our CEO on multiple occasions throughout our history. Only our independent directors serve on each of our three standing Board committees. |

| • | Robust Lead Independent Director Role. Our current Lead Independent Director, Mr. Spiegel, has substantial duties specifically documented in our Corporate Governance Guidelines, including presiding over meetings of our independent directors, providing input on materials sent to the Board, and approving Board meeting schedules to ensure that there is sufficient time for Board discussion and deliberation. |

| • | Highly Engaged Board of Directors. Our Board and its Committees held a total of 40 meetings during Fiscal 2023 with a 99% aggregate attendance rate. Directors may contact members of management directly and our Board and its Committees may engage independent advisors at their sole discretion. |

| • | Meaningful and Appropriate Risk Oversight. Our Board and its Committees actively monitor and oversee the Company’s risk management program including strategic, competitive, economic, operational, financial, legal, regulatory, cybersecurity, ESG, compliance and reputational risks. |

| • | Focused and Thoughtful Approach to Director Recruiting. The Nominating, Governance and Corporate Social Responsibility Committee (the “Nominating Committee”), with the assistance of an outside search firm, is continuing its search to identify, evaluate and conduct due diligence on potential director candidates to further strengthen our Board in the future. |

| • | Protections Against Director Overboarding. The Board appreciates that serving on a public board of directors is a significant responsibility and time commitment. To this end, the Board has approved a policy in our Corporate Governance Guidelines to review and limit the number of public company boards on which our directors may serve. Board members who are executive officers of other public companies may not serve on more than two public company boards, and Board members who are retired from full-time employment may not serve on more than four public company boards. Additionally, our CEO may not serve on more than one other public company board unless otherwise determined by the Nominating Committee. |

| • | Strong Director Education Program. AEO has a robust director education program to enhance our directors’ knowledge on topics and risks relevant to oversight of our business. Our directors regularly hear from third-party experts on topics pertinent to our industry and the Company. |

| • | Meaningful Stock Ownership Requirements. We maintain stock ownership guidelines that are applicable to our directors and executives. Our non-employee directors must, within five years of joining the Board, hold Company stock worth at least five times their annual cash retainer. In the case of our CEO, the stock ownership guideline is six times his base salary and, in the case of our other named executive officers, the guideline is three times their respective base salaries. |

| • | Director Elections by Majority Vote with Resignation Policy. In an uncontested election, our directors are elected by a majority of votes cast and, if a director does not receive a majority of votes cast, he or she must promptly tender his or her resignation to the Board (with the Board determining whether to accept or reject such resignation, taking into consideration the Nominating Committee’s recommendation on whether to accept or reject such resignation). |

| • | Prohibition on Hedging or Pledging Company Stock. We maintain “no hedging” and “no pledging” policies that generally prohibit directors and employees from engaging in hedging or pledging transactions with respect to our stock. |

| • | Ongoing Stockholder Engagement. As a matter of policy and practice, we foster and encourage engagement with our stockholders on an ongoing basis. We welcome feedback and value regular dialogue with our stockholders. Further information regarding our Fiscal 2023 stockholder engagement is outlined on page 35. |

| 2024 Proxy Statement

|

|

|

13

|

| PROXY STATEMENT SUMMARY |

Director Snapshot

| Name | Age | Director Since |

Occupation | Independent | Current Committee Memberships |

Other Current Public Company Directorships | ||||||||

| Sujatha Chandrasekaran | 56 | 2018 | Former Senior Executive Vice President, Chief Digital and Information Officer, CommonSpirit Health | Yes |

|

• AC • CC • NC |

|

• Cardinal Health • Brenntag SE (ETR: BNR) • ATOS (PAR: ATO) | ||||||

| Deborah A. Henretta | 62 | 2019 | Former Group President, Procter & Gamble Global Beauty | Yes |

|

• AC • CC • NC |

|

• Corning, Inc. • Meritage Homes Corporation • NiSource | ||||||

| Cary D. McMillan | 66 | 2007 | Former Chief Executive Officer of True Partners Consulting, LLC | Yes |

|

• AC • CC† • NC |

|

• Hyatt Corporation (NYSE: H) | ||||||

| Janice E. Page | 75 | 2004 | Former Group Vice President of Sears | Yes |

|

• AC • NC† • CC |

|

— | ||||||

| David M. Sable | 70 | 2013 | Vice Chair of Stagwell | Yes |

|

• AC • CC • NC |

|

• Ethan Allen Interiors Inc. (NYSE: ETD) | ||||||

| Jay L. Schottenstein | 69 | 1992 | Chief Executive Officer of the Company | No | — | • Designer Brands Inc. (NYSE: DBI) | ||||||||

| Noel J. Spiegel* | 76 | 2011 | Former Deputy Managing Partner at Deloitte & Touche, LLP | Yes |

|

• AC† • CC • NC |

|

• Radian Group Inc. (NYSE: RDN) | ||||||

AC Audit Committee

CC Compensation Committee

NC Nominating Committee

† Committee Chair

* Lead Independent Director

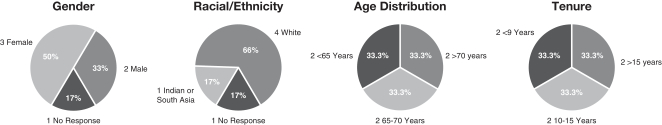

We believe diversity can and should be described and defined in many different ways. We encourage our associates and directors to bring their authentic selves to their work, but we also believe that, like our associates, our board members have the right to choose to identify whether or to what extent they belong to a particular community, including underrepresented communities. The following charts are based on the independent directors who have chosen to self-identify and have consented to disclosure:

| 14

|

|

|

|

| PROXY STATEMENT SUMMARY |

ESG Risk Oversight Highlights

AEO’s ESG strategy—Building a Better World—was launched in 2021 and is grounded in the pillars of Planet (Environment), People (Social) and Practices (Governance). The Board takes a comprehensive approach to its ESG risk oversight role, including ensuring that management is effectively aligning the Company’s ESG strategy with its business strategy, capturing ESG risk specifically in all risk management oversight, and understanding the evolution of the Company’s ESG communication strategy, quality of the program data, transparency of the Company’s disclosures, and the overall materiality of the program, its goals and its purpose. For highlights of our goals and achievements made through our ESG initiatives, see “ESG at AEO (“Building a Better World”)” beginning on page 36 of this Proxy Statement. For a more detailed description of AEO’s program, please visit investors.ae.com/esg/. Our website, ESG Report, and ESG information contained therein specifically are not part of or incorporated into this Proxy Statement.

Cybersecurity Risk Oversight Highlights

The Board actively engages in an ongoing understanding and oversight of of cyber risks. During Fiscal 2023, the Board focused on the following best practices to stay current with its obligations and commitments to all relevant stakeholders in this area:

| • | Empowering management to embrace a “trust by design” philosophy when developing or evaluating new technology, products, and business arrangements. |

| • | Educating itself about industry best practices and management’s processes to identify, assess and oversee the risk associated with service providers and third parties involved in the Company’s supply chain. |

| • | Ensuring rigorous third-party assessment of AEO’s cyber risk management program. |

| • | Enhancing enterprise resilience by ensuring management has conducted and reported on rigorous simulations and arranging protocols with third-party specialists before a crisis exits. |

| • | Understanding escalation protocols for when the Board should be notified, including incidents involving ransomware. |

| • | Staying attuned through targeted director education, both individually and collectively, about evolving oversight practices, mandatory disclosures, reporting structures, and metrics. For example, Ms. Chandrasekaran holds an NACD cybersecurity oversight CERT certification. |

Compensation Highlights from Fiscal 2023

Fiscal 2023 was marked by strong performance, producing record revenue and significant gains in adjusted operating income.(1) Our leaders were at the forefront of efforts to improve profitability and streamline strategic priorities. The strength of their business and leadership capabilities were key to the delivery of our results, and overall compensation was linked to the strength of our performance.

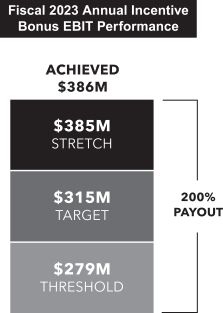

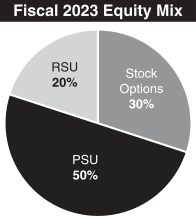

| • | Strong EBIT(1) results supported a 200% bonus payment for Fiscal 2023. |

| • | Relative TSR (“RTSR”)(2) achievement over the three-year performance period ended February 3, 2024 resulted in the performance-based restricted stock units (“PSUs”) granted in Fiscal 2021 being earned at 85% of target. |

| (1) | Adjusted operating income and EBIT are non-GAAP or adjusted measures. See Appendix A of this Proxy Statement for additional detail on adjusted results and other important information regarding the use of non-GAAP or adjusted measures. |

| (2) | For the 2021 PSUs, RTSR performance was measured against performance of the S&P 1500 Specialty Retail Index. |

| 2024 Proxy Statement

|

|

|

15

|

| PROXY STATEMENT SUMMARY |

Additional specific executive compensation highlights for Fiscal 2023 include:

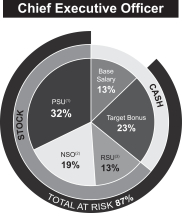

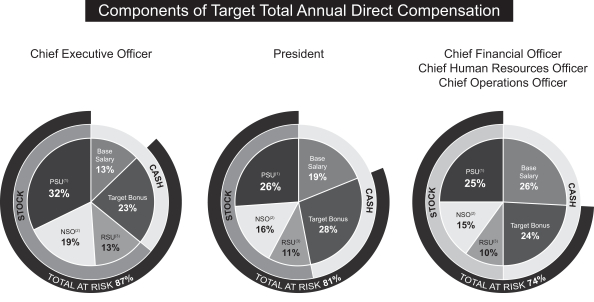

| • | Alignment of CEO Pay with Performance. For Fiscal 2023, a full 87% of our CEO’s target compensation was at risk and subject to the achievement of performance goals and changes in stockholder value, as demonstrated in the chart below. |

| (1) | PSUs are defined as performance-based restricted stock units |

| (2) | NSOs are defined as nonqualified stock options |

| (3) | RSUs are defined as time-based restricted stock units |

| • | Independent Compensation Consultant. The Compensation Committee retained an independent compensation consulting firm, Frederic W. Cook & Co., Inc. (“FW Cook”), to advise on matters related to the CEO’s and other executives’ compensation. FW Cook does not provide any other services to the Company (other than its services for the Compensation Committee). |

| • | No Payment of Dividends on Unearned/Unvested Awards. We do not pay dividends or dividend equivalents on unearned and/or unvested equity incentive awards. |

| • | Clawback Policy. In connection with the SEC’s and NYSE’s new rules requiring adoption of a clawback policy applicable to incentive-based compensation for executive officers of listed companies, the Company has adopted an Incentive Based Compensation Recovery Policy (the “Clawback Policy”). Current executive officers of the Company have agreed in writing to the terms and conditions of the Clawback Policy. Under the Clawback Policy, if the Company is required to restate its financial results due to material noncompliance with financial reporting requirements under the federal securities laws, the Company will recoup any erroneously awarded incentive-based compensation from the Company’s current and former executive officers. Additionally, the Company’s 2023 Stock Award and Incentive Plan (the “2023 Stock Plan”) includes additional award forfeiture provisions that provide for the cancellation or forfeiture of an award (in full or in part) in the event that the award recipient engages in misconduct related to the restatement of financial statements. |

| • | No Guaranteed Employment or Compensation. We do not maintain employment contracts of defined length with our CEO or other named executives, nor do we provide multi-year guarantees for base salary increases, bonuses, or long-term incentives. |

| • | Double-Trigger Change-in-Control Benefits and Vesting. In the event of a change in control, our executives, other than our CEO, will only receive benefits if there is a qualifying termination of employment (i.e., a double-trigger). Our CEO does not have a change-in-control agreement with the Company. All of our executives’ equity incentive awards are double-trigger. |

| • | No Change in Control Tax Gross-Ups. We do not provide tax gross-ups on change-in-control benefits. |

| • | Stock Ownership Guidelines. We have stock ownership guidelines for both the Board and management to ensure a commonality of interest with stockholders. |

| • | Anti-Hedging and Anti-Pledging Policy. Policies are in place that prohibit both employees and Board members from engaging in these practices. |

| 16

|

|

|

|

PROPOSAL ONE: ELECTION OF DIRECTORS

General

The Board is divided into three classes. Each class of directors is elected for a three-year term. On the recommendation of the Nominating Committee, the Board fixed the size of the board at seven directors.

On the recommendation of the Nominating Committee, the Board has nominated three candidates, each of whom is currently a director of the Company, to be elected as Class II directors at the 2024 Annual Meeting. If re-elected, the Class II directors will serve for three-year terms ending at the 2027 Annual Meeting of Stockholders, or when their successors are duly elected and qualified. The terms of the remaining Class III and Class I directors are scheduled to expire at the Annual Meetings of Stockholders to be held in 2025 and 2026, respectively.

Biographical information regarding each nominee and each incumbent director is set forth below as of May 1, 2024. In addition, information about each director’s specific experience, attributes and skills that has led the Board to believe that each of the directors is highly qualified to serve as a member of the Board is set forth below.

Each of our directors has contributed to the mix of skills, core competencies and qualifications of the Board. Our directors are highly educated and have diverse backgrounds and talents and extensive track records of success in what we believe are highly relevant positions with a variety of well-respected companies in a wide range of industries. The Board believes that through their varying backgrounds, our directors bring a wealth of experiences, new ideas and solutions to our Board.

Each of the nominees has consented to be named as a nominee. If any nominee should become unavailable to serve, the Board may decrease the number of directors pursuant to our Amended and Restated Bylaws (the “Bylaws”) or may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board. The Board has no reason to believe that any nominee will be unavailable or, if elected, unable to serve.

| 2024 Proxy Statement

|

|

|

17

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

The Board of Directors recommends that the stockholders vote “FOR”

the following Class II director nominees:

|

Janice E. Page

| ||

|

Age: 75

Director since: June 2004

Independent

Committees: • Audit • Compensation • Nominating (Chair)

Current Public Company Directorships: • None

|

BACKGROUND Ms. Page spent 27 years in apparel retailing, holding numerous merchandising, marketing and operating positions with Sears Roebuck & Company (“Sears”), including Group Vice President from 1992 to 1997. While at Sears, Ms. Page launched the direct-to-consumer business and oversaw sporting goods, men’s, women’s and children’s apparel, footwear and accessories, and beauty and fragrances, among other responsibilities. She holds a B.A. from Pennsylvania State University.

| |

|

SKILLS AND QUALIFICATIONS | ||

| Ms. Page has extensive knowledge of the apparel retail industry and brings to the Board in-depth experience across diverse consumer product categories, as well as retail operations. Her service and tenure on public company boards allows her to provide the Board with a variety of perspectives on corporate governance issues.

| ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS Ms. Page serves on the advisory boards for the Daveler Entrepreneurship Scholarship of the University of South Florida and Champions for Learning Center for Innovation.

| ||

|

PREVIOUS DIRECTORSHIPS Ms. Page previously served as a director of R.G. Barry Corporation from 2000 to 2014, Hampshire Group, Limited from 2009 to 2011 and Kellwood Company from 2000 to 2008. Ms. Page also served as Trustee of Glimcher Realty Trust, a real estate investment trust that owns, manages, acquires and develops malls and community shopping centers from 2001 to 2004.

| ||

| 18

|

|

|

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

|

David M. Sable

| ||

|

Age: 70

Director since: June 2013

Independent

Committees: • Audit • Compensation • Nominating

Current Public Company Directorships: • Ethan Allen Interiors Inc. (NYSE: ETD) |

BACKGROUND Mr. Sable has served as Vice Chair at Stagwell Global since October 2023. He is also Co-Founder and Partner of DoAble, a Marketing Consultancy focused on branding, positioning and big ideas. As Senior Advisor to WPP plc (“WPP”), a multinational communications, advertising, public relations, technology, and commerce holding company, he mentored and consulted across the company. Previously he was Chairman of VMLY&R, a global marketing agency, from 2011 to 2019. He propelled Y&R to a top-five global creative firm at Cannes, developed new resources and practices, expanded the global footprint of subsidiary company VML, and ultimately helped unify Y&R and VML into VMLY&R, one of the most successful agencies in the industry today.

Prior to his time at Y&R, Mr. Sable served at Wunderman, Inc., a leading customer relationship manager and digital unit of WPP, as Vice Chairman and Chief Operating Officer from August 2000 to February 2011. Mr. Sable was a Founding Partner and served as Executive Vice President and Chief Marketing Officer of Genesis Direct, Inc., a pioneer digital omni-channel retailer, from June 1996 to September 2000. Mr. Sable attended New York University and Hunter College in New York.

| |

|

SKILLS AND QUALIFICATIONS | ||

| With more than 30 years of experience in digital leadership and marketing communications, Mr. Sable brings to the Board his strategic insight and ability to connect talent across marketing disciplines and geographies. The Board also benefits from his extensive involvement with community programs.

| ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS In 2013, Fast Company named Mr. Sable one of the 10 Most Generous Marketing Geniuses. He currently serves on the Board of Directors of the International Special Olympics, as well as on the Executive Board of UNCF and he was Executive Producer on MTV’s highly acclaimed REBEL MUSIC series.

| ||

| 2024 Proxy Statement

|

|

|

19

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

|

Noel J. Spiegel

|

||

|

Age: 76

Director since: June 2011

Independent (Lead

Committees: • Audit (Chair) • Compensation • Nominating

Current Public Company Directorships: • Radian Group Inc. (NYSE: RDN)

|

BACKGROUND Mr. Spiegel was a partner at Deloitte & Touche, LLP (“Deloitte”), where he practiced from September 1969 until his retirement in May 2010. In his over 40-year career at Deloitte, he served in numerous management positions, including as Deputy Managing Partner, member of the Executive Committee, Managing Partner of Deloitte’s Transaction Assurance practice, Global Offerings and IFRS practice and Technology, Media and Telecommunications practice (Northeast Region), and as Partner-in-Charge of Audit Operations in Deloitte’s New York office. Mr. Spiegel holds a B.S. from Long Island University and he attended the Advanced Management Program at Harvard Business School.

| |

|

SKILLS AND QUALIFICATIONS Mr. Spiegel provides expertise in public company accounting, disclosure and financial system management to the Board and, more specifically, to the Audit Committee. | ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS From 2006 to 2017, Mr. Spiegel was a Trustee, Chair of the Executive Committee and President of the Jewish Communal Fund of New York, a 501(c)(3) donor-advised fund. | ||

|

PREVIOUS DIRECTORSHIPS Mr. Spiegel previously served as a director at Vringo, Inc. from 2013 to 2016 and vTv Therapeutics Inc. (Nasdaq: VTVT) from 2015 to 2022.

| ||

| Awards and Recognitions: • National Association of Corporate Directors (“NACD”) Top 100 (2020)

|

| 20

|

|

|

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

The following Class III Directors have terms that

expire as of the 2025 Annual Meeting:

|

Deborah A. Henretta

| ||

|

Age: 62

Director since: February 2019

Independent

Committees: • Audit • Compensation • Nominating

Current Public Company Directorships: • Corning, Inc.(NYSE: GLW) • Meritage Homes Corporation (NYSE: MTH) • NiSource, Inc. (NYSE: NI) |

BACKGROUND Ms. Henretta has over 30 years of business leadership experience across both developed and developing markets, as well as expertise in brand building, marketing, philanthropic program development, and government relations. She joined Procter & Gamble (“P&G”) in 1985. In 2005, she was appointed President acting as Senior Executive Officer of P&G’s business in Association of Southeast Asian Nations, Australia and India. She was appointed group president of P&G Asia in 2007, group president of P&G Global Beauty Sector in June 2013, and group president of P&G E-Business in February 2015. She retired from P&G in June 2015.

Ms. Henretta is a partner at Council Advisors (formerly G100 Companies) where she assisted in establishing a Board Excellence program that provides director education on board oversight and governance responsibilities, including in the areas of digital transformation and cybersecurity, as well as a partnership program for New Director Training. She holds an M.A. in advertising from Syracuse University and a B.A. in communications and a Hobart degree in humane letters from St. Bonaventure.

| |

|

SKILLS AND QUALIFICATIONS | ||

| Ms. Henretta has significant experience in business leadership and global and international operations. She is skilled in brand building, marketing, and emerging market management. Ms. Henretta has risk management experience as an executive at P&G tasked with specific risk management duties. She also brings significant knowledge of digital transformation and cybersecurity to the Board. In April 2023, Ms. Henretta completed the Competent Boards Global ESG Certificate and Designation (GCB.D).

| ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS | ||

| Ms. Henretta was a member of Singapore’s Economic Development Board (“EDB”) from 2007 to 2013. She contributed to the growth strategies for Singapore, and was selected to serve on the EDB’s Economic Strategies Committee between 2009 and 2011. In 2008, she received a U.S. State Department appointment to the Asia-Pacific Economic Cooperation’s Business Advisory Council. In 2011, she was appointed chair of this 21-economy council, becoming the first woman to hold the position. In that role, she advised top government officials, including former President Barack Obama and former Secretary of State Hillary Clinton.

Ms. Henretta serves on the Board of Trustees of both St. Bonaventure University and Xavier University.

| ||

|

PREVIOUS DIRECTORSHIPS Ms. Henretta previously served as a director of Staples, Inc. (Nasdaq: SPLS) from 2016 to 2017.

| ||

| 2024 Proxy Statement

|

|

|

21

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

|

Cary D. McMillan

| ||

|

Age: 66

Director since: June 2007

Independent

Committees: • Audit • Compensation (Chair) • Nominating

Current Public Company Directorships: • Hyatt Corporation (NYSE: H)

Awards and Recognitions: • NACD Top 100 (2023) |

BACKGROUND Prior to his retirement in 2020, Mr. McMillan served as Chief Executive Officer of True Partners Consulting, LLC, a professional services firm providing tax and other financial services, since December 2005. From October 2001 to April 2004, he was the Chief Executive Officer of Sara Lee Branded Apparel. Mr. McMillan served as Executive Vice President of Sara Lee Corporation (“Sara Lee”), a branded consumer packaged goods company, from January 2000 to April 2004. From November 1999 to December 2001, he served as Chief Financial and Administrative Officer of Sara Lee. Prior thereto, Mr. McMillan served as an audit partner with Arthur Andersen LLP. Mr. McMillan holds a B.S. from the University of Illinois and is a CPA.

| |

|

SKILLS AND QUALIFICATIONS | ||

| Mr. McMillan brings to the Board demonstrated leadership abilities as a Chief Executive Officer and has a deep understanding of business, both domestically and internationally. His experience as a former audit partner and CPA also provides him with extensive knowledge of financial and accounting issues. Furthermore, Mr. McMillan’s current and prior service on other public boards provides the Board with diversified knowledge of best corporate governance and compensation practices.

| ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS | ||

| Mr. McMillan serves on the AEO Foundation Board and brings a wealth of philanthropic experience to the position. He serves on a number of nonprofit boards in Chicago including as Treasurer of both the Millenium Park Foundation and WTTW, the local PBS station. He is also a Trustee of the Art Institute of Chicago.

| ||

|

PREVIOUS DIRECTORSHIPS | ||

| Mr. McMillan previously served as a director of McDonald’s Corporation (NYSE: MCD) from 2003 to 2015, Hewitt Associates, Inc. from 2002 to 2010, and Sara Lee from 2000 to 2004.

| ||

|

| ||

| 22

|

|

|

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

The following Class I Directors have terms that

expire as of the 2026 Annual Meeting:

|

Jay L. Schottenstein

| ||

|

Age: 69

Director since: March 1992

Executive

Committees: • None

Current Public Company Directorships: • Designer Brands Inc. (NYSE: DBI)

Awards and Recognitions: • World Retail Congress Retail Hall of Fame Inductee (2024) • T. Kenyon Holly Award for Outstanding Humanitarian Achievement (Two Ten Footwear Foundation) (2016) • Humanitarian of the Year: American Red Cross of Greater Columbus (2010) |

BACKGROUND Mr. Schottenstein has served as our Chief Executive Officer since December 2015. Prior thereto, he served as our Interim Chief Executive Officer from January 2014 to December 2015. He has served as Chairman of the Board since March 1992. He previously served the Company as Chief Executive Officer from March 1992 until December 2002 and as a Vice President and Director of the Company’s predecessors since 1980. He has also served as Chairman of the Board and Chief Executive Officer of Schottenstein Stores Corporation (“SSC”) since March 1992 and as President of SSC since 2001. Prior thereto, Mr. Schottenstein served as Vice Chairman of SSC from 1986 to 1992. He has been a Director of SSC since 1982. Mr. Schottenstein also has served since March 2005 as Executive Chairman of the Board of Directors of Designer Brands Inc. (f/k/a DSW Inc.) (NYSE: DBI) and formerly served as that company’s Chief Executive Officer from March 2005 to April 2009. He has served as an officer and director of various other entities owned or controlled by members of his family since 1976. He is a graduate of Indiana University.

| |

|

SKILLS AND QUALIFICATIONS | ||

| Mr. Schottenstein has deep knowledge and extensive experience with respect to the Company’s operations and the retail industry in general. His expertise in merchandising, operations, retail, real estate, brand building, and team management has guided the Company from a single-brand company to a multi-brand $5+ billion global specialty retailer.

| ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS Mr. Schottenstein dedicates significant time to civic and cultural organizations. In 1985, he and his wife founded the Jay and Jeanie Schottenstein Foundation, the couple’s personal philanthropic organization. Together, they have donated millions of dollars to causes that improve the world, from arts and culture to mental health and cardiovascular research.

The Schottensteins support many local organizations, including the Columbus Museum of Art, the United Way of Central Ohio, and The Ohio State University. In 2008, the Schottensteins endowed the biennial Jay and Jeanie Schottenstein Prize in Cardiovascular Sciences at The Ohio State University, an esteemed award given to outstanding medical and research professionals in the field. In 2010, Mr. and Mrs. Schottenstein were named Humanitarians of the Year by the American Red Cross of Central Ohio. In 2021, the Schottensteins pledged $10.15 million to The Ohio State University toward improving students’ access to behavioral healthcare and reducing stigma surrounding mental illness. Mr. Schottenstein is a member of the board of directors at the Columbus Partnership and the Columbus Development Corporation.

PREVIOUS DIRECTORSHIPS Mr. Schottenstein previously served as a member of the Board of Directors for Albertsons Companies Inc. (NYSE: ACI) from 2006 to 2022. | ||

| 2024 Proxy Statement

|

|

|

23

|

| PROPOSAL ONE: ELECTION OF DIRECTORS |

|

Sujatha Chandrasekaran

| ||

|

Age: 56

Director since: March 2018

Independent

Committees: • Audit • Compensation • Nominating

Current Public Company Directorships: • Cardinal Health (NYSE: CAH) • Brenntag SE (ETR: BNR) • ATOS (PAR: ATO)

Awards and Recognitions: • Directors & Boards: Director to Watch (2023 and 2019) • Modern Healthcare: Top 25 Women Leaders in Healthcare (2022) • Forbes: Innovative Technology leader (2021) • NACD Governance Fellow (2018) • IDG: CIO Hall of Fame (2017) |

BACKGROUND Ms. Chandrasekaran has been an advisor and independent consultant in the technology and

Ms. Chandrasekaran holds a bachelor of engineering degree from University of Madras, India; a master of business systems from Monash University, Melbourne Australia; and an Executive Development Education Certificate from London Business School. She is certified as NACD.DC.

| |

|

SKILLS AND QUALIFICATIONS | ||

| Ms. Chandrasekaran brings vast information, artificial intelligence (“AI”) and digital technology expertise and a wealth of leadership experience in the global retail, eCommerce, consumer and supply chain industries to the Board. Ms. Chandrasekaran is an industry thought leader in digital business transformation, digital business models, innovation and talent transformation. She possesses deep technical expertise in cybersecurity, data, Al and multiple technologies. Ms. Chandrasekaran also brings significant risk management and data protection experience as an executive level Enterprise Risk Committee member at Kimberly-Clark Corporation, CommonSpirit Health and the Timberland Company and the Enterprise Privacy Council at Walmart Inc.

| ||

|

SELECT PROFESSIONAL AND COMMUNITY CONTRIBUTIONS | ||

| Ms. Chandrasekaran serves as a director of Pando.AI a privately held AI & digital supply chain platform company, and Agendia, Inc., a privately held commercial-stage company focused on precision oncology for breast cancer. Ms. Chandrasekaran is the founder and chair of the board at T200 Foundation, a non-profit focused on developing women in technology.

| ||

|

PREVIOUS DIRECTORSHIPS | ||

| Ms. Chandrasekaran previously served as a director of Barry Callebaut AG (SIX: BARN), publicly listed on the Swiss stock exchange, from 2018 to 2020 and Blume Global Technologies, a company focused on digital supply chain platform software-as-a-service, data and AI platform from 2019 to 2023.

| ||

| 24

|

|

|

|

CORPORATE GOVERNANCE

The following section discusses the Company’s corporate governance, including the role of the Board and its Committees. Additional information regarding corporate governance, including our Corporate Governance Guidelines, the charters of our Audit, Compensation, and Nominating Committees and our Code of Ethics, which applies to all of our directors, officers (including the Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) and employees, may be found on our Investors website at investors.ae.com. Any amendments or waivers to our Code of Ethics will also be available on our website. The Code of Ethics includes our privacy and data security policies, as well as our policy on anti-corruption and bribery. We also have a comprehensive Code of Conduct that governs the behavior of our production, sourcing and supply chain business partners, and we routinely audit the factories with which we do business in order to ensure compliance with our expected standards of operations, human rights and quality in our products. A copy of the corporate governance materials is available in print to any stockholder upon request.

The Evolving Role of the Board

AEO benefits greatly from the vast industry-relevant experience, deep institutional knowledge, and thoughtful engagement of our Board. During Fiscal 2023, the Board continued to adapt and respond to the remarkable speed, volume and proliferation of issues that have created challenges, opportunities and responsibilities for the Company. As the business environment has grown more complex with macroeconomic uncertainty, geopolitical tensions, regulatory unpredictability, political polarization, culture wars, cyber threats, and the growth of generative artificial intelligence, our Board tapped into their experience and expertise to ensure that the Company is continuing to conduct its business to enable its continued success and increase in value over the long-term notwithstanding this unprecedented complexity. Far from a one-size-fits-all approach, our Board has used its knowledge, agility and focus to ensure that best-in-class policies, practices, and processes are in place, acknowledging the dynamic nature of our business and the material risks facing our industry and the Company.

Our Board’s Principles of Effectiveness

As the expectations and responsibilities of the Board continued to evolve during Fiscal 2023, our directors adhered to critical fundamental principles to maintain effective operation:

| • | Constant attention on AEO’s priorities. While the number of issues that require Board attention has expanded, the Company and the directors have carefully crafted meeting agendas to ensure sufficient time and focus was given to those issues that would or could materially impact the business in the near-, medium-, and long-term. Further, the Board was able to align priorities while distributing responsibilities to each independent director serving on each of the three committees. |

| • | Effective collaboration with Management. The Board’s relationship with management has been central to its effectiveness. A relationship of mutual trust and candor ensures that information is timely received and the Board’s feedback can be reflected in day-to-day operations. The Board has leveraged management’s expertise to stay informed on emerging issues and identification of issues to share feedback and receive input frequently. |

| • | Cohesiveness of the Directors. Our directors have skills of leadership, diplomacy, judgment and overall business acumen that are vital to ensuring an effective, engaged oversight role. The ability to amicably raise and discuss different perspectives, and a willingness to build consensus and collaborate with each other have been vital to the well-functioning operation of the Board. |

| • | Balancing the Near- and Long-Terms. The Board has helped Management balance the need to deliver near-term results with developing longer-term stockholder value. The Board has empowered management to consider the longer-term direction of the business and has helped management see around corners, balance competing interests, anticipate risks and threats and explore new opportunities to achieve its new long-term corporate strategy. |

| • | Participate in the Innovation. As much as AEO is an innovator in retail, the Board has ensured that it has developed policies, practices and processes that are tailored to the needs of the business. While the Board remains informed about peers and the market as appropriate, our directors have remained open to creative approaches to unprecedented challenges in a way that is appropriate for AEO and all of its stakeholders. |

| 2024 Proxy Statement

|

|

|

25

|

| CORPORATE GOVERNANCE |

Our Board’s Primary Responsibilities

Board Oversight of AEO’s Strategy and Capital Deployment

The Board receives frequent updates on the Company’s performance and is actively engaged in reviewing and assessing the Company’s strategy, both long- and short-term, including major business and organizational initiatives, capital allocation priorities and potential business development opportunities. During Fiscal 2023, the Board was instrumental in the oversight of management’s profit improvement work which was initiated during the year. The Board reviews performance against strategy on a regular basis through robust discussions at Board meetings and through regular updates from management. In addition, at least one Board meeting per year is focused on review of strategy and strategic alignment, including identification of any risks that could impact results. At this meeting, the Board provides input on and oversight of the short-term strategic goals and direction of the Company. The Board also reviews and approves capital deployment, including dividends and share repurchase plans.

Board Oversight of Risk Management

The Board as a whole has the responsibility for risk oversight and management, with a focus on the most significant risks facing the Company, including strategic, competitive, economic, operational, financial, legal, regulatory, cybersecurity, ESG, compliance, and reputational risks. In addition, Board Committees oversee and review risk areas that are particularly relevant to their respective areas of responsibility and oversight and regularly report to the full Board on such areas. The risk oversight responsibility of the Board and its Committees is supported by our management reporting processes, which are designed to provide visibility to the Board to those Company personnel responsible for risk assessment, including our management-led Enterprise Risk Management Committee, and information about management’s identification, assessment, and mitigation strategies for critical risks. The Company’s Enterprise Risk Management Committee is chaired by the Chief Financial Officer and is composed of all members of our executive leadership team, as well as other key financial-control representatives. The Board receives regular Enterprise Risk Management risk report from the Chief Financial Officer during routine Board meetings. In addition, our Company employs a Chief Compliance Officer who provides regular updates to the Audit Committee on compliance-related matters. In overseeing risk management, the Board and management also leverage the expertise of external advisors, as needed.

|

Risk Oversight by the Board | ||||

|

Full Board

| ||||

| • Assesses major risks facing the Company and reviews options for risk mitigation with the assistance of management and the Board Committees

• Monitors risks that have been delegated to a particular Committee through regular reports provided by the respective Board Committee

| ||||

| Audit Committee | Compensation Committee | Nominating Committee | ||

| • Assesses major financial risk exposures and steps taken by management to address the same • Responsible for the review and assessment of information technology and cybersecurity risk exposures and the steps taken to monitor and control those exposures (see details below) • Reviews risks identified during the internal and external auditors’ risk assessment procedures |

• Oversees risk management related to employee compensation plans and arrangements • Assesses whether the Company’s compensation plans and practices may incentivize excessive risk-taking and discusses at least annually the relationship between risk management policies and compensation |

• Manages risks associated with corporate governance policies and practices • Reviews any risks and exposures relating to director and executive succession planning • Oversees risk management related to the Company’s governance and corporate social responsibility matters | ||

| 26

|

|

|

|

| CORPORATE GOVERNANCE |

Cybersecurity & Data Governance Oversight

The Board recognizes the importance of maintaining the trust and confidence of our various stakeholders. The Board as a whole has responsibility for the Company’s oversight and management of cybersecurity risks. At the management level, to more effectively prevent, detect and respond to information security threats, the Company has a dedicated Chief Information Security Officer whose team is responsible for leading our company-wide cybersecurity strategies, policies, standards, architectures, operations and processes. The Audit Committee receives regular reports from the Chief Information Security Officer on pertinent cyber risk exposures, the status of projects designed to fortify our Information Security Program, metrics on the effectiveness of this program, and the emerging threats in this area. Furthermore, on at least a quarterly basis or more often as needed, the Chief Information Security Officer provides pertinent cybersecurity risk exposures and updates along with various other business units as part of the enterprise risk management report to the Audit Committee. On an annual basis, management invites third-party cyber experts to present to the Audit Committee on best practices in cybersecurity oversight. The Board also receives quarterly reports from management on risks and action plans related to data governance, artificial intelligence opportunities and privacy compliance.

Board Oversight of Sustainability and Our ESG Program

We engage with a diverse group of stakeholders, including our vendors and partners, our associates, our customers, our communities, and our investors to ensure we are thoughtfully considering their perspectives to determine priorities within our Build A Better World strategy. Our Board plays an active and vital role in overseeing our ESG initiatives and ensuring that any ESG risks and opportunities are integrated into the Company’s long-term strategy. Given the breadth of matters that fall within the ESG umbrella for a retail company of our size and scale, oversight of those issues is allocated among each of the Committees as outlined below.

| Nominating Committee | Audit Committee | Compensation Committee | ||

| Environmental Impact | Privacy and Data Security | Human Capital Management Disclosures | ||

| Culture/IDEA | Anti-Corruption and Bribery | Executive Compensation | ||

| Human Rights | Business Ethics and Integrity | Employee Well-Being | ||

| Philanthropy/Charitable Giving | Responsible Innovation |

| ||

| Board Structure and Governance Issues | ESG Measurement, Controls and Reporting |

| ||

| Public Policy |

|

| ||

At the management level, given the breadth of issues that touch ESG, all ESG matters are ultimately coordinated by a committee of our Chief Financial Officer, Chief Human Resources Officer, Chief Supply Chain Officer, Chief Accounting Officer, and General Counsel & Chief Compliance Officer. Depending on the topic, we have subject matter experts who present proposals and ideas to the committee, which provides a robust and holistic review of the various matters presented, including how each proposal aligns with AEO’s strategy and returns value to our stakeholders.

Director Selection and Nominations

The Nominating Committee periodically reviews the appropriate size of the Board, whether any vacancies are expected due to retirement or otherwise, and the need for particular expertise on the Board. In evaluating and determining whether to recommend a candidate to the Board, the Nominating Committee reviews the appropriate skills and characteristics required of Board members in the context of the background of existing members and in light of the perceived needs for the future growth of our business. This includes a review of issues of diversity in background and experience in different substantive areas such as retail operations, marketing, technology, distribution, mergers and acquisitions, and finance. The Board seeks the best director candidates based on the skills and characteristics required without regard to race, color, national origin, religion, disability, marital status, age, sexual orientation, gender, gender identity and expression, or any other basis protected by federal, state, or local law. The Nominating Committee has formalized its diversity focus by mandating that any search that the Nominating Committee engages for a new director must include women and minority candidates in the pool from which the Nominating Committee selects director candidates. The Nominating Committee will continue to review the efficacy of this policy on a going-forward basis. Board diversity is valued and provides many benefits, including creativity, variety in approaches to problem solving, and the ability to work effectively in our various markets. We also value a Board that reflects the diverse makeup of our associate and customer base.

Pursuant to its charter, the Nominating Committee has the authority to retain consultants and search firms to assist with the process of identifying and evaluating director candidates and to approve the fees and other retention terms for any such consultant or search firm.

| 2024 Proxy Statement

|

|

|

27

|

| CORPORATE GOVERNANCE |

Director Skills and Qualifications

The Nominating Committee believes that the current members of the Board collectively have the level and balance of skills, experience, diversity, and character to execute the Board’s responsibilities. The table below is a summary of the range of skills and experiences that each director brings to the Board, each of which we find to be relevant to our business. Because it is a summary, the table does not include all of the skills, experiences, and qualifications that each director offers, and the fact that a particular experience, skill, or qualification is not listed does not mean that a director does not possess it. All of our directors exhibit high integrity, an appreciation for diversity of background and thought, innovative thinking, a proven record of success, and deep knowledge of corporate governance requirements and best practices.

| ATTRIBUTES, EXPERIENCE AND SKILLS |

|

|

|

|

|

|

| |||||||

| SKILLS CENTRAL TO AEO’S STRATEGY |

||||||||||||||

| Retail Industry |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

| Marketing and Consumer Insight |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

| Technology and Digital |

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

| Real Estate |

✓ | ✓ | ||||||||||||

| International |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

| CORE COMPETENCIES |

||||||||||||||

| Leadership |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

| Risk Management |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

| Audit Committee Financial Expertise |

✓ | ✓ | ✓ | ✓ | ||||||||||

| Cybersecurity |

✓ | |||||||||||||

| Crisis Management |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Director Tenure

The Nominating Committee and the Board believe it is important for the Board to be “refreshed” by adding new directors from time to time, balanced against the importance of having directors who have deep, historical experience and institutional knowledge of the Company, its strategies and market opportunities and challenges. Accordingly, the Company does not have a mandatory retirement age or term limits for its directors.

In the last six years, the Board appointed three new independent directors, all of whom brought diverse backgrounds and experience to the Company. Of our current directors, two joined the Board in the last six years. The Nominating Committee and the Board also believe that our longer-serving directors bring critical skills and a historical perspective to the Board that are highly relevant in a cyclical business such as retail. In addition, the Nominating Committee and the Board believe that longer-serving directors have a deep knowledge and understanding of our business, balanced against the fresh information and perspectives brought by our newer directors.

| BALANCED TENURES OF INDEPENDENT DIRECTORS

| ||

| 5 – 9 years: |

Two Directors | |

| 10 – 15 years: |

Two Directors | |

| 16 – 19 years: |

Two Directors | |

| 28

|

|

|

|

| CORPORATE GOVERNANCE |

Director Time Commitments and Protections Against Overboarding

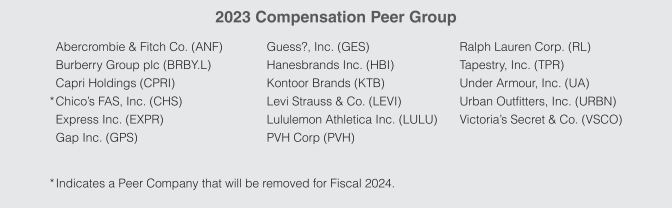

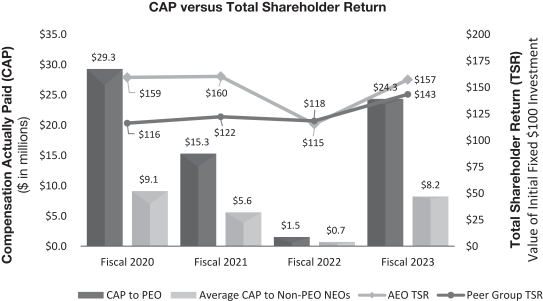

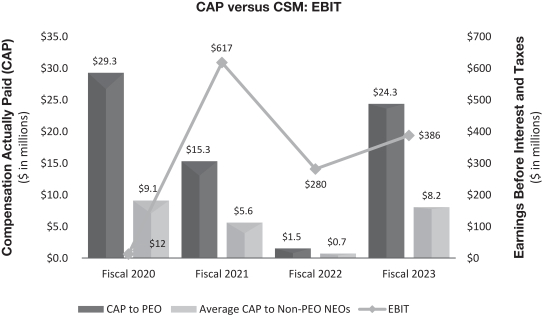

The Board appreciates that serving on a public board of directors is a significant responsibility and time commitment. Board members are expected to spend the time needed and meet as often as necessary to discharge their responsibilities properly. In considering each Board member’s ability to properly discharge their duties, the Nominating Committee will annually review each Board member’s various time commitments, including without limitation their primary occupation, service on public company boards and committee memberships, as well as service with private companies and non-profit organizations.