Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Fiscal Year Ended January 31, 2015 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-33338

American Eagle Outfitters, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | No. 13-2721761 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 77 Hot Metal Street, Pittsburgh, PA | 15203-2329 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(412) 432-3300

Securities registered pursuant to Section 12(b) of the Act:

| Common Shares, $0.01 par value | New York Stock Exchange | |

| (Title of class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Sections 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for at the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO þ

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of August 2, 2014 was $1,874,117,608.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 195,022,073 Common Shares were outstanding at March 9, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Part III — Proxy Statement for 2015 Annual Meeting of Stockholders, in part, as indicated.

Table of Contents

AMERICAN EAGLE OUTFITTERS, INC.

| Page Number |

||||||

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

14 | |||||

| Item 2. |

15 | |||||

| Item 3. |

15 | |||||

| Item 4. |

15 | |||||

| PART II | ||||||

| Item 5. |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 16 | ||||

| Item 6. |

19 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 | ||||

| Item 7A. |

35 | |||||

| Item 8. |

36 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 70 | ||||

| Item 9A. |

70 | |||||

| Item 9B. |

72 | |||||

| PART III | ||||||

| Item 10. |

72 | |||||

| Item 11. |

72 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 72 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

72 | ||||

| Item 14. |

72 | |||||

| PART IV | ||||||

| Item 15. |

72 | |||||

2

Table of Contents

PART I

General

American Eagle Outfitters, Inc., a Delaware corporation (the “Company”), operates under the American Eagle Outfitters® and aerie® by American Eagle Outfitters® brands. Founded in 1977, American Eagle Outfitters is a leading apparel and accessories retailer that operates more than 1,000 retail stores in the U.S. and internationally, online at ae.com and aerie.com and international store locations managed by third-party operators. Through its brands, the Company offers high quality, on-trend clothing, accessories and personal care products at affordable prices. The Company’s online business, AEO Direct, ships to 81 countries worldwide.

We have company operated stores in the United States, Canada, Mexico, Hong Kong, China and the United Kingdom. American Eagle Outfitters® and aerie® merchandise is also available at international store locations managed by third party operators. As of January 31, 2015, we operated 955 American Eagle Outfitters stores and 101 aerie stand-alone stores. Our third party operated store base has grown to 99 stores in 16 countries and products purchased through our online business, AEO Direct, ship to 81 countries worldwide.

We operated the 77kids by American Eagle Outfitters® brand until the exit of the business during Fiscal 2012. Our Consolidated Financial Statements reflect the results of 77kids as discontinued operations for all periods presented.

As used in this report, all references to “we,” “our” and the “Company” refer to American Eagle Outfitters, Inc. and its wholly owned subsidiaries. “American Eagle Outfitters,” “AEO” and the “AEO Brand” refer to our company operated American Eagle Outfitters stores. “aerie” refers to our aerie® by American Eagle Outfitters® stores. “AEO Direct” refers to our e-commerce operations, ae.com and aerie.com.

Our financial year is a 52/53 week year that ends on the Saturday nearest to January 31. As used herein, “Fiscal 2015” refers to the 52 week period ending January 30, 2016. “Fiscal 2014” and “Fiscal 2013” refer to the 52 week period ended January 31, 2015 and February 1, 2014, respectively. “Fiscal 2012” refers to the 53 week period ended February 2, 2013. “Fiscal 2011” and “Fiscal 2010” refer to the 52 week periods ended January 28, 2012 and January 29, 2011, respectively.

Information concerning our segments and certain geographic information is contained in Note 2 of the Consolidated Financial Statements included in this Form 10-K and is incorporated herein by reference. Additionally, a five-year summary of certain financial and operating information can be found in Part II, Item 6, Selected Consolidated Financial Data, of this Form 10-K. See also Part II, Item 8, Financial Statements and Supplementary Data.

Brands

American Eagle Outfitters Brand

The American Eagle Outfitters® brand targets 15 to 25 year old men and women. Denim is the cornerstone of the American Eagle Outfitters® product assortment, which is complemented by other key categories including pants, shorts, sweaters, fleece, outerwear, graphic t-shirts, footwear and accessories. American Eagle Outfitters® is honest, real, individual and fun. American Eagle Outfitters® is priced to be worn by everyone, everyday, delivering value through quality and style.

Gaining market share through differentiated fashion, product innovation, and having the right product, in the right size for every customer are the main focuses within the AEO Brand. Delivering value, variety and versatility to our customers remains a top priority. We strive to offer quality and value at all levels of the assortment, punctuated with promotions.

3

Table of Contents

aerie

The aerie® brand is a collection of intimates and personal care products for women that want to feel good about who they are, inside and out. The collection is available in 101 stand-alone aerie stores throughout the United States and Canada, online at aerie.com and at select American Eagle Outfitters® stores. aerie, with bras and undies at the core, and offerings in sleep, swim and apparel is beautiful, feminine, soft, sensuous, yet comfortable and real.

Business Priorities & Strategy

We are focused on delivering results through four near-term priorities: (1) pursuing revenue and profit improvement in both the American Eagle Outfitters and aerie brands through more compelling product assortments, product focused marketing messages and unique customer experiences digitally and in stores; (2) continued evolution of our omni-channel capabilities (flexible fulfilment, full utilization of our omni-channel distribution center and maximizing our investments in technologies and tools); (3) growing our digital business through further site enhancements, expanded product line, improved customer engagement and continued upgrades to our mobile site; and (4) improvement in profitability of our stores and repositioning the store fleet.

AEO Direct & Omni-Channel Capabilities

We sell merchandise via ae.com and aerie.com, which are the digital manifestation of the lifestyle that our brands represent. In addition to purchasing items directly from our digital channels, customers can experience AEO Direct in-store through our Store-to-Door program. This program enables store associates to sell any item available online to an in-store customer in a single transaction. Customers are taking advantage of Store-to-Door by purchasing extended sizes that are not available in-store, as well as finding a certain size or color that happens to be out-of-stock at the time of their visit. The ordered items are shipped to the customer’s home free of charge. Additionally, in Fiscal 2014, we began fulfilling online orders at stores through our Buy Online Ship-from-Store program and we plan to further enhance our websites, increase CRM capabilities through personalization, segmentation and customer lifecycle management.

We are focused on delivering an omni-channel approach to customer engagement, which will eventually lead to a single view of the customer and inventory. We have made investments including a re-launched mobile app and enhanced websites. We will continue to invest in initiatives geared towards integration of our shopping channels as well as expanded product line offerings.

Real Estate

We remain focused on real-estate strategies to grow our business and strengthen our financial performance utilizing our most productive formats in the right markets, including underpenetrated markets, AEO Factory stores and aerie side-by-side locations. Also, we will selectively close stores and maintain flexibility within our real estate portfolio through short-term lease extensions.

At the end of Fiscal 2014, we operated in all 50 states, Puerto Rico, Canada, Mexico, Hong Kong, China and the United Kingdom. During Fiscal 2014, we opened 60 new stores, consisting largely of AEO Factory stores and international store openings. These store openings, offset by 70 store closings, brought our total store base to 1,056 stores at the end of Fiscal 2014.

Our stores average approximately 6,200 gross square feet and approximately 5,000 on a selling square foot basis. Our gross square footage increased by approximately 2% during Fiscal 2014.

During Fiscal 2014, we renovated a total of 44 AEO stores through remodels, refurbishes and refreshes. We evaluate each store and determine the appropriate capital spend based on financial performance and non-financial factors including the location and condition of the store, the center and competitors. Remodels result in a newly constructed store, sometimes larger in size, in the most current store design including new storefront, floors, fixtures, marketing and lighting. Refurbishes consist of selective changes that include new store front, floors and fixtures. Refreshes include certain aspects of our current store format, including paint and new fixtures.

4

Table of Contents

In Fiscal 2015, we plan to open approximately 20 to 25 AEO stores primarily in the Factory store format and continue our international expansion. We also plan to remodel and refurbish approximately 25 existing AEO stores and close approximately 50 AEO stores and 20 aerie stores. Our square footage is expected to decline slightly in Fiscal 2015.

The table below shows certain information relating to our historical store growth from continuing operations.

| Fiscal 2014 |

Fiscal 2013 |

Fiscal 2012 |

Fiscal 2011 |

Fiscal 2010 |

||||||||||||||||

| Consolidated stores at beginning of period |

1,066 | 1,044 | 1,069 | 1,077 | 1,075 | |||||||||||||||

| Consolidated stores opened during the period |

60 | 64 | 16 | 21 | 25 | |||||||||||||||

| Consolidated stores closed during the period |

(70 | ) | (42 | ) | (41 | ) | (29 | ) | (23 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total consolidated stores at end of period |

1,056 | 1,066 | 1,044 | 1,069 | 1,077 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Fiscal 2014 |

Fiscal 2013 |

Fiscal 2012 |

Fiscal 2011 |

Fiscal 2010 |

||||||||||||||||

| AEO Brand stores at beginning of period |

944 | 893 | 911 | 929 | 938 | |||||||||||||||

| AEO Brand stores opened during the period |

60 | 64 | 16 | 11 | 14 | |||||||||||||||

| AEO Brand stores closed during the period |

(49 | ) | (13 | ) | (34 | ) | (29 | ) | (23 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total AEO Brand stores at end of period |

955 | 944 | 893 | 911 | 929 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Fiscal 2014 |

Fiscal 2013 |

Fiscal 2012 |

Fiscal 2011 |

Fiscal 2010 |

||||||||||||||||

| aerie stores at beginning of period |

122 | 151 | 158 | 148 | 137 | |||||||||||||||

| aerie stores opened during the period |

— | — | — | 10 | 11 | |||||||||||||||

| aerie stores closed during the period |

(21 | ) | (29 | ) | (7 | ) | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total aerie stores at end of period |

101 | 122 | 151 | 158 | 148 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Consolidated Store Locations

As of January 31, 2015, we operated 1,056 wholly-owned stores under the American Eagle Outfitters and aerie brands as shown below:

United States, including the Commonwealth of Puerto Rico — 920 stores

| Alabama | 15 | Indiana | 22 | Nebraska | 6 | Rhode Island | 3 | |||||||||||||

| Alaska |

5 | Iowa | 11 | Nevada | 5 | South Carolina | 15 | |||||||||||||

| Arizona |

12 | Kansas | 9 | New Hampshire | 10 | South Dakota | 3 | |||||||||||||

| Arkansas |

8 | Kentucky | 14 | New Jersey | 27 | Tennessee | 25 | |||||||||||||

| California |

59 | Louisiana | 14 | New Mexico | 3 | Texas | 68 | |||||||||||||

| Colorado |

11 | Maine | 6 | New York | 64 | Utah | 9 | |||||||||||||

| Connecticut |

14 | Maryland | 19 | North Carolina | 27 | Vermont | 2 | |||||||||||||

| Delaware |

5 | Massachusetts | 28 | North Dakota | 4 | Virginia | 27 | |||||||||||||

| Florida |

57 | Michigan | 27 | Ohio | 37 | Washington | 20 | |||||||||||||

| Georgia |

31 | Minnesota | 18 | Oklahoma | 11 | West Virginia | 8 | |||||||||||||

| Hawaii |

4 | Mississippi | 9 | Oregon | 11 | Wisconsin | 20 | |||||||||||||

| Idaho |

3 | Missouri | 16 | Pennsylvania | 59 | Wyoming | 1 | |||||||||||||

| Illinois |

30 | Montana | 2 | Puerto Rico | 6 | |||||||||||||||

5

Table of Contents

Canada — 101 stores

| Alberta | 11 | New Brunswick | 3 | Ontario | 55 | |||||||||||||||

| British Columbia | 12 | Newfoundland | 1 | Quebec | 12 | |||||||||||||||

| Manitoba | 2 | Nova Scotia | 3 | Saskatchewan | 2 | |||||||||||||||

International — 35 stores

| China |

9 | Hong Kong | 5 | Mexico | 18 | United Kingdom | 3 |

International Operations

As of January 31, 2015, we had 101 company-operated stores in Canada, 18 in Mexico, nine in China, six in Puerto Rico, five in Hong Kong and three in the United Kingdom. We continue to evaluate further opportunities to expand internationally, which may include additional company-operated stores as well as stores operated by third party operators under license, franchise and/or joint venture agreements.

We have agreements with multiple third party operators to expand our brands internationally. Through these agreements, a series of franchised, licensed or other brand-dedicated American Eagle Outfitters stores have opened and expect to continue to open in areas including Eastern Europe, the Middle East, Central and South America, Northern Africa and parts of Asia. These agreements do not involve a significant capital investment or operational involvement from the Company. We plan to continue to increase the number of countries in which we enter into these types of arrangements as part of our strategy for profitable international expansion. As of January 31, 2015, we had 99 stores operated by our third party operators in 16 countries. International third party operated stores are not included in the consolidated store data or the total gross square feet calculation.

Purchasing

We design our merchandise and source its manufacture from third-party factories. During Fiscal 2014, we purchased substantially all of our merchandise from non-North American suppliers.

All of our merchandise suppliers must agree to the terms and conditions of our Master Purchase Agreement (MPA) and to conduct business with us in accordance with the policies and procedures set forth in our Corporate Vendor Manual (the “Manual”). The Manual includes, but is not limited to, policies and procedures covering the following topics: social responsibility; quality assurance; product safety and testing; product labeling and other regulatory requirements; supply chain security; our intellectual property; and our shipping process.

We maintain a quality control department at our distribution centers to inspect incoming merchandise shipments for uniformity of sizes and colors and for overall quality of manufacturing. Periodic inspections are also made by our employees and agents at manufacturing facilities to identify quality issues prior to shipment of merchandise.

Corporate Responsibility

We are firmly committed to the principle that the people who make our clothes should be treated with dignity and respect. We seek to work with apparel suppliers throughout the world who share our commitment to providing safe and healthy workplaces. At a minimum, we require our suppliers to maintain a workplace environment that complies with local legal requirements and meets universally-accepted human rights standards.

Our Vendor Code of Conduct (the “Code”), which is based on universally-accepted human rights principles, sets forth our expectations for suppliers. The Code must be posted in every factory that manufactures our clothes in the local language of the workers. All suppliers must agree to abide by the terms of our Code before we will place production with them.

6

Table of Contents

We maintain an extensive factory inspection program to monitor compliance with our Code. New garment factories must pass an initial inspection in order to do business with us. Once new factories are approved, we continue to review their social compliance performance both through internal audits by our compliance team, and through the use of third-party monitors. We review the outcome of these inspections with factory management with the goal of helping them to continuously improve their performance. Although our primary goal is to remediate issues and build long term relationships with our vendors, in cases where a factory is unable or unwilling to meet our standards, we will take steps up to and including the severance of our business relationship.

In Fiscal 2013, AEO signed the Accord on Fire and Building Safety, aligning with nearly 100 brands, non-governmental organizations (NGOs) and trade unions, to improve workplace safety in Bangladesh. The International Labor Organization (ILO), an organization that gives equal voice to workers, employers and unions, is Chair of the Steering Committee of the Accord. The Accord is a five-year program that will establish in-factory training; facilitate the creation of factory health and safety committees; review existing building regulations and enforcement; and develop a worker complaint process and mechanism for workers to report health and safety risks. AEO is also engaged with the ILO on Better Work programs in Cambodia, Haiti, Indonesia and Vietnam and is a member of the Better Work Buyers Partners.

Security Compliance

During recent years, there has been an increasing focus within the international trade community on concerns related to global terrorist activity and protecting the supply chain. Various security issues and other terrorist threats have brought increased demands from the Bureau of Customs and Border Protection (“CBP”) and other agencies within the Department of Homeland Security that importers take responsible action to secure their supply chains. We have been a certified member of the Customs — Trade Partnership Against Terrorism program (“C-TPAT”) since 2004. C-TPAT is a voluntary program offered by CBP in which an importer agrees to work with CBP to strengthen overall supply chain security. As part of this program, we are subject to validations by CBP.

Historically, we took significant steps to expand the scope of our security procedures, including, but not limited to: a significant increase in the number of factory audits performed; a revision of the factory audit format to include a review of all critical security issues as defined by CBP; a requirement that all of our international logistics partners, including forwarders, consolidators, shippers and brokers be certified members of C-TPAT; and inspections of all potential production facilities. Additionally, we also evaluate additional oversight options for high-risk security countries and among other things, implemented full third-party audits on an annual basis. In Fiscal 2013, we took the audits one step further, and conducted security audits of our own to validate the results we receive from the third-party audits, and continue with this practice today. We also implemented security training for our domestic logistics partners, along with conducting periodic audits on their facilities as well.

Trade Compliance

We act as the importer of record for substantially all of the merchandise we purchase overseas from foreign suppliers. Accordingly, we have an affirmative obligation to comply with the rules and regulations established for importers by the CBP regarding issues such as merchandise classification, valuation and country of origin. We have developed and implemented a comprehensive series of trade compliance procedures to assure that we adhere to all CBP requirements. In its most recent review and audit of our import operations and procedures, CBP found no material, unacceptable risks of non-compliance.

In addition to CBP requirements, we also ensure compliance with all other government agencies and their corresponding regulations including but not limited to the Federal Trade Commission (FTC), the Consumer Product Safety Commission (CPSC), the Food and Drug Administration (FDA) and U.S. Fish and Wildlife services. We have policies and procedures in place for labeling, packaging, product testing, obtaining required documentation and making appropriate declarations to reduce the risk of non-compliance.

7

Table of Contents

Product Safety

We are strongly committed to the safety and well being of our customers. We require our products to meet applicable laws and regulations. In certain cases, we also voluntarily adopt industry standards and best practices that may be higher than legally required or where no clear laws exist.

To ensure compliance with our product safety standards, we maintain an extensive set of testing protocols for each category of products. All of the products we sell are tested by an independent testing laboratory in accordance with applicable regulatory requirements. In rare cases where a safety issue has been discovered in a product that has reached our store shelves, we respond with a comprehensive recall process.

Merchandise Inventory, Replenishment and Distribution

Merchandise is generally shipped directly from our vendors and routed through third-party transloaders at key ports of entry to our U.S. distribution centers in Warrendale, Pennsylvania, Ottawa, Kansas and most recently Hazelton, Pennsylvania, or to our Canadian distribution center in Mississauga, Ontario. Additionally, an increasing amount of product is shipped directly to stores from our transloaders, by-passing our distribution centers which reduces transit times and lowers operating costs. In 2014, we opened a third-party distribution center in the Netherlands to support our European international store and e-commerce growth. We also operate third-party distribution centers in Mexico City, Hong Kong and Shanghai. Additionally, we opened a new 1,000,000 square foot omni-channel distribution center in Hazleton, Pennsylvania in July 2014, and will phase out our distribution center in Warrendale, Pennsylvania in Fiscal 2015.

Upon receipt at one of our distribution centers, merchandise is processed and prepared for shipment to the stores or forwarded to a warehouse holding area to be used for store sales replenishment. The allocation of merchandise among stores varies based upon a number of factors, including geographic location, customer demographics and store size. Merchandise is shipped to our stores two to five times per week depending upon the season and store requirements. Our current e-commerce distribution center, located in Ottawa, Kansas, ships merchandise directly to customers in all 50 states and 81 countries worldwide.

Customer Credit

We offer co-branded credit cards (the “AEO or aerie Visa Credit Card”) and private label credit cards (the “AEO or aerie Credit Card”) under the AEO and aerie brands. These credit cards are issued by a third-party bank (the “Bank”) and we have no liability to the Bank for bad debt expense, provided that purchases are made in accordance with the Bank’s procedures. Once a customer is approved to receive a Visa Credit Card or private label Credit Card and the card is activated, the customer is eligible to participate in our credit card rewards program. Customers who make purchases at AEO and aerie earn discounts in the form of savings certificates when certain purchase levels are reached. Also, AEO and aerie Visa Credit Card customers who make purchases at other retailers where the card is accepted earn additional reward points to be used at American Eagle Outfitters and aerie. AEO and aerie Credit Card holders will also receive advance notice of American Eagle Outfitters sales events offered throughout the year. The AEO and aerie Credit Cards are accepted at all of our U.S. stores and at ae.com and aerie.com. The AEO Visa and aerie Visa Cards are accepted in all of our stores and AEO Direct sites as well as merchants worldwide that accept Visa®.

Competition

The retail apparel industry is highly competitive both in stores and on-line. We compete with various individual and chain specialty stores, as well as the casual apparel and footwear departments of department stores and discount retailers, primarily on the basis of quality, fashion, service, selection and price.

8

Table of Contents

Trademarks and Service Marks

We have registered AMERICAN EAGLE OUTFITTERS®, AMERICAN EAGLE®, AE®, AEO®, LIVE YOUR LIFE®, aerie® and the Flying Eagle Design with the United States Patent and Trademark Office. We also have registered or have applied to register these trademarks with the registries of the foreign countries in which our stores and/or manufacturers are located and/or where our product is shipped.

We have registered AMERICAN EAGLE OUTFITTERS®, AMERICAN EAGLE®, AEO®, LIVE YOUR LIFE®, aerie® and the Flying Eagle Design with the Canadian Intellectual Property Office. In addition, we have acquired rights in AEtm for clothing products and registered AE® in connection with certain non-clothing products.

In the United States and in other countries around the world, we also have registered, or have applied to register, a number of other marks used in our business, including our pocket stitch designs.

These registered trademarks are renewable indefinitely, and their registrations are properly maintained in accordance with the laws of the country in which they are registered. We believe that the recognition associated with these trademarks makes them extremely valuable and, therefore, we intend to use and renew our trademarks in accordance with our business plans.

Employees

As of January 31, 2015, we had approximately 38,000 employees in the United States, Canada, Mexico, Hong Kong, China and the United Kingdom of whom approximately 31,000 were part-time and seasonal hourly employees. We consider our relationship with our employees to be good.

Executive Officers of the Registrant

Mary M. Boland, age 57, has served us as Executive Vice President, Chief Financial and Administrative Officer, and Principal Financial Officer since July 2012. Prior to joining the Company, Ms. Boland served Levi Strauss & Co. as Senior Vice President Finance of Global Levi’s from 2011 to 2012 and as Senior Vice President Finance of the Americas from 2006 to 2011. Prior to that time, Ms. Boland held a variety of finance positions with General Motors Corporation from 1979 to 2006 including Vice President and Chief Financial Officer, North America from 2003 to 2006.

Jennifer M. Foyle, age 48, has served as our Global Brand President — aerie since January 2015. Prior thereto, Ms. Foyle served as Executive Vice President, Chief Merchandising Officer — aerie from February 2014 to January 2015 and Senior Vice President, Chief Merchandising Officer — aerie from August 2010 to February 2014. Prior to joining the Company, Ms. Foyle was President of Calypso St. Barth from 2009 to 2010. In addition, she held various positions at J. Crew Group, Inc., including Chief Merchandising Officer, from 2003 to 2009.

Charles F. Kessler, age 42, has served as our Global Brand President – American Eagle Outfitters since January 2015. Prior thereto, he served as our Executive Vice President, Chief Merchandising and Design Officer — American Eagle Outfitters from February 2014 to January 2015. Prior to joining us, Mr. Kessler served as Chief Merchandising Officer at Urban Outfitters, Inc. from October 2011 to November 2013 and as Senior Vice President, Corporate Merchandising at Coach, Inc. from July 2010 to October 2011. Prior to that time, Mr. Kessler held various positions with Abercrombie & Fitch Co. from 1994 to 2010, including Executive Vice President, Female Merchandising from 2008 to 2010.

Roger S. Markfield, age 73, has served as Vice Chairman, Executive Creative Director since February 2009 and as a Director since March 1999. From February 2007 to February 2009, Mr. Markfield served as a non-executive officer employee of the Company. Prior to February 2007, he served us as Vice Chairman since

9

Table of Contents

November 2003, as President from February 1995 to February 2006, and as Co-Chief Executive Officer of the Company from December 2002 to November 2003. Mr. Markfield also served the Company and its predecessors as Chief Merchandising Officer from February 1995 to December 2002. Mr. Markfield was formerly on the Board of Directors of DSW Inc. from 2008 to 2012.

Simon R. Nankervis, age 48, has served as our Executive Vice President, Global Commercial Operations since January 2015. Prior thereto, he served as our Executive Vice President, Americas and Global Country Licensing from February 2014 to January 2015, Senior Vice President, Americas and Global Country Licensing from April 2013 to February 2014 and as Vice President, International Franchising and Global Business Development from October 2011 to March 2013. Prior to joining us, Mr. Nankervis was Managing Director at Busbrand Pty Ltd, an Australian based international brand management company, from 2002 to 2011.

Michael R. Rempell, age 41, has served as our Executive Vice President and Chief Operations Officer since June 2012. Prior thereto, he served as our Executive Vice President and Chief Operating Officer, New York Design Center, from April 2009 to June 2012, as Senior Vice President and Chief Supply Chain Officer from May 2006 to April 2009, and in various other positions since joining us in February 2000.

Jay L. Schottenstein, age 60, has served as Interim Chief Executive Officer since January 2014. He has also served as Chairman of the Company and its predecessors since March 1992. He served the Company as Chief Executive Officer from March 1992 until December 2002 and prior to that time, he served as a Vice President and Director of the Company’s predecessors since 1980. He has also served as Chairman of the Board and Chief Executive Officer of Schottenstein Stores Corporation (“SSC”) since March 1992 and as President since 2001. Prior thereto, Mr. Schottenstein served as Vice Chairman of SSC from 1986 to 1992. He has been a Director of SSC since 1982. Mr. Schottenstein also served as Chief Executive Officer from March 2005 to April 2009 and as Chairman of the Board since March 2005 of DSW Inc., a company traded on the New York Stock Exchange. He has also served as an officer and director of various other entities owned or controlled by members of his family since 1976. Mr. Schottenstein also serves as Executive Chairman and Director on the Board of Directors of DSW Inc.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are available under the “About AEO, Inc.” section of our website at www.ae.com. These reports are available as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”).

Our corporate governance materials, including our corporate governance guidelines, the charters of our audit, compensation, and nominating and corporate governance committees, and our code of ethics may also be found under the “About AEO, Inc.” section of our website at www.ae.com. Any amendments or waivers to our code of ethics will also be available on our website. A copy of the corporate governance materials is also available upon written request.

Additionally, our investor presentations are available under the “About AEO, Inc.” section of our website at www.ae.com. These presentations are available as soon as reasonably practicable after they are presented at investor conferences.

Certifications

As required by the New York Stock Exchange (“NYSE”) Corporate Governance Standards Section 303A.12(a), on June 9, 2014 our Chief Executive Officer submitted to the NYSE a certification that he was not aware of any violation by the Company of NYSE corporate governance listing standards. Additionally, we filed with this Form 10-K, the Principal Executive Officer and Principal Financial Officer certifications required under Sections 302 and 906 of the Sarbanes-Oxley Act of 2002.

10

Table of Contents

Our ability to anticipate and respond to changing consumer preferences, fashion trends and a competitive environment in a timely manner

Our future success depends, in part, upon our ability to identify and respond to fashion trends in a timely manner. The specialty retail apparel business fluctuates according to changes in the economy and customer preferences, dictated by fashion and season. These fluctuations especially affect the inventory owned by apparel retailers because merchandise typically must be ordered well in advance of the selling season. While we endeavor to test many merchandise items before ordering large quantities, we are still susceptible to changing fashion trends and fluctuations in customer demands.

In addition, the cyclical nature of the retail business requires that we carry a significant amount of inventory, especially during our peak selling seasons. We enter into agreements for the manufacture and purchase of our private label apparel well in advance of the applicable selling season. As a result, we are vulnerable to changes in consumer demand, pricing shifts and the timing and selection of merchandise purchases. The failure to enter into agreements for the manufacture and purchase of merchandise in a timely manner could, among other things, lead to a shortage of inventory and lower sales. Changes in fashion trends, if unsuccessfully identified, forecasted or responded to by us, could, among other things, lead to lower sales, excess inventories and higher markdowns, which in turn could have a material adverse effect on our results of operations and financial condition.

The effect of economic pressures and other business factors

The success of our operations depends to a significant extent upon a number of factors relating to discretionary consumer spending, including economic conditions affecting disposable consumer income such as payroll taxes, employment, consumer debt, interest rates, increases in energy costs and consumer confidence. There can be no assurance that consumer spending will not be further negatively affected by general, local or international economic conditions, thereby adversely impacting our business and results of operations.

Seasonality

Historically, our operations have been seasonal, with a large portion of total net revenue and operating income occurring in the third and fourth fiscal quarters, reflecting increased demand during the back-to-school and year-end holiday selling seasons, respectively. As a result of this seasonality, any factors negatively affecting us during the third and fourth fiscal quarters of any year, including adverse weather or unfavorable economic conditions, could have a material adverse effect on our financial condition and results of operations for the entire year. Our quarterly results of operations also may fluctuate based upon such factors as the timing of certain holiday seasons, the number and timing of new store openings, the acceptability of seasonal merchandise offerings, the timing and level of markdowns, store closings and remodels, competitive factors, weather and general economic conditions.

Our ability to react to raw material cost, labor and energy cost increases

Increases in our costs, such as raw materials, labor and energy may reduce our overall profitability. Specifically, fluctuations in the cost associated with the manufacture of merchandise we purchase from our suppliers impacts our cost of sales. We have strategies in place to help mitigate these costs and our overall profitability depends on the success of those strategies. Additionally, increases in other costs, including labor and energy, could further reduce our profitability if not mitigated.

Our ability to rebalance our store fleet and drive improved performance through new store openings, selective closings and existing store remodels and expansions

Our ability to drive improved performance will depend in part on our ability to rebalance our store fleet and expand and remodel existing stores on a timely and profitable basis. During Fiscal 2015, we plan to open approximately 20 to 25 new American Eagle Outfitters stores primarily in the Factory store format in North

11

Table of Contents

America and continue our international expansion. Additionally, we plan to remodel and refurbish 25 existing American Eagle Outfitters stores and close approximately 70 stores during Fiscal 2015. Accomplishing our store rebalancing and expansion goals will depend upon a number of factors, including the ability to obtain suitable sites for new and expanded stores at acceptable costs, the hiring and training of qualified personnel, particularly at the store management level, the integration of new stores into existing operations and the expansion of our buying and inventory capabilities. There can be no assurance that we will be able to achieve our store expansion and rebalancing goals, manage our growth effectively, successfully integrate the planned new stores into our operations or operate our new and remodeled stores profitably.

Our efforts to expand internationally

We are actively pursuing additional international expansion initiatives, which include wholly-owned stores and stores operated by third parties in select international markets. The effect of these arrangements on our business and results of operations is uncertain and will depend upon various factors, including the demand for our products in new markets internationally. Furthermore, although we provide store operation training, literature and support, to the extent that the franchisee, licensee or other operator does not operate its stores in a manner consistent with our requirements regarding our brand and customer experience standards, our business results and the value of our brand could be negatively impacted.

A failure to properly implement our expansion initiatives, or the adverse impact of political or economic risks in these international markets, could have a material adverse effect on our results of operations and financial condition. We have limited prior experience operating internationally, where we face established competitors. In many of these locations, the real estate, labor and employment, transportation and logistics and other operating requirements differ dramatically from those in the locations where we have more experience. Consumer demand and behavior, as well as tastes and purchasing trends, may differ substantially, and as a result, sales of our products may not be successful, or the margins on those sales may not be in line with those we currently anticipate. Any differences that we encounter as we expand internationally may divert financial, operational and managerial resources from our existing operations, which could adversely impact our financial condition and results of operations. In addition, we are increasingly exposed to foreign currency exchange rate risk with respect to our revenue, profits, assets, and liabilities denominated in currencies other than the U.S. dollar. We may in the future use instruments to hedge certain foreign currency risks; however, these measures may not succeed in offsetting all of the negative impact of foreign currency rate movements on our business and results of operations.

As we pursue our international expansion initiatives, we are subject to certain laws, including the Foreign Corrupt Practices Act, as well as the laws of the foreign countries in which we operate. Violations of these laws could subject us to sanctions or other penalties that could have an adverse effect on our reputation, operating results and financial condition.

Our ability to achieve planned store financial performance

The results achieved by our stores may not be indicative of long-term performance or the potential performance of stores in other locations. The failure of stores to achieve acceptable results could result in additional store asset impairment charges, which could adversely affect our results of operations and financial condition.

Our international merchandise sourcing strategy

Our merchandise is manufactured by suppliers worldwide. Although we purchase a significant portion of our merchandise through a single international buying agent, we do not maintain any exclusive commitments to purchase from any one vendor. Because we have a global supply chain, any event causing the disruption of imports, including the insolvency of a significant supplier or a major labor slow-down, strike or dispute including any such actions involving ports, transloaders, consolidators or shippers, could have an adverse effect on our

12

Table of Contents

operations. Given the volatility and risk in the current markets, our reliance on external vendors leaves us subject to certain risks should one or more of these external vendors become insolvent. Although we monitor the financial stability of our key vendors and plan for contingencies, the financial failure of a key vendor could disrupt our operations and have an adverse effect on our cash flows, results of operations and financial condition. Other events that could also cause a disruption of imports include the imposition of additional trade law provisions or import restrictions, such as increased duties, tariffs, anti-dumping provisions, increased United States Customs and Border Protection (CBP) enforcement actions, or political or economic disruptions.

We have a Vendor Code of Conduct (the “Code”) that provides guidelines for all of our vendors regarding working conditions, employment practices and compliance with local laws. A copy of the Code is posted on our website, www.ae.com, and is also included in our vendor manual in English and multiple other languages. We have a factory compliance program to audit for compliance with the Code. However, there can be no assurance that all violations can be eliminated in our supply chain. Publicity regarding violation of our Code or other social responsibility standards by any of our vendor factories could adversely affect our reputation, sales and financial performance.

We believe that there is a risk of terrorist activity on a global basis. Such activity might take the form of a physical act that impedes the flow of imported goods or the insertion of a harmful or injurious agent to an imported shipment. We have instituted policies and procedures designed to reduce the chance or impact of such actions. Examples include, but are not limited to, factory audits and self-assessments, including audit protocols on all critical security issues; the review of security procedures of our other international trading partners, including forwarders, consolidators, shippers and brokers; and the cancellation of agreements with entities who fail to meet our security requirements. In addition, CBP has recognized us as a validated participant of the Customs — Trade Partnership Against Terrorism program, a voluntary program in which an importer agrees to work with customs to strengthen overall supply chain security. However, there can be no assurance that terrorist activity can be prevented entirely and we cannot predict the likelihood of any such activities or the extent of their adverse impact on our operations.

Our reliance on our ability to implement and sustain information technology systems

We regularly evaluate our information technology systems and are currently implementing modifications and/or upgrades to the information technology systems that support our business. Modifications include replacing legacy systems with successor systems, making changes to legacy systems or acquiring new systems with new functionality. We are aware of inherent risks associated with operating, replacing and modifying these systems, including inaccurate system information and system disruptions. We believe we are taking appropriate action to mitigate the risks through testing, training, staging implementation and in-sourcing certain processes, as well as securing appropriate commercial contracts with third-party vendors supplying such replacement and redundancy technologies; however, there is a risk that information technology system disruptions and inaccurate system information, if not anticipated and/or promptly and appropriately mitigated, could have a material adverse effect on our results of operations.

Our ability to safeguard against security breaches with respect to our information technology systems

Our business employs systems and websites that allow for the storage and transmission of proprietary or confidential information regarding our business, customers and employees including credit card information. Security breaches could expose us to a risk of loss or misuse of this information and potential liability. We may not be able to anticipate or prevent rapidly evolving types of cyber-attacks. Actual or anticipated attacks may cause us to incur increasing costs including costs to deploy additional personnel and protection technologies, train employees and engage third party experts and consultants. Advances in computer capabilities, new technological discoveries or other developments may result in the technology used by us to protect transaction or other data being breached or compromised. Data and security breaches can also occur as a result of non-technical issues including intentional or inadvertent breach by employees or persons with whom we have commercial

13

Table of Contents

relationships that result in the unauthorized release of personal or confidential information. Any compromise or breach could result in a violation of applicable privacy and other laws, significant financial exposure and a loss of confidence in our security measures, which could have an adverse effect on our results of operations and our reputation.

Our reliance on key personnel

Our success depends to a significant extent upon our ability to attract and retain qualified key personnel, including senior management. Collective or individual changes in our senior management and other key personnel could have an adverse effect on our ability to determine and execute our strategies, which could adversely affect our business and results of operations. There is a high level of competition for senior management and other key personnel, and we cannot be assured we will be able to attract, retain and develop a sufficient number of qualified senior managers and other key personnel.

Failure to comply with regulatory requirements

As a public company, we are subject to numerous regulatory requirements, including those imposed by the Sarbanes-Oxley Act of 2002, the SEC and the NYSE. In addition, we are subject to numerous domestic and foreign laws and regulations affecting our business, including those related to labor, employment, worker health and safety, competition, privacy, consumer protection, import/export and anti-corruption, including the Foreign Corrupt Practices Act. Although we have put into place policies and procedures aimed at ensuring legal and regulatory compliance, our employees, subcontractors, vendors and suppliers could take actions that violate these requirements, which could have a material adverse effect on our reputation, financial condition and on the market price of our common stock. In addition, recent regulatory developments regarding the use of “conflict minerals,” certain minerals originating from the Democratic Republic of Congo and adjoining countries, could affect the sourcing and availability of raw materials used by suppliers and subject us to costs associated with the regulations, including for the diligence pertaining to the presence of any conflict minerals used in our products, possible changes to products, processes or sources of our inputs, and reporting requirements.

Fluctuations in foreign currency exchange rates could adversely impact our financial condition and results of operations

We have foreign currency exchange rate risk with respect to revenues, expenses, assets and liabilities denominated in currencies other than the U.S. dollar. We currently do not utilize hedging instruments to mitigate foreign currency exchange risks. Specifically, fluctuations in the value of the Canadian Dollar, Mexican Peso, Chinese Yuan, Hong Kong Dollar, British Pound and Euro against the U.S. Dollar could have a material adverse effect on our results of operations, financial condition and cash flows.

Other risk factors

Additionally, other factors could adversely affect our financial performance, including factors such as: our ability to successfully acquire and integrate other businesses; any interruption of our key infrastructure systems, including exceeding capacity in our distribution centers; any disaster or casualty resulting in the interruption of service from our distribution centers or in a large number of our stores; any interruption of our business related to an outbreak of a pandemic disease in a country where we source or market our merchandise; extreme weather conditions or changes in climate conditions or weather patterns; the effects of changes in current exchange rates and interest rates; and international and domestic acts of terror.

The impact of any of the previously discussed factors, some of which are beyond our control, may cause our actual results to differ materially from expected results in these statements and other forward-looking statements we may make from time-to-time.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

14

Table of Contents

We own two buildings in urban Pittsburgh, Pennsylvania which house our corporate headquarters. These buildings total 186,000 square feet and 150,000 square feet, respectively. We lease one location near our headquarters, which is used primarily for store and corporate support services, totaling approximately 51,000 square feet. This lease expires in 2022.

We rent approximately 131,000 square feet of office space in New York, New York for our designers and sourcing and production teams. The lease for this space expires in May 2016. We also lease an additional 35,000 square feet of office space in New York, New York, with various terms expiring through 2018.

We lease 9,200 square feet of office space in San Francisco, California that functions as a technology center for our engineers and digital marketing team focused on our omni-channel strategy. The lease for this space expires in 2019.

We also lease offices in international locations including 5,800 square feet in Mexico City expiring in 2020, 15,400 square feet in Hong Kong expiring in 2017 and 11,300 square feet in Shanghai, China expiring in 2017.

We own a distribution facility in Ottawa, Kansas consisting of approximately 1,220,000 total square feet. This facility is used to support new and existing growth initiatives, including AEO Direct and aerie.

We own a 423,000 square foot building located in a suburban area near Pittsburgh, Pennsylvania, which houses a distribution center and contains approximately 120,000 square feet of office space. In Fiscal 2013, we announced plans to close this facility in Fiscal 2015 and transfer operations our facility in Hazleton, Pennsylvania. In the same suburban area near Pittsburgh, Pennsylvania, we own a 45,000 square foot building, which houses our data center and additional office space and lease an additional location of approximately 18,000 square feet, which is used for storage space. This lease expires in 2015.

We opened a new distribution facility in 2014 in Hazleton, Pennsylvania consisting of approximately 1,000,000 total square feet. This is designed to enable faster, more efficient product deliveries and to support our long-term expansion goals.

We lease a building in Mississauga, Ontario with approximately 294,000 square feet, which houses our Canadian distribution center. The lease expires in 2018.

We lease our flagship store in the Times Square area of New York, New York. The 25,000 square foot location has an initial term of 15 years with three options to renew for five years each. This flagship store opened in November 2009 and the initial lease term expires in 2024.

All of our stores are leased and generally have initial terms of 10 years. Certain leases also include early termination options, which can be exercised under specific conditions. Most of these leases provide for base rent and require the payment of a percentage of sales as additional contingent rent when sales reach specified levels. Under our store leases, we are typically responsible for tenant occupancy costs, including maintenance and common area charges, real estate taxes and certain other expenses. We have generally been successful in negotiating renewals as leases near expiration.

We are a party to various legal actions incidental to our business, including certain actions in which we are the plaintiff. At this time, our management does not expect the results of any of the legal actions to be material to our financial position or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable

15

Table of Contents

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is traded on the NYSE under the symbol “AEO”. As of March 9, 2015, there were 520 stockholders of record. However, when including associates who own shares through our employee stock purchase plan, and others holding shares in broker accounts under street name, we estimate the stockholder base at approximately 55,000. The following table sets forth the range of high and low closing prices of the common stock as reported on the NYSE during the periods indicated.

| Market Price | Cash Dividends per Common Share |

|||||||||||

| For the Quarters Ended |

High | Low | ||||||||||

| January 31, 2015 |

$ | 14.63 | $ | 11.91 | $ | 0.125 | ||||||

| November 1, 2014 |

$ | 14.81 | $ | 10.42 | $ | 0.125 | ||||||

| August 2, 2014 |

$ | 11.97 | $ | 10.28 | $ | 0.125 | ||||||

| May 3, 2014 |

$ | 14.85 | $ | 10.95 | $ | 0.125 | ||||||

| February 1, 2014 |

$ | 16.52 | $ | 12.77 | $ | 0.125 | ||||||

| November 2, 2013 |

$ | 19.97 | $ | 13.24 | $ | 0.125 | ||||||

| August 3, 2013 |

$ | 20.48 | $ | 17.62 | $ | 0.125 | ||||||

| May 4, 2013 |

$ | 22.55 | $ | 18.38 | $ | 0.00 | ||||||

During Fiscal 2014 and Fiscal 2013, we paid quarterly dividends as shown in the table above. No cash dividends per common share were paid for the quarter ended May 4, 2013 as the dividend payment was accelerated into the previous quarter. The payment of future dividends is at the discretion of our Board of Directors (the “Board”) and is based on future earnings, cash flow, financial condition, capital requirements, changes in U.S. taxation and other relevant factors. It is anticipated that any future dividends paid will be declared on a quarterly basis.

16

Table of Contents

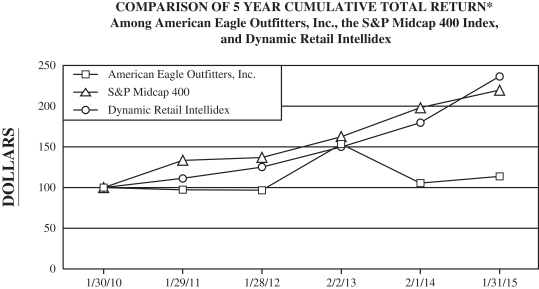

Performance Graph

The following Performance Graph and related information shall not be deemed “soliciting material” or to be filed with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

The following graph compares the changes in the cumulative total return to holders of our common stock with that of the S&P Midcap 400 and the Dynamic Retail Intellidex. The comparison of the cumulative total returns for each investment assumes that $100 was invested in our common stock and the respective index on January 30, 2010 and includes reinvestment of all dividends. The plotted points are based on the closing price on the last trading day of the fiscal year indicated.

| * | $100 invested on 1/30/10 in stock or 1/31/10 in index, including reinvestment of dividends. |

| Indexes calculated on month-end basis. |

| 1/30/10 | 1/29/11 | 1/28/12 | 2/2/13 | 2/1/14 | 1/31/15 | |||||||||||||||||||

| American Eagle Outfitters, Inc. |

100.00 | 97.35 | 96.68 | 153.44 | 105.38 | 113.69 | ||||||||||||||||||

| S&P Midcap 400 |

100.00 | 133.46 | 137.07 | 162.51 | 198.05 | 219.62 | ||||||||||||||||||

| Dynamic Retail Intellidex |

100.00 | 111.23 | 125.20 | 150.00 | 179.72 | 236.56 | ||||||||||||||||||

17

Table of Contents

The following table provides information regarding our repurchases of common stock during the three months ended January 31, 2015.

Issuer Purchases of Equity Securities

| Period |

Total Number of Shares Purchased |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Programs |

Maximum Number of Shares that May Yet be Purchased Under the Program |

||||||||||||

| (1) | (2) | (1)(3) | (3) | |||||||||||||

| Month #1 (November 2, 2014 through November 29, 2014) |

— | $ | — | — | 18,400,000 | |||||||||||

| Month #2 (November 30, 2014 through January 3, 2015) |

— | $ | — | — | 18,400,000 | |||||||||||

| Month #3 (January 4, 2015 through January 31, 2015) |

— | $ | — | — | 18,400,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

— | $ | — | — | 18,400,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | There were no shares repurchased as part of our publicly announced share repurchase program during the three months ended January 31, 2015 and there were no shares repurchased for the payment of taxes in connection with the vesting of share-based payments. |

| (2) | Average price paid per share excludes any broker commissions paid. |

| (3) | In January 2013, our Board authorized the repurchase of 20.0 million shares of our common stock. The authorization of the remaining 18.4 million shares that may yet be purchased expires on January 28, 2017. |

The following table sets forth additional information as of the end of Fiscal 2014, about shares of our common stock that may be issued upon the exercise of options and other rights under our existing equity compensation plans and arrangements, divided between plans approved by our stockholders and plans or arrangements not submitted to our stockholders for approval. The information includes the number of shares covered by and the weighted average exercise price of, outstanding options and other rights and the number of shares remaining available for future grants excluding the shares to be issued upon exercise of outstanding options, warrants and other rights.

Equity Compensation Plan Table

| Column (a) | Column (b) | Column (c) | ||||||||||

| Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) |

Weighted-average exercise price of outstanding options, warrants and rights(1) |

Number of securities remaining available for issuance under equity compensation plans (excluding securities reflected in column (a))(1) |

||||||||||

| Equity compensation plans approved by stockholders |

2,390,469 | $ | 16.28 | 8,895,719 | ||||||||

| Equity compensation plans not approved by stockholders |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

2,390,469 | $ | 16.28 | 8,895,719 | ||||||||

| (1) | Equity compensation plans approved by stockholders include the 1999 Stock Incentive Plan, the 2005 Stock Award and Incentive Plan, as amended (the “2005 Plan”), and the 2014 Stock Award and Incentive Plan (the “2014 Plan”). |

18

Table of Contents

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA.

The following Selected Consolidated Financial Data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included under Item 7 below and the Consolidated Financial Statements and Notes thereto, included in Item 8 below. Most of the selected Consolidated Financial Statements data presented below is derived from our Consolidated Financial Statements, if applicable, which are filed in response to Item 8 below. The selected Consolidated Statement of Operations data for the years ended January 28, 2012 and January 29, 2011 and the selected Consolidated Balance Sheet data as of February 2, 2013, January 28, 2012, and January 29, 2011 are derived from audited Consolidated Financial Statements not included herein.

| For the Years Ended(1) | ||||||||||||||||||||

| (In thousands, except per share amounts, ratios and other financial information) |

January 31, 2015 |

February 1, 2014 |

February 2, 2013 |

January 28, 2012 |

January 29, 2011 |

|||||||||||||||

| Summary of Operations(2) |

||||||||||||||||||||

| Total net revenue |

$ | 3,282,867 | $ | 3,305,802 | $ | 3,475,802 | $ | 3,120,065 | $ | 2,945,294 | ||||||||||

| Comparable sales increase |

(5 | )% | (6 | )% | 9 | % | 4 | % | (1 | )% | ||||||||||

| Gross profit |

$ | 1,154,674 | $ | 1,113,999 | $ | 1,390,322 | $ | 1,144,594 | $ | 1,182,151 | ||||||||||

| Gross profit as a percentage of net sales |

35.2 | % | 33.7 | % | 40.0 | % | 36.7 | % | 40.1 | % | ||||||||||

| Operating income |

$ | 155,765 | $ | 141,055 | $ | 394,606 | $ | 269,335 | $ | 339,552 | ||||||||||

| Operating income as a percentage of net sales |

4.7 | % | 4.3 | % | 11.4 | % | 8.6 | % | 11.5 | % | ||||||||||

| Income from continuing operations |

$ | 88,787 | $ | 82,983 | $ | 264,098 | $ | 175,279 | $ | 195,731 | ||||||||||

| Income from continuing operations as a percentage of net sales |

2.6 | % | 2.5 | % | 7.6 | % | 5.6 | % | 6.7 | % | ||||||||||

| Per Share Results |

||||||||||||||||||||

| Income from continuing operations per common share-basic |

$ | 0.46 | $ | 0.43 | $ | 1.35 | $ | 0.90 | $ | 0.98 | ||||||||||

| Income from continuing operations per common share-diluted |

$ | 0.46 | $ | 0.43 | $ | 1.32 | $ | 0.89 | $ | 0.97 | ||||||||||

| Weighted average common shares outstanding — basic |

194,437 | 192,802 | 196,211 | 194,445 | 199,979 | |||||||||||||||

| Weighted average common shares outstanding — diluted |

195,135 | 194,475 | 200,665 | 196,314 | 201,818 | |||||||||||||||

| Cash dividends per common share |

$ | 0.50 | $ | 0.375 | $ | 2.05 | $ | 0.44 | $ | 0.93 | ||||||||||

| Balance Sheet Information |

||||||||||||||||||||

| Total cash and short-term investments |

$ | 410,697 | $ | 428,935 | $ | 630,992 | $ | 745,044 | $ | 734,695 | ||||||||||

| Long-term investments |

$ | — | $ | — | $ | — | $ | 847 | $ | 5,915 | ||||||||||

| Total assets |

$ | 1,696,908 | $ | 1,694,164 | $ | 1,756,053 | $ | 1,950,802 | $ | 1,879,998 | ||||||||||

| Short-term debt |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Long-term debt |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Stockholders’ equity |

$ | 1,139,746 | $ | 1,166,178 | $ | 1,221,187 | $ | 1,416,851 | $ | 1,351,071 | ||||||||||

| Working capital |

$ | 431,420 | $ | 512,513 | $ | 705,898 | $ | 882,087 | $ | 786,573 | ||||||||||

| Current ratio |

1.94 | 2.23 | 2.62 | 3.18 | 3.03 | |||||||||||||||

| Average return on stockholders’ equity |

7.7 | % | 7.0 | % | 17.6 | % | 11.0 | % | 9.6 | % | ||||||||||

| Other Financial Information(2) |

||||||||||||||||||||

| Total stores at year-end |

1,056 | 1,066 | 1,044 | 1,069 | 1,077 | |||||||||||||||

| Capital expenditures |

$ | 245,002 | $ | 278,499 | $ | 93,939 | $ | 89,466 | $ | 75,904 | ||||||||||

| Net sales per average selling square |

$ | 525 | $ | 547 | $ | 602 | $ | 547 | $ | 526 | ||||||||||

| Total selling square feet at end of period |

5,294,744 | 5,205,948 | 4,962,923 | 5,028,493 | 5,026,144 | |||||||||||||||

| Net sales per average gross square |

$ | 420 | $ | 444 | $ | 489 | $ | 438 | $ | 422 | ||||||||||

| Total gross square feet at end of period |

6,613,100 | 6,503,486 | 6,023,278 | 6,290,284 | 6,288,425 | |||||||||||||||

| Number of employees at end of period |

38,000 | 40,400 | 40,100 | 39,600 | 39,900 | |||||||||||||||

19

Table of Contents

| (1) | Except for the fiscal year ended February 2, 2013, which includes 53 weeks, all fiscal years presented include 52 weeks. |

| (2) | All amounts presented are from continuing operations for all periods presented. Refer to Note 15 to the accompanying Consolidated Financial Statements for additional information regarding the discontinued operations of 77kids. |

| (3) | The comparable sales increase for the period ended February 2, 2013 is compared to the corresponding 53 week period in Fiscal 2011. Additionally, comparable sales for all periods include AEO Direct sales. |

| (4) | Total net revenue per average square foot is calculated using retail store sales for the year divided by the straight average of the beginning and ending square footage for the year. |

| ITEM 7. MANAGEMENT’S | DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion and analysis of financial condition and results of operations are based upon our Consolidated Financial Statements and should be read in conjunction with those statements and notes thereto.

This report contains various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which represent our expectations or beliefs concerning future events, including the following:

| • | the planned opening of approximately 20 to 25 AEO stores in the Factory store format in North America and continued international expansion during Fiscal 2015; |

| • | the success of our efforts to expand internationally, engage in future franchise/license agreements, and/or growth through acquisitions or joint ventures; |

| • | the selection of approximately 25 American Eagle Outfitters stores in the United States and Canada for remodeling and refurbishing during Fiscal 2015; |

| • | the potential closure of approximately 50 American Eagle Outfitters and 20 aerie stores in the United States and Canada during Fiscal 2015; |

| • | the planned opening of approximately 30 new international third party operated American Eagle Outfitters stores during Fiscal 2015; |

| • | the success of our core American Eagle Outfitters and aerie brands through our omni-channel outlets within North America and internationally; |

| • | the expected payment of a dividend in future periods; |

| • | the possibility that our credit facilities may not be available for future borrowings; |

| • | the possibility that rising prices of raw materials, labor, energy and other inputs to our manufacturing process, if unmitigated, will have a significant impact to our profitability; and |

| • | the possibility that we may be required to take additional store impairment charges related to underperforming stores. |

We caution that these forward-looking statements, and those described elsewhere in this report, involve material risks and uncertainties and are subject to change based on factors beyond our control, as discussed within Part I, Item 1A of this Form 10-K. Accordingly, our future performance and financial results may differ materially from those expressed or implied in any such forward-looking statement.

Critical Accounting Policies

Our Consolidated Financial Statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), which require us to make estimates and assumptions that may affect the

20

Table of Contents

reported financial condition and results of operations should actual results differ from these estimates. We base our estimates and assumptions on the best available information and believe them to be reasonable for the circumstances. We believe that of our significant accounting policies, the following involve a higher degree of judgment and complexity. Refer to Note 2 to the Consolidated Financial Statements for a complete discussion of our significant accounting policies. Management has reviewed these critical accounting policies and estimates with the Audit Committee of our Board.

Revenue Recognition. We record revenue for store sales upon the purchase of merchandise by customers. Our e-commerce operation records revenue upon the estimated customer receipt date of the merchandise. Revenue is not recorded on the purchase of gift cards. A current liability is recorded upon purchase, and revenue is recognized when the gift card is redeemed for merchandise.

We estimate gift card breakage and recognize revenue in proportion to actual gift card redemptions as a component of total net revenue. We determine an estimated gift card breakage rate by continuously evaluating historical redemption data and the time when there is a remote likelihood that a gift card will be redeemed.

Revenue is recorded net of estimated and actual sales returns and deductions for coupon redemptions and other promotions. The estimated sales return reserve is based on projected merchandise returns determined through the use of historical average return percentages. We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate our sales return reserve. However, if the actual rate of sales returns increases significantly, our operating results could be adversely affected.

We recognize royalty revenue generated from our license or franchise agreements based upon a percentage of merchandise sales by the licensee/franchisee. This revenue is recorded as a component of total net revenue when earned.

Merchandise Inventory. Merchandise inventory is valued at the lower of average cost or market, utilizing the retail method. Average cost includes merchandise design and sourcing costs and related expenses. We record merchandise receipts at the time which both title and risk of loss for the merchandise transfers to us.

We review our inventory in order to identify slow-moving merchandise and generally use markdowns to clear merchandise. Additionally, we estimate a markdown reserve for future planned markdowns related to current inventory. If inventory exceeds customer demand for reasons of style, seasonal adaptation, changes in customer preference, lack of consumer acceptance of fashion items, competition, or if it is determined that the inventory in stock will not sell at its currently ticketed price, additional markdowns may be necessary. These markdowns may have a material adverse impact on earnings, depending on the extent and amount of inventory affected.

We estimate an inventory shrinkage reserve for anticipated losses for the period between the last physical count and the balance sheet date. The estimate for the shrinkage reserve is calculated based on historical percentages and can be affected by changes in merchandise mix and changes in actual shrinkage trends. We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate our inventory shrinkage reserve. However, if actual physical inventory losses differ significantly from our estimate, our operating results could be adversely affected.

Asset Impairment. In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) 360, Property, Plant, and Equipment (“ASC 360”), we evaluate long-lived assets for impairment at the individual store level, which is the lowest level at which individual cash flows can be identified. Impairment losses are recorded on long-lived assets used in operations when events and circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts of the assets. When events such as these occur, the impaired assets are adjusted to their estimated fair value and an impairment loss is recorded separately as a component of operating income under loss on impairment of assets.

21

Table of Contents

Our impairment loss calculations require management to make assumptions and to apply judgment to estimate future cash flows and asset fair values, including forecasting useful lives of the assets and selecting the discount rate that reflects the risk inherent in future cash flows. We do not believe there is a reasonable likelihood that there will be a material change in the estimates or assumptions we use to calculate long-lived asset impairment losses. However, if actual results are not consistent with our estimates and assumptions, our operating results could be adversely affected.