DocumentExhibit 99.1

Eldorado Gold Corporation

Annual Information Form

in respect of the Year-Ended December 31, 2023

Dated: March 28, 2024

About this Annual Information Form

Throughout this annual information form (“AIF”), references to “we,” “us,” “our,” “Eldorado” and the “Company” mean Eldorado Gold Corporation and its subsidiaries. References to “Eldorado Gold” mean Eldorado Gold Corporation only. References to “this year” mean 2023.

For all other defined technical and other terms, please refer to our Glossary section on page 120. All dollar amounts are in United States dollars unless stated otherwise.

Except as otherwise noted, the information in this AIF is as of December 31, 2023. We prepare the financial statements referred to in this AIF in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, and file the AIF with appropriate regulatory authorities in Canada and the United States. Information on our website is not part of this AIF, or incorporated by reference. Filings on SEDAR+ are also not part of this AIF or incorporated by reference, except as specifically stated. For greater certainty, Eldorado’s Climate Change & GHG Emissions Report, its February 22, 2024 news release, as well as each of the Kışladağ Technical Report, Efemçukuru Technical Report, Olympias Technical Report, Skouries Technical Report and Lamaque Technical Report are expressly excluded from incorporation by reference herein.

You can find more information about Eldorado Gold, including information about executive and director compensation and indebtedness, principal holders of our securities, and securities authorized for issuance under equity compensation plans (such as our incentive stock option plan and performance share unit plan, among others), in our most recent management proxy circular filed on SEDAR+ (www.sedarplus.com) under the name Eldorado Gold Corporation. For additional financial information, you should also read our audited consolidated financial statements and management’s discussion and analysis (“MD&A”) for the year ended December 31, 2023. You can find these documents and additional information about the Company filed under our name on SEDAR+ (www.sedarplus.com) and EDGAR (www.sec.gov), or you can ask us for a copy by writing to:

Eldorado Gold Corporation

Corporate Secretary

11th Floor, 550 Burrard Street

Vancouver, British Columbia, V6C 2B5

Table of Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| |

2021 | |

2022 | |

2023 and 2024 to date | |

| |

| |

| |

| |

| |

| |

| |

Kışladağ | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Forward-Looking Information and Risks

Certain of the statements made and information provided in this AIF are forward-looking statements or information within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. Often, these forward-looking statements and forward-looking information can be identified by the use of words such as “anticipates,” “believes,” “budgets,” “continue,” “commitment”, “confident,” “estimates,” “expects,” “forecasts,” “foresee,” “future,” “goal,” “guidance,” “intends,” “opportunity,” “outlook,” “plans,” “potential,” “project,” “prospective,” “scheduled,” “strive,” or “target” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “can,” “could,” “likely,” “may,” “might,” “will” or “would” be taken, occur or be achieved.

Forward-looking statements or information contained in this AIF include, but are not limited to, statements or information with respect to:

•Eldorado Gold’s beliefs for future value and stakeholder returns, strategic priorities, business objectives, and anticipated advancements across its assets;

•Eldorado Gold’s guidance and outlook, including expected production, timing of production, cost guidance, sustaining and growth capital expenditures, expected flotation, carbon-in-leach and heap leach recoveries of ore (both tonnes and expected grade);

•Our Kışladağ operations, including: expected heap leach tonnes of ore and production resulting from optimization of the crushing roll and fine ore-in plant agglomeration circuit that was installed in 2023, the expectation for construction and commissioning of the North ADR Facility (as defined herein) in 2024, and the expectation that the NWRD (as defined herein) will provide sufficient capacity to hold the waste rock the Company expects will be generated based on the current mine plan;

•Our Efemçukuru operations, including: plans for a north mine rock storage facility, the development and infrastructure for expansion towards the Kokaripinar and Bati vein systems and the anticipated management of site water;

•Our Olympias operations, including: the planned expansion to 650 ktpa of ore and timing and specific activities to achieve such throughput, the ability to meet future backfill requirements, planned extension of the second decline and development of the third decline, the commissioning of an underground maintenance workshop and the Company’s expectations of related time savings, and the extent to which the existing workshop and fuel storage at Olympias, as well as additional planned power generation will be adequate to support future production increases;

•Our Skouries Project (as defined herein), including statements regarding construction and development of the Skouries Project, expected recovery methods and estimates on capital costs;

•Our Lamaque Complex (as defined herein), including: plans to mine and process ore, expected resource conversion and resource expansion drilling at the Ormaque deposit, planned capital spend on tailings management and electric underground trucks, planned exploration programs and the site’s compliance with Towards Sustainable Mining (“TSM”) guidelines, and the need for new low-profile mining equipment in connection with the proposed mining of the Ormaque deposit;

•Eldorado Gold’s strategy and expectations with respect to currency holdings, hedging and inflation;

•the Company’s sustainability practices generally, its compliance with the Sustainability Integrated Management System (“SIMS”), the expectation that Kışladağ and Efemçukuru will be verified in 2024, and that further sustainability assessments are expected to occur in 2025;

•the filing of a new report under the Modern Slavery Act (as defined herein);

•the addition of primary equipment to our fleet in the future, including jumbos, bolters, trucks, and loaders;

•the anticipated economic and social impacts of our projects, including the expected benefits of the Kassandra Mines (as hereinafter defined) to the Halkidiki Prefecture;

•the Company’s pursuit of operational improvements at its tailings facilities, which it expects will lead to a lower risk profile for the facilities;

•the Company’s strategy with respect to human rights impact assessments at its Greek and Turkish operations, including the timing thereof;

•the Company’s intentions with respect to its response to the Carbon Disclosure Project’s Climate Change and Water surveys, including the timing and frequency thereof;

•the Company’s strategy with respect to the Voluntary Principles on Security and Human Rights;

•favourable economics for the Company’s heap leaching plan and the ability to extend mine life at Eldorado’s projects;

•sales from the Olympias project (“Olympias” or the “Olympias Project”), including the imposition of the value-added tax thereon;

•future changes in law and tax rates;

•the intervention filed by Hellas Gold (as hereinafter defined) related to a challenge to the Kassandra Mines Environmental Impact Assessment and the upcoming hearing related thereto;

•the Company’s strategy with respect to the Kassandra Mines, including the anticipated results therefrom;

•the potential sale of any of our non-core assets, including the Certej project;

•planned capital and exploration expenditures;

•conversion of mineral resources to mineral reserves;

•Eldorado Gold’s expectation as to its future financial and operating performance, including expectations around generating free cash flow, estimated cash costs, expected metallurgical recoveries and gold (and by-product) price outlook;

•improved concentrate grade and quality;

•intentions and expectations regarding non-IFRS financial measures and ratios;

•gold price outlook and the global concentrate market;

•Eldorado’s targets, intentions and expectations related to mitigating greenhouse gas emissions, including the timing thereof and operations related thereto;

•Eldorado’s strategy, plans and goals, including its proposed exploration, development, construction, permitting and operating plans and priorities and related timelines and schedules;

•nomination of the Company’s directors in 2024;

•risk factors affecting our business; and

•results of litigation and arbitration proceedings.

Forward-looking statements or information is based on a number of assumptions, that management considers reasonable, however, if such assumptions prove to be inaccurate, then actual results, activities, performance or achievements may be materially different from those described in the forward-looking statements or information. These include assumptions concerning: timing, cost and results of our construction and development activities, improvements and exploration; the future price of gold and other commodities; exchange rates; anticipated values, costs, expenses and working capital requirements; production and metallurgical recoveries; mineral reserves and resources; our ability to unlock the potential of our brownfield property portfolio; our ability to address the negative impacts of climate change and adverse weather (including increased precipitation at Kışladağ); consistency of agglomeration and our ability to optimize it in the future; the cost of, and extent to which we use, essential consumables (including fuel, explosives, cement, and cyanide); the impact and effectiveness of productivity initiatives; the time and cost necessary for anticipated overhauls of equipment; expected by-product grades; the use, and impact or effectiveness, of growth capital; the impact of acquisitions, dispositions, suspensions or delays on our business; the sustaining capital required for various projects; and the geopolitical, economic, permitting and legal climate that we operate in (including recent disruptions to shipping operations in the Red Sea and any related shipping delays, shipping price increases, or impacts on the global energy market).

With respect to the Skouries Project, we have made additional assumptions about inflation rates; labour productivity, rates and expected hours; the scope and timing related to the awarding of key contract packages and approval thereon; expected scope of project management frameworks; our ability to continue to execute our plans relating to Skouries on the existing project timeline and consistent with the current planned project scope (including our anticipated progress regarding the integrated extractive waste management facility (“IEWMF”) and two test stopes); the timeliness of shipping for important or critical items (such as the framing for filter press plates); our ability to continue to access our project funding and remain in compliance with all covenants and contractual commitments in relation thereto; our ability to obtain and maintain all required approvals and permits, both overall and in a timely manner; no further archaeological investigations being required, the future price of gold, copper and other commodities; and the broader community engagement and social climate in respect of the Skouries Project.

In addition, except where otherwise stated, Eldorado has assumed a continuation of existing business operations on substantially the same basis as exists at the time of this AIF. Even though we believe that the assumptions and expectations represented by such statements or information are reasonable, there can be no assurance that the forward-looking statement or information will prove to be accurate. Many assumptions may be difficult to predict and are beyond our control.

Forward-looking statements or information is subject to known and unknown risks, uncertainties and other important factors that may cause actual results, activities, performance or achievements to be materially different from those described in the forward-looking statements or information. These risks, uncertainties and other factors include, among others: risks relating to our operations in foreign jurisdictions (including recent disruptions to shipping operations in the Red Sea and any related shipping delays, shipping price increases, or impacts on the global energy market); development risks at Skouries and other development projects; community relations and social license; liquidity and financing risks; climate change; inflation risk; environmental matters; production and processing; waste disposal; geotechnical and hydrogeological conditions or failures; the global economic environment; risks relating to any pandemic, epidemic, endemic or similar public health threats; reliance on a limited number of

smelters and off-takers; labour (including in relation to employee/union relations, the Greek transformation, employee misconduct, key personnel, skilled workforce, expatriates, and contractors); indebtedness (including current and future operating restrictions, implications of a change of control, ability to meet debt service obligations, the implications of defaulting on obligations and change in credit ratings); government regulation; the Sarbanes-Oxley Act (“SOX”); commodity price risk; mineral tenure; permits; risks relating to environmental sustainability and governance practices and performance; financial reporting (including relating to the carrying value of our assets and changes in reporting standards); non-governmental organizations; corruption, bribery and sanctions; information and operational technology systems; litigation and contracts; estimation of mineral reserves and mineral resources; different standards used to prepare and report mineral reserves and mineral resources; credit risk; price volatility, volume fluctuations and dilution risk in respect of our shares; actions of activist shareholders; reliance on infrastructure, commodities and consumables (including power and water); currency risk; interest rate risk; tax matters; dividends; reclamation and long-term obligations; acquisitions, including integration risks, and dispositions; regulated substances; necessary equipment; co-ownership of our properties; the unavailability of insurance; conflicts of interest; compliance with privacy legislation; reputational issues; competition, and those risk factors discussed in the section titled “Risk Factors in Our Business” below.

Forward-looking statements and information is designed to help you understand management’s current views of our near and longer term prospects, and it may not be appropriate for other purposes. There can be no assurance that forward-looking statements or information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on the forward-looking statements or information contained herein. Except as required by law, we do not expect to update forward-looking statements and information continually as conditions change.

Reporting Mineral Reserves and Mineral Resources

There are differences between the standards and terms used for reporting mineral reserves and resources in Canada, and in the United States pursuant to the United States Securities and Exchange Commission (the “SEC”). The terms mineral resource, measured mineral resource, indicated mineral resource and inferred mineral resource are defined by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) and the CIM Definition Standards for Mineral Resources & Mineral Reserves (the “CIM Definition Standards”) adopted by the CIM Council, and must be disclosed according to Canadian securities regulations.

These standards differ from the requirements of the SEC applicable to domestic United States reporting companies. Accordingly, information contained in this AIF with respect to mineral deposits may not be comparable to similar information made public by United States companies subject to the SEC’s reporting and disclosure requirements.

Except as otherwise noted, Simon Hille, FAusIMM, our Executive Vice President, Technical Services and Operations, is the “Qualified Person” under National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) responsible for preparing or supervising the preparation of, or approving the scientific or technical information contained in this AIF for all our properties except Quebec. With respect to our properties in Quebec, Jessy Thelland, géo (OGQ No. 758) a member in good standing of the Ordre des Géologues du Québec, is the qualified person as defined in NI 43-101 responsible for, and has verified and approved, the scientific and technical disclosure contained in this AIF. Simon Hille and Jessy Thelland are employees of the Company.

About Eldorado

Eldorado owns and operates mines in Türkiye, Canada and Greece. Eldorado’s focus is on the production of gold and base metals such as silver, lead and zinc. In addition, the Company is advancing a copper-gold development project. Its activities involve all facets of the mining industry, including exploration, discovery, acquisition, financing, development, production, reclamation and operation of mining properties. Eldorado Gold is governed by the Canada Business Corporations Act (CBCA) and is headquartered in Vancouver, British Columbia.

Each operation has a general manager and operates as a decentralized business unit within the Company. We manage exploration, merger and acquisition strategies, corporate financing, global tax planning, consolidated financial reporting, regulatory compliance, commodity price and currency risk management programs, investor relations, engineering for capital projects and general corporate matters centrally, at our head office in Vancouver. Our risk management program is developed by senior management and monitored by the board of directors (the “Board of Directors” or “Board”).

Properties as of March 28, 2024

Operating Gold Mines:

•Kışladağ, Türkiye (100%)

•Efemçukuru, Türkiye (100%)

•Lamaque, Canada (100%)

•Olympias, Greece (100%)

Other Mines and Development Projects:

•Skouries, Greece (100%) copper-gold development project

•Stratoni, Greece (100%), silver-lead-zinc mine, currently on care and maintenance

•Perama Hill, Greece (100%) development project, currently on care and maintenance

Kışladağ, Efemçukuru, Lamaque, Olympias and Skouries are material properties for the purposes of NI 43-101. The term “Kassandra Mines” is used throughout this AIF to reference the Stratoni and Olympias mines and Skouries. The Stratoni mine in turn consists of two deposits: Mavres Petres and Madem Lakkos, which were mined out previously. The term “Lamaque Complex” is used throughout this AIF to reference the active Triangle Mine (Upper and Lower), the Ormaque Deposit, the Parallel Deposit, the Plug #4 Deposit and the Sigma mill. The term “Skouries” and “Skouries Project” are used interchangeably throughout this AIF.

Eldorado Gold Corporation

Head Office:

11th Floor, 550 Burrard Street

Vancouver, British Columbia, V6C 2B5

Telephone: 604.687.4018

Facsimile: 604.687.4026

Website: www.eldoradogold.com

Registered Office:

Suite 2900 – 550 Burrard Street

Vancouver, British Columbia, V6C 0A3

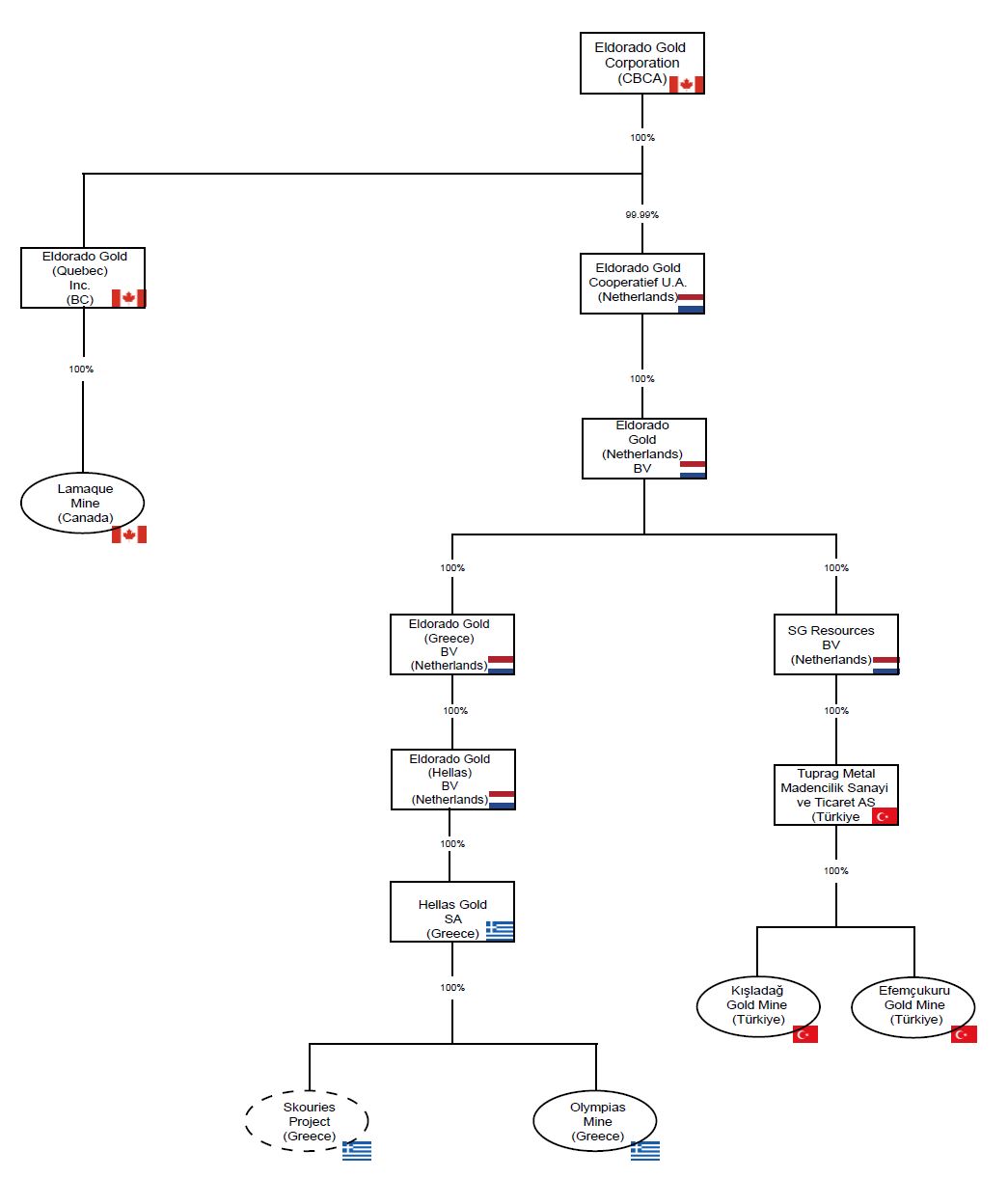

Our corporate structure as at December 31, 2023 is illustrated in the chart below (other than those subsidiaries permitted to be excluded under applicable securities laws).

Subsidiaries

We abbreviate and refer to our subsidiaries as follows:

•Hellas Gold Single Member S.A. (“Hellas Gold”)

•Eldorado Gold (Québec) Inc. (“Eldorado Québec ”)

•SG Resources B.V. (“SG”)

•Tüprag Metal Madencilik Sanayi ve Ticaret AS (“Tüprag”)

Key Events in Our Recent History

2021

In January 2021, the Company entered into a definitive arrangement agreement with QMX to acquire the remaining outstanding shares of QMX. The acquisition closed on April 7, 2021 for share consideration of C$81 M ($64 M), and cash consideration of C$28 M ($22 M).

In January 2021, Eldorado launched its SIMS, which provides minimum standards for health, safety, environmental, social and security performance across Eldorado’s sites. SIMS is aligned with leading international standards include the Responsible Gold Mining Principles, TSM guidelines, the International Cyanide Management Code and the Voluntary Principles on Security and Human Rights.

In January 2021, Mr. Steven Reid was appointed as Chair of the Board.

In February 2021, the Company announced its wholly-owned subsidiary, Hellas Gold had entered into an amended investment agreement (the “Investment Agreement”) with the Hellenic Republic to govern the further development, construction and operation of the Kassandra Mines. The Investment Agreement amends the 2003 transfer agreement between Hellas Gold and the Hellenic Republic (the “Transfer Agreement”), and provides a modernised legal and financial framework to allow for the advancement of Eldorado’s investment in the Kassandra Mines. The Investment Agreement was subsequently ratified by the Hellenic Republic and the amendments to the Transfer Agreement became legally effective on March 23, 2021.

In February 2021, the Company announced an inaugural resource estimate for the recently-discovered Ormaque deposit within its Lamaque Complex in Québec. Inferred mineral resources for Ormaque were initially announced as 2.6 M tonnes at a grade of 9.5 grams per tonne gold, for 803,000 ounces of contained gold. Please see “About our Business” for further information and “Mineral Reserves and

Mineral Resources” for current resource estimates.

On March 30, 2021, the Company completed a flow-through private placement of 1,100,000 common shares at a price of C$16.00 per share for proceeds of C$17.6 M ($13.9 M). The proceeds were used to fund the Lamaque Complex decline project.

In April 2021, the Greek Ministry of Energy and Environment approved a modification to the Kassandra Mines Environmental Impact Assessment to allow for the use of dry stack tailings disposal at the Skouries Project. Dry stack technology involves filtering tailings to remove water prior to stacking and compacting the dry material in a designated tailings area.

In July 2021, the Company acquired 15,041,746 common shares of Probe Metals Inc. (“Probe”) at a price of $1.575 per common share, for an aggregate purchase price of C$24 M ($19 M). Immediately following the acquisition, Eldorado owned 11.5% of the outstanding common shares of Probe. The common shares were acquired pursuant to a private transaction.

In August 2021, the Company completed an offering of 6.25% senior notes, with an aggregate principal amount of $500 M, due in 2029 (the “Notes”). Eldorado used the net proceeds from the sale of the Notes to:

•redeem its then outstanding $234 M 9.5% senior secured notes (which were due 2024), effective September 9, 2021;

•repay all amounts owing under its then outstanding term loan facility and revolving credit facility; and

•pay fees and expenses in connection with the foregoing.

•The remaining net proceeds were used for general corporate purposes.

In September 2021, the Company provided an update on its exploration programs including:

•At the Lamaque Complex, infill drilling at the Ormaque deposit confirmed grade continuity within ore lenses of the inaugural Inferred Resource and expanded several lenses laterally. Drillholes testing deeper levels identified several new mineralized zones.

•Significant drill results from the Bonnefond deposit in the then recently acquired Bourlamaque project area (formerly a QMX project area) indicated additional upside potential.

•At Efemçukuru, drilling at Kokarpinar focused on both conversion drilling within inferred resources and testing the previously undrilled Kokarpinar Northwest Splay.

In October 2021, the Company executed an amended and restated senior secured credit facility (the “Fourth ARCA”). The Fourth ARCA consists of a $250 M revolving senior secured credit facility (the

“Revolving Facility”) with an option to increase the available credit by $100 M through an accordion feature, as well as a letter of credit facility. The Fourth ARCA amended and replaced the May 2019 $450 M senior secured credit facility. For more information on the Notes and Fourth ARCA, please refer to pages 101 and 102. On October 15, 2021, the Company announced that operations at Stratoni would be suspended at the end of 2021. The mine and plant were transferred to care and maintenance during 2022.

On October 27, 2021, the Company completed a sale of the Tocantinzinho Project, a non-core gold asset in Brazil. Eldorado received $20 M in cash consideration and 46,926,372 common shares of G Mining Ventures Corp (“GMIN”), representing 19.9% of the outstanding common shares of GMIN at the sale date. Deferred cash consideration of $60 M is payable on the first anniversary of commercial production of the Tocantinzinho Project, with an option to defer 50% of the consideration at a cost of $5 M. The Company currently holds approximately 17.7% of GMIN's outstanding shares.

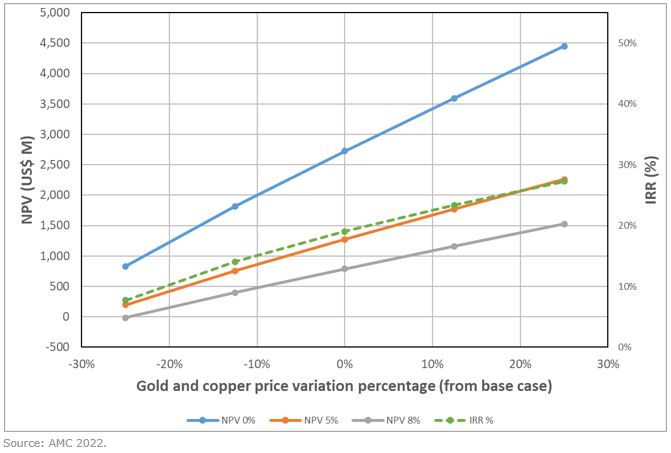

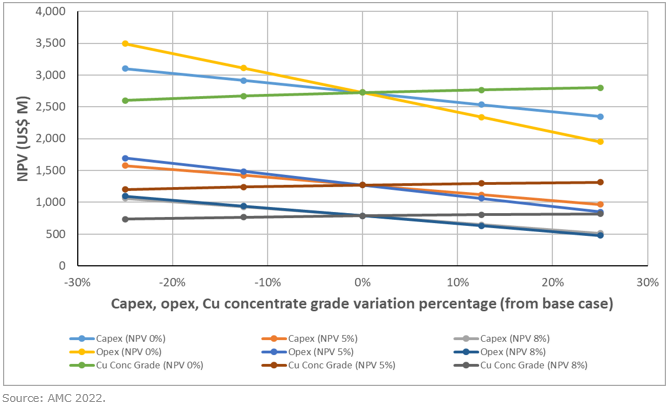

In December 2021, the Company published the results of the Skouries Project Feasibility Study. Skouries is a high-grade copper-gold asset with a 20-year mine life and expected average annual production of 140,000 ounces of gold and 67 M pounds of copper (combined approximately 312,000 ounces gold equivalent). Highlights of the study (at an estimated gold price of $1,500 per ounce and an estimated copper price of $3.85 per pound) include an after-tax Internal rate of return (“IRR”) of 19% and an after-tax net present value (“NPV”) (5%) of $1.3 B.

In December 2021, the Company announced the successful completion of the Triangle-Sigma decline project at the Lamaque Complex. The completion of the growth project, connecting the ore transportation ramp between the Triangle mine and the Sigma processing plant, was on schedule and on budget.

In December 2021, the Company announced completion of the commissioning of the HPGR circuit at Kışladağ. The circuit, a key growth project, was expected to increase recovery by approximately 4% to 56%.

In December 2021, the Company updated its Reserve and Resource statement. The Company’s proven and probable gold reserves totalled 15.3 M ounces as of September 30, 2021, compared to 17.7 M ounces as of December 31, 2020, a decrease of 14%.

2022

In January 2022, the Company announced the appointment of Ms. Carissa Browning to the Board of Directors.

In February 2022, the Company published its inaugural Climate Change and Greenhouse Gas Emissions (“GHG”) Report, outlining a target of mitigating GHG emissions by 30% from 2020 levels, by 2030 on a ‘business as usual’ basis; equal to approximately 65,000 tonnes of carbon dioxide equivalent.

On February 24, 2022, the Company announced the results of a technical study updating the current operation at the Lamaque Complex, updated economics on the Upper Triangle zones (zones C1 through C5), as well as preliminary economic assessment on the inferred resources on the Lower Triangle zones (zones C6 through C10) and the Ormaque deposit. Highlights of the study included an updated resource estimate for the Ormaque deposit totaling 2,223,000 tonnes at a grade of 11.74 g/t gold of Inferred Resources, for 839,000 contained ounces of gold.

In September 2022, the Company entered into a mandate letter (the “Mandate Letter”) with Greek banks for a credit committee approved €680 M project finance facility for the development of the Skouries Project (the “Term Facility”). The Mandate Letter included a long-form term sheet, which contained customary terms and conditions. The Company’s Revolving Facility was also amended in September 2022 to permit the revolving credit facility to be used to provide a bank-issued letter of credit in favour of the Greek banks under the Mandate Letter. The bank-issued letter of credit was expected to be used to backstop the Company’s equity commitments to Hellas Gold in respect of the expected development and construction of the Skouries Project.

In December 2022, the Company announced that its wholly-owned subsidiary, Hellas Gold had entered into the Term Facility with National Bank of Greece S.A. and Piraeus Bank S.A. as lead arrangers. Consistent with the Company’s previous disclosure, the Term Facility will provide 80% of the expected future funding required to complete the Skouries Project. The Term Facility is non-recourse to Eldorado and the collateral securing the Term Facility covers the Skouries Project and the Hellas Gold operating assets. The remaining 20% of the Skouries Project funding is expected to be fully covered by Eldorado’s existing cash and future cash flow from operations. Until such further equity is fully invested, Eldorado’s

investment undertaking for the Skouries Project will be fully backstopped by a letter of credit from the Company’s Revolving Facility. Drawdown on the Term Facility was subject to customary closing conditions.

On December 15, 2022, the Company announced that its Board of Directors approved, conditional upon the initial drawdown of the Term Facility, the investment decision and full re-start of construction at Skouries.

2023 and 2024 to Date

On April 5, 2023 the Company announced that its wholly owned subsidiary Hellas Gold had satisfied all necessary conditions precedent and had closed its previously announced €680 M Term Facility for the development of the Skouries Project.

On May 30, 2023 the Company announced it had entered into agreements with respect to a C$81.5 M strategic investment in Eldorado by the European Bank for Reconstruction and Development (the "EBRD"). The investment was effected by way of a private placement whereby the EBRD subscribed for 6,269,231 shares at a price of C$13.00 per share. (the “EBRD Private Placement”).

In addition, the Company announced that it had entered into an agreement with BMO Capital Markets and National Bank Financial, on behalf of a syndicate of underwriters (collectively, the “Underwriters”), pursuant to which the Underwriters agreed to purchase on a bought deal basis 10,400,000 million common shares of the Company at the same price as the EBRD Private Placement (that is, at C$13.00 per common share), for gross proceeds of C$135 million (the “Bought Deal Offering”).

On June 7, 2023 the Company announced the closing of the Bought Deal Offering. [Proceeds from the Bought Deal Offering are expected to be used to fund growth initiatives across Eldorado's portfolio, including some not currently contemplated within the Company's five-year plan, as well as for general corporate and working capital purposes. The growth initiatives may include but are not limited to: Perama Hill; the expansion of Olympias to 650 ktpa; bringing the Ormaque discovery into production; and exploration opportunities in Türkiye and Quebec.]

On June 14, 2023 the Company announced the closing of the EBRD Private Placement. The proceeds of the EBRD Private Placement have been invested in the Skouries Project, and have been credited against the Company’s 20% equity funding commitment under the terms of the Term Facility that closed on April 5, 2023.

On December 13, 2023 the Company announced a number of executive management changes including:

•the retirement of Joe Dick in 2024;

•the appointment of Louw Smith as Executive Vice President, Development, Greece effective January 1, 2024;

•the appointment of Paul Ferneyhough as Executive Vice President, Chief Strategy & Commercial Officer effective November 1, 2023; and

•the appointment of Simon Hille as Executive Vice President, Technical Services & Operations effective November 1, 2023.

On January 2, 2024 the Company announced the appointment of Paul Ferneyhough as Executive Vice President and Chief Financial Officer of the Company with immediate effect. Mr. Ferneyhough succeeded Philip Yee, who retired as of the same date. Mr. Ferneyhough assumed additional responsibility for the Human Capital Resources role following the departure of Lisa Ower, Executive Vice-President, Chief People Officer & External Affairs.

About our Business

Eldorado is a global gold and base metals producer. We believe our international expertise in exploration, mining, finance and project development places us in a strong position to grow in value and deliver returns for our stakeholders as we create and pursue new opportunities.

Eldorado’s strategy is to focus on jurisdictions that offer the potential for long-term growth and access to high-quality assets. Fundamental to executing on this strategy is the strength of the Company’s in-country teams and relationships with affected parties. The Company has a highly skilled and dedicated workforce of over 4,800 people worldwide, with the majority of employees and management being nationals of the country of operation. Through discovering and acquiring high-quality assets, safely developing and operating world-class mines, growing resources and reserves, responsibly managing impacts and building opportunities for local communities, Eldorado strives to deliver value for all its stakeholders.

From time to time, we may evaluate and re-align our business objectives, including considering suspension or delay of projects or disposition of assets.

We are committed to the following four strategic priorities:

•Quality Assets

Our business is based on a portfolio of long-life, low-cost assets in prospective jurisdictions. Our goal is to manage our asset portfolio to allow the Company to achieve long-term growth with solid margins and enhance our ability to generate free cash flows and earnings per share.

•Operational Excellence

We invest in new technologies and continue training our people in order to increase productivity, reduce risk and operate to guidance year-on-year. We also work to complete these goals in a socially responsible and sustainable manner.

•Capital Discipline

Capital discipline underpins every business decision we make. Eldorado Gold considers all competing uses of cash and prioritizes capital for sustaining its operations and developing its key projects.

•Accountability

We are committed to doing business honestly, respecting our neighbors, minimizing our environmental impacts and keeping our people safe. Operating this way is essential to the sustainability of our business.

An Overview of Our Business

Below we describe each stage of the mining life cycle and the role of our dedicated teams at each phase.

Exploration

Eldorado’s Exploration and Corporate Development teams actively evaluate potential new assets within our focus jurisdictions and in new regions with the objectives of generating opportunities and growing a high-quality portfolio, expanding and enhancing mineral resources, and providing geoscience support to sustain Eldorado Gold's operations and advanced projects. They assess early and advanced stage exploration projects, acquire licenses through staking prospective open ground, commercial agreements and participation in license auctions and conduct near-mine and grassroots exploration programs with the primary goal of adding value through discovery and increasing our mineral resources and reserves. Our exploration programs are focused primarily in the countries in which we operate: Canada, Greece and Türkiye. During early-stage exploration, our teams visit prospective areas to conduct geological, geochemical and geophysical surveys and associated sampling, often partnering with other companies or prospectors to benefit from their local knowledge and experience. If results indicate a potential mineralized deposit, we drill exploration holes to determine whether economically viable concentrations of metals may exist. Successful projects will continue to advanced exploration, wherein drilling programs will define mineral resources whilst in parallel assessments are undertaken to determine potential for future development.

Evaluation and Development

During the evaluation and development stage, our engineering, technical services and metallurgy teams conduct studies to determine:

•the Mineral Resources contained in a project;

•the optimal mining methods and mineral recovery processes;

•the required infrastructure;

•the best placement and design of facilities, based on impact and migration assessments; and

•the required mine monitoring, closure and reclamation plans.

These studies provide information on the capital costs required for development and the longer-term economics of the project. We are then able to decide if a capital investment makes economic sense, and meets our required return rate in order to make capital allocation and construction decisions.

Construction

The assessment of the project’s environmental impact (generically referred to as an “EIA” herein, but also referred to as an “Environmental Impact Study” (“EIS”) or, if social factors are included, an Environmental and Social Impact Assessment ( “ESIA”)) and other relevant permits require approval by government authorities. Once we have received this, along with management’s investment committee approval as well as Board approval to proceed, our Capital Projects team can begin construction. Explicit requirements described in each EIA guide our activities and help us manage any social and environmental risks.

This construction phase requires the greatest input of capital and resources over a project’s life cycle, and throughout this phase we can add significant value to local economies through local job growth and procurement.

Mining and Processing

During production, our operations team and site personnel are responsible for mining and extracting ore from our underground mines (Efemçukuru, Olympias, Lamaque) and open pit mine (Kışladağ) as well as exploring for new reserves to expand production and mine life. The ore is processed on-site to produce concentrates or doré. Any leftover materials generated by our mining activities, which typically include topsoil, waste rock and tailings, are either placed on-site in engineered facilities for storage and treatment, or reused elsewhere on-site as part of construction activities, rehabilitation, or as underground backfill. Rigorous environmental monitoring – to test air, water and soil quality, noise, blast vibration and dust levels – enables us to comply with environmental regulations and our operating licenses and permits.

Reclamation and Closure

Restoring the land so it is compatible with the surrounding landscape is a priority for us and our communities in which we operate. How we conduct our rehabilitation in one jurisdiction impacts how we are welcomed in another. Therefore, prior to and throughout a mine’s operation, our operations teams develop and continuously enhance plans for the mine’s future closure in order to:

•protect public health and safety;

•prevent environmental damage;

•return the land to a natural condition, or an acceptable and productive alternative; and

•provide for long-term social and economic benefits

Sales of Mineral Products

We produce gold doré as well as gold, silver, lead and zinc contained in concentrates. Our in-country marketing teams are responsible for finding downstream smelters and refineries and establishing long-term working relationships and purchase agreements. These agreements outline the terms and conditions of payment for our products, and specify parameters and penalties for the quantity, quality and chemical composition of our doré and concentrate.

The gold doré produced at Kışladağ is refined to market delivery standards at gold refineries in Türkiye and sold at the spot price on the Precious Metal Market of the Borsa Istanbul. Gold doré is produced at Lamaque and is sold to local refineries in Ontario.

Contracts are also in place for the sale of concentrates from Greece and Türkiye. These include gold concentrates from Efemçukuru and Olympias as well as lead/silver and zinc concentrates from Olympias. These concentrates are sold under contract and are paid based on payable terms and metal prices for the contained metals.

Production and Costs

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2023 |

| 2023 | 2022 | Change | First

quarter | Second

quarter | Third

quarter | Fourth quarter |

| Total |

| Gold ounces produced | 485,139 | 453,916 | 31,223 | 111,509 | 109,435 | 121,030 | 143,166 |

Production costs ($M) | 478.9 | 459.6 | 19.30 | 109.7 | 116.1 | 115.5 | 137.6 |

Cash operating costs1 ($/oz sold) | 743 | 788 | (45) | 778 | 791 | 698 | 716 |

Total cash costs1 ($/oz sold) | 850 | 878 | (28) | 857 | 928 | 794 | 830 |

All-in sustaining costs1 ($/oz sold) | 1,220 | 1,276 | (56) | 1,207 | 1,296 | 1,177 | 1,207 |

Revenue ($M) | 1,008.5 | 872.0 | 136.5 | 227.8 | 229.0 | 244.8 | 306.9 |

Average realized gold price1 ($/oz sold) | 1,944 | 1,787 | 157 | 1,932 | 1,953 | 1,879 | 1,999 |

| Kışladağ |

Gold ounces produced | 154,849 | 135,801 | 19,048 | 37,160 | 34,180 | 37,219 | 46,291 |

Tonnes to pad | 13,220,164 | 11,287,923 | 1,932,241 | 3,134,713 | 3,029,900 | 3,620,640 | 3,434,911 |

Grade (grams per tonne) | 0.78 | 0.74 | 0.04 | 0.70 | 0.76 | 0.85 | 0.78 |

Production costs ($M) | 122.8 | 120.1 | 2.7 | 30.5 | 27.5 | 28.6 | 36.1 |

Cash operating costs1 ($/oz sold) | 657 | 773 | (116) | 708 | 687 | 622 | 623 |

All-in sustaining costs1 ($/oz sold) | 900 | 1,000 | (100) | 875 | 937 | 884 | 909 |

| Lamaque |

| Gold ounces produced | 177,069 | 174,097 | 2,972 | 37,884 | 38,745 | 43,821 | 56,619 |

| Tonnes milled | 838,419 | 833,297 | 5,122 | 199,656 | 192,087 | 198,430 | 248,246 |

Grade (grams per tonne) | 6.76 | 6.65 | 0.11 | 6.06 | 6.43 | 7.04 | 7.36 |

Production costs ($M) | 119.5 | 116.7 | 2.8 | 29.2 | 28.3 | 26.9 | 35.1 |

Cash operating costs1 ($/oz sold) | 643 | 642 | 1 | 721 | 676 | 624 | 580 |

All-in sustaining costs1 ($/oz sold) | 1,089 | 1,036 | 53 | 1,217 | 1,117 | 1,099 | 977 |

| Efemçukuru |

| Gold ounces produced | 86,088 | 87,685 | (1,597) | 19,928 | 22,644 | 21,142 | 22,374 |

| Tonnes milled | 547,089 | 544,450 | 2,639 | 132,898 | 138,159 | 138,045 | 137,987 |

Grade (grams per tonne) | 5.64 | 5.82 | (0.18) | 5.45 | 5.85 | 5.46 | 5.81 |

Production costs ($M) | 80.1 | 73.1 | 7.0 | 17.7 | 20.4 | 20.6 | 21.4 |

Cash operating costs1 ($/oz sold) | 797 | 701 | 96 | 869 | 697 | 817 | 816 |

All-in sustaining costs1 ($/oz sold) | 1,154 | 1,091 | 63 | 1,094 | 1,111 | 1,205 | 1,201 |

| Olympias |

Gold ounces produced | 67,133 | 56,333 | 10,800 | 16,537 | 13,866 | 18,848 | 17,882 |

| Tonnes milled | 454,122 | 395,711 | 58,411 | 104,382 | 110,140 | 124,705 | 114,895 |

Grade (grams per tonne) | 8.23 | 8.00 | 0.23 | 8.57 | 7.31 | 8.33 | 8.70 |

Production costs ($M) | 156.5 | 149.5 | 7.0 | 32.3 | 40.0 | 39.8 | 44.9 |

Cash operating costs1 ($/oz sold) | 1,133 | 1,409 | (276) | 992 | 1,439 | 885 | 1,224 |

All-in sustaining costs1 ($/oz sold) | 1,688 | 2,155 | (467) | 1,532 | 2,036 | 1,319 | 1,872 |

1 These financial measures and ratios are non-IFRS financial measures or ratios. See the section ‘How we measure our costs’ in this document for explanations and discussion of these non-IFRS financial measures or ratios.

How We Measure Our Costs

The Company has included certain non-IFRS financial measures and ratios in this document, as discussed below. The Company believes that these financial measures and ratios, in addition to conventional measures prepared in accordance with IFRS, provide investors with an ability to evaluate the underlying performance of the Company. The non-IFRS financial measures and ratios are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These financial measures and ratios do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Certain additional disclosures for these non-IFRS financial measures and ratios have been incorporated by reference and can be found in the section ‘Non-IFRS and Other Financial Measures and Ratios’ in the December 31, 2023 MD&A filed on February 22, 2024 available on SEDAR+ (www.sedarplus.com).

Cash Operating Costs and Total Cash Costs are calculated using the standard developed by the Gold Institute, a worldwide association of suppliers of gold and gold products including leading North American gold producers. The Gold Institute stopped operating in 2002, but its standard is still widely used in North America to report cash costs of production. Adoption of the standard is voluntary, so you may not be able to compare the costs reported here to those reported by other companies.

Cash Operating Costs and Cash Operating Costs per Ounce Sold

Cash Operating Costs and Cash Operating Cost per ounce sold are non-IFRS financial measures and ratios. In the gold mining industry, these metrics are common performance measures but do not have any standardized meaning under IFRS. The Company calculates costs following the recommendations of the Gold Institute Production Cost Standard. Cash operating costs include direct operating costs (including mining, processing and administration), treatment, refining and transportation charges, but exclude royalty expenses, depreciation and amortization, share based payment expenses and reclamation costs. Revenue from sales of by-products including silver, lead and zinc reduce cash operating costs. Cash operating costs per ounce sold is calculated by dividing cash operating costs by gold ounces sold in the period. The Company discloses cash operating costs and cash operating cost per ounce sold as it believes these measures assist investors and analysts in evaluating the Company’s operating performance and ability to generate cash flow. The most directly comparable IFRS measure is production costs.

Total Cash Costs, Total Cash Costs per Ounce Sold

Total Cash Costs and Total Cash Costs per ounce sold are non-IFRS financial measures and ratios. Total cash costs is defined as the sum of cash operating costs (as defined above) and royalties. Total cash costs per ounce sold is calculated by dividing total cash costs by gold ounces sold in the period. The Company discloses total cash costs and total cash costs per ounce sold as it believes these measures assist investors and analysts in evaluating the Company’s operating performance and ability to generate cash flow. The most directly comparable IFRS measure is production costs.

All-in Sustaining Cost (AISC), AISC per Ounce Sold

AISC and AISC per ounce sold are non-IFRS financial measures and ratios. AISC is defined based on the definition set out by the World Gold Council, including the updated guidance note dated November 14, 2018. The Company defines AISC as the sum of total cash costs (as defined above), sustaining capital expenditure relating to current operations (including capitalized stripping and underground mine development), sustaining leases (cash basis), sustaining exploration and evaluation cost related to current operations (including sustaining capitalized evaluation costs), reclamation cost accretion and amortization related to current gold operations and corporate and allocated general and administrative expenses. Corporate and allocated general and administrative expenses include general and administrative expenses, share based payments and defined benefit pension plan expense. Corporate and allocated general and administrative expenses do not include non-cash depreciation. As this measure seeks to reflect the full cost of gold production from current operations, growth capital and reclamation cost accretion not related to operating gold mines are excluded. Certain other cash expenditures, including tax payments, financing charges (including capitalized interest), except for financing charges related to leasing arrangements, and costs related to business combinations, asset acquisitions and asset disposals are also excluded. AISC per ounce sold is calculated by dividing AISC by gold ounces sold in the period.

The Company discloses AISC and AISC per ounce sold as it believes these measures assist investors, analysts and other stakeholders with understanding the full cost of producing and selling gold and in evaluating the Company’s operating performance and ability to generate cash flow. In addition, the Compensation Committee of the Board of Directors uses AISC per ounce sold, together with other

measures, in its Corporate Scorecard to set incentive compensation goals and assess performance. The most directly comparable IFRS measure is production costs.

Sustaining and Growth Capital

Sustaining and growth capital are non-IFRS financial measures. The Company defines sustaining capital as capital required to maintain current operations at existing levels, including capitalized stripping and underground mine development. Sustaining capital excludes non-cash sustaining lease additions, unless otherwise noted, and does not include capitalized interest, expenditure related to capitalized evaluation, development projects, or other growth or sustaining capital not related to operating gold mines. Growth capital is defined as capital expenditures for new operations, major growth projects or enhancement capital for significant infrastructure improvements at existing operations. The Company uses sustaining capital to understand the ongoing capital cost required to maintain operations at current levels, and growth capital to understand the cost to develop new operations or related to major projects at existing operations where these projects will materially increase production from current levels. The most directly comparable IFRS measure is additions to property, plant and equipment.

Average Realized Gold Price per Ounce Sold

Average realized gold price per ounce sold is a non-IFRS financial measure. The Company defines average realized gold price per ounce sold as revenue from gold sales adding back treatment charges, refining charges, penalties and other costs that are deducted from proceeds from gold concentrate sales, divided by gold ounces sold in the period. The definition of average realized gold price per ounce sold changed in Q1 2022 to add back to revenue certain costs that are deducted from proceeds from gold concentrate sales. These include treatment charges, refining charges, penalties and other costs. In prior periods these costs reduced average realized gold price per ounce sold. As these costs are included in cash operating costs (defined above), this adjustment to average realized gold price per ounce sold will result in greater comparability between metrics. Average realized gold price per ounce sold for 2021 and earlier periods has been adjusted to conform with presentation in subsequent periods. The Company uses average realized gold price per ounce sold to better understand the price realized in each reporting period for gold sales. The most directly comparable IFRS measure is revenue.

Free Cash Flow

Free cash flow is a non-IFRS financial measure. The Company defines free cash flow as net cash generated from (used in) operating activities of continuing operations, less net cash used in investing activities of continuing operations before increases or decreases in cash from the following items that are not considered representative of our ability to generate cash: term deposits, restricted cash, cash used for acquisitions or disposals of mineral properties, marketable securities and non-recurring asset sales. The Company discloses free cash flow as it believes this measure is a useful indicator of its ability to operate without reliance on additional borrowing or usage of existing cash. The most directly comparable IFRS measure is net cash generated from (used in) operating activities of continuing operations.

Working Capital

Working capital is a non-IFRS financial measure. The Company defines working capital as current assets less current liabilities. Working capital does not include assets held for sale and liabilities associated with assets held for sale. The Company discloses working capital as it believes this measure is a useful indicator of the Company’s liquidity. The most directly comparable IFRS measures are current assets and current liabilities.

Environmental, Social and Governance

Governance

Eldorado focuses on contributing to the sustainable development of the communities and regions where we work by fostering safe, inclusive and innovative operations, engaging with communities, responsibly producing products and maintaining or restoring healthy natural environments. We implement technology in regards to environmental practices such as dry-stack tailings, and invest in building capacity in areas such as infrastructure, education and healthcare to create a positive lasting legacy everywhere we operate.

Our governance systems, including policies, frameworks and transparent disclosure practices underpin our environmental, social and governance (“ESG”) efforts. The Board of Directors works to utilize the diverse perspectives and experiences of directors in its oversight of Eldorado’s business and sustainability activities, and has increased its focus on integrating sustainability performance into governance models and compensation. Corporate governance and a commitment to transparency are the core of our business. Eldorado Gold’s Sustainability Committee and Corporate Governance and Nominating Committee of the Board of Directors are responsible for overseeing Eldorado’s ESG activities.

Eldorado Gold’s Sustainability Committee comprises selected members of the Board of Directors. Their task is to oversee and monitor the environmental, health, safety, social, human rights and other sustainability policies, practices, programs and performance of the Company. The Sustainability Committee is also responsible for overseeing matters related to climate change. The whole Board is aligned with management in ensuring we provide our people with safe, healthy and secure workplaces.

ESG Frameworks

Since the introduction of SIMS in 2021, the focus of Eldorado has been implementation of the standards and completing integrated assurance at our operating sites, which includes verification against SIMS, Responsible Gold Mining Principles and Towards Sustainable Mining standard. Lamaque and Olympias were verified in 2022 and 2023, respectively. Kışladağ and Efemçukuru are expected to be verified in 2024. Lamaque achieved AAA ratings, the highest possible score, across all indicators in Biodiversity, Tailings and Water. Olympias achieved AAA ratings across all indicators in Tailings and Biodiversity. Assured scores are available publicly on Mining Association of Canada’s TSM website.

Eldorado engaged an independent third-party to conduct Human Rights Assessments across all of its operating jurisdictions, and those assessments were completed by 2022. As per SIMS, we will repeat these assessments every 3 years. The next assessments are planned for 2025.

Eldorado also developed a Climate Change Strategy and continued the development and implementation of an Energy and Carbon Management System through setting climate-related targets and operationalizing governance, management, and programs related to climate change mitigation and adaptation. In February 2022, Eldorado published its first Climate Change & GHG Emissions Report (the “Climate Change Report”) aligned with the Task Force on Climate-Related Financial Disclosures (“TCFD”). The Climate Change Report details Eldorado’s governance, management, risks, strategy, metrics and targets related to climate change. Effective January 1, 2024, Eldorado Gold and Eldorado Quebec are also subject to Canada’s new “Fighting Against Forced Labour and Child Labour in Supply Chains Act (the “Modern Slavery Act”). Eldorado is committed to meeting its obligations under the Modern Slavery Act. Later this year, Eldorado will be preparing and delivering the necessary disclosure document listing, among other things, steps that Eldorado has taken to prevent and reduce risks of forced labour and child labour.

More information on our Sustainability frameworks can be found on our website.

Health, Safety and Environmental Initiatives

The health and safety of our employees and local affected parties is a key priority of Eldorado. We are committed to the high health and safety standards, adhere to stringent safety regulations and have systems in place to promote a culture of safety.

Eldorado is committed to supporting the protection of international human rights through best practices in all of our business activities. While governments have the primary responsibility for protecting and upholding the human rights of their citizens, Eldorado recognizes its responsibility to respect human rights everywhere we operate. In addition, we recognize that we have an opportunity to promote human rights where we can make a positive contribution. Eldorado adheres to the World Gold Council’s Conflict Free Gold Standard, and produces an annual externally-assured Conflict Free Gold Report confirming that the Company’s operations do not contribute to unlawful armed conflict or human rights abuses.

Eldorado’s properties are routinely inspected by regulators to determine that the properties are in compliance with applicable laws and regulations. In addition, Eldorado conducts internal inspections and participates in external audits to assess the Company’s conformance with its policies and standards.

Our tailings facility monitoring programs include collecting and analyzing geotechnical, hydrological and environmental data from across our facilities. Physical inspections by site personnel and external providers are conducted and equipment such as piezometers and other sensors may be used to collect data. The heap leach facilities at our Kışladağ operation are monitored continuously by site operations and geotechnical teams, with frequent physical inspections being performed. Routine surveys of the facilities may be paired with satellite monitoring data to perform analyses to identify any potential deformation that may take place. Our monitoring programs continuously assess the stability of tailings materials as well as dam structures and related infrastructure.

In accordance with the Mining Association of Canada’s Guide to the Management of Tailings Facilities, as well as applicable regulations in the jurisdictions where we operate, our tailings facilities regularly undergo third-party inspections by experts and government authorities. In 2021, Eldorado established an independent tailings review board (ITRB) to provide technical guidance on design and operational practices. The third party inspections and independent reviews assess the stability and structural integrity of our tailings facilities and note improvements that may be made to further mitigate risks. For further information about Eldorado’s tailings facilities, please see our “Tailings Facilities and Stewardship Overview”, which has been produced in accordance with the Church of England Pension Fund and the Swedish Council (https://www.eldoradogold.com/responsibility).

Prior to and throughout a mine’s operation, we conduct research to establish best practices for mine reclamation and closure. Whenever possible, remediation and reclamation will begin in parallel with other work being carried out across the mine. After a mine site is permanently closed, we conduct further environmental monitoring and reclamation activities, as required by the mine’s EIA and mine licenses. Eldorado also has closure plans for all of its operations. These closure plans assist us to properly estimate the key activities and costs associated with implementing the required closure provisions.

More information on our health and safety, social, and environmental initiatives can be found on our website.

Our Workforce

At the end of 2023, we directly employed 4,869 employees and contractors worldwide. The vast majority of our workforce are nationals of the countries where we operate, and many of our employees are from local communities near our operations.

We have permanent employees and contractors in five countries. The table below shows the number of personnel working at our operations by country at December 31, 2023.

| | | | | | | | | | | |

| Employees | Contractors | Total |

| Türkiye | 1,339 | 915 | 2,254 |

| Canada | 578 | 201 | 779 |

| Greece | 1,032 | 725 | 1,757 |

| Romania | 66 | 3 | 69 |

| Netherlands | 9 | 1 | 10 |

| Total | 3,024 | 1,845 | 4,869 |

To provide a healthy and safe work environment, our workforce is trained on a regular and ongoing basis. These training programs emphasize health and safety, accident avoidance and skills development.

Material Properties

Kışladağ

Technical Report

The scientific and technical information regarding Kışladağ in this AIF is primarily derived from or based upon the scientific and technical information contained in the technical report titled “Technical Report, Kışladağ Gold Mine, Turkey” with an effective date of January 17, 2020 (Kışladağ Technical Report) prepared by Stephen Juras, Ph.D., P.Geo., Paul Skayman, FAusIMM, David Sutherland, P.Eng., Richard Miller, P.Eng. and Sean McKinley, P.Geo., who are all “Qualified Persons” under NI 43-101. Peter Lind, P.Eng. is responsible for the scientific and technical information previously prepared by Paul Skayman; Mike Tsafaras, P.Eng. is responsible for the scientific and technical information previously prepared by Richard Miller. Ertan Uludag, P.Geo., is responsible for the scientific and technical information (except from section 14.7) previously prepared by Stephen Juras, Ph.D., P.Geo. Sean McKinley, P.Geo. is responsible from Section 14.7 which was previously prepared by Stephen Juras, Ph.D., P.Geo. Peter Lind, Mike Tsafaras and Ertan Uludag are “Qualified Persons” for the purposes of NI 43-101. David Sutherland, Sean McKinley, Peter Lind, Mike Tsafaras, and Ertan Uludag are all employees of the Company.

The Kışladağ Technical Report is available under Eldorado Gold’s name on SEDAR+ and EDGAR.

Property Description, Location and Access

The Kışladağ gold mine has been an operating open pit mine in commercial production since 2006 with surface facilities consisting of a crushing plant, heap leach pads and an adsorption, desorption, regeneration (ADR) plant, along with ancillary buildings.

Kışladağ is located in west-central Türkiye lying 180 km to the east of the Aegean coast between Izmir and Ankara. The Kışladağ Project site lies 35 km southwest of the city of Uşak, which has a greater area population of approximately 370,000 inhabitants and near the village of Gümüşkol. Access to the mine is via the main highway towards Ankara from Uşak, and a secondary highway 35 km southwest towards Eşme. A 5.3 km private mine access road connects the mine to the public highway. The mine site sits on the western edge of the Anatolian Plateau at an elevation of approximately 1,000 m, in gentle rolling topography. The climate in this region is arid with warm dry summers and mild wet winters.

There are no permanent water bodies in the area and water supply is limited to ephemeral streams and shallow seasonal stock ponds. Water is supplied to the mine from various well fields with a capacity of approximately 280 m3/hr. A dam was constructed in partnership with the water authority in 2016 and is connected to the site to serve as an additional reservoir to support operations.

The Turkish Electricity Distribution Corporation provides power to the site via two transmission lines from the Uşak industrial zone, 154 kV (27.7km) and 34.5 kV (25km).

The Kışladağ Project land position consists of a single operating license, number 85995, with a total area of 17,192 ha. According to Turkish mining law, Tüprag retains the right to explore and develop any mineral resources contained within the license area provided fees and taxes are maintained. The license was issued on April 9, 2003 and renewed on May 10, 2012 and is currently set to expire on May 10, 2032. Duration of the mining license can be extended if the mine production is still going on at the end of the license period.

No environmental liabilities have been assumed with the Kışladağ Project.

The current project’s EIA area covers 2,509 ha. The land is classified as forestry (49%), treasury (7%), with the remaining area belonging to private land holders. As of December 31, 2023, Tüprag is the majority owner of private land within the concession.

Mining licenses in Türkiye are divided into 5 groups. The Kışladağ license is in group 4, which includes gold, silver, and platinum mines. Royalty rates for group 4 licenses are calculated on a sliding scale implemented in 2015. Royalty rates are based on the run of mine (ROM) sales price. The ROM sales price is calculated by subtracting processing, transport, and depreciation costs from the gold and silver revenues. This amount is then multiplied by the appropriate royalty rate. The royalty rates are

determined once a year by the General Directorate of Mines based on the average sales price of gold and silver quoted on the London Metal Exchange. Doré produced at Kışladağ is considered to be the product of ore processing and is eligible for a factored royalty rate. The corporate tax rate in Türkiye is 25%.

Table 1-1: Royalties Calculation

| | | | | | | | |

| Average Annual Gold Price ($/oz) | Royalty (%) | Factored Royalty (%) |

901 - 1000 | 3.75% | 2.25% |

1001 - 1100 | 5.00% | 3.00% |

1101 - 1200 | 6.25% | 3.75% |

1201 - 1300 | 7.50% | 4.50% |

1301 - 1400 | 8.75% | 5.25% |

1401 - 1500 | 10.00% | 6.00% |

1501 - 1600 | 11.25% | 6.75% |

1601 - 1700 | 12.50% | 7.50% |

1701 - 1800 | 13.75% | 8.25% |

1801 - 1900 | 15.00% | 9.00% |

1901 - 2000 | 16.25% | 9.75% |

2001 - 2100 | 17.50% | 10.50% |

> 2100 | 18.75% | 11.25% |

With an average realized gold price at Kışladağ for 2023 of $1,953, the applicable factored royalty rate was 9.75%.

There are no other royalties, overrides, back-in rights, payments or agreements or encumbrances to which the Kışladağ mine is subject. There are no known significant factors or risks that might affect access or title, or the right or ability to perform work on the Kışladağ mine, including permitting and environmental liabilities to which the project is subject.

History

In-depth exploration began in 1997. More recently in 2020, the Company announced a revised mine plan encompassing a 15-year mine life at Kışladağ supported by new Mineral Reserve estimates that were based on the completed long-cycle heap leach testwork and the replacement of the tertiary crushing circuit with a HPGR circuit. As a result of the decision to not advance with construction of a mill, an impairment reversal of $100.5 M was recognized as at December 31, 2019 relating to the previous impairment of the leach pad and related plant and equipment. An additional impairment charge of $15.3 M was also recorded as at December 31, 2019 relating to capitalized costs of the mill construction project.

Geological Setting, Mineralization and Deposit Types

Kışladağ gold mine is a gold-only porphyry deposit located in the eroded Miocene Beydağı stratovolcano in western Türkiye. Gold mineralization is centered on a set of nested subvolcanic porphyritic intrusions (monzonites and quartz monzonites) that were emplaced through the underlying Menderes metamorphic basement rocks into the base of the Beydaǧı volcanic cover.

Five intrusions have been distinguished based on crosscutting relationships: 1, 2 central, 2A, 2 NW, and 3. All the intrusions have a similar mineralogy and are dominated by plagioclase phenocrysts, with subordinate biotite and amphibole phenocrysts. K-feldspar occurs in minor quantities as phenocrysts but is typically the dominant phase in the groundmass. Intrusions 1 and 3 contain sparse quartz phenocrysts, and clinopyroxene was identified in intrusions 2 central, 2 NW, and 3. Strong hydrothermal alteration in intrusion 1, and especially intrusion 2A, makes the identification of primary mineral assemblages difficult. Stratigraphic layering dips gently radially outward from the eroded center of the volcanic system, with no evidence of fault-related tilting. At depth, the composite porphyry intrusions extends beyond the current limit of drilling (~1,000 m).

The deposit is associated with five main types of alteration assemblages: (1) potassic alteration focused on intrusion 1 and containing the highest gold grades, (2) sodic-calcic alteration, (3) tourmaline-white mica alteration, (4) advanced argillic alteration, and (5) late retrograde argillic alteration. Potassic alteration is characterized by biotite and K-feldspar ± magnetite and most intensely developed in the center of the deposit in intrusion 1, 2 NW, and 2 central. Sodic-calcic alteration affected the deep parts of

the deposit where it overprints the potassic alteration and is characterized by feldspars (including albite), actinolite, biotite, and magnetite ± carbonates. Tourmaline-white mica altered all intrusions but most intensely around the potassic zone. It also occurs in the metamorphic host rocks immediately next to the porphyry intrusions as well as in the volcanic pile within a few hundreds of meters around the deposit. Tourmaline is also abundant in the matrix of breccias in and around the deposit. These tourmaline breccias can be well mineralized where they contain coarse-grained pyrite. Advanced argillic alteration (quartz-alunite ± pyrophyllite ± dickite ± pyrite) is most abundant as a lithocap on the eastern side of the deposit. It also occurs along fracture-controlled zones and especially along stratigraphic contacts in the volcanic rocks around the deposit. Poorly mineralized advanced argillic alteration is present in all the intrusions and overprinted potassic and tourmaline-white-mica alteration. Pyrite has largely been oxidized to jarosite in the shallower parts of the deposit. The pervasively developed argillic alteration assemblage is dominated by kaolinite-smectite (mainly montmorillonite and nontronite) and overprinted all other alteration assemblages. It is widely distributed throughout the deposit, particularly at shallow levels, as well as in the surrounding volcanic rocks. The largest and strongest zone of argillic alteration in the deposit is focused on intrusion 2A.

Veinlets mainly occur as a low-density stockwork and show a temporal evolution from quartz-K-feldspar, quartz-pyrite, quartz-pyrite with tourmaline alteration halos in potassic alteration, pyrite-tourmaline in tourmaline-white-mica alteration, to pyrite-only veinlets cutting all other veins. Pyrite ± tourmaline veinlets are the most abundant in the deposit, and quartz veinlets are volumetrically minor. Molybdenite, chalcopyrite, and galena occur as minor phases associated with these veinlets. Molybdenite is dominantly associated with quartz-bearing veinlets in the shallower parts of the potassic zone. In the upper parts of the deposit, gold occurs mainly as nonrefractory, fine (10 μm) grains associated with pyrite, whereas in the deeper parts, within the potassic and sodic-calcic alteration zones, gold is dominantly included in the feldspar grains associated with pyrite.

Exploration

Tüprag discovered the Kışladağ deposit in the late 1980’s during a regional grassroots exploration program focusing on Late Cretaceous to Tertiary volcanic centres in western Türkiye. It selected the prospect area on the basis of Landsat-5 images that had been processed to enhance areas of clay and iron alteration, followed by regional stream sediment and soil sampling programs. Preliminary soil sampling programs identified a broad 50 ppb gold anomaly within a poorly exposed area now known to directly overlie the porphyry deposit. Early exploration of the deposit area included excavation of trenches to better characterize the soil anomaly, and ground geophysical surveys including IP-resistivity, magnetic and radiometric surveys.

Subsequent exploration work was limited to a regional airborne geophysical survey that included the Kışladağ property as part of the survey grid. No new targets were identified within the license area.

Drilling

Several drilling campaigns by both diamond core drilling and reverse-circulation (“RC”) drilling took place from 1998 through 2016 for a total of 198,000 m of which 38% was drilled in 2007 to 2010 and 26% in 2014 to 2016. It is this later drilling, mostly core holes, that provided information to enable conversion of the Mineral Resource to Reserves.

Diamond drilling in Kışladağ was done with wire line core rigs and mostly of HQ size. Drillers placed the core into wooden core boxes with each box holding about 4 m of HQ core. Geology and geotechnical data were collected from the core and core was photographed (wet) before sampling. Specific Gravity (SG) measurements were done approximately every 5 m. Core recovery in the mineralized units was excellent, usually between 95% and 100%. The entire lengths of the diamond drill holes were sampled (sawn in half by diamond saw). The core library for the Kışladağ deposit is kept in core storage facilities on site. Core recovery in the mineralized units was excellent, usually between 95% and 100%.

No exploration drilling has been undertaken subsequently, and all recent drilling has been for the purpose of ongoing production, geotechnical, or metallurgical requirements.

Sampling, Analysis and Data Verification

Samples were prepared at Eldorado’s in-country preparation facility near Çanakkale in north-western Türkiye. A Standard Reference Material (“SRM”), a duplicate and a blank sample were inserted into the sample stream at every 8th sample. From there the sample pulps were shipped to the ALS Chemex Analytical Laboratory in North Vancouver until April 2015 and Bureau Veritas (formerly Acme Labs) in

Ankara since then. All samples were assayed for gold by 30 g fire assay with an AA finish and for multi-element determination using fusion digestion and inductively coupled plasma (“ICP”) analysis.

Monitoring of the quality control samples showed that all data were in control throughout the preparation and analytical processes. In Eldorado’s opinion, the Quality Assurance (“QA”)/Quality Control (“QC”) results demonstrate that the Kışladağ deposit assay database is sufficiently accurate and precise for resource estimation.

Mineral Processing and Metallurgical Testing

Kışladağ has been processing ore from the mine since commissioning in 2006. Based on this long operating history, the operation has developed understanding around ore types and the leaching of its ore.

In 2021, the crushing circuit was modified to replace the tertiary crushers with a high pressure grinding rolls (HPGR) circuit. This modification changed the size distribution of the crushing circuit product that is being fed to the heap leach circuit, and an agglomeration circuit was added. Since commissioning the HPGR, testwork has been undertaken to assess the effectiveness of this fines agglomeration and its effect on solution percolation and recovery rates. Regular column tests are also conducted to validate leach kinetic rates and recoveries.

Mineral Resource and Mineral Reserve Estimates

The Mineral Resources of the Kışladağ deposit were classified using the CIM Definition Standards for Mineral Resources and Reserves (May 10, 2014) that are incorporated by reference into NI 43-101. The mineralization of the project satisfies sufficient criteria to be classified into Measured, Indicated, and Inferred Mineral Resource categories.

Inspection of the Kışladağ model and drillhole data on plans and cross-sections, combined with spatial statistical work and investigation of confidence limits in predicting planned annual and quarterly production, contributed to the setup of various distance to nearest composite protocols to help guide the assignment of blocks into Measured or Indicated Mineral Resource categories. Reasonable grade and geologic continuity is demonstrated over most of the Kışladağ deposit, which is drilled generally on 40 m to 80 m spaced sections. Blocks were classified as Indicated Mineral Resources where blocks containing an estimate that resulted from samples spaced within 80 m and from two or more drill holes. Where the sample spacing was about 50 m or less, and the grade estimated were from at least three drill holes, the confidence in the grade estimates and lithology contacts were the highest and were thus permissive to be classified as Measured Mineral Resources.

All remaining model blocks containing a gold grade estimate were assigned as Inferred Mineral Resources.

A test of reasonableness for the expectation of economic extraction was made on the Kışladağ mineral resources by developing a series of open pit designs based on optimal operational parameters and gold price assumptions. A pit design based on $1,800/oz Au and heap leaching was chosen to constrain mineral resources likely to be mined by open pit mining methods. Eligible model blocks within this pit shell were evaluated at an open pit resource cut-off grade of 0.25 g/t Au.