UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-23486

NN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 62-1096725 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 2000 Waters Edge Drive Johnson City, Tennessee |

37604 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (423) 743-9151

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $.01 | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2013, based on the closing price on the NASDAQ Stock Market LLC on that date was approximately $197,000,000.

The number of shares of the registrant’s common stock outstanding on March 11, 2014 was 17,649,567

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement with respect to the 2013 Annual Meeting of Stockholders are incorporated by reference in Part III, Items 10 to 14 of this Annual Report on Form 10-K as indicated herein.

PART I

Forward-Looking Statements

We wish to caution readers that this report contains, and our future filings, press releases and oral statements made by our authorized representatives may contain, forward-looking statements that involve certain risks and uncertainties. Readers can identify these forward-looking statements by the use of such verbs as “expects”, “anticipates”, “believes” or similar verbs or conjugations of such verbs. Our actual results could differ materially from those expressed in such forward-looking statements due to important factors bearing on our business, many of which already have been discussed in this filing and in our prior filings. The differences could be caused by a number of factors or combination of factors including the risk factors discussed in “Item 1A Risk Factors” of this Annual Report on Form 10-K.

| Item 1. | Business Overview |

NN, Inc. has three operating segments, the Metal Bearing Components Segment, the Plastic and Rubber Components Segment, and the Precision Metal Components Segment. As used in this Annual Report on Form 10-K, the terms “NN”, “the Company”, “we”, “our”, or “us” mean NN, Inc. and its subsidiaries.

Within the Metal Bearing Components Segment, we manufacture and supply high precision bearing components, consisting of balls, cylindrical rollers, tapered rollers, and metal retainers, for leading bearing and CV-joint manufacturers on a global basis. We are a leading independent manufacturer of precision steel bearing balls and rollers for the North American, European and Asian markets. In 2013, Metal Bearing Components accounted for 70% of total NN, Inc. sales. Sales of balls and rollers accounted for approximately 65% of our total net sales with 45% of sales from balls and 20% of sales from rollers. Sales of metal bearing retainers accounted for 5% of net sales. Through a series of acquisitions and plant expansions, we have built upon our strong core ball business and expanded our bearing component product offering. Today, we offer one of the industry’s most complete lines of commercially available bearing components. We emphasize engineered products that take advantage of our competencies in product design and tight tolerance manufacturing processes. Our customers use our components in fully assembled ball and roller bearings and CV-joints, which serve a wide variety of industrial applications in the automotive, electrical, agricultural, construction, machinery, heavy truck, rail, and mining markets.

Within the Plastic and Rubber Components Segment, we manufacture high precision rubber seals and plastic retainers for leading bearing manufacturers on a global basis. In addition, we manufacture specialized plastic products including automotive components, electronic instrument cases and other molded components used in a variety of industrial and consumer applications. Finally, we also manufacture rubber seals for use in various automotive, industrial and mining applications. In 2013, plastic products accounted for 6% of net sales and rubber seals accounted for 3% of net sales.

Our Precision Metal Components Segment is comprised of the Whirlaway Corporation (“Whirlaway”). Whirlaway is a manufacturer of highly engineered, difficult to manufacture precision metal components and subassemblies for the automotive, HVAC, fluid power and diesel engine markets. Our entry into the precision metal components market in 2006 is part of our strategy to serve markets and customers we view as adjacent to bearing components that utilize our core manufacturing competencies. These products accounted for 21% of net sales in 2013.

The three business segments are composed of the following manufacturing operations:

Metal Bearing Components Segment

| • | Erwin, Tennessee Ball and Roller Plant (“Erwin Plant”) |

| • | Mountain City, Tennessee Ball Plant (“Mountain City Plant”) |

| • | Pinerolo, Italy Ball Plant (“Pinerolo Plant”) |

| • | Veenendaal, The Netherlands Roller and Stamped Metal Parts Plant (“Veenendaal Plant”) |

| • | Kysucke Nove Mesto, Slovakia Ball Plant (“Kysucke Plant”) |

| • | Kunshan, China Ball Plant (“Kunshan Plant”) |

Plastic and Rubber Components Segment

| • | Delta Rubber Company, Danielson, Connecticut Rubber Seal Plant (“Danielson Plant”) |

| • | Industrial Molding Corporation, Inc. Lubbock, Texas Plastic Injection Molding Plant (“Lubbock Plant”) |

2

Precision Metal Components Segment

| • | Whirlaway Corporation, Wellington, Ohio Metal Components Plant 1 (“Wellington Plant 1”) |

| • | Whirlaway Corporation, Wellington, Ohio Metal Components Plant 2 (“Wellington Plant 2”) |

Financial information about the segments is set forth in Note 11 of the Notes to Consolidated Financial Statements.

Corporate Information

NN, originally organized in October 1980, is incorporated in Delaware. Our principal executive offices are located at 2000 Waters Edge Drive, Johnson City, Tennessee, and our telephone number is (423) 743-9151. Our website address is www.nninc.com. Information contained on our website is not part of this Annual Report. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and related amendments are available via a link to “SEC.gov” on our website under “Investor Relations.” Additionally, all required interactive data pursuant to Item 405 of Regulation S-T is posted on our website.

Products

Metal Bearing Components Segment

Precision Steel Balls. At our Metal Bearing Components Segment facilities (with the exception of our Veenendaal Plant), we manufacture and sell high quality, precision steel balls in sizes ranging in diameter from 5/32 of an inch (3.969 mm) to 3.5 inches (88.9 mm). We produce and sell balls in grades ranging from grade 3 to grade 1000, according to international standards endorsed by the American Bearing Manufacturers Association. The grade number for a ball, in addition to defining allowable dimensional variation within production batches, indicates the degree of spherical precision of the ball; for example, grade 3 balls are manufactured to within three-millionths of an inch of roundness. Our steel balls are used primarily by manufacturers of anti-friction bearings and constant velocity joints where precise spherical, tolerance and surface finish accuracies are required. Sales of precision steel balls accounted for approximately 65%, 67%, and 67% of the Metal Bearing Components Segment net sales in 2013, 2012, and 2011, respectively.

Steel Rollers. We manufacture tapered rollers at our Veenendaal and Erwin Plants and cylindrical rollers at our Erwin Plant. Rollers are an alternative rolling element used instead of balls in anti-friction bearings that typically have heavier loading or different speed requirements. Our roller products are used primarily for applications similar to those of our precision steel ball product line, plus certain non-bearing applications such as hydraulic pumps and motors. Tapered rollers are a component in tapered roller bearings that are used in a variety of applications including automotive gearbox applications, automotive wheel bearings and a wide variety of industrial applications. Most cylindrical rollers are made to specific customer requirements for diameter and length and are used in a variety of industrial applications. Tapered rollers accounted for approximately 24%, 21%, and 21% of the Metal Bearing Components Segment net sales in 2013, 2012 and 2011, respectively. Cylindrical rollers accounted for approximately 5% of the Metal Bearing Components Segment net sales in each of 2013, 2012, and 2011.

Metal Retainers. We manufacture and sell precision metal retainers for roller bearings used in a wide variety of industrial applications. Retainers are used to separate and space the rolling elements (rollers) within a fully assembled bearing. We manufacture metal retainers at our Veenendaal Plant.

Plastic and Rubber Components Segment

Bearing Seals. At our Danielson Plant, we manufacture and sell a wide range of precision bearing seals produced through a variety of compression and injection molding processes and adhesion technologies to create rubber-to-metal bonded bearing seals. The seals are used in applications for automotive, industrial, agricultural and mining markets.

Plastic Retainers. At our Lubbock Plant, we manufacture and sell precision plastic retainers for ball and roller bearings used in a wide variety of industrial applications. Retainers are used to separate and space the rolling elements (balls or rollers) within a fully assembled bearing.

3

Precision Plastic Components. At our Lubbock Plant, we also manufacture and sell a wide range of specialized plastic products including automotive under-the-hood components, electronic instrument cases and precision electronic connectors and lenses, as well as a variety of other specialized industrial and consumer parts.

Precision Metal Components Segment

Precision Metal Components. We sell a wide range of highly engineered precision metal components and subassemblies. The precision metal components offered include highly engineered shafts, mechanical components, fluid system components and complex precision assembled and tested parts. The products are used in the following end markets: automotive, HVAC, fluid power and diesel engine.

Research and Development

With our new corporate strategy, we are in the process of enhancing our research and development efforts. We will initially focus on adjacent markets, manufacturing process enhancements and continuing to improve our product quality. In general, these research and development efforts will entail using dedicated internal experts and resources. The amounts spent on research and development activities by us during each of the last three fiscal years are not material and are expensed as incurred.

Customers

Our products are supplied primarily to bearing manufacturers and automotive and industrial parts manufacturers for use in a broad range of industrial applications, including automotive, electrical, agricultural, construction, machinery and mining. Additionally, we supply precision metal, rubber, and plastic components to automotive and industrial companies that are not used in bearing assemblies. We supply approximately 400 customers; however, our top ten customers account for approximately 78% of our revenue. Sales to each of these top ten customers are made to multiple customer locations and divisions throughout the world. Only one of these customers, AB SKF (“SKF”), had sales levels that were over 10% of total net sales. Sales to various U.S. and foreign divisions of SKF accounted for approximately 36% of net sales in 2013. In 2013, 46% of our products were sold to customers in North America, 40% to customers in Europe, 10% to customers in Asia and the remaining 4% to customers in South America.

We sell our products to most of our largest customers under either sales contracts or agreed upon commercial terms. In general, we pass through material cost fluctuations when incurred to our customers in the form of changes in selling prices. We ordinarily ship our products directly to customers within 60 days, and in many cases, during the same calendar month, of the date on which a sales order is placed. Accordingly, we generally have an insignificant amount of open (backlog) orders from customers at month end. At the U.S. operations of our Metal Bearing Components Segment, we maintain a computerized, bar coded inventory management system with certain of our major customers that enables us to determine on a day-to-day basis the amount of these components remaining in a customer’s inventory. When such inventories fall below certain levels, additional product is automatically shipped. Additionally, we have consignment inventory arrangements with customers within our European and Asian operations of the Metal Bearing Components Segment.

During 2013, the Metal Bearing Components Segment sold products to approximately 300 customers located in 30 different countries. Approximately 84% of the net sales in 2013 were to customers outside the United States. Approximately 57% of net sales in 2013 were to customers within Europe. Sales to the segment’s top ten customers accounted for approximately 88% of the net segment sales in 2013.

During 2013, the Plastic and Rubber Components Segment sold its products to over 100 customers located principally in North America. Approximately 25% of the Plastic and Rubber Components Segment’s net sales were to customers outside the United States, with the majority of those sales to customers in Mexico, Canada & Asia. Sales to the segment’s top ten customers accounted for approximately 55% of the segment’s net sales in 2013.

During 2013, the Precision Metal Components Segment sold its products to 21 customers located in four countries. Approximately 93% of all sales were to customers located within the United States. Sales to the segment’s top ten customers accounted for approximately 99% of the segment’s net sales in 2013.

In both the foreign and domestic markets, we principally sell our products directly to manufacturers and do not sell significant amounts through distributors or dealers.

4

See Note 12 of the Notes to Consolidated Financial Statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations” for additional Segment financial information.

The following table presents a breakdown of our net sales for fiscal years 2013, 2012 and 2011:

| (In Thousands) | 2013 | 2012 | 2011 | |||||||||

| Metal Bearing Components Segment |

$ | 259,459 | $ | 252,241 | $ | 308,883 | ||||||

| Percentage of Total Sales |

69.5 | % | 68.2 | % | 72.7 | % | ||||||

| Precision Metal Components Segment |

78,756 | 76,746 | 72,272 | |||||||||

| Percentage of Total Sales |

21.1 | % | 20.7 | % | 17.0 | % | ||||||

| Plastic and Rubber Components Segment |

34,991 | 41,097 | 43,536 | |||||||||

| Percentage of Total Sales |

9.4 | % | 11.1 | % | 10.3 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 373,206 | $ | 370,084 | $ | 424,691 | ||||||

|

|

|

|

|

|

|

|||||||

| Percentage of Total Sales |

100 | % | 100 | % | 100 | % | ||||||

The change in value of Euro denominated sales when converted to U.S. Dollars resulted in net sales increasing $5.6 million in 2013 compared to 2012 and decreasing $11.7 million in 2012 compared to 2011.

Sales and Marketing

A primary emphasis of our marketing strategy is to expand key customer relationships by offering high quality, high precision application specific customer solutions with the value of a single supply chain partner for a wide variety of products and components. Due to the technical nature of many of our products, our engineers and manufacturing management personnel also provide technical sales support functions, while internal sales employees handle customer orders and other general sales support activities. For the Precision Metal Components Segment and the Plastics and Rubber Components Segment, the current sales structure consists of using a direct sales force supported by senior segment management and engineering involvement with manufacturers’ representatives utilized to supplement our direct sales force.

Our Metal Bearing Components Segment marketing strategy focuses on our ability to provide consistent, high quality products that meet the most precise specifications of leading global brands. Our marketing strategy for the Plastic and Rubber Components Segment and the Precision Metal Components Segment is to offer custom manufactured, high quality, precision products to markets with high value-added characteristics at competitive price levels. This strategy focuses on relationships with key customers that require the production of technically difficult parts and assemblies, enabling us to take advantage of our strengths in custom product development, equipment and tool design, component assembly and machining processes.

Our arrangements with both our U.S. and European customers typically provide that payments are due within 30 to 60 days following the date of shipment of goods. With respect to export customers of both our U.S. and European businesses, payments generally are due within 60 to 120 days following the date of shipment in order to allow for additional freight time and customs clearance. For some customers that participate in our inventory management program, sales are recorded when the customer uses the product. See “Business — Customers” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

Manufacturing Process

We have become a leading independent bearing component manufacturer through exceptional service and high quality manufacturing processes. Because our ball and roller manufacturing processes incorporate the use of standardized tooling, sizes, and process technology, we are able to produce large volumes of products cost competitively, while maintaining high quality standards.

The key to our high quality production of seals and retainers is the incorporation of customized engineering into our manufacturing processes, metal to rubber bonding competencies and experience with a broad range of engineered resins and custom polymers. This design process includes the testing and quality assessment of each product.

5

Within the precision metal components industry, we are well positioned in the market by virtue of our focus on highly engineered, difficult to manufacture critical components, product development and component subassemblies.

Employees

As of December 31, 2013, we employed a total of 1,721 full-time employees and 140 full time equivalent temporary workers. The following numbers are for full time employees only. Our Metal Bearing Components Segment employed 265 in the U.S., 680 in Europe and 143 in China; our Plastic and Rubber Components Segment employed 215, all in the U.S.; and our Precision Metal Components Segment employed 409, all in the U.S. In addition, there were nine employees at our corporate headquarters. Of our total employment, 19% are management/staff employees and 81% are production employees. The employees at the Pinerolo and Veenendaal Plants are unionized. We have excellent employee relations throughout NN and we have never experienced any significant involuntary work stoppages.

Competition

The Metal Bearing Components Segment of our business is intensely competitive. Our primary domestic competitor is Hoover Precision Products, Inc., a wholly owned U.S. subsidiary of Tsubaki Nakashima Co., LTD. Our primary foreign competitors are Amatsuji Steel Ball Manufacturing Company, Ltd. (Japan), a wholly owned division of NSK LTD., Tsubaki Nakashima Co., LTD (Japan) and Jiangsu General Ball and Roller Co., LTD (China). Additionally, we compete with bearing manufacturers’ in house (captive) production.

We believe that competition within the Metal Bearing Components Segment is based principally on quality, price and the ability to consistently meet customer delivery requirements. Management believes that our competitive strengths are our precision manufacturing capabilities, our wide product assortment, our reputation for consistent quality and reliability, our global manufacturing footprint and the productivity of our workforce.

The markets for the Plastic and Rubber Components Segment’s products are also intensely competitive. Since the plastic injection molding industry is currently very fragmented, we must compete with numerous companies in each industry market segment. Many of these companies have substantially greater financial resources than we do and many currently offer competing products nationally and internationally. Our primary competitor in the plastic bearing retainer market is Nakanishi Manufacturing Corporation. Domestically, Nypro, Inc. and C&J Industries are among the main competitors in the precision plastic components markets.

We believe that competition within the plastic injection molding industry is based principally on quality, price, design capabilities and speed of responsiveness and delivery. Management believes that our competitive strengths are product development, tool design, fabrication, and tight tolerance molding processes. With these strengths, we have built our reputation in the marketplace as a quality producer of technically difficult products.

While intensely competitive, the markets for our rubber seal products are less fragmented than our plastic injection molding products. The bearing seal market is comprised of approximately six major competitors that range from small privately held companies to large global enterprises. Bearing seal manufacturers compete on design, service, quality and price. Our primary competitors in the U.S. bearing seal market are Freudenberg-NOK, Trelleborg, Trostel, Uchiyama and Paulstra/Hutchinson.

In the Precision Metal Components Segment market, internal production of components by our customers can impact our business as the customers weigh the risk of outsourcing strategically critical components or producing in-house. Our primary outside competitors are Linamar, Stanadyne, A. Berger, C&A Tool, American Turned Products, Camcraft and Autocam. We generally win new business on the basis of technical competence and our proven track record of successful product development.

Raw Materials

The primary raw material used in our core ball and roller business of the Metal Bearing Components Segment is 52100 Steel, which is high quality chromium steel. Our other steel requirements include metal strip, stainless steel, and type S2 rock bit steel.

The Metal Bearing Components Segment businesses purchase substantially all of their 52100 Steel requirements from suppliers in Europe and Japan and all of their metal strip requirements from European suppliers and traders.

6

The principal suppliers of 52100 Steel for our U.S. businesses are Daido Steel, Kobe Steel, Ascometal and Ovako. The principal suppliers of 52100 Steel for our European businesses are Ascometal, Ovako, Kobe Steel and Daido Steel while the principal suppliers of metal strip are Thyssen and Theis. If any of our current suppliers were unable to supply 52100 Steel to us, we cannot provide assurances that we would not face higher costs or production interruptions as a result of obtaining 52100 Steel from alternate sources.

We purchase steel on the basis of composition, quality, availability and price. For precision steel balls, the pricing arrangements with our suppliers are typically subject to adjustment every three to six months in the U.S. and contractually adjusted on an annual basis within the European locations for the base steel price and quarterly for surcharge adjustments. In general, we do not enter into written supply agreements with suppliers or commit to maintain minimum monthly purchases of steel except for the year to year supply arrangement between Ascometal and the European operations of our Metal Bearing Components Segment.

Because 52100 Steel is principally produced by non-U.S. manufacturers, our operating results would be negatively affected in the event that the U.S. or European governments impose any significant quotas, tariffs or other duties or restrictions on the import of such steel, if the U.S. Dollar decreases in value relative to foreign currencies or if supplies available to us would significantly decrease. The value of the U.S. Dollar factors into the steel price as the suppliers’ base currencies are the Euro and Japanese Yen.

The Metal Bearing Components Segment has historically been affected by upward price pressure on steel principally due to general increases in global demand and global increased consumption of steel. In general, we pass through material cost fluctuations to our customers in the form of changes in selling price.

For the Plastic and Rubber Components Segment, we base purchase decisions on quality, service and price. Generally, we do not enter into written supply contracts with our suppliers or commit to maintain minimum monthly purchases of resins, rubber compounds or metal stampings.

The primary raw materials used by the Plastic and Rubber Components Segment are engineered resins, injection grade nylon and proprietary rubber compounds. We purchase substantially all of our resin requirements from domestic manufacturers and suppliers. The majority of these suppliers are international companies with resin manufacturing facilities located throughout the world. We use certified vendors to provide a custom mix of proprietary rubber compounds. This segment also procures metal stampings from several domestic and foreign suppliers.

The Precision Metal Components Segment produces products from a wide variety of metals in various forms from various sources primarily located in the U.S. Basic types include hot rolled steel, cold rolled steel (both carbon and alloy), stainless, extruded aluminum, die cast aluminum, gray and ductile iron castings, hot and cold forgings and mechanical tubing. Some material is purchased directly under contracts, some is consigned by the customer, and some is purchased directly from the steel mills.

On August 22, 2012, the U.S. Securities and Exchange Commission (“SEC”) issued a rule under Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act requiring companies to publicly disclose their use of conflict minerals that originated in the Democratic Republic of the Congo (“DRC”) or an adjoining country. Under the rule, issuers are required to conduct a reasonable due diligence process to ascertain the source of conflict minerals, defined as tantalum, tin, gold or tungsten, that are necessary to the functionality or production of their manufactured or contracted to be manufactured products. Companies are required to provide this disclosure on a new form to be filed with the SEC called Form SD. Companies are required to file Form SD by May 31, 2014 for the 2013 calendar period and annually by May 31 every year thereafter.

Based on diligence conducted within our supply chain, we have determined that conflict minerals are not necessary to the functionality or production of the products manufactured by us, and further based on a reasonable country of origin inquiry, we have determined that any conflict minerals that might be contained in such products did not originate in the DRC or an adjoining country, or such conflict minerals originated from recycled or scrap materials.

Patents, Trademarks and Licenses

We do not own any U.S. or foreign patents, trademarks or licenses that are material to our business. We do rely on certain data and processes, including trade secrets and know-how, and the success of our business depends, to some extent, on such information remaining confidential. Each executive officer is subject to a non-competition and confidentiality agreement that seeks to protect this information. Additionally, all employees are subject to company ethics policies that prohibit the disclosure of information critical to the operations of our business.

7

Seasonal Nature of Business

Historically, due to a substantial portion of sales to European customers, seasonality has been a factor for our business in that some European customers typically reduce their production activities during the month of August.

Environmental Compliance

Our operations and products are subject to extensive federal, state and local regulatory requirements both domestically and abroad relating to pollution control and protection of the environment. We maintain a compliance program to assist in preventing and, if necessary, correcting environmental problems. In the Metal Bearing Components Segment, the Kysucke Plant, the Veenendaal Plant, the Pinerolo Plant and Kunshan Plant are ISO 14000 or 14001 certified and all received the EPD (Environmental Product Declaration), except for the Veenendaal Plant’s stamped metal parts business. Based on information compiled to date, management believes that our current operations are in substantial compliance with applicable environmental laws and regulations, the violation of which could have a material adverse effect on our business and financial condition. We have assessed conditional asset retirement obligations and have found them to be immaterial to the consolidated financial statements. We cannot assure that currently unknown matters, new laws and regulations, or stricter interpretations of existing laws and regulations will not materially affect our business or operations in the future. More specifically, although we believe that we dispose of waste in material compliance with applicable environmental laws and regulations, we cannot be certain that we will not incur significant liabilities in the future in connection with the clean-up of waste disposal sites. We maintain long-term environmental insurance covering the four manufacturing locations purchased with the Whirlaway acquisition (two of which have ceased operations). We are currently a potentially responsible party of a remedial action at a former waste recycling facility used by us. See Item 3 and Note 15 of the Notes to Consolidated Financial Statements.

Executive Officers of the Registrant

Our executive officers are:

| Name |

Age |

Position | ||

| Richard D. Holder | 51 | Chief Executive Officer and President | ||

| Frank T. Gentry, III | 58 | Senior Vice President – Managing Director, Metal Bearing Components | ||

| James H. Dorton | 57 | Senior Vice President – Corporate Development and Chief Financial Officer, General Manager Plastic and Rubber Components | ||

| Thomas C. Burwell, Jr. | 45 | Vice President – Chief Accounting Officer and Corporate Controller | ||

| William C. Kelly, Jr. | 55 | Vice President – Chief Administrative Officer, Secretary, and Treasurer | ||

| Jeffrey H. Hodge | 52 | Vice President – General Manager, U.S. Ball and Roller and NN Asia Divisions | ||

| James R. Widders | 57 | Vice President – General Manager, Precision Metal Components Division |

Set forth below is certain additional information with respect to each of our executive officers.

Richard D. Holder was named President and Chief Executive Officer effective June 3, 2013. Prior to joining NN, he held a variety of leadership positions at Eaton Corp., a diversified global leader in power management and electrical systems. Most recently, he served as the President of Eaton Electrical Components, a division of Eaton’s Electrical Sector from 2010 to 2013. Other leadership positions at Eaton include Executive Vice President of Eaton Business Systems from 2007 to 2010, Vice President and General Manager of the Power Distribution and Assemblies Division from 2004 to 2006, and Vice President Supply Chain and Operational Excellence from 2001 to 2004. Prior to joining Eaton, Holder served as Director of Aircraft and Technical Purchasing for US Airways and also held a variety of leadership positions at AlliedSignal Corp. and Parker Hannifin Corp.

Frank T. Gentry, III, was appointed Vice President – Managing Director Metal Bearing Components Division in April 2009 and promoted to Senior Vice President in May 2010. Prior to that, Mr. Gentry was Vice President – General Manager U.S. Ball and Roller Division from August 1995. Mr. Gentry joined NN in 1981 and held various manufacturing management positions within NN from 1981 to August 1995.

James H. Dorton joined NN as Vice President of Corporate Development and Chief Financial Officer in June 2005. In May 2010, he was promoted to Senior Vice President. In January 2012, Mr. Dorton assumed the additional

8

responsibility of General Manager of the Plastic and Rubber Components Segment of NN. Prior to joining NN, Mr. Dorton served as Executive Vice President and Chief Financial Officer of Specialty Foods Group, Inc. from 2003 to 2004, Vice President Corporate Development and Strategy and Vice President – Treasurer of Bowater Incorporated from 1996 to 2002 and as Treasurer of Intergraph Corporation from 1989 to 1996. Mr. Dorton is a Certified Public Accountant.

Thomas C. Burwell, Jr. joined NN as Corporate Controller in September 2005. He was promoted to Vice President Chief Accounting Officer and Corporate Controller in 2011. Prior to joining NN, Mr. Burwell held various positions at Coats, PLC from 1997 to 2005 ultimately becoming the Vice President of Finance for the U.S. Industrial Division. From 1992 to 1997, Mr. Burwell held various positions at the international accounting firm BDO Seidman, LLP. Mr. Burwell is a Certified Public Accountant.

William C. Kelly, Jr. was named Vice President and Chief Administrative Officer in June 2005. In March, 2003, Mr. Kelly was elected to serve as Chief Administrative Officer. In March 1999, he was elected Secretary of NN and still serves in that capacity as well as that of Treasurer. In February 1995, Mr. Kelly was elected Treasurer and Assistant Secretary. He joined NN in 1993 as Assistant Treasurer and Manager of Investor Relations. In July 1994, Mr. Kelly was elected to serve as NN’s Chief Accounting Officer, and served in that capacity through March 2003. Prior to joining NN, Mr. Kelly served from 1988 to 1993 as a Staff Accountant and as a Senior Auditor with the accounting firm of PricewaterhouseCoopers LLP.

Jeffrey H. Hodge joined NN in 1989 and has served various roles including Operations Manager, Plant Manager and Corporate Manager of Level 3 (Lean Enterprise, Six Sigma, TPM) from 2003 to 2009 before accepting his current role in 2009 as Vice President and General Manager of U.S. Ball & Roller and NN Asia Divisions. Prior to joining NN, Mr. Hodge was a member of the U.S. military from 1985 to 1989.

James R. Widders was named Vice President and General Manager of the Precision Metal Components Division on December 15, 2010. Mr. Widders had 13 years of service at Whirlaway prior to its acquisition by NN. Prior to joining NN, he served as Vice President and General Manager at Technifab, Inc. a manufacturer of molded foam components for the Aerospace industry and in various management positions with GE Superabrasives, a division of General Electric.

Corporate Developments

On September 4, 2012, the Board of Directors announced that Chairman and Chief Executive Officer, Roderick R. Baty informed the Board that he will retire from his positions of Chairman, Chief Executive Officer and President. Mr. Baty’s retirement was effective June 3, 2013.

| Item 1A. | Risk Factors |

The following are risk factors that affect our business, financial condition, results of operations, and cash flows, some of which are beyond our control. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K. If any of the events described below were to actually occur, our business, financial condition, results of operations or cash flows could be adversely affected and results could differ materially from expected and historical results.

From time to time a large portion of our capital structure may be in the form of debt. As such, we continue to heavily rely on our current lenders as a major source of long term capital.

We are dependent on the continued provision of financing from our revolving credit lenders and our fixed rate notes lenders for a major portion of our capital structure. As such we must continually meet our existing financial and non-financial covenants or risk potential default. In the event of default, the degree to which our current lenders and/or potential future lenders will continue to lend to us will depend in large part on our results from operations and near term business prospects at the time of the default.

A recession impacting both U.S. and European automotive and industrial markets once again could have a material adverse effect on our ability to finance our operations and implement our growth strategy.

During the three month period ended December 31, 2008 and the year ended December 31, 2009, we experienced a sudden and significant reduction in customer orders driven by reductions in automotive and industrial end market

9

demand across all our businesses. Additionally, during the latter part of 2011 and all of 2012, we experienced the impacts of a European recession in our European businesses. Prior to this time, our company had never been affected by a recession that had impacted both of our key geographic markets of the U.S. and Europe simultaneously. If we are impacted by a global recession in the future, this could have a material adverse effect on our financial condition, results of operations and cash flows from operations and could lead to additional restructuring and/or impairment charges being incurred. However, we believe we would be in a much better position to weather any recession or economic downturn given the actions taken to permanently reduce our cost base including closing or ceasing operations at four former manufacturing locations.

The demand for our products is cyclical, which could adversely impact our revenues.

The end markets for fully assembled bearings and industrial and automotive components are cyclical and tend to decline in response to overall declines in industrial and automotive production. As a result, the market for the bearing components and precision metal, plastic, and rubber products we sell is also cyclical and impacted by overall levels of industrial and automotive production. Our sales have been, and can be in the future, negatively affected by adverse conditions in the industrial and/or automotive production sectors of the economy or by adverse global or national economic conditions generally. Additionally, inflation in oil and the resulting higher gasoline prices could have a negative impact on demand for our products as a result of consumer and corporate spending reductions.

We depend on a very limited number of foreign sources for our primary raw material and are subject to risks of shortages and price fluctuation.

The steel that we use to manufacture our metal bearing components is of an extremely high quality and is available from a limited number of producers on a global basis. Due to quality constraints in the U.S. steel industry, we obtain substantially all of the steel used in our U.S. operations of our Metal Bearing Components Segment from non-U.S. suppliers. In addition, we obtain most of the steel used in our European operations from a single European source. If we had to obtain steel from sources other than our current suppliers, we could face higher prices and transportation costs, increased duties or taxes, and shortages of steel. Problems in obtaining steel, particularly 52100 chrome steel in the quantities that we require on commercially reasonable terms could increase our costs, adversely impacting our ability to operate our business efficiently and have a material adverse effect on our revenues and operating and financial results.

Increases in the market demand for steel can have the impact of increasing scrap surcharges we pay in procuring our steel in the form of higher unit prices and could adversely impact the availability of steel. Our commercial terms with key customers allow us to pass along steel price fluctuations through changing the customers’ selling prices.

We depend heavily on a relatively limited number of customers, and the loss of any major customer would have a material adverse effect on our business.

Sales to various U.S. and foreign divisions of SKF, one of the largest bearing manufacturers in the world, accounted for approximately 36% of consolidated net sales in 2013. No other customers accounted for more than 10% of sales. During 2013, sales to various U.S. and foreign divisions of our ten largest customers accounted for approximately 78% of our consolidated net sales. The loss of all or a substantial portion of sales to these customers would cause us to lose a substantial portion of our revenue and would lower our operating profit margin and cash flows from operations.

We operate in and sell products to customers outside the U.S. and are subject to several risks related to doing business internationally.

Because we obtain a majority of our raw materials from overseas suppliers, actively participate in overseas manufacturing operations and sell to a large number of international customers, we face risks associated with the following:

| • | adverse foreign currency fluctuations; |

10

| • | changes in trade, monetary and fiscal policies, laws and regulations, and other activities of governments, agencies and similar organizations; |

| • | the potential imposition of trade restrictions or prohibitions; |

| • | a U.S. Federal Tax code that discourages the repatriation of funds to the U.S.; |

| • | the potential imposition of import or other duties or taxes; and |

| • | unstable governments or legal systems in countries in which our suppliers, manufacturing operations, and customers are located. |

We do not have a hedging program in place associated with consolidating the operating results of our foreign businesses into U.S. Dollars. An increase in the value of the U.S. Dollar and/or the Euro relative to other currencies may adversely affect our ability to compete with our foreign-based competitors for international, as well as domestic, sales. Also, a change in the value of the Euro relative to the U.S. Dollar can negatively impact our consolidated financial results, which are denominated in U.S. Dollars.

In addition, due to the typical slower summer manufacturing season in Europe, we expect that revenues in the third fiscal quarter of each year will be lower than in the other quarters of the year.

Failure of our product could result in a product recall.

The majority of our products go into bearings used in the automotive industry and other critical industrial manufacturing applications. A failure of our components could lead to a product recall. If a recall were to happen as a result of our components failing, we could bear a substantial part of the cost of correction. In addition to the cost of fixing the parts affected by the component, a recall could result in the loss of a portion of or all of the customers’ business. To partially mitigate these risks, we carry limited product recall insurance and have invested heavily in the TS16949 quality program.

The costs and difficulties of integrating acquired businesses could impede our future growth.

We cannot assure you that any future acquisition will enhance our financial performance. Acquiring companies involves inherent risk in the areas of environmental and legal issues, information technology, cultural and regulatory matters, product/supplier issues, and financial risk. Our ability to effectively integrate any future acquisitions will depend on, among other things, the adequacy of our implementation plans, the ability of our management to oversee and operate effectively the combined operations and our ability to achieve desired operating efficiencies and sales goals. The integration of any acquired businesses might cause us to incur unforeseen costs, which would lower our profit margin and future earnings and would prevent us from realizing the expected benefits of these acquisitions.

Acquisitions constitute a majority of our future growth strategy.

Acquiring businesses that complement or expand our operations has been and continues to be a key element of our business strategy. This strategy calls for growth through acquisitions constituting a majority of our future growth objectives, with the remainder resulting from organic growth and increased market penetration. We cannot assure you that we will be successful in identifying attractive acquisition candidates or completing acquisitions on favorable terms in the future. In addition, we may borrow funds to acquire other businesses, increasing our interest expense and debt levels. Our inability to acquire businesses, or to operate them profitably once acquired, could have a material adverse effect on our business, financial position, results of operations and cash flows. Our borrowing agreements limit our ability to complete acquisitions without prior approval of our lenders.

Our growth strategy depends in part on companies outsourcing critical components, and if outsourcing does not continue, our business could be adversely affected.

Our growth strategy depends in part on major customers continuing to outsource components and expanding the number of components being outsourced. This requires manufacturers to depart significantly from their traditional methods of operations. If major customers do not continue to expand outsourcing efforts or determine to reduce their use of outsourcing, our ability to grow our business could be materially adversely affected.

11

Our market is highly competitive and many of our competitors have significant advantages that could adversely affect our business.

The global markets for precision bearing components, precision metal components and plastic and rubber components are highly competitive, with a majority of production represented by the captive production operations of large manufacturers and the balance represented by independent manufacturers. Captive manufacturers make components for internal use and for sale to third parties. All of the captive manufacturers, and many independent manufacturers, are significantly larger and have greater resources than we do. Our competitors are continuously exploring and implementing improvements in technology and manufacturing processes in order to improve product quality, and our ability to remain competitive will depend, among other things, on whether we are able to keep pace with such quality improvements in a cost effective manner.

Our production capacity has been expanded geographically in recent years to operate in the same markets as our customers.

We have expanded our metal bearing components production facilities and capacity over the last several years. Historically, metal bearing component production facilities have not always operated at full capacity. Over the past several years, we have undertaken steps to address a portion of the capacity risk including closing or ceasing operations at certain plants and downsizing employment levels at others. As such, the risk exists that our customers may exit the geographic markets in which our production capacity is located and/or develop vendors in lower cost countries in which we do not have production capacity.

The price of our common stock may be volatile.

The market price of our common stock could be subject to significant fluctuations and may decline. Among the factors that could affect our stock price are:

| • | economic recession or other macro-economic factors; |

| • | our operating and financial performance and prospects; |

| • | quarterly variations in the rate of growth of our financial indicators, such as earnings per share, net income and revenues; |

| • | changes in revenue or earnings estimates or publication of research reports by analysts; |

| • | loss of any member of our senior management team; |

| • | speculation in the press or investment community; |

| • | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| • | sales of our common stock by stockholders; |

| • | general market conditions; |

| • | domestic and international economic, legal and regulatory factors unrelated to our performance; |

| • | loss of a major customer; and |

| • | the declaration and payment of a dividend. |

The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock. In addition, due to the market capitalization of our stock, our stock tends to be more volatile than large capitalization stocks that comprise the Dow Jones Industrial Average or Standard and Poor’s 500 Index.

12

Provisions in our charter documents and Delaware law may inhibit a takeover, which could adversely affect the value of our common stock.

Our certificate of incorporation and bylaws, as well as Delaware corporate law, contain provisions that could delay or prevent a change of control or changes in our management that a stockholder might consider favorable and may prevent shareholders from receiving a takeover premium for their shares. These provisions include, for example, a classified board of directors and the authorization of our board of directors to issue up to 5.0 million preferred shares without a stockholder vote. In addition, our restated certificate of incorporation provides that stockholders may not call a special meeting.

We are a Delaware corporation subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Generally, this statute prohibits a publicly-held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years after the date of the transaction in which such person became an interested stockholder, unless the business combination is approved in a prescribed manner. A business combination includes a merger, asset sale or other transaction resulting in a financial benefit to the stockholder. We anticipate that the provisions of Section 203 may encourage parties interested in acquiring us to negotiate in advance with our board of directors, because the stockholder approval requirement would be avoided if a majority of the directors then in office approve either the business combination or the transaction that results in the stockholder becoming an interested stockholder.

These provisions apply even if the offer may be considered beneficial by some of our stockholders. If a change of control or change in management is delayed or prevented, the market price of our common stock could decline.

| Item 1B. | Unresolved Staff Comments |

None

| Item 2. | Properties |

The manufacturing plants for each of our segments are listed below. In addition, we lease a portion of a small office building in Johnson City, Tennessee which serves as our corporate offices.

Metal Bearing Components Segment

| Manufacturing Operation |

Country |

Approximate |

Owned or Leased | |||

| Erwin Plant |

U.S.A. | 155,000 | Owned | |||

| Mountain City Plant |

U.S.A. | 86,000 | Owned | |||

| Kilkenny Plant (non-operating) |

Ireland | 125,000 | Owned | |||

| Pinerolo Plant |

Italy | 330,000 | Owned | |||

| Kysucke Plant |

Slovakia | 135,000 | Owned | |||

| Veenendaal Plant |

The Netherlands | 159,000 | Owned | |||

| Kunshan Plant Phase I |

China | 110,000 | Leased | |||

| Kunshan Plant Phase II |

China | 75,000 | Leased |

The Kunshan Plant leases are accounted for as a capital lease and we have an option to purchase the facilities at various points in the future. Production at the Kilkenny Plant ceased on February 6, 2009 and was moved to other European Metal Bearing Components operations. The Kilkenny property is being made ready for sale with any expected sale to occur later than a year from the date of this report. As such, the property is still considered to be held and used for which the carrying value of approximately $800,000 at December 31, 2013 approximates its fair value. We do not expect to close any facilities or incur any losses from the sale of our real property within the next twelve months from the date of this report.

13

Plastic and Rubber Components Segment

| Manufacturing Operation |

Country |

Approximate |

Owned or Leased | |||

| Danielson Plant |

U.S.A. | 50,000 | Owned | |||

| Lubbock Plant |

U.S.A. | 228,000 | Owned |

Precision Metal Components Segment

| Manufacturing Operation |

Country |

Approximate |

Owned or Leased | |||

| Wellington Plant 1 |

U.S.A. | 86,000 | Leased | |||

| Wellington Plant 2 |

U.S.A. | 132,000 | Leased |

For more information, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

| Item 3. | Legal Proceedings |

All legal proceedings are of an ordinary and routine nature and are incidental to our operations. Management believes that such proceedings should not, individually or in the aggregate, have a material adverse effect on our business, financial condition, results of operations, or cash flows. In making that determination, we analyze the facts and circumstances of each case at least quarterly in consultation with our attorneys and determine a range of reasonably possible outcomes. The procedures performed include reviewing attorney and plaintiff correspondence, reviewing any filings made and discussing the facts of the case with local management and legal counsel. We have recognized loss contingencies of approximately $200,000 and $500,000 at December 31, 2013 and December 31, 2012, respectively, which we believe are adequate to cover all probable liabilities to be incurred by all of the cases in the aggregate.

Due to the impacts of the global economic recession and the resulting reduction in revenue and operating losses, our wholly owned German subsidiary Kugelfertigung Eltmann GbmH (“Eltmann” or “Eltmann Plant”) sustained a significant weakening of its financial condition and as a result, became technically insolvent at which point it was required to file for bankruptcy under German bankruptcy law. The filing was made in the bankruptcy court in Germany on January 20, 2011. As of this date, NN lost the ability to control or manage Eltmann as a result of the bankruptcy court trustee taking over effective control and day to day management of this subsidiary. As a result of loss of control of this subsidiary, NN deconsolidated the assets and liabilities of Eltmann from our Consolidated Financial Statements effective January 20, 2011. Although the bankruptcy trustee released us from all claims related to the Eltmann bankruptcy, effective October 15, 2013, until such court proceedings are finalized, we will not be able to determine definitively if any related liabilities and contingent obligations will remain our responsibility. The ultimate impact on NN of Eltmann filing for bankruptcy will depend on the findings of the bankruptcy court. However, until such court proceedings are finalized, we will not be able to determine what liabilities and contingent obligations, if any, might remain as the responsibility of NN. Under advice from legal counsel, NN does not expect any further significant impacts on our consolidated financial statements as a result of the liquidation of this subsidiary.

| Item 4. | Mine Safety Disclosures |

Not applicable

14

Part II

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is traded on The NASDAQ Stock Market LLC (“NASDAQ”) under the trading symbol “NNBR.” As of March 10, 2014, there were approximately 3,500 holders of record of our common stock and the closing per share stock price as reported by NASDAQ was $19.29.

The following table sets forth the high and low closing sales prices of the common stock, as reported by NASDAQ.

| Close Price | ||||||||

| High | Low | |||||||

| 2013 |

||||||||

| First Quarter |

$ | 9.88 | $ | 8.38 | ||||

| Second Quarter |

11.11 | 8.32 | ||||||

| Third Quarter |

15.28 | 11.27 | ||||||

| Fourth Quarter |

20.77 | 15.13 | ||||||

| 2012 |

||||||||

| First Quarter |

$ | 10.16 | $ | 5.68 | ||||

| Second Quarter |

10.21 | 7.39 | ||||||

| Third Quarter |

10.80 | 8.11 | ||||||

| Fourth Quarter |

9.28 | 7.26 | ||||||

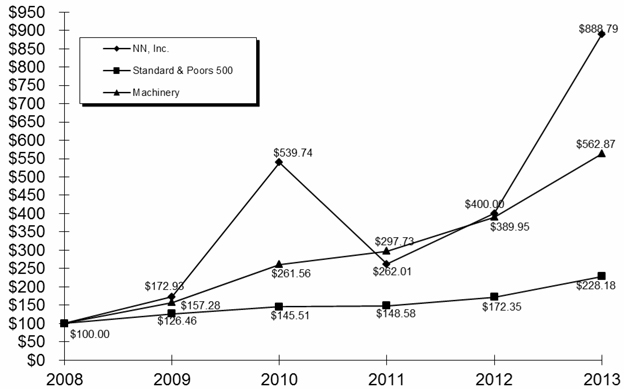

The following graph compares the cumulative total shareholder return on our common stock (consisting of stock price performance and reinvested dividends) from December 31, 2008 with the cumulative total return (assuming reinvestment of all dividends) of (i) the Value Line Machinery Index (“Machinery”) and (ii) the Standard & Poor’s 500 Stock Index, for the period December 31, 2008 through December 31, 2013. The Machinery index is an industry index comprised of 49 companies engaged in manufacturing of machinery and machine parts, a list of which is available from the Company. The comparison assumes $100 was invested in our common stock and in each of the foregoing indices on December 31, 2008. We cannot assure you that the performance of the common stock will continue in the future with the same or similar trend depicted on the graph.

15

Comparison of Five-Year Cumulative Total Return*

NN, Inc., Standard & Poors 500 and Value Line Machinery Index

(Performance Results Through 12/31/13)

| * | Cumulative total return assumes reinvestment of dividends. |

| Cumulative Return | ||||||||||||||||||||

| 12/31/2009 | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | ||||||||||||||||

| NN, Inc. |

172.93 | 539.74 | 262.01 | 400.00 | 888.79 | |||||||||||||||

| Standard & Poors 500 |

126.46 | 145.51 | 148.58 | 172.35 | 228.18 | |||||||||||||||

| Machinery |

157.28 | 261.56 | 297.73 | 389.95 | 562.87 | |||||||||||||||

The declaration and payment of dividends are subject to the sole discretion of our Board of Directors and depend upon our profitability, financial condition, capital needs, credit agreement restrictions, future prospects and other factors deemed relevant by the Board of Directors. The following table sets forth the dividends per share paid during 2013. We did not pay any dividends on common stock during 2012.

| Dividend | ||||

| 2013 |

||||

| First Quarter |

$ | 0.00 | ||

| Second Quarter |

$ | 0.00 | ||

| Third Quarter |

$ | 0.12 | ||

| Fourth Quarter |

$ | 0.06 | ||

See Part III, Item 12 – “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” of this 2013 Annual Report on Form 10-K for information required by Item 201 (d) of Regulation S-K.

16

| Item 6. | Selected Financial Data |

The following selected financial data has been derived from our audited financial statements. The selected financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited consolidated financial statements, including notes thereto.

| (In Thousands, Except Per Share Data) | Year ended December 31, | |||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||

| Net sales |

$ | 373,206 | $ | 370,084 | $ | 424,691 | $ | 365,369 | $ | 259,383 | ||||||||||

| Cost of products sold (exclusive of depreciation shown separately below) |

295,136 | 294,859 | 347,622 | 296,422 | 235,466 | |||||||||||||||

| Selling, general and administrative |

33,281 | 31,561 | 30,657 | 30,407 | 27,273 | |||||||||||||||

| Depreciation and amortization |

16,957 | 17,643 | 17,016 | 19,195 | 22,186 | |||||||||||||||

| (Gain) loss on disposal of assets |

5 | (17 | ) | (36 | ) | 808 | 493 | |||||||||||||

| Restructuring and impairment charges, excluding goodwill impairment |

— | 967 | — | 2,289 | 4,977 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

27,827 | 25,071 | 29,432 | 16,248 | (31,012 | ) | ||||||||||||||

| Interest expense |

2,374 | 3,878 | 4,715 | 6,815 | 6,359 | |||||||||||||||

| Write-off of unamortized debt issuance cost |

— | — | — | 130 | 604 | |||||||||||||||

| Other expense (income), net |

275 | 852 | (1,388 | ) | (1,682 | ) | (351 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before provision (benefit) for income taxes |

25,178 | 20,341 | 26,105 | 10,985 | (37,624 | ) | ||||||||||||||

| Provision (benefit) for income taxes |

8,000 | (3,927 | ) | 5,168 | 4,569 | (2,290 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 17,178 | $ | 24,268 | $ | 20,937 | $ | 6,416 | $ | (35,334 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic income (loss) per share: |

||||||||||||||||||||

| Net income (loss) |

$ | 1.00 | $ | 1.43 | $ | 1.24 | $ | 0.39 | $ | (2.17 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted income (loss) per share: |

||||||||||||||||||||

| Net income (loss) |

$ | 1.00 | $ | 1.42 | $ | 1.24 | $ | 0.39 | $ | (2.17 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends declared |

$ | 0.18 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average number of shares outstanding - Basic |

17,176 | 17,009 | 16,817 | 16,455 | 16,268 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average number of shares outstanding – Diluted |

17,260 | 17,114 | 16,953 | 16,570 | 16,268 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

17

| As of December 31, | ||||||||||||||||||||

| (In Thousands) | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Current assets |

$ | 125,674 | $ | 127,296 | $ | 124,025 | $ | 115,670 | $ | 98,283 | ||||||||||

| Current liabilities |

69,384 | 58,758 | 73,041 | 83,587 | 68,489 | |||||||||||||||

| Total assets |

262,402 | 265,343 | 259,461 | 248,555 | 242,652 | |||||||||||||||

| Long-term debt |

26,000 | 63,715 | 71,629 | 67,643 | 77,558 | |||||||||||||||

| Stockholders’ equity |

152,760 | 128,560 | 99,676 | 78,107 | 76,803 | |||||||||||||||

During the year ended December 31, 2012, the results were impacted by a favorable tax benefit of a net $7.3 million from removing valuation allowances on deferred tax assets in the U.S. Additionally, year ended December 31, 2012, results were negatively impacted by impairments of $1.0 million and after tax foreign exchange losses of $1.1 million related to intercompany notes. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

During the year ended December 31, 2011, the results were impacted by certain items including $5.0 million in additional start-up costs from new multi-year sales programs (all in our Precision Metals Components Segment) and $0.8 million in a one-time tax benefit from removing valuation allowances on certain deferred tax assets in Europe. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

During the year ended December 31, 2010, the results were impacted by certain items including $4.5 million from NN ceasing operations at the Tempe plant, $3.0 million in start-up costs from new multi-year sales programs (both in our Precision Metals Components Segment) and $1.1 million in costs related to the elimination of certain senior management positions. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

For the year ended December 31, 2009, the operating results were significantly impacted by the effects of the global recession and related destocking by our customers as our sales decreased 37%, excluding foreign exchange effects, from the year ended December 31, 2008. Additionally, we incurred $5.0 million in restructuring and impairment charges related to two plant closures and a reduction in force at another manufacturing location.

18

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with, and is qualified in its entirety by, the Consolidated Financial Statements and the Notes thereto and Selected Financial Data included elsewhere in this Form 10-K. Historical operating results and percentage relationships among any amounts included in the Consolidated Financial Statements are not necessarily indicative of trends in operating results for any future period.

Overview and Management Focus

Our strategy and management focus is based upon the following long-term objectives:

| • | Majority of our sales growth by 2018 in our current strategy coming from acquisitions |

| • | Sales growth in adjacent markets |

| • | Organic and acquisitive growth within all our segments |

| • | Global expansion of our manufacturing base to better address the global requirements of our customers |

Management generally focuses on these trends and relevant market indicators:

| • | Global industrial growth and economics |

| • | Global automotive production rates |

| • | Costs subject to the global inflationary environment, including, but not limited to: |

| • | Raw material |

| • | Wages and benefits, including health care costs |

| • | Regulatory compliance |

| • | Energy |

| • | Raw material availability |

| • | Trends related to the geographic migration of competitive manufacturing |

| • | Regulatory environment for United States public companies |

| • | Currency and exchange rate movements and trends |

| • | Interest rate levels and expectations |

Management generally focuses on the following key indicators of operating performance:

| • | Sales growth |

| • | Cost of products sold |

| • | Selling, general and administrative expense |

| • | Net income |

| • | Cash flow from operations and capital spending |

19

| • | Customer service reliability |

| • | External and internal quality indicators |

| • | Employee development |

Critical Accounting Policies

Our significant accounting policies, including the assumptions and judgment underlying them, are disclosed in Note 1 of the Notes to Consolidated Financial Statements. These policies have been consistently applied in all material respects and address such matters as revenue recognition, inventory valuation and asset impairment recognition. Due to the estimation processes involved, management considers the following summarized accounting policies and their application to be critical to understanding our business operations, financial condition and results of operations. We cannot assure you that actual results will not significantly differ from the estimates used in these critical accounting policies.

Goodwill and Acquired Intangibles. For new acquisitions, we use estimates, assumptions and appraisals to allocate the purchase price to the assets acquired and to determine the amount of goodwill. These estimates are based on market analyses and comparisons to similar assets. Annual procedures are required to be performed to assess whether recorded goodwill is impaired. The annual tests require management to make estimates and assumptions with regard to the future operations of its reporting units, and the expected cash flows that they will generate. These estimates and assumptions could impact the recorded value of assets acquired in a business combination, including goodwill, and whether or not there is any subsequent impairment of the recorded goodwill and the amount of such impairment.

Goodwill is tested for impairment on an annual basis as of October 1 and between annual tests if a triggering event occurs. The impairment procedures are performed at the reporting unit level for the one reporting unit that still has goodwill. In testing goodwill, we have the option to first assess qualitative factors to determine whether it is necessary to perform a two-step test. If an entity believes, as a result of its qualitative assessment, that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount including goodwill, the quantitative impairment test is required. Otherwise, no further testing is required. The decision to perform a qualitative assessment or perform a complete step 1 analysis is an annual decision made by management based on several factors including budget to actual performance, economic, market and industry considerations such as automotive production rates in the geographic markets we serve and cash flow from operations.

U.S. GAAP prescribes a two-step process for testing for goodwill impairments. The first step is to determine if the carrying value of the reporting unit with goodwill is less than the related fair value of the reporting unit. We determine the fair value of the reporting unit through use of discounted cash flow methods and market based multiples of earning and sales methods obtained from a grouping of comparable publicly trading companies. We believe this methodology of valuation is consistent with how market participants would value reporting units. The discount rate and market based multiples used are specifically developed for the units tested regarding the level of risk and end markets served. Even though we do use other observable inputs (Level 2 inputs under the US GAAP hierarchy) the calculation of fair value for goodwill would be most consistent with Level 3 under the US GAAP hierarchy.

If the carrying value of the reporting unit, including goodwill, is less than fair value of the reporting unit, the goodwill is not considered impaired. If the carrying value is greater than fair value then the potential for impairment of goodwill exists. The potential impairment is determined by allocating the fair value of the reporting unit among the assets and liabilities based on a purchase price allocation methodology as if the reporting unit was acquired in a business combination. The fair value of the goodwill is implied from this allocation and compared to the carrying value with an impairment loss recognized if the carrying value is greater than the implied fair value.

Our indefinite lived intangible asset is accounted for similarly to goodwill. This asset is tested for impairment at least annually by comparing the fair value to the carrying value, using the relief from royalty rate method, and if the fair value is less than the carrying value, an impairment charge is recognized for the difference. We elected to use Step 1 testing even though a qualitative approach was available to us.

Income taxes. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying

20

amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

The calculation of tax assets, liabilities, and expenses under U.S. GAAP is largely dependent on management judgment of the current and future deductibility and utilization of taxable expenses and benefits using a more likely than not threshold. Specifically, the realization of deferred tax assets and the certainty of tax positions taken are largely dependent upon management weighting the current positive and negative evidence for recording tax benefits and expenses. Additionally, many of our positions are based on future estimates of taxable income and deductibility of tax positions. Particularly, our assertion of permanent reinvestment of foreign undistributed earnings is largely based on management’s future estimates of domestic and foreign cash flows and current strategic foreign investment plans. In the event that the actual outcome from future tax consequences differs from management estimates and assumptions or management plans and positions are amended, the resulting change to the provision for income taxes could have a material impact on the consolidated results of operations and statement of financial position. (See Notes 1 and 12 of the Notes to Consolidated Financial Statements).

Impairment of Long-Lived Assets. Our long-lived assets include property, plant and equipment. The recoverability of the long-term assets is dependent on the performance of the companies which we have acquired or built, as well as the performance of the markets in which these companies operate. In assessing potential impairment for these assets, we will consider these factors as well as forecasted financial performance based, in large part, on management business plans and projected financial information which are subject to a high degree of management judgment and complexity. Future adverse changes in market conditions or adverse operating results of the underlying assets could result in having to record additional impairment charges not previously recognized.

Results of Operations

The following table sets forth for the periods indicated selected financial data and the percentage of our net sales represented by each income statement line item presented.

| As a Percentage of Net Sales Year ended December 31, |

||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of product sold (exclusive of depreciation and amortization shown separately below) |

79.1 | 79.7 | 81.9 | |||||||||

| Selling, general and administrative expenses |

8.9 | 8.5 | 7.2 | |||||||||

| Depreciation and amortization |