UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 000-23486

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(980 ) 264-4300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such file). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☑ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant was approximately $89 million as of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, computed using the closing price of the registrant’s common stock as quoted on the Nasdaq Stock Market LLC on that date of $4.74. Solely for purposes of making this calculation, shares of the registrant’s common stock held by named executive officers, directors and 5% or greater stockholders of the registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purposes.

As of March 12, 2021, there were 42,791,476 shares of the registrant’s common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

NN, Inc.

INDEX

| Page | ||||||||

3

PART I

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc., based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of the coronavirus pandemic (“COVID-19”) on the Company’s financial condition, business operations, and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; availability of raw materials; currency and other risks associated with international trade; our dependence on certain major customers; the impact of acquisitions and divestitures; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; unanticipated difficulties integrating acquisitions and realizing anticipated cost savings and operating efficiencies; risks associated with joint ventures; new laws and governmental regulations; and other risk factors and cautionary statements listed from time to time in our periodic reports filed with the Securities and Exchange Commission. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

Except for per share data or as otherwise noted, all U.S dollar amounts presented in tables that follow are in thousands.

Item 1.Business

Introduction

NN, Inc. is a global diversified industrial company that combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies primarily for the electrical, automotive, general industrial, aerospace and defense, and medical markets. As used in this Annual Report on Form 10-K (this “Annual Report”), the terms “NN,” the “Company,” “we,” “our,” or “us” refer to NN, Inc., and its subsidiaries. We have 32 facilities in North America, Europe, South America, and China.

On October 6, 2020, we completed the sale of our Life Sciences business (the “Life Sciences business”) to affiliates of American Securities LLC for approximately $753.3 million. The proceeds from the sale of the Life Sciences business were used to prepay $700.0 million in the aggregate on the Senior Secured Term Loan and the Incremental Term Loan immediately following the sale. We also paid in full the outstanding balance on the Senior Secured Revolver. The sale of the Life Sciences business furthers management’s strategy to improve liquidity and creates the financial flexibility to pursue key growth areas in the Mobile Solutions and Power Solutions segments.

Our enterprise and management structure is designed to accelerate growth and further balance our portfolio by aligning our strategic assets and businesses. Our businesses are organized into the Mobile Solutions and Power Solutions groups and are based principally on the end markets they serve. Mobile Solutions is focused on growth in the general industrial and automotive end markets. Power Solutions is focused on growth in the electrical and aerospace and defense end markets.

Business Segments and Products

Mobile Solutions

Mobile Solutions is focused on growth in the general industrial and automotive end markets. We have developed an expertise in manufacturing highly complex, system critical components for fuel systems, engines and transmissions, power steering systems, and electromechanical motors on a high-volume basis. This expertise has been gained through investment in technical capabilities, processes and systems, and skilled program management and product launch capabilities.

Power Solutions

Power Solutions is focused on growth in the electrical and aerospace and defense end markets, while also serving the automotive and medical end markets. Within this group we combine materials science expertise with advanced engineering and production capabilities to design and manufacture a broad range of high-precision metal and plastic components, assemblies, and finished devices used in applications ranging from power control to flight control and for military devices. We

4

manufacture a variety of products including electrical contacts, connectors, contact assemblies, and precision stampings for the electrical end market and high precision products for the aerospace and defense end market utilizing our extensive process technologies for optical grade plastics, thermally conductive plastics, titanium, Inconel, magnesium, and electroplating. Our medical business includes the production of a variety of tools and instruments for the orthopaedics and medical/surgical end markets.

Competitive Strengths

High-precision manufacturing capabilities

We believe our ability to produce high-precision parts at high production volumes is among the best in the market. Our technology platform consists of high precision machining, progressive stamping, injection molding, laser welding, material science, assembly, and design optimization. In-house tool design and process know-how create trade secrets that enable consistent production tolerances of less than one micron while producing millions of parts per day. Parts are manufactured to application-specific customer design and co-design standards that are developed for a specific use. The high-precision capabilities are part of our zero-defect design process which seeks to eliminate variability and manufacturing defects throughout the entire product lifecycle. We believe our production capabilities provide a competitive advantage as few other manufacturers are capable of meeting tolerance demands at any volume level requested by our customers. As the need for tight-tolerance precision parts, subassemblies, and devices continues to increase, we believe that our production capabilities will place us at the forefront of the industry. We have differentiated ourselves among our competitors by providing customers engineered solutions and a broad reach and breadth of manufacturing capabilities. We believe it is for these reasons, and because of our proven ability to produce high-quality, precision parts and components on a cost-effective basis, that customers choose us to meet their manufacturing needs.

Differentiated, system-critical products

The tight-tolerance and high-quality nature of our precision products is specifically suited for use in the most demanding applications that require superior reliability. Our products are critical components to the operation and reliability of larger mechanical systems. Precision parts are difficult to manufacture and achieve premium pricing in the marketplace as the high cost of failure motivates our customers to focus on quality. Our products are developed for specific uses within critical systems and are typically designed in conjunction with the system designer. Our parts are often qualified for, or specified in, customer designs, reducing the ability for customers to change suppliers.

Our ability to make products with tight-tolerance and extreme precision requirements enables our customers to satisfy the critical functionality and performance requirements of their products. We are included in customer designs and deployed in critical systems that involve high cost of failure applications and significant regulatory certification processes, including those for the Food and Drug Administration (“FDA”), Underwriters Laboratories (“UL”), and the National Aerospace and Defense Contractors Accreditation Program (“NADCAP”).

Complete product lifecycle focus

Our engineering expertise and deep knowledge of precision manufacturing processes adds proprietary value throughout the complete lifecycle of our products. Our in-house engineering team works closely with our customers to provide parts that meet specific design specifications for a given application. The relationship with the customer begins early in the conceptual design process when we provide feedback on potential cost, manufacturability, and estimated reliability of the parts. Part designs are then prototyped, tested, and qualified in coordination with the customer design process before going to full-scale production. The close working relationship with our customers early in the product lifecycle helps to secure business, increase industry knowledge, and develop significant trade secrets. Performance verification, product troubleshooting, and post-production engineering services further deepen relationships with our customers as well as provide additional industry knowledge that is applicable to future design programs and provide continuous manufacturing process improvement.

Prototype products are developed for testing, and process validation procedures are instituted. In many instances, we will file for regulatory production approval and include the customer’s proprietary processes, further discouraging supplier changes. We will assist the customer with continuous supply chain management and comprehensive customer support for the lifetime of the product and continuously seek to identify new operational efficiencies to reduce the product’s cost and improve its quality. Once our solution is designed into a platform, it is often embedded through the multi-year manufacturing lifecycle and has a competitive advantage in supporting subsequent platforms. As an added benefit, customers generally fund development, prototypes, and manufacturing tooling expenses. This discourages supplier changes and drives recurring revenue for us.

Long-term blue-chip customer base

We maintain relationships with hundreds of customers around the world. Our customers are typically sophisticated, engineering-driven, mechanical systems manufacturers with long histories of product development and reputations for quality.

5

We have no significant retail exposure, which limits volatility and provides enhanced sales visibility. Relationships with our top ten customers, in terms of revenue, average more than ten years. We have significant exposure to emerging markets in Asia, South America, and Europe through these global customers as well as key local manufacturers. The diverse nature, size, and reach of our customer base provides resistance to localized market and geographic fluctuations and help stabilizes overall product demand.

Strategic global footprint

Our 32 facilities, on four continents, are strategically located to serve our customer base and provide local service and expertise. Our global footprint provides flexibility to locally supply identical products for global customers, reducing shipping time and expense, allowing us to match costs to revenue and to capitalize on industry localization trends. In total, we operate more than 2.1 million square feet of manufacturing space. North America constitutes the largest portion of our manufacturing operations with facilities in the U.S. and Mexico. The North American facilities are strategically located to serve major customers in the United States and Mexico. Our foreign facilities are located in regional manufacturing hubs in France, Poland, China, and Brazil, and primarily serve global customers in those local markets. The Asian and South American facilities, we believe, have significant growth potential as local customer bases expand and the markets for high-precision products grow in those regions.

Synergies

We are well-positioned to take advantage of synergies between our Mobile Solutions and Power Solutions businesses as we expand new technologies in the electric vehicle, hybrid vehicle, and aerospace and defense markets.

Proven and experienced management team

Our management team has significant experience in precision manufacturing and the diversified industrial sector. Warren Veltman was named President and Chief Executive Officer in September 2019 and previously served as Executive Vice President of Mobile Solutions. Mr. Veltman joined us in 2014 as part of the Autocam acquisition, a business at which he had 30 years of experience in financial and operational leadership roles. Thomas DeByle joined NN and was named Senior Vice President and Chief Financial Officer in August 2019. Mr. DeByle has extensive experience in finance leadership roles at global manufacturers and most recently served as Chief Financial Officer, Vice President and Treasurer of Standex International since 2008. John Buchan was named Executive Vice President of Mobile Solutions in September 2019 and Executive Vice President of Mobile Solutions and Power Solutions in November 2019. Mr. Buchan joined us in 2014 as part of the Autocam acquisition, a business at which he had 18 years of experience in operations. We believe that our current management team has the necessary talent and experience to profitably operate and grow the business.

Customers

Our products are supplied primarily to manufacturers for use in a broad range of industrial applications, including automotive; electrical; agricultural; construction; residential devices and equipment; aerospace and defense; medical; heating, ventilation, and air conditioning; and fluid power and diesel engines. Sales to each of our top ten customers are made to multiple customer locations and divisions throughout the world. In 2020, our top ten customers accounted for approximately 45% of our net sales. In 2020, 70% of our products were sold to customers in North America, 8% to customers in Europe, 15% to customers in Asia, and the remaining 7% to customers in South America.

We sell our products to most of our largest customers under either sales contracts or agreed upon commercial terms. In general, we pass through material cost fluctuations when incurred to our customers in the form of changes in selling prices. We ordinarily ship our products directly to customers within 60 days, and in many cases, during the same calendar month of the date on which a sales order is placed.

Sales and Marketing

A primary emphasis of our marketing strategy is to expand key customer relationships by offering high quality, high-precision, application-specific customer solutions with the value of a single supply chain partner for a wide variety of products and components. Due to the technical nature of many of our products, our engineers and manufacturing management personnel also provide technical sales support functions, while internal sales employees handle customer orders and other general sales support activities. Our marketing strategy is to offer custom manufactured, high quality, precision products to markets with high value-added characteristics at competitive price levels. This strategy focuses on relationships with key customers that require the production of technically difficult parts and assemblies, enabling us to take advantage of our strengths in custom product development, equipment and tool design, component assembly, and machining processes.

6

Human Capital Management

Our business results depend in part on our ability to successfully manage our human capital resources, including attracting, identifying, and retaining key talent. Factors that may affect our ability to attract and retain qualified employees include employee morale, our reputation, competition from other employers, and availability of qualified individuals. As of December 31, 2020, we employed a total of 3,081 full and part-time employees and 409 temporary workers, which includes approximately 1,460 employees in the U.S. and approximately 2,030 employees in other countries employed by our international subsidiaries. Of our total employment, approximately 14% are management employees and 86% are production employees. Our employees in the France, Brazil, and Brainin de Mexico plants are subject to labor council relationships that vary due to the diverse countries in which we operate. We believe we have a good working relationship with our employees and the unions that represent them.

In response to the COVID-19 pandemic, we implemented significant changes that we determined were in the best interest of our employees and which comply with government orders in all the states and countries where we operate. In an effort to keep our employees safe and to maintain operations during the COVID-19 pandemic, we implemented a number of new health-related measures, including the requirement to wear face-masks at all times while on company property, temperature-taking protocols, increased hygiene, cleaning and sanitizing procedures at all locations, social-distancing protocols, restrictions on visitors to our facilities, and limiting in-person meetings and other gatherings.

We believe diversity and inclusion are at the core of our values and strategic business priorities. Throughout our business, we champion equality, supporting parity for women and under-represented groups as we work to create ethical, safe, and supportive workplaces where our employees thrive. We believe a diverse and inclusive workplace results in business growth and encourages increased innovation, retention of talent, and a more engaged workforce. Respect for human rights is fundamental to our business and its commitment to ethical business conduct.

Competition

Mobile Solutions

In the market in which Mobile Solutions operates, internal production of components by our customers can impact our business as the customers weigh the risk of outsourcing strategically critical components or producing in-house. Our primary competitors are: Anton Häring KG; A. Berger Holding GmbH & Co. KG; Brovedani Group, Burgmaier Technologies GmbH & Co. KG; CIE Automotive, S.A.; IMS Companies; and MacLean-Fogg Component Solutions. We believe that we generally win new business on the basis of technical competence and our proven track record of successful product development.

Power Solutions

Power Solutions operates in intensely competitive but very fragmented supply chains. We must compete with numerous companies in each industry market segment. Our primary competitors are: Checon Corporation; Deringer-Ney, Inc.; Electrical Contacts, Ltd.; Interplex Industries, Inc.; J&J Machining, LLC; Norstan, Inc.; Owens Industries, Inc.; and Precinmac Precision Machining. We believe that competition within the electrical and aerospace and defense end markets is based principally on quality, price, design capabilities, and speed of responsiveness and delivery. We believe that our competitive strengths are product development, tool design, fabrication, tight tolerance processes, and customer solutions. With these strengths, we have built our reputation in the marketplace as a quality producer of technically difficult products.

Raw Materials

Mobile Solutions

Mobile Solutions produces products from a wide variety of metals in various forms from various sources located in the North America, Europe, South America, and Asia. Basic types include hot rolled steel, cold rolled steel (both carbon and alloy), stainless, extruded aluminum, die cast aluminum, gray and ductile iron castings, hot and cold forgings, and mechanical tubing. Some material is purchased directly under contracts, some is consigned by the customer, and some is purchased directly from the steel mills.

Power Solutions

Power Solutions uses a wide variety of metals in various forms, including precious metals like gold, silver, palladium, and platinum, as well as plastics. Through our diverse network of suppliers, we minimize supplier concentration risk and provide a stable supply of raw materials at competitive pricing. This group also procures resins and metal stampings from several domestic and foreign suppliers. Power Solutions bases purchase decisions on quality, service and price. Generally, we do not enter into written supply contracts with our suppliers or commit to maintain minimum monthly purchases of materials. However, we carefully manage raw material price volatility, particularly with respect to precious metals, through the use of

7

consignment agreements. In effect, we contract the precious metals for our own stock and buy the raw materials on the same day customer shipments are priced, thereby eliminating speculation.

In each of our segments, we have historically been affected by upward price pressure on steel principally due to general increases in global demand. In general, we pass through material cost fluctuations to our customers in the form of changes in selling price. Most of the raw materials we use are purchased from various suppliers and are typically available from numerous sources, some of which are located in China and Europe. The recent coronavirus outbreak has impacted our suppliers in China and other affected regions. We are monitoring the effect of these impacts on our supply chain in order to maintain regular and timely supply of raw materials to our business segments.

Patents, Trademarks and Licenses

We have several U.S. patents, patent applications and trademarks for various trade names. However, we cannot be certain that we would be able to protect and enforce our intellectual property rights against third parties, and if we cannot do so, we may face increased competition and diminished net sales.

Furthermore, third parties may assert infringement claims against us based on their patents or other intellectual property, and we may have to pay substantial damages and/or redesign our products if we are ultimately found to infringe. Even if such intellectual property claims against us are without merit, investigating and defending these types of lawsuits takes significant time, may be expensive and may divert management attention from other business concerns.

Additionally, we rely on certain data and processes, including trade secrets and know-how, and the success of our business depends, to some extent, on such information remaining confidential. Each officer is subject to a non-competition and confidentiality agreement that seeks to protect this information. Additionally, all employees are subject to company code of ethics policies that prohibit the disclosure of information critical to the operations of our business.

Seasonal Nature of Business

General economic conditions impact our business and financial results, and certain businesses experience seasonal and other trends related to the industries and end markets that they serve. For example, European sales are often weaker in the summer months as customers slow production, automotive sales tend to slow in July and December, and sales to original equipment manufacturers are often stronger immediately preceding and following the launch of new products. However, as a whole, we are not materially impacted by seasonality.

Government Regulations

Our operations and products are subject to extensive federal, state and local regulatory requirements both domestically and abroad. For example, our business activities are subject to various laws and regulations relating to pollution control and protection of the environment. These laws and regulations govern, among other things, discharges to air or water, the generation, storage, handling, and use of automotive hazardous materials and the handling and disposal of hazardous waste generated at our facilities. Under such laws and regulations, we are required to obtain permits from governmental authorities for some of our operations. If we violate or fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators. Under some environmental laws and regulations, we could also be held responsible for all the costs relating to any contamination at our past or present facilities and at third-party waste disposal sites. We maintain a compliance program to assist in preventing and, if necessary, correcting environmental problems.

As a manufacturer of medical devices, our Taunton, Massachusetts, facility is required to register as such with the FDA.

With respect to medical and products that we may specifically develop to sell to our customers, before these devices can be marketed, we will seek to obtain a marketing clearance from the FDA under Section 510(k) of the United States Federal Food, Drug, and Cosmetic Act. The FDA typically grants a 510(k) clearance if the applicant can establish that the device is substantially equivalent to a predicate device. Clearance under Section 510(k) typically takes about four months from the date of submission.

Based on information compiled to date, management believes that our current operations are in substantial compliance with applicable environmental laws and regulations, the violation of which could have a material adverse effect on our business and financial condition. We cannot assure that currently unknown matters, new laws and regulations, or stricter interpretations of existing laws and regulations will not materially affect our business or operations in the future. As of the date hereof, compliance with these laws and regulations has not had a material effect on our capital expenditures, results of operations, and competitive position. For additional information, see “Item 1A - Risk Factors.”

8

Information about our Executive Officers

Our executive officers are:

| Name | Age | Position | ||||||||||||

| Warren A. Veltman | 59 | President and Chief Executive Officer | ||||||||||||

| Thomas D. DeByle | 61 | Senior Vice President and Chief Financial Officer | ||||||||||||

| John R. Buchan | 59 | Executive Vice President – Mobile Solutions and Power Solutions | ||||||||||||

| Matthew S. Heiter | 60 | Senior Vice President and General Counsel | ||||||||||||

| D. Gail Nixon | 50 | Senior Vice President and Chief Human Resources Officer | ||||||||||||

Warren A. Veltman was appointed President and Chief Executive Officer in September 2019 having previously served as Executive Vice President of Mobile Solutions since January 2018. Mr. Veltman joined NN as part of the Autocam acquisition in 2014 as the Senior Vice President and General Manager of our former Autocam Precision Components Group. Prior to the acquisition, Mr. Veltman served as Chief Financial Officer of Autocam Corporation from 1990 and Secretary and Treasurer since 1991. Prior to Mr. Veltman’s service at Autocam, Mr. Veltman was an Audit Manager with Deloitte & Touche LLP.

Thomas D. DeByle joined us as Senior Vice President and Chief Financial Officer in September 2019. Since 2019, Mr. DeByle has been on the board of directors of Chase Corporation (NYSE: CCF). He is also their Audit Committee Chair. Prior to joining NN, Mr. DeByle served as Chief Financial Officer, Vice President, and Treasurer of Standex International from March 2008 to August 2019. Prior to joining Standex International, Mr. DeByle held a variety of leadership positions at Ingersoll Rand, a leading diversified industrial firm, culminating in his appointment as Chief Financial Officer for the Compact Vehicle Technology Sector. Prior to joining Ingersoll Rand, Mr. DeByle held a variety of leadership positions at Actuant Corporation, a publicly held diversified industrial company, Milwaukee-based Johnson Controls, and two regional public accounting firms.

John R. Buchan was appointed Executive Vice President of Mobile Solutions in September 2019 and Executive Vice President of Mobile Solutions and Power Solutions in November 2019 having previously served as Vice President of Operations of Mobile Solutions. Mr. Buchan joined NN as part of the Autocam acquisition in 2014, where he served as the Chief Operations Officer. Prior to joining Autocam in 2002, Mr. Buchan held a variety of technical leadership roles at Benteler Automotive, culminating in his appointment as Executive Vice President of the Exhaust Products Group. Mr. Buchan has spent his entire career in operations roles, beginning with General Motors Central Foundry and Rochester Products Divisions.

Matthew S. Heiter joined us as Senior Vice President and General Counsel in July 2015. Prior to joining NN, Mr. Heiter was a shareholder in the law firm of Baker, Donelson, Bearman, Caldwell and Berkowitz, P.C. from May 1996 to December 1999 and from July 2002 to July 2015, where he served as chairman of the firm’s Securities and Corporate Governance Practice Group. From January 2000 to July 2002, Mr. Heiter served as the Executive Vice President, General Counsel, and Secretary of Internet Pictures Corporation, a publicly traded internet technology company.

D. Gail Nixon joined us in 2007 and was appointed Senior Vice President and Chief Human Resources Officer in January 2018. Ms. Nixon previously served as our Vice President of Human Resources as well as Corporate Human Resources Manager. Ms. Nixon is a member of the Society for Human Resource Management and World at Work and has earned her Senior Professional in Human Resources designation. From 2000 to 2007, she held various accounting and human resources positions with a multi-state healthcare organization, ultimately serving as its corporate human resources director.

Available Information - Securities and Exchange Commission (“SEC”) Filings

We make available free of charge, in the “Investor Relations” section of our website (www.nninc.com), our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the SEC. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Item 1A.Risk Factors

The following are risk factors that affect our business, prospects, financial condition, results of operations, and cash flows, some of which are beyond our control. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K. If any of the events described below were to actually occur, our business, prospects, financial condition, results of operations, or cash flows could be adversely affected, and results could differ materially from expected and historical results.

9

Risks Related to Our Operations

The COVID-19 pandemic and mitigation efforts to control the spread of the disease have and are expected to continue to materially impact our business, and our financial condition, results of operations and cash flows could be materially adversely affected by factors relating to COVID-19.

The COVID-19 pandemic has created significant volatility in the global economy and led to significant reduced market and economic activity and employment and has disrupted, and may continue to disrupt, the end markets we serve. The spread of COVID-19 has created a disruption in the manufacturing, delivery and overall supply chain of automobile manufacturers and suppliers. Global vehicle production has decreased, and as a result, we have modified our production schedules and have experienced, and may continue to experience, delays in the production and distribution of our products and the loss of sales to our customers. During the pandemic, our production volumes may be volatile, and we will be required to modify our production environment to ensure the health and safety of our workers. Additionally, if the global economic effects caused by the pandemic continue or increase, overall customer demand may continue to decrease, which could have a material and adverse effect on our business, results of operations, and financial condition. COVID-19 vaccines have received emergency use authorization from the United States government, but vaccine distribution has been slower than public officials hoped. Many jurisdictions continue to enforce orders restricting businesses’ normal operations, and reinstatement of broader “stay-at-home” directives and mandates remains a possibility. Additionally, the federal emergency supplemental unemployment benefit is scheduled to expire in March 2021. In addition, if a significant portion of our workforce or our customers’ workforces are affected by COVID-19 either directly or due to government closures or otherwise, associated work stoppages or facility closures would halt or delay production.

The full extent of the future effects of the pandemic on us, our customers, our supply chain, and our business cannot be assessed at this time, although we expect our 2021 results of operations are likely to be adversely affected. Our business, results of operations and financial condition could continue to be affected even after the pandemic subsides. In addition to the risks specifically described above, the impact of COVID-19 is likely to heighten other risks disclosed below.

We depend heavily on a relatively limited number of customers, and the loss of any major customer would have a material adverse effect on our business.

During 2020, sales to various U.S. and foreign divisions of our ten largest customers accounted for approximately 45% of our consolidated net sales. The loss of all or a substantial portion of sales to these customers would cause us to lose a substantial portion of our revenue and would lower our operating profit margin and cash flows from operations.

Work stoppages or similar difficulties and unanticipated business disruptions could significantly disrupt our operations, reduce our revenues and materially affect our earnings.

A work stoppage at one or more of our facilities could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows. Also, if one or more of our customers were to experience a work stoppage, that customer would likely halt or limit purchases of our products. For example, increased demand for semiconductor chips in 2020, due in part to the COVID-19 pandemic and an increased use of laptop computers, 5G phones, gaming systems and other IT equipment that use these chips, has resulted in a severe shortage of chips in early 2021. These same chips are used in automobiles in a variety of parts and information and entertainment systems. As a result, various automotive manufacturers have been forced to delay or stall new vehicle production. If efforts to address the chip shortage by the industry and the U.S government are unsuccessful, there may be further delays in new vehicle production, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

We have a complex network of suppliers, owned and leased manufacturing locations, co-manufacturing locations, distribution networks, and information systems that support our ability to consistently provide our products to our customers. Factors that are hard to predict or beyond our control, such as weather, raw material shortages, natural disasters, fires or explosions, political unrest, terrorism, generalized labor unrest, or health pandemics, such as COVID-19, could damage or disrupt our operations or our customers’, suppliers’, co-manufacturers’ or distributors’ operations. These disruptions may require additional resources to restore our supply chain or distribution network. If we cannot respond to disruptions in our operations, whether by finding alternative suppliers or replacing capacity at key manufacturing or distribution locations, or if we are unable to quickly repair damage to our information, production, or supply systems, we may be late in delivering, or be unable to deliver, products to our customers and may also be unable to track orders, inventory, receivables, and payables. If that occurs, our customers’ confidence in us and long-term demand for our products could decline. Any of these events could materially and adversely affect our product sales, financial condition, and operating results.

We operate in and sell products to customers outside the U.S. and are subject to several risks related to doing business internationally.

We obtain a majority of our raw materials from overseas suppliers, actively participate in overseas manufacturing operations and sell to a large number of international customers. During the year ended December 31, 2020, sales to customers located

10

outside of the U.S. accounted for approximately 37% of our consolidated net sales. As a result of doing business internationally, we face risks associated with the following:

•changes in tariff regulations, which may make our products more costly to export or import;

•changes in monetary and fiscal policies, laws and regulations, and other activities of governments, agencies and similar organizations;

•recessions or marked declines specific to a particular country or region;

•the potential imposition of trade restrictions or prohibitions;

•the potential imposition of import tariffs or other duties or taxes;

•difficulties establishing and maintaining relationships with local original equipment manufacturers, distributors and dealers;

•difficulty in staffing and managing geographically diverse operations; and

•unstable governments or legal systems in countries in which our suppliers, manufacturing operations, and customers are located.

These and other risks may also increase the relative price of our products compared to those manufactured in other countries, thereby reducing the demand for our products in the markets in which we operate, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

In addition, we could be adversely affected by violations of the Foreign Corrupt Practices Act (the “FCPA”) and similar worldwide anti-bribery laws, as well as export controls and economic sanction laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Our policies mandate compliance with these laws. We operate in many parts of the world that have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. We cannot assure you that our internal controls and procedures will always protect us from the improper acts committed by our employees or agents. If we are found to be liable for FCPA, export control or sanction violations, we could suffer from criminal or civil penalties or other sanctions, including loss of export privileges or authorization needed to conduct aspects of our international business, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

In addition, the prices we pay for raw materials used in our products may be impacted by tariffs. The tariffs initiated by the U.S. government in 2018 under Section 232 of the Trade Expansion Act of 1962 resulted in increased metals prices in the United States. Any future tariffs or quotas imposed on steel and aluminum imports may increase the price of metal, which could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

Failure of our products could result in a product recall.

The majority of our products are components of our customers’ products that are used in critical industrial applications. A failure of our components could lead to a product recall. If a recall were to happen as a result of our components failing, we could bear a substantial part of the cost of correction. In addition to the cost of fixing the parts affected by the component, a recall could result in the loss of a portion of or all of the customer’s business and damage our reputation. A successful product recall claim requiring that we bear a substantial part of the cost of correction or the loss of a key customer could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

Our markets are highly competitive, and many of our competitors have significant advantages that could adversely affect our business.

We face substantial competition in the sale of components, system subassemblies, and finished devices in the vertical end markets into which we sell our products. Our competitors are continuously exploring and implementing improvements in technology and manufacturing processes in order to improve product quality, and our ability to remain competitive will depend, among other things, on whether we are able to keep pace with such quality improvements in a cost-effective manner. Due to this competitiveness, we may not be able to increase prices for our products to cover cost increases. In many cases we face pressure from our customers to reduce prices, which could adversely affect our business, prospects, financial condition, results of operations, or cash flows. In addition, our customers may choose to purchase products from one of our competitors rather than pay the prices we seek for our products, which could adversely affect our business, prospects, financial condition, results of operations, or cash flows.

11

Any loss of key personnel and the inability to attract and retain qualified employees could have a material adverse impact on our operations.

We are dependent on the continued services of key executives and personnel. The departure of our key personnel without adequate replacement could severely disrupt our business operations. Additionally, we need qualified managers and skilled employees with technical and manufacturing industry experience to operate our businesses successfully. From time to time, there may be shortages of skilled labor, which may make it more difficult and expensive for us to attract and retain qualified employees. If we are unable to attract and retain qualified individuals or our costs to do so increase significantly, our operations would be materially adversely affected.

Risks Related to Legal and Regulatory Compliance

Environmental, health and safety laws and regulations impose substantial costs and limitations on our operations, environmental compliance may be more costly than we expect, and any adverse regulatory action may materially adversely affect our business.

We are subject to extensive federal, state, local, and foreign environmental, health, and safety laws and regulations concerning matters such as air emissions, wastewater discharges, solid and hazardous waste handling, and disposal and the investigation and remediation of contamination. The risks of substantial costs, liabilities, and limitations on our operations related to compliance with these laws and regulations are an inherent part of our business, and future conditions may develop, arise or be discovered that create substantial environmental compliance or remediation liabilities and costs.

Compliance with environmental, health, and safety legislation and regulatory requirements may prove to be more limiting and costly than we anticipate. To date, we have committed significant expenditures in our efforts to achieve and maintain compliance with these requirements at our facilities, and we expect that we will continue to make significant expenditures related to such compliance in the future. From time to time, we may be subject to legal proceedings brought by private parties or governmental authorities with respect to environmental matters, including matters involving alleged noncompliance with or liability under environmental, health and safety laws, property damage or personal injury. New laws and regulations, including those which may relate to emissions of greenhouse gases, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, prospects, financial condition, results of operations, or cash flows.

Our medical devices are subject to regulation by numerous government agencies, including the FDA and comparable agencies outside the U.S. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development, testing, manufacturing, labeling, marketing and distribution of our medical devices. We cannot guarantee that we will be able to obtain marketing clearance for our new products or enhancements or modifications to existing products. If such approval is obtained, it may:

•take a significant amount of time;

•require the expenditure of substantial resources;

•involve stringent clinical and pre-clinical testing, as well as increased post-market surveillance;

•involve modifications, repairs or replacements of our products; and

•result in limitations on the proposed uses of our products.

Both before and after a product is commercially released, we have ongoing responsibilities under FDA regulations. We are also subject to periodic inspections by the FDA to determine compliance with the FDA’s requirements, including primarily the quality system regulations and medical device reporting regulations. The results of these inspections can include inspectional observations on FDA’s Form-483, warning letters, or other forms of enforcement. Since 2009, the FDA has significantly increased its oversight of companies subject to its regulations, including medical device companies, by hiring new investigators and stepping up inspections of manufacturing facilities. The FDA has also significantly increased the number of warning letters issued to companies. If the FDA were to conclude that we are not in compliance with applicable laws or regulations, or that any of our medical devices are ineffective or pose an unreasonable health risk, the FDA could ban such medical devices, detain or seize adulterated or misbranded medical devices, order a recall, repair, replacement or refund of such devices, refuse to grant pending pre-market approval applications or require certificates of foreign governments for exports, and/or require us to notify health professionals and others that the devices present unreasonable risks of substantial harm to the public health. The FDA may also impose operating restrictions on a company-wide basis, enjoin and/or restrain certain conduct resulting in violations of applicable law pertaining to medical devices, and assess civil or criminal penalties against our officers, employees, or us. The FDA may also recommend prosecution to the Department of Justice. Any adverse regulatory action, depending on its magnitude, may restrict us from effectively marketing and selling our products.

12

Foreign governmental regulations have become increasingly stringent and more common, and we may become subject to more rigorous regulation by foreign governmental authorities in the future. Penalties for a company’s non-compliance with foreign governmental regulation could be severe, including revocation or suspension of a company’s business license and criminal sanctions. Any domestic or foreign governmental law or regulation imposed in the future may have a material adverse effect on us.

Risks Related to Our Capitalization

Our indebtedness could adversely affect our business, prospects, financial condition, results of operations, or cash flows.

As of December 31, 2020, we had approximately $84.9 million of indebtedness outstanding and an additional $45.4 million of unused borrowing capacity under our debt agreements. Our debt obligations could have important consequences, including:

•increasing our vulnerability to adverse economic, industry, or competitive developments;

•requiring a substantial portion of our cash flows from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flows to fund operations, capital expenditures, and future business opportunities;

•exposing us to the risk of increased interest rates, which could cause our debt service obligations to increase significantly;

•making it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under our debt agreements;

•restricting us from making strategic acquisitions or causing us to make non-strategic divestitures;

•limiting our ability to obtain additional financing for working capital, capital expenditures, product and service development, debt service requirements, acquisitions, and general corporate or other purposes; and

•limiting our flexibility in planning for, or reacting to, changes in our business or market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged and who, therefore, may be able to take advantage of opportunities that our leverage may prevent us from exploiting.

If any one of these events were to occur, our business, prospects, financial condition, results of operations, or cash flows could be materially and adversely affected. For more information regarding our indebtedness, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

Despite our indebtedness level, we may still be able to incur substantial additional amounts of debt, which could further exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. Although our debt agreements contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions, and under certain circumstances, the amount of indebtedness that could be incurred in compliance with these restrictions could be substantial. If new debt is added to our and our subsidiaries’ debt levels, the related risks that we now face could increase.

Our debt agreements contain restrictions that will limit our flexibility in operating our business.

Our debt agreements contain various incurrence covenants that limit our ability to engage in specified types of transactions. These incurrence covenants will limit our ability to, among other things:

•incur additional indebtedness or issue certain preferred equity;

•pay dividends on, repurchase, or make distributions in respect of our capital stock, prepay, redeem, or repurchase certain debt or make other restricted payments;

•make certain investments and acquisitions;

•create certain liens;

•enter into agreements restricting our subsidiaries’ ability to pay dividends to us;

•consolidate, merge, sell, or otherwise dispose of all or substantially all of our assets;

•alter our existing businesses; and

•enter into certain transactions with our affiliates.

In addition, the covenants in our debt agreements require us to meet specified financial ratios and satisfy other financial condition tests. Our ability to meet those financial ratios and tests will depend on our ongoing financial and operating

13

performance, which, in turn, will be subject to economic conditions and to financial, market, and competitive factors, many of which are beyond our control. A breach of any of these covenants could result in a default under one or more of our debt agreements and permit our lenders to cease making loans to us under our credit facility (as defined below) or to accelerate the maturity date of the indebtedness incurred thereunder. Furthermore, if we were unable to repay the amounts due and payable under our secured debt agreements, our secured lenders could proceed against the collateral granted to them to secure our borrowings. Such actions by the lenders could also cause cross defaults under our other debt agreements.

We may not be able to generate sufficient cash to service all of our indebtedness, and we may not be able to refinance our debt obligations as they mature.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

We regularly review our capital structure, various financing alternatives and conditions in the debt and equity markets in order to opportunistically enhance our capital structure. In connection therewith, we may seek to refinance or retire existing indebtedness, incur new or additional indebtedness or issue equity or equity-linked securities, in each case, depending on market and other conditions. As our debt obligations mature or if our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital, or restructure or refinance our indebtedness. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of our existing or future debt instruments may restrict us from adopting some of these alternatives. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations.

We have international operations that are subject to foreign economic uncertainties and foreign currency fluctuation.

Approximately 37% of our revenues are denominated in foreign currencies, which may result in additional risk of fluctuating currency values and exchange rates and controls on currency exchange. Changes in the value of foreign currencies could increase our U.S. dollar costs for, or reduce our U.S. dollar revenues from, our foreign operations. Any increased costs or reduced revenues as a result of foreign currency fluctuations could affect our profits. In 2020, the U.S. dollar strengthened against foreign currencies which unfavorably affected our revenue by $6.2 million. In contrast, a weakening of the U.S. dollar may beneficially affect our business, prospects, financial condition, results of operations, or cash flows.

The price of our common stock may be volatile.

The market price of our common stock could be subject to significant fluctuations and may decline. Among the factors that could affect our stock price are:

•macro or micro-economic factors;

•our operating and financial performance and prospects;

•quarterly variations in the rate of growth of our financial indicators, such as earnings per share, net income and revenues;

•changes in revenue or earnings estimates or publication of research reports by analysts;

•loss of any member of our senior management team;

•speculation in the press or investment community;

•strategic actions by us or our competitors, such as acquisitions or restructuring;

•sales of our common stock by stockholders;

•general market conditions;

•domestic and international economic, legal, and regulatory factors unrelated to our performance;

•loss of a major customer; and

•the declaration and payment of a dividend.

The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock. In addition,

14

due to the market capitalization of our stock, our stock tends to be more volatile than large capitalization stocks that comprise the Dow Jones Industrial Average or Standard and Poor’s 500 Index.

Provisions in our charter documents and Delaware law may inhibit a takeover, which could adversely affect the value of our common stock.

Our certificate of incorporation and bylaws, as well as Delaware corporate law, contain provisions that could delay or prevent a change of control or changes in our management that a stockholder might consider favorable and may prevent shareholders from receiving a takeover premium for their shares. These provisions include, for example, a classified board of directors and the authorization of our board of directors to issue up to five million preferred shares without a stockholder vote. In addition, our certificate of incorporation provides that stockholders may not call a special meeting.

We are a Delaware corporation subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Generally, this statute prohibits a publicly-held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years after the date of the transaction in which such person became an interested stockholder, unless the business combination is approved in a prescribed manner. A business combination includes a merger, asset sale or other transaction resulting in a financial benefit to the stockholder. We anticipate that the provisions of Section 203 may encourage parties interested in acquiring us to negotiate in advance with our board of directors, because the stockholder approval requirement would be avoided if a majority of the directors then in office approve either the business combination or the transaction that results in the stockholder becoming an interested stockholder.

These provisions apply even if the offer may be considered beneficial by some of our stockholders. If a change of control or change in management is delayed or prevented, the market price of our common stock could decline.

Risks Related to Acquisitions and Divestitures

Acquisitions may constitute an important part of our future growth strategy.

Acquiring businesses that complement or expand our operations has been and may continue to be a key element of our business strategy. We regularly evaluate acquisition transactions, sign non-disclosure agreements, and participate in processes with respect to acquisitions, some of which may be material to us. We cannot assure you that we will be successful in identifying attractive acquisition candidates or completing acquisitions on favorable terms in the future. In addition, we may borrow funds or issue equity to acquire other businesses, increasing our interest expense and debt levels or diluting our existing stockholders’ ownership interest in us. Our inability to acquire businesses, or to operate them profitably once acquired, could have a material adverse effect on our business, financial condition, results of operations, and cash flows. Our borrowing agreements limit our ability to complete acquisitions without prior approval of our lenders. We have had difficulty with purchase accounting and other aspects related to the accounting for our acquisitions, which resulted in material weaknesses in our internal control over financial reporting. Although we have remediated these material weaknesses, there can be no assurances we will not face similar issues with respect to any future acquisitions.

We may not realize all of the anticipated benefits from completed acquisitions or any future strategic portfolio acquisition, or those benefits may take longer to realize than expected.

We either may not realize all of the anticipated benefits from completed acquisitions or any future strategic portfolio acquisition, or it may take longer to realize such benefits. Achieving those benefits depends on the timely, efficient, and successful execution of a number of post-acquisition events, including integrating the acquired businesses into our existing businesses. The integration process may disrupt the businesses and, if implemented ineffectively, would preclude the realization of the full anticipated benefits. The difficulties of combining the operations of acquired companies include, among others:

•the diversion of management’s attention to integration matters;

•difficulties in the integration of operations and systems, including, without limitation, the complexities associated with managing the expanded operations of a significantly larger and more complex company, addressing possible differences in corporate cultures and management philosophies and the challenge of integrating complex systems, technology, networks, and other assets of each of the acquired companies;

•difficulties in achieving anticipated cost savings, synergies, business opportunities, and growth prospects from combining the acquired businesses with our own;

•the inability to implement effective internal controls, procedures, and policies for acquired businesses as required by the Sarbanes-Oxley Act of 2002 within the time periods prescribed thereby;

•the exposure to potential unknown liabilities and unforeseen increased expenses or delays associated with acquired businesses;

•challenges in keeping existing customers and obtaining new customers;

15

•challenges in attracting and retaining key personnel; and

•the disruption of, or the loss of momentum in, ongoing operations or inconsistencies in standards, controls, procedures and policies.

Many of these factors will be outside of our control and any one of them could result in increased costs, decreases in the amount of expected revenues and diversion of management’s time and energy, which could materially impact our business, prospects, financial condition, results of operations, or cash flows.

Additionally, we incurred a significant amount of debt in connection with our acquisitions in the past few years. Finally, in relation to such acquisitions, we have significantly higher amounts of intangible assets. These intangible assets will be subject to impairment testing, and we could incur a significant impact to our financial statements in the form of an impairment if assumptions and expectations related to our acquisitions are not realized.

The indemnification provisions of acquisition agreements by which we have acquired companies may not fully protect us and may result in unexpected liabilities.

Certain of the acquisition agreements from past acquisitions require the former owners to indemnify us against certain liabilities related to the operation of each of their companies before we acquired it. In most of these agreements, however, the liability of the former owners is limited in amount and duration and certain former owners may not be able to meet their indemnification responsibilities. These indemnification provisions may not fully protect us, and as a result we may face unexpected liabilities that adversely affect our profitability and financial position.

Our participation in joint ventures could expose us to additional risks from time to time.

We currently have a 49% investment in a Chinese joint venture and may participate in additional joint ventures from time to time. Our participation in joint ventures is subject to risks that may not be present with other methods of ownership, including:

•our joint venture partners could have investment and financing goals that are not consistent with our objectives, including the timing, terms, and strategies for any investments, and what levels of debt to incur or carry;

•we could experience an impasse on certain decisions because we do not have sole decision-making authority, which could require us to expend additional resources on resolving such impasses or potential disputes, including litigation or arbitration;

•our ability to transfer our interest in a joint venture to a third party may be restricted and the market for our interest may be limited;

•our joint venture partners might become bankrupt, fail to fund their share of required capital contributions or fail to fulfill their obligations as a joint venture partner, which may require us to infuse our own capital into the venture on behalf of the partner despite other competing uses for such capital; and

•our joint venture partners may have competing interests in our markets that could create conflict of interest issues.

Any divestitures and discontinued operations could negatively impact our business and retained liabilities from businesses that we may sell could adversely affect our financial results.

As part of our portfolio management process, we review our operations for businesses which may no longer be aligned with our strategic initiatives and long-term objectives. Divestitures pose risks and challenges that could negatively impact our business, including required separation or carve-out activities and costs, disputes with buyers, or potential impairment charges. We may also dispose of a business at a price or on terms that are less than we had previously anticipated. After reaching an agreement with a buyer for the disposition of a business, we are also subject to satisfaction of pre-closing conditions, as well as necessary regulatory and governmental approvals on acceptable terms, which may prevent us from completing a transaction. Dispositions may also involve continued financial involvement, as we may be required to retain responsibility for, or agree to indemnify buyers against contingent liabilities related to businesses sold, such as lawsuits, tax liabilities, lease payments, product liability claims, or environmental matters. Under these types of arrangements, performance by the divested businesses or other conditions outside of our control could affect future financial results.

General Risk Factors

Damage to our reputation could harm our business, including our competitive position and business prospects.

Our ability to attract and retain customers, suppliers, investors, and employees is impacted by our reputation. Harm to our reputation can arise from various sources, including employee misconduct, security breaches, unethical behavior, litigation, or regulatory outcomes. The consequences of damage to our reputation include, among other things, increasing the number of litigation claims and the size of damages asserted or subjecting us to enforcement actions, fines, and penalties, all of which would cause us to incur significant defense related costs and expenses.

16

Changes in U.S. tax laws could have a material adverse effect on our business, cash flow, results of operations, and financial condition.

Changes in U.S. tax laws, tax rulings, or interpretations of existing laws could materially affect our business, cash flow, results of operations, and financial condition. In particular, on December 22, 2017, the U.S. government enacted comprehensive Federal tax legislation commonly referred to as the Tax Cuts and Jobs Act of 2017 (the “U.S. Tax Cuts and Jobs Act of 2017”). The U.S. Tax Cuts and Jobs Act of 2017 introduces significant changes to U.S. income tax law that have a meaningful impact on our provision for income taxes. Accounting for the income tax effects of the U.S. Tax Cuts and Jobs Act of 2017 requires significant judgments and estimates in the interpretation and calculations of the provisions of the U.S. Tax Cuts and Jobs Act of 2017.

Item 1B.Unresolved Staff Comments

None.

Item 2.Properties

As of December 31, 2020, we owned or leased 32 facilities in a total of six countries, which includes a 49% equity interest in a manufacturing joint venture in China. Utilization of these sites may vary with product mix and economic, seasonal, and other business conditions. Our plants generally have sufficient capacity for existing needs and expected near-term growth. These plants are generally well maintained, in good operating condition, and suitable and adequate for their use. The following table lists the locations of our facilities by segment.

Mobile Solutions Group

| Location | General Character | Country | Owned or Leased | |||||||||||||||||

| Boituva, Brazil | Plant | Brazil | Leased | |||||||||||||||||

| Campinas, Brazil | Office | Brazil | Leased | |||||||||||||||||

| Dowagiac, Michigan | Plant | U.S.A. | Owned | |||||||||||||||||

| Juarez, Mexico | Plant | Mexico | Leased | |||||||||||||||||

| Kamienna Gora, Poland | Plant | Poland | Owned | |||||||||||||||||

| Kentwood, Michigan | Plant 1 | U.S.A. | Leased | |||||||||||||||||

| Kentwood, Michigan | Plant 2 | U.S.A. | Leased | |||||||||||||||||

| Kentwood, Michigan | Plant 3, Warehouse | U.S.A. | Leased | |||||||||||||||||

| Kentwood, Michigan | Office | U.S.A. | Owned | |||||||||||||||||

| Marnaz, France | Plant | France | Owned | |||||||||||||||||

| Marshall, Michigan | Plant 1 | U.S.A. | Leased | |||||||||||||||||

| Marshall, Michigan | Plant 2 | U.S.A. | Leased | |||||||||||||||||

| Sao Joao da Boa Vista, Brazil | Plant 1 | Brazil | Leased | |||||||||||||||||

| Sao Joao da Boa Vista, Brazil | Plant 2 | Brazil | Leased | |||||||||||||||||

| Wellington, Ohio | Plant 1 | U.S.A. | Leased | |||||||||||||||||

| Wellington, Ohio | Plant 2 | U.S.A. | Leased | |||||||||||||||||

| Wuxi, China | Plant | China | Leased | |||||||||||||||||

17

Power Solutions Group

| Location | General Character | Country | Owned or Leased | |||||||||||||||||

| Algonquin, Illinois | Plant | U.S.A. | Owned | |||||||||||||||||

| Attleboro, Massachusetts | Plant 1 | U.S.A. | Owned | |||||||||||||||||

| Attleboro, Massachusetts | Plant 2 | U.S.A. | Leased | |||||||||||||||||

| Attleboro, Massachusetts | Plant 3 | U.S.A. | Owned | |||||||||||||||||

| Attleboro, Massachusetts | Office, Warehouse | U.S.A. | Owned | |||||||||||||||||

| Foshan City, China | Plant | China | Leased | |||||||||||||||||

| Irvine, California | Plant | U.S.A. | Leased | |||||||||||||||||

| Lubbock, Texas | Plant 1 | U.S.A. | Owned | |||||||||||||||||

| Lubbock, Texas | Plant 2 | U.S.A. | Owned | |||||||||||||||||

| Mexico City, Mexico | Plant | Mexico | Owned | |||||||||||||||||

| North Attleboro, Massachusetts | Plant | U.S.A. | Owned | |||||||||||||||||

| Palmer, Massachusetts | Plant | U.S.A. | Leased | |||||||||||||||||

| Taunton, Massachusetts | Plant | U.S.A. | Leased | |||||||||||||||||

Joint Venture

| Location | General Character | Country | Owned or Leased | |||||||||||||||||

| Wuxi, China | Plant | China | Leased | |||||||||||||||||

In addition to these manufacturing plants, we lease office space in Charlotte, North Carolina, which serves as our corporate headquarters.

Item 3.Legal Proceedings

As disclosed in Note 15 of the Notes to Consolidated Financial Statements included elsewhere in this Annual Report, we are engaged in certain legal proceedings, and the disclosure set forth in Note 15 relating to certain commitments and contingencies is incorporated herein by reference.

Item 4.Mine Safety Disclosures

Not applicable.

18

PART II

Item 5.Market for the Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

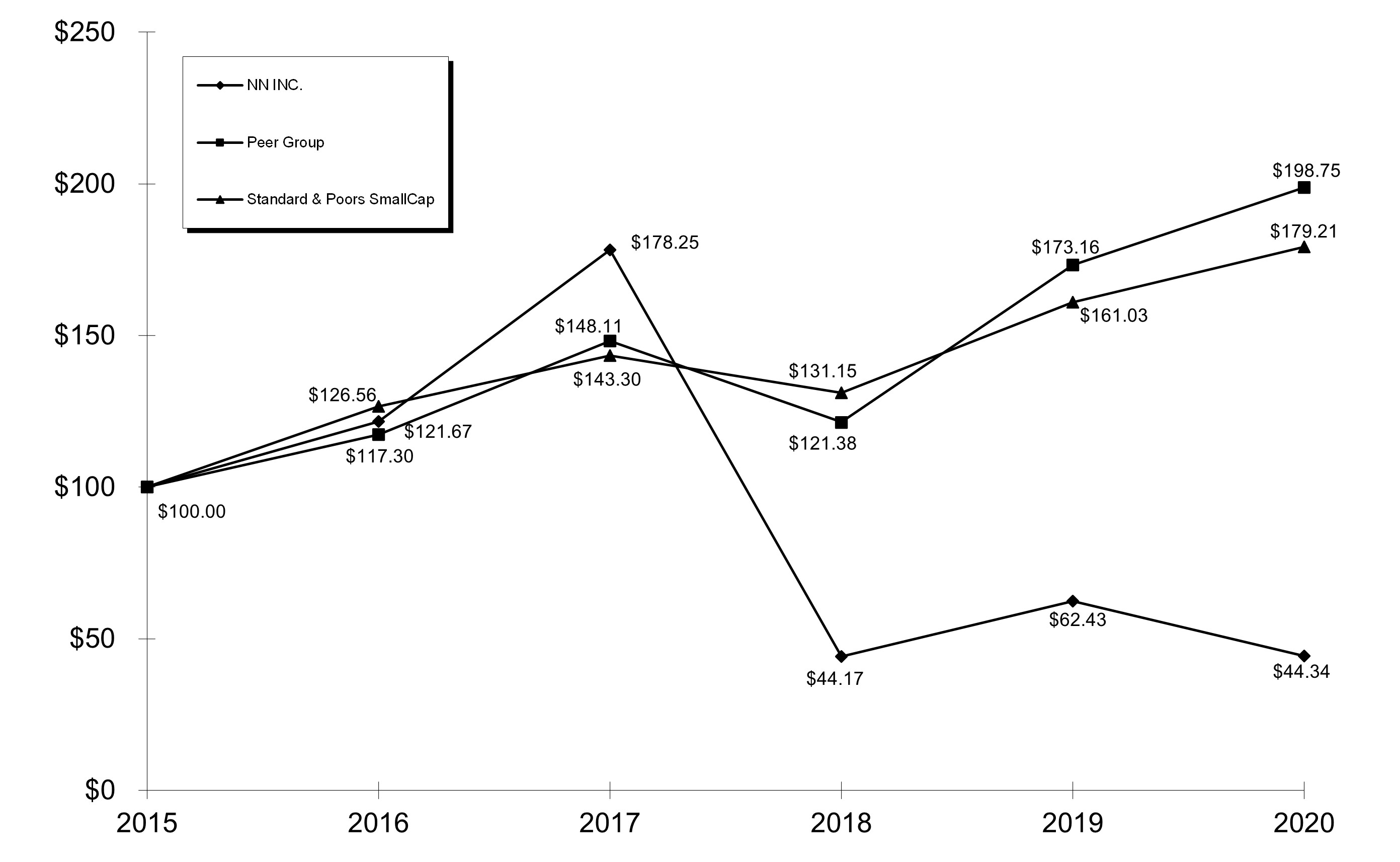

Our common stock is traded on Nasdaq under the trading symbol “NNBR.” As of March 5, 2021, there were approximately 6,363 beneficial owners of record of our common stock, and the closing per share stock price as reported by Nasdaq was $6.73. The following graph and table compare the cumulative total shareholder return on our common stock with the cumulative total shareholder return of: (i) the S&P SmallCap 600 Index and (ii) a customized peer group, for the period from December 31, 2015, to December 31, 2020. The customized peer group consists of the following companies, which we believe are in similar lines of business: Altra Industrial Motion Corp., Ametek Inc., CIRCOR International, Inc., Colfax Corporation, Crane, Enerpac Tool Group Corp, Kaman Corporation, Park-Ohio Holdings Corp. and Worthington Industries, Inc. (collectively, the “Peer Group”). The following graph and table assume that a $100 investment was made at the close of trading on December 31, 2015, in our common stock and in the S&P SmallCap Index and the Peer Group. We cannot assure you that the performance of our common stock will continue in the future with the same or similar trend depicted on the graph.

Comparison of Five-Year Cumulative Total Return

NN, Inc., Peer Group, and S&P SmallCap 600 Index

(Performance results through December 31, 2020)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||||||||||||||||

| NN, Inc. | $ | 100.00 | $ | 121.67 | $ | 178.25 | $ | 44.17 | $ | 62.43 | $ | 44.34 | ||||||||||||||||||||||||||

| Peer Group | $ | 100.00 | $ | 117.30 | $ | 148.11 | $ | 121.38 | $ | 173.16 | $ | 198.75 | ||||||||||||||||||||||||||