UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| R |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2015

OR

| £ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to ______________

Commission File No. 001-33861

MOTORCAR PARTS OF AMERICA, INC.

(Exact name of registrant as specified in its charter)

|

New York

|

|

11-2153962

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

2929 California Street, Torrance, California

|

|

90503

|

|

(Address of principal executive offices)

|

|

Zip Code

|

Registrant’s telephone number, including area code: (310) 212-7910

Securities registered pursuant to Section 12(b) of the Act: common stock, $0.01 par value per share

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No R

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No £

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer £

|

Accelerated filer R

|

Non-accelerated filer £

|

Smaller reporting company £

|

| |

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No R

As of September 30, 2014, which was the last business day of the registrant’s most recently completed fiscal second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $477,070,672 based on the closing sale price as reported on the NASDAQ Global Market.

There were 17,974,598 shares of common stock outstanding as of June 8, 2015.

DOCUMENTS INCORPORATED BY REFERENCE:

In accordance with General Instruction G(3) of Form 10-K, the information required by Part III hereof will either be incorporated into this Form 10-K by reference to the registrant’s Definitive Proxy Statement for the registrant’s next Annual Meeting of Stockholders filed within 120 days of March 31, 2015 or will be included in an amendment to this Form 10-K filed within 120 days of March 31, 2015.

|

PART I

|

| |

|

|

|

5

|

|

|

10

|

|

|

15

|

|

|

16

|

|

|

16

|

|

|

16

|

| |

|

|

PART II

|

| |

|

|

|

17

|

|

|

20

|

|

|

21

|

|

|

41

|

|

|

41

|

|

|

41

|

|

|

41

|

|

|

43

|

| |

|

|

PART III

|

| |

|

|

|

44

|

|

|

44

|

|

|

44

|

|

|

44

|

|

|

44

|

| |

|

|

PART IV

|

| |

|

|

|

45

|

| |

|

|

|

53

|

MOTORCAR PARTS OF AMERICA, INC.

GLOSSARY

The following terms are frequently used in the text of this report and have the meanings indicated below.

“Used Core” — An automobile part which has been used in the operation of a vehicle. Generally, the Used Core is an original equipment (“OE”) automobile part installed by the vehicle manufacturer and subsequently removed for replacement. Used Cores contain salvageable parts which are an important raw material in the remanufacturing process. We obtain most Used Cores by providing credits to our customers for Used Cores returned to us under our core exchange program. Our customers receive these Used Cores from consumers who deliver a Used Core to obtain credit from our customers upon the purchase of a newly remanufactured automobile part. When sufficient Used Cores cannot be obtained from our customers, we will purchase Used Cores from core brokers, who are in the business of buying and selling Used Cores. The Used Cores purchased from core brokers or returned to us by our customers under the core exchange program, and which have been physically received by us, are part of our raw material or work in process inventory included in long-term core inventory.

“Remanufactured Core” — The Used Core underlying an automobile part that has gone through the remanufacturing process and through that process has become part of a newly remanufactured automobile part. The remanufacturing process takes a Used Core, breaks it down into its component parts, replaces those components that cannot be reused and reassembles the salvageable components of the Used Core and additional new components into a remanufactured automobile part. Remanufactured Cores are included in our on-hand finished goods inventory and in the remanufactured finished good product held for sale at customer locations. Used Cores returned by consumers to our customers but not yet returned to us continue to be classified as Remanufactured Cores until we physically receive these Used Cores. All Remanufactured Cores are included in our long-term core inventory or in our long-term core inventory deposit.

MOTORCAR PARTS OF AMERICA, INC.

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to “the Company,” “we,” “us,” “MPA,” and “our” refer to Motorcar Parts of America, Inc. and its subsidiaries. This Form 10-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve risks and uncertainties. Our actual results may differ significantly from the results discussed in any forward-looking statements. Discussions containing such forward-looking statements may be found in the material set forth under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as within this Form 10-K generally.

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at www.sec.gov. Our SEC filings are also available free of charge on our website www.motorcarparts.com. You may also read and copy any document we file with the SEC at its Public Reference Room at 100 F. Street, NE, Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information on the operation of the Public Reference Room.

PART I

General

We are a leading manufacturer, remanufacturer, and distributor of aftermarket automotive parts for import and domestic cars, light trucks, heavy duty, agricultural and industrial applications. We sell our products predominantly in North America to the largest auto parts retail and traditional warehouse chains and to major automobile manufacturers for both their aftermarket programs and their warranty replacement programs (“OES”).

The current population of vehicles in the U.S. is approximately 251 million and the average age of these vehicles is approximately 11.5 years. While the aged vehicle population is favorable today, miles driven continues to fluctuate primarily based on fuel prices. We believe demand and replacement rates for aftermarket automotive parts generally increase with the age of vehicles and increases in miles driven.

The aftermarket for automobile parts is divided into two markets. The first market is the do-it-yourself (“DIY”) market, which is generally serviced by the large retail chain outlets. Consumers who purchase parts from the DIY channel generally install parts into their vehicles themselves. In most cases, this is a less expensive alternative than having the repair performed by a professional installer. The second market is the professional installer market, commonly known as the do-it-for-me (“DIFM”) market. This market is serviced by the traditional warehouse distributors, the dealer networks, and the commercial divisions of retail chains. Generally, the consumer in this channel is a professional parts installer. Our products are distributed to both the DIY and DIFM markets.

Pursuant to the guidance provided under the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) for segment reporting, we have determined that our operating segments meet the criteria for aggregation and accordingly we have one reportable segment for purposes of recording and reporting our financial results.

Growth Strategies

We are focused on growing our share in all channels within the aftermarket including, DIY, DIFM and OES. All channels of the aftermarket are growing, in particular the DIFM market. We are well positioned for growth in all channels, in particular the DIFM market in three ways: (i) our auto parts retail customers are expanding their efforts to target the DIFM market, (ii) we sell our products under private label and our own brand names directly to suppliers that focus on professional installers, and (iii) we sell our products to original equipment manufacturers for distribution to the professional installer both for warranty replacement and their general aftermarket channels. We have been successful in growing sales to all channels of the aftermarket.

Our goal is to take advantage of multiple growth strategies. To accomplish this, key elements of our strategy include:

|

· |

Grow our product lines both with existing and potential new customers. We have been awarded a significant amount of new business for all our product lines. In particular our rotating electrical products had the most significant new business gains, which we began shipping in January 2015. In addition, we were awarded further new business in all product lines, which we expect to begin shipping in the next fiscal year. |

|

· |

Introduction of new product lines. We launched a new brake master cylinder products in late July 2014. We continue to strive to expand our business by exploring new product lines. |

|

· |

The strategic acquisition of other companies or businesses. We intend to continue making strategic acquisitions to grow our business. We completed the acquisition of a small privately held remanufacturer of alternators and starters in the first quarter of fiscal 2016. |

|

· |

Creating value for our customers. A core part of our strategy is ensuring that we add meaningful value for our customers. We consistently support and pilot our customers’ supply management initiatives in addition to providing demand analytics, inventory planning, market share, and planogram information to our customers. |

Products

Our products include (i) rotating electrical products such as alternators and starters, (ii) wheel hub assemblies and bearings, and (iii) new brake master cylinders.

Our products meet or exceed original equipment manufacturer specifications. Remanufacturing generally creates a supply of parts at a lower cost to the end user than newly manufactured parts and makes available automotive parts which are no longer manufactured. Our remanufactured parts are generally sold at competitively lower prices than most new replacement parts. We believe most of our automotive parts are non-elective replacement parts in all makes and models of vehicles because they are required for a vehicle to operate.

We recycle nearly all materials in keeping with our focus of positively impacting the environment. Nearly all parts, including metal from the Used Cores and corrugated packaging, are recycled.

The increasing complexity of cars and light trucks and the number of different makes and models of these vehicles have resulted in a significant increase in the number of different automotive parts required to service vehicles. We carry over 10,000 stock keeping units (“SKUs”) for automotive parts that are sold under our customers’ widely recognized private label brand names and our Quality-Built®, Xtreme®, Reliance™ and other brand names.

Customers: Customer Concentration

We sell our products to the largest retail automotive chain stores including Advance, AutoZone, Genuine Parts (NAPA), O’Reilly, and Pep Boys, with an aggregate of approximately 17,000 retail outlets as well as a diverse group of automotive warehouse distributors and OES customers.

While we continually seek to diversify our customer base, we currently derive, and have historically derived, a substantial portion of our sales from a small number of large customers. During fiscal 2015, 2014 and 2013, sales to our four largest customers in the aggregate represented 89%, 87% and 82%, respectively, of our net sales, and sales to our largest customer, AutoZone, represented 56%, 53% and 41%, respectively, of our net sales. Any meaningful reduction in the level of sales to any of these customers, deterioration of the financial condition of any of these customers or the loss of any of these customers could have a materially adverse impact on our business, results of operations, and financial condition.

Customer Arrangements; Impact on Working Capital

We have or are renegotiating long-term agreements with many of our major customers. Under these agreements, which in most cases have initial terms of at least four years, we are designated as the exclusive or primary supplier for specified categories of our products. Because of the very competitive nature of the market and the limited number of customers for these products, our customers have sought and obtained price concessions, significant marketing allowances and more favorable delivery and payment terms in consideration for our designation as a customer’s exclusive or primary supplier. These incentives differ from contract to contract and can include (i) the issuance of a specified amount of credits against receivables in accordance with a schedule set forth in the relevant contract, (ii) support for a particular customer’s research or marketing efforts provided on a scheduled basis, (iii) discounts granted in connection with each individual shipment of product, and (iv) other marketing, research, store expansion or product development support. These contracts typically require that we meet ongoing standards related to fulfillment, price, and quality. Our contracts with major customers expire at various dates through March 2019.

While these longer-term agreements strengthen our customer relationships, the increased demand for our products often requires that we increase our inventories and personnel. Customer demands that we purchase their Remanufactured Core inventory also require the use of our available working capital. The marketing and other allowances we typically grant our customers in connection with our new or expanded customer relationships adversely impact the near-term revenues, profitability and associated cash flows from these arrangements. However, we believe the investment we make in these new or expanded customer relationships will improve our overall liquidity and cash flow from operations over time.

Competition

The market for aftermarket automotive parts is highly competitive. We compete with several large and medium sized remanufacturers, including BBB Industries and Remy International, and a large number of smaller regional and specialty remanufacturers. We also compete with overseas manufacturers, particularly those located in China, who are increasing their operations and could become a significant competitive force in the future.

We believe that the reputations for quality and customer service that a supplier provides are significant factors in our customers’ purchase decisions. We believe that our ability to provide quality replacement automotive products, rapid and reliable delivery capabilities as well as promotional support distinguishes us from many of our competitors and provides a competitive advantage. In addition, we believe favorable pricing, our core exchange program, and extended payment terms are also very important competitive factors in customers’ purchase decisions.

We seek to protect our proprietary processes and other information by relying on trade secret laws and non-disclosure and confidentiality agreements with certain of our employees and other persons who have access to that information.

Operations

Production Process. Our remanufacturing process begins with the receipt of Used Cores from our customers or core brokers. The Used Cores are evaluated for inventory control purposes and then sorted by part number. Each Used Core is completely disassembled into its fundamental components. The components are cleaned in a process that employs customized equipment and cleaning materials in accordance with the required specifications of the particular component. All components known to be subject to major wear and those components determined not to be reusable or repairable are replaced by new components. Non-salvageable components of the Used Core are sold as scrap.

After the cleaning process is complete, the salvageable components of the Used Core are inspected and tested as prescribed by our ISO TS 16949 approved quality control program, which is implemented throughout the production process. ISO TS 16949 is an internationally recognized, world class, automotive quality system. Upon passage of all tests, which are monitored by designated quality control personnel, all the component parts are assembled in a work cell into a finished product. Inspection and testing are conducted at multiple stages of the remanufacturing process, and each finished product is inspected and tested on equipment designed to simulate performance under operating conditions. Finished products are either stored in our warehouse facility or packaged for immediate shipment. To maximize remanufacturing efficiency, we store component parts ready for assembly in our production facilities.

Our remanufacturing processes combine product families with similar configurations into dedicated factory work cells. This remanufacturing process, known as “lean manufacturing,” replaced the more traditional assembly line approach we had previously utilized and eliminated a large number of inventory moves and the need to track inventory movement through the remanufacturing process. This lean manufacturing process has been fully implemented at all of our production facilities. This lean manufacturing approach enables us to significantly reduce the time it takes to produce a finished product. We continue to explore opportunities for improving efficiencies in our remanufacturing process.

Offshore Remanufacturing. The majority of our remanufacturing operations are now conducted at our facilities in Mexico and Malaysia. We continue to maintain production of certain remanufactured units that require specialized service and/or rapid turnaround in our U.S. facilities. In addition, we operate a shipping and receiving warehouse and testing facility in Singapore and China for our products.

Used Cores. The majority of our Used Cores are obtained from customers using our core exchange program. The core exchange program consists of the following steps:

|

● |

Our customers purchase from us a remanufactured unit to be sold to their consumer. |

|

● |

Our customers offer their consumers a credit to exchange their used unit (Used Core) at the time the consumer purchases a remanufactured unit. |

|

● |

We, in turn, offer our customers a credit to send us these Used Cores. The credit reduces our accounts receivable. |

Our customers are not obligated to send us all the Used Cores exchanged by their consumers. We have historically purchased Used Cores in the open market from core brokers who specialize in buying and selling Used Cores to supplement the supply of Used Cores sent to us by our customers. Although the open market is not a primary source of Used Cores, it is a critical source for meeting our raw material demands. Remanufacturing consumes, on average, more than one Used Core for each remanufactured unit produced since not all Used Cores are reusable. The yield rates depend upon both the product and customer specifications.

The price of a finished rotating electrical product sold to our customers is generally comprised of an amount for remanufacturing (“unit value”) and an amount separately invoiced for the Remanufactured Core included in the product (“Remanufactured Core charge”). The Remanufactured Core charge is equal to the credit we offer to induce the customer to use our core exchange program and send back the Used Cores to us. The ability to obtain Used Cores, materials and components of the types and quantities we need is essential to our ability to meet demand.

Purchased Finished Goods. In addition to our remanufactured goods, we also purchase certain of our finished goods from various suppliers, including several located in Asia. We perform supplier qualification, product inspection and testing according to our ISO TS 16949 certified quality system to assure product quality levels. We also perform periodic site audits of our suppliers’ manufacturing facilities. Finished products purchased are either stored in our warehouse facility or packaged for immediate shipment. We currently use our existing Torrance, California facility to store and distribute wheel hub assemblies and bearings and new brake master cylinders.

Return Rights. Under our customer agreements and general industry practice, our customers are allowed stock adjustments when their inventory of certain product lines exceeds the inventory necessary to support sales to end-user consumers (stock adjustment returns). Customers have various contractual rights for stock adjustment returns which are typically less than 5% of units sold. In some instances, we allow a higher level of returns in connection with a significant update order. In addition, we allow customers to return goods to us that their end-user consumers have returned to them. We allow this general right of return regardless of whether the returned item is defective. We seek to limit the aggregate of stock adjustment and other customer returns, including general right of return, to less than 20% of unit sales. Stock adjustment returns do not occur at any specific time during the year.

As is standard in the industry, we only accept returns from on-going customers. If a customer ceases doing business with us, we have no further obligation to accept additional product returns from that customer. Similarly, we accept product returns and grant appropriate credits from new customers from the time the new customer relationship is established. This obligation to accept returns from new customers does not result in decreased liquidity or increased expenses since we only accept one returned product for each unit sold to the new customer. In each case, the return must be received by us in the original box of the unit sold.

Sales, Marketing and Distribution. We have one of the widest varieties of the type of products we sell available to the market, and we market and distribute our products throughout North America. Our products for the automotive retail chain market are primarily sold under our customers’ widely recognized private labels. We have expanded our sales efforts beyond automotive retail chains to include warehouse distribution centers serving professional installers. We ship our products from our facilities and fee warehouses located in North America.

We publish, for print and electronic distribution, a catalog with part numbers and applications for our products along with a detailed technical glossary and informational database. We believe that we maintain one of the most extensive catalog and product identification systems available to the market.

Employees

We had 2,362 employees and 2,270 employees at March 31, 2015 and 2014, respectively, in our operations. Of these employees at March 31, 2015, 286 were located in the U.S., 8 in Canada, 1,806 in Mexico, and 262 in our Asian facilities. We had 237 administrative employees, of which 29 were engaged in sales. A union represents 1,711 employees at our Mexico facility. All other employees are non-union. We consider our relations with our employees to be satisfactory.

Governmental Regulation

Our operations are subject to federal, state and local laws and regulations governing, among other things, emissions to air, discharge to waters, and the generation, handling, storage, transportation, treatment and disposal of waste and other materials. We believe that our businesses, operations and facilities have been and are being operated in compliance in all material respects with applicable environmental and health and safety laws and regulations, many of which provide for substantial fines and criminal sanctions for violations. Potentially significant expenditures, however, could be required in order to comply with evolving environmental and health and safety laws, regulations or requirements that may be adopted or imposed in the future.

While we believe the risk factors described below are all the material risks currently facing our business, additional risks we are not presently aware of or that we currently believe are immaterial may also impair our business operations. Our financial condition or results of operations could be materially and adversely impacted by these risks, and the trading price of our common stock could be adversely impacted by any of these risks. In assessing these risks, you should also refer to the other information included in or incorporated by reference into this Form 10-K, including our consolidated financial statements and related notes thereto appearing elsewhere or incorporated by reference in this Form 10-K.

We rely on a few large customers for a majority of our business, and the loss of any of these customers, significant changes in the prices, marketing allowances or other important terms provided to any of these customers or adverse developments with respect to the financial condition of these customers could reduce our net income and operating results.

Our net sales are concentrated among a small number of large customers. During fiscal 2015, sales to our four largest customers in the aggregate represented 89% of our net sales, and sales to our largest customer represented 56% of our net sales. We are under ongoing pressure from our major customers to offer lower prices, extended payment terms, increased marketing allowances and other terms more favorable to these customers because our sales to these customers are concentrated, and the market in which we operate is very competitive. These customer demands have put continued pressure on our operating margins and profitability, resulted in periodic contract renegotiation to provide more favorable prices and terms to these customers and significantly increased our working capital needs. In addition, this customer concentration leaves us vulnerable to any adverse change in the financial condition of these customers. The loss of or a significant decline in sales to any of these customers could adversely affect our business, results of operations and financial condition.

There have been and may be additional claims filed against us in connection with the bankruptcy proceedings involving the Fenco Entities.

There have been and may be additional claims filed against us by the trustee and some or all of the creditors in connection with the bankruptcy proceedings involving the Fenco Entities.

In February 2015, M&T Bank filed a complaint in the Superior Court for the State of California, County of Los Angeles, against us and some of our executives alleging negligent misrepresentation, tortious interference with contractual relationship, conspiracy, unjust enrichment, conversion, declaratory judgment/alter ego, breach of contract and breach of the covenant of good faith and fair dealing. The plaintiff is seeking unspecified damages, punitive damages, attorneys’ fees and other relief.

In addition, the trustee has notified us and our insurance companies that the trustee may have claims for wrongful acts, breach of fiduciary duty, civil conspiracy, aiding and abetting, negligence and conversion, but has not filed any litigation at this time.

We are also a defendant in the following cases: one in Ontario Superior Court and another in the Bankruptcy Court for the District of Delaware. In each case the plaintiffs’ claim that we are liable for amounts due from the Fenco Entities to their employees under applicable U.S. and Canadian law. We are in negotiations with respect to these cases, although there can be no assurance whether the cases will settle and, if they settle, on what terms. In this connection, we have established a reserve of $1,000,000, which has been incorporated into the financial statements for the fiscal year ended March 31, 2015.

Any litigation to determine the validity of these claims, regardless of its merit or resolution, may be costly and time consuming and divert the efforts and attention of our management from its business strategy. Any adverse judgment or settlement by us of these claims could also result in significant additional expense.

Our offshore remanufacturing and logistic activities expose us to increased political and economic risks and place a greater burden on management to achieve quality standards.

Our overseas operations, especially our operations in Mexico, increase our exposure to political, criminal or economic instability in the host countries and to currency fluctuations. Risks are inherent in international operations, including:

| · |

exchange controls and currency restrictions; |

| · |

currency fluctuations and devaluations; |

| · |

changes in local economic conditions; |

| · |

repatriation restrictions (including the imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries); |

| · |

global sovereign uncertainty and hyperinflation in certain foreign countries; |

| · |

laws and regulations relating to export and import restrictions; |

| · |

exposure to government actions; and |

| · |

exposure to local political or social unrest including resultant acts of war, terrorism or similar events. |

These and other factors may have a material adverse effect on our offshore activities and on our business, results of operations and financial condition. Our overall success as a business depends, in part, upon our ability to manage our foreign operations. We may not continue to succeed in developing and implementing policies and strategies that are effective in each location where we do business, and failure to do so could materially and adversely impact our business, results of operations and financial condition.

Interruptions or delays in obtaining component parts could impair our business and adversely affect our operating results.

In our remanufacturing processes, we obtain Used Cores, primarily through the core exchange program with our customers, and component parts from third-party manufacturers. We generally purchase approximately 15-20% of our Used Cores from core brokers. Historically, the Used Core returned from customers together with purchases from core brokers have provided us with an adequate supply of Used Cores. If there was a significant disruption in the supply of Used Cores, whether as a result of increased Used Core acquisitions by existing or new competitors or otherwise, our operating activities could be materially and adversely impacted. In addition, a number of the other components used in the remanufacturing process are available from a very limited number of suppliers. We are, as a result, vulnerable to any disruption in component supply, and any meaningful disruption in this supply would materially and adversely impact our operating results.

Increases in the market prices of key component raw materials could increase the cost of our products and negatively impact our profitability.

In light of the continuous pressure on pricing which we have experienced from our large customers, we may not be able to recoup the higher costs of our products due to changes in the prices of raw materials, particularly aluminum and copper. If we are unable to recover a substantial portion of our raw materials from Used Cores returned to us by our customers through the core exchange program, the prices of Used Cores that we purchase may reflect the impact of changes in the cost of raw materials. However, we are unable to determine what adverse impact, if any, sustained raw material price increases may have on our product costs or profitability.

Substantial and potentially increasing competition could reduce our market share and significantly harm our financial performance.

While we believe we are well-positioned in the automotive aftermarket, this market is very competitive. In addition, other overseas manufacturers, particularly those located in China, are increasing their operations and could become a significant competitive force in the future. We may not be successful competing against other companies, some of which are larger than us and have greater financial and other resources at their disposal. Increased competition could put additional pressure on us to reduce prices or take other actions which may have an adverse effect on our operating results.

Our financial results are affected by automotive parts failure rates that are outside of our control.

Our operating results are affected over the long term by automotive parts failure rates. These failure rates are impacted by a number of factors outside of our control, including, the age of cars, product designs that have resulted in greater reliability, the number of miles driven by consumers, and the average age of vehicles on the road. A reduction in the failure rates of automotive parts would adversely affect our sales and profitability.

Our operating results may continue to fluctuate significantly.

We have experienced significant variations in our annual and quarterly results of operations. These fluctuations have resulted from many factors, including shifts in the demand and pricing for our products, general economic conditions, including changes in prevailing interest rates, and the introduction of new products. Our gross profit percentage fluctuates due to numerous factors, some of which are outside of our control. These factors include the timing and level of marketing allowances provided to our customers, actual sales during the relevant period, pricing strategies, the mix of products sold during a reporting period, and general market and competitive conditions. We also incur allowances, accruals, charges and other expenses that differ from period to period based on changes in our business, which causes our operating income and net income to fluctuate.

Our lenders may not waive future defaults under our credit agreements.

Over the past several years, we have violated a number of the financial and other covenants contained in our credit agreements with a syndicate of lenders, Cerberus Business Finance, LLC, as collateral agent, and PNC Bank, National Association, as administrative agent. Our most recent waiver was in June 2013. If we fail to meet the financial covenants or the other obligations set forth in our credit agreements in the future, there is no assurance that our lenders will waive any such defaults. If obtained, any such waiver may impose significant costs or covenants on us.

Our level of indebtedness and the terms of our indebtedness could adversely affect our business and liquidity position.

As of March 31, 2015, we had $80,101,000 of net debt under our credit agreement and cash on hand of $61,230,000. Our indebtedness may increase substantially from time to time for various reasons, including fluctuations in operating results, marketing allowances provided to customers, Remanufactured Core inventory purchases from our customers, capital expenditures and possible acquisitions. Our indebtedness could materially affect our business because (i) a portion of our cash flow must be used to service debt rather than finance our operations, (ii) it may eventually impair our ability to obtain financing in the future, and (iii) it may reduce our flexibility to respond to changes in business and economic conditions or take advantage of business opportunities that may arise.

Our stock price may be volatile and could decline substantially.

Our stock price has fluctuated from $21.79 to $36.43 during fiscal 2015. It may decline substantially as a result of developments in our business, the volatile nature of the stock market, and other factors beyond our control. The stock market has, from time to time, experienced extreme price and volume fluctuations. Many factors may cause the market price for our common stock to decline, including (i) our operating results failing to meet the expectations of securities analysts or investors in any quarter, (ii) downward revisions in securities analysts’ estimates, (iii) market perceptions concerning our future earnings prospects, (iv) public or private sales of a substantial number of shares of our common stock, and (v) adverse changes in general market conditions or economic trends.

Unfavorable currency exchange rate fluctuations could adversely affect us.

We are exposed to market risk from material movements in foreign exchange rates between the U.S. dollar and the currencies of the foreign countries in which we operate. In fiscal 2015, approximately 12% of our total expenses were in currencies other than the U.S. dollar. As a result of our extensive operations in Mexico, our primary risk relates to changes in the rates between the U.S. dollar and the Mexican peso. To mitigate this currency risk, we enter into forward foreign exchange contracts to exchange U.S. dollars for Mexican pesos. We also enter into forward foreign exchange contracts to exchange U.S. dollars for Chinese yuan in order to mitigate risk related to our purchases and payments to our Chinese vendors. The extent to which we use forward foreign exchange contracts is periodically reviewed in light of our estimate of market conditions and the terms and length of anticipated requirements. The use of derivative financial instruments allows us to reduce our exposure to the risk that the eventual net cash outflow resulting from funding the expenses of the foreign operations will be materially affected by changes in the exchange rates. We do not engage in currency speculation or hold or issue financial instruments for trading purposes. These contracts generally expire in a year or less. Any change in the fair value of foreign exchange contracts is accounted for as an increase or decrease to general and administrative expenses in current period earnings.

We may continue to make strategic acquisitions of other companies or businesses and these acquisitions introduce significant risks and uncertainties, including risks related to integrating the acquired businesses and achieving benefits from the acquisitions.

In order to position ourselves to take advantage of growth opportunities, we have made, and may continue to make, strategic acquisitions that involve significant risks and uncertainties. These risks and uncertainties include:

| · |

the difficulty in integrating newly-acquired businesses and operations in an efficient and effective manner; |

| · |

the challenges in achieving strategic objectives, cost savings and other benefits from acquisitions; |

| · |

the potential loss of key employees of the acquired businesses; |

| · |

the risk of diverting the attention of senior management from our operations; |

| · |

risks associated with integrating financial reporting and internal control systems; |

| · |

difficulties in expanding information technology systems and other business processes to accommodate the acquired businesses; and |

| · |

future impairments of any goodwill of an acquired business. |

Any of the foregoing, or a combination of them, could cause us to incur additional expenses, distract management and materially and adversely impact our business, financial condition, results of operations or liquidity.

Weakness in conditions in the global credit markets and macroeconomic factors could adversely affect our financial condition and results of operations.

Any weakness in the credit markets could result in significant constraints on liquidity and availability of borrowing terms from lenders and accounts payable with vendors. Modest economic growth in most major industrial countries in the world and uncertain prospects for continued growth threaten to cause further tightening of the credit markets, more stringent lending standards and terms, and higher interest rates. The persistence of these conditions could have a material adverse effect on our borrowings and the availability, terms and cost of such borrowings. In addition, deterioration in the U.S. economy could materially and adversely impact our operating results.

Our reliance on foreign suppliers for some of the automotive parts we sell to our customers or included in our products presents risks to our business.

A significant portion of automotive parts and components we use in our remanufacturing process are imported from suppliers located outside the U.S., including various countries in Asia. As a result, we are subject to various risks of doing business in foreign markets and importing products from abroad, such as:

| ● |

significant delays in the delivery of cargo due to port security considerations; |

| ● |

imposition of duties, taxes, tariffs or other charges on imports; |

| ● |

imposition of new legislation relating to import quotas or other restrictions that may limit the quantity of our product that may be imported into the U.S. from countries or regions where we do business; |

| ● |

financial or political instability in any of the countries in which our product is manufactured; |

| ● |

potential recalls or cancellations of orders for any product that does not meet our quality standards; |

| ● |

disruption of imports by labor disputes or strikes and local business practices; |

| ● |

political or military conflict involving the U.S., which could cause a delay in the transportation of our products and an increase in transportation costs; |

| ● |

heightened terrorism security concerns, which could subject imported goods to additional, more frequent or more thorough inspections, leading to delays in deliveries or impoundment of goods for extended periods; |

| ● |

natural disasters, disease epidemics and health related concerns, which could result in closed factories, reduced workforces, scarcity of raw materials and scrutiny or embargoing of goods produced in infected areas; |

| ● |

inability of our non-U.S. suppliers to obtain adequate credit or access liquidity to finance their operations; and |

| ● |

our ability to enforce any agreements with our foreign suppliers. |

Any of the foregoing factors, or a combination of them, could increase the cost or reduce the supply of products available to us and materially and adversely impact our business, financial condition, results of operations or liquidity.

In addition, because we depend on independent third parties to manufacture a significant portion of our wheel hub and other purchased finished goods, we cannot be certain that we will not experience operational difficulties with such manufacturers, such as reductions in the availability of production capacity, errors in complying with merchandise specifications, insufficient quality controls and failure to meet production deadlines or increases in manufacturing costs.

Our failure to implement and maintain effective internal control over financial reporting could result in material misstatements in our financial statements.

Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”) requires our management to assess the effectiveness of our internal control over financial reporting at the end of each fiscal year and certify whether or not internal control over financial reporting is effective. Our independent accountants are also required to express an opinion with respect to the effectiveness of our internal controls. In the past we have identified material weaknesses in our internal control over financial reporting in our discontinued subsidiary. We cannot assure that additional significant deficiencies or material weaknesses in our internal control over financial reporting will not be identified in the future. Any failure to maintain or implement new or improved internal controls, or any difficulties we encounter in their implementation, could result in significant deficiencies or material weaknesses, cause us to fail to meet our periodic reporting obligations (which may result in our failure to maintain the listing standards for our common stock) or result in material misstatements in our financial statements. Any such failure could also adversely affect the results of periodic management evaluations and annual auditor attestation reports regarding the effectiveness of our internal control over financial reporting required under SOX.

An increase in the cost or a disruption in the flow of our imported products may significantly decrease our sales and profits.

Merchandise manufactured offshore represents a significant portion of our total product purchases. A disruption in the shipping or cost of such merchandise may significantly decrease our sales and profits. In addition, if imported merchandise becomes more expensive or unavailable, the transition to alternative sources may not occur in time to meet our demands. Merchandise from alternative sources may also be of lesser quality and more expensive than those we currently import. Risks associated with our reliance on imported merchandise include disruptions in the shipping and importation or increase in the costs of imported products. For example, common risks may be:

| · |

raw material shortages; |

| · |

strikes and political unrest; |

| · |

problems with oceanic shipping, including shipping container shortages; |

| · |

increased customs inspections of import shipments or other factors causing delays in shipments; |

| · |

international disputes and wars; |

| · |

loss of “most favored nation” trading status by the U. S. in relations to a particular foreign country; |

| · |

import quotas and other trade sanctions; and |

| · |

increases in shipping rates. |

Products manufactured overseas and imported into the U.S. and other countries are subject to import restrictions and duties.

If our technology and telecommunications systems were to fail, or we were not able to successfully anticipate, invest in or adopt technological advances in our industry, it could have an adverse effect on our operations.

We rely on computer and telecommunications systems to communicate with our customers and vendors and manage our business. The temporary or permanent loss of our computer and telecommunications equipment and software systems, through casualty, operating malfunction, software virus or service provider failure, could disrupt our operations. In addition, our future growth may require additional investment in our systems to keep up with technological advances in our industry. If we are not able to invest in or adopt changes to our systems, or such upgrades take longer or cost more than anticipated, our business, financial condition and operating results may be adversely affected.

|

Item 1B.

|

Unresolved Staff Comments |

None.

The following table sets forth the location, type of facility, square footage and ownership interest in each of our facilities.

|

Location

|

|

Type of Facility

|

|

|

|

|

|

Expiration

|

| |

|

|

|

|

|

|

|

|

|

Torrance, CA

|

|

Remanufacturing, Warehouse, Administrative, and Office

|

|

231,000

|

|

Leased

|

|

March 2022

|

|

Tijuana, Mexico (1)

|

|

Remanufacturing, Warehouse, and Office

|

|

311,000

|

|

Leased

|

|

October 2016

|

|

Singapore & Malaysia

|

|

Remanufacturing, Warehouse, and Office

|

|

65,000

|

|

Leased

|

|

Various through November 2017

|

|

Shanghai, China

|

|

Warehouse and Office

|

|

27,000

|

|

Leased

|

|

March 2016

|

|

(1)

|

We have the option to extend the lease term for six additional 30-day periods.

|

We believe the above mentioned facilities are sufficient to satisfy our foreseeable warehousing, production, distribution and administrative office space requirements for our current operations.

There have been and may be additional claims filed against us by the trustee and some or all of the creditors in connection with the bankruptcy proceedings involving the Fenco Entities.

In February 2015, M&T Bank filed a complaint in the Superior Court for the State of California, County of Los Angeles, against us and some of our executives alleging negligent misrepresentation, tortious interference with contractual relationship, conspiracy, unjust enrichment, conversion, declaratory judgment/alter ego, breach of contract and breach of the covenant of good faith and fair dealing. The plaintiff is seeking unspecified damages, punitive damages, attorneys’ fees and other relief.

In addition, the trustee has notified us and our insurance companies that the trustee may have claims for wrongful acts, breach of fiduciary duty, civil conspiracy, aiding and abetting, negligence and conversion, but has not filed any litigation at this time.

We are also a defendant in the following cases: one in Ontario Superior Court and another in the Bankruptcy Court for the District of Delaware. In each case the plaintiffs’ claim that we are liable for amounts due from the Fenco Entities to their employees under applicable U.S. and Canadian law. We are in negotiations with respect to these cases, although there can be no assurance whether the cases will settle and, if they settle, on what terms. In this connection, we have established a reserve of $1,000,000, which has been incorporated into the financial statements for the fiscal year ended March 31, 2015.

Any litigation to determine the validity of these claims involving the Fenco Entities, regardless of its merit or resolution, may be costly and time consuming and divert the efforts and attention of our management from their business strategy. Any adverse judgment or settlement by us of these claims could also result in significant additional expense.

We are also subject to various other lawsuits and claims in the normal course of business. Management does not believe that the outcome of these other matters will have a material adverse effect on its financial position or future results of operations.

Not applicable.

PART II

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is traded on the NASDAQ Global Select Market under the trading symbol MPAA. The following table sets forth the high and low sale prices for our common stock during fiscal 2015 and 2014.

| |

|

Fiscal 2015

|

|

|

Fiscal 2014

|

|

| |

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

1st Quarter

|

|

$

|

29.29

|

|

|

$

|

22.13

|

|

|

$

|

9.60

|

|

|

$

|

5.75

|

|

|

2nd Quarter.

|

|

$

|

31.02

|

|

|

$

|

21.79

|

|

|

$

|

12.93

|

|

|

$

|

8.27

|

|

|

3rd Quarter

|

|

$

|

36.43

|

|

|

$

|

23.30

|

|

|

$

|

19.40

|

|

|

$

|

12.39

|

|

|

4th Quarter

|

|

$

|

31.65

|

|

|

$

|

22.12

|

|

|

$

|

27.27

|

|

|

$

|

18.51

|

|

As of June 8, 2015, there were 17,974,598 shares of common stock outstanding held by 19 holders of record. We have never declared or paid dividends on our common stock. The declaration of any prospective dividends is at the discretion of the Board of Directors and will be dependent upon sufficient earnings, capital requirements and financial position, general economic conditions, state law requirements and other relevant factors. Additionally, our agreement with our lenders prohibits the payment of dividends, except stock dividends, without the lenders’ prior consent.

Share Repurchase Program

In March 2010, our Board of Directors authorized a share repurchase program of up to $5,000,000 of our outstanding common stock from time to time in the open market and in private transactions at prices deemed appropriate by management. The program does not have an expiration date. Under this program, we repurchased and retired a total of 67,347 shares at a total cost of approximately $389,000 during fiscal 2013. We did not repurchase any outstanding common stock during fiscal 2015 and 2014.

Public Offering of Common Stock

During fiscal 2014, we filed a universal shelf registration statement on Form S-3 (File No. 333-195585) which was declared effective on May 9, 2014, for the proposed offering from time to time of up to $100,000,000 of our securities, including common stock, preferred stock, and debt securities. The securities may be offered by us from time to time at amounts, prices, interest rates, and other terms to be determined at the time of the offering.

In September 2014, we completed a public offering of 2,760,000 shares of our common stock at a price of $26.00 per share, which included the exercise in full by the underwriters of their option to purchase up to 360,000 additional shares of common stock. We received aggregate gross proceeds of $71,760,000 and net proceeds of $66,973,000 after expenses. We used the net proceeds for working capital and other general corporate purposes.

Equity Compensation Plan Information

The following table summarizes our equity compensation plans as of March 31, 2015:

|

Plan Category

|

|

Number of securities to

be issued upon

exercise of outstanding

options, warrants and

rights

|

|

|

Weighted-average

exercise price of

outstanding options

warrants and rights

|

|

|

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

|

|

|

Equity compensation plans approved by securities holders

|

|

|

1,389,254

|

(1) |

|

$

|

9.97

|

|

|

|

1,489,625

|

(2) |

|

Equity compensation plans not approved by security holders

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,389,254

|

|

|

$

|

9.97

|

|

|

|

1,489,625

|

|

| (1) |

Consists of options issued pursuant to our 2003 Long-Term Incentive Plan, 2004 Non-Employee Director Stock Option Plan, and Second Amended and Restated 2010 Incentive Award Plan. |

| (2) |

Consists of shares available for issuance under our Second Amended and Restated 2010 Incentive Award Plan and 2014 Non-Employee Director Incentive Award Plan. |

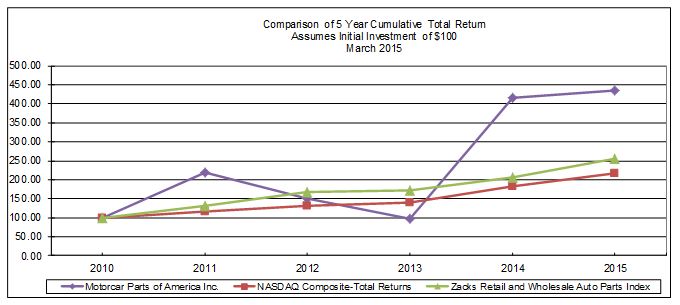

Performance Graph

The following graph compares the cumulative return to holders of our common stock for the five years ending March 31, 2015 with the NASDAQ Composite Index and the Zacks Retail and Wholesale Auto Parts Index. The comparison assumes $100 was invested at the close of business on March 31, 2010 in our common stock and in each of the comparison groups, and assumes reinvestment of dividends.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

March 2015

The following selected historical consolidated financial information for the periods indicated below has been derived from and should be read in conjunction with our consolidated financial statements and related notes thereto.

Our selected income statement data below represents our continuing operations and excludes the results of the discontinued subsidiary subsequent to its acquisition in May 2011. See Note 3 of the notes to consolidated financial statements.

|

Income Statement Data

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

301,711,000

|

|

|

$

|

258,669,000

|

|

|

$

|

213,151,000

|

|

|

$

|

178,551,000

|

|

|

$

|

161,285,000

|

|

|

Operating income

|

|

|

33,586,000

|

|

|

|

32,104,000

|

|

|

|

34,314,000

|

|

|

|

26,574,000

|

|

|

|

25,384,000

|

|

|

Income from continuing operations.

|

|

|

11,453,000

|

|

|

|

6,482,000

|

|

|

|

14,558,000

|

|

|

|

14,348,000

|

|

|

|

12,220,000

|

|

|

Basic net income per share from continuing operations

|

|

$

|

0.68

|

|

|

$

|

0.45

|

|

|

$

|

1.01

|

|

|

$

|

1.15

|

|

|

$

|

1.01

|

|

|

Diluted net income per share from continuing operations

|

|

$

|

0.65

|

|

|

$

|

0.42

|

|

|

$

|

1.01

|

|

|

$

|

1.13

|

|

|

$

|

0.99

|

|

| |

|

March 31,

|

|

|

Balance Sheet Data

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

421,760,000

|

|

|

$

|

318,853,000

|

|

|

$

|

364,969,000

|

|

|

$

|

501,898,000

|

|

|

$

|

191,865,000

|

|

|

Working capital (1)

|

|

|

66,624,000

|

|

|

|

22,077,000

|

|

|

|

33,722,000

|

|

|

|

15,311,000

|

|

|

|

1,395,000

|

|

|

Revolving loan

|

|

|

-

|

|

|

|

10,000,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Term loan

|

|

|

80,101,000

|

|

|

|

87,277,000

|

|

|

|

81,905,000

|

|

|

|

75,000,000

|

|

|

|

7,500,000

|

|

|

Capital lease obligations

|

|

|

528,000

|

|

|

|

318,000

|

|

|

|

214,000

|

|

|

|

463,000

|

|

|

|

834,000

|

|

|

Other long term liabilities

|

|

|

43,725,000

|

|

|

|

26,340,000

|

|

|

|

15,464,000

|

|

|

|

10,526,000

|

|

|

|

9,984,000

|

|

|

Shareholders’ equity (deficit)

|

|

$

|

190,203,000

|

|

|

$

|

109,636,000

|

|

|

$

|

(3,514,000

|

)

|

|

$

|

73,619,000

|

|

|

$

|

117,177,000

|

|

| (1) |

The calculation of working capital excludes the impact of the discontinued subsidiary. |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Disclosure Regarding Private Securities Litigation Reform Act of 1995

This report contains certain forward-looking statements with respect to our future performance that involve risks and uncertainties. Various factors could cause actual results to differ materially from those projected in such statements. These factors include, but are not limited to: the bankruptcy of the Fenco Entities and related claims and contingent liabilities, concentration of sales to a small number of customers, changes in the financial condition of or our relationship with any of our major customers, the increasing customer pressure for lower prices and more favorable payment and other terms, lower revenues than anticipated from new and existing contracts, the increasing demands on our working capital, the significant strain on working capital associated with large inventory purchases from customers, any meaningful difference between expected production needs and ultimate sales to our customers, our ability to obtain any additional financing we may seek or require, our ability to achieve positive cash flows from operations, potential future changes in our previously reported results as a result of the identification and correction of errors in our accounting policies or procedures or the potential material weaknesses in our internal controls over financial reporting, our failure to meet the financial covenants or the other obligations set forth in our credit agreement and the lenders’ refusal to waive any such defaults, increases in interest rates, the impact of high gasoline prices, consumer preferences and general economic conditions, increased competition in the automotive parts industry including increased competition from Chinese and other offshore manufacturers, difficulty in obtaining Used Cores and component parts or increases in the costs of those parts, political, criminal or economic instability in any of the foreign countries where we conduct operations, currency exchange fluctuations, unforeseen increases in operating costs, and other factors discussed herein and in our other filings with the SEC.

Management Overview

We are a leading manufacturer, remanufacturer, and distributor of aftermarket automotive parts for import and domestic cars, light trucks, heavy duty, agricultural and industrial applications. We sell our products predominantly in North America to the largest auto parts retail and traditional warehouse chains and to major automobile manufacturers for both their aftermarket programs and their OES programs. Our products include (i) rotating electrical products such as alternators and starters, (ii) wheel hub assemblies and bearings, and (iii) new brake master cylinders.

The current population of vehicles in the U.S. is approximately 251 million and the average age of these vehicles is approximately 11.5 years. While the aged vehicle population is favorable today, miles driven continues to fluctuate primarily based on fuel prices. We believe demand and replacement rates for aftermarket automotive parts generally increase with the age of vehicles and increases in miles driven.

The aftermarket for automobile parts is divided into two markets. The first market is the DIY market, which is generally serviced by the large retail chain outlets. Consumers who purchase parts from the DIY channel generally install parts into their vehicles themselves. In most cases, this is a less expensive alternative than having the repair performed by a professional installer. The second market is the professional installer market, commonly known as the DIFM market. This market is serviced by the traditional warehouse distributors, the dealer networks, and the commercial divisions of retail chains. Generally, the consumer in this channel is a professional parts installer. Our products are distributed to both the DIY and DIFM markets.

Pursuant to the guidance provided under the FASB ASC for segment reporting, we have determined that our operating segments meet the criteria for aggregation and accordingly we have one reportable segment for purposes of recording and reporting our financial results.

Discontinued Operation and Deconsolidation of Fenco

In May 2011, we purchased (i) all of the outstanding equity of FAPL, (ii) all of the outstanding equity of Introcan, and (iii) 1% of the outstanding equity of Fapco (collectively, “Fenco” and also referred to herein as the “discontinued subsidiary”). Since FAPL owned 99% of Fapco prior to these acquisitions, we owned 100% of Fapco.

Between May 2011 and its bankruptcy in June 2013, Fenco had been attempting to turn around its business. However, revenues generated by its undercar product line segment were not sufficient to enable Fenco to meet its operating expenses and otherwise implement its undercar product line turnaround plan. Fenco had recurring operating losses since the date of acquisition and had a working capital and equity deficiency.

In May 2013, FAPL appointed a new board of independent directors, hired an independent chief restructuring officer and all its previously existing officers resigned from FAPL. As a result of loss of control of Fenco, we deconsolidated the assets and liabilities of Fenco from our consolidated financial statements effective May 31, 2013. On June 10, 2013, the Fenco Entities filed a voluntary petition for relief under the Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. As a result of the loss of control of Fenco and the subsequent filing of the petition for relief under the Bankruptcy Code, Fenco had effectively been disposed of and we did not and do not retain any continuing involvement in the operations of Fenco (see Note 3 of the notes to consolidated financial statements). We may be subject to claims relating to the bankruptcy, as described in Item 3 – Legal Proceedings.

The accompanying consolidated financial statements include the accounts of Motorcar Parts of America, Inc. and its wholly owned subsidiaries. All significant inter-company accounts and transactions have been eliminated. We have classified Fenco operations as discontinued operations in the consolidated financial statements as a result of the Fenco Entities voluntary petition for relief under the Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware on June 10, 2013. Correspondingly, reclassifications of Fenco’s assets, liabilities, and operations for prior year periods to discontinued operations have been made.

Critical Accounting Policies

We prepare our consolidated financial statements in accordance with generally accepted accounting principles, or GAAP, in the United States. Our significant accounting policies are discussed in detail below and in Note 2 of the notes to consolidated financial statements.

In preparing our consolidated financial statements, we use estimates and assumptions for matters that are inherently uncertain. We base our estimates on historical experiences and reasonable assumptions. Our use of estimates and assumptions affect the reported amounts of assets, liabilities and the amount and timing of revenues and expenses we recognize for and during the reporting period. Actual results may differ from our estimates.

Our remanufacturing operations require that we acquire Used Cores, a necessary raw material, from our customers and offer our customers marketing and other allowances that impact revenue recognition. These elements of our business give rise to accounting issues that are more complex than many businesses our size or larger. In addition, the relevant accounting standards and issues continue to evolve.

Inventory

Non-core Inventory

Non-core inventory is comprised of (i) non-core raw materials, (ii) the non-core value of work in process, (iii) the non-core value of remanufactured finished goods, and (iv) purchased finished goods. Used Cores, the Used Core value of work in process and the Remanufactured Core portion of finished goods are classified as long-term core inventory as described below under the caption “Long-term Core Inventory.” Used Cores are a source of raw materials used in the remanufacturing of our rotating electrical products.

Non-core inventory is stated at the lower of cost or market. The cost of non-core remanufactured inventory approximates average historical purchase prices paid for raw materials, and is based upon the direct costs of material and an allocation of labor and variable and fixed overhead costs. The cost of purchased finished goods inventory approximates average historical purchase prices paid, and an allocation of fixed overhead costs. The cost of non-core inventory is evaluated at least quarterly during the fiscal year and adjusted as necessary to reflect current lower of cost or market levels. These adjustments are determined for individual items of inventory within each of the three classifications of non-core inventory as follows:

|

● |

Non-core raw materials are recorded at average cost, which is based on the actual purchase price of raw materials on hand. The average cost is updated quarterly. This average cost is used in the inventory costing process and is the basis for allocation of materials to finished goods during the production process. |

|

● |

Non-core work in process is in various stages of production and is valued at the average cost of materials issued to the open work orders. Historically, non-core work in process inventory has not been material compared to the total non-core inventory balance. |

|

● |

The cost of remanufactured finished goods includes the average cost of non-core raw materials and allocations of labor and variable and fixed overhead. The allocations of labor and variable and fixed overhead costs are determined based on the average actual use of the production facilities over the prior twelve months which approximates normal capacity. This method prevents the distortion in allocated labor and overhead costs that would occur during short periods of abnormally low or high production. In addition, we exclude certain unallocated overhead such as severance costs, duplicative facility overhead costs, and spoilage from the calculation and expense these unallocated overhead as period costs. During fiscal 2015 there was no unallocated overhead charged directly to cost of sales due to the usage of our U.S. facilities for wheel hub products and new brake master cylinder products. For the fiscal years ended March 31, 2014 and 2013, costs of approximately $1,070,000, and $1,561,000, respectively, were considered unallocated overhead charged directly to cost of sales and thus excluded from the calculation of cost for remanufactured finished goods. |

We record an allowance for potentially excess and obsolete inventory based upon recent sales history, the quantity of inventory on-hand, and a forecast of potential use of the inventory. We periodically review inventory to identify excess quantities and part numbers that are experiencing a reduction in demand. Any part numbers with quantities identified during this process are reserved for at rates based upon management’s judgment, historical rates, and consideration of possible scrap and liquidation values which may be as high as 100% of cost if no liquidation market exists for the part.

The quantity thresholds and reserve rates are subjective and are based on management’s judgment and knowledge of current and projected industry demand. The reserve estimates may, therefore, be revised if there are changes in the overall market for our products or market changes that in management’s judgment, impact our ability to sell or liquidate potentially excess or obsolete inventory. We recorded $2,675,000 and $2,708,000 for excess and obsolete inventory at March 31, 2015 and 2014, respectively.

We record vendor discounts as reductions of inventories that are recognized as reductions to cost of sales as the inventories are sold.

Inventory Unreturned

Inventory unreturned represents our estimate, based on historical data and prospective information provided directly by the customer, of finished goods shipped to customers that we expect to be returned, under our general right of return policy, after the balance sheet date. Because all cores are classified separately as long-term assets, the inventory unreturned balance includes only the added unit value of a finished good. The return rate is calculated based on expected returns within the normal operating cycle of one year. As such, the related amounts are classified in current assets.

Inventory unreturned is valued in the same manner as our finished goods inventory.

Long-term Core Inventory

Long-term core inventory consists of:

|

● |

Used Cores purchased from core brokers and held in inventory at our facilities, |

|

● |

Used Cores returned by our customers and held in inventory at our facilities, |

|

● |

Used Cores returned by end-users to customers but not yet returned to us which are classified as Remanufactured Cores until they are physically received by us, |

|

● |

Remanufactured Cores held in finished goods inventory at our facilities; and |

|

● |

Remanufactured Cores held at customer locations as a part of the finished goods sold to the customer. For these Remanufactured Cores, we expect the finished good containing the Remanufactured Core to be returned under our general right of return policy or a similar Used Core to be returned to us by the customer, in each case, for credit. |

Long-term core inventory is recorded at average historical purchase prices determined based on actual purchases of inventory on hand. The cost and market value of Used Cores for which sufficient recent purchases have occurred are deemed the same as the purchase price for purchases that are made in arm’s length transactions.