Exhibit

Exhibit 99.5

Part II

Item 8. Financial Statements and Supplementary Data.

AK Steel Holding Corporation and Subsidiaries

Index to Consolidated Financial Statements

|

| |

| Page |

| |

| |

Consolidated Statements of Operations for the Years Ended December 31, 2017, 2016 and 2015 | |

Consolidated Statements of Comprehensive Income (Loss) for the Years Ended December 31, 2017, 2016 and 2015 | |

Consolidated Balance Sheets as of December 31, 2017 and 2016 | |

Consolidated Statements of Cash Flows for the Years Ended December 31, 2017, 2016 and 2015 | |

Consolidated Statements of Stockholders’ Equity (Deficit) for the Years Ended December 31, 2017, 2016 and 2015 | |

| |

MANAGEMENT’S RESPONSIBILITY FOR CONSOLIDATED FINANCIAL STATEMENTS

We prepare our consolidated financial statements in conformity with accounting principles generally accepted in the United States of America. These principles permit choices among alternatives and require numerous estimates of financial matters. We believe the accounting principles chosen are appropriate under the circumstances, and that the estimates, judgments and assumptions involved in our financial reporting are reasonable.

We are responsible for the integrity and objectivity of the financial information presented in our consolidated financial statements. We maintain a system of internal accounting controls designed to provide reasonable assurance that employees comply with stated policies and procedures, that assets are safeguarded and that financial reports are fairly presented. On a regular basis, financial management discusses internal accounting controls and financial reporting matters with our independent registered public accounting firm and our Audit Committee, composed solely of independent outside directors. The independent registered public accounting firm and the Audit Committee also meet privately to discuss and assess our accounting controls and financial reporting.

|

| | | |

Dated: | February 15, 2018 | | /s/ Roger K. Newport |

| | | Roger K. Newport |

| | | Chief Executive Officer and Director |

| | | |

| | | |

Dated: | February 15, 2018 | | /s/ Jaime Vasquez |

| | | Jaime Vasquez |

| | | Vice President, Finance and Chief Financial Officer |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of AK Steel Holding Corporation

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of AK Steel Holding Corporation (the Company) as of December 31, 2017 and 2016, and the related consolidated statements of operations, comprehensive income (loss), stockholders’ equity (deficit), and cash flows for each of the three years in the period ended December 31, 2017, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2017 and 2016, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2017, in conformity with U.S. generally accepted accounting principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company’s internal control over financial reporting as of December 31, 2017, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated February 15, 2018 expressed an unqualified opinion thereon.

Changes in Accounting Principles

As discussed in the paragraphs under the caption “Adoption of New Accounting Principles” described in Notes 1 and 2 to the consolidated financial statements, effective January 1, 2018, the Company (a) changed its method of accounting for the presentation and disclosure of periodic pension and other post retirement (income) expense due to the adoption of Accounting Standards Update No. 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Benefit Pension Costs and Net Periodic Postretirement Benefit Cost, and (b) elected to change its method of accounting for inventories to the average cost method, while in prior years, these inventories were accounted for using the last-in, first-out (“LIFO”) method.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ ERNST & YOUNG LLP

We have served as the Company’s auditor since 2013.

Cincinnati, Ohio

February 15, 2018, except for the paragraphs included under the caption “Adoption of New Accounting Principles” described in Notes 1 and 2, as to which the date is April 30, 2018

|

| | | | | | | | | | | | |

AK STEEL HOLDING CORPORATION |

CONSOLIDATED STATEMENTS OF OPERATIONS |

Years Ended December 31, 2017, 2016 and 2015 |

(dollars in millions, except per share data) |

| | 2017 | | 2016 | | 2015 |

| | | | | | |

Net sales | | $ | 6,080.5 |

| | $ | 5,882.5 |

| | $ | 6,692.9 |

|

| | | | | | |

Cost of products sold (exclusive of items shown separately below) | | 5,253.1 |

| | 5,099.7 |

| | 6,253.3 |

|

Selling and administrative expenses (exclusive of items shown separately below) | | 284.9 |

| | 279.1 |

| | 262.9 |

|

Depreciation | | 226.0 |

| | 216.6 |

| | 216.0 |

|

Charge (credit) for termination of pellet agreement and related transportation costs | | (19.3 | ) | | 69.5 |

| | — |

|

Asset impairment charge | | 75.6 |

| | — |

| | — |

|

Charge for facility idling | | — |

| | — |

| | 28.1 |

|

Total operating costs | | 5,820.3 |

| | 5,664.9 |

| | 6,760.3 |

|

Operating profit | | 260.2 |

| | 217.6 |

| | (67.4 | ) |

Interest expense | | 152.3 |

| | 163.9 |

| | 173.0 |

|

Pension and OPEB expense (income) | | (71.9 | ) | | 16.5 |

| | 58.9 |

|

Impairment of Magnetation investment | | — |

| | — |

| | (256.3 | ) |

Impairment of AFSG investment | | — |

| | — |

| | (41.6 | ) |

Other income (expense) | | (17.1 | ) | | (4.9 | ) | | 1.4 |

|

Income (loss) before income taxes | | 162.7 |

| | 32.3 |

| | (595.8 | ) |

Income tax expense (benefit) | | (2.2 | ) | | (16.9 | ) | | (6.3 | ) |

Net income (loss) | | 164.9 |

| | 49.2 |

| | (589.5 | ) |

Less: Net income attributable to noncontrolling interests | | 61.4 |

| | 66.0 |

| | 62.8 |

|

Net income (loss) attributable to AK Steel Holding Corporation | | $ | 103.5 |

| | $ | (16.8 | ) | | $ | (652.3 | ) |

Net income (loss) per share attributable to AK Steel Holding Corporation common stockholders: | | | | | | |

Basic | | $ | 0.33 |

| | $ | (0.07 | ) | | $ | (3.67 | ) |

Diluted | | $ | 0.32 |

| | $ | (0.07 | ) | | $ | (3.67 | ) |

See notes to consolidated financial statements.

|

| | | | | | | | | | | | |

AK STEEL HOLDING CORPORATION |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) |

Years Ended December 31, 2017, 2016 and 2015 |

(dollars in millions) |

| | 2017 | | 2016 | | 2015 |

Net income (loss) | | $ | 164.9 |

| | $ | 49.2 |

| | $ | (589.5 | ) |

Other comprehensive income, before tax: | | | | | | |

Foreign currency translation gain (loss) | | 4.7 |

| | (1.5 | ) | | (3.1 | ) |

Cash flow hedges: | | | | | | |

Gains (losses) arising in period | | (11.5 | ) | | 56.1 |

| | (64.2 | ) |

Reclassification of losses (gains) to net income (loss) | | (6.1 | ) | | 39.1 |

| | 47.7 |

|

Pension and OPEB plans: | | | | | | |

Prior service credit (cost) arising in period | | 4.7 |

| | (8.3 | ) | | (7.7 | ) |

Gains (losses) arising in period | | 94.2 |

| | 11.6 |

| | (60.8 | ) |

Reclassification of prior service cost (credits) included in net income (loss) | | (53.8 | ) | | (54.8 | ) | | (60.2 | ) |

Reclassification of losses (gains) included in net income (loss) | | 6.3 |

| | 97.9 |

| | 165.0 |

|

Other comprehensive income, before tax | | 38.5 |

| | 140.1 |

| | 16.7 |

|

Income tax expense in other comprehensive income | | — |

| | 15.5 |

| | 8.0 |

|

Other comprehensive income | | 38.5 |

| | 124.6 |

| | 8.7 |

|

Comprehensive income (loss) | | 203.4 |

| | 173.8 |

| | (580.8 | ) |

Less: Comprehensive income attributable to noncontrolling interests | | 61.4 |

| | 66.0 |

| | 62.8 |

|

Comprehensive income (loss) attributable to AK Steel Holding Corporation | | $ | 142.0 |

| | $ | 107.8 |

| | $ | (643.6 | ) |

See notes to consolidated financial statements.

|

| | | | | | | | |

AK STEEL HOLDING CORPORATION |

CONSOLIDATED BALANCE SHEETS |

December 31, 2017 and 2016 |

(dollars in millions, except per share data) |

| | 2017 | | 2016 |

ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 38.0 |

| | $ | 173.2 |

|

Accounts receivable, net | | 517.8 |

| | 442.0 |

|

Inventory | | 1,385.0 |

| | 1,232.6 |

|

Other current assets | | 130.3 |

| | 94.6 |

|

Total current assets | | 2,071.1 |

| | 1,942.4 |

|

Property, plant and equipment | | 6,831.8 |

| | 6,569.0 |

|

Accumulated depreciation | | (4,845.6 | ) | | (4,554.6 | ) |

Property, plant and equipment, net | | 1,986.2 |

| | 2,014.4 |

|

Other non-current assets: | | | | |

Goodwill and intangible assets | | 306.7 |

| | 32.8 |

|

Other non-current assets | | 110.8 |

| | 112.1 |

|

TOTAL ASSETS | | $ | 4,474.8 |

| | $ | 4,101.7 |

|

LIABILITIES AND EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 690.4 |

| | $ | 589.9 |

|

Accrued liabilities | | 270.5 |

| | 234.1 |

|

Current portion of pension and other postretirement benefit obligations | | 40.1 |

| | 41.3 |

|

Total current liabilities | | 1,001.0 |

| | 865.3 |

|

Non-current liabilities: | | | | |

Long-term debt | | 2,110.1 |

| | 1,816.6 |

|

Pension and other postretirement benefit obligations | | 894.2 |

| | 1,093.7 |

|

Other non-current liabilities | | 168.9 |

| | 155.0 |

|

TOTAL LIABILITIES | | 4,174.2 |

| | 3,930.6 |

|

EXCHANGEABLE NOTES EXCHANGE FEATURE | | — |

| | 21.3 |

|

Equity (deficit): | | | | |

Common stock, authorized 450,000,000 shares of $.01 par value each; issued 315,782,764 and 314,739,500 shares in 2017 and 2016; outstanding 314,884,569 and 314,160,557 shares in 2017 and 2016 | | 3.2 |

| | 3.1 |

|

Additional paid-in capital | | 2,884.8 |

| | 2,855.4 |

|

Treasury stock, common shares at cost, 898,195 and 578,943 shares in 2017 and 2016 | | (5.4 | ) | | (2.4 | ) |

Accumulated deficit | | (2,877.0 | ) | | (2,980.5 | ) |

Accumulated other comprehensive loss | | (50.2 | ) | | (88.7 | ) |

Total stockholders’ equity (deficit) | | (44.6 | ) | | (213.1 | ) |

Noncontrolling interests | | 345.2 |

| | 362.9 |

|

TOTAL EQUITY | | 300.6 |

| | 149.8 |

|

TOTAL LIABILITIES AND EQUITY | | $ | 4,474.8 |

| | $ | 4,101.7 |

|

The consolidated balance sheets as of December 31, 2017 and 2016, include the following amounts for consolidated variable interest entities, before intercompany eliminations. See Note 15 for more information concerning variable interest entities.

|

| | | | | | | | |

| | 2017 | | 2016 |

Middletown Coke Company, LLC (“SunCoke Middletown”) | | | | |

Cash and cash equivalents | | $ | 0.1 |

| | $ | 5.0 |

|

Inventory, net | | 18.4 |

| | 16.2 |

|

Property, plant and equipment | | 425.9 |

| | 422.3 |

|

Accumulated depreciation | | (88.6 | ) | | (72.5 | ) |

Accounts payable | | 11.3 |

| | 7.8 |

|

Other assets (liabilities), net | | (1.0 | ) | | (2.3 | ) |

Noncontrolling interests | | 343.5 |

| | 360.9 |

|

| | | | |

Other variable interest entities | | | | |

Cash and cash equivalents | | $ | 0.7 |

| | $ | 0.8 |

|

Property, plant and equipment | | 11.7 |

| | 11.8 |

|

Accumulated depreciation | | (9.6 | ) | | (9.5 | ) |

Other assets (liabilities), net | | 0.8 |

| | 1.0 |

|

Noncontrolling interests | | 1.7 |

| | 2.0 |

|

See notes to consolidated financial statements.

|

| | | | | | | | | | | | |

AK STEEL HOLDING CORPORATION |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

Years Ended December 31, 2017, 2016 and 2015 |

(dollars in millions) |

| | 2017 | | 2016 | | 2015 |

Cash flows from operating activities: | | | | | | |

Net income (loss) | | $ | 164.9 |

| | $ | 49.2 |

| | $ | (589.5 | ) |

Adjustments to reconcile net income (loss) to cash flows from operating activities: | | | | | | |

Depreciation | | 209.8 |

| | 201.7 |

| | 201.7 |

|

Depreciation—SunCoke Middletown | | 16.2 |

| | 14.9 |

| | 14.3 |

|

Amortization | | 24.1 |

| | 18.4 |

| | 21.2 |

|

Asset impairment charge—Ashland Works Hot End | | 75.6 |

| | — |

| | — |

|

Impairment of Magnetation and AFSG investments | | — |

| | — |

| | 297.9 |

|

Charge (credit) for transportation costs affected by termination of pellet agreement | | (19.3 | ) | | 32.9 |

| | — |

|

Deferred income taxes | | (9.0 | ) | | (4.1 | ) | | (12.8 | ) |

Contributions to pension trust | | (44.1 | ) | | — |

| | (24.1 | ) |

Pension and OPEB expense (income) | | (64.4 | ) | | (43.8 | ) | | (63.0 | ) |

Pension and OPEB net corridor charge | | — |

| | 43.1 |

| | 131.2 |

|

Pension settlement charges | | — |

| | 25.0 |

| | — |

|

Affiliate (earnings) losses and distributions, net | | (3.5 | ) | | (6.0 | ) | | 19.7 |

|

(Gains) losses on retirement of debt | | 21.3 |

| | 9.2 |

| | (9.8 | ) |

Mark-to-market (gains) losses on derivative contracts | | (45.7 | ) | | 1.2 |

| | 13.3 |

|

Other operating items, net | | 23.6 |

| | 9.0 |

| | (19.5 | ) |

Changes in assets and liabilities, net of effect of acquired business: | | | | | | |

Accounts receivable | | (34.4 | ) | | 0.1 |

| | 228.1 |

|

Inventories | | (116.7 | ) | | 129.6 |

| | 172.9 |

|

Accounts payable and other current liabilities | | 46.2 |

| | (143.2 | ) | | (139.7 | ) |

Charge for facility idling | | — |

| | — |

| | 28.1 |

|

Other assets | | (6.5 | ) | | 40.9 |

| | (7.6 | ) |

Other pension payments | | (1.1 | ) | | (33.0 | ) | | (12.7 | ) |

OPEB payments | | (39.6 | ) | | (34.4 | ) | | (48.3 | ) |

Other liabilities | | 1.4 |

| | (6.1 | ) | | (1.1 | ) |

Net cash flows from operating activities | | 198.8 |

| | 304.6 |

| | 200.3 |

|

Cash flows from investing activities: | | | | | | |

Capital investments | | (152.5 | ) | | (127.6 | ) | | (99.0 | ) |

Investment in acquired business, net of cash acquired | | (360.4 | ) | | — |

| | — |

|

Proceeds from sale of equity investee | | — |

| | — |

| | 25.0 |

|

Proceeds from AFSG Holdings, Inc. distribution | | — |

| | — |

| | 14.0 |

|

Other investing items, net | | 4.2 |

| | 2.3 |

| | 12.5 |

|

Net cash flows from investing activities | | (508.7 | ) | | (125.3 | ) | | (47.5 | ) |

Cash flows from financing activities: | | | | | | |

Net borrowings (repayments) under credit facility | | 450.0 |

| | (550.0 | ) | | (55.0 | ) |

Proceeds from issuance of long-term debt | | 680.0 |

| | 380.0 |

| | — |

|

Redemption of long-term debt | | (848.4 | ) | | (392.8 | ) | | (14.1 | ) |

Proceeds from issuance of common stock | | — |

| | 600.4 |

| | — |

|

Debt issuance costs | | (25.3 | ) | | (20.4 | ) | | — |

|

SunCoke Middletown distributions to noncontrolling interest owners | | (79.1 | ) | | (85.1 | ) | | (96.3 | ) |

Other financing items, net | | (2.5 | ) | | 5.2 |

| | (1.0 | ) |

Net cash flows from financing activities | | 174.7 |

| | (62.7 | ) | | (166.4 | ) |

Net increase (decrease) in cash and cash equivalents | | (135.2 | ) | | 116.6 |

| | (13.6 | ) |

Cash and cash equivalents, beginning of year | | 173.2 |

| | 56.6 |

| | 70.2 |

|

Cash and cash equivalents, end of year | | $ | 38.0 |

| | $ | 173.2 |

| | $ | 56.6 |

|

See notes to consolidated financial statements.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

AK STEEL HOLDING CORPORATION |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT) |

Years Ended December 31, 2017, 2016 and 2015 |

(dollars in millions) |

| Common Stock | | Addi- tional Paid-In- Capital | | Treasury Stock | | Accum- ulated Deficit | | Accum- ulated Other Compre- hensive Loss | | Noncon- trolling Interests | | Total |

December 31, 2014 | $ | 1.8 |

| | $ | 2,259.1 |

| | $ | (1.0 | ) | | $ | (2,311.4 | ) | | $ | (222.0 | ) | | $ | 415.5 |

| | $ | 142.0 |

|

Net income (loss) | |

| | |

| | |

| | (652.3 | ) | | |

| | 62.8 |

| | (589.5 | ) |

Share-based compensation | |

| | 7.7 |

| | |

| | |

| | |

| | |

| | 7.7 |

|

Purchase of treasury stock | |

| | |

| | (1.0 | ) | | |

| | |

| | |

| | (1.0 | ) |

Change in accumulated other comprehensive loss | |

| | |

| | |

| | |

| | 8.7 |

| | |

| | 8.7 |

|

Net distributions to noncontrolling interests | | | | | | | | | | | (96.3 | ) | | (96.3 | ) |

December 31, 2015 | $ | 1.8 |

| | $ | 2,266.8 |

| | $ | (2.0 | ) | | $ | (2,963.7 | ) | | $ | (213.3 | ) | | $ | 382.0 |

| | $ | (528.4 | ) |

| | | | | | | | | | | | | |

Net income (loss) | |

| | |

| | |

| | (16.8 | ) | | |

| | 66.0 |

| | 49.2 |

|

Issuance of common stock | 1.3 |

| | 599.1 |

| | | | | | | | | | 600.4 |

|

Share-based compensation | |

| | 5.4 |

| | |

| | |

| | |

| | |

| | 5.4 |

|

Stock options exercised | | | 5.4 |

| | | | | | | | | | 5.4 |

|

Exchangeable notes exchange feature | | | (21.3 | ) | | | | | | | | | | (21.3 | ) |

Purchase of treasury stock | |

| | |

| | (0.4 | ) | | |

| | |

| | |

| | (0.4 | ) |

Change in accumulated other comprehensive loss | |

| | |

| | |

| | |

| | 124.6 |

| | |

| | 124.6 |

|

Net distributions to noncontrolling interests | | | | | | | | | | | (85.1 | ) | | (85.1 | ) |

December 31, 2016 | $ | 3.1 |

| | $ | 2,855.4 |

| | $ | (2.4 | ) | | $ | (2,980.5 | ) | | $ | (88.7 | ) | | $ | 362.9 |

| | $ | 149.8 |

|

| | | | | | | | | | | | | |

Net income (loss) | |

| | |

| | |

| | 103.5 |

| | |

| | 61.4 |

| | 164.9 |

|

Share-based compensation | 0.1 |

| | 7.6 |

| | |

| | |

| | |

| | |

| | 7.7 |

|

Stock options exercised | |

| | 0.5 |

| | |

| | |

| | |

| | |

| | 0.5 |

|

Exchangeable notes exchange feature | | | 21.3 |

| | | | | | | | | | 21.3 |

|

Purchase of treasury stock | |

| | |

| | (3.0 | ) | | |

| | |

| | |

| | (3.0 | ) |

Change in accumulated other comprehensive loss | |

| | |

| | |

| | |

| | 38.5 |

| | |

| | 38.5 |

|

Net distributions to noncontrolling interests | | | | | | | | | | | (79.1 | ) | | (79.1 | ) |

December 31, 2017 | $ | 3.2 |

| | $ | 2,884.8 |

| | $ | (5.4 | ) | | $ | (2,877.0 | ) | | $ | (50.2 | ) | | $ | 345.2 |

| | $ | 300.6 |

|

See notes to consolidated financial statements.

AK STEEL HOLDING CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in millions, except per share amounts or as otherwise specifically noted)

NOTE 1 - Summary of Significant Accounting Policies

Basis of Presentation: These financial statements consolidate the operations and accounts of AK Steel Holding Corporation (“AK Holding”), its wholly-owned subsidiary AK Steel Corporation (“AK Steel”), all subsidiaries in which AK Holding has a controlling interest, and two variable interest entities for which AK Steel is the primary beneficiary. Unless the context indicates otherwise, references to “we,” “us” and “our” refer to AK Holding and its subsidiaries. We also operate Mexican and European trading companies that buy and sell steel and steel products and other materials. We manage operations on a consolidated, integrated basis so that we can use the most appropriate equipment and facilities for the production of a product, regardless of product line. Therefore, we conclude that we operate in a single business segment. All intercompany transactions and balances have been eliminated.

Adoption of New Accounting Principles: On January 1, 2018, we adopted the following new accounting principles, both of which have been applied retrospectively to all periods presented.

Pension and Other Postretirement Benefits: On January 1, 2018, we adopted Accounting Standards Update No. 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost. Under this standard, the service cost component of periodic pension and other postretirement benefit (income) expense is included in cost of products sold and selling and administrative expenses, consistent with our treatment of other employee compensation costs. The remainder of periodic pension and other postretirement benefit expense (income) of $(71.9), $16.5 and $58.9 for the years ended December 31, 2017, 2016 and 2015, is recorded in a separate line in the consolidated statements of operations below operating profit. We have retrospectively applied the change in accounting principle to all periods presented. The adoption of this standard update had no other effect on our consolidated financial statements.

Inventory: On January 1, 2018, we changed our accounting method for valuing inventories to the average cost method for inventories previously valued using the last-in, first-out (LIFO) method. The effects of this change in accounting principle from LIFO to average cost have been retrospectively applied to all periods presented. See Note 2 for additional information.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates and assumptions that affect the amounts reported. We base these estimates on historical experience and information available to us about current events and actions we may take in the future. Estimates and assumptions affect significant items that include the carrying value of long-lived assets, including investments and goodwill; valuation allowances for receivables, inventories and deferred income tax assets; legal and environmental liabilities; workers compensation and asbestos liabilities; share-based compensation; and assets and obligations of employee benefit plans. There can be no assurance that actual results will not differ from these estimates.

Revenue Recognition: Revenue from sales of products is recognized at the time that title and the risks and rewards of ownership pass, which can be on the date of shipment or the date of receipt by the customer depending on when the terms of customers’ arrangements are met, the sales price is fixed or determinable, and collection is reasonably assured. Sales taxes collected from customers are recorded on a net basis with no revenue recognized.

Cost of Products Sold: Cost of products sold consists primarily of raw materials, energy costs, supplies consumed in the manufacturing process, manufacturing labor, contract labor and direct overhead expense necessary to manufacture the finished steel product, as well as distribution and warehousing costs. Our share of the income (loss) of investments in associated companies accounted for under the equity method is included in costs of products sold since these operations are integrated with our overall steelmaking operations, except for our share of the loss of Magnetation LLC (“Magnetation”), which was included in other income (expense) in 2015.

Share-Based Compensation: Compensation costs for stock awards granted under our Stock Incentive Plan are recognized over their vesting period using the straight-line method. We estimate stock award forfeitures expected to occur to determine the compensation cost we recognize each period.

Legal Fees: Legal fees associated with litigation and similar proceedings that are not expected to provide a benefit in future periods are expensed as incurred. Legal fees associated with activities that are expected to provide a benefit in future periods, such as costs associated with the issuance of debt, are capitalized as incurred.

Income Taxes: Interest and penalties from uncertain tax positions are included in income tax expense.

Earnings per Share: Earnings per share is calculated using the “two-class” method. Under the “two-class” method, undistributed earnings are allocated to both common shares and participating securities. We divide the sum of distributed earnings to common stockholders and undistributed earnings allocated to common stockholders by the weighted-average number of common shares outstanding during the period. The restricted stock granted by AK Holding is entitled to non-forfeitable dividends before vesting and meets the criteria of a participating security.

Cash Equivalents: Cash equivalents include short-term, highly liquid investments that are readily convertible to known amounts of cash and have an original maturity of three months or less.

Inventory: Inventories are valued at the lower of cost or net realizable value. We measure the cost of inventories using the average cost method.

Property, Plant and Equipment: Plant and equipment are depreciated under the straight-line method over their estimated lives. Estimated lives are as follows: land improvements over 20 years, leaseholds over the life of the related operating lease term, buildings over 40 years and machinery and equipment over two to 20 years. The estimated weighted-average life of our machinery and equipment is 14 years at the end of the current year. Amortization expense for assets recorded under capital leases is included in depreciation expense. Costs incurred to develop coal mines are capitalized when incurred. We use the units-of-production method utilizing only proven and probable reserves in the depletion base to compute the depletion of coal reserves and mine development costs. We expense costs for major maintenance activities at our operating facilities when the activities occur.

We review the carrying value of long-lived assets to be held and used and long-lived assets to be disposed of when events and circumstances warrant such a review. If the carrying value of a long-lived asset exceeds its fair value, an impairment has occurred and a loss is recognized based on the amount by which the carrying value exceeds the fair value, less cost to dispose, for assets to be sold or abandoned. We determine fair value by using quoted market prices, estimates based on prices of similar assets or anticipated cash flows discounted at a rate commensurate with risk.

Investments: Investments in associated companies are accounted for under the equity method. We review investments for impairment when circumstances indicate that a loss in value below its carrying amount is other than temporary.

Goodwill and Intangible Assets: Goodwill relates to our tubular and Precision Partners’ businesses. Intangible assets are recorded at cost, and those with finite lives are amortized over their estimated useful lives. We review goodwill for potential impairment at least annually on October 1 each year and whenever events or circumstances make it more likely than not that impairment may have occurred. Considering operating results and the estimated fair value of the businesses, the most recent annual goodwill impairment tests indicated that the fair value of each of our business reporting units was in excess of its carrying value. No goodwill impairment was recorded as a result of the annual impairment tests in the past three years.

Debt Issuance Costs: Debt issuance costs for the revolving credit facility are included in other non-current assets and all other debt issuance costs reduce the carrying amount of long-term debt.

Pension and Other Postretirement Benefits: We recognize, as of a measurement date, any unrecognized actuarial net gains or losses that exceed 10% of the larger of the projected benefit obligations or the plan assets, defined as the “corridor”. Amounts inside the corridor are amortized over the plan participants’ life expectancy. We determine the expected return on assets using the fair value of plan assets.

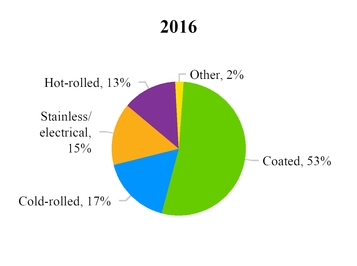

Concentrations of Credit Risk: We are primarily a producer of carbon, stainless and electrical steels and steel products, which are sold to a number of markets, including automotive, infrastructure and manufacturing, and distributors and converters. Net sales by product line are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Carbon steel | $ | 4,034.5 |

| | $ | 4,014.5 |

| | $ | 4,746.8 |

|

Stainless and electrical steel | 1,687.6 |

| | 1,654.1 |

| | 1,733.0 |

|

Tubular, components and other | 358.4 |

| | 213.9 |

| | 213.1 |

|

Total | $ | 6,080.5 |

| | $ | 5,882.5 |

| | $ | 6,692.9 |

|

Percentages of our net sales to various markets are presented below:

|

| | | | | | | | |

| 2017 | | 2016 | | 2015 |

Automotive | 65 | % | | 66 | % | | 60 | % |

Infrastructure and Manufacturing | 16 | % | | 16 | % | | 16 | % |

Distributors and Converters | 19 | % | | 18 | % | | 24 | % |

We sell domestically to customers located primarily in the Midwestern and Eastern United States and to foreign customers, primarily in Canada, Mexico and Western Europe. Net sales to customers located outside the United States totaled $627.1, $655.6 and $855.7 for 2017, 2016 and 2015. We had one customer that accounted for 12% of net sales in 2017 and we had two customers that accounted for 12% and 11% of net sales in 2016 and 2015.

Approximately 55% and 57% of accounts receivable outstanding at December 31, 2017 and 2016, are due from businesses associated with the U.S. automotive industry, including 18% of receivables due from one automotive customer as of December 31, 2017 and 16% due from one automotive customer as of December 31, 2016. Except in a few situations where the risk warrants it, we do not require collateral on accounts receivable. While we believe our recorded accounts receivable will be collected, we follow normal collection procedures if customers default. We maintain an allowance for doubtful accounts for the loss that would be incurred if a customer is unable to pay amounts due. We determine this allowance based on various factors, including the customer’s financial condition and changes in customer payment patterns. We write off accounts receivable against the allowance for doubtful accounts when it is remote that collection will occur.

Union Contracts: At December 31, 2017, we employed approximately 9,200 people, of which approximately 5,700 are represented by labor unions under various contracts that expire between 2018 and 2021. In the first quarter of 2017, members of the United Steel Workers, Local 169, ratified a labor agreement covering approximately 305 hourly employees at Mansfield Works. The new agreement expires March 31, 2021. In the third quarter of 2017, members of the United Auto Workers, Local 3044, ratified a labor agreement covering approximately 330 hourly employees at our Rockport Works. The new agreement expires September 30, 2021. In the fourth quarter of 2017, members of the United Steel Workers, Local 1915, ratified a labor agreement covering approximately 90 hourly employees at the Walbridge, Ohio facility with our wholly-owned subsidiary AK Tube LLC. The new agreement is effective January 22, 2018 and expires January 22, 2021. In the fourth quarter of 2017, members of the United Auto Workers, Local 600, ratified a labor agreement covering approximately 1,170 hourly employees at our Dearborn Works. The new agreement expires July 31, 2021. An agreement with the International Association of Machinists and Aerospace Workers, Local 1943, which represents approximately 1,725 hourly employees at our Middletown Works, expires on March 15, 2018. An agreement with the United Steel Workers, Local 1865, which represents approximately 305 hourly employees at our Ashland Works, expires on September 1, 2018.

Financial Instruments: We are a party to derivative instruments that are designated and qualify as hedges for accounting purposes. We may also use derivative instruments to which we do not apply hedge accounting treatment. Our objective in using these instruments is to limit operating cash flow exposure to fluctuations in the fair value of selected commodities and currencies.

Fluctuations in the price of certain commodities we use in production processes may affect our income and cash flows. We have implemented raw material and energy surcharges for some contract customers. For certain commodities where such exposure exists, we may use cash-settled commodity price swaps, collars and purchase options, with a duration of up to three years, to hedge the price of a portion of our natural gas, iron ore, electricity, zinc and nickel requirements. We may designate some of these instruments as cash flow hedges and the effective portion of the changes in their fair value and settlements are recorded in accumulated other comprehensive income. We subsequently reclassify gains and losses from accumulated other comprehensive income to cost of products sold in the same period we recognize the earnings associated with the underlying transaction. Other instruments are marked to market and recorded in cost of products sold with the offset recorded as assets or liabilities.

Exchange rate fluctuations affect a portion of revenues and operating costs that are denominated in foreign currencies, and we use forward currency and currency option contracts to reduce our exposure to certain of these currency price fluctuations. These derivative contracts are entered with durations up to thirty-six months. Contracts that sell euros have not been designated as hedges for accounting purposes and gains or losses are reported in earnings immediately in other income (expense). Contracts that purchase Canadian dollars are designated as hedges for accounting purposes, which requires us to record the effective gains and losses for the derivatives in accumulated other comprehensive income (loss) and reclassify them into cost of products sold in the same period we recognize costs for the associated underlying operations. We recognize gains and losses on these designated derivatives immediately in cost of products sold if we calculate hedge ineffectiveness.

We formally document all relationships between hedging instruments and hedged items, as well as risk management objectives and strategies for undertaking various hedge transactions. In this documentation, we specifically identify the asset, liability, firm commitment or forecasted transaction that has been designated as a hedged item, and state how the hedging instrument is expected to

hedge the risks from that item. We formally measure effectiveness of hedging relationships both at the hedge inception and on an ongoing basis. We discontinue hedge accounting prospectively when we determine that the derivative is no longer effective in offsetting changes in the fair value or cash flows of a hedged item; when the derivative expires or is sold, terminated or exercised; when it is probable that the forecasted transaction will not occur; when a hedged firm commitment no longer meets the definition of a firm commitment; or when we determine that designation of the derivative as a hedge instrument is no longer appropriate. Our derivative contracts may contain collateral funding requirements. We have master netting arrangements with counterparties, giving us the right to offset amounts owed under the derivative instruments and the collateral. We do not offset derivative assets and liabilities or collateral on our consolidated balance sheets.

Asbestos and Environmental Accruals: For a number of years, we have been remediating sites where hazardous materials may have been released, including sites no longer owned by us. In addition, a number of lawsuits alleging asbestos exposure have been filed and continue to be filed against us. We have established accruals for estimated probable costs from asbestos claim settlements and environmental investigation, monitoring and remediation. If the accruals are not adequate to meet future claims, operating results and cash flows may be negatively affected. Our accruals do not consider the potential for insurance recoveries, for which we have partial insurance coverage for some future asbestos claims. In addition, some existing insurance policies covering asbestos and environmental contingencies may serve to partially reduce future covered expenditures.

New Accounting Pronouncements: The Financial Accounting Standards Board (“FASB”) issued a standard update during the first quarter of 2016 to simplify several aspects of the accounting for employee share-based payments. The new guidance requires companies to record excess tax benefits and tax deficiencies in the income statement when stock awards vest or are settled. In addition, companies will no longer separately classify cash flows related to excess tax benefits as a financing activity apart from other income tax cash flows. The standard also allows companies to repurchase more of each employee’s vesting shares for tax withholding purposes without triggering liability accounting, clarifies that all cash payments made to tax authorities on each employee’s behalf for withheld shares should be presented as a financing activity on companies’ cash flows statements, and provides an accounting policy election to account for forfeitures as they occur. We adopted this update effective January 1, 2017. The adoption had a minimal effect on us. We recognized previously unrecorded excess tax benefits offset with an equal change in valuation allowance. We have elected to continue to estimate forfeitures expected to occur to determine the compensation cost we recognize each period. The presentation requirements for cash flows related to employee taxes paid for withheld shares has no effect on us since we have historically presented these as a financing activity.

FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606), during the second quarter of 2014. Topic 606, as further amended by subsequent Accounting Standard Updates, affects virtually all aspects of an entity’s revenue recognition, including determining the measurement of revenue and the timing of when it is recognized for the transfer of goods or services to customers. Topic 606 is effective for us beginning January 1, 2018. The guidance permits two methods of adoption—retrospectively to each prior reporting period presented (full retrospective method), or retrospectively with the cumulative effect of initially applying the guidance recognized at the date of initial application (modified retrospective method). Topic 606 does not have a material effect on us as most revenue transactions recorded under Topic 606 will be substantially consistent with treatment under existing guidance. Our revenue transactions generally consist of a single performance obligation to transfer promised goods and are not accounted for under industry-specific guidance. Topic 606 also provides for enhanced disclosure requirements surrounding revenue recognition and we are currently completing our responsive disclosures. We will adopt the standard using the modified retrospective method as of January 1, 2018.

FASB issued Accounting Standards Update No. 2016-02, Leases (Topic 842), during the first quarter of 2016. Topic 842 requires entities to recognize lease assets and lease liabilities and disclose key information about leasing arrangements for certain leases. We will be required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. Topic 842 is effective for us beginning January 1, 2019. We are currently evaluating the effect of the adoption of Topic 842 on our consolidated financial position and results of operations. We expect that the adoption of the standard will result in a material increase to the assets and liabilities on our consolidated balance sheets.

In June 2016, the FASB issued a new standard to replace the incurred loss impairment methodology with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. In connection with recognizing credit losses on receivables and other financial instruments, we will be required to use a forward-looking expected loss model rather than the incurred loss model. The new standard will be effective for us beginning January 1, 2020, with early adoption permitted beginning January 1, 2019. Adoption of this standard is through a cumulative-effect adjustment to retained earnings as of the effective date. We are currently evaluating the effect of this standard on our consolidated financial position and results of operations.

In August 2017, the FASB issued a standard update to better align an entity’s risk management activities and financial reporting for hedging relationships through changes to both the designation and measurement guidance for qualifying hedging relationships and the presentation of hedge results. Among other amendments, the update provided that for a cash flow hedge of a forecasted purchase or

sale of a nonfinancial asset, an entity may designate as the hedged risk the variability in cash flows attributable to changes in a contractually specified component stated in the contract. The amendments in the update are effective for fiscal years beginning after December 15, 2018. Early application is permitted and we are planning to adopt the standard on January 1, 2018. We are evaluating the possibility to elect hedge accounting treatment for iron ore derivatives that are currently not eligible for hedge accounting, but this is not expected to be fully evaluated at adoption of the new standard.

Reclassifications: We reclassified certain prior-year amounts to conform to the current-year presentation.

NOTE 2 - Supplementary Financial Statement Information

Research and Development Costs

We conduct a broad range of research and development activities aimed at improving existing products and manufacturing processes and developing new products and processes. Research and development costs, which are recorded as cost of products sold when incurred, totaled $28.1, $28.3 and $27.6 in 2017, 2016 and 2015.

Allowance for Doubtful Accounts

Changes in the allowance for doubtful accounts for the years ended December 31, 2017, 2016 and 2015, are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Balance at beginning of year | $ | 7.8 |

| | $ | 6.0 |

| | $ | 9.0 |

|

Increase (decrease) in allowance | (1.0 | ) | | 2.4 |

| | (3.0 | ) |

Receivables written off | — |

| | (0.6 | ) | | — |

|

Balance at end of year | $ | 6.8 |

| | $ | 7.8 |

| | $ | 6.0 |

|

Inventory

Inventories as of December 31, 2017 and 2016, consist of:

|

| | | | | | | |

| 2017 | | 2016 |

Finished and semi-finished | $ | 996.7 |

| | $ | 842.3 |

|

Raw materials | 388.3 |

| | 390.3 |

|

Inventory | $ | 1,385.0 |

| | $ | 1,232.6 |

|

Adoption of New Accounting Principle

In the first quarter of 2018, we changed our accounting method for valuing certain inventories from the last-in, first-out (LIFO) method to the average cost method. This method values inventory using average costs for materials and most recent production costs for labor and overhead. We believe that using the average cost method is preferable since it improves comparability with our peers, more closely tracks the physical flow of our inventory, better matches revenue with expenses and aligns with how we internally manage our business.

The effects of the change in accounting principle from LIFO to average cost have been retrospectively applied to all periods presented. As a result of the retrospective application of the change in accounting principle, certain financial statement line items in our consolidated balance sheet and our consolidated statements of operations and comprehensive income (loss) and cash flows were adjusted as follows:

|

| | | | | | | | | | | |

| As Originally Reported | | Effect of Change | | As Adjusted |

Consolidated statement of operations for the year ended December 31, 2017: | | | | | |

Cost of products sold (a) | $ | 5,365.2 |

| | $ | (112.1 | ) | | $ | 5,253.1 |

|

Income tax expense (benefit) | (17.0 | ) | | 14.8 |

| | (2.2 | ) |

Net income (loss) | 67.6 |

| | 97.3 |

| | 164.9 |

|

Net income (loss) attributable to AK Steel Holding Corporation | 6.2 |

| | 97.3 |

| | 103.5 |

|

|

| | | | | | | | | | | |

| As Originally Reported | | Effect of Change | | As Adjusted |

Net income (loss) per share attributable to AK Steel Holding Corporation common stockholders: | | | | | |

Basic | $ | 0.02 |

| | $ | 0.31 |

| | $ | 0.33 |

|

Diluted | 0.02 |

| | 0.30 |

| | 0.32 |

|

| | | | | |

Consolidated statement of comprehensive income (loss) for the year ended December 31, 2017: | | | | | |

Cash flow hedges—Reclassification of losses (gains) to net income (loss) | $ | (12.5 | ) | | $ | 6.4 |

| | $ | (6.1 | ) |

Comprehensive income (loss) | 91.1 |

| | 112.3 |

| | 203.4 |

|

Comprehensive income (loss) attributable to AK Steel Holding Corporation | 29.7 |

| | 112.3 |

| | 142.0 |

|

| | | | | |

Consolidated balance sheet as of December 31, 2017: | | | | | |

Inventory | $ | 1,147.8 |

| | $ | 237.2 |

| | $ | 1,385.0 |

|

Other non-current assets | 169.3 |

| | (58.5 | ) | | 110.8 |

|

Other non-current liabilities | 161.6 |

| | 7.3 |

| | 168.9 |

|

Accumulated deficit | (3,058.6 | ) | | 181.6 |

| | (2,877.0 | ) |

Accumulated other comprehensive loss | (40.0 | ) | | (10.2 | ) | | (50.2 | ) |

| | | | | |

Consolidated statement of cash flows for the year ended December 31, 2017: | | | | | |

Net income | $ | 67.6 |

| | $ | 97.3 |

| | $ | 164.9 |

|

Deferred income taxes | (15.2 | ) | | 6.2 |

| | (9.0 | ) |

Inventories | 1.8 |

| | (118.5 | ) | | (116.7 | ) |

Other operating items, net | 8.6 |

| | 15.0 |

| | 23.6 |

|

| | | | | |

Consolidated statement of operations for the year ended December 31, 2016: | | | | | |

Cost of products sold (a) | $ | 5,070.6 |

| | $ | 29.1 |

| | $ | 5,099.7 |

|

Income tax expense (benefit) | 3.2 |

| | (20.1 | ) | | (16.9 | ) |

Net income (loss) | 58.2 |

| | (9.0 | ) | | 49.2 |

|

Net income (loss) attributable to AK Steel Holding Corporation | (7.8 | ) | | (9.0 | ) | | (16.8 | ) |

Net income (loss) per share attributable to AK Steel Holding Corporation common stockholders: | | | | | |

Basic | $ | (0.03 | ) | | $ | (0.04 | ) | | $ | (0.07 | ) |

Diluted | (0.03 | ) | | (0.04 | ) | | (0.07 | ) |

| | | | | |

Consolidated statement of comprehensive income (loss) for the year ended December 31, 2016: | | | | | |

Cash flow hedges—Reclassification of losses (gains) to net income (loss) | $ | 27.2 |

| | $ | 11.9 |

| | $ | 39.1 |

|

Comprehensive income (loss) | 181.9 |

| | (8.1 | ) | | 173.8 |

|

Comprehensive income (loss) attributable to AK Steel Holding Corporation | 115.9 |

| | (8.1 | ) | | 107.8 |

|

| | | | | |

Consolidated balance sheet as of December 31, 2016: | | | | | |

Inventory | $ | 1,113.9 |

| | $ | 118.7 |

| | $ | 1,232.6 |

|

Other non-current assets | 165.1 |

| | (53.0 | ) | | 112.1 |

|

Other non-current liabilities | 148.4 |

| | 6.6 |

| | 155.0 |

|

Accumulated deficit | (3,064.8 | ) | | 84.3 |

| | (2,980.5 | ) |

Accumulated other comprehensive loss | (63.5 | ) | | (25.2 | ) | | (88.7 | ) |

| | | | | |

|

| | | | | | | | | | | |

| As Originally Reported | | Effect of Change | | As Adjusted |

Consolidated statement of cash flows for the year ended December 31, 2016: | | | | | |

Net income | $ | 58.2 |

| | $ | (9.0 | ) | | $ | 49.2 |

|

Deferred income taxes | 5.0 |

| | (9.1 | ) | | (4.1 | ) |

Inventories | 112.4 |

| | 17.2 |

| | 129.6 |

|

Other operating items, net | 8.1 |

| | 0.9 |

| | 9.0 |

|

| | | | | |

Consolidated statement of operations for the year ended December 31, 2015: | | | | | |

Cost of products sold (a) | $ | 6,040.3 |

| | $ | 213.0 |

| | $ | 6,253.3 |

|

Income tax expense (benefit) | 63.4 |

| | (69.7 | ) | | (6.3 | ) |

Net income (loss) | (446.2 | ) | | (143.3 | ) | | (589.5 | ) |

Net income (loss) attributable to AK Steel Holding Corporation | (509.0 | ) | | (143.3 | ) | | (652.3 | ) |

Net income (loss) per share attributable to AK Steel Holding Corporation common stockholders: | | | | | |

Basic | $ | (2.86 | ) | | $ | (0.81 | ) | | $ | (3.67 | ) |

Diluted | (2.86 | ) | | (0.81 | ) | | (3.67 | ) |

| | | | | |

Consolidated statement of comprehensive income (loss) for the year ended December 31, 2015: | | | | | |

Cash flow hedges—Reclassification of losses (gains) to net income (loss) | $ | 61.4 |

| | $ | (13.7 | ) | | $ | 47.7 |

|

Comprehensive income (loss) | (429.0 | ) | | (151.8 | ) | | (580.8 | ) |

Comprehensive income (loss) attributable to AK Steel Holding Corporation | (491.8 | ) | | (151.8 | ) | | (643.6 | ) |

| | | | | |

Consolidated statement of cash flows for the year ended December 31, 2015: | | | | | |

Net income | $ | (446.2 | ) | | $ | (143.3 | ) | | $ | (589.5 | ) |

Deferred income taxes | 62.1 |

| | (74.9 | ) | | (12.8 | ) |

Inventories | (53.8 | ) | | 226.7 |

| | 172.9 |

|

Other operating items, net | (11.0 | ) | | (8.5 | ) | | (19.5 | ) |

| |

(a) | Cost of products sold as originally reported reflects the change in presentation of pension and OPEB (income) expense further described in Note 1. |

Property, Plant and Equipment

Property, plant and equipment as of December 31, 2017 and 2016, consist of:

|

| | | | | | | |

| 2017 | | 2016 |

Land, land improvements and leaseholds | $ | 275.3 |

| | $ | 272.6 |

|

Buildings | 509.0 |

| | 489.6 |

|

Machinery and equipment | 5,958.2 |

| | 5,714.0 |

|

Construction in progress | 89.3 |

| | 92.8 |

|

Total | 6,831.8 |

| | 6,569.0 |

|

Less accumulated depreciation | (4,845.6 | ) | | (4,554.6 | ) |

Property, plant and equipment, net | $ | 1,986.2 |

| | $ | 2,014.4 |

|

Interest on capital projects capitalized in 2017, 2016 and 2015 was $1.9, $3.1 and $2.1. Asset retirement obligations were $7.8 and $7.2 at December 31, 2017 and 2016.

Goodwill and Intangible Assets

Changes in goodwill for the years ended December 31, 2017, 2016 and 2015 are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Balance at beginning of year | $ | 32.8 |

| | $ | 32.8 |

| | $ | 32.8 |

|

Acquisition | 221.0 |

| | — |

| | — |

|

Balance at end of year | $ | 253.8 |

| | $ | 32.8 |

| | $ | 32.8 |

|

Intangible assets at December 31, 2017, consist of:

|

| | | | | | | | | | | |

| Gross Amount | | Accumulated Amortization | | Net Amount |

Customer relationships | $ | 36.6 |

| | $ | (2.2 | ) | | $ | 34.4 |

|

Technology | 19.3 |

| | (1.4 | ) | | 17.9 |

|

Other | 1.0 |

| | (0.4 | ) | | 0.6 |

|

Intangible assets | $ | 56.9 |

| | $ | (4.0 | ) | | $ | 52.9 |

|

Amortization expense related to intangible assets was $4.0 in 2017. Amortization expense is included in costs of products sold. The remaining average life of our intangible assets is 6.6 years for customer relationships and 5.6 years for technology. Estimated annual amortization expense for intangible assets over the next five years is $9.0 in 2018 and $8.4 each year from 2019 through 2022.

Other Non-current Assets

Other non-current assets as of December 31, 2017 and 2016, consist of:

|

| | | | | | | |

| 2017 | | 2016 |

Investments in affiliates | $ | 77.5 |

| | $ | 76.7 |

|

Other | 33.3 |

| | 35.4 |

|

Other non-current assets | $ | 110.8 |

| | $ | 112.1 |

|

As part of our ongoing strategic review of our business and operations, in 2015 we re-evaluated our investment in AFSG Holdings, Inc. (“AFSG”), our former insurance and finance leasing businesses, which had been largely liquidated. During 2015, we received a distribution of $14.0 from AFSG. Since the distribution reduced our ability to recover our remaining investment in AFSG after the distribution, we determined our remaining investment in AFSG was impaired and recognized a non-cash charge of $41.6, or $0.23 per diluted share. In 2016, we sold the remaining non-captive insurance operations.

Accrued Liabilities

Accrued liabilities as of December 31, 2017 and 2016, consist of:

|

| | | | | | | |

| 2017 | | 2016 |

Salaries, wages and benefits | $ | 101.3 |

| | $ | 105.6 |

|

Interest | 35.0 |

| | 35.2 |

|

Other | 134.2 |

| | 93.3 |

|

Accrued liabilities | $ | 270.5 |

| | $ | 234.1 |

|

In the fourth quarter of 2015, we temporarily idled the Ashland Works blast furnace and steelmaking operations (“Ashland Works Hot End”). We incurred charges of $28.1 in the fourth quarter of 2015, which included $22.2 for supplemental unemployment and other employee benefit costs and $5.9 for equipment idling, asset preservation and other costs. The supplemental unemployment and other employee benefit costs were recorded as accrued liabilities, and the activity for the years ended December 31, 2017 and 2016 was as follows:

|

| | | | | | | | |

| | 2017 | | 2016 |

Balance at beginning of year | | $ | 6.1 |

| | $ | 22.1 |

|

Payments | | (5.3 | ) | | (20.1 | ) |

Additions to the reserve | | 0.6 |

| | 4.1 |

|

Balance at end of year | | $ | 1.4 |

| | $ | 6.1 |

|

We estimate we will incur on-going costs of less than $2.0 per month for maintenance of the equipment, utilities and supplier obligations related to the temporarily idled Ashland Works Hot End. These costs were $21.2 and $22.1 for the years ended December 31, 2017 and 2016.

We continue to engage in regular reviews of the potential viability of the Ashland Works Hot End, including an assessment of the most significant risks and benefits of a permanent idling of those idled operations. As part of these reviews, we take into consideration, among other items, our strategic focus on reducing participation in commodity markets to position the company for sustainable profitability and whether we anticipate that future market conditions will enable production from the Ashland Works Hot End to generate sustainable economic returns through steel market cycles.

The Ashland Works Hot End remains on temporary idle and no final determination has been made at this time regarding the long-term status of the operations. However, we now believe it is unlikely that the Ashland Works Hot End will restart in the near term based on forecasted supply and demand characteristics of the markets that we serve. Our assessment and timing of the impairment charge was influenced by our current production capacity and an updated evaluation of the risk of not reaching new labor agreements on a timely basis for key facilities. Factors that influenced our impairment determination included an uncertain global trade landscape influenced by shifting domestic and international political priorities, continued intense competition from domestic steel competitors and foreign steel competition. These conditions directly impact our pricing, which in turn directly impacts our assessment of the demand forecasts for the markets we serve. Despite several successful trade cases, we continue to see a high level of carbon steel imports driven by global overcapacity, particularly in China. As a result, during the quarter ended December 31, 2017, we recognized a non-cash asset impairment charge of $75.6, primarily related to the long-lived assets associated with the Ashland Works Hot End. If we decide to permanently idle the Ashland Works Hot End, we would incur certain cash expenses, including those relating to labor benefit obligations, certain take-or-pay supply agreements and potentially accelerated environmental remediation costs.

NOTE 3 - Acquisition of Precision Partners

On August 4, 2017, we acquired PPHC Holdings, LLC (“Precision Partners”), which provides advanced-engineered solutions, tool design and build, hot- and cold-stamped steel components and complex assemblies for the automotive market. Precision Partners is headquartered in Ontario, Canada and has over 1,000 employees, including approximately 300 engineers and skilled tool makers, across eight plants in Ontario, Alabama and Kentucky. We acquired Precision Partners to advance our core focus on the high-growth automotive lightweighting market and our prominent position in advanced high strength steels, further strengthen our close collaboration with automotive market customers, and leverage both companies’ research and innovation in metals forming. The consolidated financial statements reflect the effects of the acquisition and Precision Partner’s financial results beginning August 4, 2017.

We paid the initial purchase price of $360.4, net of cash acquired, with cash on hand and borrowings under the Credit Facility. The purchase price is subject to a customary working capital adjustment based on the final net working capital position at the closing date of the acquisition. For the year ended December 31, 2017, we incurred acquisition costs of $6.2, primarily for transaction fees and direct costs, including legal, finance, consulting and other professional fees. These costs are included in selling and administrative expenses in the consolidated statements of operations.

A summary of the preliminary purchase price allocation for the fair value of the assets acquired and the obligations assumed at the date of the acquisition is presented below. The purchase price allocation is preliminary and is subject to the completion of several items, including the final net working capital adjustment under the purchase agreement governing the terms of the acquisition.

|

| | | |

Accounts receivable | $ | 34.9 |

|

Inventory | 54.2 |

|

Other current assets | 2.2 |

|

Property, plant and equipment | 94.0 |

|

Amortizable intangible assets | 56.9 |

|

Goodwill | 221.0 |

|

Other non-current assets | 0.7 |

|

Total assets acquired | 463.9 |

|

Accounts payable | (37.8 | ) |

Accrued liabilities | (35.4 | ) |

Other non-current liabilities | (31.9 | ) |

Total liabilities assumed | (105.1 | ) |

Preliminary purchase price, net of cash acquired (including estimated net working capital adjustment) | $ | 358.8 |

|

Goodwill is calculated as the excess of the purchase price over the net assets recognized and primarily represents the growth opportunities in lightweighting solutions to automotive customers, as well as any synergistic benefits to be realized from the acquisition. The goodwill is not deductible for income tax purposes and Precision Partners represents its own reporting unit for goodwill impairment assessments.

NOTE 4 - Investments in Affiliates

We have investments in several businesses accounted for using the equity method of accounting. Investees and equity ownership percentages are presented below:

|

| | |

| | Equity Ownership % |

Combined Metals of Chicago, LLC | | 40.0% |

Delaco Processing, LLC | | 49.0% |

Rockport Roll Shop LLC | | 50.0% |

Spartan Steel Coating, LLC | | 48.0% |

Cost of products sold includes $7.0, $12.3 and $6.7 in 2017, 2016 and 2015 for our share of income of equity investees other than Magnetation. Our share of loss from Magnetation through the first quarter of 2015 is included in other income (expense) and totaled $16.3. No amounts for Magnetation are included in our results after March 31, 2015, when the investment was written off. As of December 31, 2017, our carrying cost of our investment in Spartan Steel exceeded our share of the underlying equity in net assets by $10.8. This difference is being amortized and the amortization expense is included in cost of products sold.

Summarized financial statement data for all investees is presented below. The financial results for Magnetation are only included through March 31, 2015, since it was unlikely after that date that we would retain our equity interest as a result of Magnetation’s bankruptcy.

|

| | | | | | | | | | | | |

| | 2017 | | 2016 | | 2015 |

Revenue | | $ | 292.7 |

| | $ | 286.4 |

| | $ | 356.4 |

|

Gross profit | | 88.9 |

| | 96.3 |

| | 68.3 |

|

Net income (loss) | | 20.7 |

| | 31.8 |

| | (9.8 | ) |

|

| | | | | | | | |

| | 2017 | | 2016 |

Current assets | | $ | 115.2 |

| | $ | 94.1 |

|

Noncurrent assets | | 73.5 |

| | 66.0 |

|

Current liabilities | | 16.2 |

| | 14.4 |

|

Noncurrent liabilities | | 58.9 |

| | 44.8 |

|

We regularly transact business with these equity investees. Transactions with all equity investees, including Magnetation, for the years indicated are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Sales to equity investees | $ | 80.6 |

| | $ | 69.2 |

| | $ | 61.4 |

|

Purchases from equity investees | 33.0 |

| | 213.5 |

| | 251.0 |

|

Outstanding receivables and payables with all equity investees as of the end of the year indicated are presented below:

|

| | | | | | | |

| 2017 | | 2016 |

Accounts receivable from equity investees | $ | 0.7 |

| | $ | 2.6 |

|

Accounts payable to equity investees | 4.1 |

| | 4.1 |

|

Magnetation

As of March 31, 2015, we concluded that our 49.9% equity interest in Magnetation was fully impaired and recorded a non-cash impairment charge of $256.3 for the quarter ended March 31, 2015. Before March 31, 2015, we believed that the fair value of our interest in Magnetation exceeded its carrying amount and that despite near-term temporary pressures on liquidity, long-term cash flow projections of Magnetation were sufficient to allow us to recover our investment in Magnetation. However, a combination of events and circumstances caused Magnetation to face near-term liquidity issues during the first quarter of 2015. On May 5, 2015, Magnetation and its subsidiaries filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code with the United States Bankruptcy Court for the District of Minnesota.

On October 6, 2016, the Bankruptcy Court approved a Global Settlement Agreement (“Settlement Agreement”) among us, Magnetation, Magnetation Inc., and Magnetation’s revolving credit facility lenders, senior secured noteholders and debtor-in-possession facility lenders to terminate the iron ore pellet offtake agreement with Magnetation and to wind down Magnetation’s business. Among other terms of the Settlement Agreement, we agreed to make a cash payment (“Termination Payment”) to Magnetation’s Chapter 11 estate in order to terminate our offtake agreement with Magnetation and cease purchasing iron ore pellets from Magnetation. The next day, the transactions contemplated by the Settlement Agreement were completed and we made a Termination Payment of $36.6, thereby terminating the pellet offtake agreement.

Also in connection with the approval of the Settlement Agreement and the payment of the Termination Payment to the bankruptcy estate, we recognized a charge in the fourth quarter of 2016 for the Termination Payment and a charge of $32.9 for the present value of remaining obligations under contracts with other third parties to transport pellets to our facilities. In the fourth quarter of 2017, we reached an agreement for transportation services that provides a timeframe to begin using the rail cars that were idled after the termination of the pellet supply agreement. As a result, we recorded a credit of $19.3 during the fourth quarter of 2017 to reduce the unpaid liability.

NOTE 5 - Income Taxes

We and our subsidiaries file a consolidated federal income tax return that includes all domestic companies owned 80% or more by us and the proportionate share of our interest in equity method investments. State tax returns are filed on a consolidated, combined or separate basis depending on the applicable laws relating to us and our domestic subsidiaries.

Components of income (loss) before income taxes for the years ended December 31, 2017, 2016 and 2015, are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

United States | $ | 91.6 |

| | $ | (40.4 | ) | | $ | (665.1 | ) |

Foreign | 9.7 |

| | 6.7 |

| | 6.5 |

|

Noncontrolling interests | 61.4 |

| | 66.0 |

| | 62.8 |

|

Income (loss) before income taxes | $ | 162.7 |

| | $ | 32.3 |

| | $ | (595.8 | ) |

Significant components of deferred tax assets and liabilities at December 31, 2017 and 2016 are presented below:

|

| | | | | | | |

| 2017 | | 2016 |

Deferred tax assets: | | | |

Net operating and capital loss and tax credit carryforwards | $ | 619.5 |

| | $ | 835.2 |

|

Postretirement benefits | 92.5 |

| | 142.6 |

|

Pension benefits | 117.5 |

| | 260.3 |

|

Inventories | 47.9 |

| | 60.5 |

|

Other assets | 71.6 |

| | 146.9 |

|

Valuation allowance | (735.7 | ) | | (1,189.7 | ) |

Total deferred tax assets | 213.3 |

| | 255.8 |

|

Deferred tax liabilities: | |

| | |

|

Depreciable assets | (121.9 | ) | | (213.3 | ) |

Other liabilities | (118.3 | ) | | (48.7 | ) |

Total deferred tax liabilities | (240.2 | ) | | (262.0 | ) |

Net deferred tax liabilities | $ | (26.9 | ) | | $ | (6.2 | ) |

We regularly evaluate the need for a valuation allowance for deferred tax assets by assessing whether it is more likely than not that we will realize future deferred tax assets. We assess the valuation allowance each reporting period and reflect any additions or adjustments in earnings in the same period. When we assess the need for a valuation allowance, we consider both positive and negative evidence of the likelihood that we will realize deferred tax assets in each jurisdiction. In general, cumulative losses in recent periods provide significant objective negative evidence on our ability to generate future taxable income. As of December 31, 2017 and 2016, we concluded that the negative evidence outweighed the positive evidence and we recorded a valuation allowance for a significant portion of our deferred tax assets. To determine the appropriate valuation allowance, we considered the timing of future reversal of our taxable temporary differences that supports realizing a portion of our federal and state deferred tax assets. This accounting treatment has no effect on our ability to use the loss carryforwards and tax credits to reduce future cash tax payments.

Changes in the valuation allowance for the years ended December 31, 2017, 2016 and 2015, are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Balance at beginning of year | $ | 1,189.7 |

| | $ | 1,232.3 |

| | $ | 1,005.3 |

|

Change in valuation allowance: | | | | | |

Included in income tax expense (benefit) | (62.3 | ) | | 11.0 |

| | 235.3 |

|

Change in deferred assets in other comprehensive income | 8.5 |

| | (53.6 | ) | | (8.3 | ) |

Effect of tax rate changes | (400.2 | ) | | — |

| | — |

|

Balance at end of year | $ | 735.7 |

| | $ | 1,189.7 |

| | $ | 1,232.3 |

|

At December 31, 2017, we had $2,634.0 in federal regular net operating loss carryforwards, which will expire between 2023 and 2037. At December 31, 2017, we had research and development (“R&D”) credit carryforwards of $1.2 that we may use to offset future income tax liabilities. The R&D credits expire between 2027 and 2028. At December 31, 2017, we had $96.6 in deferred tax assets for state net operating loss carryforwards and tax credit carryforwards, before considering valuation allowances, which will expire between 2018 and 2037.

Significant components of income tax expense are presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Current: | | | | | |

Federal | $ | (4.5 | ) | | $ | (3.7 | ) | | $ | — |

|

State | 0.3 |

| | 0.2 |

| | 0.2 |

|

Foreign | 2.4 |

| | 1.7 |

| | 1.8 |

|

Deferred: | |

| | |

| | |

|

Federal | 0.7 |

| | 15.1 |

| | 0.4 |

|

State | 0.1 |

| | 1.4 |

| | — |

|

Foreign | (0.4 | ) | | — |

| | — |

|

Benefits of operating loss carryforwards | — |

| | (16.1 | ) | | — |

|

Amount allocated to other comprehensive income | — |

| | (15.5 | ) | | (8.0 | ) |

Change in valuation allowance on beginning-of-the-year deferred tax assets | (0.8 | ) | | — |

| | (0.7 | ) |

Income tax expense (benefit) | $ | (2.2 | ) | | $ | (16.9 | ) | | $ | (6.3 | ) |

The Tax Cuts and Jobs Act of 2017 (the “Tax Act”), signed into law on December 22, 2017, reduces the corporate income tax rate to 21% beginning in 2018, among other provisions. While the effective date of the new corporate tax rates for us is January 1, 2018, we are required to calculate the effects of changes in tax rates and laws on deferred tax balances in 2017, the period in which the legislation was enacted. We have not completed our determination of the accounting implications of the Tax Act on our tax balances. However, we have reasonably estimated the provisional effects of the Tax Act in the consolidated financial statements as of December 31, 2017.

At December 31, 2017, we remeasured our deferred tax assets and liabilities based on the rate at which they are expected to reverse in the future, which is generally 21% at the U.S. federal level. As a result, our income tax expense for the fourth quarter of 2017 includes a non-cash credit of $4.3 for the decrease in the value of our net deferred tax liabilities.

The Tax Act requires us to calculate the undistributed earnings of our foreign subsidiaries, as determined under U.S. tax principles, and include a portion of these earnings in our 2017 taxable income. The transition tax provisions of the Tax Act are complex, and the Department of Treasury has issued preliminary guidance for taxpayers, with further guidance expected over the next several months. We calculated an estimated transition tax as of December 31, 2017 and will complete our analysis of the transition tax as we complete our tax return filings for 2017, including (1) confirming the accumulated earnings of the foreign subsidiaries as determined using U.S. tax principles and (2) determining the appropriate allocation of the earnings between amounts invested in cash and the amounts invested in non-cash assets. We do not expect to incur a cash tax liability for the transition tax due to the availability of existing net operating loss carryforwards.

As a result of the transition tax inclusion, we had no undistributed earnings of foreign subsidiaries at December 31, 2017 that had not been subject to U.S. income tax. Consequently, there will generally be no incremental U.S. taxable income generated if we repatriate these earnings in the future. However, foreign withholding taxes on dividend distributions could apply, unless they are eliminated by a treaty between the United States and the country where our foreign affiliate is located. Since we consider these earnings to be permanently invested in our foreign subsidiaries, we did not record any withholding taxes that would be assessed if the earnings were repatriated by payment of a dividend. If we repatriated the earnings, we estimate that the withholding tax liability would not be material at December 31, 2017.

We do not expect to incur cash tax liabilities associated with the provisions of the Tax Act in the foreseeable future due to the availability to us of existing net operating loss carryforwards. Our net operating loss carryovers generated through 2017 retain the original 20-year carryover periods and can be used to offset future taxable income without limitation.

The reconciliation of income tax on income (loss) before income taxes computed at the U.S. federal statutory tax rates to actual income tax expense is presented below:

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Income tax expense (benefit) at U.S. federal statutory rate | $ | 57.2 |

| | $ | 11.3 |

| | $ | (208.6 | ) |

Income tax expense calculated on noncontrolling interests | (21.5 | ) | | (23.1 | ) | | (22.0 | ) |

State and foreign tax expense, net of federal tax | 6.3 |

| | 0.2 |

| | (7.9 | ) |

Increase (decrease) in deferred tax asset valuation allowance | (51.8 | ) | | 11.0 |

| | 235.3 |

|

Amount allocated to other comprehensive income | — |

| | (15.5 | ) | | (8.0 | ) |

Credit for U.S. tax legislation | (4.3 | ) | | — |

| | — |

|

Transition tax on foreign earnings | 7.9 |

| | — |

| | — |

|

Other differences | 4.0 |

| | (0.8 | ) | | 4.9 |

|

Income tax expense (benefit) | $ | (2.2 | ) | | $ | (16.9 | ) | | $ | (6.3 | ) |