EXHIBIT 4.1

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number.

(Exact name of registrant as specified in its charter) |

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of principal executive offices) |

| (Zip Code) |

(

(Registrant's telephone number, including area code)

Solitario Zinc Corp.

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol |

| Name of Each Exchange on Which Registered |

|

|

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| NO ☐ |

Indicate by check mark whether the registrant has submitted electronically every

Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| NO ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Smaller reporting company | Emerging Growth Company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES |

| NO ☒ |

There were

TABLE OF CONTENTS

Page | ||

|

|

|

3 | ||

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operations | 14 | |

|

|

|

22 | ||

|

|

|

23 | ||

|

|

|

| ||

|

|

|

24 | ||

|

|

|

24 | ||

|

|

|

24 | ||

|

|

|

24 | ||

|

|

|

24 | ||

|

|

|

24 | ||

|

|

|

24 | ||

|

|

|

25 | ||

| 2 |

| Table of Contents |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

SOLITARIO RESOURCES CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(in thousands of U.S. dollars, |

| June 30, |

|

| December 31, |

| ||

except share and per share amounts) |

| 2023 |

|

| 2022 |

| ||

|

|

|

|

| ||||

Assets |

| |||||||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Short-term investments |

|

|

|

|

|

| ||

Investments in marketable equity securities, at fair value |

|

|

|

|

|

| ||

Prepaid expenses and other |

|

|

|

|

|

| ||

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Mineral properties |

|

|

|

|

|

| ||

Other assets |

|

|

|

|

|

| ||

Total assets |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity | ||||||||

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Kinross call option |

|

|

|

|

|

| ||

Operating lease liability |

|

|

|

|

|

| ||

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Long-term liabilities |

|

|

|

|

|

|

|

|

Operating lease liability – Long-term |

|

|

|

|

|

| ||

Asset retirement obligation – Lik |

|

|

|

|

|

| ||

Total long-term liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

| ||

Common stock, $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

Total shareholders’ equity |

|

|

|

|

|

| ||

Total liabilities and shareholders’ equity |

| $ |

|

| $ |

| ||

See Notes to Unaudited Condensed Consolidated Financial Statements

| 3 |

| Table of Contents |

SOLITARIO RESOURCES CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands of U.S. dollars, except per share amounts) |

| Three months ended June 30 |

|

| Six months ended June 30 |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Costs, expenses and other: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Exploration expense |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Depreciation |

|

|

|

|

|

|

|

|

|

|

|

| ||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total costs, expenses and other |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Other (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and dividend income |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Gain (loss) on derivative instruments |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

(Loss) gain on sale of marketable equity securities |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Unrealized gain (loss) on short-term investments |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Unrealized (loss) gain on marketable equity securities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

| ( | ) | |

Total other (loss) income |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

| ( | ) | |

Net (loss) income |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

(Loss) income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

| ||||

See Notes to Unaudited Condensed Consolidated Financial Statements

| 4 |

| Table of Contents |

SOLITARIO RESOURCES CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands of U.S. dollars) |

| Six months ended June 30, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Operating activities: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

|

|

|

| ||

Amortization of right of use lease asset |

|

|

|

|

|

| ||

Unrealized (gain) loss on marketable equity securities |

|

| ( | ) |

|

|

| |

Unrealized (gain) loss on short-term investments |

|

| ( | ) |

|

|

| |

Employee stock option expense |

|

|

|

|

|

| ||

Loss on sale of marketable equity securities |

|

|

|

|

|

| ||

(Gain) loss on derivative instruments |

|

| ( | ) |

|

|

| |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Prepaid expenses and other |

|

| ( | ) |

|

|

| |

Accounts payable and other liabilities |

|

| ( | ) |

|

|

| |

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

Investing activities: |

|

|

|

|

|

|

|

|

Sale (purchase) of short-term investments, net |

|

|

|

|

| ( | ) | |

Purchase of mineral property |

|

|

|

|

| ( | ) | |

Purchase of other assets - net |

|

| ( | ) |

|

| ( | ) |

Cash from sale of marketable equity securities |

|

|

|

|

|

| ||

Sale of derivative instruments – net |

|

|

|

|

|

| ||

Net cash provided (used in) by investing activities |

|

|

|

|

| ( | ) | |

Financing activities: |

|

|

|

|

|

|

|

|

Issuance of common stock – net of issuing costs |

|

|

|

|

|

| ||

Stock options exercised for cash |

|

|

|

|

|

| ||

Net cash provided by financing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

|

|

| ( | ) | |

Cash and cash equivalents, beginning of period |

|

|

|

|

|

| ||

Cash and cash equivalents, end of period |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow information: |

|

|

|

|

|

|

|

|

Acquisition of right to use asset |

| $ |

|

| $ |

| ||

See Notes to Unaudited Condensed Consolidated Financial Statements

| 5 |

| Table of Contents |

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Significant Accounting Policies

Business and company formation

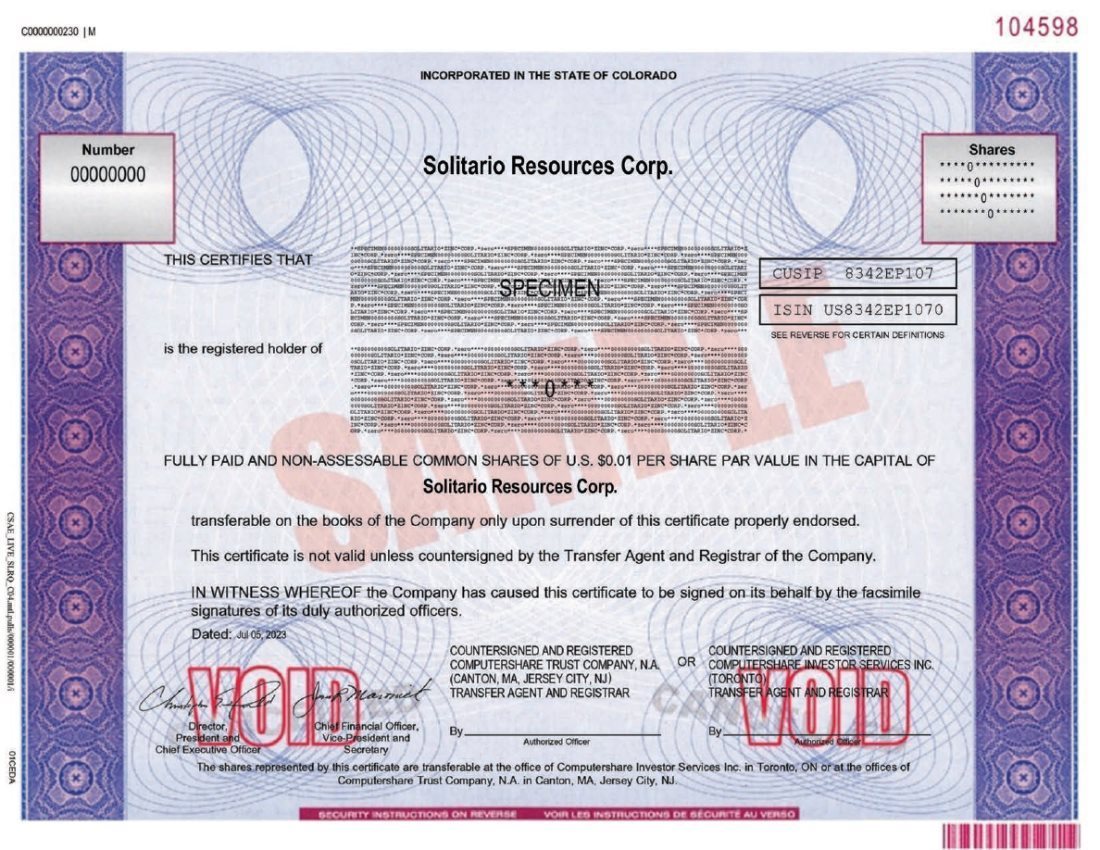

Solitario Resources Corp. (“Solitario,” or the “Company”) is an exploration stage company as defined by rules issued by the United States Securities and Exchange Commission (“SEC”). Solitario was incorporated in the state of Colorado on November 15, 1984 as a wholly-owned subsidiary of Crown Resources Corporation ("Crown"). In July 1994, Solitario became a publicly traded company on the Toronto Stock Exchange through its initial public offering. Solitario has been actively involved in mineral exploration since 1993. In June 2023 Solitario’s shareholders approved an amendment to the Company’s Articles of Incorporation to change the Company’s name from Solitario Zinc Corp. to Solitario Resources Corp., and that name change was effected in July 2023. Solitario’s primary business is to acquire exploration mineral properties or royalties and/or discover economic deposits on its mineral properties and advance these deposits, either on its own or through joint ventures, up to the development stage. At that point, or sometime prior to that point, Solitario would likely attempt to sell its mineral properties, pursue their development either on its own or through a joint venture with a partner that has expertise in mining operations, or create a royalty with a third party that continues to advance the property. Solitario has never developed a property. Solitario is primarily focused on the acquisition and exploration of precious metal, zinc and other base metal exploration mineral properties. In addition to focusing on its mineral exploration properties and the evaluation of mineral properties for acquisition, Solitario also evaluates potential strategic transactions for the acquisition of new precious and base metal properties and assets with exploration potential or business combinations that Solitario determines to be favorable to Solitario.

Solitario has recorded revenue in the past from the sale of mineral properties, including the sale of certain mineral royalties. Revenues and / or proceeds from the sale or joint venture of properties or assets, although potentially significant when they occur, have not been a consistent annual source of cash and would only occur in the future, if at all, on an infrequent basis.

Solitario currently considers its carried interest in the Florida Canyon project in Peru, its interest in the Lik project in Alaska, and its Golden Crest project in South Dakota to be its core mineral property assets. Nexa Resources, Ltd. (“Nexa”), Solitario’s joint venture partner, is continuing the exploration and furtherance of the Florida Canyon project and Solitario is monitoring progress at Florida Canyon. Solitario is working with its 50% joint venture partner in the Lik deposit, Teck American Incorporated, a wholly-owned subsidiary of Teck Resources Limited (both companies are referred to as “Teck”), to further the exploration and evaluate potential development plans for the Lik project. Solitario is conducting mineral exploration on its Golden Crest project on its own.

Solitario anticipates using its cash and short-term investments, in part, to fund costs and activities to further the exploration of the Florida Canyon, Lik and Golden Crest projects, and to potentially acquire additional mineral property assets. The fluctuations in precious metal and other commodity prices contribute to a challenging environment for mineral exploration and development, which has created opportunities as well as challenges for the potential acquisition of early-stage and advanced mineral exploration projects or other related assets at potentially attractive terms.

The accompanying interim condensed consolidated financial statements of Solitario for the three months and six months ended June 30, 2023 are unaudited and are prepared in accordance with accounting principles generally accepted in the United States of America (“generally accepted accounting principles”). They do not include all disclosures required by generally accepted accounting principles for annual financial statements, but in the opinion of management, include all adjustments necessary for a fair presentation. Interim results are not necessarily indicative of results which may be achieved in the future or for the full year ending December 31, 2023.

These consolidated condensed financial statements should be read in conjunction with the consolidated financial statements and notes thereto which are included in Solitario’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 16, 2023 and amended by that certain Amendment No. 1 to Form 10-K filed with the SEC on March 24, 2023 (as amended our “2022 Annual Report”). The accounting policies set forth in those annual financial statements are the same as the accounting policies utilized in the preparation of these condensed consolidated financial statements, except as modified for appropriate interim financial statement presentation.

| 6 |

| Table of Contents |

Risks and Uncertainties

Solitario faces risks related to health epidemics and other outbreaks of communicable diseases, which could significantly disrupt its operations and may materially and adversely affect its business and financial condition.

Solitario’s business still could be adversely impacted by the effects of the coronavirus (“COVID-19”) or other epidemics or pandemics. Although the COVID-19 public health emergency was officially terminated in May 2023, Solitario will continue to evaluate the effects of any resurgence of COVID-19 or other health events on its operations and, as Solitario did at times during the pandemic, will take proactive steps to address the impacts on its operations, including reducing costs, in response to the economic uncertainty associated with potential risks. Solitairo has also evaluated the potential impacts of market volatility, general economic uncertainty, and rising geopolitical tension on its ability to access future traditional funding sources on the same or reasonably similar terms as in past periods. Solitario will continue to monitor the effects of these risks on its operations, financial condition, and liquidity. However, the extent to which these risks ultimately impact Solitario’s business, including its exploration and other activities and the market for its securities, will depend on future developments, which are highly uncertain and cannot be predicted at this time.

Financial reporting

The condensed consolidated financial statements include the accounts of Solitario and its wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation. The condensed consolidated financial statements are prepared in accordance with generally accepted accounting principles and are expressed in US dollars.

Cash equivalents

Cash equivalents include investments in highly liquid money-market securities with original maturities of three months or less when purchased. As of June 30, 2023, $

Short-term investments

As of June 30, 2023, Solitario has $

Earnings per share

The calculation of basic and diluted earnings (loss) per share is based on the weighted average number of shares of common stock outstanding during the three and six months ended June 30, 2023 and 2022. Potentially dilutive shares related to outstanding common stock options of

| 7 |

| Table of Contents |

2. Mineral Properties

The following table details Solitario’s investment in Mineral Properties:

(in thousands) |

| June 30, |

|

| December 31, |

| ||

|

| 2023 |

|

| 2022 |

| ||

Exploration |

|

|

|

|

|

| ||

Lik project (Alaska – US) |

| $ |

|

| $ |

| ||

Golden Crest (South Dakota – US) |

|

|

|

|

|

| ||

Total exploration mineral properties |

| $ |

|

| $ |

| ||

All exploration costs on our exploration properties, none of which have proven and probable reserves, including any additional costs incurred for subsequent lease payments or exploration activities related to our projects, are expensed as incurred. During the three and six months ended June 30, 2023, Solitario advanced $

Exploration expense

The following items comprised exploration expense:

(in thousands) |

| Three months ended June 30, |

|

| Six months ended June 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Geologic and field expenses |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Administrative |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total exploration costs |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Asset Retirement Obligation

In connection with the acquisition of its interest in the Lik project in 2017, Solitario recorded an asset retirement obligation of $

Solitario has not applied a discount rate to the recorded asset retirement obligation as the estimated time frame for reclamation is not currently known, as reclamation is not expected to occur until the end of the Lik project life, which would follow future development and operations, the start of which cannot be estimated or assured at this time. Additionally, no depreciation will be recorded on the related asset for the asset retirement obligation until the Lik project goes into operation, which cannot be assured.

3. Marketable Equity Securities

Solitario's investments in marketable equity securities are carried at fair value, which is based upon quoted prices of the securities owned. The cost of marketable equity securities sold is determined by the specific identification method. Changes in fair value are recorded in the condensed consolidated statement of operations.

At June 30, 2023 and December 31, 2022 Solitario owns the following marketable equity securities:

|

| June 30, 2023 |

|

| December 31, 2022 |

| ||||||||||

|

| shares |

|

| Fair value (000’s) |

|

| Shares |

|

| Fair value (000’s) |

| ||||

Kinross Gold Corp |

|

|

|

| $ |

|

|

|

|

| $ |

| ||||

Vendetta Mining Corp. |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Vox Royalty Corp. |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Highlander Silver Corp. |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total |

|

|

|

|

| $ |

|

|

|

|

|

| $ |

| ||

| 8 |

| Table of Contents |

The following tables summarize Solitario’s marketable equity securities and adjustments to fair value:

(in thousands) |

| June 30, 2023 |

|

| December 31, 2022 |

| ||

Marketable equity securities at cost |

| $ |

|

| $ |

| ||

Cumulative unrealized loss on marketable equity securities |

|

| ( | ) |

|

| ( | ) |

Marketable equity securities at fair value |

| $ |

|

| $ |

| ||

The following table represents changes in marketable equity securities:

(in thousands) |

| Three months ended June 30, |

|

| Six months ended June 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Cost of marketable equity securities sold |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Realized (loss) gain on marketable equity securities sold |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Proceeds from the sale of marketable equity securities sold |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Net (loss) gain on marketable equity securities |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

Change in marketable equity securities at fair value |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

The following table represents the realized and unrealized (loss) gain on marketable equity securities:

(in thousands) |

| Three months ended June 30, |

|

| Six months ended June 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Unrealized (loss) gain on marketable securities |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

Realized (loss) gain on marketable equity securities sold |

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Net loss on marketable securities |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

During the three and six months ended June 30, 2023, Solitario did not sell any marketable equity securities.

During the three months ended June 30, 2022, Solitario sold

4. Leases

Solitario accounts for its leases in accordance with ASC 842. Solitario leases one facility, its Wheat Ridge, Colorado office, that has a term of more than one year. Solitario has no other material operating lease costs. During the six months ended June 30, 2023, Solitario entered into an extension of the lease as a new lease for the same facility (both the prior lease and new lease are referred to as the “WR Lease”) and recorded a net increase in the related asset and liability of $

During the three and six months ended June 30, 2023, cash lease payments of $

| 9 |

| Table of Contents |

The maturities of Solitario’s lease liability for its WR Lease are as follows at June 30, 2023:

Future lease payments (in thousands) |

|

|

| |

|

|

|

| |

Remaining payments 2023 |

| $ |

| |

2024 |

|

|

| |

2025 |

|

|

| |

2026 |

|

|

| |

Total lease payments |

|

|

| |

Less amount of payments representing interest |

|

| ( | ) |

Present value of lease payments |

| $ |

| |

Supplemental cash flow information related to our operating lease was as follows for the three and six months ended June 30, 2023 and 2022:

(in thousands) |

| Three months ended June 30, |

|

| Six months ended June 30, |

| ||||||||||

|

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Cash paid for amounts included in the measurement of lease liabilities |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Operating cash outflows from the WR Lease payments |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Non-cash amounts related to the WR lease |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leased assets recorded in exchange for new operating lease liabilities |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

5 Other Assets

The following items comprised other assets:

(in thousands) |

| June 30, |

|

| December 31, |

| ||

|

| 2023 |

|

| 2022 |

| ||

Furniture and fixtures, net of accumulated depreciation |

| $ |

|

| $ |

| ||

Office lease asset |

|

|

|

|

|

| ||

Exploration bonds and other assets |

|

|

|

|

|

| ||

Total other |

| $ |

|

| $ |

| ||

6. Derivative Instruments

Covered call options

From time-to-time Solitario has sold covered call options against its holdings of shares of common stock of Kinross Gold Corporation (“Kinross”) included in marketable equity securities. The business purpose of selling covered calls is to provide additional income on a limited portion of shares of Kinross that Solitario may sell in the near term, which is generally defined as less than one year, and any changes in the fair value of its covered calls are recognized in the statement of operations in the period of the change. At June 30, 2023, Solitario has a liability related to covered calls outstanding on its holdings of Kinross of $

| 10 |

| Table of Contents |

7. Fair Value

Solitario accounts for its financial instruments under ASC 820 Fair Value Measurement. During the six months ended June 30, 2023, there were no reclassifications in financial assets or liabilities between Level 1, 2 or 3 categories.

The following is a listing of Solitario’s financial assets and liabilities required to be measured at fair value on a recurring basis and where they are classified within the hierarchy as of June 30, 2023:

(in thousands) |

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Short-term investments |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Marketable equity securities |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinross call options |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

The following is a listing of Solitario’s financial assets and liabilities required to be measured at fair value on a recurring basis and where they are classified within the hierarchy as of December 31, 2022:

(in thousands) |

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Short-term investments |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

Marketable equity securities |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

8. Income Taxes

Solitario accounts for income taxes in accordance with ASC 740 Accounting for Income Taxes. Under ASC 740, income taxes are provided for the tax effects of transactions reported in the condensed consolidated financial statements and consist of taxes currently due plus deferred taxes related to certain income and expenses recognized in different periods for financial and income tax reporting purposes. Deferred tax assets and liabilities represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses and tax credits that are available to offset future taxable income and income taxes, respectively. A valuation allowance is provided if it is more likely than not that some portion or all of the deferred tax assets will not be realized.

At both June 30, 2023 and December 31, 2022, a valuation allowance has been recorded, which fully offsets Solitario’s net deferred tax assets, because it is more likely than not that the Company will not realize some portion or all of its deferred tax assets. The Company continually assesses both positive and negative evidence to determine whether it is more likely than not that the deferred tax assets can be realized prior to their expiration.

During the three and six months ended June 30, 2023 and 2022, Solitario recorded no deferred tax expense.

9. Commitments and contingencies

Solitario has recorded an asset retirement obligation of $

Solitario leases office space under a non-cancelable operating lease for the Wheat Ridge, Colorado office which provides for future total minimum rent payments as of June 30, 2023 of $

| 11 |

| Table of Contents |

10. Employee Stock Compensation Plans

On June 18, 2013, Solitario’s shareholders approved the 2013 Solitario Exploration & Royalty Corp. Omnibus Stock and Incentive Plan, as amended (the “2013 Plan”). Under the terms of the 2013 Plan, a total of

On June 20, 2023 Solitario’s shareholders approved the 2023 Solitario Stock and Incentive Plan (the “2023 Plan”). Under the terms of the 2023 Plan a total of

As of June 30, 2023, and December 31, 2022 there were options outstanding under the 2013 Plan that are exercisable to acquire

During the three and six months ended June 30, 2023 and 2022, Solitario did not grant any options.

During the three and six months ended June 30, 2023, options for

During the three months ended June 30, 2022, options for

During the three and six months ended June 30, 2023, Solitario recorded stock option compensation expense of $

11. Shareholders’ Equity

Shareholders’ Equity for the three and six months ended June 30, 2023:

(in thousands, except |

|

|

|

|

|

|

|

|

|

| ||||||||||

Share amounts) |

| Common |

|

| Common |

|

| Additional |

|

|

|

| Total |

| ||||||

|

| Stock |

|

| Stock |

|

| Paid-in |

|

| Accumulated |

|

| Shareholders’ |

| |||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||

Balance at December 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

Stock option expense |

|

| - |

|

|

| - |

|

|

|

|

|

| - |

|

|

|

| ||

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| ( | ) |

|

| ( | ) |

Balance at March 31, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

Stock option expense |

|

| - |

|

|

| - |

|

|

|

|

|

| - |

|

|

|

| ||

Issuance of shares - option exercises |

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

| ||||

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| ( | ) |

|

| ( | ) |

Balance at June 30, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

| 12 |

| Table of Contents |

Shareholders’ Equity for the three and six months ended June 30, 2022:

(in thousands, except |

|

|

|

|

|

|

|

|

|

| ||||||||||

Share amounts) |

| Common |

|

| Common |

|

| Additional |

|

|

|

| Total |

| ||||||

|

| Stock |

|

| Stock |

|

| Paid-in |

|

| Accumulated |

|

| Shareholders’ |

| |||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||

Balance at December 31, 2021 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

Stock option expense |

|

| - |

|

|

| - |

|

|

|

|

|

| - |

|

|

|

| ||

Issuance of shares – ATM, net |

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

| ||||

Issuance of shares - option exercises |

|

|

|

|

|

|

|

|

|

|

| - |

|

|

|

| ||||

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| ( | ) |

|

| ( | ) |

Balance at March 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

Stock option expense |

|

| - |

|

|

| - |

|

|

|

|

|

| - |

|

|

|

| ||

Issuance of shares - option exercises |

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

| |||

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| ( | ) |

|

| ( | ) |

Balance at June 30, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

At the Market Offering Agreement

On February 2, 2021, Solitario entered into an at-the-market offering agreement (the “ATM Agreement”) with H. C. Wainwright & Co., LLC (“Wainwright”), under which Solitario may, from time to time, issue and sell shares of Solitario’s common stock through Wainwright as sales manager in an at-the-market offering under a prospectus supplement for aggregate sales proceeds of up to $

During the six months ended June 30, 2023 Solitario did not sell any shares under the ATM Agreement. During the six months ended June 30, 2022, Solitario sold an aggregate of

12. Subsequent Events

On July 31, 2023 Solitario entered into a Stock Purchase Agreement (the “SPA”) with Newmont Overseas Exploration Ltd. (“Newmont”), for the purchase and sale of

| 13 |

| Table of Contents |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the information contained in the consolidated financial statements of Solitario for the years ended December 31, 2022 and 2021, and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in Solitario’s 2022 Annual Report. Solitario's financial condition and results of operations are not necessarily indicative of what may be expected in future periods. Unless otherwise indicated, all references to dollars are to U.S. dollars.

(a) Business Overview and Summary

We are an exploration stage company as defined by rules issued by the SEC, with a focus on the acquisition of precious and base metal properties with exploration potential and the development or purchase of royalty interests. Currently our primary focus is the acquisition and exploration of precious metal, zinc and other base metal exploration mineral properties. However, we continue to evaluate other mineral properties for acquisition, and we hold a portfolio of mineral exploration properties and assets for future sale, joint venture or on which to create a royalty prior to the establishment of proven and probable reserves. Although our mineral properties may be developed in the future by us, through a joint venture or by a third party, we have never developed a mineral property. In addition to focusing on our current mineral exploration properties, we also from time to time evaluate potential strategic transactions for the acquisition of new precious and base metal properties and assets with exploration potential.

Our current geographic focus for the evaluation of potential mineral property assets is in North and South America; however, we have conducted property evaluations for potential acquisition in other parts of the world. At June 30, 2023, we consider our Golden Crest project in South Dakota, our carried interest in the Florida Canyon project in Peru, and our interest in the Lik project in Alaska to be our core mineral property assets. We are conducting exploration activities the United States on our own at Golden Crest and through joint ventures operated by our partners in Peru and in Alaska at the Lik project. We also conduct potential acquisition evaluations in other countries located in South and North America.

We have recorded revenue in the past from the sale of mineral properties, however revenues and / or proceeds from the sale or joint venture of properties or assets, although generally significant when they have occurred in the past, have not been a consistent source of revenue and would only occur in the future, if at all, on an infrequent basis. We have reduced our exposure to the costs of our exploration activities in the past through the use of joint ventures. Although we anticipate that the use of joint ventures to fund some of our exploration activities will continue for the foreseeable future, we can provide no assurance that these or other sources of capital will be available in sufficient amounts to meet our needs, if at all.

As of June 30, 2023, we have balances of cash and short-term investments that we anticipate using, in part, to (i) fund costs and activities intended to further the exploration of our Lik, Florida Canyon and Golden Crest projects, (ii) conduct reconnaissance exploration and (iii) potentially acquire additional mineral property assets. The fluctuations in precious metal and other commodity prices contribute to a challenging environment for mineral exploration and development, which has created opportunities as well as challenges for the potential acquisition of advanced mineral exploration projects or other related assets at potentially attractive terms.

The extent to which our business, including our exploration and other activities and the market for our securities, may be impacted by public health threats, rising geopolitical tension, general economic uncertainty and market volatility will depend on future developments, which are highly uncertain and cannot be predicted at this time. Please see Item 1A, “Risk Factors,” in our 2022 Annual Report.

| 14 |

| Table of Contents |

(b) Results of Operations

Comparison of the three months ended June 30, 2023 to the three months ended June 30, 2022

We had a net loss of $1,040,000 or $0.02 per basic and diluted share for the three months ended June 30, 2023 compared to a net loss of $1,691,000 or $0.03 per basic and diluted share for the three months ended June 30, 2022. As explained in more detail below, the primary reasons for the decrease in our net loss in the three months ended June 30, 2023 compared to the net loss during the three months ended June 30, 2022 were (i) a decrease in exploration expense to $555,000 in the three months ended June 30, 2023 compared to exploration expense of $951,000 during the three months ended June 30, 2022; (ii); a decrease in the unrealized loss on marketable equity securities to $227,000 during the three months ended June 30, 2023 compared to an unrealized loss on marketable equity securities of $368,000 during the three months ended June 30, 2022; (iii) recording of a gain on unrealized loss on short-term investments of $14,000 compared to a loss of $47,000 during the three months ended June 30, 2022; (iv) the recording of a loss on the sale of marketable equity securities of $78,000 during the three months ended June 30, 2022, with no similar loss in the three months ended June 30, 2023; and (v) the recording of a gain on derivative instruments of $23,000 during the three months ended June 30, 2023 compared to a loss on derivative instruments of $3,000 during the three months ended June 30, 2022. Partially offsetting the above items were (i) an increase in general and administrative expense to $315,000 in the three months ended June 30, 2023 compared to general and administrative expense of $277,000 during the three months ended June 30, 2022; and (ii) a decrease in interest and dividend income to $26,000 during the three months ended June 30, 2023 compared to interest and dividend income of $41,000 during the three months ended June 30, 2022. Each of the major components of these items is discussed in more detail below.

Our net exploration expense decreased to $555,000 during the three months ended June 30, 2023 compared to exploration expense of $951,000 during the three months ended June 30, 2022 primarily as a result of (i) a later start of work at our Lik project by our joint venture partner, Teck, as Lik exploration was $28,000 during the three months ended June 30, 2023 compared to $444,000 of exploration expenditures at Lik, which included the start of a drilling program in the three months ended June 30, 2022; and (ii) a reduction in reconnaissance exploration during the three months ended June 30, 2023 to $41,000 compared to reconnaissance exploration of $79,000 during the three months ended June 30, 2022. Although our exploration expenditures at our Golden Crest project were generally comparable for the three months ended June 30, 2023 of $486,000 and $428,000 during the three months ended June 30, 2022, our focus during the 2023 period was on permitting a planned drilling program and additional soil and rock sampling program, while in the three months ended June 30, 2022 we conducted an inductive polarization study at our Golden Crest project as well as soil and rock sampling. During the three and six months ended June 30, 2023 we had three contract geologists working at our Golden Crest project, as well as several part-time employees who assisted our contract geologists in collecting, organizing and testing soil and rock samples at Golden Crest. In addition, certain of our Denver-based personnel spent a portion of their time on Golden Crest and reconnaissance exploration activities described above and related matters. We have budgeted approximately $2,000,000 for the full-year exploration expenditure for 2023, which includes approximately $1,723,000 at the Golden Crest project and $574,000 for Solitario’s share of a joint drilling program with Teck at the Lik project. We expect our full-year exploration expenditures for 2023 to be above the exploration expenditures for full-year 2022.

Exploration expense (in thousands) by project consisted of the following:

|

| Three months ended June 30, |

|

| Six months ended June 30, |

| ||||||||||

Project Name |

| 2023 |

|

| 2022 |

|

| 2023 |

|

| 2022 |

| ||||

Golden Crest |

| $ | 486 |

|

| $ | 428 |

|

| $ | 727 |

|

| $ | 555 |

|

Lik |

|

| 28 |

|

|

| 444 |

|

|

| 33 |

|

|

| 448 |

|

Florida Canyon |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

Reconnaissance |

|

| 41 |

|

|

| 79 |

|

|

| 70 |

|

|

| 174 |

|

Total exploration expense |

| $ | 555 |

|

| $ | 951 |

|

| $ | 830 |

|

| $ | 1,177 |

|

General and administrative costs, excluding stock option compensation costs, discussed below, were $257,000 during the three months ended June 30, 2023 compared to $264,000 during the three months ended June 30, 2022. The major components of our general and administrative costs were (i) salaries and benefit expense of $103,000 during the three months ended June 30, 2023 compared to salary and benefit costs of $99,000 during the three months ended June 30, 2022; (ii) legal and accounting expenditures of $66,000 in the three months ended June 30, 2023 compared to $65,000 in the three months ended June 30, 2022; (iii) office rent and expenses of $23,000 during the three months ended June 30, 2023, compared to $32,000 during the three months ended June 30, 2022; and (iv) travel and shareholder relation costs of $65,000 during the three months ended June 30, 2023 compared to $68,000 during the three months ended June 30, 2022. We anticipate the full-year general and administrative costs will be comparable for 2023 and 2022.

| 15 |

| Table of Contents |

We recorded $59,000 of stock option compensation expense for the amortization of unvested grant date fair value with a credit to additional paid-in-capital during the three months ended June 30, 2023 compared to $13,000 of stock option compensation expense during the three months ended June 30, 2022. These non-cash charges related to the expense for vesting on stock options outstanding during the three months ended June 30, 2023 and 2022. The primary reason for the increase in stock option compensation expense during the three months ended June 30, 2023 compared to the three months ended June 30, 2022 was as a result of the grant of 2,360,000 options in the third quarter of 2022, which resulted in an increase in the amortization of the grant date fair values during the three months ended June 30, 2023 compared to the same period of 2022. See Note 10, “Employee Stock Compensation Plans,” above, for additional information on our stock option expense.

We recorded a non-cash unrealized loss on marketable equity securities of $227,000 during the three months ended June 30, 2023 compared to an unrealized loss on marketable equity securities of $368,000 during the three months ended June 30, 2022. The non-cash unrealized loss during the three months ended June 30, 2023 was primarily related to (i) a decrease in the value of our 7,750,000 shares of Vendetta common stock, which decreased to a fair value of $234,000 at June 30, 2023 from a fair value of $372,000 at March 31, 2023 or a decrease of $138,000, based on quoted market prices; and (ii) a decrease in the value of our 134,055 shares of Vox Royalty Corp. (“Vox”) to $324,000 at June 30, 2023 compared to a value of $412,000 at March 31, 2023 or a decrease of $88,000 based on quoted market prices. The unrealized loss during the three months ended June 30, 2022 was primarily related to (i) a decrease in the value of our holdings of 100,000 shares of Kinross common stock, which decreased to a fair value of $358,000 at June 30, 2022 from a fair value of $588,000 at March 31, 2022 or a decrease of $230,000 based on quoted market prices; (ii) a decrease in the value of our then 8,000,000 shares of Vendetta common stock to $279,000 at June 30, 2022 from a value of $442,000 at March 31, 2022 or a decrease of $163,000 based on quoted market prices and (iii) a decrease in the value of our 134,055 shares of Vox to $303,000 at June 30, 2022 compared to a value of $383,000 at March 31, 2022 or a decrease of $80,000 based on quoted market prices. In addition, during the three months ended June 30, 2022, we transferred $78,000 of prior unrecognized loss on the sale of Vendetta common stock to realized loss on the sale of marketable equity securities, discussed below.

We did not sell any of our marketable equity securities during the three or six months ended June 30, 2023. During the three months ended June 30, 2022, we sold 500,000 shares of our holdings of Vendetta common stock for proceeds of $27,000 and recorded a loss on sale of marketable equity securities of $78,000. See Note 3 “Marketable Equity Securities” to the condensed consolidated financial statements for a discussion of the sales of Vendetta and Vox common stock.

We recorded interest and dividend income of $26,000 during the three months ended June 30, 2023 compared to interest income of $41,000 during the three months ended June 30, 2022. This decrease was primarily due to a decrease in the amount of USTS we held during the three months ended June 30, 2023 compared to the amount of USTS we held during the three months ended June 30, 2022. Partially offsetting the decrease in the outstanding balance of USTS on our interest income was an increase in the average interest rate earned on our short-term investments in USTS during the three months ended June 30, 2023 compared to the three months ended June 30, 2022. We anticipate interest income will decrease during the remainder of 2023 from the amounts recorded through the six months ended June 30, 2023 as we expect to utilize the proceeds from maturing USTS to fund our exploration and general and administrative expenditures.

We recorded a non-cash unrealized gain on our short-term investments of $14,000 during the three months ended June 30, 2023 compared to an unrealized loss on our short-term investments of $47,000 during the three months ended June 30, 2022 primarily due to the maturing of our USTS, which are marked-to-market and prior reductions in the quoted fair value of our existing USTS that were purchased at lower yield to maturities than current market values were reversed as the USTS matured and approached face value. These changes in interest rates are a result of many factors that are not related to our business and do not affect the yield-to-maturity quoted for our investments in USTS or CDs at the time we acquire these short-term investments, to the extent we hold the investments to maturity.

During the three months ended June 30, 2023, we recorded a non-cash gain on derivative instruments of $23,000 related to certain Kinross calls we sold during the three months ended June 30, 2023, compared to a loss on derivative instruments of $3,000 during the three months ended June 30, 2022 related to a reduction in the value of our holdings of Vendetta Warrants which will expired in August 2022. See Note 6 “Derivative Instruments,” above for a discussion of our Kinross calls.

| 16 |

| Table of Contents |

We regularly perform evaluations of our mineral property assets to assess the recoverability of our investments in these assets. All long-lived assets are reviewed for impairment whenever events or circumstances change which indicate the carrying amount of an asset may not be recoverable utilizing guidelines based upon future net cash flows from the asset as well as our estimates of the geological potential of an early-stage mineral property and its related value for future sale, joint venture or development by us or others. During the three and six months ended June 30, 2023 and 2022, we recorded no property impairments.

We recorded no income tax expense or benefit during the three and six months ended June 30, 2023 or 2022 as we provide a valuation allowance for the tax benefit arising out of our net operating losses for all periods presented. As a result of our administrative expenses and exploration activities, we anticipate we will not have currently payable income taxes during 2023. In addition to the valuation allowance discussed above, we provide a valuation allowance for our foreign net operating losses, which are primarily related to our exploration activities in Peru. We anticipate we will continue to provide a valuation allowance for these net operating losses until we are in a net tax liability position with regards to those countries where we operate or until it is more likely than not that we will be able to realize those net operating losses in the future.

Comparison of the six months ended June 30, 2023 to the six months ended June 30, 2022

We had a net loss of $1,420,000 or $0.02 per basic and diluted share for the six months ended June 30, 2023 compared to a net loss of $2,205,000 or $0.03 per basic and diluted share for the six months ended June 30, 2022. As explained in more detail below, the primary reasons for the decrease in our net loss were (i) an decrease in exploration expense to $830,000 during the six months ended June 30, 2023 compared to exploration expense of $1,177,000 during the six months ended June 30, 2022; (ii) a gain on derivative instruments of $23,000 during the six months ended June 30, 2023 compared to a loss on derivative instruments of $4,000 during the three months ended June 30, 2022; (iii) a realized loss of $159,000 on the sale of marketable equity securities during the six months ended June 30, 2022, with no comparable sales of marketable equity securities during the six months ended June 30, 2023; (iv); an unrealized gain on short-term investments of $35,000 during the six months ended June 30, 2023 compared to an unrealized loss on short-term investments of $98,000 during the six months ended June 30, 2022 and (v) an unrealized gain of $102,000 on marketable equity securities during the six months ended June 30, 2023 compared to an unrealized loss on marketable equity securities of $155,000 during the six months ended June 30, 2022. Partially offsetting these reductions in the loss for the six month period ended June 30, 203 compared to the six month period ended June 30, 2023 were (i) an increase in general and administrative expenses to $791,000 during the six months ended June 30, 2023 compared to general and administrative expenses of $664,000 during the six months ended June 30, 2022 and; (ii) a decrease in interest and dividend income to $53,000 during the six months ended June 30, 2023 compared to interest income of $68,000 during the six months ended June 30, 2022. The significant changes for these items are discussed in more detail below.

Our net exploration expense decreased to $830,000 during the six months ended June 30, 2023 compared to $1,177,000 during the six months ended June 30, 2022. The primary reason for the decrease was that the exploration expenditures at our Lik project in Alaska were $33,000 during the six months ended June 30, 2023 compared to exploration expenditures of $448,000 during the six months ended June 30, 2022, where our joint venture partner, Teck, completed a portion of a planned $1.3 million (total) exploration program for 2022, including drilling, of which we are responsible for one-half of the total costs incurred. We have agreed with Teck to complete a $1.1 million exploration program at Lik for 2023, of which we are responsible for one-half of that or approximately $550,000 for the full year of 2023, however due to timing of expenditures, we anticipate the bulk of those expenditures will occur in the third and fourth quarters of 2023. Partially offsetting this decrease in exploration expenditures during the 2023 period compared to the 2022 period was an increase in our expenditures at the Golden Crest project to $727,000 during the six months ended June 30, 2023 compared to Golden Crest exploration expenditures of $555,000 during the six months ended June 30, 2022, as a result of additional permitting work and soil and rock sampling during 2023 compared to 2022.

| 17 |

| Table of Contents |

General and administrative costs, excluding stock option compensation costs discussed below, were $664,000 during the six months ended June 30, 2023 compared to $638,000 during the six months ended June 30, 2022. The major components of the costs were (i) salary and benefit expense during the six months ended June 30, 2023 of $263,000 compared to salary and benefit expense of $218,000 during the six months ended June 30, 2022, with these increases as a result of increased personnel and salaries in 2023; (ii) legal and accounting expenditures of $145,000 during the six months ended June 30, 2023, compared to $197,000 during the six months ended June 30, 2022; (iii) office and other costs of $51,000 during the six months ended June 30, 2023 compared to $53,000 during the six months ended June 30, 2022; and (iv) travel and shareholder relation costs of $205,000 during the six months ended June 30, 2023 compared to $170,000 during the six months ended June 30, 2022.

During the six months ended June 30, 2023 and 2022, Solitario recorded $126,000 and $26,000, respectively, of stock option expense for the amortization of unvested grant date fair value with a credit to additional paid-in capital. The increase during the six months ended June 30, 2023 was primarily related to the addition of 2,360,000 options granted during the third quarter of 2022 with a grant date fair value of $876,000, which increased the amortization of unvested options’ grant date fair value during the six months ended June 30, 2023 compared to the six months ended June 30, 2022.

We recorded an unrealized gain on marketable equity securities of $102,000 during the six months ended June 30, 2023 compared to an unrealized loss on marketable equity securities of $155,000 during the six months ended June 30, 2022. The non-cash unrealized gain during the six months ended June 30, 2023 was primarily related to (i) an increase in the fair value of our holdings of 7,750,000 shares of Vendetta common stock to $235,000 at June 30, 2022 compared to a fair value of $229,000 at December 31, 2022, based on quoted market prices; (ii) an increase in the fair value of our holdings of 100,000 shares of Kinross common stock at June 30, 2023 to $477,000 compared to a fair value of $409,000 at December 31, 2022, based on quoted market prices; and (iii) an increase in the fair value of our holdings of 134,055 shares of Vox to $324,000 at June 30, 2022 compared to a fair value of $309,000 at December 31, 2022 based on quoted market prices. The non-cash unrealized loss during the six months ended June 30, 2022 was primarily related to (i) a decrease in the fair value of our holdings of our then 8,000,000 shares of Vendetta common stock to $279,000 at June 30, 2022 compared to a fair value of $317,000 at December 31, 2021, based on quoted market prices; (ii) a decrease in the fair value of our holdings of 100,000 shares of Kinross common stock to $358,000 compared to a fair value of $581,000 at December 31, 2021, based on quoted market prices; and (iii) a decrease in the fair value of our holdings of 134,055 shares of Vox to $303,000 at June 30, 2022 compared to a fair value of $370,000 at December 31, 2021 based on quoted market prices. We may reduce our holdings of marketable equity securities depending on cash needs and market conditions, which may reduce the volatility of the changes in unrealized gains and losses in marketable equity securities during the remainder of 2023.

We recorded interest and dividend income of $53,000 during the six months ended June 30, 2023 compared to interest and dividend income of $68,000 during the six months ended June 30, 2022. The reduction in interest income was primarily related to a reduction in our average outstanding balance of USTS during the six months ended June 30, 2023 compared to the six months ended June 30, 2022, which was partially offset by an increase in the average interest rate and income earned on our USTS during the six months ended June 30, 2023 compared to the average interest rate during the six months ended June 30, 2022. We anticipate our interest income will decrease in 2023 compared to 2022 as a result of the use of our short-term investments and our cash balances for ordinary overhead, operational costs, and the exploration, evaluation and or acquisition of mineral properties discussed above. See “Liquidity and Capital Resources” below for further discussion of our cash and cash equivalent balances.

We recorded a non-cash unrealized gain on our short-term investments of $35,000 during the six months ended June 30, 2023 compared to an unrealized loss on our short-term investments of $98,000 during the six months ended June 30, 2021 primarily due to certain of our USTS increasing in value as they approached maturity, which were previously recorded at a mark-to-market amount that was below their face value as a result of then current interest rates being higher than the yield-to-maturity rates our USTS at the time the USTS were acquired.

We did not sell any marketable equity securities during the six months ended June 30, 2023. During the six months ended June 30, 2022, we sold 1,000,000 shares of our holdings of Vendetta common stock for proceeds of $53,000 and recorded a loss on sale of marketable equity securities of $159,000. See Note 3 “Marketable Equity Securities” to the condensed consolidated financial statements for a discussion of the sale of marketable equity securities.

During the six months ended June 30, 2023, we recorded a non-cash gain on derivative instruments of $23,000 related to certain Kinross calls we sold during the three months ended June 30, 2023. During the six months ended June 30, 2022 we recorded a non-cash loss of $4,000 on our Vendetta Warrants.

| 18 |

| Table of Contents |

(c) Liquidity and Capital Resources

Cash and Short-term Investments

As of June 30, 2023, we have $2,573,000 in cash and short-term investments. As of June 30, 2023, we have $2,077,000 of our current assets in USTS with maturities of 30 days to 8 months. The USTS are recorded at their fair value based upon quoted market prices. We anticipate we will roll over that portion of our short-term investments not used for exploration expenditures, operating costs or mineral property acquisitions as they become due during the remainder of 2023. We intend to utilize a portion of our cash and short-term investments in our exploration activities and the potential acquisition of mineral assets over the next several years.

Investment in Marketable Equity Securities

Our marketable equity securities are carried at fair value, which is based upon market quotes of the underlying securities. At June 30, 2023 we own 7,750,000 shares of Vendetta common stock, 100,000 shares of Kinross common stock, 134,055 shares of Vox common stock and 200,000 shares of Highlander Silver Corp. common stock. At June 30, 2023, the Vendetta shares are recorded at their fair value of $234,000, the Kinross shares are recorded at their fair value of $477,000; the Vox shares are recorded at their fair value of $325,000 and the Highlander Silver Corp. shares are recorded at their fair value of $15,000. We did not sell any of our marketable equity securities during the six months ended June 30, 2023. During the six months ended June 30, 2022 we sold 1,000,000 shares of Vendetta common stock, as discussed above. See Note 3 “Marketable Equity Securities” in the condensed consolidated financial statements. We anticipate we may sell some portion of our holdings of marketable equity securities during the remainder of 2023 depending on cash needs and market conditions.

Working Capital

We had working capital of $3,716,000 at June 30, 2023 compared to working capital of $4,991,000 as of December 31, 2022. Our working capital at June 30, 2023 consists primarily of our cash and cash equivalents, our investment in USTS, discussed above, our investment in marketable equity securities of $1,051,000, and other current assets of $366,000, less our accounts payable of $235,000 and other current liabilities of $39,000. As of June 30, 2023, our cash balances along with our short-term investments and marketable equity securities are adequate to fund our expected expenditures over the next year.

The nature of the mineral exploration business requires significant sources of capital to fund exploration, development and operation of mining projects. We will need additional capital if we decide to develop or operate any of our current exploration projects or any projects or assets we may acquire. We anticipate we would finance any such development through the use of our cash reserves, short-term investments, joint ventures, issuance of debt or equity, or the sale of our interests in other exploration projects or assets.

Stock-Based Compensation Plans

As of June 30, 2023, and December 31, 2022 there were options outstanding from the 2013 Plan to acquire 5,340,000 and 5,390,000 shares, respectively, of Solitario common stock. The outstanding options have exercise prices between $0.60 per share and $0.20 per share. During the six months ended June 30, 2023, options for 50,000 shares were exercised with an exercise price of $0.28 per share for proceeds of $14,000. During the six months ended June 30, 2022, options for 81,750 shares were exercised with an average exercise price of $0.25 per share for proceeds of $20,000. We do not anticipate the exercise of options to be a significant source of cash flow during the remainder of 2023.

At the Market Offering Agreement

On February 2, 2021, we entered into the ATM Agreement with Wainwright, under which we may, from time to time, issue and sell shares of our common stock through Wainwright as sales manager in an at-the-market offering under a prospectus supplement for aggregate sales proceeds of up to $9.0 million. There were no sales of shares of common stock during the six months ended June 30, 2023. During the six months ended June 30, 2022, we sold an aggregate of 2,650,724 shares of common stock under the ATM Program at an average price of $0.76 per share of common stock for net proceeds after commissions and expenses of approximately $2,023,000. Solitario may sell additional shares under the ATM program during the remainder of 2023 if market conditions warrant such sales.

| 19 |

| Table of Contents |

(d) Cash Flows

Net cash used in operations during the six months ended June 30, 2023 increased to $1,765,000 compared to $1,272,000 of net cash used in operations for the six months ended June 30, 2022 primarily as a result of (i) the pre-payment of $350,000 during the second quarter of 2023 to our joint venture partner Teck for an advance on planned 2023 exploration program at the Lik project in Alaska, of which $332,000 remained in pre-paid expense at June 30, 2023 and is included in the changes in prepaid expenses and other current assets as a use of cash; (ii) an increase in non-stock option general and administrative expense to $665,000 during the six months ended June 30, 2023 compared to $638,000 during the six months ended June 30, 2022, discussed above; and (iii) a reduction in the provision of cash from changes in other prepaid expenses and other current assets of $4,000 to a total change of $228,000 during the six months ended June 30, 2023 compared to the provision of cash of $222,000 during the six months ended June 30, 2023, which was primarily due to the use of a prepaid balance of $221,000 due from Teck at December 31, 2021 during the six months ended June 30, 2022; and (iv) the use of cash of $15,000 from a decrease in accounts payable and other current liabilities during the six months ended June 30, 2023 compared to the provision of cash of $234,000 from an increased in accounts payable and other current liabilities during the six months ended June 30, 2022 as a result of increased exploration activity at our Golden Crest project during the six months ended June 30, 2022. These uses of cash were partially offset by (i) a decrease in exploration expense to $830,000 during the six months ended June 30, 2023 compared to exploration expense of $1,177,000 during the six months ended June 30, 2023; and (ii) a reduction in interest and dividend income to $53,000 during the six months ended June 30, 2023 compared to interest and dividend income of $68,000 during the six months ended June 30, 2022. Based upon projected expenditures in our 2023 budget, we anticipate continued use of funds from operations through the remainder of 2023, primarily for exploration related to our Golden Crest and Lik projects and reconnaissance exploration. See “Results of Operations” discussed above for further explanation of some of these variances.

During the six months ended June 30, 2023, we provided $1,909,000 of cash from the sale of short-term investments compared to the use of $881,000 in cash during the six months ended June 30, 2022 from the net investment in short-term investments. During the six months ended June 30, 2023 we acquired equipment and other assets used in our exploration activities of $9,000 compared to $49,000 of equipment acquired during the six months ended June 30, 2022. We received cash proceeds of $31,000 from the sale of Kinross calls during the six months ended June 30, 2023 with no similar sales during the six months ended June 30, 2022. During the six months ended June 30, 2022 we sold certain marketable equity securities for proceeds of $53,000, with no similar sales during the six months ended June 30, 2023. We also used $10,000 of our cash to acquire additional mineral claims at our Golden Crest project during the six months ended June 30, 2022 with no similar mineral property additions during the six months ended June 30, 2023. We may sell a portion of our marketable equity securities during the remainder of 2023; however, we do not anticipate the sale of marketable equity securities will be a significant source of cash during the remainder of 2023. We will continue to liquidate a portion of our short-term investments as needed to fund our operations and our potential mineral property acquisitions during the remainder of 2023. Any potential mineral property acquisition or strategic corporate investment during the remainder of 2023, discussed above, could involve a significant change in our cash provided or used for investing activities, depending on the structure of any potential transaction.

During the six months ended June 30, 2022, we received net cash of $2,023,000 from the issuance of common stock under the ATM Program, discussed above. In addition, during the six months ended June 30, 2023 and 2022 we received $14,000 and $20,000, respectively, from the issuance of common stock from the exercise of stock options, discussed above in Note 10, “Employee Stock Compensation Plans” to the condensed consolidated financial statements.

| 20 |

| Table of Contents |

(e) Mineral Resources

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

Mineral Reserves and Resources

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and applicable Canadian securities laws, and as a result we report our mineral resources according to two different standards. U.S. reporting requirements, are governed by Item 1300 of Regulation S-K (“S-K 1300”) issued by the SEC. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) adopted from the definitions provided by the Canadian Institute of Mining, Metallurgy and Petroleum. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards generally embody slightly different approaches and definitions.

In our public filings in the U.S. and Canada and in certain other announcements not filed with the SEC, we disclose measured, indicated and inferred resources, each as defined in S-K 1300. The estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves, and therefore investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into S-K 1300-compliant reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and therefore it cannot be assumed that all or any part of inferred resources will ever be upgraded to a higher category. Therefore, investors are cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically.

(f) Off-balance sheet arrangements

As of June 30, 2023 and December 31, 2022 we had no off-balance sheet obligations.

(g) Development Activities, Exploration Activities, Environmental Compliance and Contractual Obligations

We are not involved in any development activities, nor do we have any contractual obligations related to any potential development activities as of June 30, 2023. As of June 30, 2023, there have been no material changes to our contractual obligations for exploration activities, environmental compliance or other obligations from those disclosed in our Management’s Discussion and Analysis included in our 2022 Annual Report.

(h) Discontinued Projects

We did not record any mineral property write-downs during the three and six months ended June 30, 2023 and 2022.

(i) Significant Accounting Policies and Critical Accounting Estimates

See Note 1 to the condensed consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2022 for a discussion of our significant accounting policies.