SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended June 30, 2019 OR

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

SOUTHERN MISSOURI BANCORP, INC.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Missouri

|

43-1665523

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

2991 Oak Grove Road, Poplar Bluff, Missouri

|

63901

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange

on Which Registered

|

||

|

Common Stock,

par value $0.01 per share

|

SMBC

|

The NASDAQ Stock Market, LLC

|

|

Large accelerated filer

|

Accelerated filer

|

X

|

Non-accelerated filer

|

Smaller reporting company

|

As of September 13, 2019, there were issued and outstanding 9,201,783 shares of the Registrant's common stock.

|

•

|

expected cost savings, synergies and other benefits from our merger and acquisition activities might not be realized within the anticipated time

frames or at all, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected;

|

|

•

|

the strength of the United States economy in general and the strength of the local economies in which we conduct operations;

|

|

•

|

fluctuations in interest rates and in real estate values;

|

|

•

|

monetary and fiscal policies of the FRB and the U.S. Government and other governmental initiatives affecting the financial services industry;

|

|

•

|

the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in

estimates of the adequacy of the allowance for loan losses;

|

|

•

|

our ability to access cost-effective funding;

|

|

•

|

the timely development of and acceptance of our new products and services and the perceived overall value of these products and services by users,

including the features, pricing and quality compared to competitors' products and services;

|

|

•

|

fluctuations in real estate values and both residential and commercial real estate markets, as well as agricultural business conditions;

|

|

•

|

demand for loans and deposits;

|

|

•

|

legislative or regulatory changes that adversely affect our business;

|

|

•

|

changes in accounting principles, policies, or guidelines;

|

|

•

|

results of regulatory examinations, including the possibility that a regulator may, among other things, require an increase in our reserve for loan

losses or write-down of assets;

|

|

•

|

the impact of technological changes; and

|

|

•

|

our success at managing the risks involved in the foregoing.

|

|

At June 30,

|

||||||||||||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||||||||||||||||||||

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

|||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Type of Loan:

|

||||||||||||||||||||||||||||||||||||||||

|

Mortgage Loans:

|

||||||||||||||||||||||||||||||||||||||||

|

Residential real estate

|

$

|

491,992

|

26.65

|

%

|

$

|

450,919

|

28.84

|

%

|

$

|

442,463

|

31.66

|

%

|

$

|

392,974

|

34.61

|

%

|

$

|

377,465

|

35.84

|

%

|

||||||||||||||||||||

|

Commercial real estate (1)

|

840,777

|

45.53

|

704,647

|

45.07

|

603,922

|

43.21

|

452,052

|

39.81

|

404,720

|

38.43

|

||||||||||||||||||||||||||||||

|

Construction

|

123,287

|

6.68

|

112,718

|

7.21

|

106,782

|

7.63

|

77,369

|

6.82

|

69,204

|

6.57

|

||||||||||||||||||||||||||||||

|

Total mortgage loans

|

1,456,056

|

78.86

|

1,268,284

|

81.12

|

1,153,167

|

82.50

|

922,395

|

81.24

|

851,389

|

80.84

|

||||||||||||||||||||||||||||||

|

Other Loans:

|

||||||||||||||||||||||||||||||||||||||||

|

Automobile loans

|

11,379

|

0.62

|

9,056

|

0.58

|

6,378

|

0.46

|

6,221

|

0.55

|

6,333

|

0.60

|

||||||||||||||||||||||||||||||

|

Commercial business (2)

|

355,874

|

19.27

|

281,272

|

17.99

|

247,184

|

17.68

|

202,045

|

17.79

|

191,886

|

18.22

|

||||||||||||||||||||||||||||||

|

Home equity

|

43,369

|

2.35

|

39,218

|

2.51

|

35,222

|

2.52

|

25,146

|

2.21

|

23,472

|

2.23

|

||||||||||||||||||||||||||||||

|

Other

|

42,786

|

2.32

|

30,297

|

1.94

|

22,051

|

1.58

|

15,174

|

1.34

|

16,965

|

1.61

|

||||||||||||||||||||||||||||||

|

Total other loans

|

453,408

|

24.56

|

359,843

|

23.02

|

310,835

|

22.24

|

248,586

|

21.89

|

238,656

|

22.66

|

||||||||||||||||||||||||||||||

|

Total loans

|

1,909,464

|

103.42

|

1,628,127

|

104.14

|

1,464,002

|

104.74

|

1,170,981

|

103.13

|

1,090,045

|

103.50

|

||||||||||||||||||||||||||||||

|

Less:

|

||||||||||||||||||||||||||||||||||||||||

|

Undisbursed loans in process

|

43,153

|

2.34

|

46,533

|

2.98

|

50,740

|

3.63

|

21,779

|

1.92

|

24,688

|

2.34

|

||||||||||||||||||||||||||||||

|

Deferred fees and discounts

|

3

|

0.00

|

---

|

---

|

(6

|

)

|

(0.00

|

)

|

(42

|

)

|

(0.00

|

)

|

(87

|

)

|

(0.01

|

)

|

||||||||||||||||||||||||

|

Allowance for loan losses

|

19,903

|

1.08

|

18,214

|

1.16

|

15,538

|

1.11

|

13,791

|

1.21

|

12,298

|

1.17

|

||||||||||||||||||||||||||||||

|

Net loans receivable

|

$

|

1,846,405

|

100.00

|

%

|

$

|

1,563,380

|

100.00

|

%

|

$

|

1,397,730

|

100.00

|

%

|

$

|

1,135,453

|

100.00

|

%

|

$

|

1,053,146

|

100.00

|

%

|

||||||||||||||||||||

|

Type of Security:

|

||||||||||||||||||||||||||||||||||||||||

|

Residential real estate

|

||||||||||||||||||||||||||||||||||||||||

|

One- to four-family

|

$

|

395,317

|

21.41

|

%

|

$

|

414,258

|

26.50

|

%

|

$

|

352,723

|

25.24

|

%

|

$

|

326,186

|

28.73

|

%

|

$

|

316,804

|

30.08

|

%

|

||||||||||||||||||||

|

Multi-family

|

172,303

|

9.33

|

137,238

|

8.78

|

151,585

|

10.85

|

128,980

|

11.36

|

118,178

|

11.22

|

||||||||||||||||||||||||||||||

|

Commercial real estate

|

647,078

|

35.05

|

502,073

|

32.11

|

463,890

|

33.19

|

329,781

|

29.04

|

296,082

|

28.11

|

||||||||||||||||||||||||||||||

|

Land

|

241,360

|

13.07

|

214,715

|

13.73

|

184,967

|

13.23

|

137,448

|

12.11

|

120,327

|

11.43

|

||||||||||||||||||||||||||||||

|

Commercial

|

355,874

|

19.28

|

281,272

|

17.99

|

247,184

|

17.68

|

202,045

|

17.79

|

191,884

|

18.22

|

||||||||||||||||||||||||||||||

|

Consumer and other

|

97,532

|

5.28

|

78,571

|

5.03

|

63,653

|

4.55

|

46,541

|

4.10

|

46,770

|

4.44

|

||||||||||||||||||||||||||||||

|

Total loans

|

1,909,464

|

103.42

|

1,628,127

|

104.14

|

1,464,002

|

104.74

|

1,170,981

|

103.13

|

1,090,045

|

103.50

|

||||||||||||||||||||||||||||||

|

Less:

|

||||||||||||||||||||||||||||||||||||||||

|

Undisbursed loans in process

|

43,153

|

2.34

|

46,533

|

2.98

|

50,740

|

3.63

|

21,779

|

1.92

|

24,688

|

2.34

|

||||||||||||||||||||||||||||||

|

Deferred fees and discounts

|

3

|

0.00

|

---

|

---

|

(6

|

)

|

(0.00

|

)

|

(42

|

)

|

(0.00

|

)

|

(87

|

)

|

(0.01

|

)

|

||||||||||||||||||||||||

|

Allowance for loan losses

|

19,903

|

1.08

|

18,214

|

1.16

|

15,538

|

1.21

|

13,791

|

1.21

|

12,298

|

1.17

|

||||||||||||||||||||||||||||||

|

Net loans receivable

|

$

|

1,846,405

|

100.00

|

%

|

$

|

1,563,380

|

100.00

|

%

|

$

|

1,397,730

|

100.00

|

%

|

$

|

1,135,453

|

100.00

|

%

|

$

|

1,053,146

|

100.00

|

%

|

||||||||||||||||||||

|

At June 30,

|

||||||||||||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||||||||||||||||||||

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

|||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Type of Loan:

|

||||||||||||||||||||||||||||||||||||||||

|

Fixed-Rate Loans:

|

||||||||||||||||||||||||||||||||||||||||

|

Residential real estate

|

$

|

254,234

|

13.77

|

%

|

$

|

207,405

|

13.27

|

%

|

$

|

189,054

|

13.53

|

%

|

$

|

172,901

|

15.23

|

%

|

$

|

171,479

|

16.28

|

%

|

||||||||||||||||||||

|

Commercial real estate

|

658,874

|

35.68

|

557,556

|

35.66

|

476,132

|

34.06

|

356,613

|

31.41

|

313,361

|

29.75

|

||||||||||||||||||||||||||||||

|

Construction

|

116,304

|

6.30

|

104,995

|

6.72

|

89,542

|

6.40

|

58,330

|

5.14

|

51,973

|

4.94

|

||||||||||||||||||||||||||||||

|

Consumer

|

51,905

|

2.81

|

36,784

|

2.35

|

26,305

|

1.88

|

21,338

|

1.88

|

22,973

|

2.18

|

||||||||||||||||||||||||||||||

|

Commercial business

|

222,290

|

12.04

|

151,766

|

9.71

|

137,613

|

9.85

|

137,426

|

12.10

|

127,017

|

12.06

|

||||||||||||||||||||||||||||||

|

Total fixed-rate loans

|

1,303,607

|

70.60

|

1,058,506

|

67.71

|

918,646

|

65.72

|

746,608

|

65.76

|

686,803

|

65.21

|

||||||||||||||||||||||||||||||

|

Adjustable-Rate Loans:

|

||||||||||||||||||||||||||||||||||||||||

|

Residential real estate

|

237,758

|

12.88

|

243,514

|

15.58

|

253,409

|

18.13

|

220,073

|

19.38

|

205,986

|

19.56

|

||||||||||||||||||||||||||||||

|

Commercial real estate

|

181,903

|

9.85

|

147,091

|

9.41

|

127,790

|

9.14

|

95,439

|

8.41

|

91,359

|

8.67

|

||||||||||||||||||||||||||||||

|

Construction

|

6,983

|

0.38

|

7,723

|

0.49

|

17,240

|

1.23

|

19,039

|

1.68

|

17,231

|

1.64

|

||||||||||||||||||||||||||||||

|

Consumer

|

45,629

|

2.47

|

41,787

|

2.67

|

37,346

|

2.67

|

25,203

|

2.22

|

23,797

|

2.26

|

||||||||||||||||||||||||||||||

|

Commercial business

|

133,584

|

7.23

|

129,506

|

8.28

|

109,571

|

7.85

|

64,619

|

5.68

|

64,869

|

6.16

|

||||||||||||||||||||||||||||||

|

Total adjustable-rate loans

|

605,857

|

32.81

|

569,621

|

39.43

|

545,356

|

39.02

|

424,373

|

37.37

|

403,242

|

38.29

|

||||||||||||||||||||||||||||||

|

Total loans

|

1,909,464

|

103.41

|

1,628,127

|

104.14

|

1,464,002

|

104.74

|

1,170,981

|

103.13

|

1,090,045

|

103.50

|

||||||||||||||||||||||||||||||

|

Less:

|

||||||||||||||||||||||||||||||||||||||||

|

Undisbursed loans in process

|

43,153

|

2.34

|

46,533

|

2.98

|

50,740

|

3.63

|

21,779

|

1.92

|

24,688

|

2.34

|

||||||||||||||||||||||||||||||

|

Net deferred loan fees

|

3

|

0.00

|

---

|

---

|

(6

|

)

|

(0.00

|

)

|

(42

|

)

|

(0.00

|

)

|

(87

|

)

|

(0.01

|

)

|

||||||||||||||||||||||||

|

Allowance for loan loss

|

19,903

|

1.07

|

18,214

|

1.16

|

15,538

|

1.11

|

13,791

|

1.21

|

12,298

|

1.17

|

||||||||||||||||||||||||||||||

|

Net loans receivable

|

$

|

1,846,405

|

100.00

|

%

|

$

|

1,563,380

|

100.00

|

%

|

$

|

1,397,730

|

100.00

|

%

|

$

|

1,135,453

|

100.00

|

%

|

$

|

1,053,146

|

100.00

|

%

|

||||||||||||||||||||

|

Less Than

1 Year

|

1-3 Years

|

4-5 Years

|

More Than

5 Years

|

Total

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Federal Home Loan Bank advances

|

$

|

2,934

|

$

|

33,595

|

$

|

8,000

|

$

|

379

|

$

|

44,908

|

||||||||||

|

Certificates of deposit

|

467,676

|

191,025

|

20,558

|

---

|

679,259

|

|||||||||||||||

|

Total

|

$

|

470,610

|

$

|

224,620

|

$

|

28,558

|

$

|

379

|

$

|

724,167

|

||||||||||

|

Less Than

1 Year

|

1-3 Years

|

4-5 Years

|

More Than

5 Years

|

Total

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Construction loans in process

|

$

|

43,153

|

$

|

---

|

$

|

---

|

$

|

---

|

$

|

43,153

|

||||||||||

|

Other loan commitments

|

202,906

|

23,485

|

11,642

|

36,228

|

274,261

|

|||||||||||||||

|

$

|

246,059

|

$

|

23,485

|

$

|

11,642

|

$

|

36,228

|

$

|

317,414

|

|||||||||||

|

Within

One Year

|

After

One Year

Through

5 Years

|

After

5 Years

Through

10 Years

|

After

10 Years |

Total

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Residential real estate

|

$

|

178,405

|

$

|

211,478

|

$

|

74,120

|

$

|

27,989

|

$

|

491,992

|

||||||||||

|

Commercial real estate

|

231,664

|

425,260

|

175,456

|

8,397

|

840,777

|

|||||||||||||||

|

Construction

|

111,537

|

7,183

|

4,567

|

---

|

123,287

|

|||||||||||||||

|

Consumer

|

66,920

|

28,968

|

1,512

|

134

|

97,534

|

|||||||||||||||

|

Commercial business

|

205,087

|

134,912

|

12,757

|

3,118

|

355,874

|

|||||||||||||||

|

Total loans

|

$

|

793,613

|

$

|

807,801

|

$

|

268,412

|

$

|

39,638

|

$

|

1,909,464

|

||||||||||

|

Year Ended June 30,

|

||||||||||||

|

2019

|

2018

|

2017

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Total loans at beginning of period

|

$

|

1,628,127

|

$

|

1,464,002

|

$

|

1,170,981

|

||||||

|

Loans originated:

|

||||||||||||

|

One- to four-family residential

|

106,113

|

96,061

|

94,733

|

|||||||||

|

Multi-family residential and

|

||||||||||||

|

commercial real estate

|

234,075

|

185,914

|

235,427

|

|||||||||

|

Construction loans

|

97,442

|

115,919

|

69,087

|

|||||||||

|

Commercial business

|

143,776

|

134,318

|

78,342

|

|||||||||

|

Consumer and others

|

24,921

|

18,316

|

17,326

|

|||||||||

|

Total loans originated

|

606,327

|

550,528

|

494,915

|

|||||||||

|

Loans purchased:

|

||||||||||||

|

Total loans purchased (1)

|

166,112

|

72,846

|

158,808

|

|||||||||

|

Loans sold:

|

||||||||||||

|

Total loans sold

|

(50,488

|

)

|

(64,073

|

)

|

(56,131

|

)

|

||||||

|

Principal repayments

|

(431,898

|

)

|

(386,912

|

)

|

(295,615

|

)

|

||||||

|

Participation principal repayments

|

(6,438

|

)

|

(6,098

|

)

|

(7,758

|

)

|

||||||

|

Foreclosures

|

(2,278

|

)

|

(2,166

|

)

|

(1,198

|

)

|

||||||

|

Net loan activity

|

281,337

|

164,125

|

293,021

|

|||||||||

|

Total loans at end of period

|

$

|

1,909,464

|

$

|

1,628,127

|

$

|

1,464,002

|

||||||

|

______________

|

||||||||||||

|

(1)

|

Amount reported in fiscal 2019 includes the Company’s acquisition of loans from the Gideon acquisition recorded at a $144.3 million fair value.

|

|

(2)

|

Amount reported in fiscal 2018 includes the Company’s acquisition of loans from the Marshfield acquisition recorded at a $68.3 million fair value.

|

|

(3)

|

Amount reported in fiscal 2017 includes the Company’s acquisition of loans from the Capaha acquisition recorded at a $152.2 million fair value.

|

Loan Commitments

|

Loans Delinquent For:

|

||||||||||||||||||||||||

|

60-89 Days

|

90 Days and Over

|

Total Loans

Delinquent 60 Days

or More

|

||||||||||||||||||||||

|

Numbers

|

Amounts

|

Numbers

|

Amounts

|

Numbers

|

Amounts

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Residential real estate

|

22

|

$

|

1,054

|

27

|

$

|

1,714

|

49

|

$

|

2,768

|

|||||||||||||||

|

Commercial real estate

|

1

|

1

|

7

|

5,617

|

8

|

5,618

|

||||||||||||||||||

|

Construction

|

---

|

---

|

---

|

---

|

---

|

---

|

||||||||||||||||||

|

Consumer

|

10

|

46

|

14

|

176

|

24

|

222

|

||||||||||||||||||

|

Commercial Business

|

3

|

25

|

13

|

1,902

|

16

|

1,927

|

||||||||||||||||||

|

Totals

|

36

|

$

|

1,126

|

61

|

$

|

9,409

|

97

|

$

|

10,535

|

|||||||||||||||

|

At June 30,

|

||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Nonaccruing loans:

|

||||||||||||||||||||

|

Residential real estate

|

$

|

6,404

|

$

|

5,913

|

$

|

1,263

|

$

|

2,676

|

$

|

2,202

|

||||||||||

|

Construction

|

---

|

25

|

35

|

388

|

133

|

|||||||||||||||

|

Commercial real estate

|

10,876

|

1,962

|

960

|

1,797

|

1,271

|

|||||||||||||||

|

Consumer

|

309

|

209

|

158

|

160

|

88

|

|||||||||||||||

|

Commercial business

|

3,424

|

1,063

|

409

|

603

|

63

|

|||||||||||||||

|

Total

|

21,013

|

9,172

|

2,825

|

5,624

|

3,757

|

|||||||||||||||

|

Loans 90 days past due

accruing interest: |

||||||||||||||||||||

|

Residential real estate

|

---

|

---

|

59

|

---

|

---

|

|||||||||||||||

|

Construction

|

---

|

---

|

---

|

---

|

---

|

|||||||||||||||

|

Commercial real estate

|

---

|

---

|

---

|

---

|

---

|

|||||||||||||||

|

Consumer

|

---

|

---

|

13

|

7

|

34

|

|||||||||||||||

|

Commercial business

|

---

|

---

|

329

|

31

|

11

|

|||||||||||||||

|

Total

|

---

|

---

|

401

|

38

|

45

|

|||||||||||||||

|

Total nonperforming loans

|

21,013

|

9,172

|

3,226

|

5,662

|

3,802

|

|||||||||||||||

|

Nonperforming investments

|

---

|

---

|

---

|

---

|

---

|

|||||||||||||||

|

Foreclosed assets held for sale:

|

||||||||||||||||||||

|

Real estate owned

|

3,723

|

3,874

|

3,014

|

3,305

|

4,440

|

|||||||||||||||

|

Other nonperforming assets

|

29

|

50

|

86

|

61

|

64

|

|||||||||||||||

|

Total nonperforming assets

|

$

|

24,765

|

$

|

13,096

|

$

|

6,326

|

$

|

9,028

|

$

|

8,306

|

||||||||||

|

Total nonperforming loans

to net loans

|

1.14

|

%

|

0.59

|

%

|

0.23

|

%

|

0.50

|

%

|

0.36

|

%

|

||||||||||

|

Total nonperforming loans

to total assets

|

0.95

|

%

|

0.49

|

%

|

0.19

|

%

|

0.40

|

%

|

0.29

|

%

|

||||||||||

|

Total nonperforming assets

to total assets

|

1.12

|

%

|

0.69

|

%

|

0.37

|

%

|

0.64

|

%

|

0.64

|

%

|

||||||||||

|

Year Ended June 30,

|

||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Allowance at beginning of period

|

$

|

18,214

|

$

|

15,538

|

$

|

13,791

|

$

|

12,298

|

$

|

9,259

|

||||||||||

|

Recoveries

|

||||||||||||||||||||

|

Residential real estate

|

23

|

2

|

10

|

5

|

11

|

|||||||||||||||

|

Construction real estate

|

---

|

---

|

1

|

---

|

---

|

|||||||||||||||

|

Commercial real estate

|

5

|

2

|

20

|

46

|

47

|

|||||||||||||||

|

Commercial business

|

2

|

8

|

31

|

15

|

33

|

|||||||||||||||

|

Consumer

|

16

|

23

|

8

|

8

|

4

|

|||||||||||||||

|

Total recoveries

|

46

|

35

|

70

|

74

|

95

|

|||||||||||||||

|

Charge offs:

|

||||||||||||||||||||

|

Residential real estate

|

30

|

190

|

211

|

167

|

54

|

|||||||||||||||

|

Construction real estate

|

---

|

9

|

31

|

---

|

---

|

|||||||||||||||

|

Commercial real estate

|

164

|

56

|

19

|

97

|

9

|

|||||||||||||||

|

Commercial business

|

92

|

22

|

337

|

725

|

128

|

|||||||||||||||

|

Consumer

|

103

|

129

|

65

|

86

|

50

|

|||||||||||||||

|

Total charge offs

|

389

|

406

|

663

|

1,075

|

241

|

|||||||||||||||

|

Net charge offs

|

(343

|

)

|

(371

|

)

|

(593

|

)

|

(1,001

|

)

|

(146

|

)

|

||||||||||

|

Provision for loan losses

|

2,032

|

3,047

|

2,340

|

2,494

|

3,185

|

|||||||||||||||

|

Balance at end of period

|

$

|

19,903

|

$

|

18,214

|

$

|

15,538

|

$

|

13,791

|

$

|

12,298

|

||||||||||

|

Ratio of allowance to total loans

outstanding at the end of the period

|

1.07

|

%

|

1.15

|

%

|

1.10

|

%

|

1.20

|

%

|

1.15

|

%

|

||||||||||

|

Ratio of net charge offs to average

loans outstanding during the period

|

0.02

|

%

|

0.02

|

%

|

0.05

|

%

|

0.09

|

%

|

0.01

|

%

|

||||||||||

|

At June 30,

|

||||||||||||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||||||||||||||||||||

|

Amount

|

Percent of

Loans in Each Category to Total Loans |

Amount

|

Percent of

Loans in Each Category to Total Loans |

Amount

|

Percent of

Loans in Each Category to Total Loans |

Amount

|

Percent of

Loans in Each Category to Total Loans |

Amount

|

Percent of

Loans in Each Category to Total Loans |

|||||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Residential real estate

|

$

|

3,706

|

25.76

|

%

|

$

|

3,226

|

27.70

|

%

|

$

|

3,230

|

30.22

|

%

|

$

|

3,247

|

33.56

|

%

|

$

|

2,819

|

34.63

|

%

|

||||||||||||||||||||

|

Construction

|

1,365

|

6.46

|

1,097

|

6.92

|

964

|

7.30

|

1,091

|

6.61

|

899

|

6.35

|

||||||||||||||||||||||||||||||

|

Commercial real estate

|

9,399

|

44.03

|

8,793

|

43.28

|

7,068

|

41.25

|

5,711

|

38.60

|

4,956

|

37.13

|

||||||||||||||||||||||||||||||

|

Consumer

|

1,046

|

5.11

|

902

|

4.82

|

757

|

4.35

|

738

|

3.98

|

758

|

4.29

|

||||||||||||||||||||||||||||||

|

Commercial business

|

4,387

|

18.64

|

4,196

|

17.28

|

3,519

|

16.88

|

3,004

|

17.25

|

2,866

|

17.60

|

||||||||||||||||||||||||||||||

|

Total allowance for

loan losses |

$

|

19,903

|

100.00

|

%

|

$

|

18,214

|

100.00

|

%

|

$

|

15,538

|

100.00

|

%

|

$

|

13,791

|

100.00

|

%

|

$

|

12,298

|

100.00

|

%

|

||||||||||||||||||||

|

At June 30,

|

||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

||||||||||||||||||||||

|

Fair

Value

|

Percent of

Portfolio

|

Fair

Value

|

Percent of

Portfolio

|

Fair

Value

|

Percent of

Portfolio

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

U.S. government and government

agencies

|

$

|

7,270

|

11.07

|

%

|

$

|

9,385

|

14.13

|

%

|

$

|

10,438

|

14.34

|

%

|

||||||||||||

|

State and political subdivisions

|

42,783

|

65.14

|

41,612

|

62.65

|

49,978

|

68.66

|

||||||||||||||||||

|

Other securities

|

5,053

|

7.69

|

5,152

|

7.76

|

5,725

|

7.86

|

||||||||||||||||||

|

FHLB/FNBB/MIB membership stock

|

6,222

|

9.47

|

6,701

|

10.09

|

4,295

|

5.90

|

||||||||||||||||||

|

Federal Reserve Bank membership stock

|

4,350

|

6.62

|

3,566

|

5.37

|

2,357

|

3.24

|

||||||||||||||||||

|

Total

|

$

|

65,678

|

100.00

|

%

|

$

|

66,416

|

100.00

|

%

|

$

|

72,793

|

100.00

|

%

|

||||||||||||

|

Available for Sale Securities

June 30, 2019

|

||||||||||||

|

Amortized

Cost |

Fair

Value |

Tax-Equiv.

Wtd.-Avg. Yield |

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

U.S. government and government agency securities:

|

||||||||||||

|

Due within 1 year

|

$

|

4,794

|

$

|

4,788

|

1.68

|

%

|

||||||

|

Due after 1 year but within 5 years

|

2,490

|

2,482

|

1.88

|

|||||||||

|

Due after 5 years but within 10 years

|

---

|

---

|

---

|

|||||||||

|

Due over 10 years

|

---

|

---

|

---

|

|||||||||

|

Total

|

7,284

|

7,270

|

1.75

|

|||||||||

|

State and political subdivisions:

|

||||||||||||

|

Due within 1 year

|

1,984

|

1,989

|

2.23

|

%

|

||||||||

|

Due after 1 year but within 5 years

|

7,699

|

7,755

|

2.86

|

|||||||||

|

Due after 5 years but within 10 years

|

15,664

|

15,862

|

3.20

|

|||||||||

|

Due over 10 years

|

16,776

|

17,177

|

3.38

|

|||||||||

|

Total

|

42,123

|

42,783

|

3.16

|

|||||||||

|

Other securities:

|

||||||||||||

|

Due within 1 year

|

---

|

---

|

---

|

%

|

||||||||

|

Due after 1 year but within 5 years

|

---

|

---

|

---

|

|||||||||

|

Due after 5 years but within 10 years

|

3,993

|

4,068

|

5.44

|

|||||||||

|

Due over 10 years

|

1,183

|

985

|

3.35

|

|||||||||

|

Total

|

5,176

|

5,053

|

4.96

|

|||||||||

|

No stated maturity:

|

||||||||||||

|

FHLB/FNBB/MIB membership stock

|

6,222

|

6,222

|

3.82

|

%

|

||||||||

|

Federal Reserve Bank membership stock

|

4,350

|

4,350

|

5.81

|

|||||||||

|

Total

|

10,572

|

10,572

|

4.64

|

|||||||||

|

Total debt and other securities

|

$

|

65,155

|

$

|

65,678

|

3.39

|

%

|

||||||

|

At June 30, 2019

|

||||

|

(Dollars in thousands)

|

||||

|

Amounts due:

|

||||

|

Within 1 year

|

$

|

7

|

||

|

After 1 year through 3 years

|

6

|

|||

|

After 3 years through 5 years

|

2,410

|

|||

|

After 5 years

|

106,874

|

|||

|

Total

|

$

|

109,297

|

||

|

At June 30, 2019

|

||||

|

(Dollars in thousands)

|

||||

|

Interest rate terms on amounts due after 1 year:

|

||||

|

Fixed

|

$

|

109,297

|

||

|

Adjustable

|

---

|

|||

|

Total

|

$

|

109,297

|

||

|

At June 30,

|

||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

||||||||||||||||||||||

|

Amortized

Cost

|

Fair

Value

|

Amortized

Cost

|

Fair

Value

|

Amortized

Cost

|

Fair

Value

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

FHLMC certificates

|

$

|

16,373

|

$

|

16,372

|

$

|

16,598

|

$

|

16,113

|

$

|

21,380

|

$

|

21,489

|

||||||||||||

|

GNMA certificates

|

35

|

35

|

38

|

38

|

1,437

|

1,449

|

||||||||||||||||||

|

FNMA certificates

|

34,943

|

35,458

|

25,800

|

25,062

|

28,457

|

28,628

|

||||||||||||||||||

|

Collateralized mortgage obligations issued

by government agencies

|

57,946

|

58,564

|

50,272

|

48,963

|

26,814

|

26,709

|

||||||||||||||||||

|

Total

|

$

|

109,297

|

$

|

110,429

|

$

|

92,708

|

$

|

90,176

|

$

|

78,088

|

$

|

78,275

|

||||||||||||

| As of June 30, 2019 | ||||||||||||||||

|

Weighted

Average Interest Rate |

Term

|

Category

|

Minimum

Amount |

Balance

|

Percentage

of Total Deposits |

|||||||||||

|

(Dollars in thousands)

|

||||||||||||||||

|

0.00%

|

None

|

Non-interest Bearing

|

$

|

100

|

$

|

218,889

|

11.56

|

%

|

||||||||

|

1.01

|

None

|

NOW Accounts

|

100

|

639,219

|

33.76

|

|||||||||||

|

0.73

|

None

|

Savings Accounts

|

100

|

167,973

|

8.87

|

|||||||||||

|

1.38

|

None

|

Money Market Deposit Accounts

|

1,000

|

188,355

|

9.95

|

|||||||||||

|

Certificates of Deposit

|

|

|

|

|||||||||||||

|

1.50

|

6 months or less

|

Fixed Rate/Term

|

1,000

|

26,769

|

1.41

|

|||||||||||

|

1.09

|

6 months or less

|

IRA Fixed Rate/Term

|

1,000

|

1,416

|

0.07

|

|||||||||||

|

2.12

|

7-12 months

|

Fixed Rate/Term

|

1,000

|

172,979

|

9.13

|

|||||||||||

|

1.53

|

7-12 months

|

IRA Fixed Rate/Term

|

1,000

|

15,910

|

0.84

|

|||||||||||

|

2.27

|

13-24 months

|

Fixed Rate/Term

|

1,000

|

268,156

|

14.16

|

|||||||||||

|

2.02

|

13-24 months

|

IRA Fixed Rate/Term

|

1,000

|

27,241

|

1.43

|

|||||||||||

|

2.43

|

25-36 months

|

Fixed Rate/Term

|

1,000

|

58,071

|

3.07

|

|||||||||||

|

2.50

|

25-36 months

|

IRA Fixed Rate/Term

|

1,000

|

12,823

|

0.68

|

|||||||||||

|

2.09

|

48 months and more

|

Fixed Rate/Term

|

1,000

|

76,475

|

4.04

|

|||||||||||

|

1.97

|

48 months and more

|

IRA Fixed Rate/Term

|

1,000

|

19,419

|

1.03

|

|||||||||||

|

$

|

1,893,695

|

100.00

|

%

|

|||||||||||||

|

Maturity Period

|

Amount

|

|||

|

(Dollars in thousands)

|

||||

|

Three months or less

|

$

|

74,943

|

||

|

Over three through six months

|

73,929

|

|||

|

Over six through twelve months

|

145,660

|

|||

|

Over 12 months

|

132,617

|

|||

|

Total

|

$

|

427,149

|

||

| At June 30, | ||||||||||||

|

2019

|

2018

|

2017

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

0.00 - 0.99%

|

$

|

2,447

|

$

|

77,958

|

$

|

200,868

|

||||||

|

1.00 - 1.99%

|

221,409

|

356,172

|

296,964

|

|||||||||

|

2.00 - 2.99%

|

398,931

|

98,842

|

36,228

|

|||||||||

|

3.00 - 3.99%

|

56,310

|

479

|

---

|

|||||||||

|

4.00 - 4.99%

|

162

|

---

|

---

|

|||||||||

|

5.00 - 5.99%

|

---

|

---

|

3,000

|

|||||||||

|

Total

|

$

|

679,259

|

$

|

533,451

|

$

|

537,060

|

||||||

|

Amount Due

|

||||||||||||||||||||||||||||

|

Percent

|

||||||||||||||||||||||||||||

|

Less

|

of Total

|

|||||||||||||||||||||||||||

|

Than One

|

1-2

|

2-3

|

3-4

|

After

|

Certificate

|

|||||||||||||||||||||||

|

Year

|

Years

|

Years

|

Years

|

4 Years

|

Total

|

Accounts

|

||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||

|

0.00 – 0.99%

|

$

|

1,858

|

$

|

284

|

$

|

305

|

$

|

---

|

$

|

---

|

$

|

2,447

|

0.36

|

%

|

||||||||||||||

|

1.00 – 1.99%

|

157,581

|

41,688

|

14,954

|

6,863

|

323

|

221,409

|

32.60

|

|||||||||||||||||||||

|

2.00 - 2.99%

|

290,186

|

82,104

|

17,483

|

6,768

|

2,390

|

398,931

|

58.73

|

|||||||||||||||||||||

|

3.00 - 3.99%

|

18,051

|

28,904

|

5,303

|

2,994

|

1,058

|

56,310

|

8.29

|

|||||||||||||||||||||

|

4.00 - 4.99%

|

---

|

---

|

---

|

---

|

162

|

162

|

0.02

|

|||||||||||||||||||||

|

5.00 - 5.99%

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

|||||||||||||||||||||

|

Total

|

$

|

467,676

|

$

|

152,980

|

$

|

38,045

|

$

|

16,625

|

$

|

3,933

|

$

|

679,259

|

100.00

|

%

|

||||||||||||||

|

At June 30,

|

||||||||||||||||||||||||||||||||||||

|

2019

|

2018

|

2017

|

||||||||||||||||||||||||||||||||||

|

Amount

|

Percent of

Total |

Increase

(Decrease) |

Amount

|

Percent of

Total |

Increase

(Decrease) |

Amount

|

Percent of

Total |

Increase

(Decrease) |

||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||

|

Noninterest bearing

|

$

|

218,889

|

11.56

|

%

|

$

|

15,372

|

$

|

203,517

|

12.88

|

%

|

$

|

17,314

|

$

|

186,203

|

12.79

|

%

|

$

|

54,207

|

||||||||||||||||||

|

NOW checking

|

639,219

|

33.75

|

70,214

|

569,005

|

36.02

|

89,517

|

479,488

|

32.94

|

83,383

|

|||||||||||||||||||||||||||

|

Savings accounts

|

167,973

|

8.87

|

10,433

|

157,540

|

9.97

|

10,293

|

147,247

|

10.12

|

31,533

|

|||||||||||||||||||||||||||

|

Money market deposit

|

188,355

|

9.95

|

71,966

|

116,389

|

7.37

|

10,790

|

105,599

|

7.25

|

27,444

|

|||||||||||||||||||||||||||

|

Fixed-rate certificates

which mature(1):

|

||||||||||||||||||||||||||||||||||||

|

Within one year

|

467,676

|

24.70

|

156,236

|

311,440

|

19.71

|

(15,198

|

)

|

326,638

|

22.44

|

80,734

|

||||||||||||||||||||||||||

|

Within three years

|

191,025

|

10.09

|

14,231

|

176,794

|

11.19

|

13,984

|

162,810

|

11.19

|

59,011

|

|||||||||||||||||||||||||||

|

After three years

|

20,558

|

1.08

|

(24,659

|

)

|

45,217

|

2.86

|

(2,395

|

)

|

47,612

|

3.27

|

(1,408

|

)

|

||||||||||||||||||||||||

|

Variable-rate certificates

which mature:

Within one year

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

|||||||||||||||||||||||||||

|

Within three years

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

---

|

|||||||||||||||||||||||||||

|

Total

|

$

|

1,893,695

|

100.00

|

%

|

$

|

313,793

|

$

|

1,579,902

|

100.00

|

%

|

$

|

124,305

|

$

|

1,455,597

|

100.00

|

%

|

$

|

334,904

|

||||||||||||||||||

|

At June 30,

|

||||||||||||

|

2019

|

2018

|

2017

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Beginning Balance

|

$

|

1,579,902

|

$

|

1,455,597

|

$

|

1,120,693

|

||||||

|

Net increase before interest credited

|

292,585

|

111,480

|

326,432

|

|||||||||

|

Interest credited

|

21,208

|

12,825

|

8,472

|

|||||||||

|

Net increase in deposits

|

313,793

|

124,305

|

334,904

|

|||||||||

|

Ending balance

|

$

|

1,893,695

|

$

|

1,579,902

|

$

|

1,455,597

|

||||||

|

Year Ended June 30,

|

||||||||||||

|

2019

|

2018

|

2017

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Year end balances

|

||||||||||||

|

Short-term FHLB advances

|

$

|

---

|

$

|

66,550

|

$

|

20,000

|

||||||

|

Securities sold under agreements to repurchase

|

4,376

|

3,267

|

10,212

|

|||||||||

|

$

|

4,376

|

$

|

30,212

|

$

|

96,835

|

|||||||

|

Weighted average rate at year end

|

0.93

|

%

|

1.98

|

%

|

1.02

|

%

|

||||||

|

Year Ended June 30,

|

||||||||||||

|

2019

|

2018

|

2017

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

FHLB advances

|

||||||||||||

|

Daily average balance

|

$

|

92,371

|

$

|

56,593

|

$

|

96,065

|

||||||

|

Weighted average interest rate

|

2.57

|

%

|

1.84

|

%

|

1.18

|

%

|

||||||

|

Maximum outstanding at any month end

|

$

|

154,100

|

$

|

88,538

|

$

|

140,361

|

||||||

|

Securities sold under agreements to repurchase

|

||||||||||||

|

Daily average balance

|

$

|

3,988

|

$

|

5,373

|

$

|

22,198

|

||||||

|

Weighted average interest rate

|

0.90

|

%

|

0.70

|

%

|

0.43

|

%

|

||||||

|

Maximum outstanding at any month end

|

$

|

4,703

|

$

|

9,902

|

$

|

28,825

|

||||||

|

Subordinated Debt

|

||||||||||||

|

Daily average balance

|

$

|

14,994

|

$

|

14,897

|

$

|

14,800

|

||||||

|

Weighted average interest rate

|

6.14

|

%

|

5.15

|

%

|

4.37

|

%

|

||||||

|

Maximum outstanding at month end

|

$

|

15,043

|

$

|

14,945

|

$

|

14,848

|

||||||

|

•

|

The Consumer Financial Protection Bureau (“CFPB”), an independent consumer compliance regulatory agency within the FRB, was established. The CFPB is

empowered to exercise broad regulatory, supervisory and enforcement authority over financial institutions with total assets of over $10 billion with respect to Federal consumer financial protection laws. Financial institutions with assets

of less than $10 billion, like the Bank, will continue to be subject to supervision and enforcement by their primary federal banking regulator with respect to federal consumer financial protection laws;

|

|

•

|

The Federal Deposit Insurance Act was amended to require depository institution holding companies to serve as a source of strength for their depository institution

subsidiaries;

|

|

•

|

The prohibition on payment of interest on demand deposits was repealed;

|

|

•

|

Deposit insurance was permanently increased to $250,000; and

|

|

•

|

The deposit insurance assessment base for FDIC insurance is the depository institution's average consolidated total assets less the average tangible equity during the

assessment period;

|

|

•

|

Tier 1 capital treatment for "hybrid" capital items like trust preferred securities was eliminated, subject to various grandfathering and transition rules. As required

by the Act, the federal banking agencies have promulgated new rules on regulatory capital for both depository institutions and their holding companies;

|

|

•

|

Public companies are required to provide their shareholders with a non-binding vote: (i) at least once every three years on the compensation paid to executive officers,

and (ii) at least once every six years on whether shareholders should have a "say on pay" vote every one, two or three years;

|

|

•

|

A separate, non-binding shareholder vote is required regarding golden parachutes for named executive officers when a shareholder vote takes place on mergers,

acquisitions, dispositions or other transactions that would trigger the parachute payments;

|

|

•

|

Securities exchanges are required to prohibit brokers from using their own discretion to vote shares not beneficially owned by them for certain "significant" matters,

which include votes on the election of directors, executive compensation matters, and any other matter determined to be significant;

|

|

•

|

Stock exchanges are prohibited from listing the securities of any issuer that does not have a policy providing for (i) disclosure of its policy on incentive compensation

payable on the basis of financial information reportable under the securities laws, and (ii) the recovery from current or former executive officers, following an accounting restatement triggered by material noncompliance with securities law

reporting requirements, of any incentive compensation paid erroneously during the three-year period preceding the date on which the restatement was required that exceeds the amount that would have been paid on the basis of the restated

financial information;

|

|

•

|

Smaller reporting companies are exempt from complying with the internal control auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act.

|

|

•

|

cash flow of the borrower and/or the project being financed;

|

|

•

|

in the case of a collateralized loan, the changes and uncertainties as to the future value of the collateral;

|

|

•

|

the credit history of a particular borrower;

|

|

•

|

changes in economic and industry conditions; and

|

|

•

|

the duration of the loan.

|

|

•

|

the quality, size and diversity of the loan portfolio;

|

|

•

|

evaluation of non-performing loans;

|

|

•

|

historical default and loss experience;

|

|

•

|

historical recovery experience;

|

|

•

|

economic conditions;

|

|

•

|

risk characteristics of the various classifications of loans; and

|

|

•

|

the amount and quality of collateral, including guarantees, securing the loans.

|

|

•

|

We do not accrue interest income on nonaccrual loans, nonperforming investment securities, or other real estate owned.

|

|

•

|

We must provide for probable loan losses through a current period charge to the provision for loan losses.

|

|

•

|

Non-interest expense increases when we must write down the value of properties in our other real estate owned portfolio to reflect changing market values or recognize

other-than-temporary impairment on nonperforming investment securities.

|

|

•

|

There are legal fees associated with the resolution of problem assets, as well as carrying costs, such as taxes, insurance, and maintenance fees related to our other

real estate owned.

|

|

•

|

The resolution of nonperforming assets requires the active involvement of management, which can divert management’s attention from more profitable activities.

|

|

•

|

loan delinquencies may increase;

|

|

•

|

problem assets and foreclosures may increase;

|

|

•

|

demand for our products and services may decline;

|

|

•

|

loan collateral may decline in value, in turn reducing a customer’s borrowing power and reducing the value of collateral securing our loans; and

|

|

•

|

the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us.

|

|

•

|

We may be exposed to potential asset quality issues or unknown or contingent liabilities of the banks, businesses, assets and liabilities we acquire. If these issues or

liabilities exceed our estimates, our results of operations and financial condition may be adversely affected;

|

|

•

|

Prices at which acquisitions can be made fluctuate with market conditions. We have experienced times during which acquisitions could not be made in

specific markets at prices we considered acceptable and expect that we will experience this condition in the future;

|

|

•

|

The acquisition of other entities generally requires integration of systems, procedures and personnel of the acquired entity into us to make the transaction economically

successful. This integration process is complicated and time consuming and can also be disruptive to the customers of the acquired business. If the integration process is not conducted successfully and with minimal effect on the acquired

business and its customers, we may not realize the anticipated economic benefits of particular acquisitions within the expected time frame, or at all, and we may lose customers or employees of the acquired business. We may also experience

greater than anticipated customer losses even if the integration process is successful.

|

|

•

|

To the extent our costs of an acquisition exceed the fair value of the net assets acquired, the acquisition will generate goodwill. We are required to assess our

goodwill for impairment at least annually, and any goodwill impairment charge could have a material adverse effect on our results of operations and financial condition;

|

|

•

|

To finance an acquisition, we may borrow funds, thereby increasing our leverage and diminishing our liquidity, or raise additional capital, which could dilute the

interests of our existing shareholders; and

|

|

•

|

We have completed three acquisitions since June 2017 which enhanced our rate of growth. We do not necessarily expect to be able to maintain our past rate of growth, and

may not be able to grow at all in the future.

|

|

•

|

actual or anticipated quarterly fluctuations in our operating and financial results;

|

|

•

|

developments related to investigations, proceedings or litigation;

|

|

•

|

changes in financial estimates and recommendations by financial analysts;

|

|

•

|

dispositions, acquisitions and financings;

|

|

•

|

actions of our current shareholders, including sales of common stock by existing shareholders and our directors and executive officers;

|

|

•

|

fluctuations in the stock prices and operating results of our competitors;

|

|

•

|

regulatory developments; and

|

|

•

|

other developments in the financial services industry.

|

|

Total #

of Shares

Purchased

|

Average

Price

Paid Per

Share

|

Total # of Shares

Purchased as Part of

a Publicly

Announced

Program

|

Maximum

Number of

Shares That

May Yet Be

Purchased

|

|||||||||||||

|

06/01/19 - 06/30/19 period

|

25,093

|

$

|

33.07

|

25,093

|

414,649

|

|||||||||||

|

05/01/19 - 05/31/19 period

|

10,258

|

32.79

|

10,258

|

439,742

|

||||||||||||

|

04/01/19 - 04/30/19 period

|

-

|

-

|

-

|

450,000

|

||||||||||||

|

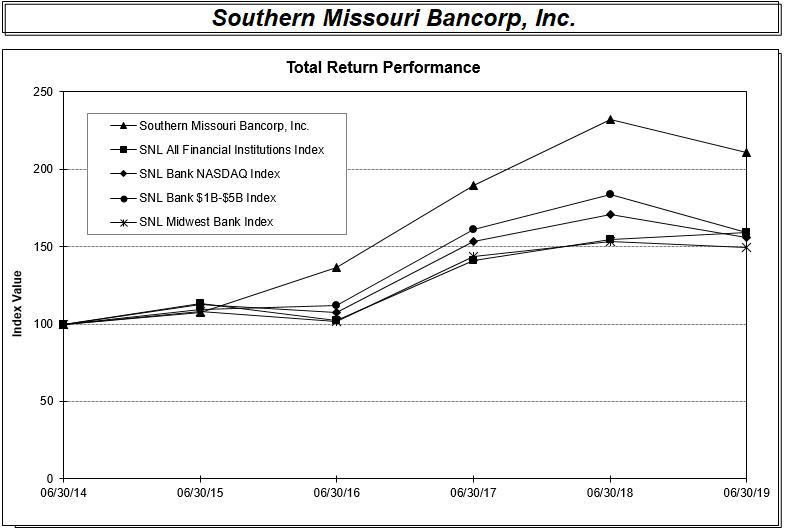

Period Ending

|

||||||||||||||||||||||||

|

Index

|

06/30/14

|

06/30/15

|

06/30/16

|

06/30/17

|

06/30/18

|

06/30/19

|

||||||||||||||||||

|

Southern Missouri Bancorp, Inc.

|

100.00

|

107.58

|

136.47

|

189.71

|

232.40

|

210.53

|

||||||||||||||||||

|

SNL All Financial Institutions Index

|

100.00

|

113.20

|

102.48

|

141.10

|

154.82

|

159.01

|

||||||||||||||||||

|

SNL Bank NASDAQ Index

|

100.00

|

112.91

|

107.25

|

153.34

|

170.73

|

155.85

|

||||||||||||||||||

|

SNL Bank $1B-$5B Index

|

100.00

|

109.35

|

111.97

|

160.80

|

183.35

|

159.41

|

||||||||||||||||||

|

SNL Midwest Bank Index

|

100.00

|

107.96

|

101.53

|

143.35

|

153.06

|

149.17

|

||||||||||||||||||

|

(Dollars in thousands)

|

At June 30,

|

|||||||||||||||||||

|

Financial Condition Data:

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||

|

Total assets

|

$

|

2,214,402

|

$

|

1,886,115

|

$

|

1,707,712

|

$

|

1,403,910

|

$

|

1,300,064

|

||||||||||

|

Loans receivable, net

|

1,846,405

|

1,563,380

|

1,397,730

|

1,135,453

|

1,053,146

|

|||||||||||||||

|

Mortgage-backed securities

|

110,429

|

90,176

|

78,275

|

71,231

|

70,054

|

|||||||||||||||

|

Cash, interest-bearing deposits

|

||||||||||||||||||||

|

and investment securities

|

91,475

|

84,428

|

97,674

|

81,270

|

78,258

|

|||||||||||||||

|

Deposits

|

1,893,695

|

1,579,902

|

1,455,597

|

1,120,693

|

1,055,242

|

|||||||||||||||

|

Borrowings

|

52,284

|

82,919

|

56,849

|

137,301

|

92,126

|

|||||||||||||||

|

Subordinated debt

|

15,043

|

14,945

|

14,848

|

14,753

|

14,658

|

|||||||||||||||

|

Stockholder's equity

|

238,392

|

200,694

|

173,083

|

125,966

|

132,643

|

|||||||||||||||

|

(Dollars in thousands, except per share data)

|

For the Year Ended June 30,

|

|||||||||||||||||||

|

Operating Data:

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||

|

Interest income

|

$

|

97,482

|

$

|

77,174

|

$

|

61,488

|

$

|

56,317

|

$

|

55,301

|

||||||||||

|

Interest expense

|

24,700

|

14,791

|

10,366

|

9,365

|

8,766

|

|||||||||||||||

|

Net interest income

|

72,782

|

62,383

|

51,122

|

46,952

|

46,535

|

|||||||||||||||

|

Provision for loan losses

|

2,032

|

3,047

|

2,340

|

2,494

|

3,185

|

|||||||||||||||

|

Net interest income after

|

||||||||||||||||||||

|

provision for loan losses

|

70,750

|

59,336

|

48,782

|

44,458

|

43,350

|

|||||||||||||||

|

Noninterest income

|

15,170

|

13,871

|

11,084

|

9,758

|

8,659

|

|||||||||||||||

|

Noninterest expense

|

49,969

|

44,475

|

38,252

|

32,686

|

32,285

|

|||||||||||||||

|

Income before income taxes

|

35,951

|

28,732

|

21,614

|

21,530

|

19,724

|

|||||||||||||||

|

Income taxes

|

7,047

|

7,803

|

6,062

|

6,682

|

6,056

|

|||||||||||||||

|

Net Income

|

28,904

|

20,929

|

15,552

|

14,848

|

13,668

|

|||||||||||||||

|

Less: effective dividend on preferred stock

|

---

|

---

|

---

|

85

|

200

|

|||||||||||||||

|

Net income available to common stockholders

|

$

|

28,904

|

$

|

20,929

|

$

|

15,552

|

$

|

14,763

|

$

|

13,468

|

||||||||||

|

Basic earnings per share available to

|

||||||||||||||||||||

|

common stockholders(2)

|

$

|

3.14

|

$

|

2.40

|

$

|

2.08

|

$

|

1.99

|

$

|

1.84

|

||||||||||

|

Diluted earnings per share available to

|

||||||||||||||||||||

|

common stockholders(2)

|

$

|

3.14

|

$

|

2.39

|

$

|

2.07

|

$

|

1.98

|

$

|

1.79

|