0000916789DEF 14Afalseiso4217:USD00009167892023-03-012024-02-2900009167892022-03-012023-02-2800009167892021-03-012022-02-2800009167892020-03-012021-02-280000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-03-012024-02-290000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-03-012023-02-280000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-03-012022-02-280000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-03-012021-02-280000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-03-012024-02-290000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-03-012023-02-280000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-03-012022-02-280000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-03-012021-02-280000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-03-012024-02-290000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-03-012023-02-280000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-03-012022-02-280000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-03-012021-02-280000916789ecd:PeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-03-012024-02-290000916789ecd:PeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-03-012023-02-280000916789ecd:PeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-03-012022-02-280000916789ecd:PeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-03-012021-02-280000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-03-012024-02-290000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-03-012023-02-280000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-03-012022-02-280000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-03-012021-02-280000916789ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-03-012024-02-290000916789ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-03-012023-02-280000916789ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-03-012022-02-280000916789ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-03-012021-02-280000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-03-012024-02-290000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-03-012023-02-280000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-03-012022-02-280000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-03-012021-02-280000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-03-012024-02-290000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-03-012023-02-280000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-03-012022-02-280000916789ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-03-012021-02-280000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-03-012024-02-290000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-03-012023-02-280000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-03-012022-02-280000916789ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-03-012021-02-280000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-03-012024-02-290000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-03-012023-02-280000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-03-012022-02-280000916789ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-03-012021-02-280000916789ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-03-012024-02-290000916789ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-03-012023-02-280000916789ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-03-012022-02-280000916789ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-03-012021-02-280000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-03-012024-02-290000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-03-012023-02-280000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-03-012022-02-280000916789ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-03-012021-02-280000916789ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-03-012024-02-290000916789ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-03-012023-02-280000916789ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-03-012022-02-280000916789ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-03-012021-02-280000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-03-012024-02-290000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-03-012023-02-280000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-03-012022-02-280000916789ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-03-012021-02-28000091678912023-03-012024-02-29000091678922023-03-012024-02-29000091678932023-03-012024-02-29000091678942023-03-012024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under §240.14a-12

HELEN OF TROY LIMITED

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

þ No fee required

o Fee paid previously with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| | | | | | | | | | | |

| | | |

| | | |

WHY HELEN OF TROY | | |

| | | |

| | | |

| Asset and employee light model | Diversified portfolio of leading brands | |

| | | |

| | | |

| Strong cash flow | Sustainable tax advantage | |

| | | |

| | | |

| Low capex needs | Integrated operating company | |

| | | |

| | | |

| Disciplined capital allocation | Proven ability to grow while expanding margin | |

| | | |

| | | |

| Proven M&A track record | History of thorough and transparent disclosure | |

| | | |

| | | |

| Outstanding people and winning culture | Shareholder friendly approach and focus | |

| | | |

| | | |

MESSAGE FROM OUR CHIEF EXECUTIVE OFFICER

| | | | | | | | |

| | Dear Shareholders: It is my pleasure to invite you to the 2024 Annual General Meeting of Shareholders (the “Annual Meeting”) of Helen of Troy Limited (the “Company”) and inform you that the Annual Meeting will be conducted online on Wednesday, August 21, 2024, starting at 11:00 a.m. Eastern Daylight Time. The Annual Meeting will be held in a virtual-only meeting format via live webcast at www.virtualshareholdermeeting.com/HELE2024. You will not be able to attend the Annual Meeting in person. Please review the instructions for virtual attendance included in the “Attending and Participating in the Virtual Annual Meeting” section of the accompanying Proxy Statement. Shareholders will be able to listen, vote, and submit questions from their home or any remote location with Internet connectivity. You will need to provide your 16-digit control number that is on your Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) or on your proxy card if you receive materials by mail. Details regarding how to attend the Annual Meeting online, how to vote and the business to be conducted at the Annual Meeting are more fully described in the accompanying Notice of Annual General Meeting of Shareholders and Proxy Statement. We continue to encourage you to help us reduce printing and mailing costs and conserve natural resources by submitting your proxy with voting instructions via the Internet. It is convenient and saves us significant postage and processing costs. You may also submit your proxy via telephone or by mail if you received paper copies of the proxy materials. Instructions regarding all three methods of voting are included in the Notice of Internet Availability, the proxy card and the Proxy Statement. At our Annual Meeting, we will vote on proposals (1) to elect the nine nominees to our Board of Directors (individually referred to as "Directors" and, collectively, the “Board”), (2) to provide advisory approval of the Company’s executive compensation and (3) to appoint Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm for the 2025 fiscal year and to authorize the Audit Committee of the Board to set the auditor’s remuneration, and transact such other business as may properly come before the Annual Meeting. The accompanying Notice of Annual General Meeting of Shareholders and Proxy Statement contains information that you should consider when you vote your shares. For your convenience, you can appoint your proxy via touch-tone telephone or the Internet at: 1-800-690-6903 or WWW.PROXYVOTE.COM It is important that you vote your shares whether or not you plan to virtually attend the Annual Meeting. If you do not plan on attending the Annual Meeting, we urge each shareholder to promptly sign and return the enclosed proxy card or appoint your proxy by telephone or online so that your shares will be represented and voted at the Annual Meeting. If you plan to attend the Annual Meeting virtually, you may also vote online at that time. On behalf of the management team and the Board of the Company, we would like to extend a thank you to our associates for their outstanding efforts to support the Company this year and to you our shareholders for your continued support and confidence. Sincerely, Noel M. Geoffroy

Chief Executive Officer |

| |

| |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Helen of Troy Limited

Clarendon House

2 Church Street

Hamilton, Bermuda

| | | | | | | | | | | | | | | | | | | | |

DATE AND TIME | | | LOCATION | | | WHO CAN VOTE |

| | | | | | |

August 21, 2024 at 11:00 a.m., Eastern Daylight Time | | | Online only at www.virtualshareholdermeeting.com/HELE2024 | | | The record date for determining shareholders entitled to receive notice of and to vote at the Annual Meeting is June 18, 2024 |

| | | | | | | | |

| Items of Business | | Board Recommendation |

Proposal 1: To elect the nine nominees to our Board of Directors | | ü FOR each Director nominee |

Proposal 2: To provide advisory approval of the Company’s executive compensation | | ü FOR |

| | |

Proposal 3: To appoint Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm for the 2025 fiscal year and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration | | ü FOR |

We will also transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

| | | | | | | | |

| Advance Voting Methods | | E-Proxy IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 21, 2024. In accordance with Securities and Exchange Commission (“SEC”) rules, we are furnishing proxy materials to our shareholders on the Internet, rather than by mail. We believe this e-proxy process expedites our shareholders’ receipt of proxy materials, lowers our costs and reduces the environmental impact of our Annual Meeting. The Notice, Proxy Statement and the Company’s 2024 Annual Report to Shareholders and any other related proxy materials are available on our hosted website at www.proxyvote.com. For additional information, please refer to the section “Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting” in the Proxy Statement. The Notice of Internet Availability of Proxy Materials and, for shareholders who previously requested electronic or paper delivery, the proxy materials, are to be distributed to shareholders on or about July 10, 2024. By Order of the Board of Directors, Tessa N. Judge Chief Legal Officer July 10, 2024 |

| |

TELEPHONE 1-800-690-6903 | |

| |

INTERNET www.proxyvote.com | |

| | | | | | | | |

| | |

| WHETHER OR NOT YOU EXPECT TO VIRTUALLY ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY AS SOON AS POSSIBLE. IF YOU DO VIRTUALLY ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON. MOST SHAREHOLDERS HAVE THREE OPTIONS FOR SUBMITTING THEIR PROXIES PRIOR TO THE ANNUAL MEETING: (1) VIA THE INTERNET, (2) BY PHONE OR (3) BY SIGNING AND RETURNING THE ENCLOSED PROXY. IF YOU HAVE INTERNET ACCESS, WE ENCOURAGE YOU TO APPOINT YOUR PROXY ON THE INTERNET. IT IS CONVENIENT, AND IT SAVES THE COMPANY SIGNIFICANT POSTAGE AND PROCESSING COSTS. | |

| | |

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | INDEX OF KEY GOVERNANCE AND RELATED INFORMATION |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

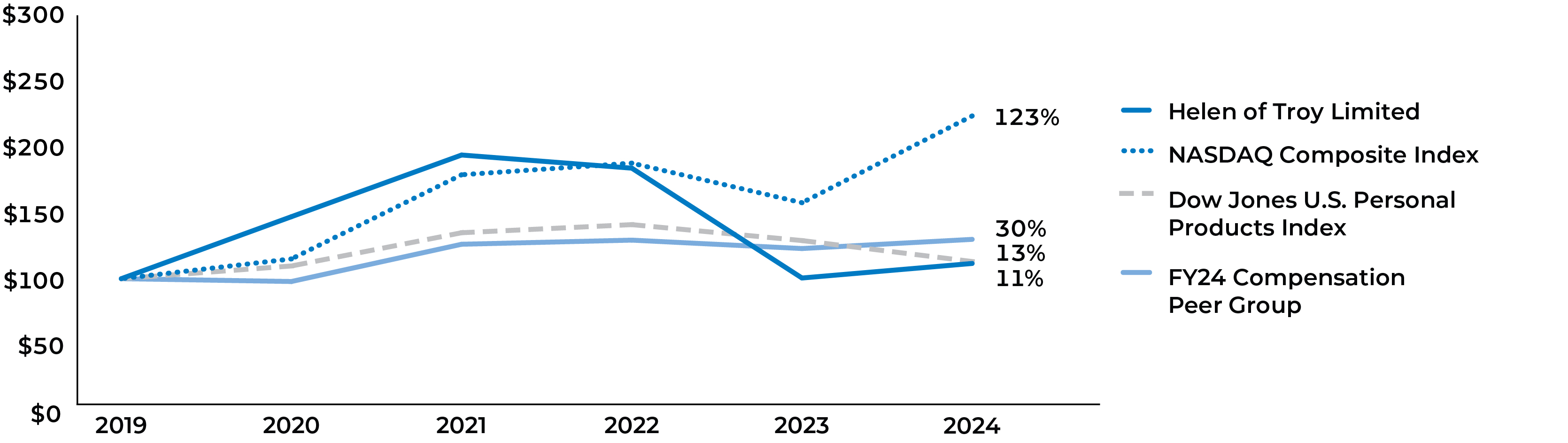

ABOUT HELEN OF TROY

We provide the below highlights of certain financial information. As this is only a summary, please refer to the complete Proxy Statement, 2024 Annual Report to Shareholders and related materials before you vote.

| | | | | |

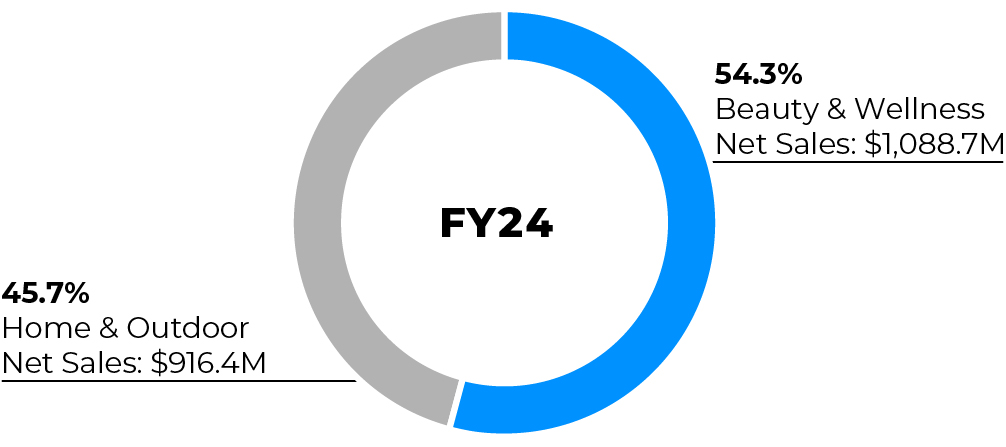

Helen of Troy Limited (NASDAQ: HELE) is a leading global consumer products company offering creative products and solutions for our customers through a diversified portfolio of well-recognized and widely-trusted brands. We go to market under a number of brands, some of which are licensed. Our portfolio of brands include OXO®, Hydro Flask®, Osprey®, Vicks®, Braun®, Honeywell®, PUR®, Hot Tools®, Drybar®, Curlsmith® and Revlon®, among others. We have built leading market positions through new product innovation, product quality and competitive pricing. We operate in two business segments: Home & Outdoor and Beauty & Wellness. | |

Strategy

| | | | | |

Fiscal 2024 concluded Phase II of our Transformation Strategy, which produced net sales and organic net sales growth and gross profit margin expansion. We expanded our Leadership Brands and international footprint with the acquisitions of Drybar, Osprey and Curlsmith. We strategically and effectively deployed capital to construct our new distribution facility in Gallaway, Tennessee, repurchased shares of our common stock, and repaid amounts outstanding under our long-term debt agreement. We began publishing an annual ESG Report, which summarizes our ESG strategy and performance, providing further transparency into our ESG efforts. During Phase II, we also initiated a global restructuring plan referred to as “Project Pegasus”, which included the creation of a North America Regional Market Organization responsible for sales and go-to market strategies for all categories and channels in the U.S. and Canada, and further centralization of certain functions under shared services. With fiscal year 2024 marking the conclusion of Phase II, we have delivered compound annual growth rates for net sales revenue of 5.1%, diluted Earnings Per Share (“EPS”) of 1.2% and adjusted diluted EPS of 2.0%. |

Fiscal 2025 begins our Elevate for Growth Strategy, which provides our strategic roadmap through fiscal 2030. The long-term objectives of Elevate for Growth include continued organic sales growth, further margin expansion, and accretive capital deployment through strategic acquisitions, share repurchases and capital structure management. The Elevate for Growth Strategy includes an enhanced portfolio management strategy to invest in our brands and grow internationally based upon defined criteria with an emphasis on brand building, new product introductions and expanded distribution. | |

We are continuing to execute our initiatives under Project Pegasus, which we expect to generate incremental fuel to invest in our brand portfolio and new capabilities. We intend to further leverage our operational scale and assets, including our new state-of-the-art distribution center, improved go-to-market structure with our North America RMO, and our expanded shared service capabilities. We also plan to complete the U.S. geographic consolidation of our Beauty & Wellness businesses, create a centralized marketing organization that embraces next-level data analytics and consumer insight capabilities, and further integrate our supply chain and finance functions within our shared services. Additionally, we are committed to fostering a winning culture and continuing our ESG efforts to support our Elevate for Growth Strategy. |

CEO Succession Plan and Leadership Change

Julien R. Mininberg retired as Chief Executive Officer (the “CEO”) on February 29, 2024, upon the expiration of the term of his Amended and Restated Employment Agreement with the Company, which became effective March 1, 2021 (the “Mininberg Employment Agreement”). Consistent with the Company’s succession plan, in April 2023, the Company announced the appointment of Noel Geoffroy, the Company’s Chief Operating Officer (“COO”), to serve as the Company’s new CEO, effective March 1, 2024. The appointment of Ms. Geoffroy as CEO was unanimously approved by the Board of Directors of the Company. Until his retirement, Mr. Mininberg continued to serve in his role with the Company and assisted with the transition of the CEO role. As contemplated by, and pursuant to the terms of, the Mininberg Employment Agreement, he ceased to serve as a Director effective upon his retirement as CEO.

Performance Highlights

The following summarizes our performance highlights for Phase II of our Transformation Strategy which began in fiscal year 2020 and concluded with the year ended February 29, 2024 (“fiscal year 2024” or “FY24”):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net sales revenue compound annual growth rate of 5.1% over the past five fiscal years | | | Operating income compound annual growth rate of 5.5% over the past five fiscal years | | | Adjusted operating income compound annual growth rate of 4.7% over the past five fiscal years |

| | | | | | |

| | | | | | |

Diluted EPS from continuing operations compound annual growth rate of 1.2% over the past five fiscal years | | | Adjusted diluted EPS from continuing operations compound annual growth rate of 2.0% over the past five fiscal years | | | Adjusted EBITDA (as defined below) compound annual growth rate of 5.7% over the past five fiscal years |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Adjusted operating income, adjusted diluted EPS and adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) from continuing operations may be considered non-GAAP financial measures as set forth in SEC rules. See “Annex A - Non-GAAP Measures” for a reconciliation of non-GAAP financial measures to our results as reported under GAAP and an explanation of the reasons why the Company believes the non-GAAP financial information is useful and the nature and limitations of the non-GAAP financial measures. On December 20, 2017, we completed the divestiture of the Nutritional Supplements segment through the sale of Healthy Directions LLC and its subsidiaries to Direct Digital, LLC. Following the sale, we no longer consolidate our former Nutritional Supplements segment’s operating results. All results presented above are from continuing operations, which exclude the operating results from the former Nutritional Supplements segment for all periods presented. Fiscal year 2020 includes approximately five weeks of operating results from Drybar Products LLC, acquired on January 23, 2020 and a full year of operating results in each subsequent fiscal year. Fiscal year 2022 includes approximately nine weeks of operating results from Osprey Packs, Inc. (“Osprey”), acquired on December 29, 2021 and a full year of operating results in each subsequent fiscal year. Fiscal year 2023 includes approximately forty-five weeks of operating results from Curlsmith, acquired on April 22, 2022 and a full year of operating results in fiscal year 2024.

PROXY VOTING ROADMAP

We provide the below highlights of certain information in this Proxy Statement. All references in this Proxy Statement to “fiscal year” or “FY” refer to our fiscal year ending on the last day in February of that year. As this is only a summary, please refer to the complete Proxy Statement and related materials before you vote.

| | | | | | | | |

| | |

| VOTING MATTERS: | | Voting Recommendation of the Board |

| Proposal | |

| | |

Elect the nine nominees to our Board of Directors | | ü FOR each nominee |

Provide advisory approval of the Company’s executive compensation | | ü FOR |

| | |

Appoint Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm for the 2025 fiscal year and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration | | ü FOR |

Our Director Nominees to the Board of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Director Since | Independent Director | Board Committee Membership |

| Director Primary Occupation | Age | A | C | N | G |

| | | | | | | | |

| Noel M. Geoffroy Chief Executive Officer Helen of Troy Limited | 53 | 2024 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Timothy F. Meeker Chairman President & Principal Meeker & Associates | 77 | 2004 | ü | | | n | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Krista L. Berry Retired, Chief Revenue Officer Everlane Inc. | 59 | 2017 | ü | n | | n | n |

| | | | | | | | |

| | | | | | | | |

| Vincent D. Carson Retired, Chief Legal Officer and Secretary Helen of Troy Limited | 64 | 2018 | ü | | n | n | |

| | | | | | | | |

| | | | | | | | |

| Thurman K. Case Retired, Chief Financial Officer Cirrus Logic, Inc. | 67 | 2017 | ü | n, E | | | n |

| | | | | | | | |

| | | | | | | | |

| Tabata L. Gomez Chief Marketing Officer McCormick & Company, Inc. | 43 | 2022 | ü | | | | n |

| | | | | | | | |

| | | | | | | | |

| Elena B. Otero Retired, Chief Marketing Officer - International The Clorox Company | 59 | 2022 | ü | | n | | |

| | | | | | | | |

| | | | | | | | |

| Beryl B. Raff Retired, Chairman & CEO Helzberg Diamond Shops, Inc. | 73 | 2014 | ü | n | | | |

| | | | | | | | |

| | | | | | | | |

| Darren G. Woody President & CEO Jordan Foster Construction, LLC | 64 | 2004 | ü | | n | n | n |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

A Audit | C Compensation | N Nominating | G Corporate Governance | |

E Audit Committee Financial Expert | n | Chair | n | Member | | |

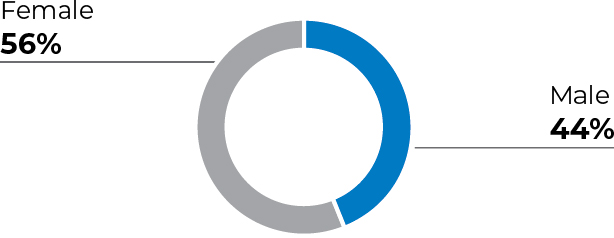

Board Nominees Snapshot

| | | | | | |

| BOARD INDEPENDENCE | BOARD GENDER DIVERSITY | |

| | |

| | |

Key Areas of Skills and Experience

| | | | | | | | | | | | | | | | | |

8/9 | Industry / Product Knowledge |

6/9 | Financial / Accounting |

5/9 | Mergers / Acquisitions |

| | | | | |

6/9 | Multinational Operations |

2/9 | Information Technology / Digital / Cybersecurity |

9/9 | Corporate Strategy / Governance |

| | | | | |

6/9 | Sales / Marketing | | | | |

Corporate Governance Highlights

We are committed to a corporate governance approach that ensures mutually beneficial results for the Company and its shareholders. In pursuit of this approach, we have implemented the following policies:

▪We maintain separate roles for Chairman and CEO.

▪We require majority voting for all Directors.

▪We require annual election for all Directors.

▪Our Nominating Committee’s policy is to review Director qualifications and skill sets on an annual basis to maintain a balance between refreshed and seasoned Directors with knowledge of the Company’s business who reflect diverse backgrounds, qualifications and personal characteristics, including gender, race, ethnicity and age.

▪The Board receives regular reports and updates on key areas of strategy and risk for the Company, including, cybersecurity, climate change and ESG, and talent and human capital management.

▪We maintain stock ownership guidelines for both our Directors and executive officers, further aligning them with our shareholders.

▪We require independent Directors to meet in executive session without management present at every regular Board meeting and throughout the year as needed.

▪The Board of Directors periodically evaluates the rotation of committee membership and chairs.

Executive Compensation Features

Overall, our executive compensation program emphasizes performance- and equity-based compensation to align it with shareholder interests and includes other practices that we believe serve shareholder interests such as paying for performance and maintaining policies relating to clawbacks of incentive awards and prohibitions on hedging or pledging Company stock.

Important features of our executive compensation program include the following:

| | | | | | | | |

| Feature | | Terms |

| Rigorous Performance Metrics | | Established rigorous performance goals based on multiple metrics that are not duplicative between short-term and long-term incentive awards. |

| Long-Term Incentives | | Established multi-year performance periods for long-term incentive awards, with minimum vesting periods for Company equity grants. |

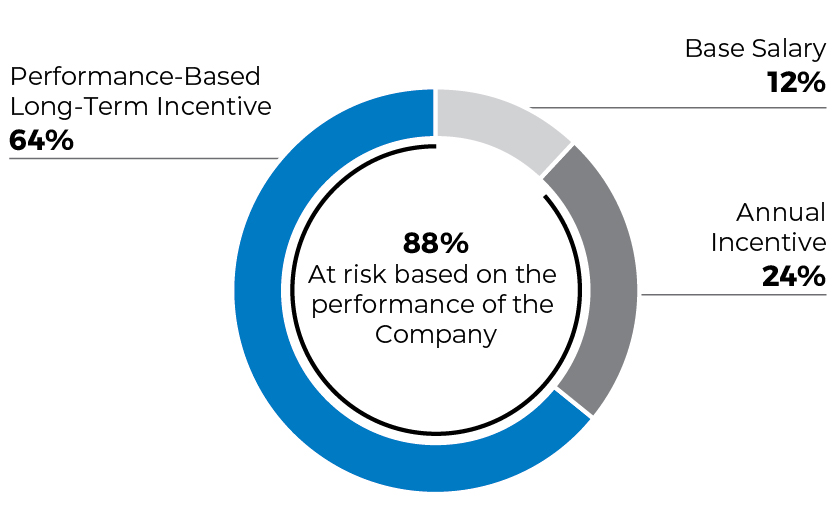

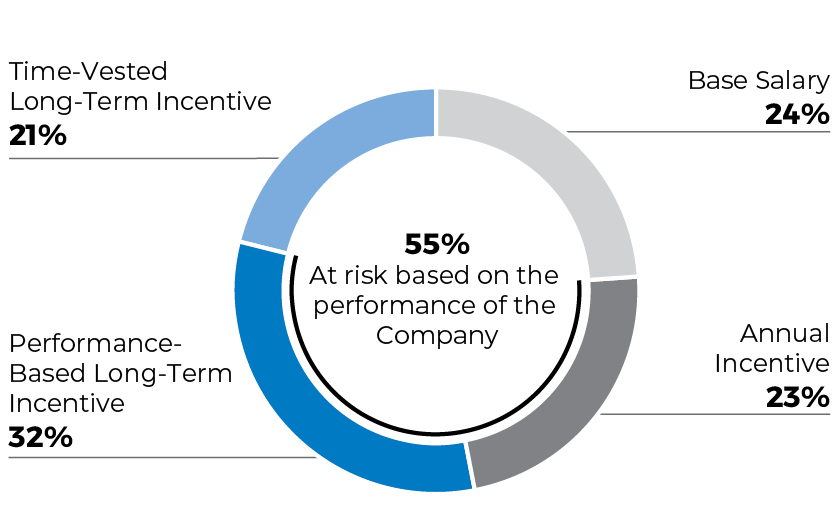

| Pay for Performance | | Our executive compensation programs are designed to demonstrate our execution on our pay for performance philosophy. Approximately 88% of target CEO pay and an average of 55% of target pay (excluding Mr. Grass’s interim CFO compensation) for our other named executive officers in fiscal year 2024 was at risk based on performance of the Company. |

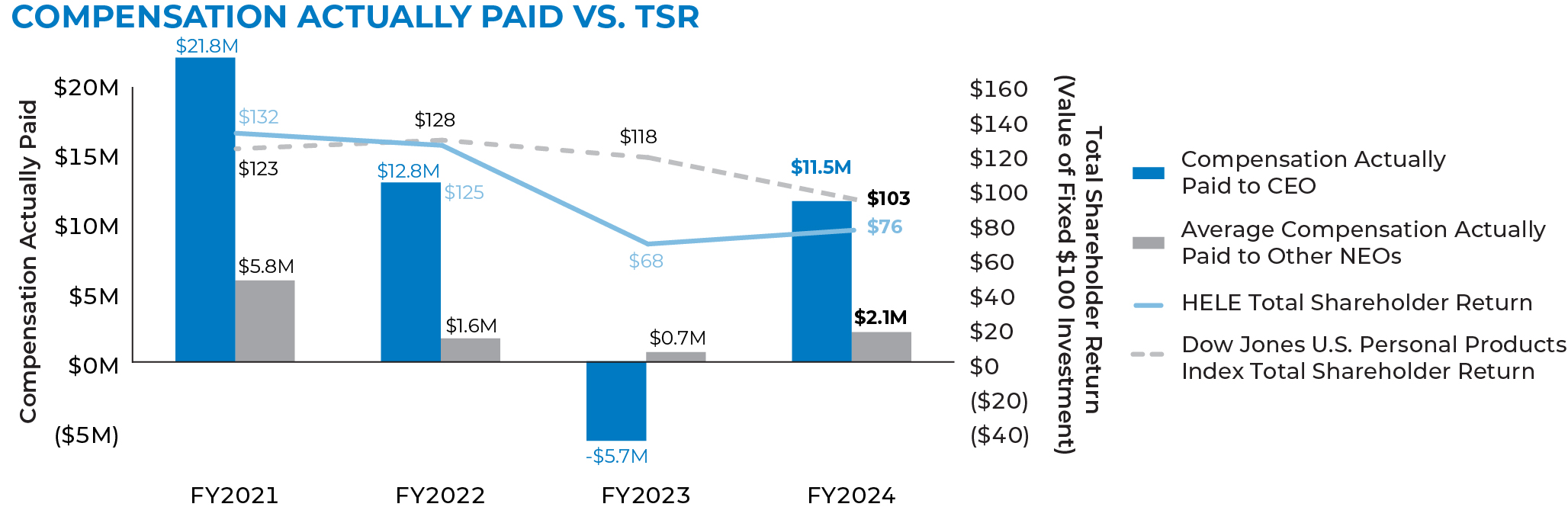

Executive Compensation Program Aligned With Shareholders

Our executive compensation program is aligned with Company performance. During fiscal year 2024, we navigated through a challenging macroeconomic environment including continued inflationary pressures, higher interest rates, lower and shifting consumer demand, and resulting reduced orders from retail customers as they rebalanced trade inventory levels. Our incentive plan results reflect Company performance. For fiscal year 2024, we made payouts to our NEOs based upon a blended 76.3% achievement of the target award measures under our annual incentive plan and we made no payouts under our long-term incentive plan. This aligns with our performance and financial results.

INFORMATION ABOUT SOLICITATION AND VOTING

Solicitation of Proxies

The accompanying proxy is solicited by the Board of Directors of Helen of Troy Limited (the “Company”) for use at its Annual General Meeting of Shareholders to be held virtually on Wednesday, August 21, 2024, promptly at 11:00 a.m., Eastern Daylight Time, and at any adjournment thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders. The Annual Meeting will be held in a virtual-only meeting format via live webcast at:

www.virtualshareholdermeeting.com/HELE2024

There will be no physical meeting location as the Annual Meeting will be conducted via webcast. If you plan to attend the Annual Meeting virtually, please review the instructions for attendance included in the “Attending and Participating in the Virtual Annual Meeting” section of this Proxy Statement. A proxy may be revoked by filing a written notice of revocation or an executed proxy bearing a later date with the Secretary of the Company any time before exercise of the proxy or by attending the Annual Meeting and voting online. The Notice of Internet Availability of Proxy Materials and, for shareholders who previously requested electronic or paper delivery, the proxy materials are to be distributed to shareholders on or about July 10, 2024. If you complete and submit your proxy, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy card but do not fill out the voting instructions on the proxy card, the persons named as proxies will vote the shares represented by your proxy as follows:

▪FOR electing the nine nominees to the Board of Directors, as set forth in Proposal 1.

▪FOR the advisory approval of the Company’s executive compensation, as set forth in Proposal 2.

▪FOR the appointment of Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm for the 2025 fiscal year and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration, as set forth in Proposal 3.

In addition, if other matters are properly presented for voting at the Annual Meeting or any adjournment thereof, the persons named as proxies will vote on such matters in accordance with their judgment. We have not received notice of other matters that may properly be presented for voting at the Annual Meeting. Your vote is important. If you do not vote your shares, you will not have a say in the important issues to be voted upon at the Annual Meeting. For Proposal 1, each nominee for Director receiving a majority of the votes cast (the number of shares voted “for” a Director nominee must exceed the number of votes cast “against” that nominee) at the Annual Meeting in person or by proxy shall be elected. To pass, Proposals 2 and 3 require an affirmative vote of a majority of the votes cast on each such proposal at the Annual Meeting. To ensure that your vote is recorded promptly, please submit your proxy as soon as possible, even if you plan to attend the Annual Meeting virtually.

The Annual Report to Shareholders for fiscal year 2024, including financial statements, is available on our hosted website at www.proxyvote.com. It does not form any part of the material provided for the solicitation of proxies. The financial statements for the 2024 fiscal year and the auditor’s report thereon will be laid before the shareholders at the Annual Meeting.

The cost of solicitation of proxies will be borne by the Company. In addition to solicitation by mail, officers and associates of the Company may solicit the return of proxies by telephone, facsimile, electronic mail, personal interview, and other methods of communication.

We will request brokerage houses and other nominees, fiduciaries and custodians to forward soliciting materials to beneficial owners of the Company’s common shares, par value $0.10 per share (the “Common Stock”), for which we will, upon request, reimburse the forwarding expense.

INFORMATION ABOUT SOLICITATION AND VOTING

Voting Securities and Record Date

The close of business on June 18, 2024, is the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. As of June 18, 2024, there were 22,813,316 shares of Common Stock issued and outstanding, each entitled to one vote per share.

Quorum; Voting

Shareholders may hold their shares either as a “shareholder of record” or as a “street name” holder. If your shares are registered directly in your name with our transfer agent, you are considered the shareholder of record with respect to those shares and this Proxy Statement is being provided directly to you by the Company. If your shares are held in a brokerage account or by another nominee, you are considered to be the beneficial owner of shares held in “street name,” and these proxy materials, together with a voting instruction card, are being forwarded to you by your broker, trustee or other nominee. As the beneficial owner of the shares, you have the right to direct your broker, trustee or other nominee how to vote.

The presence of two or more persons and representing throughout the Annual Meeting, virtually or by proxy, at least a majority of the issued shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Virtual attendance at the Annual Meeting constitutes presence for purposes of a quorum.

Abstentions and broker non-votes are also counted for purposes of determining whether a quorum is present. “Broker non-votes” occur when shares held in street name by a broker or nominee are represented at the Annual Meeting, but such broker or nominee is not empowered to vote those shares on a particular proposal because the broker has not received voting instructions from the beneficial owner.

Under the rules that govern brokers who are voting with respect to shares held by them in street name, if the broker has not been furnished with voting instructions by its client at least ten days before the Annual Meeting, those brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the appointment of the auditor and related matters, submitted to the shareholders in Proposal 3. Non-routine matters include the election of Directors submitted to shareholders in Proposal 1 and the advisory approval of the Company’s executive compensation submitted to shareholders in Proposal 2. As a result, with regard to Proposals 1 and 2, brokers have no discretion to vote shares where no voting instructions are received, and no vote will be cast if you do not vote on those proposals. We therefore urge you to vote on ALL of the proposals.

If a quorum is present, for Proposal 1, each nominee for Director receiving a majority of the votes cast (the number of shares voted “for” a Director nominee must exceed the number of votes cast “against” that nominee) at the Annual Meeting in person or by proxy shall be elected. For Proposal 3, the resolution in Proposal 3 will pass with the affirmative vote of the majority of the votes cast at the Annual Meeting in person or by proxy. For Proposal 2, the advisory votes on the executive compensation are non-binding. Although the vote of Proposal 2 is non-binding, the Compensation Committee and the Board of Directors will review and carefully consider the outcome of those advisory votes and those opinions when making future decisions regarding executive compensation programs. Notwithstanding the advisory nature of the vote, the resolution in Proposal 2 will be considered passed with the affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy. Abstentions and broker non-votes are not counted in determining the total number of votes cast and will have no effect with respect to any of the proposals because abstentions and broker non-votes are not considered to be votes cast under the applicable laws of Bermuda. Furthermore, because brokers, banks and other nominees that do not receive voting instructions may generally vote on Proposal 3 in their discretion since it is considered a routine proposal, broker non-votes are not expected for this matter.

If within half an hour from the time appointed for the Annual Meeting to begin a quorum is not present in person or by proxy, the Annual Meeting shall stand adjourned to the same day one week later, at the same time and place or to such other day, time or place the Board of Directors may determine, provided that at least two persons are present in person at such adjourned meeting and representing throughout such meeting, in person or by proxy, at least a majority of the issued shares of Common Stock entitled to vote. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the Annual Meeting as originally called.

INFORMATION ABOUT SOLICITATION AND VOTING

Attending and Participating in the Virtual Annual Meeting

This year’s Annual Meeting will be accessible through the Internet so our shareholders can participate from any geographic location with Internet connectivity. There will be no physical meeting location for the Annual Meeting. We have worked to offer the same participation opportunities as were provided at the in-person portion of our past meetings, while providing an online experience available to all shareholders regardless of their location.

You are entitled to virtually attend and participate in the Annual Meeting only if you were a shareholder or joint shareholder as of the close of business on June 18, 2024, the record date. All shareholders who want to attend the virtual Annual Meeting must use their issued control number to access the site.

To virtually attend and participate in the Annual Meeting, including to vote, you must access the Annual Meeting website at www.virtualshareholdermeeting.com/HELE2024 and enter the 16-digit control number found on the Notice of Internet Availability of Proxy Materials or on the proxy card or voting instruction card provided to you with this Proxy Statement, or that is set forth within the body of the email sent to you with the link to this Proxy Statement. We encourage you to access the Annual Meeting prior to the start time. Please allow ample time for online check-in, which will begin at 10:45 a.m. Eastern Daylight Time. If you have difficulty accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual shareholder meeting log in page. We will have technicians available to assist you.

Regardless of whether you plan to virtually attend and participate in the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Accordingly, we encourage you to log on to www.proxyvote.com and vote in advance of the Annual Meeting.

We welcome questions from shareholders. If you wish to submit a question, you may do so in two ways. You may ask questions before the Annual Meeting by logging into www.proxyvote.com and entering your 16-digit control number. Alternatively, if you want to submit a question during the Annual Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/HELE2024 following the instructions noted above.

Questions pertinent to Annual Meeting matters will be answered during the meeting, subject to time constraints. Questions not complying with our Annual Meeting rules of conduct will not be answered. Any questions pertinent to Annual Meeting matters that cannot be answered during the meeting due to time constraints will be posted online and answered at www.helenoftroy.com and will remain available for at least one year after the date of the Annual Meeting. Additional information regarding the rules and procedures for participating in the Annual Meeting will be set forth in our Annual Meeting rules of conduct, which shareholders can view during the meeting at the virtual meeting website or during the ten days prior to the Annual Meeting at www.proxyvote.com. Shareholders can also access copies of this Proxy Statement and our Annual Report to Shareholders for the 2024 fiscal year during the Annual Meeting at the virtual meeting website.

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | |

| | Proposal 1: Election of Directors The bye-laws of the Company state the number of our Directors shall be established by the Board of Directors from time to time but shall not be less than two. The Board of Directors has fixed the number of Directors at nine members. Each nominee has consented to serve as a Director if elected. Based on the recommendation of the Nominating Committee, the Board of Directors has nominated the nine candidates set forth below for election to the Board of Directors. All of the nominees, except for Noel Geoffroy, were elected as directors by shareholders at the 2023 annual general meeting of shareholders and are being presented for re-election at the Annual Meeting. Ms. Geoffroy, who was appointed to the Board of Directors upon her succession as the Company’s Chief Executive Officer on March 1, 2024, is not considered an independent Director as defined in the applicable listing standards for companies traded on the NASDAQ Stock Market LLC (“NASDAQ”). The Board of Directors has determined that the remaining eight candidates, Krista L. Berry, Vincent D. Carson, Thurman K. Case, Tabata L. Gomez, Timothy F. Meeker, Elena B. Otero, Beryl B. Raff, and Darren G. Woody are considered independent Directors. Therefore, the majority of persons nominated to serve on our Board of Directors are independent as so defined. Each Director elected shall serve as a Director until the next annual general meeting of shareholders or until his or her successor is elected or appointed. Vote Required for Approval and Recommendation The receipt of a majority of the votes cast (the number of shares voted “for” a Director nominee exceeding the number of votes cast “against” that nominee) at the Annual Meeting is required to elect each of the nine nominees for Director. In the event that any of the Company’s nominees are unable to serve, proxies will be voted for the substitute nominee or nominees designated by our Board of Directors, or will be voted for fewer than nine nominees, as the Board may deem advisable in its discretion. | | |

| | | | | |

| | | | | |

| | ü | THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” EACH OF THE NINE NOMINEES SET FORTH BELOW. | | |

| | | | | |

| | | | | |

| | | | | |

CORPORATE GOVERNANCE AND BOARD MATTERS

Nominees for the Election of Directors

Set forth below are descriptions of the business experience of the nominees for election to our Board of Directors, as well as their qualifications:

| | | | | |

| |

| NOEL M. GEOFFROY |

|

CEO and Director Since: 2024 |

|

Committees: None Age: 53 |

|

| |

| |

Biographical Information Ms. Geoffroy joined the Company in May 2022 and has served as its CEO since March 1, 2024. Prior to her appointment as the CEO, she served as the Company’s COO. Prior to joining the Company, Ms. Geoffroy served as Head of North America Consumer Healthcare at Sanofi S.A., a global healthcare company, and had held such position since January 2019. Prior to that time, she served in various leadership roles from December 2012 to December 2018 at Kellogg Company, an American multinational food manufacturing company, most recently President, US Frozen Foods. Ms. Geoffroy earned her undergraduate degree from Clemson University and her MBA from the University of Virginia. Key Qualifications Ms. Geoffroy brings over 25 years of experience in consumer-facing businesses at recognized brands and organizations, an innovative mindset, operational expertise, and seasoned leadership skills. As our CEO, Ms. Geoffroy provides essential oversight of the business and organization, and a link between management and the Board of Directors. She provides crucial insight to the Board on the Company’s strategic planning and operations. Ms. Geoffroy also plays a key role in communication with shareholders and in leading the Company’s organizational vision and strategy. Ms. Geoffroy also oversees the global business and the strategy and execution of several of the Company’s major transformation projects, a continuation from her time as COO. |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | |

| |

| TIMOTHY F. MEEKER |

|

Director Since: 2004 Chairman Since: 2014 |

|

Committees: Nominating (Chair) Age: 77 |

|

| |

| |

Biographical Information Since 2002, Mr. Meeker has served as President & Principal at Meeker and Associates, a privately-held management consulting firm. Mr. Meeker served as Senior Vice President, Sales & Customer Development for Bristol-Myers Squibb, a consumer products and pharmaceutical company, from 1996 through 2002. From 1989 to 1996, Mr. Meeker served as Vice President of Sales for Bristol-Myers’ Clairol Division. Key Qualifications Mr. Meeker has over forty years of experience in the consumer products industry resulting in extensive general management experience with responsibilities for sales, distribution, finance, human resources, customer service and facilities. In addition, he has a valued perspective on operational matters that is an asset to the Board of Directors. Mr. Meeker has served as a chairman of the National Association of Chain Drug Stores advisory committee, which allows him to bring an extensive understanding of retail mass market sales and marketing to our Board of Directors. |

|

| | | | | |

| |

| KRISTA L. BERRY |

|

Director Since: 2017 |

|

Committees: Audit, Nominating and Corporate Governance (Chair) Age: 59 |

|

| |

| |

Biographical Information Ms. Berry most recently served as the Chief Revenue Officer at Everlane Inc., a digitally based retail start up, from 2017 to 2018. Prior to that, Ms. Berry served as the Chief Digital Officer and Executive Vice President of Multi Channel of Kohl’s Corporation, a department store retail chain, from 2012 to 2016. Prior to her tenure at Kohl’s, Ms. Berry served as the General Manager of North America Direct to Consumer at Nike, Inc., a multinational footwear, apparel, equipment, accessories, and services company, from 2009 to 2011, and as General Manager of North America Digital Commerce from 2007 to 2009. Ms. Berry also held various management positions and leadership roles at Target Corporation, a retail company, from 1987 to 2007. Ms. Berry serves as an Advisory Board Member of Amer Sports. Previously, Ms. Berry served on the Board of Directors of BazaarVoice from 2017 to 2019. Key Qualifications Ms. Berry brings retail and direct to consumer leadership experience in global brands and startups to the Board of Directors, with over twenty years of digital experience, as well as critical knowledge surrounding consumer insights, digital data, social media and product merchandising. |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | |

| |

| VINCENT D. CARSON |

|

Director Since: 2018 |

|

Committees: Compensation and Nominating Age: 64 |

|

| |

| |

Biographical Information In August 2018, Mr. Carson retired from his positions as the Company’s Chief Legal Officer and Secretary, which he had held since May 2014. Prior to his appointment as Chief Legal Officer and Secretary, he served in the capacity of Vice President, General Counsel and Secretary from November 2001 to September 2010. From September 2010 to April 2014, he served as Senior Vice President, General Counsel, and Secretary of the Company. Prior to joining the Company, Mr. Carson had a 16-year legal career in private practice in El Paso, Texas. Key Qualifications As a result of his prior service as the Company’s Chief Legal Officer and Secretary, Mr. Carson brings his unique knowledge of the Company and our industry to the Board of Directors. This experience and knowledge of the Company’s structure, the consumer products industry and Federal, state, local and foreign jurisdictions bring great value and benefit to our Board of Directors and the Company. |

|

| | | | | |

| |

| THURMAN K. CASE |

|

Director Since: 2017 |

|

Committees: Audit (Chair) and Corporate Governance Age: 67 |

|

| |

| |

Biographical Information Mr. Case was the Chief Financial Officer of Cirrus Logic, Inc., a leader in high performance, low-power integrated circuits for audio and voice signal processing applications, from February 2007 to May 2022. Prior to that, Mr. Case served in various positions at Cirrus Logic, including as Vice President, Treasurer, Financial Planning and Analysis from 2004 to 2007, Vice President, Finance from 2002 to 2004, and Director of Finance from 2000 to 2002. Before his tenure at Cirrus Logic, Mr. Case served in a variety of financial leadership positions, including at Case Associates, Inc. and Public Service Company of New Mexico, an electric utilities company. Mr. Case serves on the Board of Directors for Triad Semiconductor. Mr. Case received a Bachelor of Economics degree and a Master of Business Administration from New Mexico State University. Key Qualifications Mr. Case brings broad experience in business strategy, operations, accounting, information technology, mergers and acquisitions, auditing and SEC reporting matters to the Board of Directors. In addition, his experience as a public company executive contributes to his knowledge of corporate governance and public company matters. |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | |

| |

| TABATA L. GOMEZ |

|

Director Since: 2022 |

|

|

Committees: Corporate Governance Age: 43 |

|

| |

| |

Biographical Information Ms. Gomez has served as the Chief Marketing Officer of McCormick & Company Inc. (“McCormick”), a spice and extract manufacturing company, since November 2023. In her role, she leads the global marketing organization and is a member of the Global Operating Committee of McCormick. Prior to joining McCormick, Ms. Gomez had served as Chief Marketing Officer for the Tools & Outdoor segment of Stanley Black & Decker Inc., a manufacturer of industrial tools and household hardware, since September 2022, where she oversaw a $14 billion portfolio of brands. She also served as President of the Global Hand Tools, Accessories & Storage Group, a business unit within Stanley Black & Decker, Inc. Prior to her time at Stanley Black & Decker, Ms. Gomez worked at Coty, Inc., a manufacturer and marketer of fragrances, cosmetics, hair care and other beauty products, where she was Vice President of Rimmel. She also spent 13 years at The Procter & Gamble Company in the United States, Europe, and Latin America where she served in roles of increasing responsibility in brand management, marketing and innovation. Ms. Gomez holds a Bachelor of Arts in International Relations from the Universidad Iberoamericana in Mexico City and she speaks several languages. Key Qualifications Ms. Gomez brings expertise in global marketing, brand leadership, profit & loss management and licensed product management to the Board of Directors. With broad international experience in Latin America, Europe and Asia, Ms. Gomez also provides the Board with critical international perspectives. |

|

| | | | | |

| |

| ELENA B. OTERO |

|

Director Since: 2022 |

|

Committees: Compensation Age: 59 |

|

| |

| |

Biographical Information Ms. Otero is a former executive in the international division of The Clorox Company, a manufacturer and marketer of consumer products, where she served as Chief Marketing Officer, eCommerce Officer and Strategy & Growth Officer from 2016 until her retirement in 2021. She previously served as Vice President of Marketing and General Manager of Clorox’s Home Care International business unit from 2010 to 2016 and as Vice President of Marketing and General Manager of Clorox’s Greenworks International business unit from 2008 to 2010. Prior to these roles, Ms. Otero held leadership positions in Latin America from 2002 to 2008, including responsibility for Clorox’s business operations in Puerto Rico, the Caribbean, Central America and South America. Prior to that, from 1990 to 2002, Ms. Otero held marketing leadership positions across multiple categories and brands at The Procter & Gamble Company. Key Qualifications Ms. Otero brings to the Board of Directors over thirty years of global consumer products experience, primarily in marketing, growth and strategy, ecommerce, and general management. Her experience in leading global marketing across forty countries also provides the Board with critical international perspectives. |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | |

| |

| BERYL B. RAFF |

|

Director Since: 2014 |

|

Committees: Audit Age: 73 |

|

| |

| |

Biographical Information Since April 2009 until her retirement in July 2022, Ms. Raff served as Chairman and Chief Executive Officer at Helzberg Diamond Shops Inc. (“Helzberg Diamonds”), a jewelry retailer and a wholly-owned subsidiary of Berkshire Hathaway Inc. Through June 2023, Ms. Raff continued to advise and consult the Helzberg Diamonds’ executive team as non-executive Chairman of the Board. From 2005 through April 2009, she served as Executive Vice President-General Merchandise Manager for the fine jewelry division of J.C. Penney Company, Inc., a retailer of apparel and home furnishings. From 2001 through 2005, Ms. Raff served as Senior Vice President-General Merchandise Manager for the fine jewelry division of J.C. Penney. Prior to joining J.C. Penney, Ms. Raff served in various leadership roles at Zale Corporation, a national retail jewelry chain, last serving as its Chairman and Chief Executive Officer. In May 2021, Ms. Raff was appointed to the Board of Directors of Academy Sports and Outdoors, Inc., where she serves as the Chair of the Compensation Committee. Ms. Raff served on the Board of Directors of Group 1 Automotive, Inc., an automotive retail operator, from 2007 to 2015. At Group 1 she was a member of the Compensation Committee of its Board of Directors and Chair of the Governance/Nomination Committee. Ms. Raff served on the Board of Directors of The Michaels Companies, Inc. from September 2014 through April 2021, a national retail chain of arts and crafts specialty stores, and was a member of its Compensation Committee. Ms. Raff has previously served as a Director of the NACD Heartland Chapter, a non-profit organization dedicated to excellence in board leadership. From 2001 through February 2011, Ms. Raff served on the Board of Directors, the Corporate Governance Committee and the Compensation Committee (which she chaired from 2008 to 2011) of Jo-Ann Stores, Inc., a national specialty retailer of craft, sewing and decorating products. Ms. Raff graduated from Boston University with a Bachelor of Business Administration degree and from Drexel University with a Master of Business Administration. Key Qualifications Ms. Raff is well known throughout the retail industry and brings to the Board of Directors her experience and perspective as an outstanding merchant and multi-store retail executive. The Board benefits from Ms. Raff’s extensive knowledge of the retail industry and her valuable insight on how the Company can best serve its retail partners. Ms. Raff’s current and previous service on other boards, including public companies, also provides important perspectives on key corporate governance matters. |

|

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | |

| |

| DARREN G. WOODY |

|

Director Since: 2004 |

|

Committees: Compensation (Chair), Nominating and Corporate Governance Age: 64 |

|

| |

| |

Biographical Information Mr. Woody is President and Chief Executive Officer of Jordan Foster Construction, LLC, a construction firm with offices in Austin, Dallas, El Paso, Houston, and San Antonio, Texas and field operations throughout the Southwest. The firm specializes in highway, military, commercial, and multi-family construction. He has served in this capacity since August of 2000. Previously, Mr. Woody was a partner in the law firm of Krafsur, Gordon, Mott, Davis and Woody P.C., where he specialized in real estate, business acquisitions and complex financing arrangements. Mr. Woody also served on the Board of Directors of Construction Insurance and Risk Captive of America, Limited (CIRCA), a licensed group reinsurance company from 2021 to 2023. Key Qualifications Mr. Woody brings a multi-disciplined perspective to our Board of Directors given his executive leadership and legal experience. This background enables him to provide valuable input with regard to many of the Company’s legal matters, significant transactional negotiations and the management of challenging complex projects. |

|

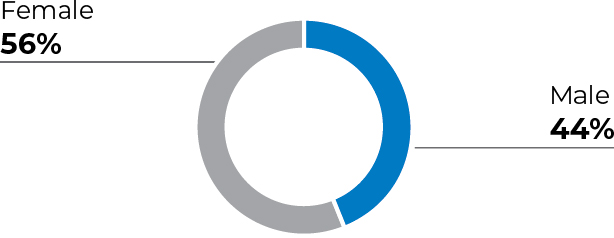

The following charts summarize the independence and gender diversity of the Director nominees:

| | | | | | |

| | |

| BOARD INDEPENDENCE | BOARD GENDER DIVERSITY | |

| | |

|

| |

CORPORATE GOVERNANCE AND BOARD MATTERS

The table below summarizes the key areas of skills and experience that our Nominating Committee and Board of Directors considered in nominating these Directors as well as their self-identified demographic background:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Geoffroy | Meeker | Berry | Carson | Case | Gomez | Otero | Raff | Woody |

Key Areas of Skills and Experience | | | | | | | | | |

Industry / Product Knowledge | n | n | n | n | n | n | n | n | |

Multinational Operations | n | | n | n | n | n | n | | |

| Sales / Marketing | n | n | n | | | n | n | n | |

| Financial / Accounting | n | n | n | | n | | | n | n |

Information Technology / Digital / Cybersecurity | | | n | | n | | | | |

| Mergers / Acquisitions | n | | | n | n | | n | | n |

Corporate Strategy / Governance | n | n | n | n | n | n | n | n | n |

Board Diversity Matrix - Demographic Background (as of June 21, 2024) | | | | | | | | | |

| Gender Expression | Female | Male | Female | Male | Male | Female | Female | Female | Male |

| Hispanic or Latinx | | | | | | n | n | | |

| White | n | n | n | n | n | | | n | n |

To see our Board Diversity Matrix as of June 23, 2023, please see the proxy statement filed with the SEC on that date. For additional information on each director’s qualifications, see our director biographies above.

Corporate Governance

Corporate governance is typically defined as the system that allocates duties and authority among a company’s shareholders, Board of Directors and management. The shareholders elect the Board and vote on extraordinary matters.

Our Corporate Governance Guidelines, as well as our Code of Ethics, and the charters of the Audit Committee, Compensation Committee, Nominating Committee, and Corporate Governance Committee (the “Governance Committee”) of the Board of Directors are available under the “Governance” heading of the Investor Relations page of our website at the following address: www.helenoftroy.com.

The Company believes that it is in compliance with the corporate governance requirements of the NASDAQ listing standards. The principal elements of these governance requirements as implemented by the Company are:

▪affirmative determination by the Board of Directors that a majority of the Directors are independent;

▪regularly scheduled executive sessions of independent Directors; and

▪Audit Committee, Nominating Committee, Governance Committee and Compensation Committee comprised of independent Directors and having the purposes, responsibilities and authority as described below under the separate committee headings and set forth in their respective charters.

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Composition and Structure

Identifying Nominees for Election to the Board

The Nominating Committee’s current process for identifying and evaluating nominees for Director positions consists of general periodic evaluations of the size and composition of the Board of Directors, applicable listing standards and laws, and other appropriate factors with a goal of maintaining continuity of appropriate industry expertise, business experience, leadership skills and knowledge of the Company. The Nominating Committee looks for a number of personal attributes in selecting candidates as specified in our Corporate Governance Guidelines including:

▪sound reputation and ethical conduct;

▪business and professional activities that are complementary to those of the Company;

▪the availability of time and a willingness to carry out their duties and responsibilities effectively;

▪an active awareness of changes in the social, political and economic landscape;

▪an absence of any conflicts of interest;

▪a level of health that allows for attendance and active contribution to most Board and committee meetings;

▪limited service on other boards; and

▪a commitment to contribute to our overall performance, placing it above personal interests.

As specified in our Corporate Governance Guidelines, the Nominating Committee makes efforts to maintain members on the Board who have substantial and direct experience in areas of importance to the Company. Our Nominating Committee charter provides that the Nominating Committee will seek to include candidates who reflect diverse backgrounds, qualifications and personal characteristics, including gender, race, ethnicity and age. The Nominating Committee considers all attributes, business diversity, professional qualifications, and experience of all candidates it believes will benefit the Company and increase shareholder value. The Nominating Committee does not assign specific weight to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. The Company will continue to take the appropriate steps to ensure the Board has the mix of qualifications, skill sets and diversity necessary to promote the long-term interests of the Company’s shareholders.

Shareholder Recommendation of Board Candidates

The Nominating Committee will consider candidates recommended by shareholders. A shareholder desiring to nominate a candidate for election to the Board at the Annual Meeting must provide timely written notice in proper form to the Secretary of the Company, at Clarendon House, 2 Church Street, Hamilton, Bermuda in accordance with our bye-laws. To be in proper form, the notice of a Director nomination should be accompanied by supporting materials required by our bye-laws, including, among other things, written consent of the proposed candidate to serve as a Director if nominated and elected, information about the proposed nominee for Director, information about the shareholder submitting the nomination, and information about any other shareholders or beneficial owners known to support the nomination. The Nominating Committee may request that the shareholder submitting the proposed nominee furnish additional information to determine the eligibility and qualifications of such candidate. Additionally, any candidate recommended by shareholders must meet the general requirements outlined in the Company’s bye-laws and Corporate Governance Guidelines. Any shareholder recommendation will be considered for nomination as a Director at the sole discretion of the Nominating Committee. Neither the Board of Directors nor the Nominating Committee is required to nominate for election any shareholder nominee recommendation. We did not receive any such Director nominee recommendations for this year’s Annual Meeting. Under the Company’s bye-laws, if a shareholder intends to nominate a person for election to the Board of Directors directly (rather than by recommending such person as a candidate to our Nominating Committee), the shareholder must submit the nomination as described in the Proxy Statement under “Shareholder Proposals.”

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Independence

The Board has determined that the following Directors and nominees for election at the Annual Meeting are independent Directors as defined in the NASDAQ listing standards: Mr. Meeker, Ms. Berry, Mr. Carson, Mr. Case, Ms. Gomez, Ms. Otero, Ms. Raff and Mr. Woody. Other than Ms. Geoffroy, our CEO, each member of the Board, including each person nominated to serve on our Board of Directors, is independent, as so defined, and each person who served on the Board in fiscal year 2024, other than Mr. Mininberg, was independent, as so defined. The foregoing independence determination of our Board of Directors included the determination that each of these eight nominated independent Directors, if elected and appointed to the Audit Committee, Compensation Committee, Governance Committee or Nominating Committee, respectively, is:

▪independent for purposes of membership on the Audit Committee under Rule 5605(c)(2) of the NASDAQ listing standards, that includes the independence requirements of Rule 5605(a)(2) and additional independence requirements under SEC Rule 10A-3(b);

▪independent under the NASDAQ listing standards for purposes of membership on the Nominating Committee; and

▪independent under the NASDAQ listing standards and applicable SEC rules for purposes of membership on the Compensation Committee, and as a “non-employee Director” under SEC Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Separation of Chairman and CEO Roles

The Board has separated the roles of the Chairman and the CEO in order to further diversify and strengthen its leadership structure. The Board separated these roles in recognition of the differences between the two roles and the value to the Company of having the distinct and different perspectives and experiences of a separate independent Chairman and CEO. Our CEO is responsible for the day-to-day management and supervision of the business and affairs of the Company (such as reviewing performance and allocating resources as the Company’s chief executive decision maker) and for ensuring that the directives of the Board are implemented. Our Chairman, on the other hand, is independent of management and is charged with presiding over all meetings of the Board and our shareholders and providing advice and counsel to the CEO and the Company’s other officers regarding our business and operations, as well as focusing on oversight and governance matters.

By separating the roles of CEO and Chairman, our CEO is able to focus his or her time and energy on managing the Company’s complex daily operations, while our Chairman can devote his time and attention to addressing matters relating to the responsibilities of our Board. Our CEO and Chairman have an excellent working relationship, and, with more than forty years of experience in the consumer products industry, our Chairman is well positioned to provide our CEO with guidance, advice, and counsel regarding the Company’s business, operations and strategy. Moreover, we believe that having a separate Chairman focused on oversight and governance matters allows the Board to more effectively perform its risk oversight role as described below. In connection with the Board’s self-evaluation process, as required by our Corporate Governance Guidelines, the Board evaluates its organization and processes to ensure that it is functioning effectively. For the foregoing reasons, we believe that our separate CEO/Chairman structure continues to be the most appropriate and effective leadership structure for the Company and our shareholders.

CORPORATE GOVERNANCE AND BOARD MATTERS

The Board’s Oversight Responsibilities

Risk Oversight

Our management is responsible for the ongoing assessment and management of the risks we face, including risks relating to capital structure, strategy, liquidity and credit, financial reporting and public disclosure, operations, acquisition and divestitures, technology and cybersecurity, governance, and legal and regulatory. The Board oversees management’s policies and procedures in addressing these and other risks and receives regular reports from senior management on areas of material risk to the Company. Additionally, each of the Board’s four committees (Audit Committee, Compensation Committee, Nominating Committee, and Governance Committee) monitor and report to the Board those risks that fall within the scope of such committee’s area of oversight responsibility. Accordingly, our Board committees have specific oversight responsibilities relating to certain aspects of risk management:

| | | | | | | | | | | |

Our Audit Committee | Our Compensation Committee | Our Nominating Committee | Our Governance Committee |

Directly oversees risk management relating to financial reporting, public disclosure, legal and regulatory compliance, data protection and cybersecurity. Additionally, periodically reviews with management the Company's disclosure controls and procedures, internal controls for financial reporting purposes and systems and procedures. Also responsible for assessing the steps management has taken to monitor and control these risks and exposures and evaluating guidelines and policies with respect to our risk assessment and risk management. | Directly oversees risk management relating to associate compensation, including any risks of compensation programs encouraging excessive risk-taking. For further information, see “Executive Compensation– Compensation Risks.” | Directly oversees risk management relating to Director nomination, including periodically assessing, developing and communicating with the Board concerning the appropriate criteria for nominating and appointing directors. Also considers matters associated with the independence of our Board. Additionally, oversees an annual review of the performance of the Board and its committees. | Directly oversees risk management regarding corporate governance, including periodically assessing the effectiveness of the Company's corporate governance policies in light of the applicable listing standards and laws. Also oversees programs relating to ESG matters and periodically evaluates the effectiveness of the Company's ESG programs and policies. Additionally, periodically evaluates the effectiveness of the Company's succession plans for the Company's senior management. |

Management identifies risks, designates associated “risk owners” within the organization and receives appropriate reports from the various risk owners as conditions change. Management works with the respective Board committees as outlined above to communicate risk factors to the Board and to enable the Board to understand our risk identification, risk management and risk mitigation measures relating to strategic matters. Additional review or reporting of risks is conducted by management as needed or when requested by the Board or a committee. Additionally, the Chairman, working with the Audit Committee and the Governance Committee, assess corporate governance practices and risks.

ESG Initiatives

We recognize that a thriving society and environment are key to the long-term success of any business. We are, therefore, committed to not only responding to the evolving needs of our key stakeholder groups, but also to strategically addressing our environmental and social impacts. We live our principles and embed them into how we operate our businesses and organization. It is our aim that through this work we continually earn the engagement, loyalty and pride of our consumers, associates, customers, shareholders, and the communities in which we live and operate.

CORPORATE GOVERNANCE AND BOARD MATTERS

We seek to maintain a best-in-class level of corporate governance on behalf of our stakeholders, including our associates, customers, consumers, communities, and shareholders. We also recognize the importance of environmental and social factors related to how we operate our business. We continued to enhance and consolidate our ESG efforts and accelerate programs related to DEI&B to support our Phase II Transformation that concluded at the end of fiscal 2024, and we will continue these efforts as we begin our Elevate for Growth Strategy.

The Governance Committee has oversight of ESG-related matters, including those related to climate change and DEI&B. Our ESG Task Force, which includes associate representatives from our business segments and global shared services, in conjunction with our Vice President, Global ESG, leads the development and implementation of our strategic ESG plan. Our Vice President, Global ESG, who reports to the Chief Legal Officer, reports regularly to the Board on these matters with ESG as a standing agenda item at scheduled quarterly Board meetings. Our goal is to align our ESG performance with relevant standards and guidelines, such as those established by the Sustainability Accounting Standards Board (“SASB”), the Task Force on Climate Finance Disclosures (“TCFD”) and the Global Reporting Initiative (“GRI”). In June 2024, we published our ESG Report, which aligns with relevant standards and guidelines such as those established by the SASB, the TCFD and the GRI. Our ESG Report summarizes our ESG strategy and performance, including in the areas of climate change, DEI&B and human capital, and environmental and natural capital management.

We are implementing a system that is designed to minimize negative impacts of our practices on the environment and we continue to work on initiatives to reduce emissions in our supply chain and product use. As part of these efforts, and in order to strengthen our support of climate action, we became a signatory of ‘We Mean Business’, a coalition of organizations and businesses with a goal of catalyzing business action to accelerate the transition to a zero-carbon economy. With our participation in this coalition, we intend to (1) report climate change data and measures to the Carbon Disclosure Project aligned with the guidelines of the TCFD, (2) implement a responsible climate policy, and (3) develop targets which were approved in October 2021 by the Science Based Targets initiative.

We will also continue to advance our DEI&B efforts as part of our ESG initiatives to support our focus on attracting and retaining top talent, and to help promote a work environment where everyone has the opportunity to grow to their fullest potential. We believe progress on these ESG initiatives will have a positive impact on our shareholders, consumers, customers, our talented worldwide associates and the communities in which we are proud to live and work. We also believe that a diverse workforce is essential to the long-term success of our business and to the growth, and the well-being, of our associates. We celebrate the diversity of our people and value the unique perspectives they bring to the Company. Across our global Company, we are committed on a global scale to cultivating an inclusive culture where all of our associates can thrive. We are advancing short- and long-term initiatives which include: leadership coaching and training to build awareness and sponsorship, targeted recruitment actions to help increase diversity of new hires, and associate learning programs to build the skills that foster inclusion. Through these initiatives, we seek to stay in touch with the needs of our associates. With this associate input and other key human capital data, we will seek to adapt our approach and actions to continue to advance this priority of the Company.

Information on our website, including in our ESG Report and our ESG Guiding Principles, is not part of this Proxy Statement or any other report we file with, or furnish to, the SEC, except as expressly set forth by specific reference in such filing.

Board Committees and Meetings

Our Board of Directors has four committees: the Audit Committee, the Nominating Committee, the Governance Committee, and the Compensation Committee. Our independent Directors also meet in executive sessions without management present. For further information and composition of these committees, see below and the section “Proxy Voting Roadmap - Our Director Nominees to the Board of Directors.”

CORPORATE GOVERNANCE AND BOARD MATTERS

Audit Committee

| | | | | | | | | | | |

| | | |