united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

1055 Maitland Center Commons, Maitland, FL 32751

(Address of principal executive offices) (Zip code)

Art Ally, The Timothy Plan

1055 Maitland Center Commons, Maitland, FL 32751

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-846-7526

Date of fiscal year end: 9/30

Date of reporting period: 9/30/21

Amended to correct the language in response to Item 11(b) of Form N-CSR on the initial filing. There is no change to the financial statements and no impact to the documents made available to shareholders.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

September 30, 2021

Dear Shareholder,

As you review the details of our various funds on the following pages, you may not recall the substantial negative effect the Covid-19 pandemic and resultant economic shutdown had on the capital markets in the middle months of 2020 (i.e., February thru September). I am pleased to report, however, that we recovered nicely during this current fiscal year. Hence, although our performance (10-1-20 thru 9-30-21) varies among our funds, nearly all were strongly up. Among our better performers were our domestic equity funds (i.e. Small-Cap Value, Large/Mid-Cap Value, Aggressive Growth and Large/Mid-Cap Growth) along with our International and Israel Common Values Funds while our weakest performer was Fixed Income. All of that simply underscores the wisdom of asset allocation since different market segments perform differently over differing periods.

The positive returns we experienced in fiscal 2021 are, we believe, in large part the result the momentum created by our country’s prior leadership during this period and the positive pro-business agenda President Trump was pursuing. With the new administration in place, we are maintaining a more cautious outlook for our economy and, therefore the equity markets. Timothy Partners, Ltd, (the “Advisor”) has always attempted to take a conservative approach to the markets as we believe our shareholders prefer a preservation of principal course to that of chasing returns. I do need to reiterate, however, that, in the capital markets in general and our funds in particular, returns can never be guaranteed.

For more complete information about the individual funds, please read each of the sub-advisor’s annual review letters in the pages that follow. They more fully detail the various factors that impacted this fiscal year’s performance along with their economic outlook for the coming year.

Although we cannot guarantee any actual outcome, I remain confident that all our sub-advisors are, in our opinion, among the best in the industry and they each continue to honor our overall policy to manage their respective funds both in accordance with our screening restrictions and with a continued conservative bias.

Finally, I would once again like to thank you for your moral convictions that led you to becoming part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

President

1

| Timothy

Plan Aggressive Growth Fund Letter from the Manager – September 30, 2021 |

|

At this this time last year we wrote that the 12-month period ending 9/30/20 was “unlike any other witnessed in U.S. history” — the onset of COVID (with U.S. deaths peaking at over 23,000 per week), a 31% contraction in GDP in the second quarter, 21.4 million jobs lost in just March/April ’20, the S&P500 down 34% in 5 weeks. It can’t be overstated how much better the subsequent 12 months were. COVID vaccines came to market in record time with effectiveness beyond almost anyone’s expectations; close to 80% of the U.S. population has received at least one dose. This, along with trillions of dollars of monetary and fiscal stimulus has brought about a strong economic and labor-market recovery (real GDP growth over 6%, and the unemployment rate down to 5.2%). And, in response, the stock market – which had already bounced back very nicely last spring & summer, was up another 30% (S&P500) in the year ending this September. This is not to say that everything has been smooth sailing: the transition to a new presidency was marred by the riot at the Capitol, the Delta variant brought about another spike in COVID cases and deaths, supply chain issues have led to shortages in key areas of the economy, and Biden’s proposed budget & tax plan has led to another political stalemate, as of this writing. The supply chain issues, in particular, have created risk for the upcoming earnings season; we will be watching very closely to see which companies are vulnerable and which are navigating the environment the best.

The Fund returned 0.7% in the September 2021 quarter, 12.2% year to date, and 34.2% for Class I over the last 12 months. This compares to the Russell Midcap Growth Index that returned -0.8% in the past quarter, 9.6% year to date, and 30.4% over the last 12 months.

The 530 basis point outperformance over the past 12 months was broad-based, with every major sector outperforming its respective benchmark. The greatest relative outperformance was seen in the healthcare, industrials, and consumer discretionary sectors. The healthcare sector had the strongest performance, as both a modest overweighting as well as superior stock selection generating notable alpha.

The Fund’s top overall contributor on a relative basis over the last 12 months was Rapid7 (3.3% avg. weight), which returned 85%. Rapid7 is a cybersecurity software company whose focused on enterprise’s Vulnerability Management. The continued rise of cybersecurity crime has led to a strong tailwind for the entire industry. Another strong performer within the tech sector was Lam Research (1.7%), which returned 98% over the past 12 months. Lam Research is one of the leading global semiconductor equipment manufacturers that is experiencing tremendous growth as the semiconductor industry is rapidly expanding to meet extraordinarily high demand levels. Lastly, Monolithic Power Systems (3.5%) was another standout performer, returning 74%. Monolithic Power Systems is a semiconductor company that designs and manufacturers power management systems utilized in the telecom, cloud computing, and industrial applications.

In general, we didn’t have too many dramatic underperformers. Our largest relative underperformer was down a modest 9% over the past twelve months. While Fidelity National (0.9%) met all of its revenue and earnings targets, the stock was a lackluster performer as investors rotated away from the merchant payment processors

2

industries into other industries that are experiencing higher organic growth rates. Another underperformer was Sunrun (0.9%), which was down 43% over the year. Sunrun is a leading national solar panel and energy storage residential system provider. While the company continues to execute well, in hindsight the stock along with the entire solar industry complex was overvalued post the election last year, leading to the underperformance over the past year. We continue to be excited about the long-term potential for Sunrun, and we are retaining our position in the security.

We are cautious in our near-term earnings outlook for the overall market given the many headwinds being seen currently. Whereas earlier this year most managements’ concerns were related to passing on price increases, those concerns are now being replaced by supply chain interruptions. The most recent wave of COVID19 has led to significant interruptions in manufacturing and transport in Southeast Asia, and that is having a significant ripple effect throughout the world. We are all witnessing the downside of a globally interconnected supply chain, which will only further accelerate the nascent trend of onshoring. The most significant interruptions are still being seen in the semiconductor industry, with lead times for nearly all chips doubling over the past few months; that is leading auto manufacturers to forecast a much slower production cadence for 2022. Other supply chain issues are leading to a slowdown in the homebuilding industry. All these factors are leading us to focus the portfolio on sectors that do not face these pressures, sectors such as the pharma/biotech sector and the software sector. We remain focused on generating alpha and producing the strongest investment results over the long run. We thank you for your continuing support and investment.

Chartwell Investment Partners, LLC

3

| The Timothy Plan International Fund |

| Letter from The Manager - September 30, 2021 |

Global equity markets had a strong performance during the fiscal year as vaccines and re-opening momentum boosted markets and the Fund participated nicely. The Fund continued its positive outperformance trend and handily beat its benchmark MSCI All Country World ex. US Index this year with a combination of great sector allocation and stock selection. From a sector standpoint, an overweight to outperforming Technology sector and underweights to underperforming Consumer Staples, Communications Services, and Real Estate helped the relative performance. From a stock standpoint, great stock selection in Industrials, Technology, and Health Care led the outperformance. The Fund’s outperformance was driven by companies such as Hong Kong-based power tools manufacturer Techtronic Industries, owner of popular power tools brands Ryobi and Milwaukee. Moreover, notable performers for the Fund included equipment rentals company Ashtead Group that owns the Sunbelt brand, Norwegian energy leader Equinor, and semiconductor technology leader ASML Holding. From a country standpoint, an underweight to China and overweight to Norway and the Netherlands was helpful. Positive country stock selection was led by Hong Kong, Japan, Belgium while stock selection in Germany, Italy and France was more challenging.

2020 was a momentous year not to be forgotten. TIME magazine put it best on its cover: “2020: The Worst Year Ever.” It was a tough period on all fronts as the global pandemic took the lives of hundreds of thousands and triggered a global recession. While 2020 was a bear market for humans, global equities rallied sharply, particularly during the last quarter of 2020 as visions of vaccine stocking stuffers danced in investor’s heads. The positive momentum carried into 2021 and equity markets followed along as corporate earnings were revised upwards throughout the year as re-opening momentum and pricing power led to robust corporate results. The Fund benefitted from being well positioned with structural growth stories and re-opening plays during the fiscal year.

Economic growth across Europe and parts of Asia accelerated in 2021 and remains well supported by strong consumer spending. Growth is likely to remain above trend over the coming quarters. Inflation is the major debate of the day with most central bankers arguing that elevated inflation is transitory while consumers suffer much higher prices and shortages of autos, groceries, furniture, housing, and many other items. Despite the elevated inflation levels, global central banks are likely to keep accommodative policies for longer even though they may begin to taper their bond buying in the coming months.

While volatility in equity markets has increased with higher inflation and shifting central bank policies, earnings results should remain well underpinned by robust re-opening momentum, strong consumer spending, and pricing power. We remain committed to a disciplined and consistent investment approach dedicated to finding long-term investments for shareholders and we thank you for your continued investment in the Fund.

Eagle Global Advisors, LLC

4

September 30, 2021

Dear Timothy Plan Large/Mid-Cap Growth Fund Shareholder:

In 2019, Timothy Plan added four new Exchange Traded Funds to our diversified product line: Timothy Plan Large/Mid-Cap Core (TPLC), Timothy Plan High Dividend Stock (TPHD), Timothy Plan International Equity Fund (TPIF), and Timothy Plan Small Cap Core (TPSC). Also, in July, 2020 we added two new ETFs that contained a structured partial move to cash in the event of a substantial market decline: Timothy Plan Large-Mid Cap Core Enhanced (TPLE) and Timothy Plan High Dividend Stock Enhanced (TPHE). These are all smart beta index funds traded on the New York Stock Exchange. Since TPLC and TPLE fit nicely into the into the investment objective of our Large/Mid-Cap Growth Fund, we incorporated these two particular ETFs into the holdings of this fund so that:

| ● | Approximately 20% of the fund is now invested in a combination of TPLC and TPLE |

| ● | And the remainder of the fund continues to be actively managed by our long-time sub-advisor, Chartwell Investment Partners. |

In addition to greatly increasing the diversification of the holdings in this fund, we believe this addition should have the positive effect of lowering our expense ratio over both the near and longer term.

For past performance of this fund and future market outlook, please read Chartwell’s Sub-Advisor’s letter.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

5

| Timothy

Plan Large/Mid Cap Growth Fund Letter from the Manager – September 30, 2021 |

|

At this time last year, we wrote that the 12-month period ending 9/30/20 was “unlike any other witnessed in U.S. history” — the onset of COVID (with U.S. deaths peaking at over 23,000 per week), a 31% contraction in GDP in the second quarter, 21.4 million jobs lost in just March/April ’20, the S&P500 down 34% in 5 weeks. It can’t be overstated how much better the subsequent 12 months were. COVID vaccines came to market in record time with effectiveness beyond almost anyone’s expectations; over two-thirds of the U.S. population has received at least one dose. This, along with trillions of dollars of monetary and fiscal stimulus has brought about a strong economic and labor-market recovery (real GDP growth over 6%, and the unemployment rate down to 5.2%). And, in response, the stock market – which had already bounced back very nicely last spring & summer, was up another 30% (S&P500) in the year ending this September. This is not to say that everything has been smooth sailing: the transition to a new presidency was marred by the riot at the Capitol, the Delta variant brought about another spike in COVID cases and deaths, inflation is running higher than it has in over a decade (at 5%+), supply-chain issues have led to shortages in key areas of the economy, and Biden’s proposed budget & tax plan has led to another political stalemate, as of this writing. The supply -chain issues, in particular, have created risk for the upcoming earnings season; we will be watching very closely to see which companies are vulnerable and which are navigating the environment the best.

In stark contrast to last year, value stocks outperformed growth stocks in the 12- month period: Russell 1000 Value +35.0%; Russell 1000 Growth +27.3%. It was the first half of this period, however, that value led the charge. When the vaccine announcements from Pfizer and Moderna came out in November, the market took it as an “all-clear” signal for economic reopening, and as often occurs coming out of recessions, value took the baton from growth (R1V up 29.3% in the 6-month period, vs. R1G up 12.4%). This helped the Fund’s relative performance, as it is usually challenging when growth leads, as we can’t own many of the largest growth stocks in the benchmark index. Similarly, it is a tailwind for the fund if small stocks outperform large stocks, as also occurred during the past year (Russell 2000 +47.7% vs. S&P500 +30.0%).

The fund’s gross return was 33.6%, ahead of the 27.3% return of the benchmark Russell 1000 Growth Index. All of the outperformance came from stock selection, as sector allocation was a net negative (especially the underweight of Communication Services, which rose 46.2%). Technology was far and away the largest contributor from a stock standpoint, accounting for nearly 700 basis points. In software, Rapid7 (2.7%) gained 84.4%, EPAM Systems (2.6%) was up 76.4%, and Palo Alto Networks (2.2%) rose 95.8%. In semiconductors, Micron Technology (0%) and NXP Semiconductors (1.8%) rose 68.3% and 58.7% respectively. And in hardware, CDW (3.3%) gained 53.7%, and Western Digital (1.7%) was up 54.1%. These results in technology were especially encouraging, as we had to make up for 270 basis points of headwinds for not owning Alphabet (Google) and Microsoft (restricted). After Technology, the next-best selection was sourced from our holdings in Industrials, particularly Capital Goods. The strong economic recovery benefitted the likes of Honeywell (1.2%), up 30.7%, Trane Technologies (1.3%) +44.2%, and Emerson Electric (1.4%) +47.0%. The Fund’s largest shortfall came in the Health Care sector. Not owning some of the high-flyer Biotech stocks like Moderna (up 444%) was part of it, but we also had self-inflicted “misses” in Vertex Pharmaceutical (0.9%), down 33.3%, and Sarepta Therapeutics (0%), which fell 43.4%.

For the portfolio, there has been no change to our time -tested, bottom-up fundamental approach to managing large and mid-cap growth investments. As an overview, the Fund remains well diversified by issuers and sectors, as all areas of the economy are impacted by broad macroeconomic trends. We have made some trades in Technology to reduce higher-valuation exposures. We have added to Consumer Discretionary, an area of underweight, as the recovery and reopening became more certain. Health Care remains an area of overweight, as we like the combination of secular growth and defensiveness. We remain focused on generating alpha and producing the strongest investment results over the long run. We thank you for your continuing support and investment.

Chartwell Investment Partners, LLC

6

September 30, 2021

Dear Timothy Plan Small-Cap Value Fund Shareholder:

In 2019, Timothy Plan added four new Exchange Traded Funds to our diversified product line: Timothy Plan Large/Mid-Cap Core (TPLC), Timothy Plan High Dividend Stock (TPHD), Timothy Plan International Equity Fund (TPIF), and Timothy Plan Small Cap Core (TPSC). These are all smart beta index funds traded on the New York Stock Exchange. Since TPSC fits nicely into the into the investment objective of our Small-Cap Value Fund, we incorporated this ETF into the holdings of this fund so that:

| ● | Approximately 10% of the fund is now invested in TPSC. |

| ● | And the remainder of the fund continues to be actively managed by our long-time sub-advisor, Westwood Capital Management. |

In addition to greatly increasing the diversification of the holdings in this fund, we believe this addition should have the positive effect of lowering our expense ratio over both the near and longer term.

For past performance of this fund and future market outlook, please read Westwood’s Sub-Advisor’s letter.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

7

LETTER FROM THE MANAGER

September 30, 2021

TIMOTHY PLAN SMALL CAP VALUE FUND

We are pleased to provide you with our report for the Timothy Plan Small Cap Value Fund for the twelve months ending September 30, 2021 and would like to thank you for entrusting your assets with us.

Looking back, the past twelve months have witnessed an incredible recovery unfold. From the initial announcement, equity markets have embraced the hope that vaccines, and now therapeutics, could see the end of the global pandemic that has ravaged the world. The rally that unfolded in November of 2020 was historic in magnitude with the S&P 500 Index gaining nearly 11% as not one but three prospective vaccine solutions emerged. The logistical challenges of deploying them across the U.S., given the requirements for transport and storage, appeared daunting as 2021 began. With the largest mobilization effort since the great World Wars, vaccinations across the U.S. began to pick up steam through the spring and caseloads began to fall as consumers and corporations were set free to go back into their world. Spending by both resumed in earnest, leading to supply shortages that persist today. Consumer confidence has rebounded and remained resilient as variants have emerged, bolstered by rising wages from a tight labor market and the wealth effect from increasing investments. This resurgence in spending and demand sparked inflation fears as prices for goods, like used cars, components, like semiconductors, and even commodities, like copper, spiked higher. Supply chain issues have expanded beyond the initial shortages and may persist for quite some time. This has led to some moderation of the economic growth projections; however, the backdrop remains optimistic for further recovery in corporate profits.

For the twelve months ending September 30, 2021, the Timothy Plan Small Cap Value Fund produced a net return of 51.33% for Class I while the Russell 2000 Index produced a return of 47.68%. Both stock selection and allocation tailwinds aided relative performance, overcoming continued headwinds from low quality and high beta securities. Many of these firms were facing financial distress prior to the optimism sparked by the vaccine announcements last November. Combined with the unprecedented stimulus efforts from central banks and governments, many firms heavily impacted with higher leverage or impaired business models were able to stave off financial distress and boost their equity prices dramatically from their lows. As has been the case before, these periods of market preference for loss-making stocks can persist over the short -term and early signs have emerged that leadership is returning to companies with strong fundamentals and higher quality attributes. This was notable in Health Care, where an underweight given a lack of exposure to biotechnology stocks, was a significant contributor to relative performance. Other areas saw more modest benefits, including Financials where banks and capital markets far outpaced gains seen elsewhere coupled with being overweight. Industrials and Consumer Staples were headwinds given strong absolute performance but with less favorable selections than some of the more cyclical areas.

Great Western Bancorp moved higher as the company agreed to be acquired at a premium and merge with another regional bank. PDC Energy rallied, as did crude oil prices, with management focused on generating cashflow and returns over higher levels of production given the current environment. Amkor Technology gained as the semiconductor cycle, particular for consumer devices including cellphones, served as a strong tailwind for demand for their products as operating leverage emerged to boost their margin profile. Oxford Industries rose as the company was well-positioned with their lifestyle brands, Tommy Bahama and Lilly Pulitzer, to capitalize on a consumer flush with cash as well as benefitting from a resumption of domestic travel. Sandy Spring Bancorp reported continued strong results, outpacing rivals, as their loan growth came with better net interest margins, not just better credit, which pushed shares higher.

Aveanna HealthCare Holdings posted solid results but investor concerns over nursing shortages and labor costs

Net returns are net of the sub-adviser’s fees, not the mutual fund fees.

Past performance is not indicative of future results. Portfolio returns reflect the reinvestment of dividend and interest income. All information provided is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned. A description of the methodology used to calculate the attribution analysis or a complete list of each holding’s contribution to overall performance during the measurement period may be obtained by contacting info@westwoodgroup.com. Benchmark Data Source: © 2021 FactSet Research Systems Inc. All Rights Reserved. Russell Investment Group is the owner of the trademarks, service marks, and copyrights related to its indexes, which have been licensed for use by Westwood.

| 3 Investing Where It Counts | |  |

8

sent shares downward. Chuy’s Holdings moved lower despite admirable margin performance as same-store comparisons fell below expectations as varied policies created uneven restaurant hours as they worked back to full capacity. Avanos Medical, a recent purchase, faced challenging gross margin pressures leading to a reduction in forward guidance even as some dynamics should abate later this year. Healthcare Services Group declined as results have been impacted more than expected and their nursing home customers remain challenged by the pandemic. James River Group Holdings fell as the company had to raise equity capital to offset the losses as they worked to run-off the last part of their Uber liability from insuring their drivers in prior years.

The Small Cap Value team is focused on seeking well-run companies with growth prospects that are underappreciated by the marketplace. We look for companies with above average growth and strong balance sheets that generate positive cash flows. Against the current backdrop, we feel our companies are well-positioned for superior relative returns in a post-pandemic world while weathering any volatility that may arise.

We thank you for your continued confidence in the Westwood process and investment teams and we look forward to serving your investment needs through the years ahead.

Westwood Management Corp.

Net returns are net of the sub-adviser’s fees, not the mutual fund fees.

Past performance is not indicative of future results. Portfolio returns reflect the reinvestment of dividend and interest income. All information provided is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned. A description of the methodology used to calculate the attribution analysis or a complete list of each holding’s contribution to overall performance during the measurement period may be obtained by contacting info@westwoodgroup.com. Benchmark Data Source: © 2021 FactSet Research Systems Inc. All Rights Reserved. Russell Investment Group is the owner of the trademarks, service marks, and copyrights related to its indexes, which have been licensed for use by Westwood.

| 4 Investing Where It Counts | |  |

9

September 30, 2021

Dear Timothy Plan Large/Mid-Cap Value Fund Shareholder:

In 2019, Timothy Plan added four new Exchange Traded Funds to our diversified product line: Timothy Plan Large/Mid-Cap Core (TPLC), Timothy Plan High Dividend Stock (TPHD), Timothy Plan International Equity Fund (TPIF), and Timothy Plan Small Cap Core (TPSC). Also, in July, 2020 we added two new ETFs that contained a structured partial move to cash in the event of a substantial market decline: Timothy Plan Large-Mid Cap Core Enhanced (TPLE) and Timothy Plan High Dividend Stock Enhanced (TPHE). These are all smart beta index funds traded on the New York Stock Exchange. Since TPLC, TPLE, TPHE and TPHE fit nicely into the investment objective of our Large/Mid-Cap Value Fund we incorporated them into the holdings of this fund so that approximately:

| ● | Approximately 10% of the fund is invested in a combination of TPLC and TPLE |

| ● | Approximately 10% of the fund is invested in a combination of TPHD and TPHE |

| ● | The remaining 80% of the fund continues to be actively managed by our long-time sub-advisor, Westwood Capital Management. |

In addition to greatly increasing the diversification of the holdings in this fund, we believe this addition should have the positive effect of lowering our expense ratio over both the near and longer term.

For past performance of this fund and future market outlook, please read Westwood’s Sub-Advisor’s letter.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

10

LETTER FROM THE MANAGER

September 30, 2021

TIMOTHY PLAN LARGE/MID CAP VALUE FUND

We are pleased to provide you with our report for the Timothy Plan Large/Mid Cap Value Fund for the twelve months ending September 30, 2021 and would like to thank you for entrusting your assets with us.

Looking back, the past twelve months have witnessed an incredible recovery unfold. From the initial announcement, equity markets have embraced the hope that vaccines, and now therapeutics, could see the end of the global pandemic that has ravaged the world. The rally that unfolded in November of 2020 was historic in magnitude with the S&P 500 Index gaining nearly 11% as not one but three prospective vaccine solutions emerged. The logistical challenges of deploying them across the U.S., given the requirements for transport and storage, appeared daunting as 2021 began. With the largest mobilization effort since the great World Wars, vaccinations across the U.S. began to pick up steam through the spring and caseloads began to fall as consumers and corporations were set free to go back into their world. Spending by both resumed in earnest, leading to supply shortages that persist today. Consumer confidence has rebounded and remained resilient as variants have emerged, bolstered by rising wages from a tight labor market and the wealth effect from increasing investments. This resurgence in spending and demand sparked inflation fears as prices for goods, like used cars, components, like semiconductors, and even commodities, like copper, spiked higher. Supply chain issues have expanded beyond the initial shortages and may persist for quite some time. This has led to some moderation of the economic growth projections; however, the backdrop remains optimistic for further recovery in corporate profits.

For the twelve months ending September 30, 2021, the Timothy Plan Large/Mid Cap Value Fund produced a net return of 30.20% for Class I, while the S&P 500 Index produced a return of 30.00%. Absolute returns are notably positive, bolstered by the recovery that unfolded after the drawdown early in 2020. Relative performance was modestly positive on strong stock selection, led by Information Technology. Exposures to the semiconductor industry, through chip designers and producers, was the largest contributor to relative performance. Financials also experienced strong performance, as banks collectively benefitted from the stimulus efforts to limit potential defaults and delinquencies, in addition to the need for capital to invest in acquisitions and equipment. Communication Services and Utilities both faced challenges from selections, as some of the more pandemic impacted areas saw far stronger recoveries.

Several of the strongest individual performers in the portfolio resided in Information Technology. Shares of NVIDIA remain extremely well positioned to continue to grow given their exposure to semiconductor chips used for gaming to automobiles. Micron Technology similarly remains well situated as the consolidation that has occurred in the memory market has helped reduce the volatility and structurally improved the industry amidst high levels of current demand. Monolithic Power Systems posted strong results on better margins and growth as their power management solutions remain critical to shrinking device sizes and the need for longer battery life. Western Alliance Bancorp, a regional bank, saw stronger loan growth and unlike some peers, strong net interest margins as well, leading to better earnings and favorable outlooks. EOG Resources moved higher, as oil prices rallied over 80 percent over the last twelve months, with strong cash generation leading to further deleveraging.

The Fund’s performance was impacted by the Communication Services sector, where more stable franchises in the cable industry failed to keep pace with the appreciation seen by some higher growth areas like digital advertising and search. Similar headwinds in the Utilities sector were seen as well. McCormick & Company faced difficult comparisons after the surge in eating at home last year, as well as some pressures on their input costs that weighed on their results. Freeport-McMoRan declined in sympathy with falling copper prices, despite their

Net returns are net of the sub-adviser’s fees, not the mutual fund fees.

Past performance is not indicative of future results. Portfolio returns reflect the reinvestment of dividend and interest income. All information provided is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned. A description of the methodology used to calculate the attribution analysis or a complete list of each holding’s contribution to overall performance during the measurement period may be obtained by contacting info@westwoodgroup.com. Benchmark Data Source: © 2021 FactSet Research Systems Inc. All Rights Reserved. Russell Investment Group is the owner of the trademarks, service marks, and copyrights related to its indexes, which have been licensed for use by Westwood.

| 1 Investing Where It Counts | |  |

11

improving capital profile, given the challenges in China with Evergrande and the potential impact on copper demand in the coming periods. Ross Stores also posted strong results but faced investor concerns over whether near-term headwinds from lean inventories and rising freight costs would disrupt their growth trajectory. Valero Energy saw improvement in their second quarter results but short-term disruptions from weather events and power outages pressured their operations. WEC Energy Group faced investor rotation into more risk-on oriented areas of the markets as results remained solid and execution was good across their utility operations.

The Westwood team remains focused on seeking high-quality companies trading at a discount to intrinsic value. Optimism has surged, leaving valuations elevated even as uncertainty persists. The likely removal of monetary stimulus by the Federal Reserve and the dysfunction in Washington limiting additional fiscal spending could create choppy trends ahead for the economy and businesses alike. Should volatility rise further as a result, the market is likely to maintain a preference for businesses with greater stability and future growth prospects. The team believes those firms with stronger balance sheets and cash generation remain well-positioned to capitalize on opportunities to deploy that capital in the coming periods to augment their growth trajectories, something often overlooked in valuations. Interest rates remaining low should help to finance such ambitions for corporations as well as consumers looking to move or improve their housing situation. Employment remains a bright spot for many, as wages are rising in this tight labor market, but further job gains have slowed highlighting a potential disconnect between current job seekers and open positions. Resolving this and lowering unemployment will be important to maintain consumer confidence and spending. In total, the overall impact to the investing landscape should provide additional opportunities to active managers as dispersion of returns increases and correlations between stocks decrease. We continue to leverage our intensive research -driven process to identify securities with company-specific opportunities and visible earnings growth. As has always been our practice, we look to invest in companies with conservative balance sheets, robust free cash flow generation, and high returns as we believe those characteristics among others help provide attractive risk-adjusted returns for the portfolio. Given the speed and magnitude of the unprecedented market recovery, we remain mindful that markets may continue to experience significant bouts of volatility and are focused on protecting client capital by investing in opportunities which we feel have measurable and limited potential for loss.

We thank you for your continued confidence in the Westwood process and investment teams and we look forward to serving your investment needs through the years ahead.

Westwood Management Corp.

Net returns are net of the sub-adviser’s fees, not the mutual fund fees.

Past performance is not indicative of future results. Portfolio returns reflect the reinvestment of dividend and interest income. All information provided is for informational purposes only and is not intended to be, and should not be interpreted as, an offer, solicitation, or recommendation to buy or sell or otherwise invest in any of the securities/sectors/countries that may be mentioned. A description of the methodology used to calculate the attribution analysis or a complete list of each holding’s contribution to overall performance during the measurement period may be obtained by contacting info@westwoodgroup.com. Benchmark Data Source: © 2021 FactSet Research Systems Inc. All Rights Reserved. Russell Investment Group is the owner of the trademarks, service marks, and copyrights related to its indexes, which have been licensed for use by Westwood.

| 2 Investing Where It Counts | |  |

12

Letter from the Manager

September 30, 2021

Timothy Plan Fixed Income Fund

The fiscal year ending September 30, 2021 saw an increase in U.S. Treasury (UST) yields as the Federal Reserve (Fed) announced they would likely begin tapering their quantitative easing (QE) purchases in November 2021 due to heightened inflation concerns. The Timothy Plan Fixed Income Fund invests in the broad U.S. investment grade bond market benchmarked to the Bloomberg Barclays Aggregate index which began the last 12 months with a yield of 1.18% and ended at 1.37%.

The 10-year UST yield rose after starting the fiscal period at 0.69%, peaking at 1.74% at the end of March 2021, and ending September 2021 at 1.49%. By comparison, the 2-year rate more than doubled after starting at 0.13% and ending the last 12 months at 0.28%. The U.S. and global economies saw significant recovery from the pandemic recessions experienced during the last fiscal period. Fiscal and monetary stimulus, the rollout of vaccines and pent-up demand gave way to an expanding economy. These factors also led to potential risks as we neared September 30, 2021. The risk of inflation became evident due to the largest fiscal deficits and money supply growth experienced since World War II. U.S. CPI accelerated at a greater than 5.0% year/year pace in all three of 3Q21’s monthly data releases, more than double the 2021 forecast issued by the Fed at its Dec. 2020 meeting.

Investment Grade (IG) Credit spreads started the last 12 months at 128 basis points (bps), narrowed to 77 by June 2021 and ended at 80 by September 2021. IG Credit bond funds continued to receive net inflows and achieved a calendar year record by September. Strong investor demand offset the impact of year-to-date issuance which reached $1.35T by the end of the fiscal period. The Mortgage- Backed Securities (MBS) sector generated nominal returns ahead of the Bloomberg Barclays Aggregate Index but suffered negative excess returns. MBS investors will continue to focus on the Fed’s QE-taper plans going forward.

The Timothy Fixed Income Fund A shares returned -2.07% for Class I, over the 12-month period ending September 30, 2021 which was below the Bloomberg Barclays Aggregate index at -0.90%. The underweight allocation to Financials detracted from relative performance as the sector generated the second highest nominal return of all other major sectors and the overall index. Security selection in MBS also hurt relative performance. Our GNMA holdings generated returns below the counterparts in the index. Our overweight to Industrials and Utilities added value as these two sectors posted higher nominal and excess returns than the Bloomberg Barclays Aggregate Index. We remain focused on generating income consistent with a prudent level of risk.

| BARROW HANLEY GLOBAL INVESTORS |

| 2200 Ross Avenue, 31st Floor | Dallas, TX 75201 | (214) 665-1900 |

13

Letter from the Manager

September 30, 2021

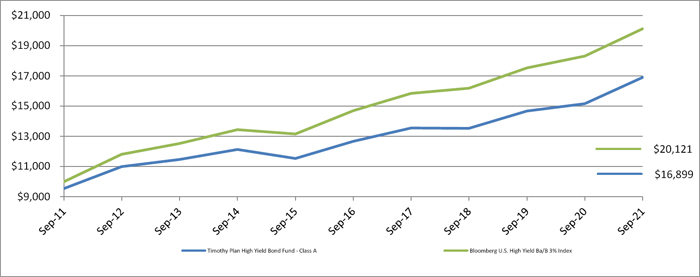

Timothy Plan High Yield Fund

During the fiscal year ending September 30, 2021, High Yield (HY) spreads started at 441 basis points (bps), declined to 236bps by June 30th, and finished the year slightly higher at 251bps. The Timothy Plan High Yield Fund invests primarily in BB and B rated HY bonds with a benchmark of the Bloomberg Barclays Ba/B HY* index. The benchmark began the last 12 months with a Yield to Worst (YTW) of 5.01%, fell to 3.43% by June 30th 2021, and ended slightly higher at 3.68%. Over the period, the HY market posted a return of 9.84% which surpassed the return of investment grade credit bonds of 1.45%. Performance of the index was led by lower quality ‘B’ rated credits.

Approaching the end of 2020, investors’ risk appetites increased following the positive vaccine news. HY spreads continued to tighten as unprecedented monetary and fiscal policies were unleashed to stimulate both consumer and business spending. Through September, the HY market posted its 10th consecutive month of positive returns and is now 3.89% higher on a calendar year-to-date basis. HY gross issuance leapt 59% year/year in 2020 with a record-high $418B of deals priced.

The Timothy High Yield Fund A shares generated a total return of 11.71% for Class I, over the 12 months ending September 30, 2021 while the Bloomberg Barclays Ba/B HY* index returned 9.84%. Security selection in Basic Industry and Consumer Cyclicals benefited performance. Within Financials, our Insurance and Finance Companies generated returns ahead of their counterparts in the index, positively contributing to performance. Detracting from performance was our security selection in Energy and an underweight allocation to Banks. The portfolio remains focused on generating a higher level of carry income consistent with a reasonable level of risk.

| * | Bloomberg Barclays U.S. HY Ba/B 3% |

| BARROW HANLEY GLOBAL INVESTORS |

| 2200 Ross Avenue, 31st Floor | Dallas, TX 75201 | (214) 665-1900 |

14

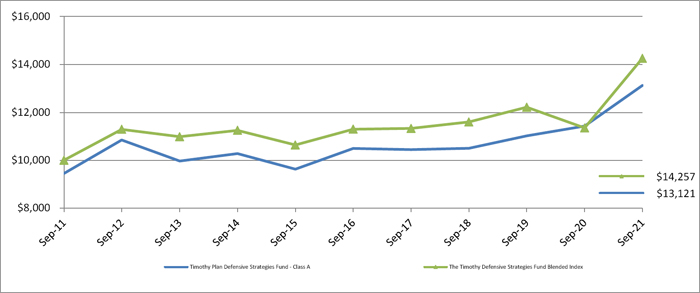

September 30, 2021

Dear Shareholder,

The Defensive Strategies Fund was designed and is managed to do what its name implies, hedge against a possible scenario of hyper-inflation which could result from our Congress’s proven unwillingness to address our core problems of too much spending and too much debt. The Fund was also designed with built-in flexibility that allows it to be adjusted to address a possible risk of extreme deflation, with the ability to convert the inflation sensitive assets to cash and fixed income securities during a deflationary environment, and to be adjusted to a more normal, traditional investment strategy.

The Fund’s portfolio is primarily comprised of several inflation sensitive investment sleeves: commodities (commodity company stocks and ETF’s), real estate (in the form of REITs), precious metals (primarily gold bullion) and silver ETFs, TIPs (Treasury Inflation Protected Bonds), with the balance in cash. Timothy Partners, Ltd. (the “Advisor”) is responsible for setting the percentages of the Fund that will be allocated to each investment sleeve. Different sub-advisors manage the holdings in each sleeve. Even after the negative effects on the economic shutdown produced by the Covid-19 pandemic, the Fund experienced a respectable 14.34% total return for the fiscal year ended September 30, 2021. For a more complete description of the elements that impacted Fund performance and the outlook for the future, please read the various sub-advisors’ reports in the pages that follow.

I would like to point out that, since there does not exist an appropriate benchmark index with which to compare our performance, we have created a blended index comprised of roughly 33% each of U.S. Government TIPs, FTSE NAREIT Equity Index and Bloomberg Commodity Index. We believe the blend offers a fairly accurate reflection and comparison of the composition of the Fund. For the fiscal year ended September 30, 2021, the blended index had a total return of 25.60%. The difference between the fund’s performance and the blended index was due mainly to the drag the gold bullion position had on the fund while it is not reflected in the index.

While no one can predict future events, I remain confident that our sub-advisors (i.e. money management firms that manage the various sleeves of this Fund) are, in our opinion, among the best in the industry, and they each continue to honor our overall policy that they manage their respective Fund sleeve both in accordance with our screening restrictions and with a conservative bias. As I stated in last year’s report, although we will do our very best to be successful, we cannot guarantee results in any of these scenarios.

Finally, I would once again like to thank you for your moral convictions that led you to become part of the Timothy Plan Family.

Yours in Christ,

Arthur D. Ally

Fund Advisor

15

Letter from the Manager

September 30, 2021

Timothy Plan Defensive Fund – Treasury Inflation Protected Securities (TIPS)

The unprecedented fiscal and monetary stimulus, initiated during the pandemic, has resulted in the largest fiscal deficit and money supply growth since World War II. These factors have also heightened fears of accelerating inflation. The Fed’s insistence that inflation will prove transitory faced an ongoing rebuttal from inflation in consumer and durable goods, such as automobiles, where production remained disrupted by supply chain issues. U.S. CPI accelerated at a greater than 5.0% year/year pace in all three of 3Q21’s monthly data releases, more than double the 2021 forecast issued by the Fed at its Dec. 2020 meeting. The Timothy Defensive Fund has an allocation of U.S. Treasury Inflation Protected Securities (TIPS) designed to help protect assets from higher rates of inflation.

In August 2021, Cleveland Fed President Loretta Mester admitted the inflation hurdle for a Fed rate hike had already been cleared, but that the second requirement, full employment, was likely to remain unachieved until year-end 2022. The U-3 unemployment rate fell 110bps to 4.8% in 3Q, but the number of businesses struggling to fill vacancies was indicative of a tighter labor market. The Bureau of Labor Statistics’ Job Openings Index (JOLT) registered 10.9mm openings, 47% above the pre-COVID high of Dec. 2018, and larger than the 8.3mm Americans who remained unemployed.

Energy markets lifted costs for producers and consumers and by the end of the fiscal period Brent Crude reached $78.52 per-barrel, its highest level in three years. Natural gas prices also rose, climbing 60% in the U.S. Meanwhile, portions of the U.S. CPI basket lagged the levels implied by market prices. Home prices, as reported by the S&P Case-Shiller home price index, had jumped 20.0% year/year by July. However, the “shelter” component of CPI had only climbed 2.8% year/year due to its survey reporting method’s tie to the rental market.

Over the previous 12-month period, investors’ future inflation expectations climbed dramatically. We measure investors’ inflation expectations as the difference between the U.S. Treasury 10-year and the U.S. TIPS 10-year. This “breakeven rate” of inflation is what would be required to make these two securities have the same yield. The “breakeven rate” of inflation started the fiscal period at 1.64%, reached a 12-month high of 2.57% in May 2021 but subsequently declined to 2.36% by the end of September. TIPS securities generated a 12-month return of 5.19%, as reported by Bloomberg Barclays. The Timothy Plan’s TIPS portfolio, within the Defensive Fund, ended the fiscal year-end period with an underweight to the 1 to 4.99-year maturity segment, overweight to the 5 to 9.99-year, and underweight to 20+ year securities. The primary goal of the TIPS allocation continues to be protection from rising inflation rates.

| BARROW HANLEY GLOBAL INVESTORS |

| 2200 Ross Avenue, 31st Floor | Dallas, TX 75201 | (214) 665-1900 |

16

The Timothy Plan Defensive Strategies Fund

Real Estate Sleeve (the “Portfolio”)

Annual Manager Letter: 12 months ended September 30, 2021

In the 12 months ending September 30, 2021, the US REIT market has surged based on positive headlines on the Pfizer COVID vaccine and the resulting momentum in consumer spending, leading to higher rent collection and rising occupancy and rents, albeit off of a low base. The combination of loose monetary policy and stimulus created a ‘perfect storm’ of rising GDP and low interest rates, which flowed from the consumer to businesses, enabling wages to rise significantly.

We believe Commercial real estate is a beneficiary of inflation, as shown by the +37.2% total return in the one year period ending September 30, 2021, in the MSCI US REIT Index (Bloomberg: RMZ). The rising demand via job growth and consumer spending was matched with low supply growth, at first due to the sheer inability to be on a construction site during a pandemic, then due to the inability to get financing from banks, and finally due to the rising construction costs from inflation. We believe these conditions should persist for a few years as the construction pipelines begin to refill and occupancy and rents catch up.

The top performing property types over the period were Regional Malls, Lodging, and Shopping Centers, while the lowest total returns were in the data center, cell tower, and triple net sectors. Chilton took over management of the portfolio on November 30, 2020, and has produced a total return of +25.5% (gross of fees) through September 30, 2021, which compares to +27.1% for the RMZ over the same period. The top contributors to relative performance were stock selection in the diversified sector, an underweight allocation to the data center sector, and stock selection in the healthcare sector. The top detractors from relative performance over the same period were an overweight allocation to the cell tower sector, and an underweight allocation to the shopping center and regional mall sectors.

Sector performance was particularly impacted by the Pfizer vaccine announcement in November 2020, which began a five month surge in the most downtrodden sectors such as regional malls, shopping centers, and lodging. However, following the 1Q21 earnings season, the market has become more focused on earnings growth and dividend growth, which we believe should continue. While the portfolio remains underweight to regional malls, lodging, and shopping centers as of September 30, 2021, we have been adding exposure to the ‘reopening’ trade by investing in healthcare and diversified REITs, which we believe provide a better risk-adjusted reward given lower valuation multiples.

An investment cannot be made directly in an index. The information contained herein should be considered to be current only as of the date indicated, and we do not undertake any obligation to update the information contained herein in light of later circumstances or events. This publication may contain forward looking statements and projections that are based on the current beliefs and assumptions of Chilton Capital Management and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements. This communication is provided for informational purposes only and does not constitute an offer or a solicitation to buy, hold, or sell an interest in any Chilton investment or any other security. Past performance does not guarantee future results.

17

| The Timothy Plan Defensive Strategies Fund Commodity Sleeve (the “Portfolio”) |  |

Annual Letter from the Manager (September 30, 2021)

We are pleased to provide you with our annual report for the Timothy Plan Defensive Strategies Fund Commodity Sleeve (the “Portfolio”) for the twelve months ending September 30, 2021. The Portfolio rose 69.1% on a gross basis. Commodities broadly posted strong gains during these twelve months with the Bloomberg Commodity Index Total Return (the “BCOM”) gaining 42.3%. The Portfolio generated 26.8% of outperformance versus the BCOM benchmark with positive contributions from energy, agriculture, and industrial metals, though underperformance in precious metals modestly detracted from this overall relative outperformance.

Energy

Energy was the best performing sector for the prior year, with the Bloomberg Energy Subindex Total Return rising 78.8%. The Portfolio’s energy holdings were also the best performing sector, gaining 109.3% for the period and generating roughly half of the Portfolio’s overall relative outperformance versus the BCOM. WTI crude oil prices jumped approximately 86.6% during the period as demand rose with pandemic travel restrictions easing, while US crude oil production remained well below pre-COVID levels. Natural gas prices more than doubled over the period rising from $2.53 per MMBTU to nearly $5.90. Upstream E&P companies held in the Portfolio benefited the most from these increasing prices, rising nearly 150% over the period. The Portfolio’s largest energy holdings as of September 30th were EOG Resources (EOG US), ConocoPhillips (COP US), and Inpex Corp (1605 JP).

Agriculture

Over the past year agricultural commodities, as proxied by the Bloomberg Commodity Agriculture and Livestock Subindex Total Return, rose by 39.1%. Over the same period the Portfolio’s agricultural holdings outperformed, rising 51.6% and providing some additional relative outperformance. The Portfolio’s largest agriculture holdings as of September 30th were Nutrien Ltd (NTR US), Deere & Co (DE US), and Coreteva Inc (CTVA US).

Metals & Mining

Industrial metal commodity futures were up strongly for the period with the Bloomberg Industrial Metals Subindex Total Return rising 37.1%. The Portfolio’s industrial metal holdings performed better than their respective commodity futures, rising 78.1% over the same period and contributing greatly to the Portfolio’s overall outperformance. The Portfolio’s exposure to steel – a commodity not included in the BCOM benchmark – was particularly beneficial as holdings in that industry appreciated more than 100% during the period. The Portfolio’s largest industrial metal holdings as of September 30th were Rio Tinto (RIO US), Vale SA (VALE US), and Teck Resources (TECK/B CN).

Precious metal futures were the only sector to finish down over the prior year with the Bloomberg Precious Metals Subindex Total Return falling (7.8%) for the twelve months ended September 30, 2021. Timothy’s precious metal miners underperformed, falling (24.2%) over the same time period as falling prices and rising fuel costs weighed on these miners. The Portfolio’s largest precious metal holdings as of September 30th were Newmont Goldcorp (NEM US), Kirkland Lake Gold (KL CN), and Kinross Gold (KGC US).

Market Outlook

The Timothy Plan Defensive Strategy Fund Commodity Sleeve currently utilizes a diversified portfolio of natural resource equities that is intended to capture commodity price movements. We believe that the supply of many global commodities has not kept pace with the demand increases resulting from the continued re-opening efforts in the wake of the pandemic. Though demand remains below pre-pandemic levels, to the extent this continues to normalize and commodity prices continue to rally, we expect the Portfolio to perform positively.

CoreCommodity Management, LLC 680 Washington Boulevard Stamford, CT 06901 Tel: 203.708.6500 www.CoreCommodityllc.com

18

Past performance is not indicative of future results. STANDARD & POOR’S, and S&P are registered trademarks of Standard & Poor’s Financial Services LLC. “Bloomberg®,” “Bloomberg Commodity IndexSM” and the names of the other indexes and sub-indexes that are part of the Bloomberg Commodity Index family are service marks of Bloomberg Finance L.P. and its affiliates. Source for all Index data: Bloomberg L.P. Commodity Sectors are represented by the Bloomberg Commodity Sector Sub-Indices. This document does not constitute an offer of any commodities, securities or investment advisory services. Any such offer may be made only by means of a disclosure document or similar materials which contain a description of material terms and risks. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. The economic statistics presented herein are subject to revision by the agencies that issue them. This information is accurate only as of the date hereof, or as of historical dates otherwise indicated herein, and we do not undertake any obligation to update this material Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. All investments are subject to risk.

CoreCommodity Management, LLC 680 Washington Boulevard Stamford, CT 06901 Tel: 203.708.6500 www.CoreCommodityllc.com

19

September 30, 2021

Dear Timothy Plan Strategic Growth and Conservative Growth Fund Shareholder:

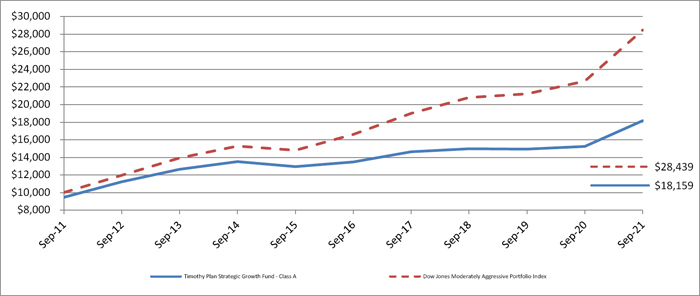

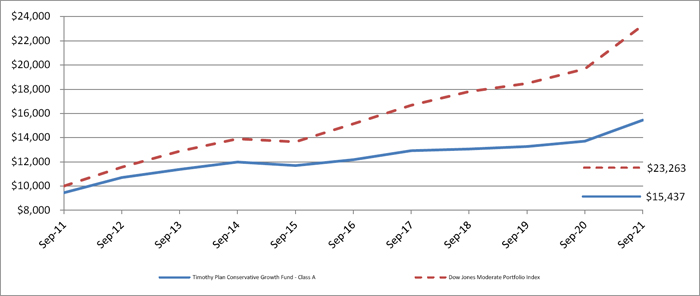

Asset allocation has normally been, and we believe it continues to be, a very prudent approach to investing. As a review, your Timothy Plan investment is a compilation of many of Timothy’s underlying funds (including six of our more recent ETF’s) and, as such, your performance is directly related to the performance of those underlying funds. Although the second and third quarters of 2020 experienced very negative returns as a result of the economic shutdown due to the Covid-19 pandemic, fiscal year 2021 (October, 2020 thru September, 2021) was a very different story as we experienced excellent performance in nearly all our underlying funds and we ended the fiscal year with very respectable returns of (17.98%) for Strategic Growth and (12.25%) for Conservative Growth. Having said that, we intend to participate in this strong market while maintaining a more cautious outlook for the economy in the year ahead. As a result, we have adjusted our positions in the underlying funds to the allocations shown below:

| Conservative Growth | Strategic Growth | ||||

| ● | Large/Mid-Cap Core ETF | 8.00 % | 9.50% | ||

| ● | Large/Mid-Cap Core Enhanced ETF | 6.00 % | 7.50% | ||

| ● | High Dividend Stock ETF | 2.00 % | 4.50% | ||

| ● | High Dividend Stock Enhanced ETF | 1.50 % | 3.00% | ||

| ● | Small-Cap Core ETF | 7.00 % | 9.00% | ||

| ● | International ETF | 14.00 % | 23.00% | ||

| ● | International Fund | 6.50 % | 10.00% | ||

| ● | High-Yield Bond Fund | 5.50 % | 5.00% | ||

| ● | Defensive Strategies Fund | 6.00 % | 7.00% | ||

| ● | Fixed Income Fund | 39.50 % | 18.50% | ||

| ● | Cash | 4.00 % | 3.00% |

Even though the Portfolios have been designed to be conservatively allocated, we understand that recent market gyrations may be unsettling for some investors. Please understand that our #1 concern is preservation of principal, and, even though we do want to participate in the markets’ strong upward trend, we will attempt to adjust our allocation above to changing market conditions.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is every one of our sub-advisors is doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

20

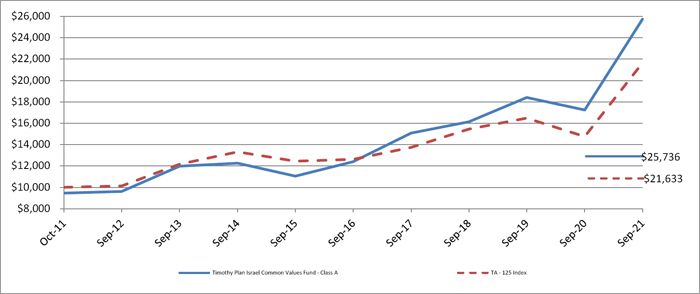

| The Timothy Plan Israel Common Values Fund |

| Letter from The Manager - September 30, 2021 |

The Israeli market came roaring back during this fiscal year as news of a Covid-19 vaccine breakthrough sent global markets soaring on hopes of ending global lockdowns. The Fund again handily beat its benchmark TA-125 index with a combination of good sector allocation and stock selection. Sector allocation was aided from an overweight to a strong performing Consumer Discretionary sector as well as underweight to underperforming Health Care, Communications Services, and Utilities sectors. These outweighed poor allocation to Consumer Staples and Real Estate. From a stock selection standpoint, the Fund did very well in the Industrials, Technology, and Materials sectors. Individual companies contributing to the strong relative performance included leading retailer Fox-Wizel (Consumer Discretionary), semiconductor metrology leader Nova Ltd (Technology), textile printing solutions leader Kornit Digital (Industrials), and insurance company Migdal Insurance (Financials). The Israeli market continues to provide the Fund ample investment opportunities.

After multiple lockdowns in Israeli cities related to the Covid-19 pandemic, the Israeli economy has come back strong. The country also became a global leader in its drive to vaccinate a major portion of its population. Both the International Monetary Fund (IMF) and the Bank of Israel (BoI) expect Israeli GDP growth to hover around 7% in calendar year 2021 while the BoI expects further growth of over 5% in 2022. This strong growth backdrop should lead to robust consumer demand with strong job creation and lower unemployment levels. While inflation at 2.2% is above recent trend, it remains within the central bank’s target range and well below the elevated levels of many other developed economies. The BoI expects inflation to moderate over the next twelve months signaling tapering of its quantitative easing measures is likely to start in the coming months.

On the political front, after four elections in two years, a new government was finally formed with the ousting of Israel’s longest serving prime minister Benjamin Netanyahu. A coalition government headed by Naftali Bennett of Yamina party and Yair Lipid of Yesh Atid party was able to get enough votes to move forward with Bennett serving as prime minister. We do not expect significant changes in policy from this new government that would materially affect the capital markets.

The Fund continues to invest alongside the innovate spirit of Israeli companies providing ample attractive investment opportunities. The economic backdrop remains supportive of continued positive earnings momentum over the coming quarters. We remain committed to a consistent investment approach dedicated to finding long-term investments for shareholders and we thank you for your continued investment in the Fund.

Eagle Global Advisors, LLC

21

September 30, 2021

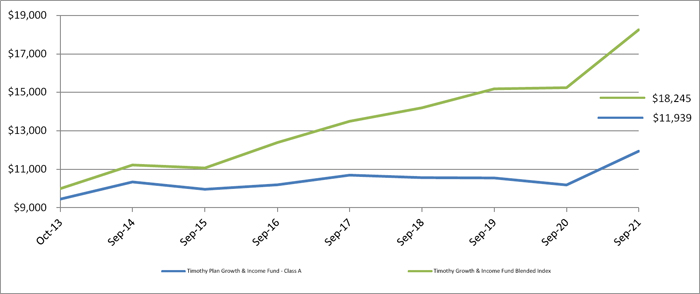

Dear Timothy Plan Growth and Income Fund Shareholder:

In 2019, Timothy Plan added four new Exchange Traded Funds to our diversified product line: Timothy Plan Large/Mid-Cap Core (TPLC), Timothy Plan High Dividend Stock (TPHD), Timothy Plan International Equity Fund (TPIF), and Timothy Plan Small Cap Core (TPSC). Also, in July, 2020 we added two new ETFs that contained a structured partial move to cash in the event of a substantial market decline: Timothy Plan Large-Mid Cap Core Enhanced (TPLE) and Timothy Plan High Dividend Stock Enhanced (TPHE). These are all smart beta index funds traded on the New York Stock Exchange. Since TPHD and TPHE fits nicely into the into the investment objective of our Growth and Income Fund, we incorporated these two particular ETFs into the holdings of this fund so that:

| ● | Approximately 60% of the fund is now invested in a combination of TPHD and TPHE. |

| ● | While the remaining fixed income portion of the fund is actively managed by our long-time fixed income sub-advisor, Barrow Hanley. |

It is our belief that this dual managed arrangement will result in both better performance and a reduction of this fund’s expense ratio.

For future market outlook for this fund, please read Barrow Hanley’s Sub-Advisor’s letter in this Annual Report.

As you know, no one can guarantee future performance. However, the one thing that I can assure you of is, for every one of our Timothy Plan Funds, all our sub-advisors are doing their very best and our team here at Timothy is working very hard to provide you an investment in which you can feel comfortable.

Sincerely,

Arthur D. Ally

President

22

Letter from the Manager

September 30, 2021

Timothy Growth and Income Fund – Fixed Income Allocation

The fiscal year ending September 30, 2021 saw an increase in U.S. Treasury (UST) yields as the Federal Reserve (Fed) announced they would likely begin tapering their quantitative easing (QE) purchases in November 2021 due to heightened inflation concerns. The fixed income allocation of the Timothy Plan Growth & Income Fund invests in the broad U.S. investment grade bond market benchmarked to the Bloomberg Barclays Aggregate index which began the last 12 months with a yield of 1.18% and ended at 1.37%.

The 10-year UST yield rose after starting the fiscal period at 0.69%, peaking at 1.74% at the end of March 2021, and ending September 2021 at 1.49%. By comparison, the 2-year rate more than doubled after starting at 0.13% and ending the last 12 months at 0.28%. The U.S. and global economies saw significant recovery from the pandemic recessions experienced during the last fiscal period. Fiscal and monetary stimulus, the rollout of vaccines and pent-up demand gave way to an expanding economy. These factors also led to potential risks as we neared September 30, 2021. The risk of inflation became evident due to the largest fiscal deficits and money supply growth experienced since World War II. U.S. CPI accelerated at a greater than 5.0% year/year pace in all three of 3Q21’s monthly data releases, more than double the 2021 forecast issued by the Fed at its Dec. 2020 meeting.

Investment Grade (IG) Credit spreads started the last 12 months at 128 basis points (bps), narrowed to 77 by June 2021 and ended slightly higher at 80 by September 2021. IG Credit bond funds continued to receive net inflows and achieved a calendar year record by September. Strong investor demand offset the impact of year-to-date issuance which reached $1.35T by the end of the fiscal period. The Mortgage- Backed Securities (MBS) sector generated nominal returns ahead of the Bloomberg Barclays Aggregate Index but suffered negative excess returns. MBS investors will continue to focus on the Fed’s QE-taper plans going forward.

Over the 12 months ended September 30th, security selection in MBS hurt relative performance. Our GNMA holdings generated returns below the counterparts in the index. Our overweight to Industrials and Utilities added value as these two sectors posted higher nominal and excess returns than the Bloomberg Barclays Aggregate Index. We remain focused on generating income consistent with a prudent level of risk.

| BARROW HANLEY GLOBAL INVESTORS |

| 2200 Ross Avenue, 31st Floor | Dallas, TX 75201 | (214) 665-1900 |

23

Fund

Performance - (Unaudited)

September 30, 2021

Aggressive Growth Fund

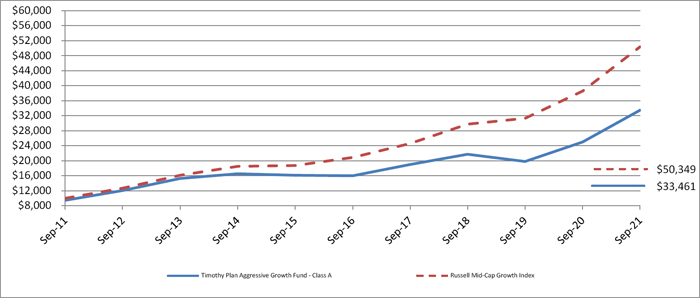

| 5 Year | 10 Year | |||

| 1 Year | Average | Average | ||

| Fund/Index | Total Return | Annual Return | Annual Return | |

| Timothy Aggressive Growth Fund - Class A (With Sales Charge) | 26.49% | 14.61% | 12.84% | |

| Russell Mid-Cap Growth Index | 30.45% | 19.27% | 17.54% | |

| Timothy Aggressive Growth Fund - Class C * | 31.87% | 15.06% | 12.62% | |

| Russell Mid-Cap Growth Index | 30.45% | 19.27% | 17.54% | |

| Timothy Aggressive Growth Fund - Class I | 34.19% | 16.20% | 10.55% | (a) |

| Russell Mid-Cap Growth Index | 30.45% | 19.27% | 15.09% | (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2021. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Aggressive Growth Fund vs. Russell Mid-Cap Growth Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Russell Mid-Cap Growth Index on September 30, 2011 and held through September 30, 2021. The Russell Mid-Cap Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

24

Fund

Performance - (Unaudited)

September 30, 2021

International Fund

| 5 Year | 10 Year | |||

| 1 Year | Average | Average | ||

| Fund/Index | Total Return | Annual Return | Annual Return | |

| Timothy International Fund - Class A (With Sales Charge) | 22.29% | 8.41% | 7.71% | |

| MSCI EAFE Index | 22.96% | 6.04% | 5.21% | |

| MSCI AC World Index ex USA Net (USD) | 23.91% | 8.94% | 7.48% | |

| Timothy International Fund - Class C * | 27.38% | 8.82% | 7.51% | |

| MSCI EAFE Index | 22.96% | 6.04% | 5.21% | |

| MSCI AC World Index ex USA Net (USD) | 23.91% | 8.94% | 7.48% | |

| Timothy International Fund - Class I | 29.68% | 9.93% | 6.55% | (a) |

| MSCI EAFE Index | 22.96% | 6.04% | 3.36% | (a) |

| MSCI AC World Index ex USA Net (USD) | 23.91% | 8.94% | 6.03% | (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2021. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan International Fund vs. MSCI EAFE Index vs. MSCI AC World Index ex USA Net (USD)

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares, the MSCI EAFE Index and the MSCI AC World Index ex USA Net (USD) on September 30, 2011 and held through September 30, 2021. The MSCI EAFE Index is a widely recognized unmanaged index of equity prices and is representative of equity market performance of developed countries, excluding the U.S. and Canada. The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 26 Emerging Markets (EM) countries. With 2,377 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

25

Fund

Performance - (Unaudited)

September 30, 2021

Large/Mid Cap Growth Fund

| 5 Year | 10 Year | |||

| 1 Year | Average | Average | ||

| Fund/Index | Total Return | Annual Return | Annual Return | |

| Timothy Large/Mid Cap Growth Fund - Class A (With Sales Charge) | 24.08% | 13.20% | 13.28% | |

| Russell 1000 Growth Total Return Index | 27.32% | 22.84% | 19.68% | |

| Timothy Large/Mid Cap Growth Fund - Class C * | 29.32% | 13.59% | 13.05% | |

| Russell 1000 Growth Total Return Index | 27.32% | 22.84% | 19.68% | |

| Timothy Large/Mid Cap Growth Fund - Class I | 31.64% | 14.74% | 11.63% | (a) |

| Russell 1000 Growth Total Return Index | 27.32% | 22.84% | 18.36% | (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2021. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Large/Mid Cap Growth Fund vs. Russell 1000 Growth Total Return Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Russell 1000 Growth Total Return Index on September 30, 2011 and held through September 30, 2021. The Russell 1000 Growth Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

26

Fund

Performance - (Unaudited)

September 30, 2021

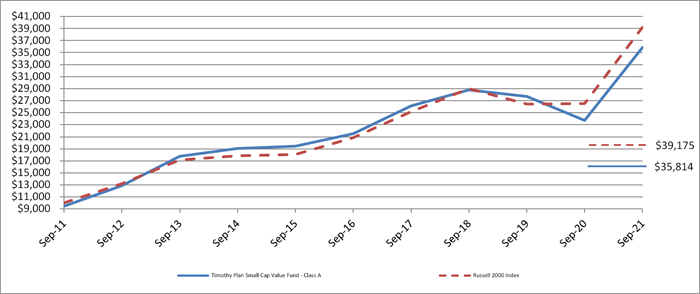

Small Cap Value Fund

| 5 Year | 10 Year | |||

| 1 Year | Average | Average | ||

| Fund/Index | Total Return | Annual Return | Annual Return | |

| Timothy Small Cap Value Fund - Class A (With Sales Charge) | 42.76% | 9.50% | 13.61% | |

| Russell 2000 Index | 47.68% | 13.45% | 14.63% | |

| Timothy Small Cap Value Fund - Class C * | 48.84% | 9.91% | 13.39% | |

| Russell 2000 Index | 47.68% | 13.45% | 14.63% | |

| Timothy Small Cap Value Fund - Class I | 51.33% | 11.02% | 9.65% | (a) |

| Russell 2000 Index | 47.68% | 13.45% | 10.86% | (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2021. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Small Cap Value Fund vs. Russell 2000 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the Russell 2000 Index on September 30, 2011 and held through September 30, 2021. The Russell 2000 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

27

Fund

Performance - (Unaudited)

September 30, 2021

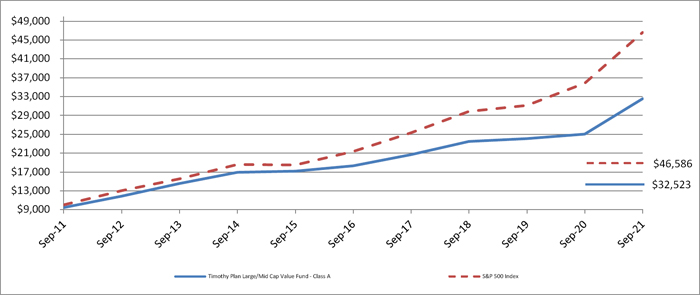

Large/Mid Cap Value Fund

| 5 Year | 10 Year | |||

| 1 Year | Average | Average | ||

| Fund/Index | Total Return | Annual Return | Annual Return | |

| Timothy Large/Mid Cap Value Fund - Class A (With Sales Charge) | 22.78% | 10.94% | 12.52% | |

| S&P 500 Index | 30.00% | 16.90% | 16.63% | |

| Timothy Large/Mid Cap Value Fund - Class C * | 27.91% | 11.36% | 12.31% | |

| S&P 500 Index | 30.00% | 16.90% | 16.63% | |

| Timothy Large/Mid Cap Value Fund - Class I | 30.20% | 12.47% | 10.56% | (a) |

| S&P 500 Index | 30.00% | 16.90% | 14.24% | (a) |

| (a) | For the period August 1, 2013 (commencement of investment in accordance with objective) to September 30, 2021. |

| * | With Maximum Deferred Sales Charge |

Timothy Plan Large/Mid Cap Value Fund vs. S&P 500 Index

The chart shows the value of a hypothetical initial investment of $10,000 in the Fund’s Class A shares and the S&P 500 Index on September 30, 2011 and held through September 30, 2021. The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. The index return does not reflect expenses, which have been deducted from the Fund’s return. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND IS NOT PREDICTIVE OF FUTURE RESULTS.

28

Fund

Performance - (Unaudited)

September 30, 2021

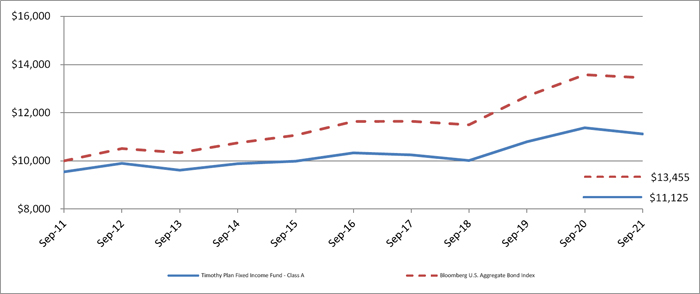

Fixed Income Fund

| 5 Year | 10 Year | |||

| 1 Year | Average | Average | ||

| Fund/Index | Total Return | Annual Return | Annual Return | |