Total | ||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| US SMALL CAP CORE ETF | ||||||||||||||||||||||||||||||||||||||||||||

| US Small Cap Core ETF | ||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to provide investment results that track the performance of the Victory US Small Cap Volatility Weighted BRI Index before fees and expenses. | ||||||||||||||||||||||||||||||||||||||||||||

| FEES AND EXPENSES OF THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below. | ||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE: | ||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 60% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT STRATEGIES | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Small Cap Volatility Weighted BRI Index (the “Index” or the “Underlying Index”) , an unmanaged, volatility weighted index created by the Fund’s Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities, rather than traditional market-cap weighting. Such a methodology is sometimes referred to as “Smart Beta.” The Index follows a proprietary rules-based methodology developed by the Fund’s Sub-Advisor, to construct its constituent securities.

The Index universe begins with the stocks included in the Nasdaq Victory US Small Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies with the bottom 10% by market capitalization as represented by NASDAQ US Small Cap Index (NQUSS) with positive earnings over the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Parent Index.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $ $358.4 million to $56.5 billion.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all of the stocks in the Index. A replication strategy means that the Fund seeks to hold all of the securities included in its index, in approximately the percentages represented by the securities in the index. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL RISKS OF INVESTING IN THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

| PAST PERFORMANCE | ||||||||||||||||||||||||||||||||||||||||||||

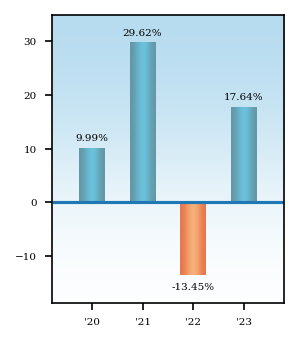

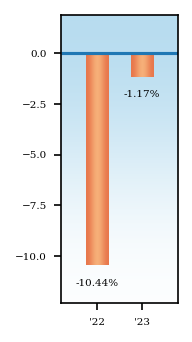

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index and to the Underlying Index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Performance data for the Fund may be available online at etf.timothyplan.com or by calling (800) 846-7526. | ||||||||||||||||||||||||||||||||||||||||||||

| Year-by-year Annual Total Returns (for calendar years ending on December 31) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for periods ending on December 31, 2023) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Small Company Risk | ||||||||||||||||||||||||||||||||||||||||||||

Small Company Risk. Small company stocks present above-average risks. This means that when stock prices decline overall, the Portfolio may decline more than a broad-based securities market index. These companies usually offer a smaller range of products and services than larger companies. They may also have limited financial resources and may lack management depth. As a result, stocks issued by smaller companies tend to be less liquid and fluctuate in value more than the stocks of larger, more established companies. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Excluded Security Risk | ||||||||||||||||||||||||||||||||||||||||||||

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Index Risk | ||||||||||||||||||||||||||||||||||||||||||||

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Equity Securities Risk | ||||||||||||||||||||||||||||||||||||||||||||

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Stock Market Risk | ||||||||||||||||||||||||||||||||||||||||||||

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Liquidity Risk | ||||||||||||||||||||||||||||||||||||||||||||

Liquidity Risk. In certain circumstances, such as the disruption of the orderly markets for the investments in which the Fund invests, the Fund might not be able to dispose of certain holdings quickly or at prices that represent true market value in the judgment of the Sub-Advisor. Markets for the investments in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, natural disasters, new legislation, or regulatory changes, and may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Index. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Passive Investment Risk | ||||||||||||||||||||||||||||||||||||||||||||

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Calculation Methodology Risk | ||||||||||||||||||||||||||||||||||||||||||||

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Tracking Error Risk | ||||||||||||||||||||||||||||||||||||||||||||

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Exchange-Traded Fund (“ETF”) Structure Risk | ||||||||||||||||||||||||||||||||||||||||||||

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result, is subject to special risks, including:

market will develop for the shares. In stressed market conditions, authorized participants may be unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares.

| ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Valuation Risk | ||||||||||||||||||||||||||||||||||||||||||||

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Large Shareholder Risk | ||||||||||||||||||||||||||||||||||||||||||||

|

You may lose money by investing in the Fund. There is no guarantee that the Fund will achieve its objective. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Risk Lose Money [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| You may lose money by investing in the Fund. | ||||||||||||||||||||||||||||||||||||||||||||

| US SMALL CAP CORE ETF | Risk Not Insured Depository Institution [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | ||||||||||||||||||||||||||||||||||||||||||||

| US Large / Mid Cap Core ETF | ||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to provide investment results that track the performance of the Victory US Large/Mid Cap Volatility Weighted BRI Index before fees and expenses. | ||||||||||||||||||||||||||||||||||||||||||||

| FEES AND EXPENSES OF THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below. | ||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE: | ||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 30% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT STRATEGIES | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large Cap Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities, rather than traditional market-cap weighting. Such a methodology is sometimes referred to as “Smart Beta.” The Index follows a proprietary rules-based methodology, developed by the Sub-Advisor, to construct its constituent securities.

The Index universe begins with the stocks included in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies by market capitalization with positive earnings over the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Index.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $2.2 trillion.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all of the stocks in the Index, in approximately the percentages represented by the securities in the Index. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL RISKS OF INVESTING IN THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

| PAST PERFORMANCE | ||||||||||||||||||||||||||||||||||||||||||||

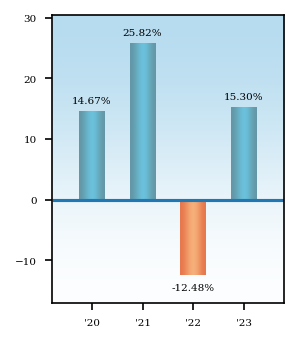

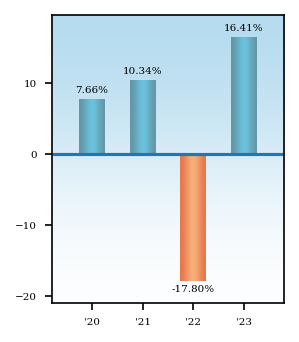

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index index and to the Underlying Index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Performance data for the Fund may be available online at etf.timothyplan.com or by calling (800) 846-7526. | ||||||||||||||||||||||||||||||||||||||||||||

| Year-by-year Annual Total Returns (for calendar years ending on December 31) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for periods ending on December 31, 2023) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Excluded Security Risk | ||||||||||||||||||||||||||||||||||||||||||||

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Index Risk | ||||||||||||||||||||||||||||||||||||||||||||

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Equity Securities Risk | ||||||||||||||||||||||||||||||||||||||||||||

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Stock Market Risk | ||||||||||||||||||||||||||||||||||||||||||||

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Passive Investment Risk | ||||||||||||||||||||||||||||||||||||||||||||

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Calculation Methodology Risk | ||||||||||||||||||||||||||||||||||||||||||||

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Tracking Error Risk | ||||||||||||||||||||||||||||||||||||||||||||

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Exchange-Traded Fund (“ETF”) Structure Risk | ||||||||||||||||||||||||||||||||||||||||||||

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result is subject to special risks, including:

| ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Valuation Risk | ||||||||||||||||||||||||||||||||||||||||||||

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Large Shareholder Risk | ||||||||||||||||||||||||||||||||||||||||||||

|

You may lose money by investing in the Fund. There is no guarantee that the Fund will achieve its objective. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Risk Lose Money [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| You may lose money by investing in the Fund. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Risk Not Insured Depository Institution [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Large-Capitalization Stock Risk | ||||||||||||||||||||||||||||||||||||||||||||

Large-Capitalization Stock Risk. The securities of large-sized companies may underperform the securities of smaller-sized companies or the market as a whole. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ETF | Mid-Capitalization Stock Risk | ||||||||||||||||||||||||||||||||||||||||||||

Mid-Capitalization Stock Risk. Mid-sized companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | ||||||||||||||||||||||||||||||||||||||||||||

| US Large / Mid Cap Core Enhanced ETF | ||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to provide investment results that track the performance of Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI Index before fees and expenses. | ||||||||||||||||||||||||||||||||||||||||||||

| FEES AND EXPENSES OF THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below. | ||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE: | ||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 302% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT STRATEGIES | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities.

In accordance with a rules-based formula, the Index tactically reduces its exposure to the equity markets during periods of significant market decline and reallocates to stocks when market prices have either further declined or rebounded. The term

The Index utilizes the following rules-based methodology to construct its constituent securities:

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $2.2 trillion.

The Index follows a mathematical index construction process designed to limit risk during periods of significant (non-normal) market decline by reducing its exposure to the equity market by allocating a portion of the Index to cash or cash equivalents. The market decline is measured at month-end by reference to the Victory US Large Cap/Mid Cap Volatility Weighted BRI Index (“Reference Index”), which is composed of similar securities as the Index but without any allocation to cash or cash equivalents.

A “significant market decline” means a decline of 10% or more from the Reference Index’s all-time daily high closing value compared to its most recent month-end closing value, during which, the Index’s exposure to the equity market may be as low as 25% depending on the magnitude and duration of such decline.

During a period of significant market decline that is 10% or more but less than 20% (the “initial trigger point”), the Index will allocate 75% of the stocks included in the Index to cash or cash equivalents, with the remaining 25% consisting of stocks included in the Reference Index.

The Index will reallocate all or a portion of its cash or cash equivalents to stocks when the Reference Index reaches certain additional trigger points, measured at a subsequent month-end, as follows:

The Index will make any prescribed allocations to cash in accordance with the mathematical formula only at month end. In the event that it does, the Fund will experience higher portfolio turnover and incur additional transaction costs.

During any periods of significant market decline, when the Index’s exposure to the market is less than 100%, the Fund will invest the cash portion dictated by the Index in 30-day U.S. Treasury bills or in money market mutual funds that primarily invest in short-term U.S. Treasury obligations.

While the Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all the stocks in the Index, at times the Fund may pursue its investment objective by investing in the Index securities indirectly by investing all or a portion of its assets in another investment company advised by the Advisor, including an exchange-traded fund (“ETF”), that seeks to track the Index or the Reference Index.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL RISKS OF INVESTING IN THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

| PAST PERFORMANCE | ||||||||||||||||||||||||||||||||||||||||||||

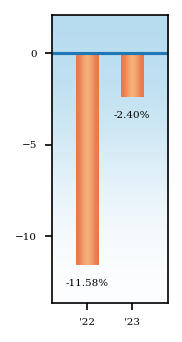

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index index and to the Underlying Index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Performance data for the Fund may be available online at etf.timothyplan.com or by calling (800) 846-7526. | ||||||||||||||||||||||||||||||||||||||||||||

| Year-by-year Annual Total Returns (for calendar years ending on December 31) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for periods ending on December 31, 2023) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Excluded Security Risk | ||||||||||||||||||||||||||||||||||||||||||||

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Index Risk | ||||||||||||||||||||||||||||||||||||||||||||

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of

time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Equity Securities Risk | ||||||||||||||||||||||||||||||||||||||||||||

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Stock Market Risk | ||||||||||||||||||||||||||||||||||||||||||||

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Passive Investment Risk | ||||||||||||||||||||||||||||||||||||||||||||

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Calculation Methodology Risk | ||||||||||||||||||||||||||||||||||||||||||||

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Tracking Error Risk | ||||||||||||||||||||||||||||||||||||||||||||

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Exchange-Traded Fund (“ETF”) Structure Risk | ||||||||||||||||||||||||||||||||||||||||||||

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result, is subject to special risks, including:

unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares.

| ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Valuation Risk | ||||||||||||||||||||||||||||||||||||||||||||

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Large Shareholder Risk | ||||||||||||||||||||||||||||||||||||||||||||

|

You may lose money by investing in the Fund. There is no guarantee that the Fund will achieve its objective. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Risk Lose Money [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| You may lose money by investing in the Fund. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Risk Not Insured Depository Institution [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Large-Capitalization Stock Risk | ||||||||||||||||||||||||||||||||||||||||||||

Large-Capitalization Stock Risk. The securities of large-sized companies may underperform the securities of smaller-sized companies or the market as a whole. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Mid-Capitalization Stock Risk | ||||||||||||||||||||||||||||||||||||||||||||

Mid-Capitalization Stock Risk. Mid-sized companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Fixed Income Risk | ||||||||||||||||||||||||||||||||||||||||||||

Fixed Income Risk. The value of the Fund’s direct or indirect investments in fixed income securities changes in response to various factors, including, for example, market-related factors (such as changes in interest rates or changes in the risk appetite of investors generally) and changes in the actual or perceived ability of the issuer (or of issuers generally) to meet its (or their) obligations. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Portfolio Turnover Risk | ||||||||||||||||||||||||||||||||||||||||||||

Portfolio Turnover Risk. Higher portfolio turnover ratios resulting from additional purchases and sales of portfolio securities will generally result in higher transaction costs and Fund expenses and may result in more significant distributions of short-term capital gains to investors, which are taxed as ordinary income. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Investment Company Risk | ||||||||||||||||||||||||||||||||||||||||||||

Investment Company Risk. An investment company or similar vehicle (including an ETF) in which the Fund invests may not achieve its investment objective. Underlying investment vehicles are subject to investment Advisory and other expenses, which will be indirectly paid by the Fund. Lack of liquidity in an ETF could result in an ETF being more volatile than the underlying portfolio of securities. | ||||||||||||||||||||||||||||||||||||||||||||

| US LARGE / MID CAP CORE ENHANCED ETF | Index/Defensive Positioning Risk | ||||||||||||||||||||||||||||||||||||||||||||

Index/Defensive Positioning Risk. Because the Index’s allocation to cash versus securities is determined at month-end, there is a risk that the Index, and thus the Fund, will not react to changes in market conditions that occur between reallocations, or will react to a short-term market swing that occurs at month end. The Fund will incur transaction costs and potentially adverse tax consequences in the event the Index allocates to cash. There is no guarantee that the Index’s prescribed defensive strategy, if employed, will be successful in minimizing downside market risk. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | ||||||||||||||||||||||||||||||||||||||||||||

| High Dividend Stock ETF | ||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to provide investment results that track the performance of the Victory US Large Cap High Dividend Volatility Weighted BRI Index before fees and expenses. | ||||||||||||||||||||||||||||||||||||||||||||

| FEES AND EXPENSES OF THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below. | ||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE: | ||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal period, the Fund’s portfolio turnover rate was 41% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT STRATEGIES | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large Cap High Dividend Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities, rather than traditional market-cap weighting. Such a methodology is sometimes referred to as “Smart Beta.” The Index follows a proprietary rules-based methodology, developed by the Fund’s Sub-Advisor, to construct its constituent securities.

The Index is comprised of the largest 100 dividend yielding stocks among the largest U.S. companies by market capitalization from the Victory US Large/Mid Cap Volatility Weighted BRI Index (“Parent Index”). The Parent Index universe begins with the stocks included in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies by market capitalization with positive earnings over the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Index.

The 100 highest dividend yielding stocks become the stocks included in the Index and are weighted based on their daily standard deviation (volatility) of daily price changes over the last 180 trading days. Stocks with lower volatility receive a higher weighting and stocks with higher volatility receive a lower weighting.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $613.7 billion.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all of the stocks in the Index, in approximately the percentages represented by the securities in the index. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL RISKS OF INVESTING IN THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

| PAST PERFORMANCE | ||||||||||||||||||||||||||||||||||||||||||||

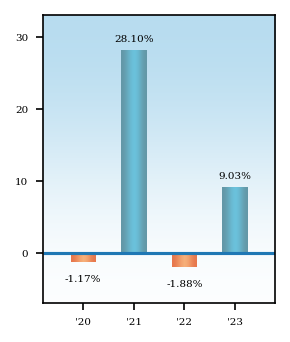

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index index and to the Underlying Index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Performance data for the Fund may be available online at etf.timothyplan.com or by calling (800) 846-7526. | ||||||||||||||||||||||||||||||||||||||||||||

| Year-by-year Annual Total Returns (for calendar years ending on December 31) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for periods ending on December 31, 2023) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Excluded Security Risk | ||||||||||||||||||||||||||||||||||||||||||||

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Index Risk | ||||||||||||||||||||||||||||||||||||||||||||

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Equity Securities Risk | ||||||||||||||||||||||||||||||||||||||||||||

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Stock Market Risk | ||||||||||||||||||||||||||||||||||||||||||||

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Passive Investment Risk | ||||||||||||||||||||||||||||||||||||||||||||

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Calculation Methodology Risk | ||||||||||||||||||||||||||||||||||||||||||||

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Tracking Error Risk | ||||||||||||||||||||||||||||||||||||||||||||

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Exchange-Traded Fund (“ETF”) Structure Risk | ||||||||||||||||||||||||||||||||||||||||||||

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result, is subject to special risks, including:

active secondary market will develop for the shares. In stressed market conditions, authorized participants may be unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares.

| ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Valuation Risk | ||||||||||||||||||||||||||||||||||||||||||||

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Large Shareholder Risk | ||||||||||||||||||||||||||||||||||||||||||||

|

You may lose money by investing in the Fund. There is no guarantee that the Fund will achieve its objective. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Risk Lose Money [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| You may lose money by investing in the Fund. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Risk Not Insured Depository Institution [Member] | ||||||||||||||||||||||||||||||||||||||||||||

| An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Large-Capitalization Stock Risk | ||||||||||||||||||||||||||||||||||||||||||||

Large-Capitalization Stock Risk. The securities of large-sized companies may underperform the securities of smaller-sized companies or the market as a whole. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Mid-Capitalization Stock Risk | ||||||||||||||||||||||||||||||||||||||||||||

Mid-Capitalization Stock Risk. Mid-sized companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ETF | Investment Strategy Risk | ||||||||||||||||||||||||||||||||||||||||||||

Investment Strategy Risk. The Fund’s dividend strategy may not be successful. Dividend paying stocks may fall out of favor relative to the overall market. In addition, the Index may not successfully identify companies that meet its objectives. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | ||||||||||||||||||||||||||||||||||||||||||||

| High Dividend Stock Enhanced ETF | ||||||||||||||||||||||||||||||||||||||||||||

| INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to provide investment results that track the performance of the Victory US Large Cap High Dividend Long/Cash Volatility Weighted BRI Index (the “Index”) before fees and expenses. | ||||||||||||||||||||||||||||||||||||||||||||

| FEES AND EXPENSES OF THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below. | ||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| EXAMPLE: | ||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| PORTFOLIO TURNOVER | ||||||||||||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 209% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL INVESTMENT STRATEGIES | ||||||||||||||||||||||||||||||||||||||||||||

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large Cap High Dividend Long/Cash Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities. In accordance with a rules-based mathematical formula, the Index tactically reduces its exposure to the equity markets during periods of significant market decline and reallocates to stocks when market prices have further declined or rebounded. The term “Long/Cash” in the Fund’s name refers to a feature of the Index that is designed to enhance risk-adjusted returns while attempting to minimize downside market risk through defensive positioning, as described below.

The Index is comprised of the highest 100 dividend yielding stocks included in the Victory US Large/Mid Cap Volatility Weighted BRI Index (“Parent Index”). The Parent Index universe begins with the stocks included in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies by market capitalization with positive earnings across the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Parent Index.

The 100 highest dividend yielding stocks included in the Index are weighted based on their daily standard deviation (volatility) of daily price changes over the last 180 trading days. Stocks with lower volatility receive a higher weighting and stocks with higher volatility receive a lower weighting.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $613.7 billion.

The Index utilizes the following index construction process designed to limit risk during periods of significant

A “significant market decline” means a decline of 8% or more from the Reference Index’s all-time daily high closing value compared to its most recent month-end closing value, during which, the Index’s exposure to the equity market may be as low as 25% depending on the magnitude and duration of such decline.

During a period of significant market decline that is 8% or more but less than 16% (the “initial trigger point”), the Index will allocate 75% of the stocks included in the Index to cash or cash equivalents, with the remaining 25% consisting of stocks included in the Reference Index.

The Index will reallocate all or a portion of its cash or cash equivalents to stocks when the Reference Index reaches certain additional trigger points, measured at a subsequent month-end, as follows:

The Index will make any prescribed allocations to cash in accordance with the mathematical formula only at month end. In the event that it does, the Fund will experience higher portfolio turnover and incur additional transaction costs.

During any periods of significant market decline, when the Index’s exposure to the market is less than 100%, the Fund will invest the cash portion dictated by the Index in 30-day U.S. Treasury bills or in money market mutual funds that primarily invest in short-term U.S. Treasury obligations.

While the Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all the stocks in the Index, at times the Fund may pursue its investment objective by investing in the Index securities indirectly by investing all or a portion of its assets in another investment company advised by the Advisor, including an exchange-traded fund (“ETF”), that seeks to track the Index or the Reference Index. | ||||||||||||||||||||||||||||||||||||||||||||

| PRINCIPAL RISKS OF INVESTING IN THE FUND | ||||||||||||||||||||||||||||||||||||||||||||

| PAST PERFORMANCE | ||||||||||||||||||||||||||||||||||||||||||||

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index index and to the Underlying Index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Performance data for the Fund may be available online at etf.timothyplan.com or by calling (800) 846-7526. | ||||||||||||||||||||||||||||||||||||||||||||

| Year-by-year Annual Total Returns (for calendar years ending on December 31) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for periods ending on December 31, 2023) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Excluded Security Risk | ||||||||||||||||||||||||||||||||||||||||||||

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Index Risk | ||||||||||||||||||||||||||||||||||||||||||||

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of

time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Equity Securities Risk | ||||||||||||||||||||||||||||||||||||||||||||

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Stock Market Risk | ||||||||||||||||||||||||||||||||||||||||||||

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Passive Investment Risk | ||||||||||||||||||||||||||||||||||||||||||||

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Calculation Methodology Risk | ||||||||||||||||||||||||||||||||||||||||||||

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index. | ||||||||||||||||||||||||||||||||||||||||||||

| HIGH DIVIDEND STOCK ENHANCED ETF | Tracking Error Risk | ||||||||||||||||||||||||||||||||||||||||||||

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not. | ||||||||||||||||||||||||||||||||||||||||||||