Securities Act File No. 033-73248

Investment Company Act File No. 811-08228

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

|

Post-Effective Amendment No. 122 |

x |

and/or

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

|

Post-Effective Amendment No. 123 |

x | |

(Exact Name of Registrant as Specified in Charter)

1055 MAITLAND CENTER COMMONS

MAITLAND, FL 32751

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (407) 644-1986

ARTHUR D. ALLY,

1055 MAITLAND CENTER COMMONS

MAITLAND, FL 32751

(Name and Address of Agent for Service)

Copies to:

DAVID C. MAHAFFEY, ESQ.

Sullivan & Worchester LLP

1666 K Street, NW

Washington, DC 20006

It is proposed that this filing will become effective:

| [ ] | immediately upon filing pursuant to paragraph (b) |

| X | on |

| [ ] | 60 days after filing pursuant to paragraph (a)(1) |

| [ ] | on (date) pursuant to paragraph (a)(1) |

| [ ] | 75 days after filing pursuant to paragraph (a)(2) |

| [ ] | on (date) pursuant to paragraph (a)(2) of rule 485 |

If appropriate check this box:

| [ ] | this post-effective amendment designates a new effective date for a previously filed post-effective amendment |

EXCHANGE-TRADED FUNDS |

|

PROSPECTUS |

|

May 1, 2024 |

|

Ticker |

|

US SMALL CAP CORE ETF |

|

US LARGE / MID CAP CORE ETF |

|

US LARGE / MID CAP CORE ENHANCED ETF |

|

HIGH DIVIDEND STOCK ETF |

|

HIGH DIVIDEND STOCK ENHANCED ETF |

|

INTERNATIONAL ETF |

|

MARKET NEUTRAL ETF |

Each listed and traded on: The New York Stock Exchange

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THE FUND’S SECURITIES OR DETERMINED WHETHER THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Table of Contents

Section 1 | Fund Summaries |

|

US Small Cap Core ETF |

4 |

US Large / Mid Cap Core ETF |

10 |

US Large / Mid Cap Core Enhanced ETF |

16 |

High Dividend Stock ETF |

23 |

High Dividend Stock Enhanced ETF |

29 |

International ETF |

36 |

Market Neutral ETF |

42 |

Section 2 | Additional Fund Information |

|

Additional Information about the Funds |

48 |

Additional Information about the International Fund |

49 |

Additional Information about the Enhanced Funds |

49 |

Additional Information about the Market Neutral Fund |

49 |

Investments |

49 |

Additional Fund Strategies |

50 |

Principal Risk Factors |

50 |

Additional Risk Factors |

58 |

Section 3 | Organization and Management of the Funds |

|

The Investment Advisor |

59 |

The Managing General Partner |

59 |

The Sub-Advisor |

59 |

Portfolio Management |

60 |

Share Price |

60 |

Premium/Discount Information |

61 |

How to Buy and Sell Shares |

62 |

Share Trading Prices |

62 |

Book Entry |

62 |

Frequent Purchases and Redemptions of Fund Shares |

62 |

Section 4 | Distributions and Taxes |

|

Taxes on Distributions |

64 |

Taxes on Exchange-Listed Share Sales |

65 |

Taxes on Purchase and Redemption of Creation Units |

65 |

Section 5 | Other Information |

|

Continuous Offering |

66 |

Portfolio Holdings Disclosure |

66 |

Shareholder Communications |

66 |

Disclaimers |

66 |

Section 6 | Other Service Providers |

68 |

Section 7 | Financial Highlights |

69 |

Section 8 | Other Information |

77 |

TABLE OF CONTENTS

PROSPECTUS (ETFS) / 2

Section 1 | Fund Summary |

The Timothy Plan believes it has a moral and ethical responsibility to invest in a biblically responsible manner. Accordingly, we strive to ensure the Timothy Plan ETFs do not invest in any company involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. Securities issued by companies engaged in these prohibited activities are excluded from the ETFs’ portfolios. These securities are referred to throughout this Prospectus (the “Prospectus”) as “Excluded Securities.”. The Advisor and Sub-Advisor maintain a list of Excluded Securities to avoid purchasing the Excluded Securities in Timothy Plan ETFs’ portfolios.

Timothy Partners, Ltd. (“TPL”) is Investment Advisor to the Funds and is responsible for determining what companies are deemed Excluded Securities, and reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but could be found offensive to fundamental, traditional Judeo- Christian values. The Advisor establishes the Biblically Responsible Investing parameters that are employed by the research service provider in the creation of the “excluded list of companies” that may not be placed into any Timothy Plan ETF portfolio. The research company may not alter, delete, or employ additional parameters without the prior knowledge and consent of the Advisor

In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated as soon as reasonably practicable with respect to the Market Neutral ETF, and at the next re-balancing with respect to the remaining ETFs.

FUND SUMMARIES

PROSPECTUS (ETFS) / 3

FUND SUMMARY

May 1, 2024

The Fund seeks to provide investment results that track the performance of the Victory US Small Cap Volatility Weighted BRI Index before fees and expenses.

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below.

(fees paid directly from your investment)

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

MANAGEMENT FEES |

|

Total Annual Operating Expenses |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be:

1 Year |

3 Years |

5 Years |

10 Years |

$ |

$ |

$ |

$ |

FUND SUMMARIES

PROSPECTUS (ETFS) / 4

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Small Cap Volatility Weighted BRI Index (the “Index” or the “Underlying Index”) , an unmanaged, volatility weighted index created by the Fund’s Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities, rather than traditional market-cap weighting. Such a methodology is sometimes referred to as “Smart Beta.” The Index follows a proprietary rules-based methodology developed by the Fund’s Sub-Advisor, to construct its constituent securities.

The Index universe begins with the stocks included in the Nasdaq Victory US Small Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies with the bottom 10% by market capitalization as represented by NASDAQ US Small Cap Index (NQUSS) with positive earnings over the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Parent Index.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $ $358.4 million to $56.5 billion.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all of the stocks in the Index. A replication strategy means that the Fund seeks to hold all of the securities included in its index, in approximately the percentages represented by the securities in the index.

The principal risks of investing in the Fund are summarized below. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Small Company Risk. Small company stocks present above-average risks. This means that when stock prices decline overall, the Portfolio may decline more than a broad-based securities market index. These companies usually offer a smaller range of products and services than larger companies. They may also have limited financial resources and may lack management depth. As a result, stocks issued by smaller companies tend to be less liquid and fluctuate in value more than the stocks of larger, more established companies.

FUND SUMMARIES

PROSPECTUS (ETFS) / 5

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates.

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition.

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods.

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods.

Liquidity Risk. In certain circumstances, such as the disruption of the orderly markets for the investments in which the Fund invests, the Fund might not be able to dispose of certain holdings quickly or at prices that represent true market value in the judgment of the Sub-Advisor. Markets for the investments in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, natural disasters, new legislation, or regulatory changes, and may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Index.

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets.

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index.

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not.

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result, is subject to special risks, including:

|

● |

Not Individually Redeemable. The Fund’s shares are not individually redeemable and may be redeemed by the Fund at its net asset value per share (“NAV”) only in large blocks known as Creation Units. The Fund may incur brokerage costs purchasing enough shares to constitute a Creation Unit. Alternatively, the Fund may redeem your shares by selling them on the secondary market at prevailing market prices. |

|

● |

Trading Issues. Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable, such as extraordinary market volatility. There can be no assurance that shares will continue to meet the listing requirements of the Exchange. There is no guarantee that an active secondary |

FUND SUMMARIES

PROSPECTUS (ETFS) / 6

market will develop for the shares. In stressed market conditions, authorized participants may be unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares.

|

● |

Market Price Variance Risk. The market prices of shares will fluctuate in response to changes in NAV and supply and demand for shares and will include a bid-ask spread charged by the exchange specialists, market makers, or other participants that trade the particular security. There may be times when the market price and the NAV vary significantly, particularly in times of market stress. This means that shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Authorized Participants Concentration Risk. A limited number of financial institutions may be responsible for all or a significant portion of the creation and redemption activity for the Fund. If these firms exit the business or are unable or unwilling to process creation and/or redemption orders, shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Tax-Efficiency Risk. Redemptions of shares may be effected for cash, rather than in kind, which means that the Fund may need to sell portfolio securities in order to complete an in-cash redemption, and may recognize net gains on these sales. As a result, investments in the shares may be less tax-efficient than investments in ETFs that redeem solely or principally in kind, and the Fund may pay out higher annual capital gain distributions than if the in-kind redemption process was used. |

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment.

FUND SUMMARIES

PROSPECTUS (ETFS) / 7

Performance data for the Fund may be available online at

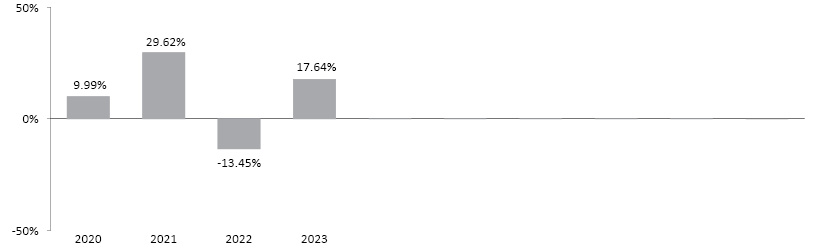

(for calendar years ending on December 31)

% |

% |

(for periods ending on December 31, 2023)

US SMALL CAP CORE ETF |

|||

1 Year |

3 Year |

Inception* |

|

Return before taxes |

|||

Return after taxes on distributions (1) |

|||

Return after taxes on distributions and sale of shares (1) |

|||

Victory US Small Cap Volatility Weighted BRI Index (2) (reflects no deduction for fees, expenses or taxes) |

|||

Russell 2000 Index(3) (reflects no deduction for fees, expenses or taxes) |

|

* |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

FUND SUMMARIES

PROSPECTUS (ETFS) / 8

INVESTMENT ADVISOR

Timothy Partners, Ltd. has served as the Fund’s investment advisor since the Fund commenced operations on December 2, 2019.

SUB-ADVISOR

Victory Capital Management Inc. (“Victory Capital” or the “Sub-Advisor”) through its Victory Solutions team, has served as the Fund’s Sub-Advisor since the Fund commenced operations on December 2, 2019.

PORTFOLIO MANAGERS

Mannik Dhillon is President of Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on December 2, 2019.

Free Foutz is the Portfolio Implementation Manager for Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on December 2, 2019.

PURCHASE AND SALE OF SHARES

The Fund issues and redeems Shares at their net asset value (NAV) only in large blocks (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed for cash and/or in-kind for securities by Authorized Participants (“APs”) that have entered into agreements with the Fund’s distributor. Individual Shares may only be purchased and sold through brokers in secondary market transactions on The New York Stock Exchange (the “Exchange”). Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Shares of the Fund will be listed for trading on the Exchange and will trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than (a premium), at or less than (a discount) NAV.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”).

TAX INFORMATION

The Fund’s distributions generally are taxable as ordinary income, qualified dividend income or capital gains. A sale of Shares may result in capital gain or loss.

PAYMENT TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares through a broker-dealer or another financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (ETFS) / 9

FUND SUMMARY

May 1, 2024

The Fund seeks to provide investment results that track the performance of the Victory US Large/Mid Cap Volatility Weighted BRI Index before fees and expenses.

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below.

(fees paid directly from your investment)

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

MANAGEMENT FEES |

|

Total Annual Operating Expenses |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be:

1 Year |

3 Years |

5 Years |

10 Years |

$ |

$ |

$ |

$ |

FUND SUMMARIES

PROSPECTUS (ETFS) / 10

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large Cap Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities, rather than traditional market-cap weighting. Such a methodology is sometimes referred to as “Smart Beta.” The Index follows a proprietary rules-based methodology, developed by the Sub-Advisor, to construct its constituent securities.

The Index universe begins with the stocks included in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies by market capitalization with positive earnings over the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Index.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $2.2 trillion.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all of the stocks in the Index, in approximately the percentages represented by the securities in the Index.

The principal risks of investing in the Fund are summarized below. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Large-Capitalization Stock Risk. The securities of large-sized companies may underperform the securities of smaller-sized companies or the market as a whole. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion.

Mid-Capitalization Stock Risk. Mid-sized companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss.

FUND SUMMARIES

PROSPECTUS (ETFS) / 11

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates.

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition.

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods.

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods.

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets.

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index.

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not.

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result is subject to special risks, including:

|

● |

Not Individually Redeemable. The Fund’s shares are not individually redeemable and may be redeemed by the Fund at its net asset value per share (“NAV”) only in large blocks known as Creation Units. The Fund may incur brokerage costs purchasing enough shares to constitute a Creation Unit. Alternatively, the Fund may redeem your shares by selling them on the secondary market at prevailing market prices. |

|

● |

Trading Issues. Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable, such as extraordinary market volatility. There can be no assurance that shares will continue to meet the listing requirements of the Exchange. There is no guarantee that an active secondary market will develop for the shares. In stressed market conditions, authorized participants may be unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares. |

FUND SUMMARIES

PROSPECTUS (ETFS) / 12

|

● |

Market Price Variance Risk. The market prices of shares will fluctuate in response to changes in NAV and supply and demand for shares and will include a bid-ask spread charged by the exchange specialists, market makers, or other participants that trade the particular security. There may be times when the market price and the NAV vary significantly, particularly in times of market stress. This means that shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Authorized Participants Concentration Risk. A limited number of financial institutions may be responsible for all or a significant portion of the creation and redemption activity for the Fund. If these firms exit the business or are unable or unwilling to process creation and/or redemption orders, shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Tax-Efficiency Risk. Redemptions of shares may be effected for cash, rather than in kind, which means that the Fund may need to sell portfolio securities in order to complete an in-cash redemption, and may recognize net gains on these sales. As a result, investments in the shares may be less tax-efficient than investments in ETFs that redeem solely or principally in kind, and the Fund may pay out higher annual capital gain distributions than if the in-kind redemption process was used. |

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment.

Performance data for the Fund may be available online at

FUND SUMMARIES

PROSPECTUS (ETFS) / 13

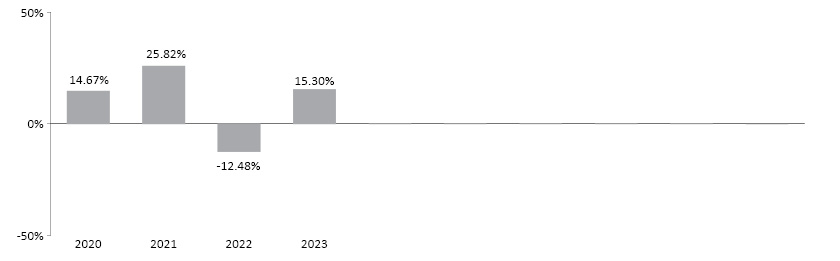

(for calendar years ending on December 31)

% |

% |

(for periods ending on December 31, 2023)

US LARGE / MID CAP CORE ETF |

|||||

1 Year |

3 Year |

Inception* |

|||

Return before taxes |

|||||

Return after taxes on distributions (1) |

|||||

Return after taxes on distributions and sale of shares (1) |

|||||

Victory US Large/Mid Cap Volatility Weighted BRI Index (2) (reflects no deduction for fees, expenses or taxes) |

|||||

S&P 500 Index (3) (reflects no deduction for fees, expenses or taxes) |

|||||

|

* |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

INVESTMENT ADVISOR

Timothy Partners, Ltd. has served as the Fund’s investment advisor since the Fund commenced operations on April 29, 2019.

SUB-ADVISOR

Victory Capital Management Inc. (“Victory Capital” or the “Sub-Advisor”) through its Victory Solutions team, has served as the Fund’s Sub-Advisor since the Fund commenced operations on April 29, 2019.

FUND SUMMARIES

PROSPECTUS (ETFS) / 14

PORTFOLIO MANAGERS

Mannik Dhillon is President of Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on April 29, 2019.

Free Foutz is the Portfolio Implementation Manager for Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on April 29, 2019.

PURCHASE AND SALE OF SHARES

The Fund issues and redeems Shares at their net asset value (NAV) only in large blocks (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed for cash and/or in-kind for securities by Authorized Participants (“APs”) that have entered into agreements with the Fund’s distributor. Individual Shares may only be purchased and sold through brokers in secondary market transactions on The New York Stock Exchange (the “Exchange”). Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Shares of the Fund will be listed for trading on the Exchange and will trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than (a premium), at or less than (a discount) NAV.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”).

TAX INFORMATION

The Fund’s distributions generally are taxable as ordinary income, qualified dividend income or capital gains. A sale of Shares may result in capital gain or loss.

PAYMENT TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares through a broker-dealer or another financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (ETFS) / 15

FUND SUMMARY

May 1, 2024

The Fund seeks to provide investment results that track the performance of Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI Index before fees and expenses.

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below.

(fees paid directly from your investment)

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

MANAGEMENT FEES |

|

Acquired Fund Fees and Expenses |

|

Total Annual Operating Expenses(1) |

|

(1) |

|

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be:

1 Year |

3 Years |

5 Years |

10 Years |

$ |

$ |

$ |

$ |

FUND SUMMARIES

PROSPECTUS (ETFS) / 16

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large/Mid Cap Long/Cash Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities.

In accordance with a rules-based formula, the Index tactically reduces its exposure to the equity markets during periods of significant market decline and reallocates to stocks when market prices have either further declined or rebounded. The term

“Long/Cash” in the Fund’s name refers to a feature of the Index that is designed to enhance risk-adjusted returns while attempting to minimize downside market risk through defensive positioning, as described below.

The Index utilizes the following rules-based methodology to construct its constituent securities:

|

● |

The Index universe begins with all publicly traded U.S. stocks and then screens for all companies with positive earnings across the last twelve months. |

|

● |

The Index identifies the 500 largest U.S. stocks by market capitalization measured at the time the Index’s constituent securities are determined. |

|

● |

The 500 stocks are weighted based on their daily standard deviation (volatility) of daily price changes over the last 180 trading days. Stocks with lower volatility receive a higher weighting and stocks with higher volatility receive a lower weighting. |

|

● |

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Index. |

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $2.2 trillion.

The Index follows a mathematical index construction process designed to limit risk during periods of significant (non-normal) market decline by reducing its exposure to the equity market by allocating a portion of the Index to cash or cash equivalents. The market decline is measured at month-end by reference to the Victory US Large Cap/Mid Cap Volatility Weighted BRI Index (“Reference Index”), which is composed of similar securities as the Index but without any allocation to cash or cash equivalents.

A “significant market decline” means a decline of 10% or more from the Reference Index’s all-time daily high closing value compared to its most recent month-end closing value, during which, the Index’s exposure to the equity market may be as low as 25% depending on the magnitude and duration of such decline.

During a period of significant market decline that is 10% or more but less than 20% (the “initial trigger point”), the Index will allocate 75% of the stocks included in the Index to cash or cash equivalents, with the remaining 25% consisting of stocks included in the Reference Index.

The Index will reallocate all or a portion of its cash or cash equivalents to stocks when the Reference Index reaches certain additional trigger points, measured at a subsequent month-end, as follows:

|

● |

The Index will return to being 100% allocated to stocks if the subsequent month-end closing value of the stocks in the Reference Index returns to a level that is less than the initial trigger point. |

FUND SUMMARIES

PROSPECTUS (ETFS) / 17

|

● |

If the Reference Index declines by 20% or more but less than 30% from its all-time daily high closing value as measured at a subsequent month-end, the Index will reallocate an additional 25% to the stocks in the Reference Index at their current securities weightings and the Index will then be 50% allocated to stocks included in the Reference Index. |

|

● |

If the Reference Index declines by 30% or more but less than 40% from its all-time daily high closing value as measured at a subsequent month-end, the Index will reallocate another 25% to the stocks of the Reference Index at their current securities weighting and the Index will then be 75% allocated to stocks included in the Reference Index. |

|

● |

If the Reference Index declines by 40% or more from its all-time daily high closing value as measured at a subsequent month-end, the Index will reallocate the remaining 25% to the stocks in the Reference Index at their current securities weighting. At this point, the Index will be 100% allocated to stocks included in the Reference Index. |

The Index will make any prescribed allocations to cash in accordance with the mathematical formula only at month end. In the event that it does, the Fund will experience higher portfolio turnover and incur additional transaction costs.

During any periods of significant market decline, when the Index’s exposure to the market is less than 100%, the Fund will invest the cash portion dictated by the Index in 30-day U.S. Treasury bills or in money market mutual funds that primarily invest in short-term U.S. Treasury obligations.

While the Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all the stocks in the Index, at times the Fund may pursue its investment objective by investing in the Index securities indirectly by investing all or a portion of its assets in another investment company advised by the Advisor, including an exchange-traded fund (“ETF”), that seeks to track the Index or the Reference Index.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The principal risks of investing in the Fund are summarized below. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Fixed Income Risk. The value of the Fund’s direct or indirect investments in fixed income securities changes in response to various factors, including, for example, market-related factors (such as changes in interest rates or changes in the risk appetite of investors generally) and changes in the actual or perceived ability of the issuer (or of issuers generally) to meet its (or their) obligations.

Large-Capitalization Stock Risk. The securities of large-sized companies may underperform the securities of smaller-sized companies or the market as a whole. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion.

Mid-Capitalization Stock Risk. Mid-sized companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss.

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates.

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of

FUND SUMMARIES

PROSPECTUS (ETFS) / 18

time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition.

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods.

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods.

Portfolio Turnover Risk. Higher portfolio turnover ratios resulting from additional purchases and sales of portfolio securities will generally result in higher transaction costs and Fund expenses and may result in more significant distributions of short-term capital gains to investors, which are taxed as ordinary income.

Investment Company Risk. An investment company or similar vehicle (including an ETF) in which the Fund invests may not achieve its investment objective. Underlying investment vehicles are subject to investment Advisory and other expenses, which will be indirectly paid by the Fund. Lack of liquidity in an ETF could result in an ETF being more volatile than the underlying portfolio of securities.

Index/Defensive Positioning Risk. Because the Index’s allocation to cash versus securities is determined at month-end, there is a risk that the Index, and thus the Fund, will not react to changes in market conditions that occur between reallocations, or will react to a short-term market swing that occurs at month end. The Fund will incur transaction costs and potentially adverse tax consequences in the event the Index allocates to cash. There is no guarantee that the Index’s prescribed defensive strategy, if employed, will be successful in minimizing downside market risk.

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets.

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index.

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not.

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result, is subject to special risks, including:

|

● |

Not Individually Redeemable. The Fund’s shares are not individually redeemable and may be redeemed by the Fund at its net asset value per share (“NAV”) only in large blocks known as Creation Units. The Fund may incur brokerage costs purchasing enough shares to constitute a Creation Unit. Alternatively, the Fund may redeem your shares by selling them on the secondary market at prevailing market prices. |

|

● |

Trading Issues. Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable, such as extraordinary market volatility. There can be no assurance that shares will continue to meet the listing requirements of the Exchange. There is no guarantee that an active secondary market will develop for the shares. In stressed market conditions, authorized participants may be |

FUND SUMMARIES

PROSPECTUS (ETFS) / 19

unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares.

|

● |

Market Price Variance Risk. The market prices of shares will fluctuate in response to changes in NAV and supply and demand for shares and will include a bid-ask spread charged by the exchange specialists, market makers, or other participants that trade the particular security. There may be times when the market price and the NAV vary significantly, particularly in times of market stress. This means that shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Authorized Participants Concentration Risk. A limited number of financial institutions may be responsible for all or a significant portion of the creation and redemption activity for the Fund. If these firms exit the business or are unable or unwilling to process creation and/or redemption orders, shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Tax-Efficiency Risk. Redemptions of shares may be effected for cash, rather than in kind, which means that the Fund may need to sell portfolio securities in order to complete an in-cash redemption, and may recognize net gains on these sales. As a result, investments in the shares may be less tax-efficient than investments in ETFs that redeem solely or principally in kind, and the Fund may pay out higher annual capital gain distributions than if the in-kind redemption process was used. |

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment.

Performance data for the Fund may be available online at

FUND SUMMARIES

PROSPECTUS (ETFS) / 20

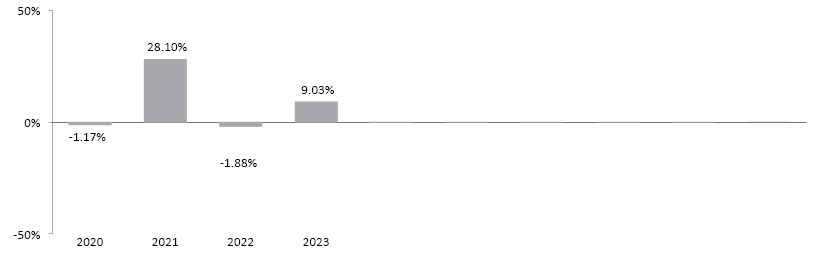

(for calendar years ending on December 31)

% |

% |

(for periods ending on December 31, 2023)

US LARGE / MID CAP CORE ENHANCED ETF |

||

1 Year |

Inception* |

|

Return before taxes |

- |

- |

Return after taxes on distributions (1) |

- |

- |

Return after taxes on distributions and sale of shares (1) |

- |

- |

Victory US Large/Mid Cap Volatility Weighted BRI Index (2) (reflects no deduction for fees, expenses or taxes) |

- |

- |

S&P 500 Index (3) (reflects no deduction for fees, expenses or taxes) |

|

* |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

INVESTMENT ADVISOR

Timothy Partners, Ltd. has served as the Fund’s investment advisor since the Fund commenced operations on July 28, 2021.

SUB-ADVISOR

Victory Capital Management Inc. (“Victory Capital” or the “Sub-Advisor”) through its Victory Solutions team, has served as the Fund’s Sub-Advisor since the Fund commenced operations on July 28, 2021.

FUND SUMMARIES

PROSPECTUS (ETFS) / 21

PORTFOLIO MANAGERS

Mannik Dhillon is President of Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on July 28, 2021.

Free Foutz is the Portfolio Implementation Manager for Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on July 28, 2021.

PURCHASE AND SALE OF SHARES

The Fund issues and redeems Shares at their net asset value (NAV) only in large blocks (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed for cash and/or in-kind for securities by Authorized Participants (“APs”) that have entered into agreements with the Fund’s distributor. Individual Shares may only be purchased and sold through brokers in secondary market transactions on The New York Stock Exchange (the “Exchange”). Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Shares of the Fund will be listed for trading on the Exchange and will trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than (a premium), at or less than (a discount) NAV.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”).

TAX INFORMATION

The Fund’s distributions generally are taxable as ordinary income, qualified dividend income or capital gains. A sale of Shares may result in capital gain or loss.

PAYMENT TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares through a broker-dealer or another financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (ETFS) / 22

FUND SUMMARY

May 1, 2024

The Fund seeks to provide investment results that track the performance of the Victory US Large Cap High Dividend Volatility Weighted BRI Index before fees and expenses.

This table describes the fees and expenses that you may pay if you buy and hold shares (“Shares”) of the Fund. Investors may incur usual or customary brokerage commissions and other charges on their purchases and sales of Shares of the Fund in the secondary market, which are not reflected in the table or the example below.

(fees paid directly from your investment)

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

MANAGEMENT FEES |

|

Total Annual Operating Expenses |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that (1) you invest $10,000 in the Fund for the time periods indicated and then sell or continue to hold all of your shares at the end of the period, (2) your investment has a 5% return each year, and (3) the Fund’s operating expenses remain the same. This Example does not take into account the brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based upon these assumptions, your costs would be:

1 Year |

3 Years |

5 Years |

10 Years |

$ |

$ |

$ |

$ |

FUND SUMMARIES

PROSPECTUS (ETFS) / 23

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover will generally indicate higher transaction costs resulting in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal period, the Fund’s portfolio turnover rate was

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large Cap High Dividend Volatility Weighted BRI Index (the “Index” or the “Underlying Index”), an unmanaged, volatility weighted index created by the Sub-Advisor (the “Index Provider”). The Index Provider is not affiliated with the Fund or the Advisor.

The Index Provider combines fundamental criteria with individual security risk control achieved through volatility weighting of individual securities, rather than traditional market-cap weighting. Such a methodology is sometimes referred to as “Smart Beta.” The Index follows a proprietary rules-based methodology, developed by the Fund’s Sub-Advisor, to construct its constituent securities.

The Index is comprised of the largest 100 dividend yielding stocks among the largest U.S. companies by market capitalization from the Victory US Large/Mid Cap Volatility Weighted BRI Index (“Parent Index”). The Parent Index universe begins with the stocks included in the Nasdaq Victory US Large Cap 500 Volatility Weighted Index, a volatility weighted index comprised of the 500 largest U.S. companies by market capitalization with positive earnings over the last twelve months.

The Fund’s Advisor provides the Sub-Advisor with the list of Excluded Securities that do not satisfy the Advisor’s proprietary BRI filtering criteria. The Index Provider then removes the Excluded Securities from the Index.

The 100 highest dividend yielding stocks become the stocks included in the Index and are weighted based on their daily standard deviation (volatility) of daily price changes over the last 180 trading days. Stocks with lower volatility receive a higher weighting and stocks with higher volatility receive a lower weighting.

The Index is reconstituted every April and October (based on information as of the prior month-end) and is adjusted to limit exposure to any particular sector to 25%. As of March 31, 2024, the Index had a market capitalization range from $679.9 million to $613.7 billion.

The Fund will not knowingly invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or non-biblical lifestyles. The Fund also reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but can be found offensive to basic, traditional Judeo-Christian values. In the event a company is subsequently discovered to be engaged in a prohibited practice, it will be liquidated at the next re-balancing.

The Fund generally seeks to track the returns of the Index before fees and expenses by employing a replication strategy that seeks to hold all of the stocks in the Index, in approximately the percentages represented by the securities in the index.

The principal risks of investing in the Fund are summarized below. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Large-Capitalization Stock Risk. The securities of large-sized companies may underperform the securities of smaller-sized companies or the market as a whole. The growth rate of larger, more established companies may lag those of smaller companies, especially during periods of economic expansion.

FUND SUMMARIES

PROSPECTUS (ETFS) / 24

Mid-Capitalization Stock Risk. Mid-sized companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss.

Excluded Security Risk. Because the Index omits Excluded Securities, the Fund may be riskier than other funds that invest in a broader array of securities. BRI may not be successful. Because the Index is reconstituted only at prescribed times during the year, the Fund may temporarily hold securities that do not comply with the BRI filtering criteria if the application of the criteria or the nature of a company’s business changes in between these dates.

Index Risk. There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the Index Provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition.

Equity Securities Risk. The value of the equity securities in which the Fund invests may decline in response to developments affecting individual companies and/or general economic conditions in the United States or abroad. A company’s earnings or dividends may not increase as expected (or may decline) because of poor management, competitive pressures, reliance on particular suppliers or geographical regions, labor problems or shortages, corporate restructurings, fraudulent disclosures, man-made or natural disasters, military confrontations or wars, terrorism, public health crises, or other events, conditions and factors. Price changes may be temporary or last for extended periods.

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Domestic and International factors such as political events, war, trade disputes, interest rate levels and other fiscal and monetary policy changes, pandemics and other public health crises and related geopolitical events, as well as environmental disasters such as earthquakes, fires and floods, may add to instability in world economies and markets generally. The impact of these and other factors may be short-term or may last for extended periods.

Investment Strategy Risk. The Fund’s dividend strategy may not be successful. Dividend paying stocks may fall out of favor relative to the overall market. In addition, the Index may not successfully identify companies that meet its objectives.

Passive Investment Risk. The Fund is not actively managed, and the Sub-Advisor does not take defensive positions under any market conditions, including declining markets.

Calculation Methodology Risk. The Index relies on various sources of information to assess the criteria of issuers included in the Index, including information that may be based on assumptions and estimates. Neither the Fund, the Index Provider, nor the Advisor can offer assurances that the Index’s calculation methodology or sources of information will provide an accurate assessment of included issuers or correct valuation of securities, nor can they guarantee the availability or timeliness of the production of an Index.

Tracking Error Risk. The Fund may be subject to tracking error, which is the divergence of the Fund’s performance from its index. Tracking error may occur because of, among other reasons, differences between the securities and other instruments held in the Fund’s portfolio and those included in the Index. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not.

Exchange-Traded Fund (“ETF”) Structure Risk. The Fund is structured as an exchange-traded fund (“ETF”) and, as a result, is subject to special risks, including:

|

● |

Not Individually Redeemable. The Fund’s shares are not individually redeemable and may be redeemed by the Fund at its net asset value per share (“NAV”) only in large blocks known as Creation Units. The Fund may incur brokerage costs purchasing enough shares to constitute a Creation Unit. Alternatively, the Fund may redeem your shares by selling them on the secondary market at prevailing market prices. |

|

● |

Trading Issues. Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable, such as extraordinary market volatility. There can be no assurance that shares will continue to meet the listing requirements of the Exchange. There is no guarantee that an |

FUND SUMMARIES

PROSPECTUS (ETFS) / 25

active secondary market will develop for the shares. In stressed market conditions, authorized participants may be unwilling to participate in the creation/redemption process, particularly if the market for shares becomes less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings, which may lead to widening of bid-ask spreads and differences between the market price of the shares and the underlying value of those shares.

|

● |

Market Price Variance Risk. The market prices of shares will fluctuate in response to changes in NAV and supply and demand for shares and will include a bid-ask spread charged by the exchange specialists, market makers, or other participants that trade the particular security. There may be times when the market price and the NAV vary significantly, particularly in times of market stress. This means that shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Authorized Participants Concentration Risk. A limited number of financial institutions may be responsible for all or a significant portion of the creation and redemption activity for the Fund. If these firms exit the business or are unable or unwilling to process creation and/or redemption orders, shares may trade at a premium or discount to NAV and bid-ask spreads may widen. |

|

● |

Tax-Efficiency Risk. Redemptions of shares may be effected for cash, rather than in kind, which means that the Fund may need to sell portfolio securities in order to complete an in-cash redemption, and may recognize net gains on these sales. As a result, investments in the shares may be less tax-efficient than investments in ETFs that redeem solely or principally in kind, and the Fund may pay out higher annual capital gain distributions than if the in-kind redemption process was used. |

Valuation Risk. The sale price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value used by the Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. The Fund relies on various sources to calculate its NAV. The information may be provided by third parties that are believed to be reliable, but the information may not be accurate due to errors by such pricing sources, technological issues, or otherwise.

By itself, the Fund does not constitute a complete investment plan and should be considered a long-term investment for investors who can afford to weather changes in the value of their investment.

Performance data for the Fund may be available online at

FUND SUMMARIES

PROSPECTUS (ETFS) / 26

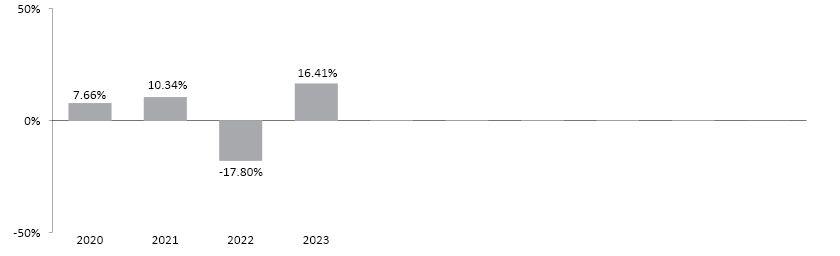

(for calendar years ending on December 31)

% |

% |

(for periods ending on December 31, 2023)

HIGH DIVIDEND STOCK ETF |

|||

1 Year |

3 Year |

Inception* |

|

Return before taxes |

|||

Return after taxes on distributions (1) |

|||

Return after taxes on distributions and sale of shares (1) |

|||

Victory US Large Cap High Dividend Volatility Weighted BRI Index (2) (reflects no deduction for fees, expenses or taxes) |

|||

Russell 1000 Value Index (3) (reflects no deduction for fees, expenses or taxes) |

|

* |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

INVESTMENT ADVISOR

Timothy Partners, Ltd. has served as the Fund’s investment advisor since the Fund commenced operations on April 29, 2019.

SUB-ADVISOR

Victory Capital Management Inc. (“Victory Capital” or the “Sub-Advisor”) through its Victory Solutions team, has served as the Fund’s Sub-Advisor since the Fund commenced operations on April 29, 2019.

FUND SUMMARIES

PROSPECTUS (ETFS) / 27

PORTFOLIO MANAGERS

Mannik Dhillon is President of Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on April 29, 2019.

Free Foutz is the Portfolio Implementation Manager for Victory Capital’s VictoryShares and Solutions platform and has been a Portfolio Manager of the Fund since it commenced operations on April 29, 2019.

PURCHASE AND SALE OF SHARES

The Fund issues and redeems Shares at their net asset value (NAV) only in large blocks (each block of Shares is called a “Creation Unit”). Creation Units are issued and redeemed for cash and/or in-kind for securities by Authorized Participants (“APs”) that have entered into agreements with the Fund’s distributor. Individual Shares may only be purchased and sold through brokers in secondary market transactions on The New York Stock Exchange (the “Exchange”). Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund.

Shares of the Fund will be listed for trading on the Exchange and will trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than (a premium), at or less than (a discount) NAV.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”).

TAX INFORMATION

The Fund’s distributions generally are taxable as ordinary income, qualified dividend income or capital gains. A sale of Shares may result in capital gain or loss.

PAYMENT TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES