|

|

Summary PROSPECTUS

January 31, 2023, as amended on February 17, 2023

International Fund

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund, including its statement of additional information (SAI) and most recent reports to shareholders, online at fund.timothyplan.com or i-i.timothyplan.com. You can also get this information at no cost by calling 800-846-7526 or by sending an e-mail request to fulfillment@ultimusfundsolutions.com. This Summary Prospectus incorporates by reference the Fund’s entire prospectus and SAI, each dated January 31, 2023.

INVESTMENT OBJECTIVE

The investment objective of this Fund is to provide you with long-term growth of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

ANNUAL

FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

| Class I | |

| Management Fee | 1.00% |

| Distribution/Service (12b-1 Fees) | 0.00% |

| Other Expenses | 0.47% |

| Acquired Funds Fees and Expenses (1) | 0.01% |

| Total Annual Fund Operating Expenses (before fee waivers/reimbursements) | 1.48% |

| Fee Waivers and/or Expense Reimbursements (2)(3)(4) | -0.05% |

| Total Annual Fund Operating Expenses (after fee waivers/expense reimbursements)(5) | 1.43% |

| (1) | Acquired Funds Fees and Expenses are the indirect costs of investing in other investment companies. Total Annual Fund Operating Expenses do not correlate to the ratio of average net assets in the Financial Highlights Table, which reflects the operating expenses of the Fund and does not include Acquired Funds Fees and Expenses. |

| (2) | As described in the "Who Manages Your Money" section of the Fund's prospectus beginning on page 60, Timothy Partners, Ltd ("TPL") has contractually agreed, through January 28, 2024, to waive five basis points (5bps) of the management fee paid by the Trust for the non-ETF holdings. |

| (3) | Also as described in the "Management of the Fund," Timothy Partners, Ltd ("TPL") has contractually agreed to waive the management fee with respect to any portion of the Fund's assets estimated to be attributable to investments in money market funds, other equity and fixed income mutual funds and exchange-traded funds managed by TPL or its affiliates that have a contractual management fee, through January 28, 2024. |

| (4) | The contractual agreements may be terminated upon 90 days' notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| (5) | The fees have been restated to reflect current expenses and may not correlate to the Financial Highlights in the Annual Report. |

SUMMARY PROSPECTUS

(CLASS I) / 1

EXAMPLE:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 YEARS | 10 Years |

| $146 | $463 | $803 | $1,764 |

Your costs for this share class would be the same whether or not you redeem your shares at the end of any period.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the Fund's most recent fiscal year, the Fund's portfolio turnover rate was 7% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

| ■ | The Fund seeks to achieve its investment objectives by normally investing at least 80% of the Fund's total assets in the securities of foreign companies (companies domiciled in countries other than the United States), without regard to market capitalizations. |

| ■ | The Fund invests using a growth investing style. Growth funds generally focus on stocks of companies believed to have above-average potential for growth in revenue, earnings, cash flow, or other similar criteria. These stocks typically have low dividend yields and above-average prices in relation to such measures as earnings and book value. Growth and value stocks have historically produced similar long-term returns, though each category has periods when it outperforms the other. |

| ■ | The Fund invests its assets in companies which the Fund's Investment Manager believes show a high probability for superior growth. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager's investment criteria. |

| ■ | The Fund allocates investments across countries and regions at the Manager's discretion. |

| ■ | The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund's principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund's assets will be held in cash and/or cash equivalents. |

| ■ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. |

PRINCIPAL RISKS OF INVESTING IN THE FUND

The Fund's investments are subject to the following principal risks:

General Risk. As with most other mutual funds, you can lose money by investing in this Fund. Share prices fluctuate from day-to-day, and when you sell your shares, they may be worth less than you paid for them.

Stock Market Risk. The Fund is an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time.

SUMMARY PROSPECTUS

(CLASS I) / 2

Foreign Risk. The Fund's investments in foreign securities may experience more rapid and extreme changes in value than funds with investments solely in securities of U.S. companies. This is because the securities markets of many foreign countries are relatively small, with a limited number of companies representing a smaller number of industries. Foreign issuers are not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect the Fund's investments in a foreign country. The Fund may invest in emerging markets. Emerging markets expose the Fund to additional risks due to the lack of historical or regulatory controls.

Issuer-Specific Risk. The value of an individual security or a particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

Currency Risk. Because the securities represented by ADRs are foreign stocks denominated in non-U.S. currency, there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the Fund's investments in foreign securities.

Larger Company Investing Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

Smaller Company Investing Risk. Investing in smaller companies often involves greater risk than investing in larger companies. Smaller companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of smaller companies, therefore, tend to be more volatile than the securities of larger, more established companies. Smaller company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if a fund wants to sell a large quantity of a small-sized company's stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities.

Growth Risk. The Fund often invests in companies after assessing their growth potential. Securities of growth companies may be more volatile than other stocks. If the portfolio manager's perception of a company's growth potential is not realized, the securities purchased may not perform as expected, reducing the Fund's return. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, "growth" stocks may perform differently from the market as a whole and other types of securities.

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund's return to be lower.

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

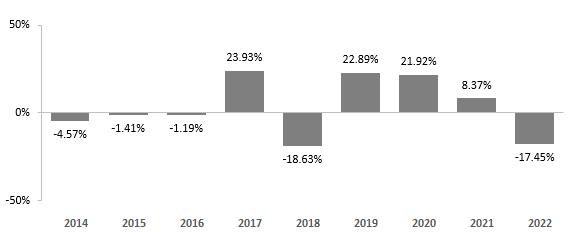

PAST PERFORMANCE

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund's performance from year to year and by comparing the Fund's performance to a broad-based index. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. More up-to-date returns are available on the Fund's website at fund.timothyplan.com, or by calling the Fund at (800) 846-7526.

SUMMARY PROSPECTUS

(CLASS I) / 3

Year-by-year Annual Total Returns for Class I Shares

(for calendar years ending on December 31)

| Best Quarter |

Worst Quarter |

| June-20 | Mar-20 |

| 21.17% | -21.51% |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| International | Class I | ||

| 1 Year | 5 Year | Since Inception (3) | |

| Return before taxes | -17.45% | 1.75% | 3.59% |

| Return after taxes on distributions (1) | -17.31% | 1.71% | 3.37% |

| Return after taxes on distributions and sale of shares (1) | -9.95% | 1.49% | 2.86% |

|

MSCI AC World Index ex USA Net (USD) (2) (reflects no deduction for fees, expenses or taxes) |

-16.00% | 0.88% | 3.47% |

| (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

| (2) | The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 26 Emerging Markets (EM) countries. With 2,377 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. Performance figures include the change in value of the stocks in the index and the reinvestment of dividends. |

| (3) | The Fund commenced investment operations on October 1, 2013. |

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Eagle Global Advisors, LLC ("Eagle") serves as Investment Manager to the Fund.

SUMMARY PROSPECTUS

(CLASS I) / 4

Portfolio Managers

Edward R. Allen III, PhD., CFA, Senior Partner; Steven S. Russo, Senior Partner; Brian S. Quattrucci, CFA, Senior Vice President; and John F Gualy, CFA, Senior Partner, of Eagle, have served the Fund since May 1, 2007.

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. Class I shares are only available to fee-based investment advisors for the benefit of their clients, institutional investors, and certain investment platforms. The minimum initial purchase or exchange into the Fund ranges from $100,000 to $0, depending upon account type. The minimum subsequent investment amount ranges from $25,000 to $0, depending upon account type. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

SUMMARY PROSPECTUS

(CLASS I) / 5