Prospectus

TIMOTHY PLAN FAMILY OF FUNDS

THE U. S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Table of Contents

| Section 1 | Fund Summaries | |

| This section provides you with an overview of the Funds, including investment objectives, fees and expenses, and historical performance information. | |

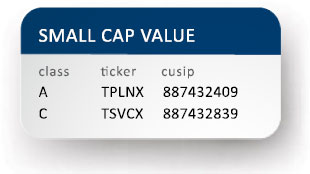

| Small Cap Value | 4 |

| Large / Mid Cap Value | 9 |

| Aggressive Growth | 13 |

| Large / Mid Cap Growth | 18 |

| Growth & Income | 23 |

| Fixed Income | 28 |

| High Yield Bond | 32 |

| International | 37 |

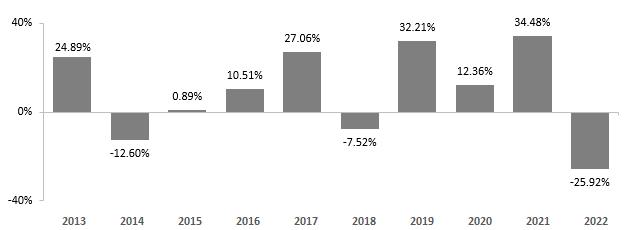

| Israel Common Values | 42 |

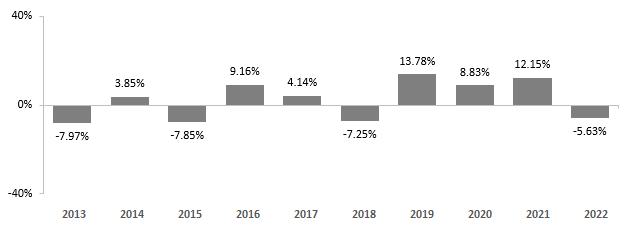

| Defensive Strategies | 47 |

| Strategic Growth | 52 |

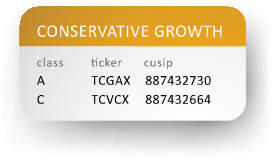

| Conservative Growth | 59 |

| Section 2 | Description of Our Funds | |

| This section sets forth a general description of important information you should know about each of our Funds. | |

| Traditional Funds | 66 |

| Asset Allocation Funds | 80 |

| Section 3 | Who Manages Your Money | |

| This section gives you a detailed discussion of our Investment Advisor and Investment Managers. | |

| The Investment Advisor | 87 |

| The Investment Managers | 88 |

| Section 4 | How You Can Buy and Sell Shares | |

| This section provides the information you need to move money into or out of your account. | |

| What Share Classes We Offer | 92 |

| How to Reduce Your Sales Charge | 93 |

| How to Buy Shares | 95 |

| How to Sell Shares | 97 |

| Section 5 | General Information | |

| This section summarizes the Funds’ distribution policies and other general Fund information. | |

| Dividends, Distributions and Taxes | 99 |

| Net Asset Value | 99 |

| Fair Value Pricing | 99 |

| Frequent Trading | 100 |

| Distribution and Service Plans | 100 |

| Fund Service Providers | 101 |

| Code of Ethics | 101 |

| Section 6 | Privacy Policy | |

| This section summarizes the Funds’ privacy policies. | |

| Privacy Policy and Customer Identification Program | 102 |

| Section 7 | Financial Highlights | |

| This section provides the Funds’ financial performance for the past five fiscal periods. | |

| Small Cap Value (Class A & C) | 105, 106 |

| Large / Mid Cap Value (Class A & C) | 107, 108 |

| Aggressive Growth (Class A & C) | 109, 110 |

| Large / Mid Cap Growth (Class A & C) | 111, 112 |

| Growth & Income (Class A & C) | 113, 114 |

| Fixed Income (Class A & C) | 115, 116 |

| High Yield Bond (Class A & C) | 117, 118 |

| International (Class A & C) | 119, 120 |

| Israel Common Values (Class A & C) | 121, 122 |

| Defensive Strategies (Class A & C) | 123, 124 |

| Strategic Growth (Class A & C) | 125, 126 |

| Conservative Growth (Class A & C) | 127, 128 |

| Section 8 | For More Information | |

| This section tells you how to obtain additional information relating to the Funds. | |

| More Information | 129 |

| Appendix A | |

| Raymond James | |

| Intermediary Defined Sales Charge Waiver Policies | 130 |

| Merrill Lynch | |

| Defined Sales Charge Waiver Policies | 131 |

| Edward Jones | |

| Defined Sales Charge Waiver Policies | 133 |

| Morgan Stanley | |

| Defined Sales Charge Waiver Policies | 135 |

TABLE

OF CONTENTS

PROSPECTUS (CLASS A & C) / 2

Section 1 | Fund Summaries

The Timothy Plan believes it has a moral and ethical responsibility to invest in a biblically responsible manner. Accordingly, we strive to ensure our Funds do not invest in any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. Securities issued by companies engaged in these activities are excluded from the Funds’ portfolios. They are referred to throughout this Prospectus (the “Prospectus”) as “Excluded Securities.” Our Funds will not intentionally purchase excluded Securities.

Timothy Partners, Ltd. (“TPL”) is Investment Advisor to the Funds and is responsible for determining what companies are deemed Excluded Securities, and reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but could be found offensive to fundamental, traditional Judeo-Christian values.

Further, suppose any of our Funds subsequently discovers a company is engaged in a prohibited practice. In that case, that security will be sold as soon as it is reasonably practicable.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 3

|

|

FUND SUMMARY

January 31, 2023

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees, to financial intermediaries, which are not reflected in the tables and examples below.

| Class A | Class C | |

Maximum sales charge (load) imposed on purchases (as % of offering price) |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 4

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total Annual Fund Operating Expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$220 |

| 3 Years | $ |

$ |

$708 |

| 5 Years | $ |

$ |

$1,223 |

| 10 Years | $ |

$ |

$2,635 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 5

| ◾ | The Fund seeks to achieve its investment objective by primarily investing at least 80% of the Fund’s total assets in U.S. stocks with market capitalizations that fall within the range of companies included in the Russell 2000® Index (the “Index”). As of June 30, 2022, the capitalization range of companies comprising the Index is approximately $240 million to $6.4 billion. This Fund invests using a value investing style. Value funds typically emphasize stocks whose prices are below average in relation to such measures as earnings and book value; these stocks often have above-average dividend yields. Growth and value stocks have historically produced similar long-term returns, though each category has periods when it outperforms the other. |

| ◾ | In determining whether to invest in a particular company, the Fund’s Investment Manager focuses on a number of different attributes of the company, including the company’s market expertise, balance sheet, improving return on equity, price-to-earnings ratios, industry position and strength, management and a number of other factors. Analyzing companies in this manner is known as a “bottom-up” approach to investing. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager’s investment criteria. |

| ◾ | The Fund may invest in equity securities of foreign issuers in the form of American Depositary Receipts (ADRs). ADRs are certificates held in trust by a U.S. bank or trust company evidencing ownership of shares of foreign-based issuers and are an alternative to purchasing foreign securities in their national market and currency. |

| ◾ | The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund’s assets will be held in cash and/or cash equivalents. |

| ◾ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography or promoting anti-family entertainment or unbiblical lifestyles. |

The Fund’s investments are subject to the following principal risks:

General Risk.

Stock Market Risk. The Fund is an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time.

Smaller Company Investing Risk. Investing in smaller companies often involves greater risk than investing in larger companies. Smaller companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of smaller companies, therefore, tend to be more volatile than the securities of larger, more established companies. Smaller company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if a fund wants to sell a large quantity of a small-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities.

Foreign Risk. The Fund’s investments in foreign securities may experience more rapid and extreme changes in value than funds with investments solely in securities of U.S. companies. This is because the securities markets of many foreign countries are relatively small, with a limited number of companies representing a smaller number of industries. Foreign issuers are not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect the Fund’s investments in a foreign country. There is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the Fund’s investments in foreign securities.

Value Investing Risk. Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock may never appreciate to the extent expected.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 6

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund’s return to be lower.

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

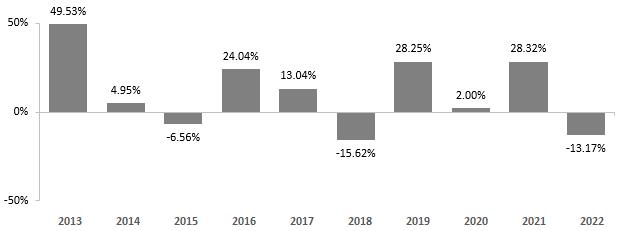

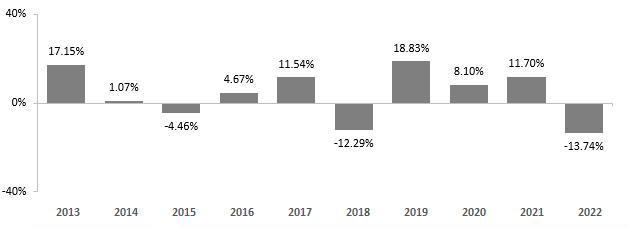

Year-by-year Annual Total Returns for Class A Shares

(for calendar years ending on December 31)

| % | % |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| Small Cap Value | Class A (3) | Class C | ||||

| 1 Year | 5 Year | 10 Year | 1 Year | 5 Year | 10 Year | |

| Return before taxes | % | % | % | % | % | % |

| Return after taxes on distributions (1) | % | % | % | % | % | % |

| Return after taxes on distributions and sale of shares (1) | % | % | % | % | % | % |

Russell 2000 Index (2) (reflects no deduction for fees, expenses or taxes) |

% | % | % | % | % | % |

| (1) |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 7

| (2) |

| (3) |

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Westwood Management Corp. (“Westwood”) serves as Investment Manager to the Fund.

Portfolio Managers

William E. Costello, CFA® and Matthew R. Lockridge have served the Fund since December 2010.

Frederic G. Rowsey, CFA® has served the Fund since December 2013.

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. The minimum initial purchase or exchange into the Fund is $1,000, or $50 through monthly systematic investment plan accounts. There is no minimum subsequent investment amount. There are no minimums for purchases or exchanges through employer-sponsored retirement plans, IRAs, or other qualified plans. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 8

|

|

FUND SUMMARY

January 31, 2023

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

(fees paid directly from your investment)

| Class A | Class C | |

Maximum sales charge (load) imposed on purchases (as % of offering price) |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total Annual Fund Operating Expenses |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 9

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$211 |

| 3 Years | $ |

$ |

$704 |

| 5 Years | $ |

$ |

$1,223 |

| 10 Years | $ |

$ |

$2,647 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 10

| ◾ | The Fund seeks to achieve its investment objective by primarily investing in U.S. common stocks. The Fund will normally invest at least 80% of the Fund’s total assets in companies whose total market capitalization exceeds $2 billion. This Fund invests using a value investing style. Value funds typically emphasize stocks whose prices are below average in relation to such measures as earnings and book value; these stocks often have above-average dividend yields. Growth and value stocks have historically produced similar long-term returns, though each category has periods when it outperforms the other. |

| ◾ | In determining whether to invest in a particular company, the Fund’s Investment Manager focuses on a number of different attributes of the company, including the company’s market expertise, balance sheet, improving return on equity, price-to-earnings ratios, industry position and strength, management, and a number of other factors. Analyzing companies in this manner is known as a “bottom-up” approach to investing. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager’s investment criteria. |

| ◾ | The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund’s assets will be held in cash and/or cash equivalents. |

| ◾ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. |

The Fund’s investments are subject to the following principal risks:

General Risk.

Stock Market Risk. The Fund is an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time.

Larger Company Investing Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

Mid-Sized Company Investing Risk. Investing in mid-sized companies often involves greater risk than investing in larger companies. Mid-sized companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of mid-sized companies, therefore, tend to be more volatile than the securities of larger, more established companies. Mid-sized company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if a fund wants to sell a large quantity of a mid-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities.

Value Investing Risk. Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock may never appreciate to the extent expected.

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund’s return to be lower.

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 11

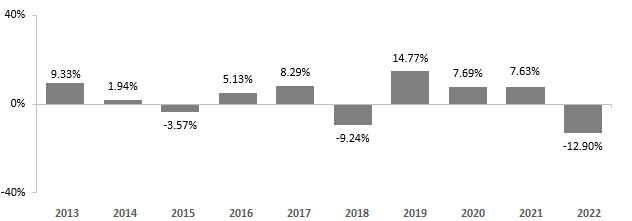

Year-by-year Annual Total Returns for Class A Shares

(for calendar years ending on December 31)

| % | % |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| Large / mid Cap Value | Class A (3) | Class C | ||||

| 1 Year | 5 Year | 10 Year | 1 Year | 5 Year | 10 Year | |

| Return before taxes | % | % | % | % | % | % |

| Return after taxes on distributions (1) | % | % | % | % | % | % |

| Return after taxes on distributions and sale of shares (1) | % | % | % | % | % | % |

S&P 500 Index (2) (reflects no deduction for fees, expenses or taxes) |

% | % | % | % | % | % |

| (1) |

| (2) |

| (3) |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 12

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Westwood Management Corp. (“Westwood”) serves as Investment Manager to the Fund.

Portfolio Managers

Matthew R. Lockridge has served the Fund since December 2012.

William D. Sheehan, CFA® has served the Fund since September 2019.

Lauren C. Hill, CFA® has served the Fund since August 2020.

Michael H. Wall has served the Fund since February 2022.

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. The minimum initial purchase or exchange into the Fund is $1,000, or $50 through monthly systematic investment plan accounts. There is no minimum subsequent investment amount. There are no minimums for purchases or exchanges through employer-sponsored retirement plans, IRAs, or other qualified plans. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 13

|

|

FUND SUMMARY

January 31, 2023

The investment objective of this Fund is to provide you with long-term growth of capital.

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

(fees paid directly from your investment)

| Class A | Class C | |

Maximum

sales charge (load) imposed on purchases |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 14

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total

Annual Fund Operating Expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$231 |

| 3 Years | $ |

$ |

$733 |

| 5 Years | $ |

$ |

$1,261 |

| 10 Years | $ |

$ |

$2,709 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 15

| ◾ | The Fund seeks to achieve its investment strategy by normally investing at least 80% of the Fund’s total assets in U.S. common stocks without regard to market capitalizations. |

| ◾ | The Fund invests using a growth investing style. Growth funds generally focus on stocks of companies believed to have above-average potential for growth in revenue, earnings, cash flow, or other similar criteria. These stocks typically have low dividend yields and above-average prices in relation to such measures as earnings and book value. Growth and value stocks have historically produced similar long-term returns, though each category has periods when it outperforms the other. |

| ◾ | The Fund invests its assets in the securities of a limited number of companies, which the Fund’s Investment Manager believes show a high probability for superior growth. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager’s investment criteria. |

| ◾ | The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund’s assets will be held in cash and/or cash equivalents. |

| ◾ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. |

The Fund’s investments are subject to the following principal risks:

General Risk.

Stock Market Risk. The Fund is an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time.

Larger Company Investing Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

Smaller Company Investing Risk. Investing in smaller companies often involves greater risk than investing in larger companies. Smaller companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of smaller companies, therefore, tend to be more volatile than the securities of larger, more established companies. Smaller company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if a fund wants to sell a large quantity of a small-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities.

Growth Risk. The Fund often invests in companies after assessing their growth potential. Securities of growth companies may be more volatile than other stocks. If the portfolio manager’s perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the Fund’s return. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities.

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund’s return to be lower.

High Portfolio Turnover Risk. The Fund has in the past experienced high portfolio turnover (greater than 100%). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 16

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

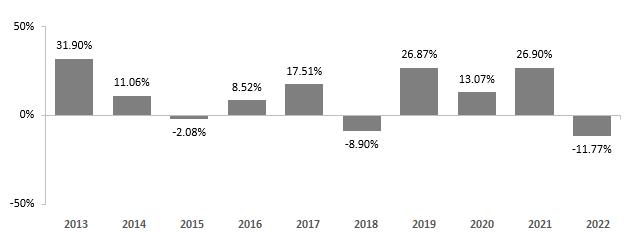

Year-by-year Annual Total Returns for Class A Shares

(for calendar years ending on December 31)

| % | % |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| Aggressive Growth | Class A (3) | Class C | ||||

| 1 Year | 5 Year | 10 Year | 1 Year | 5 Year | 10 Year | |

| Return before taxes | % | % | % | % | % | % |

| Return after taxes on distributions (1) | % | % | % | % | % | % |

| Return after taxes on distributions and sale of shares (1) | % | % | % | % | % | % |

Russell Midcap Growth Index (2) (reflects no deduction for fees, expenses or taxes) |

% | % | % | % | % | % |

| (1) |

| (2) |

| (3) |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 17

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Chartwell Investment Partners (“Chartwell”) serves as Investment Manager to the Fund.

Portfolio Managers

Frank L. Sustersic, CFA, Senior Portfolio Manager of Chartwell, has been serving the Fund since December 1, 2016.

Peter M. Schofield, CFA, Principal and Senior Portfolio Manager, has been serving the Fund since December 18, 2010.

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. The minimum initial purchase or exchange into the Fund is $1,000, or $50 through monthly systematic investment plan accounts. There is no minimum subsequent investment amount. There are no minimums for purchases or exchanges through employer-sponsored retirement plans, IRAs, or other qualified plans. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 18

|

|

FUND SUMMARY

January 31, 2023

The investment objective of this Fund is to provide you with long-term growth of capital.

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Class A | Class C | |

Maximum sales charge (load) imposed on purchases (as % of offering price) |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 19

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total Annual Fund Operating Expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$217 |

| 3 Years | $ |

$ |

$713 |

| 5 Years | $ |

$ |

$1,236 |

| 10 Years | $ |

$ |

$2,670 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 20

| ◾ | The Fund seeks to achieve its investment objective by primarily investing at least 80% of the Fund’s total assets in larger U.S. stocks. Larger stocks refer to the common stock of companies whose total market capitalization is generally greater than $2 billion. Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. |

| ◾ | The Fund invests using a growth investing style. Growth funds generally focus on stocks of companies believed to have above-average potential for growth in revenue, earnings, cash flow, or other similar criteria. These stocks typically have low dividend yields and above-average prices in relation to such measures as earnings and book value. Growth and value stocks have historically produced similar long-term returns, though each category has periods when it outperforms the other. |

| ◾ | The Fund normally invests in a portfolio of securities which includes a broadly diversified number of common stocks that the Fund’s Investment Manager believes show a high probability of superior prospects for above average growth. The Fund’s Investment Manager chooses these securities using a “bottom-up” approach of extensively analyzing the financial, management and overall economic conditions of each potential investment. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager’s investment criteria. |

| ◾ | The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund’s assets will be held in cash and/or cash equivalents. |

| ◾ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. |

The Fund’s investments are subject to the following principal risks:

General Risk.

Stock Market Risk. The Fund is an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities.

Growth Risk. The Fund often invests in companies after assessing their growth potential. Securities of growth companies may be more volatile than other stocks. If the portfolio manager’s perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the Fund’s return. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities.

Larger Company Investing Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

Mid-Sized Company Investing Risk. Investing in mid-sized companies often involves greater risk than investing in larger companies. Mid-sized companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of mid-sized companies, therefore, tend to be more volatile than the securities of larger, more established companies. Mid-sized company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if a fund wants to sell a large quantity of a mid-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period.

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund’s return to be lower.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 21

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

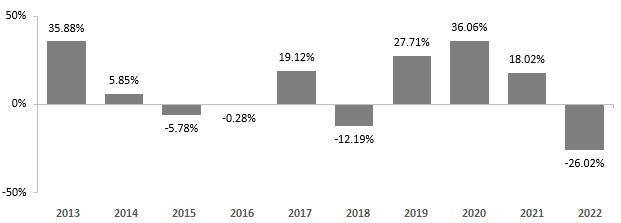

Year-by-year Annual Total Returns for Class A Shares

(for calendar years ending on December 31)

| % | % |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| Large / Mid Cap Growth | Class A (3) | Class C | ||||

| 1 Year | 5 Year | 10 Year | 1 Year | 5 Year | 10 Year | |

| Return before taxes | % | % | % | % | % | % |

| Return after taxes on distributions (1) | % | % | % | % | % | % |

| Return after taxes on distributions and sale of shares (1) | % | % | % | % | % | % |

Russell 1000 Growth Index (2) (reflects no deduction for fees, expenses or taxes) |

% | % | % | % | % | % |

| (1) |

| (2) |

| (3) |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 22

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Chartwell Investment Partners (“Chartwell”) serves as Investment Manager to the Fund.

Portfolio Managers

Frank L. Sustersic, CFA, Senior Portfolio Manager of Chartwell, has served the Fund since December 1, 2016.

Peter M. Schofield, CFA, Principal and Senior Portfolio Manager, has been serving the Fund since December 18, 2010.

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. The minimum initial purchase or exchange into the Fund is $1,000, or $50 through monthly systematic investment plan accounts. There is no minimum subsequent investment amount. There are no minimums for purchases or exchanges through employer-sponsored retirement plans, IRAs, or other qualified plans. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 23

|

|

FUND SUMMARY

January 31, 2023

The investment objective of this Fund is to provide total return through a combination of growth and income and preservation of capital in declining markets.

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

(fees paid directly from your investment)

| Class A | Class C | |

Maximum sales charge (load) imposed on purchases (as % of offering price) |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 24

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total Annual Fund Operating Expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$238 |

| 3 Years | $ |

$ |

$850 |

| 5 Years | $ |

$ |

$1,488 |

| 10 Years | $ |

$ |

$3,202 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 25

To achieve its goal, the Fund will invest varying percentages of the Fund’s total assets in the investment allocations set forth below:

| ◾ | To achieve its goals, the Fund primarily invests in equity securities, including affiliated Exchange Traded Funds (“ETF’s”), and in fixed income securities. The Fund will normally hold both equity securities and fixed income securities, with at least 25% of its assets in equity securities and at least 25% of its assets in fixed income securities. The Advisor is responsible for determining the allocation of Fund assets to be invested in equity and fixed income securities. The Advisor will adjust those allocations from time to time in response to market changes |

| ◾ | The Fund’s fixed income holdings are U.S. government securities, corporate bonds, municipal bonds and/or sovereign bonds of any maturity, as well as ETFs that invest primarily in such securities. Any non-US government securities in the Fund’s portfolio consist primarily of issues rated “Baa2” or better by Moody’s Investors Service, Inc. (“Moody’s”) or “BBB” or better by Standard & Poor’s Ratings Group (“S&P”) and unrated securities determined by the Advisor to be of equivalent quality, as well as high quality money market instruments. |

| ◾ | The Fund’s fixed income Investment Manager reviews the various sectors looking for historical patterns of undervalue or overvalue in an effort to identify appropriate fixed income securities to purchase. The Investment Manager also analyzes interest rate risk in the bond market and makes adjustments in the maturities of bonds to adjust for this risk. Lastly, if a bond is being downgraded, or the company has other issues that may affect the bond, the Investment Manager reviews it to see if the bond should be sold. |

| ◾ | The Fund’s fixed income portfolio’s duration is adjusted based on a regularly conducted analysis of the interest rate risk. Typically, the duration of the Fund’s bond portfolio runs between 1 and 8 years. The Investment Manager shortens portfolio durations when its research indicates a rising interest rate environment to preserve capital. |

| ◾ | The Fund’s equity securities are sold when such considerations as valuation, earnings and relative price strength are determined to warrant a sale. The Advisor reviews a stock if there is a major change in its corporate structure or management. |

| ◾ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. |

The Fund’s investments are subject to the following principal risks:

General Risk.

Stock Market Risk. Overall stock market risks may affect the value of the Fund. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money.

Fixed Income Risk. The Fund invests in fixed income securities. These securities will increase or decrease in value based on changes in interest rates. If rates increase, the value of the Fund’s fixed income securities generally will decline, and those securities with longer terms generally will decline more. Your investment will decline in value if the value of the Fund’s investments decreases. There is a risk that issuers and counterparties will not make payments on fixed income securities and repurchase agreements held by the Fund. Such defaults could result in losses to the Fund. Securities with lower credit quality have a greater risk of default. In addition, the credit quality of securities held by the fund may be lowered if an issuer’s financial condition changes. Lower credit quality may lead to greater volatility in the price of a security and in shares of the Fund. Lower credit quality also may affect liquidity and make it difficult for the Fund to sell the security.

Management Risk. The Advisor’s judgments about the attractiveness, value and potential appreciation of a particular asset class or individual security in which the Fund invests may prove to be incorrect. The Fund may experience losses regardless of the overall performance of the market.

Small Cap Company Risk. Smaller capitalization companies may experience higher failure rates than do larger capitalization companies. In addition, smaller companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Such companies may have limited product lines, markets or financial resources and may lack management depth. The trading volume of securities of smaller capitalization companies is normally less than that of larger capitalization companies, and therefore may disproportionately affect their market price, tending to make them fall more in response to selling pressure than is the case with larger capitalization companies. Some small capitalization stocks may be illiquid. These risks may be enhanced for micro-cap securities. Many micro-cap companies tend to be new and have no proven track record. Some of these companies have no assets or operations, while others have products and services that are still in development or have yet to be tested in the market. Because micro-cap stocks trade in low volumes, any size of trade can have a large percentage impact on the price of the stock.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 26

Foreign Investment Risk. Foreign investing involves risks not typically associated with U.S. investments. These risks include, among others, adverse fluctuations in foreign currency values as well as adverse political, social and economic developments affecting a foreign country. In addition, foreign investing involves less publicly available information, and more volatile or less liquid securities markets. Investments in foreign countries could be affected by factors not present in the U.S., such as restrictions on receiving the investment proceeds from a foreign country, foreign tax laws, and potential difficulties in enforcing contractual obligations. Foreign accounting may be less transparent than U.S. accounting practices and foreign regulation may be inadequate or irregular. Owning foreign securities could cause the Fund’s performance to fluctuate more than if it held only U.S. securities.

Municipal Securities Risk. The power or ability of an issuer to make principal and interest payments on municipal securities may be materially adversely affected by economic conditions, litigation or other factors. The Fund’s right to receive principal and interest payments may be subject to the provisions of bankruptcy, insolvency, and other laws affecting the rights and remedies of creditors, as well as laws, if any, which may be enacted by Congress or state legislatures extending the time for payment of principal and/or interest or imposing other constraints upon the enforcement of such obligations. In addition, substantial changes in federal income tax laws could cause municipal security prices to decline because the demand for municipal securities is strongly influenced by the value of tax exempt income to investors.

Sovereign Debt Risk. The Fund may invest in sovereign debt obligations. Investment in sovereign debt obligations involves special risks not present in corporate debt obligations. The issuer of the sovereign debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay principal or interest when due, and the Fund may have limited recourse in the event of a default. During periods of economic uncertainty, the market prices of sovereign debt, and the Fund’s net asset value, may be more volatile than prices of U.S. debt obligations.

Exchange Traded Fund Risk. An ETF may trade at a discount to its net asset value. Investors in the Fund will indirectly bear fees and expenses charged by the underlying ETFs in which the Fund invests, in addition to the Fund’s direct fees and expenses. The Fund will also incur brokerage costs when it purchases shares of ETFs. In addition, the Fund will be affected by losses of the underlying ETF and the level of risk arising from the investment practices of the underlying ETF.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities.

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund’s return to be lower.

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 27

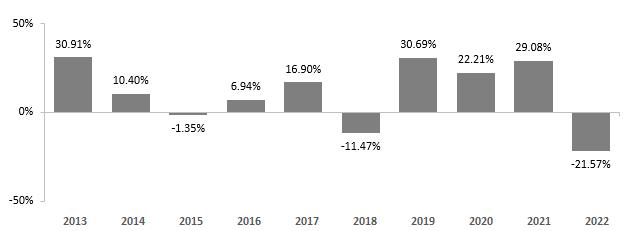

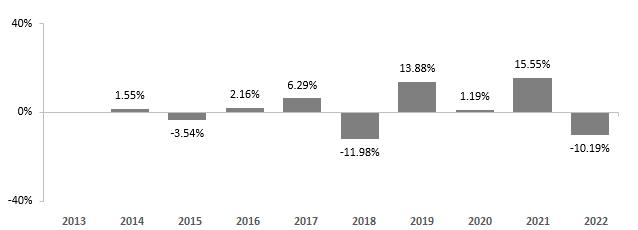

Year-by-year Annual Total Returns for Class A Shares

(for calendar years ending on December 31)

| % | % |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| Growth & Income | Class A (3) | Class C | ||||

| 1 Year | 5 Year | Since Inception(4) |

1 Year | 5 Year | Since Inception(4) | |

| Return before taxes | % | % | % | % | % | % |

| Return after taxes on distributions (1) | % | % | % | % | % | % |

| Return after taxes on distributions and sale of shares (1) | % | % | % | % | % | % |

Timothy Growth and Income Fund Blended Index (2) (reflects no deduction for fees, expenses or taxes) |

% | % | % | % | % | % |

| (1) |

| (2) |

| (3) |

| (4) |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 28

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Effective May 1, 2019, Barrow, Hanley, Mewhinney & Strauss, LLC (“Barrow Hanley”) serves as Investment Manager to the fixed income allocation of the Fund’s investment portfolio.

Portfolio Managers

Art Ally, President and Chief Investment Officer of Timothy Partners, Ltd., manages the equity allocation of the Fund’s investment portfolio and determines the allocations between equity and fixed income investments since May 1, 2019.

Mr. J. Scott McDonald, CFA, Mr. Mark Luchsinger (1), CFA, and Ms. Deborah A Petruzzelli, have served the Fund since May 2019.

Mr. Justin A. Martin, CFA, and Mr. Matthew K. Routh, CFA, have served the fund since 2021.

| (1) | Mark C. Luchsinger, CFA is retiring and will no longer serve as a portfolio manager to the Growth and Income Fund effective April 30, 2023. |

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. The minimum initial purchase or exchange into the Fund is $1,000, or $50 through monthly systematic investment plan accounts. There is no minimum subsequent investment amount. There are no minimums for purchases or exchanges through employer-sponsored retirement plans, IRAs, or other qualified plans. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 29

|

|

FUND SUMMARY

January 31, 2023

The investment objective of this Fund is to generate a high level of current income consistent with prudent investment risk.

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

(fees paid directly from your investment)

| Class A | Class C | |

Maximum sales charge (load) imposed on purchases (as % of offering price) |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 30

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total Annual Fund Operating Expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$174 |

| 3 Years | $ |

$ |

$593 |

| 5 Years | $ |

$ |

$1,038 |

| 10 Years | $ |

$ |

$2,275 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 31

| ◾ | To achieve its goal, the Fund normally invests at least 80% of its assets in a diversified portfolio of corporate bonds, U.S. government and agency securities, convertible securities and preferred securities. The Investment Manager will only purchase securities for the Fund that are investment grade, with a rating of at least “BBB” as rated by Standard & Poor’s or a comparable rating by another nationally recognized rating agency. The Fund may also invest in debt securities that have not been rated by one of the major rating agencies, so long as the Fund’s Investment Manager has determined that the security is of comparable credit quality to similarly rated securities. |

| ◾ | In managing the portfolio, the Fund’s Investment Manager concentrates on sector analysis, industry allocation and securities selection, deciding which types of bonds and industries to emphasize at a given time, and then which individual bonds to buy. The Fund attempts to anticipate shifts in the business cycle in determining types of bonds and industry sectors to target. In choosing individual securities, the Fund seeks out securities that appear to be undervalued within the emphasized industry sector. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager’s investment criteria. |

| ◾ | The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund’s assets will be held in cash and/or cash equivalents. |

| ◾ | The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or unbiblical lifestyles. |

The Fund’s investments are subject to the following principal risks:

General Risk.

Interest Rate Risk. When interest rates rise, bond prices fall; the higher the Fund’s duration (a calculation reflecting time risk, taking into account both the average maturity of the Fund’s portfolio and its average coupon return), the more sensitive the Fund is to interest rate risk. A change in the economic environment that causes interest rates to rise back to more historically “normal” levels could have a pronounced negative effect on the Fund.

Credit Risk. The Fund could lose money if any bonds it owns are downgraded in credit rating or go into default. For this reason, the Fund will only invest in investment-grade bonds. The degree of risk for a particular security may not be reflected in its credit rating. Bonds rated at the time of purchase BBB by Standard & Poor’s or, unrated, but determined to be of comparable quality by the Investment Manager, are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities.

Sector Risk. If certain industry sectors or types of securities don’t perform as well as the Fund expects, the Fund’s performance could suffer.

Excluded Security Risk. Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier that other Funds that invest in a broader array of securities.

Investing In Other Funds Risk. The Fund invests in the securities of other investment companies. To the extent that the Fund invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Fund’s return to be lower.

Cybersecurity Risks. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 32

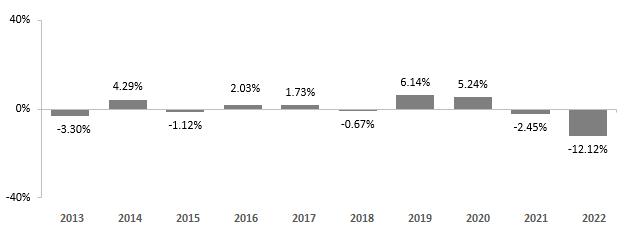

Year-by-year Annual Total Returns for Class A Shares

(for calendar years ending on December 31)

| % |

Average Annual Total Returns

(for periods ending on December 31, 2022)

| Fixed Income | Class A (3) | Class C | ||||

| 1 Year | 5 Year | 10 Year | 1 Year | 5 Year | 10 Year | |

| Return before taxes | % | % | % | % | % | % |

| Return after taxes on distributions (1) | % | % | % | % | % | % |

| Return after taxes on distributions and sale of shares (1) | % | % | % | % | % | % |

Bloomberg U.S. Aggregate Bond Index (2) (reflects no deduction for fees, expenses or taxes) |

% | % | % | % | % | % |

| (1) |

| (2) |

| (3) |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 33

Investment Advisor

Timothy Partners, Ltd.

Sub-Advisor

Barrow, Hanley, Mewhinney and Strauss, LLC (“Barrow Hanley”) serves as Investment Manager to the Fund.

Portfolio Managers

Mark C. Luchsinger, CFA (1) , J. Scott McDonald, CFA, and Deborah A. Petruzzelli, have served the Fund since July 1, 2004.

Justin Martin, CFA, has served the Fund since 2021.

Matthew K. Routh, CFA, has served the Fund since 2021.

| (1) | Mark C. Luchsinger, CFA is retiring and will no longer serve as a portfolio manager to the Growth and Income Fund effective April 30, 2023. |

Purchase and Sale of Shares

You may purchase, redeem or exchange shares of the Fund on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of the Fund either through a financial advisor or directly from the Fund. The minimum initial purchase or exchange into the Fund is $1,000, or $50 through monthly systematic investment plan accounts. There is no minimum subsequent investment amount. There are no minimums for purchases or exchanges through employer-sponsored retirement plans, IRAs, or other qualified plans. The Fund shares are redeemable on any business day by contacting your financial advisor, or by written request to the Fund, by telephone, or by wire transfer.

Tax Information

The Fund’s distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan. Tax-deferred arrangements may be taxed later upon withdrawal of monies from those accounts.

Payment to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 34

|

|

FUND SUMMARY

January 31, 2023

The investment objective of this Fund is to generate a high level of current income consistent with prudent investment risk.

This table describes the fees and expenses you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Class A | Class C | |

Maximum sales charge (load) imposed on purchases (as % of offering price) |

||

| Maximum deferred sales charges (load) (as a percentage of the lesser of original purchase price or redemption proceeds) (1) (2) | ||

| Redemption fees | ||

| Exchange fees |

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 35

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | |

| Management Fee | ||

| Distribution/Service (12b-1 Fees) | ||

| Other Expenses | ||

| Acquired Funds Fees and Expenses (3) | ||

Total Annual Fund Operating

Expenses |

||

| Fee Waivers and/or Expense Reimbursements (4)(5)(6) | - |

- |

Total Annual Fund Operating Expenses |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

| (6) |

| (7) |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| Class A | Class C (with redemption) |

Class C (without redemption) | |

| 1 Year | $ |

$ |

$187 |

| 3 Years | $ |

$ |

$616 |

| 5 Years | $ |

$ |

$1,071 |

| 10 Years | $ |

$ |

$2,334 |

The Example does not reflect sales charges (loads) on reinvested dividends and other distributions. If these sales charges (loads) were included, your costs would be higher.

The Fund pays transaction costs, such as commissions, when

it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected

in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent

fiscal year, the Fund’s portfolio turnover rate was

FUND SUMMARIES

PROSPECTUS (CLASS A & C) / 36

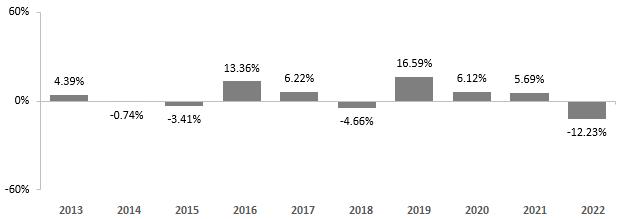

| ◾ | To achieve its goal, the Fund normally invests at least 80% of its total assets in a diversified portfolio of high yield fixed income securities. These include corporate bonds, mortgage-backed securities, convertible securities and preferred securities. The Investment Manager will generally purchase securities for the Fund that are not investment grade, meaning securities with a rating of “BB” or lower as rated by Standard & Poor’s or a comparable rating by another nationally recognized rating agency. The Fund may also invest in debt securities that have not been rated by one of the major rating agencies, so long as the Fund’s Investment Manager has determined that the security is of comparable credit quality to similarly rated securities. |