| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

TIMOTHY PLAN

|

|

| Prospectus Date |

rr_ProspectusDate |

Apr. 29, 2020

|

|

| Timothy Strategic Variable |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Strategic Growth Portfolio

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Strategic Growth Portfolio is to generate medium to high levels of long-term capital growth.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES OF THE PORTFOLIO

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The table below describes fees and expenses that you may pay if you buy and hold shares of the Portfolio. The table does not reflect expenses incurred from investing through an Insurance Company Separate Account or Qualified Plan and does not reflect variable annuity or life insurance contract charges. If it did, your expenses would be higher. Each Portfolio pays annual operating expenses from its assets, so their effect is included in the Portfolio’s share price. Separate Account Owners and Qualified Plan Participants should refer to their Insurance Company’s Prospectus or their Qualified Plan document, as applicable, for information on those fees or charges.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Portfolio Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the Portfolio’s most recent fiscal year, the Portfolio’s turnover rate was 78% of the average value of the Portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

78.00%

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

The fees and expenses are not used to calculate the Portfolio’s net asset values and do not correlate to the ratio of Expenses to Average Net Assets found in the Financial Highlights sections of this prospectus.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example:

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated, reinvest dividends and distributions, and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The example does not reflect any insurance product fees or any additional expenses that participants in a qualified plan may bear relating to the operations of their plan. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Strategic Growth Portfolio is a “Fund-of-Funds” and under normal circumstances will typically invest at least 75% of its assets in the following underlying Funds in order to achieve its investment objective. The following range of percentages is a general guide regarding the anticipated investment allocation among the Funds:

| | | | Timothy Plan Traditional Funds | | % of Fund’s Net Assets Invested in Timothy Plan Traditional Funds | | Large/Mid Cap Growth Fund | | 0 - 20% | | Large/Mid Cap Value Fund | | 0 - 20% | | Small Cap Value Fund | | 0 - 10% | | Aggressive Growth Fund | | 0 - 10% | | International Fund | | 0 - 20% | | High Yield Bond Fund | | 5 - 15% | | Defensive Strategies Fund | | 5 - 30% | | Israel Common Values Fund | | 0 - 10% | | Fixed Income Fund | | 0 - 20% | | US Large/Mid Cap Core ETF | | 0 - 40% | | High Dividend Stock ETF | | 0 - 20% | | International ETF | | 0 - 30% | | US Small Cap Core ETF | | 0 - 20% |

Timothy Partners, Ltd. (“TPL”) will determine the specific asset allocation program on a continuous basis, based on its forecast of the overall market. On each day that the Fund is open for business, TPL will review the asset allocation program and reallocate, as necessary, for any new funds invested in the Fund. The Advisor also will reallocate the Fund’s investments in the Traditional Funds at the end of each fiscal quarter to maintain the asset allocation program.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

1. General Risk | As with most other mutual funds, you can lose money by investing in the Strategic Growth Portfolio. Share prices fluctuate from day to day, and when you sell your shares, they may be worth less than you paid for them.

2. Portfolio Risk | The Portfolio is indirectly subject to the following risks that are inherent in the Traditional Funds in which the Portfolio invests: - Commodities-based Exchange Traded Funds Risk: Commodity ETFs invest in Physical Commodities and/or Commodity Futures Contracts which Contracts are highly leveraged investment vehicles, and therefore generally considered to be high risk. By investing in underlying funds holding Commodity ETFs, the Portfolio assumes portions of that risk. ETFs may only purchase commodities futures contracts (the buy side), therefore the risks include missing opportunities to realize gains by shorting futures contracts (the sell side) in deflationary economic periods. It is possible an underlying Fund’s entire ETF investment could be lost. Also, ETF’s have expenses associated with them, and although indirect, these expenses may cause the Portfolio’s return to be lower.

- Country-Specific Risk: One underlying fund invests in Israeli securities, and Israel is subject to unique political and economic risks. As a result, Israeli securities can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The investments in the securities of Israel may experience more rapid and extreme changes in value than funds with investments solely in securities of U.S. companies or funds that invest across a larger spectrum of the foreign market. This is because the securities market in Israel is relatively small, with a limited number of companies representing a smaller number of industries. Israeli issuers are not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect the Portfolio’s investments in a foreign country.

- Credit Risk: If investment grade bonds are downgraded in credit rating or go into default, the result could be a loss of value, and the Portfolio could lose money. The degree of risk for a particular security may or may not be reflected in its credit rating. Bonds that are unrated, or rated BBB by Standard & Poor’s at the time of purchase, are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities. High yield securities (“junk” bonds) are subject to greater risk of loss than investment grade securities. Unrated bonds or bonds rated BB or lower by Standard & Poor’s at the time of purchase (“junk” bonds) are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities.

- Currency Risk: Securities represented by ADRs are foreign stocks denominated in non-U.S. currency, and there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the investments in foreign securities. For securities that are foreign stocks denominated in non-U.S. currency, there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the investments in foreign securities.

- Emerging Market Risk: Investments in the securities of emerging countries may experience more rapid and extreme changes in value than investments solely in securities of U.S. companies and investments in a larger spectrum of the foreign market. This is because the securities markets in some emerging countries are relatively small, with a limited number of companies representing a smaller number of industries. Issuers in emerging countries are frequently not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect investments in emerging foreign countries.

- Equity Market Risk: Overall, stock market risks may affect the value of the Portfolio. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Portfolio’s investments goes down, your investment in the Portfolio decreases in value and you could lose money.

- Exchange Traded Fund Risk: An ETF may trade at a discount to its net asset value. Investors indirectly bear fees and expenses charged by the underlying ETFs in addition to the Portfolio’s direct fees and expenses. There are also brokerage costs incurred when purchasing ETFs. In addition, losses of the underlying ETF and the level of risk arising from the investment practices of an underlying ETF may impact returns.

- Excluded Security Risk: Because the underlying Funds do not invest in Excluded Securities (including certain REITs) , and will divest themselves of securities that are subsequently discovered to be ineligible, the Portfolio may be riskier than similar funds that invest in underlying funds that invest in broader arrays of securities.

- Fixed Income Risk: Fixed income securities will increase or decrease in value based on changes in interest rates. If rates increase, fixed income securities generally will decline, and those securities with longer terms generally will decline more. Your investment will decline in value if the value of fixed income securities decrease. There is a risk that issuers and counterparties will not make payments on fixed income securities and repurchase agreements. Such defaults could result in losses to the Portfolio.

- Foreign Investment Risk: Foreign investing involves risks not typically associated with U.S. investments and may experience more rapid and extreme changes in value than investments solely in securities of U.S. companies. These risks include, among others, adverse fluctuations in foreign currency values as well as adverse political, social and economic developments affecting a foreign country. In addition, foreign investing involves less publicly available information, and more volatile or less liquid securities markets. Investments in foreign countries could be affected by factors not present in the U.S., such as restrictions on receiving the investment proceeds from a foreign country, foreign tax laws, and potential difficulties in enforcing contractual obligations. Foreign accounting may be less transparent than U.S. accounting practices and foreign regulation may be inadequate or irregular. Underlying Funds owning foreign securities could cause the Portfolio’s performance to fluctuate more than if it held only U.S. securities.

- Growth Risk: Some underlying Funds invest in companies after assessing their growth potential. Securities of growth companies may be more volatile than other stocks. If a portfolio manager’s perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the Portfolio’s return. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities.

- High Portfolio Turnover Risk: Higher portfolio turnover rates may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Portfolio operating expenses or in the Example, affect the Portfolio’s performance.

- High Yield Security Risk: Investments in fixed-income securities that are rated below investment grade (“high yield securities”) by one or more Nationally Recognized Statistical Rating Organizations (NRSROs) may be subject to greater risk of loss of principal and interest than investments in higher-rated fixed-income securities. High yield securities are also generally considered to be subject to greater market risk than higher-rated securities. The capacity of issuers of high yield securities to pay interest and repay principal is more likely to weaken than is that of issuers of higher-rated securities in times of deteriorating economic conditions or rising interest rates. In addition, high yield securities may be more susceptible to real or perceived adverse economic conditions than higher-rated securities. The market for high yield securities may be less liquid than the market for higher-rated securities. This can adversely affect an underlying Fund’s ability to buy or sell optimal quantities of high yield securities at desired prices.

- Interest Rate Risk: When interest rates rise, bond prices fall; the higher an underlying Fund’s duration (a calculation reflecting time risk, taking into account both the average maturity of the Fund’s portfolio and its average coupon return), the more sensitive the underlying Fund is to interest rate risk.

- Investing In Other Funds Risk: The Portfolio invests in the securities of other investment companies. To the extent that the Portfolio invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Portfolio’s return to be lower.

- Issuer-Specific Risk: The value of an individual security or a particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

- Larger Company Investing Risk: Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

- Management Risk: An Advisor’s judgments about the attractiveness, value and potential appreciation of a particular asset class or individual security in which an underlying Fund invests may prove to be incorrect. The Portfolio may experience losses regardless of the overall performance of the market.

- Mid-Sized Company Investing Risk: Investing in mid-sized companies often involves greater risk than investing in larger companies. Mid-sized companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of mid-sized companies, therefore, tend to be more volatile than the securities of larger, more established companies. Mid-sized company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if an underlying Fund wants to sell a large quantity of a mid-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period.

- Municipal Securities Risk: The power or ability of an issuer to make principal and interest payments on municipal securities may be materially adversely affected by economic conditions, litigation or other factors. An underlying Fund’s right to receive principal and interest payments may be subject to the provisions of bankruptcy, insolvency, and other laws affecting the rights and remedies of creditors, as well as laws, if any, which may be enacted by Congress or state legislatures extending the time for payment of principal and/or interest or imposing other constraints upon the enforcement of such obligations. In addition, substantial changes in federal income tax laws could cause municipal security prices to decline because the demand for municipal securities is strongly influenced by the value of tax exempt income to investors.

- Non-Diversification Risk: Because the underlying Funds may invest in a smaller number of securities, adverse changes to a single security might have a more pronounced negative effect on a Fund than if the Portfolio’s investments were more widely distributed.

- Real Estate Investment Trust Risk: To the extent underlying Funds invest in real estate investment trusts, the Portfolio is subject to risks experienced in real estate ownership, real estate financing, or both. As the economy is subjected to a period of economic deflation or interest rate increases, the demand for real estate may fall, causing a decline in the value of real estate owned. Also, as interest rates increase, the values of existing mortgages fall. The higher the duration (a calculation reflecting time risk, taking into account the average maturity of the mortgages) of the mortgages held in REITs owned by underlying Funds, the more sensitive the Portfolio is to interest rate risks. The underlying Funds are also subject to credit risk; the Portfolio could lose money if mortgagors default on mortgages held in the REITs.

- Sector Risk: If certain industry sectors or types of securities don’t perform as well as the managers of the underlying Funds expect, the Portfolio’s performance could suffer.

- Small Cap Company Risk: Smaller capitalization companies may experience higher failure rates than do larger capitalization companies. In addition, smaller companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Such companies may have limited product lines, markets or financial resources and may lack management depth. The trading volume of securities of smaller capitalization companies is normally less than that of larger capitalization companies, and therefore may disproportionately affect their market price, tending to make them fall more in response to selling pressure than is the case with larger capitalization companies. Some small capitalization stocks may be illiquid. These risks may be enhanced for micro-cap securities. Many micro-cap companies tend to be new and have no proven track record. Some of these companies have no assets or operations, while others have products and services that are still in development or have yet to be tested in the market. Because micro-cap stocks trade in low volumes, any size of trade can have a large percentage impact on the price of the stock.

- Sovereign Debt Risk: The underlying Funds may invest in sovereign debt obligations. Investment in sovereign debt obligations involves special risks not present in corporate debt obligations. The issuer of the sovereign debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay principal or interest when due, and the Portfolio may have limited recourse in the event of a default. During periods of economic uncertainty, the market prices of sovereign debt, and the underlying Funds’ net asset values, may be more volatile than prices of U.S. debt obligations.

- Stock Market Risk: The Portfolio is predominately an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time.

- Treasury-Inflation Protected Securities Risk: Because the real rate of return offered by TIPS, which represents the growth of purchasing power, is guaranteed by the Federal Government, TIPS may offer a lower return than other fixed income instruments that do not have such guarantees. Other conventional bond issues may offer higher yields.

- Value Investing Risk: Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock may never appreciate to the extent expected.

- Precious Metals Risk: The Fund’s gold and silver may be subject to loss, damage, theft, or restriction on access, and the Fund’s recovery may be limited, even in the event of fraud, to the market value of the metals at the time the fraud is discovered. International crises may motivate large-scale sales of precious metals which could decrease their prices and adversely affect the value of the Shares. The price of metals may also be adversely affected by the sale of gold or silver by ETFs or other exchange traded vehicles tracking the precious metals markets. In the event of the insolvency of the Custodian, a liquidator may seek to freeze access to the metals held in all of the accounts held by the Custodian, including the Fund’s Allocated Account. Although the Fund would retain legal title to the allocated gold and silver bars, the Fund could incur expenses in connection with obtaining control of the allocated gold or silver, and the assertion of a claim by such liquidator for unpaid fees could delay redemptions.

- Cybersecurity Risks: Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

As with most other mutual funds, you can lose money by investing in the Strategic Growth Portfolio.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-Diversification Risk: Because the underlying Funds may invest in a smaller number of securities, adverse changes to a single security might have a more pronounced negative effect on a Fund than if the Portfolio’s investments were more widely distributed.

|

|

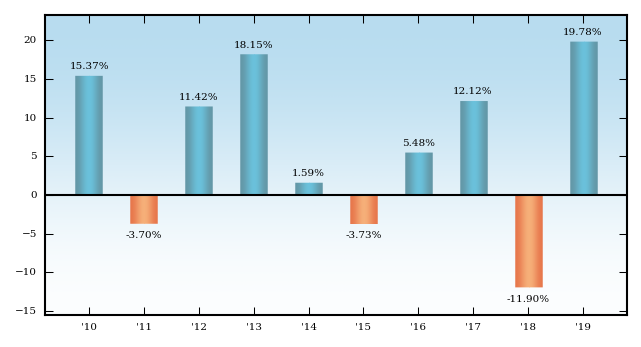

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PAST PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

Although past performance of the Portfolio is no guarantee of how it will perform in the future, historical performance may give you some indication of the risk of investing in the Portfolio because it demonstrates how the Portfolio’s returns have varied over time. The bar chart shows changes in the Portfolio’s returns for the last ten years, and the table shows how the Portfolio’s average annual total returns compare over time to the returns of a broad-based securities market index. The performance information in this Prospectus does not reflect charges or expenses associated with the Insurance Companies Separate Accounts, variable contracts, or Qualified Plans that an investor in the Portfolio may pay.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart shows changes in the Portfolio’s returns for the last ten years, and the table shows how the Portfolio’s average annual total returns compare over time to the returns of a broad-based securities market index.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Although past performance of the Portfolio is no guarantee of how it will perform in the future

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Year-by-year Annual Total Returns for Portfolio Shares (for calendar years ending on December 31)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| | | | Best Quarter | | Worst Quarter | | Sept-10 | | Sept-11 | | 12.66% | | -16.53% |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns (for periods ending on December 31, 2019)

|

|

| Timothy Strategic Variable | Timothy Strategic Variable |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management Fee |

rr_ManagementFeesOverAssets |

0.10%

|

[1] |

| Distribution/Service (12b-1 Fees) |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses (including administrative fees, transfer agency fees, and all other ordinary operating expenses not listed above) |

rr_OtherExpensesOverAssets |

0.39%

|

|

| Acquired Funds’ Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

1.33%

|

[2] |

| Total Annual Portfolio Operating Expenses |

rr_ExpensesOverAssets |

1.82%

|

[3] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 185

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

573

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

985

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 2,137

|

|

| 2010 |

rr_AnnualReturn2010 |

15.37%

|

|

| 2011 |

rr_AnnualReturn2011 |

(3.70%)

|

|

| 2012 |

rr_AnnualReturn2012 |

11.42%

|

|

| 2013 |

rr_AnnualReturn2013 |

18.15%

|

|

| 2014 |

rr_AnnualReturn2014 |

1.59%

|

|

| 2015 |

rr_AnnualReturn2015 |

(3.73%)

|

|

| 2016 |

rr_AnnualReturn2016 |

5.48%

|

|

| 2017 |

rr_AnnualReturn2017 |

12.12%

|

|

| 2018 |

rr_AnnualReturn2018 |

(11.90%)

|

|

| 2019 |

rr_AnnualReturn2019 |

19.78%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2010

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

12.66%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(16.53%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

19.78%

|

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

3.74%

|

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

5.97%

|

|

| Timothy Strategic Variable | Return after taxes on distributions | Timothy Strategic Variable |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

19.18%

|

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

2.68%

|

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

5.22%

|

|

| Timothy Strategic Variable | Return after taxes on distributions and sale of shares | Timothy Strategic Variable |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

11.93%

|

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

2.64%

|

|

| 10 Year |

rr_AverageAnnualReturnYear10 |

4.55%

|

|

| Timothy Strategic Variable | Dow Jones Global Moderately Aggressive Portfolio Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

22.84%

|

[4] |

| 5 Year |

rr_AverageAnnualReturnYear05 |

7.77%

|

[4] |

| 10 Year |

rr_AverageAnnualReturnYear10 |

9.17%

|

[4] |

|

|