| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

TIMOTHY PLAN

|

|

| Prospectus Date |

rr_ProspectusDate |

Jan. 29, 2020

|

|

| Timothy Small-Cap Value Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Small Cap Value Fund CLASS I: TPVIX

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of this Fund is to provide you with long-term growth of capital,

|

|

| Objective, Secondary [Text Block] |

rr_ObjectiveSecondaryTextBlock |

with a secondary objective of current income.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 63% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

63.00%

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

Total Annual Fund Operating Expenses do not correlate to the ratio of average net assets in the Financial Highlights Table, which reflects the operating expenses of the Fund and does not include Acquired Funds Fees and Expenses.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example:

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Class I shares of the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example, No Redemption Narrative [Text Block] |

rr_ExpenseExampleNoRedemptionNarrativeTextBlock |

Your costs for this share class would be the same whether or not you redeem your shares at the end of any period.

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

- The Fund seeks to achieve its investment objective by primarily investing at least 80% of the Fund’s total assets in U.S. stocks with market capitalizations that fall within the range of companies included in the Russell 2000® Index (the “Index”). As of the latest reconstitution of the Index on June 28, 2019, the capitalization range of companies comprising the Index is approximately $2 million to $10 billion. This Fund invests using a value investing style. Value funds typically emphasize stocks whose prices are below average in relation to such measures as earnings and book value; these stocks often have above-average dividend yields. Growth and value stocks have historically produced similar long-term returns, though each category has periods when it outperforms the other.

- In determining whether to invest in a particular company, the Fund’s Investment Manager focuses on a number of different attributes of the company, including the company’s market expertise, balance sheet, improving return on equity, price to earnings ratios, industry position and strength, management and a number of other factors. Analyzing companies in this manner is known as a “bottom up” approach to investing. Companies that meet or exceed specific criteria established by the Manager in the selection process are purchased. Securities are sold when they reach internally determined pricing targets or no longer qualify under the Manager’s investment criteria.

- The Fund may invest in equity securities of foreign issuers in the form of American Depositary Receipts (ADRs). ADRs are certificates held in trust by a U.S. bank or trust company evidencing ownership of shares of foreign-based issuers and are an alternative to purchasing foreign securities in their national market and currency.

- The Fund may, from time to time, take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political, or other conditions. When the Fund takes a defensive position, the Fund’s assets will be held in cash and/or cash equivalents.

- The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or alternative lifestyles.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

General Risk | As with most other mutual funds, you can lose money by investing in this Fund. Share prices fluctuate from day to day, and when you sell your shares, they may be worth less than you paid for them. Stock Market Risk | The Fund is an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time. Smaller Company Investing Risk | Investing in smaller companies often involves greater risk than investing in larger companies. Smaller companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of smaller companies, therefore, tend to be more volatile than the securities of larger, more established companies. Smaller company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if a fund wants to sell a large quantity of a small-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period. Excluded Security Risk | Because the Fund does not invest in Excluded Securities and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other funds that invest in a broader array of securities. Foreign Risk | The Fund’s investments in foreign securities may experience more rapid and extreme changes in value than funds with investments solely in securities of U.S. companies. This is because the securities markets of many foreign countries are relatively small, with a limited number of companies representing a smaller number of industries. Foreign issuers are not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect the Fund’s investments in a foreign country. There is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the Fund’s investments in foreign securities. Value Investing Risk | Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock may never appreciate to the extent expected. Cybersecurity Risks | Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices utilized by the Fund potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

As with most other mutual funds, you can lose money by investing in this Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PAST PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. More up-to-date returns are available on the Fund’s website at www.timothyplan.com, or by calling the Fund at (800) 846-7526.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

(800) 846-7526

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.timothyplan.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

|

|

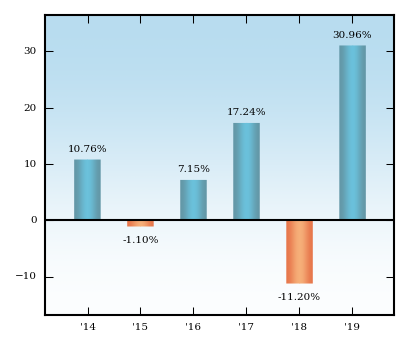

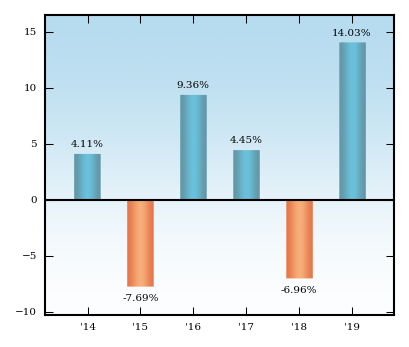

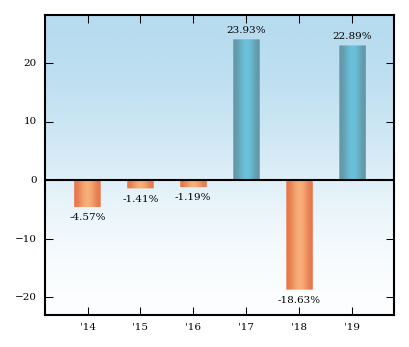

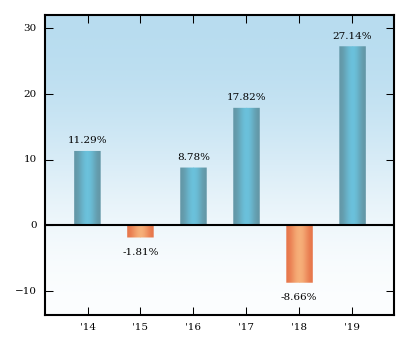

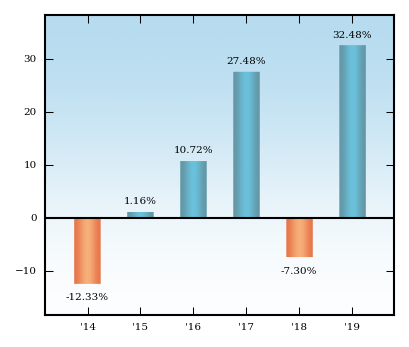

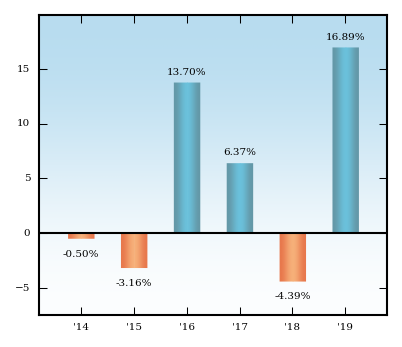

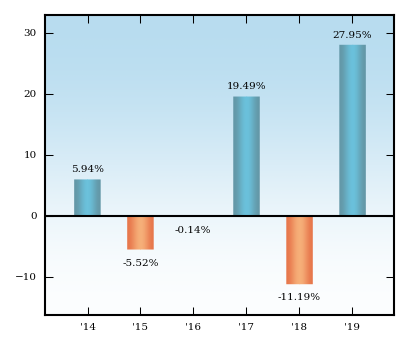

| Bar Chart [Heading] |

rr_BarChartHeading |

Year-by-year Annual Total Returns for Class I Shares (for calendar years ending on December 31)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| | | | Best Quarter | | Worst Quarter | | Mar-19 | | Dec-18 | | 15.03% | | -20.54% |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns (for periods ending on December 31, 2019)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns displayed are for Class I shares only, and after-tax returns for other classes may vary.

|

|

| Timothy Small-Cap Value Fund | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management Fee |

rr_ManagementFeesOverAssets |

0.85%

|

|

| Distribution/Service (12b-1 Fees) |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.42%

|

|

| Fees and Expenses of Acquired Funds |

rr_AcquiredFundFeesAndExpensesOverAssets |

none

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.27%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 129

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

403

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

697

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

1,534

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

129

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

403

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

697

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,534

|

|

| 2014 |

rr_AnnualReturn2014 |

5.24%

|

|

| 2015 |

rr_AnnualReturn2015 |

(6.37%)

|

|

| 2016 |

rr_AnnualReturn2016 |

24.40%

|

|

| 2017 |

rr_AnnualReturn2017 |

13.29%

|

|

| 2018 |

rr_AnnualReturn2018 |

(15.36%)

|

|

| 2019 |

rr_AnnualReturn2019 |

28.56%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Mar. 31, 2019

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

15.03%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2018

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(20.54%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

28.56%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.50%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.91%

|

[2] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

|

| Timothy Small-Cap Value Fund | Return after taxes on distributions | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

27.41%

|

[3] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.58%

|

[3] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.12%

|

[2],[3] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

[3] |

| Timothy Small-Cap Value Fund | Return after taxes on distributions and sale of shares | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.72%

|

[3] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.55%

|

[3] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.33%

|

[2],[3] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

[3] |

| Timothy Small-Cap Value Fund | Russell 2000 Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

25.53%

|

[4] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

8.23%

|

[4] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.82%

|

[2],[4] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

[4] |

|

|