AS FILED WITH THE SECURITIES

AND EXCHANGE COMMISSION

ON 4/17/2017

FILE NOS: 811-08228

33-73248

SECURITIES AND EXCHANGE COMMISSION

------------------------------------

Washington, D.C. 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

[X ] | |

| Pre-Effective Amendment No. |

[ ] | |

| Post-Effective Amendment No. |

[76] | |

| and |

||

| REGISTRATION STATEMENT UNDER |

||

| THE INVESTMENT COMPANY ACT OF 1940 |

[X ] | |

| Amendment No. |

[77] |

(Check appropriate box or boxes.)

THE TIMOTHY PLAN

(Exact name of Registrant as Specified in Charter)

1055 MAITLAND CENTER COMMONS

MAITLAND, FL 32751

(Address of Principal Executive Office)

407-644-1986

(Registrant’s Telephone Number, including Area Code:)

ARTHUR D. ALLY, 1055 MAITLAND CENTER COMMONS

MAITLAND, FL 32751

(Name and Address of Agent for Service)

Please send copy of communications to:

DAVID D. JONES, ESQUIRE

18630 Crosstimber

San Antonio, TX 78258

Approximate Date of Proposed Public Offering: As soon as practicable following effective date.

It is proposed that this filing will become effective (check appropriate box):

/X/ immediately upon filing pursuant to paragraph (b)

/ / on (date) pursuant to paragraph (b)

/ / 60 days after filing pursuant to paragraph (a)(1)

/ / on (date), pursuant to paragraph (a)(3)

/ / 75 days after filing pursuant to paragraph (a)(2)

/ / on ___________ pursuant to paragraph (a)(2) of rule 485

If appropriate, check the following box:

/ / this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

Registrant declares hereby that an indefinite number or amount of its securities has been registered by this Registration Statement.

A Rule 24f-2 Notice for the Trust’s fiscal year ended December 31, 2016 was filed on February 16, 2017

PROSPECTUS

April 30, 2017

| TIMOTHY PLAN VARIABLE SERIES | ||||

| Strategic Growth Portfolio | ||||

| Conservative Growth Portfolio |

PORTFOLIO SERIES: THIS PROSPECTUS OFFERS PORTFOLIO SHARES ONLY.

THE PORTFOLIOS ARE DISTRIBUTED THROUGH: Timothy Partners, Ltd., 1055 Maitland Center Commons, Maitland, Florida 32751

The Timothy Plan Strategic Growth Portfolio Variable Series (“Strategic Growth Portfolio”) and the Timothy Plan Conservative Growth Portfolio Variable Series (“Conservative Growth Portfolio”) (each a “Portfolio” and, collectively, the “Portfolios”) are offered only to separate accounts (the “Separate Accounts”) established by various insurance companies (collectively, the “Insurance Companies”) and to certain eligible qualified retirement plans (“Qualified Plans”). The Portfolios are intended to serve as investment vehicles for variable life insurance, variable annuity and group annuity products of Insurance Companies or for Qualified Plans. The general public may not directly purchase shares of the Portfolios.

The Portfolios invest in the Timothy Plan Traditional Funds. The Timothy Plan believes that it has a responsibility to invest in a moral and ethical manner. Accordingly, none of the Traditional Funds invest in any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or alternative lifestyles. Securities issued by companies engaged in these prohibited activities are excluded from the Portfolios’ portfolios and are referred to throughout this Prospectus as “Excluded Securities.” Under a zero-tolerance policy, Excluded Securities will not be purchased by any of our Traditional Funds. Timothy Partners, Ltd. (“TPL”) is investment advisor to the Traditional Funds and to the Portfolios, and is responsible for determining those securities that are Excluded Securities, and reserves the right to exclude investments, in its best judgment, in other companies whose practices may not fall within the exclusions described above, but nevertheless could be found offensive to basic, traditional Judeo-Christian values. Further, if a company whose securities are being held by one of our Traditional Funds is discovered to have changed its policies and is engaging in a prohibited practice, that security will be sold as soon as is reasonably practicable.

Because none of our Traditional Funds will invest in Excluded Securities, and will divest itself of securities that are subsequently discovered to be ineligible, each Fund’s pool of eligible investments may be limited to a certain degree. Although TPL believes that the Portfolios can achieve their investment objectives within the parameters of ethical investing, eliminating Excluded Securities as investments in the Traditional Funds may have an adverse effect on a Portfolio’s performance and ongoing expenses.

THE PORTFOLIOS ARE DISTRIBUTED THROUGH:

Timothy Partners, Ltd., 1055 Maitland Center Commons, Maitland, Florida 32751

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Section 1 | Portfolio Summaries | |||||

| This section sets forth a general description of important information you should know about each of our Portfolios. | ||||||

| Strategic Growth Portfolio | 3 | |||||

| Conservative Growth Portfolio | 8 | |||||

| Section 2 | Who Manages Your Money | |||||

| This section gives you a detailed discussion of our Investment Advisor and Portfolio Manager. | ||||||

| The Investment Advisor | 13 | |||||

| Section 3 | How You Can Buy and Sell Shares | |||||

| This section provides the information you need to move money into or out of your account. | ||||||

| How to Buy Shares | 14 | |||||

| How to Sell Shares | 14 | |||||

| Section 4 | General Information | |||||

| This section summarizes the Portfolios’ distribution policies and other general Portfolio information. | ||||||

| Temporary Defensive Strategies | 15 | |||||

| Dividends, Distributions and Taxes | 15 | |||||

| Fair Value Pricing | 15 | |||||

| Fund Service Providers | 16 | |||||

| Code of Ethics | 16 | |||||

| Privacy Policy | 16 | |||||

| Customer Identification Program | 16 | |||||

| Section 5 | Financial Highlights | |||||

| This section provides the Portfolios’ financial performance for the past five fiscal years. | ||||||

| Strategic Growth Portfolio | 17 | |||||

| Conservative Growth Portfolio | 18 | |||||

| Section 6 | For More Information | |||||

| This section tells you how to obtain additional information relating to the Portfolios. | ||||||

| 19 | ||||||

| Page | 2 |

PORTFOLIO SUMMARY

TIMOTHY PLAN VARIABLE SERIES

The investment objective of the Portfolio is to generate medium to high levels of long-term capital growth.

FEES AND EXPENSES

Investors using a Portfolio to fund a Separate Account will pay certain fees and expenses in connection with the Portfolio, which are estimated in the table below. Each Portfolio pays annual operating expenses from its assets, so their effect is included in the Portfolio’s share price. These figures do not reflect any fees or charges imposed by any Insurance Company or Qualified Plan. Separate Account Owners and Plan Participants should refer to the Insurance Company’s prospectus or plan document, as applicable, for information on those fees or charges.

Annual Portfolio Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Management Fee (2) |

0.10% | |||||||

| Distribution/Service (12b-1 Fees) |

0.00% | |||||||

| Other Expenses (including administrative fees, transfer agency fees, and all other ordinary operating expenses not listed above) |

0.29% | |||||||

| Acquired Funds’ Fees and Expenses (3) |

1.38% | |||||||

| Total Annual Portfolio Operating Expenses (1) |

1.77% | |||||||

| (1) | The annual operating expenses of the Portfolio as shown in the table above are as of the Portfolio’s fiscal year ended December 31, 2016. |

| (2) | Management Fees are 0.10% of the average daily net assets of the Portfolio which is paid to the Portfolio’s Advisor, Timothy Partners. Ltd. |

| (3) | Fees and expenses of Acquired Funds represent the pro rata expense indirectly incurred by the Portfolio as a result of investing in the Timothy Plan Traditional Funds that have their own expenses. The fees and expenses are not used to calculate the Portfolio’s net asset values and do not correlate to the ratio of Expenses to Average Net Assets found in the Financial Highlights sections of this prospectus. |

Example:

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated, reinvest dividends and distributions, and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The example does not reflect any insurance product fees or any additional expenses that participants in a qualified plan may bear relating to the operations of their plan. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Time Period | Amount | |

| 1 Year |

$180 | |

| 3 Years |

$557 | |

| 5 Years |

$959 | |

| 10 Years |

$2,084 |

PORTFOLIO TURNOVER

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the Portfolio’s most recent fiscal year, the Portfolio’s portfolio turnover rate was 32% of the average value of its portfolio.

| 3 | Page |

PRINCIPAL INVESTMENT STRATEGIES

The Strategic Growth Portfolio normally will invest at least 75% of its assets in the following Timothy Funds according to the following approximate range of percentages:

| Timothy Plan Traditional Fund | % of Fund’s Net Assets Invested in Traditional Fund | |

| Small Cap Value Fund |

2 - 10% | |

| Large/Mid Cap Value Fund |

10 - 20% | |

| Large/Mid Cap Growth Fund |

10 - 20% | |

| Aggressive Growth Fund |

2 - 10% | |

| High Yield Bond Fund |

5 - 15% | |

| Fixed Income Fund |

0 - 15% | |

| International Fund |

10 - 20% | |

| Israel Common Values Fund |

0 - 10% | |

| Emerging Markets Fund |

0 - 10% | |

| Defensive Strategies Fund |

10 - 30% | |

| Growth & Income Fund |

5 - 20% |

Timothy Partners, Ltd. (“TPL”) will determine the specific asset allocation program on a continuous basis, based on its forecast of the overall market. On each day that the Fund is open for business, TPL will review the asset allocation program and reallocate, as necessary, for any new funds invested in the Fund. The Advisor also will reallocate the Fund’s investments in the Traditional Funds at the end of each fiscal quarter to maintain the asset allocation program.

PRINCIPAL RISKS

| 1. | General Risk | As with most other mutual funds, you can lose money by investing in the Strategic Growth Portfolio. Share prices fluctuate from day to day, and when you sell your shares, they may be worth less than you paid for them. |

| 2. | Portfolio Risk | The Portfolio is indirectly subject to the following risks that are inherent in the Traditional Funds in which the Portfolio invests: |

| ◾ | Commodities-based Exchange Traded Funds Risk: Commodity ETFs invest in Physical Commodities and/or Commodity Futures Contracts which Contracts are highly leveraged investment vehicles, and therefore generally considered to be high risk. By investing in underlying funds holding Commodity ETFs, the Portfolio assumes portions of that risk. ETFs may only purchase commodities futures contracts (the buy side), therefore the risks include missing opportunities to realize gains by shorting futures contracts (the sell side) in deflationary economic periods. It is possible an underlying Fund’s entire ETF investment could be lost. Also, ETF’s have expenses associated with them, and although indirect, these expenses may cause the Portfolio’s return to be lower. |

| ◾ | Country-Specific Risk: One underlying fund invests in Israeli securities, and Israel is subject to unique political and economic risks. As a result, Israeli securities can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The investments in the securities of Israel may experience more rapid and extreme changes in value than funds with investments solely in securities of U.S. companies or funds that invest across a larger spectrum of the foreign market. This is because the securities market in Israel is relatively small, with a limited number of companies representing a smaller number of industries. Israeli issuers are not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect the Portfolio’s investments in a foreign country. |

| ◾ | Credit Risk: If investment grade bonds are downgraded in credit rating or go into default, the result could be a loss of value, and the Portfolio could lose money. The degree of risk for a particular security may or may not be reflected in its credit rating. Bonds that are unrated, or rated BBB by Standard & Poor’s at the time of purchase, are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities. High yield securities (“junk” bonds) are subject to greater risk of loss than investment grade securities. Unrated bonds or bonds rated BB or lower by Standard & Poor’s at the time of purchase (“junk” bonds) are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities. |

| ◾ | Currency Risk: Securities represented by ADRs are foreign stocks denominated in non-U.S. currency, and there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the investments in foreign securities. For securities that are foreign stocks denominated in non-U.S. currency, there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the investments in foreign securities. |

| ◾ | Emerging Market Risk: Investments in the securities of emerging countries may experience more rapid and extreme changes in value than investments solely in securities of U.S. companies and investments in a larger spectrum of the foreign market. This is because the securities markets in some emerging countries are relatively small, with a limited number of companies representing a smaller number of industries. Issuers in emerging countries are frequently not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect investments in emerging foreign countries. |

| ◾ | Equity Market Risk: Overall, stock market risks may affect the value of the Portfolio. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Portfolio’s investments goes down, your investment in the Portfolio decreases in value and you could lose money. |

| Page | 4 |

| ◾ | Exchange Traded Fund Risk: An ETF may trade at a discount to its net asset value. Investors indirectly bear fees and expenses charged by the underlying ETFs in addition to the Portfolio’s direct fees and expenses. There are also brokerage costs incurred when purchasing ETFs. In addition, losses of the underlying ETF and the level of risk arising from the investment practices of an underlying ETF may impact returns. |

| ◾ | Excluded Security Risk: Because the underlying Funds do not invest in Excluded Securities (including certain REITs) , and will divest themselves of securities that are subsequently discovered to be ineligible, the Portfolio may be riskier than similar funds that invest in underlying funds that invest in broader arrays of securities. |

| ◾ | Fixed Income Risk: Fixed income securities will increase or decrease in value based on changes in interest rates. If rates increase, fixed income securities generally will decline, and those securities with longer terms generally will decline more. Your investment will decline in value if the value of fixed income securities decrease. There is a risk that issuers and counterparties will not make payments on fixed income securities and repurchase agreements. Such defaults could result in losses to the Portfolio. |

| ◾ | Foreign Investment Risk: Foreign investing involves risks not typically associated with U.S. investments and may experience more rapid and extreme changes in value than investments solely in securities of U.S. companies. These risks include, among others, adverse fluctuations in foreign currency values as well as adverse political, social and economic developments affecting a foreign country. In addition, foreign investing involves less publicly available information, and more volatile or less liquid securities markets. Investments in foreign countries could be affected by factors not present in the U.S., such as restrictions on receiving the investment proceeds from a foreign country, foreign tax laws, and potential difficulties in enforcing contractual obligations. Foreign accounting may be less transparent than U.S. accounting practices and foreign regulation may be inadequate or irregular. Underlying Funds owning foreign securities could cause the Portfolio’s performance to fluctuate more than if it held only U.S. securities. |

| ◾ | Growth Risk: Some underlying Funds invest in companies after assessing their growth potential. Securities of growth companies may be more volatile than other stocks. If a portfolio manager’s perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the Portfolio’s return. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities. |

| ◾ | High Portfolio Turnover Risk: Higher portfolio turnover rates may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Portfolio operating expenses or in the Example, affect the Portfolio’s performance. |

| ◾ | High Yield Security Risk: Investments in fixed-income securities that are rated below investment grade (“high yield securities”) by one or more Nationally Recognized Statistical Rating Organizations (NRSROs) may be subject to greater risk of loss of principal and interest than investments in higher-rated fixed-income securities. High yield securities are also generally considered to be subject to greater market risk than higher-rated securities. The capacity of issuers of high yield securities to pay interest and repay principal is more likely to weaken than is that of issuers of higher-rated securities in times of deteriorating economic conditions or rising interest rates. In addition, high yield securities may be more susceptible to real or perceived adverse economic conditions than higher-rated securities. The market for high yield securities may be less liquid than the market for higher-rated securities. This can adversely affect an underlying Fund’s ability to buy or sell optimal quantities of high yield securities at desired prices. |

| ◾ | Interest Rate Risk: When interest rates rise, bond prices fall; the higher an underlying Fund’s duration (a calculation reflecting time risk, taking into account both the average maturity of the Fund’s portfolio and its average coupon return), the more sensitive the underlying Fund is to interest rate risk. |

| ◾ | Investing In Other Funds Risk: The Portfolio invests in the securities of other investment companies. To the extent that the Portfolio invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Portfolio’s return to be lower. |

| ◾ | Issuer-Specific Risk: The value of an individual security or a particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. |

| ◾ | Larger Company Investing Risk: Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. |

| ◾ | Management Risk: An Advisor’s judgments about the attractiveness, value and potential appreciation of a particular asset class or individual security in which an underlying Fund invests may prove to be incorrect. The Portfolio may experience losses regardless of the overall performance of the market. |

| ◾ | Mid-Sized Company Investing Risk: Investing in mid-sized companies often involves greater risk than investing in larger companies. Mid-sized companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of mid-sized companies, therefore, tend to be more volatile than the securities of larger, more established companies. Mid-sized company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if an underlying Fund wants to sell a large quantity of a mid-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period. |

| ◾ | Municipal Securities Risk: The power or ability of an issuer to make principal and interest payments on municipal securities may be materially adversely affected by economic conditions, litigation or other factors. An underlying Fund’s right to receive principal and interest payments may be subject to the provisions of bankruptcy, insolvency, and other laws affecting the rights and remedies of creditors, as well as laws, if any, which may be enacted by Congress or state legislatures extending the time for payment of principal |

| 5 | Page |

| and/or interest or imposing other constraints upon the enforcement of such obligations. In addition, substantial changes in federal income tax laws could cause municipal security prices to decline because the demand for municipal securities is strongly influenced by the value of tax exempt income to investors. |

| ◾ | Non-Diversification Risk: Because the underlying Funds may invest in a smaller number of securities, adverse changes to a single security might have a more pronounced negative effect on a Fund than if the Portfolio’s investments were more widely distributed. |

| ◾ | Real Estate Investment Trust Risk: To the extent underlying Funds invest in real estate investment trusts, the Portfolio is subject to risks experienced in real estate ownership, real estate financing, or both. As the economy is subjected to a period of economic deflation or interest rate increases, the demand for real estate may fall, causing a decline in the value of real estate owned. Also, as interest rates increase, the values of existing mortgages fall. The higher the duration (a calculation reflecting time risk, taking into account the average maturity of the mortgages) of the mortgages held in REITs owned by underlying Funds, the more sensitive the Portfolio is to interest rate risks. The underlying Funds are also subject to credit risk; the Portfolio could lose money if mortgagors default on mortgages held in the REITs. |

| ◾ | Sector Risk: If certain industry sectors or types of securities don’t perform as well as the managers of the underlying Funds expect, the Portfolio’s performance could suffer. |

| ◾ | Small Cap Company Risk: Smaller capitalization companies may experience higher failure rates than do larger capitalization companies. In addition, smaller companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Such companies may have limited product lines, markets or financial resources and may lack management depth. The trading volume of securities of smaller capitalization companies is normally less than that of larger capitalization companies, and therefore may disproportionately affect their market price, tending to make them fall more in response to selling pressure than is the case with larger capitalization companies. Some small capitalization stocks may be illiquid. These risks may be enhanced for micro-cap securities. Many micro-cap companies tend to be new and have no proven track record. Some of these companies have no assets or operations, while others have products and services that are still in development or have yet to be tested in the market. Because micro-cap stocks trade in low volumes, any size of trade can have a large percentage impact on the price of the stock. |

| ◾ | Sovereign Debt Risk: The underlying Funds may invest in sovereign debt obligations. Investment in sovereign debt obligations involves special risks not present in corporate debt obligations. The issuer of the sovereign debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay principal or interest when due, and the Portfolio may have limited recourse in the event of a default. During periods of economic uncertainty, the market prices of sovereign debt, and the underlying Funds’ net asset values, may be more volatile than prices of U.S. debt obligations. |

| ◾ | Stock Market Risk: The Portfolio is predominately an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time. |

| ◾ | Treasury-Inflation Protected Securities Risk: Because the real rate of return offered by TIPS, which represents the growth of purchasing power, is guaranteed by the Federal Government, TIPS may offer a lower return than other fixed income instruments that do not have such guarantees. Other conventional bond issues may offer higher yields. |

| ◾ | Value Investing Risk: Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock may never appreciate to the extent expected. |

| ◾ | Precious Metals Risk: The Fund’s gold and silver may be subject to loss, damage, theft, or restriction on access, and the Fund’s recovery may be limited, even in the event of fraud, to the market value of the metals at the time the fraud is discovered. International crises may motivate large-scale sales of precious metals which could decrease their prices and adversely affect the value of the Shares. The price of metals may also be adversely affected by the sale of gold or silver by ETFs or other exchange traded vehicles tracking the precious metals markets. In the event of the insolvency of the Custodian, a liquidator may seek to freeze access to the metals held in all of the accounts held by the Custodian, including the Fund’s Allocated Account. Although the Fund would retain legal title to the allocated gold and silver bars, the Fund could incur expenses in connection with obtaining control of the allocated gold or silver, and the assertion of a claim by such liquidator for unpaid fees could delay redemptions. |

Who Should Buy This Portfolio

The Strategic Growth Portfolio is most appropriate for investors who understand the risks of investing in moderately- to aggressively-oriented equity and bond funds and who wish to allocate their investments among multiple funds with a single investment.

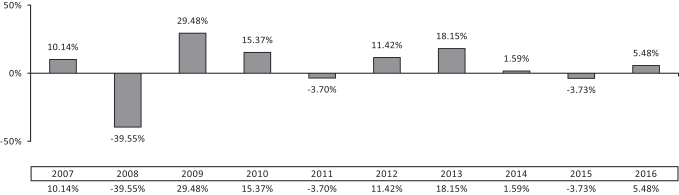

PAST PERFORMANCE

Although past performance of the Portfolio is no guarantee of how it will perform in the future, historical performance may give you some indication of the risk of investing in the Portfolio because it demonstrates how the Portfolio’s returns have varied over time. The bar chart shows changes in the Portfolio’s returns for the last ten years. The performance table shows how the Portfolio’s average annual total returns compare over time to the returns of a broad-based securities market index. The performance information in this prospectus does not reflect charges associated with the Separate Accounts, variable contracts, or Qualified Plans that an investor in the Portfolio may pay.

| Page | 6 |

Year-by-year Annual Total Returns for Portfolio Shares

(for calendar years ending on December 31)

The Portfolio’s total return for the most recent quarter ended March 31, 2017 was 2.58%.

| Best Quarter |

Worst Quarter | |

|

Jun-09 |

Dec-08 | |

|

16.67% |

-24.48% | |

Average Annual Total Returns

(for periods ending on December 31, 2016)

| Strategic Growth Portfolio | ||||||

| 1 Year | 5 Year | 10 Year | ||||

| Return before taxes | 5.48% | 6.31% | 2.66% | |||

| Return after taxes on distributions | 3.26% | 5.14% | 1.09% | |||

| Return after taxes on distributions and sale of shares | 4.77% | 4.70% | 1.44% | |||

| DJ Global Moderately Aggressive Portfolio Index (1) (reflects no deduction for fees, expenses or taxes) |

9.31% | 9.34% | 5.37% | |||

| (1) | The DJ Global Moderately Aggressive Portfolio Index is a widely recognized measure of portfolios with similar levels of risk. The Index assumes reinvestment of all dividends and distributions and does not reflect any asset-based charges for investment management or other expenses. |

| 7 | Page |

PORTFOLIO SUMMARY

TIMOTHY PLAN VARIABLE SERIES

INVESTMENT OBJECTIVE

The investment objective of the Portfolio is to generate moderate levels of long-term capital growth.

FEES AND EXPENSES

Investors using a Portfolio to fund a Separate Account will pay certain fees and expenses in connection with the Portfolio, which are estimated in the table below. Each Portfolio pays annual operating expenses from its assets, so their effect is included in the Portfolio’s share price. These figures do not reflect any fees or charges imposed by any Insurance Company or Qualified Plan. Separate Account Owners and Plan Participants should refer to the Insurance Company’s prospectus or plan document, as applicable, for information on those fees or charges.

Annual Portfolio Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Management Fee (2) |

0.10% | |||||||

|

Distribution/Service(12b-1 Fees) |

0.00% | |||||||

| Other Expenses (including administrative fees, transfer agency fees, and all other ordinary operating expenses not listed above) |

0.33% | |||||||

| Acquired Funds’ Fees and Expenses (3) |

1.30% | |||||||

| Total Annual Portfolio Operating Expenses (1) |

1.73% | |||||||

| (1) | The annual operating expenses of the Portfolio as shown in the table above are as of the Portfolio’s fiscal year ended December 31, 2016. |

| (2) | Management Fees are 0.10% of the average daily net assets of the Portfolio which is paid to the Portfolio’s Advisor, Timothy Partners, Ltd. |

| (3) | Fees and expenses of Acquired Funds represent the pro rata expense indirectly incurred by the Portfolio as a result of investing in the Timothy Plan Traditional Funds that have their own expenses. The fees and expenses are not used to calculate the Portfolio’s net asset value and do not correlate to the ratio of Expenses to Average Net Assets found in the Financial Highlights sections of this prospectus. |

Example:

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated, reinvest dividends and distributions, and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same. The example does not reflect any insurance product fees or any additional expenses that participants in a qualified plan may bear relating to the operations of their plan. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Time Period | Amount | |

| 1 Year |

$176 | |

| 3 Years |

$545 | |

| 5 Years |

$939 | |

| 10 Years |

$2,041 |

PORTFOLIO TURNOVER

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the Portfolio’s most recent fiscal year, the Portfolio’s portfolio turnover rate was 21% of the average value of its portfolio.

| Page | 8 |

PRINCIPAL INVESTMENT STRATEGIES

The Conservative Growth Portfolio normally will invest at least 75% of its total assets in the following Timothy Funds according to the following approximate range of percentages:

| Timothy Plan Traditional Fund | % of Fund’s Net Assets Invested in Traditional Fund | |

| Small Cap Value Fund |

2 - 10% | |

| Large/Mid Cap Value Fund |

5 - 15% | |

| Large/Mid Cap Growth Fund |

5 - 15% | |

| Aggressive Growth Fund |

2 - 5% | |

| High Yield Bond Fund |

5 - 15% | |

| Fixed Income Fund |

20 - 40% | |

| International Fund |

0 - 15% | |

| Israel Common Values Fund |

0 - 10% | |

| Emerging Markets Fund |

0 - 10% | |

| Defensive Strategies Fund |

10 - 30% | |

| Growth & Income Fund |

5 - 20% |

Timothy Partners, Ltd. (“TPL”) will determine the specific asset allocation program on a continuous basis, based on its forecast of the overall market. On each day that the Fund is open for business, TPL will review the asset allocation program and reallocate, as necessary, for any new funds invested in the Fund. The Advisor also will reallocate the Fund’s investments in the Traditional Funds at the end of each fiscal quarter to maintain the asset allocation program.

PRINCIPAL RISKS

| 1. | General Risk | As with most other mutual funds, you can lose money by investing in the Conservative Growth Portfolio. Share prices fluctuate from day to day, and when you sell your shares, they may be worth less than you paid for them. |

| 2. | Portfolio Risk | The Portfolio is indirectly subject to the following risks that are inherent in the Traditional Funds in which the Portfolio invests: |

| ◾ | Commodities-based Exchange Traded Funds Risk: Commodity ETFs invest in Physical Commodities and/or Commodity Futures Contracts which Contracts are highly leveraged investment vehicles, and therefore generally considered to be high risk. By investing in underlying funds holding Commodity ETFs, the Portfolio assumes portions of that risk. ETFs may only purchase commodities futures contracts (the buy side), therefore the risks include missing opportunities to realize gains by shorting futures contracts (the sell side) in deflationary economic periods. It is possible an underlying Fund’s entire ETF investment could be lost. Also, ETF’s have expenses associated with them, and although indirect, these expenses may cause the Portfolio’s return to be lower. |

| ◾ | Country-Specific Risk: One underlying fund invests in Israeli securities, and Israel is subject to unique political and economic risks. As a result, Israeli securities can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The investments in the securities of Israel may experience more rapid and extreme changes in value than funds with investments solely in securities of U.S. companies or funds that invest across a larger spectrum of the foreign market. This is because the securities market in Israel is relatively small, with a limited number of companies representing a smaller number of industries. Israeli issuers are not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect the Portfolio’s investments in a foreign country. |

| ◾ | Credit Risk: If investment grade bonds are downgraded in credit rating or go into default, the result could be a loss of value, and the Portfolio could lose money. The degree of risk for a particular security may or may not be reflected in its credit rating. Bonds that are unrated, or rated BBB by Standard & Poor’s at the time of purchase, are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities. High yield securities (“junk” bonds) are subject to greater risk of loss than investment grade securities. Unrated bonds or bonds rated BB or lower by Standard & Poor’s at the time of purchase (“junk” bonds) are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities. |

| ◾ | Currency Risk: Securities represented by ADRs are foreign stocks denominated in non-U.S. currency, and there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the investments in foreign securities. For securities that are foreign stocks denominated in non-U.S. currency, there is a risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of the investments in foreign securities. |

| ◾ | Emerging Market Risk: Investments in the securities of emerging countries may experience more rapid and extreme changes in value than investments solely in securities of U.S. companies and investments in a larger spectrum of the foreign market. This is because the securities markets in some emerging countries are relatively small, with a limited number of companies representing a smaller number of industries. Issuers in emerging countries are frequently not subject to the same degree of regulation as U.S. issuers. Also, nationalization, expropriation or confiscatory taxation or political changes could adversely affect investments in emerging foreign countries. |

| ◾ | Equity Market Risk: Overall, stock market risks may affect the value of the Portfolio. Factors such as domestic economic growth and market conditions, interest rate levels, and political events affect the securities markets. When the value of the Portfolio’s investments goes down, your investment in the Portfolio decreases in value and you could lose money. |

| 9 | Page |

| ◾ | Exchange Traded Fund Risk: An ETF may trade at a discount to its net asset value. Investors indirectly bear fees and expenses charged by the underlying ETFs in addition to the Portfolio’s direct fees and expenses. There are also brokerage costs incurred when purchasing ETFs. In addition, losses of the underlying ETF and the level of risk arising from the investment practices of an underlying ETF may impact returns. |

| ◾ | Excluded Security Risk: Because the underlying Funds do not invest in Excluded Securities (including certain REITs) , and will divest themselves of securities that are subsequently discovered to be ineligible, the Portfolio may be riskier than similar funds that invest in underlying funds that invest in broader arrays of securities. |

| ◾ | Fixed Income Risk: Fixed income securities will increase or decrease in value based on changes in interest rates. If rates increase, fixed income securities generally will decline, and those securities with longer terms generally will decline more. Your investment will decline in value if the value of fixed income securities decrease. There is a risk that issuers and counterparties will not make payments on fixed income securities and repurchase agreements. Such defaults could result in losses to the Portfolio. |

| ◾ | Foreign Investment Risk: Foreign investing involves risks not typically associated with U.S. investments and may experience more rapid and extreme changes in value than investments solely in securities of U.S. companies. These risks include, among others, adverse fluctuations in foreign currency values as well as adverse political, social and economic developments affecting a foreign country. In addition, foreign investing involves less publicly available information, and more volatile or less liquid securities markets. Investments in foreign countries could be affected by factors not present in the U.S., such as restrictions on receiving the investment proceeds from a foreign country, foreign tax laws, and potential difficulties in enforcing contractual obligations. Foreign accounting may be less transparent than U.S. accounting practices and foreign regulation may be inadequate or irregular. Underlying Funds owning foreign securities could cause the Portfolio’s performance to fluctuate more than if it held only U.S. securities. |

| ◾ | Growth Risk: Some underlying Funds invest in companies after assessing their growth potential. Securities of growth companies may be more volatile than other stocks. If a portfolio manager’s perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the Portfolio’s return. In addition, because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities. |

| ◾ | High Portfolio Turnover Risk: Higher portfolio turnover rates may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Portfolio operating expenses or in the Example, affect the Portfolio’s performance. |

| ◾ | High Yield Security Risk: Investments in fixed-income securities that are rated below investment grade (“high yield securities”) by one or more Nationally Recognized Statistical Rating Organizations (NRSROs) may be subject to greater risk of loss of principal and interest than investments in higher-rated fixed-income securities. High yield securities are also generally considered to be subject to greater market risk than higher-rated securities. The capacity of issuers of high yield securities to pay interest and repay principal is more likely to weaken than is that of issuers of higher-rated securities in times of deteriorating economic conditions or rising interest rates. In addition, high yield securities may be more susceptible to real or perceived adverse economic conditions than higher-rated securities. The market for high yield securities may be less liquid than the market for higher-rated securities. This can adversely affect an underlying Fund’s ability to buy or sell optimal quantities of high yield securities at desired prices. |

| ◾ | Interest Rate Risk: When interest rates rise, bond prices fall; the higher an underlying Fund’s duration (a calculation reflecting time risk, taking into account both the average maturity of the Fund’s portfolio and its average coupon return), the more sensitive the underlying Fund is to interest rate risk. |

| ◾ | Investing In Other Funds Risk: The Portfolio invests in the securities of other investment companies. To the extent that the Portfolio invests in other mutual funds, exchange traded funds and other commingled funds, it will indirectly bear the expenses of those funds, which will cause the Portfolio’s return to be lower. |

| ◾ | Issuer-Specific Risk: The value of an individual security or a particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. |

| ◾ | Larger Company Investing Risk: Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. Also, larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. |

| ◾ | Management Risk: An Advisor’s judgments about the attractiveness, value and potential appreciation of a particular asset class or individual security in which an underlying Fund invests may prove to be incorrect. The Portfolio may experience losses regardless of the overall performance of the market. |

| ◾ | Mid-Sized Company Investing Risk: Investing in mid-sized companies often involves greater risk than investing in larger companies. Mid-sized companies may not have the management experience, financial resources, product diversification and competitive strengths of larger companies. The securities of mid-sized companies, therefore, tend to be more volatile than the securities of larger, more established companies. Mid-sized company stocks tend to be bought and sold less often and in smaller amounts than larger company stocks. Because of this, if an underlying Fund wants to sell a large quantity of a mid-sized company’s stock, it may have to sell at a lower price than would otherwise be indicated, or it may have to sell in smaller than desired quantities over an increased time period. |

| ◾ | Municipal Securities Risk: The power or ability of an issuer to make principal and interest payments on municipal securities may be materially adversely affected by economic conditions, litigation or other factors. An underlying Fund’s right to receive principal and interest payments may be subject to the provisions of bankruptcy, insolvency, and other laws affecting the rights and remedies of creditors, as well as laws, if any, which may be enacted by Congress or state legislatures extending the time for payment of principal |

| Page | 10 |

| and/or interest or imposing other constraints upon the enforcement of such obligations. In addition, substantial changes in federal income tax laws could cause municipal security prices to decline because the demand for municipal securities is strongly influenced by the value of tax exempt income to investors. |

| ◾ | Non-Diversification Risk: Because the underlying Funds may invest in a smaller number of securities, adverse changes to a single security might have a more pronounced negative effect on a Fund than if the Portfolio’s investments were more widely distributed. |

| ◾ | Real Estate Investment Trust Risk: To the extent underlying Funds invest in real estate investment trusts, the Portfolio is subject to risks experienced in real estate ownership, real estate financing, or both. As the economy is subjected to a period of economic deflation or interest rate increases, the demand for real estate may fall, causing a decline in the value of real estate owned. Also, as interest rates increase, the values of existing mortgages fall. The higher the duration (a calculation reflecting time risk, taking into account the average maturity of the mortgages) of the mortgages held in REITs owned by underlying Funds, the more sensitive the Portfolio is to interest rate risks. The underlying Funds are also subject to credit risk; the Portfolio could lose money if mortgagors default on mortgages held in the REITs. |

| ◾ | Sector Risk: If certain industry sectors or types of securities don’t perform as well as the managers of the underlying Funds expect, the Portfolio’s performance could suffer. |

| ◾ | Small Cap Company Risk: Smaller capitalization companies may experience higher failure rates than do larger capitalization companies. In addition, smaller companies may be more vulnerable to economic, market and industry changes. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the short term. Such companies may have limited product lines, markets or financial resources and may lack management depth. The trading volume of securities of smaller capitalization companies is normally less than that of larger capitalization companies, and therefore may disproportionately affect their market price, tending to make them fall more in response to selling pressure than is the case with larger capitalization companies. Some small capitalization stocks may be illiquid. These risks may be enhanced for micro-cap securities. Many micro-cap companies tend to be new and have no proven track record. Some of these companies have no assets or operations, while others have products and services that are still in development or have yet to be tested in the market. Because micro-cap stocks trade in low volumes, any size of trade can have a large percentage impact on the price of the stock. |

| ◾ | Sovereign Debt Risk: The underlying Funds may invest in sovereign debt obligations. Investment in sovereign debt obligations involves special risks not present in corporate debt obligations. The issuer of the sovereign debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay principal or interest when due, and the Portfolio may have limited recourse in the event of a default. During periods of economic uncertainty, the market prices of sovereign debt, and the underlying Funds’ net asset values, may be more volatile than prices of U.S. debt obligations. |

| ◾ | Stock Market Risk: The Portfolio is predominately an equity fund, so it is subject to the risks inherent in the stock market in general. The stock market is cyclical, with prices generally rising and falling over periods of time. Some of these price cycles can be pronounced and last for a long time. |

| ◾ | Treasury-Inflation Protected Securities Risk: Because the real rate of return offered by TIPS, which represents the growth of purchasing power, is guaranteed by the Federal Government, TIPS may offer a lower return than other fixed income instruments that do not have such guarantees. Other conventional bond issues may offer higher yields. |

| ◾ | Value Investing Risk: Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, “value” stocks may perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. It is also possible that a value stock may never appreciate to the extent expected. |

| ◾ | Precious Metals Risk: The Fund’s gold and silver may be subject to loss, damage, theft, or restriction on access, and the Fund’s recovery may be limited, even in the event of fraud, to the market value of the metals at the time the fraud is discovered. International crises may motivate large-scale sales of precious metals which could decrease their prices and adversely affect the value of the Shares. The price of metals may also be adversely affected by the sale of gold or silver by ETFs or other exchange traded vehicles tracking the precious metals markets. In the event of the insolvency of the Custodian, a liquidator may seek to freeze access to the metals held in all of the accounts held by the Custodian, including the Fund’s Allocated Account. Although the Fund would retain legal title to the allocated gold and silver bars, the Fund could incur expenses in connection with obtaining control of the allocated gold or silver, and the assertion of a claim by such liquidator for unpaid fees could delay redemptions |

Who Should Buy This Portfolio

The Conservative Growth Portfolio is most appropriate for investors who understand the risks of investing in moderately risk-oriented equity and bond funds, but who also wish to realize current income and allocate their investments among multiple funds with a single investment.

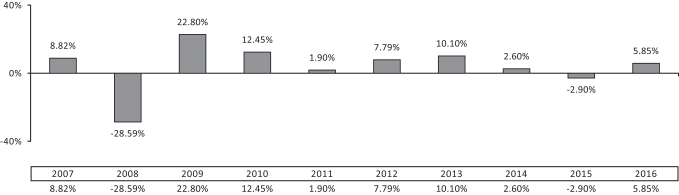

PAST PERFORMANCE

Although past performance of the Portfolio is no guarantee of how it will perform in the future, historical performance may give you some indication of the risk of investing in the Portfolio because it demonstrates how the Portfolio’s returns have varied over time. The bar chart shows changes in the Portfolio’s returns for the last ten years. The performance table shows how the Portfolio’s average annual total returns compare over time to the returns of a broad-based securities market index. The performance information in this prospectus does not reflect charges associated with the Separate Accounts, variable contracts, or Qualified Plans that an investor in the Portfolio may pay.

| 11 | Page |

Year-by-year Annual Total Returns for Portfolio Shares

(for calendar years ending on December 31)

The Portfolio’s total return for the most recent quarter ended March 31, 2017 was 2.39%.

| Best Quarter |

Worst Quarter | |

|

Jun-09 |

Dec-08 | |

|

12.68% |

-16.93% | |

Average Annual Total Returns

(for periods ending on December 31, 2016)

| Conservative Growth Portfolio | ||||||||

| 1 Year | 5 Year | 10 Year | Life of Fund | |||||

| Return before taxes | 5.85% | 4.59% | 3.19% | 3.95% | ||||

| Return after taxes on distributions | 3.80% | 3.02% | 1.40% | 2.60% | ||||

| Return after taxes on distributions and sale of shares | 4.73% | 3.27% | 1.77% | 2.62% | ||||

| Dow Jones Global Moderate Portfolio Index (1) (reflects no deduction for fees, expenses or taxes) |

7.67% | 7.37% | 5.08% | 6.75% | ||||

| (1) | The DJ Global Moderate Portfolio Index is a widely recognized, measure of portfolios with similar levels of risk. The Index is rebalanced monthly to the appropriate percentage of risk experienced by the all stock Portfolio Index over the previous thirty-six months. |

| Page | 12 |

Section 2 | Who Manages Your Money

To help you understand how the Portfolios’ assets are managed, this section includes a detailed discussion of the Portfolios’ Investment Advisor and the Portfolio Manager. For a more complete discussion of these matters, please consult the Statement of Additional Information, which is available by calling (800) 846-7526 or by visiting Timothy Plan’s website at www.timothyplan.com.

TIMOTHY PARTNERS, LTD.

Timothy Partners, Ltd. (“TPL”), 1055 Maitland Center Commons Boulevard,, Maitland, FL 32751, is a Florida limited partnership organized on December 6, 1993, and is registered with the Securities and Exchange Commission as an investment advisor. TPL supervises the investment of the assets of each Portfolio in accordance with the objectives, policies and restrictions of the Trust. To determine which securities are Excluded Securities, TPL conducts its own research through an affiliated research entity, and consults a number of Christian ministries on these issues. TPL retains the right to change the sources from whom it acquires its information, at its discretion. TPL has been the advisor to the Portfolios since their inceptions.

For its services as investment advisor to the Portfolios, TPL is paid an annual fee equal to 0.10% of the average daily net assets of each Portfolio.

COVENANT FUNDS, INC.

Covenant Funds, Inc., a Florida corporation (“CFI”), is the managing general partner of TPL. Arthur D. Ally is President, Chairman and Trustee of the Trust, as well as President and 75% shareholder of CFI. Mr. Ally had over eighteen years of experience in the investment industry prior to founding TPL, having worked for Prudential Bache, Shearson Lehman Brothers and Investment Management & Research.

PORTFOLIO MANAGER

Arthur D. Ally is primarily responsible for the day-to-day management of the Portfolios. Mr. Ally founded and has provided his services to the Timothy Plan continuously since 1994, drawing from over thirty five years’ experience in the investment industry. Mr. Ally is not compensated for his activities as the portfolio manager for the Portfolios, nor does he provide daily investment management services for any other accounts of any type. Neither he nor any employee of the Advisor or the underwriter may purchase securities held in any of the Timothy Plan Funds.

A discussion of the considerations employed by the Board of Trustees in 2016 of their approval of TPL as Advisor to the Trust, and each Sub-Advisor as manager of the Funds is available in the Funds’ semi-annual report dated June 30, 2016.

The SAI also contains additional information about the compensation paid to the portfolio manager, other accounts and account types managed by the Advisor, and other relevant information.

A MORE COMPREHENSIVE DISCUSSION OF THE ADVISOR’S ACTIVITIES, COMPENSATION, AND OTHER ACCOUNTS AND ACCOUNT TYPES MANAGED BY THE ADVISOR MAY BE FOUND IN THE STATEMENT OF ADDITIONAL INFORMATION (“SAI”) DATED APRIL 30, 2017. THE SAI IS AVAILABLE UPON REQUEST AT NO CHARGE BY CALLING THE TRUST AT (800) 846-7526.

| 13 | Page |

Section 3 | How You Can Buy and Sell Shares

Purchases and redemptions of shares in either of the Portfolios may be made only by an insurance company for its separate accounts at the direction of Variable Contract owners or by a Qualified Plan on behalf of its participants. Please refer to the Prospectus of your Separate Account or Plan Document, as applicable, for information on how to direct investments in, or redemptions from, the Portfolios and any fees that may apply. Generally, the Insurance Company or Qualified Plan places orders for shares based on payments and withdrawal requests received from Separate Account owners or Plan Participants during the day and places an order to purchase or redeem the net number of shares by the following morning. Orders are usually executed at the net asset value per share determined at the end of the business day during which a payment or withdrawal request is received by the Insurance Company or Qualified Plan. There are no sales or redemption charges. However, certain sales or deferred sales charges and other charges may apply to your Separate Account or Plan Account. Those charges are disclosed in the Separate Account offering prospectus or plan document. The Trust reserves the right to suspend the offering of any of the Portfolios’ shares, or to reject any purchase order.

Purchase orders for shares of a Portfolio, which are received by the Portfolios’ transfer agent in proper form prior to the close of trading hours on the New York Stock Exchange (NYSE) (currently 4:00 p.m. Eastern time) on any day that the Portfolios calculate their net asset value, are priced according to the net asset value determined on that day. Purchase orders for shares of a Portfolio received after the close of the NYSE on a particular day are priced as of the time the net asset value per share is next determined.

OTHER PURCHASE INFORMATION

For economy and convenience, share certificates will not be issued.

The public offering price for a Portfolio is based upon its net asset value per share. Net asset value per share of a Portfolio is calculated by adding the value of the Portfolio’s investments, cash and other assets, subtracting the Portfolio’s liabilities, and then dividing the result by the number of shares outstanding. The assets of each Portfolio are valued at market value or, if market quotes cannot be readily obtained, fair value is used as determined by the Board of Trustees. The net asset value of each Portfolio’s shares is computed on each day on which the New York Stock Exchange is open for business at the close of regular trading hours on the Exchange, currently 4:00 p.m. Eastern time.

Each Portfolio purchases Class A Shares of the Timothy Funds at net asset value without any sales charges. With respect to securities owned by the Timothy Funds, securities listed or traded on a securities exchange for which representative market quotations are available will be valued at the last quoted sales price on the security’s principal exchange on that day. Listed securities not traded on an exchange that day, and other securities which are traded in the over-the-counter markets, will be valued at the last reported bid price in the market on that day, if any. Securities for which market quotations are not readily available and all other assets will be valued at their respective fair market values as determined by the Advisor in conformity with guidelines adopted by and subject to the review of the Board of Trustees. Money market securities with less than 60 days remaining to maturity when acquired by a Timothy Fund or a Portfolio will be valued on an amortized cost basis, excluding unrealized gains or losses thereon from the valuation. This is accomplished by valuing the security at cost and then assuming a constant amortization to maturity of any premium or discount. If a Timothy Fund or a Portfolio acquires a money market security with more than 60 days remaining to its maturity, it will be valued at amortized cost when it reaches 60 days to maturity unless the Trustees determine that such a valuation will not fairly represent its fair market value.

Redemption proceeds normally will be wired to the Insurance Company or Qualified Plan on the next business day after receipt of the redemption instructions, but in no event later than 7 days following receipt of instructions. The Portfolios may suspend redemptions or postpone payments when the NYSE is closed or when trading is restricted for any reason (other than weekends or holidays) or under emergency circumstances as determined by the U.S. Securities and Exchange Commission (the “SEC”).

The Trust has adopted policies and procedures designed to prevent and protect frequent purchases and redemptions of Portfolio shares (“market timing”). Those policies apply to all the Timothy Funds in which each Portfolio invests. However, since purchases and redemptions of shares in the Portfolios may be made only by an insurance company or by a qualified plan on behalf of its participants, the Board of Trustees has exempted the Portfolios from those policies and procedures.

If the Board of Trustees determines that it would be detrimental to the best interests of the remaining shareholders of a Portfolio to make payments in cash, a Portfolio may pay the redemption price, in whole or in part, by distribution in-kind of readily marketable securities, from that Portfolio, within certain limits prescribed by the U.S. Securities and Exchange Commission. Such securities will be valued on the basis of the procedures used to determine the net asset value at the time of the redemption. If shares are redeemed in-kind, the redeeming shareholder will incur brokerage costs in converting the assets to cash.

| Page | 14 |

Section 4 | General Information

Temporary Defensive Strategies

Each Portfolio may, for temporary defensive purposes, invest up to 100% of its assets in obligations of the U.S. government, its agencies and instrumentalities, commercial paper, and certificates of deposit and banker’s acceptances. When a Portfolio takes a temporary defensive position, it will not be investing according to its investment objective, and at such times, the performance of the Portfolio will be different than if it had invested strictly according to its objectives. A discussion of the Trust’s policies for disclosing a Portfolio’s securities holdings may be found in the Statement of Additional Information (“SAI”), relating to the Portfolios dated April 30, 2017.

The Portfolios may be offered to Separate Accounts of both variable annuity and variable life insurance contracts sponsored by Insurance Companies and to Qualified Plans. Due to differences in tax treatment and other considerations, the interests of various contract owners participating in a Portfolio and the interests of Qualified Plans investing in such Portfolio may conflict. The Trust’s Board of Trustees will monitor events in order to identify the existence of any material irreconcilable conflicts and to determine what action, if any, should be taken in response to any conflict.

Dividends, Distributions and Taxes

Dividends paid by a Portfolio are derived from its net investment income. Net investment income will be distributed at least annually. A Portfolio’s net investment income is made up of dividends received from the stocks it holds, as well as interest accrued and paid on any other obligations that might be held in its portfolio.

A Portfolio realizes capital gains when it receives such a distribution from a Timothy Fund or sells shares of a Timothy Fund for more than it paid for it. A Portfolio may make distributions of its net realized capital gains (after any reductions for capital loss carry forwards), generally once a year.

Under current tax law, dividends or capital gains distributions from a Portfolio are not currently taxable when left to accumulate within a Variable Contract. Depending on the Separate Account, withdrawals from the Account may be subject to ordinary income tax, and an additional penalty of 10% on withdrawals before age 59 1/2.

The Board of Trustees has delegated to the Advisor and/or Investment Managers, under the oversight of the Board of Trustees Pricing Committee, responsibility for determining the value of Fund portfolio securities under certain circumstances. Under such circumstances and under the Pricing Committee’s oversight, the Advisor or Investment Manager of the underlying Funds will use its best efforts to arrive at the fair value of a security held by the Funds under all reasonably ascertainable facts and circumstances. The Advisor must prepare a report for the Board not less than quarterly containing a complete listing of any securities for which fair value pricing was employed and detailing the specific reasons for such fair value pricing. The Trust has adopted written policies and procedures to guide the Pricing Committee, Advisor and Investment Managers with respect to the circumstances under which, and the methods to be used, in fair valuing securities.

Except for the International Fund, Israel Common Values and Emerging Markets Funds, which have a higher probability of Fair Value Pricing, the Funds generally invest the vast majority of their assets in frequently traded exchange listed securities of domestic issuers with relatively liquid markets and calculate their NAV as of the time those exchanges close. Except for the International Fund, Israel Common Values and Emerging Markets Funds, the Funds typically do not invest in securities on foreign exchanges or in illiquid or restricted securities. Accordingly, except for those Funds, there may be very limited circumstances under which any Fund would hold securities that would need to be fair value priced. Examples of when it would be likely that a Fund security would require fair value pricing include but are not limited to: if the exchange on which a portfolio security traded were to close early; if trading in a particular security were to be halted on an exchange and did not resume trading prior to calculation of NAV; if a significant event that materially affected the value of a security were to occur after the securities’ exchange had closed but before the Funds’ and Portfolios’ NAVs had been calculated; and if a security that had a significant exposure to foreign operations was subject to a material event or occurrence in a foreign jurisdiction in which the company had significant operations; or in the event that the Fixed Income or High Yield Bond Funds were to invest in certain types of bonds that had limited marketability, such as “church bonds”.

When a security is fair value priced, it means that the Advisor or Investment Manager is calculating the value of that security on a day and under circumstances where reliable pricing information from normal sources is not available or is otherwise limited. Accordingly, there is always the possibility that the Advisor’s or Investment Manager’s calculations concerning security value could be wrong, and as a result, the Portfolios’ NAVs on that day could be higher or lower, depending on how the security was valued, than would otherwise be the case.

When a security is Evaluated Priced, it means the Advisor and Investment Manager are relying on a nationally recognized company that provides daily pricing of international and domestic securities. Accordingly, there is the possibility that the pricing firm’s calculations or pricing techniques could be wrong, and as a result the Portfolios’ NAVs on that day could be higher or lower, depending on how the security was valued, than would otherwise be the case.

| 15 | Page |

Principal Underwriter

Timothy Partners, Ltd. also acts as principal underwriter for the Trust. As underwriter, TPL facilitates the registration of each Portfolio’s shares under state securities laws and offers its shares for sale. TPL does not receive any compensation for serving as underwriter of the Trust.

The Board of Trustees of the Trust has approved Codes of Ethics for the Funds, the Portfolios, Investment Advisor, Sub-Advisors, and Principal Underwriter. These Codes govern the personal activities of persons who may have knowledge of the investment activities of the Funds and/or Portfolios, require that they file regular reports concerning their personal securities transactions, and prohibit activities that might result in harm to the Funds and/or Portfolios. The Board is responsible for overseeing the implementation of the Codes. The Trust has filed copies of each Code with the Securities and Exchange Commission. Copies of the Codes of Ethics may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. The Codes are also available on the SEC’s EDGAR database at the SEC’s web site (www.sec.gov). Copies of this information can be obtained after paying a duplication fee, by electronic request (publicinvest@sec.gov) or by writing the SEC’s Public Relations Section, Washington DC 20549-0102. The Board of Trustees also has approved anti-money laundering procedures which it believes are reasonably designed to detect and prevent attempts to utilize the Portfolios for illegal purposes. Day to day responsibility for the monitoring of such activities has been delegated to the Transfer Agent, subject to Board oversight and periodic independent audit.

The following is a description of the Portfolios’ policies regarding disclosure of nonpublic personal information that you provide to the Portfolios or that the Portfolios collect from other sources. Your shares of a Portfolio are held through an insurance company, broker-dealer, or other financial intermediary, and the privacy policy of the pertinent institution would govern how your nonpublic personal information would be shared with nonaffiliated third parties.

CATEGORIES OF INFORMATION THE PORTFOLIOS COLLECT

The Portfolios collect the following nonpublic personal information about you:

| 1. | Information the Portfolios receive from you on or in applications or other forms, correspondence, or conversations (such as your name, address, phone number, social security number, assets, income and date of birth); and |

| 2. | Information about your transactions with the Portfolios, their affiliates, or others (such as your account number and balance, payment history, parties to transactions, cost basis information, and other financial information). |

CATEGORIES OF INFORMATION THE PORTFOLIOS DISCLOSE

The Portfolios do not disclose any nonpublic personal information about their current or former shareholders to unaffiliated third parties, except as required or permitted by law. The Portfolios are permitted by law to disclose all of the information they collect, as described above, to their service providers (such as the Portfolios’ custodian, administrator and transfer agent) to process your transactions and otherwise provide services to you.

CONFIDENTIALITY AND SECURITY

The Portfolios restrict access to your nonpublic personal information to those persons who require such information to provide products or services to you. The Portfolios maintain physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Customer Identification Program

The Board of Trustees of the Trust has approved procedures designed to prevent and detect attempts to launder money as required under the USA PATRIOT Act. The day-to-day responsibility for monitoring and reporting any such activities has been delegated to the transfer agent, subject to the oversight and supervision of the Board.

| Page | 16 |

Section 5 | Financial Highlights

The table below sets forth data for one share of capital stock outstanding throughout each year represented.

The Financial Highlights Table is intended to help you understand the Portfolio’s financial performance for the past five years. Certain information reflects financial results for a single Portfolio share. The total returns in the table represent that rate that an investor would have earned (or lost) on an investment in the Portfolio (assuming reinvestment of all dividends and distributions). The information contained in the tables for the years ended December 31, 2012, 2013, 2014, 2015 and 2016 has been audited by Cohen & Company, Ltd., Independent Registered Public Accounting Firm, whose report, along with the Portfolio’s financial statements, are included in the annual report, which is available upon request.

Financial Highlights

Strategic Growth Portfolio Variable Series

Selected data based on a share outstanding throughout each year presented.

| For the Year December 31, |

For the Year December 31, |

For the Year December 31, |

For the Year December 31, |

For the Year December 31, |

||||||||||||||||

| Net asset value, beginning of year |

$ | 10.46 | $ | 11.65 | $ | 11.67 | $ | 9.94 | $ | 9.05 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||||||||||||

| Net investment income (A) |

0.04 | 0.04 | 0.14 | 0.26 | 0.09 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments |

0.53 | (0.48 | ) | 0.05 | 1.54 | 0.94 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

0.57 | (0.44 | ) | 0.19 | 1.80 | 1.03 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LESS DISTRIBUTIONS: |

||||||||||||||||||||

| From net investment income |

(0.04 | ) | (0.16 | ) | (0.21 | ) | (0.07 | ) | (0.14 | ) | ||||||||||

| From net realized gains on investments |

(0.90 | ) | (0.59 | ) | - | - | - | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

(0.94 | ) | (0.75 | ) | (0.21 | ) | (0.07 | ) | (0.14 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of year |

$ | 10.09 | $ | 10.46 | $ | 11.65 | $ | 11.67 | $ | 9.94 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return (B) |

5.48% | (3.73)% | 1.59% | 18.15% | 11.42% | |||||||||||||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||||||||||||||

| Net assets, end of year (in 000's) |

$ | 23,531 | $ | 24,336 | $ | 31,391 | $ | 27,423 | $ | 18,253 | ||||||||||

| Expenses (C) |

0.39% | 0.30% | 0.45% | 0.42% | 0.44% | |||||||||||||||

| Net investment income (C)(D) |

0.34% | 0.32% | 1.14% | 2.43% | 0.82% | |||||||||||||||

| Portfolio turnover rate |

32% | 33% | 15% | 17% | 30% | |||||||||||||||

| (A) | Per share amounts calculated using average shares method, which more appropriately presents the per share data for the year. |

| (B) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (C) | These ratios exclude the impact of expenses of the underlying security holdings as represented in the Schedule of Investments. |

| (D) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

| 17 | Page |

Financial Highlights

The table below sets forth data for one share of capital stock outstanding throughout each year represented.