| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

TIMOTHY PLAN

|

|

| Prospectus Date |

rr_ProspectusDate |

Jan. 30, 2017

|

|

| Timothy Plan Defensive Strategies Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Defensive Strategies Fund

CLASS I: TPDIX

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of this Fund is the protection of principal through aggressive, proactive reactions to prevailing economic conditions.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 58% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

58.00%

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

Total Annual Fund Operating Expenses do not correlate to the ratio of average net assets in the Financial Highlights Table, which reflects the operating expenses of the Fund and does not include Acquired Funds Fees and Expenses.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example:

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Class I shares of the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example, No Redemption Narrative [Text Block] |

rr_ExpenseExampleNoRedemptionNarrativeTextBlock |

Your costs for this share class would be the same whether or not you redeem your shares at the end of any period.

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

To achieve its goal, the Fund will invest varying percentages of the Fund’s total assets in the investment sectors set forth below:- Real Estate Investment Trusts (REITs), that invest in different kinds of real estate or real estate related assets, including shopping centers, office buildings, hotels, and mortgages secured by real estate, all of which are historically sensitive to both inflation and deflation.

- Commodities-based securities, including but not limited to, exchange traded funds (ETFs), other pooled investment fund securities, and commodities-related stocks, for the purpose of providing the opportunity to invest in inflation sensitive physical commodities and/or commodities futures markets . ETFs are investment securities that are registered as investment companies and invest in a basket of other securities, mostly common stocks, that are included in a specific index. Pooled investment fund securities are securities that invest in a basket of other securities, mainly stocks, but are not registered as investment companies and do not trade on an exchange.

- Various Fixed Income securities and Treasury-Inflation Protection Securities (TIPS). TIPS have coupon payments and underlying principal that are automatically increased to compensate for inflation as measured by the consumer price index (CPI). The fixed income securities in which the Fund may invest, other than TIPS, include U.S. Treasury bills, notes and bonds, corporate notes and bonds, and federal agency-issued securities.

- Cash and cash equivalents.

- During times of significant market upheaval, the Fund may take positions that are inconsistent with the Fund’s principal investment strategies. During such times, the Fund may take large, small, or even no position in any one or more of the Asset Classes, may invest in gold and other eligible precious metals to the maximum extent allowed, and/or may hold some or all of the Fund’s assets in cash and/or cash equivalents. When the Fund takes such positions, it will not be investing in accordance with its principal investment strategies and may not achieve its stated investment objective.

- The Fund will not invest in Excluded Securities. Excluded Securities are securities issued by any company that is involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment, gambling enterprises, or which is involved, either directly or indirectly, in abortion or pornography, or promoting anti-family entertainment or alternative lifestyles.

- Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. To allow for optimal flexibility, the Fund is classified as a “non-diversified” fund, and, as such the Fund’s portfolio may include the securities of a smaller total number of issuers than if the Fund were classified as “diversified”.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

General Risk | As with most other mutual funds, you can lose money by investing in this Fund. Share prices fluctuate from day to day, and when you sell your shares, they may be worth less than you paid for them. Real Estate Investment Trust Risk | The Fund is subject to the risks experienced in real estate ownership, real estate financing, or both. As the economy is subjected to a period of economic deflation or interest rate increases, the demand for real estate may fall, causing a decline in the value of real estate owned. Also, as interest rates increase, the values of existing mortgages fall. The higher the duration (a calculation reflecting time risk, taking into account the average maturity of the mortgages) of the mortgages held in REITs owned by the Fund, the more sensitive the Fund is to interest rate risks. The Fund is also subject to credit risk; the Fund could lose money if mortgagors default on mortgages held in the REITs. Commodities-based Exchange Traded Funds | Commodity ETFs invest in Physical Commodities and/or Commodity Futures Contracts which Contracts are highly leveraged investment vehicles, and therefore generally considered to be high risk. By investing in Commodity ETFs the Fund assumes portions of that risk. ETFs may only purchase commodities futures contracts (the buy side), therefore the Fund’s risk includes missing opportunities to realize gains by shorting futures contracts (the sell side) in deflationary economic periods. It is possible the Fund’s entire ETF investment could be lost. Treasury-Inflation Protection Securities Risk | Because the real rate of return offered by TIPS, which represents the growth of your purchasing power, is guaranteed by the Federal Government, TIPS may offer a lower return than other fixed income instruments that do not have such guarantees. Other conventional bond issues may offer higher yields, and the Fund may invest in such bond issues if deemed advantageous by the Advisor and Investment Managers. Interest Rate Risk | When interest rates rise, bond prices fall; the higher the Fund’s duration (a calculation reflecting time risk, taking into account both the average maturity of the Fund’s portfolio and its average coupon return), the more sensitive the Fund is to interest rate risk. Credit Risk | The Fund could lose money if any bonds it owns are downgraded in credit rating or go into default. For this reason, the Fund will only invest in investment-grade bonds. The degree of risk for a particular security may be reflected in its credit rating. Bonds rated at the time of purchase BBB by Standard & Poor’s, or unrated, but determined to be of comparable quality by the investment manager, are subject to greater market risk and credit risk, or loss of principal and interest, than higher-rated securities. Sector Risk | If certain industry sectors or types of securities don’t perform as well as the Fund expects, the Fund’s performance could suffer. Excluded Security Risk | Because the Fund does not invest in Excluded Securities (including certain REITs), and will divest itself of securities that are subsequently discovered to be ineligible, the Fund may be riskier than other Funds that invest in a broader array of securities. Non-Diversification Risk | Because the Fund may invest in a smaller number of securities, adverse changes to a single security will have a more pronounced negative effect on the Fund than if the Fund’s investments were more widely distributed. Precious Metals Risk | The Fund’s gold and silver may be subject to loss, damage, theft, or restriction on access, and the Fund’s recovery may be limited, even in the event of fraud, to the market value of the metals at the time the fraud is discovered. International crises may motivate large-scale sales of precious metals which could decrease their prices and adversely affect the value of the Shares. The price of metals may also be adversely affected by the sale of gold or silver by ETFs or other exchange traded vehicles tracking the precious metals markets. In the event of the insolvency of the Custodian, a liquidator may seek to freeze access to the metals held in all of the accounts held by the Custodian, including the Fund’s Allocated Account. Although the Fund would retain legal title to the allocated gold and silver bars, the Fund could incur expenses in connection with obtaining control of the allocated gold or silver, and the assertion of a claim by such liquidator for unpaid fees could delay redemptions.

Who Should Buy This Fund

This Fund is most appropriate for investors who seek a hedge against inflation, understand the risks of investing in each of the various asset classes, and who are willing to accept moderate amounts of volatility and risk.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

As with most other mutual funds, you can lose money by investing in this Fund.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-Diversification Risk | Because the Fund may invest in a smaller number of securities, adverse changes to a single security will have a more pronounced negative effect on the Fund than if the Fund’s investments were more widely distributed.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PAST PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. More up-to-date returns are available on the Fund’s website at www.timothyplan.com, or by calling the Fund at (800) 846-7526.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table provide some indication of the risks of investing in the Fund by showing the variability of the Fund’s performance from year to year and by comparing the Fund’s performance to a broad based index.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

(800) 846-7526

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.timothyplan.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

|

|

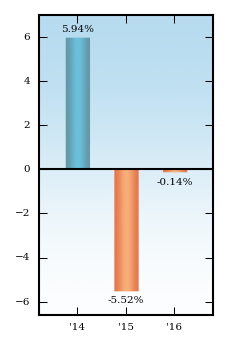

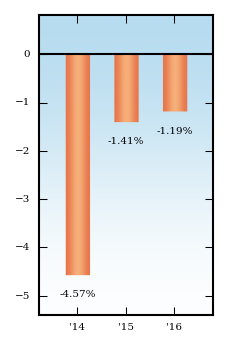

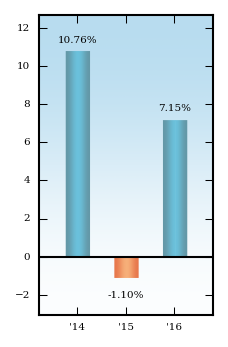

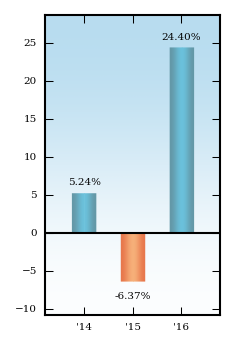

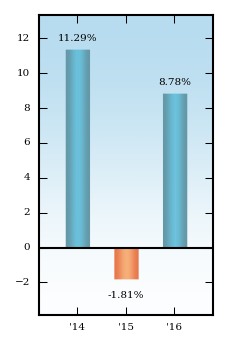

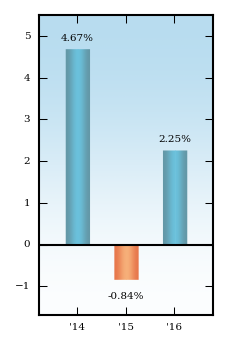

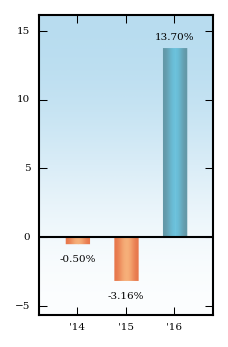

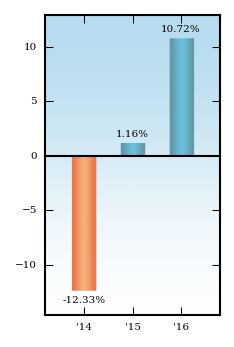

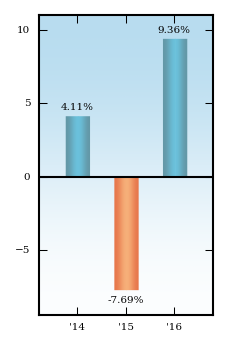

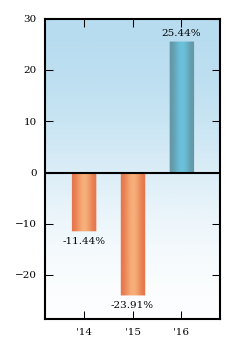

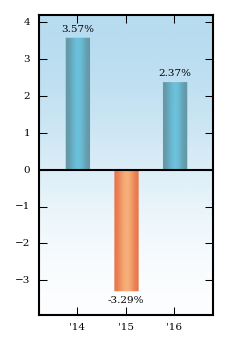

| Bar Chart [Heading] |

rr_BarChartHeading |

Year-by-year Annual Total Returns for Class I Shares

(for calendar years ending on December 31)

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| | | | Best Quarter | | Worst Quarter | | Mar-16 | | Sep-14 | | 5.62% | | -5.02% |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns

(for periods ending on December 31, 2016)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns displayed are for Class I shares only, and after-tax returns for other classes may vary.

|

|

| Timothy Plan Defensive Strategies Fund | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management Fee |

rr_ManagementFeesOverAssets |

0.60%

|

|

| Distribution/Service (12b-1 Fees) |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.58%

|

|

| Fees and Expenses of Acquired Funds |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.14%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.32%

|

[1] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 134

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

418

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

723

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

1,590

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

134

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

418

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

723

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,590

|

|

| 2014 |

rr_AnnualReturn2014 |

4.11%

|

[2] |

| 2015 |

rr_AnnualReturn2015 |

(7.69%)

|

[2] |

| 2016 |

rr_AnnualReturn2016 |

9.36%

|

[2] |

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Mar. 31, 2016

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

5.62%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2014

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(5.02%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

9.36%

|

|

| 5 Year |

rr_AverageAnnualReturnYear05 |

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

1.20%

|

[2] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

|

| Timothy Plan Defensive Strategies Fund | Return after taxes on distributions | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

9.19%

|

[3] |

| 5 Year |

rr_AverageAnnualReturnYear05 |

|

[3] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

0.91%

|

[2],[3] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

[3] |

| Timothy Plan Defensive Strategies Fund | Return after taxes on distributions and sale of shares | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

5.41%

|

[3] |

| 5 Year |

rr_AverageAnnualReturnYear05 |

|

[3] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

0.84%

|

[2],[3] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

[3] |

| Timothy Plan Defensive Strategies Fund | DJ Moderately Conservative US Portfolio Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

9.26%

|

[4] |

| 5 Year |

rr_AverageAnnualReturnYear05 |

|

[4] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

7.02%

|

[2],[4] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 2013

|

[4] |

|

|